Q1-2025

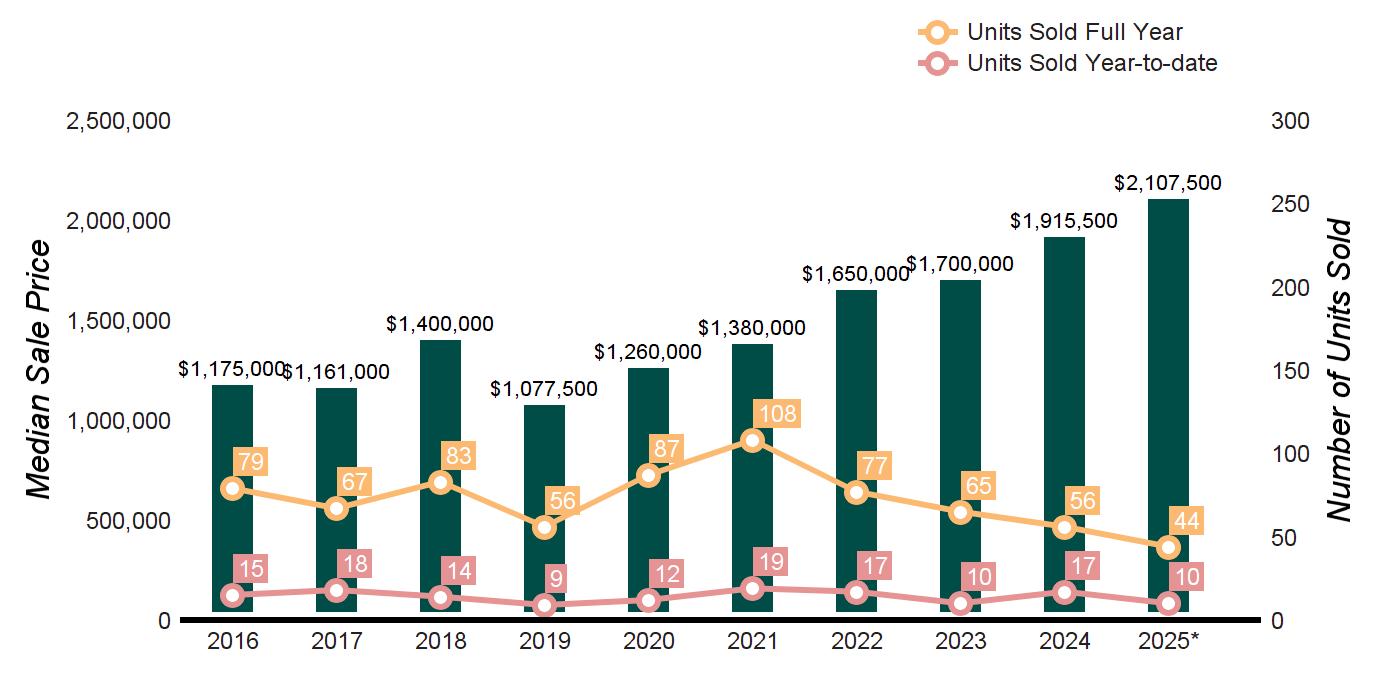

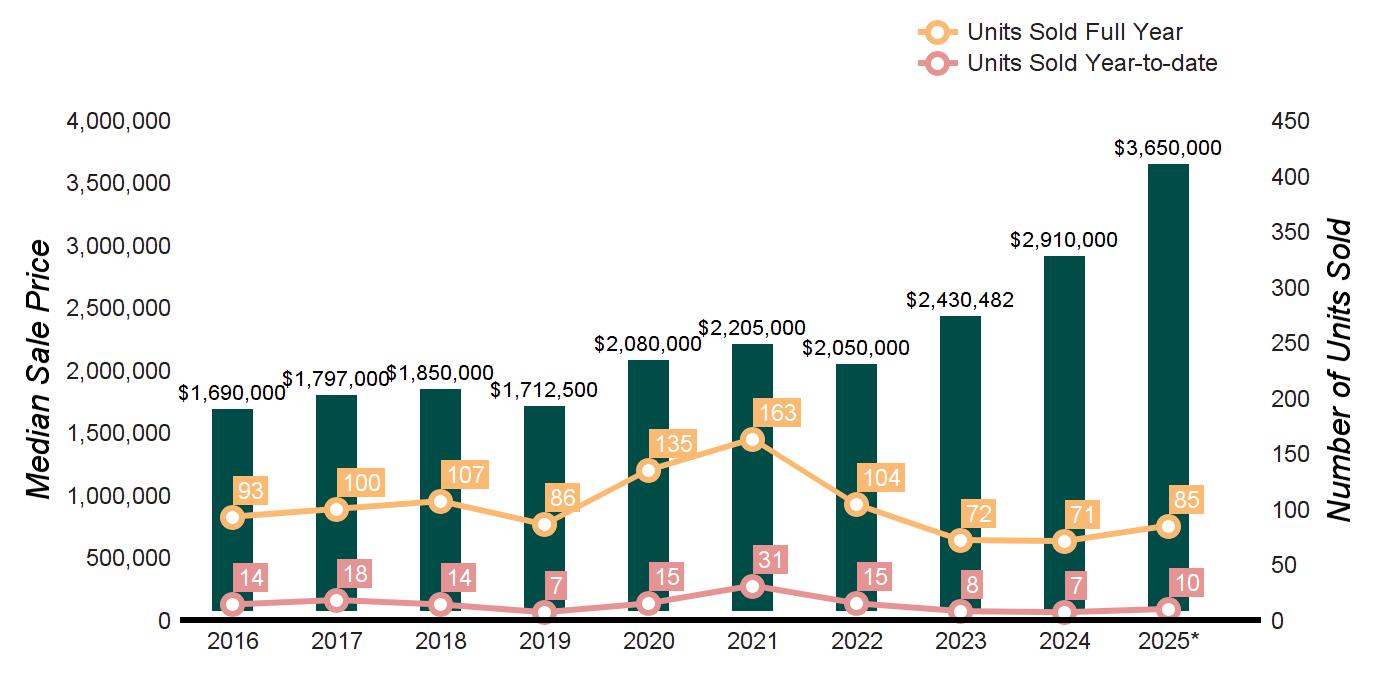

The first quarter of 2025 brought a striking juxtaposition to Greater Greenwich real estate: a decline in overall unit volume, yet a surge in prices, especially at the upper end. In a market known for its affluence and architectural range, the story this quarter was one of vertical, not horizontal, movement. Fewer homes sold, but those that did, sold for more, and often much more.

