LEADER

BUILDING A

BUILDING A

Three farmers construct their operations with one eye on their families' futures and the other on the future of agriculture.

Horizon Farm Credit, ACA

Thomas H. Truitt, Jr., CEO

Board of Directors

David R. Smith, Chair

Michael S. Nelson, Vice Chair

Paul D. Baumgardner

Julie Bolyard

Carl Metzgar

Jay McGinnis

Sharon McClellan

Fred R. Moore, Jr.

4 6 8

Samuel BowerCraft

Brian L. Boyd

Kevin D. Grim

John Travis Hastings

Laura M. Heilinger

Monica Hepler

Anthony M. Ill

William K. Jackson

Sam Parker

Brian L. Reiff

Jennifer L. Rhodes

Paul Schmidt

Richard D. Shuman

Charles F. Ulmer

Christine Waddell

Charles M. Wright IV

If you have any questions or ideas for the editorial staff of the Leader, contact Becca Stoops at 888.339.3334, email her at bstoops@horizonfc.com or write her at Horizon Farm Credit | 300 Winding Creek Blvd | Mechanicsburg, PA 17050. This publication is for you, our reader. We’d love to hear from you!

The Leader is published semi-annually for stockholders, friends and business associates. If you wish to no longer receive this publication, please email: bstoops@horizonfc.com. Use “Unsubscribe Leader” in the subject line.

The Farm Credit Administration does not require the association to distribute its quarterly financial reports to shareholders. However, copies of its complete report are available upon request or see quarterly updates online at horizonfc.com

The shareholders’ investment in the association is materially affected by the financial condition and results of operations of AgFirst Farm Credit Bank and copies of its quarterly financial report are available upon request by writing:

Susanne Caughman

AgFirst Farm Credit Bank | P.O. Box 1499 | Columbia, SC 29202-1499

Address changes, questions or requests for the association’s quarterly financial report should be directed to Horizon Farm Credit, ACA, by calling 888.339.3334 or writing:

Horizon Farm Credit | 300 Winding Creek Blvd | Mechanicsburg, PA 17050

At Farm Credit, we’re in the business of making dreams a reality. Our member-owners are the reason we exist, and we focus our talents, technologies, and passions toward serving the people feeding the world.

Farming isn’t a 9-5 job, and it’s certainly not for the faint of heart. Producers’ plans can change in the blink of an eye, yet they persevere. That’s what makes farmers incredible — their persistence and unwavering commitment to providing for their communities.

Farmers are dreamers and doers. They bring their visions to life and create amazing things, all with the purpose of serving others and creating a lasting legacy.

The biggest adventure you can take is to live the life of your dreams, and Farm Credit is here to support you every step of the way. Not only do we provide rural America with best-in-class solutions for financial needs, but we’re also a partner in every way.

You’re never alone in your journey when you’re a Farm Credit customer. From a team of cheerleaders providing encouragement, to a cohort of experts ready at your fingertips with tools to help your business succeed, we’re committed to helping you build a brighter future.

In this edition of the Leader, you’ll find three inspiring stories from dreamers who either persevered through adversity or mustered the courage to bring their dreams to life. I hope you find as much encouragement in their journeys as I have.

It’s special having a front row seat watching our customers achieve their dreams. From all of us at Farm Credit, thank you for allowing us to be inspired by you.

Tom Truitt Chief Executive Officer

A constant factor in farming is change — the need to always transform business models as the years progress. Technology elevates, generations expand, and each manager takes on their unique approach to the farm while looking toward the future of the business. At Skyline Dairy in Smithsburg, Maryland, there have been numerous changes to concrete the future of the dairy farm.

Washington County, MD

Lynn Strite’s family has been farming for over 50 years, managing through the ever-changing industry. It wasn’t a surprise when his son, Joel, decided to take on the same business.

“For much of my time farming, we milked out of the same barn that my grandfather milked in,” notes Lynn. “A 24-unit tie-stall barn converted to a 12-unit step-up that was redone in 1996.”

Within the last ten years, they decided an upgrade was due to keep up with industry demands and introduce more cattle. Upon transitioning, they chose to partner with neighboring dairyman Lyndon Miller, who was also looking to upgrade his herd. Lyndon previously milked 120 Registered Holsteins in a BouMatic double-6 parlor.

“I felt that installing a new parlor wasn’t the best move forward,” shares Lyndon, who handles most of the cattle care at the current facility where he offers his expertise in dairy management. “Joining with the Strite family was the most sensible shift for my operation.”

