Blazing

A TRAIL

Learn how three local farmers are paving the way for the future of our industry.

Learn how three local farmers are paving the way for the future of our industry.

Horizon Farm Credit, ACA

Thomas H. Truitt, Jr., CEO

Shawn D. Wolfinger, Chair

David R. Smith, Vice Chair

Richard A. Allen

Paul D. Baumgardner

Julie Bolyard

Samuel BowerCraft

Brian L. Boyd

Kevin D. Grim

Steven H. Gross, Jr. John Travis Hastings

Laura M. Heilinger

Anthony M. Ill

William K. Jackson

T. Jeffery Jennings

Fred R. Moore, Jr. Michael S. Nelson

Jennifer L. Rhodes

Paul H. Schmidt

Douglas D. Scott

Larry A. Seibert

Richard D. Shuman

Alan N. Siegfried

Dennis D. Spangler

Charles F. Ulmer

Christine Waddell

Fred N. West

Charles M. Wright IV

If you have any questions or ideas for the editorial staff of the Leader, contact Jenny Kreisher at 888.339.3334, email her at jkreisher@horizonfc.com or write her at Horizon Farm Credit | 300 Winding Creek Blvd | Mechanicsburg, PA 17050. This publication is for you, our reader. We’d love to hear from you!

The Leader is published quarterly for stockholders, friends and business associates. If you wish to no longer receive this publication, please email: jkreisher@horizonfc.com. Use “Unsubscribe Leader” in the subject line.

The Farm Credit Administration does not require the association to distribute its quarterly financial reports to shareholders. However, copies of its complete report are available upon request or see quarterly updates online at horizonfc.com

The shareholders’ investment in the association is materially affected by the financial condition and results of operations of AgFirst Farm Credit Bank and copies of its quarterly financial report are available upon request by writing:

Susanne Caughman

AgFirst Farm Credit Bank | P.O. Box 1499 | Columbia, SC 29202-1499

Address changes, questions or requests for the association’s quarterly financial report should be directed to Horizon Farm Credit, ACA by calling 888.339.3334 or writing:

Horizon Farm Credit | 300 Winding Creek Blvd | Mechanicsburg, PA 17050

One of the many aspects I admire about the Farm Credit System is our ability to give a voice to our members — the farmers that produce the food and fiber for our country and beyond. Along with our mission to provide agriculture with access to consistent and reliable credit, we have a duty to represent our membership and advocate for the issues that matter most to them and the businesses.

Many of our members have that same calling — to serve in leadership roles with the goal of furthering their community or the commodity they grow. Some serve locally, working with their neighbors and friends, while others serve nationally, meeting with legislators and others from across the country (or even globe) to bring awareness to their purpose.

Regardless of the scope, leadership in agriculture has never been more important, and the three customers we feature in this issue of the Leader are paving the way for the farmers of the future.

If you’re not sure where to start, I recommend checking out our AgBiz Masters educational program. This two year programs covers a variety of business management topics, arming you with the knowledge you need to lead your business on a path towards success. You can find more information on AgBiz Masters on page 14.

Within these pages, I hope you find inspiration to find an organization that speaks to you and what you find important. It takes all of us to shape the future of ag.

Wishing you a safe and happy fall, Thomas H. Truitt, Jr.

Data integrity isn’t just a fancy phrase to us — it’s a critical component to the way we do business and work with our customers. Horizon Farm Credit has established thorough policies and procedures to protect your confidential information. Our Association will never collect personal information about you unless you choose to provide that information.

Here are just some of the ways we protect your sensitive information:

• We hold any and all confidential information you provide in strict confidence and in accordance with applicable laws.

• We safeguard your information in accordance with the highest security standards.

Using the most advanced technology, we safeguard your information to help prevent unauthorized access, and test these systems regularly.

Only authorized persons are permitted access to your information. We do not trade or sell your information to third party organizations.

