Bo Derek

“Whoever said that money can’t buy happiness simply didn’t know where to go shopping.”

“Whoever said that money can’t buy happiness simply didn’t know where to go shopping.”

The LM Wider Team

LM Leasing instructions

We Deliver

Integrated F&B & Leisure Specialists

LM In The Centre

City centre:mk

Rental Growth - Back in Fashion

Affordable Luxury

Power Brands

centre:mk is a truly unique asset, the beating heart of the City and a regional mega mall –we love it!

LM have the largest retail and leisure team of any independent UK agency and work on the most exciting range of assets. Not afraid to “roll up our sleeves” we know that a lot of agency is hard graft. We pride ourselves on building strong relationships with our clients and their assets, we have worked on many instructions for several decades, always adapting our strategic advice to reflect an ever-changing market.

The team we have put forward for centre:mk are the best in the market, their range of experience and skill sets are complementary, and I know they will work hard to help you achieve your goals. They have the full support of all at LM and if we are to be instructed, centre:mk will become a flagship instruction for LM which we hope to help grow and adapt for many years to come.

NEIL HOCKIN, MD AND HEAD OF LEASING

High Street & Family

International

Pop Ups

Leisure – A Key Opportunity

Queens Court Leisure

Queens Court Restaurants

Grab & Go

Outside & Above

Using Space Creatively

MK 2030

Phygital Future

The How

Don’t Take Our Word For It

LM are the UK’s foremost independent retail and leisure agency. We provide market leading advice on mixed use, retail and leisure destinations.

The LM team provides leasing, development, lease advisory, investment and strategic asset advice across the sector. We benefit from a mix of experienced market leaders, ambitious Directors, younger associates and surveyors all of whom are passionate about the assets we work on and delivering the best deals in terms of both financial performance and tenant mix for our clients.

LM has a collaborative and supportive culture. We promote diversity at every level through the company, we enjoy working (and playing) together, and wherever possible promote from within, from graduates upwards.

We are on a journey to be carbon neutral, from a paper free office to E.Vehicles and employee benefits – we are proud of how far we have come but there is more to do!

We understand that clients have their own social and environmental agendas and policies and we enjoy working closely with you to make the asset more sustainable and relevant.

Elifar 202320 leasing agents in our team

50 Leasing Instructions

The world of retail is changing at an unprecedented rate. Standing still or relying on how we historically approached the market are not options. LM have always been at the forefront of shopping centre leasing and development. No one works harder to help their clients achieve their goals & objectives.

750 Leasing transactions per year

Teamwork x Collaboration

We are fun to work with. In the age of a more corporate approach it is often forgotten that both we and our clients perform best when we work as a team.

100 pop up and temp lets

Baskingstoke, Festival Place

Blackpool, Houndshill

Bracknell, The Lexicon

Brighton, Churchill Square

Bristol, Cabot Circus

Bromley, The Glades

Cambridge, Lion Yard

Canterbury, Whitefriars

Exeter, Princesshay

Metrocentre

Glasgow, Braehead

Lakeside

Guilford, The Friary

Leeds, Victoria

Leicester, High Cross

London, Brent Cross

London, Southbank

London, The O2

Norwich, Chantry Place

Southampton, West Quay

Staines, Two Rivers

Stratford Centre

Warrington, Golden Sq

Watford, Atria

Windsor, Windsor Yards

We provide strategic and leasing advice on 50 Retail and Leisure destinations in the UK.

From Glossy to Gritty and everything in between…

We love curating regional mega malls and bringing vibrant cities to life – day and night!

Our primary focus has always been acting for Landlords and this strengthens our relationships with the agents who act for the most exciting new brands as they know we can be trusted with confidential requirements.

1.

1.

Over the last 12 months, LM have transacted with all the below occupiers.

In our first 12 months as newly appointed joint agents on Victoria Leeds, we worked at a pace leasing in excess of 42,000 sq ft over 17 transactions securing a total annual rental roll of over £1.1 million. The tenant mix has been elevated with the introduction of Monica Vinader, Ace & Tate, Jimmy Fairly, Whistles & Townhouse to name a few.

