“The

“The

The Harbus interviews ECs on how they spent their precious three summer months.

Abhiram Karuppur,

Industry Insights & Travel Editor

Christina Vosbikian (MBA ’25)

Where did you work this summer?

For myself! I was (and still am) working on my women’s healthcare navigation startup, which hasn’t formally launched yet. I did this as an HBS Rock Summer Fellow, which was great in terms of providing me with an extra “perk” of support and community throughout the summer.

Why did you choose to pursue entrepreneurship?

I came to HBS to make a career pivot from traditional finance to entrepreneurship, so summer was a perfect time to dive into that pivot – all the way. I was a policy major in college and have remained

heavily involved in impact work over the years, particularly in women’s equity and health. As I took a step back to consider where I wanted my career to go, women’s health felt like a natural place to focus – given some of my career and personal interests. The choice to work on something of my own also fell out naturally, as I learned more, brainstormed, back-stepped, and ideated again (over and over)! On the learning front, I would like to thank all of the incredible patients, doctors, nurses and healthcare workers who have fielded my (many) questions this year!

What is your advice for RCs looking at similar internship opportunities?

Take a bet on yourself!

It’s impossible to figure out the “when / how / what” of entrepreneurship. I definitely don’t have it all figured out –but I think the only way to try is head-first and all the way! So get out there and explore what you’re interested in – and start

trying to make an impact in that space. The rest will work out, if you keep at it (at least I think and hope so!).

Johann Farhat (MBA ’25)

Where did you work this summer?

This summer, I had the privilege of working as the Marketing Strategy and Innovation Director for Chelsea Football Club, reporting to the Chief Marketing Officer. The move from being a Chelsea fan to a Chelsea employee over these three months has been truly exceptional, with a lot of learnings on the behind-thescenes of marketing projects at Chelsea FC.

Why did you choose to work with this organization?

Soccer has been a central part of my life from the moment I started walking. My family fondly remembers me constantly

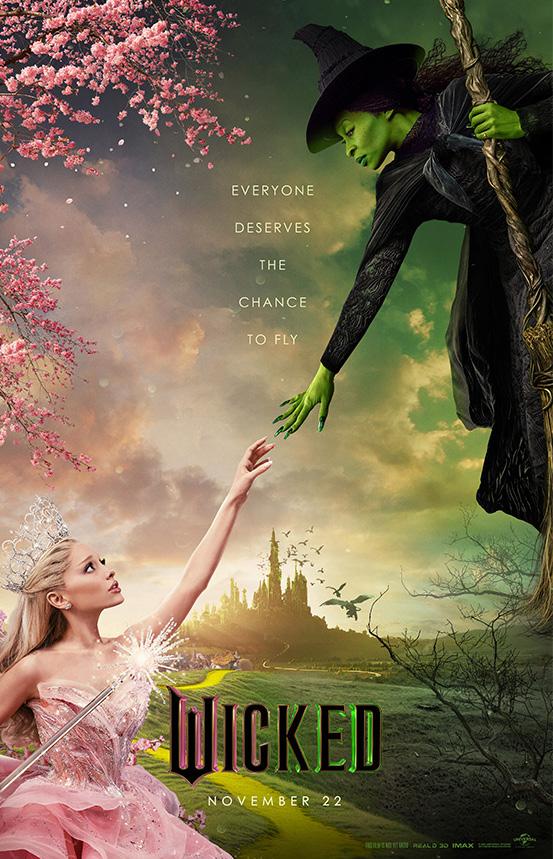

Sitting in a plush recliner seat in 2012, I was thrilled as a flurry of red images burst on screen to open my first viewing of The Avengers. Up to that point, movies to me had functioned more as concerts than music festivals; I would have much rather luxuriated in the depth of a single artist’s catalog than the greatest hits of multiple acts. My enjoyment of the hero’s journey on screen was wrapped in the simplicity of the experience; one hero triumphing over one villain, maybe two or three if the Herculean limits of said hero were to face even greater odds. While The Avengers was not the first Marvel attempt to break through the uni-hero mold (I’m looking at you, my beloved Spider-Man 3), it was the first movie I had seen capture truly outsized monetary value in the cultural currency of the cinematic universe. As The Avengers squad united in a rotating pan – weaponry at the ready, triumphant horns blaring inspirational tones – I felt my first blast of giddiness at the mashing of all these characters into one cultural product. In the world of consumer

packaged goods (“CPG”), I would argue that the same cultural delight heralded by Marvel’s superhero franchises is arising in the universification of our favorite products to eat and drink. “CPG universification” involves blending seemingly disparate brands and products to create unexpected combinations, generating buzz and a reconceptualization of CPG as entertainment. Perhaps no company has better understood the entertainment value of CPG than Liquid Death, from its intentionally kitschy “Murder your thirst” tagline on its tallboy water cans to a publicity stunt in which the Company offered a fighter jet as a giveaway prize, poking fun at Pepsi’s notorious 1996 campaign. The water company even recently introduced the first hot fudge sundae sparkling water in collaboration with the growing ice cream chain, Van Leeuwen. While one intuitively understands that there is likely not a huge underdiscovered market niche for hot sundae waters (or even a smaller, more dismal niche for Pepsi’s Peeps soda), this wacky collaboration is a critical prong in the company’s entertainmentforward marketing strategy, creating a universe in which

THE HARBUS NEWS CORPORATION

Harvard Business School

Gallatin House Basement

Boston, MA 02163

phone: 617-495-6528

fax: 617-495-8619

general@harbus.org

www.harbus.org

Editor-in-Chief

TIM FORD tford@mba2025.hbs.edu

Chief Executive Officer

EDOUARD LYNDT elyndt@mba2025.hbs.edu

Chief Operations Officer

NATASHA LARSEN natasha@harbus.org

Chief Revenue & Marketing Officer

VAUGHN KURTENBACH vaughn@harbus.org

Chief Design Officer

GARRETT TONGE garretttonge@me.com

Editorial Team

Arts & Leisure

DANIELLE MITALIPOV

Entrepreneurship

CHUCK ISGAR

Industry Insights

ABHIRAM KARUPPUR

MICHELLE YU

MEREDITH NOLAN

SANTI GIL GALLARDO

Crossword

DELANEY BURNS

MAYA BISWAS

Women’s Leadership

REGINA GOMEZ TYLER CONFOY

Contributors

JAKE GOODMAN WILL HENNESSY

JOHN MAHONEY

TALHA MINHAS

EDDIE OVEY

ADHITYA RAGHAVAN

RAMYA VIJAYRAM

Board of Directors

STAN CHANG

UPOMA DUTTA

GABRIEL ELLSWORTH

RASEEM FAROOK

NATASHA LARSEN

SUMIT MALIK

HARSHA MULCHANDANI

RYO TAKAHASHI

ASHA TANWAR

The Harbus is a publication of the Harbus News Corporation, a nonprofit, independent corporation of the Commonwealth of Massachusetts. The Harbus is published monthly throughout the academic year, distributed free of charge to members of the Harvard Business School community, and is updated continually on harbus.org. E-mail the editor if you would like to contribute. Off-campus subscriptions are available. Copyright ©2017, the Harbus News Corporation. The Harbus is committed to equality and diversity and we strive to provide a forum for the free exchange of ideas. As a result, the opinions reflected in articles, editorials, photographs and cartoons are those of the authors and artists and do not necessarily reflect the opinions of the Harbus, explicitly or implied, regardless of author or artist.

SUBMISSIONS POLICY The Harbus welcomes your opinions, letters to the editor and other contributions. All submissions must include your name, section and a phone number. Please email submissions to eic@harbus.org. The editors reserve the right to edit all submissions and will print submissions at their discretion. All submissions become the property of The Harbus.

Congress shall make no law… abridging the freedom of speech, or of the press… - First Amendment, U.S. Constitution

Tim Ford, Editor-in-Chief

The Great Displacement is upon us! Robots are coming for our jobs, automation is overtaking manual labor, and your boss from this summer’s internship prefers Microsoft Copilot to working with you.

