I can vividly remember the first conference call with Brian Sharoff of PLMA, Bob Anderson of Walmart and Peter Berlinski and myself from Private Label magazine. While I wasn’t certain of what the outcome of the call would be, I was certain that there was a strong desire to recognize the individuals that made our industry what it has become today, a vital resource for consumers seeking quality and innovation at a fair price. We honored the first inductees in 2006.

On March 21, I will be attending the Hall of Fame Dinner and will be honored to accept the Lifetime Achievment award on Edward P. Salzano’s behalf. Edward began his career in the food industry in the 1970s. He’s been involved with PLMA since 1982 and served as its chair from 1998-2000. His tenure with LiDestri and work with Paul Newman are just two of many bright spots in an illustrious career. I’m grateful to consider Edward a valued colleague, but more than that, a cherished friend.

And speaking of grateful, many thanks to PLMA for continuing to honor those who have given so much to the industry. You can read more about the 2024 inductees on PLMA’s Hall of Fame website and in an upcoming issue of Store Brands magazine.

As for being a vital resource for consumers, according to a PLMA study covered on page 18 of this issue, the US Store Brand industry has reached nearly a quarter of a trillion USD, more precisely, $236,000,000,000. If you include Europe and the rest of the globe, the numbers are staggering. It would be a great exercise to determine the extent this translates to savings for consumers and profits for retailers and suppliers. Impressive is an understatement.

Finally, thanks to the suppliers to whom this issue is annually dedicated. These are the companies that are leaders in their field or have their sights set on becoming one. They are bold, innovative and committed to making our industry even stronger. And thanks as well to our content partners for their insightful and generous support.

Kind regards,

Phillip Russo Founder / Editor phillip@globalretailmag.com

Everything we do is a root in the rich soil that takes strong relationships, knowledge, and timing to do it right. And it all starts with a single seed.

Seneca’s high quality produce is sourced from over 1,400 American farms—family farmers we have done business with for many years, and in some cases generations. Our motto of Farm Fresh Goodness Made Great echoes throughout our fundamental beliefs, which have been key to our success since 1949.

Next year, Seneca Foods will be celebrating 75 years in business. We have spent these years working hard to become one of the most highly integrated fruit and vegetable processing companies in the US. We manage many—and in some cases all—aspects of production, to provide families with a wide range of nutritious fruit and vegetable products that are safe, satisfying and sustainable.

We do it together, the same way we have for over seven decades. Because our roots run deep.

Seneca, we're still doing things the way we always have - the right way. Think globally, grow locally.

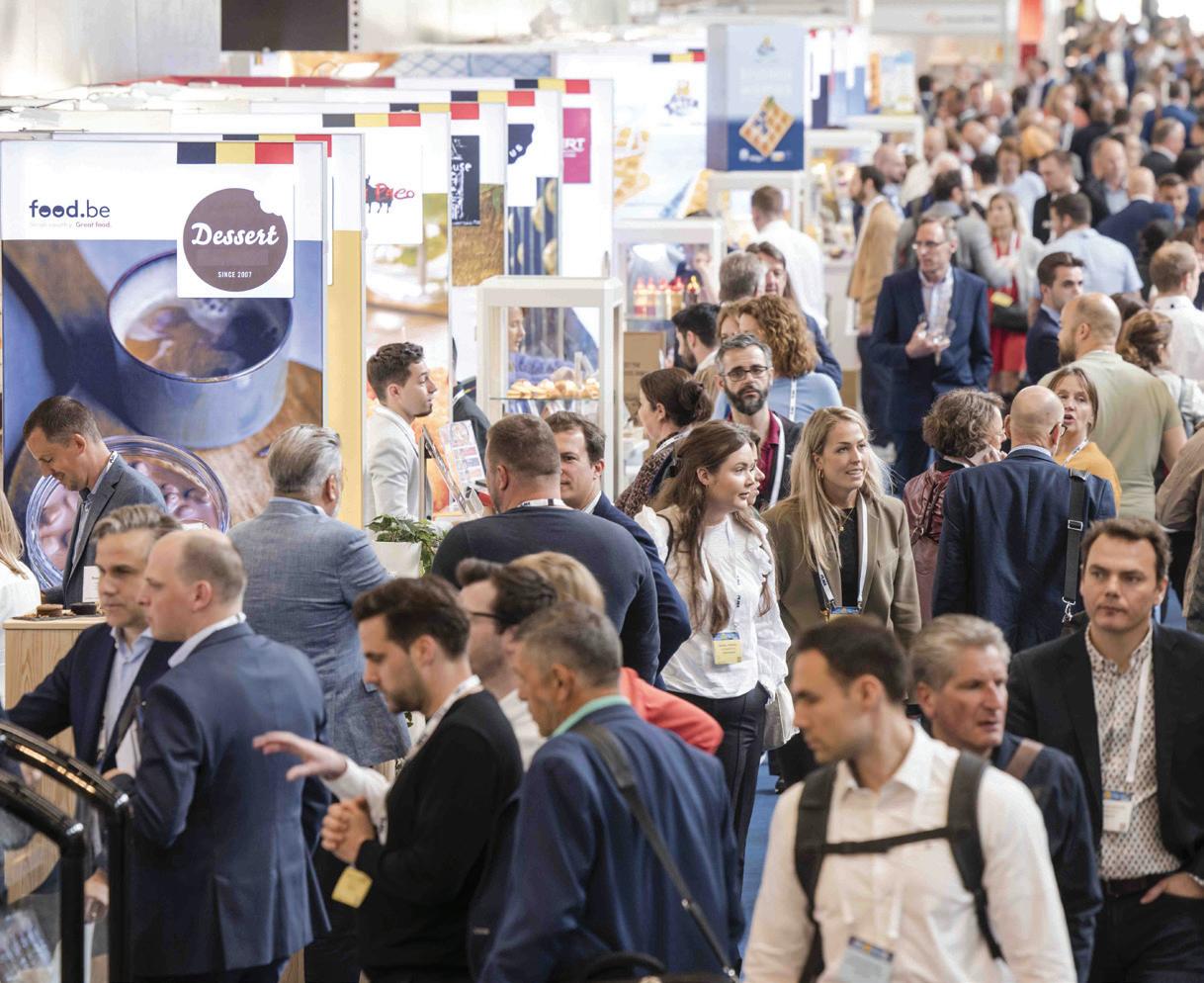

When planning your calendar for the month of May, make sure to leave time for PLMA’s World of Private Label International Trade Show in Amsterdam.

More than 2.800 private label manufacturers from over 70 countries will show their newest and best products to retailers, wholesalers and other private label buyers.

In total, nearly 30.000 trade professionals from 120 countries will get together in Amsterdam to start or strengthen partnerships, identify innovation and plan for growth in the years ahead. The show is a not-to-be-missed event for anyone involved in private label.

Go to plma.nl/visit to register

MARCH 2024 I VOLUME 12 I NUMBER 1 OF 4

Phillip Russo EDITOR / PUBLISHER phillip@globalretailmag.com

Jacco van Laar BRAND AMBASSADOR jacco@globalretailmag.com

Melissa Subatch CREATIVE DIRECTOR info@melissasubatchdesign.com

Andrew Quinn DIGITAL DIRECTOR andrew.quinniii@gmail.com

Luisa Colombo EUROPEAN DIRECTOR luisa@globalretailmag.com

Ana Maria Jimenez Aguilar BUSINESS DEVELOPMENT ana@globalretailmag.com

Sabine Geissler GREENTASTE.IT Italian Business Development s.geissler@greentaste.it

CONTRIBUTORS

Perry Seelert Emerge perry@emergefromthepack.com

Christopher Durham Velocity Institure cdurham@retailbrandsinstitute.org

Maria Dubuc Marketing By Design mdubuc@mbdesign.com

Hans Kraak Kraak Media kraakmedia@gmail.com

Elena Sullivan sullivan.elena@gmail.com

Tom Prendergast PLMA tprendergast@plma.com

Kevin Ryan, MS, PhD CEO, Malachite Strategy and Research kevin@malachite-strategy.com

Published, Trademarked and all rights reserved by: Kent Media

Phillip Russo, Principal 45 Upper Kent Hollow Road Kent, CT 06757 Tel. +1 917 743 6711

MARIA DUBUC

A creative and workflow expert in the retail landscape, Maria’s 30-year career translates branding experiences into eye-catching design that is unique and distinct for each client. he has created new private brands and redesigned/repositioned existing brands with leading retailers, while also implementing workflow management systems specifically tailored to the clients’ needs. Current clients include The Home Depot, Smart & Final, PetSmart, 7-Eleven, PriceSmart, BJ’s Wholesale Club, Sprouts Farmers Market, WinCo Foods, Natural Grocers and more. With SKU counts from 1,000 to more than 10,000 annually.reinvention and innovative execution.

CHRISTOPHER DURHAM

President of the Velocity Institute

Prior to this he founded the groundbreaking site My Private Brand. He is the co-founder of The Vertex Awards. He began his retail career building brands at Food Lion and Lowe’s Home Improvement. Durham has worked with retailers around the world, including Albertsons, Family Dollar, Petco, Staples, Office Depot, Best Buy, Metro Canada. Durham has published seven definitive books on private brands, including Fifty2: The My Private Brand Project and Vanguard: Vintage Originals.

REBECCA HAMILTON

Rebecca is the CEO of award-winning Fish Agency and sister agency Whitespace Brands Inc. With over 30 years of experience, she has established herself as one of North America’s leaders in the fields of strategic branding, retail design, and communications for clients in the retail sector. Under Rebecca’s oversight, the Fish Agency brings brands to life at retail and has consistently delivered high ROIgenerating retail experiences for its clients. She mentors and leads highly experienced and integrated teams that provide store design, package design for CPG and private brands, digital/social initiatives, “phygital” experiences, and advertising services.

HANS KRAAK

Hans Kraak is educated in biology and journalism and wrote three books about nutrition and health. He worked for the Dutch ministry of Agriculture, Nature and Food quality and the Netherlands Nutrition Centre. As editor in chief he publishes in the Dutch Magazine for Nutrition and Dietetics, as a food and wine writer he published in Meininger’s Wine Business International and reports for PLMA Live EU and PLMA USA.

