GENERAL SITUATION IN MEXICO

Weekly Review I March 26, 2025

Weekly Review I March 26, 2025

Trump says ‘there’ll be flexibility’ on reciprocal tariffs

• U.S. President Donald Trump announced that a new wave of reciprocal tariffs is set to begin on April 2.

• The goal is to shrink a $1.2 trillion global trade deficit by matching or exceeding foreign tariffs on American goods and targeting non-tariff barriers.

• Trump confirmed a 25% secondary tariff on any country purchasing oil or gas from Venezuela, escalating tensions with China and others heavily reliant on Venezuelan energy.

• While reaffirming his intent to impose tariffs on sectors like automobiles, pharmaceuticals, semiconductors, and aluminum, Trump stated that not all tariffs will be enforced immediately, and “a lot of countries” may receive exemptions—though no specifics were provided.

• The announcement of sector-specific tariffs, especially on autos and tech components, has raised concerns of inflationary pressure, investment hesitation, and supply chain disruptions.

• Trump’s flexibility—potentially delaying or softening some levies—was welcomed by Wall Street, with the S&P 500rising 1.8%, reflecting cautious optimism.

• Economists warn that even partial implementation could affect:

• Consumer prices (due to higher import costs),

• Production costs for U.S. and foreign manufacturers,

• And investment strategies, particularly in sectors exposed to global sourcing (e.g., auto, aerospace, medical devices).

• Mexico could be significantly impacted given its role as a key supplier to the U.S. auto and electronics markets. Uncertainty around exemptions leaves regional manufacturers exposed to cost increases and supply chain reconfigurations.

• A White House official confirmed that exact timelines for the implementation of sector-specific tariffs are still to be determined and remain at Trump’s discretion.

• The Federal Reserve is closely tracking these developments as they weigh on inflation expectations and business confidence.

• Policymakers are debating whether monetary policy should respond preemptively to possible tariff-induced inflation or slowdown in investment.

• U.S. automakers and pharmaceutical firms have privately lobbied for waivers or delays, and some succeeded temporarily, but uncertainty remains high across the industrial sector.

• Equity markets rebounded amid speculation that the tariff package may be narrower than initially feared.

• Businesses in trade-sensitive industries (auto, tech, steel) remain cautious, holding back on hiring and expansion until more clarity emerges.

• Companies with cross-border operations in Mexico are reevaluating cost structures and contingency plans in case USMCA-related protections do not shield them from new duties.

Economists remain divided over the longer-term consequences:

• Some believe Trump’s tariff threats are a negotiating tactic that may result in limited actual disruption.

• Others see a risk of trade fragmentation, especially if partners retaliate or shift their supply chains away from the U.S.

• The Federal Reserve’s next move is likely to be influenced by how much the April 2 tariffs affect core inflation and consumer demand.

SOURCE: REUTERS

Mexico’s Economy Minister Marcelo Ebrard will travel to Washington this Wednesday for the fifth time this year to negotiate the future of Mexico’s automotive exports amid potential U.S. tariffs. He emphasized that such tariffs would also impact American companies operating in Mexico. As part of President Claudia Sheinbaum’s Plan México, Ebrard seeks to strengthen national industry, including the development of Mexico’s first electric bus. Altagracia Gómez, head of CADERR, stated that Mexico arrives prepared with a strategic plan for fair trade.

SOURCE: EL FINANCIERO

Hyundai Motor Group has announced a major investment of $21 billion in the United States over the next four years. The investment includes a new steel plant in Louisiana and the expansion of automotive operations in Georgia.

• Hyundai Steel will invest $5.8 billion to build its first steel plant in the U.S., expected to produce 2.7 million metric tons per year.

• The project is anticipated to create around 1,300 jobs, boosting local employment and U.S.-based supply capabilities.

• Hyundai plans to open a new vehicle assembly plant in Savannah, Georgia, further strengthening its North American production footprint and supporting the growing demand for electric vehicles.

• Tariff Mitigation Strategy: This investment appears to be a strategic move to avoid potential U.S. tariffs, as President Donald Trump has threatened new duties on countries with large trade surpluses with the U.S., including South Korea.

• Supply Chain Resilience: By localizing steel and vehicle production, Hyundai is aiming to reduce dependence on international logisticsand mitigate risks from future trade restrictions.

• Political Positioning: Trump publicly praised Hyundai’s announcement, suggesting that companies investing in U.S. manufacturing may be exempt from upcoming tariffs. This reinforces a broader policy trend favoring domestic production.

