2024 GO TEXAN PARTNER SURVEY

Prepared by: Alicia Kimzey & Ahmed Bilwani

Prepared by: Alicia Kimzey & Ahmed Bilwani

The GO TEXAN program administered its annual partner survey in February of this year. The objective of the GO TEXAN Partner Survey is to gather valuable data and information that can be used as a benchmark and reference to:

Determine the benefits that GO TEXAN Partners are actively utilizing Determine areas of improvement

Set benchmarks for future goals

With these in mind, we designed and conducted this survey to focus on Partners’ demographics, program feedback, perceived benefits, engagement with the GO TEXAN International program, and social media utilization.

With 168 respondents, data was cleaned and analyzed to generate insights for future planning. Among insights discovered, three findings (based on the aforementioned objectives) stood out the most:

The benefits utilized the most are marketing opportunities and usage of the GO TEXAN mark

A major area of improvement is expansion of current resources. Specifically retail and event opportunities. There seems to be a lack of awareness or education of all benefits offered by the GO TEXAN program

An analysis of all findings and recommendations can be found in the Conclusion section of this report.

The GO TEXAN program is a Texas Department of Agriculture initiative dedicated to identifying and supporting Texas-based businesses and connecting them with customers across the Lone Star State and around the world.

The GO TEXAN program is dedicated to showcasing the diversity and quality of Texas-based businesses. Whether we are developing new sales and business opportunities for GO TEXAN Partners or encouraging consumers to look for the iconic GO TEXAN mark when making buying decisions, we always strive to find new and meaningful ways to promote products and services that are Texas made and Texas proud.

GO TEXAN offers Partner benefits that include promotional opportunities, connections to funding, workshops, networking, and access to some of the largest events in Texas.

The following pages consist of the results from the 2024 GO TEXAN Partner Survey that was sent out to 2,719 Partners as of February 10, 2025. The survey was distributed via email to all Partners with a Survey Monkey link included. Upon completion, Partners were given a $50 discount code to use for the cost of GO TEXAN related events. Of the 2,719 Partners that received the survey, 168 Partners completed the survey. The overall survey response rate was 6.2 (168/2,719) percent. The 2023 survey response rate was 8.7 (164/1,891) percent. Some respondents chose to omit certain questions. Due to this, the amount of responses on a per question basis will show some variance.

The GT Partner Demographics section is used to understand what types of businesses are a part of our program and provide information about their business needs.

Which category is your GO TEXAN account registered under?

We found that a majority (88%) of respondents are registered in our ‘Product’ category. 12% of respondents are registered in the Associate category. Some of which are local organizations such as chambers of commerce.

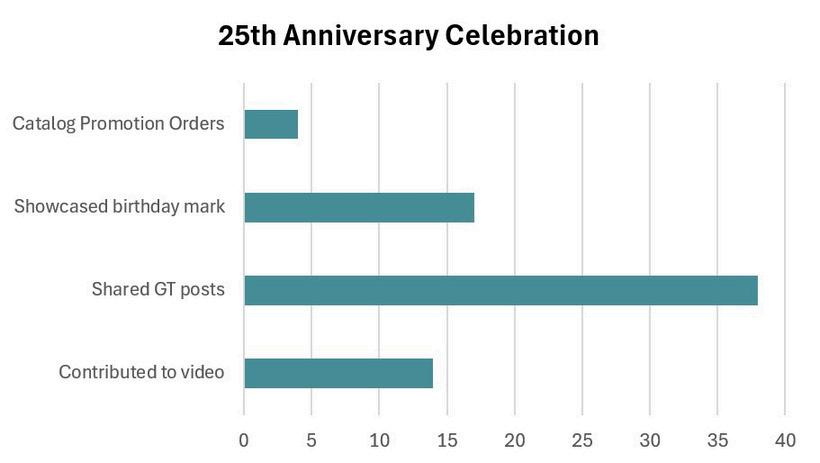

During 2024, GO TEXAN Celebrated it’s 25 Birthday and offered different opportunities for Partners to help celebrate. th

Out of 168 respondents, nearly 60% indicated that they were not aware of the GO TEXAN 25 Birthday celebration. Of the remaining 40%, respondents participated in one or more of the following: th

Contributed to video: Contributed a ‘Happy Birthday’ Video

Shared GO TEXAN Post: Shared 25 Birthday related content from GO TEXAN on to my socials th

Showcased Birthday Mark: Displayed the GO TEXAN 25 Birthday mark on social media or promotional items th

Catalogue promotion orders: Filled Ecommerce orders from the 25 Birthday Catalogue th

Which business sector best describes your business?