It’s no surprise that finding and retaining labor is an issue within the ag industry, so the partners decided to consider their options and found robotic milking to be an ideal set-up for them.

“We went on many tours and visited with other producers who use robots,” says Joel, who works with the family’s custom harvest business, and oversees labor management and expansion to their now 420 cows. “My wife, Evalinda, and I started to obtain ownership of the farm in 2015, and we decided a retrofit parlor was off the table.”

In the winter of 2018, they began their journey of pursuing robotic milking, which included construction of a new barn and installing robotic milkers, feeding vectors, and manure collectors.

In addition to Lyndon and Lynn, Joel and Evalinda worked with consultants and banking representatives to bring the plan to life. The partners sought advice from their current dairy advisor, Glenn Flickinger at 21st Century Consulting, who reached out to a Farm Credit peer in the Lancaster area as the project was nearing its start. Paige Hargett, Farm Credit Ag Lender Manager, joined the planning process in July 2021.

“Time was of the essence for this project,” Paige stated. “The initial timeline was delayed, so it was imperative for Farm Credit to work quickly to provide approval and start funding the project. It was completed and the cows were moved in April 2022.”

Six robotic milkers, two feeding vectors, and six robotic manure collectors were installed — all from Lely. The partners initially began working with another bank, but felt they weren’t receiving service that adapted with fluctuating ag industry needs. After seeking out Farm Credit, the partners felt like Farm Credit treated them better than just an account, and the Association has remained involved to help them succeed.

“Farm Credit has been good at keeping up with our needs. Even after the deal was closed, they continue to cheer us on to thrive and have remained engaged with planning out our yearly numbers.”

— Joel Strite

“Farm Credit has been good at keeping up with our needs,” explains Joel. “Even after the deal was closed, they continue to cheer us on to thrive and have remained engaged with planning out our yearly numbers.”

The construction of the barn was a large project. Consulting other robotic herds and Lely representatives, they mapped out a plan that would work for them.

“White Horse Construction from Parkesburg, Pennsylvania, built the facility,” shared Lynn. “We had meetings each week to go over different options. We went on multiple tours with Glenn and the contractor to view different barn systems, too. It wasn’t without hurdles, but we eventually managed to complete the facility.”

The adjustment for cattle took a while, but they are familiar with the robotics now. It took the partners one year to fill the barn with additional purchased cattle.

“The service from Lely hasn’t changed from day one,” he shared. “They fix issues and have people on call to attend to needs as they arise.”

The team at Skyline Dairy successfully secured the future for generations to come by thinking outside of the traditional box.

“I am excited for continued success for them, and a mutually beneficial relationship with Farm Credit,” says Paige. “I cannot wait to see where the facility and technology takes their operation, and how it helps bring the next generation back to the farm.”

Just shy of the Susquehanna River and perched on a mountain in Danville, Pennsylvania, is a new agricultural setting known as Iron Roots Tree Farm. And, nestled atop the 37 acre farmland is a brandnew home to go along with it.

Engaged couple Sarah Weber and Josh Snyder purchased the land three years ago. This past July, they broke ground to build their dream home. While they were at it, they started a Christmas tree farm, too.

“I’ve always had an interest in it,” explains Josh. “Christmas is my favorite time of year.”

The farm is currently growing Fraser Fir, Canaan Fir, White Pine, and Blue Spruce. They’ll be adding more varieties this spring.

“We named the farm Iron Roots Tree Farm for a few reasons,” Sarah shares. “Danville is the town of the ironmen. We wanted to include a local touch because we’re both locals, and we included roots to be symbolic of the trees.”

Sarah and Josh met working at the local farmer’s market for a nearby greenhouse, selling produce and flowers. Josh has an associate’s degree in horticulture and owned a landscaping business. In recent years, he’s become a property manager, but still enjoys his time working with plants.

For ten years, Josh has created Christmas wreaths as an additional stream of revenue. For the past five years, Sarah has joined him in making them as well.

“I’m just here for the ride,” Sarah grins, as they discuss the natural progression for them to start a Christmas tree farm. As a NICU nurse, Sarah also works full-time, but is committed to seeing their dreams come to life.

“There’s more of a demand for Christmas trees because less and less people want to put the work into keeping up with these farms,” she explains. “It’s a long-term investment.”

