Sports Betting: The Stakes Have Never Been Higher

Surbhi

Bharadwaj, Contributor

After half a semester at HBS, the three days of START are a blur for most of us I remember little from those days except for one statistic: 17 7 million

During his welcome address, MBA program Chair Matthew Weinzierl quizzed the incoming class on an assortment of HBS trivia 17 7 million was the number of cases HBS sold last year

To contextualize that number, Weinzierl described HBS’ mission: to pursue bold experiments in teaching A century ago, HBS settled on the case method as the bold experiment to train the managerial mind

Two months into my own education here, I have found myself in turns enthused, amused, and disappointed by how cases have played out in my classes I am convinced the method excels in teaching us how to

information deserts a critical role of the manager but I am less certain that it equips us to consider deeper structural issues When we condense complex choices into ten pages from a single point of view, we fail to see the historical context behind and structural implications of the issues we are tackling We rarely explore how consumer preferences, values, technology, and politics are all intertwined We take our constraints as a given instead of interrogating our own role in creating them and seeking to imagine new paradigms

The RC does incorporate the occasional simulation, problem set, and exercise, but the vast majority of our learning is founded on the case method

It is also as much part of HBS’s brand as its pedagogy The 17 7 million cases sold last year accounted for the majority of the $310 million HBS made from publishing Most of the 350 cases our faculty write annually are vetted and approved by company representatives While professors

lead us into critique in class, I worry that discussions based on a premise that has been moderated by public relations departments are inherently limited

The case method is so intertwined with HBS’ institutional identity and economic model that it has become the default teaching tool when alternatives may serve us better The Swiss Army Knife of skills a manager needs must be delivered through an analogously diverse set of pedagogical choices

Legal origins of the case method

The “casebook” method by Harvard Law School in the 1890s Instead of simply studying the rules of law, as had been the norm until then, students were encouraged to reason through real judicial opinions and cases As an HBS blog describes, “With the case method, pedagogical emphasis shifted from facts and

Before coming to Harvard Business School, I had never truly embraced my identity as a Latina In fact, I never considered myself part of a “minority ” Growing up in Mexico City in an environment where most people shared the same culture and background as I did, being Latina was just a given It was not something I had to think about But HBS changed that Being here has awakened in me not only the realization of my identity as a Latina but also the need to stand up for it and demand visibility

The term “minority” is one I had always struggled to associate with, but at HBS, I have experienced what it means to feel like one – less seen, less heard, and less represented compared ironic, really HBS is celebrating Hispanic Heritage Month across its platforms, promoting it on internal communication channels, social media, and public forums But when it comes to Latino representation on campus, there is still so much

more work to be done According to the 2022 census, Latinos make up 19 1% of the U S population, but at HBS, we represent only 10% of the community This gap is not just a matter of numbers; opportunities, and spaces where Latino voices are missing or marginalized Here are some of the key areas where I believe that HBS falls short:

During my RC year, I encountered fewer than 10 cases focused on Latin America, most of which were outdated and didn’t the region For instance, the Oxxo case is about to turn 20 years old In BGIE, only two cases addressed Latin American countries, and both lacked depth and nuance For example, the Brazil case centered solely on corruption without providing a broader context of the country’s rich history, culture, or economy – context that other cases typically include Latin America is home to many successful businesses and economic growth stories that deserve attention in our curriculum According to UCLA (2024), U S Latino GDP

Tim Ford,

Editor-in-Chief

How can these two arguments possibly be reconciled, you ask? Don’t worry, our advice column had plenty of insights on time management and self-care

We embrace things done differently We celebrate adventures. A German athlete moving to Wisconsin to play tennis, a snack stand server growing up to run the MBA and Doctoral Programs at HBS, and people doing crazy things with help you make gains. It amazes me what people come up with and what people make happen, especially those who commit and those who are willing to be wrong We engage with

representation and inclusivity, and the work we still have to do How can we increase Latino representation at HBS? How can we use technology to help Black and diverse founders access venture capital funding? Does the HBS case method let us adequately engage with structural challenges like these, or do we need a revised approach? I don’t know, but I hope we talk about all of this, and help move the ball forward inch by inch

in the U S is November 5th

Please register to vote, if you’ve not already – the Massachusetts deadline is October 26th Many states end registration earlier in the month Visit vote gov

Please talk to other people about why you plan to vote for your candidate, and listen when they do the same Vote early or vote on the 5th, vote in person or vote by mail, but please vote, the whole ballot

Tim Ford (MBA ’25) is originally from New Jersey He graduated from the University of Virginia with degrees in Commerce and Spanish, and completed an M.Phil. in Latin American Studies at the University of Cambridge Prior to the HBS MBA, Tim worked in growth equity at TPG in San Francisco

One year later, the U.S Supreme Court’s decision reverberates across institutions and corporations. Black investors make up only four percent of venture capitalists, and Black-founded startups receive less than one percent of $136 billion U.S. venture funding The venture industry and American stakeholders must explore technology tools to help embrace diversity, identify more opportunities, and generate higher returns on investment

McKinsey & Company stated that achieving parity in investments in Black and Hispanic ventures could generate an additional $3 9 trillion if investment and equity correlated to their market share of the U S population. If the U.S venture industry aims to identify investment opportunities that solve human problems, the conversation must evolve beyond paradigms of nuanced socioeconomics or a utopian equilibrium

“I want to provide things that people need and things that I can use that are very authentic to me,” said Serena Williams, Serena Ventures Managing Partner, who recently invested in the multibillion-dollar topical pain relief market and has also invested in fourteen companies with $1 billion of cumulative valuation technology startup led by Sheena Allen, attracted investments

Combinator, Fearless Funds, and Lombard Street Ventures. This is a prime example of the case for inclusivity, which expands deal opportunities and helps solve America’s biggest problems

Esusu, a Black-founded and startup, surpassed a $1 billion valuation in its January 2022 Series B “We founded Esusu with the vision of using data to bridge the racial wealth gap and create more equitable to-moderate income households in this country,” said co-founder Wemimo Abbey Abbey and his co-founder Samir Goel grew topline 600% year-over-year in 2021, and planned to triple headcount post-fundraise

Expanding opportunities to achieve higher success rates in acquisitions, IPOs, and ROI. triumphs of the

The case for inclusivity in the U S venture industry is not an appeal for unmerited advantages over White or Asian founders and investors Rather, the case for inclusivity is an allin approach that achieves higher

success rates in acquisitions and IPOs, and higher returns on investment

Intelligence (Al) remained the most attractive area of VC funding, with U.S.-based companies like CoreWeave, a cloud AI startup, raising $1.1 billion of equity and $7.5 billion of debt, targeting an IPO in 2025 Algorithms are becoming viable solutions for investors to demystify market trends, assess by diverse founders, and amplify viable investment opportunities

Amidst fears of recession and prolonged high interest rates, overall VC funding declined by Black-owned ventures dropped by a whopping 71%. Blackowned ventures were hurt more during the downturn in the venture industry, but “AI has the potential to enhance access to capital for Black and diverse founders,” said Abolaji Adesoji, IBM Data and AI Platform Senior Product Manager

AI algorithms that can help expand venture funding and increase return on investments include Deep Neural Networks (DNN), Bayesian networks, and Automated Machine Learning (AutoML) While these tools to support tactical offer can existing biases that prevent investors from identifying more unicorns like Tope Awotona’s Calendly and Wemimo Abbey and Samir Goel’s Esusu. The percentage of Black-founded startups receiving venture and racial disparities in the U.S It’s our responsibility to ensure that AI solutions prioritize equity, transparency, and accountability and mitigate the risks of reinforcing biases in venture funding

