Benefits Guide

2026 January 1, 2026 - December 31, 2026

2026 January 1, 2026 - December 31, 2026

Your benefits are an important part of your overall compensation. We are pleased to offer a comprehensive array of valuable benefits to protect your health, family and way of life. This guide answers some of the basic questions you may have about your benefits. Please read it carefully, along with any supplemental materials you receive.

You are eligible for benefits if you work 30 or more hours per week. You may also enroll your eligible family members under certain plans you choose for yourself. Eligible family members include:

Your legally married spouse

Your registered domestic partner (RDP) and/or their children, where applicable by state law

Your biological children, stepchildren, adopted children or children for whom you have legal custody (age restrictions may apply). Disabled children age 26 or older who meet certain criteria may continue on your health coverage.

New Hires: You must complete the enrollment process within 30 days of your date of hire. If you enroll on time, coverage is effective on the first of the month following your date of hire. If you fail to enroll on time, you will NOT have benefits coverage (except for company-paid benefits) until you enroll during our next annual Open Enrollment period.

Open Enrollment: Changes made during Open Enrollment are effective January 1 – December 31, 2026.

Due to IRS regulations, you cannot change your elections until the next annual Open Enrollment period, unless you have a qualifying life event during the year. Following are examples of the most common qualifying life events:

Marriage or divorce

Birth or adoption of a child

Child reaching the maximum age limit

Death of a spouse, RDP or child

You lose coverage under your spouse’s/RDP’s plan

You gain access to state coverage under Medicaid or The Children’s Health Insurance Program

To change your benefit elections, you must contact Human Resources within 30 days of the qualifying life event. Be prepared to show documentation of the event, such as a marriage license, birth certificate or a divorce decree. If changes are not submitted on time, you must wait until the next Open Enrollment period to change your elections.

Dependents must go through verification before their benefits begin. Proof of spouse or partnership, proof of birth, adoption or legal custody must be provided at the time of initial enrollment in order to enroll in any dependent benefits. Once proof is provided, it will be confidentially stored and will not need to be verified in future enrollments for that dependent.

Medical

Dental

Vision

Cost of Benefits

Flexible Spending Accounts (FSAs)

Life and AD&D

Disability

Employee Assistance Program (EAP)

Travel Assistance Program

Voluntary Benefits

Retirement

Paid Time Off and Additional Benefits

Contact information

Required Information You will be required to enter a Social Security number (SSN) for all covered dependents when you enroll. The Affordable Care Act (ACA) requires the company to report this information to the IRS each year to show that you and your dependents have coverage. This information will be securely submitted to the IRS and will remain confidential.

Go to

https://secure.bswift.com/d efault.aspx?abbrev=capital

There you will find detailed information about the plans available to you and instructions for enrolling. Visual Benefits Presentation

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle. Following is a brief description of each plan.

This plan gives you the freedom to seek care from any provider of your choice. However, you will maximize your benefits and lower your out-of-pocket costs if you choose a provider who participates in the network.

The plan pays the full cost of qualified in-network preventive health care services.

You pay the full cost of non-preventive health care services until you meet the annual deductible. You may also have to pay a fixed dollar amount (copay) for certain services.

Once you meet the deductible, you pay a percentage of certain health care expenses (coinsurance) and the plan pays the rest.

Once your deductible, copays and coinsurance add up to the out-of-pocket maximum, the plan pays the full cost of all qualified health care services for the rest of the year.

The High-Deductible Health Plan (HDHP) works similarly to a traditional PPO:

You may see any health care provider and still receive coverage, but will maximize your benefits and lower your out-of-pocket costs if you see an in-network provider.

The plan pays the full cost of qualified in-network preventive health care services.

You pay the full cost of non-preventive health care services until you meet the annual deductible. NOTE: If you enroll one or more family members, each covered family member is only required to meet the INDIVIDUAL IN A FAMILY deductible (up to the family limit) before the plan starts to pay expenses for that individual.

Once you meet the deductible, you pay a percentage of your health care expenses (coinsurance) and the plan pays the rest.