Josh and Sarah planted nearly 2,000 seedlings on one-and-a-half acres last year by hand and Montour County, PA

with the help of their families, who live nearby. This year, they plan to plant another 1,200 seedlings on an additional acre.

“There’s a lot of love put into every single tree,” says Sarah.

It takes eight years for Christmas trees to be ready for harvest and while they wait, the couple will continue making Christmas wreaths. They look forward to using their own trees to do so in the future.

Sarah and Josh plan to continue building their dreams on the land to accommodate future customers. Once the trees are ready for harvest, they will offer cut-your-own Christmas trees, with a pole barn to greet visitors. Josh and Sarah have plans to serve hot cocoa, string an abundance of Christmas lights, and have a spot to display Josh’s blow molds — another hobby of his. Farm animals and a petting zoo are also being considered, with the desire for Josh’s two young daughters to have a hands-on learning experience.

In the meantime, the couple is inching closer to having the construction of their home

“My hope is that their farm will eventually be a staple in the area. It’s fun to watch them grow and achieve their dreams.”

— Sharon Piccioni

completed. They will be married in May 2024 and are looking forward to settling in as husband and wife. Josh has been able to help with much of the finish work and personal touches — the custom pantry as a prime example.

Sarah’s favorite aspect of the construction process is the labor they put into it, and she’s looking forward to a soak in the new bathtub. As for Josh, he’s most thankful for being in their new home together very soon.

Sarah and Josh received land and construction loans from Farm Credit to make their tree farm and rural home dreams a reality. Their loan officer, Sharon Piccioni, has been right by their side from the beginning.

“Farm Credit has helped us achieve all of our goals with the house and the tree farm,” Sarah

explains. “Sharon has been phenomenal. She immediately responds to us and answers any question we have.”

Farm Credit supports young, beginning, and small farmers — like Sarah and Josh. The Association’s commitment to supporting the next generation of farmers allows people like Sarah and Josh the opportunity to reach their goals and make their mark on agriculture.

“My hope is that their farm will eventually be a staple in the area,” says Sharon. “It’s fun to watch them grow and achieve their dreams.”

Josh and Sarah have exciting adventures on the horizon — marriage, settling into their home, and adjusting to farm life. These new farmers are ready to start their lives together and spread some Christmas cheer while they’re at it.

Sussex County, DE

When you pull up to the Ahmad Family Farm in Greenwood, Delaware, new chicken houses greet you at the entry. An open field is to the left, and a sandy vacant strip to the right. At first glance, you would never know that a catastrophic weather event took place in the same spot less than a year ago.

Mohammed Ahmad is a contractor who was looking for an opportunity. In Pakistan — his former home country —livestock farming runs deep in his family’s roots. Mohammed wanted to continue the family tradition in America, so he sought out land and searched for years trying to find the right location. A friend suggested he look at a 27 acre poultry farm that already had two chicken houses on it. From the moment he set foot on the land, Mohammed knew it was the farm for him.

In 2014, he purchased the land and started working with Farm Credit to build additional chicken houses. Over the years, his poultry operation expanded to eight houses and more than 240,000 chickens.

Until one frightening day in April 2023, when out of nowhere, a tornado touched down in his community and demolished six of his chicken houses.

An employee was there at the time, staying in the farmhouse. The alarm on Mohammed’s phone sounded, alerting him that something was wrong with the chicken houses. He called his farmhand and learned that a tornado had touched down. The gentleman was safe in the farmhouse, but most of the farm did not fare as well. Mohammed arrived shortly after the tornado and began to access the damage.

“It was horrible,” Mohammed states. “My brother, who works here, started crying when we saw the damage.”

Only two chicken houses remained — the two original structures from when he bought the land. Luckily, those were the two housing

chickens in them at the time. A new delivery of chickens was scheduled for the following day to replenish the other houses.

Despite the devastating loss, there was a silver lining — not one animal or person was injured during this terrifying event.

With feed bins toppled over and propane tanks flipped, the destruction caused many issues, including a propane leak. The propane company responded immediately and was fortunately able to shut everything down before more damage could occur.

“God was on our side,” says Hasnain Hamid, Mohammed’s nephew. He also owns a poultry farm in Delaware and started his operation after being inspired by his uncle.

Knowing he wanted to rebuild, Mohammed called Farm Credit and they came out to his farm the next day.

“I told them I wanted to build my operation back

“I told them I wanted to build my operation back up again. So, we started the process.”

—Mohammed Ahmad

up again,” Mohammed says. “So, we started the process.”

