Carmen Rita Wong shares wisdom on smashing people’s assumptions and how the next generation of women can find success at Hispanic Executive ’s first event of 2018

by Frannie Sprouls

Carmen Rita Wong stood behind the podium, looking out at the crowd of about one hundred guests. “I never let the bias stop me,” the founder and CEO of Malecon Productions told the audience. “I let it fuel me. When you’re in a place with assumptions, all you can do is smash them.”

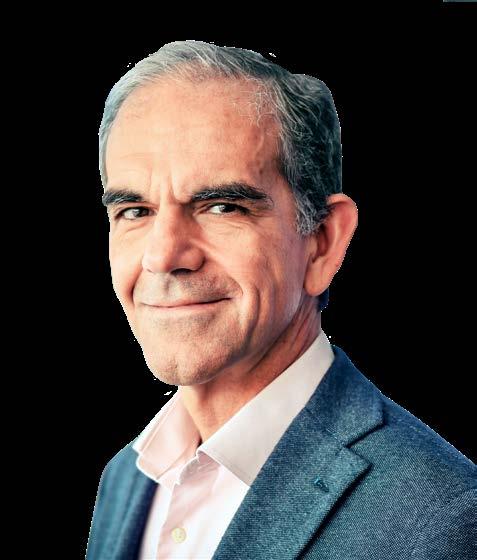

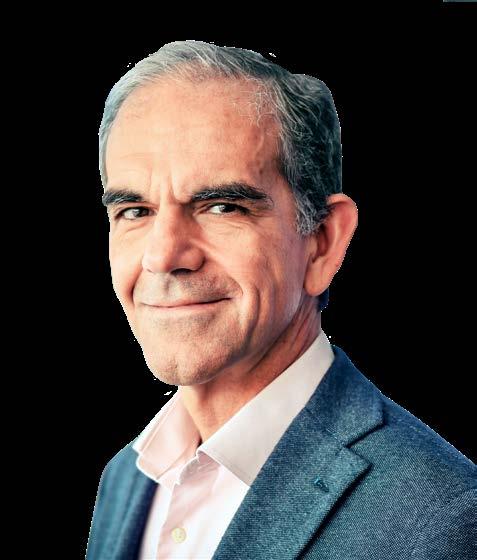

Wong was the featured speaker at Hispanic Executive magazine and Northwestern Mutual’s Leadership Luncheon: A Woman’s Worth along with Northwestern Mutual’s Peter Striano of the Striano Financial Group and Hispanic Executive publisher, Pedro Guerrero. Guests gathered for lunch at Café Boulud in Palm Beach’s Brazilian Court Hotel for the magazine’s first event of the season. Wong spoke on her inspiring personal and professional journey as an American Latina of black and Asian descent, offering words of wisdom and secrets to navigating the world as it is.

“As a woman of color in the white, male world of media and finance,

it wasn’t easy," Wong said. "There were challenges, but there were also advantages.”

With more than twenty-five years of experience, she told the crowd that she has learned a lot. What has benefited her immensely is working with different communities. “There is so much value in who we are,” she said.

Wong also discussed the importance of the change happening in today’s world because of their daughters. “I think teenage girls now—they know their worth tremendously,” she said. “This generation of young women is amazing.”

She offered two pieces of advice for the next generation of women. The first is to have grit and focus. She said they need to focus and do the work to get ahead; the roadblocks are not all-encompassing. The second is that they should go outside of their community to see how other people live.

“Living in different communities with different people has been huge,” Wong explained. “I can empathize with anyone. There is a need to get outside of your comfortable space.”

Another piece of wisdom Wong shared with the audience was how to reinvent yourself from one role to the next and from one industry to another. She draws on her creativity to find solutions, and she takes advantage of blockades.

“When things crash, I already am looking for the next thing I can get into,” she said.

Then, she advised the audience to always know how the business you’re in works and how to be good at what you do because it’s your reputation that helps you handle transitions. If two of those three

About one hundred guests attended Hispanic Executive Northwestern Mutual’s Leadership Luncheon: A Woman’s Worth, which was held at Café Boulud in Palm Beach’s Brazilian Court Hotel.

things are accomplished, she said, you’ll be surprised at your value.

“Just keep the quality of work up and your momentum up,” Wong explained. “Never stop believing. Blow some people’s minds, and they will never forget you.”

Leading Latinas: From Maria Fernandez of Sony Music

Tackling today's issues facing the Hispanic community

How Joe Beery connects to the work of Thermo Fisher Scientific and why he has a stake in the company’s future success

by Jonas Weir

Dystonia: it’s a word that Joe Beery, chief information officer of Thermo Fisher Scientific, never thought would be a part of his life. But it has now become integral to his personal and professional journey.

In 1996, Joe and his wife, Retta, brought home their newborn twins, Noah and Alexis, but the infants were plagued with severe health problems that Joe, Retta, and their physicians did not understand. The symptoms included body tremors, seizures, and eventually difficulty walking. Noah had drooling and motor skills issues, and Alexis had trouble breathing. To make the case even more curious, their symptoms would fluctuate throughout the day.

The twins were then misdiagnosed with cerebral palsy. After years of research, Retta found an article that led them to a new diagnosis of a rare and poorly understood genetic disorder called dopa-responsive dystonia (DRD)—a movement disorder caused by a deficiency in dopamine. So they started Noah and Alexis on a synthetic dopamine called levodopa, and they began to get healthier.

After years of healthy living, though, Noah and Alexis began to show symptoms again. So, Retta asked Joe, who had just started working for Invitrogen (which became Life Technologies and was later acquired by Thermo Fisher), to see if it was possible to sequence their children’s genomes to find the root problem.

In 2010, Noah and Alexis’s samples were sent to the Baylor College of Medicine for sequencing analysis. The

“I felt like it was my job, in the position that I’m at the company, to promote my heritage and my people.”

JOE BEERY

researchers found that the twins had genetic mutations that affected the synthesis of both dopamine and serotonin. So, not only were the twins producing low levels of dopamine, but they were extremely deficient in serotonin. When the doctors added 5-hydroxytryptophan (5-HTP), a serotonin precursor, to their treatment, the twins’ health returned to normal, and they were able to begin living full, healthy lives again. If it wasn’t for Joe’s connection to the industry and the sequencing technology the company creates, Noah and Alexis’s lives could have turned out quite differently.

“Our next-gen sequencers—from a father’s perspective and from a family

perspective—in essence saved my twins lives,” Joe says. “From a Thermo Fisher perspective, I tell people that I would basically do whatever the company asked me to do simply because I owe the lives of both my children to the products that we manufacture.”

Needless to say, Joe Beery is personally invested in Thermo Fisher’s mission of helping customers make the world healthier, cleaner, and safer. To that end, he also has a strong interest in seeing the global company succeed long beyond his tenure. For him, diversity and inclusion are imperative to that success. He discussed this topic with Hispanic Executive, along with digital transformation, and more.

What does diversity and inclusion mean at Thermo Fisher?

There’s a lot of focus on diversity and inclusion here at Thermo Fisher, and I have seen an emphasis on this from the top down. It’s important, as a large global company, that we recognize that diversity—including geographical and cultural diversity—makes a big difference.

I’ve actually been an executive sponsor of several of our employee resource groups (ERGs). We have a women’s ERG and the African American Heritage resource group, and I sponsored the Latin American heritage group. I now am the sponsor of the millennial employee resource group. A lot of our diversity is actually from the ground up. In sponsoring these groups, we’ve been able to focus on diversity and inclusion at all levels of the company.

What compels you to volunteer and get involved with the employee resource groups that you have?

There are two things. One is that I’m Hispanic, and I think we’re underserved. I felt like it was my job, in the position that I’m at the company, to promote my heritage and my people.

