Choosing benefits is one of the most important decisions you will make all year Carefully consider your benefit options and your anticipated needs Then follow the instructions to enroll yourself and any eligible dependents in health and insurance benefits for 2026.

Providing great benefit choices to you and your family is just one of the many ways we support the physical, financial, and emotional well-being of the people who make our company successful you.

We recognize how important benefits are to you That’s why we’re committed to supporting your overall wellness with a comprehensive benefits program designed to meet your unique needs Key features of your benefits include:

Choice among many popular benefit options

Effective and affordable health care coverage Programs to help ensure financial security for you and your family.

Use this guide to better un make the best choices for enroll by the enrollment de

For new employees, the effective date of coverage for most plans is the first of the month following your hire date For existing employees enrolling during Open Enrollment, the effective date of most plans is January 1, 2026.

Login to your UKG account https://ew46.ultipro.com/default.aspx

Access your enrollment by navigating to the Myself Menu and select the “Manage My Benefits” option

Review your benefit choices, including any new plans and benefit changes

Understand how the plans work

Learn about the tools and resources available with each plan

Select the benefits that work the best for you and your family.

Full-time employees (30+ hrs./wk.) – Eligible the first day of the month, on or after date of hire; must choose benefits within 31 days of hire date. Eligible dependents – Includes your legal spouse/domestic partner and children to age 26, plus disabled dependent children of any age who meet plan criteria

Enroll within 31 days from your date of hire. If you don’t enroll within this time period, you will not have benefits coverage, except for plans and programs that are fully paid by Groupe SEB.

This is your annual opportunity to enroll for benefits or change your existing benefits This year’s Open Enrollment period is from November 10th – November 21st

Generally, benefits you elect during Open Enrollment will be effective 01/01 through 12/31, unless you experience a qualifying life event that lets you change coverage mid year or makes you ineligible for coverage

After your enrollment opportunity ends, you won’t be able to change your benefits coverage during the year unless you experience a qualifying life event, such as marriage, divorce, birth, adoption, or a change in your or your spouse/domestic partner’s employment status that affects

The FSAs and HSA require you to re-enroll each year if you wish to participate. If you do not make changes to your current coverage within the enrollment time period, your coverage will continue in 2026. However, if you are enrolled in a Health Savings Account (HSA) or a Flexible Spending Account (FSA), you MUST re-enroll in these benefits for the 2026 benefit calendar year.

Qualifying life events include, but aren t limited to, marriage, divorce, legal separation, birth or adoption of a child, or a change to your or your spouse/domestic partner’s employment status that affects your eligibility for benefits Becoming

Changes allowed anytimeduring theyear (qualifyinglife eventnot necessary)

Health insurance exists to help offset the costs of medical events, whether they’re planned or happen unexpectedly Insurance doesn’t pay everything, leaving you with out-of-pocket costs In addition to your plan premiums, out-of-pocket costs include copayments, deductibles, and coinsurance Each plan also includes an out-of-pocket maximum It is important to understand how these costs work before you choose a plan

For 2026, you have a choice of medical plans with a range of coverage levels and costs. This gives you the flexibility to choose what’s best for your needs and budget

Cigna Basic PPO, a traditional open access point of service plan (grandfathered only)

Cigna Health Fund HDHP, a qualified plan that is paired with a tax-favored Health Savings Account (HSA).

Cigna Value Plan HDHP, a qualified plan that is paired with a tax-favored Health Savings Account (HSA)

All of Groupe SEB’s medical plans offer:

Comprehensive, affordable coverage for a wide range of health care services

Flexibility to see any provider you want, although you will save money when you stay in-network. Free in-network preventive care, with services such as annual physicals, recommended immunizations, well-woman and well-child exams, flu shots, and routine cancer screenings covered at 100%.

Prescription drug coverage included with each medical plan.

Financial protection through annual out-of-pocket maximums that limit the amount you will pay each year

Choice of four coverage levels: Employee Only, Employee + Spouse/Domestic Partner, Employee + Child(ren), and Employee + Family

Consider which plan features are most important to you.

Do you want to:

Pay the lowest premium cost, which may make it the least expensive option if you expect to have low health care usage?

Balance your out-of-pocket and paycheck costs with a moderate premium cost?

Pay the highest premium cost in order to keep your out-of-pocket costs as low as possible when you need care?

Open and contribute to a tax-free HSA, which has no “use it or lose it” rule and offers the opportunity to invest money for future medical costs?

