Monthly Market Update

Monthly Market Update

September 2025

Victoria and BC Real Estate Markets Show Seasonal Slowdown, Stable Prices, and Signs of Shifting Momentum

September 2, 2025

The Victoria and BC real estate markets experienced a seasonal cooldown in August, with fewer sales, steady prices, and a cautious eye on the Bank of Canada’s upcoming rate decision.

Victoria Market: A Quiet but Steady Summer

Finish

Greater Victoria saw a larger-than-usual dip in sales last month, resulting in the slowest August since 2022. A total of 525 properties sold across the Victoria Real Estate Board region, down 3.7% from August 2024 and 22.8% from July 2025.

� Condominium sales fell 16% year-over-year with 152 units sold.

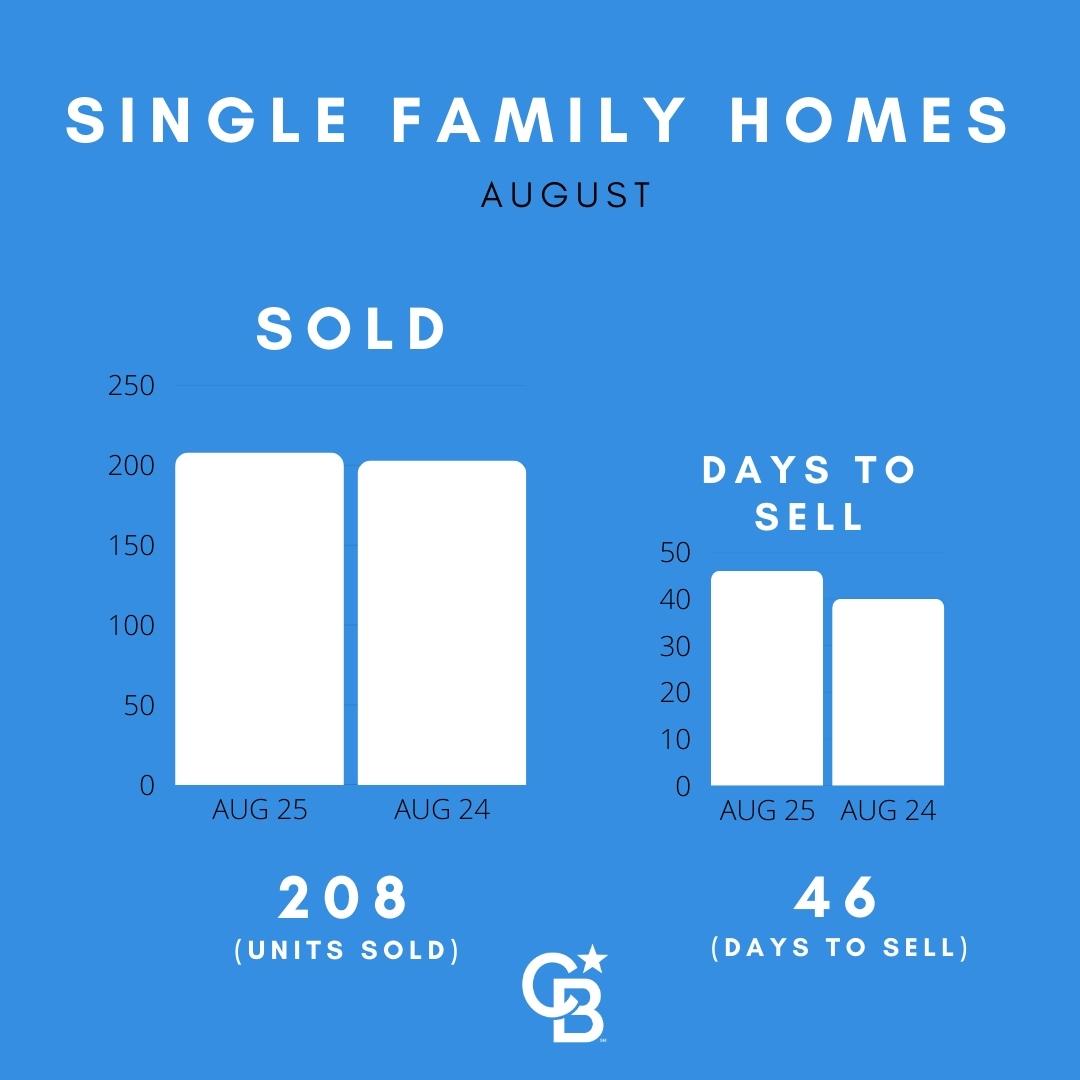

� Single-family home sales bucked the trend, increasing 6.3% year-over-year with 268 transactions.

Inventory also edged lower for the second consecutive month. At the end of August, there were 3,600 active listings, down 2.8% from July but up 12.8% compared to last year. Despite the monthly decline, available listings remain nearly 50% above their long-run average.

“August was a quiet but steady month,” said Victoria Real Estate Board Chair Dirk VanderWal. “It’s typical for buyers and sellers to pause during late summer for vacations and back-to-school. The market tends to pick up again in fall as more listings come online.”