Mohammed secured a construction loan and started the process from the beginning, again. It took three months to clear the debris from the farm. Since then, the chicken houses have been under construction, and new flocks have been added over the past few months.

“We are very satisfied with how things are going,” says Hasnain. “Everyone is very helpful and collaborative at Farm Credit. They are one of the best lenders out there because they are so easy to work with.”

Since Mohammed is going through the construction process once more, he decided to add another chicken house on that sandy strip

of land. When everything is complete, he will have nine houses total.

Remnants of that challenging day can still be seen around the farm. The top of a feed bin has a puncture wound from a projectile object, and a twisted sheet of metal is jammed into a tree just past the chicken houses. Mohammed wants to leave it there as a reminder that they made it through the other side unharmed.

A lot has taken place at Ahmad Family Farm over the past year. Devastation and destruction were a big part of it. But, what really stands out is the resilience that Mohammed and his family have shown. They are grateful, rebuilding, and giving the kind of support to one another that only family can.

Buying land and building your dream home can be a very rewarding process, but one that can also be overwhelming. Whether you are currently in the process of buying land and building a home, or are planning to do so in the future, there are a multitude of factors to consider when buying land and building.

Farm Credit is here to help, and this article will help break down things to know when preparing to make your dream a reality.

One very important detail when deciding to build a home is the land you build on. When choosing your lot, take into consideration the following components.

Determine where you would like to live and what factors are important to you — like living in a very rural area or somewhere closer to a town or city, commute time, and proximity to amenities.

Land is classified as agricultural or residential, both of which are typically acceptable to build on. The difference may be in the amount of acreage that is attached. If you think you may need more acreage to grow crops or raise

livestock, an agricultural zoning will be a better fit for you.

To build a house, the property needs to have a percolation test done (be perc’d) to put in a septic system. If the property listing states the land has been perc’d, you will know how many bedrooms can be supported. The listing will also inform you if it has a well.

Utilities, Road Options, and Easements

Questions to ask include:

• Are utilities already on the property or do they need to be added?

• Is the driveway established, and do you have to share with neighbors?

• Does the property have easements? Easements are limitations of what you can do with the property. For example, if the property is in forest conversation, you will not be able to remove any wooded area from the property.

Surveys are not always required when purchasing land but may be necessary depending on the property and requirements for title work. A house survey — typically completed quickly and inexpensively — will determine where the house location will be on the land. A metes and bounds survey assesses property lines and land markings, is typically more expensive, and can take a longer time to complete.

Once you’ve bought the land, you’ll want to research potential home builders to determine who you’re most comfortable working with. You can request referrals to speak with previous clients and ask to walk through properties they’re currently building.

You’ll also want to thoroughly review the contract, the builder’s plans, and the timeline before

you sign on the dotted line. This will help you understand what the builder is doing and ensure they stick to the timeline you agreed upon.

When building your own home, there are typically two types of loans.

Lot Loan Options

If you are ready to purchase the land you want to build on but aren’t ready to build yet, a lot loan is a great option. Farm Credit offers lot financing with a 20% down-payment with 5-, 10- and 15-year fixed terms. It must be established as a buildable lot, which means it has already been perc’d. You do not need to have a timeline for when you are planning to build, so you can wait for as long as you need to start building your home.

Construction Loan Options

If you’re ready to buy land and build your home, Farm Credit offers 15- and 30-year constructionto-perm loans. During the building phase, you only pay interest. Once you have finished the 12-month construction period, the loan will revert back to a 15- or 30-year term.

To qualify, you must have a registered builder — no self-building is allowed. Farm Credit will finance up to 95% of loan to value, which is determined by the appraisal. Mortgage insurance and escrows may be required depending on your appraisal. There will also be a 10% cash reserve requirement before receiving the loan to ensure you have some funds in case of unexpected costs.

Before getting approved for a loan, you’ll want to make sure your credit score is good, ideally 700 and above. You’ll also be evaluated on the cash you have on hand before getting approved.

Beyond ensuring you can meet the requirements for a downpayment, having cash reserves for unexpected costs that occur in the building phase will help you pay for those quickly to stay on track with your timeline.

A 12-month construction loan comes with a sample draw schedule to prepare you for your building process. Each percent listed below is an example of how your loan would be applied to the building process:

20% will go toward the foundation draw: site preparation, excavation, footings, foundation walls, and waterproofing.

20% will go toward the framing draw: outside and inside wall framing, roof framing, roof sheathing/felt, and roof shingles.