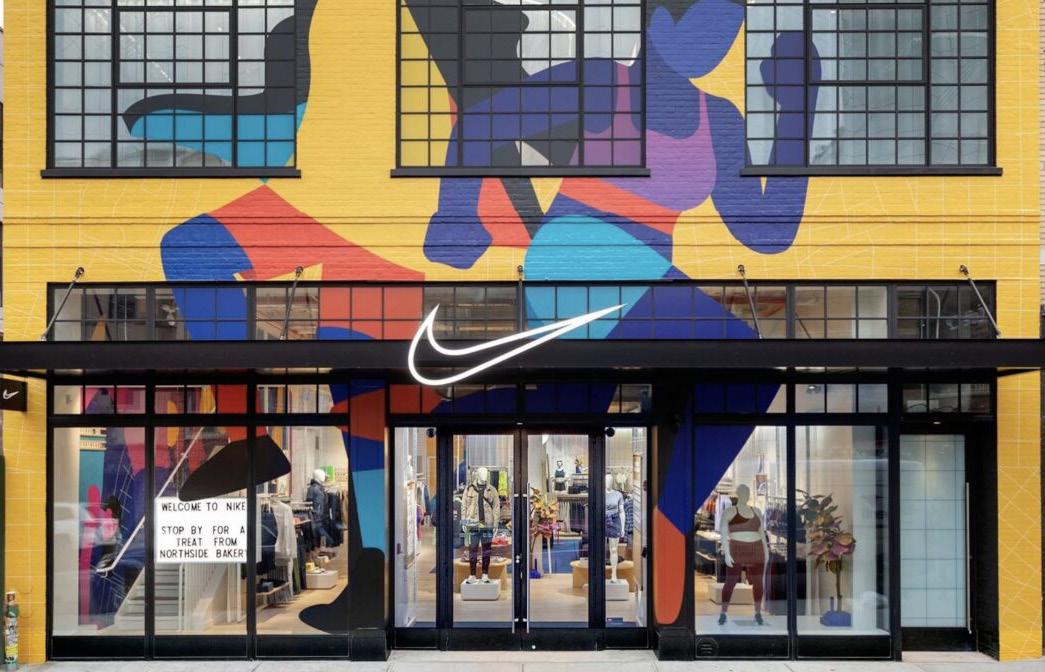

At Lakeside we have developed a clear strategy on focussing likeminded higher end brands towards a section on the upper mall which is now ‘super prime’. Clustering has improved turnover performance culminating in recent upsizes for Hugo Boss, Calvin Klein & Goldsmiths. When opportunities have arisen at lease events, we have been able to elevate the mix by replacing Kuoni, TM Lewin, Cath Kidston with the likes of Rituals, Lacoste & TAG. The super prime section is now fully let with competitive tension for new opportunities and with strong rental growth post COVID. There has also been an added spillover effect on the mall either side of this section helping to attract the likes of Nike, Pull & Bear and Stradivarius.

We convinced Monki to take their first store outside of London in Bristol – adding their bespoke brightly lit fascia was the first stepping stone to ‘enliven’ and ‘warm up’ Concorde Street which had been the weaker of the two main fashion malls in Cabot Circus. Leveraging off Monki’s presence, we attracted Bershka, Foot Asylum (later adding a Women focused extension) and more recently Lounge (under offer). Concorde Street is now fully let with further demand, and we are now pushing rents above the prevailing post COVID tone.

The Restaurant & Leisure team have a breadth of knowledge, advising on over 20 schemes across the UK, including The O2 Arena, Southbank, Lakeside and Atria Watford.

LM are the sole restaurant and leisure advisors on The O2, and have been pivotal in curating the strongest leisure mix in the UK. We have been involved in market leading transactions including bringing the UK’s first TOCA Social alongside iFly’s flagship UK location. Recently we have also secured Padel Social Club who have taken external space on excess land. This is alongside the largest Cineworld in the Southeast, Hollywood Bowl, Oxygen and Mamma Mia The Party.

LM are also the sole restaurant and leisure advisors on Brent Cross. From what was a very limited restaurant and leisure offering, LM have significantly enhanced the mix and are advising on multiple leisure deals equating to over 250,000 sq ft of space surrounding the shopping centre. Furthermore, we are creating a bespoke food hall in a vacant retail unit of 7,000 sq ft. We have been integral to the process, from design meetings to naming conversations, and now have all units in solicitors hands.

We have been involved in key deals on the Canary Wharf estate, which include the largest electric karting track in the UK, Capital Karts, who took surplus car parking space. We also recently secured The Cube for their first London flagship location and let a further 30,000 sq ft of car parking space to Flip Out, for a family entertainment centre. Other recent lettings on the estate include Fallow, Dishoom and Hawksmoor.

A big Centre needs a big team. We have hand picked a team ideally suited to this instruction.

LM are based in Covent Garden at the heart of Londons Retail and Dining epicentre.

The size of the LM team allows us to rescource fully, ensuring that all enquiries are answered and viewings on site can be accompanied.

We play to our strengths and are a close knit team, we work well together and with joint agents.

Born in the same week as centre:mk, Hayley has been leasing retail and leisure developments since 2002, she is an Equity Director at LM and a hands-on team leader.

Efficient and tenacious – Hayley is renowned in the industry for maintaining positive relations with agents and occupiers, even when negotiating the most complex or difficult deals. She understands how to curate a joyful shopping experience and vibrant mix, at the same time as driving rental values. Recent highlights have included securing Dunelms first full-size in-town store, bringing Astrid & Miyu to Bristol and persuading Mint Velvet and Space NK to take space in a covered shopping centre. There’s no doubt about it, Hayley is a grafter and will not let you down. Her happy clients include Hammerson, The Crown Estate and APAM.

Hayley will be handing over at least two other projects to other Directors in the team to ensure she has capacity to dedicate time to centre:mk.

Favourite deal in the last 12 months Zara Upsize Watford

Brand to watch Hush

Eats At Lina Stores

Wowed by Mumbai Markets

Will Hooper aka @Hoopsretail, has worked on a number of leading shopping and leisure destinations including Lakeside, Victoria Leeds and Canary Wharf.

He has a keen eye for emerging brands and he is a proven dealer having recently negotiated a number of high profile transactions with the likes of Boggi Milano, Bloobloom, Mango and Jimmy Fairly.

Will has developed long lasting relationships over the years with leading retail brands and agents and is able to entice a broad spectrum of occupiers to any given asset.

Will has recently moved off a project that was taking up appromimately 50% of his time. He has capacity to commit wholeheartedly to centre:mk alongside Lakeside and Victoria Leeds.

Favourite deal in the last 12 months Boggi Milano, Canary Wharf

Brand to watch ARNE

Eats At Nessa, Soho

Wowed by Marina Bay Sands, Singapore

Ruvan Sangra runs the restaurant and leisure team at Lunson Mitchenall. Working with both landlords and restaurant and leisure operators across the LM portfolio.

