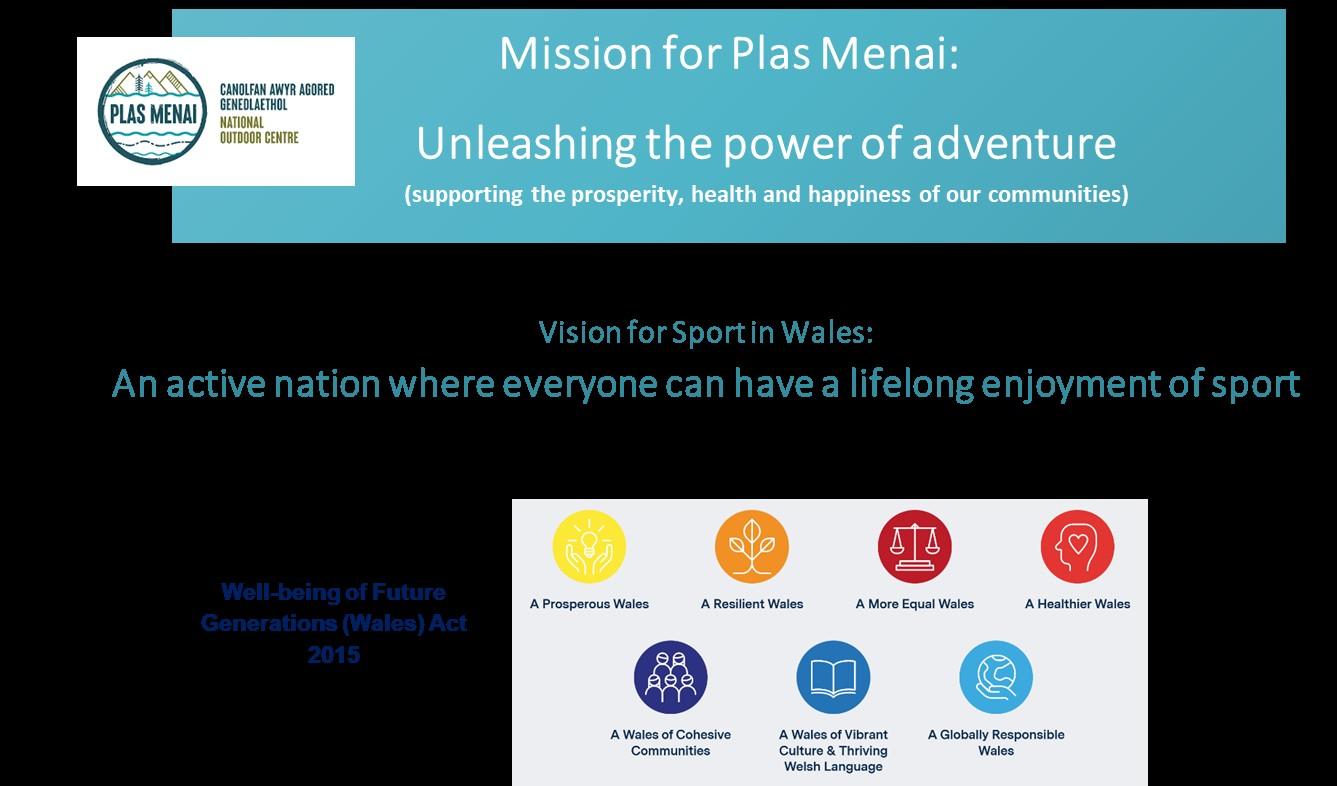

BUILDING AN EXCITING, DYNAMIC AND AMBITIOUS PARTNERSHIP FOR THE FUTURE DELIVERY OF PLAS MENAI, THE NATIONAL OUTDOOR CENTRE

Wellbeing of Future Generations Act

Service Specification

Contract Reporting & Monitoring

Strategic clarity

Operational clarity

Sport Wales Vision & Objectives

Operating Agreement

Capital Investment

Plas Menai Strategic Framework Communications themes

Partnership Board

Retaining the golden thread back to our purpose and ‘why’…

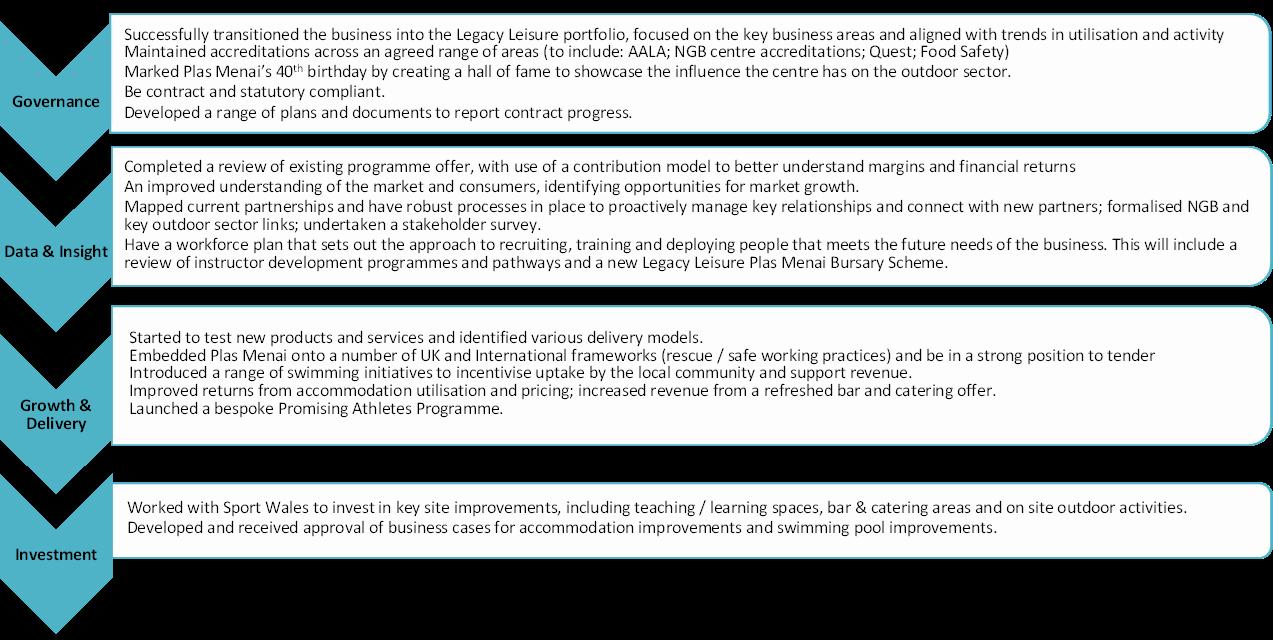

Year 1

Developing a strong, intelligence driven baseline and testing of product development