I also think that companies that are going to be successful for the next fifty years are the ones that are focusing on actually integrating a lot of this into how they do their jobs—because the world is changing

SVP & CIO

In 2016, Thermo Fisher Scientific opened its Software Center of Excellence in Tijuana, Mexico. But the company might have opened the center somewhere else if it weren’t for the foresight of chief information officer Joe Beery.

The company already had software developers in India, and leadership was looking for a similar cost structure. But they wanted a workforce that was in the same time zone as its San Diego, California, facility, which is home to about five hundred IT professionals.

Beery had previously worked with software centers in Guadalajara, and he felt that Mexico was a good place to attract talent—and it was in the right time zone. He was also on the advisory board for the San Diego Economic Development Center, and he knew the organization was developing was a cross-border initiative with nearby Tijuana, so he and the company began to look at that as an option.

“I found that all of the high-tech companies in the Bay Area fly over Tijuana,” Beery says. “They don’t stop because it’s hard to get to because you have to fly into San Diego, and San Diego doesn’t have a big airport. They all go to Monterrey, Mexico City, or Guadalajara. We kind of took a chance on Tijuana, and I can tell you that it’s been a home run.”

Now, Beery makes frequent trips there to connect with the workforce, which he says is a highly motivated, younger group.

“It’s just been a really great addition to the Thermo Fisher team, both in terms of cultural diversity as well as just raw technical horsepower,” he says. “I love going there.”

and jobs are changing every single day. The digital world is just completely going to change the way many jobs are done today. I want Thermo Fisher to be successful well beyond my life, and I think that’s one of the reasons we have to do this.

You’ve mentioned that your Hispanic heritage comes from Spain, and that because you are a white-passing Hispanic, you have a unique perspective on what diversity and inclusion means. Can you elaborate on that?

It’s been an interesting journey because what I’ve learned the most and what I’ve seen is that it’s not always what you see or what you think when you meet someone. I look white, but my green eyes actually came from the Hispanic side of the family. Everybody assumes that they came from my Anglo side.

You can’t have an unconscious bias about who somebody is based on what they look like. The opposite of that is when people sometimes treat me one way because of how I look and then they treat me another

way when they know where I came from. I’ve never changed; I’ve been the same person since I was born.

I have learned that people have biases that can change. When I first started at another company, I didn’t tell them that I was half Hispanic, and they had a large program to hire minorities. When they found out, they asked me to change the form to check the Hispanic box, and then I was treated differently.

I think that’s when I think about the fact that I can see the bias both ways and then I can see if there is a bias when somebody finds out that I’m actually Hispanic. I think that’s what has been fascinating about it.

Then, there are other people I found that share similar but almost opposite experiences. There are people with the names Garcia or Mendoza or Lopez, and people will have an idea of who they are. Then, they meet them in person and find out that that’s their married name. It’s the same formula.

Do you see that changing in the future?

Yeah I think so. I think it’s fascinating. I have three millennials at home, and I’m very close to all of my kids. I think the millennials have this figured out. I have so much hope in the next generation.

Seriously, there’s just a different level of acceptance that I think they’ve grown up with. Maybe it’s good parenting or maybe it’s that they’ve figured it out on their own, but I’ve never seen or heard any of my kids or any of their friends treat people differently because of a last name, color of their skin, or anything like that.

I also think that companies like Thermo Fisher are really embracing the fact that there is a competitive advantage from diversity. If it isn’t the fact that kids are growing up without some of these biases, companies are starting to see that your heritage or your diversity and being inclusive are competitive advantages.

How Dennis Verges uses solutions-based, big-picture thinking to prioritize diversity and challenge the status quo in his work and community

by Amanda Garcia

“Try not to become a man of success, but rather try to become a man of value.”

These words from Albert Einstien are inscribed on the inside of the silver business card case that Dennis Verges has carried for more than a decade, and with each new milestone in his career, the words take on new meaning.

In the earlier years, Verges was focused on becoming a man of value by creating and adding value to his own personal brand as he engaged several entrepreneurial pursuits. But more recently, he has shifted his focus to investing in the success of others and becoming a person who brings value to his whole community.

As a serial entrepreneur who is always on the move, Verges has his hands in many projects in the town where he resides, Elgin, Illinois, a small city at the end of one of Chicago’s west-bound commuter train lines. “I like to think that I can create value in Elgin by encouraging the leadership in our community to think strategically and stay focused on the big picture,” he says,

emphasizing the importance of networking and proactive listening. “If I can help the people of Elgin discover their own value, that will, in turn, increase my own value.”

One of his favorite stories of connecting people’s greatest skills with an area of need is the time he made a recommendation for the new director of Elgin’s Downtown Neighborhood Association. “When I told the board of directors that Jennifer Fukala was the perfect fit for the job, they interviewed and eventually hired her—and she is a perfect fit,” he says. “That’s a perfect example of how I find personal success in the success of others.”

That example also highlights Verges’ desire to remain focused on big-picture goals without prioritizing his own personal agenda. “That goes back to me being a man of value,” he says, citing the dynamic combination of his father’s outgoing, Puerto Rican personality and his Sicilian mother’s industrious ambition. “I am passionate about connecting people and bringing value to their work.”

One project that Verges is particularly invested in right now is the Elgin Math and Science Academy (EMSA), Elgin’s first public charter school, which is set

to open in August 2018. As a founding board vice president with a background in finance, Verges was initially brought on to help guide the school’s fiduciary process. But in the past few months, his role has expanded to include outreach as well as promoting the new school with a special emphasis on diversity.

Not only has the school put measures in place to ensure an economically and racially diverse student body, but Verges is personally constructing policies to build diversity among contracted service providers and suppliers. “Truly prioritizing diversity can’t be limited to our student population,” he says. “It starts at the top with our board members, and then it trickles down to our teachers and the businesses we hire, which creates a culture of real inclusion.” EMSA’s kitchen supplies will be provided by a woman-owned business, and the school’s goal is to hire a local business for grounds maintenance. “This is one way that we’re going to make a real difference in Elgin,” he says EMSA will also use the Expeditionary Learning Program in all its classrooms. Its first school year will include students in kindergarten through third grade, and then it will add a class each year for the next five years until it services kindergarten through eighth grade. Students will be selected from a lottery system, and the cost of enrollment will be the same as a traditional public school. “It’s going to be amazingly great for Elgin because it allows a new option for parents with young children, like me,” Verges says. “Plus, it gives students who can’t afford private school an opportunity to learn in a uniquely academic environment.”

For Verges, proactively promoting diversity in all aspects of his life is vital to “servicing the customer from a 360-degree standpoint.” He says that incorporating diversity of thought, economic status, age, gender, and other demographics is important when learning about a population and understanding its greatest needs, wants, and motivations. Whether he’s strategizing with his business clients, connecting people with opportunity, or starting a charter school, Verge focuses

“We must include everyone who shares our vision of a healthy community, equal opportunity for education, and a supportive business environment.”

DENNIS VERGES

on a diverse group of end-users so he can reach a bigger audience and create a greater impact.

“As our country becomes more diverse, we must realize that, if we aren’t intentional about including diverse voices, we will only create splinters and eventually crumble,” Verges says. “We must include everyone who shares our vision of a healthy community, equal opportunity for education, and a supportive business environment.”

Verges says this kind of thinking is what has earned him the reputation of being “disruptive in a good way” from leadership in the City of Elgin. A personal mandate to create change and disrupt the way business is currently happening and a passion for making meaningful connections and preemptively servicing his customers has made Verges a force to be reckoned with, both in his career and volunteer work. “No matter what I’m working on, my goal is always to sell a solution,” he says. That means he is always prepared to challenge his colleagues by constantly asking them, “How are we creating solutions for the most amount of people?”