KATIE LOCKE

If you’ve ever met Katie, you’ve seen or heard her excitement for building or rebuilding brands. Her passions also include just about every facet of food and eating experiences. For the past 9 years, Katie has worked in Sales & Marketing for Marketing by Design (MBD), a branding and packaging design agency specializing in high volume retailer programs. At MBD, Katie gets to blend her passions by talking to thousands of National and Private brand leaders, mostly in the food industry, about expanding & enhancing their presence in market and on shelf.

KEVIN RYAN, a visionary strategist at Malachite Strategy & Research, unveils his groundbreaking predictions for the food industry in 2024. With insights gleaned from his extensive experience in CPG and retail and shared through his influential newsletter, Foodstuff, Kevin forecasts transformative trends that blend consumer habits with innovative business strategies. From the evolution of breakfast battles to the embrace of faux experiences, his analysis not only challenges the status quo but also offers a roadmap for private label brands navigating these dynamic shifts. Explore more of Kevin’s thought-provoking perspectives and join the conversation on shaping the future of food at Malachite Strategy & Research and Foodstuff

Edward Salzano is an accomplished COO and Senior P&L Executive with an extensive background in leadership and an outstanding entrepreneurial and corporate record. He was the Co-creator of Francesco Rinaldi pasta sauce. In 2013, Mr. Salzano founded EDNJ Associates, Inc., a marketing and consulting firm. He currently consults with corporate leadership in numerous industries, including: security, logistics, technology, vitamin, staffing, food, beverage, pharmaceutical, health and fitness. He is recognized as one of the leading authorities in the Private Brand Industry. epsalzano197@gmail.com

PERRY SEELERT

A retail branding and marketing expert, with a passion for challenging conventional strategy and truths. Perry is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose.

COSMOPROF / COSMOPACK

Bologna

28 – 29 MAY

www.cosmoprof.com

VELOCITY CONFERENCE + EXPO

Charlotte, NC

13 - 15 MAY

www.velocityinstitute.org

PLMA’S WORLD OF PRIVATE LABEL

Amsterdam

28 -29 MAY

www.plmainternational.com

IDDBA

Houston, TX 9 - 11 JUNE

www.iddba.org

SUMMER FANCY FOOD SHOW

New York, NY

23 - 25 JUNE

www.specialtyfood.com

FOOD TAIPEI

Taipei, Taiwan

26 - 29 JUNE

foodtaipei.com.tw/en/index.html

COSMOPROF NORTH AMERICA

Las Vegas, NV

23 - 25

www.cosmoprofnorthamerica.com

In 2023, store brands continued to be the brightest light in US grocery food and nonfood.

Unit sales were nominally even, off by only 0.1%, compared to national brands which shed 2.8%. Store brand unit share came in at 20.7%, an improvement of 0.5 points from 2022 and setting a record. Dollar sales rose by 4.7%, compared to a gain of 3.4% for national brands. Store brand dollar share moved up to 18.9%, ahead 0.2 points from 2022, likewise a new high.

In arguably the most important metric, annual store brand dollar sales moved ahead to $236.3 billion, an increase of $10.1 billion from the previous year and establishing another all-time mark.

Among the ten departments that Circana tracks for PLMA, all but Tobacco (off 16%) experienced store brand dollar sales growth. Leading were Beauty (plus 10.5%), General Food (up 10%), Beverages (up 8.9%) and Home Care (up 8.7%). Next in line were Frozen (plus 4.4%), General Merchandise (up 4%), Refrigerated (up 1.8%) and Liquor (plus 1%).

Sluggish unit sales overall continue to perplex retailers and suppliers of all products. Consumers remain cautious. Among reasons cited are lingering inflation, persistently high prices at the shelf, an uncertain economy and jobs market, and an emphasis on reducing waste.

Looking at store brand unit sales in departments, there were gains in four:

Home Care (up 1.4%), Beauty (1%), General Merchandise (0.8%), and General Food (0.4%). Marginal declines were recorded in Refrigerated (down 0.3%), Frozen (-1.1%), and Beverages (-1.3%).

For store brand dollar sales, 2023 was a year of two different halves. For the first six months, compared to the same period in 2022, sales increased by 8.2%, vs. a gain of 5.1% for national brands. Over the last six months, store brands were ahead by 1.4% while national brands improved by 1.9%.

"Overall, our industry is healthier than ever," assures Peggy Davies, PLMA president. "One of every five food or non-food grocery products sold across the U.S. carries the retailer’s name or own brand and was supplied by a store brand manufacturer."

Compared to 2019, US annual store brand dollar sales in 2023 increased by $60.2 billion, a gain of 34%. Store brand dollar share rose 1.2 points to a record 18.9%. During the four year period, store brand unit sales were ahead by 500 million and unit share improved 0.8 points to 20.7%, also a new high, according to PLMA's 2024 Private Label Report, with data provided by Circana Unify+.

Annual sales of US store brands increased 34% since 2019

"Traditional business activity has come all the way back from pre-pandemic levels. In November 2023, we conducted our most successful Chicago trade show ever, a soldout event that attracted a record number of 1,685 exhibitors and more than 13,000 retailers, suppliers, and other visitors."

"Most of all, the 'Store Brands Phenomenon,' as we like to call it, continues to be well positioned," adds Davies. "Retailers must ensure their offerings are 'value-right,' providing strong value and quality in categories where shoppers are targeting cutbacks, irrespective of income levels, according to a leading trade magazine. That's a challenge we believe can be perfectly met by the inherent qualities of store brands." PLMA's 2024 Private Label Report is now

Head

A full-service strategy, creative, production and workflow packaging design agency built to meet the challenges and opportunities facing Private Label and National Brands today. Let’s chat! Katie Locke - klocke@mbdesign.com

PLMA’s 2024 World of Private Label International Trade Show, scheduled for 28 and 29 May at the RAI Amsterdam Convention Centre, is the premier gathering for the private label industry for sourcing and business opportunities.

A record-breaking 2,850 exhibitors representing over 70 countries, promises to make this year’s show larger and more dynamic than ever. An additional exhibit hall will be used to accommodate the strong demand for exhibit space. The World of Private Label welcomes more than 60 national and regional pavilions. Among the new pavilions are: Dubai, Egypt, Georgia, Germany (Thuringia), Italy (Organic), Poland, South Korea, Thailand and the Netherlands.

The latest trends in food and nonfood - including organic, plant-based and sustainable products and packaging - will be on display on the trade show floor.

The trade show is expected to attract more than 16,000 professionals; retail buyers from supermarkets, discounters, hypermarkets, convenience stores and specialty stores and more, from over 120 countries from all continents. Appropriately themed “Connect. Source. Grow.”, One retail executive said the show provides the ideal opportunity to source new products

and strengthen business relationships.

“World of Private Label is a must-go and a recurrent happening for our company on our calendars. We return every year,” the retailer said.

One of the popular parts of the trade show is the innovation and new product development area known as the Idea Supermarket. This section features private label ranges from 64 supermarkets, hypermarkets, discounters, specialty stores and drugstores around the world. Also in this area is the New Product Expo, which will feature 500+ new products developed by exhibitors. Plus, there will be a display of winning products from retailers that earned an award in International PLMA Salute to Excellence Awards for best private label product of 2024. This year’s pre-show seminar program will be enhanced by three concurrent workshops that will be led by industry experts touching relevant topics in a smaller interactive setting. Participation in the seminars and workshops is free of charge to all registered retailers, exhibitors, visitors, and industry professionals.

At PLMA, connections are made, ideas are shared and success stories are written. Join for an unparalleled journey into the world of private label excellence.

Q. Good to see you again Peggy and look forward to saying hello in May in Amsterdam. You took over leadership of PLMA at one of the most tumultous times for the industry, the association and quite frankly, the world. In 20 words or fewer, can you recap the last few years?

A. Very funny Phil. The last couple of years not only has PLMA faced some unprecedented challenges, but also the industry, our member manufacturers and their retail partners in how to effectively conduct business, develop relationships and grow partnerships. The market changed possibly faster than ever before and needed to adapt quickly. I am impressed by the industry’s agility and its adeptness to embrace new business opportunities. We found new ways to support our members, by organizing online seminars on trending topics and by creating even more networking opportunities. I am also proud of the dedication and enthusiasm of the PLMA teams who never gave up. I look forward to a new era and the possibilities that lie ahead.

Q. Since its inception in 1979, PLMA has defined the private label industry worldwide, and is the leading organisation serving the industry. Without revealing any secrets, what is PLMA’s secret?

A. I don’t think there’s a secret. Over the years, we have been able to bring manufacturers and retailers together in a variety of venues, whether it is trade shows, online learning sessions, roundtable discussions or conferences. We give them the opportunity to network, build partnerships, and to learn about what’s on the horizon for private label. I’m pleased our support is recognized and appreciated by our members and the industry.

Q. Imagine I am a manufacturer active in private label industry. In what ways can you help me? Why would I want to become a member?

A. It’s our mission to provide our membership with a range of services that help them profitably grow their business. Member manufacturers have access to valuable resources to meet their needs including market insights, network opportunities, executive education programmes and business development opportunities. All this plus the biggest private label trade show in the world.

Q. It’s been another stellar year for retail brands. What’s motivating consumers?

Today’s consumers are looking for products they can relate to and satisfy their family’s needs. Whether that’s value or quality or innovative products they know they will consistently find them on their retailers’ shelves. I think this is particularly true after being impacted, in the recent past, by supply chain issues and economic uncertainty. A retailer knows their customer’s preferences and buying habits and that knowledge is very powerful when it comes to creating a successful private label portfolio. With their own brand, the retailer builds strong consumer

loyalty when they stock their shelves with the quality, assortment, and value products the customer knows they can only find in that particular store. It’s a win all around. For the consumer, the retailer, and the private label supplier.

