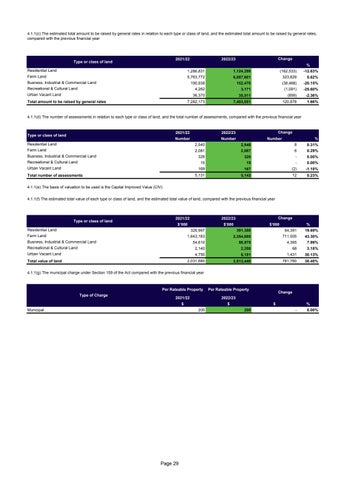

4.1.1(c) The estimated total amount to be raised by general rates in relation to each type or class of land, and the estimated total amount to be raised by general rates, compared with the previous financial year

2021/22

Type or class of land

Change

2022/23

%

Residential Land

1,286,831

1,124,298

Farm Land

5,763,772

6,087,601

323,829

5.62%

190,938

152,470

(38,468)

-20.15%

Busness, Industrial & Commercial Land Recreational & Cultural Land

-12.63%

4,262

3,171

(1,091)

-25.60%

36,370

35,511

(859)

-2.36%

7,282,173

7,403,051

120,878

1.66%

Urban Vacant Land Total amount to be raised by general rates

(162,533)

4.1.1(d) The number of assessments in relation to each type or class of land, and the total number of assessments, compared with the previous financial year

Type or class of land

2021/22

2022/23

Number

Number

Change Number

%

Residential Land

2,540

2,548

8

0.31%

Farm Land

2,081

2,087

6

0.29%

326

326

-

0.00%

15

15

-

0.00%

169

167

(2)

-1.18%

5,131

5,143

12

0.23%

Busness, Industrial & Commercial Land Recreational & Cultural Land Urban Vacant Land Total number of assessments 4.1.1(e) The basis of valuation to be used is the Capital Improved Value (CIV)

4.1.1(f) The estimated total value of each type or class of land, and the estimated total value of land, compared with the previous financial year

Type or class of land

2021/22

2022/23

$’000

$’000

Residential Land

Change $’000

%

326,997

391,388

64,391

19.69%

1,643,183

2,354,688

711,505

43.30%

54,610

58,975

4,365

7.99%

Recreational & Cultural Land

2,140

2,208

68

3.18%

Urban Vacant Land

4,750

6,181

1,431

30.13%

Total value of land

2,031,680

2,813,440

781,760

38.48%

Farm Land Busness, Industrial & Commercial Land

4.1.1(g) The municipal charge under Section 159 of the Act compared with the previous financial year

Type of Charge

Per Rateable Property

Per Rateable Property

2021/22

2022/23

$ Municipal

$ 200

Page 29

Change $

200

% -

0.00%