SOURCE: CNN

• INITIATIVE WITH DRAFT DECREE TO REFORM AND ADD VARIOUS PROVISIONS TO THE FEDERAL LABOR LAW

Presented by: Sen. Amalia Dolores García Medina (LNal - MC) (View profile of the actor)

Objective: To include workplace cyberbullying as grounds for terminating the employment relationship without liability for either the employer or employee, depending on the offender. Employers will be required to implement protocols to prevent and address cyberbullying, with penalties for violators.

Status: 2025-03-20 - Published in the Parliamentary Gazette

• INITIATIVE WITH DRAFT DECREE TO ADD SECTION VI) AND AMEND THE SUBSEQUENT SECTION OF ARTICLE 74 OF THE FEDERAL LABOR LAW REGARDING MANDATORY REST DAYS

Presented by: Sen. Juan Carlos Loera De la Rosa (Chih - MORENA) (View profile of the actor)

Objective: To establish November 2nd of each year as a mandatory rest day.

Status: 2025-03-19 - Published in the Parliamentary Gazette

• DRAFT INITIATIVE TO REFORM AND ADD VARIOUS PROVISIONS OF THE FEDERAL LABOR LAW ON SALARY TRANSPARENCY

Presented by: Deputy Mirna María de la Luz Rubio Sánchez (Hgo - MORENA) (View actor profile)

Objective: To ensure salary transparency by prohibiting clauses that limit workers’ access to salary criteria, requiring employers to disclose pay scales, and mandating the creation of mixed salary transparency committees in companies with over 50 employees. Employers must guarantee equal pay for equal work and prevent retaliation against employees seeking pay equity.

Status: 2025-03-19 - Published in the Parliamentary Gazette

• INITIATIVE WITH DRAFT DECREE TO REFORM ARTICLE 63 OF THE FEDERAL LABOR LAW

Presented by: Sen. Julieta Andrea Ramírez Padilla (BC - MORENA) (View profile of the actor)

Objective: To establish that employees will be granted at least one hour of rest during continuous work shifts.

Status: 2025-03-19 - Published in the Parliamentary Gazette

• DECLARATION OF PUBLICITY OF THE OPINION WITH DRAFT DECREE TO REFORM THE TENTH PARAGRAPH OF ARTICLE 25 AND SECTION XXIX-Y OF ARTICLE 73 OF THE POLITICAL CONSTITUTION OF THE UNITED MEXICAN STATES, REGARDING ADMINISTRATIVE SIMPLIFICATION AND DIGITIZATION

Presented by: Constitutional Points (View composition)

Objective: To require all levels of government to implement public policies for administrative simplification and digitization of procedures and services, regulatory best practices, and the development of public technological capacities. It authorizes Congress to issue a national law establishing principles and obligations for these areas.

Status: 2025-03-19 - Published in the Parliamentary Gazette

• INITIATIVE WITH DRAFT DECREE TO REFORM, ADD, AND REPEAL VARIOUS PROVISIONS OF THE PUBLIC WORKS AND RELATED SERVICES LAW

Presented by: Federal Executive

Objective: To create the Digital Public Procurement Platform aimed at automating the entire public procurement process for greater speed and transparency. It introduces new contracting strategies, including strategic dialogues, market research, social witnesses, and tighter regulations to prevent conflicts of interest and monopolistic practices. It also establishes legal measures to enforce compliance and extend sanctions.

Status: 2025-03-13 - Published in the Parliamentary Gazette

• INITIATIVE WITH DRAFT DECREE TO ADD A FOURTH PARAGRAPH TO ARTICLE 5 OF THE LAW ON PROTECTION AND DEFENSE OF FINANCIAL SERVICE USERS

Presented by: Sen. Luisa Cortés García (Oax - MORENA) (View profile of the actor)

Objective: To require financial institutions to provide preferential service to elderly individuals, people with disabilities, or those in a bedridden state, establishing alternative, effective, and efficient service mechanisms that ensure the health of users, especially when they are unable to travel to the institution’s physical location.

Status: 2025-03-19 - Published in the Parliamentary Gazette

The export manufacturing industry (INDEX) in Mexicali is developing a data intelligence model to identify buyers’ needs and align supply and demand, fostering innovation and technological growth in Baja California. INDEX President Salvador Maese Barraza highlighted that this initiative will strengthen the “Hecho en México” strategy by integrating procurement and technology committees with the state’s Economy and Innovation Secretariat to refine supply profiles. Currently, only 3% of export companies’ supplies are locally sourced, presenting an opportunity to enhance economic resilience. The project includes company visits to gather data directly from decision-makers, which will be compiled into a technological platform to analyze trends and strengthen the supply chain.

