Boost engagement, raise morale, and elevate the overall employee experience with a performance management process that speaks to your unique culture and people.

Learn more:

As CFO, Susan Pikitch helped shepherd the USGA through an intensely complicated period so the nonprofit could support one of the few sports that was safe to play during the pandemic. Pikitch spoke with Profile about USGA’s ability to pull together in a crisis and about how providing sound numbers as a finance leader isn’t enough.

P70

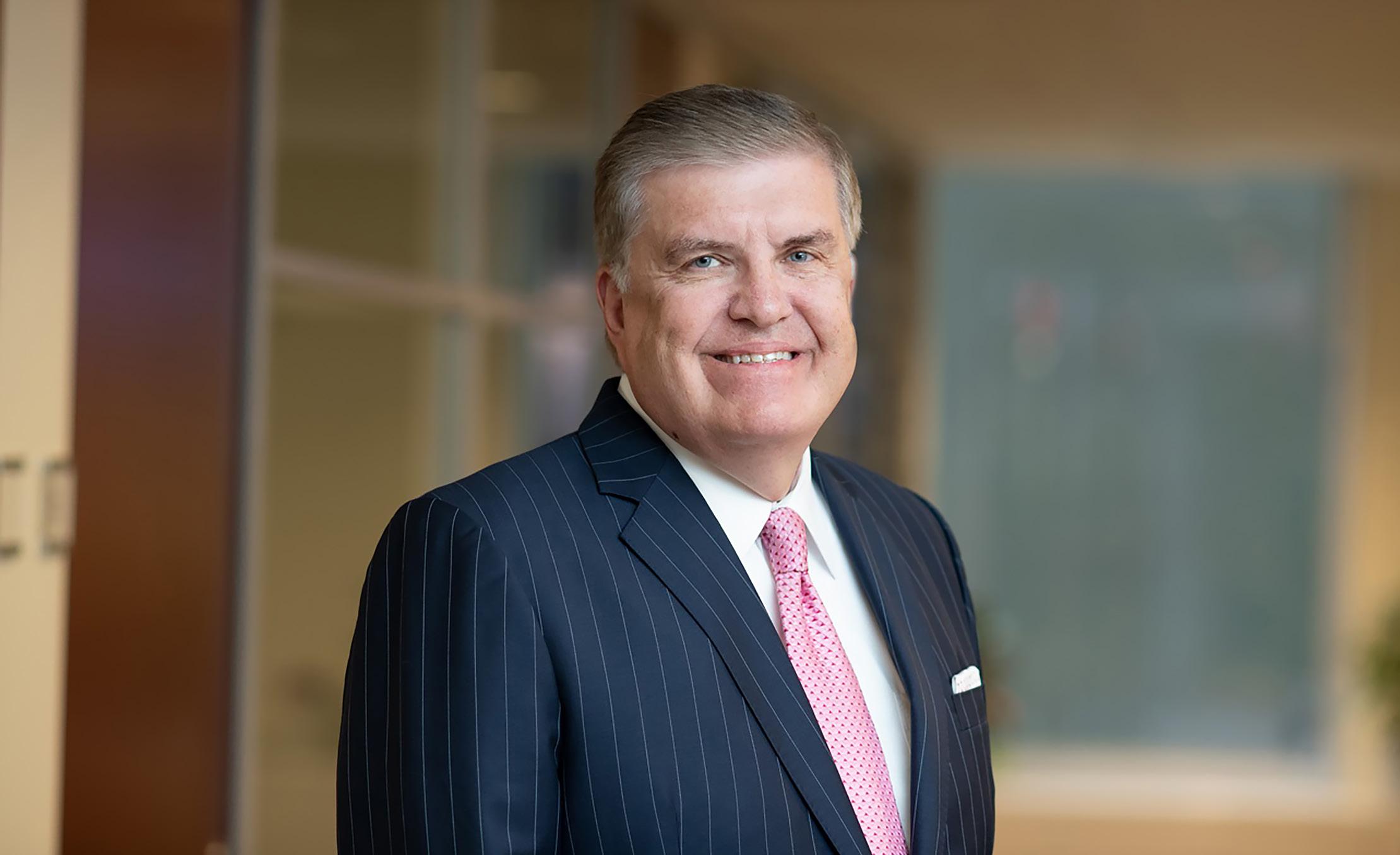

With a twenty-six-year tenure at Dominion Energy Virginia, Ed Baine is helping lead the largest offshore wind project in the US

P16

As CIO and chief digital officer at data company Snowflake, Sunny Bedi ensures the organization has no equal

P28

Brian Keys leverages technology to help the baseball team come out strong as the league enters the modern era

P42

Denise Novey builds a world-class tax function and accounting strategies to breathe life into the Tupperware brand

P59

Pablo Brizi found a perfect match in Hilton Grand Vacations, a company committed to fostering a culture of acceptance

P118

Michelle Labbe brings a new meaning to “people” and “talent” to support one of the largest, completely remote, global freelance networks at Toptal

P125

Editor’s Letter P6

Focus P7

Index P145

Christina Khosravi supported the Los Angeles Lakers during a pandemic and championship run with a focus on business analytics and strategy

P46

Jacqueline De Souza never stops looking for ways to improve operations, whether it’s fraud prevention, process digitalization, or employee development

P136

Stephanie Lepori uses her knowledge as chief accounting officer to lead Caesars

Entertainment during a time of change

CREATIVE

VP, Creative Production

Kevin Warwick

Managing Editor

Frannie Sprouls

Editors

Melaina K. de la Cruz

Sara Deeter

KC Esper

Julia Thiel

Hana Yoo

Staff Writers

Zach Baliva

Billy Yost

Contributing Writers

Pamela Bloom

Lucy Cavanagh

Peter Fabris

Will Grant

Taylor Karg

Russ Klettke

Natalie Kochanov

Keith Loria

Maggie Lynch

Abigail Sutter

Designer

Anastasia Andronachi

Senior Photo Editor/Staff

Photographer

Sheila B. Sarmiento

Photo Editor/Staff

Photographer

Cass Davis

Social Media Manager

Ashley Rupprecht

Profile® is a registered trademark of Guerrero, LLC.

© 2022 Guerrero, LLC

guerreromedia.com

1500 W. Carroll Ave. 2nd Floor Chicago, IL 60607

Subscriptions + Reprints

For a free subscription, please visit profilemagazine.com/ subscribe. Printed in China. Reprinting of articles is prohibited without permission of Guerrero, LLC. For reprint information, contact Reprints & Circulation Director Stacy Kraft at stacy@guerreromedia.com.

CEO & Publisher

Pedro A. Guerrero

Chief of Staff

Jaclyn Gaughan

President, Group Publisher

Kyle Evangelista

VP, Hispanic Division

Head of Audience & Engagement

Vianni Lubus

VP, Finance

David Martinez

VP, Sales

Ben Julia

Senior Director, Client Operations

Cheyenne Eiswald

Senior Client Services Manager

Rebekah Pappas

Client Services Manager

Brooke Rigert

Director, Client Services–

Corporate Partnerships

Taylor Frank

Director, Talent Acquisition & Engagement

Haylee Himel

Director, Talent Acquisition

Heather Steger

Senior Director, Corporate Partnerships & DEI Solutions

Krista Horbenko

Director, Events

Jill Ortiz

Communications Manager

Cristina Merrill

Director, Sales

Kelly Stapleton

Director, Sales Training & Development

Alexa Johnson

Director, Sales Onboarding

Justin Davidson

Content & Advertising Managers

Allyssa Bujdoso

Rebekah Crone

Samantha Eberly

Brandon Havrilka

Annie Peterson

Zak Shelton

Hannah Tanchon

Drew Thomas

Ashley Watkins

Facebook: @profilemagazineofficial

LinkedIn: @Profile-Mag

Twitter: @Profile_ExecMag

Instagram: @profilemagazineofficial

Math was never my favorite subject. I lost interest during grade school, and my focus drifted to English and history. I didn’t go above and beyond to reach calculus in high school, opting instead to continue taking German through senior year.

In college, the math course I chose was specifically created for journalism majors with a focus on scenarios that would come up during reporting. And my copy of Math Tools for Journalists is tucked in with my various editing-related books, the page about calculating percentage change tabbed with a yellow Post-It.

