GENERAL SITUATION IN MEXICO

Weekly Review I June 25, 2025

Weekly Review I June 25, 2025

• Ceasefire Announced: A truce between Israel and Iran calmed geopolitical tensions, reducing fears of a wider conflict in the region.

• Markets Rally: Global equity markets responded positively. The Dow Jones, S&P 500, and Nasdaq all closed with gains above 0.5%.

• Oil Prices Fall Sharply: Brent crude dropped by more than 6%, falling below $70 per barrel. WTI followed a similar path, closing near $64.

• Energy Costs Down: The drop in oil prices is expected to ease transportation and production costs across sectors globally.

• Lower Inflation Pressure: Analysts project a short-term drop in headline inflation, giving central banks like the Fed and ECB more room to delay further rate hikes.

• Fed Signals Patience: The Federal Reserve reiterated its cautious stance. Although no immediate rate cut was announced, expectations are shifting toward possible easing in late Q3.

• Winners: Airlines, logistics companies, and consumer goods firms are likely to benefit from cheaper fuel.

• Losers: Oil producers and service firms saw stock prices decline due to lower expected profits.

• Currency Effects: Oil-exporting currencies (e.g., Mexican Peso, Canadian Dollar) weakened slightly, while import-heavy economies like India saw their currencies strengthen.

• Short-Term: Relief, Long-Term Uncertainty: Markets are temporarily stable, but the situation remains fragile. Any new escalation could trigger another oil spike.

• Volatility Expected: Traders are watching OPEC+’s upcoming decisions (late June) and further geopolitical developments that could disrupt supply again.

• Global Impact: If prices remain low, global supply chains and industrial activity may recover slightly, especially in energy-sensitive sectors.

SOURCE: REUTERS

• INITIATIVE TO AMEND THE FEDERAL LAW FOR THE PREVENTION AND IDENTIFICATION OF OPERATIONS WITH RESOURCES OF ILLEGAL ORIGIN, AND THE FEDERAL PENAL CODE

Presented by: Joint Commissions of Justice and Legislative Studies

Objective: This reform updates Mexico’s anti-money laundering and anti-terrorism financing laws to broaden oversight, redefine key terms, and expand obligations for fiduciaries, notaries, and real estate actors.

Status: Approved by the Commissions in the Senate

• INITIATIVE TO THE SOLID WASTE LAW OF MEXICO CITY, REGARDING TECHNOLOGICAL WASTE

Presented by: Deputy Claudia Pérez Romero (PAN)

Objective: Mexico City boroughs will be required to install containers for technological waste from IT industries and electronics manufacturers, as well as place additional containers in strategic locations within their jurisdictions to ensure efficient collection

Status: To be referred to the Commission on Environmental Preservation, Climate Change, and Ecological Protection

BAJA CALIFORNIA

As part of the ProBaja international mission, a delegation from the Government of Baja California and economic promotion agencies visited Switzerland to attract investment, strengthen the innovation ecosystem, and build strategic partnerships. With support from Switzerland Global Enterprise, the agenda focused on industrial development and public-private collaboration. Key meetings included a visit to Laubscher Präzision AG to learn about precision manufacturing and innovation in a family business, and a discussion with CSEM’s vice president on technology transfer and entrepreneurship. At Technopark Zurich, the delegation engaged with Swiss startups exploring opportunities in Mexico. The mission, which included officials from SEI and Ensenada’s economic commission, will continue in Germany.

SOURCE: MEXICO NOW

During the Paris Air Show, a delegation from Chihuahua—comprising state officials, aerospace cluster representatives, and private sector leaders—held over 50 meetings with global aerospace companies to strengthen existing ties and attract new investments, particularly in advanced technologies. Companies expressed strong interest in the region’s skilled workforce and its public-private collaboration model. Plans were also announced for a trade mission to Poland in 2026 and for hosting the “Mars Challenge” aerospace hackathon in Chihuahua to promote youth innovation. At the GACP Summit, Chihuahua was recognized as one of Mexico’s most advanced aerospace hubs, with five OEMs, over 40 certified companies, and a solid talent base.

SOURCE: MEXICO NOW

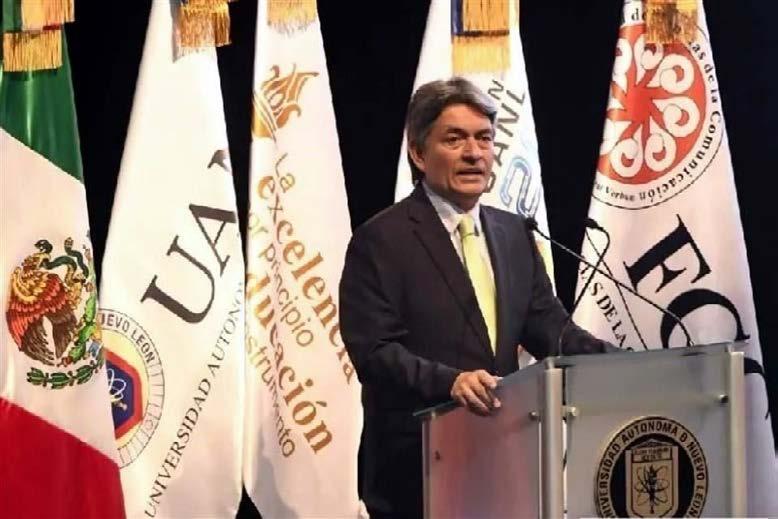

The Government of Nuevo León has appointed Juan Paura García as the new Secretary of Economy, replacing Iván Rivas. Paura, who currently serves as Secretary General of the Autonomous University of Nuevo León (UANL), brings extensive public administration experience since 2002, including roles as Monterrey’s municipal treasurer, delegate of Prodecon in Nuevo León, and various positions within the state’s Finance Secretariat.

SOURCE: MILENIO

Guanajuato celebrated Ford’s 100th anniversary in Mexico by highlighting the company’s key role in advancing electromobility, driving automotive investment, and generating specialized employment. Since establishing its transmission plant in Irapuato in 2015, Ford has strengthened the regional supply chain and now produces the power unit for the Mustang Mach-E, Mexico’s first mass-produced electric vehicle. The state’s automotive sector accounts for 72% of its exports— over $26 billion—making it a national leader in production. Recent efforts include over $2.3 billion invested in electromobility projects, creating more than 11,000 jobs. Guanajuato’s government emphasized its commitment to hybrid and electric vehicle development, supported by specialized training programs like Ford’s Competency Development Center, positioning the state for continued industrial leadership.

SOURCE: MEXICO INDUSTRY

The second edition of Francia Recluta was inaugurated at Tecnológico de Monterrey, Querétaro, as a joint initiative by the French Embassy in Mexico and CCI France México to connect young Mexican talent with French companies operating in the country. The event highlighted the growing French community in Querétaro and emphasized dual education, international mobility, and academic-industry collaboration. Over 700 French companies in Mexico generate more than 180,000 direct jobs, and over 3,100 Mexican students pursue studies in France annually. A cooperation agreement was signed between the university and the French Chamber of Commerce to strengthen ties between higher education and the private sector. The forum also celebrated the role of companies like Schneider Electric and Valeo in developing local talent and promoting responsible, innovative business practices.

SOURCE: MEXICO INDUSTRY

On the 20th anniversary of Mexico City’s Metrobús system, Head of Government Clara Brugada inaugurated four fully electric bi-articulated buses—claimed to be the first of their kind in the world. Manufactured by Volvo, Hyundai, and Yutong, these units are part of the city’s broader electromobility strategy. The goal is to deploy 420 electric buses by 2030. The new prototypes, supported by the international ZEBRA initiative, will be tested alongside efforts in Bogotá and Curitiba. Each 27-meter unit can carry up to 270 passengers, offers over 330 kilometers of range, charges in two hours, and is fully accessible. The buses feature Metro-style sliding doors and a silent, zero-emission design tailored to Mexico City’s infrastructure. According to Mobility Secretary Héctor Ulises García Nieto, this innovation marks a global milestone in public transport and will benefit more than 1.8 million daily users, improving service quality and advancing sustainable urban mobility.

SOURCE: ENERGY MAGAZINE

PepsiCo has officially joined the federal government’s “Made in Mexico” program, reaffirming its $100 million investment in the State of Mexico between 2023 and 2025. The company allocated $80 million to expand its electric vehicle fleet, $17 million to upgrade production and distribution systems, and $9 million to its agricultural innovation hub, CDAS. Annually, PepsiCo purchases 580,000 tons of Mexican-grown potatoes and corn—20% of Mexico’s total potato production—supporting over 50,000 agricultural jobs. With 15 production plants and 276 distribution centers, PepsiCo’s operations represent 0.5% of Mexico’s GDP and directly employ 4,500 people in the State of Mexico. Over 200 of its products—including Sabritas, Gamesa, and Quaker—will now carry the “Made in Mexico” seal. Federal officials emphasized the company’s responsible, inclusive model rooted in local development and sustainability. PepsiCo also reaffirmed its long-term confidence in Mexico, hinting at further investment to strengthen its supply chain and domestic operations.

SOURCE: EL ECONOMISTA

Tetra Pak Mexico announced the expansion of its Mexicali facility, which specializes in the production of caps for packaging. With an investment of 750 million pesos, the company increased the plant’s production capacity by 40%.

With an investment of USD 325 million, Chinese company Hengli Hydraulics launched its first manufacturing facility in Mexico, located in Santa Catarina, Nuevo León. The project will be executed in three phases and is expected to generate a total of 800 direct jobs, positioning the company as a strategic new player within the industrial ecosystem of northern Mexico.

Korean company SL MEX will create 385 new jobs with an initial investment of 45 million dollars to establish a production plant in the Logistik II industrial park in Villa de Reyes. The facility, with an annual capacity of one million automotive lighting modules, will supply BMW, General Motors, Hyundai, and Kia.

Benchmark Electronics, a company specializing in electronic manufacturing services, has inaugurated a new facility at the San Jorge Industrial Park in Tlajomulco de Zúñiga, Jalisco. The investment will boost its operational capacity by over 50%. The project is expected to drive key industry sectors and create up to 3,000 jobs over the next five years.

SOURCES: MEXICO INDUSTRY, CLUSTER INDUSTRIAL

EOR VS. ENTITY SETUP IN MEXICO: WHICH FITS YOUR STRATEGY?

Foreign companies expanding to Mexico must decide between using an Employer of Record (EOR) or setting up their own legal entity—two distinct models with major implications for compliance, speed, and long-term strategy. This blog explores how EORs enable rapid hiring and low administrative burden, while entity setup provides greater control and permanence. It breaks down the financial, operational, and legal trade-offs, guiding investors, manufacturers, and service firms in choosing the right approach based on their time horizon, project scope, and risk appetite. Whether you’re testing the market or building a long-term presence, this post offers actionable insight.