Year 2

Initial delivery of growth and continued product and brand development

Year 3

Comprehensive product portfolio rollout and brand exploitation

Year 4

Consolidation, learning and refinement

Year 5

Sustainable delivery

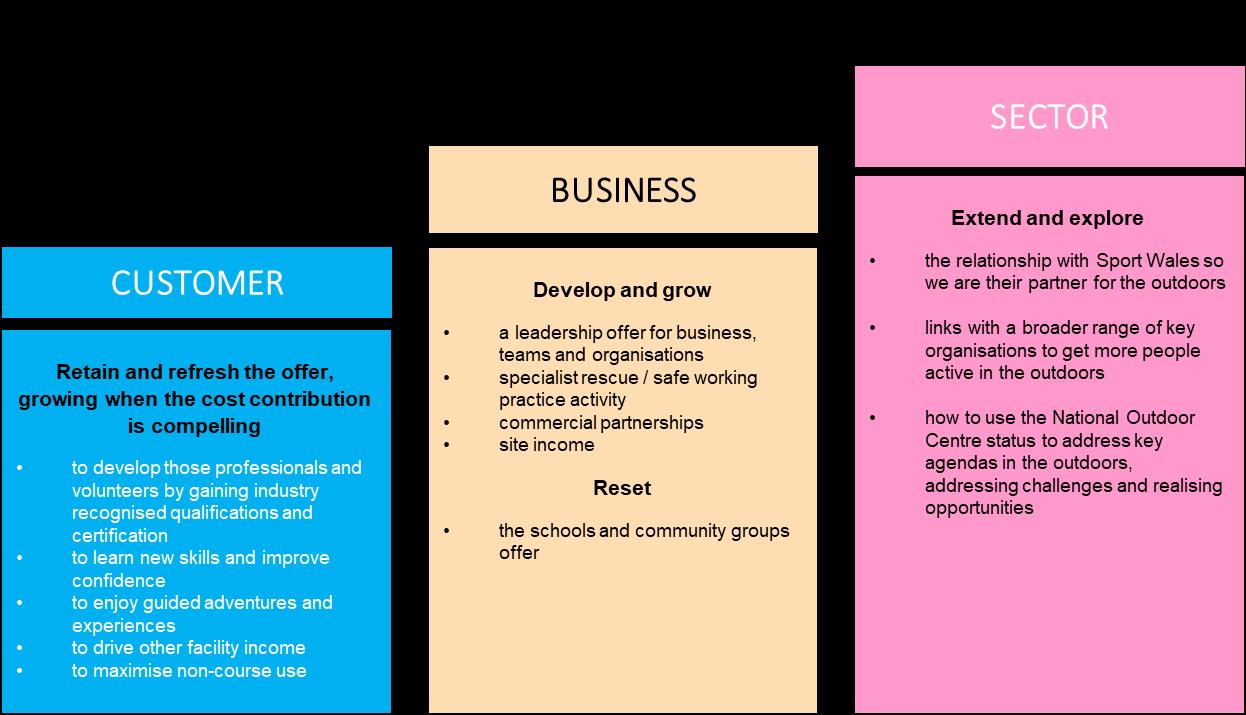

LEARN: Skills Courses NURTURE: Education & Community offer DEVELOP: Qualifications & Certification

For individual development, for qualification progression and to gain skills to undertake adventures

Local schools and community groups

Schools beyond North Wales catchment

International schools

Further & Higher Education partnerships

NGB awards covering dinghy sailing, windsurfing, powerboating, PWC, cruising and kayaking

Across the whole qualification pathway, for professional and volunteer instructors

Water Rescue Training courses, accredited by Rescue 3 Europe, for organisations that have employees who spend time working in or around the water.

ENJOY: Guided Adventures and Social Experiences

For individuals, groups and families using our unique destination and skilled staff

SUCCEED: Specialist services

Safe working practices in outdoor environments

Adventure days

Family adventure holidays

Bespoke offers to include guiding Challenges

Providing exceptional NGB, SPORT & SECTOR expertise and support

Sector leadership/ Contribution to coaching standards / Role model / Workforce development FACILITIES & COMMERCIAL

Leadership and team development

Bespoke training, cpd and instruction

Sports facility use including swimming pool and equipment

hire

Hosting of competitions, events, teams, clubs

Exploiting the Plas Menai and National Outdoor Centre brand

Bar and Catering

Accommodation

Including partner hosting meetings & conferences

Supported by improvements in the CAPITAL ASSETS

Improvements in business practice

Commercial partnerships

Evidencing impact and social return

Underpinned by the highest standards of GOVERNANCE and a constant focus on SUSTAINABILITY

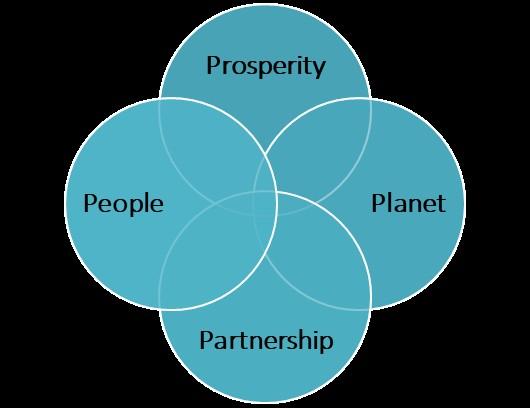

Prosperity – contributions to the economy

People – social well-being

Planet – contribution to environmental health

Partnership – our collaboration ethos that ensures we meet contractual commitments

Nick de Bois – Chair, British Tourism Authority

VisitBritain/Daniel Struthers

Nick de Bois – Chair, British Tourism Authority

VisitBritain/Daniel Struthers

Tourism delivers economic prosperity for every region in Britain.

