EMPLOYEE BENEFITS

Updated 2024

Our Employee Benefits Handbook provides comprehensive information about the benefits available to you as a valued member of our team. These benefits are designed to support your health, well- being, and professional growth.

Eligibility

Most Employee benefits are only available to full-time employees , but there are some exceptions . Each benefit may have different qualifications and eligibility requirements. It is important to review the specific details for each benefit to understand how to qualify and take full advantage of what we offer. Please see Firm Administrator to apply for benefits and for answers to your questions about benefits.

LEAVE POLICY

1. Leave Year Begins July 1 and Ends June 30

2. All Leave MUST be requested via PCS

• Log into PCS and click the pull down beside add on the ribbon at the top of the screen.

• Click on:

• Enter your time off request and submit.

VACATION

1. Leave is accrued on the last day of the month.

2. Maximum Carry-over allowed on 6/30 = two hundred (200) hours.

3. Employees may donate 20 hours of leave to a fellow employee annually (no rate adjustment). Please notify firm administrator if you wish to donate to someone.

Full - time (40 hours) Employees

• Earn 12 days per year from the start of employment to their fifth anniversary. Leave is accrued on the last day of the month.

• Earn 18 days per year from the day after their fifth anniversary. Leave is accrued on the last day of the month.

• Use"AdminVacation" work code in Practice CS (PCS)

Part - time (30 - 40 hours) Employees

• Earn 9.6 days per year from start of employment to their fifth anniversary.

• Earn 14.4 days per year from the day after their fifth anniversary.

• Use “AdminVacPart" work code in PCS.

WITHOUT PAY

1. Managing Partner approval required for all LWOP.

2. Use “ADMLWOP" work code in PCS.

FLOATING HOLIDAY

1. Employees Earn 8 hours of floating holiday annually.

2. Employees should use “Adminfloat" work code in PCS

3. Floating holiday does not carry over at 6/30 (Use it or lose it!)

CHARITY DAY

1. Employees earn one day of charity leave annually.

2. Firm Administrator approval required.

3. Employee Reporting of Charity Event activities and pictures must be posted in Teams under GW Values

4. Charity day DOES NOT carry over. (Use it or lose it!)

5. Employees should use "Charityday" work code in PCS

JURY DUTY

1. Employees will be paid for up to three days of Jury duty annually.

2. Employees must submit their jury duty notification to the firm administrator.

3. Employees should use "ADMJURY" work code in PCS.

FUNERAL LEAVE

1. Employees will be paid up to three days of bereavement leave for the death of an immediate family member.

2. Immediate family is defined as - parent, spouse, siblings, and children.

3. Employees should use "Admfuneral" work code in PCS.

HOLIDAYS

GWCPA observes the following holidays:

• New Years Day

• Tax Season Relief Day (day after last day of tax season)

• Memorial Day

• Independence Day

• Labor Day

• Thanksgiving Day

• Friday after Thanksgiving

• Christmas Day

Employees should use " Admholiday " work code in PCS.

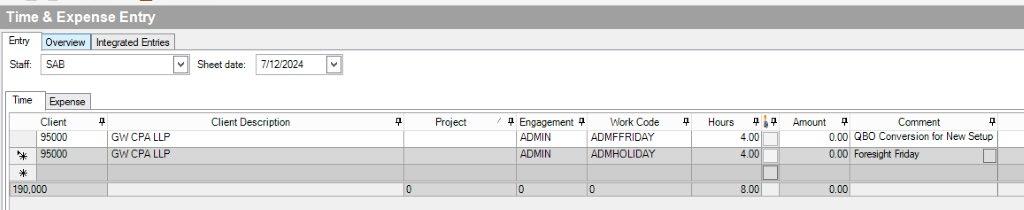

FORESIGT FRIDAYS (NEW 2024)

Starting this July 12th and ending August 30th, we're excited to launch "Foresight Fridays," an initiative aimed at fostering our value of foresight anticipating and preparing for future needs and challenges. Every Friday, each team member is encouraged to spend four hours on activities that promote forward-thinking and innovation.

