ELECTRONICALLY FILED COURT OF COMMON PLEAS

Thursday, October 17, 2024 11:56:26 AM

CASE NUMBER: 2022 DR 00353 Docket ID: 628939039

Mike Foley

CLERK OF COURTS MONTGOMERY COUNTY OHIO

IN THE COMMON PLEAS COURT OF MONTGOMERY COUNTY, OHIO

DIVISION OF DOMESTIC RELATIONS

KATHERINE MCCLAIN

502 SHILOH DRIVE

HARRISON TOWNSHIP, OH 45415

PLAINTIFF, vs. DANIEL MCCLAIN

P.O. BOX 503

PICKERINGTON, OH 43147

DEFENDANT.

Case No. 2022 DR 00353

SETS No. 7130915221

JENNIFER PETRELLA, Judge

DECISION

This matter is before the Court pursuant to the Complaint for Divorce with Children filed by Katherine E. McClain (hereinafter "Plaintiff' or "Wife" or "Mother") on May 19, 2022. Daniel W. McClain (hereinafter "Defendant" or "Husband" or "Father") filed an Answer on May 26, 2022, and his Amended Answer and Counterclaim was filed October 5, 2022. Both parties appeared with counsel for an evidentiary hearing commencing on September 10, 2024, and concluding on

September 11, 2024. Attorney Trisha Duff, represented Plaintiff, while Defendant was represented by Attorney Adam Messaros.

While the parties negotiated previously, they were unable to come to full agreement and each presented direct testimony, documentary evidence, as well as witnesses on their behalf.

After any objections raised, the following Exhibits were admitted into evidence for Plaintiff: 1, 2, 4, 5, 6, 6A, 7, 12, 24, 24A, 24B, 24C, 240, 24E, 25, 26, 27, 28, 29,32, 33,34,36, 37, 37A,37B, 39, 40,41,42, 43,45,46,48, 49, 50, 52.

After any objections raised, the following Exhibits were admitted into evidence for Defendant: E, N, Q, R, W, X, Y, Z.

The Court also relied upon its exhibits. These included the August 12, 2022 Guardian ad Litem report and her supplemental reports submitted to the Court on October 12, 2023 and January 26, 2024; the Psychological / Custody Evaluation submitted February 5, 2024; and parties' Virtual Home Tours, submitted on August 15, 2024.

The Court interviewed the children initially on August 9, 2024. The Court experienced an issue with the recording of these interviews, and counsel was put on notice as soon as the issue was discovered. Counsel was informed that they would be provided an opportunity to request the children be interviewed upon the close of evidence. Defense moved the Court to have the children be interviewed again. The Court scheduled these interviews for Friday, October 4, 2024.

The parties, by and through counsel, negotiated and came to agreement, stipulating to several items. This Court finds that the stipulations are fair and equitable. The stipulations shall be included in the Final Judgment and Decree of Divorce in this matter. There are also issues to which the parties were unable to reach agreement. The Court shall now determine the following issues:

1. SpousalSupport

2. Marital Debts

3. Equity of Real Estate

4. Allocation of Parental Rights

5. Parenting Time

6. Child Support & Health Care

The Court, in making the findings of fact, has considered all evidence admitted in this case. The Court has reviewed its own records, as well as evaluated the credibility and weight of all testimony and evidence. The Court applied the usual credibility tests to the witnesses.

JURISDICTION AND GROUNDS

The parties were married on July, 14, 2001 in Arlington, Virginia. The parties separated in April 19, 2022, when Defendant left the marital home. The parties agreed that they are incompatible.

There were four children born as issue of this marriage under the Court's jurisdiction: C.H.M. (may be referred to as H.M., as he is often called), born February 1, 2007; J.M., born August 3, 2009, F.M. born December 10, 2010; and E.M. August 19, 2014. No other children are expected of this marriage.

Neither party is a member of the armed services or currently participating in any bankruptcy proceedings. Both parties were residents of the state of Ohio for more than six (6) months, and the county of Montgomery at least ninety (90) days, prior to the filing of the Complaint for Divorce, as well as Defendant's Answer, Amended Answer and Counterclaim. As stated previously, the parties agreed that they are incompatible and that their marriage is irretrievably broken. It is upon these grounds that the Court grants them the relief they request, a Divorce.

BANK ACCOUNTS

The Plaintiff and Defendant each have their own checking and savings accounts. The parties stipulated that any separate bank accounts remain in the

party's name and are not subject to division.

PERSONAL PROPERTY AND HOUSEHOLD GOODS

The parties stipulated that most household goods and personal property has been separated without dispute, Plaintiff testified that she wishes to have the Legos returned, or at least a portion, as they were taken to the Defendant's house by the boys, but were never brought back to her home. She testified that the boys frequently asked for them. She also requested that the boys' bikes be returned to her home. Plaintiff's last dispute of personal property item involves two bike racks. She requested that they sell two bike racks and she use the proceeds from one to outfit her current vehicle with a bike rack for the boys' bikes.

Defendant testified that he wants a compressor, planer and Craftsman tool box. Plaintiff agreed to Defendant taking all of these. According to testimony, he understood from a mechanic that Plaintiff could take one of the bike racks (the new one bought for a previous vehicle, but not installed) and trade it in for a new one for her Honda Odyssey. If she didn't want to do that, then he requested it be gifted to their oldest son and then sell the other bike rack.

In light of the testimony provided, the Court finds that the parties have essentially stipulated to the compressor, planer and Craftsman (red) tool box being distributed to Defendant. Additionally, it is reasonable for the boys to have some of the legos in Plaintiffs home. Legos should be split as the boys wish, and the boys will bring those Legos back to the Plaintiff's home. The Court finds that the bikes should travel with the boys, or if the boys prefer to keep with the parent who is facilitating the course events, that is also reasonable.

As a matter of equity, the Court finds that Plaintiff can trade-in the new bike rack for a bike rack that fits her existing vehicle. The second bike rack shall be sold. Any shortage on the cost of the new bike rack for Plaintiff's existing vehicle

should be satisfied with the proceeds of the second bike rack, before distribution between the parties. If there is no shortage, then the Court orders proceeds from the sale of the second bike rack should be split evenly between the Plaintiff and Defendant.

VEHICLES

The parties stipulated that they will keep the vehicle they are currently driving. Plaintiff is entitled to keep the 2005 Honda Odyssey, while Defendant will keep his 2010 Nissan Pathfinder. Defendant agreed to execute the title, in order for Plaintiff to keep solely in her name. This shall be completed within thirty (30) days of the issuance of this decision. Any debts, maintenance or other repairs are the responsibility of the party who has the vehicle and they will hold the other party blameless.

