In 2021, employees began leaving their companies in record numbers to redefine their work/life balance. To counter the Great Resignation, seven HR executives are building company cultures that attract top talent and encourage them to stay.

Since joining FedEx in 2020, Auriel Rawlings has developed regional, company-wide diversity and inclusion initiatives, and is now tackling employee relations, recruitment, and policy and procedures. In a Q&A with Profile, she speaks on the importance of culture initiatives at FedEx and how that focus helps the organization differentiate itself during the Great Resignation.

P26

Pamela Bucher reveals the behind-the-scenes work that goes into preparing SeatGeek for its future as a public company

P10

Fidelity Investments’ Wendy John strives to create a workplace that honors and celebrates the differences among people

P17

How Chief Accounting Officer Meagan Thompson integrates excellence with care at Safe Harbor Marinas

P50

How Nick Warner uses small experiments to create better customer experiences at Route P58

Seth Goldstrom helps companies reach their full potential through his transformation work at McKinsey & Company

P68

How Wilson Ho’s robust IT and security strategy keeps car-sharing company Turo ahead of the competition

P72

In Every Issue

Editor’s Letter P7

Index P81

Julie Allen keeps reinventing herself, but she always finds a way to shine a light on young, creative talent at the Howard Hughes Corporation

P54

Betsy Philpott was always told it was impossible to work in sports as a lawyer. As senior vice president and general counsel for the Washington Nationals, she’s proved the naysayers wrong.

P74

Carlos Huereca grew up in a family of small business owners and watched leadership in action, not just in business but also in how they treated people. He brings these lessons and twenty years of expertise to Corporate Relocation International as its chief human resources officer.

P29

Editorial Director

Frannie Sprouls

Editors

Jaylyn Bergner

Sara Deeter

Melaina K. de la Cruz

Michele Cantos Garcia

Brittany Farb Gruber

Julia Thiel

Staff Writers

Zach Baliva

Billy Yost

Contributing Writers

Zachary Brown

Will Grant

Frederick Jerant

Joseph Kay

Natalie Kochanov

Keith Loria

Maggie Lynch

Claire Redden

Designer, Profile

Anastasia Andronachi

Senior Designer

Vince Cerasani

Designers

Rebecca Kang

Arturo Magallanes

Senior Photo Editor & Staff Photographer

Sheila Barabad Sarmiento

Photo Editor & Staff Photographer

Cass Davis

Contributing Photo Editor

Sarah Joyce

Special Projects Editor

Sara Deeter

Creative Production Coordinator

Melaina K. de la Cruz

CEO & Publisher

Pedro A. Guerrero

President, Group Publisher

Kyle Evangelista

Chief of Staff

Jaclyn Gaughan

SALES

Director, Sales

Stuart Ziarnik

Director, Sales Onboarding

Justin Davidson

Manager, Onboarding Sales & Development

Hannah Tanchon

Sales Researchers

Titus Dawson Kemp Pile

Lead Recruiter, Guerrero Search

James Ainscough

Senior Director, Corporate Partnerships & DEI Solutions

Krista Horbenko

Digital Product Manager

Aleksander Tomalski

Director, Talent Acquisition & Engagement

Haylee Himel

Talent Acquisition Managers

Josie Amidei

Jordyn Gauger

Content & Advertising Managers

Samantha Eberly

Brandon Havrilka

Sarah Kupfer

Megan Murphy

Maya Porterfield

Ashley Watkins

Profile® is a registered trademark of Guerrero, LLC.

© 2023 Guerrero, LLC guerreromedia.com

1500 W. Carroll Ave. Suite 200 Chicago, IL 60607

Subscriptions + Reprints

AUDIENCE & ENGAGEMENT

VP, Hispanic Division

Head of Audience & Engagement

Vianni Lubus

Director, Events

Jill Ortiz

Events & Marketing Manager

Ashley Parish

Communications & Engagement

Manager

Cristina Merrill

Associate Manager, Digital Marketing

Aliana Souder

Social Media Manager

Suleidys Tellez

OPERATIONS

VP, Finance

David Martinez

Director, Circulation

Stacy Liedl Staff Accountant

Natallia Kamenev

Senior Director, Client Operations

Cheyenne Eiswald

Senior Manager, Client Services

Rebekah Pappas

Manager, Client Services

Brooke Rigert

Office Manager and Administrative Assistant

Emiko Daniel

Facebook: @profilemagazineofficial

LinkedIn: @Profile-Mag

Twitter: @Profile_ExecMag

Instagram: @profilemagazineofficial

For a free subscription, please visit profilemagazine.com/subscribe. Printed in China. Reprinting of articles is prohibited without permission of Guerrero, LLC. For reprint information, contact Stacy Liedl at stacy@guerreromedia.com.

I should’ve known that I wanted to be an editor much earlier than I did. Throughout high school, I wanted to be a writer. I participated in National Novel Writing Month (writing fifty thousand words between November 1 and 30) my senior year, and I was going to study journalism at the University of Nebraska–Lincoln and become a reporter.

But I would swap papers and short stories with friends for peer editing throughout high school. I printed the pages, got out a red pen, and used the proper proofreading marks as I read. Some papers had few markups, while others had so many that it looked like the paper was bleeding.

That was in the back of my mind as I started my journalism classes and reporting for the student newspaper. During one of the freshman welcome nights, I stopped by the booth for the student chapter of ACES, which was then called the American Copy Editors Society. I started attending meetings and went to a regional conference. By sophomore year, I was a full-fledged ACES member and started working on the newspaper copy desk one to two nights a week in addition to reporting.

I found so much more joy as a copyeditor. Reporting made me anxious, and editing gave me energy. So I pivoted. I set aside my reporter’s notebook and have never looked back.

That realization set up my career to what it is today. And many others the past couple years have had similar realizations.

The COVID-19 pandemic and the subsequent work expectations put a lot of things in perspective. People weren’t satisfied with their work environments, so they left to find that satisfaction.

This is the Great Resignation, but our sister brand American Healthcare Leader said it better: this is the Great Realization. In this issue, we’re showcasing HR executives who are building cultures that not only draw people in but also support them once they are hired.

Cover star Carlos Huereca lives this out in his role as chief human resources officer at Corporate Relocation International. Culture is key for him, and HR leaders need to create meaning and purpose for every employee. “Whatever actions you take or projects you’re leading as a professional, unless you’re focused on people and creating an environment where they can operate at their best, it’s just not going to be sustainable,” he says.

People are showing us what they want from their career and their lives. Now it’s time to make it happen.

Frannie Sprouls Managing Editor

Twice a month, Profile delivers exclusive insights from business leaders straight to your inbox.

What is a company without those who lead it? Executives provide their blueprint for cultivating a successful career.

Snigdha Kumar, Digit

Wendy John, Fidelity Investments

Jill Robinson, Atlanta Braves

In 2021, SeatGeek started making moves to go public. It wasn’t entirely unexpected. The popular tech and mobile ticketing company, founded in 2009, spent a decade building partnerships with sports teams, leagues, venues, promoters, and other partners to attract millions of users to its platform. Fast Company and others recognized it as one of the most innovative companies for live events.

But to go public, SeatGeek would need the right person to refine its financial processes, build its accounting team, and lead the complex transaction—and it found that person in veteran accounting leader Pamela Bucher.

Bucher joined SeatGeek as vice president and global controller in the summer of 2021, and brought more than thirty years of experience to the role. The Pennsylvania native studied accounting and business information systems at Shippensburg University and completed an MBA at Penn State. After starting her career as an auditor at Arthur Andersen, Bucher spent her formative years at the Hershey Company and then Revlon.

A long tenure gave her the rare opportunity to serve in many roles and master the inner workings of an iconic multinational food manufacturer. “I was able to hold many roles at Hershey, and it was a perfect fit for me because the combination of systems, numbers, and business has always appealed to me,” she explains.

Bucher started at Hershey as an internal auditor and soon moved into accounting and analyst roles where she was implementing systems and coordinating integrations. In the late 1990s, she worked with IT professionals to prepare the company for the Y2K transition and complete an important enterprise software transition.