Once your deductible and coinsurance add up to the out-ofpocket maximum, the plan pays the full cost of all qualified health care services for the rest of the year. NOTE: If you enroll one or more family members, each covered family member is only required to meet the INDIVIDUAL IN A FAMILY out-of-pocket maximum (up to the family limit) before the plan starts to pay covered services at 100% for that individual.

The HDHP comes with a type of savings account called a health savings account (HSA). The HSA lets you set aside pre-tax dollars to help offset your annual deductible and pay for qualified health care expenses.

Here’s how the HSA works:

You contribute pre-tax funds to the HSA through automatic payroll deductions.

In addition, we will contribute $1,000 annually to your HSA, if you enroll in employee-only coverage and $2,000 annually if you enroll yourself and one or more family members.

Your contributions, in addition to the company’s contributions, may not exceed the annual IRS limits listed below.

You can withdraw HSA funds, tax free, to pay for qualified health care expenses now or in the future. Unused funds roll over from year to year and are yours to keep, even if you change medical plans or leave your employer.

You must meet certain eligibility requirements to have an HSA: You must a) be at least 18 years old, b) be covered under a qualified HDHP, c) not be enrolled in Medicare and d) cannot be claimed as a dependent on another person’s tax return. For more information, visit www.irs.gov/formspubs/about-publication-969

For a complete list of qualified health care expenses, visit www.irs.gov/forms-pubs/about-publication-502.

Adult children must be claimed as dependents on your tax return for their medical expenses to qualify for payment or reimbursement from your HSA.

Following is a high-level overview of the coverage available. For complete coverage details, please refer to the Summary Plan Description (SPD).

Company Contribution to Your Health Savings Account (HSA) (per calendar year; prorated for new

Coinsurance percentages and copay amounts shown in the above chart represent what the member is responsible for paying.

*Benefits with an asterisk ( * ) require that the deductible be met before the Plan begins to pay.

To be eligible for the HSA, you cannot be covered through Medicare Part A or Part B or TRICARE programs. See the plan documents for full

1. If you use an out-of-network provider, you will be responsible for any charges above the maximum allowed amount.

2. The deductible and out-of-pocket maximums are embedded, meaning the no one member will pay more than the per person limit. Key Medical Benefits

Capital contributes to your HSA. Capital will contribute $1,000/$2,000 for those enrolled in the HDHP Plan.

Subtract Capital’s contribution from the IRS maximum when looking to maximize your contribution.

Capital University will not monitor whether contributions exceed the legal maximums. You, the participant, are responsible for ensuring that your contributions stay within allowed limits and, if they exceed those limits, you must take the appropriate actions.

You can continue to contribute to your HSA as long as you are not enrolled in any part of Medicare, including A, B or D. If you are deferring Medicare, you may want to start working with Medicare three-to-six months before turning 65.

Capital University will not monitor whether contributions exceed the legal maximums. You, the participant, are responsible for ensuring that your contributions stay within allowed limits and, if they exceed those limits, you must take the appropriate actions.

*The SECURE 2.0 Act, Section 109, increases the age 50+ contribution limit for individuals who have attained ages 60, 61, 62 and 63 that participate in 403(b) plans. Such individuals may contribute up to the greater of $10,000 or 150 percent more than the regular catch-up amount in 2026. The increased amounts are indexed for inflation after 2026. Please note that participants that will attain age 64 before the close of the taxable year Dec. 31, 2026, should be excluded from receiving the communication due to SECURE 2.0 provision language stating if a person attains age 64 before the close of the tax year Dec. 31, 2026, that individual is not eligible for the increased catch-up contribution amount.

Please note: The 2025 403(b) limits are listed. The 2026 limits have not been released.

For all retirement questions please contact TIAA Retirement Accounts at 1-800-842-2252. WEEKDAYS 8 A.M. – 10 P.M. (EST).

We are proud to offer you a dental plans.

This plan offers you the freedom and flexibility to use the dentist of your choice. However, you will maximize your benefits and lower your out-of-pocket costs if you choose a dentist who participates in the Delta Dental Premier network. The following is a high-level overview of the coverage available.

Coinsurance percentages shown in the above chart represent what the member is responsible for paying.

*Benefits with an asterisk ( * ) require that the deductible be met before the Plan begins to pay.