Close to home, ECs are experiencing a displacement uniquely our own – the arrival of the HBS Class of 2026. RCs have displaced us from our roles in line at Spangler at 12:15 / 12:35, from the Royale dance floor at 2am on Gatsby night, from the 8:00am Aldrich alcoves for discussion group (kidding). For the Harbus, the RC class is swiftly displacing the grizzled EC veterans in the newsroom.

In this edition, you’ll find cutting RC insights ranging from economic analysis to hopes and dreams for the next two years. RCs explore brand sponsorship deals at the Olympics, the implications of macroeconomic data for stock price performance, and the etymology of brand names. I may have had to look up what “etymology” met, but you better believe I still had edits on the first draft. Class of 2026 writers also dive deep into the HBS community – our student leaders, our uniquely

gifted classmates, the trials and tribulations of getting here. I might have thought ECs who have been here for more than three weeks might be better positioned to opine on HBS community, but alas, here we are.

Good for the RCs. But the Harbus ECs can still hold our own – at least now that we have ChatGPT Edu. To prove it, this edition includes an article generated entirely by Artificial Intelligence, and I bet you won’t be able to tell which one. I fed this newfangled writer the following assignment (“prompt” in robo-speak):

“I work for the Harbus student newspaper at Harvard Business School. All our articles are linked here: https://www. harbus.org/. In the upcoming edition, I want to do a joke where we have AI generate an article, and see if people notice. Can you please write a kind of tongue in cheek funny 1,200-word article about some business or HBS topic, pretending to be a student, but slipping in a clue or two that you might actually be AI?”

With prompting like this, what could go wrong?

I’ll confess two ways in which the RCs may have an edge on AI. First, despite maintaining a positive attitude, AI was surprisingly unreceptive to feedback. For instance, consider the following exchange after ChatGPT fed

me an unrealistically glamorous headshot for the fictitious writer we created, with lots of techy icons in the background:

Me: “Make it less AI and more like a normal headshot.”

AI: [Generates headshot of perhaps the most beautiful person I have (n)ever seen]. “Here is the headshot with a more natural, professional look. If you need any further adjustments or additional images, just let me know!”

Me: “Why is this person positively glowing? Make it a bit less fancy please.”

AI: [Literally the same person but slightly messier hair, still radiant]. “Here is the more understated and natural headshot. If this works for you, great! If you need any more adjustments or additional images, just let me know!”

Me: “No way the lighting was this good. Make the lighting worse plz.”

AI: [Just switched the shadow from one side to the other].

“Here’s the headshot with more realistic and slightly less polished lighting. I hope this one fits the bill! If you need anything else, feel free to ask.”

Me: “The background looks fake.”

AI: [Arbitrarily decides to give the person a haircut]: “Here is the headshot with a different background. This should give it a more professional yet relatable

feel. Let me know if this works for you!” Me: “Fine.”

Second, AI didn’t quite seem to grasp the “lived experience” of today’s HBS student. We debated the merits of including reference to the debaucherous Priscilla Ball (to my knowledge, last held in 2013), and discussed the range of avocado toast options at a restaurant of which I had never heard.

Ultimately, I suppose it will be abundantly clear which article is AI-generated – just look for an unreasonably good headshot, references that make no sense, and a not-so-subtle robotic undertone. But maybe that’s a good thing. Try though they might, the RCs AI might still have some catching up to do. Good luck from the Harbus to all those embarking on their MBA journey, and welcome back to those beginning the second chapter.

Tim Ford (MBA ’25) is originally from New Jersey. He graduated from the University of Virginia with degrees in Commerce and Spanish, and completed an M.Phil. in Latin American Studies at the University of Cambridge. Prior to the HBS MBA, Tim worked in growth equity in San Francisco.

Eddie Ovey, Contributor

The EC year is a crucial career juncture – a prime moment to explore job opportunities and prepare for your professional future. Many of you may be considering launching a search fund and will start to prepare by taking Financial Management of Smaller Firms and joining the ETA club. Some will then decide this is the right path early next year, and seriously engage investors to raise their fund and start searching. However, even with this preparation, many new searchers find it takes several months after launching to start searching effectively.

This learning curve isn’t unique to recent MBA graduates. This year, I launched my traditional search fund, Grandview Peak Capital, nearly five years after graduating from Harvard Business School, and yet, it still took several months to scale up my search effectiveness. Drawing from my personal experience, this article aims to provide those of you thinking about search with five areas of preparation to prioritize during your EC year so that you can efficiently search shortly after graduation.

1. Focus on a select few industries.

Search is no longer a secret. Not only are many MBA graduates raising a fund from investors to search fulltime (traditional search funds), many are also searching parttime or full-time while drawing on previous savings (selffunded search). Stanford has been tracking and reporting on traditional search funds since 1984, and as of 2023 the count had reached 681 traditional search funds raised. Most importantly, in 2023, 94 traditional search funds were raised, nearly 14% of the forty-year total.

This increased appetite for entrepreneurship through acquisition is felt first-hand by business owners. They’re now inundated with emails from “entrepreneurs seeking to buy one exceptional business” and “preserve their legacy.” In the search community, you’ll often hear the retelling of the anecdotal (but probably true) story of a business owner who accumulated all these emails in a folder, and then when he finally decided he wanted to sell his business, he just picked a random “entrepreneur” in that folder to start discussions with.

How can you differentiate yourself, not only from private equity and strategic buyers, but also the increased number of other entrepreneurs looking to “partner with one great business”? The answer is to be thoughtful about the industries in which you want to search.

Owners will be much more inclined to engage with you if they recognize that you embody the same passion and knowledge about their industry as they do. If you can provide unique insights in early discussions, they’ll see you as a key thought partner. And if they’re close to the stage of selling their business, they’ll see in you someone that they could trust. Therefore, it’s important to spend time during your EC year contemplating the macrotrends, industries, and business models you’d target during your search. Having worked as a chemical engineer before business school, I decided to start my search in the

development sprints. Which of these activities did you find energizing? Did any of these activities cause you dread?

It’s important to take time during your EC year to understand what kind of CEO journey you’d like to have and what unique strengths you will bring as an operator. If your background is in M&A, perhaps you should explore roll-up theses instead of buying a small software company. Or if you have experience leading large teams, perhaps you should consider services businesses with a large in-person workforce instead of businesses that work remotely.

With my more technical

the experience they bring on paper. Try to understand how many searchers they support each year and how many Boards they currently sit on. This will help you understand their bandwidth and likely responsiveness. Try to understand deals that they decided to pass on, why they passed, and their process in coming to that decision.

Most importantly, look for investors that you trust and enjoy talking with. Hopefully, these investors will be in your life for the next 10 years, so make sure you enjoy interacting with them and are eager to build long-term relationships.

chemicals industry with a few specific business models I liked. While I plan to do additional searching over the next few months in chemicals, I’m also starting to tee up another large industry to focus on, hopefully for an even longer duration.

2. Understand your unique strengths. In whatever business you buy, there will be new skills to learn and new challenges to face. But considering that 31% of traditional search fund-acquired companies have ended as partial or total losses, it’s critical to buy a company that you will be capable of leading through ups and downs.

Imagine yourself as the CEO of a small company. You start your day with several meetings coaching and training your teams. Next, you spend time working on a potential M&A opportunity to tuck into your company. Lastly, you have several calls with your product and engineering teams to discuss the next three product

and operations background, I’m focusing on finding a techenabled services or software business. While I’m not opposed to opportunistic, inorganic growth, I have not pursued rollup theses as I don’t believe it matches my core strengths.

3. Build relationships with investors.

This is a key activity during EC year – networking to determine which investors you will partner with long-term for your search fund.

Look for investors that understand the industries in which you’ll search, and the growth paths you’ll pursue. An investor may have more experience in blue collar businesses, health care, or software. Partnering with investors whose experience you value is not only important during the search but becomes even more important in building a strong Board of Directors postacquisition.

Look for investors that can add value to your search, beyond

4. Email deliverability.

Before I launched my search fund, my first email sequences had 90% open rates and 35% reply rates. “I’m getting the hang of this,” I initially thought. As I scaled up my second set of sequences, I was suddenly closer to 65% open rates and 15% reply rates. What changed? Was it industry-specific dynamics in my target fields? Had my email quality lowered? Were there other factors at play?