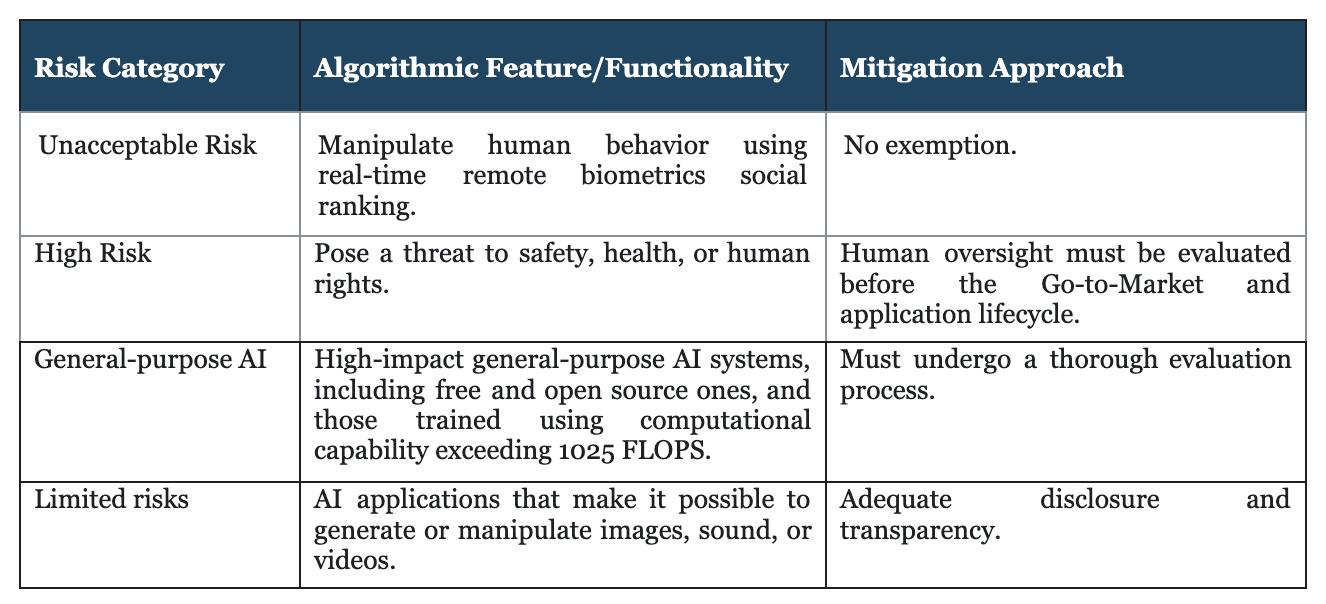

On August 1st, 2024, the European parliament enforced the EU AI Act to regulate AI systems across the EU’s private and public sectors. Broadly, by categorizing risks posed by generative AI in order of severity of adverse impact, the U.S Venture Industry can apply the AI Risk management framework, conceptualized by the EU AI legislature, to build algorithmic features and functionality that expand venture investment and funding opportunities

The Supreme Court and Congress have a responsibility to interpret the Equal Protection Clause of the Fourteenth Amendment and tackle the idea of a merit-based utopia, which ignores 248 years of American history – over a third marked by the Reconstruction era, Jim Crow, and the recent and fragile

Jake Goodman, Contributor

Once relegated to the pantry shelves of bodybuilders and health buffs, protein has risen to become a staple ingredient in your waffles, pasta, and even gummies. In an era where consumers demand more from their food – more nutrition, more function, and more convenience – protein-packed products have lately become rising stars of the consumer packaged goods (CPG) industry. But this surge is not just about muscle; it is about meeting the needs of a fast-evolving, health-conscious market that’s hungry for innovation in staple categories.

What has propelled protein into the mainstream? According to Kantar’s Defining Better 2024 study, among the shoppers seeking healthier items, 42% said they are interested in seeing more high-protein grocery products. I would argue protein is an accessible and easily understood message to signal the health value of a product. The trendiness of protein requires no consumer behavior change for a protein-packed product to be successful. In contrast to more obscure messaging with substances like nootropics or goji, protein is a fundamental part of the human diet that has been most commonly associated

with animal meat for centuries. What is different now is protein is diffusing into other use cases and meal occasions. Staple foods – bread, cereal, pasta – are easy targets for a lower carbohydrate, higher protein offering with attractive packaging meant to signal a new paradigm for these legacy categories.

Breakfast, in particular, has seen an explosion of products highlighting their proteinforward offerings. In fact, the space is seeing a follower effect in which the large incumbents are latching onto the strategies of disruptors. Mason Dixie Foods, one of the fastest-growing frozen comfort food brands in the U.S., best known for its clean-label biscuits, sandwiches and waffles, has seen 87% dollar growth since 2021. Meanwhile, Banza, famous for its chickpea waffles, created a protein-packed chickpea waffle. Larger CPG conglomerates have been diving into the space as well, scrambling to play defense against dynamic startups. Kellanova launched a proteinpacked version of Eggos in May of this year, while General Mills has released several cereal SKUs focused on protein, such as the new Wheaties Protein and Ghost Protein Cereal, in collaboration with well-known protein powder manufacturer Ghost.

Part of the push into protein from food conglomerates has been a response to the rise of weight loss drugs like Ozempic, Mounjaro and Wegovy. With

around six percent of US adults having used or currently using weight loss drugs, concerns around muscle mass loss are prompting food conglomerates to evaluate new ways to serve these consumers at a moment when these drugs threaten overall packaged food volume. In response, Nestlé created Vital Pursuit, a new line of foods intended to be a companion for GLP-1 weight loss medication users, set to launch in the fourth quarter of 2024. Vital Pursuit will offer a variety of proteinforward frozen formats such as bowls with whole grains or protein pasta, sandwich melts, and pizzas.

Large CPG players are also facing competition from wellcapitalized startups in the space, whose recent fundraises highlight growing investor interest. In September 2024, Create, an early stage CPG company building innovative creatinebased products, notably creatine gummies, announced it had raised $5 million in a Series A funding round led by Unilever Ventures. Izzy Hemington, Principal at Unilever Ventures, commented that they were impressed by Create’s ability to “reimagine the creatine landscape with products which resonate with a broader audience.” The company believes it will skyrocket to $25 million in revenue this year, primarily through Amazon and TikTok Shop with additional distribution in GNC and Wegmans.

Meanwhile, David, founded by Peter Rahal, known for founding and selling RXBAR for $600 million, announced a $10 million fundraise in August 2024. David claims to produce “science-based, delicious food” that will have “the most protein per calorie of any currently available protein bar” while remaining sugar-free and artificial sweetener/flavor-free. The company is affiliated with popular gurus in the health and wellness space: Peter Attia, M.D., and Andrew Huberman, Ph.D. Their support will elevate the product in the hyper-aware digital health social media bubbles that fed their prominence. Rahal’s second venture in the space is indicative of a certain belief that science-backed formulations can unlock incremental demand to compete with Rahal’s former company. Rahal eventually aims to apply the same underlying philosophy of David’s protein bars to other categories, namely ice cream and other salty snacks to help customers build muscle and lose fat.

Protein has even made its way to the entrepreneurial scene on campus. Dylan Paul (MBA ’25) is building Pluff, a high protein treat focused on providing consumers with a delicious alternative to traditional high protein products. Pluff is made from high quality ingredients, including Greek yogurt, heavy cream and whey protein blended together, producing a puddinglike consistency. Every serving features 20 or more grams of protein, low sugar content and a total calorie count below 200, all within 4oz. Paul decided to create Pluff as he believes “consumers

are tired of the same boring high protein products such as protein bars, powders and shakes and are dying to try something new that tastes better.”

With increased interest from the investing world, CPG conglomerates, and startups, protein appears to be a powerful framework by which to reinvent legacy and emerging CPG categories. What is new feels old; the key to muscle strength is hidden in your everyday staples. As consumers continue to prioritize health and functionality in their food choices, the focus on protein not only reinvents legacy categories but also opens up new frontiers for innovation, driving the food industry toward a more nutrient-dense and sustainable future. According to McKinsey, over the past five years, $4 billion has been invested to develop novel ingredients ranging from mycelium proteins to animal-free eggs. While it may be difficult to find protein newsworthy or novel, it is clear that innovation and the mainstreaming of high protein foods will create strong brands in the years to come, muscling out the legacy options.

Jake Goodman (MBA ’26) is originally from Davie, Florida. He graduated from Brown University with an honors degree in English and Economics in 2019. Prior to HBS, Jake worked in corporate development, strategic finance, and retail strategy and operations at Gopuff, a rapid convenience app, in Miami, and for Barclays in New York City. He is an avid banjo and guitar player and misses the Florida sun dearly.