Ruvan’s enthusiasm for food and exploring different cuisines contributes to his plethora of knowledge on the restaurant industry.

His recently completed high profile restaurant deals include Six by Nico, Fallow and Hai Di Lao.

Leisure deals include, TOCA Socials first UK site and The Cube’s first London flagship soon to open.

As a restaurant and leisure specialist, Ruvan is able to dedicate as much time as you need to deliver on your leisure aspiration from idea inception to delivery alongside Jacob.

Favourite deal in the last 12 months Fallow Restaurant #2 + The Cube Live London

Brand to watch Bibi

Eats At Sabor

Wowed by Endo at The Rotunda

Alexandra works on broad range of instructions across the UK from Guildford to Glasgow!

She thrives on all things retail – and specialises in aspirational towns and cities - leaving no stone left unturned in the search for the perfect occupier.

Recent highlights include securing Oliver Bonas and Mango stores in Windsor and bringing Whistles and Phase Eight to Victoria Leeds.

Half Ukrainian- half Glaswegian- half Londoner - 150% focused on ethical and local brands.

Alex has just come back to 5 days having been working 4 days after return from maternity leave. She is excited to take on a new large project.

Favourite deal in the last 12 months Whistles in Victoria Gate, Leeds

Brand to watch Scamp & Dude Eats At Barrafina, Covent Garden

Wowed by Dubai Marina Mall

Jacob works on a variety of key mixeduse instructions across the UK including the likes of Atria Watford, The Chimes Uxbridge and Southbank Place.

Having joined LM in mid 2022, he previously specialised in the commercial leasing of new-build mixed-use developments, with a strong focus on urban regeneration and commercial placemaking.

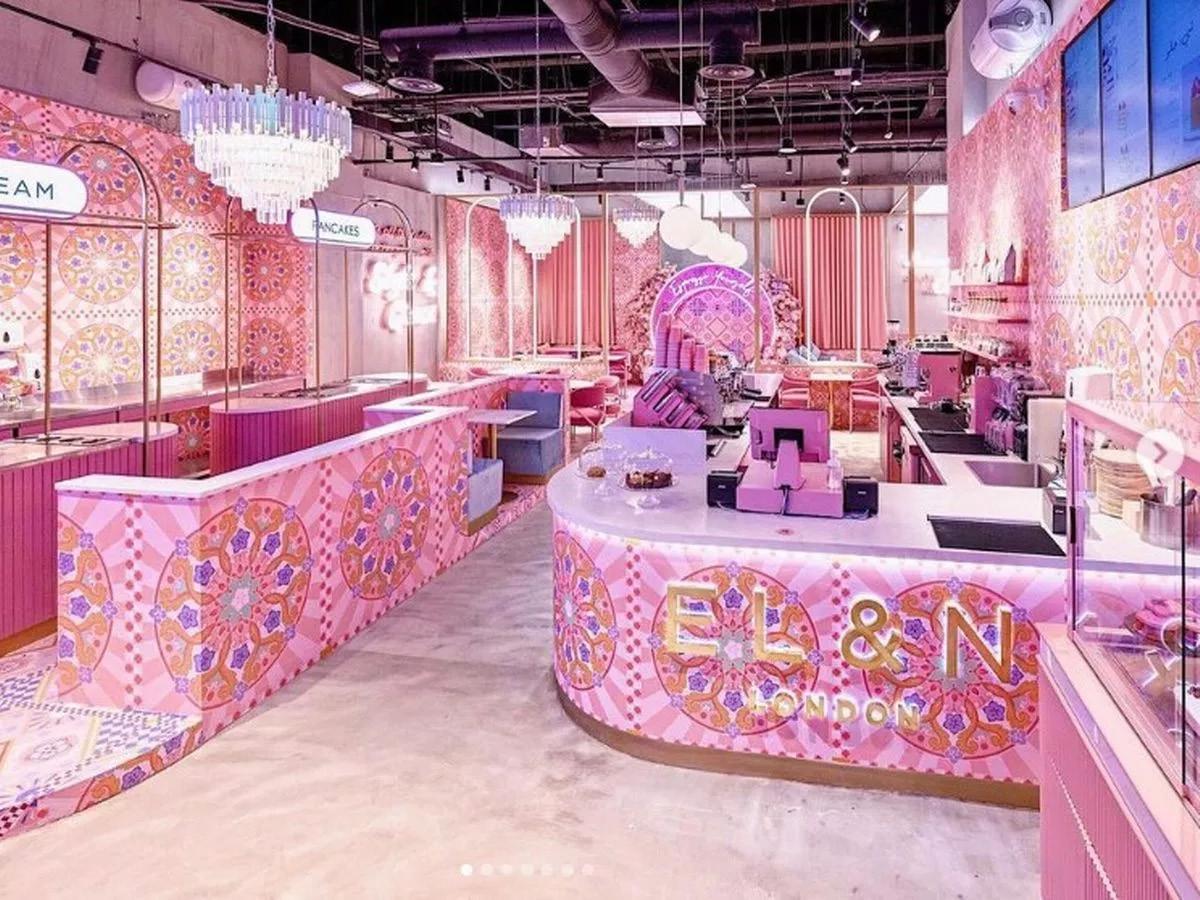

He has a hunger for identifying new and exciting F&B/leisure concepts that not only deliver a quality offering, but that also add a point of difference to the surrounding commercial landscape. Notable recent deals include the likes of Haute Dolci, Gails, and his favourite CrossFit operator, Gymnasium.