You and Groupe SEB share the cost of your medical benefits Groupe SEB pays a generous portion of the total cost and you pay the remainder through payroll deductions Your specific cost is based on the plan and coverage level you select

Medical and Prescription Drug Plan

Health Fund

Preventive Visits and Services

No charge when you use In-Network doctors and facilities

Emergency Rooms and Urgent Care Centers

Covered at In-Network rates for both In-Network and Out-of-Network facilities

/ 70% coinsurance

min. / $60 max.) Brand Name Drugs* (if authorized by Cigna)

Coverage Only

Spousal Surcharge:

Brand

/ 55% coinsurance ($60 min. / $120 max.)

advantage of Cigna's contracted discounts with In-Network pharmacies*. (Out-of-Network prescriptions are not covered; you will have to pay full price.)

Tobacco surcharge: If an employee uses any tobacco products (including but not limited to cigars, cigarettes, cigarillos,

tobacco snuff, dip, loose tobacco smoked via pipe or hookah, and vapors and e-cigarettes they will be subject to the tobacco surcharge.

The High-Deductible Health Plan (HDHP) costs you less from your paycheck, so you keep more of your money This rewards you for taking an active role as a health care consumer and making smart decisions about your health care spending As a result, you could pay less for your annual medical costs

Your per-paycheck costs are lower compared to Groupe SEB’s other health plans, giving you the opportunity to contribute the cost savings to a tax-free Health Savings Account (HSA). You pay for your initial medical costs until you meet your annual deductible, and then you pay a percentage of any further costs until you reach the annual out-of-pocket maximum

To help you pay your deductible and other out-ofpocket costs, the HDHP lets you open a Health Savings Account (HSA) and make before-tax contributions directly from your paycheck

Groupe SEB will also contribute to your HSA to help cover your annual deductible:

All withdrawals from your HSA are tax-free, as long as you use the money to pay for eligible health care expenses

In addition, all the money in the account is yours and will never be forfeited It rolls over from year to year, and you can take it with you if you leave the company or retire

After age 65, you can withdraw funds for any reason without a tax penalty you pay ordinary income tax only if the withdrawal isn’t for eligible health care expenses.

As with all Groupe SEB health plans, preventive care is fully covered you pay nothing toward your deductible and no copays when you receive care from in-network providers

Preventive care includes annual physicals, well-child and well-woman exams, immunizations, flu shots, and cancer screenings

Extensive provider network

The HDHP uses Cigna’s large network of doctors and other health care providers.

Your contributions, and any company contributions to the Health Savings Account may help pay your deductible and coinsurance

Note:Youwon’tpayfederaltaxesonHSAcontributions.However,youmaypaystatetaxesdependingonyourresidence. Consultyourtaxadvisortolearnmore.

If you enroll in the HDHP, you are eligible to open an HSA. An HSA is a tax-free savings account you can use to pay for eligible health expenses anytime, even in retirement.

Build tax-free savings. You can make before-tax deductions from your paycheck into your HSA, allowing you to save money by using tax-free dollars to pay for eligible medical, prescription, dental, and vision expenses. The total amount that can be contributed to your HSA each year is limited by the IRS. The following limits for 2026 include any company contributions you receive from Groupe SEB:

Up to $4,400 for employee-only coverage.

Up to $8,750 if you cover dependents.

Add $1,000 to these limits if you’re age 55 or older.

Receive Company contributions. For 2026, Groupe SEB will make the following contribution to your account:

Health Fund $200 / Value Plan $100 for employee-only coverage.

Health Fund $1,000 / Value Plan $500 if you cover dependents.

Keep your money. Unlike an FSA, the money in your HAS is always yours to keep and can be rolled over from year to year. You can take your unused balance with you when you retire or leave Groupe SEB.

Earn interest and invest for the future. Once your interestbearing HSA reaches a minimum balance, you can start an investment account, which offers a variety of no-load mutual funds similar to 401(k) investments.

Use it like a bank account. Pay for eligible medical, prescription, dental, and vision expenses for yourself and your family by swiping your HSA debit card or reimburse yourself for payments you’ve made (up to the available balance in your account). Keep in mind that you may only access money that is actually in your HSA when making a purchase or withdrawal. There’s no need to turn in receipts (but keep them for your records).