SOURCE: INDUSTRIAL NEWS BC

FEMIA, the Mexican Federation of Aerospace Industry, organized the “Sé Proveedor Aeroespacial” seminar in Hermosillo, Sonora, which successfully brought together key players in the aerospace industry. The event featured insightful presentations on industry trends, certification transitions, and supply chain optimization. Attendees engaged in networking activities, including B2B meetings and speed-dating sessions with major aerospace companies such as Bombardier, Collins Aerospace, GE Aerospace, Latécoère, and Safran. The seminar served as a valuable platform for strengthening business relationships, fostering innovation, and enhancing Mexico’s position in the global aerospace sector.

SOURCE: FEMIA

The government of Nuevo León has announced a series of tax incentives aimed at attracting investments outside the metropolitan area and boosting the state’s economy. These include a 100% Payroll Tax (ISN) exemption for exporting companies operating through the Colombia Bridge, as well as discounts for companies investing over $50 million and creating more than 100 jobs, based on the percentage of local suppliers used. Additionally, taxpayers with ISN debts can benefit from subsidies and reductions in fines. Special incentives have been introduced for sectors like automotive, with significant discounts for manufacturers and suppliers, and for priority groups such as women, people with disabilities, and entrepreneurs. These measures are designed to strengthen local businesses’ competitiveness, improve financial regularization, and contribute to the economic stability of the state.

SOURCE: CLUSTER INDUSTRIAL

Cruz Perez Cuellar, the licensed municipal president of Ciudad Juarez, participated in the “Smart City Summit & Expo 2025 Fair” in Taiwan, where he presented the Municipal Government’s investments in technology and public safety. He discussed topics such as joining the smart cities network, developing smart commercial corridors, technology education, and fostering partnerships with entrepreneurs and the private sector. The event, held from March 18 to 22 in Taipei and Kaohsiung, is the largest of its kind in Asia, focusing on artificial intelligence, sustainability, security, and smart mobility. Perez Cuellar’s visit, at the invitation of the Taipei Economic and Cultural Office, also included plans to visit major Taiwanese companies like Wistron, Foxconn, and Pegatron in Ciudad Juarez, where Taiwanese businesses contribute significantly to local employment. He was accompanied by key officials, including Roberto Mora Palacios, Raúl Monárrez, and businessman Octavio Fuentes.

SOURCE: MEXICO NOW

During a working tour in Houston, Guanajuato Governor Libia Dennise García Muñoz Ledo, accompanied by Secretary of Economy Claudia Cristina Villaseñor Aguilar, met with María Elena Orantes, representative of the Mexican Consulate in Houston, and local business leaders to strengthen international ties and promote Guanajuato’s competitive advantages. The discussions focused on enhancing bilateral business in key sectors such as aerospace, energy, tourism, and automotive. Governor García Muñoz Ledo also invited entrepreneurs to invest in Guanajuato, highlighting its strong economy, education system, and legal certainty. The delegation visited the Houston Spaceport to propose collaboration on developing specialized human capital for the aerospace industry and integrating Guanajuato businesses into global supply chains. These actions reaffirm the government’s commitment to positioning Guanajuato as a leading destination for investment, innovation, and technological development.

SOURCE: MEXICO NOW

The Mexican government will invest 122.6 billion pesos in water infrastructure projects from 2024 to 2030 to strengthen water supply and management. The plan, led by the National Water Commission (Conagua), consists of 17 strategic projects targeting regions with severe water shortages and a “Master Plan” addressing municipal needs. In 2025 alone, 15 billion pesos will be invested, benefiting 36 million people. Key projects include desalination in Rosarito, dams in Baja California, Durango, and Zacatecas, and a 50-billion-peso plan for Mexico City and surrounding states. Additional projects will be developed in southern states like Guerrero and Oaxaca. This initiative follows a severe water crisis that influenced the 2024 elections, with concerns about a “Day Zero” scenario in Mexico City. President Claudia Sheinbaum emphasized that the plan also includes agricultural irrigation modernization to free up water for human consumption.

