Guard It With Your Life

You can easily lose your exempt status.

By Kathleen M. Clayton, CPA, PSA, MBA PRINCIPAL | HOLMDEL, NJ

Nonprofits are organized and operate under two scenarios. One, the organization is a “nonprofit” or a “nonprofit corporation” as defined by the state statute under which it is organized. A second, the organization qualifies as “tax-exempt” under the Internal Revenue Code. An organization of either designation can lose its tax-exempt status for a variety of reasons.

Once you have set up your organization, your state might require you to file some type of annual report. Most states do. As a first step to preparing your report, check with your Secretary of State’s office to determine if your nonprofit status is current. Typically, there are steps you can take to correct your status if you are not current; those steps vary by state.

Best Practices of Highly-Effective Nonprofit Organizations

profit company. As well, you must stop telling the public you are tax-exempt and stop soliciting and collecting donations deemed to be charitable by donors. Grants from private foundations and government sources can be in jeopardy. As such, protecting your status, especially if you are a 501(c)(3), should be an ongoing, primary concern for your organization.

What to “do” to maintain your status

First, stay current with your annual reporting requirements. Most tax-exempt entities must file some level of Form 990 each year, regardless of your gross revenue, assets, or activity. Even inactive organizations are required to file annually.

If your status is revoked, you may have to pay federal income tax like a for-profit company ... Protecting your tax-exempt status should be an ongoing, primary concern for your organization.

The way you achieved your tax-exempt status was by applying to the IRS after you had registered your nonprofit with your state. You filed Forms 1023/1023EZ or 1024/1024EZ with the IRS. Assuming you met the agency’s requirements, you were determined to be tax-exempt under a provision of the Internal Revenue Code 501. With that determination came specific “do’s” and “don’ts” for the organization. Failure to do or don’t accordingly can result in the IRS revoking your exempt status. If your status is revoked you may have to pay federal income tax like a for-

A few organizations, mainly churches and religious groups, may not have to file, but may opt to do so in order to demonstrate transparency to the public.

Your organization’s board and management should pay close attention to a formal “compliance” calendar that tracks all federal and state reporting requirements and due dates. Failure to file the required Form 990 for three consecutive years will result in your tax-exempt status being automatically revoked. As well, the IRS makes information regarding tax status publicly available through the Tax Exempt Organization Search (formerly EO Select Check) on the IRS website. Donors and prospective donors use the online tool to research your organization’s status and filings.

5 //

CONTENTS

2

4 / Understanding and Managing Conflicts of Interest in Nonprofit Organizations

AUDIT & ASSURANCE

7 / How Nonprofits Must Handle Crypto Under FASB ASU 2023-08

8 / HBK Nonprofit Solutions Contacts

OUTSIDE THE LINES

9 / Future-Proofing Fundraising in an Era of Change

CLIENT SPOTLIGHT

12 / Bayonne Economic Opportunity Foundation: Improving the Quality of Life for Low-Income Residents

ABOUT HBK NONPROFIT SOLUTIONS

HBK Nonprofit Solutions is a dedicated team of subject matter specialists within HBK CPAs & Consultants, an Accounting Today Top 50 CPA firm. With more than 800 clients in the nonprofit sector, and more than 75 years providing financial compliance and consulting to nonprofits, we offer the hands-on experience and technical skills to help nonprofit organizations fulfill their missions.

The IRS uses the Form 990 series to continuously monitor your activities, so pay particular attention to your annual Form 990 and 990EZ as a means to prove your worthiness to both the IRS and the general giving public.

Another must “do”: Operate exclusively within your exempt purpose. When an organization applies for exempt status, it promises to fulfill a certain charitable mission or purpose. This promise is what the IRS based your tax-exempt determination on. It is important to evaluate new programs and revenue streams to be certain they fit into the determined exempt purpose. Often referred to as “mission creep,” revenues earned outside of your determined purpose could be subject to unrelated business income tax (UBIT).

Operating exclusively for exempt purposes as well as meeting reporting requirements applies for all tax-exempts. The IRS uses the Form 990 series to continuously monitor your activities, so pay particular attention to your annual Form 990 and 990EZ as a means to prove your worthiness to both the IRS and the general giving public.

What “not to do” to maintain your status

Maintaining your 501(c)(3) status means following rules regarding private benefit/inurement, lobbying and political campaign activities, and unrelated business income.