Never pay taxes. Contributions are made on a before-tax basis, and your withdrawals will never be taxed when used for eligible expenses. Any interest or earnings on your HSA balance build tax-free, too*

*Money in an HSA grows tax-free and can be withdrawn tax-free if it is used to pay for qualified health care expenses (for a list of eligible expenses, see IRS Publication 502, available at www.irs.gov). If money is used for ineligible expenses, you will pay ordinary income tax on the amount withdrawn plus a penalty tax before age 65. After age 65, withdrawals for ineligible expenses are not penalized. Please review your state regulations and talk with a tax advisor as you may have to pay state taxes depending on your residency.

To establish and contribute to an HSA, you:

Must be enrolled in a high-deductible health plan, like Groupe SEB’s Health Fund or Value Plan.

Cannot be covered by any other medical plan that is not a qualified high-deductible plan. This includes a spouse’s medical coverage unless it’s an HDHP.

Cannot be enrolled in a traditional Health Care FSA in 2026.

Cannot be enrolled in Medicare, including Parts A or B, Medicaid, or TRICARE.

Cannot be claimed as a dependent on another person’s tax return.

Cannot be a veteran who has received treatment, other than preventive care, through the Department of Veterans Affairs within the past three months.

1 2 3 4

When you enroll in the HDHP medical plan, you will be eligible for the HSA account. Elect how much you want to contribute up to the IRS limit.

Groupe SEB will deposit an employer contribution into your account. You can change how much you contribute throughout the year if it doesn’t exceed the IRS limit.

Use your HSA balance to pay for eligible expenses, tax-free, including your deductible, coinsurance, prescriptions, and more

Unused money in your HSA automatically rolls over from year to year. You never lose funds in your HSA.

details.

Tax-advantaged FSAs are a great way to save money. The money you contribute to these accounts comes out of your paycheck without being taxed, and you withdraw it tax-free when you pay for eligible health care and dependent care expenses. Remember, you can’t have a fullservice Health Care FSA and an HSA at the same time.

Contributionlimits.

Set aside up to $3,400 for eligible health care expenses and $7,500 for dependent care expenses. Unused funds, except what can be rolled over, are forfeited at year’s end.

Loweryourtaxableincome.

Money you set aside is pretax dollars, so you pay taxes on a smaller amount.

Takeadvantageofpayrolldeduction.

Contribute equal amounts each pay period.

Changesnotallowed.

Unless you experience a qualifying life event, you cannot change your annual contribution amount.

Separateaccounts.

You cannot use Health Care FSA funds to pay dependent care expenses, or vice versa.

GroupeSEBoffersyouthefollowingFSAs,administeredbyCigna: FSAFastFacts

HealthCareFSA DependentCareFSA

Plan your health care FSA contribution amount carefully. Any unused funds greater than any allowed rollover amount are forfeited. Be sure to keep all expense receipts for your tax records because you may need to provide proof of eligible expenses and how the funds were used.

Tax-advantaged FSAs are a great way to save money. The money you contribute to these accounts comes out of your paycheck without being taxed, and you withdraw it tax-free when you pay for eligible health care and dependent care expenses

HSAvs.HealthCareFSA:What’sthedifference?

Availableifyouenrollina…

Eligible for Company contributions

Change your contribution amount anytime

Access your entire annual contribution amount from the beginning of the plan year

Access only funds that have been deposited

“Use-it-or-lose-it” at year-end

Money is always yours to keep

* Except for allowed rollover amount.

When you enroll in a Health Care FSA, you will receive a debit card, which you can use to pay for eligible expenses Depending on the transaction, you may need to submit receipts or other documentation to Cigna

Health Care FSA – Plan deductibles, copays, coinsurance, and other health care expenses. To learn more, see IRS Publication 502 at www.irs.gov.

Dependent Care FSA – Child Day care, babysitters, home care for dependent elders, and related expenses. To learn more, see IRS Publication 503 at www.irs.gov.

Another way to save money through tax-free spending is with Groupe SEB’s commuter benefits program You can use before-tax dollars to pay for monthly parking or transit costs related to your work commute It’s easy and flexible Before- tax deductions are allowed up to the IRS limit of $340 per month for parking or transit

Annual deductible (Waived for Preventive Care)

Preventive/Diagnostic services

Basic services

Major services

Having vision coverage allows you to save money on eligible eye care expenses, such as periodic eye exams, eyeglasses, contact lenses, and more for you and your covered dependents

Exam (once per 12 months)

Materials (once per 12 months)

Lenses (once per 12 months)

Frames (once per 12 months)

Contact lenses (instead of glasses) *

$10 Copay

$25 copay

$25 copay $130 allowance $105 allowance

*Coverage for Elective contact lenses is shown in the chart above. In addition, your vision plan also provides coverage for Medically Necessary contact lenses, when needed Go to http://www myuhcvision com to learn more

2026perpayperiodcost(pre-tax) Basedon24pays

2026perpayperiodcost(pre-tax) Basedon26pays

Our wellness program is designed to help you maintain or move toward a healthy lifestyle through preventive care and other assistance when you need it You also have access to tools and resources you can use to learn more about your personal health and monitor your progress toward your health goals

Cigna’s Well-Being Solution rewards you for going the extra mile. When you achieve certain health and wellness goals, you’ll receive rewards.

