BY CHRISTYN CIANFARANI

The word “unprecedented” seems to be cropping up with alarming regularity lately — and not in good places. Unprecedented tariffs. Unprecedented challenges. Unprecedented threats.

I’ve been saying the word a lot myself in public since the pandemic hit in early 2020 and the first half of 2025 has seen me use it so many times that it risks veering into cliché. But to describe the current reality for Canada’s defence industry and our broader nation as unprecedented is also accurate.

Never have we faced such unpredictability from our closest ally and largest trading partner. Never have national defence and issues of Canadian sovereignty occupied so much space in the public conversation. And never have we needed a course correction more than we do right now.

For the more than 700 defence, security and emerging technology businesses that my association represents, the trade war with the United States and its various knock-on effects have been existential.

Our two countries share a tightly integrated defence industrial base (40 per cent of the Canadian defence sector by sales is composed of subsidiaries of U.S.headquartered companies) and a unique security relationship dating back to the Second World War. Both have been dealt enormous shocks since January.

Companies here in Ottawa, a selection of whom you’ll hear from directly in this section, are weathering the storm with the same resilience they displayed during the pandemic. Flexibility and innovation are in their DNA, so this comes as no surprise. But this challenge is also very different and with no end in sight companies need clear and informed direction from the very top if they are to grow and seek new opportunities in what is, by nature, a

Simply put: Unprecedented times call for unprecedented measures. It’s time to get to work.

highly managed global defence market.

When I wrote this column last year, I called on the Canadian government to start “picking winners” as it seeks to boost our country’s lagging productivity.

Rather than scattershot investments and programs, I argued, government must zero in on sectors (yes, like defence) that can deliver big returns on investment, basing its choices on metrics like strong

R&D and export intensity. The Business Council of Canada backed up those arguments with an excellent report titled “Security and Prosperity” last fall.

If our plea was urgent then, it’s a fivealarm emergency now.

Canada’s leaders must start by investing in national defence and, for the first time in decades, they have the political cover to do so. The public has woken up to the global realities we face. According to recent polling, 78 per cent of Canadians now say that defence should be a top priority for the government. That’s 20 points higher than it was during our darkest days in Afghanistan.

But money alone isn’t going to be enough. The government must go beyond what was outlined in its recent election platform and translate it into the next federal budget.

It must also detail how Canadian companies can support that plan, in consultation with industry, and push through reforms to a procurement system that was built for a world that no longer exists.

Industry, in turn, must be more ambitious, resisting the ever-present lure of foreign acquisition and opting to scaleup and invest in Canada, for Canada.

None of this will be easy. But if we make the right choices now, we will see dividends paid not only in economic productivity, but in national sovereignty and in a resurgence of the global influence that we once cultivated and leveraged among our closest allies.

Simply put: Unprecedented times call for unprecedented measures. It’s time to get to work.

Christyn Cianfarani has served as president and CEO of the Canadian Association of Defence and Security Industries (CADSI) since 2014. The association represents more than 700 defence, security and emerging technology companies across Canada.

The Canadian and American defence industrial bases are highly integrated, an arrangement that stretches back to the Second World War. With this relationship now in a period of unprecedented uncertainty, the Canadian government has committed to sourcing more defence goods and services domestically, while diversifying how and where it buys equipment abroad.

The Canadian defence sector will need to adjust in tandem, taking its cues from government in what remains a highly managed market. In this article, three local defence firms share how they are adjusting and preparing for what may come next.

Q:How has the trade war affected your business and how are you planning for the next few years?

The trade war has catalyzed strategic shifts at CCX Technologies, not disrupted our operations. Anticipating a Canadian government shift toward prioritizing domestic technology and capabilities, we’re increasing investment and effort in R&D initiatives to position ourselves as a key partner for the government’s future technology needs.

We’re also strengthening our U.S. market position by strategically partnering with established U.S. companies to ensure sustained growth within this complex market and facilitating reciprocal market access by leveraging our Canadian presence to enable our U.S. partners’ entry into the Canadian marketplace.

Finally, we’ve accelerated European expansion and are actively pursuing government-supported initiatives to establish a strong market presence.

Our strategy for the coming years involves a calculated expansion into new international markets, building upon the momentum gained in Europe, while reinforcing our core business through strategic partnerships and a heightened focus on Canadian innovation.

Q: What can all levels of government do to support businesses like yours in the short and medium term?

To bolster 100 per cent Canadian SMEs like CCX Technologies, governments should implement a definitive strategy focused

on prioritizing and investing in domestic technological capabilities — beyond standard procurement reforms. Specifically, that will mean procurement policies that actively favour Canadian-owned enterprises with unique

technologies and expertise, ensuring domestic capabilities are the primary consideration.

Canada also needs dedicated investment funds aimed at scaling and expanding Canadian capabilities. This

Q: How has the trade war affected your business and how are you planning for the next few years?