Q. Do you have figures for the growth in private label across Europe? Which regions have seen the most growth?

A. We just received updated data from NielsenIQ revealing private label now accounts for 38.5% of the European grocery market, with sales of €340 bn in the 17 countries surveyed. It also shows that in 2023 consumers massively switched to private labels, as many worried about high inflation rates. In 14 of the 17 countries researched, at least 1 out of 3 products is a private label. Switzerland and Belgium together with Spain, Portugal, United Kingdom and the Netherlands are the countries with the highest private label unit share of 50% or higher.

Q. There are a lot of reports that show the changing consumer habits and the shift they make from a-brands to private label due to inflation, price increase, lack of ingredients and/or the global uncertainties. It is said that during economic downturn and recessions private label market shares will grow. Do you think that this momentum of private label will endure?

A. Private label was growing steadily prior to recent economic fluctuations, so we don’t see the industry backsliding when the market normalizes. Yes, own brands certainly benefit when consumers are looking for value. In fact, the cornerstones of the industry are quality at a value. Prior economic downturns have demonstrated that once consumers have recognized the quality of private label products, the items become their brand of choice.

I believe that as retailers continue to invest in innovation and assortment in their private label portfolios, consumers will include the retailer’s brand in their shopping baskets.

Q. What are some of the new trends in private label?

Private label leads innovation in both health and sustainability. Sustainability does not only focus on the product as planet friendly, but the packaging is also part of the criteria. What’s also interesting, is the trend of private label moving into other areas of the store like home and personal care. Retailers offer under their private label great sun-care products, beauty & cosmetics, and perfumes. Additionally, retailers are continuously modernizing their offerings with attractive packaging in vibrant colours to stay ahead of the curve. It’s clear today’s private label success is spread across most categories and trends. We forecast that we will see a growing number of new products entering the market this year.

A. What are you most looking forward to about this year’s World of Private Label? What are your expectations?

I especially look forward to the diversity of the exhibitors and retail attendees who are on a mission to grow their business. It’s always amazing to see how much people enjoy meeting each other, how much they prefer to see and smell the products. I expect that PLMA’s World of Private Label 2024 will provide a dynamic platform for networking, sourcing, learning, and connecting industry stakeholders. Our show is always a source of new products and, in the competitive private label market, facilitates business growth.

Q. What trends can the industry expect to find at PLMA’s World of Private Label?

With a record breaking 2.800+ exhibitors from 70 countries, the industry can expect a variety of trendy product features, including organic choices, free-from alternatives, plant-based meat substitutes, sustainable solutions, healthy options, and many more. I highly recommend visiting the Idea Supermarket, where you’ll find a comprehensive showcase of trends, innovations, and new product development from the past year all in one convenient location.

A. What would you recommend to exhibitors and retailers in terms of preparation for a successful show?

To ensure a successful trade show, I recommend setting clear objectives, for both exhibitors and retailers. To help them with that, we will launch the 2024 online Show Navigator earlier than ever in April. Show Navigator holds details of all exhibitors, allows for extensive company, product and country searches. Our Matchmaker function allows retailers to set up appointments. In addition, exhibitors will be able to see which retail and wholesale companies are registered to attend the show. I would also recommend planning some free time to walk the aisles, get inspired by ideas or products, and meet people that can make a difference in your business.

PLMA’s World of Private Label 2024 will provide a dynamic platform for networking, sourcing, learning, and connecting industry stakeholders.

Q. Can you give me more information on the additional programs?

Of course, the day before the trade show, on Monday 27 May, we host our seminar program featuring the latest insights into private label. And, for the first time, we’re introducing three interactive workshops tailored for smaller groups on relevant topics in the industry. For registered attendees there is no charge to attend.

Q. So, should I come to Amsterdam in May?

That’s a trick question, right? Visiting Amsterdam in May for PLMA’s World of Private Label is a must for anyone in the industry. It’s the global hub for networking, discovering new trends, and forging international business connections. With thousands of exhibitors showcasing the latest private label products and innovations, it’s the event of the year for industry professionals looking to stay ahead in the market. Plus, Amsterdam’s is a great city that adds an extra layer of excitement to the experience.

I’ll take that as a yes. Thanks for your time Peggy and have a great show!

Over the years, private labels have become distinguishing elements for many retailers all over the globe. Successfully managing private labels, however, has specific aspects that are not covered frequently in retail programs. PLMA’s Executive Education Program fills this gap in business education with a comprehensive training session in February. It offers lectures and interactive sessions designed for both manufacturers and retailers. The sessions will cover what executives need to know about private label: new product development, strategy, manufacturer-retailer relations, logistics, marketing and much more.

Enhancing Resilience through Incremental Innovation in Private Label"

Several times a year, PLMA provides its member manufacturers and retailers with an opportunity to expand their knowledge of the private label business through dedicated one-hour webinars. During lunch hours, registrants nourish their intellect and satisfy their appetite for knowledge by attending an interactive online session designed to future-proof their private label business and help ensure success in years to come.

The one-hour session on 27 March is about "Enhancing Resilience through Incremental Innovation in Private Label" and will be led by Rabobank from 12:30-13:30 CET How will branded companies be attempting to regain lost ground and how may incremental innovation help private label to consolidate their wins? Cyrille Filott and Sebastiaan Schreijen of Rabobank will take us along in their thoughts on current market dynamics and the opportunities for the right type of innovation during this Lunch & Learn session.

NEXT COMING UP:

Lunch & Learn with NielsenIQ – June 2024

continued on next page >

“Private Label is a Brand”

Milan, Italy

Private label is a brand and unlike national brands, which often rely on extensive marketing campaigns and widespread recognition, private labels develop their brand identity through retailer trust, exclusivity, quality and value.

PLMA’s Private Label Summit offers valuable insights into the latest trends and opportunities in private label, and gives views on competitive challenges. The summit features speakers such as market research specialists and retail executives. It provides a platform to collectively explore and discuss the current private label landscape.

The distinctive event brings together manufacturers, retailers, trade press, and industry consultants for a two-day program of in-depth presentations, panel discussions, networking, and, this year, a store tour diving into Milan's retail landscape. The event rotates each year among major cities in Europe. Registration will open in July.

PLMA’s monthly news video-broadcast touches on the latest topics that the industry is facing through extensive reporting and in-depth research. One-on-one interviews with top executives in private label give insights and views on current events, as well as future outlooks.

Online Newsletter

A quick and easy way to stay updated on industry news across Europe with articles on retail, channel and format developments, legal issues that affect the private label business, product and packaging innovation, consumer trends and private label marketing and merchandising.

Status of Private Label Market Shares

PLMA member manufacturers and retailers have free access to the latest statistics on private label market shares and development in 17 countries across Europe.

Created by NielsenIQ, the Yearbook provides information on thousands of products that can be easily analysed from last year and the past 2 years. The Yearbook helps identify categories where private label penetration growth is possible, provides insight into new business opportunities and serves as a benchmark for your company’s private label strategy.

RAI Amsterdam Convention Centre

For more than 35 years, PLMA’s annual World of Private Label International Trade Show brings together retailers and manufacturers to connect, to make new contacts, to find new products and discover new ideas that help their private label programs succeed and grow.

FEATURING :

Monday 27 May 2024

As the Private Label Industry gathers for the 2024 World of Private Label to do business, additional programmes to widen knowledge and stay updated in private label are offered. In the afternoon of one day prior to the show opening, PLMA offers a variety of workshops and a special seminar programme that provides the latest market research and trends by leading industry experts, international consultancies, retailers and many more. In addition, the winners of the International 2024 PLMA Salute to Excellence Awards will be announced, honouring retailers for their excellence in private label.

Admission to the seminars and workshops is complimentary to all registered visitors and exhibitors in possession of a valid 2024 World of Private Label entrance badge.

Location: RAI Forum room

FEATURING:

PLMA focuses on identifying and keeping track of trends, innovation and new product developments in private label, observing the latest offered on the shelves of the retailers, as well as detecting the newest available for private label by manufacturers.

Get inspired and see the latest trends, product development and new private label ranges introduced by more than 60 retailers from Europe, the Americas and Asia in the past year. Search for innovation and new products among the 500+ selected submissions by this year’s exhibitors. Or check out the displays with the best of the best in private label that won awards in the International Salute to Excellence Awards, selected by trade professionals and experts.

