TransformYour RetirementPlanwith ThisPowerfulCombo

This article orginally appeared on Kiplinger.com on July 31, 2024.

Let’s talk about how nature inspires planning for retirement income.

Somewhere in the primordial past, hydrogen and oxygen atoms came into being. They were fine as stand-alone elements, but they really showed their value when they combined as H2O to become the useful substance we know as water

In the same way, combining seemingly unrelated retirement products that come on the market at di�erent times may produce some surprising results

The Retirement Big Bang

First, Congress in 1987 created the HECM, for Home Equity Conversion Mortgage, that enables homeowners 62 and over to create additional income and liquid savings from the value of their home.

Second, Congress adopted legislation in 2014 to permit a type of deferred income annuity called a QLAC, which enables IRA holders to defer RMDs from their accounts, and therefore defer taxes, while

providing guaranteed lifetime income starting no later than age 85.

Despite the tax and product feature advantages, neither has attracted a large share of retirement planning interest when o�ered on a standalone basis.

However, when HECM is combined with QLAC, a transformation occurs that, while not the stu� of lifepreserving water, could provide the income and financial liquidity to make the di�erence in a retiree’s retirement finances We call it H2I, for HomeEquity2Income

How HECM and QLAC work separately

A QLAC, in addition to the tax savings of deferring RMDs, provides guaranteed lifetime income and the flexibility to select the date annuity payments begin and the income pattern you want. For example, our sample investor (female age 70) can use the maximum QLAC amount of $200,000 and purchase $70,000 per year of lifetime income starting at age 85 Visit our QLAC calculator to get a free quote to evaluate these options While QLAC provides substantial longevity protection, purchasers give up access to the QLAC reserve. In other words, they can’t access the money they spent to purchase QLAC and have to wait for annuity payments.

A HECM gives homeowners 62 and over access to value of their home in the form of regular tax-free income and a line of credit, without selling or renting the house they’ve lived in for years While there is no requirement to repay the mortgage loan balance or even loan interest, too much borrowing can reduce the line of credit later in retirement, when there could be significant long-term care costs and a reduction in any legacy from the house passed on to heirs HECM rules prohibit using the amounts borrowed to purchase an annuity product like QLAC

HECM and QLAC could have continued in their own orbits, except conditions here on earth changed over the past decade or two, bringing a perfect opportunity for the combination of the two products.

During the period from the launch of HECM:

Home values increased by nearly 300%

Longevity increased by 2 5 to 4 5 years (pre-Covid)

Cost of long-term care insurance increased by up to 400%

Pensions mostly disappeared covering only 15% of private-sector workers

Higher Social Security benefits created higher tax rates

How to think about a combination

When QLAC appeared on the scene in 2014 it appeared to be a natural addition to retirement income planning and we figured that there’d be a meet-up with HECM during this process. However, the industries of mortgages (HECM) and annuities/insurance (QLAC) work in silos They don’t see each other or talk about how they might together benefit the consumer Unlike with H2O, though, we didn’t need an asteroid to crash into earth to bring change

The way to combine is more art than science It starts with meeting retiree objectives around income, liquidity and legacy And income is further defined by lifetime payments, low taxes, and low risk Liquidity is defined by the ability to have access to savings to cover unplanned expenses For retirees, that’s likely to be expenses related to long-term-care or modification of your home for those who want to age in place Legacy is self-explanatory what you leave to a spouse or beneficiaries after loans are paid o�.

Importantly, the HECM/QLAC combination must be aided by a planning methodology that looks at all major asset classes while attempting to make planning understandable to investors and planners

alike. In our case, we began to look at how best to include the equity in the home with savings from a rollover IRA to meet these retiree objectives.

What are the considerations in designing H2I?