We are fortunate in that only about five per cent of our business involves crossborder flows of equipment and material. Our Canadian operations deliver mostly for customers in Canada and likewise our operations in the U.S., U.K. and in Europe. Our approach of delivering for global customers with teams embedded in those markets has reduced the impact across the organization.

We have been paying very close attention to our supply chains and each new announcement to identify any new affected areas and are seeking to minimize our risk profile.

funding should prioritize Canadian-owned entities to ensure IP and economic benefits remain within Canada. In tandem, we should develop incentives and frameworks to galvanize a robust domestic investment community focused on Canadian innovation.

Q:Over a longer timeline, defence spending and investment in Canada’s defence industry look poised to increase. What might those new investments mean for your business?

Increased Canadian defence spending presents a significant opportunity for CCX Technologies and Canada’s defence sector. As a 100 per cent Canadian-owned SME in platform security, we offer sovereign solutions that keep critical data and IP within Canada.

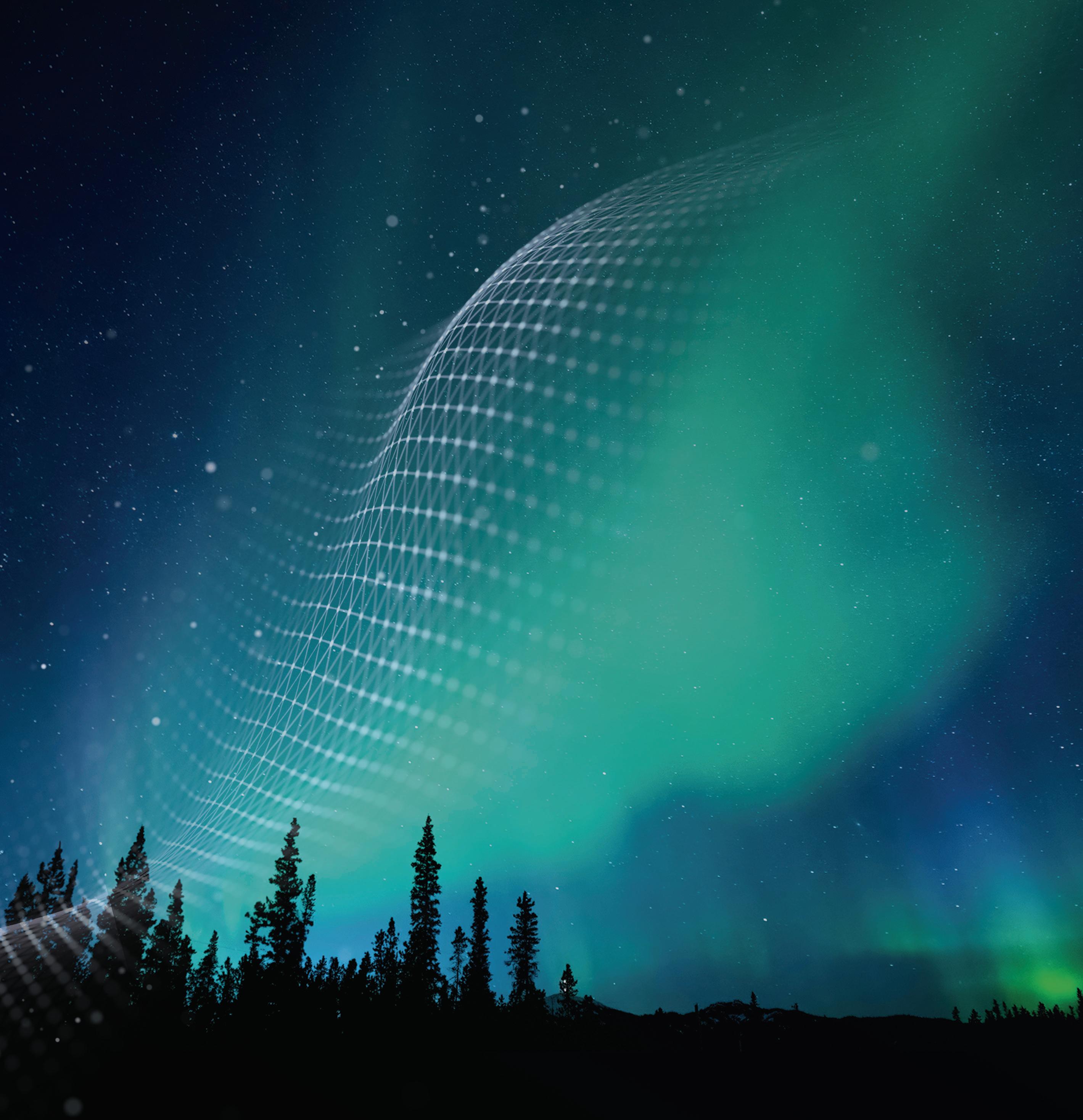

Anticipating defence priorities outlined in initiatives such as “Our North, Strong and Free,” CCX Technologies is strategically advancing Canadian technologies in secure RF, networking and communications. This proactive development positions us as a key domestic partner ready to meet Canada’s evolving defence needs and we urge Canada to prioritize Canadian solutions.