• Tourism is usually worth £127bn a year, around 9% of GDP.

• It was the UK’s third largest service export, and accounted for almost a third of all hotel investment in Europe.

• The industry supported 3.1m jobs in every part of the UK, and incorporated over 200,000 SMEs

• British residents took 99.1 million overnight trips in England, totalling of £19.4 billion.

• There were 41 million inbound visits to Britain, totalling £28.4 billion in spend.

International visitor numbers and spend have been rebounding post-COVID. In 2020 & 2021, Britain saw a loss to the visitor economy of £147bn (£50bn inbound, £97bn domestic).

Source: International Passenger Survey.

Wales is set to beat pre-pandemic spend levels in 2023, but visits are set to remain below the million mark.

Top 5 Inbound markets for Wales:

• Republic of Ireland

• USA

• Germany

• France

• Netherlands

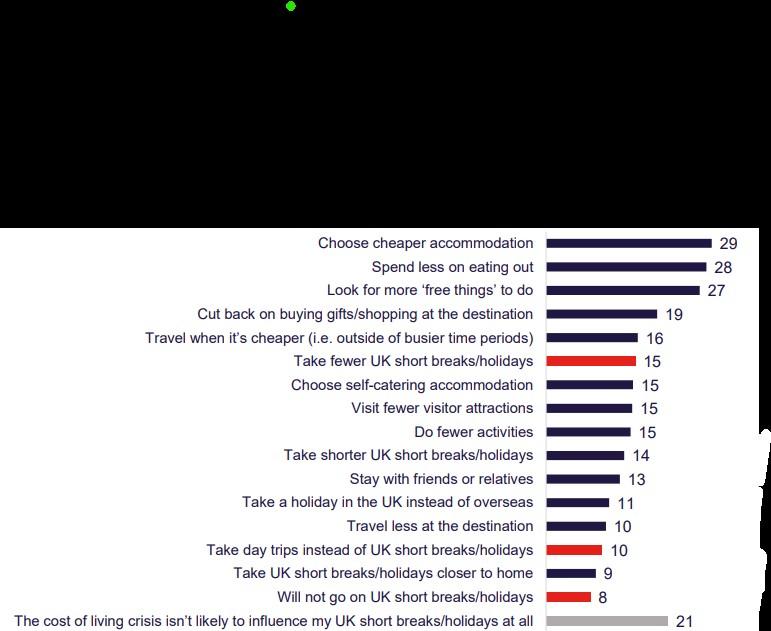

Cost of living: Pressures on finances mean leisure travel is deprioritised and businesses in the sector are facing increased costs.

Visitor documentation: We are competing against the Schengen VISA area which is c.30% cheaper for access to 27 countries.

Experience at the border: Last Summer we saw delays at the border and flight cancellations which could have a negative impact on perceptions.

Regional spread: In 2019, London received more than £15.7bn in inbound visitor spend, in comparison to £9bn in the Rest of England, and £2.5bn and £515m in Scotland and Wales respectively.

Urgency: Britain is seen as a destination to visit one day, not today.

Awareness: International visitors know less about the fantastic locations in Wales, Scotland, and England’s regions in comparison to London.

36% of respondents indicated they are more likely to choose a trip in the UK than overseas.

1. UK holidays are easier to plan (56%)

2. Shorter / quicker travel (46%)

3. UK holidays are cheaper (45%)

4. To avoid long queues at airports/cancelled flights (40%)

5. Uncertainty around restrictions at overseas destinations (27%) Both long term domestic and overseas overnight trip intentions have steadily increased since December 2022.

The top potential barrier to taking overnight UK trips in the next 6 months is the ‘rising cost of living’, followed by ‘UK weather’ and ‘personal finances’.

Top barriers to taking an overnight UK trip in next 6 months (May 2023):

1. Rising cost of living (35%)

2. UK weather (29%)

3. Personal finances (28%)

4. Rising cost of holidays / leisure (25%)

5. My general health (19%)

6. The cost of fuel (18%)

7. Limited annual leave (15%)

8. Difficulty getting money back if trip is cancelled (7%)

9. Prioritising overseas travel post-pandemic (7%)

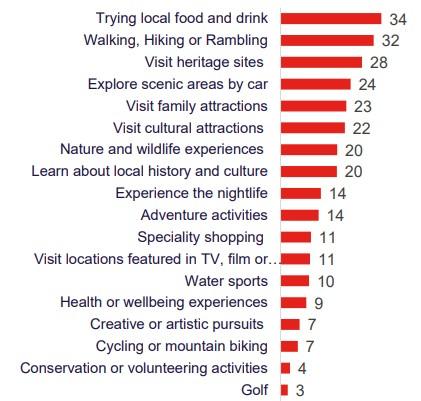

In July – September, ‘trying local food and drink’ is the top activity planned for a domestic trip.