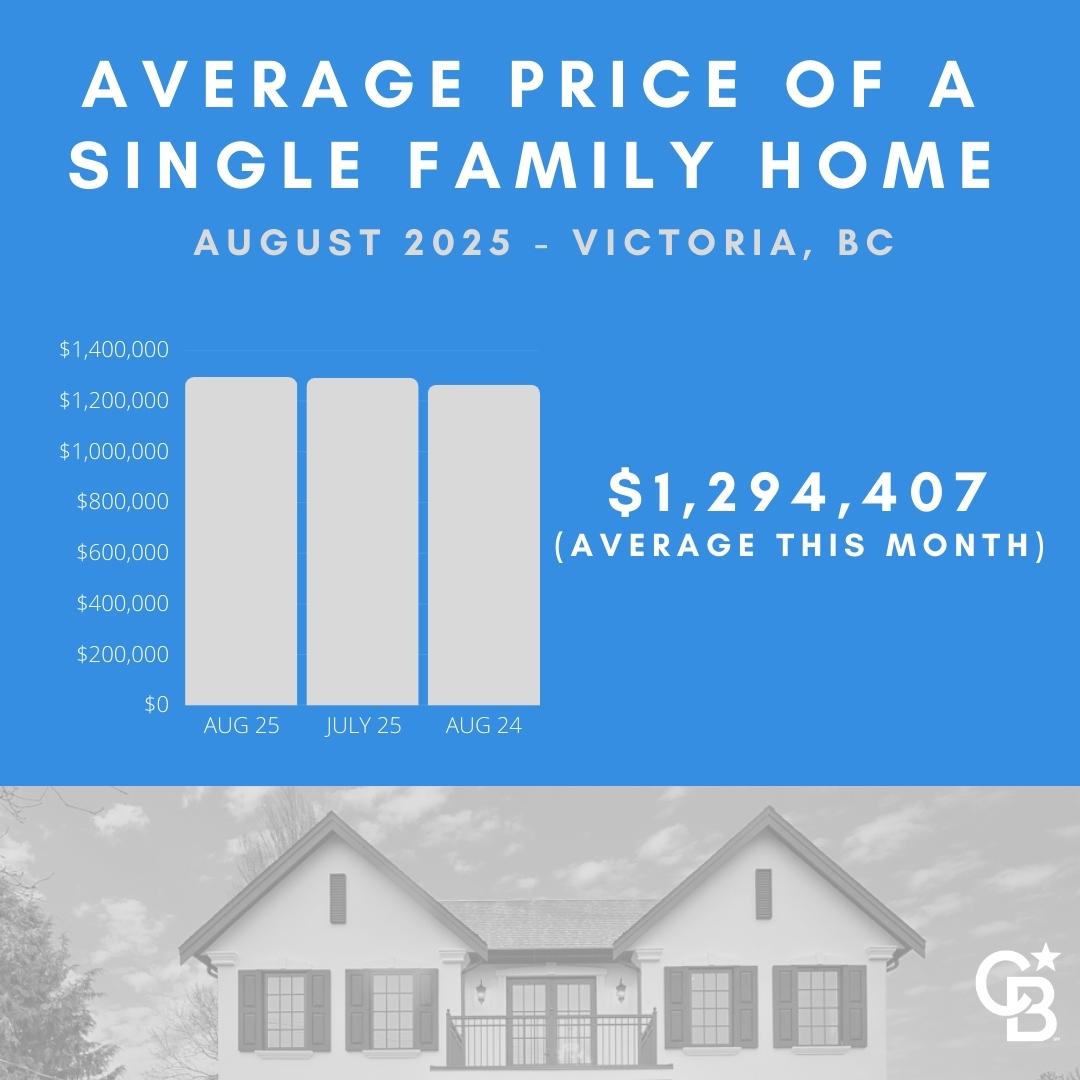

Price trends remain stable. The benchmark price for a singlefamily home in Victoria’s core rose 1.6% year-over-year to $1,308,100, though slightly lower than July’s $1,338,800. The

benchmark condo price fell 1.4% from last year to $551,300, also easing from July.

The current market pace allows buyers and sellers more time for careful decisions, a sharp contrast to the frenzied conditions of five years ago.

Vancouver and the Lower Mainland: Slowest August in Over a Decade

Metro Vancouver mirrored Victoria’s slowdown. After a strong July, sales fell sharply, marking the region’s slowest August since 2012. While inventory is declining month to month, it remains well above average levels. Median prices slipped across all home types, reflecting a more cautious market.

Provincial Outlook: Stabilization and Flat Prices

According to the BC Real Estate Association (BCREA), provincial resale inventory has stabilized at just over 40,000 listings—the highest level in more than a decade. This stability, coupled with weaker demand in the Lower Mainland, has put downward pressure on prices there. By contrast, markets with stronger demand, including Vancouver Island, may see modest growth.

“Trade-related uncertainty upended hopes for a more normal market through the first half of 2025,” said BCREA Chief Economist Brendon Ogmundson. “But many regions are now settling into long-run averages and should move into 2026 with some momentum.”

Overall, BCREA forecasts flat average home prices in 2025, with modest increases expected in 2026 as supply and demand rebalance.

Economic Context: All Eyes on the Bank of Canada

The broader economic backdrop is adding to the uncertainty. Canada’s inflation rate dropped to 1.7% in July, lower than economists expected. Gasoline costs were the main driver of the decline, though shelter expenses—including rents and mortgage interest—continue to climb.