SOURCE: DOSSIER POLÍTICO

Echo Global Logistics expands its presence in Mexico with new offices in Mexico City, aiming to strengthen cross-border trade with the U.S. and double its business in 2025. CEO Douglas Waggoner emphasized Mexico’s importance amid the nearshoring trend, while Echo Mexico President Troy Ryley highlighted the role of local talent and strong carrier relationships. The company has expanded services beyond transportation to include customs management, warehousing, and border crossings. With an $80 million annual investment in technology, Echo is enhancing visibility and efficiency in logistics operations. The company anticipates significant growth despite industry challenges.

SOURCE: T21

The Mexican company Energía Real has announced an ambitious expansion plan with a projected investment of 700 million dollars by 2031. The capital will be primarily allocated to the production and storage of on-site solar energy, by installing systems in business facilities and industrial parks.

The Chinese company Yadea, a manufacturer of electric motorcycles, has announced the construction of a new plant in Ocoyoacac, State of Mexico, with a projected investment of 78.6 million dollars. The facility is expected to be completed by May 2025 and is projected to generate around 200 jobs in the region.

The U.S. company Resideo announced an investment of 4.9 million dollars to establish a corporate office in Aguascalientes, which will provide support and service to its clients, primarily in North America. The planned office will be located in the northern part of the city and will create employment for 150 highly qualified professionals.

The Korean-owned company Dual Borgstena will invest 15 million dollars in the construction of a new plant located in the Parque Industrial Libramiento Norte in Monclova, Coahuila. This new facility is expected to initially generate around 300 jobs, with a projection to reach 1,000 jobs by 2027. The plant will span 14,000 square meters and is scheduled to begin operations in September 2025.

Grupo Fermaca announced a US $3.7 billion investment in Durango, including a $2.7 billion hyperscale data center and a $1 billion nitrogen fertilizer plant. The Fermaca Digital City data center, set to be the largest in Latin America with a 250-megawatt capacity, will serve major digital companies like Amazon and Netflix. The project includes infrastructure such as gas pipelines and fiber optic networks to support operations. Meanwhile, the Fermachem fertilizer plant in Lerdo aims to produce 600,000 tons of urea annually, reducing Mexico’s reliance on imports. These projects align with President Claudia Sheinbaum’s Plan Mexico to boost economic growth.

SOURCE MEXICO INDUSTRY

Turnkey operations offer a fast, low-risk path for companies entering Mexico by handling everything from facility setup to legal compliance. These comprehensive services help businesses start production quickly—often within weeks—while maintaining quality, controlling costs, and avoiding the need to establish a legal entity. Ideal for accelerating time-to-market, especially under complex regulatory conditions.

Using an Employer of Record (EOR) in Mexico allows companies to hire local talent quickly without setting up a legal entity. EORs handle HR, payroll, and compliance with local labor laws—reducing risk, saving time, and ensuring a smooth hiring process. It’s an ideal solution for testing the market, scaling teams, or managing temporary projects.

Complying with USMCA

• Emilio Cadena, CEO of Prodensa, stated that if the U.S. maintains tariff exemptions under the USMCA, companies not yet complying would need 6 to 12 months to adapt.

• Shifting suppliers is complex and requires investment in infrastructure, as well as ensuring sufficient factories, machinery, and workforce. According to the Cato Institute, 40% of exports to the U.S. would need to transition from Most Favored Nation (MFN) status to avoid a 25% tariff imposed on March 4.

• This shift affects multiple sectors, including aerospace, medical devices, and capital goods, beyond the automotive industry. The uncertainty surrounding the U.S. decision on April 2 is delaying investment projects, with 30% of Prodensa’s clients putting plans on hold, particularly Chinese investors.

• While Cadena sees short-term uncertainty, he remains optimistic in the medium term, given Mexico’s growing importance in U.S. supply chains.

Source: REFORMA

For Mexican exporters, taking full advantage of the United States-Mexico-Canada Agreement (USMCA) can mean the difference between a competitive edge and increased operational costs.

As global trade becomes increasingly competitive, cost optimization is a top priority for exporters. Export products that qualify as originating under the USMCA can benefit from an exemption from the 25% tariff. This makes compliance with rules of origin a critical factor in reducing trade costs and improving market positioning.

For Mexican exporters, the challenge is twofold:

• Confirming whether their products qualify for USMCA tariff benefits.

• Identifying the necessary modifications in supply chains, inputs, or manufacturing processes to meet USMCA origin requirements if they do not initially qualify.