As she moved into leadership roles, Bucher gained broad experience and a deep understanding of how financial decisions impact all parts of an organization. She also focused on building strong partnerships with her counterparts. “Good relationships in a company help financial leaders know what the business is driving towards so they can bridge the gap between business and accounting,” she says.

By 2009, Bucher had managed a Sarbanes-Oxley certification process, implemented a new profit and loss system, and led financial planning and analysis. Hershey’s CFO was impressed and gave her an expatriate assignment as the CFO of Hershey Canada. Bucher took her husband and four children to Canada, where she led the full finance team and spent nearly three years leading major business initiatives, including the integration of a key strategic acquisition. In 2012, Bucher returned to Pennsylvania and finished out her tenure at Hershey as the company’s global controller.

When Bucher came to SeatGeek in 2021, the company was already evaluating paths

to become a public company. Although the COVID-19 pandemic had devastated the live events industry, concerts and sporting events were starting to resume. “I had to assess the processes and team and bring my experience to bear to determine what we would need to get in place and how to help best prepare the company to meet its goals,” she says.

While SeatGeek had a strong accounting function in place, public companies must meet strict regulations in financial reporting. First, Bucher worked on completing the audits of the historical financial statements and building a team to bring outsourced functions in-house. She made key hires, put new processes and timelines in place, and

Pamela Bucher VP, Chief Accounting Officer, and Controller SeatGeek

worked to change workflows and mindsets to prepare team members and employees for life as a scrutinized public entity with shareholder responsibilities.

Going public will put SeatGeek on a new and different playing field. While the company’s roots lie in helping consumers buy and sell tickets via its marketplace, SeatGeek also powers a new, open entertainment industry through its enterprise business to give teams, venues, and shows seamless access to their audiences. “Our enterprise ticketing software allows our customers to efficiently grow their businesses while delivering the best possible experience for fans, and that’s where our future growth initiatives are focused,” she explains.

SeatGeek powers over two hundred clients across sports and entertainment, including the New Orleans Saints, Dallas Cowboys, Arizona Cardinals, Cleveland Cavaliers, and Jujamcyn Theaters’ five Broadway theaters in New York City; it also has leaguewide agreements with the National Football League, Major League Soccer, and tickets over half of the English Premier League in the UK. In 2021, SeatGeek secured a deal to handle all ticketing for all Barclays Center events, including Brooklyn Nets games, New York Liberty games, and concerts. Fans use SeatGeek’s digital platform to purchase, manage, or transfer tickets on desktop and mobile devices in real time. Bucher says her colleagues are pursuing similar deals at other venues as part of SeatGeek’s business plans.

As SeatGeek’s leaders prepare to stand on the trading floor, they are putting the right pieces into place. They have strong primary ticketing relationships, a leading tech platform, growing brand awareness, millions of users, and a solid financial team. One day soon, they’ll ring the opening bell and celebrate a successful company milestone years in the making.

Connor Group congratulates Pamela Bucher on this well-deserved honor! Working closely with Pamela and SeatGeek on their public company readiness has been a privilege, and we look forward to the continued relationship. In the last decade, Connor Group has assisted on more than two hundred IPOs and is a leader in preparing companies for IPOs and the growth that follows.

“Our enterprise ticketing software allows our customers to efficiently grow their businesses while delivering the best possible experience for fans, and that’s where our future growth initiatives are focused.”

PAMELA BUCHER

Snigdha Kumar has worked in her birth country of India along with Myanmar and Indonesia. While the economies may not be as developed as those of the US, the countries’ openness to helping vulnerable populations secure credit was, in many ways, far ahead of the country where Kumar would pursue her graduate studies in public policy analysis at Harvard University.

Kumar, now head of product operations at Digit, didn’t need to conduct a policy study or analysis to reach this conclusion. She lived it.

“I knew upon moving here that I would need to build a credit score,” the executive remembers. “I needed a credit score to secure a credit line, but I was trying to get a credit line to build my credit score. I couldn’t get either. These are the building

blocks of financial planning here, and I felt like I was in some awful ‘chicken or the egg’ hypothetical. It seemed so backwards.”

If it was this hard for a person who had the benefit of pursuing a distinguished education halfway across the world, how

As head of product operations, Snigdha Kumar offers a glance into the mission-led future of Digit and Oportun

“Both organizations are so missionaligned . . . there’s a perfect marriage to make life for our members better.”

SNIGDHA KUMAR

much harder was it for someone with more financial challenges in their lives?

That’s the problem Kumar has been seeking solutions for ever since. Oportun’s acquisition of Digit is poised to create the perfect synergy of financial products and advocacy to ensure that access to credit, financial security, and economic well-being are no longer a luxury—they’re a right.

And Kumar believes Digit’s acquisition couldn’t be more perfectly paired. While writing her graduate thesis on digital savings for the underserved, Kumar interviewed executives at both Digit and Oportun for her research. The continuity between the two was evident, especially in strong contrast to the upward of 300 percent APR payday lenders were charging those who felt they had no alternative but to pay.

“Both organizations are so missionaligned,” Kumar explains. “They’re both so focused on doing right by their members, and the best part is that we offer complimentary products. We’re not stepping on each other’s toes; there’s a perfect marriage to make life for our members better.”

The goal isn’t simply to introduce new financial products—it’s to fundamentally change the way banking works in the United States. Kumar describes this as “building a self-driving car, but for money.”

The organizations’ mission is to bring lending, banking, savings, and investing into one cohesive experience for members that can be done without leaving home. The process should be automated, effortless,

and, most importantly, take some of the stress out of the process for members who have experienced economic hardship.

Kumar is currently working on the instant disbursement of their loan amounts. For members who may not have a bank account, they may be hit with paycheck-cashing or other predatory fees to access their loan amount and it may even take up to two to three days to access their funds. The instant disbursement project would allow members to open a bank account instantly, receive their loan amounts instantly and spend the funds via a debit card.

Kumar’s team is also thinking much more long-term about savings. The vision on the Digit side of the business is to leverage artificial intelligence and account information to understand financial goals for members and help plan accordingly. For example, if members are saving up for a wedding, they could be instantly approved for low-interest credit lines that may help account for unforeseen expenses.

When loans have been paid off, Digit can suggest intelligent savings goals or retirement planning. “The whole idea is to find ways to serve members with a 360-degree perspective,” Kumar explains. “It’s not just about lending. It’s about helping people to create long-term financial success in their lives effortlessly.”

Kumar has always been drawn to the ways in which financial systems can make the world a better, not poorer, place. The

daughter of two parents who worked in government-backed financial institutions, Kumar was well-accustomed to high-level dinner table discussions of using finance for good from a very young age. The small child heard stories of people saved from poverty who went on to successful and prosperous lives. She’s continued her parents’ mission to a T.

“I feel like my job has made me even closer to my family,” Kumar explains. “We can all have these conversations now from different perspectives, but we’re all working toward the same goal.”

Inside the company, Kumar has been a valuable resource for easing fears that can accompany business acquisitions. Employees who may have had reservations about losing a brand identity or somehow having their mission-driven work altered were able to talk to Kumar, someone who had a significant working understanding of Oportun and how well the two companies would complement each other.

“I was happy to tell people that I had strongly considered working at Oportun,” Kumar remembers. “The two of us together creates so much more value than some of our competitors.”

Oportun’s strength and reputation in the lending space, Kumar says, pairs well with Digit’s focus on financial savings and well-being. And both organizations are dedicated to helping their members do more than make it past a hard moment. They want to ensure prosperity in the long term.

“It’s not just about lending. It’s about helping people to create long-term financial success in their lives effortlessly.”

SNIGDHA KUMAR

At Workiva, innovation is everything. The global software-as-a-service (SaaS) company pushes the boundaries to power transparent reporting for a better world. Consumers, employees, shareholders, and stakeholders expect more from business—more action, transparency, and disclosure of both financial and nonfinancial information.

