Monthly Market Update

Monthly Market Update

June 2025

Steady, Balanced, and Busy: Victoria’s Real Estate Market in May

Victoria’s real estate market in May delivered positive news for both buyers and sellers. The tone of the month was one of balance—a welcome shift from the highly competitive markets we've seen in recent years. With ample new listings hitting the market, inventory outpaced brisk sales, providing buyers with more choice and reducing competition for high-demand properties. Sellers, meanwhile, continued to benefit from stable prices and steady interest rates.

This stability might not make headlines for excitement, but it's exactly what many consumers have been hoping for: a more predictable and comfortable market to navigate.

In terms of activity, 758 properties sold across the Victoria Real Estate Board region in May. While that's just 0.7% shy of the 763 sales in May 2024, it's a notable 18.1% jump from April 2025— marking the highest monthly sales total since May of last year.

We also saw a significant surge in new listings, the highest since May 2008, which helped maintain balance across our market segments. However, it’s important to remember that Victoria’s housing market is made up of many micro-markets. The experience of shopping for a downtown condo can be entirely different from searching for a suburban detached home, and your strategy should reflect that.

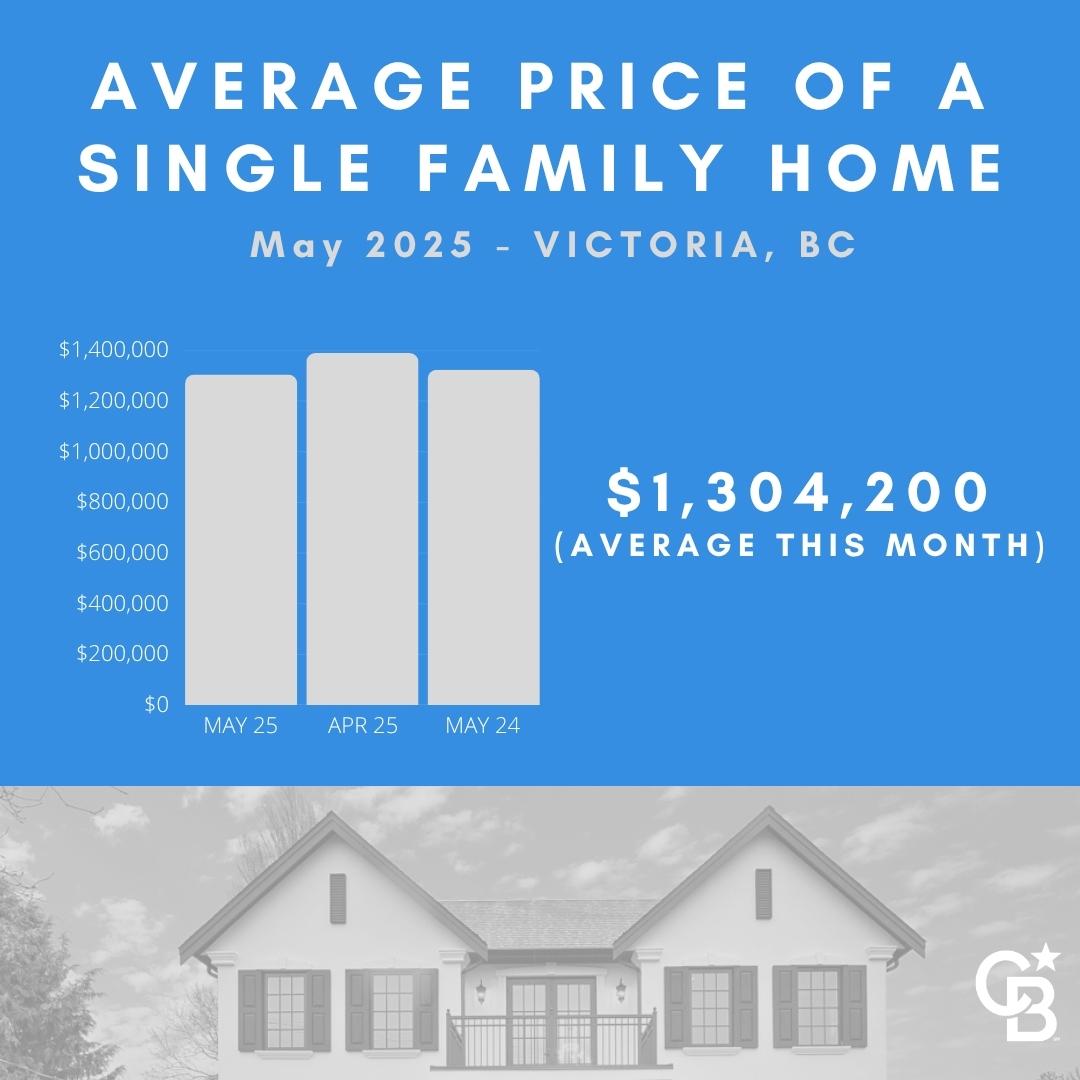

Condo sales in May dipped slightly—down 6% from last year with 221 units sold. On the other hand, single-family home sales saw a

modest increase of 0.5%, with 401 units sold. The sweet spot for demand appears to be homes priced under $1.4 million—a price range that continues to attract strong buyer interest.

As always, presentation matters. In today’s market, spotless condition and attention to detail are more important than ever. Homes that show pride of ownership—whether it’s fresh paint on baseboards, a weeded garden bed, or a tidy front entry—tend to sell faster and for better prices.

If you're thinking of listing, we’re here to help. We offer complimentary home walk-throughs, either with our team or alongside a professional stager, to ensure your home is market-ready.

The time and care you invest before hitting the market can make all the difference in achieving a smooth and profitable sale.

Interest Rates Holding Steady

For the second time in a row, the Bank of Canada just announced it’s holding the policy interest rate steady. With continued rate stability, this could be a great time for buyers who’ve been waiting on the sidelines to step into the market.

This second straight pause comes after seven consecutive drops in their rate, keeping the benchmark rate at 2.75%.

From a buyer’s perspective, many have been waiting for rates to continue dropping. The Bank took a cautious stance, saying: "Governing Council is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy."

While rates may not return to pandemic-era levels, we’re not too far off from where they were in the pre-COVID market.

Have questions about your property's value or how to prepare for a summer sale? We’re happy to chat anytime.

Sincerely,

Michele, Mark and Eric

First Time Home Buyer’s GST Rebate

Here’s a summary of the First-Time Home Buyers’ GST Rebate (FTHB GST Rebate):

Eligibility

• Must be a first-time home buyer (18+, Canadian citizen/permanent resident, and haven’t owned a home in the past 4 years).

• Applies to:

- New homes bought from a builder

- Owner-built homes

- Shares in a co-op housing corporation

Rebate Details

• Offers up to $50,000 in GST rebate (federal portion of HST).

• Full rebate on homes valued up to $1 million.

• Phased out between $1 million–$1.5 million (e.g., 50% rebate for a $1.25M home).

• No rebate for homes $1.5 million or more.

Conditions

• Home must be the buyer’s primary residence.

• Buyer must be the first occupant of the home.

• Applies if purchase/construction starts on or after May 27, 2025, and:

- Agreement signed before 2031

- Home substantially completed before 2036

Restrictions

• Can only claim the rebate once in a lifetime.

• Ineligible if spouse/partner already claimed it.