A tailored approach that includes origin assessments, supply chain optimizations, and regulatory compliance strategies can help exporters reduce costs and mitigate trade risks.

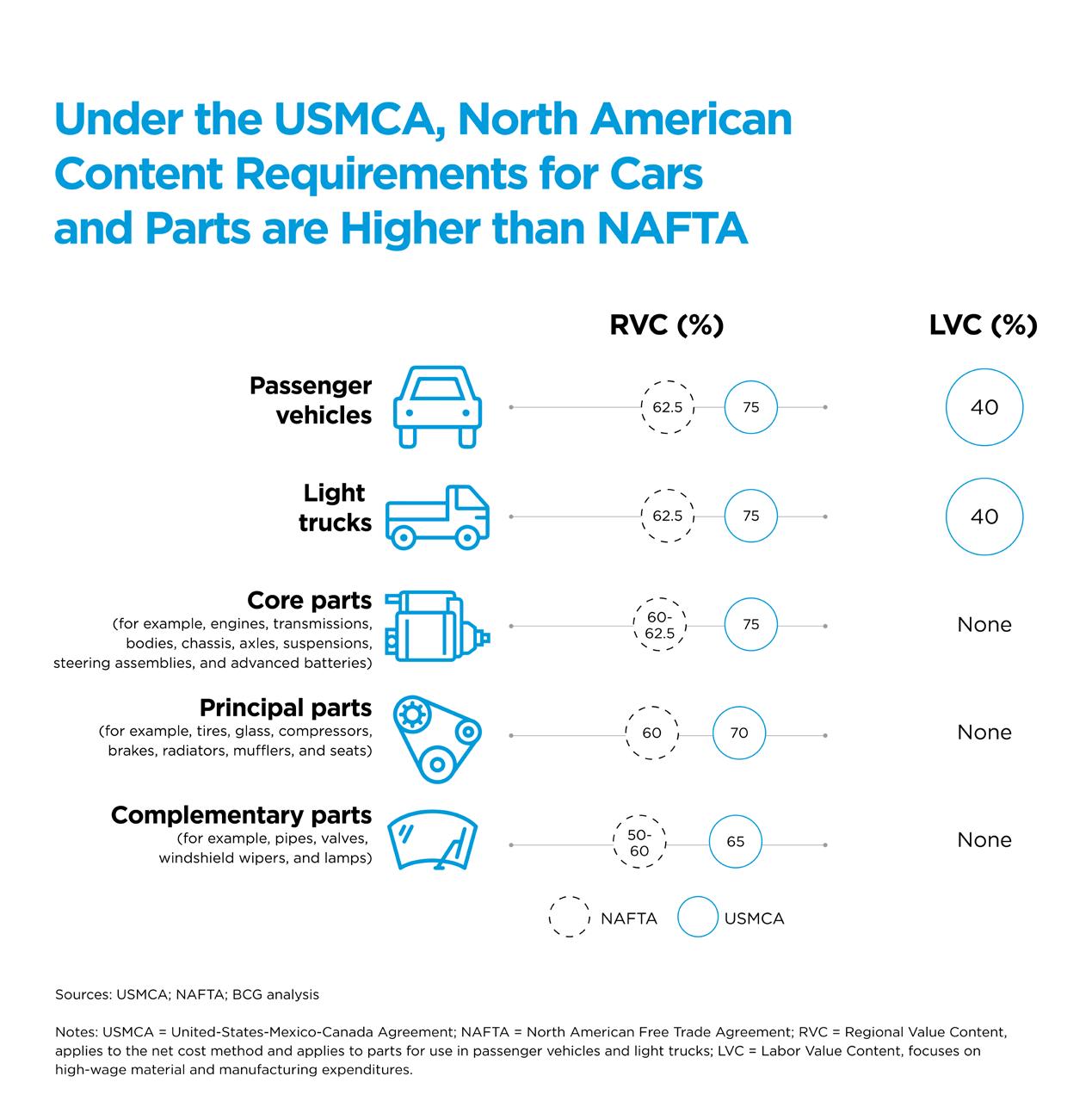

The USMCA determines a product’s eligibility for tariff exemptions based on its rules of origin. These rules take into account:

• The manufacturing process and the extent of transformation.

• The percentage of regional value content (RVC) from North America.

• The origin of inputs used in production.

A comprehensive origin assessment is essential to verify if a product qualifies for preferential treatment or requires adjustments to meet compliance standards.