The Iowa-based Workiva provides more than 4,300 organizations across the world with regulatory, financial, and environmental, social, and governance (ESG) cloud reporting technology. “We view our platform as a living, growing thing,” CFO Jill Klindt says. “We’re constantly adding functionality and new solutions. We always want to make it better, more secure, and more trustworthy.”

The company has grown and evolved since its inception in 2008—and so has Klindt.

Klindt’s original aspiration was to be a veterinarian, but ultimately pivoted toward business when she realized that path was not for her. She earned her degree in

accounting from Iowa State University and spent the first ten years of her career with finance and accounting positions at Wells Fargo Financial, CitiMortgage, and Principal Residential Mortgage.

Then Workiva, which is located near Iowa State as part of its tech incubation corridor, came calling in 2008. In the past ten years, Klindt has been controller, director and senior director of finance and accounting, and chief accounting officer. She was instrumental in taking Workiva public in 2014, and in February 2021, she stepped into the CFO role.

CFOs are uniquely positioned to reshape the future of corporate finance and investment as a catalyst for growth, value creation, and social impact. And Klindt is leveraging her expertise and leadership to help Workiva expand its impact within ESG reporting, both externally and internally.

There is a powerful motivation for organizations to report ESG data, which is a complex reporting process. Organizations must capture and manage data from both financial and nonfinancial sources, then

map the data to multiple reporting standards from agencies such as the Sustainability Accounting Standards Board, the Global Reporting Initiative, and the Task Force on Climate-Related Financial Disclosures.

Workiva, which has years of experience solving complex financial business reporting problems, launched its ESG reporting solution in 2021. “ESG is a perfect fit for how companies can use our platform to pull together a lot of different data—whether it’s financial or nonfinancial data—into a very structured form,” says Klindt, who aids fellow CFOs in understanding how this transparency of nonfinancial information holds equal weight for the betterment of companies, their stakeholders, and the planet.

That same year, Workiva became the first SaaS company to join the UN Global Compact CFO Taskforce, committing to measure its progress toward implementing the CFO Principles on Integrated Sustainable Development Goals (SDGs) Investment and Finance.

Klindt was selected to chair the Consulting and Tech, Media, and Telecommunications

macro-sector work stream, and has addressed a prestigious group of corporate and nongovernmental organization leaders in Paris. She is also part of the CFO Leadership group, working alongside fellow global CFOs to make sense of the complex ESG ecosystem.

When it comes to Workiva’s own ESG responsibilities, Klindt helps track a course for consistent progress and excellence through her leadership of the company’s internal ESG Task Force. This task force supports the company’s executive management team in its oversight of long-term ESG strategies and goals, and follows a comprehensive approach to align the company’s business values, decisions, and ethics with the most cutting-edge ESG strategies.

While Workiva’s ESG solution is currently a small, but growing part of its business, Klindt states that the company believes it can be even bigger. “We think of this as a generational opportunity,” she says. “It has a lot of growth for us in the future.”

Part of that growth also comes from Workiva’s collaborative culture, which Klindt embodies as a leader. Collaboration of teams is critical. “If we are supporting the company and the company goals,” she explains, “then we ourselves grow in that framework—trusting our coworkers to make the right decisions and trusting that we can share our ideas and be heard.”

It’s essential to a team’s success to pull in different points of view and experiences.

“We’re holding ourselves accountable to the inclusion of other ideas,” she explains. “We have a really high integrity of how we operate, and doing the right thing every time, and doing the right thing for our coworkers, company, and customers to grow our product to support our efforts the best way possible.”

In doing so, Klindt and her team will continue enabling Workiva to push the boundaries to meet the demand for trust in the global economy.

Eric Workiva“We view our platform as a living, growing thing. . . . We always want to make it better, more secure, and more trustworthy.”

JILL KLINDT

Wendy John has been at the helm of Fidelity Investments’ diversity and inclusion (D&I) strategy since 2020. As head of global diversity and inclusion and chief diversity officer (CDO), she’s helped crystallize and amplify the firm’s focus on creating an inclusive environment during a time in which issues of racial injustice, social unrest, and violence against communities due to their identity have demanded authentic visibility, transparency, and advocacy.

Her passion for inclusion comes from a sincere place. Born in Trinidad and Tobago, John grew up celebrating the many distinct cultures and people that call there home. “I grew up learning that our differences weren’t obstacles, but were, instead, things that could bring us together and make us stronger,” she says, adding that her “entire life feels like an ongoing study in D&I.”

As a child, she excelled at math, and it was at her all-girls high school that she encountered her first professional mentor, her math teacher, who steered her in the direction of actuarial science. “She was truly instrumental in encouraging me to pursue my passion, not because I was a young woman, but because I was skilled and capable,” John says.

Unfortunately, the highly specialized program she needed was not being offered at the girls’ school. So, John transferred to a large all-boys school, where she was one of fewer than ten girls. “Attending an all-boys school was a first of sorts for me,” John remembers. “It was the first time I was keenly aware that I was in the ‘minority.’ Still, I was committed to doing my best work, and learning all I could.”

John’s completion of that program resulted in a Descartes Fellowship to the University of Waterloo in Canada, where she majored in actuarial science, a pursuit which eventually brought her to Fidelity Investments.

“I have served in multiple roles during my twenty years at Fidelity, many of which gave me the opportunity to consider the

experiences we create for our associates, customers and communities we serve,” she says. “That reflection drives a very personal awareness of how intersectionality can impact your lived and perceived experiences. I’ve worked hard to create safe spaces for myself and others to share and honor those perspectives because I know how powerful that acknowledgment can be.”

Her formative experiences in the Caribbean and her more than thirty years living in North America have shaped her thoughtful approach. John ensures that Fidelity’s more than sixty thousand associates feel seen, heard, and valued for their unique contributions to the firm’s mission of strengthening and securing its clients’ financial well-being.

The CDO role was not something John actively pursued; she was content doing D&I work off the side of her desk. Earlier in her tenure, John had informally brought Black associates together to network and pursue professional development. She also participated in various women’s networking events. Both activities were the foundation for two of the company’s ten affinity groups.

“I knew the importance of being supported and the impact of my early mentors like my math teacher, so I continued to do the same for others,” she says. The opportunity to do that at scale was a key element of her decision to accept the CDO role weeks after George Floyd’s murder.

“Fidelity had two other D&I leaders before me, but I’m the first person of color,” John explains. “And though I appreciated the nuances of stepping into the role when I did, I know I was chosen for my proven business acumen, ability to lead and drive change, and my successful tenure at the firm.”

With her hiring, Fidelity elevated the D&I office to be a peer of human resources and other important corporate functions. The move emphasized the accountability all associates share in creating a more diverse and inclusive workplace environment.

John embarked on a listening tour, meeting both internally with key stakeholders, including leadership of the affinity groups, senior business leaders, and other associates as well as externally with clients, prospects, regulators, industry organizations, and peer CDOs. She did this with a clear intent of understanding the landscape in order to identify clear priorities and establish a revamped strategy and action plan.

John has already made several significant moves. She quickly established a senior D&I advisory council comprising leaders from across Fidelity’s regions and business units, who provide a listening post and advisory arm for the firm’s efforts. She also adapted the D&I office into a program management office (PMO) structure designed to scale. She expanded the team’s data analytics capabilities, as well. John describes her

“Driving sustainable change in this space— like any undertaking of significance— requires time, a listening and learning posture, persistence, humility, and an ongoing commitment to change.”

WENDY JOHN

team’s work as aspirational, measured and consistent—not performative.

“We are building with the future in mind; one where everyone is respected and valued,” she says. “This is all of our work, not just that of one group.”

Within the first six months of John’s leadership, Fidelity issued its first D&I report , outlining the firm’s commitments. Together with creating a robust strategy and action plan, a new inclusive hiring hub, and various training modules, Fidelity onboarded more than sixteen thousand new employees in 2021, increasing both gender and ethnic diversity.

And those affinity groups that John helped establish? They now boast almost twenty-eight thousand members and a 45 percent global participation rate, with engagement in professional development programs, community volunteering, leadership, and mentoring activities.