10% will go toward windows and door draw: installation windows, exterior doors, and skylights.

25% will go toward the drywall draw: basement and slab concrete, rough-in plumbing, rough-in electric and wiring, rough-in HVAC, exterior siding being completed, outside wall insulation, drywall hug, drywall finished and ceiling textured, and well work and septic.

15% will go toward the trim draw: interior doors, interior trim, cabinet installation, and counter tops being installed.

10% will go toward the final draw: completion of the home according to the construction contract, including the seeding, grading, driveway, carpeting, resilient flooring, and final approval from all inspecting authorities in the county where the house is built.

At the completion of the house, it must have a certificate of occupancy, which will be provided by the county or township authority. Everything must be compliant with their codes before you can be approved to move into your home. *This credit only applies to loans in which the majority of the loan funds go toward construction of a primary or second home. Total loan amount may include funds for land acquisition. Limited to one credit per

There may also be upfront fees that are required in your county and state that you’ll want to prepare for.

Repayment ratios are also taken into consideration during the approval process. You do not want your debt ratio to be over 40%. Your lender may also ask for supporting financials like tax returns, W-2 statements, bank statements, paystubs, and profit and loss statements.

The thought of building a home can seem overwhelming — finding the right neighborhood, the perfect floorplan, and a builder you can trust takes time. But once the

paint dries and the keys are handed over, you will have the home of your dreams, built to suit you and your family’s needs — a place where you can gather, grow, and make memories.

No matter what your home sweet home looks like, Farm Credit is here to help make your dream a reality. To get started on building your dream home, contact a member of our team by calling 888.339.3334 or visit horizonfc.com to fill out our online form. For applications received in 2024 and closed by February 28, 2025, we’re offering a credit of $500 that can be applied to your loan fees*.