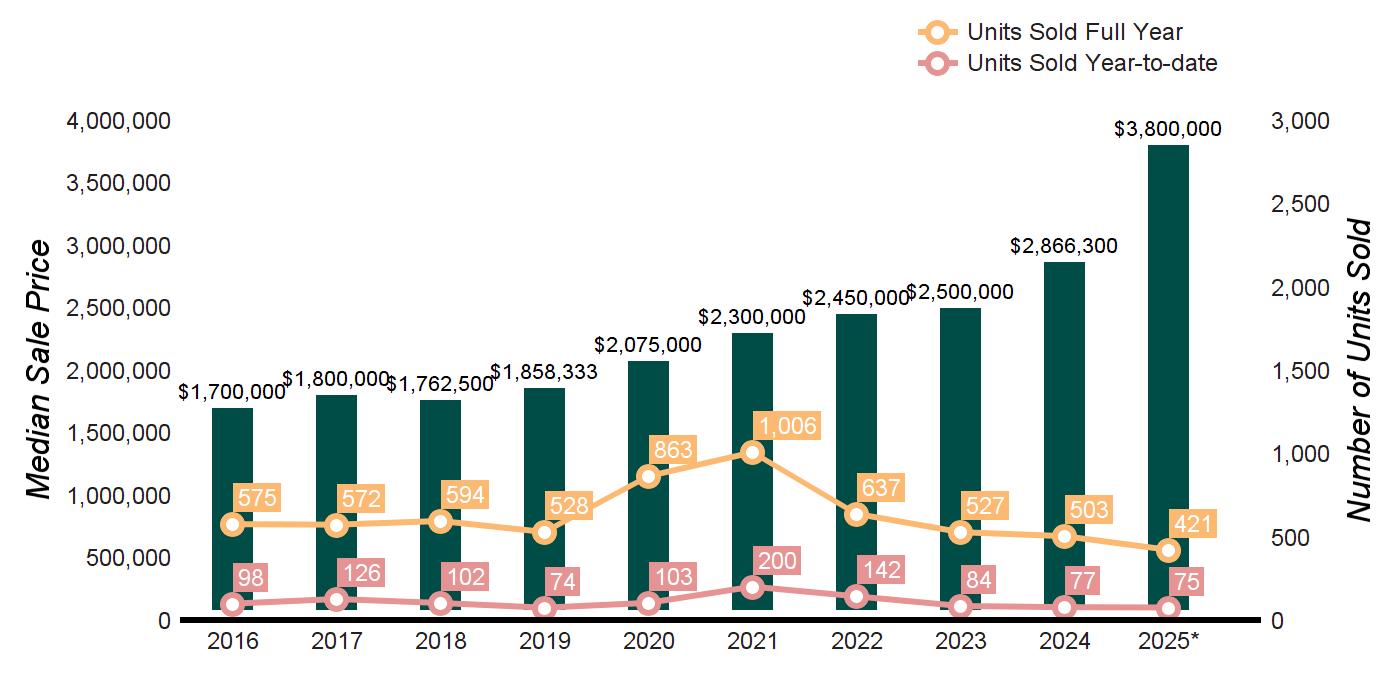

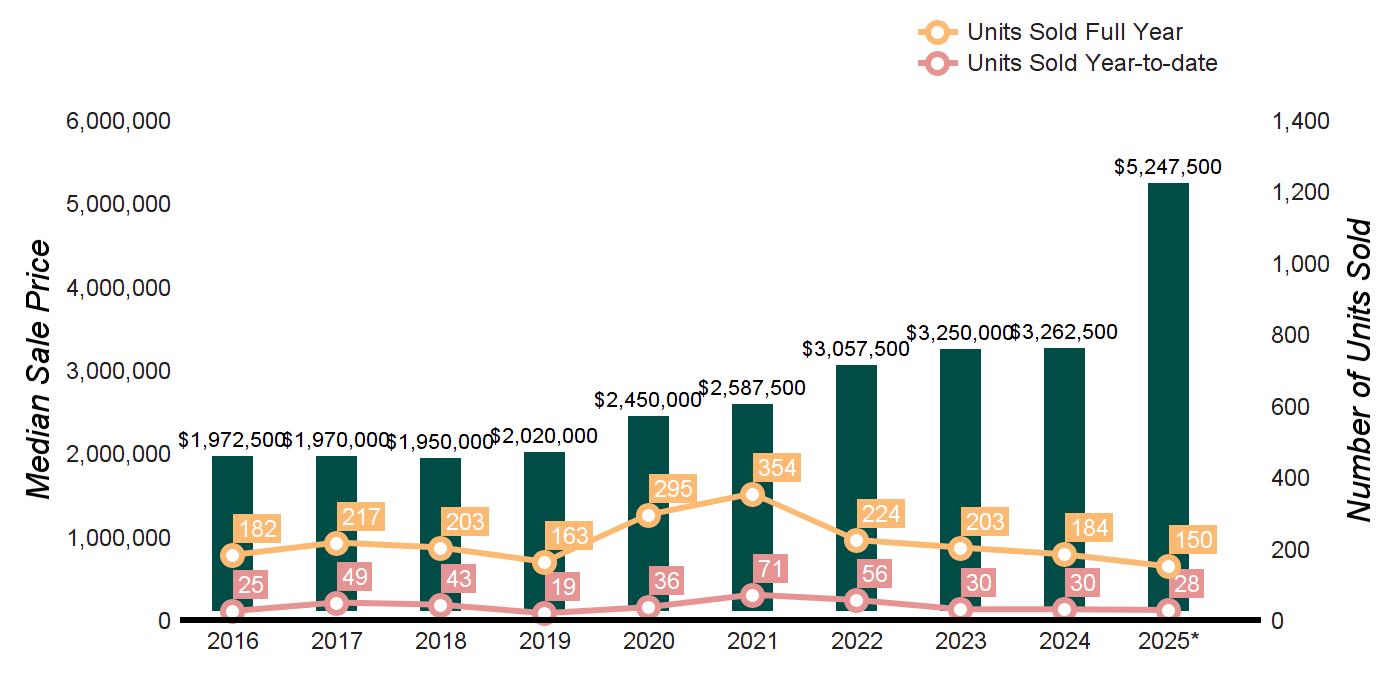

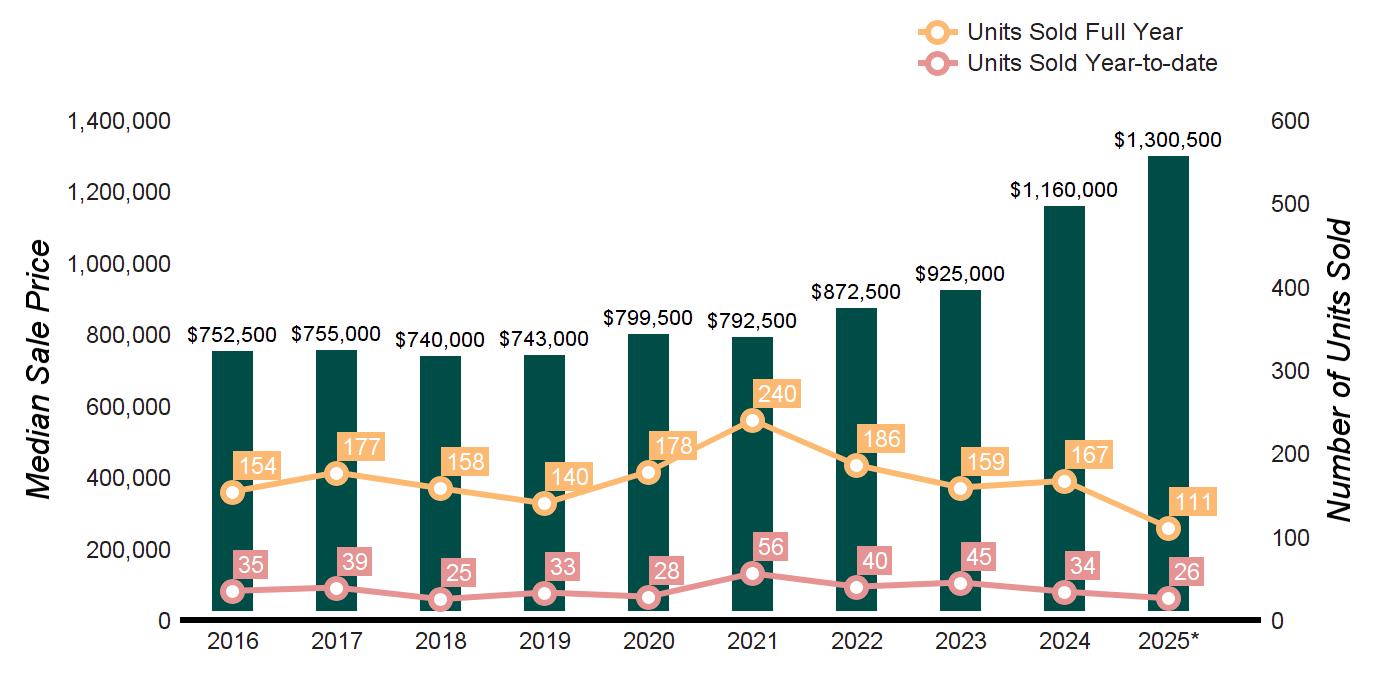

Across Greater Greenwich, the number of single-family homes sold declined slightly by 3.9% compared to Q1 2024, yet the average sale price soared by 39%, landing just over $5.1 million. This significant price escalation wasn’t limited to a few outliers. The median sale price also jumped 24.5%, reaching $3.8 million, suggesting that strength was broadly distributed throughout the market, not just in ultra-luxury sales.