RETIREMENT

Defendant has a Church Pension Fund and stipulated that Plaintiff is entitled to receive her marital share of one-half of the proceeds held within this account. (See, Defendant's Exhibit M). Plaintiff has no pension.

The Court orders Attorneys for each party to assist them in executing the necessary documentation to have Defendant's pension split to provide Plaintiff her equal share. The total cost for necessary document preparation shall be split equally between the parties.

INCOME AND SPOUSAL SUPPORT

Plaintiff argues that Defendant should be held to the salary at St. Paul's, which was $93,000.00, plus $30,000 for housing and monies he had access to in an expense account. She contests that this higher wage be used rather than his current salary of $80,500.00 from the Reynoldsburg School District, as it was his own fault that he was removed from St. Paul's active service as rector.

Additionally, she testified that she should be imputed at the federal minimum wage, even though she stated is not going to work herself. She testified that while she worked when the children were young (working evenings / weekends), that she now must be available for her children at all times.

As for income, the Court finds that the expense account was a reimbursement from out of pocket expenses he paid from the salary, not additional income. Even if these funds are above the salary he was being paid, they were only paid upon his showing a receipt. There was no evidence presented that showed these expenses were anything but related to his ministry. Also, the Court finds that the Defendant gave credible testimony that the housing allowance was a one-time gift from the church to the couple. Plaintiff benefitted from the housing allowance, as it was used for down payment to purchase their home, and part of their shared equity.

Both parties testified as to Defendant holding different academic positions and therefore differing incomes. It is unclear from testimony whether Defendant's loss of position at St. Paul's was due to his actions, due to Plaintiff's allegations or combination thereof. Therefore, the Court is unwilling to impute and additional

$12,500.00 to Defendant's income as a penalty of fault. On the contrary, though, Plaintiff achieved her Special Education Certification and had her own business worked while the children were very young. Now, at ages where they are in school and more independent, it is reasonable the Plaintiff could be imputed income of the state minimum wage which in 2024, is $10.45/hour or $21,736.00/annually.

Plaintiff also testified that she never got her half of the proceeds from a motorcycle that Defendant sold, any of the moneys from the van being held in the attorney's account (Defense Attorney's IOLTA) or her half of escrow funds. She testified that when the Defendant changed house and auto insurance, the insurer informed her that an escrow check would have been sent to him, for deposit in the

new insurance on the house.

Alternatively, Plaintiff testified that prior to moving to Dayton (2017), she sold her private practice. She testified that she receive $85,000.00 for this, but couldn't testify as to where the money went or what it was used to purchase. The Court finds that it would be inequitable for Plaintiff to benefit from a previously sold motorcycle or unknown escrow return, as she, herself was unable to provide details accounting for the funds from the sale of her business. Neither party shall be asked to exchange funds regarding these items. Funds being held in the IOLTA account will be addressed in the next section regarding Tax and Other Outstanding Debts.

Based on the years of marriage and income levels attributed or imputed to the parties, the Court finds it reasonable that the Defendant pay spousal support in the amount of $1,050.00 per month for seven years or 84 months, commencing November 1, 2024. The court shall retain jurisdiction over the time and amount of spousal support.

TAXES AND IOLTA FUNDS & OUTSTANDING DEBTS

The parties have prepared taxes for tax years 2021, 2022, and 2023, for which they anticipate receiving a tax refund. However, there is an existing tax obligation from 2020. The parties are unsure whether their refund will be intercepted to pay off what is owed or if they will be required to pay directly. Regardless, tax refunds shall be held in the IOLTA account, until the tax debt is known. The tax debt shall be paid with any refund monies, prior to equal distribution to the parties. If the refund monies do not cover the tax obligation, the parties are ordered to release funds and make up any deficiency by splitting the cost equally.

As recorded previously, the parties have sold their cabin, resulting in proceeds amounting to $21,417.36. These funds, along with $17,590.20 from the sale of the Ford Transit are being in held in Defendant's attorney IOLTA account.

Defendant bought the cabin with a retirement account that was cashed-in. Defendant testified that his parents paid the balance owed on the cabin, in the amount of $13,169.12, prior to its sale (at the time of this divorce). There was no further testimony suggesting that the retirement account used to purchase the cabin was premarital.

Plaintiff's debts include student loan debt, and debt of the mortgage on the marital home. Additionally, Plaintiff testified that H.M. had gotten invisalign treatment per a recommendation of a dentist that was completed. Next, due to an issue with how insurance was applied, F.M. began his treatment, and is almost completed. J.M. was also recommended for this treatment, but was started after F.M. Plaintiff testified that Defendant agreed to pay one-half of J.M.'s treatment, but said no to paying on F.M.'s treatment. Plaintiff still proceeded with treatment for both. She testified that her parents paid for the treatment for both boys and that Defendant contributed nothing. Per Plaintiff's Exhibits, it appears that J.M.'s treatment cost $4,128.00 and a balance of $2,941.79 was owed as of June, 2024 (Exhibit 25 and 26). As for F.M., it appears that the initial costs was $5,885.00 and there is still a total of $460.00 owed as of June, 2024. (Exhibit 27).

Plaintiff further testified that Defendant was using their USAA Visa credit card, creating at least 12 different overdrafts. She asked him to remove her name as her credit was being negatively affected. Per Exhibit 32, Plaintiff showed two overdraft occasions on November 8, 2023 and January 23, 2024. The balance as of January 15, 2024 was $1,553.25. Defendant removed her name from the account as of August 8, 2024. (Exhibit 33).

Plaintiff further testified that she has encountered additional costs for insurance, as he changed their auto / house policy. She had to take insurance available on the spot for the two vehicles, and had no time to shop around or she couldn't legally drive. The change resulted in her cost between $200 and $600 more. She was informed that Defendant would receive escrow back to be

deposited into a new account for housing, but she doesn't know how much he got back and doubts he ever followed through with this. Additionally, because she was removed from the insurance she testified that she could no longer see the history of the account she was on for over 20 years. (See Exhibits 34 and 35).

Defendant testified that while H.M. attended Miami Valley on a scholarship, there were still school fees. Defendant paid for these with help of his parents, in order to get H.M.'s grade transcript forwarded to Oakwood, in the amount of $1,333.00. (See Exhibit W.) He testified that he also paid off the HVAC unit loan that was still in existence after the Otterbein House was sold. This totaled $2,063.87 (Exhibit N). Additionally, there was a tax debt on the car (personal property debt) from the City of Williamsburg in the amount of $472.62 that he paid. (Exhibit E). Defendant testified that his parents again assisted and paid off an American Express debt of $21,017.64 (Exhibit Q).