When I first started on Profile, I assumed that the finance function focused only on numbers—budgets, taxes, cash flow, etc. But the past couple years, I’ve seen the conversation evolve into how finance leaders should go beyond the numbers and help shape business strategies.

Our Guest Editor Susan Pikitch, CFO at the United States Golf Association, notes that early in her career, the finance function was viewed as command and control. Now, she says she wants to be thought of the “CFGo” and be more than just a “numbers reporter.”

“It’s about helping the business understand why they should care by providing insights into the data,” she explains. “Put yourself in the shoes of the people you’re trying to help. How do I help you achieve your goal?”

Pikitch leads an impressive lineup of finance executives—with titles including CFO, chief accounting officer, and chief investment officer—who are shaping the future of the finance function. Cover star Stephanie Lepori, chief administrative and accounting officer at Caesars Entertainment, leans into technology innovation to improve not only team member experience but also customer experience.

The Hershey Company’s Jennifer McCalman takes a process improvement approach to her role as chief accounting officer. University of Miami’s Charmel Maynard, RingCentral’s Vaibhav Agarwal, and Shift4’s Gail Miller create development opportunities for their team members and seek to diversify the finance leadership pipeline. And David Stephenson shares how he took a long-term perspective on guiding Airbnb through the COVID-19 pandemic.

Finance is not just about reporting the numbers. It’s about how finance leaders can secure their seat at the table, interpret the meaning behind the data, and guide business strategy.

FrannieSprouls Managing Editor Gillian Fry

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

HR in FINANCE FOCUS: HR IN FINANCE

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

Stacy Klevay Newton, Oportun Inc. P8 Jim Minogue, Mizuho Americas P12

FOCUS FOCUS FOCUS FOCUS FOCUS FOCUS

Stacy Klevay Newton Chief People Officer Oportun

Stacy Klevay Newton Chief People Officer Oportun

Oportun’s mission is to provide hardworking people with affordable capital and integrate them into the financial mainstream, all the while helping them establish a credit history. This is also a personal goal for Chief People Officer Stacy Klevay Newton.

When Klevay Newton was twenty-seven years old, she was a newly divorced single mother who was $27,000 in debt and making $27,000 a year. “I literally could not make ends meet,” she remembers. “We had macaroni and cheese with hot dogs many nights because it was the cheapest option.”

Klevay Newton pawned her grandmother’s earrings to afford the new tires she needed to make it to a job interview. She also estimates that she spent thousands of dollars renting furniture for what was probably a $400 couch.

These stories aren’t rare. But Klevay Newton’s firsthand experience with the hardship of those who are working to extricate themselves from difficult situations provides a compelling lens as a leader at Oportun.

Since arriving just a few years ago, Klevay Newton has helped foster a feeling of community and family in an organization that was already excelling at it. During the COVID-19

pandemic, Klevay Newton has also helped completely reshape Oportun’s in-person protocols and ushered in a new, permanent era of remote work while finding ways to keep employees connected to one another and the company’s mission of service.

NO PERSONA REQUIRED

When it comes to establishing a familial rapport with her team, Klevay Newton says the work of trying to maintain two different personas just doesn’t make sense for anyone.

“I don’t separate between my family at work and my family at home,” she explains. “My father and his brother built a metal manufacturing organization, and I grew up feeling like every person there was a member of my own family. I love and value the great people I work with at Oportun and those within my home. I think that integration is one solution to a lot of what we are all struggling with right now.”

More concretely, Klevay Newton says she doesn’t have to shed one persona when she ends her workday. It allows her to bring her most authentic and present self to work, and she wants everyone at Oportun to feel the same.

Klevay Newton has helped promote those efforts by serving as an executive sponsor of Oportun’s Women’s Initiative Network as well

“All of the wonderful things that I knew were true about this company were really brought to life [in 2020].”

Stacy Klevay Newton

as its True Colors Pride Network. “Both of those groups are just roaring along,” she says, “and it’s so exciting to be connecting with people through these groups and the fantastic events they put on.”

She has also noticed something about everyone she works with: if your mission and values don’t align with the organization, Oportun probably isn’t the place for you. “You just can’t survive here because it becomes obvious so quickly,” Klevay Newton explains. “That alignment with mission is such an authentic part of our culture that the very few people who have come through here who didn’t have it didn’t last long.”

The COVID-19 pandemic has undoubtedly been one of the more challenging periods in Klevay Newton’s tenure, but she says it’s also a career highlight. “All of the wonderful things that I knew were true about this company were really brought to life during that period of time,” Klevay Newton explains.

She recalls nine consecutive months of morning calls where the entire focus was on caring for Oportun’s people and strategizing innovative ways to support them during such a difficult period. Programs to address mental, emotional, and financial wellness were created

along with mindfulness seminars, health webinars, and other resources.

To maintain a feeling of comradery as Oportun sent its workforce home, Oportun hosted “Oportun’s Got Talent,” a chance for employees to show off their skills, such as singing, art, or even world-class weightlifting. “The day before Christmas, we were sent a video from all five of the finalists who had gotten together to record a song wishing peace and joy to everyone,” Klevay Newton says. “It was so amazing for these people to get together on their own to do this for us, and it really speaks to the spirit of what remote work can be.”

Oportun has taken lessons from the pandemic that will truly reshape the nature of work for its people. They will continue to be a remote-first organization, which Klevay Newton believes will provide a true strategic advantage for the company.

“The feedback we’ve received is that people really have no interest in looking to be in an office to do their base work,” Klevay Newton says. “Instead, they want more opportunities to connect and collaborate with other people. That’s the missing link that we’ll continue to work to solve for in this environment. We’ll continue to find those connection points over and over again.”

As a proud graduate of the Ohio State University, Stacy Klevay Newton quotes the great Woody Hayes: “You can never pay back, so you should always try to pay forward.”

Klevay Newton currently mentors seven people within Oportun. “Raul Vazquez, our CEO, has invested in me. Our previous chief people officer invested in me. There’s just a continual sense of help and service here, and I want to provide that same opportunity to everyone that I can,” she explains.

She also spends a great deal of time volunteering on behalf of her church and in her community. She currently serves on the interim-pastor search committee, the finance committee, and participates in the church’s Community Coalition for Haiti. She has also done volunteer work with Big Brothers, Big Sisters; United Way; and the Virginia Zoo.

“I don’t separate between my family at work and my family at home. . . . I think that is one solution to a lot of what everyone is feeling right now.”

“To achieve long-term success [from an HR perspective], you have to be able to have an environment, where yes, you’re producing results, but in a way that’s flexible and fair and concerned about the welfare of your people,” remarks Jim Minogue, chief human resources officer at Mizuho Americas on his management of his team during the COVID-19 pandemic. “The

last eighteen months have really been an example of what we can accomplish when we put our minds to it.”

Minogue recalls, “I was at the job two months when we were all sent home. Thankfully, my experience with the transition and my ability to be flexible helped the firm that I’d just gotten to know transition to this period.”

He explains that his background in HR, which spans a broad spectrum of roles and

Jim Minogue on the effective practices that have enabled company development during the COVID-19 pandemicindustries, contributes to his ability to be flexible. “I’ve had global roles, regional roles, and functional roles. My HR knowledge is pretty extensive,” he says.

“I went through two phases of my career,” Minogue adds. “The first was very technically oriented—I ran comp, recruiting, training. I have a deep knowledge in the disciplines of HR. The second phase of my career was really talent management and the more advanced side of

human resources, such as succession planning and organizational development.”

Some of his experience extends beyond his time in HR. “When you’ve been around long enough, you’ve been through many different world events and national events,” he says. One of the ways that he has led companies through these massive transitions is by relying on his ability to pivot and remain flexible and strong in the face of major events.

For example, Minogue was the HR global head at Brown Brothers Harriman when September 11 happened. “Our ability to keep our people safe and secure during those periods of time— being able to conduct business and making sure our environment was safe—was very critical,” he emphasizes.

Minogue describes managing Mizuho’s transition during the COVID-19 pandemic as “an incredible undertaking,” but he credits the

Jim Minogue CHRO Mizuho Americas

Jim Minogue CHRO Mizuho Americas

company’s commitment to flexibility to make the adjustment from senior management, frequent communication, tested processes, and programming as a team to make the adjustment. His contribution as a leader was done by taking the “extra steps.” He adds that being a successful leader during a time of this type of transition demands “positively taking steps to show people that you care.”

Taking these steps requires credibility that you gain through experience and going the extra mile to ensure that people can rely on you as a leader. “Credibility is important when it comes to being courageous,” Minogue says. “You have to lead in a positive and forward-looking way. Have the courage to advocate a solution for an organization, which a lot of times the organization may not know it needs. But if you have the credibility and courage to present that solution, that’s so much more effective than if you just throw out those ideas.”

To create these solutions, especially during transitionary times, he says that he wakes up with the thought process of, “What can I do today that will make the environment better for people in HR and the firm as a whole?”

For Minogue, one way to improve the organization is by bringing forward diversity, equity, and inclusion (DEI) initiatives. “I’ve been a big, big champion of diversity and inclusion for

a long, long time, probably before they called it diversity and inclusion,” he says. “What [Mizuho] is trying to do, is build a diversity and inclusion initiative from two perspectives. One is from a strategic perspective, and one is a strategic form of grassroots.”

To support Mizuho’s DEI efforts, Minogue and his team have reorganized the company’s employee resource groups. He has also presented both diversity and career development strategies. However, the grassroots initiative is one that Minogue says is “unique.” He says, “We’re holding diversity dialogues to really increase sensitivity to what our colleagues of color are going through in dayto-day situations.”

Minogue states that the diversity dialogues have been very impactful. “When a colleague gets up and tells a very personal story—that has a much different impact on you than reading it in the paper. Believe me, it does.”

These types of initiatives also help establish the company’s set of values, which is a primary tenet of leading a company from an HR perspective. “If you understand those [values], then that gets you well on the way to getting you to achieve. I’m really reflecting on the last eighteen months, which have really highlighted what can be done and what can’t be done in the direst of circumstances.”

“Have the courage to advocate a solution for an organization. . . . If you have the credibility and courage to present that solution, that’s so much more effective than if you just throw out those ideas.”

Jim Minogue

What is a company without those who lead it? Executives provide their blueprint for cultivating a successful career.

Ed Baine, Dominion Energy Virginia P16 Fred Schacknies, TechnipFMC P22 Ed Baine President Dominion Energy Virginia

Ed Baine President Dominion Energy Virginia

Ed Baine has seen Dominion Energy Virginia transform throughout his twenty-six years at the company. Now, he’s leading its clean energy transformation and grid modernization efforts.

By BILLY YOSTEd Baine, president of Dominion Energy Virginia, is currently overseeing the company’s critical effort to provide customers with safe, reliable, affordable, and clean energy. The company is developing the largest offshore wind project in the United States, growing its solar and energy storage portfolio, pursuing license extensions of four nuclear units, and enhancing the energy grid to not only be more resilient and reliable but also provide better service.

The transformational period at the Richmond, Virginia-based company is in many ways reflective of the journey of its president. Baine has risen through many positions over the past twenty-six years, continuing to accrue new responsibilities before ultimately finding himself at the helm of the company’s largest segment.

It’s a long way to climb from the Lunenburg County tobacco farm on which Baine was raised, a farm that had originally been part of a 2,000-acre plantation. Twohundred acres were eventually purchased by his grandfather and siblings and turned into a family business.

“What I learned very early was that no one can be successful alone,” Baine remembers. “We were in a place where no one had much, so people had to help each other. To

this day, our family lives by the Bible verse [Luke 12:48] ‘To whom much is given, much will be required.’”

One of the highlights of Baine’s leadership during Dominion Energy Virginia is the Coastal Virginia Offshore Wind (CVOW) project, which is located twenty-seven miles off the coast of Virginia Beach. The Project Construction Group expects to complete CVOW in 2026.

The clean, sustainable energy of the 180 projected turbines will power up to 660,000 homes, annually bypassing as much as 5 million tons of carbon dioxide.

In conjunction with solar projects, the complementary resources will line up with wind and solar energy production peaking

at different times of the day and during the year.

Dominion Energy is also growing its energy storage efforts and working to make sure the four nuclear units in Virginia continue to provide zero-carbon energy. Work is underway to enhance the energy grid to meet customer needs.

“It’s an exciting time to be in our industry, within the Commonwealth of Virginia in particular,” Baine says. “We always talk about being better tomorrow than we are today, and since there have been more changes in the industry in the past five years than probably the previous twenty, there is never a shortage of ideas and projects to think about how we can constantly improve the customer experience and our operations.”

When Baine speaks of changes at Dominion Energy, the scale is immense. In September 2021, the company acquired the 20-megawatt Dry Bridge Energy Storage project in Chesterfield County. It is expected to go live in 2022 and will be capable of powering five thousand homes at peak usage.

It’s just one of eleven recently proposed new solar and energy storage projects, and if approved by state regulators, the entire rollout would produce more than 1,000 megawatts of solar power and energy storage.

“Ed’s broad experience and collaborative leadership style will be instrumental in

“I’ve learned to trust those who have seen something in me.”

ED BAINE

Pike is the leading, integrated provider of construction, repair and engineering services for distribution and transmission powerlines and substations, with a growing portfolio of turnkey and renewable projects. In addition, we offer storm restoration and gas distribution services. We work with investor-owned, cooperative and municipal utility clients across the country. We continuously expand our offerings to supply our customers with the ideas, technology, experience, manpower and equipment to perform any job.

navigating unprecedented industry change and delivering Dominion’s clean energy future,” notes Miki Deric, managing director for utilities and business advisory services in North America at Accenture.

To ensure reliability and resiliency for customers during this clean energy transition, Dominion Energy is also modernizing the grid. It is making significant investment in transmission infrastructure, while also moving forward on a ten-year effort to transform the distribution grid. The company has also made significant progress on its strategic undergrounding program and is partnering with others on rural broadband to help close the digital divide in Virginia.

“Ed is the rare leader that combines transformational vision with an exceptional operations background and ability to execute. Pike is honored to partner with Ed and his team,” says Matt Simmons, senior vice president at Pike Electric.

Baine says leadership at this level wasn’t his initial motivation, but he remains grateful that those around him saw something in him.

“As an engineer early on, I took the MyersBriggs personality test and was a strong introvert,” he says, laughing. “But I had leaders who took an interest in me and were willing to provide me with opportunities in my career to grow and develop.”

As Baine has moved along in his own career, he’s taken the mentorship and guidance he received and done his best to give it back to those on their own journeys. The piece of advice he most adamantly works to impart is to just go for it, even if you don’t think you’re ready.

“Don’t be afraid, because you have the capability and talents but just might not be leveraging, or even aware of, all the abilities you have,” Baine says. “When I was a planning

engineer, I had a leader come and tell me he wanted me to be a supervisor of operations. I was really nervous, but I’ve learned to trust those who have seen something in me.”

Baine says it’s always been imperative for him to interact with more than just those at the leadership level. He always took note of the leaders who would take time to speak with him earlier in his career, even if they were just walking down the hall. He also remembers the feeling of those who didn’t feel the need to speak.

“People will judge you,” Baine says. “If you go to a jobsite, if you stop to talk to people, if you try and get to know them, if you listen, then people will know that you care, and you will be able to build trust within the organization. You can understand what is going well and what needs to be improved, and then you can be a better decision-maker as a leader.”

Baine takes those conversations seriously and has regularly offered mentorship and guidance to future leaders. Often the best thing a mentor can do is simply listen, he says. Most of the time, answers can be found simply by discussing an issue out loud.

“It is great to read the leadership books, but experience is one of the greatest teachers as well,” Baine says. “It’s so valuable to be able to pick up a phone, call someone, and ask ‘How did you handle this type of situation?’”

Baine doesn’t think he’s reached any pinnacle. He says he always sees himself as a work in progress. “But when I think about my journey here,” he notes, “I am humbled and honored by it and realize that there is still much to do.”

West Cary Group: “As one of the largest Black-owned advertising agencies in the country, West Cary Group is honored to provide our creative, data science, and technology solutions in pursuit of Dominion Energy’s mission to deliver clean, reliable, and affordable energy.” —Moses Foster, President and CEO

“It is great to read the leadership books, but experience is one of the greatest teachers as well.”

ED BAINE

Fred Schacknies is ready for anything. He’s spent more than twenty years in corporate treasury roles where he’s managed risk and led investment strategies for top global companies competing in complex industries like technology, hospitality, and oil and gas.

It takes a special kind of person to thrive in business environments where uncertainty and volatility are common elements. Schacknies learned how to navigate the unexpected when he was just fourteen years old. Like most American teenagers, he was enjoying time with friends and preparing for a year at a typical high school. That’s when Schacknies got some surprising news: his family was moving to Egypt.

The news didn’t come as a total shock. Schacknies’s parents were United States diplomats, after all. But when they accepted a foreign assignment in the Middle East, the young student had to pack his bags, say goodbye to his friends, leave everything he knew, and fly around the world to make a new home in Cairo.

Schacknies found himself in the middle of an Arab culture he didn’t know surrounded by people who spoke a foreign language he didn’t understand. Poverty was prevalent and threats of violence were real. He remembers once obeying orders to shelter in place ahead of a possible air evacuation that never materialized.

Life as a US foreign service dependent made Schacknies resilient. Despite the

From mergers to spinoffs to crises to IPOs, Fred Schacknies has seen it all. Now he’s helping TechnipFMC chart a new path forward

inherent struggles and challenges, he ultimately learned to accept something that has become a theme in his life. “Circumstances can change at any time,” he says, “and people who can learn to be comfortable when everything changes unlock opportunities that others miss.”

Schacknies came back to the United States to study economic and international relations at Brown University. Upon graduation, he realized he could leverage his unique experience in new ways and took a job for a financial group in Riyadh, Saudi Arabia.

Over the next many years, Schacknies continued to develop his expertise and leadership in tax and corporate treasury, first as the director for an in-house bank at Lucent Technologies (Nokia), and later as

In 2009, Schacknies moved to Hilton Worldwide. He became senior vice president and treasurer and stayed at the iconic global hospitality company for more than ten years.

Before Schacknies joined the corporation, the Blackstone Group bought Hilton Hotels for $26 billion. A year later, with Schacknies serving as assistant treasurer, the two companies restructured the deal with Blackstone pouring $800 million in to reduce Hilton’s debt from $20 billion to $16 billion. In 2013, Hilton went public with what was at the time the highest ever hotel IPO.

But perhaps Schacknies’s most important deal at Hilton came in 2016 when he simultaneously orchestrated two massive and important spin-offs that created a total of

three public companies. In February of that year, Hilton Worldwide Holdings moved most of its real estate into a real estate investment trust (REIT). The shrewd move maximized returns to investors because REITs funnel all but 10 percent of their taxable dollars to shareholders. The REIT was created to hold about three-fourths of Hilton’s hotel assets.

The company also spun its timeshare business into another standalone company known as Hilton Grand Vacations. The divestitures helped Hilton focus on its core while Schacknies moved to adjust finance strategies in response.

Today, Schacknies serves as treasurer for TechnipFMC, an international oil and gas company with twenty-three thousand employees and $13.4 billion in annual

“Circumstances can change at any time, and people who can learn to be comfortable when everything changes unlock opportunities that others miss.”

FRED SCHACKNIES

revenue. TechnipFMC operates in forty-one countries. The company helps its clients in big energy maximize profitability from seabed and surface oil and gas hardware systems, and it also owns a fleet of twentyone vessels that install oil pipelines deep on the seabed.

“Fred joined TechnipFMC in December 2020 at the pivotal point of a transformational spin-off, a recapitalization, and the departure of a highly regarded CFO,” says Kevin Joyce, director for Societe Generale Americas Securities/Energy. “When the industry was seeing only glimpses of recovery, he immediately contributed to the rapid positive financial and operating trajectory we’ve witnessed by TechnipFMC.”

TechnipFMC, like Hilton, is a company facing shifting market dynamics and consumer behaviors. “Energy is in a huge transition as demand goes up and technology moves forward,” Schacknies says. “I’ve lived through enough dynamic change to know I can thrive here and help make a difference no matter what we face.”

One way that Schacknies can make a difference is by bringing stability to the balance sheet. TechnipFMC was created through complex mergers and partnerships. It was reformed when leaders spun off Technip Energies, a part of the company that held massive amounts of cash for its biggest projects.

TechnipFMC is using proceeds from the deal to pay down its debt, and with the

Energies component gone, what remains is a lean company that has a smaller cash footprint by “intent and design.” Schacknies says he can now be more aggressively efficient and get the company back to investment-grade metrics with industry-appropriate leverage.

Doing so will take what Schacknies calls a marriage of talent and culture. “We want to get the right people in the right roles to do the right things,” he explains. “We support a company that designs and builds incredible machines that operate in the most hostile environments in the world, and that permeates my team. We are problem-solvers at heart.”

Schacknies is the kind of leader who loves developing others and helping them identify growth opportunities. Although he recognizes not everyone shares his innate ability to remain calm in the face of astounding difficulty, he says it’s something anyone can learn. When it comes to making hires and building his team, he’s not just looking for experience, technical skill, and cultural fit—he’s also looking for people of good character.

Character matters because Schacknies’s teams are trusted to deliver consistent results against all odds. Treasury is working with every other part of TechnipFMC to drive innovation and serve clients working in an unpredictable era in a dangerous and turbulent industry. It’s a big job, but one for which Schacknies has been preparing his whole life.

“We support a company that designs and builds incredible machines that operate in the most hostile environments in the world, and that permeates my team. We are problem-solvers at heart.”

FRED SCHACKNIES

Societe Generale Corporate & Investment Banking (SG CIB) is a marketing name for the corporate and investment banking businesses of Societe Generale and its subsidiaries worldwide. In the United States, certain securities activities are conducted by Societe Generale Group’s wholly-owned subsidiary SG Americas Securities, LLC (“SGAS”), a registered broker-dealer and member of NYSE, FINRA and SIPC. Services provided outside the United States may be provided by affiliates of SGAS. This material has been prepared solely for information purposes, and does not constitute an offer, a solicitation of an offer or invitation, or any advice or recommendation, from Societe Generale or any of its affiliates (“SG”) to buy or sell any security or financial instrument or product, or participate in any trading strategy, activity or arrangement. Not all securities or financial instruments or products offered by SG are available in all jurisdictions. This communication is not intended for or directed at retail clients/investors in or outside the United States. It is for institutional and/or qualified investors only. Please contact your local SG office for any further information. © 2021 Societe Generale and its affiliates. All rights reserved.

Throughout his career, Sunny Bedi has been attracted to positions where he is involved in problem-solving and process automation. Ever since graduating from the University of San Francisco with a BS in biology and an MBA in international business, those are the top things he has considered when contemplating joining a company.

“When you look at building things, creating things, establishing the right process and structure around it, IT is in the middle of it all,” he notes. “I didn’t want to be limited to (or) confined to one function, and since IT has the ability to touch all of them, I have been associated with it my entire career.”

Bedi’s impressive résumé includes stints at Accenture, Deloitte, JDSU, VMware, and Nvidia. In January 2020, he joined Snowflake, an $83 billion data company located in San Mateo, California. As CIO and chief digital officer, he became responsible for running the entire IT, security, and data team to support the company across global markets.

“What excites me about content is going to companies that are small, that are

trying to get big, and really putting all the right infrastructure, processes, people, and tools together,” he shares. “Snowflake was embarking on that journey two years ago when I joined, which was the same path I took at VMware and NVIDIA when they were smaller companies, and they are both now massive companies.”

His intention is to repeat that same success at Snowflake. For instance, when he started with NVIDIA, the company had fewer than two thousand people, and when he left, it had more than sixteen thousand. When he came aboard Snowflake, it likewise had a workforce of fewer than two thousand, which has now almost doubled in size in a short time.

“Success starts by developing long-term road maps, partnering and aligning with the business functional leaders to lay out what happens in the next couple of years—what type of initiatives should we be staggering, which should come sequentially, and initiatives that should be handled in parallel,” Bedi explains. “We need to make sure IT is looked at as an enabler for all implementations and by no means slowing business

down in the automation they need for each functional area.”

One important lesson he learned from his past jobs is that teams shouldn’t all have to be in one geographical location. Rather, hiring employees should be a truly global process.

For example, when Bedi joined Snowflake, all its headcount was slated to be in the Bay Area, but he knew that it would be “super expensive” and nearly impossible to hire that many people for the type of growth the company was expecting.

“Now we have a truly global employee base that we are creating. We’re extremely fast in getting projects completed and scaling the company in a manner that is very natural and organic and doesn’t have any waste in it,” he says. “We wouldn’t have been able to do that if we had not invested in the global workforce. Now we have more than 50 percent of our headcount that doesn’t sit in the Bay Area, which allows us to have 24/7 coverage and scale initiatives in a graceful manner.”

Another valuable lesson he’s learned is the importance of investing in the right

platforms right from the get-go. That means avoiding ad hoc or Band-Aid solutions.

“Don’t buy or invest for the next six months, because those things don’t scale with [the company]. You know how the company is going to grow,” he declares. “Have a longer-term vision and a longer-term strategy on what is needed for the company and invest appropriately. It may take a little more time to get there, but then you’re setting the company up for success.”

One thing Bedi is passionate about is the philosophy of being customer zero, meaning that Snowflake has implemented the products it’s selling internally, and its own employees are finding value in them.

Snowflake on Snowflake is an initiative that is something that is very close to Bedi’s heart, as Snowflake teams use Snowflake to make critical, data-driven decisions.

“The customers on the other side of the transaction are people who are like me, who talk like me, who run functions like me—they are the chief data officers, chief information officers, security officers,” he explains. “So when our sales team goes and talks to them, a good customer will ask, ‘How do you guys use the product?’ And if we haven’t implemented that product that we’re selling to customers in the most incredible way, then

Nat and Cody Gantz Sunny Bedi CIO and Chief Digital Officer Snowflakewe don’t really have a leg to stand on. So it’s a validation, and externally, that messaging becomes even stronger.”

By using the products in-house, Bedi’s team is also able to work with Snowflake’s engineering and product management team on tweaks that can improve the products before customers get their shot with them.

Bedi also subscribes to the notion that companies need to look at where they want to go if they’re going to get ahead. That helps him plan out the future.

“On the IT side, we have road maps established for finance, for sales, and we’re going to new markets and still heavily investing in key skills and people,” he shares. “We are rolling out new products. So there is a significant NPI and growth related demand between now and the next year; and IT is in the middle of all this action enabling transformation and scale. that are out there between now and next year, and IT is in the middle of all those initiatives.”

TCS is an IT services, consulting, and business solutions leader. As a strategic partner of Snowflake, TCS worked with their CIO organization to implement ITSM processes and launch a global service desk. TCS’ domain and next-gen technologies expertise helped Snowflake build a future-ready system, improve user-experience, and reduce operational costs.

“What excites me about content is going to companies that are small, that are trying to get big, and really putting all the right infrastructure, processes, people, and tools together.”

SUNNY BEDI

Eliminate passwords to stop credential-based attacks.

After thirty-three years at Sonoco, Jerry Cheatham remains dedicated to making a positive difference for his colleagues

Jerry Cheatham was driving with his buddies from Charlotte, North Carolina, to Myrtle Beach, South Carolina. The highway took them through Hartsville, South Carolina, where they stopped to get gas. Cheatham remembered people from his college days who lived there. “This place is in the middle of nowhere,” he remembers thinking. “Why would anybody live here?”

A year later, he would be one of those people. Cheatham accepted a position with the Hartsville-based Sonoco, the multibillion consumer, industrial, healthcare, and protective packaging company. Sunoco, the gas company, he had heard of; Sonoco, the global packaging company, he had not. Last July, he celebrated his thirty-third year with the company.

But the story gets better. “From the very place at the gas station where I uttered those words,” he says with a laugh, “my wife-to-be lived right across the street. I got a great job, a great career, and a great wife.”

Cheatham is Sonoco’s staff vice president of finance for industrial North America. He grew up in Greenville, South Carolina, upstate in the foothills of the Blue Ridge Mountains,

with three brothers and two sisters. “We were very much a working-class family,” he says. “Money was never in abundance, but both of my parents were loving and supporting.”

They were also inspiring role models who instilled in their children an indelible work ethic and respect for education. Neither of his parents finished high school, and Cheatham became the first in his family to attend college (first at South Carolina State University, and later, at Vanderbilt, where he earned his MBA).

The Cheatham children were never told to get a job, he said, “but we always knew we needed one. My first was as a paperboy when I was between ten and eleven. I hit the federal payroll in 1977 working in restaurants and have been gainfully employed ever since.”

Cheatham’s path to Sonoco was guided in part by four mentors. One was a high school accounting teacher. The second was a former pro football player and educator who worked in a local recreation department.

“I spent a lot of time in that rec center,” Cheatham says. “I didn’t know anyone directly who had been to college. He was the individual who really planted that seed, along with my grandfather. He was a contractor. I worked one summer for him laying bricks, and in the hot sun of South Carolina I learned pretty quick that I wasn’t going to survive in that kind of work, so I’d better hit the books a little harder than I had been.”

And then there was Frank Jonas of Arthur Andersen & Company, the public accounting firm, which recruited on the South Carolina State University campus. During the interview, Jonas asked Cheatham if he could live in Charlotte. “For the right money, I could live in Montana,” Cheatham replied.

“He gave me my first professional job,” Cheatham recalls. “I’m grateful he took a chance on me.”

“I know what a lifechanger education can be.”

JERRY CHEATHAM

After four years, Cheatham pursed an opportunity to join Sonoco. He would evolve his role from finance to a process improvement role. He was later asked to lead the effort to consolidate Sonoco’s accounting functions. In essence, he considers his job to provide leadership, to use financial information to drive business performance, and to uphold Sonoco’s core values of integrity, respect, service, and accountability.

Cheatham attended Vanderbilt University from 1997 to 1999 while he was working for Sonoco in Nashville. “I had a goal of obtaining an MBA from a top-tier business school as a means of equipping me with skills that would help advance my career,” he says.

“I accomplished that goal by attending Vanderbilt’s Executive MBA program while working full time.”

Cheatham is currently the staff VP of finance for Sonoco’s Industrial North American businesses that is comprised of five operating units. Among his current initiatives include optimizing Sonoco’s Shared Service Center in North America, expanding the footprint of its pricing analytics and optimization software application and serving as co-executive sponsor for the Work Environment team that is a part of Sonoco’s Diversity & Inclusion Council.

As to his own leadership style, he considers a statue outside of Sonoco’s corporate office that says, “People build businesses.” He expresses pride in every member of his team. “They make me look better,” he says. “What I value the most in others is humility and believing in something bigger than themselves. Someone who is driven and who has an insatiable curiosity.”

Cheatham and his wife, Carla, are celebrating their thirtieth anniversary this year. They have three daughters. One is a nurse. Another is a financial analyst. “She once told me that spending the day with me at work was the single most boring day ever,” he says, laughing. “But she had a change of heart after one semester of chemical engineering at Clemson.” The third daughter is an early education major at the University of South Carolina and dreams of opening her own dance studio.

Education is a key component of his charitable efforts as well. Cheatham has been a member of the South Carolina Independent Colleges and Universities, an advocacy organization representing twenty-one of South Carolina’s nonprofit colleges and universities, since 2014. He is the current chair on the Board of Trustees. He is also president of the Darlington County Education Foundation, which raises funds and awards grants for teachers to enhance the educational experience for public school students across Darlington County. He also serves on the Board of Trustees for Coker University.

“I’m always looking for ways to make a difference,” he says. “I know what a lifechanger education can be.”

Pricefx: “We believe that successful pricing needs visionaries. Jerry Cheatham had the vision to improve profitability by optimizing pricing at Sonoco. He needed to partner with a team he could trust. With the guidance of Pricefx, Big Data Pricing, and internal alignment at Sonoco, we were able to show an ROI within six months and have now expanded to multiple business units.”

—Vicki Roberts, Senior Account Executive

—Vicki Roberts, Senior Account Executive

“What I value the most in others is humility and believing in something bigger than themselves.”

JERRY CHEATHAM

The combination of Quaker Chemical and Houghton International is best described as a marriage of equals. The two companies were both founded more than a hundred years ago, both headquartered in the Philadelphia area, and both roughly the same size with a similar client base and global footprint.

Internally, company leaders were effusive about the largest transaction either company had ever undertaken, giving the deal initiative the acronym “MIH” for “Made in Heaven.”

It took a long courtship before the two industrial process fluids manufacturers made it to the altar, though.

Robert T. Traub, vice president, general counsel, and corporate secretary for Quaker Houghton, began his career with Quaker Chemical in 2000 and says there’s been

informal talk of combining the two companies since before the 1990s. “The talk never went very far, but a transaction of some sort was always out there as a possibility,” he says.

In 2016, talks got serious, culminating in a deal in 2017 and a closing in August 2019 that formed the new Quaker Houghton entity. A lengthy regulatory approval process provides an interesting case study, and Traub, along with the legal teams from both companies, were key players. How they and corporate leaders executed the deal set the stage for what appears to be the makings of a happy, long-lived marriage.

Defining the financial parameters of the deal was the trickiest issue in the early stages of negotiations. Houghton was a private company, with a majority stake held by one family. While the transaction was essentially a merger of equals, the financial mechanism would involve a

“We looked at the best of both worlds, or even some new things in some cases. . . . Everyone agreed to listen courteously to new ideas.”

ROBERT T. TRAUB

purchase by Quaker of Houghton’s stock. Thus, determining a fair value for Houghton shareholders and a fair price for Quaker’s shareholders to pay required detailed, patient negotiation.

As Quaker’s general counsel, Traub provided legal counsel as the leaders of the two companies hashed out cash to be paid to Houghton’s shareholders, stock to be provided in the new Quaker Houghton and percentage of ownership for stakeholders in the discussions leading to a letter of intent and then to the stock purchase agreement to send to regulators. The discussions led to a deal in which Houghton owners would be the largest shareholder, but the new entity would be a public company. Houghton owners would hold three seats on Quaker Houghton’s Board of Directors.

Deciding who would occupy corporate leadership roles was another challenge for the negotiators, but this process was completed without acrimony, according to Traub. “It was decided during the negotiations that the Quaker CEO would be CEO of the new company,” he says. “The makeup of the rest of the executive leadership team was resolved through a comprehensive 360-degree review process between us at Quaker and our counterparts at Houghton.”

The antitrust review by US and European Union regulators took over two years. In order for the deal to be approved, the combined company had to divest a small part (about 3 percent) of its combined revenue at close. The fact that both companies were part of a somewhat specialized industry complicated this process, as the number of potential buyers was fairly small, and the assets were in several different regions. Buyers had to gain approval from regulators, so the divestment process was not a simple bidding process or typical divestiture.

As the two companies worked to find an appropriate buyer and negotiate a deal, they took advantage of the lengthy approval process by setting the groundwork for the post-merger corporate integration. Legal counsel was essential here, as the regulators strictly dictate what company leaders can discuss while a merger winds its way through the regulatory process and the companies took great care to not run afoul of regulatory “gun-jumping” parameters.

The two parties could not share information that could lead to charges of collusion should the deal fail to gain approval. “Neither party could disclose to the other party what it wouldn’t want disclosed to a competitor,” Traub says. “Lawyers were always in the

Faegre Drinker is a firm with one shared focus: the client. We understand your priorities. We bring you fresh ideas that work. And we deliver excellence — without arrogance. With more than 1300 attorneys, consultants and professionals across 21 locations in the U.S., London and Shanghai, we’re ready to partner with you to overcome challenges and advance your most ambitious business and legal goals. How can we help?

room during these discussions, and we did a lot of educating of the clients to ensure only allowable planning occurred.”

Sharing data like sensitive customer information was strictly off-limits but hashing out which business process software platforms would best serve the post-merger entity was kosher. “We could design what the future might look like, but not take any steps to begin combining the organizations until the deal was closed,” Traub says. It was up to the lawyers to draw clear boundaries and educate functional leaders on these antitrust matters.

The two sides could have waited for regulatory approval before undertaking this preliminary integration planning work, but acting proactively paid off. “All that planning made for a much smoother integration,” Traub says.

“A combination such as the Quaker Houghton transaction requires leaders to walk the tightrope of planning for the future without getting ahead of the approval process,” says Doug Raymond, partner at Faegre Drinker Biddle & Reath. “When we represented Quaker Houghton in the combination, we witnessed firsthand the influence of Rob’s steady guidance and vision on the success of this merger.”

The success of any major corporate combination depends partly on the ability of leaders to merge two different company cultures as the two organizations become one. In this case, Quaker and Houghton were like cultural siblings. Both competed for the same contracts in the same industries, so they shared a similar organizational model. They also had many long-tenured key employees with low turnover.

This indicated that both had a healthy culture, Traub says, which boded well for integration.

“We decided early on that we wouldn’t take one culture and push it down through the organization,” Traub says. Instead, the leadership team analyzed cultural and organizational mores from both companies and looked to create a new culture by choosing what they considered the best practices from each.

“We looked for the best from both worlds, or even some new things in some cases,” Traub says.

As part of this philosophy, leaders devised a new set of core values and developed working norms for themselves. Chiefly, all communications between leaders would be open with everyone getting fair hearing of their ideas.

“Everyone agreed to listen courteously to new ideas even if they disagreed with them,” Traub says. Leaders also pledged to be fully engaged during meetings, even virtual meetings, and not be distracted by incoming email or texts.

Leaders are embracing new ideas in several operational areas, including environmental, social, and corporate governance (ESG). After the combination, the company formed a new Board-level sustainability committee. As the top lawyer and corporate secretary of Quaker Houghton, Traub has assisted in various parts of the overall sustainability and ESG efforts and helped this new board committee craft its initial charter.

The company is setting certain goals for carbon emission reduction, formulating products with less environmental impact, and boosting workforce diversity. “We’re putting some great young minds to work on this effort,” Traub says.

It’s a new era for Quaker Houghton, and the company is moving ahead smoothly thanks to a well-executed combination. With that work largely in the rearview mirror, Traub and his legal team will help the company reap the benefits of the combination of two former rivals and plot its future.

“We decided early on that we wouldn’t take one culture and push it down through the organization. We looked for the best from both worlds, or even some new things in some cases.”

ROBERT T. TRAUB

It’s an outdated business model. A day laborer looking for work goes to a contingent staffing branch location and fills out a stack of paperwork required to onboard before they can take a work shift. They get approved (often days later), return to a branch location, wait to be dispatched, get a ride to a job site, work a shift, check out, receive a day’s pay, and commute home. It’s time-consuming, inefficient and error-prone. Someone needed to disrupt the staffing industry, and Jeff Dirks was the right man for the job.

Dirks, a respected innovator and technology leader, is helping staffing and recruiting giant TrueBlue digitally transform

After building businesses and leading world-class tech organizations, Jeff Dirks helps TrueBlue redefine how people connect with work

and reimagine the way workers and employers connect. It’s big business. Each day, the company engages its massive database to assign and dispatch as many as twenty-five to thirty thousand associates to job sites. Incorporating new technologies to help improve the process attracts and retains better candidates, produces more satisfied clients, and helps TrueBlue stand out in a highly competitive landscape for workers.

Although Dirks, who joined TrueBlue in 2018, is new to staffing, his unique hybrid experience makes him the perfect person to shake up the industry. The veteran tech leader logged two decades building companies in senior business leadership positions as CEO and chief operating officer of venture

capital-backed startups. He then spent ten years in chief technology officer and chief information officer roles at larger public companies. As a result, he knows how businesses are built, and he understands the power of technology to help those businesses thrive.

After starting his career at IBM, Dirks was a vice president at a startup known as FourGen Software, where he was VP of R&D and led a team of 135 software developers developing supply chain management software for Fortune 500 companies. “I’ve always been interested and passionate about the intersection of tech innovation for business benefit,” he says. “I like to find inefficiencies and think backward to see how tech can solve a problem and create value.”

That’s exactly what Dirks did later at Seattle-based CapitalStream. As president and COO, he led the launch of banking’s first real-time web-based credit application and real-time credit scoring service. When Bank of America, Merrill Lynch, and others adopted the technology, CapitalStream attracted a major suitor that acquired the company.

After twenty years in startups and ten years leading companies, Dirks never pictured himself in staffing. But when TrueBlue started recruiting him, he noticed something that seemed surprisingly appealing.

“The legacy staffing industry had an old-school reputation and was generally a technology adoption laggard,” he notes. “While those facts were at first discouraging,

Jeff Dirks Chief Technology & Information Officer TrueBlue Mike NakamuraI soon realized they actually represented an opportunity for me to use technology and innovation to totally transform how people connect with work.”

At TrueBlue, Dirks began working with the business’s leadership to identify a problem and then work backward to introduce a novel and elegant solution. The problem is friction. It takes workers too long to find jobs, and companies often get inconsistent or unreliable results. Dirks’s vision is to “connect anyone, anywhere, anytime with any job” by introducing the complete virtualization of the client experience.

Dirks and his team aim data science and machine learning at huge amounts of historical data to create algorithms that identify TrueBlue associates with the highest levels of interest in a job and the highest probability of showing up for their shift. Then, they seamlessly match labor supply with demand as associates/workers, armed with a smartphone, swipe an app to search for jobs within their preferred radius, set their schedule, pick a job site, self-dispatch, check in, work, and get paid without encountering any of the obstacles that once stood in their way.

But it doesn’t end there. For Dirks, that’s just the starting point. He says TrueBlue is starting to invest in advanced tools like conversational AI guides that will help associates manage their work daily and provide a guided pathway to help them get their work done in a way that reduces human interaction and drives efficiency. While some of these steps are still underway, Dirks says the digital transformation of TrueBlue’s on-demand

business will be fully complete by the second half of 2022.

Dirks has also made some important internal changes. He took TrueBlue’s IT out of data centers and into the cloud to remove hardware costs and speed up performance time. In 2019, the team deployed about one thousand “changes” or project enhancements. In 2020, the more agile function deployed more than ten thousand changes. Improvements that once took a year to go from idea to approval to reality now speed through the process in weeks, days, or even hours.

Prior to starting his career in the civilian world, Dirks was a US Army intelligence analyst serving at Field Station Berlin before the fall of the Berlin Wall. At the time, he used technology for data collection. Now, he’s using it to help other veterans. Dirks knows that soldiers returning to civilian duty can encounter work-related challenges, and he is proud that TrueBlue puts about thirty thousand veterans to work each year.

The world, the workplace, and the way we work are all changing. Nobody can predict exactly what will happen next but whatever happens, Dirks and his colleagues at TrueBlue are building and perfecting the platform that will connect people to jobs in a whole new way.

ServiceNow Employee Workflows helps organizations support a hybrid workforce and manage flexible workplace experiences by providing a unified employee experience platform. Simplify complex employee journeys in the flow of work, while boosting employee productivity and operational efficiency across the enterprise. Learn more at servicenow.com/hybridwork.

Joey Votto was enjoying a career year when his team faced the Chicago Cubs in August of 2017. The lefthanded first baseman was batting .317 with 31 home runs and leading the National Leagues in walks. When Votto dug in for his at bat in the top of the fifth inning, what he saw surprised him. Cubs third baseman Kris Bryant had abandoned his usual position and was standing in the outfield.

MLB insiders call this defensive formation “the shift.” It’s a technique managers use to defend against hitters known for attacking or avoiding a certain part of the field. Cubs

manager Joe Maddon knew that Votto, a lefthanded power hitter, rarely hits the ball to the left side of the infield. In fact, Maddon had the exact information.

In 2017, Votto only hit a ground ball 39.6 percent of the time. He was more likely to hit a fly ball, a line drive, or a popup, which he did a combined 60.4 percent of the time. Furthermore, only 30.7 percent of Votto’s batted balls went to the third-base side of the diamond. By moving Bryant to the outfield, Maddon increased his chances of getting Votto to make an out.

The Cubs, like every other MLB team, know Votto’s tendencies because it has spray charts on every single player in the league.

The shift and other tactics are driven by data, science, and analytics. Today’s coaches and managers use searchable databases, wearable sensors, virtual reality, pitch tracking, motion capture, biomechanical cameras, and other tech tools to develop players, decrease injuries, boost performance, sell tickets, engage with fans, and gain a competitive edge.

Brian Keys helps Votto’s team harness the power and potential of these tools. Keys has been with the organization for nearly two decades. Over that time, he’s had a frontrow seat to baseball’s high-tech revolution. “Twenty years ago, IT in baseball was all about connecting a network and providing laptops,” he says. “Now we are developing

applications and analyzing data to help our team move up in the win column.”

As senior vice president of technology for the Cincinnati Reds, Keys manages a team of twenty-one business analysts, systems engineers, application developers, cybersecurity analysts, and others who work on solutions for their colleagues both in business and baseball operations. On the baseball side, they are building applications two hundred people use to scout and develop players around the world.

Those users collect photos, video flies, and other content Keys’s team feeds into a warehouse. Coaches, trainers, and managers can then access those assets in real time to

“Twenty years ago, IT in baseball was all about connecting a network and providing laptops. Now we are developing applications and analyzing data to help our team move up in the win column.”

BRIAN KEYS

Offload complex tasks of supporting, maintaining, expanding, and securing your network today. CBTS Network as a Service (NaaS) is a hosted and managed cloud-based solution combining the best of cloud-managed technologies like Cisco Meraki, VMware, Viptela, and more to create flexible networks opti

mized for over 90 percent of client environments—including the Cincinnati Reds. With NaaS, enterprise networks can quickly expand to new locations, automatically provision site-to-site VPNs, and ensure secure access to servers.

compare side-by-side footage of a player’s swing or scrutinize a pitcher’s arm angle.

In today’s ultracompetitive game, every move matters, and these tools give teams an edge over the opponent. Keys and his colleagues are working at all Major League, Minor League, spring training, and instructional-league facilities to install high-speed and biomechanical cameras. The high-speed units shoot twenty-two thousand frames per second to analyze the rotation of the ball coming out of a pitcher’s hand. Their biomechanical counterparts help coaches monitor a player’s pitching or hitting mechanics.

New initiatives will take what the Reds do at its MLB Great American Ballpark and mirror it at spring training facilities in Arizona, where Keys is moving data to the cloud and updating scouting and development tools. There, players wear various sensors to gather hundreds of data points throughout a player’s swing, and that information goes into a high-tech system to create frame-byframe video.

For more information, visit cbts.com

While all MLB franchises have these tools, Keys says his IT professionals set the Reds apart. “Anyone can buy technology or figure out how to mine data, but the secret is in how you analyze and present it to the baseball guys.”

Modern baseball clubs also leverage the power of technology in their corporate offices. The organization relies on Keys’s team to power business departments by leveraging software tools. His team is developing tools to help collect customer information and

increase sales and data that can enhance and customize the fan experience. In the wake of COVID-19, which kept fans from ballparks for the 2020 season, he’s introducing touchless, contactless, and self-service concession and retail solutions.

Keys’s background makes him the right man for the job. Prior to joining the Reds, he spent many years as an electrical engineer and IT project manager. He’s not a pure developer, and that, Keys says, is an asset. “I can build systems, but I can also manage people and projects. I love working with people, and I can have tech conversations that seem somewhat normal, so our coaches and athletes actually take and use the information we are sharing with them,” he explains. Keys’s experience as an athlete helps, too. He played baseball, soccer, and basketball until he became more interested in numbers and started tracking his team’s stats.

Keys is quick to point out that while stats and innovations are an important part of today’s game, he’s not asking players to become robotic. After all, the human element makes the game unpredictable. When the Cubs tried the shift against Votto, he hit a double and went three-for-five in the game.

“Anyone can buy technology or figure out how to mine data, but the secret is in how you analyze and present it to the baseball guys.”

BRIAN KEYSThe Cincinnati Reds use Network as a Service (NaaS) from CBTS to quickly create pop-up networks at any facility. By combining the best of cloud-managed technologies like Cisco Meraki, VMware, and anti-malware security, CBTS NaaS ensures secure data access to lighten your enterprise IT burden. Visit CBTS.com for more information.

A look behind the scenes of company-wide initiatives and goals, acquisitions, and brand development

Christina Khosravi, Los Angeles Lakers

Sean Condon, ASICS

Michelle Randall-Berry, International Game Technology

Denise Novey, Tupperware Brands

Jen Stoural, Smartsheet

Brixton

How Christina Khosravi, with her focus on business analytics and strategy, supported the Los Angeles Lakers during a pandemic and a championship run

By BILLY YOSTWhen one thinks of the people at the Los Angeles Lakers, it’s easy to imagine the larger-than-life players, the Hollywood sheen, and the fireworks that embody the seventeen-time NBA champions. But when speaking with Director of Business Analytics & Strategy Christina Khosravi, CFO Joe McCormack, and Senior Director of Corporate Development & Planning Elaine Shen, it’s something else that makes the most startling first impression.

What abounds most profoundly from a conversation with all three is an approach centered in trust, teamwork, and respect. These are finance team members who pay tribute to each colleague who has helped

Christina Khosravi Director of Business Analytics & Strategy Los Angeles Lakers

Christina Khosravi Director of Business Analytics & Strategy Los Angeles Lakers

the Lakers make it through one of the most difficult periods in modern history.

But today, the focus is on Khosravi.

Khosravi joined the Lakers in 2017, but she started her career at Barclays Investment Bank in New York City. She remembers the beginning of her career well, as she began her job in September 2008 with her employer acquiring the assets of what remained of Lehman Brothers.

“Right out of college, I was immediately exposed to utilizing large sets of data in planning scenarios and helping our clients understand what their positions would mean to their respective bottom lines,” Khosravi explains.

Khosravi transitioned into sports after graduating from UCLA Anderson, where a background in finance, data relationships, and scenario planning propelled her interest in working in sports analytics. Her day-today focus as head of business analytics and strategy at the Lakers is to provide databased insights and recommendations, and she’s been adding value since day one.

“We had a lot of strong candidates for Christina’s role,” Shen says. “But what really

stood out for us was her finance experience and her passion for business analytics and its ability to impact revenue streams.”

Khosravi manages a team that includes individuals in CRM and data strategy and digital analyst roles. They work closely with revenue-generating departments—ticketing, corporate partnerships, and marketing— similar to an internal consulting arm.

She additionally helps with finance projects, including dashboards for visual financial metrics and analyses for strategic planning. Her background helps her to contribute readily to the in-house capability of the Lakers finance team and allows her to partner easily with external corporate finance advisors when specialized expertise or independent perspective is desired.

The COVID-19 pandemic tested the resiliency of individuals and organizations alike. One of the most telling examples of the Lakers’ values was its emphasis on retaining its entire staff.

“I think it says a lot about the executive team and management here that, while focusing on maintaining our internal workforce, also took a step back to determine how

“Every year is a different challenge, but it’s the people here like Christina that keep this place strong and attract the kind of talent we have.”

JOE MCCORMACK

to support the individuals that operate our games, partnering with AEG and the tenant teams at Staples Center in creating a fund to support arena staff,” Khosravi says.

McCormack credits the IT department, under the leadership of Chief Technology Officer Rick Allen, with the swift transition to work-from-home set-ups within a matter of days, allowing for critical business continuity. He also credits the accounting department, led by AJ Harris, vice president of finance and accounting and controller, who pivoted to paperless and electronic banking.

During this period, Khosravi played a key role in the arena lease renewal and agreement. “We were dedicated to understanding every inch of the lease that had been signed and revised over the last twenty seasons,” Khosravi says. “We wanted to focus on enhancing the fan experience, growing revenues together, and really building a value-based partnership.”

Khosravi said the negotiation was viewed much more as a collaborative partnership with AEG and all parties worked to achieve value collectively. “There was a lot of data collection and interpretation, and that was all Christina,” McCormack says. “Every

other week there was an entirely new set of information to dive into and question.”

Shen agrees, highlighting the qualitative expertise Khosravi was able to bring—especially in viewing through the lens of how other teams navigate their lease agreements. “While we rely on Christina for the numbers and data,” she says, “the research and additional context she brings really elevates her contributions.”

For Khosravi and her team, a season without fans in attendance did not distract them from both short-term and longterm goals. “We revamped our tech stack, transitioning to new partners with custom products best suited to our business needs,” Khosravi says. “We prioritized our loyal and dedicated fan base, diving into better understanding preferences and touchpoints with the short-term goal of being able to welcome them back seamlessly to Lakers games this season.”

Cross-department collaboration was key as the business analytics and strategy team leveraged a close partnership with IT and legal. This initiative will continue to pay dividends in the long term as the Lakers consider the enhanced fan experience for seasons to come.

Kyle Dewitt“We wanted to focus on enhancing the fan experience, growing revenues together, and really building a value-based partnership.”

CHRISTINA KHOSRAVI

TPS is proud to have served as the Lakers’ Financial Advisor in the Lakers and Christina in the negotiations with AEG. This transaction will continue to power the Lakers leading NBA position in brand awareness, venue, TV, social media….and, of course, championships!

Stout is proud to help recognize Christina, Elaine, Joe, and the entire Lakers finance team as they continue to lead the evolution of sports finance.

Stout is a global investment bank and advisory firm specializing in corporate finance, valuation, financial disputes, and investigations. We serve a range of clients, from public corporations to privately held companies across numerous industries, including professional sports. For thirty years, our clients and their advisors have relied on our premier expertise, deep industry knowledge, and unparalleled responsiveness on complex financial matters.

Stout and the Lakers share the belief that open minds, strategic collaboration, and the relentless pursuit of excellence on behalf of our clients is paramount to success. Like the Lakers, Stout has a meticulous track record of delivering results and maintains the highest client satisfaction rating in our industry.

“Over the years, the Lakers finance team has continued to impress us with their ability to address increasingly complex and diverse corporate finance issues in the ever-changing industry of professional sports, all while sustaining the unique culture that Dr. Buss instilled.”

—Tim Cummins, Managing Director “Data analytics has the power to unleash new insights for innovative organizations such as the Lakers. Christina’s expertise has led to great benefits for the organization and will undoubtedly drive continued innovation and future success.”

—Jeff Mordaunt, Managing Director

What may be hard to illustrate is how much all three of them reference each other and the wider Lakers organization throughout the conversation. From Lakers CEO Jeanie Buss and the wider Buss family to President of Business Operations Tim Harris to General Counsel Dan Grigsby, it’s clear that the finance team is impactful because of its collaboration and cohesion within an organization that is aware that it operates better when it’s on the same page.

This mindset may have been a contributor to the Lakers’ 2019-2020 championshipwinning season.

“I’m always reminded of something Tim Harris says,” Khosravi says. “‘We’re in the people business, and that’s not only for fans to build a relationship with the team, but for us to build relationships with each other.’ The value and importance of growing those relationships is clear in every conversation we have.”

“She’s right,” McCormack agrees. “Every year is a different challenge, but it’s the people here like Christina that keep this place strong and attract the kind of talent we have.”

“What really stood out for us was [Christina’s] finance experience and her passion for business analytics strategy and its ability to impact revenue streams.”

ELAINE SHEN

When Canadian tennis star Leylah Fernandez won her first Women’s Tennis Association title at the 2021 Monterrey Open, she did it in a pair of ASICS. Since 1949, the Japanese sporting goods brand has equipped and empowered amateur and professional runners, wrestlers, tennis players, and other competitors. Whether they’re training for the French Open or a local 5k, ASICS’ customers are pushing the limits to see what they can accomplish— and that’s exactly why Sean Condon joined ASICS in 2017.

Condon, a respected digital leader who has optimized online processes and led strategy for Fortune 100 companies and startups alike, was attracted by the opportunity to help ASICS break free from its traditional sales models. “Wholesale was always the predominant sales channel, and this iconic brand was set up to support a system that was changing,” he says. “We needed to shift to building one-to-one relationships with our consumers and enhance our direct-toconsumer marketing and capabilities.”

To succeed, Condon would have to apply a start-up mentality to an established global corporation. Like his company’s loyal consumers, he would have to push himself to the limits.

Leading large-scale initiatives that transform a company and change its culture is no easy task, but Condon thrives in a challenge. “I run towards the opportunity to build something from scratch or try something new because that’s where I can have the biggest impact,” he says.