Planning for the future is about understanding the market forces and trends as best we can and making investment decisions based on those trends. The uncertainty in the CanadaU.S. relationship is making anticipating that trend very difficult and we have been looking at where Canada is seeking to sustain relationships, especially in Europe. NATO members, Canada and partners in the Indo-Pacific are all increasing their defence and national security spending, so we certainly see opportunity in those spaces to invest, identify potential M&A opportunities and expand existing delivery.

Q: What can all levels of government do to support businesses like yours in the short and medium term?

The biggest thing that all orders of government can do is to prioritize buying Canadian. The governments of Ontario and New Brunswick are taking clear action to prioritize Canadian suppliers for all their needs, which is encouraging. Where there is no Canadian supplier, governments will need to make trade-offs. Where a Canadian solution is ready, governments should absolutely be buying from Canadian companies and strengthening domestic suppliers and supply chains. Buying Canadian delivers benefits to communities across the country, strengthens our

domestic industry and helps sustain innovation and commercialization to make Canadian companies competitive internationally.

Q:Over a longer timeline, defence spending and investment in Canada’s defence industry look poised to increase. What might those new investments mean for your business?

Prioritizing buying Canadian is clearly something we hope to see from the incoming government as it seeks to increase defence spending. Canada should be buying in Canada wherever it can on defence, especially as it is poised to spend tens of billions in new investment between now and 2030.

As a Canadian company, Calian stands ready to mission-critical solutions for any upcoming capital defence program. Canada has clear ambitions: Arctic sovereignty and space programs; addressing personnel shortages; and buying a series of generational platforms. Calian is ideally suited to deliver for the people part though training and health services and for capital programs through systems integration, advanced

manufacturing and IT, data, cybersecurity and emissions security solutions.

Q:How has the trade war affected your business and how are you planning for the next few years?

The trade war has deepened our commitment to manufacture domestically within Canada. Our current international and domestic business, led by services, will be largely unaffected since the tariffs only target goods. Some hardware may be subject to increased U.S. tariffs. For example, certain component prices within our manufactured Nortac Wave product may increase due to tariffs imposed by Canada on U.S.-made parts.

We will continue with our core strategy in global and domestic markets. Nortac’s established international relationships and domestic government contracts underpin the company’s resilience and we expect

growth to be strong over the next few years. The utility of Nortac Defence’s developed product portfolio in the current security and defence environment is increasingly apparent. The products are dual-use and the company is pushing into non-military markets worldwide under the Nortac brand name, adding additional resilience to the business model.

Q:What can all levels of government do to support businesses like yours in the short and medium term?

The Canadian government supports Nortac Defence very well in its international growth initiatives through its trade commissioners and defence attachés in its embassies worldwide. The Canadian Commercial Corporation (CCC) is proving invaluable to support larger transactions with government-to-government initiatives. Clearly, technology development is an expensive business with investment frontloaded in advance of sales.

An observation is that Canada has a strong SME sector for defence technology but these companies operate, in the main, in isolation. To leverage the innovation, cost effectiveness and utility of these

SMEs to satisfy government defence requirements and increased collaboration between them would be beneficial, as well as the government making the defence procurement process quicker, cheaper and simpler.

Future competitive advantage at the national security level will be leveraged by those countries who prioritize engaging their SMEs. Canada is poised to take the lead in its interactions with smaller defence technology firms.

Q: Over a longer timeline, defence spending and investment in Canada’s defence industry look poised to increase. What might those new investments mean for your business?

Increased defence spending is clearly positive for Nortac Defence so long as its products have a market fit. As for all tech companies, retaining relevance and remaining at the leading edge of product development and innovation is an expensive challenge. So long as SMEs are embraced in the procurement structures for increased defence spending, then this will be a huge opportunity for innovation and growth of SMEs in the defence sector in Canada.

Proudly supporting the Royal Canadian Air Force and Canadian Armed Forces, the Airbus A330 MRTT – the world’s most advanced multirole tanker – delivers more fuel, cargo, and passengers to enhance North American Aerospace Defence Command (NORAD) and NATO operations.

BAE Systems has played a vital role in the Canadian defence and security industrial base for more than a century. Since 1911, it has worked with the Canadian Armed Forces to contribute to the country’s security, while also delivering world-class innovations and employing thousands of Canadians.