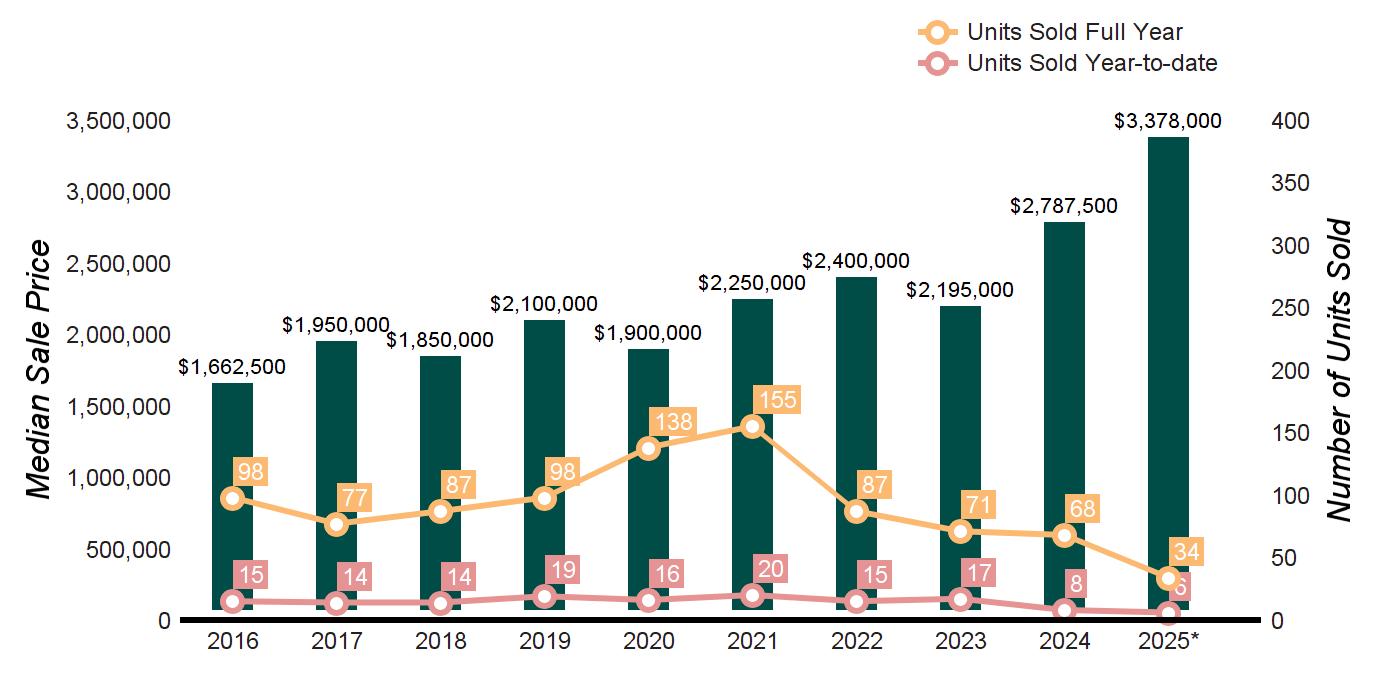

What explains this divergence? Simply put: inventory remains low, but wealth remains high. Even as days on market ticked up slightly and the saleto-list ratio fell to 96.6%, buyer demand at the top of the market was robust. Sales over $10 million tripled year-over-year in Q1, and price brackets between $6 and $10 million also saw increased activity. Meanwhile, sales in the $1M–$3M range declined across nearly all submarkets, suggesting price sensitivity remains at more modest levels.