Favourite deal in the last 12 months Haute Dolci

Brand to watch Akoko, Soho

Eats At L’entrecote, Marylebone

Wowed by Galleria Vittorio

Emanuele II – Milan, Italy

A unique blend – major city centre + dominant regional mall. More than roundabouts and concrete cows! 1

A top ten UK shopping centre. centre:mk is unique in its nature as it serves both as a city centre and regional shopping destination making it one of the most dominant city centre schemes in the UK.

The affluent catchment stretches from Birmingham to the M25 and Oxford to Cambridge.

The city centre is exceptionally well-connected with a properly thought out road and cycle network and good rail link.

• Footfall close to 22M

• 1.3m sq ft under the same roof, all on one level with no escalators or lifts

• Affluent and wide catchment of 10.7M people

• Top 10 destination

• Average sales density £1,020 per sq ft

• 98% conversion

JLP, H beauty, M&S and Primark – to suit a wide range of demographic. From the retailers’ point of view this firmly puts the centre on their first-tier requirement list.

Consumers are driven by different demands. Whether it be budgetary, personal, social agendas or a desire to keep up with the latest trends. Having a broad range of pricing points is important.

centre:mk thrives at mid-price point and has a good value offer in certain sectors (Next, M&S, Primark, TK Maxx, Superdrug). With a great looking JLP and recent addition of H Beauty which is a game-changer in terms of bringing more affluent consumers to the centre.

centre:mk has great accessibility with an abundance of parking spaces which means that the centre has an ability to extend the catchment as customers are willing to travel further.

There is a long-standing requirement to bring a university campus to Milton Keynes. If this can be achieved, this will be a real opportunity for the centre to bring a younger customer in which will have a positive effect on both retail and F&B trade and will allow us to bring more urban/emerging brands to centre:mk.

LM have been working with asset managers and owners for 40 years to help them maximise the potential of their ownership. Our background and passion relate to shopping centres, providing leasing, development, lease advisory or investment advise. One of our key strengths is adapting our advice to clients specific business plans, whether this be driving rental growth, preparing for sale, enhancing tenant mix or repurposing and development. We achieve this by working as a joined up team with the client and their other consultants - all closely aligned on achieving the same end goal. The process, order of transactions and release of information to the wider market is controlled for maximum impact.

The balance between supply and demand to create competitive tension for space is key to driving rental growth. We have worked hard with our clients, in the post covid world, to ensure key retailers are in optimal units and new brands are targeted for empty space and relocation backfills. A rebasing of rental levels has helped, but we are now beginning to see the upside with improved demand and encouraging signs of rental growth.

Over the last 24 months we have agreed new leases or right sizing deals with a range of major fashion, food, convenience and luxury brands including Zara, JD Sports, H&M / H&M Home, Harrods, Primark, Next, Apple, Rolex, Goldsmiths, Reserved, Clarks, Superdrug and Marks & Spencer among others. Through our portfolio ranging from Central London to major regional shopping destinations we have exposure to new International brands and emerging UK concepts. Our ability to apply this intel to our client instructions is market leading. We have agreed multiple UK firsts for new formats and concepts such as Harrods H Beauty in Lakeside, The Qube in Canary Wharf and Toca at The O2.

Like many major shopping destinations Lakeside emerged from COVID with two failed department store anchors and a high vacancy rate. LM have been instrumental in reanchoring the scheme leasing the former Debenhams to M&S, multiple retailer upsizes and new lettings to the likes of Nike Unite, Pull & Bear, Stradivarius, Goldsmiths Rolex, H&M Home, Footasylum and Calvin Klein. Since the end of COVID Lockdown LM have transacted over 175 new lettings and re-gear deals.

At present we have less than 1% of floor space vacant, not under construction or in solicitors hands. Through a targeted leasing campaign we have seen unit shop rental growth increase by almost 40% in parts of the scheme.

Following re-anchoring the centre with a new Frasers / SD (and Flannels coming soon too) we have been busy combining shop units to upsize top performers in the centre (Hotel Choc, Beaverbrooks) converting vacant restaurants to leisure / retail (new letting to Urban Outfitters, cinema under offer). With only one shop unit void and several offers, we are now looking at strategic asset management initiatives to replace underperforming occupiers, and driving rental growth. Rents on the lower mall of Chantry Place have risen to meet the tone on the prime upper mall dispelling perception of the lower mall as a secondary pitch.

Filling vacant space with the right brand is essential even if on a temporary basis. We are always on the hunt for innovative pop-ups and seasonal occupiers to bring excitement and drive customer interest. Temporary uses we have attracted include a house plant nursery, an Immersive Everywhere Snowman attraction, art galleries, electric vehicle brands, The Charity Supermarket and English vineyard pop-ups. New interesting uses drive consumer interest and boost footfall. Having a simple leasing process for short term pop-ups allows for a quicker route to full occupancy. The shop fitting process can be bewildering for online brands taking their first steps into bricks and mortar so a simple shopfit procedure including the Landlord having fully tested life safety systems for example is a game changer.

A structured tenant mix takes time to build and is essential for long term sustainable rental growth. We always work closely with lease advisory teams to ensure the mix we aspire to fits with the existing rental tone and has long term financially viable for operators. An example is where we have clustered Home and childrenswear brands who typically have lower affordability thresholds. Alternatively, new entrant fashion brands or upsizing over trading jewellers to improve rental tone on new lettings. The timing of new deals to hit major rent review and renewal cycles is key and we have great experience across our portfolio executing this process.