Despite the progress she’s made in partnership with many of her enterprise colleagues, John is unequivocally clear: there’s more to do. “Driving sustainable change in this space—like any undertaking of significance—requires time, a listening and learning posture, persistence, humility, and an ongoing commitment to change.” Fidelity knows that making progress in D&I will positively impact its ability to ensure that the goal of financial well-being becomes a reality for its increasingly diverse customers.

“I grew up learning that our differences weren’t obstacles, but were, instead, things that could bring us together and make us stronger.”

WENDY JOHN

How an all-star front office staff contributes to on-field success for 2021 World Champion Atlanta Braves

By ZACHARY BROWN

By ZACHARY BROWN

The Atlanta Braves cruised through the fall of 2021.

A regular season record of eighty-eight wins and seventy-three losses was good enough to take the team to the top of the National League East and into a head-to-head divisional series matchup against the Milwaukee Brewers. The Braves won three games to one.

In the next round, the Braves beat the 106-win Dodgers 4 games to 2, and also just needed 6 games to defeat the Houston Astros on its way to its fourth World Series Championship.

During the 2021 season, three Braves players hit 30 or more home runs: Ozzie Albies stole 20 bases, ace Charlie Morton logged 14 wins and 216 strikeouts, and Will Smith tallied 37 saves. Adam Duvall managed 45 runs batted in (RBI) in 55 games after joining the team via trade on July 30. On the field, an all-star caliber lineup fueled the franchise to victory. A high-performing front office team contributed outside the lines.

That team includes President and CEO Derek Schiller, General Manager Alex Anthopoulos, Chief Legal Officer Greg Heller, and CFO Jill Robinson. While scouts, coaches, and managers develop players and drive

baseball outcomes, members of the executive leadership team handle long-term business development strategies, build and manage revenue streams, improve operations, foster strong community relationships, and engage a devoted fan base.

Prior to stepping in to manage the Braves accounting, finance, and IT teams that total about forty-five people, Robinson spent sixteen years with McKesson Corporation, where she ultimately led financial operations for a $3 billion technology segment. The Naperville native studied accounting at the University of Illinois at Urbana-Champaign and later earned her CPA license.

Top-level, veteran financial executives and other key leaders bring tangible and intangible results that can translate to roster moves and in-game success. Chairman Terry McGuirk praised Robinson’s expertise upon her arrival in 2018.

“Her experience raises our financial planning and reporting capabilities to match the expansion of our business successes. She will bring a wealth of knowledge to our baseball operations and real estate ventures, as well as the intricacies of functioning as a public company,” he told the Atlanta Business Chronicle . Robinson not only manages financial operations for the team but also handles the Braves’ activities related to the Battery Atlanta, a mixed-use development near the team’s stadium.

Under Robinson’s leadership, accounting, finance, and IT helped the Braves navigate the early days of COVID-19 as the pandemic shut down professional sports leagues. MLB cut the 2020 season short before opening without fans in attendance. Lower revenue streams led to creative cost restructuring and head count eliminations, but Atlanta offered its partners alternative solutions, renegotiated key contracts, and retained 54 percent of its sponsorship revenue.

Accounting and finance are sophisticated at the Braves, which is owned by Liberty Media—making it one of the few sports teams listed on the Nasdaq (BATRA). Liberty purchased the team, now valued by Forbes at $2.1 billion, for $400 million in 2007. It has a team payroll of $175 million and ranks as MLB’s tenth most valuable organization (The New York Yankees hold the top spot at $6 billion).

Days after the Braves’ decisive game six victory in 2021, fans lined the streets of Atlanta to catch a glimpse of the golden World Series Trophy as the championship parade wove its way downtown. The team

dedicated the win to the memory of home run king and franchise hero Hank Aaron.

In the proceeding and following days, staffers inside the team’s Truist park were celebrating their own achievements. The Braves earned $6 million per game in revenue and ended 2021 with $104 million in profit.

Established: 1871

Hometowns: 3 (Boston, Milwaukee & Atlanta)

World Series Titles: 4 (1914, 1957, 1995, 2021)

Division Titles: 14 consecutive titles between 1991 and 2005

Mascot: Blooper

Notable Players: Andruw Jones, Phil Niekro, Greg Maddux, John Smoltz, Chipper Jones, Tom Glavine, Hank Aaron, Warren Spahn

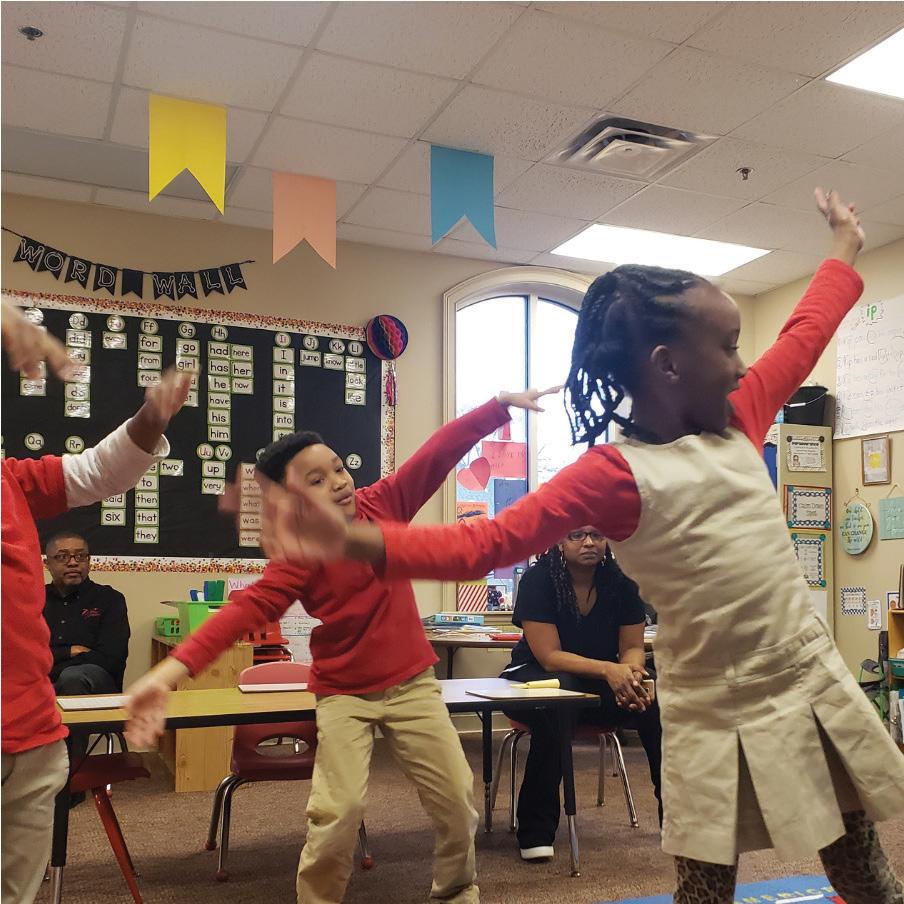

ArtsNOW is the leading PreK–12 professional learning organization providing innovative and customized educational solutions with an emphasis on arts integration. An Atlanta-based nonprofit organization, ArtsNOW is reshaping education by integrating visual, digital, and performing arts into all subjects to equip educators and engage students for greater academic and personal achievement. We celebrate our relationship with, and appreciation for, Jill Robinson and the entire Atlanta Braves team!

Visit artslearning.org/who-we-are to learn about the ways we use the arts to change learning—and change lives.

ArtsNOW is leading the way in integrated learning solutions. Our teachers are reshaping education for more powerful student engagement.

We inspire greater academic and personal achievement, leading to positive community impact.

We’re not just teachingwe bring learning to life!

We celebrate our relationship with, and appreciation for, Jill Robinson and the entire Atlanta Braves team!

In 2021, employees began leaving their companies in record numbers to redefine their work/life balance. To counter the Great Resignation, seven HR executives are building company cultures that attract top talent and encourage them to stay.