BAE Systems’ heritage companies include Hawker Siddeley, Avro Canada which produced the Avro Arrow aircraft, and de Havilland Canada, which left our business in 1980 and became its own entity. From these beginnings through to today, they have worked alongside the military and fellow Canadian companies to deliver both protection and economic prosperity.

“From world-leading defence platforms to a range of services, our strengths and core capabilities include providing design, manufacture, integration, and support services for the Canadian Armed Forces across land, sea, air, space and digital domains,” says Anne Healey, Director, BAE Systems Canada.

The company’s Hawk jet trainer has provided training for thousands of Royal Canadian Air Force pilots, she notes. The company is also responsible for the design of a fleet of 15 River Class Destroyer warships for the Royal Canadian Navy, to be built in partnership with Irving Shipbuilding and Lockheed Martin Canada.

“We worked with another Canadian company, Cellula Robotics, on the autonomous, uncrewed submarine, Herne. Trials off the south coast of England late last year saw the craft conduct a pre-programmed intelligence, surveillance, and reconnaissance mission powered by Nautomate, our platform agnostic, highspecification autonomous military control system,” says Healey.

BAE Systems’ Swedish businesses, Hägglunds and Bofors, offer globally proven and world-renowned capabilities for personnel transport through snow and other tough terrain conditions and mobile firepower with the Beowulf tracked vehicle and ARCHER wheeled howitzer.

Recent enhancements in munitions production also offers Canada the opportunity to build up its stockpiles to boost its defence capabilities, and following donations to Ukraine.

BAE Systems also has the T-series of hybrid and electric uncrewed aerial systems capable of lifting payloads between 68 and 300 kilograms over short- to medium-range missions, providing logistics support for troops, including delivering ship-to-ship on the current deployment of the UK’s aircraft carrier, HMS Prince of Wales. The Royal Canadian Navy frigate HMCS Ville de Québec is also playing a key role in this carrier strike group deployment.

In terms of innovation, the company’s new PHASA-35 solar-powered aircraft, is capable of flying more than 20,000 metres (66,000 feet) high, well above commercial air traffic. “It delivers persistent and cost-effective imagery and communications by utilizing a range of world-leading technologies including advanced composites, energy management, solar electric cells, and photo-voltaic arrays, not currently available from existing air and space platforms,” explains Healey. “It could be very valuable in border patrol operations,” she adds.

Furthermore, BAE Systems makes valuable contributions to sustainable transportation. “Our hybrid and electric drivetrain powers more than three thousand buses in Canada, delivering sustainable municipal transport in several cities, including Ottawa and Halifax, where most of our employees are based,” says Healey.

BAE Systems’ energy and infrastructure strategies reduce greenhouse gas emissions across its operations, while supporting business growth. “We’re working with our customers to deliver products and services that support their operational performance, whilst developing energy-efficient plans, embedding environmental considerations within the overall platform or capability,” Healey explains.

Healey says the company will continue to expand, employing more Canadians in high-value jobs.

“We have more than 150 suppliers in Canada and last year we spent more than $300 million with them,” says Healey, who stresses that the economic impact of BAE Systems supports an estimated 8,000 jobs in Canada.

“We aim to grow that significantly in the years ahead. We often talk of a century of commitment, and a partnership with purpose because that is the legacy we continue today, with a bright future of growth ahead of us in, and with, Canada.”