Plaintiff wants to be paid one-half of the dental expenses and have one-half of the equity in the house, as well as her share of the funds being held in escrow. Defendant proposed that his parents be paid what they are owed, and agreed that Plaintiff's parents be paid what they are owed as well. He would like to be paid for one-half of the credit card debt, half of the proceeds of the cabin, and paid for onehalf of the equity in the marital home. Plaintiff argued that payments by his parents were gifts, as there was no promissory note or documentation as to a loan with interest.

The Court is not inclined to call the monies provided to the parties by their respective parents purely gifts. It is reasonable to believe that family members want to help their children, but also can expect repayment without an existence of a formalized loan.

Regardless, the debts outlined above are marital debts with the Plaintiff and Defendant each owing one-half. It is on the Plaintiff and Defendant to satisfy payment to whomever they owe. Therefore, the Court orders that Plaintiff and

Defendant are each entitled to one-half of the proceeds held in IOLTA after the tax burden is completely satisfied.

Additionally, the Court finds that Plaintiff did not prove what the exact amount her insurance cost increased, just somewhere between $200 and $600. When unbundling insurance, an increase is normal. The Court will award Plaintiff a one-time amount of $400.00 for this increase, as a matter of equity.

The Plaintiff is also entitled to an apportioned cost of the dental treatment for the children, as recommended by a dentist and performed with an older child before these children. The total outlay for both children was $10,013.00. Plaintiff is entitled to repayment in line with the percentage of medical expenses as determined by the Child Support Calculation Worksheet. Per the worksheet, Defendant is responsible for 66% of medical costs. Therefore, Defendant is responsible for 66% of $10,013.00, or $6,608.58. Defendant owes this amount to Plaintiff.

As to the Defendant's debts, the Court finds his testimony credible and finds that Plaintiff benefitted from these debts being paid, regardless of the source of funds. The Plaintiff shall owe Defendant one-half the debt of the HVAC system, tax debt on the car and the American Express credit card, or a total of $12,443.57.

REAL ESTATE

As to the marital home, Plaintiff testified that she and Defendant are joint owners on the deed. (Exhibit 36). They stipulated that they paid $165,000.00 for the home in 2022 (the appraised value of the house at that time), and that as of August 1, 2024, they owed $125,306.52. (Exhibit 37 A). Plaintiff testified that no improvements have been made on the home, and that Homes.com currently values the house at $183,816.00. (Exhibit 37B). She questioned whether that was too high since no improvements had been made. However, the second page of her exhibit, was a print-out from Trulia which listed the house at $210,400.00. (Id.)

Defendant provided other online sites for home value. Zillow listed the house at $210,400.00 (Exhibit X), Realtor.Com lists it at $221,977.00 (Exhibit Y) and Redfin listed the house at $223,939.00. No official appraisal was provided by either party. However, at least one piece of documentation submitted by both parties included an estimated value of $210,400.00.

The Court, therefore finds this value to be appropriate, resulting in $85,093.48 in equity ($210,400 minus $125,306.52). For Plaintiff to remain in the marital home, she must refinance and provide Defendant one-half this amount, or $42,546.74. Plaintiff testified that her parents would co-sign the loan with her so there was no concern of her being able to refinance. This refinance should be done in ninety (90) days from the issuance of this decision. Therefore, the sum of $42,546.74 is hereby due the Defendant within ninety (90) days of this decision.

If for any reason, Plaintiff is unable to refinance, the Court orders that the house is to be sold. The parties will then contract with a mutually-agreed upon licensed realtor and will list the house within thirty (30) days of that determination (and no later than 120 days of this decision). Plaintiff is hereby responsible to continue meeting all obligations related with the house, until sold. The parties are ordered to accept an offer within 5% of the list price. Once all obligations of the sale are met, the remaining net proceeds shall be divided equally by the Plaintiff and Defendant. Plaintiff shall vacate the home in accordance with the sale.

ALLOCATION OF PARENTAL RIGHTS & RESPONSIBILITIES

As noted previously, the parties have four sons as issue of this marriage. C.M., born February 1, 2007; J.M., born August 3, 2009, F.M. born December 10, 2010; and E.M. August 19, 2014.

Mother and Father have both attended the Court's mandatory parenting class, "Helping Children Succeed After Divorce."

Pursuant to R.C. 3109.04(F)(1 ), the Court considered all factors to determine what is in the child's best interest.

Plaintiff Katherine McClain is 43 years old and Defendant Daniel McClain is 46 years old.

Plaintiff resides in the marital home as residential parent of the three younger sons. Defendant is living with his girlfriend and the parties' oldest son in Pickerington, Ohio.

Mother filed for Divorce initially on May 19, 2022, requesting to be residential parent and temporary custodian of all four sons. She was awarded temporary custody through a Temporary Order, filed June, 13, 2022. Father filed an Answer on May 26, 2022, and Amended Answer and Counterclaim on October 5, 2022. He requested custody of all sons or in the alternative Shared Parenting. An Agreed Entry filed November 14, 2022, named Mother as the temporary custodian and residential parent of the three youngest children, while Father was named the temporary custodian and residential parent of the eldest child. On November 16, 2022, parties began Conciliation. Per an Agreed Entry filed December 13, 2022, Plaintiff/Mother agreed that if Defendant/Father moved out of the area for a job, that she would move with the three youngest children. Conciliation later concluded on February 13, 2023, and parties returned moving forward on their divorce. Mediation was scheduled in May and June, but failed to resolve the matters in the relationship.

While Plaintiff wishes to remain legal custodian and residential parent of the three younger children, there has been some angst regarding the schooling for J.M. for the past two years. Defendant is now wishing to be residential parent of all four sons within a Shared Parenting arrangement.

The Court appointed a Guardian ad Litem to this case. She met and submitted her initial report to the Court and counsel for parties on August 12, 2022. She submitted two subsequent updates on October 12, 2023 and January 26, 2024. She was not subpoenaed for the final hearing in the matter. Additionally, the

parents and four children submitted to a Psychological/ Custody Evaluation, which was provided to the Court on February 5, 2024. Here, too, the psychologist administering the evaluation was not subpoenaed to court for trial. As mentioned prior, Defendant moved the Court to interview the children. The Court first interviewed them on August 9th , but as an audio recording failed to be produced, that parties were given an option to move the Court for another interview, at the close of the evidentiary hearings. Defendant so moved and the interviews were held October 4, 2024.

The Guardian ad Litem first met with the children early in the case, and she submitted her initial report on August 12, 2022. At that time, she recommended that H.M. be placed in the Legal Custody of Father, allowing him and Mother to determine appropriate parenting time. Additionally, she mentioned that the three younger children also wanted to live with their mom, and had different requests for parenting times with Father. E.M. wanted more time with Father, while F.M. was concerned that Father wouldn't take him to activities and J.M. wanted flexibility to determine if he would stay longer or leave earlier when with Father. Additionally at that time, the children wanted to continue to be home-schooled and the GAL recommended that all family members have a psychological assessment and for the children to have an independent educational assessment.