Auriel Rawlings is used to working globally. In her previous role as FedEx’s diversity, equity, and inclusion (DEI) advisor, her purview included 103 countries and territories and 40,000 team members for the Asia Pacific, Middle East, and Africa regions. Rawlings is now the regional human resources manager for Northern Africa and the Middle East because of her dedication and passion for helping make employee voices heard—no matter the location or role.

There’s little wonder as to why Rawlings was promoted yet again at FedEx, her third role since 2020. The advisor earned the 2021 “Women

Worth Watching” award, completed Yale School of Management’s Fostering Diversity and Inclusion executive education program, and earned the DEI in the Workplace certificate from the University of South Florida Muma College of Business.

Since joining FedEx in 2020, Rawlings has developed regional company-wide diversity and inclusion initiatives, and now is taking on employee relations, recruitment, and policy and procedures.

Rawlings spoke with Profile about the importance of culture initiatives, including DEI, at FedEx and how that focus is continuing to help the organization differentiate itself as a preferred employer during the Great Resignation.

As the leader explains, the terrain has shifted, and employers need to be ready to approach talent recruiting and retention as a “two-way street.”

What has the Great Resignation looked like from your perspective? Has it impacted FedEx’s space as much as healthcare and tech companies?

Self-awareness is at an all-time high. People want more out of their lives, in addition to their dayto-day jobs. The time at home during COVID-19 allowed them to focus on family, hobbies, and new business ventures. Positive mental health and well-being satisfy a deep need for more

meaningful connections, and the trend to prioritize personal lives over a job, translates to an all-time low tolerance for toxic workplaces. Working from home gave individuals the freedom to ditch the morning commute, to wear comfortable clothes, and people are embracing this and no longer restricting their identities for a workplace.

We recognize that our success depends on the talent, dedication, and well-being of our people. As we grow, we strive to recruit, retain, develop, and provide advancement opportunities for our team members. We experienced headwinds due to labor shortages, however we viewed this challenge as an opportunity. Competitive pay, benefits, flexible schedules, hybrid work models, and other perks allowed us to gain considerable traction on the labor front.

The FedEx commitment to innovation and quality is fueled by our inclusive culture, where team members feel safe to bring all of who they are to work. We have dedicated employee teams as part of our diversity pillars at FedEx, who work to consistently foster open and respectful workplaces through awareness initiatives, resource sharing, engagement activities, and outreach to team members.

We are committed to a workplace where everyone is treated fairly and has equal opportunity to succeed. FedEx was founded

on a people-first philosophy, and respect is a foundation of our workplace culture and business practices. Our diverse workforce, supplier base, and supporting culture enable us to best serve our customers and compete in the global marketplace.

Could you speak to the power of culture as it relates to the mass exodus of employees over the last few years?

Companies create experiences which influence the culture and business performance. Studies show that people with positive employee experiences are eight times more likely to stay at a company than those with negative experiences. Culture is what makes people stay or leave.

Culture is the way a company operates. It is the lifeline of its bottom line and has a domino effect from hiring to business performance. If employees aren’t passionate about the company’s vision, they won’t be enthusiastic about executing the plan. This can lead to a toxic workplace and negative customer experience.

Culture also is the attitude and behavior of the organization’s leadership and employees every day; how they respond in critical situations and to various challenges, and how they treat each other, their customers, and business partners.

Compared to the rest of the world, the Middle East hasn’t seen the same trend in mass resignations, thanks to the significant number of candidates in the market. For example, a hiring manager may receive hundreds, and in some

“Today, everything is a two-way street. Just as companies ask candidates why we should hire them, we have to be open to show why they should work for us.”

Auriel Rawlings

cases thousands, of applications. While a highly competitive market, there is a strong focus on employee retention, as it can be costly and time consuming to replace a departing staff member.

How can leaders better prioritize recruiting and retention beyond just responding to the Great Resignation in the short term?

Leaders have an opportunity to attract and select candidates who not only offer the skills required for the role, but also match and will work well within—and support—the organization’s culture.

A strong commitment to DEI is an important aspect of a company’s approach to recruitment and retention. Candidates with nontraditional backgrounds, with career breaks, or who address gaps within the current workforce will diversify your team, helping to bring a range of ideas and opportunities to your planning, discussions, and activities. Central to this success, however, is that any strategy on DEI must be more than talk—having a concrete plan in place and showing the actions and results in these areas to your team.

Finally, leaders must create opportunities for growth within the organization, identifying employees ready for promotion and creating a pipeline of future leaders and creating programs that give employees the opportunity to develop their skills and network across the organization. I developed a program like this within FedEx and have used the experience to promote and create opportunities for others.

Is there any other kind of evolution you think needs to occur to adapt to this moment?

Today, everything is a two-way street. Just as companies ask candidates why we should hire them, we have to be open and show why they should work for us. Beyond the job role and salary or benefits package, having a clear and compelling reason for a candidate to be excited about joining the company can be supported by the organization’s culture values, beliefs, and ethics.

I believe that companies must embrace the future of work, which sparks passion and enthusiasm in employees to be productive and deliver results each day.

“Any strategy on DEI must be more than talk—having a concrete plan in place and showing the actions and results in these areas to your team.”

Auriel Rawlings

Auriel Rawlings

Regional HR Manager, Middle East & Northern Africa FedEx Express

By Billy Yost

Photos by Sheila Barabad Sarmiento

By Billy Yost

Photos by Sheila Barabad Sarmiento

When making the decision to come to Corporate Relocation International (CRI), Carlos Huereca found himself on the other side of a conversation he’d had with his parents when he was thirteen years old. Accepting the job required a move to Dallas, and Huereca gave his eldest son (who was also thirteen at the time) a similar explanation to the one he’d received at the same age.

“It was an odd feeling, having that same conversation that my parents had with me when I was his age,” Huereca remembers. “But I think he understood the opportunity for the entire family, just as I did when we made the move from Ciudad Juárez, Mexico, to El Paso, Texas.”

After twenty years of experience learning businesses from the inside out in service, sales, finance, and eventually human resources, Huereca accepted an offer to join CRI in 2021 as a key member of the C-suite, overseeing and

leading both HR and operations. It represented a chance to tackle some of the most pressing issues in the current job market, including recruiting, retention, and putting what can often seem like buzzwords into action.

The CHRO built out an incredible variety of skills over the past two decades with just two organizations: ADP and Dish Network. In those two companies, he held eleven different roles; his promotions speak to a commitment to development, an inherent curiosity, and a commitment to finding new ways of enabling those around him.

Huereca says that commitment is deeprooted. Growing up in Juárez, the future HR leader watched his parents transform a furniture business that started in their home into a successful organization with multiple stores, a warehouse, and delivery trucks.

“I was born into a family of small business owners,” Huereca says. “I had a great opportunity to see great leadership in action. It wasn’t just the business; it was how they treated

people and dealt with difficult situations. It made me very passionate about leadership and helping people.”

In Huereca’s own professional journey, he’s enhanced his own skill set through not just experience but also education. The CHRO continually has invested in his own education, including an MBA and the extensive SHRM-CP certification. Huereca also invested heavily in the development of his team, encouraging them to seek out as many different educational and professional experiences as possible.

“The more you are able to expand your expertise and knowledge through professional certifications, the more value you’ll be able to provide, not only internally to the business, but also to the clients you’re supporting,” he explains. “From my experience, it helps set yourself apart and really aid all parts of your role.”

In coming to CRI, Huereca immediately put his enhanced skills to use. The privately held company recently had undergone a series of acquisitions to widen its footprint,

Founded in 1987, Corporate Relocation International (CRI) provides full-service relocation and global assignment management services and has recently become one of the fastest-growing companies and disruptors in the industry. Part of the cover photoshoot took place in CRI’s warehouse at its Carrollton, Texas, headquarters. Custom crating, pictured here, is just a small part of CRI’s employee relocation services.enhance its capabilities, and strengthen the successful organization.

The move also presented Huereca with a dual challenge: learning every part of the business, while also working to understand the recently acquired companies and how those company cultures could be integrated into one larger, unified organization.