In recognition of your commitment to this value, once you've completed these four hours, you can enjoy the remainder of the day off as a paid holiday. Four hours is the maximum holiday time you can take.

If you only perform two hours of foresight activities, then you only receive two hours of holiday time. Participation is optional at this point, but if you do not participate then you are expected to work a full day unless you take personal leave.

What Can You Do During Foresight Fridays?

Here are some suggestions for activities you might engage in during these four hours. Feel free to choose something that resonates with your role, interests, or professional development goals:

1. Listening to Future - focused Podcasts or Webinars: Explore content that discusses trends in technology, economy, or your specific industry. This can help you stay ahead of emerging trends and gather insights that might benefit our business.

2. Learning About New Technologies: Take time to understand how tools like ChatGPT or Microsoft Co-Pilot can aid in enhancing our services or improving client interactions. Experiment with these technologies to see if they can be adapted for our projects or internal processes.

3. Innovating Client Solutions: Review a client’s current setup and brainstorm ways to enhance their systems, whether through new software applications or optimizing existing processes. This could involve drafting a proposal for a new accounting software integration or a custom tool that addresses specific challenges.

4. Developing Internal Tools: Work on software or systems for internal use that could improve efficiency or employee satisfaction. This might be automating a common task, enhancing data security, or creating a more collaborative virtual workspace. Example opportunities: New Tax Research Software, Standard Operating Procedures Software, New Employee Onboarding Software, Exploring New Features of Existing Software (Zenefits), etc.

5. Participating in Strategy Workshops: Join a workshop or session that focuses on strategic planning and long-term goals. These can provide valuable insights into aligning your daily work with our larger business objectives.

6. Engaging with Thought Leaders: Reach out to or follow the work of leading thinkers in areas relevant to our business. This could be through social media, attending a live Q&A, or reading recently published papers and articles.

How to Participate

Each week, choose an activity that aligns with our foresight objectives. After spending four hours on this activity and documenting it in Teams, you’re free to take the rest of the day off. Here is how you will code your time in PCS.

HEALTH CARE INSURANCE

1. GWCPA pays the following benefits for full-time employees (40 hours).

• 100% of BlueChoice Advantage HMO HSA Silver Plan Premium Employee coverage.

• 100% of BlueChoice Advantage HSA Silver National Plan Premium Employee coverage

• 80% of BlueChoice HMO Platinum Plan Employee Coverage

• 100% BlueChoice Dental Plan Employee Coverage

• 100% Vision Coverage through Davis Vision Employee Coverage (starting January 2024).

2. Employee pays difference for additional coverage for dependents.

3. Full-time employees are eligible for health care coverage after 30 days of employment.

LIFE AND DISABILITY INSURANCE

1. GWCPA pays 100% of premium for Life insurance which pays up to 2 times your annual base salary to your beneficiary in the event of your death. Benefit over $50k is added to your paycheck with the last payroll at the end of each month.

2. GWCPA pays 25% of premium for Short Term Disability which pays 60% of your salary for a 6-11 week disability. You must be out of work for two weeks before short-term disability kicks in. The percentage of premiums paid by GW will be taxable to employees.

3. GWCPA pays 100% of premium for Long Term Disability which pays 60% of your salary if you become disabled. The percentage of premiums paid by GW will be taxable to employees.

FLEXIBLE SPENDING ARRANG EMENT (FSA)

1. Cafeteria plans are flexible benefits plans that allow employees to choose from a variety of benefits. Contributions to a cafeteria plan are made pre-tax, lowering your total taxable income and reducing income, Medicare, and Social security taxes.

2. The FSA are available for dependent care assistance, adoption assistance, and medical care reimbursements.

3. The benefits are subject to an annual maximum and are subject to an annual “use-orlose” rule.

4. The maximum amount of reimbursement which is reasonably available to a participant for such coverage must be less than 500 percent of the value of the coverage.

5. Employees make elections annually and submit receipts for reimbursement to Firm Administrator.

6. You can submit receipts for reimburse up until March or the following year.

401K RETIREMENT ACCOUNT

1. Employees become eligible to participate in our 401(k) benefit plan at open enrollment (July) after they have been employed for one year AND worked more than 1,000 hours.

