GENERAL SITUATION IN MEXICO

Weekly Review I October 9, 2024

Weekly Review I October 9, 2024

The Mexican automotive industry closed the first half of 2024 as the country’s largest source of foreign exchange, surpassing key sectors like remittances and tourism. According to the Mexican Automotive Industry Association (AMIA), light vehicle exports during this period reached $95 billion, representing a 17% increase compared to the combined foreign exchange from remittances and tourism. The industry has been on a continuous growth trajectory since 2021, accounting for nearly 30% of the country’s foreign exchange. In September 2024, production reached 378,583 vehicles, an 11.7% increase from the same month in 2023, marking the best September in Mexican automotive history. Cumulatively, over 3 million vehicles were produced from January to September, solidifying Mexico’s status as the leading vehicle producer in Latin America and a key player in global production. Exports also set records, with 315,706 units shipped in September, reflecting a 4.8% growth from the previous year and a trade surplus of $52.068 billion. AMIA estimates that Mexico could reach 4 million vehicles produced by the end of 2024, driven partly by the rising demand for electric and hybrid vehicles.

SOURCE: MEXICO INDUSTRY

In her inaugural address as President of Mexico, Claudia Sheinbaum announced the launch of “Olinia,” an affordable fully electric vehicle designed and built by young Mexican engineers. This initiative is part of her broader strategy to strengthen Mexico’s position in the global automotive and semiconductor industries. The Olinia project, one of 100 key actions during her presidency, aims to make electric transportation accessible to more people. Additionally, Sheinbaum revealed plans to develop a national semiconductor production program and leverage Mexico’s lithium resources for electric vehicle batteries, focusing on local technological expertise to support these advancements.

SOURCE: MEXICO BUSINESS NEWS

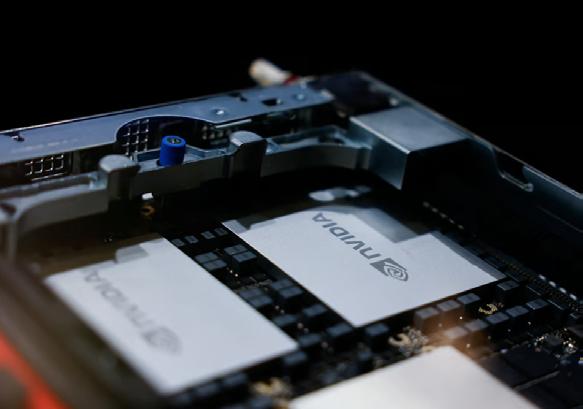

Foxconn is constructing the world’s largest factory in Mexico to produce advanced artificial intelligence servers for Nvidia, highlighting a significant shift in global technology supply chains away from China. Located in Guadalajara, the plant will assemble Nvidia’s Blackwell GB200 AI servers, driven by surging demand, according to Foxconn President Young Liu. This move aligns with Western governments and companies’ efforts to relocate sensitive tech manufacturing closer to home amid rising geopolitical tensions and supply chain disruptions. The U.S. has facilitated this transition through substantial subsidies, leading to major investments from companies like Taiwan Semiconductor Manufacturing (TSMC), Intel, and Samsung. While Foxconn still operates large facilities in China, including the biggest iPhone plant, Liu anticipates that China’s share of Foxconn’s global manufacturing presence will gradually decrease to just over 70%. The shift towards server production is accelerating due to the critical role these servers play in cloud computing infrastructure for major firms like Google and Amazon. Liu also suggested that the trend of “sovereign AI”—the need for countries to develop their own AI capabilities for national security—will drive localized server production in the future, coining the term “sovereign server” to describe this trend.

SOURCE: EL FINANCIERO

Federico Serrano Bañuelos has been appointed president of the Index Zona Costa association in Baja California, with the goal of boosting the manufacturing industry in the cities of Ensenada, Rosarito, Tecate, and Tijuana, which together comprise over 1,700 companies and generate more than 357,000 jobs. Serrano, with prior experience as president of the national Index, replaces Pedro Montejo Peterson, who is now the Secretary of Economic Development in Tijuana. His work plan focuses on strengthening relationships with public and private entities, developing internal committees, and promoting labor stability to attract foreign investment. He also emphasized the industry’s ability to adapt to technological innovations, aiming to enhance the region’s economic competitiveness.