The GAL met with the family again and submitted her first updated report on October 12, 2023. At this time, H.M. and Mother's relationship had deteriorated further, including her filing a CPO against him. Mother had filed a CPO against Father as well. Even though the parties had agreed to shared summer parenting time, Mother had taken the three younger boys and left the state. According to testimony at the divorce hearing, Mother was in state for some of this time. However, Father had minimal contact (some phone / video) and filed an emergency order to return children to Ohio. Father had not seen the children for almost 3 months.

All three children reported that they wanted more time with their Father; J.M. was most vocal. Additionally, J.M. told the GAL that he wanted to attend Oakwood, H.S. The GAL noted that Mother continued to allege safety concerns for children with Father. She had been talking to other professionals about her view of Daniel's behavior, but none of those professionals ever engaged in conversation with the Defendant. Additionally, a CPO on behalf of the younger children was dismissed and none of them reported feeling unsafe around Father or brother. Again, GAL made a recommendation that a full psychological assessment be completed and that the Father be awarded parenting time according to the standard order. The GAL warned both parents to not involve children in specifics of the divorce, and that Father should also keep H.M. from talking about it with his younger brothers.

The GAL completed a second update and submitted to the Court on January 26, 2024. F.M. reported wanted to start seeing his Father again but still have some weekend time with mom. J.M. reported being upset he couldn't go to Oakwood this year, and wanted to go for H.S. He also reported that Mother took them on a vacation because Father had a Title 4 filed against him and that she said that would make Father mad. J.M. reported he was confused by Mother's concern. He reported that even while Mother wasn't saying things about Father, she would make comments that made Father look like he was lying and J.M. felt this was influencing his younger brothers. He reported that she and H.M. still do not talk. The youngest, E.M. had also confirmed that he had not seen his Father for a month or two because of the Title 4. At the time of this report, he was 8, and said his mom said people made complaints against their dad and that was why the children weren't seeing him. He thought the complaints may be the old ladies complaining about the incense at church. He reported wanting to spend more time with Father, but that he also liked being at his mom's.

At the time of the GAL second update, the psychological report had not

been completed. Without that insight, she suggested split custody (Father having H.M., with Mother continuing to be legal custodian of the three younger children). She recommended additional parenting time for Father (Friday 4pm through Monday morning and weekday visits being 4pm through 9pm). She also recommended a brick and mortar school in 2024/2025 school year. She also didn't believe the parents effectively communicated for shared parenting.

As recommended multiple times by the Guardian ad Litem, the parties and the children all submitted to a psychological assessment for custody. While this psychological report was an independent evaluation, he noted that the parties have engaged in therapy, had the children in therapy and had prior evaluations. Mother has opinions from two "professionals" who identified the need for civil protection orders against the Defendant and referrals to children services, but yet, only met with her. There was no meeting or even inquiry with Father, and this psychologist pointed out that this is ethically questionable. This court agrees and gives no weight to any opinion where only one side is able to share their information.

The psychologist here points out that both parents have shared information with the children, both parents have placed the children in the middle of this divorce, and that both have caused their children damage. Father permits the oldest son to have no contact with Mother and did not place him in therapy regarding the same. According to therapist, Mother sees no ability to reconcile with her oldest child, and consistently lays blame on this child for concerns of safety. Mother admits that she shared too much with the children, and yet it continues.

The psychologist continues that he has concerns with the three youngest children's education. Mother continues to not have them assessed. He also finds that the parents were doing all they could to point out how the other parent is failing as a parent and continually taking steps to damage the other parent's relationship

with their children. He noted that neither had signs of pathology where they would endanger themselves or their children, but also are too educated to be causing such destruction to their children's well-being. The psychologist concluded that they should enter a shared parenting agreement but to use a parent coordinator to confront them on ineffective and inappropriate communication.

As stated previously, this Court, too, met with the children. The Court found that the children have shifted some in their wishes, since what was reported in the early year(s) of this divorce. While the eldest son is nearing 18, he continues to feel that his Mother wants no relationship with him, and he is not expecting one to occur. He relayed that at the heart of this matter was that she shared the specifics of her first CPO against his Father with him, and also he was hurt that she never came after him, when he stayed behind or just left on his own. He stated that she has never apologized to him for how she has or continues to treat him.

The next oldest, J.M. is focused on his future. During his first discussion with the Court, he clearly expressed that wanted to be at a school where he could be prepared for his future and secondary education. He wanted very much to be with his Father and oldest brother. At the time of the second discussion, he had relayed that the school had added more science and labs and that he was looking forward to participating in a play in the spring. He would rather not go to a new school system during the middle of the year. However, he continued to opine that his Mother manipulates information putting their Father in a poor light, and that she may be trying to get musical instruments and lessons for the children in order to gain their favor.

F.M. says he wants to be with his Father, but still have time with Mother on weekends. While all of the children want an end to the divorce, this child appeared extremely torn at the first meeting. He loves his activities and all he is connected to here locally, but also wants more time with his Father and brothers.

The youngest, E.M., was very vocal that he had been denied so much time with his Father, that he wanted to be there now. He had discussed this fully with his brothers, and was not apparent that his wishes were independently achieved. However, at the second meeting he also relayed feeling that his Mother was spending more time on her business and that she did little with him. He said that his Father was more active with him.

Per the record, there have been agreed orders to address the need for Father to pay child support and his wanting the support to be decreased. It does not appear there was any child support addressed with the eldest child in Father's custody since 2022. Additionally, Mother has twice removed the children out-ofstate during summer vacation time, where make up parenting time had to be ordered by the Court, and yet does not appear to have been fulfilled.

While both parents are educators, Mother took the primary role of homeschooling the children. However, per Mother's testimony, the children were 'late readers,' and consistently did not read until age eight or nine; she also relayed this to the Guardian ad Litem. Even though it had been recommended on more than one occasion, Mother failed to engage in an educational assessment.

Father supported the children attending a brick and mortar school. He felt the children would be home schooled until 8th grade but then matriculate to a more traditional school to prepare for secondary education. Mother testified that she was against any change, and felt he was unilaterally making education decisions without her. For example, Mother testified that Father was promising J.M. to go to Oakwood without her knowledge, and that she only knew about this because J.M. told her; intimating she was completely left in the dark. While Father did only discuss with J.M., Mother was asked and did participate in a school tour.