The rise of legalized sports betting highlights the

Meredith Nolan, Industry Insights Editor

The kickoff of Fall signals another proverbial kickoff – the return of America’s favorite pastime, NFL football. Tens of millions of Americans will not just watch, but also “play” by joining a fantasy football league. The American Gaming Association expects bettors will wager a staggering $35 billion through legal sportsbooks this NFL season, up 31% from last year. It has been only six years since the U.S. Supreme Court struck down a federal statute preventing sports wagering. In that time, sports betting has rapidly grown, driven by both legalization in thirty-eight states and the District of Columbia and technological innovations powering more advanced betting. Fans can bet on more than just the outcome of the game; they can bet on a collection of outcomes across multiple games at the press of a button. As the industry approaches a national scale, questions have been raised about the impact of legalized sports betting and widespread speculative trading, including what exactly, if anything, needs to change to protect fans, players, and the integrity of sports themselves.

Proponents argue that the legalization of a practice that was already taking place illegally has allowed for more responsible oversight of the industry and for states and leagues to financially benefit. In the first five years of legalization, it is estimated that states received $3 billion in incremental tax revenue from sports betting. Leagues, like the NFL, NBA, NHL and MLB, benefitted directly from both the lucrative partnership agreements with sport betting platforms like DraftKings, FanDuel and Caesar’s, and the higher engagement from fans who have a literal stake in the game. The billions received by states, leagues, and betting platforms –who can reinvest the capital into business development – make it unlikely that sports betting will become illegal again, at least in the near term. As a professor in the business of sports at Washington University in St. Louis told the New York Times, “there is no putting the toothpaste back in the tube.”

However, the legalization of sports betting has highlighted the serious risks associated with the creation of a speculative market. The most obvious of these is a higher rate of gambling addiction, especially among young fans. Calls to gambling addiction help centers reportedly doubled in several states following the legalization of sports betting. The gamification of the sports betting “marketplace” is a major driver

of this worrying trend. Thirty states have legalized online sports betting, enabling the rise of mobile betting. On mobile betting apps, platforms have eliminated customer friction, making it seamless and fun for fans to wager. The development of more advanced algorithms and simulations to price risk has empowered platforms to offer more complex wager structures. No longer are fans only betting on the outcome of a single game, they can engage in prop bets – micro bets on specific occurrences in a game, or complex parlays – a series of bets that all must hit for the bettor to win. All have their own risks. Prop bets have made preserving the integrity of games even harder. It provides temptation for players to fix aspects of their performance to hit a certain line, which can be harder to detect than throwing an entire game. Complex parlays tend to have lower odds, but higher payouts – making them particularly attractive from a margin perspective for betting platforms, but riskier from a

consumer perspective.

These cross-sell and upsell products have powered the rise of legalized sports betting platforms like DraftKings, FanDuel and Caesar’s. The high cashflow nature of these businesses lets them heavily invest in customer acquisition, from sports betting ads during games and at stadiums to attractive entry offers, like “Bet $5, Get $200 in Bonus Bets” from FanDuel. These promos create powerful flywheel effects for betting platforms, likely at the expense of fans’ long-term wellbeing.

The ability to engage in increasingly complex bets has also heightened the risk of player scandal. Legalized sports betting has created a marketplace, which to be efficient and fair, is dependent on equal access to information. However, with prop bets in particular, the sheer number of potential bets across multiple leagues and hundreds of players has made it easier and more tempting than ever for individuals to trade on asymmetric information, or for players to throw the odds. As a

result, there have been a number of major player betting scandals. Each league sets its own rules and regulations for players, in coordination with their player associations – which has led to nuances that players must carefully navigate or face severe penalties.

Unsurprising given its status as the largest sports league in the U.S., the NFL has one of the strictest sets of rules: NFL employees are unable to wager at all, but NFL players can bet on other sports under certain conditions (i.e., not betting on team facilities or on team trips, etc.). For leagues, these scandals risk the very integrity of the sport. There are also serious concerns about players’ wellbeing. With money on the line, fanfare can descend into fanaticism and aggression. NCAA President Charlie Baker has even called for states to ban college prop bets given the growing number of player scandals and the harassment that these young players face from bettors when money is at stake. For individual sports,

the onslaught of outrage from a surprise loss is a particularly heavy burden. Several tennis players have publicized the abuse they received after losing a key match when the odds were stacked in their favor, including threats to their life.

Altogether, leagues and states are grappling with how to protect fans, players, and the integrity of the game – and that requires keeping up with the latest technology. The companies developing sophisticated predictive models that power betting marketplaces also help monitor the market. The NFL has a strategic partnership with Genius Sports, who “powers over 98% of the legalized US sports betting market with official NFL data, driving innovations such as player props, micro-betting, same-game parlays” and who is also charged with monitoring and flagging irregularities. This dynamic has worked so far likely because leagues are highly motivated to ensure games are fair – or risk losing their appeal to fans. However, the proliferation of AI and more advanced predictive algorithms, which price risk across a range of sectors, has opened the door for new markets beyond sports. One example of this, Polymarket, one of the largest prediction market platforms, enables users to bet on nearly any geopolitical event. While it is currently illegal to bet on U.S. politics within the U.S., like sports betting, it is likely to be a topic for regulators to grapple with as demand for these products grows.

The ongoing debate around legalized sports betting potentially foreshadows the key questions and risks we will face with the advance of predictive modeling. As new market opportunities grow, where should we draw the line on what can and cannot be traded? What are the right guardrails to put in place to protect individuals? Will the burden fall on governments to design and enforce regulations, or will we charge the technology companies themselves? With the rapid pace of technological change, we may need to address some of these questions sooner rather than later.

Special thanks to Matthew Young (HBS ’25) and Abby Desai (HBS ’26) for their industry insights.

Meredith Nolan (MBA ’26) is originally from outside of Washington, D.C. She graduated from the University of Virginia with a BS degree in Commerce in 2020. Prior to the HBS MBA, Meredith worked in private equity in San Francisco on TPG’s Consumer team.

How activist investors have been quietly upending corporate America.

Michelle Yu, Industry Insights Editor

There are few things that almond milk lattes and animated children’s movies have in common. Dependence on consumer demand? Absolutely. Status as an agent of joy? Sure. Energy-inducing? Perhaps.

But on Wall Street, a more concrete through line has recently connected lattes with movies. That line is activist investing. Though shareholders at Starbucks and Disney both called for changes in the last year to reinvigorate growth amid slumping sales and flailing stock prices, only one of these boardroom battles went in favor of the activist. Why?

History might offer some clues. Activist investing is not a new concept. In fact, the practice has existed for roughly a century, dating all the way back to the 1920s when Benjamin Graham wrote to Northern Pipeline, in which he had a small stake, requesting that the company sell the bulk of its ancillary assets in exchange for dividends paid out to shareholders. After executives ridiculed and rejected his proposal, Graham took to the Street, imploring other investors to join his campaign. His plea was ultimately successful and planted the seed for what would eventually become fertile ground for activist investing.

Today’s campaigns are slightly more complex but share the same goal: increase shareholder value. Their proposed strategies to achieve this goal range from leadership changes and strategic overhauls to capital reallocation and divestitures. These categories of recommendations to management have become, according to former Tenet Healthcare CEO and current HBS professor Trevor Fetter, pretty textbook.

“I think the basic activist campaign types will continue to fit in four basic buckets: lever it up [and return capital to shareholders], break it up, sell it, or change the board and management,” says Fetter. “You don’t see many campaigns with strategies beyond those four themes.”

Many activists specialize in particular campaign strategies. Jana Partners, for example, has successfully campaigned for the sales of PetSmart, Whole Foods, and Pinnacle Foods. Calls for a sale typically arise if an activist investor believes a company’s growth potential is capped or the industry is consolidating, whereby selling the company is viewed as the best way to preserve shareholder value. In the case of Jana Partners, each sale came with a multi-million

dollar payout for the activist. Those potential gains for investors may explain why new data from Lazard shows activist campaign activity rose by 29% over the historical five-year average in the first half of 2024, making it the busiest first half of a year on record. With all three of the major indices hovering near all-time highs, activist investors are likely paying even closer attention to the stocks that are still underperforming the broader market — and what, if anything, can be done to fix that. Rather than wait for management to turn around the company, investors want to take control of their own bets. After all, they do have some — or a lot of — skin in the game when it comes to stock price deterioration, so if a company has been posting flat or negative growth for several consecutive quarters, why stay idly aboard a sinking ship when there are plenty of other boats keeping afloat?