You can read more about Horizon Farm Credit’s privacy and security measures, and learn how you can protect your personal information, over on our website: horizonfc.com/privacy-security

Spending almost 25 years serving in a leadership role at the National Grape Cooperative Association has proven to be time well spent for David.

“It’s a positive experience,” says David. “If you’re doing your job right, you’re learning the job as you go, and you can take that knowledge and apply it throughout life — how to deal with other people, how to reach compromises, how to lose an argument and turn the other cheek and go forward, because we're all working for the same goals here.”

David, who with his wife Patricia owns and operates the 280 acre 3 Girls Vineyard, has served on the cooperative’s Board of Delegates for seven years and on the Board of Directors for 17 years. The farmer-owned cooperative, which includes 800 members, may not be familiar to most Americans, but grape juice from their processing and marketing subsidiary, Welch’s Juices, has been a household staple for years. Consequently, the success of Welch’s is tied to the success of his vineyards, David notes.

“If you want to complain about something, then you need to be prepared to do something to step up and fix it,” says David. “If there’s something I don’t like, I want to be involved in fixing it,” he says. “Plus,” he adds, “this business is everything in my life and I want to be involved in running it. It’s just so important — my family, everything — is dependent on the success of Welch’s so I want to be involved in helping them be successful.”

“If you want to have a successful family business going forward, you need to invest your time in that overall business,” says David. “The management of Welch’s is very important to the success of my personal business, and I don’t like relying on other people to manage my business.”

National Grape Cooperative Association has four production regions in the country

The

David Mobilia, owner and operator of 3 Girls Vineyard in North East, Pennsylvania, not only grows grapes that land in products distributed across the country, but he also leads the way for others in his industry to succeed.

and “Welch’s is our marketing arm, we own it completely,” explains David. “We own the company, the processing, marketing, it’s all ours. It’s farmer-owned, it belongs to us directly.”

Each region has a number of Directors — David is one of 13 total Directors.

“We’re managing our company for the best possible returns for our ownership, the people that we work for, and that’s very important - we work for the ownership.”

“We spent a lot of time and thought working on how to make our processes better and more equitable for the ownership. We are beholden to the people that we work for in trying to do the best we can to make the best results for these people,” he says.

David is leveraging more than 30 years of experience in the vineyard to not only help Welch’s, but continue to be effective managing 3 Girls Vineyard, where he owns 250 acres and rents the remaining 30 acres.

“This is a business where it’s hands-on, and if you’re going to do this and do this well, you need to be completely and totally engaged in growing,” says David. “Equipment, as in any aspect of ag, costs a lot of money, so to be able to afford it you have to be able to use it a lot and then you need to have the land. It’s so capital intensive, this business.”

“I bought a lot of property and a lot of equipment and at first this business was pretty tough and we were not swimming in money, so in order to grow and expand I needed to borrow money and it was risky for banks,’’ he says. Farm Credit “understood the business and I was fortunate enough to have some really good employees help me out. They took a risk with me. “

Even now, “I talk to my relationship manager

and let him know what’s going on. I have a wonderful relationship with Farm Credit,” says David. “They understood what I was trying to do — I was trying to get to scale as quickly as I could and they understood why.

“I remember before I was with Farm Credit, I was trying to get a loan at a commercial bank and the lender I was dealing with kept asking me for my weekly pay stub and I didn’t have one. I just couldn’t get through to them that I didn’t know what I was going to make. And then I brought in Farm Credit and they understood at least what the growing season was like, what 25 degrees on April 28th meant to me.”

Additionally, “when I wanted to expand, some of the farms I bought were not in the best of shape and I had to fix them up,” he says. “But understanding that a new farm, even though it’s a little cheaper, means that I’m going to have to fix up a building or fix a trellis or improve drainage, or if I need another sprayer or another tractor — these guys understood the capital needs.”

David credits relationship manager Jim Hogue, now retired, with helping him in the beginning, as “I couldn’t have done it without Jim,” says David. Today, Farm Credit relationship manager Larry Labowski is working with David.

