GENERAL SITUATION IN MEXICO

Weekly Review I December 18, 2024

Weekly Review I December 18, 2024

The Secretariat of Economy held a meeting with 155 entrepreneurs, startups, consultants, and professionals from the space industry, all categorized as small and medium-sized enterprises, to foster greater professional activity and economic participation in Mexico in 2025. Attendees introduced themselves, outlining their space sector specialties and how they could contribute to Mexico’s economy by developing international projects. The group agreed to create a list of global events, fairs, congresses, and symposia where Mexican space industry presence should be ensured. Periodic meetings will be held to provide feedback, exchange experiences, and generate seed capital for future space-related ventures. This meeting follows a similar event in Milan during the 75th International Astronautical Congress, where 200 young Mexican professionals, half from Mexico and the other half working abroad on space projects, gathered. The event included participants from institutions such as UNAM, IPN, INAOE, and several space industry SMEs like DEREUM LABS, HYPERNOVA AEROSPACE, and COSMOS MEXICO. The gathering was organized by the Secretariat of Economy’s General Directorate for the Aerospace Sector as part of a broader strategy to foster technological development and enhance Mexico’s economy.

SOURCE: MEXICO NOW

Dongfeng Motor Corporation, with over 50 years of experience in vehicle manufacturing, is entering the Mexican market as part of its strategy to compete in Latin America’s growing automotive industry. The Chinese brand joins 36 others seeking to tap into the Mexican market with a diverse portfolio of vehicles, including SUVs, sedans, pickups, and electric models. Initially, Dongfeng will launch 10 models, including compact cars, SUVs, and pickups, offering combustion, hybrid, and electric options, with warranties ranging from 3 to 5 years or 100,000 to 150,000 km. Among the models expected in February 2025 are the SX3, Shine Max, E70, and Rich 6. Dongfeng’s vehicles will feature advanced technology, fuel efficiency, and modern design, targeting key segments like family and work vehicles. The brand plans to establish a robust distribution and after-sales network to support its market penetration and expects to introduce five additional models by 2026. This move marks a significant expansion for Dongfeng, strengthening its global presence and competing in Mexico’s competitive automotive sector.

SOURCE: MEXICO INDUSTRY

Grupo Valcas is investing $1.1 billion to develop a 500-hectare park in northern Ensenada, featuring a 350-hectare industrial zone and a 150-hectare technology park aimed at fostering regional economic growth, creating 10,000 jobs, and strengthening industry-academia collaboration. The project, supported by land-use guidelines from Sidurt, seeks to attract technology companies and establish a specialized tax precinct. With a development timeline of 5 to 10 years, the park will address water supply needs through desalination options. Positioned as a complement to Tijuana’s industrial parks, the project highlights Baja California’s potential for broader regional development and innovation.

SOURCE: MEXICO NOW

Sonora Governor Alfonso Durazo led the launch of the Sonoran Association of Industrial Parks (ASPI), a key initiative to boost the state’s industry and economy through the Sonora Sustainable Energy Plan. Durazo emphasized that the project positions Sonora as a competitive hub by utilizing clean energy, which is increasingly demanded by businesses. He noted that the initiative integrates industrial policy—a field neglected for decades in Mexico—to foster the development and adoption of new energy sources. According to INEGI, Sonora has seen significant industrial growth, ranking second nationwide with a 5.2% increase over the past year.

SOURCE: PROYECTO PUENTE

NUEVO LEON

FINSA, a leading industrial park developer in Mexico, has begun work on its fifth park in Nuevo León, FINSA Monterrey Apodaca II, spanning 79 hectares in two phases. Strategically located in a high-demand industrial corridor with abundant labor, public transport, and excellent connectivity to the U.S. and central Mexico, the park aims to host 20 companies across various sectors, potentially generating 35,000 direct and indirect jobs. This sustainable development incorporates circular economy practices, including water reuse systems, solar panels for common areas, and a 20 MVA electrical substation. Sergio Argüelles, FINSA’s CEO, highlighted the park’s role in leveraging nearshoring opportunities, attracting global investments, and boosting Mexico’s competitiveness. Currently, FINSA operates four parks in Nuevo León, supporting 94 companies and 31,000 jobs, while nationally, it manages over 12 million square meters of industrial space, with 17% certified under LEED sustainability standards.