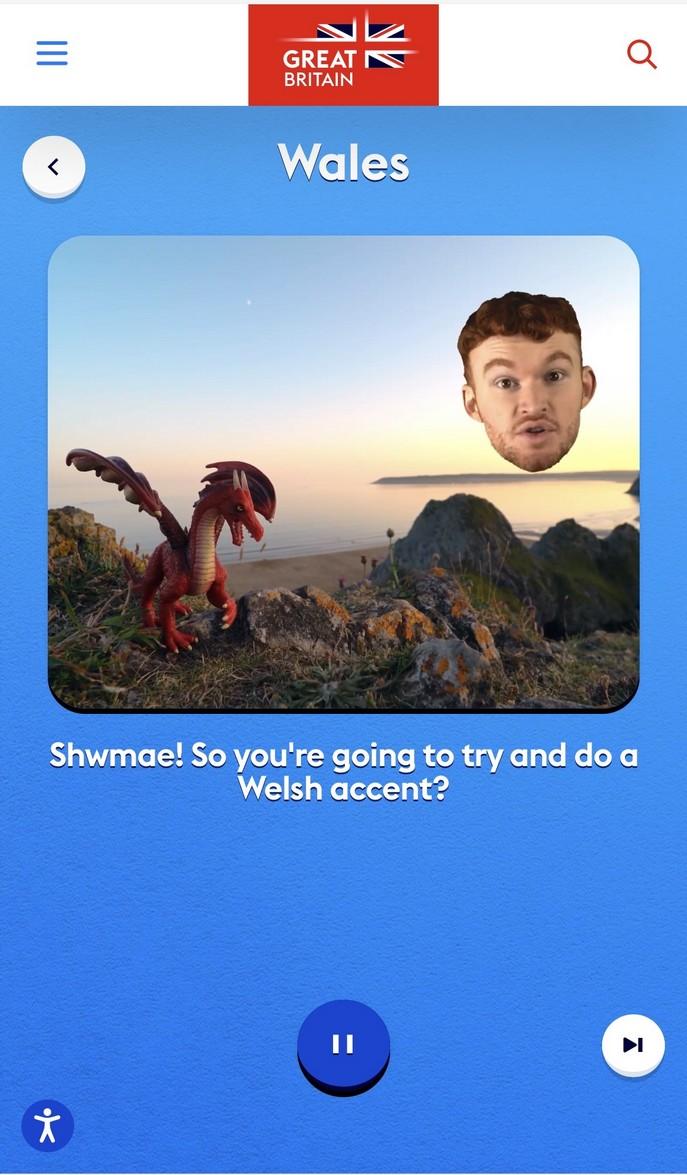

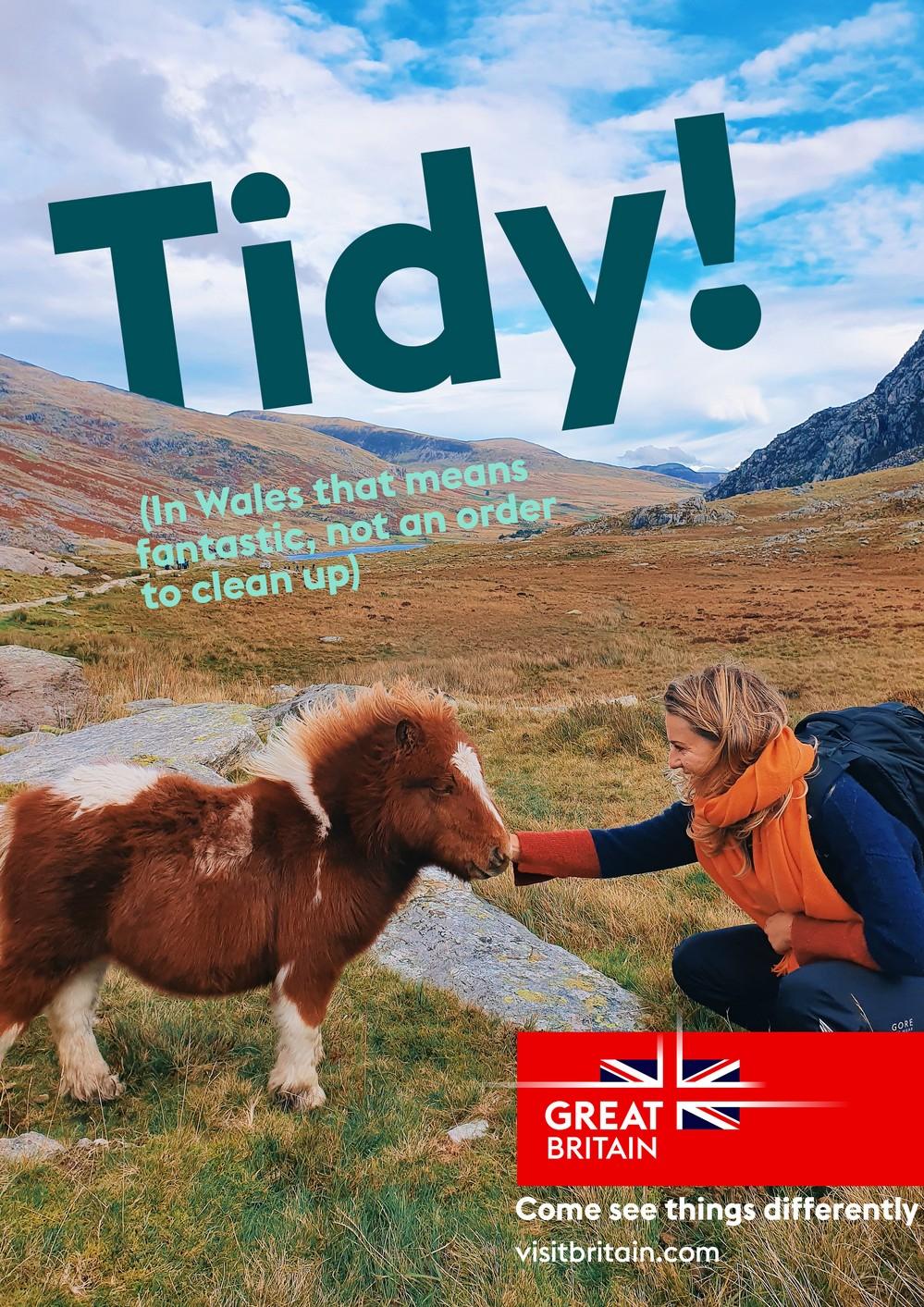

Our new international GREAT marketing campaign – ‘See Things Differently’ – showcases Britain as a dynamic, diverse and exciting destination in our key international markets.

Our USA and Canada campaign champions our regional diversity by highlighting local accents and phrases.

British Airways and VisitBritain have joined forces in a new campaign that gives an insider’s view on modern Britain, with all its vibrancy and warmth, to inspire US visitors to book their next visit.