“Through working with Dave over the past ten years, I’ve recognized his perseverance and leadership through the ups and downs of the concord grape market,” says Larry. “His involvement in the industry gives him a better understanding of why the industry is in the condition that it is at that moment.”

“I can always count on a report, whether good or bad, on where he sees his business in the next six months or year based on the current industry outlook. This process allows him to create a plan on how he needs to react to current conditions,” Larry says.

Growing grapes is common to David’s area. With the mitigating aspects of Lake Erie and Lake Ontario, the lakeshores play host to New York’s “grape belt.” “You get six or seven miles away from the lakes and it’s impossible to grow grapes,” he says. “The lakes are a heat sink; they help us avoid frosts in the spring and keep it warmer in the fall to avoid frosts.”

Four full-time employees help keep 3 Girls Vineyard moving ahead, supplemented in the early part of the year when extra hands are necessary.

“Harvest obviously is busy at times, but spring is the busiest time of year, when we do our repair planting, fertilizer applications, and residual herbicide applications,” says David.

September and October end up being harvest season at the vineyard. “We’re fortunate,” says David. “The processing plant is three miles from the plant that we deliver to, so our fruit goes from the vine to the tank in about four or five hours.”

David mostly utilizes the flagship Native American varieties of Concord and Niagara grapes to ship to Welch’s.

Grapes that sit for too long, explains David, oxidize, turn brown and “get an off flavor.” Additionally, “we get paid a premium for higher sugar content.”

He adds, “When the grapes go into Welch’s, they take a probe sample, blend it and get juice to put into a refractometer which will read what the Brics sugar level is and whatever the Brics read determines how much we get paid.”

Sugar levels are dependent on “just doing a good job farming,” says David. “You can’t overcrop your vines, plus nutrition is huge — soil health and quality — your spray program, and how you prune the vines — it’s all tied together. It’s just doing your job right, and of course weather.”

Many local, state and national leaders are within Farm Credit’s footprint, representing farmers from all across the country. One of these prominent leaders is Lee McDaniel of Darlington, Maryland, residing in Harford County. Lee is a past president of the National Association of Conservation Districts (NACD). His leadership has been a widespread asset to many all over the country.

As most stories begin, Lee grew up on the family farm his parents purchased in 1959. Indian Spring Farm, which he and his wife, Connie, currently manage is measured at 850 acres where they grow corn, soybeans and alfalfa. Conservation practices on the farm include cover crops, no-till, grassed waterways, diversions, spring developments, strip cropping, stream-bank protection, grassed and wooded buffers, and stream crossings.

What was once a large dairy operation in its prime, the farm had eventually transitioned into raising beef animals, but now is a producer of crops and a storage facility. “The farm and the surrounding location are a historic treasure,” expresses Lee. “Wartime stories and the inhabitants of the people surrounding the farm are present in the land.” Lee once found a tomahawk on one of his many field inspections. The farm was once one of the largest producing operations in the state. The buildings’ impressive features are distinct to the area — there are even some of the first-built Harvestore Silos resting in line with “patent pending” printed on the sides.

Lee began his farming venture in 1972. He reflects, “It was a year to remember. Tropical storm Agnes wiped out most of our crops in that first year.” After that, Lee and his family charged ahead, planning for years to come and

There’s a notable saying, “A company is only as good as the people it keeps,*” and that sentiment holds true for the employees and customers of Farm Credit. The knowledge and agricultural experience these parties bring to the table is surely a credit to Farm Credit’s success.Harford County, MD

*[M.K. Ash]Story and photos by Andrea Haines

were prosperous. In the 1980s, Lee collaborated with his conservation district to work on the sand bars. The farm was displayed on a “field day” as an example of proper conservation practices as members from Washington D.C. and other farmers toured the property. It was then that Lee was asked to consider the state conservation presidency.