While you might adopt di�erent criteria in defining the combination, here are the ones we used:

1 Meet governmental regulatory constraints

2 Make it understandable to the market

3. Deliver outcomes matched to retiree objectives

The first challenge is that the regulatory world wants to keep certain products separate for various reasons while a real-life person wants to see a total plan, and not one made of two or more components separately managed. The answer comes through a planning method that combines these components, and an implementation that is, unfortunately, separate

The second challenge is to take that plan and make it understandable. While di�erent approaches are possible, our view is to share easy-to-understand graphics, based on deterministic assumptions, and focusing on retiree objectives, rather than focusing on product components In addition to all the technical questions being answered by product experts, the planning should answer this question: “What does it do to my plan for retirement income?”

The third challenge is meeting the retirement objectives and to recognize how they change based on life stages As we said above, the basic retiree objectives include:

Income Meet budget, be predictable and last a lifetime Liquidity Focus on larger amounts in middle stages of retirement Legacy Provide funds for surviving spouse and then for beneficiaries

Meeting Retiree Objectives

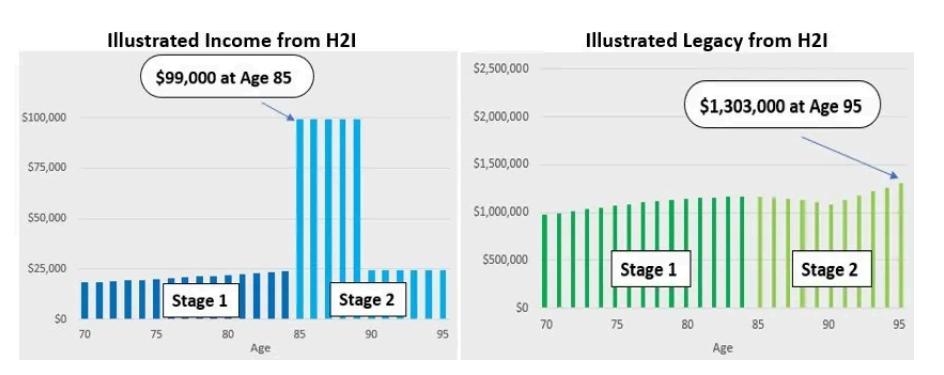

Set out below is the plan presented to our sample investor, a 70-year-old female, with $1 million in the value of her home and $1 million in her rollover IRA She wants more income, and liquid savings to address long-term care costs. She considers an H2I plan but is also aware of her option to subsequently insert H2I into a Go2Income plan.

1. Income Objective

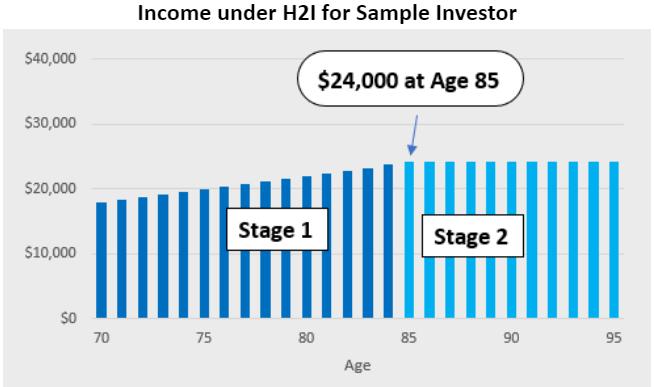

Income from H2I comes from two sources: (a) during Stage 1 she is drawing tax-free amounts from her HECM line of credit, and (b) during Stage 2 her income comes from QLAC annuity payments, after paying tax-deductible interest on HECM. H2I planning creates a seamless income connection between stages 1 and 2. She can spend this income any way she wants, add to her investments, or use it to buy health, LTC or life insurance as part of her planning.