From the CHRO perspective, it was incredibly important for Huereca to create processes and structure around the integration of those new businesses. “You have to create that consistency across the whole organization, but that’s not an easy task,” he explains. “How do we integrate these organizations with the least amount of friction as possible, while still maintaining the same value and solutions to our clients during the process? It’s never easy, but it’s been a great success.”

More broadly, he says a focus on culture is key, and not just as a buzzword. Building culture, as Huereca sees it, is about creating purpose and meaning for every employee. Mission statements

“Unless you’re focused on the people and creating an environment where they can operate at their best, it’s just not going to be sustainable.”

Carlos Huereca

A long and successful HR track record comes with some advice for those hoping to grow their own HR careers. Carlos Huereca says they need to be OK with getting uncomfortable.

“You will be a better HR professional if you learn to look at the business outside of that one lens,” Huereca explains. “Whether it’s finance, sales, or something else, learning about your business will help you bring value to your organization and understand where people are coming from. It’s easy to stay in your lane, but the best in HR understand they need to be able to approach a challenge from many different vantage points.”

are great, but if you aren’t creating clarity about what that statement actually means and questioning how to achieve it, it’s just platitudes.

“The word ‘engagement’ is used a lot, but again, it’s about putting this into action,” the CHRO says. “You have to create opportunities for people to demonstrate their value and understand how they are contributing to an organization’s mission. And you have to look at that work from the associate’s perspective.

“If you take the time to truly listen to people about their desires and what matters to them,” he continues, “you can create projects and initiatives that really align with their strengths and values within the company. But you have got to take that time.”

It’s one thing to take the time to listen, he notes, but it’s another to create the space where people feel comfortable and confident in you as a leader to speak up. Culture is built on relationships.

Huereca says the pandemic provided the HR field the opportunity to truly demonstrate

its value in not just culture-building, but also supporting the entire organization. If HR wasn’t at the decision table pre-2020, it certainly is now. Any forward-thinking business made that spot available as they’ve moved through the new uncertainties of remote work, an incredibly competitive job market, and the support of the multitude of stakeholders that help make a business thrive.

CRI does just that, with Huereca at the helm leading both HR and operations. The CHRO’s leadership approach of building trust not only brought him to where he is today but also informs all decisions moving forward.

“Whatever actions you take or projects you’re leading as a professional, unless you’re focused on the people and creating an environment where they can operate at their best, it’s just not going to be sustainable,” Huereca says. “To every HR leader out there, don’t lose sight of that. You can drive results while also doing what’s best for your people.”.

When it comes to issues of retention, recruiting, and culture, Carlos Huereca believes the increasing importance of flexibility in the workplace will be a key indicator of how well a business can handle difficult times.

“As we move out of the pandemic, I think the organizations that are able to provide flexibility to their people are the ones that will really be able to weather the storm,” he says. “Flexibility helps any business not only address the concerns of people within your organization, but in facing those external challenges that seem to always be ahead of us.”

“It wasn’t just the business; it was how [my family] treated people and dealt with difficult situations. It made me very passionate about leadership and helping people.”

Carlos Huereca

Leadership runs deep in the DNA of Walt Rodgers. His mother served as a prominent member of South Carolina’s House of Representatives, and his father worked as a colonel for the United States Department of the Army. Those jobs took the family around the world, and the values Rodgers picked up along the way became the foundation for his life and career.

“I learned to be adaptable and connect with people,” he says. Today, Rodgers continues his family legacy of servant leadership as a business and HR veteran as RelaDyne’s chief human resources officer.

Shortly after graduating from Wake Forest University with a bachelor’s degree in business, Rodgers started working at Ferguson

Enterprises, a Virginia-based, value-added distributor across residential, nonresidential, new construction and repair, maintenance, and improvement (RMI) end markets. Ferguson was on a tremendous growth trajectory; Rodgers worked in sales and operations to help the company double in size roughly every five years.

Ferguson’s management training program started an important development progression for him. He managed locations, then regions, and ultimately, an entire business group. Rodgers, like his parents before him, was a natural leader. “My responsibilities grew when I had an opportunity to guide careers and anchor that with great customer service,” he explains.

Rodgers stayed at Ferguson for nearly twenty-eight years and spent twenty-five of those years working alongside friend and colleague Larry Stoddard. The teams and business

units they led helped bring in billions of dollars as they learned to build what Rodgers calls a “high-speed, low-drag” organization dedicated to its customers for the benefit of associates and shareholders.

In 2010, Stoddard became president and CEO of RelaDyne, an established leader in lubricant sales, distribution, and equipment reliability services. One of his first calls was to several old friends from Ferguson. But Stoddard didn’t want Rodgers to head up a business unit—he wanted him to build and lead a robust human resources function.

Although an operations leader, Rodgers also helped develop internal talent, introduce training curricula, and create a leadership pipeline for Ferguson’s parent company. Stoddard knew Rodgers could execute his vision to make RelaDyne an employer of choice and

Walt Rodgers draws on his leadership experience to take RelaDyne’s people strategy to the next level

attract the right talent to gain market share and make an impact.

Under his leadership, recruiters identify and onboard talented, motivated people with an entrepreneurial spirit. That’s because RelaDyne is about more than its products—leaders are creating a customer-centric business anchored by safety and provides solutions, services, and value. RelaDyne focuses on innovation. “Our associates make us different,” Rodgers says, adding that those associates and the company’s capabilities will differentiate it from its competitors.

In some ways, Rodgers and Stoddard are replicating the playbook they learned, practiced, and perfected at Ferguson. “We were trained by the best, and we knew we had the opportunity to replicate the culture of excellence and a desire for continuous improvement,” Rodgers says.

That culture and mindset guides everything. RelaDyne has gone from two hundred employees to two thousand. The company uses the best technology to build a large fleet of trucks. Still, Rodgers knows it is the people— not the computers or the vehicles—that power RelaDyne.

Some of the company’s growth has been organic, while some has come through a calculated series of strategic acquisitions. In 2019, RelaDyne purchased CIRCOR International’s

services division, including its six brands, making it a significant global player. Other key moves on the traditional side—including the acquisitions of Cardwell Distributing, Western Marketing, PPC Lubricants, and New West Oil— have opened new regional markets. The deals also bring new talent and new leaders into the RelaDyne ecosystem.

RelaDyne hosts a town hall after each merger so new associates can learn about the company’s culture, customs, and opportunities. “We stand in front of new associates and tell them they’re in a special place,” Rodgers says. “I want them to know we’re going to take care of them, invest in their future, and give them the tools they need to succeed and build a rewarding career.” RelaDyne offers competitive salaries and robust, comprehensive benefits packages that include free medical insurance plan options, no-cost life insurance, health savings accounts, retirement plans with an employer match, and more.

In March 2022, RelaDyne unveiled My.RelaDyne.com, the company’s new and enhanced portal designed to make online ordering and account management easier than ever before. With the right teams, tools, and equipment in place, Stoddard, Rodgers, and their colleagues are pursuing a new goal—they want to see RelaDyne continue to bring innovation and opportunity to its associates, customers, and key stakeholders.

Since 1948, HORAN has created plans to control health care costs, protect your wealth and insure your life. But the end game at HORAN is more than a set of plans. We believe good health and true wealth create a better quality of life for our clients and their families.

“I want [new employees] to know we’re going to take care of them, invest in their future, and give them the tools and resources they need to succeed and build a rewarding career.”

Walt Rodgers

Scan

Michelle Loo understands the value of taking learning into your own hands.

“You have to be brave enough to aid your own learning,” Loo says. “If you don’t understand something, ask questions. Early in my career, I did not have the courage to do that, and I think that’s common for people starting out.”

But Loo also recognizes the ways in which identity can factor into workplace development. “As a female and as a minority, it’s an added challenge to put myself out there and ask,” she notes. “Personally, that has taken me years to find the confidence to do.”

Today, Loo strives to empower others to discover their own confidence. Her years of experience across the human resources (HR) field, particularly in the benefits space, led her to GitHub, a software development platform home to more than 83 million developers worldwide. As the company’s director of global benefits, Loo is doing what she does best: putting cutting-edge programs into practice, while keeping an eye on the industry’s emerging HR and employee trends.