We are experts in re-gears. We have been doing this ahead of the market for 15+ years to extend term, take out breaks and bringing forward refits. Our agency team has extensive experience across the sector on this including our sizeable database of operator turnover performance to understand key business drivers from operators in order to bring forward transactions.

The ability to react quickly to new interest is essential in the current competitive shopping centre leasing market. Having basic information on services, costs, floor plans in pdf/dwg and a commercial legal team makes deals happen quicker. This includes Landlord approvals and shop fit sign off. Quick deals build leasing momentum and timely rental evidence helps drive rental growth.

In conclusion, the fundamentals of growing rents are consistent - demonstrating strong footfall dynamics from an appealing customer base and proving excellent retailer performance are important but controlling supply and demand is the key. The way we achieve this changes from asset to asset and client to client, but in each case we like to help set up and then deliver on a clear strategy.

centre:mk’s wealthy demographic needs a wider offering to entice this consumers frequency of visit. We will improve the affordable luxury offer beyond the usual suspects and attract names who may in the past have avoided covered shopping centre environments.

We will need to curate a tenant mix based on price point which will assist consumer navigation around the ownership and improve average transaction value.

H Beauty is a great anchor for aspirational brands and the recent investment in the mall finishes within the lower run of Silbury Arcade helps to create a luxury feel.

Velvet, Aesop, Astrid & Miyu and In side Story to choose Milton Keynes for their next store will encourage similar brands to join the line-up and allow us to elevate further adding the likes of Hush, Monica Vinader and Neom.

The addition of better-quality allday offerings such as Ole & Steen or Gails would complement the trajectory of the retail vision.

Glasses by Ray Ban

Sofa by Loaf

Glasses by Ray Ban

Sofa by Loaf

Midsummer Arcade provides the strongest mix of young fashion, though the athleisure and urban offer could be enhanced.

This busy prime mall is where we will focus new and international brands – the price point is mass to mid market and we see non-fashion additions being important to maintaining a vibrant mix.

Sweaty Betty would tie in nicely with H Beauty and provide a good bridge to the bottom end of Silbury Arcade whilst elevating Midsummer Place. The introduction of a power brand such as Nike for their ‘Rise’ format would assist in convincing the likes of Under Armour and Castore.

There is a small student market within the catchment, and this is impacting brand perception but provides an area of growth for the asset. The third-party efforts to secure the addition a University Campus to the city centre will greatly assist. Relocating Levi’s and introducing Size? will provide a solid basis to convince Urban Outfitters and The North Face.

centre:mk is the heartbeat of the city and it needs to continue to serve its catchments broad demographic.

Family offers and day to day footfall uses are important subcategories, introducing the likes of Miniso, Mooch and Mountain Warehouse would bolster the offering towards the top end of Silbury Arcade.

Several toy stores have come and gone from centre:mk and this is something LM would like to explore further – could Crown Walk be the right place for this use at a lower rent?

Young families require entertainment to lengthen shopping trips, adding alternative uses to keep kids entertained and give parents a break will increase spend. The integration of additional family focussed QSR beyond fast food favourites will resonate with the consumer in this area.

As new global brands emerge and existing operators update their portfolio, centre:mk needs to be on their radar as brands start to look at the top UK Shopping Centres.

LM are always keeping up to speed with emerging talent from overseas, this quarter our team scoured Milan and Rome for the latest developments and trends.

While most brands new to the UK will tend to secure London as their first site, we always get early meetings with them to make sure our instructions are on their radar at the earliest stage. Recent examples include likes of Sepho ra, Reserved and Parfois.

International brands are an integral part of a regional destination line up, but the UK retail and leisure market is a world-leading hotbed for new talent. Examples include Sosander’s pursuit of physical retail and Self Portrait and Rixo’s growing market share in the affordable luxury market as well as the growth of Scamp & Dude and Lounge.

We love using pop up and trial lettings to make the tenant mix more interesting and this is an excellent platform for local brands to shine. A designated pop-up space could be allocated to ensure we always have a changing tenant mix and something to keep customers returning. We have found some innovative new businesses via researching on social media or simply pounding the streets of local towns.

There has been a rise in the number of vintage / second hand clothing stores and a big shift towards authenticity and use of organic materials and fair trade - many of these tend to work best on a pop up basis, creating a buzz by being in place for a short time. The quality of these operators has really improved and The Charity Supermarket are an excellent example of how to do this right. We have been amazed at the response to this, with people flying in to the UK to visit, and it generated unbelievable social media activity.

Different uses not usually seen in a big mall really go down well with customers– in our view there are simply not enough plant shops, and artisan cupcakes in the world and we intend to address this!

Not all uses can afford high value prime rents and secondary pitch in centre:mk is quite limited –the cross malls provide excellent connectivity with the city and can be used to make the tenant mix more interesting, the external units also provide secondary space with easy access.

Targeting leisure within centre:mk should be a key priority as this will have a halo effect on the shopping centre, restauranteurs and evening economy.