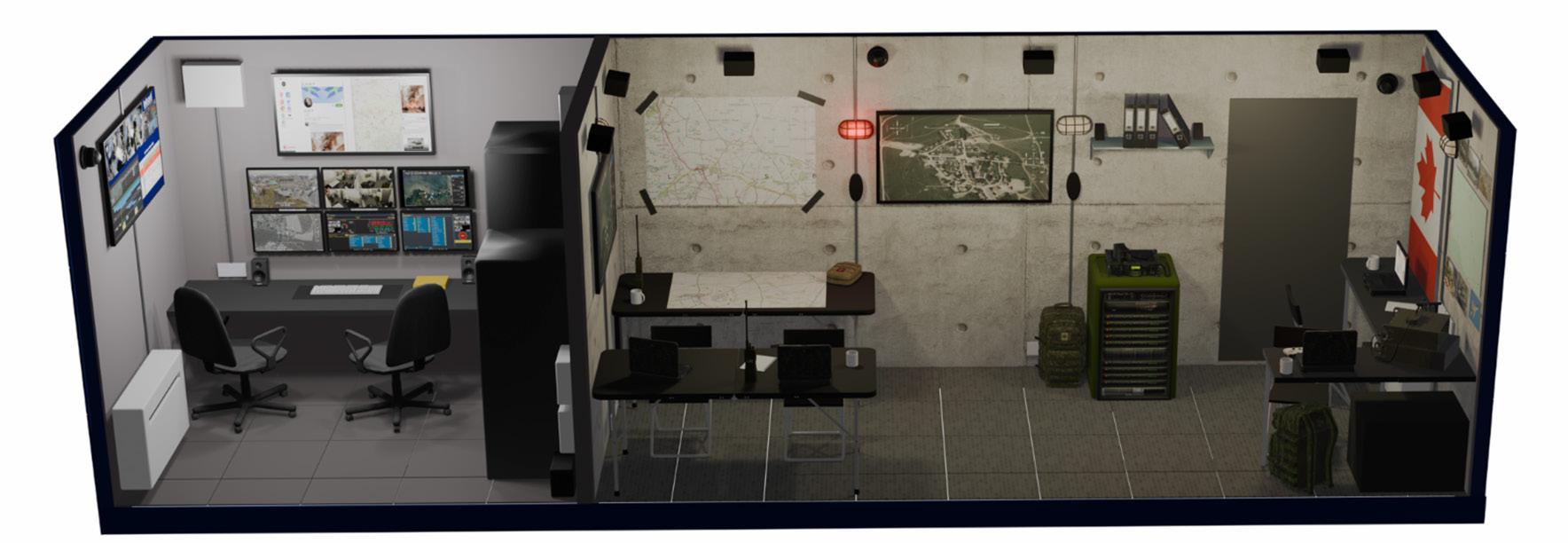

Adaptable training module can replicate virtually any military or first responder scenario, providing significant training benefits — and cost savings

Retired Canadian Armed Forces (CAF) veteran and Babcock Canada’s Senior Business Development Manager – Land, Rob Marois, says he never thought he’d get back into a combat situation in Afghanistan. But that was before trying the Babcock Immersive Training Experience (BITE), a technology-driven training platform offering a new way of learning for military and emergency personnel.

“It gave me goosebumps,” says the former Royal Dragoons Commanding Officer and Chief of Operations with Task Force Kandahar during NATO’s International Security Assistance Force (ISAF) engagement in the country.

“And I say this as someone who was skeptical going in,” adds Marois. “It brought me right back to an abandoned building we had used as a command post” in Afghanistan’s southern Panjwayi district.

“It had the guns going off, the helicopters coming in, all the different smells and aromas that go with that, the shaking of the building, the lights dimming. It was all the same.”

Launched in the U.K. in 2024, BITE has been used to support innovation and trial events for multiple end users and is now set to launch in Canada at CANSEC 2025 in Ottawa. Following its event debut, BITE will be available for demonstration at Invest Ottawa’s research and development complex Area X.0.

Complete the contact form in the training section of Babcock Canada’s website if you would like to experience BITE for yourself.

Ensuring real-time training exercises are as similar as possible to front-line combat or other emergencies are the whole point of BITE, which provides a suite of realistic land, sea, and air simulations; dynamic controls; full data capture; and adaptable design.

The module can replicate virtually any scenario

in a “safe-to-try” environment — from a command post in a ground war situation, to a ship at sea, to a helicopter medevac or civilian emergency.

“It’s only limited by the imagination of the training audience and what they want to do,” says Marois, adding that BITE can be tailored completely to a client’s requirements. “This hyper-realistic system is adaptable to both current and future theatre-specific mission training requirements. It can be deployed anywhere in Canada or even overseas, supporting missions like Operation REASSURANCE with the Canadian-led NATO Multinational Brigade in Latvia.”

Realism is achieved through tailored soundscapes, seismic simulation, climate control, generated aromas, and visual stimuli piped into the training module by unseen training supervisors. As the exercise takes place, the team in the control room is able to measure trainee performance in real-time

through observation and the recording of biometric data, enabling them to critically assess and problem solve before repeating the exercise.

It’s all part of a realistic training offering designed to prepare users for the physical and cognitive stresses of real-life operations.

“It’s extreme pressure,” explains Marois. “The cognitive load is through the roof.”

Marois says BITE’s main benefit for trainees and their organizations is the realistic “bridge” it provides between traditional classroom-based learning and actual deployment. But there are other benefits:

• Typical field training exercises are timeconsuming and often rushed — BITE doesn’t have these same time pressures, because it doesn’t require an actual command post to be set up or a ship put to sea, allowing trainees to get in more “sets and reps.”

• Building greater confidence in trainees’ decision-making capability, thanks to this continuous high-level training.

• Cost savings by not having to deploy expensive military equipment for training (along with less wear-and-tear on military gear).

“In the army, we often say ‘train as you fight’ or ‘train as you operate.’ That’s because your hardest day should be in training, not in real operations,” Marois explains. “BITE provides that level of training by bridging the gap between traditional classroom learning and live operations.”

Customers can buy a BITE module outright, lease it, or use it as a pay-as-you-go service.

“BITE is also a hit with the general public,” Marois says, recalling a demonstration Babcock recently delivered at an event in Florida.