Location: RAI Elicium

FOR MORE INFORMATION

WWW.PLMA.COM

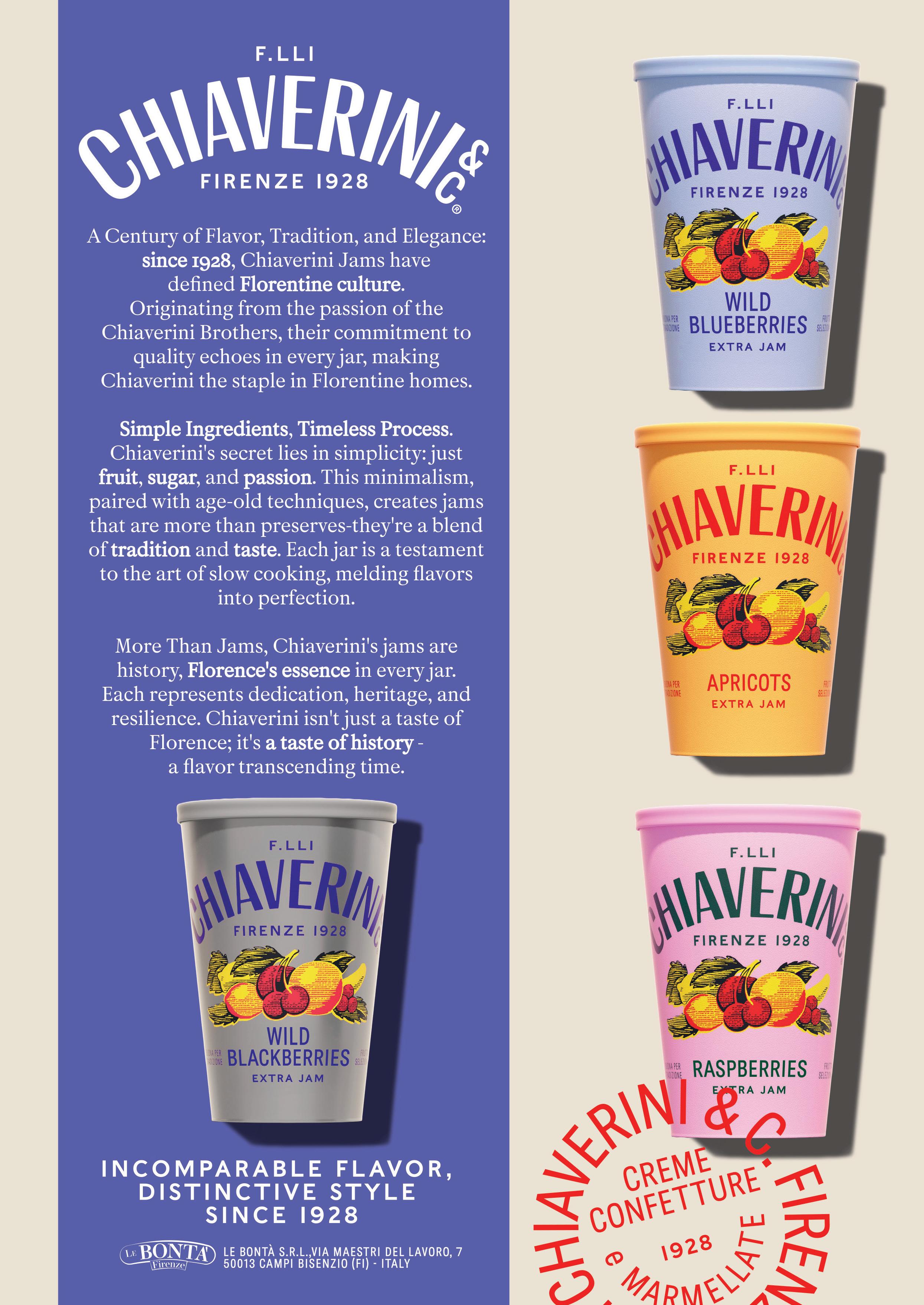

Chiaverini Jams join the family of products from brands Nuova Terra: a broad selection of natural and organic cereals, seeds and soups; I Toscanacci: a line of high-quality sauces without preservatives; Bonvé: a line of vegan and organic sauces and Accademia Toscana: a range of sophisticated and very high-quality sauces for the Italian and foreign markets.

Since 1928, Chiaverini Jams have defined Florentine culture. Originating from the passion of the Chiaverini Brothers, their commitment to quality echoes in every jar, making Chiaverini the staple in Florentine homes.

Simple Ingredients,

Timeless Process:

Chiaverini’s secret lies in simplicity: just fruit, sugar, and passion. This minimalism, paired with age-old techniques, creates jams that are more than preserves—they’re a blend of tradition and taste. Each jar is a testament to the art of slow cooking, melding flavors into perfection.

Iconic Flavors:

Chiaverini’s Blackberry jam, with its ripe berry sweetness, is a timeless favorite. Oranges with zest capture sunny groves’ essence, offering a zesty, refreshing kick. Figs and Almonds jam marries fig sweetness with almond crunch, creating a symphony of textures. These flavors evoke cherished memories and grace Florentine breakfast tables.

The Chiaverini “Pail” packaging isn’t just a container; it’s an icon evolving from rustic wood to sleek aluminum. The new line, with distinct colors for each flavor, appeals to collectors while preserving the brand’s essence and tradition.

While tradition remains, Chiaverini adapts. The new packaging reflects this balance, merging history with modernity. Preserving jams isn’t just about taste; it’s about preserving a legacy—one jar at a time.

Chiaverini's jams are history, Florence's essence in every jar. Each represents dedication, heritage, and resilience. Chiaverini isn't just a taste of Florence; it's a taste of history—a flavor transcending time.

Chiaverini Jams:

Where Tradition Meets Taste, and History Resides in Every Jar.

For more information: www.lebonta.it

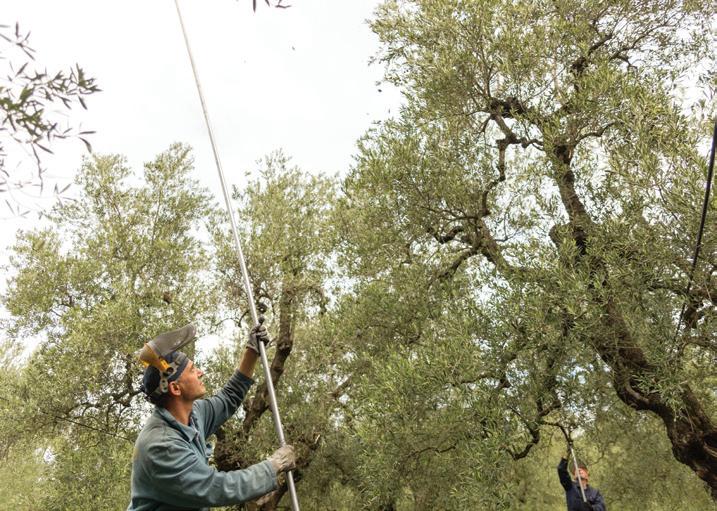

Certified Origins was born in 2006 thanks to the union of two Tuscan cooperatives of farmers and an organization specializing in international sales and distribution to export and provide fresh and authentic Extra Virgin Olive Oil to families everywhere in the world.

Today, we remain cooperative-owned and continually expand our portfolio by directly sourcing from farmers in the Mediterranean region. The confidence and trust built over decades in the industry means we can guarantee the quality of our products and give us access to the scale necessary to work with retail organizations.

Our international distribution and warehousing network and services mean we can deliver anywhere in the globe within 4-8 weeks, and in as short as 2 days in the USA and Canada.

Our international distribution and warehousing network and services are interconnected with our production plants, allowing us to offer efficient warehousing services and to deliver anywhere globally within 4-8 weeks and in as short as two days in the USA and Canada.

Since 2019, we have invested over $1.2 Million in Research & Development in technology & tracking systems. We deploy the latest technologies and third-party certifications to reduce the risk of information manipulation at the source while monitoring our food supply chain’s quality and safety standards.

We are ISO 22005 certified to guarantee traceability across our supply chain, and we utilize Oracle blockchain technology to ensure transparency from farm to bottle for our EVOO and Tomato sauce programs.

Thanks to our partnerships with the University of Salento and Eurofins, we can scientifically verify the authenticity of Extra Virgin Olive Oil’s origin by investing in nuclear magnetic resonance (NMR) and isotopic signatures technologies.

We built an extensive private database of unique «fingerprints» with 1k+ different geolocalized samples of olive oils to provide scientific support to EVOO authenticity to our partners. Each year, our data increases by hundreds of samples to further improve the accuracy of the results.

• CARBON REDUCTION:

Certified Origins launched multiple lines of carbon-neutral certified Italian EVOOs under its flagship brand, Bellucci.

• RECYCLED PACKAGING:

Certified Origins utilizes 50% recycled PET and recycled cardboard materials.

• GREEN ENERGY:

Certified Origins Italian facility uses energy supplied by photovoltaic panels and olive pits as a fuel source.

www.certifiedorigins.com

With the “Best Solution” concept BeSo®EFFECTIVE, the CHT Group offers a powerful range of effects that provide textiles with high-performance properties. Depending on the application field the innovative effects developed by our experts can be used on a great variety of materials, they can be configured and combined in a multitude of ways, and each effect meets the highest requirements in terms of performance and sustainability.

The BeSo®EFFECTIVE range includes modern products especially designed to support your sustainable textile manufacturing. They have been specially chosen with regard to material health requirements in accordance with the Cradle to Cradle Certified® Product Standard. In addition, BeSo®EFFECTIVE products are suitable for almost all standards such as bluesign®, GOTS, ZDHC, OEKO-TEX® and are Inditex listed.

BeSo®EFFECTIVE is therefore the best solution in terms of performance and sustainability.

Potential savings for various fibers

• Optimization of your processes

• Ecological savings due to minimal consumption of water and energy

• The key to strengthening your sustainable textile manufacturing

• Supporting the UN SDGs

3, 6, 12 and 13 focusing on energy and climate protection, portfolio management, supply chain responsibility, employee engagement, resource efficiency and responsible production

BeSo®RESPONSIBLE –your resource-efficient concept Clothing is essential for our life. However, enormous quantities of water and energy are needed for the manufacture of textiles.

It may surprise you to learn that the fashion industry utilizes around 90 billion cubic meters of water per year. It’s time to reconsider! We enable you to save energy and water with the BeSo®RESPONSIBLE system.

BeSo®RESPONSIBLE is CHT’s best solution that can be tailored to your individual requirements, ensuring optimal efficiency during the entire textile dyeing processes. It is up to you to take responsibility!

Our product groups for realizing the BeSo®RESPONSIBLE effects

• COTOBLANC®: efficient soaping agents

• REWIN: improve fastness on cellulose or polyamide

• REVOFIX: improve the rubbing fastness of dyed articles

• REDULIT: prevent undesired reduction of dyes

• INTENSOL: machine additives to remove deposits and soilings

• PAFIX: improve the fastness of polyamide dyeings

• SARABID: leveling agents

• CHT-DISPERGATOR: dispersing agents

• EGASOL: leveling agents with fiber affinity

• BEZAKTIV ONE: dyes to save water and energy when dyeing CO

• BEMACRON HP-LTD: dyes for low temperature dyeing of PES

• C2C by CHT: dye selections to support the achievement of C2C Certified®

• CHT Textile Dyes App: most advanced technical app for saving resources during dyeing

• BEZAKTIV Soaping Advisor: optimize your rinsing baths to save water and increase efficiency

For More Information brand-retail-service@cht.com

Clothing is essential for our life. However, textile production requires a tremendous amount of resources. It is time for a new approach! With the BeSo®RESPONSIBLE system, we empower you to save resources. BeSo®RESPONSIBLE is CHT’s be st so lution that can be tailored to your individual requirements, ensuring optimal efficiency during the entire textile dyeing processes. It is up to you to take responsibility!

BeSo®RESPONSIBLE – just one of our smart effects with character.

Wash BeSo® RESPONSIBLE RESOURCE SAVING MANUFACTURING by CHT

Our products meet the highest standards.