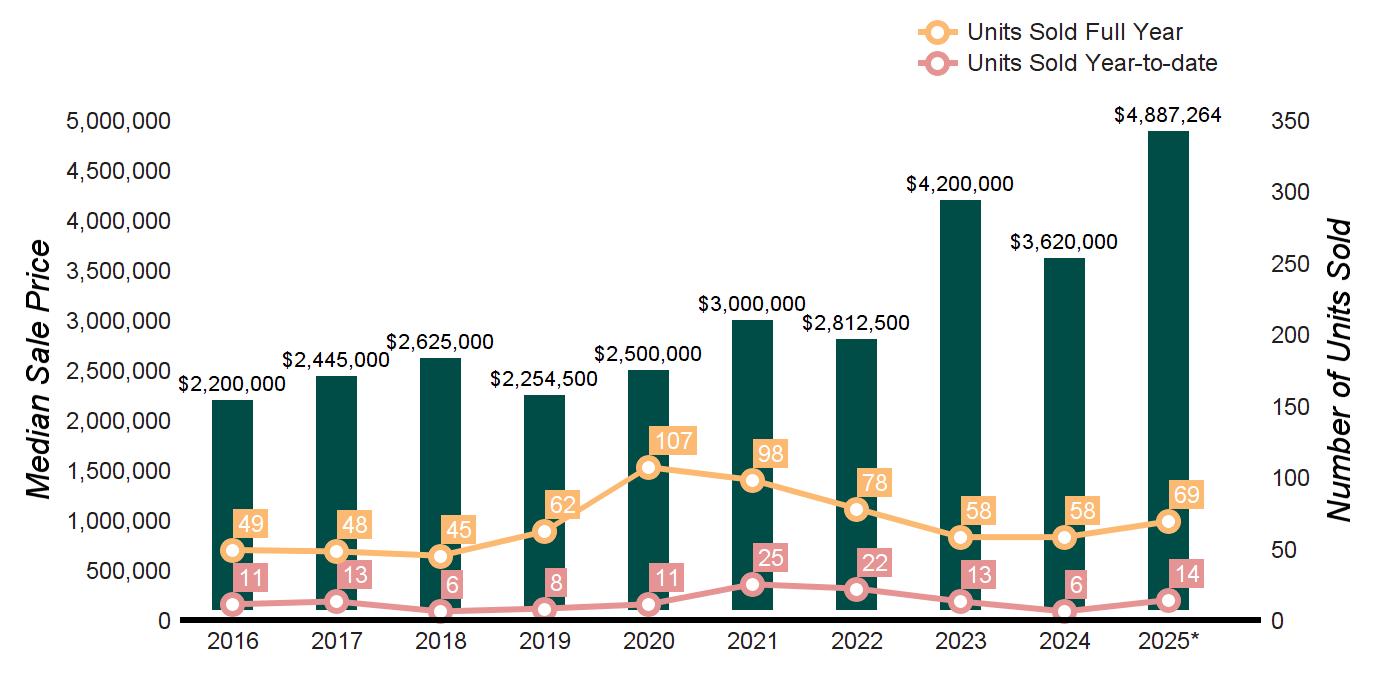

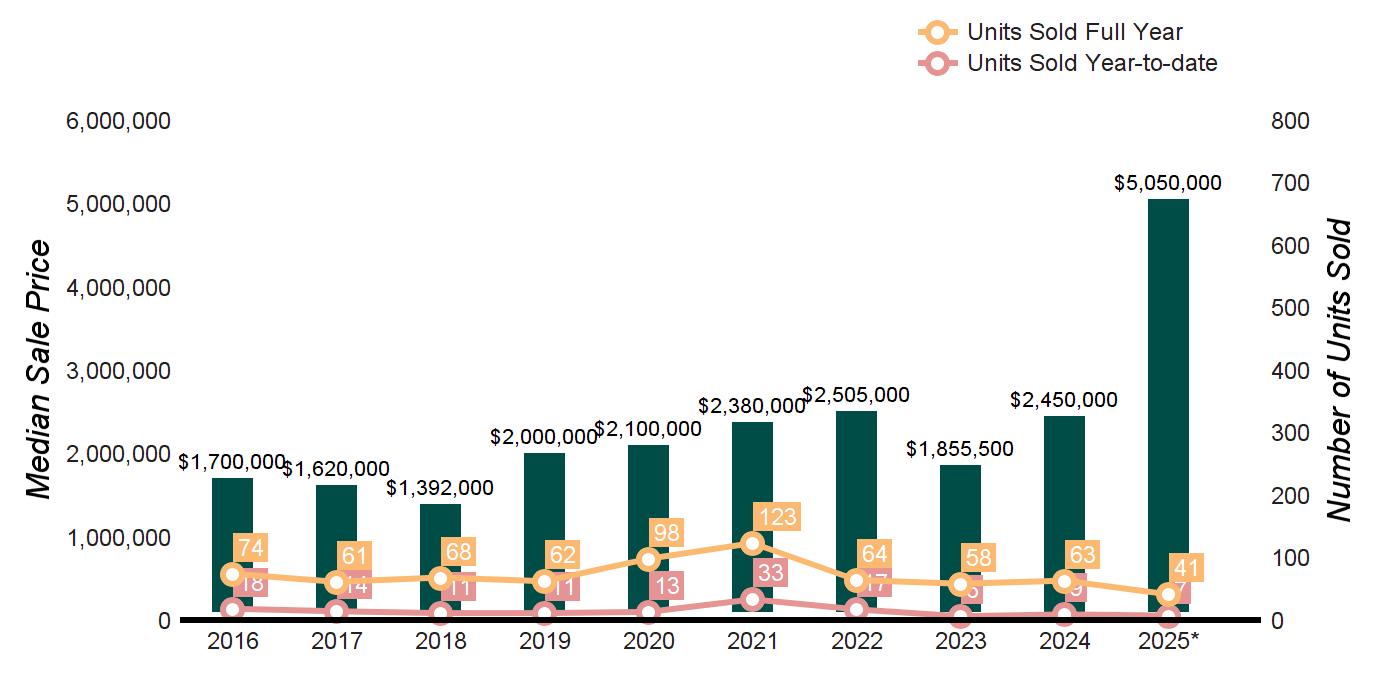

Geographically, North of the Parkway stood out with the most dramatic price movement. Homes sold doubled compared to Q1 last year, and the average sale price rose over 50%, to $6.3 million. While some of that jump reflects a small sample size, it also reveals a growing appetite for privacy, land, and larger estates, echoing a post-pandemic preference that remains sticky. Yet even in more centrally located neighborhoods like Cos Cob, prices climbed: the median sale price rose 31.7%, despite a 41% drop in transaction volume.

South of the Parkway, often considered the heartbeat of classic Greenwich luxury, delivered consistent strength. Sales dipped slightly (28 vs. 30 last year), but both average and median sale prices surged, up 40% and 27%, respectively. This submarket continues to reflect a flight-to-quality: fewer listings, but buyers willing to pay more for best-in-class homes.

In Old Greenwich, the story was a bit more nuanced. Sales dropped 25%, and the average sale price declined 23%. However, price per square foot remained flat, and time on market was minimal. It’s likely a case of low-quality inventory rather than declining demand.

Supply-demand ratios across most price segments suggest a high-demand environment, especially between $2M and $6M. In the $10M+ range, pending sales were up 150% year-over-year, signaling continued enthusiasm from ultra-wealthy buyers undeterred by borrowing costs or geopolitical noise.

As Q2 begins, the Greenwich market sits at an inflection point: prices are rising, but affordability is shrinking. The town’s unique blend of prestige, privacy, and proximity to Manhattan continues to draw interest, but buyer patience is growing, especially at lower price points where economic pressures loom larger.

The overall tone is one of confidence at the top, and caution at the bottom. In this dual-speed market, success will come to sellers who understand which audience they're addressing, and to buyers who know that even in a cooling economy, Greenwich real estate continues to set a pace of its own.

At Houlihan Lawrence, we recognize that every home sale or purchase is a deeply personal and significant decision, and we remain uniquely positioned, with local expertise, market insight, and trusted relationships, to guide buyers and sellers through every step of the journey.

With Warm Regards,

Liz Nunan President and CEO

11 WYNNWOOD RD, GREENWICH, CT

Coveted Golden Triangle location offers stunning five-bedroom Colonial with pool, spa, pool house with bar, tennis court and entertaining terraces set back on 2.24 private, flat acres near town on a cul-de-sac. With screened-in porch, game room, theater. $9,750,000 | M 203.561.9373