1. If you use an out-of-network provider, you will be responsible for any charges above the maximum allowed amount.

We are proud to offer you a vision plan.

This plan gives you the freedom to seek care from the provider of your choice. However, you will maximize your

and lower your out-of-pocket costs if you choose a provider who participates in the Eye Med network. The following is a high-level overview of the coverage available.

(once every 12 months) $150 allowance, 20% off

Contact Lenses (once every 12 months; in lieu of glasses) $150 allowance, 15% off balance over $150

We provide you with an opportunity to participate in our flexible spending accounts (FSAs) administered by Custom Design Benefits. FSAs allow you to set aside a portion of your income, before taxes, to pay for qualified health care and/or dependent care expenses. Because that portion of your income is not taxed, you pay less in federal income, Social Security and Medicare taxes.

You may contribute up to $3,400 to cover qualified health care expenses incurred by you, your spouse and your children up to age 26. Some qualified expenses include:

Coinsurance

Copayments

Deductibles Prescriptions and Over-the-Counter Drugs

Menstrual Care

Dental treatment

Orthodontia

Eye Exams, Materials, LASIK

For a complete list of eligible expenses, visit www.irs.gov/pub/irs-pdf/p502.pdf.

If you enroll in the HSA medical plan, you may only participate in a limited-purpose Health Care FSA. This type of FSA allows you to be reimbursed for eligible dental, orthodontia and vision expenses while preserving your HSA funds for eligible medical expenses.

You may contribute up to $7,500 (per family) to cover eligible dependent care expenses ($3,750 if you and your spouse file separate tax returns). Some qualified expenses include:

Care of a dependent child under the age of 13 by babysitters, nursery schools, preschool or daycare centers

Care of a household member who is physically or mentally incapable of caring for him/herself and qualifies as your federal tax dependent

For a complete list of eligible expenses, visit www.irs.gov/pub/irs-pdf/p503.pdf.

Life insurance provides your named beneficiary(ies) with a benefit after your death.

Accidental death and dismemberment (AD&D) insurance provides specified benefits to you in the event of a covered accidental bodily injury that directly causes dismemberment (i.e., the loss of a hand, foot or eye). In the event that your death occurs due to a covered accident, both the life and the AD&D benefit would be payable.

Basic Life/AD&D (Company-paid)

This benefit is provided at NO COST to you through Unum

YOU MUST ENROLL EACH YEAR TO PARTICIPATE

Because FSAs can give you a significant tax advantage, they must be administered according to specific IRS rules: Health Care FSA: Unused funds will NOT be returned to you or carried over to the following year.

Dependent Care FSA: Unused funds will NOT be returned to you or carried over to the following year.

You can incur expenses through 2025. You have 2.5 months to file 2025 claims.

Supplemental Life/AD&D (Employee-paid)

If you determine you need more than the basic coverage, you may purchase additional coverage through Unum for yourself and your eligible family members.

Disability insurance provides benefits that replace part of your lost income when you become unable to work due to a covered injury or illness.

Life is full of challenges, and sometimes balancing them all can be difficult. We are proud to provide a confidential program dedicated to supporting the emotional health and well-being of our employees and their families. The EAP is provided at NO COST to you through UNUM.

TheEAPcanhelpwiththefollowingissues,amongothers:

Mental health

Relationships or marital conflicts

Child and eldercare

Substance abuse

Grief and loss

Legal or financial issues

EAP Benefits

Assistance for you and your household members

Unlimited toll-free phone access and online resources

The travel assistance program through Unum can assist with many unexpected travel emergencies within the U.S. and abroad. Examples include replacing lost prescriptions and passports, medically necessary repatriation, emergency cash coordination, interpreter/translator services, and more. The Travel Assistance Program is offered through UNUM. Please contact HR for additional details.

Our benefit plans are here to help you and your family live well and stay well. But did you know that you can strengthen your coverage even further? It’s true! Our voluntary benefits through Voya are designed to complement your health care coverage and allow you to customize our benefits to you and your family’s needs. The best part? Benefits from these plans are paid directly to you! Coverage is also available for your spouse and dependents. You can enroll in these plans during Open Enrollment they’re completely voluntary, which means you are responsible for paying for coverage at affordable group rates.