Lee has served on the Harford Soil Conservation District’s Board since 1997 and as Chairman of the Board since 2005. He has served as President of the Maryland Association of Soil Conservation Districts for two terms, from 2005 to 2009, and the NACD Board of Directors and Executive Board from 2015 to 2017. He is a graduate from Cornell University with a bachelor’s degree in ag economics.

Lee’s family has been involved with Farm Credit since the 1960s when his parents, William and Dorothy, worked with their first loan officer. “We’ve always had a good relationship with Farm Credit,” he explains. Lee and his wife have since built a house and moved out of the original stone-made farmhouse, overlooking the fire-resistant bricks of the castle-shaped barns. “Our current relationship manager has aided us in the construction of our new house, along with projects around the farm,” says Lee.

The McDaniel’s relationship manager, Ellie Grossnickle, has been working with Lee and his family for close to two years. “I appreciate how open and honest Lee is in our conversations. He’s always willing to show me around the farm and I can understand his priorities and the direction he wants to be moving in,” she says. “Right now, the goal is to make significant improvements to the barns and tenant houses on the property to restore them back to their

original state. However, their new house is a prime example of renewable energy.”

Lee chuckles, “The house is ‘old people friendly’ and self-sufficient.” Equipped with geothermal HVAC/heat, solar panels for electricity, and carbon sequestered, the house needed to follow true to their livelihoods. After all, Lee has been diligent in educating about urban programs, tribal conservation, water issues, and farming practices. “NACD and NRCS have awarded $6.5 million in grants to conservation districts for a multitude of projects to assist small-scale conservation and urban assistance since 2016,” he shares. “Agriculture is always under such scrutiny, and we’ve been able to assist with educating and implementing programs for farming and urban communities to create a balance.”

Serving on a national level, Lee has had the opportunity to experience more diverse issues. “Each area has its own situation that all play into a larger end result,” he shares.

“For example, western areas are focused on air quality, water quantity and wildfires. Southern areas may focus on tropical storms and natural disasters.” Lee has become well versed in so many diverse issues that he is commonly asked to guest speak on podcasts and other media outlets. “I always come back to a person’s roots,” he explains. “Just like I tell the [NACD] student interns, start in your local district and move in different directions, and attend as many meetings as possible to learn from others.”

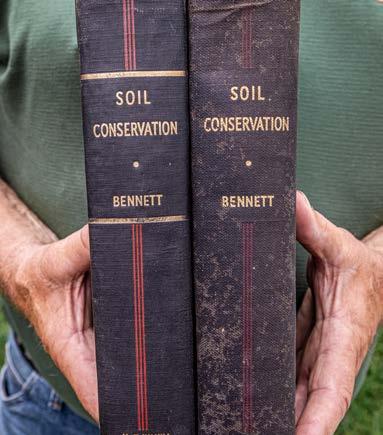

Lee holds on to some sentiments from educators of the past and refers to this knowledge often. “When cleaning out the old barns, I found a safe and some old books. Ironically, one was from the ‘father of conservation’ himself, Hugh Hammond Bennett. The book even has a few words inscribed, ‘I am depending on young Americans like yourself to complete this task of safeguarding our heritage of good soil.’” The book is a real treasure to Lee, making the farm’s unique history just a bit more special.

Kevin Anderson is a fifth-generation farmer who owns and operates Wimberly Farms, alongside his family. His grandfather was a part-time farmer who raised Wye Angus cattle, and was the local agriculture teacher for Somerset County. The extension service needed someone to supply public varieties of seed, and that was when his grandfather began their seed business. After Kevin graduated from a two-year ag program at the University of Maryland in College Park, he decided to become the first full-time farmer in his family.

With guidance from his father, Kevin oversees the day-to-day operations at Wimberly Farms, which was lovingly named after his greatgrandmother. His wife, Liz, manages the office and the seed plant, and they have two daughters in college. In addition to being a licensed seed dealer for UniSouth Genetics, they operate a seed conditioning facility. The couple also condition and sell wheat and barley seed.