We found that a vast majority of respondents fall into the Consumer Package Goods (CPG) category The next leading categories were Gifts and Accessories, Economics and Tourism, and Home Goods.

Due to the difference between the CPG category and others, CPG was broken down further into subcategories to understand what subgroups Partners belonged to.

The “Other packaged” category is our leading subgroup. The next three (in order) are Sauces/Spices Nut, Fruit, or Vegetables Meat

In which area of the supply chain does your company operate?

Among respondents, Partners indicated that they operate in these areas of the supply chain. The top 3 are:

1. Retail or Direct to Consumers

2 Wholesale

3. Business or Trade Group

The heat map below shows where respondents businesses are located. The top 2 counties were Dallas County and Harris County. The surrounding counties for each also had some concentration of respondents. Largerly due to Dallas and Harris counties being part of larger metropolitan areas (Dallas-Fort Worth and Houston, respectively).

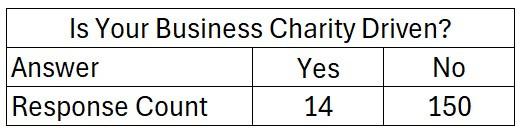

Is your business charity driven?

Most GO TEXAN Partners are for-profit entities. While a majority of our GT Partners are not charity driven, respondents did list the charities they participate in:

The Humane Society

Scholarships for Area Youth & Agriculture

Human Trafficking of Children

Children's Advocacy of Denton County

Animal Shelters

Compassion Corsicana

West Houston Area Ministries

SIMS Foundation

HAAM

Bise Village

Trusted World

Jonathan’s Place

Unbound Houston

North Texas Food Bank

MD Anderson's Children's Cancer Hospital

THCW Scholarship Fund.

Integrate Charitable Contributions for Community Programs

Wounded Warrior Project

Grassland Restoration

Does your business use any of the following certifications? Please select all that apply.

A majority of respondents (69.0%) do not currently hold any of the above certifications. Among Partners who do, the most popular among our sample are Gluten-Free, some other type of certification, and Vegan.

The respondents who listed ‘other’ certification categories are listed below:

Other Third-Party Certifications

Dairy Free

Harmonized GAP+

Plant based, no animal fats or animal testing, member of Leaping Bunny

SQF

Other Claims

Biodegradable

Keto

No MSG

No sodium, No preservatives

Nut Free

Real Texas Honey

Regenerative Organic Salt-free, sugar-free, preservative free

Seed Oil Free

Soy Free

Sugar Free

Texas Inspected and Passed

What is the age range of your target audience?

The top target audience age range of respondents’ businesses is 35-44 years old. However, response counts indicate that there is a cluster of target age groups comprised of:

35-44

45-54

25-34

55-64

The lower count for Under 18 could be due to the lower purchasing power and purchasing-decision authority of the category. The relatively lower count of 18-24 years old can be explained due to similar reasons as this is an age group considered to be young adults.

Which of the following best indicates your ownership status?

84% of respondents are full time business owners.

What is the size of your company?

The response rate for this question was 97% Among respondents, the vast majority of GT Partners indicated that their business has 10 or less employees. All other groups had similar answers within the range of 3-6%.

G O T E X A N S A L E S I N F O R M A T I O N

Respondents were surveyed about their sales activities where they sell their products, how they reach customers, and the interest in wholesale or retail sales. We also collected information on sales volume and performance metrics to better understand trends across the partner network.

How do you sell your product(s)? Please select the top three.

Responses show that the top 3 methods of sales are:

1. Online Sales

2. Wholesale

3. Festivals and Craft shows

Are you interested in selling to retailers, wholesalers, or both?

About 71.8% of respondents are interested in selling both wholesale and retail.

I am interested in selling to retailers- 25

I am interested in selling to wholesalers- 2

I am interested in selling to both- 117

I am not interested- 19

Do you currently work with a distributor or broker?

Majority of respondents indicated an interest with working with a distributor or broker. Based on data provided, we can infer that 74% of all respondents to this question either currently work with either a wholesaler or distributor, or have an interest in doing so.

Partners listed all of the retailers they currently sell in. The highest concentration (most mentioned) retailers appear in larger fonts. Specific retailers mentioned the most were HEB

Central Market

United Supermarket

Where does your business use the GO TEXAN mark?

Other uses of the mark:

Booth and Display Signage

Event Banners

License Plate

GO TEXAN Certificate

Recipe Cards

Radio Ad Mentions

Social Media Graphics

School Menus

Promotional Items

Why don’t you use the GO TEXAN mark?