Loo’s journey into benefits began in college, when she realized the relevance of her planning and organization skills to HR. Building on her natural inclination, she started to ground herself in the basics of the field. She entered the technology sector as a recruiting coordinator at Google, but soon felt ready for a broader challenge.

Loo made the jump to vacation rental start-up Airbnb in 2011. Over the next seven years, she grew with the company, from HR coordinator to benefits manager for the Americas. “As I progressed at Airbnb, I started gravitating toward the benefits space,” she says. “Since Airbnb did not have any parental leave policies or a leave administrator in place, for example, I got a chance to build things from the ground up and see how all of the pieces come together to create the foundation of a company benefits program.”

Loo’s growth during those seven years also involved following her own advice and taking the initiative to learn. “I pursued my master’s in HR. while working at Airbnb when it was a start-up,” she says. “That meant class every Saturday for an entire year, on top of my full-time role—and full-time roles at start-ups are more than forty hours a week.”

“A start-up is a blank slate. There’s an opportunity to create programs from scratch that reflect the company’s stage, culture, and goals.”

Michelle Loo

Between her education and Airbnb responsibilities, Loo acquired an indisputable expertise in benefits. She came to appreciate the upsides of working on a small, communicative HR team at a disruptive company, and she learned to align her benefits programs with not only an organization’s evolving financial position but also the unique expectations of its employees.

“A start-up is a blank slate,” Loo explains. “There’s an opportunity to create programs from scratch that reflect the company’s stage, culture, and goals. But with that, one of the challenges is prioritization because you can’t go from zero to one hundred with your programs. You need to prioritize what’s most important to the company at that point in time, build out a benefits strategy that reflects those priorities, and then figure out how and if the programs can scale.”

Loo has sought out similar opportunities and challenges ever since, first at cryptocurrency company Coinbase and now at GitHub, where she has adjusted her approach to fit the company’s highly dispersed workforce. Critical to executing that approach is her team, and she makes a concerted effort to get to know her team members as people, not just employees.

“What’s most important to me is that my team feels acknowledged and trusted,” she says. “Letting them know that they are appreciated is so important because within HR, there’s a lot of work happening behind the scenes that is often not seen externally.”

Loo encourages her team to ask questions and leverage their resources—advice she would offer to anyone aspiring to lead in the benefits space. She herself networks with fellow

HR professionals and engages with industry organizations as part of her efforts to stay abreast of where the field is headed, especially in the wake of COVID-19 and the Great Resignation.

“People have realized that there are more ways of working than being physically present in an office space,” Loo says. “Companies have to decide where they stand on the working environment, and then figure out how their programs and benefits can support that.”

For instance, Loo witnessed a shift away from onsite employee perks toward more flexible benefit models designed with equity in mind. She sees such flexibility, along with an attentiveness to diversity and belonging, as an advantage for employers looking to attract and retain talent.

“People are expecting their leaders to take a stance, and with that comes the company’s actions. How diverse are our benefit programs? How do they support people who might want to relocate to a state that allows them freedom over their reproductive health?” she asks. “There’s a

big focus on this conversation when people are looking to a new employer.”

Another key element of the conversation is mental health. “Companies are enhancing mental health benefits and focusing on partnering with managers and leaders to promote them,” Loo says. “At GitHub last year, we implemented Modern Health, a global mental well-being platform providing coaching, therapy, live community sessions, and digital programs to employees in all sixteen countries we operate in.”

Jack Larkin appreciates the unique approach and expertise Loo brings to her role. “As part of Michelle’s team at Airbnb and GitHub, we’ve seen her show immense care for the well-being of her employees,” says Larkin, president and CEO of the Larkin Company, the leave and benefits management provider for GitHub. “We’ve been proud to help bring that to life for her team.”

As the HR landscape continues to change, Loo will evolve right alongside it—with the full weight of her self-confidence behind her.

“What’s most important to me is that my team feels acknowledged and trusted. Letting them know that they are appreciated is so important because within HR, there’s a lot of work happening behind the scenes that is often not seen externally.”

Michelle Loo

It was a question that stayed with Elizabeth Norberg for a long time.

After sixteen years at Starwood Hotels and Resorts, she was a seasoned HR veteran. Norberg was leading company-wide initiatives and reporting to top executives at the well-known business with 180,000 employees and 1,300 properties across 100 countries.

She eventually left hospitality for healthcare and in the midst of a difficult and stressful situation, a senior clinical leader was the one who delivered the query: “I save lives for a living, and what do you do?”

“Leaders sometimes fall into a trap of thinking that people can be secondary, but people impact everything, and I value helping people reach their full potential.”

Elizabeth Norberg

Norberg left the conversation determined to find greater clarity about how her actions as an HR leader impact people, businesses, shareholders, and communities.

The search for an answer to the physician’s question propelled Norberg, who had worked in five industries at that point, to step into retail by joining Foot Locker Inc. in late 2018. As executive vice president and global chief human resources officer, Norberg leads all aspects of an important people and corporate communications strategy with the goal to build the organization of the future and unite communities of talent as the iconic sportswear and footwear retailer invests in technology to engage its customers in new ways.

Foot Locker traces its roots back to Woolworth’s and Kinney Shoes. The first Foot Locker store opened in 1974, and the name of the public company was changed to Foot Locker Inc. in 2001. The company has locations in twenty-eight countries and annual revenue of approximately $9 billion. The organization has about 50,000 employees and approximately 2,800 stores worldwide.

Leading all aspects of human resources and corporate communications is a big job, but Norberg is up to the task. Growing up as part of an immigrant family with modest means in smalltown Colorado gave her a strong work ethic. “I was raised to appreciate what we can all do to positively contribute, and that work ethic is still with me today,” she explains.

Norberg didn’t always plan to pursue a career in human resources. Although she studied business management, a fanatical obsession with world travel sparked in her an unending curiosity about people. Norberg, who calls herself a “well-traveled nomad,” doesn’t only take posh guided tours or sit on white sand beaches. She packs a backpack and heads for the secret spots only locals know.

The immersive approach helped Norberg experience the true beauty of more than forty countries and all but two of the US states. Seeing places like China, Namibia, Indonesia, Cambodia, Hong Kong, Thailand, France, Spain, Italy, the Netherlands, Belgium, Germany, Argentina, Chile, England, Columbia, Mexico, Canada,

Austria, Greece, Croatia, and Austria deepened her interest in culture, her appreciation for diversity, and her passion for people.

“Leaders sometimes fall into a trap of thinking that people can be secondary, but people impact everything, and I value helping people reach their full potential,” she explains.

That’s exactly what she’s doing at Foot Locker—and at a particularly important time in company history. The business is in the process of transforming its assortment as it works to diversify and broaden its selection, while its biggest vendor Nike, which represented approximately 70 percent of sales in 2021, continues its push into direct-to-consumer.

With more changes on the horizon, Foot Locker has no choice but to diversify, innovate, and digitize—and Norberg’s people strategies are leading the way.

Foot Locker spent decades building a solid foundation, and Norberg is quick to point out that none of her plans move the company away

from its core culture. “People like to use the word ‘transformation,’ but we aren’t simply changing from one thing into something totally new,” she explains. “We are building on our solid foundation to create a better version of who we are—a natural evolution that capitalizes on new opportunities.”

No company was immune from the disruptions of 2020. Fortunately, Foot Locker spent the previous two years investing in technology and improving its networks. When the COVID-19 pandemic forced nonessential workers home, the company assumed the incredible task to go online, accelerating the full-scale adoption of its budding e-commerce platforms, loyalty programs, and omnichannel experiences.

HR supported the endeavors by introducing a new people strategy anchored by technology, diversity, and an internal customer service strategy. Norberg and her colleagues leveraged technology and partnered with Axonify to create a culture of learning through Lace Up,

“[The diversity initiatives] started as a company transformation, evolved to a culture transformation, and became a total transformation to help the company and our workforce get through the challenges that seemed to increase in 2020.”