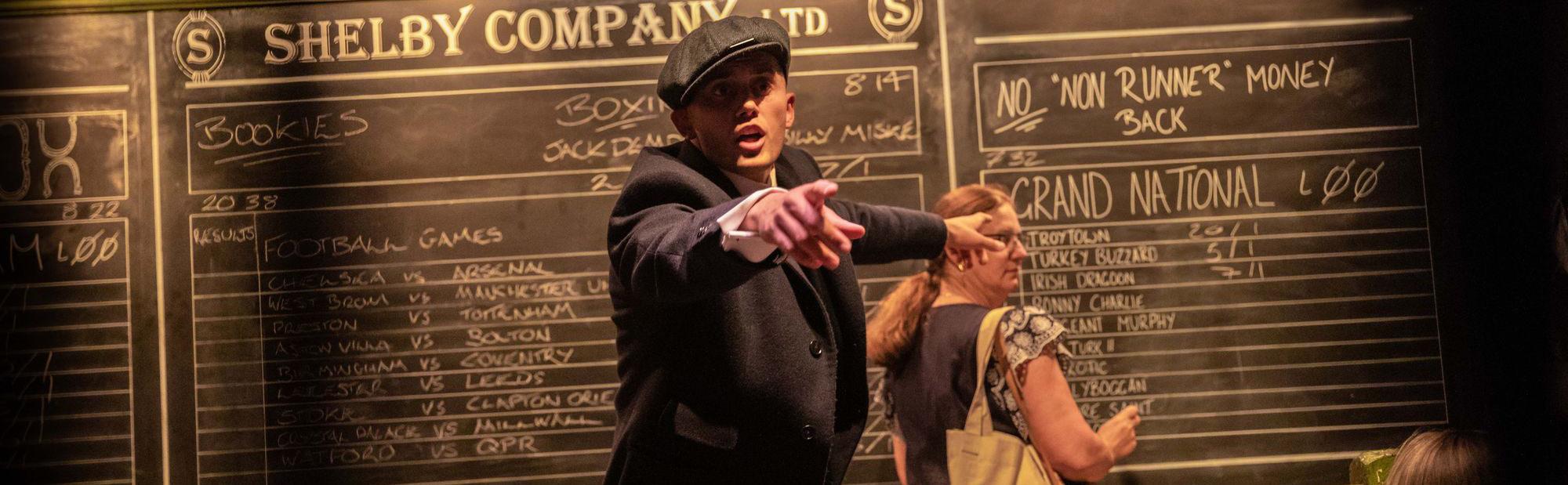

The current restaurant and leisure provision within centre:mk contributes to circa 6% of the overall quantum, which presents an opportunity to considerably enhance the offering. Currently, there are several market leaders and LM have strong relationships with all of these operators. We would advise targeting a destination UK attraction – Immersive Everywhere being an outstanding example of that. They have the IP to well-known household names such as The Snowman, Peppa Pig and Star Trek, and delivering an operator of this ilk will pull on a huge catchment, far beyond Milton Keynes.

We have also included the likes of Capital Karts who can consider external multistory parking, as well as other targets such as The Cube Live, TOCA Social and Monopoly Lifesized, Locations we can consider for leisure include the first floor of the H Beauty and the Boots, and also surrounding land adjacent to JLP.

The JLP is over 200,000 sq ft and whilst we would want them to continue to trade the entirety of the space, we should also be considering alternative options if they were to downsize. Immersive Everywhere could erect an external structure if we did have surplus space surrounding the centre.

Leisure is a key offering within any top UK shopping centre, so this should be a priority for centre:mk.

To improve the offering and enhance the evening trade, leisure should be targeted as a key priority.

Everyman have MK as a top target. A deal with them may be financially challenging but we think they would be a game changer.

Virtual Reality should also be targeted. We have a strong relationship with Sandbox who have recently opened their Central London and Birmingham sites and are actively considering new locations.

Activation of the Queens Court external space is crucial. This could be via a letting to an external restaurant + bar, padel courts or working closely with the on-site team to curate a year-round calendar of events. We have included visuals of Canary Wharf’s screening of Wimbledon and Argent’s activation of the ‘Canalside Green Steps’!

Using the central space to create yearround interest will support F&B in the surrounding units enabling this to grow as a destination.

With the large external square, considerable frontages and the opportunity for external seating, Queens Court provides a great foundation to improve the tenant line up. This space requires its own identity, to ensure it is not an ancillary function that purely acts as a service for shoppers.

A rebrand can be conducted in the way of a name change, alterations in lighting, greenery, ambience, and branded entrance points, to ensure Queens Court establishes itself as a day and night destination and extends the evening offering.

There are key uses that we should look to add to this area, including an all-day operator such as Willow, a Mediterranean operator such as Comptoir Libanais and The Real Greak.

We would consider adding Quick Service Restaurants, such as Wingstop and Archies, to the entrance points of Queens Court in the Metro Bank and former Byron Burgers.

centre:mk is a strong performer for both Nando’s and Wagamama, so we should approach Wagamama regarding an upsize into Queens Court, alongside a refit of the Nando’s!

To coincide with a leisure anchor, we should approach the likes of The Alchemist to extend the evening and all day offering.

There is an existing concentration of ‘Grab-And-Go’ operators within Middleton Hall, however we feel there is an opportunity to expand this offering throughout the centre, creating ‘pit-stops’ for customers in other areas of the scheme, especially along Midsummer Avenue.

The addition of alternative grab-and-go uses such as poke operators, crepe’s and vegan specialists would ensure a greater variety of offering beyond coffee and create a point of difference.

Targeting artisan brands, who are now considering opportunities outside of London, such as Gail’s and Ole & Steen, will add an element of character to the current offering.

Fitted or ‘white-boxed’ units will enable us to be attract more aspirational brands to centre:mk.

The external units provide secondary space with easy access. External units are ideal for service uses, the type of thing customers wish to “nip” into town for – they need to have lower rental values to ensure they are sustainable for small businesses and independent operators.

The external units and vacant space above can provide opportunities to bring in interesting and useful uses – can we relocate the Post Office? Yoga studios (hotpod), small gyms/clubs, chiropractors, physio, vets or a childrens play café. These uses can often occupy first floor space with a small ground floor access.