On the Lower Eastern Shore, in a town called Princess Anne, sits a 3,000 acre family farm. A Maryland Agriculture Hall of Fame sign greets you at the entrance, as soybean plants sway in the background. Welcome to Wimberly Farms, an operation that grows soybeans, corn, wheat, and barley. They are recognized beyond their rural setting as a licensed seed grower and conditioner that distributes across the country.

Kevin has learned over the years that in order to achieve success, you need to get out of your comfort zone. Wimberly Farms has seen steady growth, and part of that is because Kevin is willing to get off the farm and educate himself. He serves on several committees and organizations at the county, state, and national levels.

“The ag community is very small”, explains Kevin. “A lot of what has helped me is being involved in these groups. I’ve gained a perspective of how other people view things. I had to get outside of my own little world.”

Kevin is currently the Chairman of the Board at UniSouth Genetics, Past President and current member of the Maryland Grain Producers Board, Past President and current member of the Maryland Crop Improvement

Association, and a member of the Somerset Soil Conservation Service. He has been involved with the National Corn Growers Association, Farm Bureau and numerous other ag organizations over the years. Additionally, he has participated on many non-ag boards including the Maryland Critical Area Commission, Somerset Planning & Zoning, and the Board of Trustees for their daughters’ school. Liz has recently joined the Junior Achievement Board, and has previously served in many capacities in ag and non-ag related organizations. She was also appointed by President George W. Bush as the State Executive Director of the Farm Service Agency. “Being involved in non-ag organizations gives us opportunities to share our story with other groups of people”, comments Liz.

For years, Kevin has made it his mission to learn and contribute to the agricultural community. He frequently travels to Annapolis and Washington D.C. to meet with legislators and to testify for or against bills of interest to ag, including the Farm Bill.

At times, it’s frustrating, because you wonder if it means anything”, says Kevin. “But just when

you start to get a little down, you see something positive come out of all the hard work.”

Wimberly Farms has been rewarded for their many innovative efforts over the years. In 2002, Kevin was a top four winner for the National Young Farmer Achievement Award by the American Farm Bureau Federation. Then, in 2007, he was recognized as a National Outstanding Young Farmer by the Outstanding Farmers of America.

Kevin and Liz have found great value in winning these awards, but it’s not about the recognition for them. It’s about the people – the friendships that were built over the years. They have a strong network of fellow farmers that span across the country. They’re grateful for those relationships, and continue to connect daily on social media after all these years.

“Your involvement at the state and national level doesn’t come back to you in a financial reward. It comes back in a personal one. The reward is personal growth and helping the industry,” Kevin reflects.

Farm Credit has been connected with Wimberly Farms since 1985, when the Andersons took out their first operating loan.

“In nearly forty years, I’ve worked with three relationship managers,” he explains. “And they’ve all been first class. Farm Credit has helped us a lot.”

Amy Rowe, Farm Credit relationship manager, has enjoyed working with the Andersons as well.

“We are proud to have Kevin and Liz Anderson as customers,” she says. “Their involvement in local, state, and national organizations provides representation of our area, and brings back knowledge to our community. We appreciate their dedication to the agricultural industry.”

Kevin, the Anderson family, and Wimberly Farms are a testament to what’s achievable when you’re willing to challenge yourself. Family, community service, friendships, and open-mindedness have been the cornerstones to their success story.

Get more information about Wimberly Farms at wimberlyfarmsinc.com.

“Your involvement at the state and national level doesn’t come back to you in a financial reward. It comes back in a personal one. The reward is personal growth and helping the industry.”