Accident insurance can soften the financial impact of an accidental injury by paying a benefit to you to help cover the unexpected out-of-pocket costs related to treating your injuries. Some accidents, like breaking your leg, may seem straightforward: You visit the doctor, take an X-ray, put on a cast and rest up until you’re healed. But in reality, treating a broken leg can cost up to $7,5001. And it’s not only broken limbs an average non-fatal injury could cost you $6,620 in medical bills2 When your medical bill arrives, you’ll be relieved you have accident insurance on your side.

Most of us don’t have an extra $7,000 ready to spend and even if we do, we don’t want to spend it on medical expenses. Unfortunately, the average cost to treat a critical illness is just that: $7,0003. But with critical illness insurance, you’ll receive a lump-sum benefit if you are diagnosed with a covered condition. You can use this benefit however you like, including to help pay for: treatments, prescriptions, travel, increased living expenses and more.

When you or a dependent need to be hospitalized, your family deserves to focus on their well-being, not the stress of the average three-day hospital stay, which can cost you $30,0001 . Hospital indemnity insurance can help reduce costs by paying you or a covered dependent a benefit to help cover your deductible, coinsurance and other out-of-pocket costs due to a covered hospitalization.

With your Employee Assistance Program and Work/Life Balance services, confidential assistance is as close as your phone or computer.

Your EAP is designed to help you lead a happier and more productive life at home and at work. Call for confidential access to a Licensed Professional Counselor* who can help you.

A Licensed Professional Counselor can help you with:

• Stress, depression, anxiety

• Relationship issues, divorce

• A nger, grief and loss

• Job stress, work conflicts

• Family and parenting problems

• A nd more

You can also reach out to a specialist for help with balancing work and life issues. Just call and one of our Work/Life Specialists can answer your questions and help you find resources in your community.

Ask our Work/Life Specialists about:

• Child care

• Elder care

• Financial services, debt management, credit report issues

• Identity theft

• Legal questions**

• Even reducing your medical/dental bills!

• A nd more

Unum’s EAP services are available to all eligible partners and employees, their spouses or domestic partners, dependent children, parents and parents-in-law.

Not available in all states

*The counselors must abide by federal regulations regarding duty to warn of harm to self or others. In these instances, the consultant may be mandated to report a situation to the appropriate authority.

**State-mandated limitations for legal services in WA apply.

• E xpert support 24/7

• Convenient website

• Short-term help

• Referrals for additional care

• Monthly webinars

• Medical Bill SaverTM — helps you save on medical bills

Online and Phone support:

Unlimited, confidential, 24/7

In-person: You can get up to 3 visits, available at no additional cost to you with a Licensed Professional Counselor. Your counselor may refer you to resources in your community for ongoing support. Secure, HIPAA-compliant video EAP sessions for those who may prefer the use of technology to receive the service; video counseling services are in lieu of face-toface sessions.

Toll-free 24/7 access:

• 1-800-854-1446

• www.unum.com/lifebalance

Turn to us when you don't know where to turn.

The Work-life balance employee assistance program, provided by HealthAdvocate, is available with select Unum insurance offerings. Terms and availability of service are subject to change. Service provider does not provide legal advice; please consult your attorney for guidance. Services are not valid after coverage terminates. Please contact your Unum representative for details.

Capital University’s 403 (b) plan makes saving for retirement easy and painless.

Half-time or greater employees who join Capital University on or after January 1, 2023, will be eligible for 2.5% employer contributions subject to a 5-year vesting schedule into a 403 (b) plan with TIAA. After 5 years of employment with Capital, the University’s contribution rate goes to the employer maximum contribution rate and the employee becomes fully vested. The current employer maximum rate is 4.5%. Employees hired before January 1, 2023 are fully vested.

Part-time employees are not eligible for employer contributions.

Half-time or greater employees hired on or after January 1, 2023, are subject to an auto-enrollment of 5% personal contribution unless they elect differently. The employee is eligible to contribute into a 403 (b) plan via payroll deduction up to the federal maximum. All employee contributions have immediate vesting.