SOURCE: GRUPO EN CONCRETO

Fibra MTY, Mexico’s first internally managed real estate trust, has acquired the “Batach” industrial portfolio in Monterrey for $192.4 million as part of its expansion strategy. The portfolio includes eight Class A industrial buildings with a gross rentable area of 185,966 m² on 347,306 m2 of land. The acquisition is being completed in two phases: an initial $119 million payment for six stabilized warehouses and $73.4 million for two under-construction warehouses to be delivered in mid-2025. The portfolio is expected to generate $14.1 million in annual net operating income, enhancing cash flow and strengthening Fibra MTY’s position in Mexico’s industrial real estate market. As of September 2024, Fibra MTY’s portfolio comprises 112 properties with a 96% occupancy rate and a total rentable area of 1.76 million m2

SOURCE: MEXICO NOW

Governor Manolo Jiménez Salinas led a successful tour in Italy to promote Coahuila’s competitive advantages and attract new investments. The state strengthened relations with Italian automotive companies already operating in Coahuila and signed a collaboration agreement with the Mexico-Italy Chamber of Commerce (CAMEXITAL) to facilitate strategic partnerships and promote Coahuila’s economic potential. Networking events highlighted key investment opportunities in the region, particularly in strategic industries, while showcasing Coahuila’s robust infrastructure and resources to Italian business leaders. These efforts aim to position Coahuila as a prime destination for international investments.

SOURCE: GOVERNMENT OF COAHUILA

A delegation from the Chihuahua government recently met with Foxconn executives to follow up on joint projects and reinforce trade relations with Taiwanese companies operating in the region. Governor Eugenia Campos previously visited Taiwan in October 2024, where she discussed leveraging Taiwanese technologies to boost growth in key industries such as electronics, semiconductors, automotive, medical devices, aerospace, and renewable energy. Foxconn, a global leader in electronics manufacturing, currently operates three plants in Chihuahua. In September 2023, the company announced a $500 million investment to relocate two plants within the state, creating over 5,000 jobs.

SOURCE: MEXICO INDUSTRY

Executives from Proma Group, an Italian automotive components manufacturer, met with Tere Jiménez, Governor of Aguascalientes, to discuss the state’s competitive advantages as a strategic destination for investment. Andrea Massimo Fusco, Vice President of Proma México, expressed the company’s interest in expanding its operations in Mexico, citing Aguascalientes’ skilled workforce and dynamic industrial environment. Proma specializes in high-tech components such as seat structures, body assemblies, and suspension crossmembers, operating 27 plants across 10 countries. During the meeting, state officials highlighted Aguascalientes’ 18% export growth in early 2024, driven by the automotive sector, positioning the state as a national leader in economic growth and a trusted destination for foreign investment.

SOURCE: MEXICO NOW

The Head of Government of Mexico City, Clara Brugada Molina, launched the MERCOMUNA social program to strengthen family and community economies. It aims to benefit one million people in high social vulnerability over the next six years. The program provides MXN 1,000 grocery vouchers, allowing recipients to purchase basic food items from local businesses. Initially, 20,000 people, 75% women, and 25% men, will benefit. The program, born during the COVID-19 pandemic to support families in Iztapalapa, will expand to reach one million beneficiaries by 2025. Local businesses are encouraged to join the initiative, which currently includes 6,500 small businesses across the city, marked with a sticker indicating participation.

SOURCE: GOBIERNO DE LA CIUDAD DE MÉXICO

Marcelo Ebrard, Secretary of Economy, met with Manola Zabalza, Secretary of Economic Development for Mexico City, to discuss investment projects and regional growth. Ebrard urged officials to capitalize on opportunities in each region and track investments to boost local economies. He emphasized the importance of the “Made in Mexico” label for export certainty. Zabalza highlighted the need for Mexico City to be open to private investment, aligning with the specific needs of its 16 boroughs. She reassured investors by promoting certainty and security, referencing the newly established Mexico City Investment Agency (InCDMX), which aims to attract investment. The meeting also included other key officials focused on economic development.