— Kevin Anderson

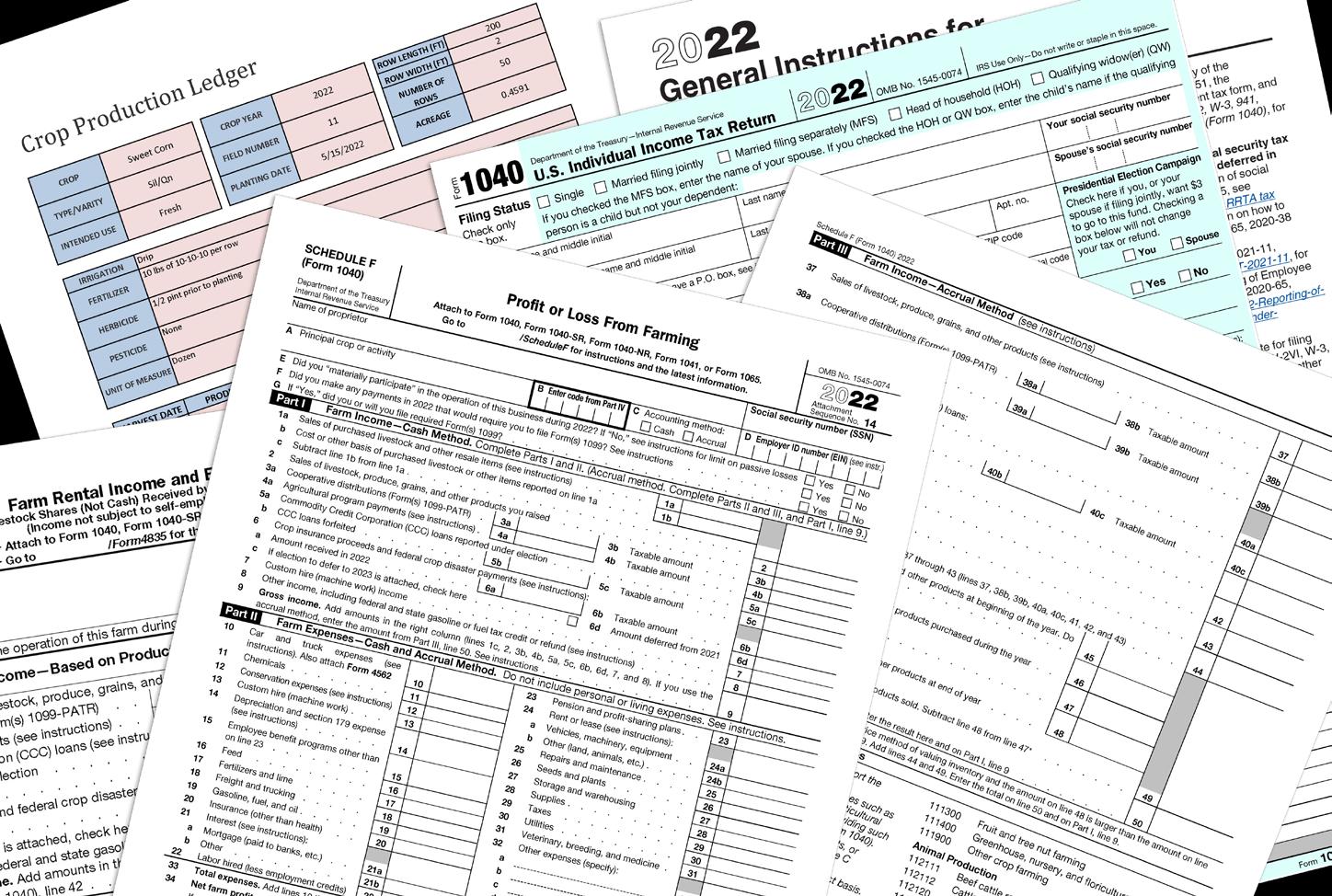

Not everyone enjoys doing taxes, but they are an annual requirement for most of us. If you are a farmer or small business owner, tax time can be especially challenging — but it doesn't have to be!

