GENERAL SITUATION IN MEXICO

Weekly Review I June 12, 2024

Weekly Review I June 12, 2024

Claudia Sheinbaum, Mexico’s president-elect, plans significant changes in the automotive sector outlined in the “100 Steps Towards Transformation” document. Her strategy includes modernizing transportation infrastructure, attracting foreign investment, and promoting sustainability and innovation. She aims to implement electric transportation systems in major cities, expand public transit networks, and incentivize the use and production of electric vehicles (EVs) through fiscal incentives and support programs. She also intends to update environmental vehicle standards to support electromobility and consolidate nearshoring efforts to attract automotive companies, creating jobs and fostering technological development. The plan includes leveraging nearshoring to strengthen the automotive supply chain and increase national content in production, supported by a program for knowledge transfer and collaboration with educational and technological institutions.

SOURCE: MEXICO BUSINESS

General Motors (GM) has launched the Chevrolet Equinox EV, an electric SUV manufactured in Mexico at its Ramos Arizpe plant. This is the third electric vehicle model produced in the country, following GM’s Chevrolet Blazer EV and Ford’s Mustang Mach-E. The Equinox EV, equipped with GM’s Ultium battery platform, offers a range of up to 513 km on a full charge, features a 180 kW (241 hp) motor, 32.6 kg-m of torque, and FWD traction. It includes a dual-port portable charger compatible with 110V and 220V for versatile charging needs. Set to debut in Mexico in August 2024 at MX$829,900 (US$45,000), GM plans to facilitate access to over 1,000 intelligent charging stations across the country through a credit program. The Ramos Arizpe plant received a US$1 billion investment in 2021 to produce electric vehicles, with plans for Cadillac’s OPTIQ launch to expand the electric vehicle portfolio. With advanced safety features, extensive connectivity, and over 500 km of autonomy, the Equinox EV competes effectively in its segment and is available for pre-order starting June 24.

SOURCE: MEXICO BUSINESS

INDUSTRIES

BMW and Nissan are expanding their operations in Mexico to meet the growing demand for electric vehicles (EVs) and adapt to market changes. BMW is building a battery manufacturing facility next to its assembly plant in San Luis Potosi, investing around MX$15.8 billion (US$864.1 million), to produce EVs starting in 2027. They’re also integrating digital tools for better management. Nissan is enhancing its supply chain to handle fluctuations in consumer demand, facing challenges like labor shortages and recovery delays post-COVID. They’re shifting towards sedans and small crossovers due to high interest rates and vehicle costs. Both companies are investing in new transportation methods to ensure efficient delivery despite disruptions.

SOURCE: MEXICO BUSINESS

In Mexico’s automotive market, vehicle sales remain strong, but electric and hybrid vehicles represent only a small fraction, indicating a slow adoption of sustainable technologies. Ricardo Apaez, from Driven CLAUT Innovation Center, noted that despite significant growth, only 1.4% of vehicles sold were electric last year. The lack of federal incentives and slow migration to electric vehicles have hindered expansion. However, there’s a shift towards plug-in hybrids. Driven CLAUT is at the forefront of developing advanced mobility solutions, emphasizing clean air and safe travel. The center’s reputation has made it a strategic partner for industry leaders. The International Mobility Of The Future Summit (IMOF), organized by CLAUT, promotes collaboration and innovation in the automotive sector. Despite the small market share, the industry is on a path of growth, driven by competition and collaboration. IMOF 2024 will be held on June 26 and 27 in Monterrey, Nuevo Leon.

SOURCE: MEXICO INDUSTRY

The Automotive Cluster of Guanajuato (CLAUGTO) and CONALEP Guanajuato have forged a significant collaboration aimed at enhancing the integration of technical education with the automotive industry in the region. This agreement seeks to offer CONALEP Guanajuato students direct exposure to the automotive sector, aligning their skill sets with industry demands. By fostering a closer relationship between CLAUGTO and educational institutions like CONALEP, the partnership aims to develop specialized talent and facilitate employment opportunities while strengthening the automotive ecosystem in Guanajuato.

SOURCE: CLUSTER INDUSTRIAL

A delegation of 16 Taiwanese entrepreneurs met with the governor of Sonora, Alfonso Durazo Montaño, to learn about the economic potential of the region. Governor Durazo Montaño explained the state’s comprehensive economic strategy, led by the Sonora Sustainable Energy Plan, to representatives from Hsinchu Science Park and the Industrial Technology Research Institute (ITRI), as well as personnel from 11 companies in the electrical, electronic, textile, plastics manufacturing, and industrial equipment sectors. This meeting stemmed from a visit to Taiwan and the signing of a memorandum of understanding with the ITRI College in September 2023. Governor Durazo Montaño expressed pleasure at the visit, noting the importance of the Taiwanese companies, which are leaders in technological innovation globally. The Taiwanese entrepreneurs learned about Sonora’s competitive advantages in electromobility and renewable energy generation. Governor Durazo Montaño highlighted that in 2023, Sonora was one of the leading states in attracting foreign direct investment in the northern border, totaling $2.711 billion, making it the second-largest recipient of FDI in the country.

SOURCE: MEXICO INDUSTRY

Kurt Honold Morales, Secretary of Economy and Innovation of Baja California, highlighted the state’s growing importance in Mexico’s semiconductor industry at the “Accelerating the semiconductor industry in Mexico” Forum in Guadalajara. He emphasized significant investments from companies like Qualcomm and Infineon while addressing opportunities, particularly in professional training. Efforts are underway to address skill gaps through financing of educational programs. Baja California plans to host a specialized forum in 2025 to further accelerate the semiconductor industry, focusing on trends, labor aspects, and operational challenges. Additionally, the state hosts the “Collaboration Forum for Semiconductors Mexico-United States,” promoting coordinated efforts to strengthen the production chain in a binational region.

SOURCE: MEXICO INDUSTRY

The Mexican Data Centers Association (MEXDC), led by Amet Novillo and Adriana Rivera, met with Ivan Rivas, Secretary of Economy of Nuevo Leon, Mexico, to discuss the association’s plan for driving the country’s technological development. They shared insights from a recent market study, projecting over 68,000 job opportunities in the data center industry over the next five years. Specifically, in Monterrey, where 11 data centers are currently operating, they anticipate a five percent growth. MEXDC highlighted significant direct and indirect investment projections, emphasizing the potential impact on the country’s GDP. Discussions revolved around challenges such as sustainability, energy, talent, and regulations, with a focus on establishing a collaborative strategy for industry growth. Secretary Rivas expressed readiness to welcome the data center industry to Nuevo Leon, citing its favorable infrastructure and resources. Amet Novillo stressed the importance of this meeting in laying the groundwork for collaborative efforts to support the region’s economic sectors through technological infrastructure development.

SOURCE: DATA CENTER DYNAMICS

Index Coahuila organized its Annual Meeting 2024 at the Eagle Pass Convention Center in Texas, aiming to foster collaboration and envision the future for the border region of Piedras Negras and Eagle Pass. The event gathered business leaders, officials, and maquiladora industry representatives to discuss impactful projects for the upcoming year. Key attendees included notable figures like Humberto Martinez Cantu, President of Index Nacional, and Erika Zielke, Consul General of the United States Consulate in Nuevo Laredo. Among the projects highlighted

was the Puerto Verde Nava Project, focusing on constructing a modern border crossing between Piedras Negras and Eagle Pass to drive economic development and promote environmental sustainability. Index Coahuila plans to focus on growth, technology, and logistics for the next two years, supported by legal certainty and the IMMEX program. The Annual Meeting has emerged as a crucial event for the maquiladora industry, fostering collaboration, innovation, and laying the foundation for sustainable growth in the region.

SOURCE: MEXICO INDUSTRY

During a trip to Spain, Daniel Hernandez, director of the Automotive Cluster of Queretaro and president of REDCAM, met with Navarrean government representatives and automotive companies.

Organized by Navarra’s International Plan, the meeting discussed historical collaborations and the current automotive sector status in Queretaro and Navarra. Mexico is a priority for Navarra, with 29 companies and 37 plants present, exporting €52 million to Mexico in 2023. The relationship between Navarra and Queretaro began three years ago through missions between both regions.

SOURCE: MEXICO INDUSTRY

Nissan UK and the government of Aguascalientes strengthen ties. Esau Garza de Vega, Secretary of Sedecyt in Aguascalientes, explored Nissan’s plants in the United Kingdom to adopt electric vehicle technologies and sustainable practices, highlighting the EV36Zero project. Inspired by Nissan’s initiatives, Aguascalientes seeks to become a hub of electromobility in Mexico and Latin America. Additionally, the state plans to implement renewable energy projects, including wind and solar parks.

SOURCE: LIDER EMPRESARIAL

Guanajuato is gearing up to spearhead projects in aerospace and the medical cluster. The forthcoming administration, led by Secretary of Economic Development Ramon Alfaro Gomez, stresses the urgency of executing pending projects, particularly in aerospace, to counteract the 50,000-job deficit caused by the pandemic. Alfaro emphasizes the need to diversify into new sectors while also pushing for advancements in automotive technology and strengthening the agrifood, chemical, and pharmaceutical industries to attract investments.

Silao, strategically positioned for international business, will see collaboration between the state and municipal governments. With significant industrial parks and investment projects, Silao’s central location and connectivity make it pivotal for both Guanajuato and the broader central region of Mexico. This year, investments in the state are expected to surpass 10 billion pesos, with interests from Chinese, Japanese, and European capitals, particularly in the energy and renewable energy sectors.

SOURCE: PAGINA CENTRAL

Jose de Jesus Rodriguez Cardenas, president of the National Chamber of Commerce, Services, and Tourism of Mexico City, stated that the attractiveness of Mexican exports to the U.S. is no longer based on the exchange rate. He urged businesses to continue seizing opportunities in the U.S. market despite political transitions. Despite the strong peso, Mexican exports to the U.S. reached a historic high in April, showing confidence in and competitiveness of Mexican products. He emphasized that current competitiveness is driven by quality, skilled labor, and service, not just exchange rates.

SOURCE: LA JORNADA

According to the latest State Competitiveness Index report by the Mexican Institute for Competitiveness (IMCO), the State of Mexico remains in 21st place, unchanged from 2023. The Index evaluates 50 points across six sub-indices, including investment, economy, infrastructure, labor market, and the rule of law. Mauricio Massud Martinez, president of the Council of Chambers and Business Associations of the State of Mexico (Concaem), highlighted the need for policy adjustments, civic participation, and legal certainty. Concerns include a decline in the political system and governance index, falling 12 positions due to issues like debt and corruption. The business sector calls for improved public policies and citizen engagement to enhance competitiveness and attract investments.

SOURCE: MILENIO

The Chinese furniture company invested 70 million dollars for its first facility in Salinas Victoria, Nuevo Leon. The project expects to create 4,000 jobs.

The American transportation company opened its services office in San Pedro, Nuevo Leon with an of investment of 600 million dollars, generating 1,000 jobs.

With an initial investment of 600 million dollars, DEACERO is announcing a new expansion in Ramos Arizpe, Coahuila. It will create around 1,000 jobs. The plant is expected to start operations the 1Q of 2026.

The Japanese air conditioning manufacturer announced the investment of 121 million dollars to expand operations in Tijuana, Baja California. The project expects to create 1,150 jobs. Operations are expected to star the 1Q of 2025.

Borgwarner has inaugurated its third plant in Saltillo, Coahuila, dedicated to the production of vehicle heating parts, with an investment of 47 million dollars and the creation of 350 jobs.

The news was announced in March 2023.

The Chinese wires manufacturer announced a 18.7 million dollars investment to set up in Lagos de Moreno, Jalisco. The company expects creating 203 jobs. They begun operations in June 2024.

The company inaugurated a plant in Toluca, Estado de Mexico to produce axles for EVs with an investment of 36.7 million dollars, creating 150 jobs. This plant will begin operations in July 2024.

The German automaker will invest 1,074.1 billion dollars for the transition of its electromobility processes in San Jose Chiapa, Puebla, which will generate 500 jobs.

SAG Mexico is planning the acquisition of a third plant for the production of aluminum components, which is expected to be operational in 2025. No investment amount or jobs data.

SOURCES: CLUSTER INDUSTRIAL, MEXICO INDUSTRY

ENVIRONMENTAL

• SAN LUIS POTOSI: DECREE REFORMING VAR-

IOUS PROVISIONS OF THE STATE TAX LAW ON ECOLOGICAL TAXES

Presented by: Executive Power of the State of San Luis Potosi

Purpose: Emission: Direct discharge to the atmosphere of substances or energy (e.g., odors, particles, gases).

Subject(s): Physical persons, legal entities, federal, state, and municipal governments, decentralized organizations, majority state-owned enterprises, and relevant federal trusts.

Targets atmospheric emissions of specific pollutants from production processes.

Defines taxable emissions, including CO2, methane, nitrous oxide, black carbon, and various fluorocarbons.

Tax base: Measured in tons of pollutant emissions from fixed sources.

Fiscal incentives: General incentives for environmental preservation, technological innovation, and clean energy use.

100% incentives for new businesses, exemption for the first 25 tons emitted, and reduced tax rates.

Implementation: Effective from July 1.

Status:Published on June 10, 2024, in the Official Gazette.