Part-time employees are eligible to contribute into a 403 (b) plan via payroll deduction up to the federal maximum. Part-time employees are NOT subject to the auto-enrollment provision. All employee contributions have immediate vesting.

Capital University reserves the right to make changes to the plan as needed at any time. Learn more about your investment choices online at TIAA.org/capital. For a full look at plan provisions, see HR or log into your account to access our Plan Document.

There are additional benefits that come from working in a university setting as well as working in a caring community. This summary highlights these benefits and the options that are available to employees working at least half-time. For more detailed information, please contact human resources at 614.236.6168 or benefits@capital.edu.

Staff and Administrators (Half-Time or Greater)

20 days per year

Maximum account balance =25 days

Faculty and other employees working less than 12 months

Employees in this category follow academic calendar year and do not accrue vacation leave.

Administrators and Faculty (Half-Time or Greater) 20 days per year

Maximum account balance =6 months

Staff (Half-Time or Greater) 22 days per year

Maximum account balance =6 months

Capital observes the following holidays:

❖ Good Friday

❖ Memorial Day

❖ Juneteenth

❖ Fourth of July

❖ Labor Day

❖ Wednesday before Thanksgiving

❖ Thanksgiving Day

❖ Friday after Thanksgiving

❖ Extended Holiday Break (includes Christmas Eve through New Year’s Day)

Up to five days paid leave for immediate family members spouse/ domestic partner, child or step-child, mother, father. Up to three days paid leave for other family members brother, sister, mother-in-law, father-in-law, sister-in-law, brotherin-law, grandmother, or grandfather.

Employees, their spouses and dependent children are eligible for tuition remission for undergraduate programs at Capital University. Students are required to complete a Free Application for Federal Student Aid (FAFSA). Employees may also participate in graduate level programs if they are job related. Eligible employees may apply for Tuition Exchange which allows their dependent children to attend a participating school for a discounted tuition.

Capital University’s dining services are offered on campus through Aladdin. They offer discounted meal rates at the Main Dining Room (MDR, located on the second floor of the Student Union) for faculty and staff. You can also load CapBucks on your ID badge by visiting the Aladdin office (located in the MDR) or by phone 614.236.6125.

Below are some of the added benefits that are available to employees of the University, including special offers and discounts. To take advantage of these offers, identify yourself as a Capital University employee. You may also be required to show your Capital University ID card.

❖ Athletic events

❖ Capital Center (workout options)

❖ Libraries (we have 3)