Find out more at:

Frostkrone Food Group is proud to mark a quarter-century of pioneering finger food and snack creations. Since its inception, the group has been at the forefront of culinary innovation, crafting an array of beloved products enjoyed by consumers across the globe. With operations spanning eight locations worldwide, Frostkrone Food Group has established itself as a trusted partner in the retail and food service industries. From Scandinavia to the USA, the group’s diverse product range caters to a wide array of tastes and preferences.

With its wide product range, extensive experience, and global presence, Frostkrone Food Group is positioned as a strong partner for retail and food service.

From street food favourites to convenient pizza pockets, delicate finger food varieties to entirely vegan options, Frostkrone Food Group leads innovation in the “Fingerfood & Snacks” category, offering just the right product for every culinary occasion.

Produced with innovative technology, Frostkrone’s Flavourites offer sophistication and versatility. This allows for flexible adjustments in size and weight, catering precisely to different needs. This versatility is particularly advantageous for the food service industry, ensuring consistent and accurate portioning.

Crunchy Homies are the evergreens of the snack world. Long-standing bestsellers like the Crunchy Mozzarella Stick have maintained their popularity over many years.

Snack time at a completely new level: Burger Balls bring the full flavour of the original in a cool and convenient finger food style.

Dive into the world of “Really?!”: an extensive selection of entirely vegan, plant-based delights. Designed to mirror the texture and appearance of beloved classics, our products promise an unparalleled burst of flavour without any compromises.

Driven by a passion for finger food, the Frostkrone Food Group continuously pursues innovative product ideas that delight consumers and provide retail and food service partners with an appealing product selection. With a keen awareness of global trends and a deep understanding of the ever-evolving food market and consumer preferences, the group develops innovative, tailored concepts to foster growth.

frostkrone-foodgroup.com

Headquartered in Angri (Salerno, Italy), La Doria is a leading Italian group in the vegetable canning sector, particularly in the production of tomato derivatives, ready-made sauces, canned pulses, juices and fruit drinks. Today, La Doria is Europe’s leading producer of canned pulses, peeled tomatoes and tomato pulp in the retail sector and one of Italy’s leading producers of fruit juices and drinks. The company is also Europe’s leading producer of private label ready-made sauces. As a supplier to major retail and discount chains around the world, La Doria stands out as a group that is primarily dedicated to the production of private labels, the brands of major retailers. In fact, more than 97% of the group’s turnover is generated in this segment.

Underlying this specialization is a strong and determined mission to dominate the large retail and organized distribution markets, offering excellent quality products at very competitive prices as an alternative to the brand.

The Group currently has 6 production plants, 3 in the province of Salerno (Angri, Fisciano, Sarno), 1 in Faenza (Ravenna), 1 in Lavello (Potenza) and 1 in Parma. The international market is the most important sales channel for La Doria, accounting for over 80% of its turnover. The company has significant market shares in the UK, Germany, the rest of Europe, Australia and Japan.

La Doria’s business model is based on the synergy between values considered inalienable - legality, ethics, transparency, respect for human rights, respect for the environment, development of the territory - and the economic solidity of the Group. Convinced that leadership also entails responsibility in the field of sustainable practices, the company has made a concrete and firm commitment to operate with respect for people and the environment at all stages of the production and distribution chain. The responsible management of energy resources, the reduction and recycling of waste and the sustainability of packaging are some of the main guidelines followed by the Group in terms of environmental sustainability.

A firm believer in responsible supply chain management, La Doria implements a series of measures aimed at promoting fair working conditions and the rights of workers involved in harvesting in conjunction with growers’ organizations. The link with the territory is another issue that has been close to the company’s heart since its origins. This includes initiatives to promote young people’s right to education and training and their integration into the labor market, as well as projects to regenerate the area and promote social welfare. The Group also contributes to the growth of the local economy by using a high percentage of suppliers operating in the South of Italy.

commerciale.estero@gruppoladoria.it

Lucart, a major European manufacturer of thin MG paper for flexible packaging, is a key player in the consumer goods and away-from-home markets as a producer and transformer of tissue and airlaid paper. Its attention to people, sustainable processes, and approach to innovation means they offer cutting-edge products that meet market challenges and customers’ needs.

Fiberpack® is their flagship project in this field: it combines advanced technology and environmentally friendly processes, demonstrating that circular economy principles are fully applicable to the tissue sector.

Lucart created this project starting from the idea of using all the elements of beverage cartons according to circular economy principles. The production process relies on an innovative technology that separates the cellulose fibers found in beverage cartons from polyethylene and aluminum by physical-mechanical action. With this technology, they avoid substances that may be harmful to people or the environment. They produce tissue products with the fibers obtained through

this process and recover the aluminum and polyethylene, converting them into a homogeneous material called Al.Pe.®, which other industries use to produce various items.

The tons of Fiberpack® paper Lucart has produced from 2013 to 2021 have contributed to the recovery of more than 7.6 billion beverage cartons, saving more than 3.3 million trees and preventing more than 195,000 t of CO2e from being emitted into the atmosphere.

Lucart’s continuous research and development work has led to many projects aiming to improve the quality and performance of its products. One such project has led to the innovative QMilk® process, which makes it possible to extract and transform the basic proteins in milk into a soft and precious fiber without using chemical agents. The process preserves the amino acids, and all the moisturizing and nourishing properties of milk in the resulting fiber. It guarantees a 100% natural formula that is dermatologically tested, ultrasoft, and highly resistant.

Lucart is also the only brand in its target market to offer Airlaid products with exceptional absorbency and strength performance. The Airlaid technology uses long, highly resistant cellulose fibers that never come into contact with water during the production process (dry paper) to remain super absorbent. Fibers treated with this process naturally form a “dam” structure, offering outstanding results: can absorb up to 7 times its weight and, thanks to its exceptional resistance, can be reused up to 20 times, compared to 1 or 2 for competitive products.

Lucart is a company made up of people who choose to use innovative and sustainable processes in development, transformation, and manufacturing of paper products, collaborating responsibly for the future of their business and the planet.

Lucart has always been at the forefront of the study of innovative packaging able to reduce the environmental impact of its products. After launching the world’s first line of toilet paper with materbi corn starch packaging in 1997, the company created a series of products with entirely plastic-free packaging in 2019.

www.lucartgroup.com

Versatile and ready to bake. Our puff-pastries are produced in Italy according to simple and genuine recipes since 1988, directly imported from our Sister Company and stocked in US, in compact and protective cases, for a quicker and efficient service.

Our dough, free from GMO and artificial colors, rests for more than 24hrs according to the Italian artisan tradition. With a longer frozen shelf-life, our gourmet puff-pastries get ready and super fragrant in less than 25 minutes into the oven. This is what makes our products the perfect choice both for in-store-bakery and retail frozen shelves.

Our experience has your taste

Private label is also possible for those who need to customize their offer. Indeed, our Company is able to satisfy different requests in terms of shape, fillings, toppings and recipes.

Our company is BRC and IFS certified with the highest score. The food safety is guaranteed in all phases of the management, production and distribution processes. We use 100% renewable energy for production and every day we accomplish sustainable choices trying to reduce our impact on the environment.

Continuous R&D allows The Perla Company to follow new international trends and develop healthier, fruit’s richer and above all plantbased products. Kosher certified and Vegan options also available. For more info please contact f.piccoli@theperlacompany.it www.italianpastrexcellence.com

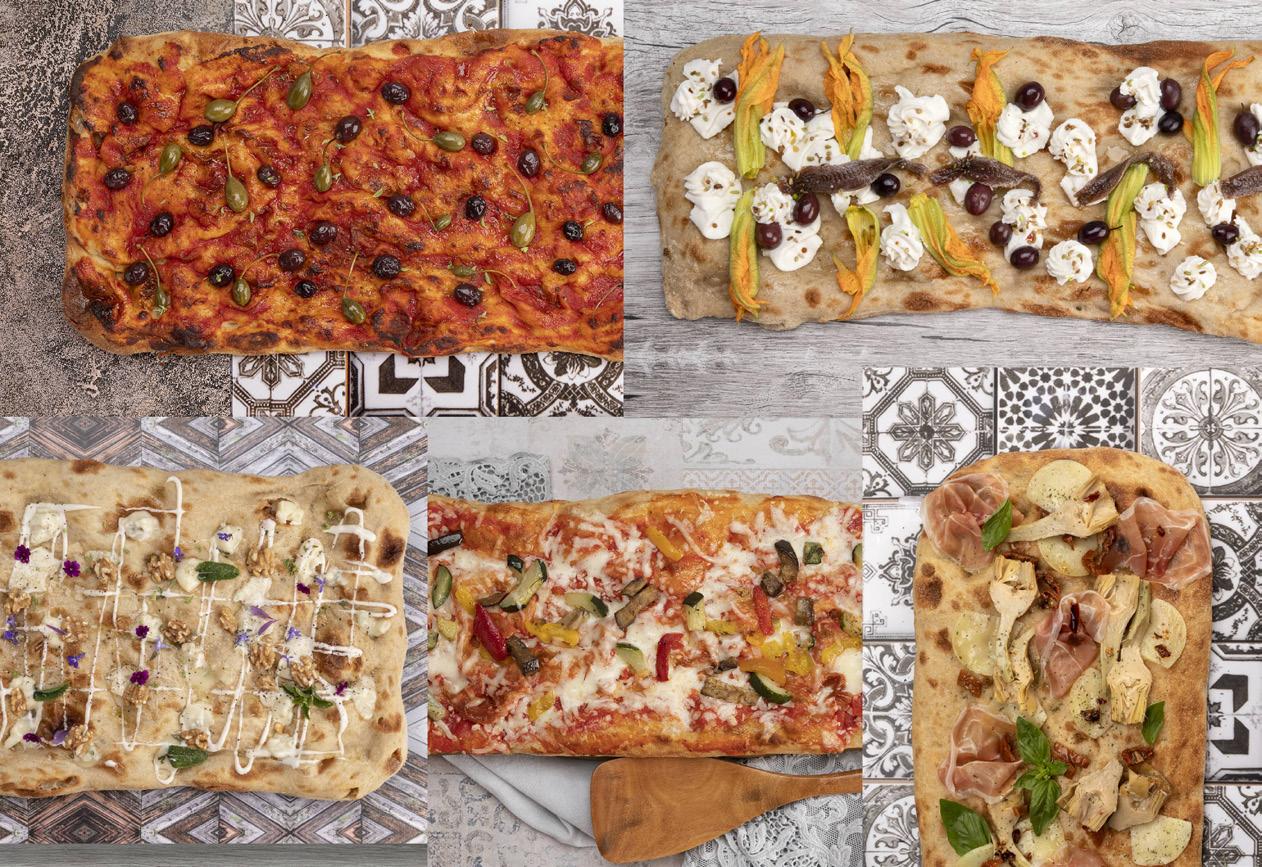

The Valsa Group is a top producer of frozen, chilled, and ambient pizzas and snacks. Their main objective is to spread the authentic Italian food culture worldwide. Their head office is situated in Valsamoggia, at the heart of Italy. “Although our history started here, our roots expand from the North to the South through our 10 factories, following a purely Italian business journey.”