If a product does not meet USMCA’s origin requirements, exporters must analyze the reasons why. Common factors preventing qualification include:

• Non-originating inputs: Raw materials or components sourced from outside North America.

• Insufficient value-added transformation: The product does not undergo enough manufacturing or processing to qualify as originating.

• Incorrect tariff classification: The product may be misclassified, affecting eligibility under USMCA’s origin rules.

A non-compliance diagnosis identifies these obstacles and provides a roadmap for modifications that align with the trade agreement’s requirements. If the product does not qualify, an origin assessment can highlight specific adjustments that could make it eligible, such as sourcing alternative inputs or modifying production steps.

Successfully optimizing tariff exemptions under USMCA goes beyond simply meeting origin requirements. Companies looking to enhance their long-term trade competitiveness should explore advanced strategies, including supply chain restructuring, leveraging trade zones, and adopting digital compliance tools. These approaches can help reduce costs, improve efficiency, and ensure long-term regulatory compliance.

Focus: Supplier and material sourcing, specifically where they are sourced

Goal: Ensure raw materials and components come from USMCA-compliance suppliers to meet Regional Value Content requirements and qualify for tariff exemptions.

• Shifting procurement strategies to source from Mexico, the U.S. or Canada instead of non-USMCA regions

• Restructuring supplier agreements to prioritize USMCA-compliance input sourcing

• Certifying suppliers to confirm that materials meet origin criteria

Focus: Production and assembly adjustments, focusing on how a product is made

Goal: Modify how a product is manufactured or assembled to ensure it undergoes substantial transformation and qualifies as originating under the USMCA.

• Reconfiguring manufacturing steps to ensure a tariff shift or RVC increase.

• Optimizing the assembly process so components undergo the required transformation.

• Reassessing tariff classification strategies to minimize duties and ensure compliance.

Focus: Material and design adjustments, changing what materials are used in the process

Goal: Replace non-originating materials or alter product composition to increase the share of USMCA-originating content and enhance compliance.

• Substituting non-originating materials with regionally-sourced alternatives

• Introducing additional processing steps to increase the regional value content

• Establishing partnerships with regional manufacturers to increase local content

In addition to meeting USMCA origin requirements, Mexican exporters must ensure full compliance with customs and trade regulations.

Risk

• Proper documentation to support origin claims and avoid customs disputes.

• Audit preparation in case of a verification request from authorities.

• Regularly review HS Codes and consult tariff classification experts to avoid misclassification.

• Establish backup suppliers within North America to maintain compliance with regional value content (RVC) requirements.

• Stay updated on USMCA regulatory updates and consult trade specialists when modifications to the agreement arise

Mexican exporters can maximize their competitiveness by taking a strategic approach to USMCA compliance. By conducting a detailed origin assessment and implementing supply chain optimizations, companies can:

• Reduce tariff costs.

• Ensure full regulatory compliance.

• Minimize risks in international trade operations.

• For exporters looking to fully capitalize on USMCA benefits, expert guidance and proactive planning are the keys to long-term success.

The Exporter’s Checklist for USMCA Compliance

Ensuring USMCA compliance is essential for Mexican exporters to maintain tariff benefits and avoid penalties during customs audits or verification processes.

• Maintain Accurate Documentation

• Verify Supplier Compliance

• Confirm Product Eligibility & Origin Calculations

• Prepare for a Customs Verification Visit

• Stay Updated on Regulatory Changes

• Leverage Technology for Compliance Management

The USMCA tariff landscape is more complex than ever, forcing exporters to take a closer look at both short-term cost strategies and longterm trade resilience. What once may have been a straightforward compliance exercise is now a critical business function—one that directly impacts profitability, market access, and supply chain agility.

Companies that are proactive rather than reactive will gain a significant competitive edge. Regular origin assessments, supply chain optimizations, and risk evaluations are no longer just best practices—they are essential for mitigating unexpected tariff liabilities and regulatory hurdles.

The reality is that trade agreements evolve, enforcement intensifies, and supply chain disruptions remain unpredictable. The companies that will thrive are those that don’t wait to see what happens next—they anticipate challenges, adjust their strategies frequently, and ensure that they remain compliant before audits and penalties become a problem.

USMCA compliance is not just a box to check— it is a strategic advantage. Now is the time to reassess, restructure, and reinforce your company’s trade position, ensuring that you protect your margins, maintain tariff exemptions, and secure your long-term competitive standing in North America.

The companies that lead tomorrow are those that optimize today.