Monthly Market Update

Monthly Market Update

August 2025

VREB’s Monthly Market update

� The VREB has issued an updated media package that includes stats on how many listings and sales there currently are, plus pricing trends in the Greater Victoria area.

� As of the end of July 2025, there were 3,703 active MLS® listings, a slight 2% drop from June but 10.6% higher than July 2024.

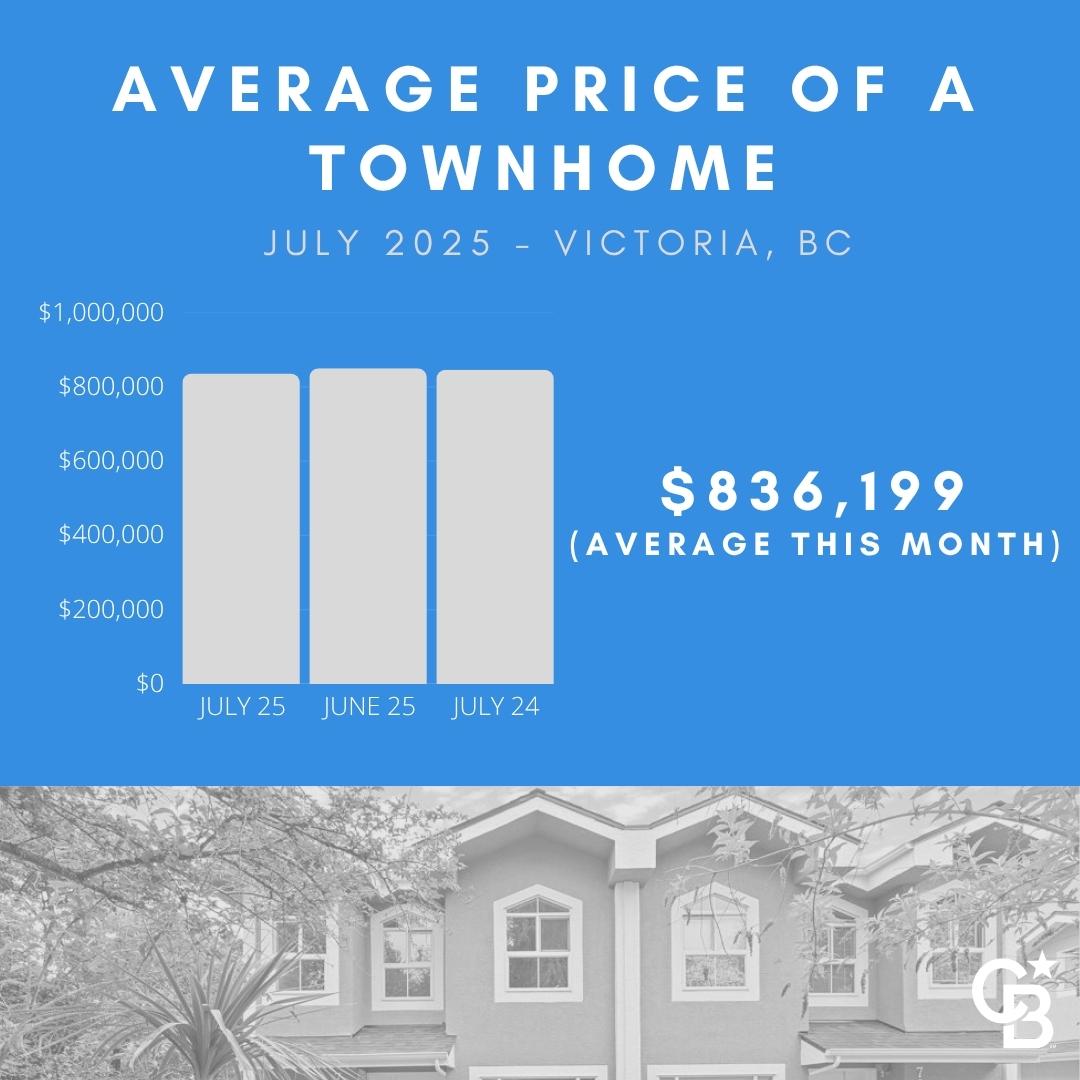

� The benchmark price for a single-family home in the Victoria core area rose from $1,296,100 in July 2024 to $1,338,800 in July 2025—a 3.3% gain. Meanwhile, benchmark condo prices dipped slightly from $567,800 down to $563,300.

Bank of Canada & National Trends from Canadian Mortgage Trends

� On July 30, 2025, the Bank of Canada held its policy rate at 2.75%, marking the third straight decision to pause. Most economists expect at least two rate cuts later in 2025, perhaps starting in September.

� Despite lower policy rates, fixed mortgage rates are climbing again, with many five-year fixed rates now above 4%, thanks to rising bond yields.

� Around 60% of mortgage holders renewing in 2025 and 2026 are expected to face higher payments—especially those with fixed-rate mortgages.

� According to CMHC data:

o Canadian housing starts were broadly flat in May 2025 (~279,500 annualized units), then surged 0.4% in June to ~283,700 units, beating expectations.

o CMHC had forecast a 6.6% decline in total housing starts for 2025, with a gradual rebound expected in 2026.

Victoria Summer Market: Quiet but with Growing Momentum

� As is typical in summer, sales and new listings have slowed in Greater Victoria. Inventory remains steady in the low-to-mid 3,700s range

� Prices are largely stable—single-family homes showing modest growth, condos down slightly.

� This summer market pattern—fewer buyers and sellers—is normal. But signs of increased activity as fall approaches are already noticeable in more showings, early inquiries, and re-positioning by sellers.

Looking Ahead: Fall Market Expectations

� Falling interest rates later in 2025 could improve affordability and encourage renewed buying.

� Mortgage payments for many renewals may increase temporarily in 2025, which could dampen demand—but also spur more fixed-rate renewals and refinancing activity.

� Housing starts may begin to rise more strongly in 2026, helping long-term supply.

Perspective Key Take-Aways

Buyers More time and options in summer. If you’re renewing soon, beware of rIsing payments. Keep an eye out for better rates later in fall.

Sellers Well-presented homes are still selling. With demand picking up into fall, pricing strategically matters.

Investors / Movers Inventory is modest but stable. As interest rates ease, activity may pick up—especially in popular neighbourhoods.

In Summary

1. The new VREB media package (today) shows slightly fewer listings than June, but more than last year, and modest price gains for homes.

2. The Bank of Canada paused rates at 2.75%, but fixed mortgage rates remain elevated at or above 4%.

3. Housing starts are flat nationally, with a small bump in June—but overall down from last year, with a modest recovery expected next year.

4. Locally, it’s a classic quiet summer real estate market with low activity—but early signs of momentum for a busier fall market.

5. The Vancouver Region saw its highest monthly sales count of The year in July, though sales were still down considerably relative to their long-run monthly average. Meanwhile, active listings declined marginally month-over-month for the fIrst time this year.

6. Greater Victoria saw its busiest July for home sales in four years, with townhomes registering their highest monthly sales count since April 2022. Meanwhile, active listings declined for the first time this year.

If you’d like, We can explain how the MLS® media package breaks down by property type or neighbourhood—or share tips on timing your listing ahead of the fall upswing!

Sincerely,

Michele, Mark and Eric