“One military member, who hadn’t experienced a live active operation, felt so immersed in her BITE demonstration, she immediately wanted a second one.”

BY DAVID SALI

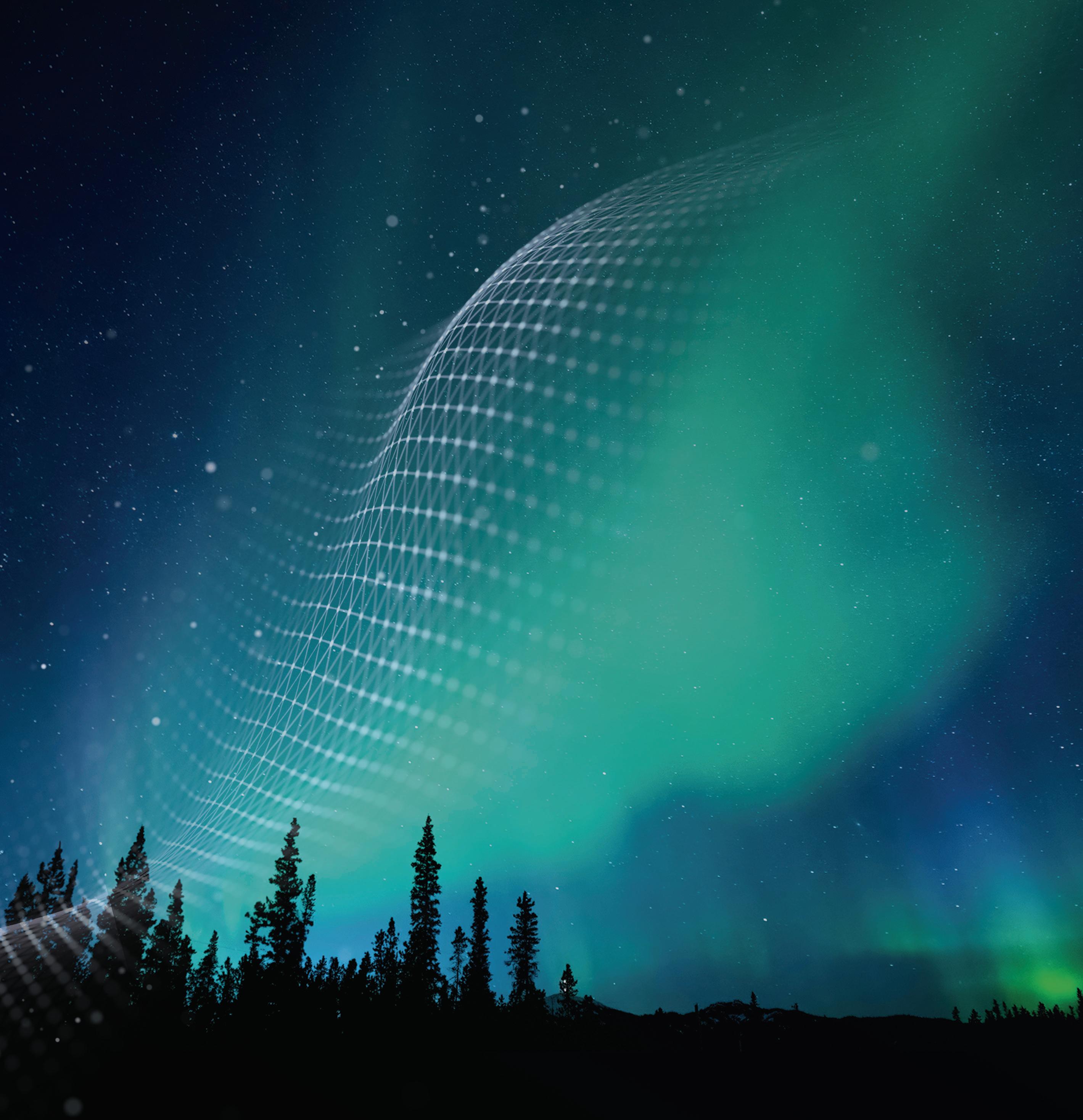

The Canadian arm of a Norway-based multinational company is expanding its Kanata office and plans to hire dozens of workers in a bid to capitalize on a growing push for more homegrown defence and security solutions.

Founded in Ottawa in 1992 as Gallium Visual Systems, Kongsberg Geospatial was acquired by Norwegian defence giant Kongsberg Gruppen in 2006.

The firm’s flagship product is TerraLens, geospatial visualization software that helps clients such as the U.S. Navy create 2D and 3D models of combat environments. The company has been expanding its products and services in recent years, adding offerings such as software that helps pilots of drones used in mission-critical operations like fire rescues and organ delivery navigate beyond their visual line of sight, as well as training software that simulates realworld conditions for clients such as the Canadian Armed Forces.