Our European and GCC campaign uses a Britain’s love of tea, through destination and short films to tell a fresh and exciting Britain.

Our activity with international media includes Welsh product and destinations, and work with Visit Wales and Welsh suppliers have a presence at trade events.

Educational Trips: In January 2023, trade buyers from Germany, Canada and Brazil visited Wales.

Media: Facilitated an Australian journalist from Great Walks Magazine to visit Snowdonia in May, and a French journalist from Le Monde to visit Cardiff in February.

Trade Events:

• ExploreGB

• Destination Britain North America

• World Travel Markets

• ITB Berlin

• Meet the Trade (i.e Paris Nov 22)

Following the de Bois Review, DCMS announced that it will provide £1.8m over the next three years for VisitEngland to develop and administer a new accreditation scheme.

• Under the new scheme, Economy Partnership

• The North East is also Development Partnership

• VisitEngland recently

NewcastleGateshead

Northumberland, Cornwall and the West, Marketing

Derby, Visit Hertfordshire, Tourism, Birmingham,

• Successful implementation support the delivery landscape that can

75 Million Visitors in 2019

• New rides

• Increasing capacities (night flights)

• Commercial Growth

• Developed pipeline of opportunities

• Balanced portfolio of underground & outdoor sites

• Developing our sites into short stay destinations with a range of themed accommodation

• Rollout & reinforce a Brand Platform underpinned by consumer | Staff proposition

• Events (consumer)

• Sponsorship

• Flatten Visitation Profile

• Strategic UK locations

• Clustering sites in Regions

• Accommodation packages underpinned by attractions

• Activate new revenue streams – F&B / Events / Third Party Commission –extend the stay!

• Partnerships

• Ensure the digital customer journey maximises upsell | Short break proposition

• Procurement Strategy

• Leverage Scale

• ESG Strategy

• 20% of guests are repeat visitors

• Excellent Guest Satisfaction of 90%

• 66% of guests stay overnight

• Excellent NPS OF 67%

• 54% Families

• 19% Mixed Groups

• 43% of guests travel over 2 hours to our sites

HUGE – Short Break Opportunity

Single Day Positioning

• Weather impact / Walk up traffic high

• Revenue limited to experiences

• Corporate offering - limited

• Events / Parties – limited scope

• Scope of Offer / Place

• Adventure Highway

• Tiered Accommodation

• Differentiation of Sites

Short Break Positioning

• Increase dwell | Develop Loyalty | Resilience

• Clustering sites - Packages

• Premium offering

• Extend Events

• Off-peak business generation

• Corporate incentives / meetings

• Groups

• Opportunity to ‘package’ Wales as a Short Break Destination

• Unique Tiered Accommodation offerings

• Flatten the seasonality curves (Easter + Winter Events)

• Higher % of premium offerings / increased ADR / Tourism Levy

Scope to Grow ‘Premium’ Accommodation offerings!

• Premiumization of the Tyn-y-Coed - 2024

• Unique ‘Adventurer’ theme

• Increasing room capacity from 18 to 27 rooms

• Higher % of premium offerings / increased ADR / Tourism Levy

• Nurture a Short Break Positioning – ‘Cluster’ Locations (Define PLACE)