While the occupiers have done a great job in dressing their rear (closed) frontages to keep them bright, it still creates an odd feeling that there are lots of voids in the area. Clustering the external units together where possible will create a more vibrant pitch.

We would love to bring a more local vibe to the city centre – a butcher, baker, candlestick maker – an old fashioned local high street to grab your essentials and to showcase local heroes.

For any secondary units, having them ready to let as a white box with all M&E/health and safety certificates up to date, will help to deliver deals with smaller businesses. The south side of centre:mk has the potential to increase the malls external presence – we envisage outside seating in the sun, and a long term vision to bring the space in between centre:mk and the future developments along Midsummer Boulevard into better use – fountains, picnic areas, a place to meet in an exciting new urban realm.

2. Ministry Co-Working – perhaps not quite the right brand for MK but a smaller co-working / study hub could work here!

3. Private dentists, GP’s and skin clinics – External units could be utilised for interesting service uses

4. Wellness studios – independent yoga classes or a full on yoga School??

5. Wild Things Play Centre – give parents free time for spending, design it a little different to the usual plastic horridness

6. LMA Liverpool - can we bring the new MK university into our campus? As seen in Liverpool and Gloucester…

7. Family Club – combining workspace, nursery, gym, relaxation space for families – top floor of H Beauty?

8. Phenix Salon Suites – a hub for independent hairdressers and salon treatments – needs 4-8,000 sq ft and can work at first floor level

MK has grown from the largest and most ambitious of the New Town projects into a vibrant and unique City, and whilst many of the core principles that shaped its development in the 70’s/80’s have stood the test of time, it does need to evolve if growth is to continue.

centre:mk offers a family friendly, safe and welcoming environment. However, there is an opportunity to remodel parts of the ownership to provide complementary uses that give a more inclusive proposition.

We feel the southern facade has the potential to create a point of difference to the current offer. This could bring together the prime internal facing retail units and the current food offer on Queens Court and link with Midsummer Place and the new residential developments planned along Midsummer Boulevard. We should look at the addition of more leisure uses, provide a pedestrian friendly external street environment and maximise the potential of the south facing shop fronts by having more trading frontages and building linear units beneath the canopy. All of this would help create an exciting and vibrant City Centre zone that complements the existing offer.

Best in class developments such as Battersea Power Station, Union Market (Washington) and Vulkan in Oslo show how internal and external environments can work in harmony. Small external units that satisfy the needs of local and regional retailers selling convenience products and regional and national restaurant brands will add diversity and bring new shoppers to the City.

Linking with new residential developments and existing leisure attractions in a pedestrian friendly boulevard will encourage dual-use visits and provide amenity value. centre:mk will remain the “Heart of the City” and provide its prime shopping pitch with the external areas acting as a link to new developments whilst encouraging greater dwell time and diversity of uses as well as providing the opportunity for year-round events.

Customers are choosing and paying more for brands with sustainability and environmental credentials. Supporting small businesses and local produce, unpackaged options, organic and sustainable products is just the start.

Allbirds and Bamboo clothing are great examples of brands with sustainability and environmental impact at the forefront of their minds. Repair is back in vogue – Nudie offers free repairs for their jeans forever.

Space 10 is Ikea’s innovation hub in Copenhagen. It’s tasked with resolving big ESG issues on a small scale. Informing consumers on topics such as building flat pack furniture without disposal spanners (think about how many get thrown away each year) and can flat pack furniture be 3D printed and manufactured locally to reduce the impact of shipping. All of this is in a cool exhibition space which is accessible to the public.

Younger generations are even more socially and environmentally conscious and look for opportunities to support charities, and minimise the impact on the planet. We have been working with “The Charity Supermarket” who run fabulous pop up’s, bringing in an interesting footfall driving use (queues out the door over the weekend) and supporting charities at the same time.

The way our customers are living has changed. The rise of work from (or near) home has changed the dynamic of the weekday customer in Citys like Milton Keynes. Fitness classes, lunch spots and quieter working areas will be popular with workers looking for a change of scene. Open spaces with fresh air and greenery are vital for making centre:mk a positive experience for shoppers. Making the City Centre a vibrant place to live /work /shop /play is important to maintain its appeal.

Clothing rental has been around for some time in the formalwear sector but has developed further owing to its appeal to the sustainable shopper. Rental allows higher end fashion to become more accessible. Examples of this use are starting to pop up in

The world is changing and the future of our City centres is being influenced by a wide variety of trends. We need to adjust our future strategy to position centre:mk to serve our customers needs.

bricks and mortar sites – e.g. By Rotation recently showcased pieces in a pop-up in Belgravia, which was hugely popular. Rental rather than buying is likely to be a growing sector in other sectors such as home furnishing and technology.

GymShark’s new flagship store is both flexible and community led. Focusing on customer experience including free gym classes, events and mental health space. Their adaptable layout can be cleared in just 20 minutes to host bigger events & gym classes. Its great to see shops acting as places to meet up for exercise and enhance a feeling of community – centre:mk’s accessibility makes it a great centre for brands such as this to expand.

The Lobby in Stockholm is a great initiative by one of Sweden’s largest commercial Landlords (AMF) to deliver flexible incubator space to emerging and online retail brands. The 6,000 sq ft store provides wall space, racking , hanging rails and booths as well as a coffee shop and an exhibition zone. Allowing young brands to test the market with their products is a great way to grow your own tenants. We think Crown Walk is an ideal location to create something similar in centre:mk.