Many searchers are finding that it’s become increasingly difficult to have emails land in business owners’ inboxes during cold outreach, largely due to email changes made by Google earlier this year. Current hot topics in search include how to set up your email properly, how many daily emails to send, how long email sequences should be, and the like. However, there is one thing that searchers can’t change, and that’s the age of their email domains.

One of the key factors that influences email deliverability is

how long the email domain has been functioning and healthy. Figure out early on what your search fund name will be and buy two to three domains similar to this name this Fall. Then start very slowly, just sending a few emails per day from those domains and use them more actively for non-search activity during your EC year. That way, when you get serious about using those domains in the Summer or Fall after graduating, you’ve built up healthy and reputable domains for your outreach that also have one-year domain age.

5. Start searching part-time. Searching is all about selling yourself. It’s important to be strategic, thoughtful, and analytical when it comes to selecting the industries and business models on which you will focus. But in connecting with business owners, you’re ultimately selling yourself. And selling requires reps – lots of reps.

You don’t need your search fund raised and tech stack in place to start getting reps at a small scale today. Pick an industry of interest and start building connections. Attend a conference. Connect with experts to help you ramp up and navigate the industry. Practice communicating your value prop as a business buyer compared to the alternatives a business owner may be considering.

As I started dabbling in search even before talking with investors, I found the work hard but enjoyable. I enjoyed learning about different business models. I enjoyed talking with business owners. I didn’t enjoy some of the blunt rejection I got from business owners and brokers, but I also realized I could handle it. By experimenting, I was able to then fully commit to this next step in my career.

Summary.

Most of you thinking about launching a search fund are exploring many career paths in parallel. That’s to be expected and is the right approach –explore! However, if you are considering a search fund, my advice is to actively explore it. You learn best by doing. The above recommendations help you not only explore if this path is right for you but will also help you search more effectively when you officially launch.

Eddie Ovey (MBA ’19) is originally from Iowa but now resides with his wife in Utah. His work experience includes strategy and program management at Entrata, sales and operations at Homie, tech and supply chain consulting at Deloitte, and operations at Dow Chemical. He has an MBA from Harvard Business School and a BS in Chemical Engineering from Brigham Young University.

Michelle Yu, Industry Insights Editor

For the last couple of years, Wall Street has graded the state of the economy on a seemingly counterintuitive rubric. In the wake of rampant inflation, which soared to a 40-year high of 9.1% in June 2022 due to increased fiscal spending, near-zero interest rates, supply chain shortages, and tight labor market conditions, weak economic data has been welcomed with open arms by the U.S. stock market. While the average Joe would decry an uptick in unemployment or a twofold increase in initial jobless claims, investors were rewarding it.

Why is that?

It all comes back to the Federal Reserve, who began hiking rates in March 2022 to combat inflation. The game plan was standard practice, à la former Fed Chair Paul Volker in the 1980s: make it harder for

consumers and corporations to borrow money, thereby slowing the circulation of cash and rate of spending. This marked a stark departure from the era of free money in the early years of the COVID-19 pandemic, where companies faced few hurdles when trying to secure capital, regardless of how unhealthy their balance sheets or lofty their goals were. By July 2023, the Fed had raised rates 11 times, bringing them to a 23-year high and marking the fastest pace of rate hikes since Volker’s tenure. While higher rates were perhaps just what the doctor ordered to cure inflation, they have been a tougher pill for the stock market to swallow. Rate increases have taken the biggest toll on companies with high valuations, especially growthoriented technology stocks that benefited the most from low interest rates. There are a few reasons for this: 1) riskier assets become less attractive in higher rate scenarios because investors can find more attractive yields in

classes like bonds; 2) the amount of cash that capital-intensive growth stocks are expected to retain is often reduced, as higher rates impact borrowing costs, thus decreasing profit margins; 3) securing low-cost debt becomes more difficult, making companies even more reliant on public market returns; and 4) if the rate increases do in fact work in the Fed’s favor and lower inflation, growth will also likely slow, wherein defensive stocks (think sectors that provide essential goods and services) will outperform, as they are typically less affected by economic downturns.

Within this more restrictive environment, much of the conversation on Wall Street over the last year has asked: “when is enough enough?” When will the Fed stop raising rates, thereby relieving pressure on corporations and consumers? When will inflation be at a secure enough place that people will not have to worry about it ticking back up again? Are rate cuts even

on the table yet?

Investors have reviewed economic data with a fine-tooth comb, searching for evidence that the Fed’s job is near-complete. Employment reports have faced the most scrutiny because any print that shows job additions, lower unemployment, or wage increases on a monthly basis means consumers have more power to spend. The resulting uptick in economic activity then threatens the Fed’s work against inflation, which could incentivize officials to keep rates higher for longer. And that is precisely why, up until recently, bad news on the economy has been cheered on by investors. When the number of new jobs added in April 2024 totaled 175,000, below the Street-estimated 240,000, the Dow Jones Industrials, S&P 500, and Nasdaq Composite surged between 1.3% and 2.1%.

On the flip side, stocks fell on the heels of the January 2023 jobs report, wherein payrolls increased by 517,000, blowing

past the consensus expectation of 187,000. One might think that most people would welcome signs of a robust job market, but for investors, this just meant the Fed had more work to do. As such, a clear trend — as paradoxical and backwards it may seem — was beginning to emerge: bad news on the economy was good news for stocks, and vice versa. Since the Fed began raising rates more than two years ago, there has been considerable progress towards its 2% inflation target. July’s Consumer Price Index (CPI) showed inflation of 2.9%, the lowest level since March 2021. Higher housing costs remain the stickiest part of inflation, accounting for 90% of the year-over-year increase, while food prices continue to trend down. Gas prices were unchanged during July, though J.P. Morgan warns energy is historically the most volatile component of CPI’s basket of goods.

But at a headline inflation level, mission accomplished,

right? Well, not exactly.

It seems the paradox has reversed. Bad news is no longer good news: bad news is simply bad news once again. And the shift in sentiment has been nothing subtle.

Weak economic reports that would have pleased investors just a few months ago are now being punished. Key manufacturing data dropped to an eightmonth low in July, signaling a slowdown in consumer spending and industrial activity. Stocks sold off in response, as investors feared the economy may not be as strong as it appears.

Then came the July employment report — the former poster child for bad-news-isgood-news — where job growth came in at 114,000, below the 185,000 estimate. The more concerning figure, however, was the unemployment rate of 4.3%, its highest level since October 2021. In response, investors referenced the so-called Sahm Rule, which says an economy has entered a recession once the

three-month moving average of the unemployment rate is at least half a percentage point higher than the 12-month low. Not surprisingly, stocks plunged, with the Dow posting its worst day in nearly two years on August 5th. Volatility moved in the opposite direction, spiking as investors rapidly sold in and out of positions to protect their portfolios.

The sell-off extended beyond the U.S. to other major markets, including Japan, which suffered its worst single-day drop since Wall Street’s Black Monday in 1987. Adding fuel to the fire was an unwinding of the yen carry trade — a.k.a., selling the Japanese yen to fund the purchase of higher-yielding currencies or other assets — after the Bank of Japan ended its historic regime of negative interest rates earlier this year and raised rates this summer. More proof that bad news is now just bad news.

“If data were to decline materially, the market would

price even more rate cuts. It definitely causes volatility because it’s really connected to these levered positions that are out there,” says Ben Emons of FedWatch Advisors. “I would look at leading indicators in particular.”

A 1% increase in retail sales during July, paired with a decline in weekly jobless claims, returned some hope to investors, but lingering concerns still remain. Goldman Sachs is now forecasting a 20% chance of a recession this year, up from 15% prior to the July jobs report, while J.P. Morgan says there is a 35% probability, compared to the previous 20%. Retailers like Home Depot are cutting their sales outlooks as consumers spend less on home improvement projects due to higher rates and economic unease. The once thriving experiences sector, fueled by the post-pandemic travel boom, is also warning of a slowdown. Disney says the lower-income consumer is facing more stress than before,

which is weighing on theme park traffic. Even fast-food chains and packaged goods companies like McDonald’s, Starbucks, and PepsiCo are reporting sales declines as household saving reserves dry up.