2.Liquidity Objective

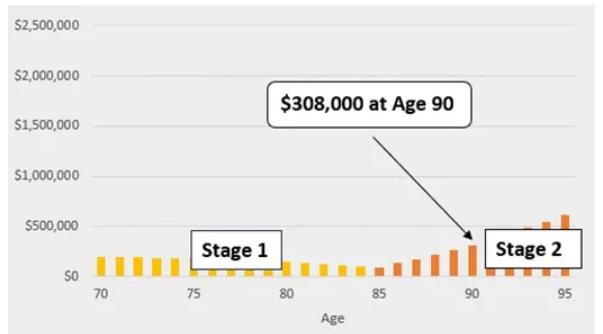

During Stage 1 her liquidity in the form of a line of credit (LOC) starts at $330,000, grows with a HECM interest rate and then is reduced as her loan balance grows from her drawdowns and interest. After Stage 1 the LOC grows dramatically when drawdowns stop and interest is being paid via QLAC payments. That growth is particularly valuable if she incurs the cost of long-term care. To illustrate, if she needs an additional $50,000 per year for, say, nursing care starting at age 90, she’ll still pass over $1 million to her heirs at age 95. My next blog will go into greater detail.

3.Legacy Objective

Her legacy from H2I is the value of her home less the loan balance on HECM The gain or loss vs the original value of the home is the market appreciation less the loan balance. In Stage 2 with interest being paid, the legacy grows dramatically. If the appreciation is reduced in half, however, the amount passed at 95 will be reduced from $2 million to $1 million.

Like a lot of retirees, our investor hasn’t purchased LTC insurance and is relying on her retirement savings to cover the cost of nursing or other costs She is thinking she might have to downsize or sell her home With H2I she may be able to avoid that To illustrate, if she needs an additional $50,000 per year for, say, nursing care starting at age 85, she can pull that from her HECM and still pass over $1 million to her heirs at age 95 and have a line of credit if costs are higher All the while, aging in place See the example below

H2I as Part of a Complete Retirement Income Plan

H2I is an approach that helps retirees access the 25% to 40% of their net worth that homes in many cases represent. That’s an asset that can allow you to stay in your home, even when the cost of longterm care for a husband-and-wife might average as much as $750,000. You won’t hear about HECM and QLAC from most financial advisers or planners. That’s because they focus on splitting retirement assets among di�erent buckets, like stocks, bonds and cash. If they consider equity in your house, it’s the cash you get after selling it

Your next step could be just to consider how H2I might benefit you and your family. It could also become a core component of a holistic retirement approach (Go2Inome) that considers all your assets and how they best fit together As we pointed out in our last blog, here’s how H2I could fit into your plan

Get started at Go2Income

In the grand scheme, H2I is not more important than H2O But for retirees it’s a pretty good leap forward. We know that most retirees want lifetime income, liquidity, and legacy. Combining two products QLAC with HECM can provide that retiree trifecta.

Jerry Golden, Founder

Visit Go2Income Personal Planning to start a plan risk-free You can ask one of our analysts to help you make adjustments. And then decide whether you want the peace of mind that lifetime income and greater liquidity can provide.

How'Home-BasedPlanning'Can AddressLong-TermCareCosts

We’re living longer in retirement, and more of us want to age in place rather than sell the family home

A recent policy paper by AARP listed the goals of the age-in-place population:

Ensure access to a�ordable, high-quality long-term services and supports (LTSS) that maximizes the dignity, independence and protection of older adults

Create age-friendly, livable communities that enable people to age in place and continue as engaged members of their communities

Support family caregivers

Provide ample opportunities to generate, save and preserve financial resources

Those goals all seem reasonable and smart. Our focus is around number four and about planning to preserve resources while meeting retiree objectives

How much could Boomers pay for LTC costs?