Being an effective influencer in any project or workplace often requires this kind of drive and solutions-based, service-oriented thinking, Verges says. It also demands hard work, follow-through, and a great investment of time that often goes unseen. However, Verges says it’s also a richly rewarding experience that can bring lasting change to culture and community—one that he believes is worth every moment. “Seeing the students arrive for their first day of class at EMSA this August is going to be incredible,” Verges says. And for this thought-leader and change-maker, it’s sure to be a living manifestation of what it means to find meaningful success as a “man of value.” Surely Einstein would be proud.

“Dennis has a keen sense of the entire credit and collections process. He has that unique ability where he is able to successfully maintain a balance between addressing and satisfying the needs of the customer base while at the same time managing the related financial risk of Screen Americas Corporation.

Congratulations Dennis on being featured for a second time in the Hispanic Executive Magazine. It is a well deserved honor.” Vinny Cuzzo, The CLP Group, LLC

Top-level insight and updates on business in America

Rudy Reyes’s work is paving the way for 5G connectivity

As the United States prepares for the upcoming and much-anticipated shift to the 5G network, major cities are revamping parts of their infrastructure to accommodate the increase in capacity.

Crafting the blueprint for such an endeavor can be daunting. That’s where Rudy Reyes, the vice president and associate general counsel of the western region at Verizon, and his team come in. For example, Reyes’s Verizon team worked handin-hand with Mayor Darrell Steinberg and the Sacramento City Council to determine what residents needed and how they could go about paving the way for 5G.

“We were true partners in every way,” Reyes says.

With early cellphone technology, the devices used large towers. These towers, however, won’t work for the 5G network; the upgrade requires smaller, more sophisticated cells—and lots of them. So, the City of Sacramento and Reyes’s team faced the challenge of installing these cells at a cost-effective rate.

Nonetheless, Mayor Steinberg set an aggressive schedule, Reyes says. But because city officials and Reyes’s team worked to streamline permits and remove barriers, they were able to meet the deadlines, and workers are ready to install these small cells on light poles throughout the city. Now, Sacramento is set be one of the first cities to have 5G because of the work Reyes and his team put in.

The upgrade will spark a revolution in how Sacramento residents work and connect, Reyes says.

“It’s a game-changer,” Reyes says. “It’s the next generation of wireless connectivity.”

The three key things 5G will have are: increased speed, increased capacity, and decreased latency, Reyes says. The

increase in speed and capacity are necessary partly because so many people have multiple devices connected to the internet at any one time. But Reyes says the upgrade can help more people connect to the information they need faster.

“We had a higher purpose,” Reyes says. “We put the citizens first.”

Serving a higher purpose is something that Reyes has always pursued. When he was a child, Reyes wanted to be either a priest or police officer. However, he found the law. Growing up, Reyes says he watched a lot of court-themed TV shows, such as The People’s Court, which left an impression. “I was impressed by how both sides presented a case,” he says.

In college, Reyes studied Russian and Soviet studies at Harvard University, where he graduated magna cum laude He then went on to pursue a law degree at Harvard Law School, where he graduated cum laude in 1998.

Early on in his law career, Reyes worked at several law firms and specialized in litigation. Dealing with litigation— in particular, cases where people acted improperly—adversely affected Reyes. “It wore me down,” he says.

Instead of litigation, Reyes wanted to use his legal acumen for something that was more future-focused. So, he applied for a job at Verizon at a time where cellphones were just becoming ubiquitous. “I about fell out of my chair when Verizon made the offer to me,” he says.

Now, after fifteen years with the company, Reyes is still excited by the work he’s doing to develop the future of telecommunications infrastructure—if only because he has seen so much change over his career.

When Reyes joined Verizon in 2003, the landscape of technology and telecommunications was wildly different than it is today. Connectivity was only at 3G, cellphones looked like bricks compared to the sleek smartphones of today, and YouTube didn’t even exist yet.

Reyes’ first case was working on price regulation for traditional landline telephone companies in California. This case predated the iPhone, Reyes notes.

With 3G connectivity, cellphones could call, text, and connect to social media in a very basic way. Then the industry expanded under 4G, and broadband speeds increased as did overall connectivity. The cloud began to develop as well.

Reyes explains it like this: Under 3G, you could navigate with your phone, but because the networks weren’t as quick, you would miss your turn. With 4G, you’d receive the turn direction just in time. And with 5G, not only would you have more than enough time to make your turn, but the technology will support fleets of driverless vehicles that can operate autonomously.

This shift is also how we went from games like Tetris just ten years ago to more sophisticated ones like Candy Crush Saga.

Anticipating the 5G upgrade change means many cities will have to create the infrastructure for it. And like his work with the City of Sacramento, that’s exactly the type of challenge that excites Reyes.

“I feel blessed,” Reyes says.

Reyes might not be the only one excited by that type work. He says that his seven-year-old son told him that when he grows up, he wants to create 6G.

“I have no idea where he got that from,” Reyes says with a laugh.

Fernández Government Solutions is a full service Latina-owned lobbying rm based in Sacramento, CA with a wide range of corporate and public sector clients.

JORGE ACEVEDO SVP, Generation Innovation and Strategy Constellation

Jorge Acevedo and his team set the course for Constellation’s future through long-term investments and a culture of innovation

by Cristina Merrill

Jorge Acevedo is at the intersection of strategy and execution. As the senior vice president of generation innovation and strategy at Constellation— which provides power, natural gas, renewable energy, and energy-management products and services across the continental United States—Acevedo is responsible for both the strategic direction of Constellation’s commercial business and its innovation strategy as well as strategic transactions, market development, and venture investing.

“Our main goal is developing strategies to grow our business, and our focus is on executing strategy—not just talking about

it,” he says. “That’s fundamentally what we do as an organization.”

Acevedo, however, has held multiple roles within the organization that have helped him get to where he is today.

After graduating from the University of South Florida with a master’s in accounting, Acevedo began working in public accounting. Following more than six years with PwC, though, he decided it was time for a change. He wanted to take his skills in-house.

Through his network, he landed at Exelon Corporation in accounting in 2002. In 2012, Exelon merged with Constellation—bringing together two

separate cultures and businesses. Instead of resisting change, Acevedo saw an opportunity to get involved in the commercial side of the business. So, he accepted a role as the vice president of finance for the newly merged Constellation, and his new responsibilities gave him a good purview across the organization.

“I think the opportunity to create our generation-to-customer-matching strategy was a huge opportunity for us as an organization,” he says of the merger. He adds that the merger brought two very distinct

“We invest in companies and innovative energy technologies and different business models, and we try to build a portfolio that’s really balanced with a broad range of development stages and different types of technologies,” he says. “But CTV is where we focus on getting ahead of the curve and working with companies to really focus on deploying their technologies across our customer base. I can’t emphasize that enough. Anyone can invest in companies financially. I think the value we bring to our partners and what they really

“Our people are our largest asset, in my opinion, and investing in their development is probably the most important thing a leader can do.”

JORGE ACEVEDO

cultures together and what came of it was an enhanced, more strategic culture.

Acevedo took on his current role in 2017. He says he loves his work, and his role has just as much to do with culture as business growth.

“From an innovation perspective, I’m trying to drive culture,” he says. “I’m trying to foster a culture of innovative ideas where we respect everyone and where we make sure we get our people’s perspectives within our organization. We’re trying to create that culture at every layer—all the way down and all the way up.”

Constellation Technology Ventures (CTV), the venture investing arm of the firm, also falls under Acevedo’s umbrella. He says it’s one of the defining factors that helps set Constellation apart from other similar firms.

like about us is that we work with them to commercialize their technologies with our customer base.”

With all of these responsibilities, Acevedo leads a team of approximately sixty people.

“We’re a unique team,” he says. “We’re not the core of the business, but we’re there to position and steer our organization.”