So what comes next? With stocks already returning to the levels they saw before the massive August 5th sell-off, were recessionary concerns overblown?

“The good news is that good news is good news now,” says Emons, who is keeping a close eye on the Fed’s next move. What the central bank does at its September meeting will likely have a major impact on the markets. It is all but certain that the Fed will lower rates, according to the CME FedWatch Tool, but whether that means 25 or 50 basis points remains to be seen. Economic data almost always lags current conditions, so the question is whether there is more bad news (which, remember, is now just bad news) to come. If so, are rate cuts in

September enough to save the economy from dipping, even briefly, into a recession?

As one Wall Street insider told me, those complaining about inflation may soon realize that higher egg prices are far better than not having a job at all. The paradox of bad-news-is-goodnews may finally be over, but perhaps rooting for warning signs in the first place led to more trouble than they were worth to begin with. Michelle Yu (MBA ’26) is passionate about all things media, with experience in business news, documentary film, broadcast journalism, and television. She graduated from Columbia University with a degree in Film and Media Studies and was a producer for CNBC prior to HBS.

The

Meredith Nolan, Industry Insights Editor

To the joy of many, including myself, this summer brought the return of one of the world’s biggest sporting events: the 2024 Summer Olympics in Paris. The Olympics is an opportunity for countries to send the best of the best to perform on the world stage, for audiences to become experts on events ranging from basketball to badminton to breaking, and for brands to vie for the attention of over three billion viewers, per EMarketer.

As someone who was fortunate enough to attend the Olympics for a few days, I had not fully appreciated the businessside of the Games until I was almost unable to buy a coffee because I did not have a Visa credit card. As the Olympics’ official payment sponsor for nearly 40 years, Visa is the only credit card accepted at Olympic concessions, forcing customers to either take out a Visa prepaid card at the stadiums or pay cash. Deliberately introducing customer friction comes at a heavy price – though economic terms of Visa’s arrangement with the International Olympic Committee (IOC) are undisclosed, contracts are estimated to be worth several hundred million dollars at a minimum. Coca Cola and Chinese dairy company Mengniu are rumored to be paying an estimated three billion dollars to be an official sponsor of the Olympic Games from 2021 to 2032.

The steep price to become an official Olympic sponsor reflects the unique degree of access that sponsors enjoy, and brand deals now represent a core IOC revenue stream. A non-profit organization, the IOC generates the majority of its revenue from the sale of media rights and commercial partnerships. From 2017 to 2021, the IOC generated $7.6 billion of revenue, 61% from broadcast rights and 30% from its highest sponsorship tier, The Olympic Partner (TOP) global sponsorship program. At Paris, the TOP program consisted of only fifteen sponsors, all marquee companies in their respective sectors, including AB InBev, Airbnb, Alibaba, Coca Cola / Mengniu, Intel, Omega, P&G, Samsung, and Visa to name a few. These partners generally receive exclusive category rights (i.e., they are the only corporate sponsor in their industry) and the right to use Olympic imaging.

Capitalizing on their unique positioning, TOP sponsors often use the Olympics as an opportunity to launch new products or to introduce new audiences to existing products.

Visa CMO Frank Cooper III explained their strategy to Forbes, saying, “we consistently

use the global stage of the Olympics to introduce new payment technologies. During the London Games in 2012, we promoted the idea of ‘contactless payments.’ At Río 2016, we introduced the first-ever NFCenabled, tokenized wearable...In Tokyo in 2020, we focused on the convenience and security of cashless payments.”

Along the same vein, AB InBev made Corona Cero, its zero-alcohol beer, the global beer sponsor of the Olympic Games after becoming an Olympic partner in January 2024. Growing from only 19 markets at the start of 2024, AB InBev expanded Corona Cero into an additional 21 markets ahead of the Paris Olympics, clearly identifying the Olympics as a unique customer acquisition opportunity for the relatively new product given the absence of leading non-alcoholic options Guinness 0 and Heineken 0.0 at Olympic venues. In theory, the lack of competition and sheer size of the Olympics makes it a compelling product launch opportunity. In practice, however, there are risks

to such a strategy, exacerbated by the costly investment required. For one, introducing customer friction and eliminating choice may frustrate potential new customers. When I could not use a credit card to buy coffee, I just used cash – and I am not sure if that made me any more excited to get a Visa credit card. Regular ticket holders who learned that the only beer available for purchase at Paris stadiums was non-alcoholic (due to Paris laws restricting the sale of alcohol at sports venues) might have left with a sour taste in their mouth for Corona Cero. Alternatively, instead of becoming an official Olympic sponsor, brands can also directly sponsor athletes or National Olympic Committees (NOCs) to take advantage of the unique branding and storytelling opportunity of the Olympics. All sponsorships must comply with “Rule 40,” the IOC’s guidelines on how athletes and brands can commercialize activities around the games. Notably, there is a designated “blackout period” during which non-Olympic

partners face severe restrictions in how they can use sponsored athletes or NOCs’ images and athletes are similarly restricted in sponsor acknowledgement. For years, as opposed to penalizing brands themselves, violation of Rule 40 risked athletes’ Olympic eligibility, making it a point of contention between athletes and the IOC.

However, this changed in 2019 when the IOC updated Rule 40 to relax restrictions on nonOlympic sponsors – in exchange for signing a contract exposing them to potential penalties for rule violations. Subject to certain conditions, like avoiding use of Olympic copyrighted terms, companies are now allowed to congratulate sponsored athletes for their athletic performances and athletes can thank sponsors.

The IOC also launched a pilot program (“Pilot Project”) ahead of the Paris 2024 Olympics, which allowed for sporting goods brands, like Nike, Adidas, and Under Armor, to use official Olympic images and hashtags under certain conditions for sponsored athletes or NOC teams

– further broadening access for non-official Olympic partners.

For Nike in particular, this development comes at a critical juncture, as the Company faces financial headwinds and increasing competition from disruptive athletic brands. In June, the company revised its 2025 revenue guidance to be down mid-single digits, following a flat fiscal year 2024 (up 1% on currency-neutral basis), citing headwinds in digital, its lifestyle brands, and key markets like China. The Company is also in the midst of executing a two billion dollar cost savings initiative to improve supply chain efficiency and drive “newness” in product innovation. The company plans to re-allocate these savings into reinvigorating the brand, per recent earnings announcements. As part of these efforts, Nike doubled down on the Olympics. During its fiscal Q4 earnings call, Nike’s Chief Financial Officer, Matthew Friend, outlined Nike plans to reinvest “nearly one billion dollars in consumer-facing activities in Fiscal 25…to accelerate [Nike’s] return to strong growth. This includes…driving bigger, bolder brand campaigns, starting with EC24 and the Paris Olympics.”

To that end, Nike was expected to spend more on the Paris Olympics than any prior Olympics, per reports from Vogue Business. Nike not only served as an official sponsor of the US Olympic team, it also hosted a three-day, multi-million dollar event with 40 athletes, 400 media and partners, and 13 new AI-generated sneakers (“A.I.R” sneakers), all designed to re-energize the Nike brand. Nike’s investment in Paris 2024 emphasizes how it’s not only the athletes who are taking the world stage during the Olympics.

Fortunately for brands like Visa and Nike, who decided to invest heavily into the Paris Olympics, early results suggest Paris 2024 was widely a success in terms of viewership, engagement, and content production. In the US, NBC Universal reported a total audience delivery of 30.6 million primetime viewers, up 82% vs. the Tokyo Olympics. NBC Sports social channels also registered 6.55 billion impressions on Olympics content, up 184% and 53% vs. Tokyo and Rio respectively. Clearly, the Games present companies with an Olympicsized consumer engagement opportunity – the only question is how best to “pay” to play.

Meredith Nolan (MBA ’26) is originally from outside of Washington, D.C. She graduated from the University of Virginia with a BS degree in Commerce in 2020. Prior to the HBS MBA, Meredith worked in private equity in San Francisco on TPG’s Consumer team.