Partners who choose not to use the GT mark do so for a variety of reasons. While some are uncertain about the value it brings to their product packaging or feel the cost of participation outweighs the potential benefits, others cited they have not incorporated it onto their packaging due to a lack of consumer knowledge of what the GO TEXAN mark means

Did the total sales of your business in 2024 increase, decrease, or stay the same compared to 2023?

68.4% of respondents reported that their sales increased in 2024 because of their GO TEXAN Partnership.

Please select where you had the most sales this year.

Respondents show that Festivals and Craft Shows are their top place to sell products. When grouped together, we can see that 67.5% of respondents they experienced the most sales in a direct, in-person setting.

In this section, we explored our Partners’ interest and readiness to engage with international markets through TDA’s exportfocused programs. Respondents were asked about their company size, experience with exporting, and whether they have specific markets they’re interested in pursuing. We also gauged preferences for engaging internationally—whether through travel abroad or U.S.-based activities. 2 5

O T E X A N

I N T E R N A T I O N A L

O P P O R T U N I T I E S

Are you interested in exploring TDA International programs that provide access for small ag businesses to export markets around the world?

1/3 of respondents indicated that they were interested in TDA’s international program to scale their business.

Do you have a market in mind that you want to explore?

Among Partners that indicated interest in international exporting opportunities, a majority (61.7%) indicated that they have not chosen a new market.

What is your readiness for entering an export market?

Among Partners that indicated interest in international exporting opportunities, 19.2% of Partners are ready to learn more about exporting but are not ready to export today.

Are you willing to travel internationally, or do you want to start exploring through U.S. based activities?

More than half of our respondents indicated that they are willing to travel internationally and start exploring through U.S. based activities.

Yes: 28

No: 20

3 0

Partners were asked which social media platforms they follow GO TEXAN on as well as if they were interested in being featured.

67% of respondents (114) marked that they were interested in being featured on GO TEXAN’s social media platform. Respondents were contacted with a link to upload content to be featured on GO TEXAN’s social media platforms.

1

Which social media accounts do you follow?

The top platform that Partners follow GO TEXAN on is the Facebook page. Instagram is a close second. Considering many respondents are also CPG brands, they likely are primarily active on these two platforms which are more customer-facing compared LinkedIn.

Partner Group is a group made on Facebook. Based on the data above, we can infer that that 57% of all followings and connections are on the Facebook platform overall.

2

Respondents were asked to give their feedback on the value and impact of the program benefits, their impressions of the monthly newsletter, and suggestions for areas where GO TEXAN can improve. This section highlights the insights gained from their responses, helping us better understand what’s working well and where we can enhance our efforts to support GO TEXAN Partners.

In which of these areas do you feel that GO TEXAN can improve?

Overall, respondents showed that the top 2 areas of improvement for the GO TEXAN program are Digital Features and Events. Respondents expressed that they want to see more events offered throughout the year and more digital promotions of their companies on social media.

On our original survey answers, we listed ‘ no benefit’ as an area of improvement. During review, we noticed that there were no implications to this answer.

After reviewing additional comments, we were able to identify that the issue was actually a lack of education on what the benefits are

Please rate your satisfaction with the following attributes of the monthly GO TEXAN newsletter.

The chart below reflects satisfaction levels on readability, design and content.

Please rate your satisfaction with the following attributes of the monthly GO TEXAN newsletter.

Outside of announcements and social media links, we break our content out into two sections: Events and SUSTA/International related content. The chart below reflects the responses.

We see from the report that Partners are overall satisfied with the event opportunities mentioned in the newsletter. For international content, more respondents are satisfied than they are dissatisfied. However, a large majority feel nuetral about this type of content. This could be due to the amount of respondents who are not currently interested in international programs and opportunities.

How likely are you to recommend the GO TEXAN program to a local business you know?

In order to measure satisfaction of GO TEXAN Partners, we asked (on a scale of 1-10) “How likely are you to recommend this program to others?”. We used this question to analyze the net promoter score (NPS). NPS is a standard measure of satisfaction and customer experience used across all industries. Responses with a rating of 9-10 are considered promoters while those rated 0-6 are considered detractors. We take the difference of these and compare it to the total number of responses.

Industry benchmarks suggest that NPS in the range of 30-50 are ideal with above 50 being considered a mark of distinction. GO TEXAN scored 54. Meaning among statewide campaigns, we have one of the highest levels of satisfaction with our stakeholders (GO TEXAN Partners). This indicates that we provide enough benefits to our Partners that they recommend this program to their fellow Texas businesses.