Annual tax planning is a proactive way to minimize tax liabilities and ensure all available allowances, deductions, exclusions, and exemptions are working together in the most tax-efficient way. This can reduce your total income tax paid each year. We’ve seen increased commodity prices and unexpected twists and turns in the industry this year. Items like equipment trades, timber sales, and even a large business loss can affect your bottom line and tax return this year, but may also prevent an unexpected tax bill in future years.

Common expenditures to reduce taxable income include:

• Prepaying inputs and other allowed items, capital expenditures, and retirement contributions. Depending on your entity structure, retirement plan contributions can be significant, especially for self-employed individuals via a Simplified Employee Pension (SEP) or other qualified plan. Having a diversification of retirement assets outside of farming is a good thing!

• Healthcare deductions: create an employee benefits deduction to allow for business deduction of these expenses. A common way that farmers do this is farm income averaging. This is a way to average all or some of your farm income using rates from the three prior years.

If a farm loss is inevitable, common ways to increase income include:

• IRA distributions

• IRA to ROTH IRA conversions. In the pathway of an IRA to ROTH IRA conversion, this can generate taxable income on the tax return, but the earnings are tax free. If you have a farm loss, the income that is generated from the conversation would have no income tax consequences rolled into an IRA.

• Selling of non-farm capital assets

• Are your repair bills high this year? You can make an election to capitalize repairs rather than expensing them. This can be adjusted on an annual basis.

1. Update your balance sheet and profit/loss statement. Having your records up-to-date is important because the balance sheet gives a financial snapshot of your business at that time. Comparing your profit and loss year-end statement aids you in measuring your business’ success. This means you have to dig deep into reconciling your bank accounts and cleaning up the check register. If you aren’t sure where to start with these items, contact us — we have a few templates for you to use!

2. Review your budget and examine your cash reserves. This process is important to know how much cash you’ll have available between now and year-end. Did you purchase or plan to purchase any fertilizer, feed, chemicals, etc. that are considered a prepay? These were purchased at a discount, but are usually stored and used in the next coming year. It’s important to identify the prepaid expenses to possibly move these items to the balance sheet. These prepays can increase your expenses, but may take your profit into a loss. A rule of thumb is to use 50 or 100 percent of the prepays and move those into the next year.

3. Do you have dead assets? Be sure to review your depreciation schedule for all of your current livestock buildings, machinery, and equipment. Clearing out old items that are no longer on the farm is important to update on the depreciation schedule.

Last, but not least, start tabulating your amounts for 1099 filings and wrapping up your fourth quarter payroll filings. Soon, it will be time to file 1099s and distribute your employee’s W2s. This year’s tax deadline for entity filers is March 15, 2023 and individual filers is April 15, 2023.

Keep these items on your to-do list for tax preparation to save some money or spark your interest to get last year’s tax filing amended and save you tax dollars. Call your tax accountant and business financial team to schedule an appointment for more guidance and to discuss these options.

Have you been maximizing your tax deductions? Are there items that are falling through the tax cracks?

As you prepare for the end of the year, consider these common items that you may need to analyze every year.

Thank you to everyone who submitted a photo for our 2023 calendar contest. We are excited to reveal the winning images for the cover and each month, along with the photographers behind the lens! If your photo(s) didn’t make the calendar this year, it may be used in a Farm Credit advertisement, on our social media pages, or even in a future issue of the Leader magazine or other publications. Our 2024 calendar contest will go live on January 1, 2023. Visit horizonfc.com anytime before August 4, 2023 to submit your favorite photos!

The Farm Credit Foundation for Agricultural Advancement’s 2023 Scholarship Program is open! High school seniors or students currently enrolled in a technical/trade school, college, or university program who plan to pursue a career in ag can apply for up to $10,000 in scholarships to use toward their education.

The Foundation will award at least ten scholarships to eligible students who reside within Horizon Farm Credit’s 100 county territory and Washington, DC. More information about this year’s program, including the full list of eligibility requirements and applications, can be found on our website: FCFoundationForAg.org.