• Create Short Break Packages – Incentivise longer stays

• Develop ties with other accommodation partners

• Develop GREEN transportation between sites

Double EBITDA growth over 5 years

Site Growth from 6 to 17

Average Ridership growth of 23.1% to 1.8m

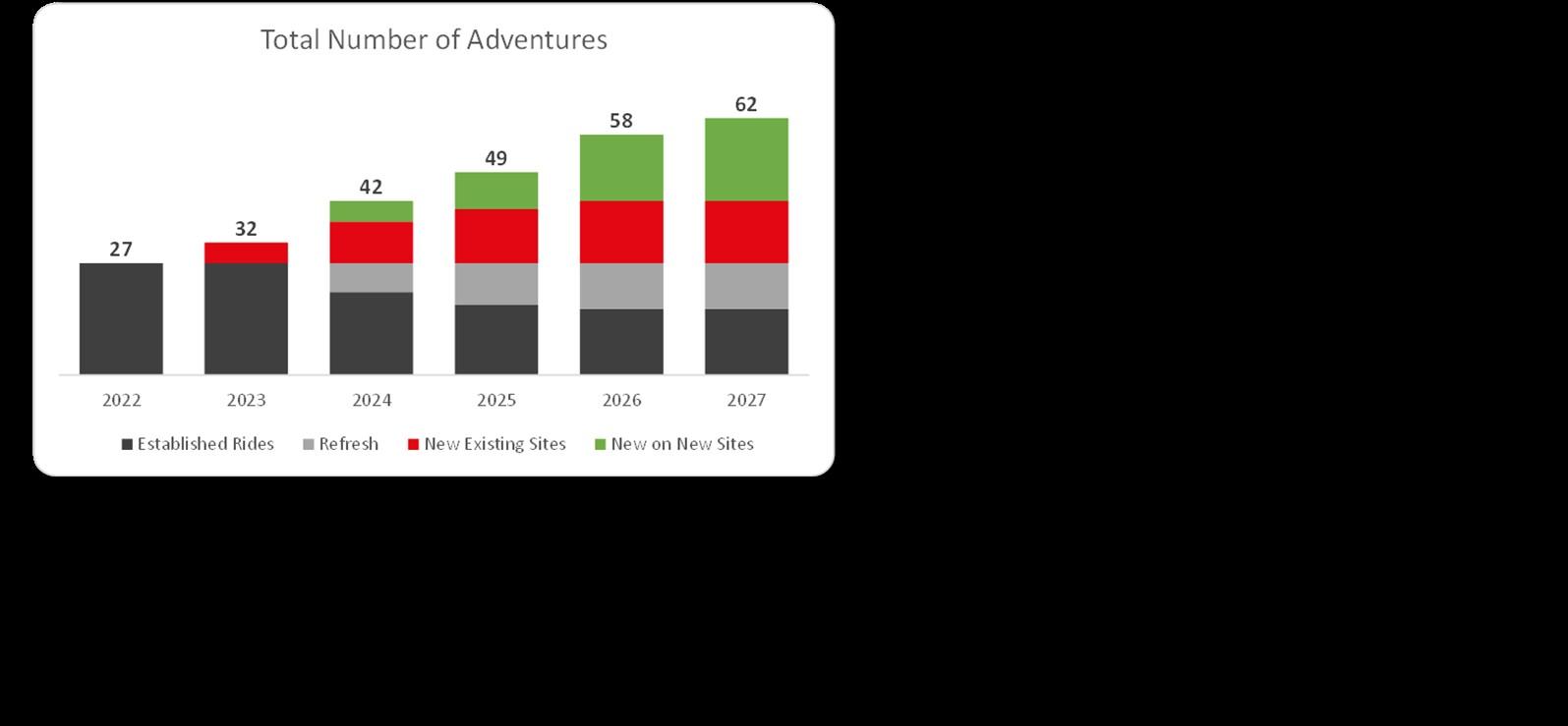

Total adventures increasing from 27 to 62

Room Nights from 5,352 to 12,828 (hotel + themed pods)

• 76 Million Visitors in 2019 (24%

• 6% Tourist Development Tax (TDT) taken from Hotel Bookings within Orange County – 11000 hotel rooms

• 25% of takings went to Visit Orlando Destination Marketing Organization ($100m in 2019)

• Convention Center generated $3 billion economic impact annually

• 75% paid for other City-Wide Venues:

• Convention Center Debt Provision for Built / Upkeep / Expansion plans

• Amway Center, Camping World Stadium / Music / Group events management

• Arts / Museums – cultural enrichment

• Sports Commission - bringing large scale sporting events to City of Orlando

6.5% sales tax was used to supplement service provision for tourism / schools & infrastructure & removal of State Tax

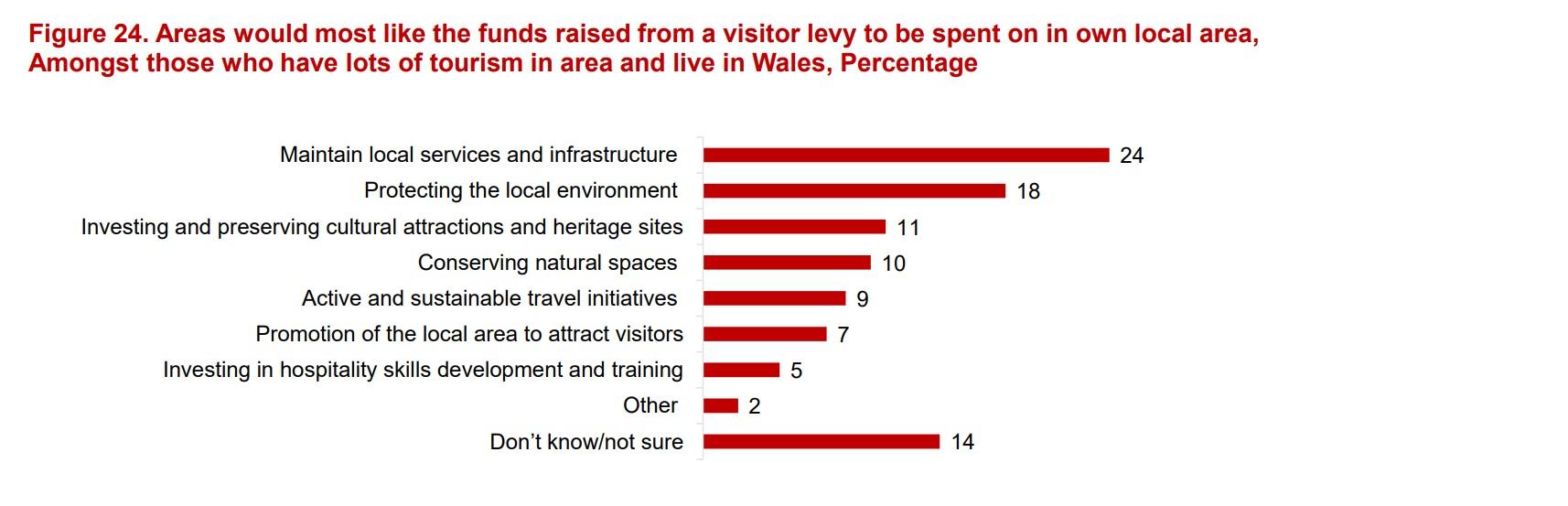

Who / How will this be managed?

1. Local Government?

2. Regional Marketing Organisations %?

3. % splits consistent?

Which services could be Funded?

1. County run venues that create economic impact

2. National Park Support | Beach Development?

3. Marketing that creates visitation | partner wealth

WHAT is contentious?

4. Sports & Arts – cultural enrichment

1. Funding of public services

2. Funding of City owned Buildings?

3. Expenditure on Marketing?

• Bod yn hyderus a chydlynol, yn canolbwyntio ar wella llesiant economaidd, cymdeithasol ac amgylcheddol y rhanbarth.

• Rydym am weld y rhanbarth yn datblygu mewn ffordd gynaliadwy, gyda chyfleoedd i bobl ennill sgiliau newydd ar gyfer y dyfodol a chael gyrfaoedd gwerth chweil. Rydym am weld busnesau'n tyfu a chymunedau'n ffynnu.

• Byddwn yn gwneud hyn tra'n hyrwyddo ein iaith, ein diwylliant a'n treftadaeth ac yn unol â'r nodau llesiant i Gymru.

• To be confident and cohesive, focused on improving the region’s economic, social and environmental well-being.

• We want to see the region develop in a sustainable way, with opportunities for people to gain new skills for the future and develop rewarding careers. We want to see businesses grow and communities prosper.

• We'll do this while being champions of our language, culture and heritage and in line with the well-being goals for Wales.