SOURCE: MEXICO INDUSTRY

NUEVO LEON

In the Monterrey-Saltillo corridor, four major energy projects are being prepared to provide between 100,000 and 200,000 kilovolt-amperes (kVA), with the first operational by 2025 and the last by August 2026, addressing the rising energy demand driven by nearshoring, according to Jorge Arrambide from Santos Elizondo. These projects will provide relief until 2029, with additional projects planned for 2027 and 2028. One key challenge for the industry is the lack of electrical infrastructure, with transmission lines and substations growing at 3.1% and 5% between 2017 and 2021, respectively. Nearshoring has increased the need for more energy, requiring annual investments of $6.4 billion, 28% higher than before.

SOURCE: EL ECONOMISTA

CHIHUAHUA

Chihuahua, with its strong automotive industry employing over 172,000 people, is positioning itself to harness the potential of electromobility, which promises to boost competitiveness and create specialized, sustainable jobs. At the “Electromobility Forum: Strategies and Emerging Opportunities,” industry leaders, academics, and government officials explored the opportunities electric mobility brings to the region. Organized by the Chihuahua Automotive Cluster, the event emphasized the importance of strategic collaboration for Chihuahua to become a global leader in clean technologies. Experts highlighted that electromobility is an opportunity for economic and social growth, with the state poised to benefit from innovation and sustainable development.

SOURCE: MEXICO INDUSTRY

During the North Capital Forum held from October 2 to 4 in Mexico City, Coahuila’s competitive advantages and upcoming investment opportunities were highlighted. Governor Manolo Jimenez met with executives from companies like Stellantis, GM, and Magna to discuss future investments in the state. He emphasized Coahuila’s strategic location, strong industrial growth, skilled workforce, and stability, positioning it as a key hub for automotive and manufacturing industries. Jimenez also participated in panels on electric vehicles, noting Coahuila’s leadership in Mexico’s EV production. He highlighted the state’s industrial strengths and its role in supporting North America’s competitiveness in the electric vehicle market.

SOURCE: MEXICO NOW

The Aerospace Cluster of the Bajio region will host the Aerospace Summit 4.0 2024 in Leon, Guanajuato, aiming to boost the aerospace industry’s development in the region. The event, set for October 24, will bring together local business leaders and aerospace companies, offering significant business opportunities. Oscar Rodriguez, president of the cluster, emphasized Guanajuato’s potential due to its strategic location and highlighted the importance of collaboration between government, academia, and businesses to close industry gaps. The aerospace sector in the region currently generates 6,500 jobs and contributes 0.5% of the state’s GDP. The summit will also focus on supporting SMEs in adopting new technologies and attracting specialized talent to strengthen the industry.

SOURCE: MEXICO INDUSTRY

The Aerospace Component Testing Laboratory was inaugurated at the Aeronautical University in Queretaro (UNAQ) to support research, create specialized jobs, and contribute to the goal of achieving net-zero carbon emissions in the aerospace industry by 2050. The lab will focus on clean technology research and study the effects of sustainable aviation fuels (SAF) compared to conventional hydrocarbons, specifically in GE Aerospace engines. Governor Mauricio Kuri emphasized the lab’s global scope, while GE Aerospace Mexico’s director, Andres Soler Perez Salazar, highlighted the project’s sustainability-driven solutions. UNAQ’s rector, Enrique Gerardo Sosa Gutierrez, called the lab a significant milestone for both the institution and the state, marking it as one of the few labs where GE will conduct tests contributing to a more sustainable aerospace future.

