HENLEY IS DEVELOPING THE LEADING EXPRESS CAR WASH PLATFORM ACROSS THE SOUTHEASTERN UNITED STATES – A VALIDATED, SCALABLE, HIGH-MARGIN BUSINESS MODEL.

INVESTMENT RATIONALE

• Validated Business Model

The inaugural Florida site has materially exceeded underwriting expectations at stabilization across membership growth, wash volumes, margins, and investor returns.

• Scalable Operating Platform

Implementation of AI assisted site selection, distinctive branding, and a seasoned operations team positioned for rapid market expansion.

• Compelling Market Dynamics

A $28 billion global industry exhibiting 7% CAGR, characterized by significant fragmentation and platforms valued at 12–15x EBITDA multiples.

• Direct Equity Ownership

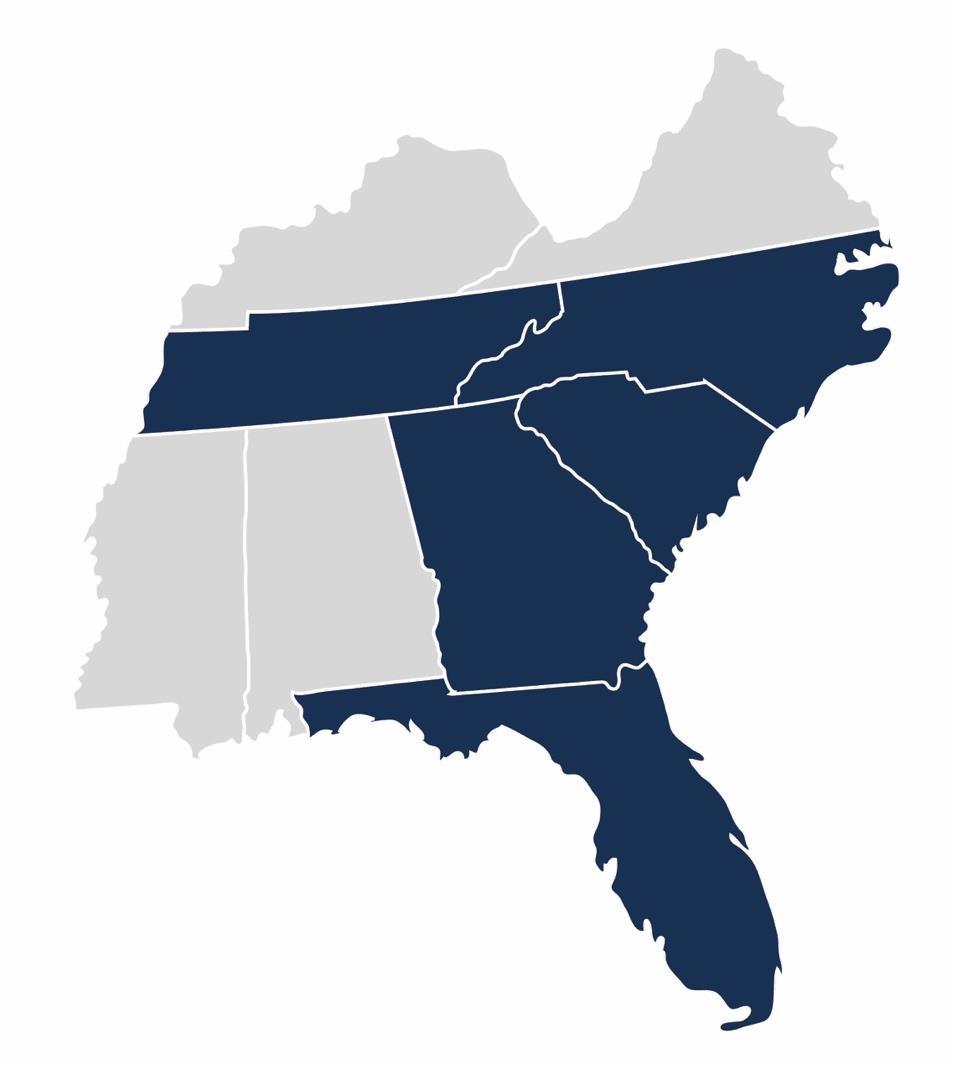

Direct equity interests in a diversified portfolio of 10 sites spanning Florida, Georgia, the Carolinas, and Tennessee.

• Attractive Returns Profile

Projected equity multiple of 3.3x and a 40% IRR, with upside potential evidenced by Fund I currently tracking significantly over original underwrite.

• Predictable Cash Flow

Distributions generated from stabilized stores underpinned by membership-based recurring revenue streams.

• Tax Optimization

U.S. bonus depreciation provisions have potential to significantly enhance after-tax investor returns.

• Management Alignment

Henley's co-investment and subordinated profit sharing ensures strong alignment of interests with all investors.

AQUASONIC IS A PROVEN, REPEATABLE MODEL. FUND III PROVIDES THE OPPORTUNITY TO INVEST AT SCALE, ALONGSIDE

INSTITUTIONS, IN ONE OF THE FASTEST-GROWING GEOGRAPHIC REGIONS IN THE U.S.

• $28bn global industry projected to grow at 7% CAGR through 2030 1

• Increasing number of registered vehicles nationwide drivingdemand 4

• Rising consumer expenditure on professional car wash services

• Key industry segments: express conveyor washes, in-bay automatic washes, and self-service facilities

• Approximately 62,7000 car wash facilities nationwide, including around 18,000 state of the art conveyor operations; US could support 40,000 express tunnels with 700 new installations annually 2

• M&A and IPO activity providing clear exit pathways for investors

• The sector continues to demonstrate 7% compound annual growth 1

• Highly fragmented market. Top 10 operators own less than 10% of stores3

Defensive Business Characteristics:

• Resilient to e-commerce disruption due to inherent service nature

• Labor-efficient operations with high-margin potential

• Subscription-based models provide recurring revenue streams, mitigating risks related to seasonality and adverse weather conditions

Consolidation Opportunity:

• Industry is in the early stages of consolidation, professionalization and increasing institutional ownership

Experience Investment Management:

• Sponsor brings global investment perspective, having deployed over $4bn across diverse sectors, geographies, and economic cycles

• Active development pipelines across Fund I and Fund II (9 sites)

• Three years dedicated to developing best-in-class operational strategy

• Highly experienced operating team with 50+ years of combined expertise, including industry veterans from several top-performing car wash facilities

1.

2.

3

4.

Over $4bn deployed across a multiple of sectors and geographies in 100+ investments1

“I have been an investor with the Henley Group for around 15 years - they are smart hard working investors who have delivered consistently over time”

- Richard G, HNW, US Investor

“We have been an active investor with Henley in multiple opportunities over the past few years. The thematic and strategic investment ideas and execution rank among the top investment managers we work with. We have enjoyed great access to senior leadership and know the Henley team works tirelessly to maximize our returns. We look forward to a continued and lasting relationship in the years ahead”

- Adrian B, CIO/CEO Large Family Office, US Investor

“Henley have provided us access to a ‘syndicated pool’ of larger deals than we would ordinarily gain access to with our capital. We have a focus on land backed deals and a small amount allocated to prop tech via Henley.

To date we have been very happy with the returns; quality and pricing of the deals; and continue to allocate capital to deals when the timing is right and they fit our criteria”.

- Jacques B, HNW, International Investor

“Henley has consistently shown me a variety of different opportunities across multiple asset classes on which I have invested in. They communicate frequently, not only to discuss when investments are performing well, but also when problems may be occurring”.

- Nazmin K, HNW, International Investor

200,000+ washes per year Sales of $3,000,000+ per year

- E-Commerce Resistant: Service-based model immune to online disruption

- Sustainability Focus: Uses only 20% of water compared to home washing

- Operational Efficiency: 210-second service delivery premium, with 150 cars per hour at max throughput

- Value Preservation: Professional maintenance protects vehicle value

- Convenience Features: Complimentary high-powered vacuum systems

- Membership Growth Excellence: Membership growth significantly outpacing projections, exceeding underwriting expectations and prompting upward revision of l ong-termforecasts

- Industry-Leading Conversion Rates: Conversion rates surpassing industry benchmarks, with one in three customers subscribing versus the industry average of one in ten

- Volume Performance: Wash volumes exceeding plan, with the inaugural site trending toward over 300,000 washes annually

- Enhanced Return Projections: Returns have been positively reforecast; Fund I was initially underwritten conservatively and is now tracking above initial expectations

COMPETITIVE DIFFERENTIATORS

- Distinctive Brand Identity: Fostering strong customer loyalty and clear market differentiation

- Proprietary Technology: Cleaning chemistry and advanced equipment specifically engineered to resolve prevalent consumer challenges

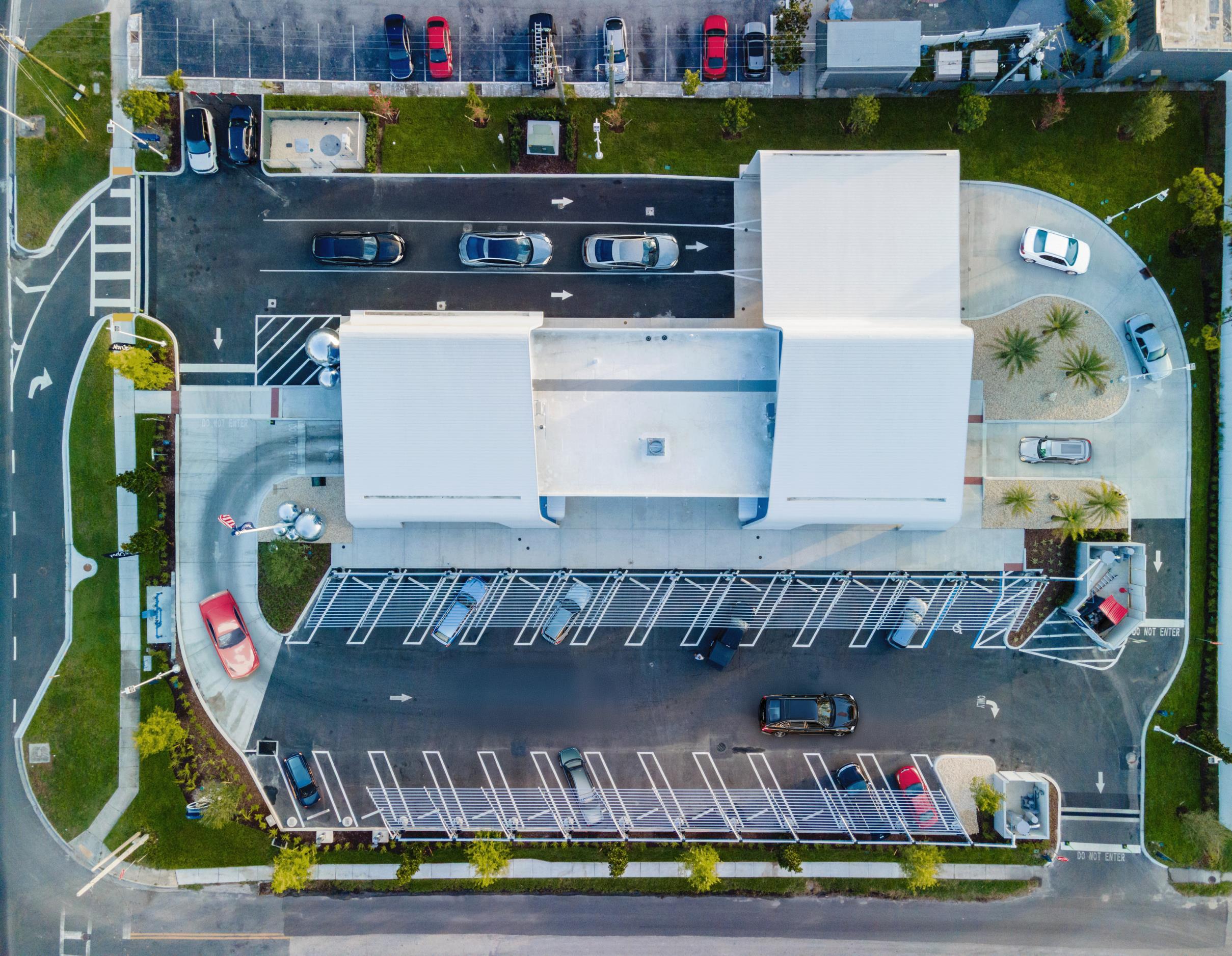

- Site Selection Excellence: Proprietary scoring system rigorously selects only premium locations

- Best-in-Class Digital Marketing: App-based engagement, loyalty rewards and tailored promotions driving higher membership conversion and retention

- Compelling Returns: Robust projected multiples coupled with cash distributions

- Builtfor Scale: Technology and operations structured for consistent expansion across geographies

- Minimum Investment: $250,000

- Portfolio Size: 7-10 sites (maximum)

- Final Acquisition Deadline: December 31, 2026

- Fund Closing Deadline: December 31, 2025

- Return on Investment: EM: 3.3x / IRR: 44% / CoC: 33.6%

- Geographic Focus: Southeastern United States Expansion