That is likely what many Starbucks investors were thinking earlier this year. A pullback in consumer spending due to persistently high inflation, coupled with ongoing weakness in China, weighed on sales and transactions, which fell by 3% and 5%, respectively, during the most recent quarter. Founder Howard Schultz also blamed management, including newly inaugurated CEO Laxman Narasimhan, whom Schultz had hand-picked himself. In a post on LinkedIn, Schultz said “U.S. operations are the primary reason for the company’s fall from grace” and encouraged changes to the customer experience, mobile ordering, and product innovation.

Questions around Narasimhan’s ability to reignite growth and reverse Starbucks’ sagging stock price, which had fallen by 20% since he assumed

the role, began to circulate. Within months, it was reported that Elliott Management had taken a sizable stake in the company, demanding changes to the board, and not long after, Starbucks announced it was replacing Narasimhan with Chipotle CEO Brian Niccol. In this case, the activist investor got its way.

No such luck for Trian Partners and founder Nelson Peltz’s 15-month proxy fight with Disney. Like Starbucks, Disney has undergone several leadership changes in the last few years, culminating in CEO Bob Iger’s return to the role he retired from in 2020 after his handpicked successor, Bob Chapek, was ousted. Declining theme park traffic, box office failures, and streaming subscriber losses were just some of the issues that contributed to Disney’s first earnings loss since 2001 and its stock’s worst single-day drop in company history. They were also why Peltz was demanding a seat on Disney’s board. In a 133-page white paper released in March, Peltz called the board “the root cause of Disney’s underperformance” and added “it is unlikely that Disney can realize its full potential if it refuses to sufficiently right-size expenses in legacy businesses that are growth challenged.”

But while Peltz’s proxy fight garnered significant media attention — which was only exacerbated by the support of ousted Marvel chairman Ike Perlmutter, who had pledged 80% of his Disney shares to Peltz — the board ultimately voted against Peltz’s demand for a seat at its annual meeting in April. The decision seemingly served as the final straw for Peltz, as he reportedly sold his entire Disney stake just one month later.

Despite the industry’s mixed track record as of late, fighting from activists at large may be far

from over. With the Starbucks win putting wind in its sails, Elliott Management is ramping up pressure on target companies including Southwest Airlines, SoftBank, Texas Instruments, and Anglo American.

Corporations are also becoming more proactive in hedging against activist investors, with Intel recently tapping Morgan Stanley and other advisors for protection. A study from Harvard Law’s Forum on Corporate Governance says settlements between activists and companies are being reached at a faster and more frequent pace, suggesting the time- and cost-intensive nature of these campaigns is becoming too much of a burden for management teams. Some companies are even outsourcing the task of protecting boards from activists through services offered by firms like PJT Partners.

“It’s hard for an outside investor to know what a company should do better than what the company management team does,” says HBS professor Suraj Srinivasan, who adds that one thing working in management’s favor is they typically know best. While activist investors can offer valuable perspectives and drive necessary change, management teams are often more attuned to the company’s long-term vision, built from years of dayto-day involvement and firsthand experience.

Campaigns are becoming more diversified, too. Barclays reports that activist campaigns doubled in the Asia-Pacific region during the first half of the year compared to last year. Industryleading activists now account for only one-fifth of ongoing campaigns worldwide, meaning newer players are entering the scene. A key driver for this trend is the SEC’s introduction of the universal proxy card, which allows investors to vote for

any combination of candidates proposed for a company’s board of directors, rather than being limited to the slates put forward by management or activists.

“[The universal proxy card is] a game changer — to be able to essentially mount an activist campaign for a fraction of the cost that it used to be when you had to have your own proxy card,” says Fetter. “Now it’s much easier and cheaper to run a campaign.”

Quantity does not equate to quality, however, and the more time companies spend defending themselves against activist investors, the less time they have to focus on operations and growth. One could argue that the seismic increase in activist investor campaigns is doing more harm than good, suggesting Iger was not too far off when he called Peltz’s proxy fight a “distraction” to Disney. While activist campaigns are sometimes warranted, such as in the case of Elliott Management and Starbucks, other companies seemingly have targets on their backs for all the wrong reasons. This is especially true for sectors like real estate, retail, and energy, which may not be in strong enough financial positions to take on the restructuring or costcutting measures that activists propose.

Because the general public is not privy to many of the insider conversations that companies are having with these activist investors, there are many unknowns. The question of whether all activist investor campaigns are warranted is not entirely answerable, as it depends on several factors, including the specific context of each campaign, the company’s unique circumstances, and the perspectives of various stakeholders. Some campaigns might aim to genuinely unlock shareholder value, while others

Continued from page six

may be more focused on achieving quick profits without regard to long-term sustainability.

At the core of the debate is whether activist investor campaigns are a net positive or net negative for the corporate landscape.

“Almost always, [companies] begrudgingly accept that activism is actually good for capital markets in general because it does create a level of [...] performance [...] and governance accountability,” says Srinivasan.

However, even with the best intentions, the outcomes of activist campaigns are not guaranteed. While some campaigns lead to positive changes, others may result in unintended ramifications. A study by McKinsey shows shareholder returns are not

sustained 40% of the time after the activist exits a stake. But what would have happened to the company had the activist never entered to begin with? Predicting the future impacts of an activist’s proposals is inherently uncertain

and knowing the counterfactual is impossible, which makes it difficult to judge a campaign’s merits.

And so, just as almond milk lattes and animated children’s movies may share surface-level

similarities, the underlying complexities of activist investing suggest no single campaign can be judged by a simple set of criteria. Whether it is Starbucks making leadership changes at the behest of Elliott

Management or Disney standing firm against Peltz’s demands, each case brings with it layers of nuance, context, and unforeseen consequences. While the rise in activist campaigns may provide some companies with a muchneeded push toward growth, it can also risk short-term fixes that may derail long-term success. Ultimately, determining whether an activist investor’s actions are warranted is a question that resists a straightforward answer — just as the intricate dynamics of business cannot always be reduced to the price of a latte or a movie ticket.

Michelle Yu (MBA ’26) is passionate about all things media, with experience in business news, documentary film, broadcast journalism, and television. She graduated from Columbia University with a degree in Film and Media Studies and was a producer for CNBC prior to HBS.

Allison Schwartz, Contributor

For EC students, generative AI was hardly a reality in the workplace before starting HBS. ChatGPT’s consumer app launched on November 30th, 2022 – just a month before Round 2 HBS applications were due. On the same day EC students began classes last year, as we sat debating Supreme’s marketing strategy, OpenAI released the enterprise version of ChatGPT. While we spent the past year reading cases in Allston, our former employers have been experimenting with new ways to integrate AI into the workplace. Many students come to business school for a “break” from work, but during this period of historic platform shifts, how can HBS students ensure we’re not just sitting on the sidelines?

This summer, EC’s had the chance to get back in the game, and I connected with classmates to better understand how they sought to catch-up on the rapid adoption of AI. During their internships, students overall found AI valuable for research, but limited for complex analysis. They noted surprising differences in organizational AI policies and returned to campus eager to use AI for coursework and daily use.

For many students, the business school internship is a chance to pivot into a new function or industry. One EC, who previously worked in Consumer Packaged Goods (“CPG”), leveraged ChatGPT to get up to speed during her private equity summer internship. She

used AI to quickly understand new industries and define complicated financial concepts, saying it was easier to use than Google search. However, she found AI less useful for building actual work products, especially data analysis. “I’d use ChatGPT to ask for 20 examples of opportunities in an industry and iterate with more specifics, such as companies within the UK and of a specific size. But it wasn’t very useful for analysis in Excel. ChatGPT was inaccurate with everything I tried, including running regressions and pulling in revenue data from the internet,” she said.