Later, Mother removes children from the state in July, 2023, and doesn't return until after a court-order from late August, 2023. Not only does she prevent

the children from parenting time with the Father (the parties were still under a virtually equal parenting scheduled from a November, 2022 agreement), she also returns after the school year at Oakwood is underway. She then decides the children will attend Branches and Vine, and informs Father of this, requesting no say or input, nor providing any further information.

Mother also clearly testified that Father never inquired about parenting time when she returned to Ohio. She intimated that he was not doing all he could to be part of the children's lives. While Father still had a November, 2022 court order giving him virtually equal access to his children, he was not free to communicate with Mother as Mother had filed a CPO against him in July, 2023, before leaving with the children. None of the children were protected parties, but he was still restricted in any communication with her. This CPO was dismissed, but not until October, 2023.

Despite the lack of coordinated decision-making between the parents on education, Mother testified that they are excelling in school, and that they are now enjoying extracurricular activities and do not want to leave. This past summer, Father relocated to Pickerington for work and wanted to enroll children in school in his district. He based this on the fact that both he and Mother were previously held to be residential parents. That was the determination of the Court while the parties still lived in close proximity. The Court therefore ordered the children to remain in the current school until custody could be determined.

Mother called her Father as witness. He testified on her behalf and relayed that the children, particularly J.M., as a teen-ager, was defiant with his Mother at times. The witness testified that he seemed to be know too much than a child should about their divorce, and felt that Defendant was coaching the boy. This same witness, who appeared remotely, also prepared a statement and admitted reading from it during the hearing to make sure he covered all he wanted to say.

Father presented a witness who knew the children as her children often

spent time with the boys, and whose family also attended church with McClain's. She testified that during the pend ency of the divorce, the Plaintiff brought the boys to her son's birthday party and stayed, even though she knew that the Defendant and Henry were there. Testimony revealed that at the time of this event, H.M. was protected by a CPO against the Plaintiff.

This witness later relayed that she and others in the church did not believe Mother's accusations about Defendant and encouraged her to seek treatment. Plaintiff was sure they were given false information and encouragement from Defendant to speak out against her mental well-being, but the witness testified that it was from her own observations.

Whether the witness' inserting herself in another church family's matter was overstepping or not, the Court also saw instances throughout testimony where Mother's credibility was questionable.

For instance, Mother accounted extreme details of her relationship with Defendant and information about his jobs and their finances - where they were living and the different jobs he was holding, but then could not talk about where the funds from the sale of her own business went. She testified how she was not listed as a parent to Henry at Oakwood, and was given no access, but later testifies about how she was able to get Henry's transcript and knew his attendance record.

Mother frequently laughed at inappropriate areas of testimony and repeatedly acted as a victim and Father as the man who isolated her from her family and friends.

The Court finds to the contrary that Defendant encouraged her to work throughout their marriage, and she did this. She not only pursued a degree in higher education, she maintained and operated her own business. While Defendant continued to move to new employment for advancement or because of disenchantment, Plaintiff continued to be supportive. The couple decided to cut

ties with her family upon the discovery that their eldest son was unsafe while in the care of her parents. There was no evidence that this was ever a unilateral decision by either party or any attempt to isolate Plaintiff. When Plaintiff wanted to get out of their first home locally because of sensitivity to electronics, Defendant found a home with analog features to assist in the transition.

Now, the fact that Defendant leaves the home, and had discussions with the children about potential new schooling or even coming to live with him over an hour away is inappropriate. Mother was entitled to know the address where the children would be staying for parenting time, before they did. Additionally, Father should have never talked about them moving at the end of summer or during Christmas break, when custody was still an issue before the Court. Additionally, the psychologist mentioned that Father lacks trust in others, and is not forthcoming. This was evidenced by his refusal to respond to Mother when she inquired multiple times about his potential move to the Columbus area this past summer, or even to broach the school tour at Oakwood himself.

The Court is inclined to agree with the psychologist who completed the analysis of all parties, and the GAL in her limited information. Both parents have placed their children in the midst of a highly contentious divorce, where the parties' communication has declined over the three years of fighting. Additionally, Mother has taken the children away from the Father on the basis of unfounded fears for their safety. There is no corroboration given for her allegation of alcohol abuse, and any domestic violence filings were dismissed. In fact, the only protective order issued against a parent was against Mother on behalf of H.M. Additionally, when the children have been available, Father continued to actively participate in parenting time as scheduled.

For these children to have a relationship with both parents, the Court finds that shared parenting is a must. If they are placed in the legal custody of Mother, Father will remain relegated to a minimal standard order of parenting time, or the

children will be removed from the state where he may be denied even that. While the Court believes the Father would be more likely to provide the children with appropriate and additional time with their Mother, if a child did not want to go, the Court is not convinced that he would go the extra mile and encourage the son or facilitate it. Additionally, as the Court finds the younger children are in fact enjoying their school, and curricula appears to be meeting reasonable academic standards, it is not inclined to remove children during this school year. However, the Court finds it imperative that time with Father must be more equal, and the children must have an end to the tug-of-war that has continued over this multi-year divorce.

The Court therefore orders, Father shall continue to be sole legal custodian of H.M. H.M. may engage in parenting time if he and Mother can agree. As for the three younger sons, parents shall enter a shared parenting plan with Mother as residential parent for school purposes. As for parenting time, Father shall have children on Thursday at 6pm through Sunday at 6pm three weekends out of every month.

Mother shall have the children one weekend every month, coordinating with J.M.'s science lab at the school on Friday. She must provide Father with the dates of the one weekend she will have the three boys each month, within 30 days of the filing of this Decision, if the J.M.'s science labs are known. If there is more than one lab scheduled in the month, Mother is responsible for getting J.M. to the first one and Father for the subsequent ones (assuming they are not remote work). If science labs dates are unknown, then Mother is responsible communicating directly with Father within 48 hours of her being made aware of the date, so the parents can coordinate the weekend parenting time schedule. Direct communication may be made through an app, so long as the minimum time requirement of 48 hours is met.

For the weeks where the sons are with Mother over a weekend, Father shall have the sons for evening parenting time on Wednesday, 5pm until 8pm.

For Holidays and Breaks, including summer (week on / week off), parenting time shall be in accordance with the Court's Standard Order, unless the parties can agree to a schedule that suits them better. Father is ordered to facilitate the sons in their normal activities, including but not limited to scouting, biking, or playing music, whenever they are staying with him.

The Court orders the parties to participate in using an agreed upon app, in which the sons who are subject of the Shared Parenting Plan, shall have their appointments, school events and any extracurricular activities shared. Attorneys will assist in identifying an app that will best suit the parties' needs.