He describes that team as somewhat of a lightning rod for the organization. That’s because his team works in a sort of gray area of speculation. One of the biggest challenges he and his team face is articulating the value of what they do to the rest of the organization. Acevedo emphasized how the goals his team meets are not about short-term payback. Instead, they have a long return cycle. It can sometimes be challenging, he says, for those focused on

near-term financial goals to see the value in these projects.

“We’re not gambling,” he says. “ We’re making informed decisions. We have a lot of research behind it. People interpret the opportunities differently.”

One of Acevedo’s major responsibilities is to rigorously review ideas before they are presented to the rest of the executive team. Every possibility must be explored, he says.

“It’s really about taking an idea and looking at it from multiple lenses and perspectives to make sure we’ve thought through every angle so that when we present these ideas to our organization, they get higher adoption and a higher success rate moving forward,” he says.

Once his team understands their goals, Acevedo says that his main focus is to empower his team.

“Once the team is aligned, their job is to go execute,” he says. “Their job is to come and ask me when they need my help. My job is to check in every now and then to make sure things are going well and help them overcome any obstacles that may be in the way of them accomplishing their goals.”

As someone who has held multiple roles within Constellation, he believes that up-and-coming team members should get to know the business. In fact, he’s passionate in his belief that those who want to move up should get the most comprehensive view that they can of where they work. He also notes that so many people in business are subject-matter experts, but those who want to rise even further should make sure to get an overall view of their companies and understand the business and its goals. They should also understand their role in all of that.

To that end, Acevedo is helping people in their development. He regularly meets with members of his team and has an open-door policy with other employees throughout Constellation, which proves to be a great recruiting tool.

“Our people are our largest asset, in my opinion,” he says. “Investing in their development is probably the most important thing a leader can do.”

Choose Constellation as your guide. We have the energy experience and market insights to help you ask the right questions and find the right answers. Our expertise, innovative thinking and dedicated customer service will help you understand options for your home, and customize solutions for your business. That’s why two million customers—including two-thirds of Fortune 100 companies—consider Constellation America’s energy choice®.

Energy made simple. Energy made simple.

Alex Rodriguez taps into a collaborative culture to make great strides in Spirit Airlines’ IT department

by Cristina Merril

Although some aspects of the airline industry have stayed the same since Alex Rodriguez, senior director of software engineering at Spirit Airlines, began his career in the mid-1990s, many others have gone through dramatic transformations. That is especially true for the pace of technological change and how it affects his responsibilities.

But with that pace comes an adrenaline rush, and that’s just one of the reasons Rodriguez loves his job.

“IT in the airline industry is a 24/7 effort to address a variety of issues in systems, all of which are mission-critical,” Rodriguez says. “But I enjoy the feeling of accomplishment—especially when my team and I succeed at meeting project deadlines that others would consider impossible. We have a positive impact on millions of guest experiences.”

His first such success was in 2006 when he helped develop the customerloyalty program for AirTran Airways, which was one of the first airlines to leverage real-time information to directly benefit consumers. Previously, the company experienced a lag between the time a passenger made a reservation and when the booking data was available.

“With real-time access, AirTran was able to provide loyalty customers with credits and points as soon as they took off,” Rodriguez says. “We knew immediately when customers were in flight, and by the time they landed, they could see the points in their accounts.”

His years of experience have given Rodriguez foundational knowledge of nearly all airline operations. His successes are largely based on understanding how each system functions and how it is integrated, which gives him insight into how to effectively leverage connections between systems. For example, by pulling data from

the operations system, he is able to inform customer inquiries into flight statuses.

The ability to optimize experiences and knowledge is very much in keeping with The Spirit Way—the company’s dedication to challenging the status quo by offering unbundled, stripped-down air fares that allow guests to pay only for the options they choose. Internally, however, the focus on cost led to an early challenge for Rodriguez. Spirit’s website had been built using freeware, which was costeffective and easy to use. But over time, it became more expensive to support and maintain. Additionally, the shareware

session-management system caused continuous crashes, which resulted in the site being ranked near the bottom when compared to other airlines.

So, Rodriguez introduced an enterprise system and worked with his team to redesign the site in an adrenalinepumping four months. This dramatically increased uptime performance, improved load time, and created a more contemporary user interface. Now by using daily benchmarks and comparing the website against similar sites, Spirit has been ranked as high as number three and regularly lands at number five or six.

“We can’t incorporate all our great ideas fast enough. We’re inevitably trying to tweak development so that we can make continuous improvements.”

ALEX RODRIGUEZ

There was some early resistance to making the necessary investment for the ultimate transformation of the site, but after a series of early quick-wins, support for Rodriguez’s efforts quickly increased throughout the company.

“Once you go from crashing almost daily to stable operation and positive guest feedback, more and more people get on board and are much more willing to welcome the next improvement,” he says.

The redesigned site is also mobile responsive, meaning that it adapts to mobile devices rather than displaying the full functionality and layout intended for larger screens.

Under Rodriguez, the IT team also launched Spirit’s mobile app in 2017. The app provides guests with capabilities to check in, check flight statuses, add bags to booking, and select seat assignments. In the near future, Free Spirit members will also be able to make new reservations and manage their travel on the app. The app was developed in just five months in partnership with Navitaire, Spirit’s reservation system provider.

Those kinds of improvements and innovations—and the speed with which they’ve been accomplished—are possible because Rodriguez has the right structure and teams in place and Spirit has a culture in which everyone works together toward common goals.

Rodriguez first learned the importance of strategic alignment, with

appropriate staff positioned at all levels in multiple departments, when he developed and launched Silver Airways’ reservation system in just ten months in 2012. He developed collaborative workflows between revenue, management, marketing, testing, IT, and operations so that all pillars supported the project’s structure and objectives.

When Rodriguez joined Spirit, he was pleasantly surprised to find that most departments already functioned as a cooperative family. “Everyone works together as a team,” he says. “On a project like the website, the approach was that if we can be a resource to help better our guests’ experiences, then we’re all pitching in.”

Over the past year, that spirit has contributed to improved overall operating performance, including more on-time departures and arrivals and fewer delays and cancellations.

Moving forward, Rodriguez says that managing ongoing platform and technology changes and adapting to an evolving scope of responsibilities are his most difficult challenges.

“We can’t incorporate all our great ideas fast enough,” he explains. “We’re inevitably trying to tweak development so that we can make continuous improvements.”

And with so many constant new sources of adrenaline, Rodriguez and Spirit’s IT department are almost certainly destined to succeed.

by Bob Olaf

As executive director of Comcast’s security fusion center in Moorestown, New Jersey, Jorge Nieves leads multiple teams that help protect the global telecommunications company from both cybersecurity threats—such as hackers, viruses, malware, and more—as well as physical security threats. The 24/7 Security Operations, Cyber Threat Intelligence, Threat Hunting, Machine Learning, and Physical Security Technologies teams all fall under his purview. You could say that Nieves is the last line of defense for cyberattacks. And that’s a daunting task considering that Comcast has 59,000 employees that serve

more than 21 million customers. That’s a lot of data.

Although Nieves has been in his current role at Comcast for more than a year and a half, he did not rise to a position of such responsibility without first gaining plenty of experience. In fact, Nieves considers himself a seasoned security professional with vast experience in many areas of technology security and security program development across enterprise and carrier class networks. In the past, he has demonstrated success in leading teams in areas such as security engineering, security operations, project management, incident response, machine learning, intrusion

detection and prevention, forensics, IT audit, and regulatory compliance.

In addition to his expertise in the cybersecurity field, he has experience in leading people, including setting strategic and tactical goals along with mentoring, coaching, and career development.

In fact, in 2015, he graduated from the National Association for Multiethnicity in Communications’ Executive Leadership Development Program. The program prepares leaders to be successful by deepening their understanding of the changing landscape of the media and entertainment industry, developing enterprise-wide perspectives, enhancing their capacity to convert strategy into action, and cultivating innovation-focused mind-sets.