Another student used Perplexity to help with market research for her healthcare VC internship. “I basically used AI as a form of search,” she said.

“AI was really good at finding academic articles related to my topic of interest because it can summarize lengthy documents. I used Perplexity because I needed to cite specific literature.”

Students found mixed signals regarding organizational AI policies. A student working at JPMorgan mentioned that OpenAI’s website was blocked internally. “I heard there’s a proprietary version being tested, but didn’t get any training on this,” they said. “I used my phone for ChatGPT and Perplexity, but definitely wasn’t supposed to.”

At BCG, the opposite was true. “I used an enterprise version of ChatGPT and was praised every time I used it. I was even allowed to put certain case information there,” one previous intern said. “I also tried an internal GenAI

tool for slide-building, but to be honest this did not work well at all.”

After engaging with AI this summer, some students are more determined to try new AI tools during the school year. “I still use ChatGPT nearly every day,” a student said. “It helps me define tricky concepts in cases and build additional arguments for case questions.”

“I’ve used AI for interview prep. Since Perplexity is connected to the web, I’ll link a company’s website before a call and ask Perplexity to analyze what the team does, any recent company announcements and suggested questions to ask my interviewer,” another student said.

As for the future? “AI

has made me realize that the judgment piece of business matters so much more than being able to do the analysis,” another EC said. “But one thing I’ve stopped doing is saying ‘thank you’ to it. I’ve started to see ChatGPT as more of the internet than a person.”

Allison Schwartz (MBA ’25) is originally from Philadelphia, Pennsylvania. She graduated from the University of Pennsylvania with a degree in Computer Science. Prior to HBS, Allison worked as a data scientist in technology companies and political campaigns. She previously worked at Lyft, Modern Treasury and the Democratic National Committee (DNC).

reached $3.7 trillion in 2022, with a growth rate surpassing that of China and India Where are these contributions seen in our classrooms? We need to push the research team and faculty to create more relevant cases on Latin America

Faculty Representation

Currently, fewer than 10 Latino professors teach across the RC and EC courses. This lack of diversity among faculty is disheartening for Latino students who are looking for mentors who can relate to their experiences and who can bring important perspectives into academic conversations. Having more Latino faculty is crucial – not only for students seeking representation but also for driving more research and case studies centered on Latin America We in our professors, just as much as in our curriculum

Student Representation

As I mentioned earlier, Latinos make up only 10% of the HBS community, despite representing almost 20% of the

U S population While HBS has made efforts to bridge the gap, like Admissions visiting Latin American countries, there is clearly more to be done Increasing the number of Latino students should be a priority if HBS is serious about diversity That said, I am thankful for HBS’s made it possible for many of us to be here regardless of our socioeconomic background It is a great step, but there is still room to grow

Student Clubs Latino student organizations like LASO and the LatAm Club have continuously struggled to gain the recognition and platform they deserve compared to other Club was not mentioned in the DEI email for Hispanic Heritage Month, and the club was given the last choice of dates for the LatAm Business Conference with MIT This pattern of oversight extends beyond events, and club leaders feel frustrated by the lack of institutional support Per one club leader, “Sometimes, we feel like second-class ” This article is not meant to

the challenges I have experienced as a Latina student at HBS. My hope is to spark a conversation about how the school can better support and elevate Latino voices. Celebrating Hispanic Heritage Month is important, but it rings hollow if the work to create equity and visibility is not happening in real, meaningful ways. I envision an HBS where all students, regardless of where they come from, have equal opportunities to succeed and feel represented. To my fellow Latinos and Hispanics: sigamos para adelante, los admiro y los quiero

Regina Gomez (MBA ’25) was bor n and raised in Mexico City, Mexico She graduated from Tecnológico de Monterrey with a degree in Economics Prior to HBS she worked at Mastercard and Strateg y and Operations Manager specializing in the payments industry

Arjun Prakash, Contributor

Organizations that seek to create strong cohesion among their constituents often rely on intense orientation processes to quickly forge interpersonal bonds The military has Basic Training, professional sports have Training Camp, and Greek Life (the American sort) has pledging For the appropriate HBS analog, one might automatically point to START; in fact, this was only the start

Those that report to Required Curriculum Headquarters™ assure students that HBS will transform them to an extent rivaled only by characters in a Shia LaBeouf franchise Initial intuition may be that this metamorphosis is divisible – we get skills and new knowledge from the classroom while cultivating connections that reshape our outlook outside Aldrich

fortnights of the RC year, the in-class and out-of-class components often feel in competition; spinning on a hamster wheel of three-case days draws precious time, energy, and highlighter ink that could otherwise be spent illuminating new social possibilities. In essence, these weeks are a reminder to those found forgetful that business school does, indispensably, involve school

To be sure, it is a good and desirable thing for a program that carries the imprimatur of Harvard Business School to be rigorous and developmental

Our friends by the Longwood station, among others, may scoff at our consideration of arduous classwork, but the real issue is likely the mythology that surrounds business school as purely experiential. In the trucks of August, you haul anticipation for a two-year sabbatical from responsibility full of uninterrupted pursuit of self-actualization

However, it’s possible that these aren’t irreconcilable differences, and perhaps FRC

could provide a measure of reality

On one hand, yes - the goal of taking FRC is to develop

business. Students who have demonstrated excellence in engineering, social science, and military professions may

Generally Accepted Accounting Principles. Classmates with (increasing their debt-to-equity ratio to attend business school)

principles and nebulous contexts

And every section’s heroic CPAs are called to fact-check the room with dispatch when case musings become Generally Unaccepted

But take a stroll through Spangler on any FRC eve, and in addition to many expressions that resemble the Kumon logo’s o-face, you recognize some tangible goodwill abound Classmates convene to decipher the most recently dropped insuring themselves against the

morrow’s elegantly planned Cold Call (special shoutout to Section D’s Professor Zou for her masterful weaving). With every study session come study breaks, and with study breaks come conversations revealing the story behind the troops in your trench Credit is due to the HBS grading policy that incentivizes collaboration and cross-learning And FRC is certainly not alone in translating schoolwork into a team sport – TOM, FIN1, and other RC courses often bear similar responsibility for uniting students under a banner of struggle and support

Indeed, one valuable feature of the HBS student body is that each person likely comes to campus with a course that they could tutor A classmate who lends a hand to another in the RC Fall may receive their principal back in full during EC Spring So it’s true that getting to know your classmates at Mighty Squirrel Taproom, Benihana, or an aluminum smelting plant is

common cause in case-based analysis thereof And it’s true that

business school is a short space of time that we strive to maximize in ways beyond the latter word’s attendant responsibilities

But when we close the books a couple years from now, I think we’ll look back on this time as foundational in our Start of Something New The group chats and chatting groups we formed to tackle the case of a September night may have endured long into and after our time by the Charles And the personal journey that an MBA (and Headquarters) promised would have been deepened by the intense experiences shared among our fellow travelers In the perceived contest between classwork and connection, it just may be that both sides balance

Ar jun Prakash (MBA ’26) previously worked at McKinsey & Company and the Center for Medicare and Medicaid Innovation He enjoys tennis, TV dramas, political history, and Boston and Michigan sports

John Mahoney, Contributor

Long before he moved to the US as a teenager, became a startup founder, or decided to attend HBS, Florian “Flo” Kränzler was a tennis player. And while his illustrious career on the court spanned two decades and included a Bavarian Championship, a trip to German Nationals, and multiple All-Conference honors at the University of Wisconsin-Green Bay, his journey began inauspiciously, almost 4,000 miles from where he now lives in Chase Hall

Born and raised in Munich a city in Southern Germany with a rich history and cultural tradition Kränzler began playing soccer and tennis at an early age He enjoyed both sports throughout primary school, but demands on his time as he approached high school forced him to choose between the two The success he had experienced on the court, paired with his proximity to the renowned Niki Pilić Tennis Academy, ultimately led him to pursue tennis

Fully committed to the sport for the first time, Kränzler blossomed into a tennis star while training at Coach Pilić’s Academy (Pilić won Davis Cup championships for several European nations and coached 24-time major champion Novak Djokovic) A rigorous, 350-day-a-year training schedule allowed him to become a Bavarian Champion at just 15, and he quickly found himself playing in tournaments all across Europe With his sights set on a professional career, Kränzler began to consider where his talent could

take him. Though it wasn’t a common path for European players just ten years ago, he and his family saw college tennis in the U.S. as an opportunity to develop his game while pursuing an undergraduate degree and gaining valuable life experience in a new country. This setting would allow the academically-inclined Kränzler to continue his playing career while receiving an education that would prepare him for life after tennis He considers himself an “early adopter” of this practice, which has become far more prevalent in recent years.