Continued from front cover

water and hot fudge sundaes can make sense to consume at once.

Unlocking the brand equity accessible in these surprise moments offers a critical competitive advantage in a consumer environment in which private label products grew unit mix by 0.7% and grew dollar sales by 6% in 2023. Many brands are betting big on the economic effect of joining seemingly disparate products, assuming splashy launches will attract consumers’ attention away from cheaper substitutes. With their eccentric products in hand, brands are asking consumers, “Does it even matter if it tastes good, as long as it intrigues you?” In mid-August, self-dubbed “bestie” brands, Oreo and Coca-Cola, launched limited edition sandwich cookies and drinks mixing the familiar tastes of two iconic brands to yield an unexpected surpriseand-delight for customers. On the salty side of the aisle, CheezIt partnered with Hidden Valley for their June release of Cheez-It x Hidden Valley Ranch Crackers, following the successful launch of Hidden Valley Ranch’s Cheezy Ranch Condiment & Dressing. Certain brands have even become more explicit in their aim to be associated with entertainment. Netflix launched a branded popcorn with Indiana Popcorn, featuring flavors such as Cult Classic Cheddar Kettle Corn and Swoonworthy Cinnamon Kettle Corn to enjoy while watching one’s favorite new show. Meanwhile, the surging prebiotic soda company, Olipop, released its newest flavor, Olipop x Barbie Peaches & Cream, in collaboration with Mattel to massive success, outselling eggs at the supermarket Sprouts during its launch.

On the heels of such innovation and continued pressure from thrifty customers trading down to private label substitutes, Mars announced a $36 billion deal to acquire Kellanova, known for iconic brands including Pringles, Cheez-It, Pop-Tarts, Rice Krispies Treats, NutriGrain, Eggo, Kellogg’s (international) and RXBAR. Late last year, Kellanova was created by Kellogg’s, which spun off its North American cereal business, now known as WK Kellogg Co., from its snack business, now known as Kellanova. Kellanova has outperformed its peers since the spinoff, growing comparable sales 4% year-overyear and raising its full-year 2024 guidance.

Mars has historically been prized for its chocolate-forward portfolio, owning such brands as M&Ms, Snickers, Extra, Kind, Trufru, Twix, Skittles, Hubba Bubba, Altoids, 3 Musketeers, and more. A private company, Mars has struggled

as U.S. chocolate sales have dropped by 5.5% over the past year following a run-up in cocoa prices. Together with Kellanova and pending antitrust review, Mars would control 8% of the U.S. snack market, rivaling its largest competitor, PepsiCo, which commands a 9% share. Importantly, there is limited overlap between the two companies’ product portfolios, with Mars having a larger presence in confections and chocolate snacking while Kellanova has a larger presence in salty snacks. Combined, Mars and Kellanova would control seven snack and confectionery brands generating over $1 billion of sales a year, creating a tremendous platform for innovation with meaningful dollar impact to win back the many customers who have turned away from the allure of branded products for private label substitutes. Such investment in innovation will be necessary to serve the notable uptick in snacking over the past few years. Nearly half of U.S. consumers are eating three or more snacks a day, up 8% in the past two years, according to a report published by Circana Group in 2023. Meanwhile, snack discovery is increasingly associated with forms of entertainment. According to Mondelez International, 56% of global consumers find snack information on social media, while 54% report finding snack information through video content such as YouTube. It is reasonable to envision a product roadmap in which snacking follows the trajectory of a film

– from discovery online, to the main event of delightful consumption, to the glowing review or taste test on TikTok.

As CPG crystallizes as an entertainment vessel, the realizable value of brand equity will increase. Just as Mattel is mining its intellectual property for a slate of upcoming films after the success of Barbie, I would not be surprised to both see continued intra-company cross-pollination of CPG products (I’m personally waiting for Eggos baked with M&Ms, or Skittles flavored Pop-Tarts, or Twix Rice Crispies from Mars) as well as the diversification

of CPG into entertainment vehicles, a tradition Mars has already employed for many years with its “spokescandy” cast of M&Ms characters. Surely there may be brand dilution and consumer confusion if conglomerates over-rotate into collaborations and gimmicks, but ultimately, I believe Mars is smartly capitalizing on the delightful entertainment that is the universification of U.S. snack cabinets. The opportunity for CPG companies to capture outsized economic value will depend on their ability to entice consumers with undreamt-of treats, calling each other into

Jake Goodman (MBA ’26) is originally from Davie, Florida. He graduated from Brown University with an honors degree in English and Economics in 2019. Prior to HBS, Jake worked in corporate development, strategic finance, and retail strategy and operations at Gopuff, a rapid convenience app, in Miami, and for Barclays in New York City. He is an avid banjo and guitar player and misses the Florida sun dearly.

Santiago Gil Gallardo (MBA ’26) explores the most crucial decision in branding.

Industry Insights Editor

Juliet may have been onto something when she mused that “A rose by any other name would smell as sweet.” But would people queue up for hours to buy the latest iPhone if Apple were called “Executex”? What about “Matrix Electronics”?

(Believe it or not, both were strong contenders.) In the world of business, names are not just labels – they are the first chapter in a brand’s story, and sometimes, they are worth billions.

Think about it: your name is your first possession. It shapes you before you can shape it back and, most importantly, it plants an idea – a perception of who you are – in people’s minds before you can have any say. Psychological research supports this idea; for instance, the Pygmalion Effect demonstrates how the expectations others have of us, often influenced by something as simple as a name, can significantly shape our outcomes – creating a selffulfilling prophecy where we grow into the identity our name suggests. Some of the most profound character explorations in literature follow this very arc.

From Grendel to Frankenstein’s monster, these characters are molded by the perceptions imposed upon them, ultimately accepting – and even embracing – the identities they have been assigned by others. A name can honor legacy, inspire greatness, weigh heavily, or simply feel right. It is a profound choice because names carry power – they are shortcuts to understanding, distilling complex identities into a single word. Simply put, names are the threads that weave identity into the fabric of our existence.

This principle applies even more acutely to brands. A brand name isn’t just a word; it is a vessel of meaning, conjuring images, feelings, and expectations in the minds of consumers. In a marketplace crowded with choices, a name can be the difference between triumph and obscurity. The name is the first touchpoint in establishing the brand’s most critical mission: to develop a narrative that resonates and sticks in the minds of consumers.

According to Kantar BrandZ’s 2024 report, Apple became the first company to boast more than $1 trillion in brand value alone. The mere concept of what Apple represents in our collective psyche is worth nearly as much as the GDP of Saudi Arabia. Such a valuation is anything but an anomaly. The report further reveals that the top 10 most valuable global brands are collectively worth over $4 trillion. As expected, tech giants reign supreme, with Google ($753 billion), Microsoft

($713 billion), and Amazon ($577 billion) following Apple’s lead. Breaking the trend are the golden arches of McDonald’s, which ranks fifth and boasts a brand value surpassing $222 billion – greater than the market capitalization of many Fortune 500 companies. Kantar currently estimates that the Global Top 100 collectively represent $8.3 trillion in brand value – just below their $8.7 trillion peak in 2022, but still 76% above their pre-Covid valuation.

These figures underscore a crucial point: in today’s market, a brand’s name and identity can be its most valuable asset. But what makes these names so powerful? Often, it is a combination of clever etymology, cultural resonance, and strategic positioning. Consider Nvidia, which ranks 6th in Kantar’s report with a brand value of $202 billion and is the largest mover with a 178% year-over-year increase. The name “Nvidia” is a portmanteau, combining “Invidia” (Latin for “envy”) with “Vidia” (relating to video technology). Envy, represented by the color green, resonates throughout Nvidia’s branding. In other words, Nvidia’s name is directly imbued with the aspiration to create such high-quality technology that it would naturally become the industry’s envy. This etymological foundation subtly positions the company as both forward-thinking and desirable, reinforcing its cutting-edge ethos. While most consumers might not dissect the name, its impact on brand perception is undeniable.

But what is it, exactly, about the etymology of names that resonates so deeply?