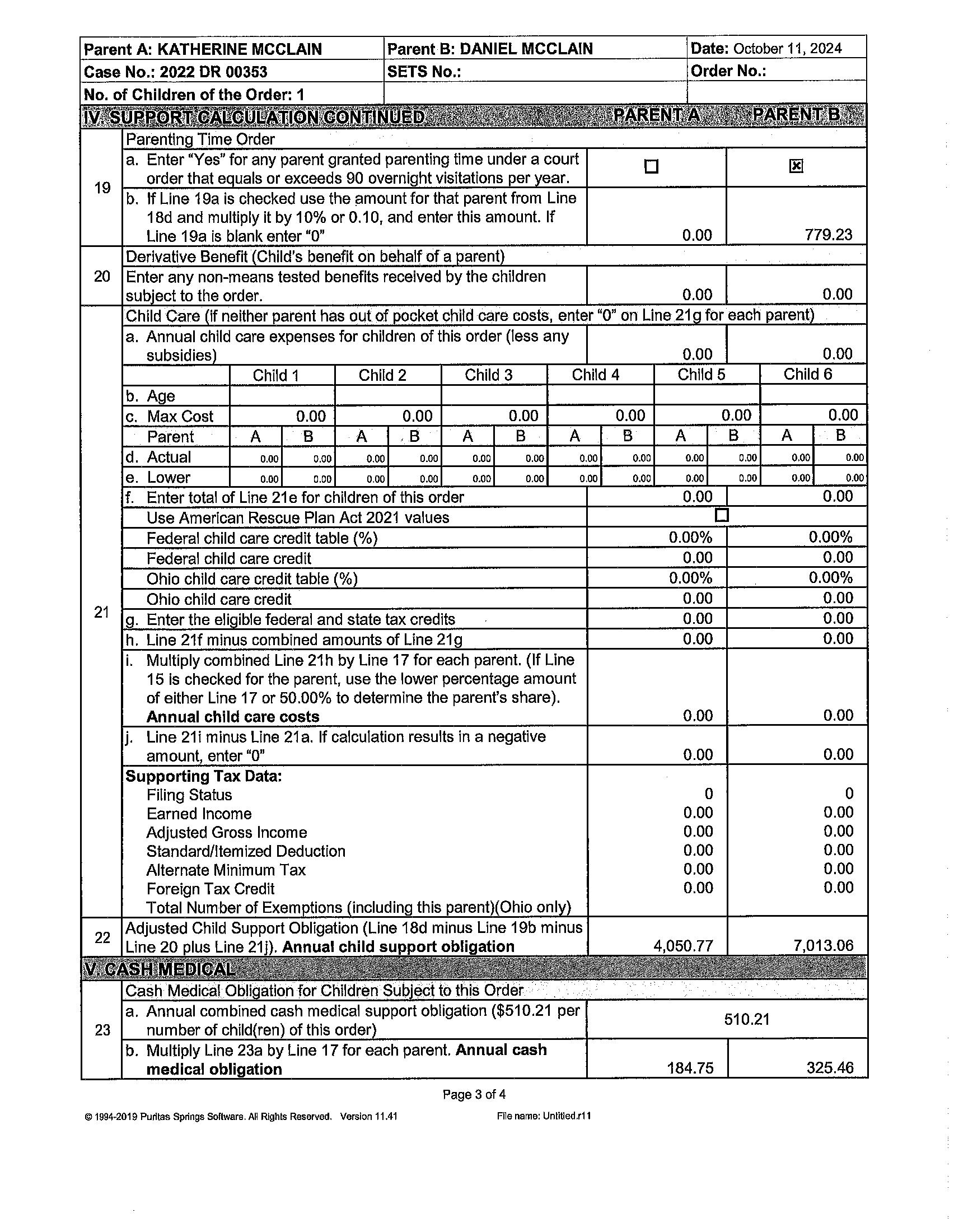

CHILD SUPPORT

As to Child Support, the Court finds the Father is the obligor for the three youngest sons. Mother is designated the residential parent for school purposes of the three youngest sons, and the obligor for the eldest son. With the increased time Father will enjoy with the three youngest sons, he will have at least 90 overnights with them, entitling him to a statutory reduction of 10%. Additionally, as no testimony was provided, any health care coverage shall be the responsibility of the residential parent. Therefore, Mother shall carry health care for the 3 younger sons and Father for the eldest son.

As Father is cohabitating with another adult, he will not receive any further deviation for the additional overnights that he has been given through the Court's order.

The Court has calculated the child support obligations for each party. Mother's total Child Support obligation is $360.02. As Father is obligor for three children, he is being given a credit for the amount that Mother owes him. This leaves Father's total Child Support obligation as $778.89 per month, including the 2% processing fee. Child Support obligations are effective November 1, 2024.

FUTURE TAXES

Parties shall file 2024 taxes separately. Plaintiff shall claim E.M. and F.M. as dependents until H.M. emancipates. Defendant shall H.M. and J.M. until H.M. emancipates. Following his emancipation (H.M.), Plaintiff shall claim E.M. in all years until F.M. emancipates. Defendant shall claim J.M. in all years until both have emancipated. Once E.M. is the only non-emancipated son, Plaintiff shall claim him in even years and Defendant shall claim him in odd years. The parties may only claim the children as dependents, if they are in substantial compliance with their child support obligation.

TEMPORARY ORDER

As there was no motion by the Defendant, any and all arrearages from the Court's Temporary Order for spousal support is hereby waived. Additionally, the Court will not retain child support arrearages from the temporary order as Plaintiff was not contributing to Defendant for care of the eldest son, and also withheld parenting time from Father on more than one occasion.

MISCELLANEOUS MATTERS

Except as otherwise stated, within thirty (30) days of the filing of this Decision, each party shall execute, transfer and deliver all titles, deeds, conveyance, certificates, or any other documents or information necessary to effectuate this order.

Any and all restraining orders are released.

All prior Orders, not inconsistent with this Decision are merged in this Decision. Any other motions before this Court not specifically addressed herein are hereby denied.

The parties shall pay any and all remaining court costs or fees in this matter in equal portions (fifty-fifty percent).

FINAL JUDGMENT AND DECREE

The Court orders Plaintiff's counsel, Attorney Trisha Duff, to prepare the Final Judgment and Decree of Divorce in this matter which incorporates all matters that the parties stipulated and is consistent with the above Decision of this Court. The Final Decree shall comply with the provisions of the Montgomery County Domestic Relations Rule 4.24 required language for decrees and agreed orders. Said decree shall be exchanged and provided to opposing counsel, within twenty-one (21) days of the filing of this Decision. The decree shall then be presented to this court within twenty-eight (28) days of the filing of this Decision, not later than November 12, 2024.

It is SO ORDERED.