❖ Schumacher Gallery

❖ Music and theater productions

❖ Parking privileges

❖ Bookstore discounts

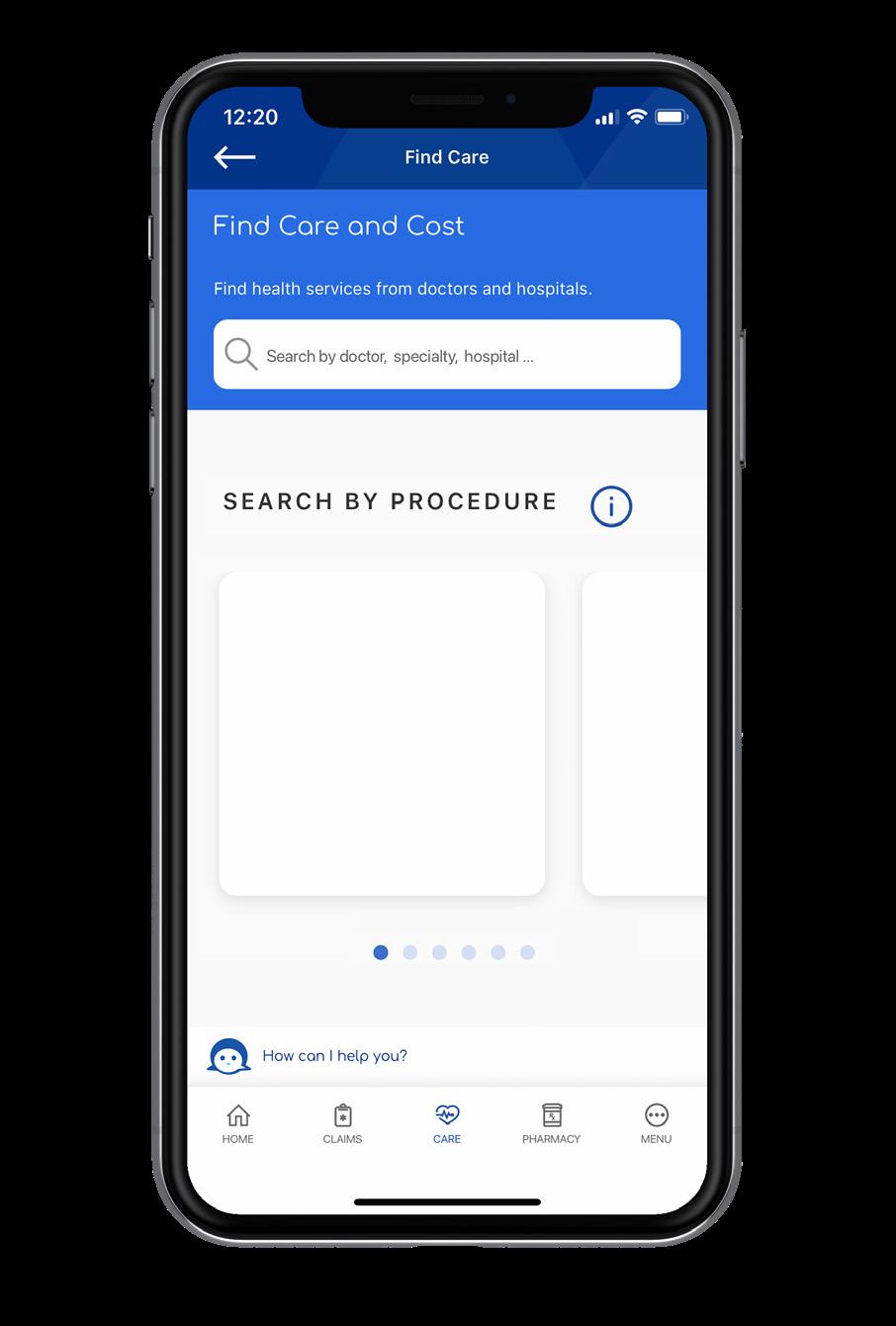

Choosing a doctor you trust is important — and choosing one in your plan’s network can keep your costs down. The Find Care tool on the SydneySM Health app and anthem.com can help you meet both needs.

The Find Care tool brings together details about doctors in your plan’s network. You can customize your search by name, location, specialty, or procedure. You also can compare information such as costs, languages spoken, and office hours.* To make sure a care provider is in your plan’s network, view the doctor or facility profile.

To help you find care providers who would be a good fit for you, we sort your search results and provide the top three matches using Personalized Match. There are more options available below your top three, and you can always re-sort these search results by distance or name.

After viewing your initial search results, you can filter your results by selecting the relevant boxes on the left or browsing by list or map views.

Search by name, specialty or procedure.

Customize and refine results

Compare doctors and cost

Scan the QR code to download the Sydney Health mobile app. Then select Find Care and Cost from the Care menu. Or you can log in to anthem.com and select Find Care and Cost from the Care menu.

¿Prefieres obtener información en español? Tienes opciones. Si tu teléfono móvil ya está configurado en español, la aplicación Sydney Health también estará en español. Si no es así, selecciona el menú dentro de la aplicación Sydney Health y elige el idioma de la aplicación. También puedes visitar espanol.anthem.com.