• GUANAJUATO: DECREE REFORMING AND ADDING VARIOUS PROVISIONS TO THE CLIMATE CHANGE LAW FOR THE STATE OF GUANAJUATO AND ITS MUNICIPALITIES

Presented by: Executive Power of the State of Guanajuato

Purpose: Promote participation in carbon markets.

Include climate mitigation and adaptation criteria in environmental compensation measures. Design measures to reduce greenhouse gas emissions focusing on the electric, industrial, waste, transport, and agriculture sectors.

The Secretariat of Sustainable Economic Development will work with the private sector on adopting circular economy practices and low-emission strategies.

Establish the State Climate Change Commission to coordinate public administration efforts.

Status: Published on June 10, 2024, in the Official Gazette.

Explore Prodensa Insights for expert analysis and industry trends. Visit our website www.prodensa.com/insights for full information

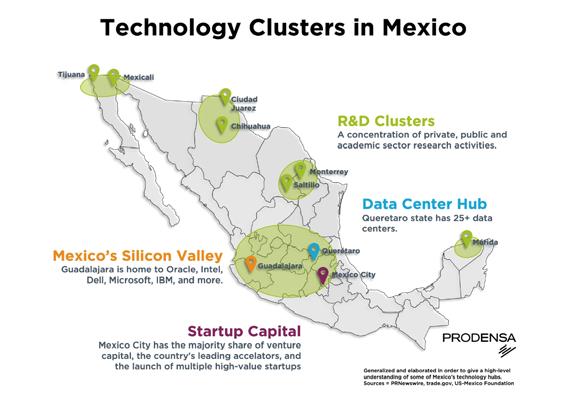

Mexico’s tech sector is experiencing explosive growth, driven by factors like nearshoring and government investment. This surge translates to a golden opportunity for service providers across various industries.

Key takeaways:

• Nearshoring Boom: Mexico’s proximity to the U.S. and skilled workforce make it a prime location for nearshoring. This creates a demand for service providers in areas like logistics, R&D, software development, and engineering.

• Tech Hubs Emerge: Cities like Monterrey, Tijuana, Juarez, and Guadalajara are becoming hubs for IT talent, R&D initiatives, and major tech companies.

• Competitive Advantages: Mexico boasts a well-educated workforce with lower wages compared to other skilled markets, along with strong bilingual capabilities – a perfect fit for serving U.S. companies.

Explore Prodensa Insights for expert analysis and industry trends. Visit our website www.prodensa.com/insights for full information

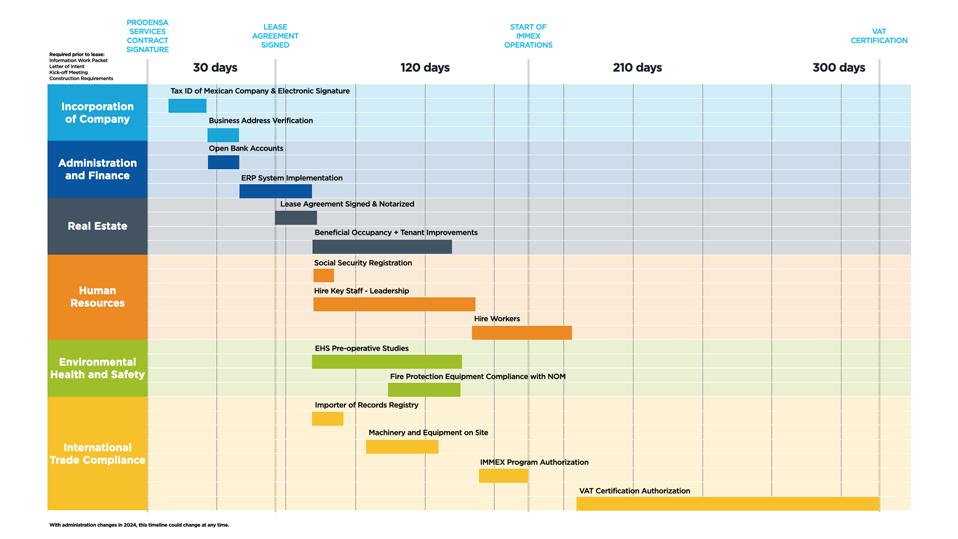

Mexico’s maquiladora industry offers a wealth of opportunities for global manufacturers, from cost-effective labor to strategic location. But a successful launch requires careful planning and execution. This guide walks you through the key milestones for establishing a maquiladora operation in Mexico, ensuring a smooth and compliant start-up.