Etymologically rich names possess a unique ability to operate on a subconscious level, creating layers of meaning that permeate a brand’s identity. This depth, while not always immediately apparent, contributes significantly to overall brand perception and resonance. The subliminal effect of such names can be a potent force in cultivating brand identity and fostering consumer loyalty. This subconscious impact works through a network of interwoven mechanisms. Names rooted in cultural or historical references tap into collective memories and shared values, creating an instant, if unspoken, connection. The very sounds of a name can evoke certain qualities or emotions, influencing perception before conscious thought even begins. These etymologically rich names activate related concepts in the mind, building a web of associations that reinforces the brand’s desired attributes. In fact, names that feel right are processed more easily by the brain, leading to a sense of familiarity and preference. Ever struggled to find the right word to describe something, only to recognize it immediately upon hearing it? The same principle applies here.

Nike is a prime example of this powerful psychological effect. Named after the Greek goddess of victory, the brand embodies triumph and success. Its name, both simple and powerful, is instantly recognizable and easy to recall, resonating deeply with athletes and aspirational consumers. The iconic swoosh logo further amplifies this identity, symbolizing movement, speed, and the relentless pursuit of excellence. Together, the name and logo craft a unified narrative that has elevated Nike to the pinnacle of global branding. In the automotive sector, Volvo derives its name from the Latin “volvere” and translates to “I roll.” This root not only emphasizes motion – the very essence of what a car does –but also implies progress and forward momentum, contributing to Volvo’s reputation for reliable, forward-thinking vehicles. While these examples showcase the power of positive etymology, the flip side can be equally impactful. A poorly chosen name can lead to embarrassment, lost sales, or even total brand failure. One oftcited example is the Chevy Nova, which supposedly did not sell well in Latin American markets given “no va” means “doesn’t go” in Spanish – not ideal for a car. As it turns out, however, that story is utterly apocryphal; the model sold quite well. Mitsubishi, in turn, actually had to learn that lesson when it was forced to change the name of the

Pajero SUV to Montero, given the former’s lewd connotations in many Spanish-speaking countries. There seems to be a pattern amongst car companies, as the Ford Pinto faced a similar fate in Brazil, where the name is slang for male genitalia, leading to mockery and poor sales. In a different product category, “snow” seems like a great name for a line of soaps and detergents, evoking purity and cleanliness. However, international expansion might pose challenges for Barf, the Iranian company whose Farsi name unfortunately conveys the opposite impression in Englishspeaking markets.

On a lighter note, some brands have found success by playfully subverting expectations. Häagen-Dazs, for instance, was crafted to evoke a sense of European quality, even though it has no meaning in any language and was created by a Polish immigrant in the Bronx. This creative approach to naming has served the brand well, helping it build a premium image despite its invented etymology. While the power of etymology in branding is clear, it is crucial to strike a delicate balance. Overemphasis on etymological cleverness can lead to names that, while intellectually satisfying, fail to connect with the average consumer. The challenge lies in crafting names that work on multiple levels – appealing both to those who appreciate the etymological depth and those who simply find the name catchy

or memorable. They serve not just as labels, but as gateways to the brand’s story, inviting consumers to engage more deeply with what the company represents.

As we navigate an increasingly digital and global marketplace, the art and science of naming become ever more crucial. Whether you’re a budding entrepreneur or a seasoned business leader, remember that in the world of branding, a name is not just a name – it is the foundation of your company’s identity, the seed of its story, and potentially, the key to its success. HBS students interested in pursuing entrepreneurship might leave the task of creating a company name to the last minute, but consumers and investors ultimately do judge a book at least partially by its cover. A decision that could, it appears, be worth billions.

In the end, Juliet was wrong. A rose by any other name might smell as sweet, but it wouldn’t sell as well. In the business world, names matter. They can be the difference between a billiondollar brand and a cautionary MBA case study.

Santiago Gil Gallardo (MBA ’26) is originally from Mexico City. He graduated from Tecnológico de Monterrey with a degree in Industrial and Systems Engineering. Before HBS, he worked in venture capital at IGNIA and investment banking at a boutique firm in Mexico City.

Charli XCX

Danielle Mitalipov, Editor

Unlike the iconic hue of her recent album Brat, Charli XCX isn’t green. The Essex-born artist made her Billboard debut in 2012 with Icona Pop collab single “I Love It,” followed by “Boom Clap” in 2014. In the decade since, Charli XCX has eschewed traditional pop stardom in favor of developing a more experimental sound –although she has stated that she does “not identify with music genres,” her EP “Vroom Vroom” (produced by the late SOPHIE) is widely credited with pioneering the subgenre of hyperpop. The avant-garde pivot has made her a critical darling, but the singer isn’t immune to doubt about the road not taken. “I used to never think about Billboard / But now I’ve started thinkin’ again / Wonderin’ ‘bout whether I think I deserve commercial success,” she sings wistfully on “Rewind.”

The smash debut of Brat has earned Charli XCX that elusive commercial success alongside critical acclaim, proving that she is not just a pop savant but a savvy businesswoman to boot. “I like the marketing of pop music more than I am interested in actual pop music,” she recently told Billboard magazine. “Desire is cultivated by being a little bit hard to reach, a little bit separate. That’s why people want to wait in a queue at f–king Supreme, you know what I mean?” The buzz around Brat might look effortless, but its branding and go-to-market strategy have been a masterclass in shrewdly cultivating that desire.

Take, for instance, the album’s distinctive cover art. Kermit might have lamented that bein’ green means blending in, but the aggressive lime color of Brat was designed to stand out: Charli XCX and her creative

team spent five months selecting the perfect bilious shade. The typography, a pixelated Arial font, is an homage to social media in the early aughts, an era which inspired the album. The resulting aesthetic is “garish” and “unfinished,” according to Brat creative consultant Brent David Freaney. It’s a clever combination that both draws the consumer’s eye and hints at the whiplash of its tracklist, which ping pongs frenetically between brash beats that ooze confidence and tender tracks revealing an underlying insecurity.

If its catchy tunes and slick branding poised Brat for success, the ingenious rollout of the project secured the momentum for its dizzying cultural ascent.

The music video for “360,” the album’s final single, began to stoke online furor ahead of Brat’s release by teasingly showcasing internet icons including Julia Fox, Gabriette, and Rachel Sennott. The video even includes a cameo from OG “it girl” Chloë Sevigny, who struts out of a convertible to join her fellow microcelebrities in a group pose reminiscent of a Renaissance painting, with Charli XCX at its center. “I was told everyone was doing bratty versions of themselves,” Sevigny remarked of the direction she received for her guest appearance.

Sevigny’s remarks speak to the creative vision of Brat, which Charli XCX has described as inclusive despite its trappings of exclusivity – anyone can be a brat in their own unique way. “Actually, everyone can join the club. It’s just that everybody joins at slightly different times in slightly different ways,” she explained. Deliberate marketing has helped extend that open invitation to fans (Charli XCX noted that “my private Instagram posts, or the 400-person Boiler Room, or a random cinema screening of a new music video in L.A., or a text message from me” are points of contact which

allow fans to “join the club”), but it has also contributed to an ethos of authenticity, according to former Warner Music strategist Hugo Lieber (MBA ’26). “What really hits home is an ability to communicate authentically with fans and bring them into the fold…Brat was a perfect storm of cultural moments and marketing,” he explained. Brat’s social media rollout has been especially instrumental in building that genuine connection. For instance, social media posts come directly from Charli XCX’s accounts, and her “antipromotion” promotions – such as a tongue-in-cheek tweet poking fun at marketing ideas presumably from her label –positions Brat as a subversion of commercial expectation. Other posts lean into meme culture by sharing Brat art generators or semi-jokingly proclaiming that “kamala IS brat.”

Iterations on tracks also showcase the refreshingly freewheeling and unpretentious nature of Charli XCX’s creative process. The remix of “Girl, so confusing” featuring Lorde, for example, was an unplanned addendum to the original track, in which Charli XCX reveals her misgivings about the “Royals” singer, whom she cryptically describes as a musician who prefers poetry to parties and has “the same hair.” Lorde, upon hearing the track the day before Brat’s release, suggested creating a new version of the song which resolves their grievances via lyrical dialogue – or, as her verse more punchily puts it, “let’s work it out on the remix.” “There was such a rawness and an immediacy to what I was saying,” Lorde noted. There’s something very brat about that…Only Charli could make that happen.” The spontaneous release spurred further excitement about the album, fulfilling the song’s winking prophecy that “when we put this to bed / the internet will go crazy.”