Elizabeth Norberg

Elizabeth Norberg

Elizabeth Norberg

With technology, people, and diversity efforts underway, Norberg and her team turned their attention to communication and a greater internal customer focus. First, they integrated all messaging built on constituents that make up the “Four Rs”—public relations, investor relations, employee relations, and corporate responsibility. HR recruited and reorganized leaders to build a seasoned team to streamline messaging. The team also reemphasized a longstanding commitment to serve customers and increase shareholder value.

Hiring top talent and reengaging existing talent is a critical imperative for Foot Locker. Norberg and her team revamped the company brand and leveraged opportunities with hybrid work models to secure top talent previously out of reach, while expanding opportunities for career growth with the existing workforce.

As supply chain issues, global conflicts, increasing competition, and a lasting pandemic bring additional uncertainty, Foot Locker finds itself at an inflection point. “The next two to three years are critical to success, but I believe we’ve built the rocket ship that will take us to the next level. Our consistently low turnover and high workforce engagement scores tell us we are on the right track,” Norberg says.

A series of strategic moves and acquisitions will help fuel that trajectory. In recent months, Foot Locker announced long-term partnerships with Adidas and Reebok, forged into the Asia-Pacific region with the acquisition of sneaker boutique atmos, and brought in retail chain WSS to reach the Latinx consumer. With a new geographic footprint, a stronger connection to its customers, and robust digital platforms, the famed sports and shoe retailer is ready to put its best foot forward.

At Foot Locker, Norberg harnesses the power of talented employees to serve customers, drive outcomes, and generate profits. In doing so, she’s discovered the answer to the question posed to her by a doctor so many years ago. What does she do? She helps people be successful, which helps the organization to create value and win.

Compensation Advisory Partners LLC: “Elizabeth has been a wonderful HR partner at Foot Locker. She displays a keen understanding of the issues and works to put Foot Locker in the best position at all times. Elizabeth is a pleasure to work with!” —Margaret Engel, Founding Partner

While he joined BJ’s Restaurants at a particularly challenging moment, Bryan Levine helps team members weather the storm thanks to the company’s strong culture

By Billy YostBJ’s Restaurants

In March 2020, Bryan Levine had just given notice at his job to accept the role of director of compensation and benefits at BJ’s Restaurants. He’d been interested in the organization for years and even applied for a position there earlier in his career, but it hadn’t worked out. He was excited to finally be part of an organization that emphasized doing the right thing over increasing its bottom line. Then the pandemic hit, and everything looked like it was in jeopardy.

“I would be lying if I said it wasn’t a moment of pure panic,” Levine says. “But I called my leader, and was assured that nothing had changed, and

the company was going to make it through. It was a challenge that was going to need HR help on all fronts, but we didn’t know that quite yet.”

Levine had spent the last handful of years building out total rewards expertise, but as the pandemic progressed and weeks turned into months, the HR executive assumed an all-hands-on-deck approach to help the company weather its most challenging moment.

As he was coming on board, BJ’s, like many restaurant groups, was in the process of laying off thousands of employees. Soon it became clear that restaurant management also would have to be furloughed. Levine finally had gotten a dream role, only to find a nightmare unfolding around him.

“The goal, from the outset, was to ensure our team members were going to be taken care of through this entire ordeal,” Levine explains. “On the HR side, we made sure to keep their benefits active. We just asked that those team members send in payments for whatever their normal contribution for benefits was. We even set up a payment process through PayPal to make this change as easy as possible.”

With laws at the federal, state, and local level changing daily, the organization pivoted constantly, trying to bring back as many employees as possible. First, there was takeout business, then alcohol sales. Levine and his team worked to ensure general managers met the guidelines to maintain their exemption status and evolving roles to enable more people could return to work.

“The common theme I’ve seen since I got to BJ’s is that the leadership team wants to do what is right, even if that might cost the organization more money,” Levine explains. “The focus here is on the team member and the team member experience. I think most organizations say they operate that way, but I now have the opportunity to work for a business that doesn’t just say it—they act on it.”

That commitment evolved from focusing on emergency management to long-term recruiting, retention, and member experience. At a time when recruiting is the toughest it’s been in decades, Levine says it’s imperative for BJ’s to differentiate itself from its competition.

For starters, the HR team has been building out fixed-indemnity plans that provide lowcost insurance for hourly employees who may not have any other kind of coverage. “For an organization of our size, we’re trying to find ways to benefit our employees that still make

sense for a mid-sized company,” Levine explains. “We’ve taken the same approach when it comes to continuing education.”

BJ’s also currently is creating a tuition reimbursement program that Levine says will help build loyalty, as well as opportunities for hourly employees to rise into more senior roles eventually. “If we’re going to invest in the education of our team members, we also want to have a shot at retaining that talent,” Levine says. “We want to incentivize people to stay.”

Internal promotion already is a hallmark of the way BJ’s does business, Levine says, but he wants to ensure that employees who join as part-time workers in high school, for example, have the chance to grow under the company’s umbrella.

“We want our team members to know that no matter what role they want to work toward, they can stay here as long as they want,” Levine explains.

The HR team also conducted a full pay equity analysis; the results didn’t surprise Levine. The company’s pay equity numbers were solid, but HR wants to ensure that no matter what a prospective employee’s background or experience may be, there aren’t any unnecessary roadblocks standing in their way.

It’s what Levine loves about his company. Their approach is always evolving, and the benefits team is encouraged to think outside the box to determine the best ways to attract and retain talent. He credits the company’s internal culture with some of its success.

A national leader in employee benefits program design, education, communication, and administration –helping employees live more securely

“I’ve seen this organization at its most challenged, and I’ve seen it on the other side of it,” Levine says. “The culture has remained the same—if not gotten stronger—through the hard times. That’s the sign of a place you want to be.” A leader in providing part-time worker benefits – helping employers recruit and retain talent.

Not long after Jason Olson and his wife brought their baby girl, Della, home from the hospital, they noticed something on her skin. What they thought might be an allergic reaction turned into a year-long journey beginning at the Seattle Children’s Hospital and ending at the National Institute of Health.

with those of Cockayne syndrome, a multisystem degenerative disorder associated with reduced life expectancy.

When Della was diagnosed, Olson was less than a year into his position as director of human resources at Fivos, a company providing data solutions for medical providers, registries, and device manufacturers to deliver better outcomes for patients.

“It has changed my relationship with my work. I know I don’t have the background to cure genetic diseases directly. Still, my profession allows me to help organizations seeking to advance medical research and patient care,” he explains.

Olson, recently promoted to vice president of human resources, operates at multiple levels to oversee HR for Fivos across the US, Egypt, and India. “There isn’t room for ego. Even though I’m VP of HR, I’ve ditched the ‘I’m too senior or important for that’ mentality,” he says. Even before his promotion, the overarching theme of Olson’s career has been his willingness to step into new areas, take on challenges, and get the job done.

By Claire ReddenDella was diagnosed with a rare neurodegenerative disorder called Xeroderma pigmentosum-Cockayne syndrome complex, or XP-CS—a diagnosis that occurs in less than one in a million people. Characterized by a heightened sensitivity to UV light, Xeroderma pigmentosum is an autosomal recessive multisystem disorder inhibiting the DNA’s ability to repair itself after being exposed to ultraviolet radiation. Della’s unique diagnosis combines the characteristics of Xeroderma pigmentosum

“I’ve always had this mindset of ‘I’m going to solve this problem; I’m going to take on this challenge; I’m going to step into this uncomfortable place,’ and I think that serves well for an HR leader, as we’re constantly pulled into difficult and challenging situations,” Olson says.

When Olson came to the company, then known as Medstreaming, it was in a period of growth. It had acquired other businesses that had not been wholly integrated, creating a disjointed cultural infrastructure Olson knew

Jason Olson is willing to step up to any challenge—no matter how large or small— to support Fivos Health’s mission of driving innovation, lowering costs, and improving patient outcomes

“If we try to stand individually, we’ll fail, but when we work together as a team, we can succeed.”

Jason Olson

Jason Olson VP of HR Fivos Health