• Datblygu a gwella cysylltedd ac isadeiledd digidol

• Improving and developing digital connectivity and infrastructure

• Manteisio ar arloesedd yn ein sectorau gwerth uchel a hyrwyddo ymchwil

• Promoting research and exploiting innovation in our high value sectors

• Creu swyddi newydd o werth uchel ac annog pobl ifanc i aros

• Creating new high value jobs and giving young people a reason to stay

• Amddiffyn ein hamgylchedd a datblygu ein rhanbarth yn gyfrifol

• Protecting our environment and developing our region responsibly

Cadeirydd | Chair Is-Gadeirydd | Vice-Chair

Arweinyddion Leaders

Cyng.

Ymgynghorwyr Advisers

Yr athro | Professor Edmund Burke Is-Ganghellor, Prifysgol Bangor Vice-Chancellor, Bangor University

Prif Weithredwyr Chief Executives

Dafydd Gibbard

Cyngor Gwynedd Gwynedd Council

Dafydd Evans

Prif Weithredwr | Chief Executive Grŵp Llandrillo Menai

Yr athro | Professor Maria Hinfelaar Is-Ganghellor a Prif Weithredwr Prifysgol Glyndŵr Wrecsam Vice-Chancellor and Chief Executive Officer of Wrexham Glyndŵr University

Yana Williams

Prif Weithredwr, Coleg Cambria Chief Executive, Coleg Cambria

Cyngor Sir Conwy Conwy County Borough Council

Askar Sheibani

Cadeirydd, Bwrdd Cyflawni Busnes / Prif Weithredwr, Comtek Network Systems (UK) Ltd.

Chair, Business Delivery Board / Chief Executive, Comtek Network Systems (UK) Ltd

Ian Bancroft

Cyngor Sir Wrecsam Wrexham County Borough Council

Dylan Williams

Cyngor Sir Ynys Môn Isle of Anglesey County Council

Graham Boase Cyngor Sir Ddinbych Denbighshire County Council

Rhun ap Gareth Cyngor Sir Conwy Conwy County Borough Council

Neal Cockerton Cyngor Sir y Fflint Flintshire County Council

Cyng. | Cllr. Dyfrig Siencyn Cyngor Gwynedd Gwynedd Council

Cyng. | Cllr Mark Pritchard Cyngor Sir Wrecsam Wrexham County Borough Council

Cyng. | Cllr. Jason McLellan Cyngor Sir Ddinbych Denbighshire County Council

| Cllr. Llinos Medi Huws Cyngor Sir Ynys Môn Isle of Anglesey County Council

Cyng. | Cllr. Charlie McCoubrey

Cyng. | Cllr. Ian Roberts Cyngor Sir y Fflint Flintshire County Council

Cyng. | Cllr. Dyfrig Siencyn Cyngor Gwynedd Gwynedd Council

Cyng. | Cllr Mark Pritchard Cyngor Sir Wrecsam Wrexham County Borough Council

Cyng. | Cllr. Jason McLellan Cyngor Sir Ddinbych Denbighshire County Council

| Cllr. Llinos Medi Huws Cyngor Sir Ynys Môn Isle of Anglesey County Council

Cyng. | Cllr. Charlie McCoubrey

Cyng. | Cllr. Ian Roberts Cyngor Sir y Fflint Flintshire County Council

Creu Swyddi | Job Creation

Creu hyd at 4,200 swyddi ychwanegol net

Create up to 4,200 net additional jobs

GVA

Cynhyrchu hyd at £2.4 biliwn GVA

ychwanegol

Generate up to £2.4 billion additional GVA

Targed buddsoddiad

Cynllun Twf

Growth Deal investment

£240m

Targed Cyfanswm

buddsoddiad

Total investment target

dros | over £1bn

Bwyd-amaeth a Thwristiaeth

Agri-food and Tourism

Cysylltedd Digidol

Digital Connectivity

Arloesedd mewn Gweithgynhyrchu Uwch

Innovation in High Value Manufacturing

Ynni Carbon Isel

Low Carbon Energy

Tir ac Eiddo

Land and Property

Rhwydwaith Talent Twristiaeth

Tourism Talent Network

Hwb Economi Wledig Glynllifon

Glynllifon Rural Economy Hub

Safleoedd a Choridorau Allweddol

Cysylltiedig

Connected Key Sites and Corridors

Porth Caergybi, Ynys Môn

Holyhead Gateway, Anglesey

Yr Ychydig % Olaf

The Last Few %

Ynni Lleol Blaengar

Smart Local Energy

Cyd-destun cyfnewidiol: allyriadau a bioamrywiaeth yn cynyddu fel

blaenoriaeth Targedau Allyriadau a Bioamrywiaeth • Allyriadau gweithredol sero net

• 40% yn llai o garbon corfforedig

• 10% o gynnydd net mewn bioamrywiaeth

Dull yn seiliedig ar risg - targedau wedi'u rhoi yn eu lle i liniaru

• Risg i enw da

• Risg i'r gwaddol

• Risg gyllido posib yn y dyfodol

• Risg strategol

Changing context: emissions & biodiversity escalating as a priority Emissions and Biodiversity targets

• Net zero operational emissions

• 40% reduced embodied carbon

• 10% Biodiversity Net Gain

Risk-led approach – targets put in place to mitigate

• Reputational risk

• Legacy risk

• Potential future funding risk

• Strategic risk

Rhwydwaith Talent Twristiaeth

Tourism Talent Network

Hwb Economi Wledig Glynllifon

Glynllifon Rural Economy Hub

Safleoedd a Choridorau Allweddol

Cysylltiedig

Connected Key Sites and Corridors

Porth Caergybi, Ynys Môn

Holyhead Gateway, Anglesey

Yr Ychydig % Olaf

The Last Few %

Ynni Lleol Blaengar

Smart Local Energy

Twristiaeth

Bydd y prosiect yn ceisio sicrhau sgiliau twristiaeth a lletygarwch ar gyfer y dyfodol a chynyddu'r budd masnachol o un o'r sectorau mwyaf sefydledig a thwf cyflymaf yn y rhanbarth.