President and managing director

Jordan Freed says it’s a booming business, and it’s about to get even bigger thanks to a new contract with NAV Canada, the nonprofit private organization that owns and operates the country’s civil air navigation system.

The “multi-decade” deal will see Kongsberg Geospatial work with Kongsberg Defence and Aerospace, a business unit of its Norwegian parent, to build software that will help airports provide remote air traffic control service.

The system is being tested at Kingston Airport with the aim of getting the green light from Transport Canada for use in terminals across the country. Freed says

the past seven years.

The new space comes decked out with cutting-edge laboratory facilities and a product demonstration room as well as room for an additional 30 employees.

Freed says he expects the company will have no trouble filling its new digs. He says Kongsberg Geospatial is perfectly positioned to win contracts from a new Liberal government that has pledged to boost defence spending and implement a “made-in-Canada” procurement policy for military equipment amid rising trade tensions with the United States.

“We have a major opportunity,” Freed said in a recent interview. “We have a government that’s just come in with a requirement … to radically increase defence spending. We have a geopolitical situation that means industry needs to step up and provide our government with solutions that are developed in Canada or developed with international partners to provide options that are not U.S.-based. Kongsberg is uniquely situated for that.”

Three years ago, Kongsberg Geospatial unveiled a long-term strategic blueprint that projected the company would double its revenues within five years. It actually hit that mark two years earlier than expected, prompting management to draw up a new five-year plan that sets a target of 50 per cent revenue growth by 2030.

the software could eventually be installed at up to 80 Canadian airports over the next 15 years.

“It’s really been about not just capacity growth but capability growth,” he explains.

Fuelled by growing service offerings, Kongsberg Geospatial has been on an expansion tear of late. The firm now has about 90 employees, up from around 40 when Freed joined the firm three years ago.

At the beginning of May, the company took over 10,000 square feet of space on the first floor of 411 Legget Dr. in Kanata north, the same building where Kongsberg Geospatial has occupied 19,000 square feet on the fourth floor for

Freed is confident the company will reach that goal. While he concedes the “race for talent” is fierce in the Kanata tech hub and Kongsberg Geospatial doesn’t have the name recognition of some of its bigger competitors, he believes the best is yet to come for the upstart firm.

Still, Freed also admits nothing is guaranteed in today’s volatile political and economic landscape.

“The geopolitical situation is incredibly uncertain,” he said. “As much as we believe it is a huge opportunity for the international companies that have subsidiaries here in Canada, that can change on a dime.”

“It’s really been about not just capacity growth but capability growth.”

JORDAN FREED, PRESIDENT AND MANAGING DIRECTOR, KONGSBERG GEOSPATIAL

BY DAVID SALI

An Ottawa-based organization that specializes in funding defence and security startups hopes to ramp up its investments after its venture capital arm was acquired by Toronto-based VC giant Kensington Capital Partners.

Kensington has purchased One9’s investment team led by founder and managing partner Glenn Cowan, the companies announced recently.

As part of the deal, all of One9’s future investment activities will take place under the Kensington umbrella. Financial terms of the deal were not disclosed.

The transaction cements a relationship between the two organizations that began five years ago when Kensington, a private equity and VC firm that manages more than $2.6 billion in assets, and One9 partnered to create special purpose vehicles to fund up-and-coming defencetech ventures.

In short order, Kensington became the lead investor in One9’s inaugural $10-million fund. With Kensington’s backing, One9 has since invested a total of about $23 million in six startups.

Cowan, a former Canadian special forces commander, founded One9 after being discharged from the military following a training accident. He says there was a “logical synergy” between his group and Kensington, which has been boosting its investments in the defence sector over the past few years.

“Kensington was really the first institutional investor in Canada that really said, ‘Hey, you know what? Investing in this sector is not scary,’” Cowan said.

Kensington senior managing director Rick Nathan, who was introduced to Cowan in 2019, credits the ex-military officer for helping open his eyes to the industry’s true potential.

“Glenn was awesome at identifying and getting access to really strong investment opportunities in this sector and not just the access, but then working with the companies to help build them

and grow them for success,” Nathan said.

The veteran venture capitalist says the defence and security sector is suddenly in the spotlight as governments across the globe try to navigate a rapidly evolving geopolitical landscape.

“When you have both major parties in Canada talking about how much they’re going to be increasing defence spending, you know something has changed,” Nathan said.

“Looking around the world, we see all major countries increasing their spending on this sector. We also see growing threats in cybersecurity. No companies are decreasing their budgets for cyber. You kind of put that all together, and you say, ‘This is a really interesting growth idea.’ So we decided to combine forces.”

While the defence-tech sector has traditionally been dominated by huge multinationals, Cowan said that’s changing.

“We’re seeing a seismic shift away from (major defence contractors) and (original equipment manufacturers) owning the market to emerging, disruptive, venturebacked startup companies carving out a really competitive piece of the wider

national security-defence ecosystem,” he explained.