Americans incur more than $400 billion in LTTS costs every year People over 65 make up the bulk of those who need care at a nursing facility and a larger percentage of those who receive in-home care to assist with daily activities Home care can cost about $62,000 a year, while care in a facility could be $108,000 to $126,000. Here’s a projection of average costs considering the duration of a stay for a man, a woman and a couple

At some point, what you are required to pay for long-term health care may outstrip your bank and investment accounts and force you to dip into your hard-earned retirement savings. As you can see, the average cost for a private room in a nursing home for a couple can be as much as $745,000

Since the probability of incurring at least a portion of these costs is 70%, you need to plan ahead to ensure your financial resources are available when you need them and in a way that you can easily access

How Boomers plan to pay for long-term care

We have options, including some provided by the government, but in many cases, they require compromises in how to spend our money, or decisions about our lifestyles we would rather not make From a study that’s about 10 years old, the four most popular options that participants chose for funding LTC were:

Use personal savings

Purchase a private long-term care insurance policy

Spend down savings to qualify for Medicaid

Sell home and use the proceeds

Others in the study hadn’t even thought about how they would cover LTC costs.

While I’m sure the planning has changed in the interim, I consider these options pretty challenging and, in some cases, life-changing More recent studies agree that purchasing long-term care insurance at the Boomer’s current age is quite expensive. And with such a large percentage of the population wanting to age in place (a recent AARP survey puts it at more than 75% of adults over 50), selling your home is less appealing.

What is Sally going to do?

Sally, a 70-year-old woman who stands in as our example retiree, is now focused on this issue, and she is wondering about next steps, even with her $1 5 million in retirement savings and $1 million in equity in her home. Sally has done a good job using savings within a plan to meet her retirement goals of income, liquidity and legacy Now she wants to explore how to address the expense of long-term care within or in addition to that plan.

The thought of spending on average of $375,000 (roughly the average cost of a three-year stay with a private room in a nursing home) is pretty daunting Here are some options she’s thought about

Set aside investments so she can pay for LTC with her personal savings That would require her to spend less, impacting her lifestyle even during the years that she feels great.

Buy insurance to pay for long-term care. Like many consumers, Sally didn’t buy long-term care insurance when she was younger. Buying it now will be much more expensive and reduce funds for other expenses

Spend down savings to qualify for Medicaid She has a lot of savings, so this is probably impractical.

Stay at home and bring in help. Sally wants to age in place for as long as she can. She is a little nervous about the costs for care, along with home modifications and the need to spend down savings at such a rapid rate

Is there another option?

What about home-based planning?

Since she’ll be aging in place, she plans to live in her home for a long time and thus considers “homebased planning” The specific option Sally considers is an approach called HomeEquity2Income (H2I), which combines a home equity conversion mortgage (HECM) with a deferred income annuity called a QLAC. This combination provides both current cash flow and a line of credit through an HECM to reduce or eliminate the necessity to spend her savings on long-term care costs For more on this, see my article Transform Your Retirement Plan With This Powerful Combo.

To illustrate, here’s how H2I measures up for Sally when she uses $200,000 from her rollover IRA savings to purchase a QLAC, establishes an HECM line of credit of $330,000 against the equity in her home and funds $75,000 per year in LTC costs from 85 to 89 only from H2I not from her retirement savings

In summary, this is what H2I does as measured against her personal objectives:

Don’t run out of money: $20,000 additional income at start and continuing for life

Grow income each year: 2%-per-year increase until age 85

Lower income taxes: Income tax-free until age 85

Cover unfunded expenses: $75,000 per year in LTC costs from 85 to 89

Leave a meaningful legacy: $1.3 million

Now let’s address her retirement savings and plan for retirement income.

What about drawing down only from an HECM?

While the coverage of $375,000 in LTC costs is pretty nice, couldn’t Sally have done the same thing without transferring $200,000 from her savings to purchase QLAC and simply draw down from HECM?

Here is our response:

Sally got more than the LTC costs covered, as H2I also provided tax-favored income starting at $20,000 and continuing for life.