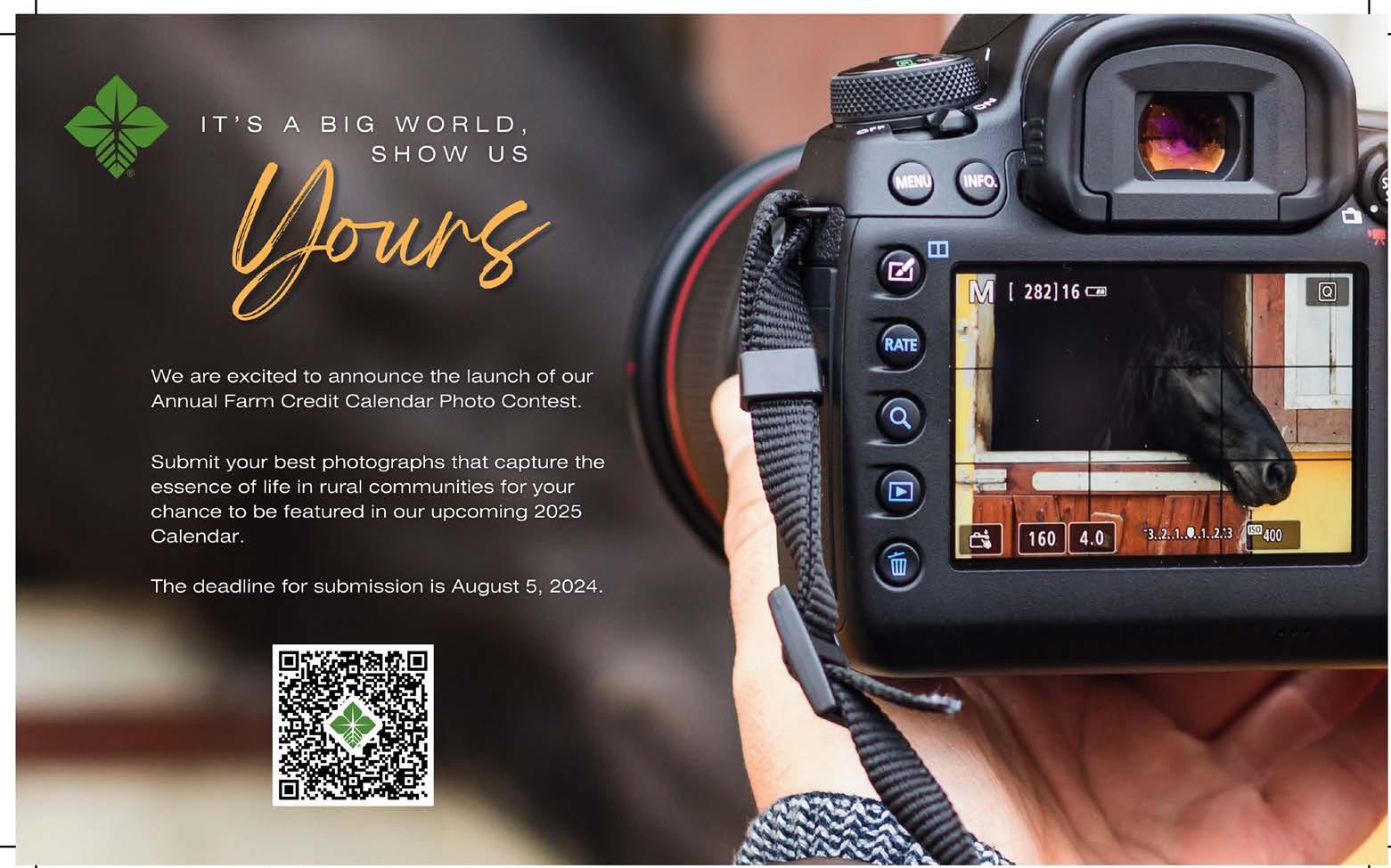

The Farm Credit Foundation for Agricultural Advancement was founded in 2015 and aims to ensure the future of agriculture is bright by investing in young adults pursuing careers in agriculture. With nearly 60,000 jobs opening within agriculture every year, a scholarship program is the perfect way to make a positive impact on the industry and the next generation of agriculturalists.

Each year, the Foundation offers scholarships to high school seniors or those currently enrolled in a two- or four-year higher education program, with plans to pursue a career in agriculture. These students aim for careers ranging from

farmers and producers to food scientists, veterinarians, ag teachers, and more.

This year, the Foundation awarded 39 scholarships totaling $315,000 to students from across Horizon Farm Credit’s 100 county footprint. The scholarships give students an opportunity to make their dreams come true. On the page to the right are the names of the individuals who received a scholarship in 2024.

For more information about the Farm Credit Foundation for Agricultural Advancement and its scholarship program, please visit FCFoundationForAg.org.

Alana Alexander-Giles of Marriottsville, MD

Shalelyn Armstrong of Port Royal, PA

Cheyenne Bastian-Brown of Ralston, PA

Brooke Beamesderfer of Annville, PA

Michael Berger of Weatherly, PA

Chloe Bomgardner of Jonestown, PA

Dalena Bryant of Frederick, MD

Jaclyn Bryant of Frederick, MD

Brielle Carter of Harrington, DE

Edwina Chen of Newark, DE

Andrea Clark of Newport, PA

Kaitlyn Collins of Clayton, DE

Charles Colvin V of Malvern, PA

Sam Curley of Mount Airy, MD

Sarah Diehl of McVeytown, PA

Peyton Dugan of Shepherdstown, WV

Avery Dull of Westminster, MD

Peyton Easton of Dover, DE

Alex Empet of Kingsley, PA

Ava Esterly of Pottstown, PA

Hayden Fox of North East, PA

Darcy Heltzel of Martinsburg, PA

Georgia Horosky of St. Peters, PA

Natalie Hummel of Macungie, PA

Kennah Kerns of Clearbrook, VA

Avery Kerrick of Greenwood, DE

Ashlynn Kidwell of Sykesville, MD

Sarah Lasko of Conneaut Lake, PA

Cody Lehman of Nescopeck, PA

Carly Lindley of Frederick, MD

Luke Michaud of Smyrna, DE

Brock O’Day of Seaford, DE

Tate Ondrik of New Market, MD

Breann Poole of Mt. Pleasant, PA

Hannah Uhlman of Exton, PA

Ella Vandervort of Townsend, DE

McKenna Vest of Clayton, DE

Faith Wolfe of Centre Hall, PA

Kelsey Zepp of New Windsor, MD

We distributed over $79 million in cash this spring!

When you work with Farm Credit, you’re not just a customer — you’re a member of our Association. One of the many benefits of membership is our unique patronage program, which reduces your cost of borrowing by sharing a portion of our Association’s profits with you.

From farm storage buildings to livestock barns and poultry houses, and everything in between, construction projects tend to rack up additional costs and fees, but that shouldn’t keep you from growing.

For applications received in 2024 and closed by February 28, 2025, we’re offering a credit of up

*This

*This