2. Employer Contributions

a. All employer contributions are discretionary.

b. GWCPA will determine each July 1 the employer match

c. GWCPA will determine Profit Sharing Contribution by October 1 each year.

d. Compensation = Gross Taxable Compensation plus Sect 125 Deferrals.

e. Roth Deferrals (after tax) are allowed effective 10/1/2023 – See Firm Administrator.

OTHER BENEFITS

REFERRALS

1. GWCPA pays commission for bringing in new business. 10% of the gross fees COLLECTED and adjusted for write-downs (if any) will be paid to the employee at the end of the fiscal year.

2. The period covered for commissions is June 1 – May 31st.

NEW HIRES

1. If an employee refers a new hire, the employee will receive $1,000.00 bonus.

2. If the new employee is here after one year, the referring employee will receive an additional $500.00.

BUSINESS ORGANIZATIONS

• GWCPA encourages participation in business organizations.

1. The firm pays annual dues and reimbursement costs for attendance at approved organizational functions. See Firm administrator for approved organizations.

2. Professional dues and licenses fees are paid by the firm.

EDUCATIONAL ASSISTANCE POLICY

GWCPA will reimburse an employee up to a maximum of $5,250 per year for continuing education through an accredited program that either offers growth in an area related to his or her current position or that may lead to promotional opportunities. This education may include college credit courses, continuing education unit courses, seminars, CPA exam review course (1 per employee) and certification tests that are job-related.

An employee must secure a passing grade of “B” or its equivalent or obtain a certification to receive any reimbursement. Expenses must be validated by receipts and a copy of the final grade or certification received.

Full-time and part-time (30 hour) regular employees who have completed one year of employment are eligible under this policy.

To receive reimbursement for educational expenses, employees should follow the procedures listed here:

1. Prior to enrolling in an educational course, the employee must provide Firm Administrator with information about the course for which he or she would like to receive reimbursement and discuss the job-relatedness of the continuing education.

2. A tuition reimbursement request form should be completed by the employee, and the appropriate signatures obtained.

3. A copy of the tuition reimbursement request form must be submitted to the Firm Administrator. The employee will maintain the original until he or she has completed the educational course.

4. Once the course is successfully completed, the employee should resubmit the original tuition reimbursement request form with the reimbursement section filled out, including appropriate signatures, as well as receipts and evidence of a passing grade or certification attached.

5. The Firm Administrator will coordinate the reimbursement.

AT WORK STUDY PROGRAM

Any employee that is pursuing their degree or certification can study during business hours if their workload permits. This is only available during slow times and when there are no GWCPA projects or tasks to complete. Accounting staff must first inform the manager of low work and obtain approval. The maximum hours of work study per week is 8 hours. There should be no work study during tax season (January 1, through April 15).

Employees should use "AdmCPA" work code in PCS for CPA related. Employees should use "AdmWorkStudy" work code in PCS for all other.

CPA CREDENTIAL

1. $1,000 is paid for passing the CPA exam while employed at the firm.

2. Reimbursements limited to employee expense reimbursement amounts:

a. Exam Review Course (1 per employee)

b. Exam fees (4 exams per employee)

3. CPA candidates do not have to use leave for sitting for exam – 18-month Period from 1st exam taken Employees should use "AdmCPA" work code in PCS

4. GWCPA pays for CPE to maintain CPA License (40 Hours per Year)

5. Employees should use "AdmCPE" work code in PCS for courses taken.

WHOL ESALE BUSINESS MEMBERSHIP

• After one year of employment we will provide monthly membership to your choice of Sam’s Club or B.J.’s

GWCPA TEAM ACTIVITIES

• GWCPA has annual functions such as:

o March 15th celebration (held after the March 15th deadline).

o Summer function (held in June).

o Fall outing (held in September).

o Attendance to the MACPA’s Women to watch awards (held in September)

o Movie Nights

o Wine Parties

o Halloween Party

o Winter holiday Party

o We celebrate everyone’s birthday with a sweet treat of their choice.

o Everyone gets a lunch of their choice during work anniversary month.

o Beverages and a kitchen for your convenience.

o Free Parking

o Various parties and functions during the year.