Sally still passed along a legacy of over $1 3 million just from H2I

With only, say, a $50,000 QLAC premium, her legacy at 85 would be reduced by more than half, and her liquidity would be wiped out at age 90. With no QLAC, her legacy is reduced by 75%, and liquidity again is gone by age 90. What the chart below shows is that within the statutory limits, the maximum funding of a QLAC makes sense

Making up the di�erence in her retirement income plan

What about the transfer of $200,000 from her rollover IRA savings? While the analysis requires you to take a hard look at what Sally is doing with her retirement savings, here are a few points to consider:

She’s deferring taxable RMDs (required minimum distributions) to age 85 and creating tax-free income from HECM.

With the substitution of immediate income annuities for a portion of her fixed income portfolio, she can replicate or exceed her original income even with the $200,000 outflow

With greater safe income, she can increase her allocation to equities.

Conclusions for Boomers who want to age in place

LTC insurance purchased by Boomers is costly and, where possible, should be used to fund “catastrophic” large-amount LTC costs

There will be other costs for age-in-place Boomers beyond care-related payments

You can minimize the drain on retirement savings to cover LTC costs, unless you’re OK going on Medicaid.

We’ve taken you through the steps to address the costs of long-term care with a H2I plan, based on your own assets and needs Visit Go2Income Personal Planning to start a plan risk-free One of our analysts can help you make adjustments as you build a plan that gives you lifetime income, greater liquidity and a clear path to paying long-term care costs

Jerry Golden, Founder

ADifferentWaytoApproach YourMortgageinRetirement

The concept that retirees should pay o� their mortgage stems from a combination of historical economic conditions, cultural values surrounding homeownership and debt, and financial planning principles aimed at ensuring security and peace of mind in retirement This idea has been passed down through generations, although individual circumstances today may lead to di�erent approaches

Nearly 40% of retirees, for instance, have a mortgage And the average mortgage balance is over $100,000, which translates to average annual mortgage payments of $10,000 that will last at least 12 years or more

That doesn’t mean retirement plans are doomed to fail if they include a mortgage. Rather, we think that in designing your plan for retirement, you ought to consider the equity in your home, and then decide whether a mortgage, either existing or new, belongs in your plan

No di�erences between mortgages for Millennials and Boomers

The market for cars, clothes and restaurants is di�erent for the Millennial generation vs Baby Boomers.

However, that’s not the case for mortgages. It’s the same product whether you are age 30 or 60. Why should that be the case for a financial vehicle when at age 30 you’re concerned about mortality and paying o� the mortgage if you pass away early but at 60 you’re concerned about longevity and making mortgage payments into your 80s and beyond?

Let’s work through an example for a Boomer

A Boomer with a mortgage

Mary, the 70-year-old cousin of Sally, the consumer we often refer to as our sample investor, is also 70 and has a $150,000 mortgage (against a home worth $1 million) and mortgage payments of nearly $13,000 a year for the next 15 years until the mortgage is paid o�. She’s generating $100,000 in income from her retirement savings and $25,000 in Social Security benefits, but that $13,000 mortgage payment represents more than 10% of her income Compounding this issue is her desire to age in place like 75% of aspiring and current retirees.

Her options regarding her mortgage

Like lots of retirees, she’s always considering her options when it comes to housing and finances. Here are the options she’s considering:

Continue as is and cut back spending other than on the mortgage But unless absolutely necessary, she wants to be able to spend at her budgeted amount, which includes trips to see the grandkids and other small luxuries.

Sell the house and downsize. She’s moved a few times in her life and hated it. Plus, she loves the house she’s in, along with the neighborhood

Pay o� the mortgage by taking $150,000 from retirement savings That would remove the $13,000 in yearly mortgage payments, but also reduce her annual income from savings by $7,500 to $9,000 in her Go2Income plan. Is the net gain, and the reduction in savings and liquidity, worth it?

Replace her existing forward mortgage with a home equity conversion mortgage (HECM) Also known as a reverse mortgage, a HECM would eliminate her monthly mortgage payments, but over time see her legacy fall.