The influence of social media on retail brands is huge. Glossier spotlights on bestselling products, makeup and skincare tutorials and colour swatching. In-depth behind the scenes videos add a further layer and allows employees to become advocates.

German designer Philip Plein’s new ‘crypto concept’ in his London flagship store, uses QR codes to offer prices in alternative digital currencies and a free trading platform for metaverse art.

Uniqlo Toyko - 5,000 sq m over 12 floors. Multilingual customer support and MY UNIQLO allows customers to create their original UNIQLO products with custom design. Additionally, the AIRism showcase, displays the technology and materials behind their clothing.

Taking customer experience to another level is the way to win new hearts and keep customers returning to centre:mk rather than shopping online. Shopping for less things and more experiences seems to be a continuing trend after lockdown, and with a cost of living crisis, customers seem to be prioritising wellbeing and interaction over fashion.

Wilson NYC is a must visit in New York – the store displays custom curated clothing, has a one-of-a-kind indoor park, tennis court, basketball court and on site equipment customisation station.

We love Reformation’s chic, eco-friendly store – it offers a fantastic retail experience with interactive touchscreens to explore collections and latest trends. Its dressing rooms also add to the personalisation with customised lighting, and phone plug ins for music.

Showfields (New York) store creates an evolutionary retail concept which aims to inspire a sense of discovery in its customers through constantly revolving experiences and brands. Mixing bricks and mortar retail, online retailers, events, art and even has its own slide.

eBay’s collab with Offset allows customers to get exclusive pricing on collectable kicks if they wear them out of the door once purchased. Bringing in 10 new styles per day, alongside influencers within their stores to attract their audience.

The North Face x Gucci’s collab allow brands to leverage market position. Luxury operators get mainstream exposure and High St retailers benefit from a sprinkling of limited edition glitz.

B2B marketing has moved on, and centre:mk needs to compete for brands on the same playing field as London estates and the top UK cities. The London Estates present their assets with high quality marketing collateral tailored to their target audience. Strong imagery with on brand messaging is essential. The marketing collateral needs to be updated regularly and available in multiple formats. The digital version is critical, but sometimes nothing beats talking to a retailer with an old fashioned brand book. Most retailers will have retained agents and getting them on side from the outset makes the process smoother. The branding needs to be linked into the B2C message and should include examples of the latest consumer marketing initiatives.

Social media TikTok, Insta, Snapchat & podcasts are the new breeding ground for emerging retail brands. Tapping into these social media channels is becoming a key part of retail agency. Landlords will look to “grow their own“ tenant mix and will use influencer’s to appeal to both consumers and e-tailers offering. Shorter leases and having ready-fitted units are key to ensuring a constantly evolving mix.

Nothing talks to retailers like statistics. Generic consumer information is easy to provide. centre:mk has some very strong stats to shout about and this should be the back bone of the messaging. For key brands, a more structured approach such as bespoke marketing pack, but with impartial view from CACI or similar may be required. Retailers love trading statistics, NDA’s can make this difficult to disclose. Providing baskets of sales density information across market sectors is achievable. Several of our existing clients have integrated Power BI to the leasing process with great success.

Think Globally. Research one international city a quarter to look at what’s new and exciting. If it’s practical, go and see it. If not, use social media channels to inspire and guide the strategy. Brands tend not to just arrive in the UK, they carry out research and use consultants. LM has unique relationships with acquisition agents. Over 90% of LM’s fee income is derived from Landlords and there are no plans to change this, so occupier agents trusts us with their early enquiries.

To lease to international brands we need to get busy senior execs and VP’s not in the UK on side - a curated video and interactive viewer can be invaluable leasing tools.

https://chinatown.co.uk/en/

https://vimeo.com/canarywharfgroup

https://aberdeenstandard-chs.visualiseinfo.co.uk/ Churchill_Square/

https://vimeo.com/528218101/a8b9bd256a

Lunson Mitchenall pride ourselves on resourcing instructions to exceed our clients expectations, we build long term partnerships with our clients and with mutual trust; LM are advisors not brokers and our success is aligned with that of our clients assets.

Lunson Mitchenall have provided, development, leasing and lease advisory advise on Churchill Square Brighton for 30 years.

This has encompassed retail, leisure and food & beverage. I have always found them to be professional and knowledgeable, with a great capacity for lateral thought and problem solving.

ED JENKINS, HEAD OF SHOPPING CENTRE AM, ABRDNHayley is a proactive and valued member of the asset team, who has a holistic approach to leasing, understands the client’s financial requirements and asset business plan objectives.

She brings a positive can-do attitude, staying fully involved in a deal beyond instructing solicitor, and has a thoughtful approach to complex deal structures in order to improve the occupier mix and manage any financial concerns.

KATHERINE ARMSTEAD – THE CROWN ESTATEI have worked with the LM Retail and F&B teams on Brent Cross for the last 2 years. They have great market knowledge and provide top level advise on all leasing aspects at the centre. They are proactive and have had some great ideas particularly on leisure and F&B uses, where we are looking to extract value out of non-income producing parts of the ownership. The LM team work well together and obviously enjoy what they do.

MILLIE EDWARDS, SENIOR LEASING MANAGER, HAMMERSON PLCThe Lunson Mitchenall team pitched for and won a leasing mandate on the Victoria Quarter/Victoria Gate in Leeds 12 months ago. Their pitch highlighted the Leasing Focus required and they are executing in line with this plan diligently, at pace and creatively. Their knowledge of the market and other instructions has facilitated ‘First store out of London’ for a number of occupiers.

ROBERT HADFIELD, DIRECTOR, RIVINGTON HARK