You can earn rewards for actions like completing a biometric screening, Health Assessment, and preventive care assessment and/or flu shot. Visit www.mycigna.com to view a complete list of activities to earn rewards.

Earn up to $1,000 in Cigna Wellness Rewards by participating in healthy activities. The more you do, The more you earn!

Shop for over 400 items across 50 brands or redeem Wellness Cash for a variety of gift cards.

Obtain special discounts on programs and services designed to help you enhance your health and wellness. Discounts are available for the following programs: weight management and nutrition, fitness clubs, vision and hearing care, alternative medicine and healthy lifestyle products. For more information, call 800.258.3312 or visit Cigna.com/rewards and use the password: savings.

Better health. Getting the right health screenings each year can reduce your risk for many serious conditions. And remember, preventivecaredoesn’tcostyouanything

A healthier wallet. A PCP can help you avoid costlytripstotheemergencyroom.Yourdoctor will also help coordinate specialist care, if needed

Peaceofmind.Advice from someone you trust means a lot when you’re healthy, but it’s even moreimportantwhenyou’resick

Good preventive care can help you stay healthy and detect any “silent” problems early, when they’re most likely to be treatable. Most in-network preventive services are covered in full, so there’s no excuse to skip them.

Have a routine physical exam each year You will build a relationship with your doctor and can reduce your risk for many serious conditions.

Get regular dental cleanings. Numerous studies show a link between regular dental cleanings and disease prevention including lower risks of heart disease, diabetes, and stroke

See your eye doctor at least once every two years If you have certain health risks, such as diabetes or high blood pressure, your doctor may recommend more frequent eye exams

When you don’t feel well, or your child is sick, the last thing you want to do is leave the comfort of your home to sit in a crowded waiting room full of other sick people. A virtual visit, included as a covered service under your medical plan, lets you see and talk to a doctor from the comfort of your home or office without an appointment. When you seek care through virtual visits, you’ll pay a flat copay amount, which is the same as you would pay for an office visit. Consider a virtual visit when your doctor isn’t available, you become ill while traveling, or you’re considering visiting a hospital emergency room for a non-emergency health condition. To learn more and register for care, go to www.mycigna.com

There are various challenges we experience in our day-to-day lives, all which can impact our mental and emotional health.

Cigna understands that having tools at your fingertips reduces the added difficulty of finding and accessing support, which is why we developed the Cigna Total Behavioral Health Programs Digital Resource Guide (link Behavioral Resource Guide). Whether you want to reduce stress, make a change, or talk to someone, the guide highlights the available tools and resources to help find the right fit.

Virtually connect with a Talkspace licensed therapist via live video and private texting; access online resources via the Talkspace app. Psychiatrist services are also available.

Ginger provides a behavioral digital/virtual care delivery model that brings together trained coaches, therapists and psychiatrists who provide evidence-based, appropriate care to members when they need it Support is available for conditions, such as: stress, sleeping issues, anxiety and depression

MDLIVE medical services have expanded to include behavioral health services Customers can consult with a counselor or psychiatrist for most nonemergency conditions and get prescriptions (if medically necessary)

Resilience and stress reduction app with science-based games and activities

On-demand peer coaching and personalized learning based cognitive behavioral therapy

Your Employee Assistance Program (EAP) offers a variety of counseling and work/life services to help you and your family balance changes and challenges you may face. This includes 3 free counseling sessions (per issue, per year), childcare & eldercare support, and legal, financial & ID theft consultations and referrals. To access these benefits, you can call 877.622.4327 or go online www.myCigna.com.

Child Care: We’ll help you find a place, program or person that’s right for your family.

Financial Services Referral: Free 30-minute financial consultations by phone and 25% off tax preparation.

Identity Theft: Get a free 60-minute expert consultation by phone for prevention or if you are victimized.

Legal Consulting: Get a free 30-minute consultation with a network attorney and 25% off select fees.