The Bank of Canada has held rates steady through its last three meetings but came close to cutting in July. With softer inflation and weaker GDP data, many analysts now expect a rate cut at the September 17 meeting. Some, however, caution that stronger domestic demand could delay any easing.

Economists remain divided. Andrew Grantham of CIBC forecasts rate cuts starting in September, while others argue the Bank may hold until more data on jobs and growth come in.

What It Means for Buyers and Sellers

For now, stability defines much of the BC housing market. Buyers are seeing more inventory and less competition than in recent years, while sellers are adjusting expectations to longer listing periods and different price points.

With interest rates potentially heading lower, the fall market could see a boost in activity across Victoria and the province. But for the moment, late summer has brought a pause—a breather that gives both sides of the market space to plan for the months ahead.

Michele, Mark and Eric’s take on the market

Here in Greater Victoria, the late-summer slowdown is no surprise. August is often a month where people take a step back to enjoy the season and focus on family, travel, and back-to-school. What stands out this year, however, is the balance in the market: buyers have more time to consider their options, and sellers are learning to be patient.

If interest rates ease this fall as many expect, we could see renewed energy in the market. But even without a big change in rates, Victoria remains a market with strong fundamentals — desirable lifestyle, limited land supply, and steady long-term demand. In short, this quieter moment is more a pause than a downturn, and it’s setting the stage for a more active fall season.

Sincerely,

Michele, Mark and Eric