Now, in managing his own team, he tries to be very open and collaborative. To be a good team leader, he likes listening to his team to get a better understanding of their challenges and priorities.

Nieves actually considers mentoring to be one of his priorities as a leader. He mentors people across function in addition to mentoring other up-and-coming Hispanic leaders and others interested in cybersecurity. In fact, he advocates that others mentor as well to grow their professional and personal networks. He also recommends that people talk to others outside of their industry to help them grow professionally. After all, he was not always in the IT field.

After growing up in Camden, New Jersey, Nieves actually earned an accounting degree but then quickly moved into IT. He said he had struggles growing up, and that made him want to have a better

life. Now, he’s spent years in IT, taking on increasingly complex projects, from assessing systems to IT security.

Today, he is considered an expert in the field who is laser-focused on constant innovation. In that capacity, he works with like-minded outside vendors, such as ReliaQuest, who are focused on innovation.

“Working with Jorge over the years has been an absolute pleasure,” says Brian Murphy, CEO of ReliaQuest. “He is focused on delivering measurable results for his organization and is willing to put the work in and invest in his team to deliver results. I appreciate his willingness to give feedback and appreciate his view that cybersecurity is a team sport. Jorge is easy to trust and someone you always want involved in making the tough decisions. He begins and ends with being a good person, which ultimately drives trust and results.”

Known for his work in the field, Nieves has become known as an expert of sorts. He even works with governmental organizations, such as the FBI and other law enforcement agencies. Additionally, he is a part of the working group focused on cybersecurity information sharing for the Communications Security, Reliability, and Interoperability Council. A subset of the FCC, the council’s mission is to provide recommendations to the FCC to ensure, among other things, optimal security and reliability of communications systems, including telecommunications, media, and public safety.

And with that expertise behind its cybersecurity, Comcast is sure to continue to innovate and lead in the space.

ReliaQuest custom-architects scalable security platforms that get smarter over time. By combining your existing tools and technologies with the reliability of co-management and the speed and agility of managed detection and response (MDR) services, ReliaQuest transforms your organization into a proprietary security platform—giving you unmatched visibility while normalizing your spend. Re-think what it means to Make Security Possible.

How Jose Rivera helped the next generation of Riveras take their place at JMR Wealth Management Group

by Jeff Silver

JOSE RIVERA Managing DirectorWealth Management

UBS Wealth Management

Since the 2008 financial crisis, many have chosen to forgo the financial services industry as a career. That’s not the case for Adam and Nicholas Rivera, who have opted to work with their father, Jose Rivera, managing director, wealth management with UBS Financial Services. The decision to join their father is helping the family business, the JMR Wealth Management Group, to continue to provide services to the next generation of clients.

Rivera attributes his sons’ career paths to his wife. “Ever since the boys were toddlers, when she talked about the future she would say, ‘When you become partners with dad . . .” he says.

JMR Wealth Management Group is truly a family operation. Rivera has been in business with his cousin, David Maldonado, for more than twenty years. After studying finance in college, Adam spent two years at JP Morgan as a sales assistant on the firm’s fixed-income trading desk before joining JMR five years ago. Nicholas worked in a variety of UBS home-office positions for two years after earning his finance degree. He then followed in his brother’s footsteps in the fall of 2017. Both have earned Certified Financial Planner licenses and, at their father’s urging, are pursuing other professional licenses.

With thirty-five years of experience, Rivera can teach his sons a great deal that

isn’t found in textbooks. Among other topics, he stresses the importance of business ethics as well as the fiduciary responsibility financial advisors have toward their clients.

“I can teach what it takes to be successful in the real world,” Rivera points out. “Calling people, doing seminars, entertaining, and speaking in public are things that have helped me get to where I am.”

He is also preparing his sons for responding to market downturns and corrections, which they and many other younger financial professionals have never experienced. Last year, for example, the stock market experienced the least volatility of any year ever recorded, according to an article by Yahoo Finance on December 28, 2017. Although high-frequency trading and constantly updated digital news feeds can spark sharp, momentary fluctuations, Rivera keeps a chart of monthly performance from 2008 as a teaching tool.

“In 2008, we were down 6 percent one month, 5 percent, the next, down 8, down 16, month after month after month,” he says. “It was hell coming to work every day, but staying focused on personal service, diversification, and long-term planning is how you reassure clients during tough times like that.”

Rivera is able to provide that kind of advice and reassurance by having an intimate knowledge of his clients’ goals and having developed detailed financial plans that address their objectives. With that knowledge, he helps his clients determine the long-term steps needed to manage their assets.

“If someone comes to me with a chunk of money to invest just so they can ‘see what I can do,’ I’m not interested,” Rivera says. “When we take on a client, we always get a full picture of their current

Personal connections to both the Jackie Robinson Foundation and the Hispanic Federation make Jose Rivera’s volunteer activities more than casual efforts.

As treasurer and head of the investment committee at the Jackie Robinson Foundation, he can indulge his passion for baseball. (He once tried out for the New York Mets.) As a member of the Hispanic Federation’s Finance and Investment Committee, he has participated in relief efforts for Puerto Rico, where many of his relatives still live. In fact, the Hispanic Federation helped coordinate US donation drives that have collected more than $15 million and millions of pounds of food, water, and other aid.

status and objectives so we can create an extensive and customized financial plan for them.”

To help prepare his sons for the business and to introduce them to clients, Rivera involves them in calls and appointments and has them assume responsibility for presenting various topics. He says that clients initially ask for assurances they’ll be working primarily with him as the more experienced professional. Within six months, though, those concerns fade.

“Involving my sons early in the process shows clients how capable they are and makes them feel comfortable,” Rivera says. “Even with older clients who have

their own children who will inherit their money, it’s a great way to introduce my kids to the next generation and ensure a very smooth transition.”

As he acts as a mentor to his sons, Rivera is very aware of how much the industry has evolved since his own career began. In fact, Adam and Nicholas are helping to implement UBS technology upgrades to the team’s day-to-day operations. Binders filled with paper printouts of daily portfolio performance have been retired in favor of electronic archives. Rivera still makes a point of reminding his sons of the days when he would drop a sales ticket into a suction

tube and then have to wait for an execution notice to be sent back confirming the order.

“My success is going to be measured by how successful my kids are—not by what I’ve already accomplished,” Rivera says. “I believe the secret to growing your power is to give it away—and by empowering others, you grow your impact and your influence exponentially.”

When asked if working with his sons has changed any of his previous plans, Rivera does admit to one major adjustment. “My new goal is to retire sooner,” he says. “Seeing how Adam and Nicholas have developed gives me comfort in knowing that when I leave, clients will be in great hands.”

Jose M. Rivera, ChFC® CIMA®, CPWA®, CPM®, CLU® Managing Director–Wealth Management Senior Portfolio Manager

JMR Wealth Management Group UBS Financial Services Inc. 299 Park Avenue New York, NY 10171

212-821-2790

jose.m.rivera@ubs.com

ubs.com/team/jmr

FOR NEARLY FIFTY YEARS, NIKE’S INNOVATIVE DESIGNS HAVE HELPED ATHLETES RUN FASTER, JUMP HIGHER, AND PERFORM BETTER. ONE OF THE BIGGEST INNOVATIONS HAPPENING AT NIKE RIGHT NOW, HOWEVER, IS ONE YOU WON’T SEE ON TV OR ON STORE SHELVES.

Genaro Lopez, director of enterprise records and information management at Nike’s world headquarters in Beaverton, Oregon, is working to make effective records management cool. This year, he and his team have launched a campaign to change the way the company thinks about what records they should keep and what they can delete or toss. It’s a campaign called Make the Cut, and it’s an effort unprecedented in scale for a challenge facing many large organizations today. And, as usual, Nike is ahead of the game.

“It’s all about how we are creating the future,” Lopez says. “I tell my team: ‘How are we changing the game? This is our opportunity to innovate in our space. We’re probably never going to be footwear designers or material scientists, but this is our opportunity to think creatively about the work we do for the company—to do things that have never been done around records management at Nike or at any company.’”

Director of Enterprise Records and Information Management

Nike could power 272 World Cup matches with the energy it takes to store its nine petabytes of data.

If Nike printed its nine petabytes of stored data, it could fill ten Olympic stadiums.

If printed out, Nike’s records could fill more than 380 million shoeboxes.

It just makes sense. How many emails do employees send in a day? How many contracts do they draft? How much marketing copy, how many prototypes, and how many versions are created every single day? Making records, to some companies, is just the cost of doing business. You don’t become the best in your game without leaving footprints.

Since the corporate world’s work moved from paper to digital, the number of documents in Nike’s—and many other companies’ for that matter—servers has exploded. By 2017, Nike had reached over nine petabyes of data across its many systems.

“We decided to make some interesting comparisons, translating the quantity of data we had in our servers to how many Olympic stadiums that data could fill or how many Nike shoeboxes you could fill with that data,” Lopez explains.

If you printed it all out, it would stack up higher than 380 million shoeboxes or fill ten Olympic stadiums. The energy it takes to store that data is enough to power 272 World Cup matches.

In the age of seemingly limitless cloud storage and simple backup for peace of mind, it’s become easy to keep everything. However, any librarian, museum curator, or editor will tell you: when you keep everything, each piece has a little less meaning. It’s the selection, deciding what not to keep, that makes things important. Plus, large corporations like Nike have legal and regulatory obligations to retain business records that can carry severe penalties if not followed.

To take on the task of culling this data, Lopez assembled the finest resources the athletics giant had at its disposal. He and his team created intuitively designed tools and worked with an external design agency to create effective, visually striking messaging. For Lopez and his team, though, making sure only the most important records are kept is a team effort on a global scale. Getting that message across required arresting visuals of those shoeboxes, stadiums, and World Cup matches to make an abstract problem more concrete.

In a series of stunningly designed graphics on computer lock screens, posters, and physical installations, Lopez’s team rolled out a global campaign in ten languages to raise awareness of the issue. It’s a campaign on par with anything Nike would use to promote its newest gear. At a company this expansive and with so many internal campaigns, it has to be in order to stand out.

Establishing awareness of the scope of the problem, however, was only the beginning. There needs to be something for people to do with their newfound awareness of the issue. So, Lopez found that it was equally important to offer an easy way to take action.

“We all own the problem, and we all own the solution,” Lopez says. “We not only need to get people excited, but we also need to make it easy to do the right thing.”

Having previously developed intuitive tools to make creating contracts easier for Nike employees, Lopez has a mind for user experience. His priority is to meet users at their level to get the best results. So, he streamlined the records-compliance process by cutting through the exhaustive task of finding and deciphering regulations and policies. To Lopez, finding out what records to keep and how long to keep them should be straightforward. Gone are the days of scrolling through a manual or using the “find” function to track down

Descending from an Ecuadorian college professor and a high school teacher from New England, Genaro Lopez grew up to always value learning and curiosity. His heritage has inspired a curiosity that’s driven him to everything from research biology to a victory on the TV show Jeopardy! to his role in shaping the culture at Nike.

Growing up in the Los Angeles area, Lopez was inspired by his father, a professor of animal physiology, who came to the United States from Guayaquil, Ecuador, for graduate school. Spending time in his father’s lab inspired Lopez to study biology at University of California – Berkeley.

How does Lopez’s success at Nike fit into the bigger picture? A 2015 release of data by the company reveals that more than 50 percent of Nike employees identify as non-white, racially and ethnically diverse personnel represent 60 percent of the growth in Nike’s US leadership and management since 2011, and 18 percent of US employees identify as Hispanic or Latino. For those who rise to a position of leadership, the question is often, “What now?”

Today, Lopez operates at Nike with a strong belief in the power of a diverse workforce and the importance of representation. In a company as diverse as Nike, Lopez hopes that his presence paves the way for more diverse talent leadership in the future.

“It not just me I’m representing,” stresses Lopez. “People who encounter me will always remember that the Latino they met in legal was an expert in his area, and that creates opportunities for others.”

a jargon-filled rule on records compliance, all of which reduced the likelihood that anyone would actually be successful finding and following the official guidance.

“We’re really sensitive to what is a realistic expectation to ask of people who are not experts in this field,” Lopez says. “We don’t assume prior knowledge in the design of our tools. We want to shorten the gap between someone wanting to do the right thing and having the answers they need to do it.”

Thanks to Lopez and his team, employees now only need to enter their name, the country they work in, and the type of record they have, whether it’s a finance spreadsheet, a vendor contract, or even a prototype for next year’s hottest sneaker. From those quick and easy three answers, employees can instantly be told exactly how long they need to keep their record and where to go for help if they still have questions.

After nearly a year of planning, that campaign has gained enthusiastic support from a company of 74,000 people spread across 190 countries. In fact, in the wake of this campaign, Nike’s European logistics team was able to identify half a million documents that no longer needed to be kept but were nevertheless occupying

It’s a remarkable level of visibility for a corporate records management function, especially at Nike. The new Make the Cut website received more visitors in the first two hours of its launch than the previous records management site received in the entire previous year. Lopez’s enthusiasm

“It’s been successful, but we’re in mile one of a marathon,” Lopez says. “We’ll know we’ve reached a milestone when it’s become a part of the culture.”

In that mission, Lopez means to make sustainable and effective records management as natural to Nike as the fast-paced energy that already drives the

“Our culture is one of our most valuable assets. ‘Just Do It’ is not just a marketing tag,” Lopez says. “It’s how our work gets done. With our new, all-connected world and Nike’s unique culture, we will ultimately only be successful with the buyin of the whole company. This is not just a one-time sales pitch to the organization. If only the legal department takes it to heart, we’re not going to get it done. We’re continuing to highlight teams across the entire global enterprise that are doing great work to help on our internal platforms.”

Many organizations talk about the power of their company culture and the need for buy-in, but in this case, cultural change and personal ownership can be measured by the petabyte, the Olympic

WWorldview Cruzando fronteras: Strategies driving business across borders

How Jose Olalla uses his engineering background to handle business development and digital transformation for a global banking group

by Kelli Lawrence

On paper at least, the cities of Madrid and Houston have a few similarities. Both are sizable cities; Madrid is the third largest in the European Union, and Houston is the fourth largest in the United States. Both are steeped in historic architecture, industry, and each area’s respective culture. Both have professional sports teams of note: baseball by way of Houston’s 2017 World Series Champion Astros, and fútbol via Cristiano Ronaldo and Real Madrid.

But when Madrid native Jose Olalla uprooted his family and resettled in Houston two years ago as part of his new role with BBVA (Banco Bilbao Vizcaya Argentaria), one enormous difference from his homeland stood out: transportation.

“How Houstonians live in the city is very different,” Olalla says with a nod to the fact that almost half of Madrid gets around the metropolitan area via public transportation. “The majority of people here never walk on the streets. Everyone drives everywhere. It was kind of shocking.”

Growing up in Spain, with an engineer for a father, Olalla had, from a young age, a desire to solve problems with mathematical logic. As far back as elementary school, he excelled in math. So, it wasn’t much of a surprise when he chose a telecommunications engineering program at Universidad Politécnica de Madrid for his collegiate years. The surprise came when he completed the entire six-year program in only five years—at the top of his class— only to conclude that he had no interest in pursuing engineering as a profession.

“I enjoyed the content of the program,” Olalla says. “But the engineers I knew at the time were very introverted and hard to communicate with. They spent all their time just thinking about work and nothing else. I decided that I didn’t want to be what those guys were, if possible.”

Instead, he spent a few years working at a consulting firm before coming on board with a domestic bank owned by the government of Spain in 1992. That bank was Argentaria, which merged with Banco Bilbao Vizcaya about seven years later. Throughout the 1990s, Olalla cultivated an interest in business—finance and financial planning, more specifically—which led him to additional training and education. By the time of the BBVA merger, he’d earned an

JOSE OLALLA Head of Business Development and Digital Transformation USA BBVA

MBA from the University of Chicago Booth School of Business.

As the twenty-first century began, both Olalla and the merged banking group for whom he now worked began to chart new, wider courses for leadership and growth. Today, BBVA has grown to operate in more than thirty-five countries, one of which is BBVA Compass in the United States. Meanwhile, Olalla has led teams involved in areas such as e-business, customer analytics, strategy, marketing, innovation, and information technology. “I have been very lucky to work in so many different positions, including group CIO from 2009 to 2012,” he says. “But the role that probably had more impact in the company and gave me the most opportunity was when I was global head of multichannel strategy from 2012 to 2014.”

Along the way, in close to a dozen different capacities, he’s logged a lot of time developing his management style. He recalls learning early on that he had to step aside to let his teams develop—even when that meant letting them learn to solve problems he could easily and quickly fix himself. “I learned you have to let them do it; otherwise, neither you nor they will ever develop as professionals,” he says. “You have to find the right balance. It’s about working with your staff to establish goals and then empowering them and letting them find their own path to get there instead of telling them what to do all the time.”

Nowadays, as head of business development and digital transformation— and with his home in Houston—Olalla leads a diverse team of eight men and women, which includes staff originally from Turkey, Pakistan, and Mexico. The position involves a bit of travel to say the least; he counted ninety-two flights for himself (mostly domestic flights from Houston to Birmingham, Alabama) and 106 nights away from home in 2017. But to say his work at BBVA is nothing like

the engineering road he almost chose is to put it lightly.

“I get to work so much more with people than I would have if I’d been an engineer,” he says. “I enjoy it all: working with teams, having to manage big groups of people, and dealing with different ways people are motivated, both what they expect from life and what they expect from work.”

Nonetheless, the logical lessons he learned long ago are never too far away. “It was hard to get an engineering degree, but it helped me learn a very structured way of thinking and approaching problems,” he says. “It also helped me learn to work hard and not be afraid of challenges.”

We are passionate about the customer experience. Every day we connect 500 million consumers with leading brands across thirteen countries, helping blue-chip companies meet increasing consumer needs.

We have developed long-lasting client relationships through our deep understanding of the verticals and cultural environments where they compete, providing unique insights into our clients’ businesses and consumer needs.

Our motivated team of over 150,000 employees is an enabler for our business model and a core competitive advantage. Atento’s is the only CRM/BPO firm among the top twenty-five companies to work for in the world, according to the Great Place to Work Institute.

Accenture congratulates Jose for his distinguished leadership at BBVA Compass. He has made a measurable impact, aligning his teams to achieve the bank’s vision of being a leader in digital capabilities. Accenture has enjoyed a long history working with BBVA globally. BBVA Compass’ relationship with Accenture to support its ongoing digital transformation in the United States reflects the bank’s commitment to technology innovation and leadership. Jose’s dedication towards new digital solutions are resulting in new products and services to the Bank’s customers. With Jose’s vision and focus, BBVA Compass will successfully navigate its ongoing customer centric transformation to a digital bank.

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. With approximately 442,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. www.accenture.com

Creating value by focusing on your customers and managing their journeys.

Are your customer’s needs satisfied?

Effortless experience

Are your customer’s expectations met?

Atento stands as the leading provider of customer relations services and solutions in Latin America and ranks among the top three worldwide. Our strong operational presence in Latin America and Spain allows us to suppor t clients in our local markets and to provide a leading nearshore solution to companies in the US. With over 100 Solution Centers and more than 150 thousand employees around the world.

Miguel

became an expert in opening Latin American markets for direct-selling companies

by Jonas Weir

Just a few years ago in 2012, Miguel Beas joined a direct-selling company that markets anti-aging products, such as health and beauty products and nutritional supplements. Although the company was founded in 2009, Latin America was not even on the table for the company. Today, however, the company is currently making its way into Argentina. It’s the last country that company has to reach in Latin America—which is currently its second largest market, making up about $300 million in business. It’s an impressive six-year journey that wouldn’t be possible without Beas.

As the company’s president of Latin America, Beas brought with him decades of experience in opening international markets for direct selling and multilevel marketing companies.

“Let’s say my two first years at the company were spent trying to create the international platform in Latin America,” Beas says. “Now, we are probably the best in offering the international platform for our industry.”

The international platform was no overnight success, though, and it might not have not come to fruition without Beas’s keen insight into Latin America combined with the company’s active spirit.

“Our culture is youthful,” Beas says. “So, we decided to be proactive.”

In his role, Beas oversees everything from sales to legal to marketing for all countries from Chile to Mexico. Each market—which might range from a larger country such as Brazil to a cluster of smaller countries such as Central America—has a general manager that reports to Beas, and

he credits those managers with helping fuel the company’s success. In fact, surrounding himself with the right people is one of the leadership skills that Beas has honed over his career.

“Obviously, studying the law helped me a lot, but the most important thing is to find the right people for your team,” Beas says. “I always try to work with people who are better than myself. I’m very proud of the team I created in the past six years in Latin America because they are the best of the best.”

When looking for team members, Beas looks for people with good communication skills first and foremost. In addition to traditional sales skills, he says that his team members also need to be able to collaborate and work as team.

As far as his own leadership, Beas

says that his number one asset is his ability to listen. That way he can pick up on any opportunity, no matter how crazy it might seem.

“Spend hours with your team, and listen, listen, listen,” Beas says. “I’ve never done anything by myself, but you have to be crazy enough to pay attention every time you have an opportunity.”

It’s Beas’s shrewd ability to pick up opportunities is essential to its success in Latin America, especially Brazil.

Brazil has been host to some of Beas and his team’s most ingenious marketing ideas. In 2017, they bought the naming rights to a giant stadium in Rio de Janeiro that played a major role in the 2016 Olympics. Now, that arena hosts everything from UFC events to concerts by artists, such as Demi Levato and Radiohead. But the company has gone even further by picking up on local customs and traditions.

“Right after that, we discovered that the second biggest sport in Brazil is volleyball,” Beas says. “So, we decided to go further, and we made an agreement with the biggest volleyball team in Rio to sponsor the team. So, we are always in media and television not only with the arena but with the volleyball team as well.”

In addition to sponsoring both men’s and women’s volleyball teams, Beas and his team found the opportunity to make one of their company’s products the official energy of the carnival celebrations in São Paulo and Rio de Janeiro.

With those type of marketing ideas coming from his team, Beas now looks forward to success in Argentina.

“Obviously, studying the law helped me a lot, but the most important thing is to find the right people for your team. I always try to work with people who are better than myself.”

MIGUEL BEAS

“The business opportunity is huge,” Beas says.

And the company is entering the market in a big way by hosting an event in Buenos Aires for than eight thousand people. In fact, Beas hopes that Argentina will be in his company’s top twenty-five markets by the end of the year.

Although it is his most recent company’s first year in the country, it’s not Beas’s first foray into Argentina.

Beas grew up in Spain and attended the University of Murcia in Murcia, Spain, where he studied law. After college, he began working for his first direct-selling company, Forever Living, and when the company needed someone to help launch the company in Argentina, Beas applied, got the job, and moved Buenos Aires.

From there, Forever Living moved him from Argentina to Brazil, Peru, and then Colombia.