SOURCE: 24 HORAS

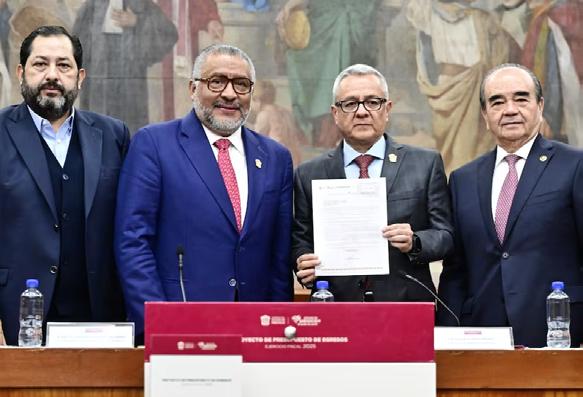

The government of the State of Mexico, led by Finance Secretary Óscar Flores Jiménez, presented the 2025 Fiscal Package to the State Congress, totaling 388.6 billion pesos. The budget prioritizes sectors such as security, health, water, mobility, agriculture, and municipal support, without increasing public debt. Flores emphasized the package’s responsible crafting, under the principles of republican austerity, while considering both local and global economic realities. For 2025, robust revenue is expected, with adjustments to environmental taxes in collaboration with the 125 municipalities. The focus will remain on public policies enhancing public welfare and investments in public works across the state, ensuring transparency and efficiency in public spending. Legislators, led by Maurilio Hernández González, will conduct a thorough review of the proposals. Horacio Duarte Olivares, Secretary General of Government, highlighted the package as a reflection of Governor Delfina Gómez Álvarez’s commitment to the state’s development and social vision.

SOURCE: DIARIO PORTAL

Executives from Proma Group met with Tere Jiménez, Governor of Aguascalientes. The Italian company specializes in the production of components for the automotive industry.

With an investment of $22.5 million, Emerson will build its new plant in the Bafar Norte Industrial Complex in Chihuahua. This complex is expected to generate around 600 direct jobs.

SOURCE: MEXICO INDUSTRY

• INITIATIVE TO REFORM THE FIRST PARAGRAPH OF ARTICLE 87 OF THE FEDERAL LABOR LAW REGARDING THE INCREASE FROM 15 TO 30 DAYS OF SALARY IN THE PAYMENT OF ANNUAL CHRISTMAS BONUS FOR WORKERS

Presented by: Deputy Napoleón Gómez Urrutia (MORENA)

Subject: Proposes increasing the annual Christmas bonus payment for workers in Mexico from 15 to 30 days of salary to improve worker compensation and economic well-being.

Status: Presented to the plenary of the Chamber of Deputies

• INITIATIVE THAT ADDS VARIOUS PROVISIONS TO THE FEDERAL LABOR LAW

Presented by: Deputy Manuel de Jesús Baldenebro Arredondo (MORENA)

Subject: Proposes adding a chapter titled “Work through Digital Platforms,” granting digital platform workers equal rights under the Constitution and requiring their social security registration within 30 days.

Status: Approved by the Senate and sent to the Executive for its approval

• REFORM AND ADDITION OF PROVISIONS TO THE FEDERAL LABOR LAW AND THE FEDERAL LAW OF WORKERS IN THE SERVICE OF THE STATE, ARTICLE 123 OF THE CONSTITUTION

Presented by: Submitted by the Executive Subject: Establishes explicit measures in both sections of Article 123 of the Constitution to eradicate the gender wage gap in labor laws.

Status: Approved by the Chamber of Deputies and sent to the Executive for its approval

• PROPOSAL TO EXTEND FISCAL INCENTIVES IN THE NORTHERN BORDER REGION

Presented by: Sen. Juan Carlos Loera De la Rosa (Chih - MORENA)

Subject: Urges the Federal Executive to extend fiscal incentives in the northern border region for six more years to strengthen the regional economy, boost investment, improve competitiveness, and enhance family welfare in this strategic area.

Status: Published in the Parliamentary Gazette

• THIRD MODIFICATIONS TO MISCELLANEOUS TAX RESOLUTION 2024

Presented by: Ministry of Finance and Public Credit

Subject: Establishes virtual assets authorized by the Bank of Mexico as legal tender. Requires financial technology institutions to register and obtain authorization from the Bank of Mexico to operate with virtual assets. Grants one year for the Bank of Mexico to analyze and approve eligible virtual assets for legal tender.

Status: Published in the DOF

• FEDERAL EXPENDITURE BUDGET FOR 2025

Presented by: Budget and Public Account Commission

Subject: Approved total expenditure of MXN 9.3 trillion with a budget deficit of MXN 1.17 trillion. Resources are allocated across various ministries, prioritizing public health, security, education, and social programs.

Status: Approved, Sent to the Executive

• GENERAL CYBERSECURITY CITIZEN LAW; REPEALS PROVISIONS OF THE FEDERAL PENAL CODE

Presented by: Sen. Jesús Lucía Trasviña Waldenrath

Subject: Repeals the chapter on “Illicit Access to Systems and Computer Equipment” in the Federal Penal Code. Proposes a General Cybersecurity Citizen Law to protect digital information, create the National Cybersecurity Agency, and establish a National Cybersecurity Policy and Cyber Incident Registry.