Lacking any real familiarity with the United States, Kränzler began to market himself to American college programs. While he jump-started the process by creating a player profile accessible to coaches across the US, it was a tournament victory over a member of the UW-Green Bay team that proved to their coach that he could not only compete but excel at the highest level of collegiate tennis. With a scholarship offer on the table, he investigated the program further and was comforted by the presence of other Germans on the team, as well as its track record of success in the Horizon League conference So, just days after turning 18 and receiving his driver’s license, capable only of speaking what he describes as “rudimentary” English, Kränzler left his home in Germany and set out for Wisconsin

Upon his arrival, he quickly achieved on-court success he achieved a winning record playing fourth singles, and immediately joined the first doubles group as part of a team that won the 2015 Horizon League Championship His team

advanced to the NCAA Division I Tournament, where Kränzler battled Aleksandar Vukic a current professional who ultimately became a three-time All-American and qualified for all four Grand Slam events in 2024 to a first-set tiebreak before ultimately losing, ending his freshman season However, this early success demonstrated significant promise, and expectations were high from Kränzler in the years to come

Off the court, the transition to life in the United States was sometimes difficult The distance from home proved challenging amidst the brutal Wisconsin winters, but Kränzler was intentional about finding community in Green Bay, improving his English skills by joining university clubs and actively building relationships with students from the US and around the globe

Though there were setbacks along the way, he made his mark both in the classroom and on the court at UW-GB, earning a double major in Math and Economics as well as Male Athlete of the Year honors after receiving 1st-Team All-Conference accolades as a junior and senior. His path to success in Wisconsin served as a prelude to the success he would go on to achieve later in life As a leader on his team and on campus, he found ways to excite and motivate individuals from diverse backgrounds to accomplish more than they had previously thought possible

Things in the US had gone better than he ever could have expected, and Kränzler had reached the point in his life and career where he had long assumed he would pursue professional tennis. Unfortunately, his collegiate success had come at a

price overuse injuries to his knees and back had him reliant on over-the-counter pain medication just to take the court, and he had grown accustomed to teammates and friends commenting on his seemingly constant limp. Doctors confirmed what he already knew years of intense daily training had taken a toll on his joints, and further pursuit of competitive tennis would only make things worse With this knowledge (and a college degree in hand), he made the difficult decision to hang up his racket and pursue a career in business

As he looked to transition to life post-tennis, he first thought that consulting, with its fast-paced nature and emphasis on teamwork skills, would be a natural fit However, he found an exciting career opportunity with a promising company in Southern California that helped corporate clients grow by launching innovative start-up ventures and partnerships, a job he described as “the best of both worlds,” given its applicability to his tennis background It was not a 9-to-5, and Kränzler quickly realized that, much like in his tennis career, repetition and a willingness to work longer and harder than others would allow him to rise above the competition. Furthermore, the varied nature of the work required him to develop clear, concrete strategies while maintaining flexibility Forced to think and act like a founder a role he took on more formally in 2023 at Zero3, a carbon accounting platform he was asked to be decisive and enterprising early in his career. Unsurprisingly, he thrived in this first role, leveraging the “fail fast, fail often,

ethos that he had developed on the court in order to grow businesses in the US and Germany

While he found this role fulfilling, Kränzler knew that it was time for the next phase of his life and career Since arriving at HBS, he has taken full advantage of the experience, leaning into the opportunity to make new friends from a variety of backgrounds here on campus. He has been amazed by the incredible professional and personal backgrounds of this year’s RC cohort. In the future, he hopes to leverage his athletic and professional experience to pursue a career in finance, ideally in Investment Banking Perhaps most importantly, as a Munich native, he has already volunteered to help plan next year’s Oktoberfest Trek - so do not be surprised if you see his name on your Slack feed in the weeks and months to come. Prost!

John Mahoney (MBA ’26) is a native of West Des Moines, Iowa He graduated from the University of Notre Dame in 2021 with a degree in Finance. While in college, he was a walk-on defensive back for the Fighting Irish and wrote a book about his experience, titled History Through The Headsets Prior to coming to HBS, John worked in consulting and strategy in Minneapolis and Chicago and quickly course correct”

Tyler Confoy (MBA ’26) connects with Jana Kierstead on life, work, and the future of business education.

Tyler Confoy, Women’s Leadership Editor

Jana Kierstead always knew she wanted to work in some form of service operation. First as a snack bar girl at her grandfather’s country club in Rye, New York. Then, as a Hotelie at Cornell during undergrad, and most recently as the Executive Director of MBA, Doctoral Programs and External Relations. From the time Jana started at HBS in 1999, she has been instrumental in launching both the FIELD Global Immersion course and Harvard Business School Online, and along the way has gone from managing zero to over 300 people. I spoke to Jana about life before HBS, and the journey she’s been on here for 25 years

Where did you grow up?

I’m a New Yorker, so I grew up in Westchester and Manhattan. School was super impactful for me. I went to the same school

a fairly dysfunctional childhood and that was, for me, stability. I know this is where I found my love for thi s k i nd of a co mm un it y and what it can do for people

what did you think you were going to do when you grew up?

My family had country clubs. I was always at the snack bar, or I worked as a waitress. So, I thought it was always going to be some sort of service-based business.

I went to Cornell; I was a Hotelie, and I learned how to run a service-based business. The was try hotels, and I realized I was not a 24/7 gal. Media was a family business, so I went to work for my dad’s media company. I got to commute back and forth with him to work, so that was really special. I went and got my MBA [at Northwestern], did a summer in banking, and got the offer. I said, “Thanks, but no thanks,” and I went and worked at CBS. That was the dream job coming out of school. Loved it, but there was a CEO change, and so the strategy group that I was in dissolved. I tried executive search after that, for media companies. It didn’t speak to me.

I got engaged, got married, moved to Boston, and I thought, okay, let me take some time off. I ended up [with] three days between jobs, and I went from AT Kearney Executive Search to HBS.

inclined toward mentoring and I kind of moved around and did every job in the shop, and then I was the Director, MBA Career Services [starting in 2004]. Booms, busts, great recessions, it was a super interesting time to be in Careers.

Nitin Nohria became Dean in 2010, and he decided he wanted to create the FIELD course. He asked me if I would build up the infrastructure that is now GEO (Global Experience

Office. So, I started to work with

faculty, and then moved over to the Executive Director of MBA Program role [in 2012]. In this role I oversee admissions, support, student global and careers. I was [in this role] for 17 months and got another phone call from Nitin and he said, “I’m doing this online thing, this HBX thing. Can you go over to HBX and do what you did for FIELD

for HBX?” I was like, “Um? I don’t know software, I have no hardware experience. I’m not your gal.” Either way I ended up at HBX [now Harvard Business School Online] for two and half years. I agreed to go as long as I was able to come back to this role, because I love students.

How did you lead in the HBX role when you didn’t have much technical experience?

I spent a lot of time on Wikipedia. What’s Python? What’s Jingo? What’s a technology stack? I had no clue. I asked a lot of questions. Apparently they were halfway decent, because the team said I did pretty well. That whole experience was super interesting. How do you create a startup in an organization like this?

What do you get excited about in your role here?

I get really excited when do. It doesn’t so much matter if it’s a leap or a pivot, but when they take the time to really understand

the job that’s a good match. And it doesn’t always happen right out of school. You either need to build skills, or you get a little distracted by what everybody’s your way back to the thing that you’re meant to do. That’s the best, because then it doesn’t feel like work.