It’s this authenticity that gives Charli XCX a credible claim to both tap into and define our cultural zeitgeist with Brat.” Clever social media presence is all but a requirement for musicians today, but Charli’s music has always been inextricably linked with social media (she made her musical debut by posting songs on MySpace in 2008). And although plenty of pop stars have recently paid lip service to 2010s indie sleaze, skeptics who accused Charli of merely appropriating the era were promptly reminded that she had lived it, performing in underground raves as a fourteen year-old. Nor can her work be reduced to stale club throwbacks, given her cutting edge contributions to hyperpop, a genre characterized by Atlantic magazine as a “rebellion [that] marches under the seemingly tame mantle of pop” by incorporating the transgressive properties of other genres such as, coincidentally, “punk’s brattiness.”

That first-hand experience likely helped her recognize the growing cultural backlash against the polished minimalism which dominated the early 2020s, musically and otherwise. The grimy party girl glamor of Brat is true to Charli’s origins, but it’s also a well-timed invitation to let loose in the face of an uncertain future and all its accompanying anxieties, a role pop music has historically played with aplomb (see the “recession pop” of 2008). However, the album is more than mere escapism. Its lighthearted promotion of debauchery conceals a more important offer it makes to young women in particular, urging them to consider a loud and unpolished alternative to the “clean girl” aesthetic of recent years. That messier mode of femininity is not limited to smudged eyeliner and three a.m. tequila shots – it also encourages honest examination into the messy complexity of women’s internal lives, including

the less-than-perfect way they can treat other women. Like “Girl, so confusing,” many of the songs on Brat explore Charli’s fraught relationships with other women, which contain pettiness and jealousy just as they contain love and admiration. “You can, I think, experience envy and still be a good person who champions other women…[but] we don’t talk about it because we’re all supposed to be strong and confident,” she elaborated in an interview with Vox magazine. Ultimately, Brat’s success indicates a growing hunger for pop that takes risks, according to Media & Entertainment Club co-president Miles Jefferson (MBA ’25). “I can’t help but think that the rise of indie female artists like Charli and Chappell Roan are somehow a response to the success of super safe and clean cut [artists such as] Taylor Swift,” he pointed out. It’s time for pop to evolve beyond onedimensional feminist anthems (such as Katy Perry’s cloying recent single “Woman’s World”) and role model girl-next-door pop stars. Better to be real than relatable, Brat argues. Perhaps it’s no surprise that the album shares a name with Barbie’s bolder and more impudent cousin (looking at you, Bratz). Move over Barbie pink – this summer is Brat green.

Danielle Mitalipov (MBA ’25) is an RC interested in both sustainability and entertainment & media. She is a Student Sustainability Associate (SSA), and helped organize the HBS Climate Symposium. Prior to HBS, she studied philosophy at Stanford University, and led merchandising for a global brand at adidas. Outside of school, she is usually writing or watching the latest release at the Coolidge Corner Theater.

Chuck Isgar (MBA ’25) speaks with Grayce Co-Founder Kassidee Kipp (MBA ’10) to discuss how the company has embraced a B2B2C model and leaned into human care partners.

When Kassidee Kipp (MBA ’10) and her co-founder Julia Cohen Sebastien started Grayce five years ago, very few employers knew that a benefits category focused on “caregiving” existed. Covid, however, spurred a focus on employee retention and satisfaction, and Grayce plays an important role in that mission: ensuring that caretakers are provided with the support they need. Caretakers refer to people who spend time helping take care of the physical, emotional, and logistical needs of a family member or other close relationship. While not a part of an employee’s “day job,” caretaking responsibilities outside of work can be all consuming, hence the incentive for employers to help their employees manage.

Through a “tech-enabled services” approach, Grayce creates a care plan to support each member, wherever they are on the care journey. Grayce helps with topics ranging from educating about healthcare options after a diagnosis, to understanding how to handle insurance claims, to putting together a list of homes for an upcoming move. Each of these can represent daunting tasks embedded in “complex systems,” according to Kipp.

Grayce’s mission is to provide a “concierge”-like strategic partner that supports the caretaker in traversing these different challenges. They do this by providing access to licensed clinical social workers, called “care partners.” In a space that has an increasing number of competitors, Grayce differentiates themselves by taking an approach that embodies both technology and human services, whereas many competitors have leaned harder into the technology aspect.

This model seems to be working, with the company achieving Net Promoter Scores in the 80’s and high member loyalty. However, building this company is not as simple as having happy end users. The company is B2B2C in that they sell to employers, often a Chief Human Resources Officer (CHRO), but the end users are the employees who utilize the service. There is an inherent challenge embedded in this model: an employee’s role as a caretaker is not always easily identifiable. Even though

there is usually a sizable portion of any employee population that is playing the role of a caretaker, a CHRO cannot necessarily quantify this as well as they might be able to quantify metrics like the number of visits to a doctor that employees take over any given time period.

Despite the difficulty of finding caretakers, there is a perhaps unexpected boost for the business: the scope of caretakers is significantly larger than what one might initially imagine. Kipp initially thought they would target caretakers focused on supporting aging parents. However, they quickly learned that there is a large population of caretakers tending to the needs of kids, spouses, and beyond. They decided to broaden the platform, including with respect to geography: just because an employee is based in a foreign country does not mean you can “geofence your users” as the people they are taking care of are often located across the globe.

Grayce works under a model wherein most employers pay a platform fee to get going, after which the employer is

charged per employee who uses Grayce’s platform. In this way, Grayce has an incentive to find the caretakers in the population, but the company must strike a balance as it relates to usage. Kipp shared that the company is “not seeking to maximize [daily active users].” Rather, the company’s goal is to be top of mind when someone has a crisis, while simultaneously providing ongoing support to those who are actively in caretaking roles.

Initially the company sold personal coaching time with its care partners on an hourly basis. That coaching is now unlimited, but the company tries to allocate human support where it is most valuable. Relatedly, the company has a robust online community which can help provide insights on caretaking topics such as supporting loved ones through loneliness, where 1-1 coaching may be less helpful than a community-based approach.

Kipp shared that the company receives “so many applications for care partners” and attributes this to a variety of factors: social workers who work with big, bureaucratic hospital

organizations experience burnout themselves and they appreciate that Grayce allows them to use their skillset in a more modern form. Further, Grayce allows them to work from home and gain flexibility. Kipp hinted that over time, the company will likely be able to “more sophisticatedly” match caretakers to care partners.

Grayce has gradually moved upmarket: while they used to focus on law firms and tech companies, they find themselves now targeting larger workforces such as manufacturers and big sporting goods stores. A key question going forward will be activation, especially given the company’s incentive to identify and onboard the caretakers in a customer’s employee population..

The company of over 30 employees recently raised a $10.4 million Series A round of financing led by Maveron. Kipp shared that they will use the proceeds to hire key functional leaders, build out their development team, and make significant investments into their sales efforts. With “margins upwards of 70%,” it seems as if

the company has found a business model that works and solves the needs of several groups: employers are able to decrease employee churn, care partners are finding themselves with more flexible and engaging work, and most importantly, caretakers are receiving the support for which they desperately yearn.

Chuck Isgar (MBA ’25) loves all things startups. He created and runs Above Board, a weekly newsletter which features Q&A’s about startup investment, board management, and corporate governance. Most recently, he served as the Chief of Staff at Scenery, a Series A-stage startup. Chuck previously co-founded and was the CEO of Intern From Home, a recruiting technology company that served students from over 600 colleges. Chuck was a Schwarzman Scholar at Tsinghua University and earned his bachelor’s from Brown University.

Talha Minhas, Contributor

HBS attracts world-class individual talent, but the sum would be no greater than the whole of its parts without a cohort of community leaders striving to build a conducive learning environment for all. At the heart of this community is the Student Association (SA) – HBS’ take on student government – which strives to enrich the student experience and ensure every student feels they belong on campus. To understand what makes the SA tick, I interviewed its current Co-Presidents, Hayden Tanabe and Taylor Walden.