Bydd y prosiect yn annog cydweithio rhwng y sector cyhoeddus a phreifat i gydlynu gweithredu ar sgiliau a twristiaeth a lletygarwch yn y rhanbarth.

datblygu cynnyrch, gan drawsnewid twf y sector

The project sets out to future-proof tourism and hospitality skills provision and increase the commercial benefits from one of the best established and fastest growing sectors in the region.

Successfully delivered, it will stimulate public-private collaboration to coordinate action on skills and product development, transforming growth of the tourism and hospitality sector in the region.

Glynllifon Bydd y prosiect yn creu hwb economi wledig nodedig o'r radd flaenaf ar ystâd Glynllifon ger Caernarfon. Bydd yn darparu cyfleusterau safonol ar gyfer cynhyrchu bwyd ar y safle i fusnesau newydd a’r rhai sy’n barod i ehangu, megis unedau busnes a Chanolfan Wybodaeth. Bydd hyn yn cynnig profiad ymarferol i gefnogi arloesedd a thwf menter.

Bydd y prosiect yn cryfhau cyfleoedd i gydweithio, datblygu'r gadwyn gyflenwi a thwf o fewn y sector bwyd a diod yng Ngogledd Cymru.

The project will create a distinctive, world-class Rural Economy Hub on the Glynllifon estate near Caernarfon. It will provide regional start-ups or expanding businesses with facilities such as business units and an on-site Knowledge Centre. These will offer practical experience to support innovation and enterprise growth.

The project will strengthen opportunities for collaboration, supply chain development and growth within an expanding food and drink sector in North Wales.

Hwb Economi Wledig

Glynllifon

Glynllifon Rural Economy Hub

Rhwydwaith Talent

Twristiaeth

Tourism Talent Network

Penderfynu ar gyd- Paratoi'r Achos Paratoi'r Achos Cymeradwyo'r Achos Paratoi'r Achos Cymeradwyo'r Achos Gweithredu a Monitro Gwerthuso destun y prosiect Amlinellol Strategol Busnes Amlinellol Busnes Amlinellol Busnes Lawn Busnes Llawn Implementation and Evaluation

Determine the project Prepare the Strategic Preparing the Outline Approval of the Outline Preparing the Full Approval of the Full Monitoring context Outline Case Business Case Business Case Business Case Business Case

#3 - Safleoedd a Choridorau Allweddol

Cysylltiedig

Nod y prosiect hwn yw gwella dibynadwyedd ac

ansawdd gwasanaethau symudol ar y prif ffyrdd a llwybrau rheilffordd yng Ngogledd Cymru, gan alluogi gwasanaethau ffibr llawn i safleoedd masnachol allweddol ar draws y rhanbarth.

Bydd y prosiect yn canolbwyntio ar ddatblygu

rhwydweithiau ffibr optig, sy'n hanfodol ar gyfer

darparu band eang 4G, 5G a gigabeit galluog.

#3 - Connected Key Sites and Corridors

This project aims to enhance the reliability and quality of mobile services on the main roads and rail routes in North Wales, enabling full-fibre services to key commercial sites across the region.

The project will focus on developing fibreoptic networks, which are essential for delivering 4G, 5G and gigabit capable broadband.

#4 - Yr Ychydig % Olaf

Er bod gweddill y DU wedi elwa o well cysylltedd yn

ystod y blynyddoedd diwethaf, mae rhannau o Ogledd Cymru yn dal i fod heb wasanaeth band

eang cyson, sydd wedi effeithio ar gymunedau, busnesau a'r economi ehangach.

Bydd y prosiect hwn yn mynd i'r afael â'r y 'bwlch

digidol' (y gwahaniaeth mewn ansawdd cysylltedd

rhwng trefi a chymunedau gwledig) ac yn ystyried sut all cysylltedd gyrraedd llefydd sydd heb fand eang cyflym iawn (30 megabits yr eiliad).

#4 - The Last Few %

Despite the rest of the UK benefiting from improved connectivity in recent years, parts of North Wales still lack consistent broadband coverage, which has impacted communities, businesses and the wider economy.

This project will address the 'digital divide' (the difference in connectivity quality between towns and rural communities) and consider how connectivity can reach the last of the region’s premises currently without superfast (30 megabits per second) broadband.

Bwriad y prosiect hwn yn gwella capasiti'r porthladd trwy

adfer tir (creu tir newydd o'r môr) yn yr harbwr. Wrth

wneud hyn, y nod yw sicrhau bod y porthladd yn gallu

cwrdd â gofynion cynyddol ymweliadau busnes a thwristiaeth.

Mae'r porthladd yn un o'r llwybrau trafnidiaeth prysuraf

rhwng y DU ac Iwerddon. Fel ail borthladd prysuraf y DU mae'n gyswllt trafnidiaeth pwysig rhwng y ddwy wlad.

This project will enhance the port’s capacity through land reclamation (creating new land from the sea) within the harbour. In doing this,the aim is to ensure the port can meet the increasing demands of both business and tourism visits to the region.

The port is one of the most used transport routes between the UK and Ireland. As the UK’s second busiest port it is an important transport link between both countries.

#5 - Porth Caergybi, Ynys Môn #5 - Holyhead Gateway, AngleseyNod y prosiect hwn yw cefnogi'r cynlluniau ynni ledled

Gogledd Cymru sy'n cyfrannu tuag at gyflawni targedau

ynni adnewyddadwy, datgarboneiddio sydd ag elfen o

berchnogaeth leol. Bydd hefyd yn helpu i sicrhau

buddsoddiad preifat a chymunedol mewn prosiectau ynni

newydd. Mae Perchnogaeth leol yn golygu asedau sy'n

eiddo i randdeiliaid yn gweithredu ac wedi eu lleoli yng

Ngogledd Cymru, gall rhain fod yn unigolion, cymunedau, busnesau neu sefydliadau eraill.

The project aims to support energy projects across North Wales which will help achieve renewable energy and decarbonisation targets and have an element of local ownership. It will also help unlock private and community investment in new energy projects. Local ownership is defined as assets owned by stakeholders located and operating in North Wales, whether that’s individuals, communities, businesses or other organisations.

uchelgaisgogledd.cymru ambitionnorth.wales