Have there been mentors in your life who have had a It’s corny and cliche, but it’s my dad for sure. I learned a ton from him — just how you conduct yourself and how you engage in business. I learned a ton from Nitin, our former dean. He just has a very special way of engaging the people. It was amazing to watch. We are so lucky [with our faculty members, too]. I’ll pick up the phone and just say, “I don’t know what to hours?” Me, as an employee, and I get to go and meet with someone who is a consultant for Fortune 500 companies.

What core leadership principles have you developed? I believe in hiring all-around players as opposed to position players. Really smart people withgreatattitudesandresilience I’d take that any day over an expert in X, Y or Z. I think we can teach people skills. But to have the grits and the can-do and positivity and energy and overall skill set, I would hire for that any day over the position player.

What’s the best piece of advice you’ve received?

Create your own personal board of advisers, people who you can go to who will call you out and say, “That is blankity blank,” or “This is what you said you were setting out to do, are you still on that path?” People who know you well and can ask you the tough questions.

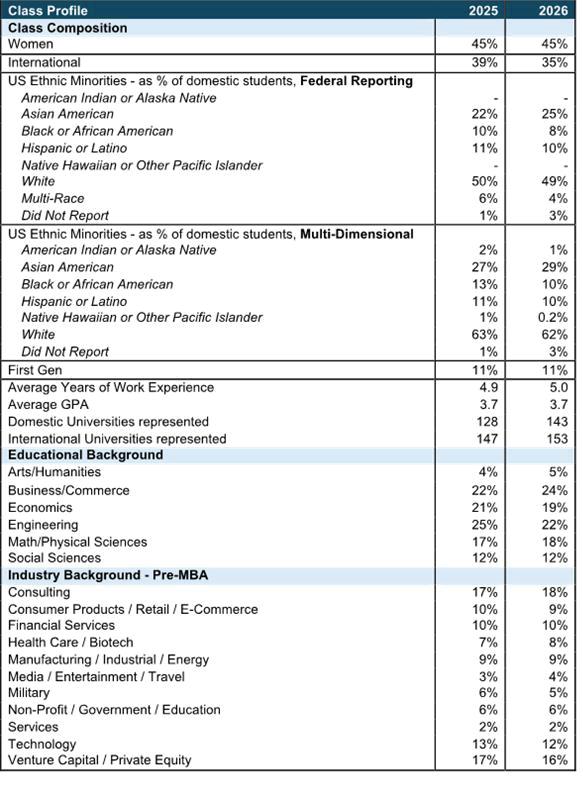

How have you seen students change over your time with the MBAprogram?

Certain sectors were born while I’ve been here. Private equity, hedge funds, venture

Continued from page ten capital, that wasn’t a thing

different world where the students’ industry backgrounds were rather homogeneous, and their interests leaving were pretty homogeneous And now it’s 1,800 different job searches It’s a completely individualized ballgame because people are coming in with so many different experiences, and they’re wanting to do a variety of things

What excites you and what scares you the most about the future of business education?

What excites me? I believe that business can change lives I believe that business can end the cycle of poverty I believe it is the answer to a lot of the problems of the world What scares me is that I feel like business has become, maybe, a dirty word in a younger generation I ask my kids, “You guys have any interest in coming to the business school?” They’re like, “No, what?” I think they

don’t necessarily understand, which obviously is my failing, what a business degree can do, or what business is That bookstore you’re working in? That’s a business You have to understand how to run it if you want to be successful So, I’m concerned about the pipeline I’m concerned about making sure people understand the value of business and its role in solving problems, and how to open up that aperture for people

How have you seen the perceived value of an MBA change and how do you think it will continue to change? I think the press and media

Sorry, but this a 50-or 60-year experience, to be honest, and yes, those are the most immersive But in my experience, this experience lasts a lifetime, so I would not measure the value of an MBA on which job you get out of here

I don’t remember how much I it’s not relevant anymore But

how it impacts your life, the partnerships that you're able to make at work; how it impacts deals, or understanding of other cultures, or friendships; and how it impacts the way that you navigate your career and life... all will be impacted by HBS for a lifetime

Wh e n yo u w ere le ad i n g the RC orientation program, you mentioned that HBS is no longer co mm e nt i ng on s oci a l i ssu e s. Could you expand on that?

We want to encourage discourse in all parts of life, whether it’s inside the classroom or outside the classroom If the institution has a view, that can silence [voices], and we don’t want to be in that position An academic setting is different from a corporate setting In an academic setting, you want to actually get more voices in the room, and us having a voice does not make sense So, we will not have a voice, even though we care deeply And I think that’s the one thing I want to make sure doesn’t get misconstrued Just because we’re not commenting on something doesn’t mean

we don’t care that people are struggling or there’s been a loss

We care deeply, and we’re going to be reaching out to individuals

in their home region or something like that, but we’re not going to comment on it

What do you enjoy doing outside of work?

I go to a lot of soccer games

My children are athletes I have one who just graduated from college, and she’s looking for a job it’s really fun to have a former career coach as a mom one who’s at University of Wisconsin, she’s a sophomore; and then a son who’s a senior at boarding school And then we have a lot of pets It’s slightly insane Three cats, one bunny, and we will be welcoming a new dog in the new year

It’s so bad, but I hope to get that back to a normal state I’ve only been in the new job since January (“External Relations” was added to Jana’s title in January, which includes Alumni Relations & Development)

And the last couple of hours? Again, embarrassing, The Dodo It’s an Instagram account that shows all rescues, pet stories

What do the first couple hours of your day look like? It’s on brand. Or there are a couple African safari [Instagram accounts] about the elephants I really enjoy. So, I look at my happy pet stories. Or once in a while, Ted Lasso. It’s gotta be upbeat.

That’s embarrassing Well, there are the farm chores I gotta feed the cat, the pets, and clean up after all the pets And then honestly, I open up my laptop

Nick Lamb, Information Research Specialist Learning Technology, Baker Library

The Class of 2026 enthusiastically turned out for the Baker Library MBA Open House on Tuesday, August 20th, the library’s welcome event for START week The Class of 2026 bested previous classes, with eight in 10 incoming students attending the Open House event this year In fact, with 841 students in attendance, the Class of 2026 set a record for the library’s annual start-of-term event

There was much to learn about the library at the Open House: library tours were offered, with notable stops being the library’s two reading rooms, the de Gaspé Beaubien Reading Collections & Archives) and the – Contemporary Collections) Students learned about library services at three “stations” in Room Reading Stamps the First, at the “Ask Us” station, incoming students could ask the librarians questions about library services at HBS Next, at the “Subscriptions & Citation Resources” station, students were able to subscribe to the Highlights Industry Newsletters (informative biweekly newsletters curated by the Baker librarians) and the library’s various digital newspapers (including NYT, WSJ, FT, com) Bloomberg and WaPost, This year, resources for Citing

Sources for MBAs, among other library learning opportunities, were also featured Third, the “Special Collections & Archives” station distributed copies of the General Shoe Company, dating from 1921 (only one page in length!), and highlighted other

historical materials from the library’s expansive collections

There was also much fun to be had that day: Sasha, the Harvard University Police Department’s community engagement dog, stopped by the Open House (as an exception to the policy of only service animals being allowed in the library) The library gave Sasha a special dogshaped balloon, and Sasha gave her signature “wave” to attendees (as well as her “business card” for future student club events) The library provided refreshments and a variety of giveaways, ranging from Baker items to glossy books about HBS entitled, Problem Solving: HBS Alumni Making a Difference in the World As always, there was great energy that day, and students had the opportunity to meet staff and fellow students in the impressive space of the

Stamps Reading Room House? Open the Missed It’s not too late to learn more about Baker Library! Visit the library’s MBA orientation page for more information: https:// www library hbs edu/open-house

If you have additional questions, you can always reach out to Baker Library:

infoservices@hbs edu The librarians are here to help, ranging from assistance with research questions (where can I overviews (how do I search on the Bloomberg terminal?), and more Welcome to HBS Class of 2026!

theories to practical situations and outcomes This shift was part of a larger cultural movement toward instrumentalism and pragmatism ”

HBS’ inaugural deans, Edwin Francis Gay and Wallace Donham, were ardent devotees of the “case method ” They believed the best way to train managers, as with lawyers, was to immerse them in realworld decision-making With a wide mandate over the newly founded HBS, the deans were able to reimagine management education In his institutional biography, The Golden Passport: Harvard Business School the Limits of Capitalism and the Moral Failure of the MBA Elite, journalist Duff MacDonald notes, “The only thing holding Gay back from a full-scale implementation was a lack of actual cases and of professors capable of teaching in such a way ”

What followed was a century-long pursuit of case production HBS faculty currently produce over 350 cases per year, which are licensed by universities around the world 30% of HBS’s revenues last year came from publishing, double the amount received from MBA tuition Over the course of a century, the case has become as much a “product” as a “pedagogical method ”

Training the managerial mind

Before starting RC, I spent a year in the MPA International Development program at Harvard Kennedy School (HKS)

My academic year consisted of economic, political, and development theory, coupled with a smattering of HKS case studies and a joint degree seminar with HBS cases Moving from relatively diverse pedagogy at HKS to a purely case-based environment at HBS has left me rife with comparisons of the two experiences

While HKS trained my critical mind (I learned increasingly sophisticated ways to say “I don’t know”), HBS has been training my managerial one (I am gaining an unfounded making capabilities)

impressed by the encompassing reality the case creates I have often found myself completely ensconced in the context of the protagonist be it Erik Peterson or Mr Butler regardless of how different it might be from my own context Cases, which are ultimately stories, have been far easier to remember than dry theory I have been able to micromanage strategies and tactically analyze issues in ways that seem directly relevant to my post-MBA career I initially felt daunted by approaching a case before having been “taught” it, but I have been gaining the before my entire section

But any of the tens of Harvard Business Review articles on the case method could have told you this

…and the moral mind

I worry more that the wholesale embrace of the case method at HBS does not adequately acknowledge the method’s inadequacies While embracing the character of key challenges at hand, it also prevents us from looking at structural issues and asking normative questions The case traps us in reacting to how the world is without asking how the world should be

You could argue that such normative questions belong in the realm of law, politics and philosophy We came here for a business education to learn how to make decisions within the constraints of the world as it is If this were true, I would rest my case But we are simultaneously told about our ability to be “changemakers” in society at

of business, which itself is endogenous to society As future stewards of large amounts of learn how to wield this power positively

The case method limits us to considering the second order implications of our actions It implicitly teaches us to operate in a world akin to Milton Friedman’s responsibility is to maximize “rules of the game ” This does not consider that rulemaking is endogenous and that our actions by which we are bound Some of my professors have sought to explore these second order implications in class, but usually time permitting

While putting ourselves in the shoes of the protagonist is a valuable thought exercise, it is also inherently a limited one We often only meet the “companyvetted” version of the protagonist, rather than the “real” person While we get the insider view, we are also limited to dinner table niceties, the protagonist our host who has given us a view into their home

The case aspires to Socratic standards of deliberation, but instead of delving deeply into arguments as one would in a small discussion, we are limited to bite-sized quips in a 90-person classroom We prioritize the “feeling of knowing” over actual knowledge. In focusing on “practical knowledge,” the case method sidelines the study of theory, which can transcend time Combined with its retrospectivity, the case method limits our ability to ask imaginative questions about the future As MacDonald writes, “Because a case study is by its very nature backward looking, [MBA graduates are]

armed with conventional answers to conventional questions ” We take the status quo as a given without being creative about the premise of the case itself

I would be excited to explore with my classmates how to challenge the premises with which we’re presented Can we envisage a world where burdening young people with debt isn’t a lucrative path to ‘growth’? Where companies and governments engage in good faith interactions for societal

imagine such worlds, can we think of ways to get there?

Sometimes there are glimmers of what such a class might look like For example, at the end of the Heidi Roizen case in LEAD, a classmate questioned the premise of networking, which is inherently based on biased social networks and “ingroups ” Instead of abiding by the constraints of the case, her comment challenged its very premise It asked us to imagine a more meritocratic world where biased social networks don’t moderate access to opportunities Unfortunately, in the pithy style of the case discussion we engaged with the question for two further comments and then moved along the teaching plan

Diverse pedagogy for wellrounded leaders

I obviously chose to come to HBS because I believe spending two years of my life in Aldrich is valuable I still think so and believe the case method can help me achieve many of my academic goals for business school However, I worry that the cultish embrace of the case method, founded in the business model of the school itself, prevents us from gaining fully from its strengths, which might shine more in a mixed methods environment, where cases complement learning in large lectures and small seminars To become

diverse toolkit HBS does well to equip us with classes across more It would also do us well to do so in a pedagogically diverse manner I am excited for my classroom learning, but I hope to supplement it with lectures and readings elsewhere in the university, where theorizing does not take the current paradigm as a given and instead seeks to reimagine it

Regardless of where we came from, the moment we stepped into HBS, we stepped into great privilege That leaves us with a moral responsibility to use that privilege for good At the end of these two years, we will certainly know ourselves quite well I worry that we will know less of the world at large, and at worst, be blinded by our hubris The case method succeeds in creating future protagonists of cases people who can isolate a problem from its context and optimize given the constraints they face but not visionaries who challenge the constraints themselves It equips us to be “doers” but not “do-gooders ” And HBS has a moral responsibility too 17 7 million cases is a lot of reach It’s at least 25 million hours of time learners around the world spend poring over cases every year HBS should reimagine what it can achieve with this platform, and aspire to shape the world for the better

Surbhi Bharadwaj (MBA / MPAID ’26) grew up in Delhi She studied economics and statistics at Yale and worked in management consulting in New York and inter national development in east Africa before moving to Cambridge last fall She hopes to use her career to support digital infrastructure and climate adaptation in emerging markets

Frederick Daso, Contributor

Being a founder is hard

Being a founder from HBS? Even harder

There are so many de-risked paths to handsome remuneration wouldn’t you go down one of those well-trodden roads?

They’re prestigious and wellknown professions promising reliable career stability Some

might even think you’re stupid for foregoing those options in pursuit of your passions Yet, maybe you seek something more than more than prestige, validation, and predictability You seek purpose your conviction, tenacity, and curiosity, not your resume. There’s no better way to do that than through entrepreneurship It can be away in solitude while others congregate towards their welltracked careers. Therefore, you should only

do it if you’re truly serious about

the endeavor And fortunately, you don’t have to go at it alone Join the Entrepreneurship Club. We are

here to support founders, joiners, and explorers Founders – we have your back with resources and knowledge from a long lineage of successful HBS entrepreneurs Joiners – there is an endless startups for you to join, and they could use your help to make it to the next stage of growth Explorers – you’re not yet sure what you want to be That’s

totally okay You have time, and

the E-Club is here to help you Whatever you decide, I hope in your journey to become a founder or joiner I hope this is

you have the courage to do one thing: start Start now Create a list of ideas that you’re passionate about off the top of your head Downselect to two or three that seem the most interesting to you Then start talking to

c us t o me rs Do n ' t w o rr y a b out whether the idea is valuable or not yet. What matters is getting started an d lea r ning to a sk the r igh t

questions You’ll be taking the

leaving your unique impact on the world E-Club will be with you along every step of the way

Prior to coming to HBS, Frederick Daso (MBA ’25) was a Senior Contributor to Forbes for five years covering early-stage startups from pre-seed to Series B, and a product manager at an early-stage tech startup. Currently, he serves as aVenture Fellow in General Catalyst’sVenture Fellow program, and hopes to become a VC after HBS.

“I believe that everyone has a lot of potential, and when you’re using it in areas you truly care about, you can make more impact.”

Jay Bhandari, Contributor

Sam Berube, Contributor

Between Two Classes is an interview series where we explore the diverse worldviews of our HBS classmates.

This interview is with Michelle Tan (MBA ’25). Michelle grew up in China and attended Columbia University, where she studied Economics and Intellectual History. After school, Michelle worked in investment banking before transitioning to startups in Silicon Valley. Michelle held operating roles at startups like WeWork and Culdesac before founding Unearth AI, an AIbased mapping and location analytics platform that was acquired earlier this year.

What impact has your childhood had on the person you are today?