Tanabe, currently in his third student government position, sees his role as a Co-President as an opportunity to enhance the HBS experience for everyone.

“I’ve always been a student government kid… And I also know what it feels like not to feel like I belong. I think that this role gives a nice opportunity to make sure that everyone does feel like they belong [here at HBS].” His experience pairs nicely with the fresh perspective brought by Walden, who is currently serving in her first-ever student government position. Friends first, then Co-Presidents, Walden and Tanabe complement each other in a Yin and Yang duality: Walden’s natural tendency to stay grounded combines harmoniously with Tanabe’s high energy, lead-from-the-front approach, ultimately shaping a dynamic student experience at HBS.

The SA’s far-reaching

remit covers all things student experience. With a strong focus on diversity, equity, and inclusion, the Co-Presidents have put together a well-rounded team of 14 individuals representing the student body, Sections, and affinity groups. “We lean on [our team] for input and advice... Everything that we do, we will always give our team a heads up and collect input from them before it goes broad,” commented Tanabe. The team makes decisions with a highly collaborative approach, driving outcomes that generate value distributed equitably across the student body.

Walden and Tanabe have adopted a “less is more” approach, focusing on the few things that will create the most

impact for students. This year’s major focus areas include enhancing financial accessibility, increasing student engagement, and strengthening campus resources. For instance, they plan on improving access to resources (free coffee on Mondays and a $10 printing credit for every student), along with making events like Holidazzle more affordable by redistributing funds from less popular events. Boosting attendance at community-wide programs like MyTakes, which support diverse student affinity groups while fostering vulnerability and close connection, is another priority goal. Finally, there is a concerted effort to enhance the Products Office by expanding its offerings and leveraging its revenue to

further subsidize event costs. Altogether, the SA endeavors to use initiatives like these to improve the student experience through better resource management and inclusive programming.

Collecting feedback from the student body to identify areas of improvement is fundamental to Walden and Tanabe’s leadership approach. With a diverse executive team that includes representatives from each Section, the SA aims to be agile and responsive to student needs. “Our hope is that not only do they focus on their role and the scope of what it is, but we have a smaller team than years past, so we can be nimble,” explains Tanabe. This revamped structure will let the SA swiftly collect and act on feedback. The SA is scheduled to meet with Section presidents, initially every week and transitioning to bi-weekly and monthly checkins, to gather insights from each group of 90. “Hayden and I will meet with every Section president... to get real-time feedback,” mentioned Walden, highlighting the commitment to understanding and addressing student needs. The SA leadership also values direct interaction, and invites students to share their perspectives through channels like email and WhatsApp. By being physically present at most events, Walden and Tanabe seek to ensure that student voices are heard and acted upon.

The message for RCs eager to make their way into SA is clear: seize the opportunity to get involved and make a difference. As Walden shared, “It’s so rewarding to be involved at the Section level because your

Section is such a big part of your RC year.” This is not only a way to build genuine relationships with peers and faculty, but also to shape a top-notch Section experience. Even if it is your first time running for a leadership position, do not let fear hold you back. “You face your fears and you do it, and then you come out on the other side,” encourages Walden. Various positions beyond Section presidency are equally valuable, and your involvement, whether through formal roles or ad hoc additional responsibilities, can significantly impact your community. Remember, a rising tide lifts all boats, and stepping up to contribute will enhance both your experience and that of your peers. Tanabe and Walden are determined to enhance the HBS student experience during their time as Co-Presidents. Their commitment to making the student experience even better than their own exemplifies HBS’ mission to educate leaders who make a difference in the world. As Walden and Tanabe’s experiences show, stepping up to lead can make your time at HBS even more rewarding and impactful, enriching both your journey and that of your classmates.

Talha Minhas (MBA ’26) is originally from Pakistan. He graduated from Lahore University of Management Science (LUMS) with a bachelors in Management Science. Prior to the HBS MBA, Talha worked in e-commerce and fintech across South Asian emerging markets.

Adhitya

Adhitya Raghavan, Contributor

As I step into my second year at Harvard Business School, I’m filled with a mix of emotions – excitement, nervousness, and a touch of nostalgia. Beginnings and endings have a way of heightening our senses, making us more attuned to the changes that lie ahead and the experiences we’ve left behind.

Leaving behind the comfort of freshly cooked Indian food at home, the familiarity of focusing solely on one thing – be it an internship or, in my case, working on a startup idea – is never easy. It’s bittersweet to part with what we know and step into the unknown. But in this bittersweetness lies the beauty of new beginnings. It’s

an opportunity to form new friendships, discover new places, and learn new things. For many of us, the start of the second year feels like a fresh chapter in our stories. We’ve successfully navigated the challenges of the first year,

and now we’re given the chance to approach things with a fresh perspective. I’m particularly excited about meeting new RCs and ECs in my role as a dorm ambassador, and I look forward to taking new classes that push me out of my comfort zone, like

Negotiation.

Whether discussing case studies in a new light or diving into an entirely different extracurricular, let curiosity guide you. As I reflect on my first year, I fondly remember some of these leaps of faith – the biggest being singing on stage during Cabaret and dancing with my section during EKTA. Yes, those moments trump any and all academic or professional achievements.

The power of beginnings and endings lies in the blank slate they offer. They give us a unique chance to craft a new persona, leave behind the baggage of the past, and start fresh. You might make minor tweaks, or you might entirely reinvent yourself – academically, socially, or personally. Either way, this is your moment to shape your journey. As I plunge into my second year, I do so

with excitement and a sense of adventure. I don’t know exactly what lies ahead, but I do know that it will be a year to remember. I hope to continue writing my story with passion, curiosity, and an open heart. To all the students embarking on this journey with me, I wish you the best of luck as you chart your own paths. Let’s embrace the beginnings and endings with a sense of wonder, and a commitment to making this year truly memorable.

Adhitya Raghavan (MBA ’25) is originally from Chennai, India. He learned about rockets during his undergrad at Princeton, studying Mechanical and Aerospace engineering. Adhitya loves playing sports and attempting to write poetry, and hopes to build his own energy company post-HBS.

How Joe Critchlow’s (MBA ’26) college football experience brought him to Cambridge.

Even amidst the chaos of START week, Joe Critchlow was hard to miss among the 2026 RC class. He looks the part of a Division I quarterback – at 6’4” with bright red hair, he stands out in any crowd. And while his natural athletic ability helped him contribute to victorious performances in tug-of-war and bucketball during the Section Olympics, it’s unlikely that his classmates in Section H fully appreciated his athletic pedigree or his one-of-a-kind journey to HBS.

Over the last 10 years, Critchlow’s path to campus led him through packed football stadiums in Tennessee and Utah, remote Québécois villages, and a yearlong stint in Hong Kong at the height of the COVID-19 pandemic. Along the way, he met and married his wife, Allie, and became the father to two sons, Brooks and Cal, all while pursuing a career in consulting at Bain & Co. He’s achieved more in his 27 years than many do in a lifetime, and much of that can be attributed to his first love – the game of football.

The son of a former college quarterback, Critchlow’s football life began in earnest at the age of eight in Franklin, Tennessee, just outside Nashville. He played several sports throughout his youth, but football – and the quarterback position – was his passion from the start. A natural leader, he always felt comfortable with the ball in his hand, and even as a young player gravitated to the more intellectual elements of the game, memorizing Pop Warner playbooks and analyzing film long before he was ever expected to do so. When asked about how he separated himself from others, even early in his career, he said that he “learned quickly that if you can be smart about how you play the game, you can give yourself a leg up.”

That leg up let him excel at Franklin High School, where he earned the Mid-State Mr. Football Award following his senior season. His success naturally led to attention from college coaches throughout the Southeast, and he first envisioned continuing his career close to home at Vanderbilt, where he had begun to build a strong relationship with the coaching staff. His

desire to balance academics with the allure of playing in the SEC seemed to dovetail well with what the Commodores had to offer, and the thought of staying in his home city was appealing. However, things weren’t that simple.