Now, Beas has more than twenty years opening markets in Latin America and developing a deep knowledge of local laws and regulations. In fact, he estimated that he has spent 80 percent of his career in Latin American and 20 percent in Europe.

In his current role, Beas spends the majority of his time away from home working for the company. But to him, that’s alright because he believes in the company he works for.

“I can tell you I am totally connected to the mission, to the philosophy, and to the owners of the company,” he says. “We live the brand, not only me as a person, but my colleagues as well.”

Family and mentors proved just as influential as business skills in his mainland move to a leadership role at U.S. Bank

by Lior Phillips

JORGE RIVERA SVP, Associate General Counsel U.S. Bank

By 2010, after years of legal work in the financial services industry, Jorge A. Rivera had worked his way up the ladder to become senior vice president and deputy general counsel of Popular Inc., the largest financial institution based in Puerto Rico and one of the top fifty bank holding companies in the United States. In this role, he advised the organization on numerous strategic transactions and complex bank regulatory matters. It was the result of a career that he wouldn’t have had without the support of his friends, family, and community at large.

In 2016, however, Rivera made a pivotal change. He accepted a role as senior vice president and associate general counsel for Minneapolis-based U.S. Bank. The new role was based in Washington, DC, which meant he and his family would leave their home and community and start again in the nation’s capital.

Rivera says the leap was worth it. In his leadership role at U.S. Bank, he builds

on his legal experience by serving as an influential advisor and playing a crucial role in the bank’s regulatory strategy. Rivera and his team at U.S. Bank are responsible for providing regulatory guidance and expertise on matters that impact the full range of the bank’s consumer products and services.

“The financial services industry plays a crucial role in powering human potential. At U.S. Bank, that means providing our customers, communities, and stakeholders with the resources, tools, and guidance they need to achieve their possible,” Rivera says. “This is one of the reasons why this industry has always appealed to me—and why I was attracted to U.S. Bank as an employer.”

Rivera also recognizes that there have been other influences that have been key to his success.

“I’ve been lucky to have people in my career who I looked up to, not only professionally but also personally,” he says. “These mentors played an important role in helping

me understand where I wanted go and what was important to me in life.”

Senior Vice

President

General Counsel

and Associate

for his extraordinary leadership and outstanding contribution to U.S. Bank and the legal profession

new york . washington, d.c

los angeles palo alto

london paris frankfurt

brussels tokyo and outstanding contribution to

brussels . tokyo . hong kong beijing melbourne sydney We are proud to recognize

One major influence on Rivera’s career was Ignacio Alvarez, the president and CEO of Popular. Alvarez, who was the general counsel for Popular prior to being appointed CEO, has been a constant in Rivera’s professional life. The balance that Alvarez struck between his personal and professional lives, more than anything, was something that the young Rivera aspired to. “He not only has a phenomenal intellect, but he’s also an incredible human being,” Rivera says. “His ability to work through complex issues quickly and provide sensible legal and business advice was something I always looked up to.”

Of course, family and community are just as important. The decision to leave Puerto Rico was not one made lightly. “Family and family values are crucial to us as Puerto Ricans,” he says. “I carry those values with me every day.”

Rivera’s time in Puerto Rico prepared him well to take on a leadership role in the law division of a major commercial bank.

At Popular, Rivera developed a deep skill set in helping organizations and individuals through the challenges associated with lessthan-ideal economic conditions. He says that experience helped him better understand the full scope of challenges facing financial institutions. Paired with his intellectual curiosity, that has readied him for his role at U.S. Bank—a role that he was attracted to for a variety of reasons.

Beyond the opportunities the role afforded, Rivera was drawn to U.S. Bank

because of its culture and values. “I’ve always had great respect for U.S. Bank,” he says. “It constantly delivers outstanding results by leveraging a deeply rooted set of core values, which starts with putting people first and doing the right thing.”

Additionally, U.S. Bank’s law division has made it a priority to positively impact the communities it serves, including Rivera’s native Puerto Rico. “I’ve been able to provide pro bono assistance to victims of Hurricane Maria,” Rivera says. “That’s one of the aspects of U.S. Bank that I appreciate the most: its commitment to help build and support vibrant communities, including a very strong pro bono program.”

Because he, himself, has drawn so much from his personal interactions and sense of community, Rivera has been inspired to lead with commitment to the well-being of his team members. He sees having a strong team morale as a top priority because he says that success follows when individuals feel comfortable in the workplace and can truly be themselves.

“I see myself as a facilitator and collaborator,” he says. “Many times you’re truly successful when you allow yourself to take a step back and empower others to lead. I can then act as a source of knowledge and guidance in pursuit of a common goal.”

Sullivan & Cromwell is pleased to recognize the accomplishments of Jorge Rivera, a leader in the banking bar and a master of the complex legal and regulatory regime applicable to banks. We are proud to have had the honor of working with him both at Popular, Inc. and at U.S. Bancorp.

Plotting the path to Hispanic leadership

How Daniel Gandarilla is helping to unify Texas Health Resources' 26,000 employees through new learning programs

by Jeff Silver

Texas Health Resources (THR), one of the largest faith-based nonprofit healthcare systems in the United States, has grown rapidly over its twentyyear history. The result is a sprawling organization that has grown to more than 26,000 employees, more than 350 care access points, and the Texas Health Physician Group, which includes more than 6,000 physicians and approximately 600 nurses and physician assistants.

This broad reach is effective in helping the organization provide care to the more than seven million residents of the Dallas/ Fort Worth area. The aggregation of so many locations and staff, however, also created a decentralized organization with processes and protocols that were not uniform from

one facility to the next. So, in 2015, Daniel Gandarilla assumed the role of chief learning officer with a targeted directive to enable the employees to establish “one Texas Health.”

With senior leadership support, he launched Texas Health Resources University (THRU), which is intended to maximize the performance and potential of the Texas Health workforce. “Our biggest task is challenging students—the employees, physicians, and nurses we train—to understand their roles as stewards of an entire organization,” Gandarilla says.

THRU is well positioned to achieve its objective because it has strong support from top leaders within the organization. Members of the most senior executive team

form a cabinet and serve as “deans” and “department chairs” for learning functions across the different business units. Their involvement has helped Gandarilla and his team integrate into the business and its operations.

As part of its mission, THRU focuses on five different service lines: clinical education and leadership, academic partnerships and grants, organizational learning and leadership development, physician learning solutions, and shared learning services. These priorities have prompted innovations such as the Operating Room New Graduate Nurse Residency, which trains graduates in the culture and requirements of their new specialties and aligns with the organization’s workforce plans. THRU also created the Talent Acceleration Program, which assess, develops, and mentors high-potential individuals for future roles within the organization. Engaging physicians in their own leadership development and learning also supports organizational innovation, Gandarilla says. This engagement also resulted in collectively developed recommendations for tackling real-world problems, such as how to get physicians in a physician practice home sooner to achieve a better work/life balance.

Prior to THRU, each business unit created its own training, which led to extensive duplication. Now, THRU compares new requests for learning activities against expectations and existing resources and collaborates with other units to find a common, shared approach. The process has helped standardize everything from newhire orientation to training on administering EKGs. It has also helped streamline resources. For example, THRU consolidated

fourteen modules of stroke education down to just three.

Over the past year, THRU has been particularly focused on providing the greatest value possible by introducing new programs and reducing costs. For example, training for the two-year renewal of Basic Life Support and Advanced Cardiac Life Support certifications was streamlined by introducing the American Heart Association’s Resuscitation Quality Improvement Program, which places mobile, computerized mannequin skillsstations in nursing units. This is expected to save the organization $750,000 annually.

THRU also identifies programs that might no longer be appropriate to the evolving healthcare environment. That was the case when it ended a partnership with a local community college to provide associate degrees in nursing because THR now focuses on bachelor’s degree-prepared nurses.