Status: Published in the Parliamentary Gazette

ENVIRONMENTAL

• AMENDMENTS TO MEXICO CITY FISCAL CODE

Presented by: Ecology and Sustainable Development Commission

Subject: Extends the deadline for banning non-biodegradable plastic beverage containers. Prohibits containers with 25% recycled plastic starting Jan 1, 2027, and with 30% recycled plastic by 2028.

Status: Published in the Parliamentary Gazette

• TRANSITIONAL ARTICLE TWO OF THE STATE WASTE LAW REFORM DECREE

Presented by: Ecology and Sustainable Development Commission

Subject: Extends the deadline for banning non-biodegradable plastic beverage containers. Prohibition for containers with 25% recycled plastic starts Jan 1, 2027, and with 30% recycled plastic by 2028.

Status: Published in the Parliamentary Gazette

An Employer of Record (EOR) in Mexico serves as a strategic partner for companies aiming to expand into the Mexican market without establishing a legal entity. By acting as the legal employer, an EOR manages compliance with local labor laws, payroll, and benefits administration, allowing businesses to focus on their core operations.

Key Benefits of Utilizing an EOR in Mexico:

• Simplified Market Entry: Facilitates rapid expansion by handling administrative and legal requirements.

• Compliance Assurance: Ensures adherence to Mexico’s comprehensive labor laws, mitigating legal risks.

• Efficient Payroll Management: Manages payroll processes, including mandatory benefits and tax withholdings.

• Cost Savings: Reduces the need for significant upfront investment in infrastructure and administrative personnel.

• Risk Mitigation: Transfers employment liabilities to the EOR, protecting the parent company from potential legal issues.

• Hands-on Support: Some EOR providers may lack a physical presence in Mexico, potentially affecting service quality.

• Flexibility: Certain EOR solutions might not offer customizable services tailored to specific business needs.

• Regulatory Scrutiny: Recent changes in Mexican labor laws have increased oversight on outsourcing practices, necessitating careful compliance management.

• Understanding Mexico’s Labor Laws:

Mexico’s labor laws are among the most comprehensive in Latin America, emphasizing worker protections and social justice. Key provisions include a standard 48-hour workweek, mandatory benefits such as a Christmas bonus and paid vacation, and strict anti-discrimination regulations. An EOR ensures that companies comply with these laws, facilitating smooth operations in the Mexican market.

In summary, partnering with an experienced EOR in Mexico enables companies to navigate the complexities of the local labor market efficiently, ensuring compliance and operational effectiveness while minimizing risks associated with international expansion.

Startups are revolutionizing foreign trade and logistics in Latin America by leveraging technology to enhance efficiency, transparency, and access to capital. At the recent TradeHub Customs & Trade Innovation Summit, industry leaders highlighted several key innovations:

• Democratizing Access to Capital: Companies like Mundi are providing rapid, technology-driven financing solutions to businesses with monthly revenues between $500,000 and $10 million, a segment often underserved by traditional banks. This approach accelerates business operations by reducing the time required to secure capital.

• Enhancing Efficiency and Transparency: Startups are developing platforms that streamline customs processes, track shipments in real-time, and optimize supply chain management. These innovations reduce delays and increase reliability in trade operations.

• Facilitating Market Access: By offering digital tools and platforms, startups are enabling small and medium-sized enterprises (SMEs) to participate more effectively in international trade, opening new markets and opportunities previously inaccessible to them.

These technological advancements are reshaping the logistics landscape in Latin America, fostering a more inclusive and efficient trade environment.

Over the past three decades, Mexico’s port system has undergone a significant transformation, evolving from rudimentary infrastructure to a dynamic and competitive network. This progress was initiated by the 1993 Ports Law, which established Comprehensive Port Administrations (APIs) and attracted substantial private investment.

Today, Mexico’s port terminals are not merely points of cargo transit but integral components of national and regional logistics networks, enhancing the country’s competitiveness in international trade. These ports facilitate efficient import and export processes, supporting various industries and contributing to economic growth.

The modernization of port infrastructure has led to increased capacity and improved services, positioning Mexico as a key player in global trade routes. The strategic location of its ports, combined with ongoing investments, continues to bolster Mexico’s role in international commerce.

THE WEEKLY REPORT WILL RETURN IN JANUARY 2025.