Refinance her forward mortgage with HomeEquity2Income (H2I). Under H2I, she generates more income and does a better job of maintaining her legacy.

Her choice

The approach we’ll focus on here is to refinance a forward mortgage as part of an H2I plan. There are a couple of steps involved, but if you follow the HomeEquity2Income plan I’ve written about recently,

including in my article Transform Your Retirement Plan With This Powerful Combo, you will see that the reasons a Boomer might order an H2I-Refi plan include:

Eliminating mortgage payments for the term of the current mortgage

Generating additional current and lifetime cash flow

Creating additional liquidity for unplanned expenses

Delivering a reasonable amount of legacy from the value of a home

Mary originally liked the idea of continuing her mortgage payments to eliminate the mortgage at 85 and leave the house unencumbered at her passing That plan is OK and fits the conventional wisdom about paying o� the mortgage.

Mary is one, however, who could use additional cash flow from eliminating mortgage payments and then some to maintain her home and have funds to pay for caregivers she might bring into the house.

High-level results from H2I

To prepare, she read my most recent H2I article, How 'Home-Based Planning' Can Address Long-Term Care Costs, but learned that for her to fund those costs, she must refinance the current mortgage. ( A recent poll conducted by University of Michigan’s Institute for Healthcare Policy and Innovation found that long-term health care costs top the list of concerns of older Americans.)

This refinancing requirement means that the $150,000 mortgage balance is paid out of the line of credit set up under the HECM component of H2I This leaves a smaller line of credit than if there were no loan. (Paying part of the mortgage o� with savings and the balance with a HECM line of credit is another option )

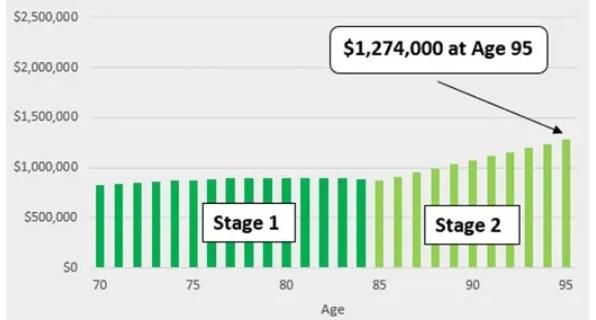

While there are lots of assumptions that could be tested, the bottom-line results under H2I for her three primary objectives were:

Current cash flow changed with (a) the elimination of outflow of $13,000 per year for the term of the mortgage and (b) the addition of H2I inflow of $15,000 (and growing) per year for life That means an extra $28,000 in cash flow over the next 15 years and thereafter $20,500 annually for life That addition of combined cash flow can be spent on her budget, providing gifts to kids and grandkids or growing her savings and legacy.

Liquidity from moving from the existing mortgage to an H2I plan jumped from $0 to over $300,000 at 90 not counting the potential reinvestment of the additional cash flow Her legacy at 95 would be $1 3 million for H2I, and substantially more if she reinvests the additional cash flow

Year-by-year results from H2I

The adjustments a retired mortgage holder can make with H2I, and the di�erent applications of income, are clear in the charts below H2I provides for more cash and liquidity and can still result in a meaningful legacy.

Cash flow

H2I, which combines HECM with a deferred income annuity called a QLAC, allows Mary to end her mortgage payments and to generate additional income for life.

Liquidity

The HECM component also provides a line of credit even after paying o� the forward mortgage that can help pa

Legacy

Finally, when the QLAC payments start at age 85, Mary will be able to pay interest on the line of credit, which ena

Like most investors, Mary has a number of objectives. H2I gives her options to create the best plan to meet her personal goals.

Even for the dedicated DIY retirement planner, we don’t expect you to dig into H2I alone Order your own Go2Income plan to learn about how to use the equity in your residence to create more retirement income and a new source of liquidity as you prepare for long-term health care and other needs

Jerry Golden, Founder