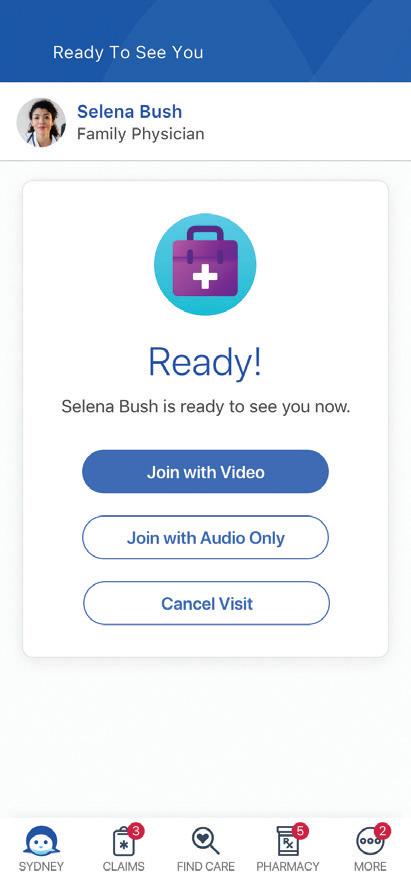

H hguorht lautri:eracv

Dtsoc-on ruo S yendyhtlaeH .ppa

1.R .ni gol dna )tey

2.O drowssap dna

adna ppa ruo

3.S tcele Ceratceles neht dna

V tisi amoc.mehtn

1.R .ni gol dna )tey

2.O drowssap dna

amoc.mehtn .

VeraC lautri

arof emas eht amoc.mehtn ruo dna

S yendyhtlaeH .ppa

3.F eht mor Cera tceles ,bat VeraC lautri eht

dkcilc ,nehT .unem

Osnoitp

VtisiV oedi

naicisyhp.tnemgduj1 potlanoitan.stneilc2 I .rehgihuoYyamosla ruoyhtlaeh.nalpr ssorCdnaeulB.dleihSL htiwnegordyH.htlaeHS

A eulBssorCeulBdleihS H ,)TIR(yhtlaeH®ecnaillA

L dnatonetirwrednu b ,erihspmaH.cnIdna u .CLL:oihOytinummoC ,xafriaFehtnwoTI noitaroproC)eracpmoC(V W kramedartmehtnA ecnarusn,seinapmoC.cnII

Use SydneySM Health to keep track of your health and benefits — all in one place. With a few taps, you can quickly access your plan details, Member Services, virtual care, and wellness resources. Sydney Health stays one step ahead — moving your health forward by building a world of wellness around you.

Search for doctors, hospitals, and other healthcare professionals in your plan’s network and compare costs. You can filter providers by what is most important to you, such as gender, languages spoken, or location. You’ll be matched with the best results based on your personal needs.

Use My Health Dashboard to find news on health topics that interest you, health and wellness tips, and personalized action plans that can help you reach your goals. It also offers a customized experience just for you, such as syncing your fitness tracker and scanning and tracking your meals.

Connect directly to care from the convenience of home. Assess your symptoms quickly using the Symptom Checker or talk to a doctor via chat or video session.

This resource center helps you connect with organizations offering no-cost and reduced-cost programs to help with challenges such as food, transportation, and child care.

See a full picture of your family’s health in one secure place. Use a single profile to view, download, and share information such as health histories and electronic medical records directly from your smartphone or computer.

Tienes opciones. Si tu teléfono móvil ya está configurado en español, la aplicación Sydney Health también estará en español. Si no es así, selecciona el menú dentro de la aplicación Sydney Health y elige el idioma de la aplicación. También puedes visitar espanol.anthem.com

the app anytime to:

Find care and compare costs.

See what’s covered and check claims.

Check your plan progress.

You can also set up an account at anthem.com/register to access most of the same features from your computer.

Complete pair of prescription eyeglasses

Non-prescription sunglasses

% OFF

Remaining balance beyond plan coverage These discounts are not insured benefits and are for in-network providers only.

• You’re on the Insight Network

• For a complete list of in-network providers near you, use our Enhanced Provider Locator on eyemed.com or call 1-866-804-0982

• For LASIK providers, call 1-877-5LASER6

Don’t forget this travel essential!

Pack your worldwide emergency travel assistance phone number and leave travel worries at home.

If you experienced a medical emergency while traveling, would you know whom to call?

Whenever you travel 100 miles or more from home — to another country or just another city — be sure to pack your worldwide emergency travel assistance phone number. Travel assistance speaks your language, helping you locate hospitals, embassies and other “unexpected” travel destinations. Add the number to your cell phone contacts, so it’s always close at hand. Just one phone call connects you and your family to medical and other important services 24 hours a day.