Their daily commitment could be easily summed up: CULTURE. EXCELLENCE. INNOVATION.

The Valsa Group has introduced a new line of pizzas called “Pizza al Metro”. This concept is designed to

showcase the traditional Italian method of ordering pizzas in large slabs that can stretch up to one meter in length. Many pizzerias offer these pizzas in quarter, half, one meter, or even meter multiples, making it easier for customers to order according to their desired length.

A real Italian product with a unique aromatic profile made from selected grains, natural long leavening, and traditional hand stretching. Perfect for retailers looking to transport their customers to Italy with just one bite.

The group’s strategic strength is the combination between traditional manufacturing process and a greater focus on convenience for the consumer, keeping the highest quality standards: in contemporary market, convenience supported by premium quality, is essential to create value into supply chain.

The Valsa Group is a reputable and established business partner in 50 countries across the globe. Their success is attributed to their sustainable practices, efficient production capacity, seamless organizational integration, and innovative convenience solutions. They are particularly dedicated to promoting process transparency, reducing waste, and utilizing green energy.

Through the brands Valpizza, La Pizza+1, Forno Ludovico, Megic Pizza, Ghiottelli, Il Borgo and Tuscanya Bakery, Valsa Group is the unique large-scale and highly qualified partner able to supply a wide range of items in each category, from frozen to deli.

The V-Label brand is an internationally recognized symbol to identify vegetarian, vegan and raw vegan products and services par excellence.

It was created in 1976 as an institutional symbol of the Italian Vegetarian Association and is presently the most recognized synonym for vegetarian and vegan products by consumers all over the world. Its clear, unique image is intuitively associated with vegetarianism and veganism in every corner of the world, effectively breaking down any language barrier.

Officially presented internationally at the first European Vegetarian Congress held in Italy in 1985, it quickly spread first to Europe, and shortly thereafter to the rest of the world.

The V-Label brand is now registered in more than 70 countries worldwide and can be found everywhere around the world: it clearly and safely identifies products and services of various types, from food to textiles, and from footwear to cosmetics as compatible

with the vegetarian and vegan lifestyle. In addition to being available in the food sector (finished products, raw materials, drinks) and in the non-food sector (cosmetics, personal hygiene and home care products, textiles, clothing, footwear), the V-Label brand is a point of reference for catering as well.

But being international doesn’t just mean being widespread, it requires much more than this. It entails being able to transmit and receive, often technical, content properly without making any mistakes. This is possible due to the the close relationships we have worked to maintain with our customers. In most cases, the V-Label brand is distributed by local managers who, because they are familiar with the local language and culture, are better able to convey information to producers and consumers. This local approach also allows us to handle technical material in documents without risking translation errors or problems with understanding.

Despite the widespread availability of the brand in extremely different areas, both in terms of culture and traditions, the V-Label brand has maintained the same verification criteria and standards in every place. This uniformity aims to offer seriousness and quality to consumers who rely on the V-Label brand when choosing which products to buy.

The balance between the local approach and adaptation and the standardization of criteria and processes so that they remain unchanged is what makes the V-Label brand truly international, even more than its widespread coverage.

www.vlabel.org

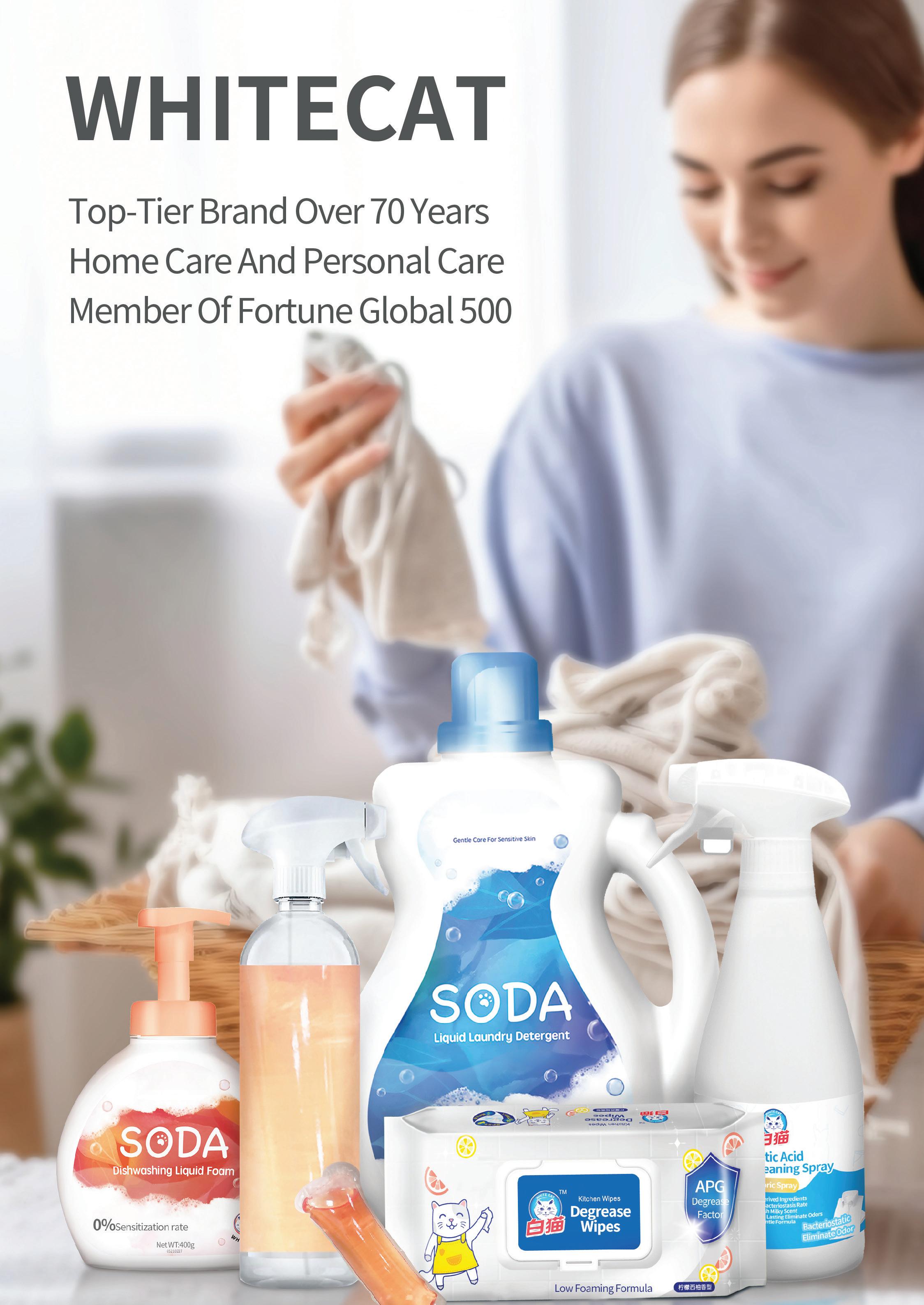

In the quaint village of Yongtai, Shanghai county, China, 1948 marked the inception of an entrepreneurial venture that would evolve into Shanghai Whitecat. Initially focused on providing post-war China with essential laundry soap, this small, private manufacturing company embarked on a journey characterized by necessity, groundbreaking innovation, and an unwavering commitment to safeguarding the health of families.

Motivated by the pressing needs arising after World War II, Shanghai Whitecat tirelessly worked to supply the local community with laundry cleaning products that surpassed traditional soap made from soap beans and “Yizi” (a concoction of pig pancreas and plant ash). The goal was simple yet profound: to enhance cleanliness and well-being for families.

Shanghai Whitecat achieved its first milestone in 1959 by introducing mainland China to the first domestically produced package of synthetic laundry detergent powder, “Gong nong.” This marked the beginning of a series of groundbreaking innovations: 1963: Introduced the first autonomous washing powder paper bag packaging machine. 1981: Developed and produced the first domestically packed Super Concentrated Laundry Powder.

1987: Awarded the “Shanghai Famous Brand” certificate for both Whitecat and Jaimei brand Laundry Powder.

1995: Whitecat Laundry Powder received the “Golden Bridge Award” for National Best-selling Domestic Product for four consecutive years.

2004: Whitecat liquid detergent attained the prestigious title of “China Famous Brand.”

2018: Whitecat Lemon Black Tea Dishwashing liquid secured the “2017 China Biggest Award of Quality Consumer – Quality Gold Award.”

2018: Shanghai Hutchison Whitecat Co., Ltd., was honored as one of “China’s Top 100 Daily Chemicals.”

As Shanghai Whitecat celebrates its longevity, the narrative transcends labels and brands, becoming a story of enduring innovation, necessity, and countless lives touched. With trust built over decades of hard work and substantial investment in research and development, Whitecat boasts:

• Over 100 national patents.

• Annual investments of millions of dollars in R&D.

• A team of over 50 research and development personnel, with over 50% holding Master’s or doctoral degrees.

• The only national standard laboratory in the light chemicals industry.

• State-of-the-art scientific equipment, including gas chromatography/mass spectrometry (GC/MS) and Fourier infrared spectrometer.