SOURCE: MEXICO INDUSTRY

Coparmex CDMX has endorsed the new economic plan of Mexico City’s government under Clara Brugada. The employers’ association outlined six key priorities for economic development, including creating a “one-stop” business portal to simplify procedures, promoting formal economic practices with empathy, and encouraging strategic investments in infrastructure and mobility. Other focuses include addressing water issues, improving public safety, and enhancing tourism and culture. Adal Ortiz Avalos, president of Coparmex CDMX, praised Brugada’s openness towards the business sector and emphasized the need for continuous dialogue to address the city’s challenges effectively.

SOURCE: 24 HORAS

Francisco Cuevas Dobarganes, director of the Industrial Union of the State of Mexico (UNIDEM), urged Mexico’s President Claudia Sheinbaum to include the industrial sector in a federal investment project aimed at improving living conditions in the eastern region of the State of Mexico. This area, which includes municipalities such as Ecatepec, Chalco, and Texcoco, faces significant challenges in water access, drainage, housing, and mobility. The project, targeting over 10 million residents, aims to address these issues.

Cuevas emphasized the importance of involving the industrial sector in forums and consultations to enhance public infrastructure and create better employment opportunities near residents’ homes. He also called for changes in land use to attract businesses by improving security, energy access, and urban conditions. Cuevas praised Sheinbaum’s initiative, highlighting the region’s potential for development and stressing the need to avoid viewing it solely through an electoral lens.

SOURCE: EL SOL DE TOLUCA

ARZYZ will invest 650 million dollars to expand its plant in Cienega de Flores, Nuevo Leon, generating 1,300 jobs. The company will include a technical school and a research center in its facilities.

The new IMMSA plant was inaugurated with an investment of 26 million dollars. This project will generate 130 direct jobs and will be dedicated to manufacturing steel structures for train wagons.

Hofusan Industrial Park announces an expansion in Nuevo Leon, supported by a 1 billion dollar investment. The project will include 100 industrial warehouses and services such as hotels and shopping centers.

With an investment of over 10 million dollars and the creation of 165 new jobs, the Comverge plant was inaugurated at the Airport Industrial Park in Colon, Queretaro. This company focuses on the production of fiber optic cables.

Makino has started the construction of its Innovation Technology Center in Queretaro, with an investment of 21 million dollars, which will generate over 200 highly specialized jobs. This center will focus on manufacturing and automation.

Opella announced a total investment of 119 million dollars in Ocoyoacac, Estado de Mexico. This project will span the period from 2020 to 2028, aiming to expand production capacity and generate over 500 direct jobs in the region.

SOURCES : MEXICO NOW, MEXICO INDUSTRY, CLUSTER INDUSTRIAL

40-Hour Workweek:

President Claudia Sheinbaum supports the 40hour workweek.

Reduction should be gradual and consensual, involving both business leaders and workers.

Discussions ongoing with no fixed timeline.

Ley Silla:

Initiative mandates seats for workers during shifts.

Approved in the Chamber of Deputies, awaiting Senate review.

Labor and Social Welfare Commission:

Chaired by Senator Geovanna Bañuelos de la Torre from PT (Labor Party).

New Initiatives:

Holiday Bonus: Proposal to increase holiday bonus from 15 to 30 days.

Disabilities in the Workplace: Requires companies with 50+ employees to have 5% of workforce with disabilities.

Meal Breaks: Proposal to provide dignified meal spaces.

Active Breaks:

Mandatory two 20-minute physical activity breaks for sedentary workers.

Mexico has emerged as a top destination for global investors, driven by its strategic location, competitive labor costs, and strong trade agreements. Proximity to the U.S. and Canada, combined with benefits from the USMCA, makes Mexico a key hub for businesses targeting North America.

Key sectors include:

Automotive: Mexico is the 7th largest global producer of automobiles, contributing a third of the country’s total exports.

Aerospace: The sector is growing at 14% annually, with clusters in cities like Queretaro and Monterrey.

Medical Devices: Mexico is the largest supplier to the U.S., with over 500 companies operating in the sector.

Electronics: The country is the 2nd largest electronics exporter to the U.S., with major production hubs in Tijuana and Guadalajara.