Use your travel assistance phone number to access:

• Hospital admission assistance*

• Emergency medical evacuation

• Prescription replacement assistance

• Transportation for a friend or family member to join a hospitalized patient

• Care and transport of unattended minor children

• Assistance with the return of a vehicle

• Emergency message services

• Critical care monitoring

• Emergency trauma counseling

• Referrals to Western-trained, English-speaking medical providers

• Legal and interpreter referrals

• Passport replacement assistance

With the Assist America Mobile App, you can:

• Call Assist America’s Operation Center from anywhere in the world with the touch of a button.

• Access pre-trip information and country guides.

• Search for local pharmacies (U.S. only).

• Download a membership card.

• View a list of services.

• Search for the nearest U.S. embassy.

• Read Assist Alerts.

Download and activate the app today from the Apple® App Store or Google PlayTM.

Reference Number: 01-AA-UN-762490

24/7 services anywhere in the world

Unum travel assistance services are provided by Assist America, Inc., a leading provider of global emergency assistance services through employee benefit plans. Assist America’s medically certified personnel are ready to help 24 hours a day, 365 days a year, and can connect you with pre-qualified, English-speaking and Western-trained medical providers anywhere in the world.

Unum travel assistance services are provided by Assist America, Inc., a leading provider of global emergency assistance services through employee benefit plans. Assist America’s medically certified personnel are ready to help 24 hours a day, 365 days a year, and can connect you with pre-qualified, Englishspeaking and Western-trained medical providers anywhere in the world.

Whether traveling for business or pleasure, one phone call connects you to:

• Multilingual, medically certified crisis management professionals

• A state-of-the-art global response operations center

You can access travel assistance services through the phone number on your travel assistance wallet card. If you have misplaced your card, contact your human resources department and ask for a replacement.

• Qualified medical providers around the world

If you need travel assistance anywhere in the world, contact us day or night.

Within the U.S. 1-800-872-1414

Outside the U.S. (U.S. access code) +609-986-1234

Via e-mail: medservices@assistamerica.com

Whether traveling for business or pleasure, one phone call connects you to:

Which countries can I travel to?

• Multilingual, medically certified crisis management professionals

Assist America’s services have no geographical exclusions. Its worldwide network stands ready to help wherever your travels take you.

• A state-of-the-art global response operations center

• Qualified medical providers around the world

Is my family covered?

Travel assistance FAQs

Your spouse and dependent children up to age 19 (or the age specified by your medical plan) are covered.**

Which countries can I travel to?

Are pre-existing conditions excluded?

Assist America’s services have no geographical exclusions. Its worldwide network stands ready to help wherever your travels take you.

No. Whether your medical emergency is the result of a new or pre-existing condition, Assist America’s trained representatives will help you find qualified medical care and facilities.

my family covered?

What about sports-related injuries?

Your spouse and dependent children up to age 19 (or the age specified by your medical plan) are covered.**

Are pre-existing conditions excluded?

Whether you’ve been involved in recreational or extreme sporting, worldwide emergency travel assistance will provide support for all your medical needs.

No. Whether your medical emergency is the result of a new or pre-existing condition, Assist America’s trained representatives will help you find qualified medical care and facilities.

Who pays for the services I use if I have a travel emergency?

What about sports-related injuries?

Assist America arranges and pays for 100% of the services the company provides, with no caps or chargebacks to either you or your employer. But you must call Assist America first — you can’t be reimbursed for services you arrange on your own.*

Whether you’ve been involved in recreational or extreme sporting, worldwide emergency travel assistance will provide support for all your medical needs.

Who pays for the services I use if I have a travel emergency?

Assist America arranges and pays for 100% of the services the company provides, with no caps or chargebacks to either you or your employer. But you must call Assist America first — you can’t be reimbursed for services you arrange on your own.*

Perks at Work is here to help you save more on everyday purchases, both big and small. Whether you’re buying a new TV or planning a vacation, Perks at Work gives you access to employee pricing and rewards points on a variety of retailers.

Follow these simple steps to get started:

1. Go to www.perksatwork.com and click “Register for Free”

2. Enter your work email address, and type your company name in the Company box

3. Select “Create My Account” and start saving!