NOTICE OF FINAL APPEALABLE ORDER

Copies of the foregoing order, which may be a final appealable order, shall be served upon the parties by the Clerk in a manner prescribed by Civ.R. 5(B) within three days of entering this judgment upon the journal. The Clerk shall then note the service in the appearance docket pursuant to Civ.R. 58(8). Service shall then be deemed complete.

KATHERINE MCCLAIN PLAINTIFF

TRISHA M DUFF ATTORNEY FOR PLAINTIFF

409 E MONUMENT AVE SUITE 400 DAYTON, OH 45402

DANIEL MCCLAIN DEFENDANT

ADAM R MESAROS

ATTORNEY FOR DEFENDANT

7051 CLYO ROAD

CENTERVILLE, OH 45459

Assignment Office

Bailiff

JAP/STA/10/17/24

Parent A: KATHERINE MCCLAIN Parent B: DANIEL MCCLAIN

Date: October 11, 2024

Case No.: 2022 DR 00353 SETS No.: Order No.:

No. of Children of the Order: 1

If a sole residential order, check one of the two boxes below:

Parent A Is residential parent;

Parenting Arrangement

Parent B is residential parent; Parent B is qbli or • • Parent A is obli or

lfa shared parenting order, check one of the two boxes below: . .· Parent Ais obligor

Parent B Is obligor

Annual Gross Income (Figure must represent the sum of gross income inclusions and exclusions as described in Ohio Revised Code 3119.01 C 12

Annual Amount of Overtime, aonuses and Ccml'mlsslons

a. Year 3 3 ears ago

b. Year 2 2 ears ago)

c. Year 1 last calendar year

2 3-year avera e "Reasonable expectation" see instructions)

d. Income from overtime, bonuses, and commissions (Enter the lower of the average of Lines 2a, plus Line 2b plus line 2c, or Line 2c See instructions)

Calculation for S.elf-Em lo ment Income

b. Ordinar and necessary business ex enses

3 c. 6.2% of adjusted gross income or actual marginal difference between actual rate paid and F.I.C.A. rate

d. Adjusted annual gross income from self-employment (line 3a minus Line 3b minus Line 3c 4

or social securit disabili /retirement benefits

6

Case No.: 2022 DR 00353

No. of Children of the Order: 1

Adjustment for other Minor Chlldren Not of This Order. (Note: Line 9 is ONLY completed If either parent has any cl'llldren outside of this order. If neither parent has any children outside of this order enter "O" on Urie 9f and roceed to Line 10 For each • arent: •

Enter the numberof"other" children NOT Including children ofthls·order)

a. Enter the total number of children (including children of this order and other children)

b. Enter the number of children sub·ect to this order

c. Line 9a minus Line 9b

d. Using the Basic Child Support Schedule, enter the amount from the corresponding cell for each parent's total annual gross income from Line 7 for the number of children In Line 9a

e Divide the amount in Line 9d b the number In Line 9a

f Multiply the amount from Line 9e by the number in Line 9c. This is the adjustment amount for other minor children for each arent.

Ad ustment for Out-of~Pocket Health Insurance Premiums10

a. ldentif the health insurance obli ors See instructions

b. Enter the total, actual out-of-pocket costs for health insurance premiums for the parent s identified on line 10a See Instructions)

11 Annual court ordered spousal support paid; if no spousal support Is paid, enter •o·

12 Total ad·ustments

income on Line 14, determine if the parent's obligation is located In the shaded area of the schedule. If the parent's obligation is in the shaded area of the schedule for the children of this order, check the box.

Share: Enter the percentage of parent's income to 17 combined adjusted annual gross income (Line 14 divided by Line 16 for each arent

a_asic Child Support Qbligation-Chooi;;e one of the following statutory methods for obtaining the support ot:>Hgatio.n when the ar111llal income falls between the tcible's $600 increments. The most common is • • Interpolate:·. 0-Low;~:lnter olate;O-High Use minimum order for c· is> $336,000

a. Using the Basic Child Support Schedule, enter the amount from the corresponding cell for each parent's adjusted gross income on Line 14 for the number of children of this order. If either parent's Line 14 amount is less than lowest income amount on the Basic Schedule, enter "960"

18 b. Using the Basic Child Support Schedule, enter the amount from the corresponding cell for the parent's combined adjusted annual gross income on Line 16 for the number of children of this order. If Line 16 amount Is less than lowest income amount on the Basic Schedule, enter "960". 12,215.53

8,989.31

c. Multiply the amount in Line 18b by Line 17 for each parent. Enter the amount for each arent 4,423.24 7,792.29

d. Enter the lower of Line 18a or Line 18c for each parent, if less than "960", enter "960"

Case No.: 2022 DR 00353

No.: No. of Chlldren of the Order: 1

a. Enter "Yes" for any parent granted parenting time under a court 19 order that e uals or exceeds 90 overni ht visitations er ear.

b. If Line 19a is checked use the amount for that parent from Line 1 Bd and multiply it by 10% or 0.10, and enter this amount. If Line 19a is blank enter "O"

Derivative Benefit Child's benefit on behalf of a arent

20 Enter any non-means tested benefits received by the children Date: October 11,

sub'ect to the order.

Child Care If neither parent has out of ocket child care costs, enter "0" on Line 21 for each arent

a. Annual child care expenses for children of this order (less any subsidies

b. A e C.

d.

e.

f. Enter total of Line 21 e for children of this order

Use American Rescue Plan Act 2021 values

Federal child care credit table %)

Federal child care credit

Ohio chlld care credit table %

Ohio child care credit

Enter the eli ible federal and state tax credits

h. Line 21f minus combined amounts of Line 21

i. Multiply combined Line 21h by Line 17 for each parent. (If Line 15 Is checked for the parent, use the lower percentage amount of either Line 17 or 50.00% to determine the parent's share).

Annual chlld care costs

j. Line 21i minus Line 21a. If calculation results in a negative amount enter "O"

Supporting Tax Data:

Filing Status

Earned Income

Adjusted Gross Income

Standard/Itemized Deduction

Alternate Minimum Tax

Foreign Tax Credit

Total

a. For 3119.23 factors (Enter the monthly amount)

D Special or unusual needs ....