Pet Care: From vets to dog walkers, we’ll help you ensure your pets are well taken care of.

Senior Care: Learn about solutions related to caring for an aging loved one.

Groupe SEB offers programs to help ensure financial security for you and your family We also provide access to voluntary benefits designed to help you save money on valuable supplemental insurance coverage

You automatically receive basic life and accidental death and dismemberment (AD&D) insurance so that you can protect those you love from the unexpected. There is no cost to you for this coverage. You can also choose supplemental coverage.

Groupe SEB pays full cost of coverage *. Please see HR for additional benefit details

Employee basic AD&D** equal to the employee basic life benefit.

*Federal tax law requires Groupe SEB to report the cost of companypaid life insurance in excess of $50,000 as imputed income.

**AD&D benefits are paid in addition to any life insurance if you die in an accident or become seriously injured or physically disabled

Employee supplemental life – may elect up to 5 times your annual earnings to a max of $500,000

Spouse/domestic partner supplemental life – may elect up to $250,000 (can’t exceed 50% of employee’s supplemental life amount)

Child supplemental life – Optional child life insurance provides $1,000 of life insurance for newborn children through 6 months old and $10,000 of life insurance for children older than 6 months through age 25

Note: Any voluntary life coverage enrolled in over the guaranteed issue amount will require Evidence of Insurability (EOI). If you don’t enroll in any life or disability insurance plans when first eligible, you will have to provide EOI to receive coverage at a later date.

Shouldyouloseyourlife,sight,hearing,speechor useofyourlimb(s)inanaccident,AD&Dprovides additional benefits to help keep your family financially secure AD&D benefits are paid as a percentage of your coverage amount- from 50% to100%-dependingonthetypeofloss.

Be sure you ' ve selected a beneficiary for all your life and accident insurance policies. The beneficiary will receive the benefit paid by a policy in the event of the policyholder's death. It’s important to designate a

and keep thatinformationup-to-date

Groupe SEB s voluntary benefits, such as accident, critical illness, and hospital indemnity insurance, provide an added layer of financial protection by paying a cash benefit to help you cover various expenses not covered under a major medical plan.

Accident insurance supplements your primary medical plan and disability programs by providing cash benefits directly to you in cases of accidental injuries. You can use this money to help pay for uncovered medical expenses, such as your deductible or coinsurance, or for ongoing living expenses, such as your mortgage or rent.

Employee Only

Employee + Spouse/Domestic Partner

Employee + Child(ren)

Employee + Family

A broken leg meant Mary had to stay off her feet for a while, with several weeks of physical therapy. While she was recovering, Mary’s accident insurance helped her cover the costs.

Mary used part of her accident insurance benefit toward her physical therapy expenses. She used the rest toward after school care for her children while she was at physical therapy appointments.

A heart attack forced Steve to take an extended leave. While he has medical insurance through Groupe SEB, Steve was still responsible for paying out-of- pocket costs that he didn’t anticipate. With his critical illness insurance, Steve was able to afford the treatment he needed without dipping into his savings.

Steve used part of his critical illness insurance benefit toward his deductible and coinsurance for a surgery and hospital stay. He used the rest toward ongoing costs for outpatient cardiac rehabilitation and prescription medications.

A trip to the hospital can be stressful, and so can the bills. Even with a major medical plan, you may still be responsible for copays, deductibles, and other out-of- pocket costs. A hospital indemnity plan provides supplemental payments directly to you for expenses that your medical plan doesn't cover for hospital stays.

Critical Illness insurance provides a cash benefit when a covered person is diagnosed with a covered critical illness or event after coverage is in effect. Benefit amounts available $10,000, $20,000. $30,000.

CriticalIllnessCoverageLevel

Only Employee + Spouse/Domestic Partner Employee + Child(ren)

+ Family

Miguel was having trouble breathing and had to be hospitalized for several days. He used his hospital indemnity insurance to pay expenses that his primary medical plan didn’t cover.

No one intends to be unsafe online, but it’s important to have tools that help you protect you. Chances are your personal info is already out there, making you more vulnerable to cybercrime.

LifeLock Identity Alert System

Monitoring for fraudulent use of your Social Security number, name, address, or date of birth in applications for credit and services. The patented system sends alerts by text, phone, email, or mobile app.

Credit Monitoring + Application Alerts

We monitor key changes to your credit file and alert you to help detect fraud.

Dark Web Monitoring

Identity thieves can sell your personal information on hard-to-find dark web sites and forums. LifeLock patrols the dark web and notifies you if we find your information.

U.S.-Based Identity Restoration Specialists

If your identity is compromised, an Identity Restoration Specialist will personally handle your case and help restore your identity.

Wishbone Pet Health Insurance

Easy to understand plans, 90% reimbursement, $250deductible, excellent customer care.

Includes pet ID tag and monitoring service with The Pet Tag and 24/7 pet telehealth powered by AskVet.

Rates are subject to age and breed of pet. Direct billed to employee.

Total Pet Discount Plan

Discounts for a number of services including prescription medications, food, toys, treats and more. Access to pet telehealth 24/7, discounts on veterinary care as well as lost pet recovery service.

Group rate for this plan is $10.75/month for one pet and $17.50/month for @ or more pets.

Rates are payroll deducted.

You won’t pay income tax on any voluntary benefits you choose because contributions are deducted on a post-tax basis.

PerkSpot provides a range of benefits:

Full team of negotiators working with merchants

98% of discounts are better than retail prices

Access to local and national merchants

Wellness perks including gym memberships and vacation savings programs

Mobile optimization

More than 5,000 merchants, restaurants, gyms, auto dealers, theaters and more

You can receive exclusive employee-only discounts on your home and auto insurance coverage. Through the program with Farmers Insurance, you can apply to insure your auto, home, and other property against loss, and yourself against personal liability.

The program offers a number of advantages:

Convenient direct pay options to pay your premiums

Special employee discounts

A tenure discount for years of service.

You may apply for insurance at any time. You do not need to wait for your current policy to expire to call for free quotes.

More perks. More savings. More of what makes you happy. Support your personal and financial well-being through exclusive deals and limited-time offers on the products, services and experiences you need and love. Start saving on:

Electronics * Appliances * Apparel * Cars Flowers * Fitness Memberships * Gift Cards Groceries * Hotels * Movie Tickets * Rental Cars * Special Events * Theme Parks * And More!

Through our partnership with SoFi at Work, we can help you find ways to reduce your student debt sooner and plan for a stronger future, opening the door to greater financial well-being in general

With SoFi at Work, you could save on student loan refinancing with exclusive rates and bonuses Plus, with their benefits Dashboard, you get access to many more tools and features all opening the door to a brighter financial future Employees will receive special rate discounts or welcome bonuses for the following products:

Loan Refinancing

PLUS Loan Refinancing

Student Loans

Loans

Explore the savings and possibilities today when you enroll at SoFi.com/groupeseb

Groupe SEB provides financial assistance to full-time regular salaried employees having 6 months of full-time employment. If approved, the Company will reimburse up to 75% of tuition to a maximum of $5,000 per calendar year.

Groupe SEB will reimburse 80% of approved adoption related expenses (custody battles excluded) up to $10,000.

Birthing and non-birthing employees are eligible for a limited number of paid time off to be used within 6 months of birth or adoption. Benefit coordination will apply to all New Jersey employees based on the NJ Family Leave Insurance. Please see HR for additional benefit details.

Based on your grade level, you would be eligible to an annual Discretionary Bonus Plan. This plan is designed to pay a percentage of your annual base salary and is dependent upon company results as well as individual performance. As the Bonus is associated to a target to be achieved, it can be granted only in case the Recipient has an effective working period prior to September 1st, and is active in payroll effective January 1st of subsequence year.

Bonuses are usually paid during the Spring and are based on performance and objectives achievement of the prior year. It is understood that the bonus plan is subject to change from time to time at Groupe SEB’s discretion, notwithstanding, no employee has a guarantee of a bonus. All bonus payments at Groupe SEB are at the discretion of the company, and employees do not have an accrued right to a bonus payment, or any portion thereof.

For clarity, neither the Annual Discretionary Bonus, nor any other bonus are to be included in the calculation of compensation during any termination notice period or for any other termination entitlements.

Vacation

Employees earn vacation according to years of service: 1 - 4 years 15 days / 3 weeks

5 -10 years 20 days / 4 weeks 10 or more 25 days / 5 weeks

Vacation must be taken during the year earned. Managers at Senior Level receive:

1 year – 15 days

2-4 years – 20 days

5+ years – 25 days

Vacation Accrual:

Number of eligible days/12 months

15 days = 1.25 days/month

20 days = 1.66 days/month

25 days = 2.08 days/month

Personal Time

One day earned per full calendar quarter worked; days accumulate during year earned.

Unused personal days may be saved as sick days for future use and coordination of benefits with Short Term Disability or Family Leave.