One9’s portfolio includes a company that has already made a successful exit, Florida-based Tomahawk Robotics.

Founded by a former U.S. Navy SEAL, Tomahawk makes hardware and software that controls drones, robots and other unmanned vehicles. Less than two years after One9 invested in the fledgling firm, it was sold in 2023 for US$120 million.

“It represented a great return for us,” Cowan said. “That was a hugely validating deal.”

The organization’s lone Canadian investment so far is Ottawa-based Ventus Respiratory Technologies. The startup has developed a respirator that Cowan describes as “body armour for the lungs” designed to protect military personnel, police officers and first responders from breathing in carcinogens and heavy metals.

He says the system is now evolving into a piece of wearable equipment that allows users to communicate with radios, drones, virtual reality systems and other technology.

Cowan says that while many Canadian venture capital firms have traditionally

been “skittish” about putting money into defence startups, he believes the national investment community’s perception of the industry is changing.

“I say it’s so much more than guns, bombs and bullets,” he explained.

“Canada is waking up now to the (realization) of how important this sector is going to play in our economic security, our national security, our climate security, our energy security, our sovereignty, our Arctic security.”

Nathan agrees, saying the Canadian tech ecosystem has “all the building blocks” to build a vibrant defence-tech sector.

“We have the AI talent, we have the robotics and autonomous vehicles, we have space-tech, cybersecurity,” he said. “These are huge categories where Canada does have the talent. There is a very significant overlap between what we’re focusing on together in this national security thesis and what are already the leading subsectors of tech.”

Kensington is also acquiring a minority stake in One9 Capability Labs. Based in a 7,000-square-foot facility near Hintonburg, the One9-owned entity is an “innovation hub” that provides support services to the Ottawa firm’s portfolio companies and other private defence organizations.

Cowan says the lab is a place where tech founders, members of the Canadian Armed Forces, academics and others with a stake in the defence sector can gather under one roof to brainstorm ideas and help incubate world-leading technologies.

“We want to be that one-stop shop for all national security end users,” he said.

Still, Cowan noted that securing Canadian military contracts is a “painfully slow” process for small domestic firms. Cowan worries that Canada is “going to lose an incredible amount of Canadian companies to the Americans that can just move that much faster” if federal procurement policies aren’t streamlined.

“For Canada to be successful in this sector, we need Canadian customers,” he says. “We need the Canadian Armed Forces to buy Canadian.”

With a defence portfolio that began between the First and Second World Wars, PCL Construction has a proud history of supporting Canada’s focus on security, defence, and sovereignty.

PCL Construction is Canada’s largest – and one of North America’s largest –construction companies, operating in the buildings, solar, heavy industrial and civil infrastructure sectors. We partner with clients to transform city skylines and build communities.

Our long history of building in Canada includes everything from expanding healthcare and educational infrastructure, mass transit projects, a broad range of civil infrastructure (like bridges, water and wastewater treatment), social spaces like professional sports arenas, to a variety of federal government projects including heritage rehabilitation plus defence and security infrastructure.

Founded in 1906 in Stoughton, Saskatchewan, PCL opened our Canadian and corporate headquarters in Edmonton in the 1930’s where it remains today. PCL has solid presence from coast to coast to coast and at present is working on projects in every province and territory.

PCL is 100 per cent employee owned across all levels of the organization, meaning that from field coordinator to CEO, every PCLer can invest in the health and success of our company. Our culture of ownership models the highest standards of corporate social responsibility with an uncompromising commitment to safety, diversity, inclusion, sustainability and innovation.

Privileged to deliver defence and security projects across Canada since the end of the First World War, PCL has more recently delivered a diverse portfolio of defence and security projects such as the Syncrolift Upgrade and Submarine Shed project in CFB Halifax, and the Communications Security Establishment Long Term Accommodations Project (new HQ and operational facilities) in Ottawa.

At present, PCL is under contract to build facilities across Canada at more than 10 Canadian Forces Bases for National Defence through Defence Construction Canada, all in support of the Canadian Armed Forces. Some of these projects support the Royal Canadian Navy’s River Class Destroyer program, the Royal Canadian Air Force’s Strategic Tanker Transport Capability project, the Canadian Army Ground Based Air Defence System project, and new Joint Task Force (North) facilities in Yellowknife for the 1st Canadian Rangers Patrol Group.

As Canada’s responsibilities and challenges at home and around the globe change and expand, PCL is committed to supporting Canada’s efforts to modernize our defence and security capabilities from coast to coast to coast.

Being part of the delivery of Canada’s defence and security infrastructure is important to PCL, and we will continue to work hard to remain a valued member of the team as Canada invests in the Canadian Armed Forces.

For more information on PCL Construction, visit PCL.com