Applications will be accepted through Friday, January 6, 2023, so don’t delay! If you have any questions, please email info@FCFoundationForAg.org

2 tsp smoked paprika

1/3 cup maple syrup

1/3 cup extra virgin olive oil

8lbs whole turkey

6 parsnips, peeled, halved lengthways

1 whole small Kabocha squash, cut into half inch thick wedges

1 bunch baby carrots, trimmed, scrubbed

10 unpeeled garlic cloves

1/3 cup roughly chopped dry roasted almonds Gravy, to serve

1/4 cup extra virgin olive oil

1 large yellow onion, chopped

3 garlic cloves, crushed

1 tbsp finely chopped fresh sage leaves

1lbs packet ground sausage

2 tbsp finely chopped fresh flat-leaf parsley leaves

200g (about 3 cookies) gingerbread men, roughly chopped

Heat ¼ cup of olive oil in a large frying pan over medium-high heat. Add onion, garlic and sage. Cook, stirring occasionally, for 4 minutes or until softened. Transfer to a large bowl. Set aside for 5 minutes to cool slightly.

Preheat oven to 450 F. Combine paprika, 2 tablespoons of the maple syrup and 2 tablespoons of the oil in a small bowl. Season with salt and pepper. Remove and discard neck from turkey. Pat turkey dry inside and out with paper towel. Loosely fill neck cavity with some stuffing. Using toothpicks, secure skin over neck cavity to enclose stuffing. Fill large cavity with remaining stuffing. Secure skin over cavity with toothpicks. Tie legs together with kitchen string. Tuck wings under turkey. Place turkey in a large roasting pan. Brush paprika mixture over turkey. Cover tightly with greased foil.

Place turkey in oven. Immediately reduce temperature to 350 F. Roast turkey for 2 hours.

In a separate pan, cook the ground sausage until lightly browned. Add parsley and gingerbread to the ground sausage. Combine all ingredients, mixing well.

Meanwhile, grease 2 large baking trays and line with baking paper. Arrange parsnips, squash, carrots and unpeeled garlic on prepared tray. Drizzle remaining oil and maple syrup over vegetables. Season with salt and pepper. Toss to coat.

Uncover turkey. Roast vegetables and turkey, basting turkey every 20 minutes, for 1 hour or until turkey is golden and juices run clear when thigh is pierced with a skewer and vegetables are sticky and tender. Cover turkey loosely with foil. Stand for 15 minutes. Uncover and remove toothpicks.

Transfer vegetables to a large serving plate. Add almonds. Gently toss to combine. Place turkey on top. Serve with gravy.

Farming today is more challenging than ever before. As you encounter new obstacles in managing your business, Farm Credit wants to help you soar above them. For new loans made through the end of the year, you’ll receive up to $250 off your origination fee, and when you submit your loan application, you’ll be entered to win one of five drones!

For a limited time, all applicants with an application deadline on or before December 31, 2022, will receive up to $250 off loan origination fees. This discount is applicable to loan origination fees only for consumer and non-consumer transactions.

Ready to take your operations to new heights? Visit HorizonFC.com/drone. today. NO PURCHASE

OR WIN. Open to individuals who are 18 or older and are legal residents of qualifying counties within the states of DE, MD, PA, VA and WV. See Official Rules for list of qualifying counties. Void outside these geographic areas and where prohibited. Sweepstakes ends on 12/30/22. To enter, submit an application for a consumer or non-consumer loan with Horizon Farm Credit by 12/30/22 and be approved by 1/31/23. Or, you can enter without applying for a loan by mail. See Official Rules on how to submit an entry by mail. Regardless of the method of entry, there is a limit of one (1) entry per person. Odds of winning depend on the number of entries received. For full Official Rules, visit https://horizonfc. com/drone. Sponsor: Horizon Farm Credit, 300 Winding Creek Blvd, Mechanicsburg, PA 17050.