Whitecat’s dynamic culture of innovation, born out of necessity in 1948, is evolving towards sustainability, ensuring healthier lives for families and our planet. The company is proud to introduce a sustainable, natureinspired line of products, including:

• Concentrated cleaning pods, sheets, and tablets.

• Lactic acid-based cleaning products.

• Soda-based cleaning products. This marks the beginning of a green, sustainable tomorrow with Whitecat. Join us on this exhilarating journey towards a cleaner, healthier world.

Shanghai Hutchison White Cat Co. Ltd. (“Shanghai White Cat” or “Whitecat”) is a foreign joint venture established by a wholly-owned subsidiary of CK Hutchison, a Global Fortune 500 company with an annual revenue of US$ 500M. With over 23 factories across China’s mainland, White Cat’s own brand products and private label services are available in China, Japan, Korea, the Middle East, Southeast Asia, the Americas, and Europe. Their motto is simple yet powerful: “If you can think it, we can make it!”

http://en.whitecat.com

Certified Origins was born in 2006 thanks to the union of two Tuscan cooperatives of farmers and an organization specializing in international sales and distribution to export and provide fresh and authentic Extra Virgin Olive Oil to families everywhere in the world.

Today, we remain cooperative-owned and continually expand our portfolio by directly sourcing from farmers in the Mediterranean region. The confidence and trust built over decades in the industry means we can guarantee the quality of our products and give us access to the scale necessary to work with retail organizations.

FOR MORE INFORMATION:

Giovanni Quaratesi, Head of Corporate Global Affairs salesteam@certifiedorigins.com

The CHT Group is a medium-sized global player for specialty chemicals and active worldwide in development, production and sales. CHT Germany GmbH in Tübingen is the headquarters of the companies focusi on sustainable chemical products and process solutions.

TEXTILE SOLUTIONS of CHT improve the quality, functionality as well as look and purity of textiles and optimize their manufacturing processes. In the fields of silicones, building materials, paints, coatings, leather, release agents, paper, agrochemicals, mining as well as cleaning and care products innovative products and process solutions are provided by the Business Field INDUSTRY SOLUTIONS.

By combining the strengths of the complete group further innovative products, applications or processes are continually developed and vast technical support is offered within the SCIENCE & SERVICE SOLUTIONS. Highly qualified specialists work in state-of-the art laboratories for development, analytics and application technique in order to work out ideas and solutions that meet the latest requirements.

The CHT Group with its own production and sales locations is represented by 26 companies worldwide. In the financial year 2023, the CHT Group generated a group turnover of 604 million Euro with around 2,400 employees.

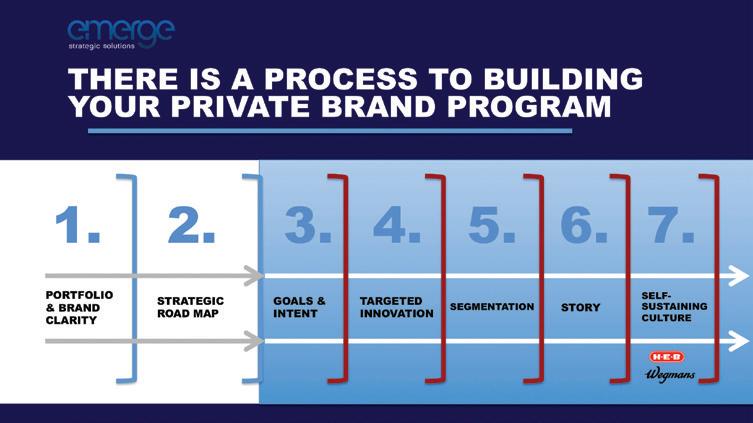

Whether you are a supplier or retailer with an interest in Private Brands, Emerge can help you to take the next leap forward in differentiating and growing your business. We are highly collaborative in our approach, and we will push you, as together we will discover the low-hanging and more aspirational opportunities for you to expand.

Building own brands and challenger brands is our true sweet spot, but we also work with many established companies/brands that need fresh thinking for their next breakthrough.

We Help Our Supplier Clients:

• Build better ways to tell the unique stories of their company and portfolio

• Reach and connect with new retailers, by customizing your approach

• Sell more effectively; connect with the trade more effectively

We Help Our Retailer Clients:

• Rationalize and optimize their portfolio, with an eye towards new segments and growth opportunities

• Develop Signature products and strategies for development, all that fit who you are

• Set up a true process for growing own brands and harnessing the right infrastructure

Let us put our experience with partnering in over 15 retail classes of trade and 5 continents to work for you in a collaboration that will make a difference.

Discover a world of new snacking possibilities with Burger Balls from Frostkrone Food Group. These bite-sized burger balls pack all the flavour of a classic burger into a convenient finger food format, perfect for satisfying those in-between meal cravings.

Street food remains popular, and not just for on the go. Whether you’re out and about or enjoying a cosy night in, these tasty treats bring the spirit of street food straight to your doorstep.

Ready to snack? Indulge in the delicious combination of succulent beef, rich cheddar cheese, and tangy tomatoes with our Cheese Burger Balls.

Available in five trendy varieties, these frozen delights are quick and easy to prepare in any standard kitchen appliance, from ovens to air fryers. They can be offered both in retail and food service establishments.

www.emergefromthepack.com

frostkrone-foodgroup.com

Global Tissue Group ® has fostered a reputation for providing value for our customers as their private label paper manufacturer for bath tissue, facial tissue, napkins and paper towels with customer service to each and every one of them. Our customers depend on our flexibility, confidentiality and quality, from paper products to services; from our specialty paper manufacturing capabilities and consistent supply to custom-tailored private label programs. Our goal is to ensure that no matter your needs, Global Tissue can deliver.

In creating diversified household paper products that cater to every market category, you can feel confident putting your label on our goods. We bring the trust and comfort of our relationship to your consumers, who will grow to depend upon our standard of manufacturing excellence – and your brand, through our private label programs, contract manufacturing, or our control brands. This is what sets us apart from our competition. Global Tissue provides value, quality and consistency, and helps organizations like yours increase their revenue. Let us enhance your paper program and your margins. Be a part of our Strong A.R.M. program, and Attract consumers, Retain them and create Margin enhancement every day.

www.globaltissuegroup.com

Headquartered in Angri (Salerno, Italy), La Doria is a leading Italian group in the vegetable canning sector, particularly in the production of tomato derivatives, ready-made sauces, canned pulses, juices and fruit drinks. Today, Doria is Europe's leading producer of canned pulses, peeled tomatoes and tomato pulp in the retail sector and one of Italy's leading producers of fruit juices and drinks. The company is also Europe's leading producer of private label ready-made sauces.

As a supplier to major retail and discount chains around the world, La Doria stands out as a group that is mainly dedicated to the production of ‘private labels’, the brands of major retailers. In fact, more than 97% of the group’s turnover is generated in this segment. Underlying this specialisation is a strong and determined mission to dominate the large retail and organised distribution markets, offering excellent quality products at very competitive prices as an alternative to the brand.

commerciale.estero@gruppoladoria.it

Le Bontà was founded in 1994 in Prato, in the Tuscan hinterland, with the aim of creating sauces, meat sauces and patès that express the best Tuscan gastronomic tradition.

In more than 20 years of activity, the Le Bontà trademark has created a production system able to response to the needs of private labels, by offering recognized product quality, the reliability of careful and meticulous management, and flexibility that facilitates the purchasing brand.

The GDOs select numerous recipes each day to put on the tables of Italian and European consumers. And, each day, as a provider of private labels, we ensure high-level consulting with the aim of shelf success and success on the table.

Chiaverini Jams join the family of products from brands Nuova Terra: a broad selection of natural and organic cereals, seeds and soups; I Toscanacci: a line of high-quality sauces without preservatives; Bonvé: a line of vegan and organic sauces and Accademia Toscana: a range of sophisticated and very high-quality sauces for the Italian and foreign markets.

Lucart is a market leader company in transformation and manufacturing of paper products.

Our attention to people, sustainable processes and approach to innovation mean that we offer cutting-edge products that meet market challenges and perfectly match our customer requirements.

Fiberpack® is our flagship project in this field: it combines advanced technology and environmentally friendly processes, demonstrating that circular economy principles are fully applicable to the tissue sector.

Lucart is also the only brand in its target market to offer airlaid products with exceptional absorbency and strength performance.

The Airlaid technology uses long, highly resistant cellulose fibres that never come into contact with water during the production process (dry paper), so that they remain super absorbent. Fibres treated with this process naturally form a ‘“dam” structure, offering outstanding results: it absorbs 50% more compared to other household paper and, thanks to its resistance, it can be reused up to 20 times.

We are a company made up of people who choose to use innovative and sustainable processes in development, transformation and manufacturing of paper products, collaborating responsibly for the future of our business and planet.

For more information:

DarioBrandi, Sales Director Export, +39 335 1014765

www.lebonta.it

www.lucartgroup.com

A division of Marketing By Design, Lucid was created to be brand builders and meaning makers.

A lifestyle-based agency that’s driven by a spirit of curiosity and ingenuity that amplifies the voice of beneficial brands whose mission is to do good in our communities and the world we live in. Brands that benefit people, pets & the planet are our main client base and by putting our focus on discovery, strategy, design development and implementation we’re creating brands that will shine in the most imaginative and inspiring ways.

We are passionate about being better every single day and doing impactful work. This in turn creates differentiators and highlights greatest areas of impact your brands have to offer against the competition.

Lorrie Allen, lallen@mbdesign.comA full-service strategy, creative and packaging artwork design agency built to meet the challenges and opportunities facing Private Label and National Brands today. Since 1990, MBD has been on a mission to produce stand out, award-winning packaging to our multichannel customers. We are a global agency that builds brand and differentiates our clients from the competition, which in return increases their ROI.

Our strategy begins by defining a clear brand voice with strong storytelling. What makes MBD different and unique is our tri-focus approach:

1. CREATE: Originality is the driving principle of our work. We bring brands to life through story-telling and visual flair. Creativity should be nurtured, encouraged to grow, and never compromised. From start-ups to international billion-dollar brands, our work helps to sell thousands of products and services globally.

2. MANAGE: Our detail driven design team take the voice and vision of the brand and adapt using our best-in-class approach to developing the packaging artwork. Unique and ownable graphics are key to portraying the quality across an entire range. While our workflow solutions tie it all together with centralization and automation.

3. ROLLOUT: MBD create more than 12,000 pieces of artwork every year with teams large enough to execute programs with thousands of SKUs, but nimble enough be brand guardians with a single voice.

We also pride ourselves with color managed artwork that is compliant and consistently on brand.

FOR MORE INFORMATION:Katie Locke, klocke@mbdesign.com

Welcome to the world of The Perla Company™, the inventor of the famous puff-pastry “Perla”.

G.M. Piccoli S.p.A. – The Perla Company™ is an Italian company specialized in frozen bakery products with more than 35 years of experience. We produce frozen ready to bake puff pastry products with new and immediately recognizable shapes, generous quantity of filling and shiny crunchy surface. Our Quality System is certified with the highest score according to the international BRC and IFS standards.

The shelf-life of the products is longer than the competitors, the shipping cases are designed to take up the least space as possible in the freezer. The Company has different product lines for any kind of need, designed according to the occasions of consumption. We have Kosher certified and Vegan products, as well as private label solutions.

Produced in Italy, then imported in USA with an available stock in NJ, our products are sold worldwide. Through our Sister-company THE PERLA COMPANY USA, Inc. we bring the typical Italian taste to the main US stores and foodservice distributors.

FOR MORE INFORMATION:

f.piccoli@theperlacompany.it - +1 (347) 776-0708

Four generations of the Reichart family have been producing the world’s freshest, best tasting tomato products since 1942. Since then, Red Gold has become the largest privately owned tomato processor in the United States with three state-of-the-art facilities in Indiana that are certified Kosher, Non-GMO, and Organic. The company also boasts a 1.5 million square foot distribution center and operates the subsidiary RG Transport trucking fleet.

Red Gold partners with local family farms across Indiana, southern Michigan, and Northwest Ohio to sustainably produce premium quality canned tomatoes, ketchup, pasta sauces, pizza sauces, enchilada sauces, salsas, sloppy joe sauce, cocktail/chili sauces, and juices for foodservice, private brands, brands, export, co-pack, club and retail channels of distribution. Superior Quality, Outstanding Service and Operational Excellence are the shared values that contributed to the employee-created mission statement: “To produce the freshest, best tasting tomato products in the world.”

Seneca Foods ensures US farm fresh goodness through our 26 facilities located in prime American growing regions. A leading global provider of packaged fruits and vegetables, Seneca’s flexible packaging solutions meet evolving consumer needs: from traditional cans and frozen foods, to convenient pouches and plastic cups. Organic options also available.

At Seneca, we believe that everyone deserves yearround access to great-tasting food that’s also great for you. That’s why we’re bringing families and organizations all over the world real food that’s nutritious, affordable, and delicious.

By remaining committed to those we serve, we’re going to continue growing as the leader in the fruit and vegetable industry. At Seneca, we’re still doing things the way we always have- the right way.

Think globally, grow locally. We’re proud to say, “We feed the world.”

www.senecafoods.com

Valsa Group as leading manufacturer of chilled, frozen and ambient pizzas and snacks, identifies its primary goal in promoting the true Italian food lifestyle all over the world. The headquarters is located in Valsamoggia, in the very heart of Italy. This is where the history of the Group began, nevertheless our roots go from North to South, through our 6 plants: in a purely Italian entrepreneurial path.

Our daily commitment could be easily summed up: CULTURE . EXCELLENCE . INNOVATION.

Valsa Group is the unique large-scale and highly qualified partner able to supply a wide range of items in each category, from frozen to deli. info@valsagroup.it

V Label Italia is the owner and the entity responsible for assigning the V-Label brand in Italy, China, the United States, the Republic of Korea and, beginning in 2020, the United Arab Emirates.

The V-Label brand was founded in 1979 as an institutional trademark of the Italian Vegetarian Association and has since that time been distinguished as the vegetarian and vegan brand par excellence around the world.

Registered in more than 70 countries around the world, it is currently the vegetarian and vegan brand name most recognized by consumers internationally.

Having become synonymous with transparency and assurance, it is presently the brand most used to identify products and services suitable for the vegetarian and vegan lifestyle. Whether applied to food, beverages, cosmetics, textiles and accessories, footwear, catering or publishing, the brand is a recognized name, valued both by manufacturers and by consumers in today’s international marketplace.

Despite its widespread use, the V-Label brand has maintained high-quality standards due to its clear and transparent criteria being applied internationally by major vegetarian and vegan associations, who ensure that the standards are met.

The brand is divided into three distinct categories: vegetarian - veganraw vegan, allowing consumers to purchase with confidence, knowing that their selections are perfectly in line with their lifestyles and have been subjected to detailed inspections and quality controls by industry experts.

In the quaint village of Yongtai, Shanghai county, China, 1948 marked the inception of an entrepreneurial venture that would evolve into Shanghai Whitecat. Initially focused on providing post-war China with essential laundry soap, this small, private manufacturing company embarked on a journey characterized by necessity, groundbreaking innovation, and an unwavering commitment to safeguarding the health of families.

Motivated by the pressing needs arising after World War II, Shanghai Whitecat tirelessly worked to supply the local community with laundry cleaning products that surpassed traditional soap made from soap beans and “Yizi” (a concoction of pig pancreas and plant ash). The goal was simple yet profound: to enhance cleanliness and well-being for families.

Shanghai Hutchison White Cat Co. Ltd. (“Shanghai White Cat” or “Whitecat”) is a foreign joint venture established by a wholly-owned subsidiary of CK Hutchison, a Global Fortune 500 company with an annual revenue of US$ 500M. With over 23 factories across China’s mainland, White Cat’s own brand products and private label services are available in China, Japan, Korea, the Middle East, Southeast Asia, the Americas, and Europe. Their motto is simple yet powerful: “If you can think it, we can make it!”

www.vlabel.org

When you think of fast food, your mind probably gravitates toward burgers, fries, or viral chicken sandwiches, but it’s really breakfast that is powering these companies. Prior to the pandemic, breakfast was the ‘final frontier’ for fast food and QSRs, and since 2022, visits for breakfast have now surpassed pre-pandemic levels.

Speaking to Business Insider back in August, Carl Loredo, Wendy’s global CMO, said “We’re competing with Cheerios as much as we’re competing with the next QSRs these days.”

What I think we’ll see in 2024 is an all-out breakfast war in QSRs, and a spillover into CPG. Not only will we see breakfast menu development increase in QSR (that’s already happening), but we’ll also see new concept launches (e.g., what if Panera launched small-format breakfast-only shops without an internal bakery?).

Kevin Ryan, a visionary strategist at Malachite Strategy & Research, unveils his groundbreaking predictions for the food industry in 2024. Read more about Kevin’s work on page 59.

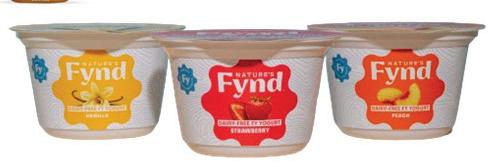

For CPG this signals troubling times. In 2024, I think we’ll see some very ugly breakfast-related packaged good declines. Traditional breakfast fare like RTE cereal is struggling after a pandemic boom and even promising categories like yogurt have stabilized after previous highs (with companies like Chobani and Yoplait now chasing dessert—Chobani Creations, Haagen Dazs Cultured Crème). To wrestle breakfast back from QSRs, they’ll have to attack the motivations that are causing people to eat breakfast out of home:

TIME PRESSURE:

Many people feel that the clock starts ticking on their workday when they leave the house in the morning. Sitting at your kitchen counter and eating means losing time. You’re either portable or you’re dead in the water.

Grocery buys and ‘stop at McD’s’ buys come out of different consumer ledgers. The same person that recoils from paying $6 for a box of cereal that is (realistically) 3-4 servings, thinks nothing of paying $4 for one breakfast combo meal. CPG must change the value perception.

QSRs are doing a good job of making themselves ever-present on social and driving the narrative that fast food breakfast is the way to go. CPG’s social game doesn’t feel as strong yet.

But honestly, it’s really just taste. I love cereal, but compared to deepfried carbs and gooey cheese, there is no contest. CPG needs to stop taking the consumer at their word and hone in on taste.

Skky Partners, the private equity firm founded by Kim Kardashian and business partner Jay Sammons, has purchased a minority stake in the condiment company TRUFF. Founded in 2017, TRUFF makes condiments infused with the flavor of truffles. The company started with a signature truffle hot sauce and has gone on to make truffle oils, mayonnaise, pasta sauce and more. The company has recently formed partnerships with Popeyes Louisiana Kitchen, Hidden Valley Ranch, Taco Bell and The Super Mario Brothers Movie. Pringles announced a limited-edition collaboration with The Caviar Company. Three Pringle x Caviar Company kits (retailing for $49, $110 and $140) are now available via an online shop. The partnership was spurred by a popular TikTok trend of pairing the iconic crisps and the deep-sea delicacy.

So What? If you’ve seen lobster mac & cheese, Wagyu beef sliders, Supreme x Oreos, or Gucci’s partnership with The North Face, you’ve already seen this strange trend in the wild. I say strange because each of these products is the embodiment of two forces you normally don’t see together: luxury and lowbrow, practical and fanciful, or elegant and every day. Why are we seeing the rise in popularity of these products and what can we expect in the future?

Traditionally, consumer goods have been segmented into clear categories - luxury vs. practical, distinctive vs. banal. However, these products and collaborations blur these lines, challenging the conventional wisdom about what categories mean and who they are for. It reflects a cultural shift towards more fluid, less binary perceptions of consumer products. In many ways, it challenges the old marketing paradigm of consumer personas where purchase drivers fit in only in one quadrant. Instead, it recognizes the complexity of modern consumers.

Identities: Today's consumers are more multifaceted, or at least not willing to compromise on their contradictory desires. Someone might appreciate the practicality of The North Face AND the aesthetics of Gucci, simultaneously. These mashups cater to hybrid consumer identities, acknowledging that people have diverse tastes and interests.