Among detractors, the lowest reporting (1-3) were reached out to on an individual basis. We noticed that among the detractors, most were unaware of what their benefits were and as a result, not accessing them.

I think the GO TEXAN Program is an invaluable resource for any business in TX, but particularly Small Businesses. The program offers information and opportunities that I know I would not have known about had I not been a partner. I believe that me and my business have and will continue to benefit and grow as a result of being a GO TEXAN partner.

Respondents were asked to share additional open-ended comments. Overall, we saw positive responses from Partners about the support that the program offers. Respondents also shared areas of improvement; more traction on shop.gotexan.org, more tier benefits for lower tiers, more benefits for Associate Partners, more exposure for small farms and ranches, more grant opportunities and greater social media presence.

“I recommend the program all the time to other business owners!”

“I think it's an amazing program that helps Texas businesses and communities.”

“As a super small business, I appreciate the opportunities that GO TEXAN provides. I also appreciate the team members - everyone is always so helpful whether I have questions via email or at events. And thank you for considering our feedback and working to improve the program!”

“I do recommend GO TEXAN...10/10!”

“We love the support and think it's beneficial for others in our industry.”

“I would enthusiastically recommend the GO TEXAN program. ”

“I recommend GO TEXAN to every Texas-based business.”

“This program has definitely introduced my products to a much wider audience over the years and I will definitely continue being a Partner ”

“We're proud to be a GO TEXAN Partner and look forward to a continued Partnership!”

“Thanks to all and the state for funding the GO TEXAN program. It is part of my business plan and I fully utilize the opportunities TDA provides.” 3 8

In this section, respondents were asked to share how specific benefits—such as the use of the GO TEXAN mark—have supported their business goals. From product packaging to marketing materials and event participation, respondents provided valuable insights into where and how they’re leveraging these tools. We also invited feedback on what additional benefits they would like to see offered.

Since joining, please mark all of the connections that GO TEXAN has assisted your company to make:

Other areas where Partners were assisted:

Participation in major Texas events (e.g., State Fair, Houston Rodeo, FWSSR, Texas Country Reporter Festival)

Increased brand exposure and potential for sales growth

Access to marketing support, including TDA marketing materials and giveaways

Networking opportunities with other GO TEXAN companies

Informative and engaging speakers

Recognition as an official Texas-made product

Assistance with researching Texas co-packers

Pride in supporting and being part of a Texas-based initiative

What additional benefits would you like to see the GO TEXAN program offer?

The top 2 additional benefits that Partners would like to see are buyer meetings and small business assistance.

Overall, the GO TEXAN Partners are satisfied with the program. The Benefits that are utilized the most are marketing opportunities and the campaign mark. Key areas of improvement and some of their underlying needs are presented below. Included in the findings are recommendations to address needs indicated by respondents.

Based on data collected, there seems to be a need for GO TEXAN program benefit education to partners. From open-ended questions, partners indicated they were not fully aware of every benefit of the program at their Tier level. Recommended steps include further research from both a qualitative and quantitative standpoint. Partners who are not aware of all benefits should be asked a series of questions to understand where the roadblock exists. Quantitatively, various points of prior benefit education should be analyzed and scored (along with deriving insights from available data). This can help the GO TEXAN program understand how much of a benefit education need can be addressed by optimizing existing systems. Additionally, some partners desired improvements that do not fall under the scope of the GO TEXAN program.

Respondents indicated that they desire general business resources. Since this falls outside of the scope of benefits this program provided in 2024, Partners should be provided with a link to find their local Small Business Development Center (SBDC) for advising and trainings as their tax-dollars prepay for these services nationwide. Additionally, different SBDCs may have different subject matter experts (SMEs). SMEs can be invited to provide presentations or help provide the GO TEXAN program with a library of resources they can share with Partners

Respondents indicated that they are already selling in retail stores or are very interested in selling products in a retail setting. Efforts to increase buyer meetings and retail connections will be carried out through the Federal State Marketing Improvement Program grant that GO TEXAN was issued in September of 2024. At the start of the year in 2025, program staff has purchased retail contacts, conducted interviews with several GO TEXAN Partners and Retailers. These interviews helped us gain insights on the needs of Retailers and GO TEXAN Partner interests as well.

GO TEXAN already offers several events for partners to participate in. Respondents indicated that events can be a good source of sales revenue for them. It is possible the desire for more events is rooted in continuing the sales revenue created by attending these events. Based on county level data found in the demographics section, events in the greater DFW and Houston areas would be most beneficial due to the concentration of partners in those areas.