• Under private inurement rules, the organization must not engage in activities that serve a private interest of, or provide a private benefit to, any individual or organization more than insubstantially. The nonprofit must not allow its income or assets to benefit insiders, including board members, management, and key employees. Such activities make the organization subject to excise tax as well as the potential loss of its exempt status.

• The IRS prohibits 501(c)(3)s from participating in political campaign activities at any level: federal, state, or local. Your 501(c)(3) is allowed to lobby, but it must be an insubstantial part of your overall activities. Lobbying occurs when an organization contacts, or influences the public to contact, members of a legislative body (including that body’s employees) for the purpose of proposing, supporting, or opposing legislation. While lobbying as an insubstantial part of your overall activities is allowed, it must be carefully monitored and disclosed on your annual Form 990.

• As a tax-exempt organization, you are not allowed to generate too much income from activities unrelated to your 501(c)(3) status. Unrelated business income (UBI) is defined as revenue generated from a regularly conducted trade or business that is not substantially related to the organization’s tax-exempt purpose. For example, rental activities and advertising can generate UBI. Too much UBI can cost you your tax-exempt status. There are many modifications, exclusions, and exemptions to the UBI rules, and not all tax-exempt organizations have the same restrictions as 501(c)(3)s. It is important to understand the type of IRC code section that governs your organization and what applies.

You’ve been revoked. Now what?

It’s a worst-case scenario, losing your exempt status. And it can happen easily if you don’t attend to your do’s and don’ts. The problem will not simply go away; you must address it immediately and with professional support.

If the reason for revocation is failure to file three or more years of returns, by all means complete

The nonprofit must not allow its income or assets to benefit insiders, including board members, management, and key employees. Such activities make the organization subject to excise tax as well as the potential loss of its exempt status.

Here are some situations in which improper actions could lead to loss of your organization’s exempt status. [For more on this subject, see “Understanding Conflicts of Interest,” page 4.] Remember, with any situations you may encounter, we’re always here to provide clarity.

How would you act?

One of your largest donors is campaigning for office. Their campaign “invites” your organization to sponsor a large table at an event. It’s an expensive sponsorship … but they’re a significant donor. Do you do it?

You just got elected treasurer of a local nonprofit. You ask to see their past 990 filings. No one seems to know anything about this and cannot locate copies. What’s your next step?

Your organization just got word your largest grant is not being renewed. One of your program directors came up with a great idea for a new activity. It’ll generate a ton of revenue, but is way outside your stated mission. Should you consider it?

A local nonprofit owns a parcel of land in town. They don’t use it and don’t have the funds to make it useful. The local real estate market is hot. The board vice president wants to purchase the land and offers a small amount for the property. The organization needs the funds. What should they do?

and file your 990s. Then reapply for status. If the reason for revocation is other than failure to file, it’s important to learn why the IRS has taken that action. Again, we encourage you to seek out professional assistance. Once the cause is understood, you will need to file a new 1023/1024 application with the IRS to reinstate your status. Correcting the offense that led to revocation will be key to your reapplication. Depending on the circumstances, the IRS may reinstate your status back to the date of revocation or only from the date the new application was filed. Retroactive reinstatement ensures contri-butions made during the revoked period remain tax-deductible for donors and tax-exempt for you. The decision might depend on how quickly you act after revocation.

Some final recommendations

Two recommendations: Handle your revocation immediately and seek professional advice. HBK Nonprofit Solutions can help; we routinely assist nonprofits in these situations. Please contact us.

Kathleen M. Clayton, CPA, PSA, MBA

Co-National Director, Nonprofit Solutions Principal | Holmdel, NJ

Kathleen has more than 40 years of experience providing auditing, accounting, tax and consulting services to privately held businesses and not-for-profit organizations. She specializes in preparing tax-exempt status applications, consulting on charitable regulations and providing outsourced management and accounting services to numerous organizations, including membership organizations, public charities, private foundations, and special improvement districts. She routinely consults with organizations that receive federal and state funding. Kathleen also is a licensed public school accountant.

For more information, contact Kathleen at (732) 453-6528 or kclayton@hbkcpa.com.

Understanding and Managing Conflicts of Interest in Nonprofit Organizations: A Compliance Guide

By Kathleen M. Clayton, CPA, PSA, MBA PRINCIPAL | HOLMDEL, NJ

Whenever the discussion about “conflict of interest” arises, it is typically not for a positive reason. Quite often, someone not fully conversant with the organization is looking for information.

Ask any board member, employee, stakeholder, journalist or the “man about town,” i.e. the general public, and they will each have a slightly different definition of what constitutes a conflict of interest. Whether the situation is an actual conflict, a potential conflict or a perceived conflict, it is incumbent on the organization to satisfactorily manage the situation.

According to the Internal Revenue Service (IRS), “A conflict of interest arises when a person in a position of authority over an organization, such as a director/trustee, officer, or manager, may benefit personally from a decision they could make.” Called an Interested Person, besides those identified above, many organizations also include board committee members and members of senior management with delegated powers, who have a direct or indirect financial interest in the decision. A conflict of interest occurs where individuals’ fiduciary obligation to further the organization’s exempt purposes is at odds with their own financial interests.

asks whether the application has already adopted a policy and if not the applicant will need to explain how it will handle conflicts it identifies and refers to both public charities and private foundations.

Organizations applying for exempt status other than 501(c)(3) use Form 1024 - Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code. While less specific regarding a conflict policy, the application alludes to specific types of transactions that may lead to a conflict such as those related to executive compensation and other financial arrangements with interested parties.

Whether the situation is an actual conflict, a potential conflict or a perceived conflict, it is incumbent on the organization to satisfactorily manage the situation.

While adoption of a conflict of interest policy isn’t required to obtain tax-exempt status, it is considered as a best practice for exempt organizations.

According to the Internal Revenue Service (IRS), “A conflict of interest arises when a person in a position of authority over an organization, such as a director/trustee, officer, or manager, may benefit personally from a decision they could make.”

From its inception, the IRS is interested in how the organization will handle a conflict of interest should one potentially arise. Form 1023Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

Even after tax-exempt status is determined, the IRS continues to be interested. On an annual basis, Form 990 asks specific questions related to this issue. For example, Part VI Questions 12a-c asks whether at the end of the organization’s tax year it had a written conflict of interest policy, whether annual disclosure is required and if the organization monitors and enforces compliance with the policy. Various 990 schedules require further disclosure of situations that may result in conflicts including Schedule L – Transactions with Interested Persons and Schedule R – Transactions with Related Parties and Unrelated Partnerships. Schedule J – Provides compensation information for certain individuals and often provides some evidence of excess compensation being paid. An important note here is that most of Form 990 and

The IRS provides a sample conflict of interest policy in its instructions for Form 1023 application at Appendix A. https://www.irs.gov/ instructions/i1023

these schedules are open for public inspection by anyone, and are easily obtained on the IRS website Tax Exempt Organization Search Tool.

Apart from any appearance of impropriety, organizations can lose their tax-exempt status unless they operate in a manner consistent with their stated purposes. Serving private interests more than insubstantially is inconsistent with accomplishing charitable purposes. The loss of status and public reputation can be devastating to the organization. Intermediate sanctions in the form of an excise tax can also be imposed. It is important to understand what type of entity the organization is – public charity, private foundation or other type of exempt organization, as the laws and required disclosures differ.

Do you need a policy?

The simple answer is yes.

The purpose of the conflict of interest policy is to protect the organization when it is contemplating entering into a transaction or arrangement that might benefit the private interest of an interested party or might result in a possible excess benefit transaction. The organization’s policy is intended to supplement but not replace any applicable

state and federal laws governing conflict of interest applicable to nonprofit and charitable organizations.

A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has an established process in place under which the affected individual will advise the governing body about all the relevant facts concerning the situation. A conflict of interest policy establishes procedures that will offer protection against charges of impropriety involving officers, directors or trustees. Many insurers require a conflict of interest policy be adopted for Directors’ and Officers’ Coverage.

What’s in the policy?

A typical conflict of interest policy includes:

1. The definition of who is an interested party

2. Specific procedures the organization will follow when a potential conflict becomes known

3. Documentation of the decisions around resolving the conflict

4. A system of periodic review of the policy by the governance party

Serving private interests more than insubstantially is inconsistent with accomplishing charitable purposes. The loss of status and public reputation can be devastating to the organization.

Policies can be as short as a paragraph or as long as several pages, but should “fit” the organization.

The IRS provides a sample policy in its instructions for Form 1023 application at Appendix A. https://www.irs.gov/instructions/i1023

If it walks like a duck...

Stakeholders, including the general public might conclude that certain transactions represent conflicts of interest. They may or may not be correct in their conclusions often making them without complete knowledge of the organization, its practices and policies.

An example often identified occurs in special event fundraising. Let’s say, the organization signs a contract with an event venue, owned by one of its board members. Yes, the board member may stand to benefit by the additional business but what if the venue is being offered for free or with little cost to the organization? Is there still a conflict? Maybe. The best result is that the facts of the situation are identified, discussed (without that board member) and resolved to the benefit of the organization, not the board member.

An issue that often surfaces is in the hiring of family members. In most organizations, this is identified as an actual conflict and a perceived conflict besides also creating future potential conflicts in employer/employee situations.

An important note is that most of Form 990 and these schedules are open for public inspection by anyone, and are easily obtained on the IRS website Tax Exempt Organization Search Tool.

In both these examples, the details of each situation and the documentation is vital to resolving the conflict as outlined in the organization’s policy.

Remember, not all press is good press, especially in conflict of interest cases.

A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has an established process in place under which the affected individual will advise the governing body about all the relevant facts concerning the situation.

How Nonprofits Must Handle Crypto Under FASB ASU 2023-08:

New Accounting Rules Explained

By Sean Kocan, CPA

PRINCIPAL | PITTSBURGH, PA

On December 13, 2023, the Financial Accounting Standards Board (FASB) issued new rules that could transform how nonprofits report crypto donations. Even though designed with for-profits in mind, ASU 202308 has wide-reaching implications for charities, foundations, and NGOs entering the digital donation space.

Why this matters to nonprofits

With digital assets like Bitcoin and Ethereum gaining traction in fundraising and philanthropy, nonprofits increasingly need clear and consistent accounting guidance. ASU 2023-08 delivers that clarity by replacing the old cost-less-impairment model with a fair value measurement approach. This means nonprofits will now reflect crypto values based on real-time market conditions, offering a more transparent view of their financial health.

Key highlights of ASU 2023-08 for nonprofits

1. Scope of the standard

ASU 2023-08 applies to crypto assets that:

• Are intangible assets under U.S. GAAP (e.g., Bitcoin, Ethereum)

• Are secured by cryptography and stored on blockchains or distributed ledgers

• Are fungible and interchangeable

• Are not issued by the nonprofit or its affiliates

What’s excluded: NFTs, stablecoins, and tokenized rights to physical or financial assets fall outside this guidance.

2. Fair value accounting

Nonprofits must now measure crypto assets at fair value at each reporting date, with gains or losses reflected in the statement of activities.

Old vs. new:

• Before: Crypto was treated like an indefinite-lived intangible asset, recorded at cost and impaired only if value declined.

• Now: Crypto is marked to fair value regularly, providing a current snapshot of asset impact.

3. Presentation and disclosures

Nonprofits need to present crypto holdings clearly in their financial statements:

• Balance sheet: Report as a separate line item (current or noncurrent, based on intended use).

• Statement of activities: Disclose unrealized gains/losses separately.

• Cash flow statement: Donations sold promptly may fall under operating cash flows unless donor restrictions apply.

Key disclosures required:

• Name, number of units, cost basis, and fair value of each significant crypto asset

• Any restrictions on selling the assets

• A roll forward of crypto asset activity

• Details of disposals, gains/losses, and how cost basis is determined

Effective date and transition

ASU 2023-08 takes effect for fiscal years starting after December 15, 2024. Nonprofits will use a modified retrospective approach— adjusting opening net assets at the start of the year they adopt the new rules.

Practical implications for nonprofits

• Greater transparency: Donors, boards, and stakeholders will get more accurate insights into crypto contributions.

• Volatility in reports: Fair value swings could impact reported changes in net assets.

• Operational adjustments: Internal controls, reporting systems, and gift acceptance policies may need updates.

Action steps for nonprofits

If your organization is considering or already accepting crypto donations:

1. Revisit your gift acceptance policies to reflect current risks and guidance.

2. Train development and finance staff on proper handling, valuation, and reporting.

FASB ASU 2023-08 marks a significant shift in how nonprofits must approach crypto asset accounting. While it introduces new responsibilities, it also enhances transparency and accountability.

3. Review your infrastructure for crypto custody—whether through a wallet, third-party processor, or intermediary nonprofit.

Conclusion

FASB ASU 2023-08 marks a significant shift in how nonprofits must approach crypto asset accounting. While it introduces new responsibilities, it also enhances transparency and accountability. Thoughtful implementation will help build trust with donors, regulators, and stakeholders in this evolving space.

For guidance on implementing ASU 2023-08, contact the HBK Nonprofit Solutions Group for support.

Melissa Crowley, CPA

Principal | Youngstown, OH

Regional Director | HBK Nonprofit Solutions

has been with HBK since 2011 and provides assurance services for a variety of nonprofit organizations. He consults on internal controls and has helped numerous clients identify and remedy control deficiencies. His expertise reflects his broad experience and background in fraud examination.

Sean is a member of the HBK Assurance Practice Committee that establishes and enforces the firm’s quality control standards for its assurance services. He is also the quality director for the firm’s Western Pennsylvania assurance practice.

Sean’s industry-related experience includes serving as the lead principal on all of the HBK Pittsburgh office’s audits of nonprofits, including providers of health services, residential and community based support services, housing and substance abuse rehabilitation, higher education, private and public K-12 education, and religious organizations. He also oversees bookkeeping, controllership and consulting roles for various nonprofits, including a health benefits education and advocacy organization and a family foundation. For more information, contact Sean at 724-934-5300 or skocan@hbkcpa.com

HBK Nonprofit Solutions Contacts

Darby Beaverson, CPA Principal, National Assurance Director Naples, FL T (239) 263-2111

E DBeaverson@hbkcpa.com

Kathleen Clayton, CPA, PSA, MBA Principal | Holmdel, NJ

T (732) 453-6528

E KClayton@hbkcpa.com

Melissa Crowley, CPA

Principal | Youngstown, OH

T (330) 758-8613

E MCrowley@hbkcpa.com

Amy Dalen, JD Principal, National Tax Director | Naples, FL T (239) 263-2111

E ADalen@hbkcpa.com

Sean Kocan, CPA Principal | Pittsburgh, PA

T (724) 934-5300

E SKocan@hbkcpa.com

Ashlynn Reeder, CPA, MST Assistant Director, Nonprofit Solutions Senior Manager | Naples, FL

T (239) 263-2111

E AReeder@hbkcpa.com

Anthony Savasta, CPA Senior Manager | Holmdel, NJ

T (732) 453-6541

E ASavasta@hbkcpa.com

Daniel Sefick, CPA, CGFM National Director, Nonprofit Solutions

Principal | Pittsburgh, PA

T (724) 934-5300

E DSefick@hbkcpa.com

Teal Strammer, CPA, CCIFP® Senior Manager | Sarasota, FL T (941) 909-7607

E TStrammer@hbkcpa.com

Outside the Lines

Future-Proofing Fundraising in an Era of Change

Fundraising is the lifeblood of nonprofit sustainability, but the ground is shifting beneath our feet.

By Daniel Sefick, CPA, CGFM NONPROFIT SOLUTIONS GROUP NATIONAL DIRECTOR PRINCIPAL | PITTSBURGH

If your fundraising strategy looks the same as it did five years ago, you’re already behind.

Nonprofits today are navigating a perfect storm: new tax rules reshaping donor behavior, generational shifts in giving preferences, and policy changes like the One Big Beautiful Bill Act (OBBBA) that are rewriting the playbook.

Fundraising is the lifeblood of nonprofit sustainability, but the ground is shifting beneath our feet.

The question isn’t whether change is coming—it’s whether your organization is ready for it. Futureproof fundraising means building a resilient “engine” that adapts and thrives regardless of policy or economic changes. Here’s how to stay strong in today’s landscape.

The landscape: why change is urgent

The fundraising environment is undergoing fundamental shifts that demand immediate attention. Understanding these changes is the first step toward building a strategy that can withstand them.

• Giving patterns are evolving. Charitable giving as a share of GDP is slipping. Fewer households are donating, while high-net-worth donors make up a larger share—creating concentration risk.

• Next-gen donors think differently. Younger supporters demand transparency, measurable impact, and partnership.

The challenge is to stabilize your current donor base and build pipelines for the next generation.

Core strategies to build resilience

The strategies below form the foundation of a future-proof fundraising engine. Some are timetested methods that deserve renewed focus; others leverage emerging opportunities. Together, they create a diversified, donor-centered approach that can weather tax policy shifts, economic downturns, and evolving donor expectations. Start by assessing which of these your organization is already doing well, and where there are gaps to fill.

Reduce reliance on a single gala, grant, or corporate sponsor. Blend individual, foundation, corporate, and digital revenue to cushion against policy-driven drops.

Monthly/recurring giving

Recurring gifts create predictable income and are driven more by loyalty than tax incentives. Messaging example: “For less than your monthly Netflix subscription, you can provide…”

Donor-advised funds (DAFs)

Strategy means nothing without execution.

The question isn’t just what to do—it’s how to actually get face-to-face with donors and prospects in ways that feel authentic, not transactional.

DAFs continue rapid growth as donors “pre-fund” giving in high-income years. Register with major sponsors like Fidelity or community foundations to ensure you’re eligible to receive gifts.

Planned and legacy giving

Bequests and beneficiary designations remain steady despite annual tax changes. Promote “impact that lasts beyond a lifetime.”

Diversify revenue sources

Reduce reliance on a single gala, grant, or corporate sponsor. Blend individual, foundation, corporate, and digital revenue to cushion against policy-driven drops.

Deepen donor relationships with data

Donors expect personalization. Segment by giving history or interest and send updates tied directly to projects they supported.

Activate your board

Your board is an underused fundraising tool—not for cold asks, but for warm introductions. Provide talking points and invite them to host small gatherings or mission tours.

Use policy change as a conversation

starter

The OBBBA can open doors: “Here’s how the new law impacts you and how your giving can maximize both your impact and your tax position.” This positions your organization as a trusted advisor.

Cutting-edge strategies

While the core strategies provide stability, staying competitive means keeping one eye on the horizon. The tools and approaches below are no longer “nice to have”—they’re becoming standard practice among forward-thinking nonprofits. Early adopters gain a competitive advantage in reaching next-gen donors and making smarter, data-driven decisions. You don’t need to implement everything at once, but exploring these innovations now positions your organization to lead rather than catch up.

Predictive analytics

Affordable tools now let nonprofits use data to predict which donors are most likely to renew, upgrade, or lapse. Imagine receiving a monthly list of top upgrade prospects and a tailored outreach plan.

Digital

assets and next-gen giving

Younger generations embrace crypto donations, micro-investing, and “impact wallets.”

Accepting digital assets or partnering with micro-donation platforms signals modern, forward-thinking leadership.

Getting in front of donors: practical tactics

Strategy means nothing without execution. The question isn’t just what to do—it’s how to actually get face-to-face (or screen-to-screen) with donors and prospects in ways that feel authentic, not transactional. The tactics below are designed to create meaningful touchpoints that build trust, spark conversations, and move relationships forward. Choose the ones that align with your organization’s culture and capacity, then commit to doing them consistently.

• Board networks: Equip board members with language to invite contacts to breakfasts, tours, or salon events.

• Mission-centered experiences: Replace generic galas with immersive experiences where donors see and feel the mission.

• Advisor partnerships: Host lunch-and-learns for wealth managers or CPAs who guide highnet-worth clients.

• Thought leadership content: Post impact videos, donor spotlights, or CEO insights to start conversations online.

• Personal Stewardship: Handwritten notes, quick thank-you videos, or coffee with your ED deepen relationships and spark face-toface meetings.

Key takeaway

Future-proof fundraising isn’t about chasing trends—it’s about creating a balanced, resilient system that blends proven strategies with forwardlooking innovation. By diversifying revenue, deepening relationships, and embracing new tools, nonprofits can remain financially strong and keep their missions moving forward, no matter what tax laws or economic shifts come next.

Younger generations embrace crypto donations, microinvesting, and “impact wallets.” Accepting digital assets or partnering with micro-donation platforms signals modern, forward-thinking leadership.

DanDaniel Sefick, CPA, CGFM

National Director, Nonprofit Solutions Group Principal | Pittsburgh

is a Principal in the Pittsburgh, Pennsylvania office of HBK CPAs & Consultants and is the National Director of HBK Nonprofit Solutions. He has been a Certified Public Accountant since 2013 and a Certified Governmental Financial Manager (CGFM) since 2019. He joined HBK in 2025. Prior to joining HBK, Dan was a Principal at CliftonLarsonAllen (CLA).

Dan has more than 14 years of specialization in government and nonprofit audits and consulting, as well as helping clients identify ways to strengthen their internal controls and achieve operational efficiencies. He has developed a specialty for yellow book audits as well as accounting and consulting services, and has extensive experience with federal grant compliance, internal controls, risk management and administration. Dan is well versed in Uniform Guidance and single audits and has managed, planned, and performed single audits for an extensive variety of government agencies, charter schools and nonprofits. Dan has also provided technical assistance to governmental entities with the implementation of Governmental Accounting Standards Board (GASB) pronouncements, and has assisted in internal control development and administering CRF, ERAP, SLFRF (ARPA), and various other federal grant programs.

For more information, contact Dan at 724-934-5300 or dsefick@hbkcpa.com

Improving the Quality of Life for Low-Income Residents of Hudson

New Jersey BAYONNE ECONOMIC OPPORTUNITY

County,

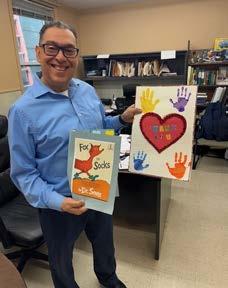

A Q&A with Anthony Segarra, BEOF Executive Director and HBK Nonprofit Solutions

In July, the Bayonne Economic Opportunity Foundation (BEOF) celebrated its 60th anniversary with more than 300 attendees to what Executive Director Anthony Segarra described as “a huge gala and an enormous success.” Over those 60 years, the nonprofit operating out of the city of Bayonne, New Jersey, has grown to deliver an extensive range of services to low-income, disabled, and elderly residents of Bayonne and the surrounding Hudson County. As a Community Action Partnership (CAP), the BEOF mission is to combat poverty and promote self-sufficiency among low-income individuals and families. Working on a current annual budget of $6 million, funded mainly by federal and state grants, they continue to provide their range of services as they look forward to 2026 when they will relocate to a newly renovated building, the former Holy Family Academy high school campus, renamed Stepping Stone Academy. We talked with Executive Director Segarra to learn more about the nonprofit, its mission and activities.

thousands in Bayonne and beyond. Today, we go beyond our roots in Head Start, now offering programs such as Weatherization, making older homes safer, warmer, and more energy-efficient. We also operate a robust food pantry and senior nutrition system, offering home-cooked meals both on-site and delivered to older adults in their homes. Together, these multicultural and intergenerational programs embody our mission: opening doors of opportunity, strengthening families, and building a healthier, more resilient community.

HBK. I see that you put a lot of focus on financial empowerment.

What started with the Head Start program has grown into a full Community Action Partnership agency, providing education, nutrition, and selfsufficiency programs that empower low-income residents to overcome economic struggles.

HBK. You offer such a wide variety of services. Tell us a little about how the organization started and the services you provide.

Segarra. We offer services for children, families, individuals, and older adults from all cultural backgrounds, meeting the needs of our community across every stage of life. What started with the Head Start program has grown into a full Community Action Partnership agency, providing education, nutrition, and self-sufficiency programs that empower low-income residents to overcome economic struggles. We began with just 15 children in a local YMCA as one of the first participants in President Lyndon Johnson’s new Head Start program, and since then have expanded to serve

Segarra. I came to the Foundation as its chief financial officer, so that is a focus of mine. In 2021, the state created a grant for financial empowerment programs, and we were one of only 10 nonprofits to receive the grant out of hundreds that applied. I am a true believer that empowering individuals with a financial understanding, teaching what money can do for you and how to make it work for you, must start from the ground up, beginning at a very young age. Building that foundation early is critical, and this grant gave us the opportunity to teach youth, individuals, families, and older adults that money is more than just a way to pay bills, it can be a tool for growth, stability, and opportunity. We use a “money trail” to help low-income people learn how to work with their money, where to spend, where to save, how to donate, and how to invest. The program helps youngsters learn about money management, but we also engage with parents, offering budgeting guidance and seminars for first-time homebuyers. While that particular grant is coming to an end, we are committed to finding ways to continue and expand this vital program.

FOUNDATION

The Bayonne Economic Opportunity Foundation (BEOF) celebrated its 60th anniversary in July.

HBK. A lot of federal funding for nonprofits has been cut or eliminated recently. How has your organization fared?

Segarra. When I came onboard as CFO in 2015, the financial department was not up to par. We were operating on about $3 million a year, with no formal budgeting process and little structure in applying for grants. We were relying on QuickBooks without a real financial management system. It took time, but with the support of our board and team members, I was able to revamp and build the financial department from the ground up, starting with a very efficient budget and financial management system that has made us stronger and more accountable. Today, we are operating at approximately $6 million annually, which reflects both our growth and our ability to expand services.

My goal has always been to bring the Foundation to a different level by looking beyond the services we already offered. We began to apply for new grants that would expand our reach, including financial empowerment and weatherization, which we introduced for the first time. These opportunities allowed us to diversify the services we provide and reduce reliance on any single funding stream. Cuts are always expected, but we continue to be proactive, anticipating challenges and offsetting them by expanding services and seeking innovative funding opportunities.

Then came COVID and its associated challenges, followed now by federal funding cuts that create another huge test. Many of our grants haven’t been eliminated, but the inconsistency in distribution has been a major strain. If funds are delayed by three months, we still need to spend the money upfront, which puts us in a difficult position. We’ve had to rely on strong relationships with our vendors, partners, and banks, who have helped us sustain operations while waiting for reimbursements. Thanks to these partnerships

We began to apply for new grants that would expand our reach, including financial empowerment and weatherization. These opportunities allowed us to diversify our services and reduce reliance on any single funding stream.

We operate a robust food pantry and senior nutrition system, offering home-cooked meals both on-site and delivered to older adults in their homes.

and the resilience of our staff, we’ve been able to maintain our programs and continue serving the community despite the obstacles.

HBK. Is there anything you can do to alleviate or at least reduce such funding challenges?

Segarra. Right now we are 90 percent dependent on the federal and state governments. I want to change that to 80 percent and 20 percent private funding. So I’ve been reaching out. I’ve been speaking to the New Jersey Chamber of Commerce and the Hudson County Chamber, explaining who we are and what we do. That’s already showing benefits. We also have been able to develop new partnerships with wonderful local companies that are helping us fund services to seniors. The local RWJ Barnabas Health hospital has been particularly helpful, sending doctors to us to provide free services like blood pressure screenings.

HBK. We know that 2026 is going to be an exciting year for the Bayonne Economic Opportunity Foundation as you move into your new location. Fill us in.

Segarra. Around 2019, the sisters of the Holy Family Academy, a girls high school, reached out to us and told us that they were closing down. They didn’t want to sell to a commercial business. They knew we were a Head Start program and asked us if we wanted to buy the building and make it a school for our children. We have 156 children in our Head Start program and a lot more on the waiting list; and we want to add early care for the youngest children. We reached out to the city, and they helped secure a bond to purchase the building. We have a fee-simple contract and are giving them our current building in exchange for the new facility. We then secured a grant that allowed us to begin renovations. With the initial $1.3 million in federal funding in 2019, we were able to replace the roof, install a new HVAC system, and remove hazardous materials to remediate the entire building. Then COVID held up the project for the next three years, but our application for additional funds had been approved, and in May of this year we received an additional $5.7 million. Hopefully we’ll be ready for occupancy this coming spring.

We have an after-school program now, but the early-care program will allow parents to drop off their children and go to work. It will help us help families in need get over the poverty line, which is what Head Start is all about.

“HBK understands the logistics, how a nonprofit works, but also our mission, which is critical to understanding what we need to do. They go outside the box to help.”

We will also be able to offer access to the arts. The arts and theater program Artists Avenue will teach music and art, which are critical parts of childhood education. They will provide their services free, which would satisfy the conditions of our grant; and they will perform for our Head Start staff, BEOF staff, and our families at no cost. We also want to provide science classes. The renovated building will include a large, multi-purpose room, which we will use for our financial empowerment initiative, where parents can learn about money and how money works and accomplish their mission of moving beyond where they are today.

HBK. We have been proud to be your accounting firm since 2015. Has it been helpful to work with a firm like HBK with a specialty in nonprofit financial support?

Segarra. HBK helped the organization get its finances in order in 2014 and 2015. I have leaned on their skills and expertise one hundred percent. I knew when I came here what I needed to do, but they added the knowledge of nonprofit finance that I needed. We worked together to bring this organization where it is now. Our relationship has been phenomenal. Their dedication and understanding of how a nonprofit needs to work is beyond any other organization I’ve seen. They understand the logistics, how a nonprofit works, but also our mission, which is critical to understanding what we need to do. Grants come with rigorous requirements, and they take the time to understand how each works and what the regulations require to ensure we are in compliance. They go outside the box to help.

We have an after-school program now, but the early-care program will allow parents to drop off their children and go to work. It will help us help families in need get over the poverty line, which is what Head Start is all about.

The local RWJ Barnabas Health hospital has been particularly helpful, sending doctors to us to provide free services like blood pressure screenings.