Personal time can be taken in full hour increments.

Groupe SEB USA observes 11 holidays per year, which vary by location; schedule is published in advance.

Sick Time (coordinated w/ Short Term Disability and Family Leave)

Hourly employees may earn up to 3 Sick Days per calendar year.

Salaried employees may earn up to 5 Sick Days per calendar year.

New hire employees will receive 10 days in first full calendar year, or 15 days for Managers at Senior Level Sick days are accrued monthly (same as vacation) 5 days = .41 days per month

Coordination of Benefits

The maximum number of days to be used in a calendar year is limited to 5.

Unused sick days may be saved for future use and coordination of benefits with Short Term Disability or Family Leave.

Quarterly Bonus Days (Millville Hourly Employees)

One day earned per full calendar quarter worked; days accumulate during year earned.

The Company 401(k) savings plan with Principal provides advantages you may not get with other types of savings plans and helps you meet one of life’s important goals —saving for a financially secure retirement.

You can contribute to your 401(k) with before-tax money or Roth after-tax money. The type of contributions you make will depend on your financial goals and circumstances.

Employees are eligible to defer 1% to 100% of earnings to a 401(k) account subject to IRS limits.

ROTH after-tax contributions are an option. Both before-tax and Roth after-tax contributions count toward the IRS maximums

Groupe SEB will match 100% up to 5% of your contribution after 1 year of service

Groupe SEB will make a 4% discretionary contribution after 1 year of service

New hires will be automatically enrolled in their 401(k) at a 5% contribution rate effective on the first pay date following the 1st of the month after date of hire You can change your contributions at any time by logging on to www Principal com or calling 1-800-5477754

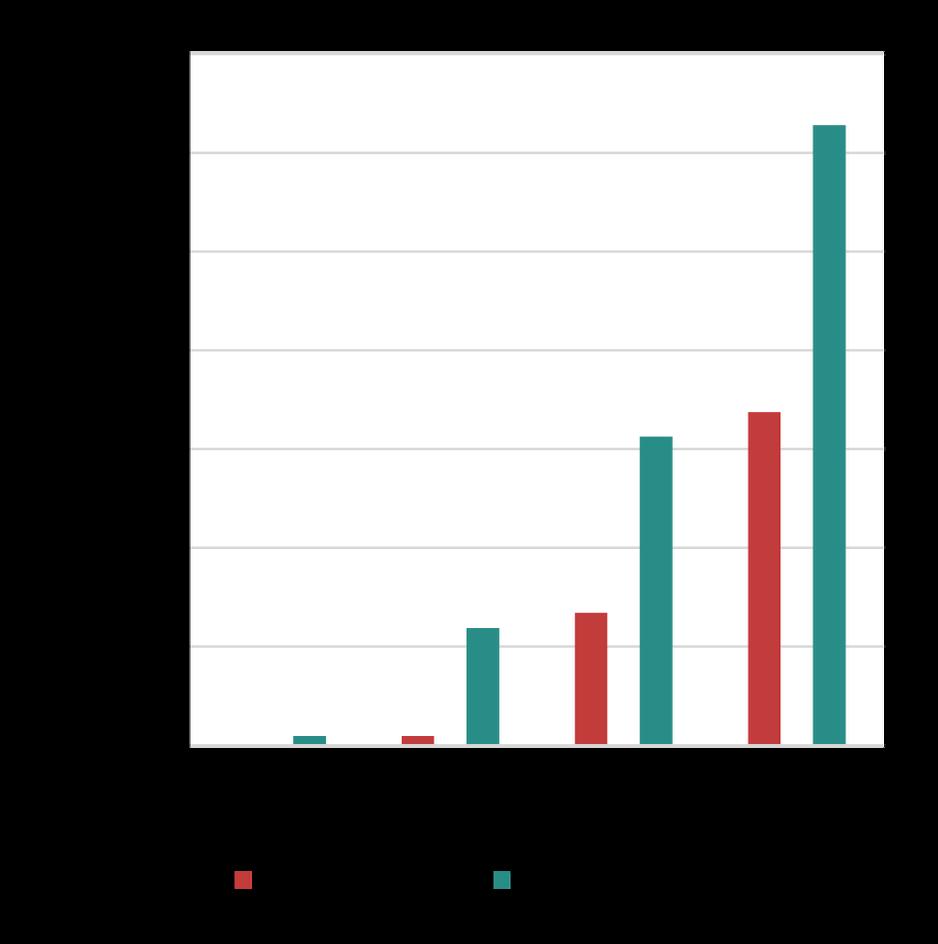

Starting your retirement savings journey early can pay off. As your account balance grows, you earn a larger amount due to compounding interest Take for example two employees Employee One begins contributing his first year of employment, while Employee Two waits until his 10th year of employment Both employees contribute 5% to their 401(k) and receive a 4% match from Groupe SEB.* When both employees are ready to retire at age 67, Employee One who signed up for the 401(k) plan the first year has nearly double the amount of Employee Two who waited several years to join the plan Employee One’s money was invested longer and was able to take advantage of compounding interest for more years Investing involves risk, including the risk of loss Before investing, carefully consider the funds’ or investment options’ objectives, risks, charges, and expenses For questions, call 1-800-547-7754

The plan offers you a variety of investment options to choose from. It’s important to carefully consider your investment goals, retirement timeframe, and risk tolerance when deciding how to invest your plan contributions. Visit http://www.Principal.com to learn more about your investment options.

Employer contributions are vested according to a six-year graded schedule

There are two main types of 401(k) retirement savings plans: traditional and Roth. Groupe SEB offers both. The difference really comes down to a single word: TAXES.

TRADITIONAL 401(k) - This one’s for anyone who wants to put off paying taxes. Any money you save or invest isn’t taxed until you withdraw it in retirement. Withdrawals are considered income and will be taxed at your current (retirement) federal and state tax rates. A traditional 401(k) also reduces your overall annual income, so you’ll pay lower taxes while working.

Example: If your annual salary is $35,000 and you contribute $5,000 to a traditional 401(k), you’ll only pay taxes on $30,000 for that year.

ROTH 401(k) - A Roth 401(k) functions similarly to a traditional 401(k) plan, with one big difference — you make contributions to a Roth 401(k) with after-tax dollars. This type of plan is for anyone who wants to pay taxes now. Then, when you pull money out of the plan during retirement, you won’t pay any taxes on the withdrawal.

Employee-managed – Easy way to save using payroll deductions. Choose from several investment funds

Contribute more each year – Higher contribution limit and catch-up feature for anyone 50 or older 2026 Limit: $24,500 ($8,000 after the age of 50) Note: Limits are for traditional and Roth 401(k) contributions combined

Increased savings potential – Contributions aren’t taxed when deducted from your paycheck, so you save more each pay period This means more interest earned, and more money in the long run.

Taxes at withdrawal – When you take money out at retirement, you’ll pay taxes at the current federal and state rates, which could be higher if rates rise each year

Employee-managed – Easy way to save using payroll deductions. Choose from several investment funds

Similar contributions – A Roth 401(k) has the same annual contribution limits as a traditional 401(k) Note: Limits are for traditional and Roth 401(k) contributions combined

Secure – Again, this type of 401(k) is transferable if you leave the Company

No taxes upon withdrawal – When you retire, the money you see in your Roth 401(k) is what you get no tax deductions occur.

Contributions are not tax deductible –Roth contributions do not allow you to lower your taxable income at the time contributions are withheld from your paycheck

www.mycigna.com

www.mycigna.com

wwwmycignacom

www.myuhcvision.com

wwwmycignacom

www.principal.com

800 754 3207

800 754 3207

833-277-7634; Monday-Thursday: 8 am-10 pm ET Friday-Sunday: 8 am-8 pm ET or email: your-benefits@sofi com

800-891-2565; Monday-Friday: 8:00 am - 6:00 pm EST or email: customercare@petbenefits.com

866 606 6057

954.324.6483

800 438 6381

800 607 9174

SoFi.com/GroupeSEB

wwwpetbenefitscom/land/ groupeseb

seb.perkspot.com

www.ticketsatwork.com

wwwmyautohomefarmerscom

https://wwwlifelockbusiness solutionscom/EmployeeBen efits/BenefitPremier

This guide is intended to describe the eligibility requirements, enrollment procedures, plan highlights, and coverage effective dates for the benefits offered by Groupe SEB. It is not a legal plan document and does not implyaguaranteeofemploymentorcontinuationofbenefits.Whilethisguideisatooltoanswermanyofyour benefitquestions,fulldetailsoftheplansarecontainedintheSummaryPlanDescriptions(SPDs),whichgovern each plan’s operation. The noted plan changes in this guide may service as a Summary of Material Modifications (SMM) to the SPD. Whenever an interpretation of a plan benefit is necessary, the actual plan documentswillprevail.