D Other court ordered payments

D Extended parenting time; extra travel

D Financial resources of child

D Relative financial resources of parties

D Obligee's income under FPL

D Remarriage/cohabitation benefits

D Federal, state and local taxes

D Significant in-kind contributions

D Extraordinary work-related expenses

D Change ln the standard of living

D Educational opportunities

D Party's responsibilities for others

D Post-secondary educational expenses

D Any other factor:

b. For 3119.231 extended parenting time (Enter the monthly amount

Parent A: KATHERINE MCCLAIN

Parent B: DANIEL MCCLAIN

Case No.: 2022 DR 00353 SETS No.: No. of Children of the Order: 3

2

Annual Gross Income (Figure must represent the sum of gross income inclusions and exclusions as described in Ohio Revised Code 3119.01 C 12)

Anrn.1aI:~rnouiit;.ofOvertime';;BonU:ses:and·.c6r:hrnlssdns:.

a. Year 3 3 ears ago

b. Year 2 2 ears a o

C. ear

"Reasonable ex ctation" see instructions

d. Income from overtime, bonuses, and commissions (Enter the lower of the average of Lines 2a, plus Line 2b plus Line 2c, or Line 2c See instructions

CalCulalioi:i'f.or;Self;.l=m lo n,ent ·1 rtccime ••.

a. Gross receipts from business

b. Ordina and necessary business ex enses

3 c. 6.2% of adjusted gross Income or actual marginal difference between actual rate aid and F. I. C.A. rate

d. Adjusted annual gross income from self-employment (Line 3a minus Line 3b minus Line 3c

• 4 Annual income from unem lo ment com ensation

5 Annual income from workers' compensation, disability insurance, or social securit disabili /retirement benefits

6 Other annual income or otential income

7 Total annual gross income (Add Lines 1, 2d, 3d, 4, 5 and 6, if Line 7 results inane ative amount enter "O"

8 Health insurance maximum multl I Line 7 b 5% or 0.05

Date: October 17, 2024

Parent A: KATHERINE MCCLAIN

Parent B: DANIEL MCCLAIN

Case No.: 2022 DR 00353 SETS No.:

Date: October 17, 2024

Order No.: No. of Children of the Order: 3 Ii).~

Adjµstrtj~nlfqr .Other Minor Child ren_Not ofThis _Ord~r. (N~te: 1.:ine

h~s )my 9Wldre:(l outside• of this.· order. If neitherp_ar,eht has--~ny

iroton ·.Llrie-'9fand'. roceed to Lin&, -1 o For each·· arent: .,.:.

Enter the number of "other" children NOT Including children of this order)

a. Enter the total number of children (including children of this order and other children

b. Enter the number of children sub'ect to this order 9

c. Line 9a minus Line 9b

d. Using the Basic Child Support Schedule, enter the amount from the corresponding cell for each parent's total annual gross income from Line 7 for the number of children in Line 9a

e Divide the amount in Line 9d b the number in line 9a

Multiply the amount from Line 9e by the number in Line 9c. This is the ad ustment amount for other minor children for each arent. /x.'d' uslmeot'.fcir-.bu(-of~PockelHe'alth Jr/saf~n6ePre·miuins•·

a. ldenti the health insurance obll or s . See Instructions

10

b. Enter the total, actual out-of-pocket costs for health insurance premiums for the arent(s identified on Line 10a See Instructions

11 Annual court ordered spousal support paid; If rt is paid, enter •o•

12 Total ad ustments to income Line 9f, lus Line 11

13 Adjusted annual gross income (Line 7 minus Line 12, if Line 13 Using the Basic Child Support Schedule and the parent's Individual

income on Line 14, determine if the parent's obligation Is located In the shaded area of the schedule. If the parent's obligation is in the shaded area of the schedule for the children of this order, check the

18

96,160.30

.~~si9]-P,hi:1tt~~uppoitd~ligatio11~Ch90.s~cihe'ot,the:fb11ow,lng'~t~t~t6rfin,.et1Jqds·.toJ,9~,@iftn_g;l_het,$liP,P,p pbl[9a'ti9_~)W:h~n ·-_the·~nnifal, inc(jrne. fal lspetyie'eri the. tapJe'$ $,6Qplri¢tijm~pts) )l;h~i,n\?-sJ!scfm.fooo\iS: ., C l ntet'"olaie:Ua;:H:6w:i1&1~l nfe ••• •h: \ O-:Usel mi6irrium:.orde·r fo'r.'c'• is_;;:i>';$33t3;'dodJi$'72Yt;ft.

a. Using the Basic Child Support Schedule, enter the amount from the corresponding cell for each parent's adjusted gross Income on Line 14 for the number of children of this order. If either parent's Line 14 amount is less than lowest income amount on the Basic Schedule, enter "960"

b. Using the Basic Child Support Schedule, enter the amount from the corresponding cell for the parent's combined adjusted annual gross income on Line 16 for the number of children of this order. If Line 16 amount Is less than lowest income amount on the Basic Schedule, enter "960".

c. Multiply the amount in Line 18b by Line 17 for each parent. Entertheamountforeach arent

d. Enter the lower of Line 1Ba or Line 18c for each parent, if less than "960", enter "960"

Page 2 of 4

Date: October 17, 2024

Case No.: 2022 DR 00353

No. of Children of the Order: 3 5l1

Parentih ?rime Or~e(

a. Enter "Yes" for any parent granted parenting time under a court

19 order that e uals or exceeds 90 overni ht visitations er ear.

b. If Line 19a Is checked use the amount for that parent from Line 18d and multiply it by 10% or 0.10, and enter this amount. If Line 19a is blank enter "0"

[')eriv-ativeTBehefit: Child'S' benefit on -be.half of a'. a rent

20 Enter any non-means tested benefits received by the children

sub'ect to the order.

:.child:C:are: ff 11eithe·r.. aren't has ·outof'. ·ocketchlld'.care c6sfate6teir,(:o•i:oon'tfi\e'.21•·

a. Annual child care expenses for children of this order (less any subsidies

21

e.

f. Enter total of Line 21e for children of this order

Use American Rescue Plan Act 2021 values

Federal child care credit table %

Federal child care credit

Ohio child care credit table %

Ohio child care credit

Enter the eli ible federal and state tax credits

h. Line 21f minus combined amounts of Line 21

i. Multiply combined Line 21 h by Line 17 for each parent. (If Line 15 is checked for the parent, use the lower percentage amount of either Line 17 or 50.00% to determine the parent's share).

Annual child care costs

j. Line 211 minus Line 21a. If calculation results in a negative amount, enter "0" Supporting Tax Data:

Filing Status

Earned Income

Adjusted Gross Income

Standard/Itemized Deduction

Alternate Minimum Tax

Foreign Tax Credit

Total Number of Exemptions includin

Special or unusual needs

D Other court ordered payments

D Extended parenting time; extra travel

D Financial resources of child

Relative financial resources of parties

D Obllgee's Income under FPL

Remarriage/cohabitation benefits

D Federal, state and local taxes 25 Significant in-kind contributions

D Extraordinary work-related expenses

Change In the standard of living

D Educational opportunities

D Party's responsibilities for others

D Post-secondary educational expenses

I&! Any other factor: