As we convene in Singapore for the TFWA Asia Pacific Exhibition & Conference this year, we stand at the cusp of significant transformations in the travel retail landscape. Long has it been stated that GTR is behind the times, but that is rapidly changing, and nowhere is that clearer than in this region.

The strategic use of technology in marketing and customer interaction is leading the charge, from the tobacco category, where detailed analysis by m1nd-set reveals a niche yet profitable market segment, to the evolution of e-commerce platforms like Jessica’s Secret, which utilize AI and data analytics, revolutionizing the pre-travel shopping experience. These platforms not only predict but actively shape consumer preferences, offering a glimpse into the future.

The re-emergence of Chinese tourists marks a defining moment for travel retail, signaling a shift toward preferences for sustainable luxury, advanced digital features and personalized experiences. Insights into consumer behaviors suggest a vigorous return with an emphasis on high-quality, culturally rich shopping experiences that resonate deeply with a new generation of travelers.

Ever at the forefront, design and marketing are busy envisioning a future reality that will mean success for the industry. Portland Design’s visionary approach is redefining airport spaces as vibrant community-centric areas, turning them into dynamic brands that enhance traveler engagement, while ALIVE’s Aviator initiative simplifies the complexities of airport marketing, ensuring that brands can seamlessly interact with the diverse APAC market.

Operators across the region, from Delhi Duty Free to Lotte Duty Free, are pioneering changes that showcase the effectiveness of digital strategies and experiential retailing. These industry leaders illustrate how integrating online and physical engagements can create a seamless consumer journey, enhancing customer satisfaction and loyalty.

Meanwhile, brands in confectionery and spirits are using regional and festive nuances to enhance brand relevance and drive sales, successfully leveraging these strategies with exclusive launches and culturally tailored products that attract affluent travelers seeking unique and luxurious experiences.

As we explore these transformative themes, our magazine is committed to bringing you the latest and most comprehensive insights. From the resurgence of markets like India and China to innovative digital transformations across the region, TFWA Asia Pacific 2024 is not just a meeting point but a launchpad for the next era of travel retail.

We invite you to enjoy this issue, immerse yourself in the wealth of information, and join us in navigating the exciting prospects to come.

Kindest regards,

HIBAH NOOR Editor-in-Chief hibah@gtrmag.com

HIBAH NOOR Editor-in-Chief hibah@gtrmag.com

MAY 2024 ·

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor May 2024, Vol 36. No. 3. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR Laura Shirk laura@gtrmag.com

SENIOR WRITER Alison Farrington alison@gtrmag.com

SENIOR EDITOR Wendy Morley wendy@gtrmag.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

12 Retail horizon

The forecast for Asia’s travel retail is robust growth through 2029, driven by a burgeoning middle class, emerging trends in innovative shopping technologies and sustainable practices

22 New era

Lotte Duty Free is redefining the shopping landscape with its innovative omnichannel approach, ensuring a fluid and cohesive experience across all stages of the consumer journey

34 Surfing the digital wave

With a keen understanding of consumer trends, Jessica’s Secret uses cutting-edge technology to craft a seamless shopping experience for travelers, prioritizing intuitive design and strategic partnerships

38 Powerful brands, community spaces

Portland Design’s Ibrahim Ibrahim calls for airports to embrace their potential as dynamic place brands, creating enriched environments that foster community and deepen brand engagement

18 A pillar of possibilities

Capitalizing on a surge in international travel to redefine retail experiences at the crossroads of culture and commerce, Delhi Duty Free is implementing digital solutions to enhance customer engagement and streamline shopping

28 Domestic promise

Gebr. Heinemann is set on expansion in the Australian domestic market, as the travel retailer reports strong trading after recent store launches at Sydney and Gold Coast duty paid airport locations

32 Ready for takeoff

As Chinese outbound travel gains momentum, a new generation of tourists is demanding personalized, sustainable and culturally rich experiences, presenting opportunities for savvy travel retailers to thrive

44 The big 5

Committed to delivering world-class visitor experiences, Jewel Changi Airport is celebrating its fifth anniversary with a year-long series of special events and retail offers under the theme “What A Feelin5”

46 Connecting the dots

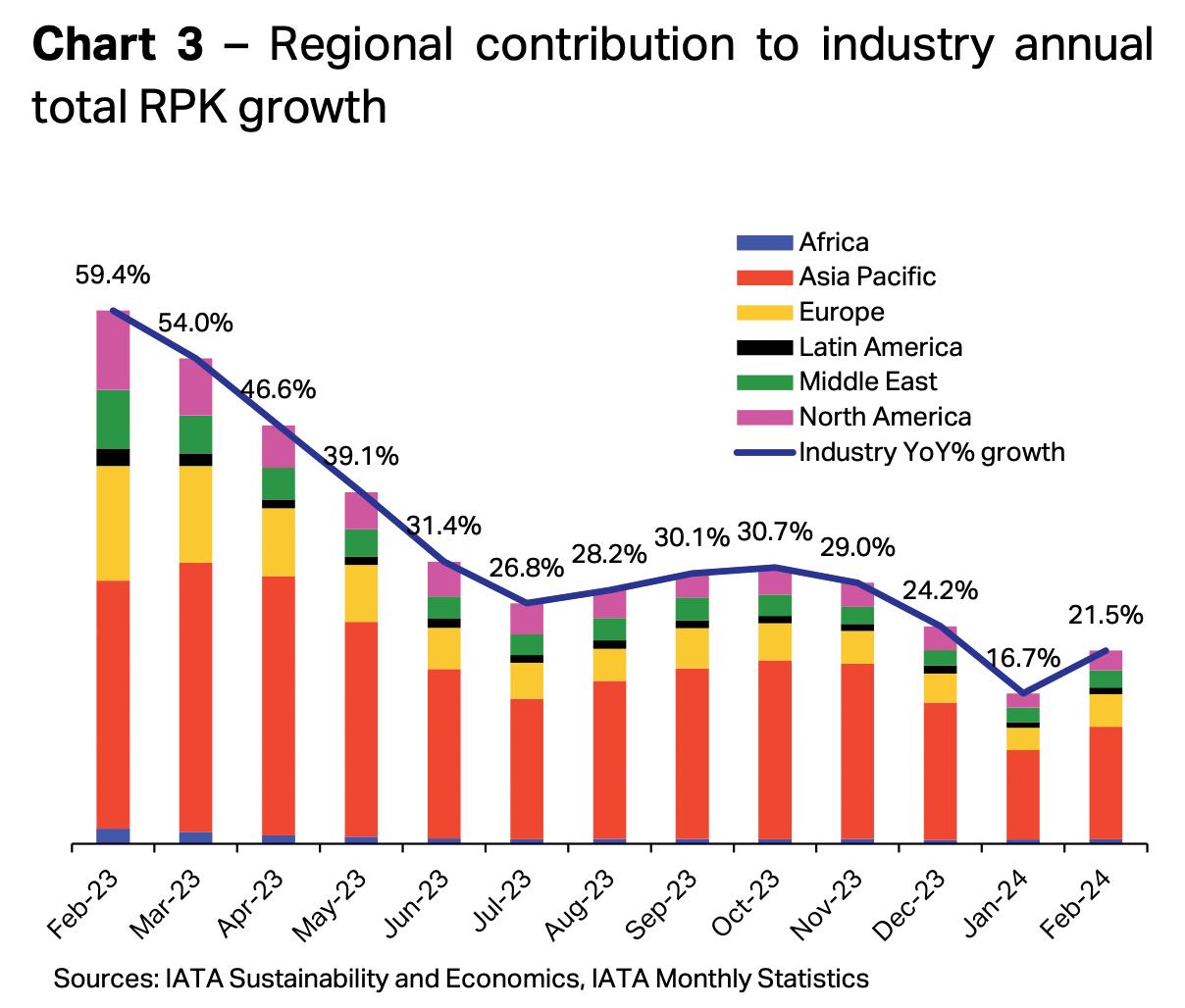

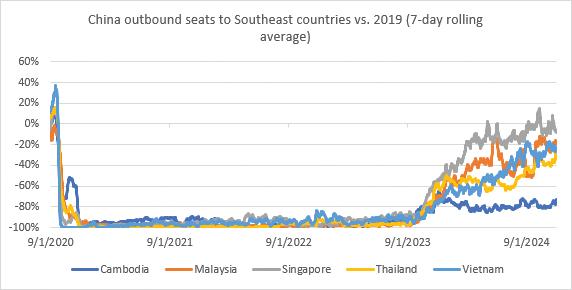

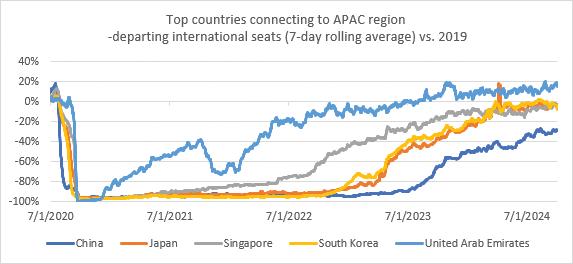

Based on input from aviation industry experts, Global Travel Retail Magazine reports on air connectivity in Asia Pacific, domestic vs. international growth in China and the potential of the Southeast Asian market within air travel

50 Effective pain relief

Sharing insights on bridging the physical and digital divide, Managing Director Charlotte Birley dishes on the transformative impact of Aviator and other initiatives at experiential marketing agency ALIVE

54 Adversaries to allies

Travel retail fails when popular items become islands; in this guest column, One Red Kite’s Ken Brocklebank suggests a new merchandising concept that can help lead to success

58 At your service

A look at Elizabeth Arden’s holistic approach to beauty and travel reveals more about its “Travel with Arden” campaign, travel pitstop concept at Changi Airport and skincare hacks for those on the move

60 A healthy glow

In this Skincare Report, experts at Blue Chip Group, Shiseido Travel Retail and Nuxe Travel Retail discuss skinimalism, multi-functional products and current category trends

64 C-Beauty rising

Premiumization in skincare is not going anywhere as brands continue to trade up, especially in China; while Asia Pacific is on the agenda for many beauty companies’ expansion plans, Global Travel Retail Magazine asks is C-Beauty a rising threat?

68 A brush of fresh air

Solidifying its footprint in Asia, Moroccanoil’s Airy Moisture is expected to become a major pillar of the brand in the region; plus, talk about travel retail sets, APAC openings and more

70 Eastern indulgence

A look at Asia’s duty free confectionery landscape with some of the region’s top retailers as they commandeer shifting trends, digital innovations and pet-friendly initiatives

74 Tasteful tradition

Global confectionery companies Mars, Mondelēz and Nestlé are leveraging regional festivities and cultural nuances to enhance brand relevance and drive sales in the Asia Pacific market

76 Preparing the next generation

With a focus on comprehensive messaging, Victorinox’s “Made to be Prepared” campaign marks a new chapter for the brand; a larger booth space at this year’s show will help showcase its two core categories in travel retail: travel gear and watches

78 Distilled elegance

Global spirits companies are responding to Asia Pacific’s growing demand for premium drinks with exclusive launches and engaging marketing strategies, transforming the channel into a hotspot for luxury spirit consumption

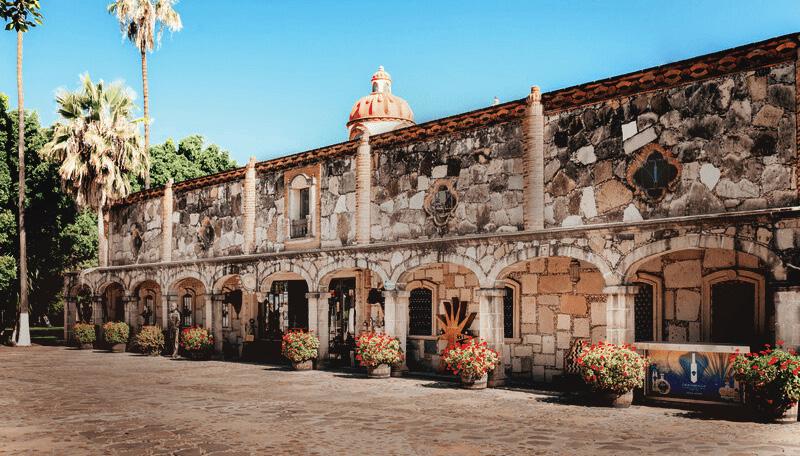

80 Spirited tradition

Fraternity Spirits offers a unique journey through Mexican heritage; anchored by Hacienda Corralejo, it pioneers in sustainability and custom aging, redefining the premium spirits landscape in travel retail

82 Investment and expansion

Jägermeister sales surged in 2023, driving global growth amid challenges; reporting an 8.1% increase in sales, it marked the second most successful fiscal year in the company’s history

84 Malt master

Kavalan’s new Master’s Select Reserve malt whiskies embody the essence of the distillery, which has been leading the art of single malt whisky in Taiwan since 2005

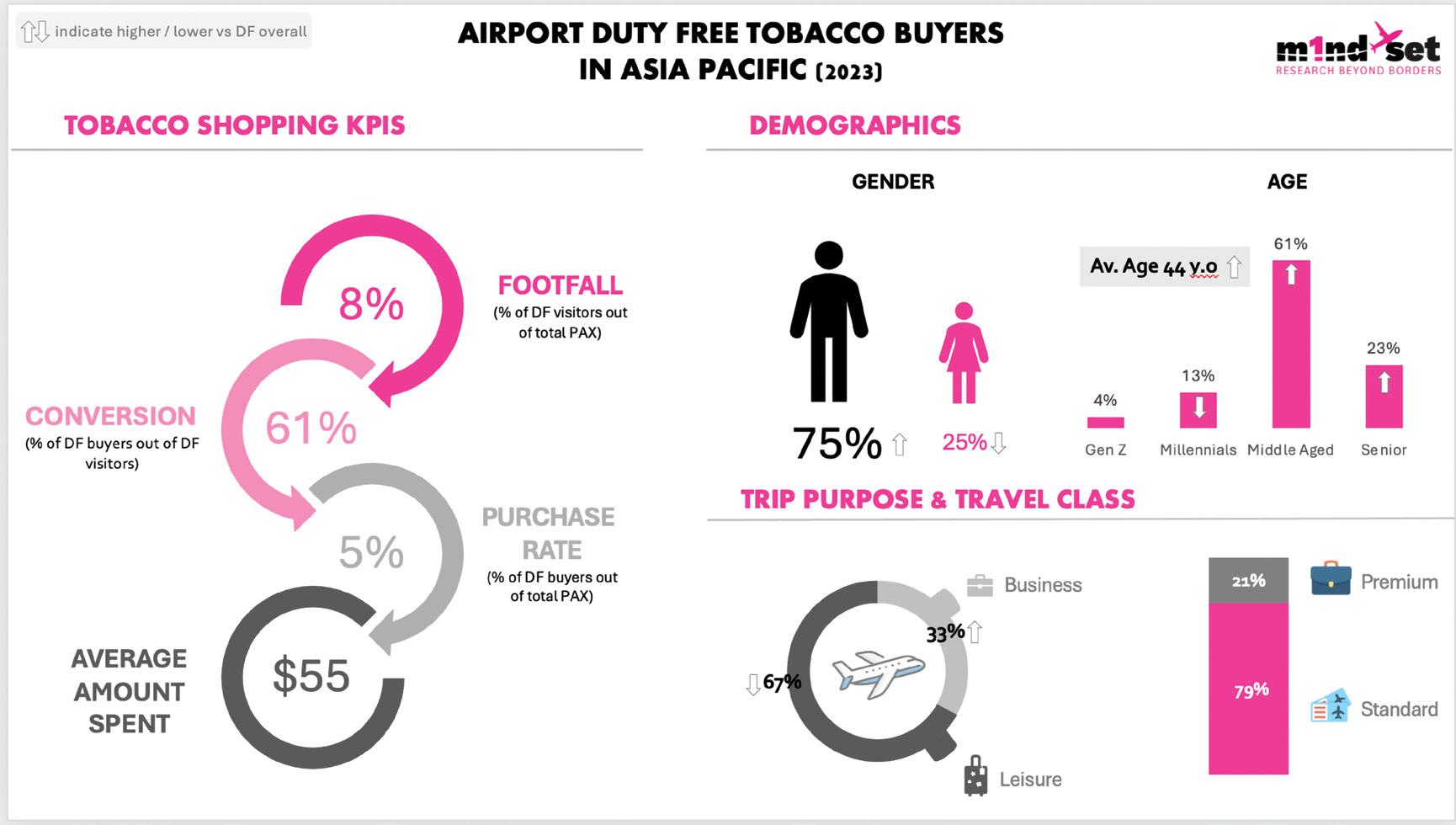

86 Purchasing potential

m1nd-set data from 2023 provides a clear indicator of the tobacco market in Asia Pacific; strong purchasing trends highlight an opportunity to capitalize on a niche but profitable segment

We’re making the journey as rewarding as the destination; bringing together Dufry’s retail and Autogrill’s F&B expertise to revolutionize the travel experience worldwide.

Low-cost carriers such as Air Asia are helping to boost travel throughout Asia, leading to increased travel retail sales

The forecast for Asia’s travel retail is robust growth through 2029, driven by a burgeoning middle class, emerging trends in innovative shopping technologies and sustainable practices

by WENDY MORLEYThe Asia travel retail market is projected to reach US$98.11 billion by 2029, up from US$63.15 billion in 2024, marking a compound annual growth rate (CAGR) of 9.21% over the fiveyear period. This growth trajectory is influenced by multiple factors including rising middle class affluence, increased digital integration and evolving consumer behaviors toward sustainable and experience-based shopping.

The revival of international travel and regional tourism has played a critical role in propelling the demand for duty free shopping, with key markets

China, Japan, South Korea and India spearheading this growth.

The expansion of new air routes and the entry of low-cost carriers (LCC) are key drivers in the growth of the Asia Pacific duty free and travel retail market. Increased consumption and higher purchasing power in China and India are likely to positively influence this market. Additionally, in this region, a preference for unique and value-added products is encouraging more travel, which is anticipated to boost demand within the duty free industry.

Trip.com CEO Jane Sun reminds us that Asia is poised to account for half of the global GDP growth, thanks in part to its thriving tourism sector

navigate various economic pressures and changing consumer demographics to maintain momentum

Sunil Tuli, President of APTRA and King Power Group (Hong Kong) Group CEO, says China remains a critical player in the region’s economic landscape, particularly in the travel retail channel, but warns the market must

The adoption of modern lifestyles and affordable travel package offerings by companies like MakeMyTrip, Cleartrip, and GoIbibo are expected to contribute to the expansion of the global duty free and travel retail market. Meanwhile, the swift expansion of social media and digital technologies will present attractive and innovative opportunities for retailers and brands in the Asia Pacific market over the forecast period.

Asia’s burgeoning middle class continues to be a pivotal element in the expansion of travel retail. Increased disposable incomes and a greater propensity for discretionary spending are fueling purchases of luxury goods, cosmetics and technology-driven products. The Asian market’s responsiveness to innovation is particularly noticeable in categories such as wearable technology, with airports emerging as critical hubs for consumer engagement with new tech.

In 2024, the travel retail market in Asia is showing promising signs of robust growth. Jane Sun, CEO of Trip.com, recently highlighted the remarkable uptick in travel bookings to Asia, with destinations like Thailand, Japan and South Korea becoming increasingly popular due to their premium wellness and eco-tourism offerings. This surge is backed by a broader economic optimism in the region, as Asian countries continue to foster environments that attract significant international attention and investment.

Conversely, the situation in China has shown the complexities of rapid economic transitions. Sunil Tuli, President of APTRA and King Power Group (Hong Kong) Group CEO, recently pointed out that despite a general slowdown, China remains a critical player in the region’s economic landscape, particularly in the travel retail channel. Last year saw a hopeful resurgence in

travel following China’s easing of travel restrictions, although the recovery has been slower than anticipated.

Airports, no longer just transit points, are becoming vibrant retail hubs where culture, commerce and technology converge. Innovative practices such as virtual reality fittings and AI-driven personalized shopping are enhancing customer experiences, making shopping seamless and more engaging.

Increasingly, travel retail is more about creating an experience than making a transaction. Innovations such as pre-travel digital shopping platforms, exemplified by partnerships like that of Lagardère Travel Retail with Inflyter, are reshaping how consumers engage with travel retail by allowing them to browse and purchase goods before they reach the airport.

The integration of technology in APAC travel retail continues to revo-

lutionize the industry, pushing beyond traditional boundaries. Advanced implementations include augmented reality (AR) fitting rooms and interactive digital kiosks; Shiseido’s advanced diagnostic tools uses AI technology that provide personalized recommendations. AI-driven data analytics are being employed by retailers like Lotte Duty Free to predict purchasing behavior and optimize inventory. Additionally, the surge in mobile commerce and the implementation of seamless omnichannel services are enabling consumers to shop anytime, anywhere, without the constraints of travel schedules.

The Chinese traveler remains a crucial customer throughout the region, and the preferences and behaviors of Chinese travelers continue to evolve, showcasing a distinct divergence based on chosen destinations, according to recent findings by travel retail research company m1nd-set. This shift, markedly influenced by the aftermath of the global pandemic, highlights a nuanced transition in both travel motivations and shopping habits among this demographic.

Chinese tourists are making a notable pivot toward destinations that are not just vacation spots but also serve

as cultural and experiential hubs. This trend reflects a broader desire among travelers to engage more deeply with the destinations they visit. Instead of traditional sightseeing or shopping excursions, many are now seeking immersive experiences that offer a sense of connection and understanding of the local culture.

The Asian consumer market is showing a marked preference for sustainable and ethically sourced products. Sustainability is becoming a cornerstone of brand and retail strategies across the region. Consumers are increasingly aware of environmental issues and seek brands that prioritize sustainable practices. This shift is influencing stock choices at duty free outlets, where eco-friendly products and packaging are becoming more prevalent.

Another noticeable trend globally, and APAC is no exception, is toward enhancing the passenger experience by providing a strong local flavor in retail offerings. This approach both caters to the cultural curiosity of international travelers and offers familiar favorites to local populations.

Lotte Duty Free’s rebranding of its downtown shopping store in Seoul to “Now in Myeong-dong” highlights local

cultural elements. The store’s design incorporates multilingual signage and local architectural cues to attract both international visitors and Korean nationals. In Australia, Heinemann Asia Pacific collaborates with local brands to offer passengers at Sydney Airport a unique selection of Australian products, thus enhancing the travel retail experience by offering a taste of the local culture.

Such initiatives across Asia Pacific travel retail demonstrate a conscious move towards creating a more engaging and culturally rich shopping environment, which is appreciated by international tourists and local consumers alike, providing a sense of place, boosting sales and promoting local culture and products on a global platform.

The next five years are critical for stakeholders in Asia’s travel retail industry. As Jane Sun optimistically notes, Asia is poised to account for half of the global GDP growth, thanks in part to its thriving tourism sector. However, as Sunil Tuli has warned, the market must navigate various economic pressures and changing consumer demographics to maintain momentum.

The Asia travel retail market is at a pivotal juncture. With robust growth projections and a rapidly changing retail environment, stakeholders need to leverage technological advancements and align with evolving consumer expectations to harness the potential of this vibrant sector. The strategies implemented today will pave the way for future successes and set a benchmark for global travel retail markets.

To capitalize on these evolving trends, airports and other travel hubs are investing heavily in enhancing the retail experience. This includes expanding luxury and duty free goods offerings as well as incorporating local products that reflect the cultural heritage of each region. Such strategic enhancements are crucial for sustaining growth and remaining competitive in the dynamic Asia travel retail market.

Delhi Duty Free’s approach is deeply rooted in understanding and responding to the evolving preferences of a diverse clientele, utilizing data analytics to tailor their service offerings

Capitalizing on a surge in international travel to redefine retail experiences at the crossroads of culture and commerce, Delhi Duty Free implements digital solutions to enhance customer engagement and streamline shoppingby HIBAH NOOR

India has been top of mind for the travel retail industry, as demonstrated by APTRA’s recent India 2024 Conference. And Delhi Duty Free has firmly positioned itself as a leader in this burgeoning market, notably acting as the Platinum Host Partner for this event, demonstrating a steadfast commitment to excellence in service and innovation in travel retail.

Delhi Duty Free (DDF) has been proactive in capitalizing on the post-pandemic recovery of global travel, taking advantage of the surge in international travel from India. The company has implemented a series of strategic initiatives aimed at optimizing customer engagement and enhancing the shopping experience. “India spearheaded the global travel retail recovery with increased passenger numbers

traveling abroad, resulting in stronger business growth,” Ashish Chopra, CEO, DDF stated. “Initiatives included enriching the product range, refining store layouts to enhance customer flow, enhancing staff training, and driving premiumization to elevate the overall shopping experience.”

Since the stores opened in 2017, the adoption of digital technologies has been paramount for the travel retailer. “Since the installation of digital enhancements such as video walls and digital screens in our stores, we have seen enhanced customer engagement,” says Chopra. “These technologies have allowed us to deliver targeted promotions, showcase product features and create immersive shopping experiences resulting in increased customer satisfaction and higher sales.” This emphasize on digital transformation is complemented by the expansion

of their online pre-order service, which integrates online and in-store shopping to provide a seamless, personalized customer experience.

DDF has proven itself a premier venue for new product launches and exclusive brand collaborations, according to Chopra, “DDF is increasingly sought out as a partner to showcase new products and exclusive launches,” he says. “Our collaborations with brands like Royal Salute for the 25-Year-Old Delhi Edition

and multi-fragrance campaigns like ‘Fly With Me’ demonstrate our commitment to offering unique and innovative products that appeal to our diverse customer base.”

The integration of local Indian products such as Single Malt Longitude 77 into the retail mix plays a crucial role in the company strategy, Chopra notes, “These products not only showcase the rich cultural heritage of India but also cater to the preferences of local and international travelers looking

for authentic experiences. We ensure a strong sense of place by curating a diverse selection of products that reflect the spirit of India.”

The rise of the Indian spirits market has favorably impacted DDF’s liquor sales. As consumer preferences shift towards premium and exclusive spirits, DDF continues to adapt its offer. The growth is mirrored in the fragrance and cosmetics categories, which have seen significant increases due to new brands, premiumization and promotional activi-

ties. “Indeed, our fragrance and cosmetics sales have experienced significant growth recently,” says Chopra. “This can be attributed to various factors such as the introduction of new brands, exclusive launches, and promotional campaigns aimed at enhancing the shopping experience.”

DDF’s approach is deeply rooted in understanding and responding to the evolving preferences of a diverse

clientele, utilizing data analytics to tailor their service offerings. “Data analytics and customer feedback play a crucial role in our continuous improvement efforts at DDF. This data-driven approach enables us to deliver personalized experiences and enhance customer satisfaction,” Chopra says.

The retailer is committed to continuously addressing the ever-changing tastes and preferences of international travelers, says Chopra. “DDF regularly updates its product selection and store layout,” he states. “We conduct market

research, monitor industry trends, and collaborate with brand partners to ensure that our offerings align with current consumer preferences. Additionally, we regularly refresh store layouts to create inviting and immersive shopping environments that resonate with our diverse customer base.”

Looking forward, Chopra is optimistic about the growth of travel retail in India, driven by economic factors and an expanding airline network. “Our out-

look for the travel retail sector in India over the next few years is optimistic. We anticipate continued growth in international travel,” he remarks, indicating his readiness to meet future market demands with continued innovation and customer-centricity.

As Delhi Duty Free continues to evolve and adapt, it aims to maintain its role as a pivotal player in shaping the future of the Indian travel retail industry, ensuring it remains at the forefront of delivering exceptional experiences to travelers worldwide.

Delhi Duty Free is committed to continuously addressing the ever-changing tastes and preferences of international travelers

Delhi Duty Free is committed to continuously addressing the ever-changing tastes and preferences of international travelers

Lotte Duty Free is redefining the shopping landscape with its innovative omnichannel approach, ensuring a fluid and cohesive experience from online exploration to in-store interaction, covering all phases from entertainment to engagement to purchase and beyond

by HIBAH NOORAt the heart of Lotte Duty Free’s strategy lies a keen understanding of the consumer landscape. The company’s innovative approach is about more than simply facilitating transactions; rather, it’s about creating memorable experiences that resonate well beyond the point of sale.

Events such as all-night parties during Chuseok, family concerts and fan meetings are not just sidelines to the retail experience, but central to it. These gatherings are meticulously designed to offer customers a blend of entertainment and shopping, a formula that has proven successful in attracting a diverse clientele. The allure of such events, especially among foreign visitors, is a testament to Lotte Duty Free’s

ability to tap into the global Korean wave, leveraging it to not only enhance the appeal of their offerings but to also make significant inroads in terms of sales and customer loyalty.

Lotte Duty Free recently unveiled its “Hit a Homerun” spring campaign. As part of the campaign, the retailer teamed up with lifestyle brand New Era to present an exclusive pop-up activation at its Myeong-dong main store.

Inspired by the MLB (Major League Baseball) World Tour Seoul Series 2024, the March pop-up showcased the Seoul Series collection featuring baseball caps worn by MLB players, as well as T-shirts and hoodies. The campaign also included a prize giveaway and several

Duty Free operates 14 stores in six overseas countries

Daehyun Ahn, Head of Travel Retail Business Innovation Group, Lotte Duty Free

shopping promotions such as exchange rate compensation and a doubling of benefits for partner credit card users.

The introduction of various popup stores and special events at Lotte Duty Free locations underscores the company’s commitment to providing a

dynamic shopping environment. Such initiatives cater to the preferences of individual shoppers, many of whom seek out experiences that transcend conventional retail boundaries. This focus on experiential retailing has not only contributed to Lotte Duty Free’s growth in sales but has also played a pivotal role in cementing its status as a leader in Korea’s tourism industry.

Daehyun Ahn, Head of Travel Retail Business Innovation Group at Lotte Duty Free, says, “The tourism and consumption trends of millennials and Gen Z focus on experiential content. Lotte Duty Free has introduced an array of retail experiences by operating these types of pop-up stores based on its product sourcing capabilities and brand collaboration experience.”

From family concerts to pool parties, the retailer gives customers the chance to not only buy products, but also participate in new and memorable experiences. This strategy, rooted in offering unique, culture-driven experiences alongside traditional duty free shopping, reflects a broader trend in the travel retail sector towards creating value that extends beyond the physical products to include emotional and memorable

experiences. This approach not only drives sales but fosters a deep sense of brand loyalty among customers. “Lotte Duty Free strives to provide differentiated customer experiences and contribute to Korea's tourism industry, beyond offering good products and cheap prices on duty free purchases,” he continues.

KCS restricts Daigou

Daigou shopping has traditionally played an important role in Korean travel retail, but earlier this year Korea Customs Services (KCS) implemented new regulations designed to control this type of trading. The impact of these rules, which relate to both individual consumers and overseas bulk buyers, are being closely monitored by travel retailers.

Under these changes, individual shoppers are prohibited from buying more than 50 pieces of any SKU or ten bags and watches. Additionally, shipping goods by freight cargo (air or sea) out of Korea for individual B2C customers is no longer an option. Returning to pre-pandemic ways, shoppers must now hand carry, or if purchasing duty free goods downtown, must collect at airport

pick-up points. This is the case for both imported and domestic products. For wholesalers, delivery by freight cargo is now possible only for carryover and in-stock products. This covers cosmetic products that have been stored for more than two months and other items including alcohol and cigarettes that have been stored for more than three months.

This quantity limit and the restriction of cargo shipments to B2B trade was put in place to help resolve market disruption and illegal deviation caused by the increase of bulk transactions. Korean retailers have already been facing a competitive market and experiencing low profitability due to a slow recovery, limited spending related to China’s weak economy and the continuing lack of Chinese travelers, and these regulations now add to the pressures.

The impact is evident, with over 40% drop in duty free sales nationwide since implementation month-on-month (January vs. February 2024, excluding inflight retail). Strict action by KCS has caused travel retailers to refocus on personalized demand among indi-

vidual consumers. Lotte Duty Free is investing in online growth, business diversification and international market development.

“Lotte Duty Free is looking for ways to send goods overseas in large quantities. We are also preparing to order and stock certain products a season earlier, so we can sell them when customers want. Furthermore, we will provide customized benefits for individual tourists and strengthen marketing activities through various activities such as special exhibitions and discount events through online and offline channels,” says Ahn.

Lotte Duty Free announced a pioneering AI and big data-based personalized marketing automation system (MAS) last year. The system enables superprecision marketing for individual consumers and maximizes shoppers’ benefits. It is designed to strengthen the retailer’s digital capabilities and progress from “simple repetitive marketing” that targets an unspecified number of people. According to Ahn, by capturing the needs of shoppers throughout the consumer journey and automatically delivering information and offers at the right time, the implementation of

personalized MAS marketing has more than doubled clicks and increased conversion rates by more than 10 times compared to traditional mass marketing.

“Lotte Duty Free currently has over 60 types of scenarios, and it plans to create new customized scenarios based on performance analysis of existing ones. Recently, various attempts have been made such as collaborating with brands to conduct personalized marketing,” he says.

Ahn outlines the strategic evolution of Lotte Duty Free, emphasizing its commitment to revolutionizing the shopping experience. By intricately weaving together its digital and physical operations, the retailer aims to create an indistinguishable and cohesive shopping journey. This innovative omnichannel model prioritizes consumer convenience, ensuring a fluid transition between online browsing and in-store purchasing.

To illustrate, Ahn mentions Lotte Duty Free’s virtual experience space where consumers can try on sunglasses without having to visit a physical store.

“At the first experiential duty free shop-

ping showroom, consumers can check product information via QR codes and kiosks and connect to an online duty free store for easy payment. We will continue to introduce online and offline stores and make shopping more convenient for our customers,” he says. “Lotte Duty Free has shut down its live e-commerce business and plans to focus on its original online and offline duty free business.”

Originally named LDF House, Lotte Duty Free’s duty free showroom has been rebranded to “Now in Myeongdong.” The store, which launched in October last year, aims to revitalize the Myeong-dong commercial district in Seoul and create a new tourist attraction. Inspired by the district’s street signage, the travel retailer also revealed the store’s new visual identity. Visuals combine English and Chinese characters to cater to international shoppers.

To celebrate the rebranding, Lotte Duty Free offered a variety of merchandise such as shopping bags, iPhone cases, stickers and Griptok in-store. The retailer also introduced its “employencer” campaign (a portmanteau of “employee” and “influencer”), which encourages its executives and employees to directly promote “Now in Myeongdong” via social media.

Gebr. Heinemann continues to focus on airside and domestic locations as part of its growth strategy in Australia. The company’s CEO Asia Pacific, Marvin von Plato, has spoken about the company’s “focus on outreach to non-travelers and on landside property development,” which has so far proven to be a shrewd direction, increasing awareness among domestic customers of the company’s retail offer on Australia’s east coast.

Von Plato says the company was pleased to start operations at the Sydney and Gold Coast Airport terminals last year with a strong response from

Gebr. Heinemann has its sights set on expansion in the Australian domestic market, as the prominent travel retailer reports strong trading after recent store launches at Sydney and Gold Coast duty paid airport locations

by ALISON FARRINGTONtravelers that has grown every month as more passengers became aware that Heinemann’s duty paid offer is available domestically now. “This has reinforced our value proposition of a world-class retail offer even in domestic; traditionally these kinds of luxury and premium concepts have been reserved for international duty free,” he tells Global Travel Retail Magazine.

More opportunities

Heinemann’s newfound presence in domestic airport retail is a boon for its brand profile. “It opens up so many doors in terms of passenger engagement that aren’t available in international

terminals,” he says. A great example is the retailer’s recent fan meet-and-greet event with F1 driver Nico Hülkenberg at its Sydney Airport domestic store a few days before the Australian Grand Prix in Melbourne. As spectators at the Melbourne race are overwhelmingly interstate visitors as opposed to overseas, von Plato says Heinemann was able to engage with more passengers (400+) than it might have been able to in the international terminal.

Building on its existing footprint in the international terminal, Heinemann’s Gold Coast opening in November 2023 has focused on local brands for the fashion and accessories offer, including

22 brands ranging from international luxury to uniquely Australian products, with a full beauty line-up joining soon, according to the company.

“We continue to look for more opportunities to increase the number of touchpoints we have with travelers as part of our goal to be a valuable travel companion and really deepen our footprint in the markets in which we operate,” says von Plato.

With the continued rise of beauty sales in Asia’s travel retail market, Gebr. Heinemann has invested in its beauty offer at Sydney Airport. “The overall

recovery is being driven by the return of Chinese free and independent travelers (FITs), who account for a significant share of the region's travel retail beauty sales,” von Plato says.

“We have dedicated a large space to beauty to offer a more expansive range that includes experiential and boutique spaces for marquee brands like La Prairie, Chanel and Dior,” he adds. These join Hermès, Acqua di Parma, Burberry, Chloé and Fresh, which are all available at an Australian airport for the first time.

Von Plato says Gebr. Heinemann keenly observes market trends in beauty, “We have watched the growth of niche

and independent brands as customers seek out newness and unique products, and clean and sustainable beauty for more conscious consumers. Our Sydney Airport store has been a great stage to launch exclusives and firsts in travel retail given its position in the airport’s ‘luxe precinct’ and the sheer size of the store.”

Heinemann has reopened stores in Kuala Lumpur and Hong Kong recently, in line with its efforts to bring its Asia business back to a pre-pandemic sales performance as quickly as possible.

Von Plato says the retailer’s business

The beauty offer at Heinemann’s Gold Coast domestic store has a full line-up coming soon

The beauty offer at Heinemann’s Gold Coast domestic store has a full line-up coming soon

in Hong Kong has come back strongly, “In fact some stores have already achieved sales figures comparable to 2019 in some months, an exceptional result considering our Sweet Dreams stores were the last in Asia Pacific to reopen after the pandemic.”

The company has looked to seasonal marketing to boost its regional appeal in Hong Kong. “We received strong support from various partners, resulting in a greater number of brand promotions compared to the previous year,” explains Von Plato.

Heinemann officially unveiled its

redesigned store at KLIA Terminal 2 international departures in May last year while the travel retail market was still slow in Malaysia. “We took the opportunity to redevelop our shops during the post-COVID recovery period, ensuring we feature a wide array of new and exclusive brands,” says von Plato. “These include beauty brands Helena Rubenstein and Sol De Janeiro, with Jelly Cat soft toys as additions to our exclusive brand line-up, contributing to our sales growth this year.”

Von Plato says this location’s success has been down to ever-changing brand

activations across the wide array of fragrances, skincare, cosmetics, watches and jewelry and confectionery categories. “It was important to feature an impressive assortment of new launches, travel retail exclusives and value options while running strong seasonal campaigns with Malaysia Airport to keep our travelers fully engaged and excited.”

Next, von Plato is working on new store openings coming up at Auckland Airport. “We are very much focused on deepening our footprint in our current markets to truly become a valuable travel companion,” he adds.

As Chinese outbound travel gains momentum, a new generation of tourists is demanding personalized, sustainable and culturally rich experiences, presenting opportunities for savvy travel retailers to thriveby WENDY MORLEY

The economic power of Chinese tourists continues to be a driving force in global tourism and related industries, including travel retail. The resilience of China's luxury market and its expected steady growth underline a recovery in consumer confidence and a resurgence in international travel post-pandemic. This shift is poised to benefit the global hospitality and retail sectors, offering broader economic advantages.

The luxury travel market is evolving to cater to the changing preferences of affluent Chinese tourists, fulfilling the desire for unique, high-quality experiences. This market is anticipated to grow significantly, its value projected at US$1.38 trillion in 2023 with an expected 7.9% CAGR from 2024 to 2030, with growth fueled by the increased spending capacity of elite

travelers, the popularity of micro-trips, and a booming global tourism sector, according to global management consultants Bain & Company.

The travel and shopping behaviors of Chinese tourists show a clear preference for destinations that are not only vacation spots but also cultural and experiential hubs. Increasingly, they seek immersive experiences that offer a deeper connection with local cultures rather than traditional sightseeing or shopping.

We are seeing significant changes in traveler demographics and preferences within this cohort. Gen Z has emerged as a crucial demographic, comprising about 30% of new Chinese travelers. These younger tourists, often with stable incomes, are opting for unique experiences to share on social media. They tend to travel to geographically closer destinations to maximize experiences on shorter trips. This group prefers to engage in luxury shopping at home more than abroad.

Sustainability has become crucial in travel and consumption decisions, with an increasing number of Chinese tourists opting for eco-friendly travel

options and prioritizing destinations that emphasize environmental conservation. This trend extends to their shopping habits, favoring products that are ethically sourced and environmentally sustainable.

Outbound travel, while increasing, is not expected to reach pre-pandemic levels until 2025, though Chinese domestic travel is booming, according to Economist Intelligence. This year has seen a significant expansion in flights to popular destinations such as Thailand, Japan and various European capitals from China, however, with airlines sometimes doubling or even tripling flights to key destinations, especially during peak travel seasons like the Lunar New Year and Golden Week.

Destination-specific marketing has become more sophisticated, utilizing both digital and traditional media to attract Chinese tourists. Jing Daily states that collaborations between tourism boards and travel agencies are producing tailored offerings that highlight unique cultural experiences and highquality shopping opportunities. These

marketing efforts are supported by digital campaigns on platforms popular in China, such as WeChat and Weibo, which not only raise awareness but also simplify travel planning and booking, increasing the overall appeal of these destinations.

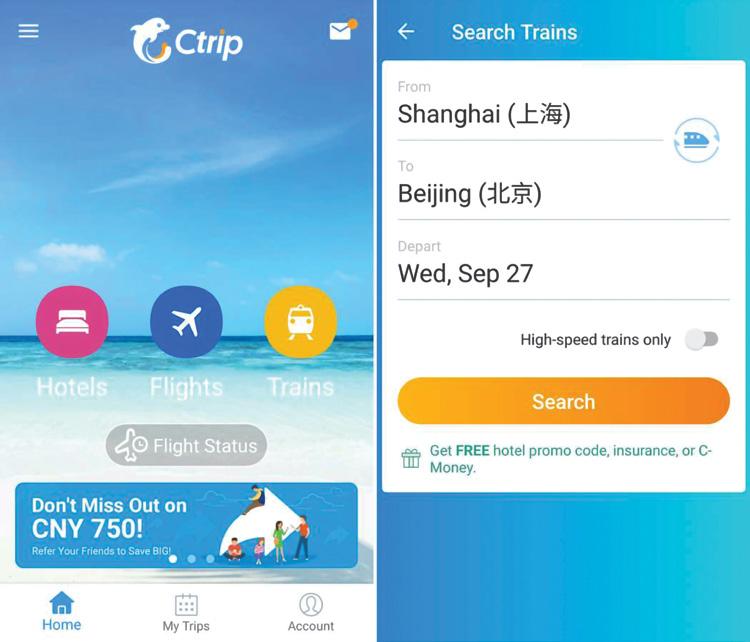

ITB China reports that the travel behaviors of Chinese tourists are increasingly shaped by advanced digital tools and platforms such as Ctrip, Qunar and Fliggy. Travel apps offering AI-powered recommendations, virtual reality previews and personalized itinerary planning are revolutionizing how journeys are planned by streamlining the planning process and providing personalized travel experiences based on individual preferences. Additionally, social media platforms play a critical role in travel decision-making, offering a mix of inspiration and practical advice that influences destination choices.

While travel has picked up since the reopening last year, the economic slowdown in China is dampening the recov-

ery pace of outbound tourism, affecting Chinese travelers' spending abroad and necessitating adjustments in business strategies to remain attractive to this key demographic. However, this scenario also drives innovation in catering to evolving preferences for more personalized and culturally relevant experiences.

Businesses can enhance their appeal by offering services such as Mandarinspeaking staff, Chinese food options, and popular Chinese payment platforms like Alipay and WeChat Pay, states Jing Daily. Digital engagement is crucial, and the convenience of these familiar platforms significantly impacts the travel decisions of Chinese tourists.

Additionally, the influence of Key Opinion Leaders (KOLs) and influencers on platforms like Douyin and Little Red Book is pivotal. Collaborations with these figures can drive awareness and attract tourists through aspirational content that showcases unique experiences and brand offerings.

As projected by Travel Daily News China, the trajectory for Chinese outbound tourism will not only recover to pre-pandemic levels but will continue to climb. The allure of global travel for Chinese tourists is not just rebounding; it's evolving with promising vigor. China's intensified desire to traverse international borders is anticipated to play a pivotal role in the global travel dynamics, fostering an era of unprecedented growth for the industry, especially in luxury retail.

With a robust increase in outbound travel from China expected, the ripple effects will be felt across various global destinations. Chinese travelers are increasingly venturing beyond traditional tourist spots, seeking out unique and upscale experiences. This shift is creating fertile ground for businesses worldwide to innovate and cater to this lucrative segment, which shows a growing preference for premium services and exclusive offerings.

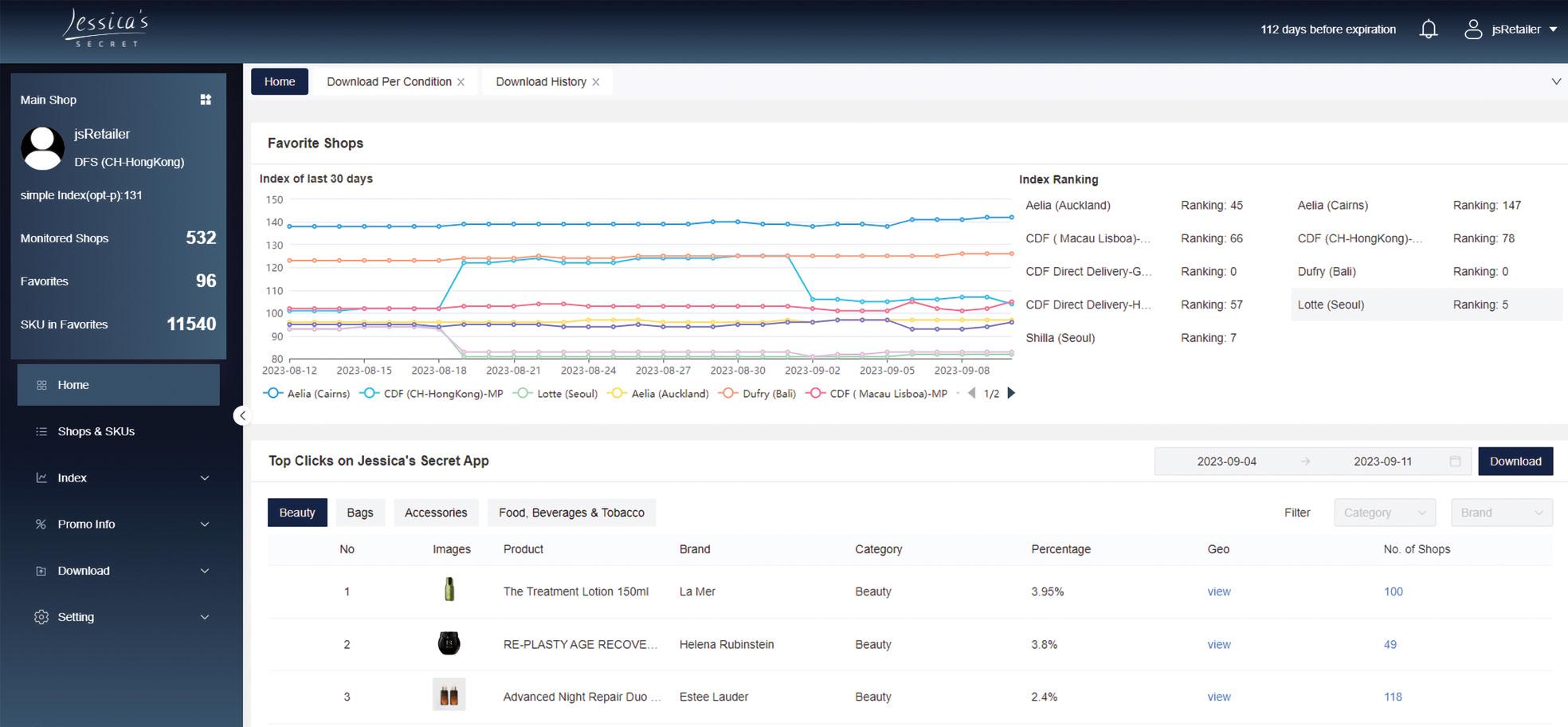

With a keen understanding of consumer trends, Jessica’s Secret uses cutting-edge technology to craft a seamless shopping experience for travelers, prioritizing intuitive design and strategic partnershipsby HIBAH NOOR

to the evolving preferences of Chinese travelers. His insights reflect a strategic commitment to enhance the travelers journey through technological innovation and user-centric features.

As the digital frontier of retail continues to expand, Jessica’s Secret has firmly positioned itself at the vanguard of travel retail’s digital transformation. Mirko Wang, CEO of Jessica’s Secret, has a clear vision on navigating the surge in online duty free shopping, especially when it comes

“From my perspective, online duty free shopping has always been a trend in the Chinese travel retail market,” he says. “Especially during the past few years of the epidemic, Chinese travelers have become more accustomed to using e-commerce to solve shopping problems, searching for which products are available at their destination before setting off.”

The foundation of Jessica’s Secret’s approach is to seamlessly connect users with a world of retail opportunities while offering unique functionalities

designed to simplify and enrich the user experience. “Jessica’s Secret has always been positioned as a bridge between the travel retail industry and travelers. There’s a direct jump function in the the app which travelers can use to go directly to the website of the retailer or brand. This function helps to lead traffic to retailer or brand sites from our app,” he notes.

The commitment to fostering an intuitive shopping experience extends to Jessica’s Secret’s strategic use of data to inform purchase decisions. “Jessica’s Secret helps and guides travelers to make purchasing decisions in the form of a price indicator calculated by utilizing powerful price database resources from all the retailers,” says Wang. “In addition, some retailers and airports have launched coupons on Jessica’s

Secret aimed at attracting more travelers to shop there.”

According to Wang, the platform has always served both the travel retail industry and travelers, particularly in the Chinese market. “Jessica’s Secret has always been positioned as a bridge between the travel retail industry and travelers,” he says.

In response to the dynamic growth of China’s travel retail market, Jessica’s Secret is implementing strategic initiatives to amplify its market presence and enhance performance. Wang details the company’s approach to engaging a growing user base and maximizing the utility of its platform for both travelers and retail partners.

Jessica’s Secret has now launched a member reward program, which is divided into four levels based on the member participation. “The purpose is to encourage travelers to use the app and its coupons more frequently while shopping,” Wang says. This tiered

rewards system is part of the company’s broader strategy to incentivize usage and increase engagement.

Wang says the innovative business model is designed to benefit the Jessica’s Secret community. “In the process of cooperating with retailers and brands, Jessica’s Secret may earn promotional fees or commissions. But earning these profits is not our purpose. We hope users can get more benefits, so we give these commissions to users in the form of points to the greatest extent, so as to increase our share of the coupon market,” he states.

While Wang says gauging the app’s tourism market share is difficult for to estimate, but those who use it are exactly the right people for travel retail brands and stores to reach. “It’s probably around 10 to 20%,” he says. “But users of Jessica’s Secret are all precise consumers, 100% of which are tourists who have purchase need. Depending on the coverage of coupons and the tacit cooperation with local retailers and brands, we will have a relatively large impact.” This

insight reflects the strategic importance of targeted partnerships and the effective distribution of benefits to sustain and grow the platform’s influence across key travel retail markets.

Jessica’s Secret’s approach to collaboration with brands and retailers exemplifies a dynamic synergy aimed at enhancing the user experience while boosting the visibility of its partners. The company’s promotional strategies emphasize the importance of cooperative relationships in the travel retail landscape. “We have many ways to cooperate with retailers, such as charging commissions and advertising fees which we give back to users, as mentioned. In addition, we also provide retailers with a lot of free advertising spots, like a banner on the homepage, for example,” Wang explains. Wang believes travel retailers are an important link in motivating tourists to shop. Therefore, Jessica’s Secret will not block communication between retailers and users if retailers have not

Jessica’s Secret already provides an AI Tracking analysis system for “almost all” leading brands and retailers in the industry

Jessica’s Secret already provides an AI Tracking analysis system for “almost all” leading brands and retailers in the industry

Jessica’s Secret’s team developed the “Watches & Wonders” Exclusive Virtual Expo

paid promotion fees. Instead, retailers are welcomed to display promotional activities on the app for free. This inclusive approach to collaboration invites a broad spectrum of retailers to engage with Jessica’s Secret users, ensuring a rich and diverse shopping experience.

“Now we have cooperation with many retailers, and we welcome more retailers to contact us for cooperative promotion to Chinese tourists,” says Wang. By fostering these collaborative efforts, Jessica’s Secret not only enhances the promotional landscape for brands and retailers but also positions itself as a pivotal platform in connecting the travel retail industry with a highly engaged traveler base.

The secret formula

Jessica’s Secret leverages a multifaceted strategy to attract and retain a robust user base, a critical factor in its success within the fiercely competitive domains of price comparison and travel retail. Wang details the strategic pillars supporting the app’s continuous growth and user satisfaction.

“We achieve attraction and retention in two ways: first, we provide travelers with more valuable functions; second, we collect and calculate various preferential and promotional information for travelers,” Wang says. This dual approach ensures that Jessica’s Secret remains not just relevant but indispensable to its users by offering unique functionalities and up-to-date promotional content.

Wang highlights the app’s innovative price indicator as a key feature, “Jessica’s Secret now provides travelers with

many interesting functions, such as the price indicator. Each score is calculated according to a grading algorithm mode on a scale of 0.1 to 10; 0.1 would be the highest price among all the data we collected worldwide, 10 means the lowest price. This feature helps travelers quickly discover which products are worth buying from this retailer.”

Jessica’s Secret also provides travelers with the ability to scan barcodes, quickly finding global price information. Soon, the app will include a “Gift with Purchase” feature, and a comparison of payment method exchange rates.

Jessica’s Secret adheres to rigorous data privacy and security protocols, with a dedication to safeguarding user information. “In recent years, China has continuously promulgated new personal information protection laws and policies, including information collection methods, collection purposes, usage methods, storage times, etc., to protect the legitimate rights and interests of Chinese travelers. Jessica’s Secret has been audited by China’s network information security department and has reached relevant standards,” Wang explains.

“In terms of actual operations, we have strengthened the creation of a network security environment to pre-

vent outsiders from intruding into our systems and stealing data,” he adds. “We have also signed information confidentiality agreements with our employees, etc., and have made improvements in all aspects.”

Wang describes how a typical Jessica’s Secret app user experience, “Half a month before traveling to a certain destination, travelers begin to frequently use Jessica’s Secret to find price information and discounts, sometimes completing product reservations during this process owning to a promotion offered by the retailer,” he says. During the journey, the app will push the duty free shops’ coupons information to users, and encourage them to visit the store.

Not only are travelers using Jessica’s Secret app, but some retailers are also cleverly using it to achieve higher sales conversions. “One traveler told me that when she was buying a necklace at an airport, the salesperson took out Jessica's Secret app and showed her the real-time price of this necklace in Hong Kong, Japan, and Taiwan, and the price she offered was the most competitive. So the traveler made the purchase decision immediately.” Wang recounts.

In response to global changes and emerging trends within the travel retail

industry, Jessica’s Secret has undergone significant transformation and expansion. “Before the pandemic, my company mainly provided service to customers. After the pandemic, we have evolved into a comprehensive big data company serving business and customer,” he states.

The introduction of innovative tools and services has enabled the company’s evolution, “We provide an AI Tracking analysis system for many top-renowned brands and retailers. Almost all the leading brands and retailers in the industry are already using our price analysis system,” Wang says. This tool represents a cornerstone of Jessica’s Secret’s value proposition, offering detailed insights into pricing strategies across the travel retail channel.

As part of a partnership, Jessica’s Secret regularly creates and releases the OTRO (Oriental Travel Retail Observer) report, further demonstrating the com-

pany’s commitment to delivering actionable intelligence to its partners. “We create a monthly report called OTRO, with multiple leading brands and retailers subscribing. We have served many big brands for more than four years,” Wang notes, highlighting the company’s role as a thought leader and information hub in the travel retail space.

Including design and IT, this is just one of the ways Jessica’s Secret caters to the nuanced needs of its business partners. “Jessica’s Secret IT department provides IT services to KingPower and CDFG, including the development and operation service of Chinese e-commerce website and membership mini-programs,” Wang states. These services, combined with Jessica’s Secret’s indepth market research capabilities and cost-effective design solutions, solidify its competitive edge and position as a comprehensive service provider in the travel retail industry.

(OTRO) is the first travel retail industry report generated from a Chinese perspective. It includes monthly sales data of duty free retailers in Hainan, transaction prices of key SKUs of wholesale trading in Hong Kong from South Korea, latest industry dynamics, regulations, brands, key SKU price changes and interview takeaways with industry experts and/or wholesale Daigous

Industry visionary, Portland Design’s Ibrahim Ibrahim calls for airports to embrace their potential as dynamic place brands, creating enriched environments that foster community and deepen brand engagementby WENDY MORLEY

In an era where every touchpoint can influence brand perception, airports have a unique opportunity to redefine their roles not just as transit points but as dynamic, influential place brands in their own right, says Ibrahim Ibrahim, Managing Director of Portland Design, renowned for his forwardthinking approach to design, branding and commerce.

Ibrahim envisions a compelling vision for the future of airports. His insights highlight the transformative potential airports hold, moving beyond conventional revenue models to become vibrant, community-centric spaces that resonate deeply with travelers and consumer brands alike.

Branded value

Ibrahim challenges the status quo, pointing out a significant oversight in

how airports have traditionally viewed their own function and potential.

“Airports have the potential to be the most powerful media platform for any brand, and I believe they are missing that opportunity. When it comes to the commercial offer, airports by and large think in traditional ways, about transaction, about turnover, MAGs (minimum annual guarantees) and rent. There is an opportunity to think of the airport firstly as a brand, to think beyond real estate, beyond a terminal, beyond a shopping center,” he says.

This critique lays the groundwork for a reimagined airport experience – one that prioritizes brand DNA, storytelling, engagement and emotional connection over mere transactions. “It’s about creating the story, defining a clear and compelling proposition,” he says. “I think the future will rest on who owns

Portland Design Managing Director Ibrahim Ibrahim says as things stand airports are missing the opportunity to be the most powerful media platform for any brand, stating they need to think beyond real estate, beyond a terminal, beyond a shopping center

the passenger. And who owns the passenger is a brand issue. I mean, own the passenger emotionally. Airports have an opportunity to really build their brands, and they need to take that opportunity.” This vision extends beyond the physical infrastructure, encompassing the social and digital realms where airports can amplify their presence and engage with a global audience.

Ibrahim sees airports as dynamic place-brands with the potential to enhance loyalty in both B2B and B2C relationships, while also building a strong sense of loyalty within their own teams.

The shift towards seeing airports as powerful brand platforms requires a fundamental change in perspective. Ibrahim points out that many airports lack a compelling social media presence, which is a missed opportunity for enhancing brand loyalty and engagement. He stresses the importance of internal branding, stating, “Much of what we’re doing is internal branding, for brands to engage their own people. It’s very interesting. We’re doing a big piece at the moment for a leading sports brand. And most of what we’re doing is internal branding.”

If an airport is now a dynamic platform that attracts and promotes partner brands, it can leverage its unique position as a brand in its own right. This shift is driven by the understanding that airports, often just seen as transit hubs, hold a captive audience of travelers who, already invested in the act of traveling, display a high propensity to spend. This makes the airport an optimal stage for brands across the duty free categories from spirits to accessories, P&C, confectionery and beyond.

Ibrahim addresses the exceptional value of interactions within this setting,

1. Data-driven media value: Ibrahim states the critical importance of leveraging data to showcase an airport’s ability to generate significant media impressions, suggesting that commercial managers must focus on quantifying and communicating the value of airport spaces as powerful spaces. He says: “They’ve got to be focused on capturing data that can prove an airport can drive media impressions and therefore determine what the value of those media impressions are.”

2. Authentic luxury experiences: While luxury is a focus of the airport retail dynamic, Ibrahim criticizes the lack of genuine luxury experiences. “I don’t believe you can ever have a luxury retail experience if you have to end up along that journey on a conveyor belt like a supermarket,” he remarks. His believes airports must create authentic luxury experiences that go beyond the product to include the entire airport experience.

3. Rethinking commercial spaces: Lastly, Ibrahim advocates for a revolutionary approach to conceptualizing commercial offers in airports. He suggests moving away from traditional retail models towards more engaging and dynamic experiential spaces: “Think about your commercial offer less and less like boxes with glass fronts and shelves with light boxes and more like a stage set that’s programmable.” He adds: “From shelves with products for sale to stages with experiences to share!”

“You can have a click in an airport, and it is very valuable because the person is right there, excited, expectant and ready to spend, engaged in the mindset of travel and discovery.” This insight highlights the value of customer engagement, where the cost per click –

or the cost of engaging a customer – is significantly outweighed by the quality and readiness of the consumer.

The opportunity is to offer more than transactional experiences. If airports create compelling, unique and engaging experiences that passengers feel are

Airport terminals could become multi-use spaces where coworking, learning, and health and wellness join retail, food and entertainment –in line with societal trends toward a more flexible work environment and a greater focus on health and personal development.

NOTE: IMAGE NOT ASSOCIATED WITH IBRAHIM IBRAHIM OR PORTLAND DESIGN

SINCE 1978

worth sharing and exploring when they get back home, the potential for brands is to recruit that passenger and turn them into a customer for life.

“If a brand spends eight cents on a Facebook click that lasts a millisecond, how much would a brand spend for the undivided attention of a fan or a potential customer for 40 minutes?” he muses. “And that passenger in an airport, don’t forget, is an A1 consumer, and is global.” Such interactions extend beyond mere transactions; they build lasting impressions and deepen consumer relationships.

By positioning themselves as brands, airports not only amplify their own identity but also create enriched environments that facilitate deeper connections between travelers and the brands within their premises. This symbiotic relationship fosters a cycle where travelers, influenced by the airport’s branding, become active promoters of the brands they engage with. This enhances brand loyalty and consumer engagement, leveraging the airport’s platform to create a community of shared interests and heightened brand interaction.

The new community Ibrahim’s vision extends beyond branding to the transformation of airports into spaces that incorporate coworking areas, health and wellness centers,

beauty services and opportunities for learning, reflecting broader trends already taking place, and creating environments that cater to the modern traveler’s needs and desires.

Ibrahim is critical of the old model that views airports primarily as shopping centers, stating, “The days of thinking about an airport like a shopping centers may be coming to an end.”

Ibrahim predicts a transformative future for airports, where coworking, learning, and health and wellness become integral components of the airport experience. He sees these elements not just as additions, but as essential features that blend with retail, food and entertainment and align with evolving societal trends towards more flexible work environments and a greater focus on health and personal development.

Envisioning how these services fit into the current airport dynamic, Ibrahim proposes a significant shift. Airports, in his view, have the opportunity to transition from being seen as transport hubs with transactional shopping to becoming vibrant, multifunctional spaces that are less like shopping centers and more akin to town squares.

In practical terms, Ibrahim imagines a day spent at the airport not just in transit but engaged in various activities: a traveler could arrive at the airport early, use a coworking space to catch up

on work, pop in and out for a coffee or a snack, participate in a whisky brand’s educational seminar, receive a haircut, dine at a restaurant, and even complete a workout session at a Peloton or Soul Cycle gym.

He explains that this would change the economic dynamics for airports. Rather than earning primarily from rent and retail turnover, airports could capitalize on the value of media impressions driven by compelling experiences and live streaming, as well as the spending of visitors who engage with multiple services throughout their stay. Ibrahim acknowledges the challenges in implementing these visionary ideas, such as existing infrastructure limitations and contractual obligations.

Ibrahim’s insights offer a compelling vision for the future of airports as multifaceted platforms that deliver experience as well as transaction. His call to action for airports to embrace their brand identity and to innovate in how they engage with travelers and brands alike points to a new direction in the travel industry, where health, wellness, work and learning become integral to the airport experience. This redefined role of airports has the potential to not only enhance the travel experience but also to contribute to the creation of more vibrant, community-focused spaces around the globe.

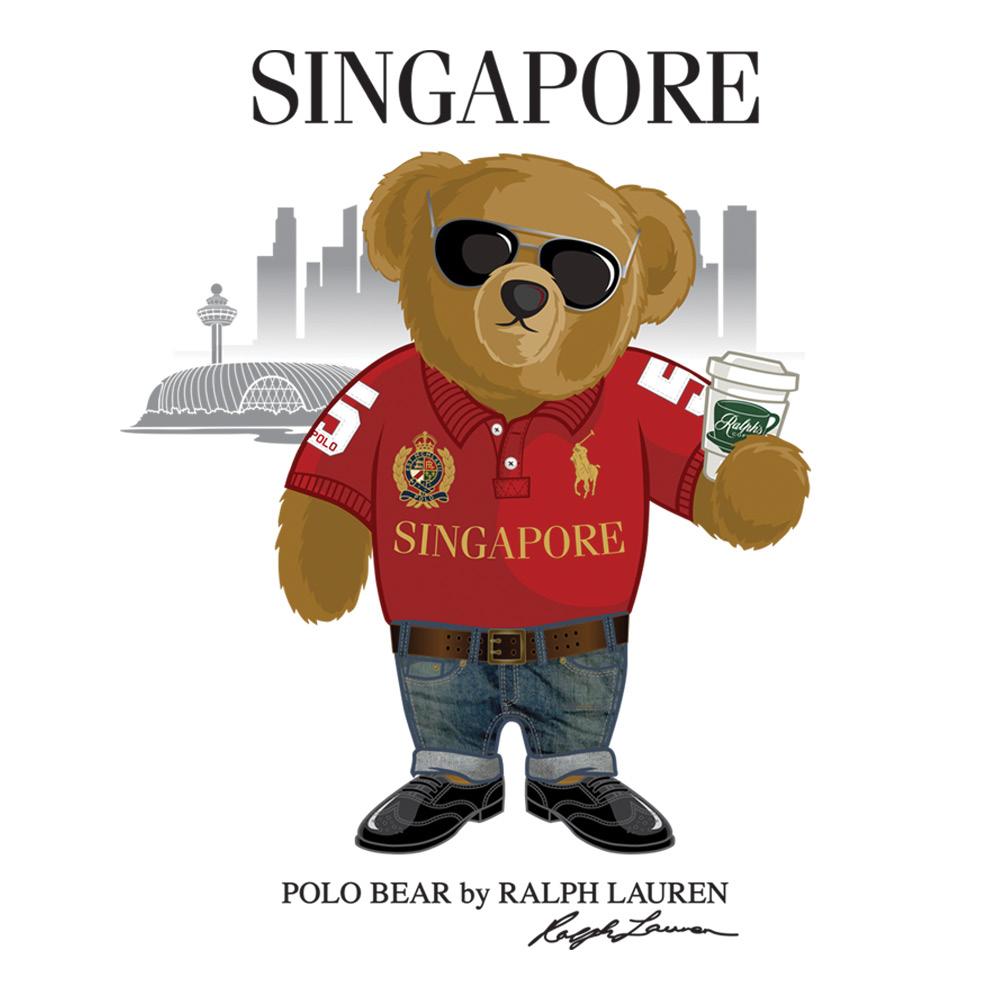

Committed to delivering worldclass visitor experiences,

Jewel Changi Airport is celebrating its fifth anniversary with a year-long series of special events and retail offers under the theme “What A Feelin5”by HIBAH NOOR

Jewel Changi Airport (Jewel) is celebrating its fifth anniversary with robust growth, recording a 26% increase in foot traffic for the fiscal year 23/24 compared to the previous year, which also saw a 20% increase in sales. Approximately 30% of the visitors were international travelers from China, Malaysia, Taiwan, the United States and Indonesia.

Canopy Park at Jewel, spanning 14,000 square meters, enjoyed a 12% rise in visitor numbers and a 35% surge in sales. Its unique Double Rewards loyalty program, which provides two sets of loyalty reward points for each transaction, witnessed a growth of over 10% in membership.

For its fifth anniversary, Jewel has planned a year-long series of special events and retail offers under the theme “What A Feelin5”, designed to evoke positive emotions through varied experiences. James Fong, CEO of Jewel Changi Airport Development, states, “Five years ago our shareholders –Changi Airport Group and CapitaLand – embarked on a bold mission to redefine the airport experience. Today we stand proud as a global icon well-loved by both local residents and travelers. As Jewel celebrates five years of creating the sparkling experience for its visitors, we continue to stay true to our commitment to deliver world-class visitor

experiences with our attractions, retail, and dining offerings. We are thrilled to announce a series of new flagship store openings and new-to-market brands as well as a behind-the-scenes tour for the Jewel Rain Vortex that has long captured the imagination of our visitors. New experiences and a series of events and Jewel-exclusive offerings will also be introduced throughout the year.

“As we look forward to more exciting years ahead, we wish to thank Singaporeans and guests from around the world for their love and extend our appreciation to our tenants and partners who have stood shoulder to shoulder with us all this time."

A new Light & Music showcase called “What A Feelin5” has been launched, featuring a five-minute show created by WET, incorporating elements like Jewel’s iconic façade and the local flora. Additionally, a new tour named “In the Eye of the Jewel Rain Vortex” will be available from the latter half of the year, providing a close-up view of the world's tallest indoor waterfall and insight into daily preparations at Canopy Park.

Jewel will host a series of marquee

events throughout the year, starting with “Jewel Blooms” during the June school holidays, from May 24 to August 11. This event will feature floral installations inspired by various emotions, designed in collaboration with Singaporean garden designer Andy Eng and Japanese floral artist Megumi Shinozaki. Additionally, Canopy Park tickets are on sale, and the Youth Floral Cup will reopen for young participants aged 7 to 12. Over 50 special collaborations and exclusive perks will be available across Jewel's retail and dining sectors as part of the anniversary celebrations. These include a Singapore-exclusive cold cup from Starbucks featuring the Rain Vortex, a Jadeite Pendant from Asian Artistry Fine Jewellery, and a Morgan Bow Handbag from Kate Spade, among others. Unique dining options will also be available, like the Cereal Lobster from Burger & Lobster and the Bejeweled Bombe from Sourbombe Artisanal Bakery.

Redefining the retail experience, Jewel is gearing up for numerous new store openings in May and June, including several flagship stores. Aligning with its

ethos of “Where the World meets Singapore, and Singapore meets the World,” the venue will host a variety of local and international brands. CHARLES & KEITH, a Singaporean fashion label, is set to expand its presence with its first flagship store at Jewel located in Basement 1. Other flagship stores include FILA’s first in Singapore, occupying a duplex at Level 2, Bimba Y Lola with its largest store in Singapore at over 1,600 square feet (149 square meters) on Level 1, and New Era at Level 2, offering unique customization services. Additionally, new-to-market brands such as IPOH TOWN, which offers traditional Ipoh cuisines, Nai Xue with its health-focused tea beverages, fashion and accessories brand SETIROM, Parisian jewelry brand Satellite Paris, and Royal Host, a popular Japanese family restaurant, are also making their debut at Jewel.

As Jewel commemorates its fifth year, it will partner with Metta Welfare Association (Metta) for a charity event. The proceeds from this event, including an auction, will support the new Maitri School/Building project, scheduled for completion by 2028. Maitri School will be Metta's second Special Education School, dedicated to educating students with moderate to severe Autism Spectrum Disorder (ASD). Twelve auction items have been donated by Jewel’s tenants for this event, including a limited-edition Louis Erard x seconde/ seconde x Watches of Switzerland watch and a BE@RBRICK FLOR@ collectible featuring a bouquet of red roses in its transparent torso. The highly coveted BLACKPINK x Starbucks® collection of tumblers, cold cups, and water bottles will also be available for bidding. For more details about the auction items and to place bids, visit the public bidding section available until April 21. For further details on the anniversary celebrations and to view the full lineup of events, visit Jewel’s dedicated 5th anniversary website.

Based on input from aviation industry experts and data analysis, Global Travel Retail Magazine reports on air connectivity in Asia Pacific, domestic vs. international growth in China and the potential of the Southeast Asian market within air travelby LAURA SHIRK

Serving as both a source and destination region, the increase of international visitors within Asia Pacific (APAC) is supported by Asia, with mainland China playing a key role in traffic flow. Elaborating on the current state of the travel industry in APAC, Joanna Lu, Head of Consultancy Asia at Cirium Ascend Consultancy, notes Cirium’s data shows the most improved international connection to APAC countries is led by United Arab Emirates, with departing international seats up 15%. “However, the main international connection is still driven by the capacity within Asia,” she says. According to Lu, Singapore, Japan and South Korea are the three markets generally recovered from the pandemic; China outbound travel to APAC is still almost 30% down versus 2019. “The main source(s) of inbound seats for Southeast Asia are also mainly from within the region, with Indonesia, Malaysia,

Singapore and Thailand leading. China inbound seats has only recovered to around 60% of the 2019 level,” says Lu.

In February of this year, Asia Pacific airlines saw passenger demand grow 53% year-on-year, which indicates international traffic to and from the region is still surging toward pre-pandemic figures. “The 2023 international passenger demand for Asia Pacific airlines recovered to 72.7% of 2019 levels,” shares Dr. Xie Xingquan, Regional Vice President for North Asia at International Air Transport Association (IATA). “International traffic within Asia reached 66.2% of 2019 levels in 2023, while the traffic between Asia and the Southwest Pacific reached 77.3%.” He says this is similar to the recovery in other markets where restrictions were removed earlier.

Speaking about the challenges in terms of restoring full connectivity and advancing traffic and financial recovery, Lu argues the concept of “full connectivity” does not exist, since changing environmental factors often results in the shift of travel patterns, which impacts traffic and capacity.

“Geopolitical tensions and regulatory hurdles can disrupt aviation connectivity and hinder the growth of the sector. Fostering regional cooperation and harmonizing regulatory frameworks are essential for promoting a healthy environment for aviation development in Asia Pacific.

Cirium’s data shows the most improved international connection to APAC is led by United Arab Emirates, with departing international seats up 15%

“The pandemic has led to significant disruptions in aircraft supply chain, airlines’ financial performance, and has reshaped human lifestyles, consumer preferences and behaviors, with a growing emphasis on health, safety and flexibility. Airlines and airports need to adapt their business models and service offerings to meet evolving customer expectations,” says Lu.

On how airlines have refocused their priorities considering the slower return of the Chinese market, Xingquan comments while domestic traffic in China has experienced far more growth than international traffic there is reason to be optimistic. From the reinstatement of its 144-hour-free-transit policy at certain points of entry to the extension of visa free travel to a number of Asian and European countries, government efforts are in place to relax visa conditions for foreigners.

In the case of Chinese travelers, the segment has shown a growing interest in cultural and nature-based tourism experiences such as visits to historical landmarks, heritage sites and natural attractions. “Family and group travel remain popular among Chinese travelers, especially for multi-generational

trips and special occasions,” says Lu. “Travel packages and services catering to families including child-friendly accommodations and activities are likely to be in demand.” Also, a “relatively small” percentage of Chinese travelers continue to value quality experiences and luxury travel options.

As discussed at Routes Asia 2024 in Langkawi, Malaysia, the Southeast Asian market is on track to be among the fastest-growing regions in the world and the untapped potential within the air travel industry is unmatched. Speaking at the event in February, ACI Asia Pacific and Middle East Director General Stefano Baronci remarked that Indonesia is expected to rank fourth among the globe’s busiest passenger markets by 2042. ACI estimates the Philippines, India, Indonesia and Thailand will top the fastest-growing markets between 2023-42, with CAGR between 6.2%-7.2%.

“Typically, any long-term growth in passenger demand is driven by macroeconomic and demographic factors. And how airlines will respond to this projected growth is a matter for

individual airlines to decide. What is key is that if the industry is to continue growing, it needs to do so sustainably. Airlines committed to Net Zero 2050 in 2021. This was reinforced by the longterm aspirational goal commitment by International Civil Aviation Organization member states in 2022,” explains Xingquan.

According to data collected by OAG for April 2024, total airline capacity in Southeast Asia was 38.8 million seats (59% domestic; 41% international), which is down 9.8% versus April 2019. Total seat capacity in the region increased 12% compared to April 2023. Regarding seats by country, Indonesia remained the highest ranked country at 11.9 million seats and accounted for 31% of the region’s air capacity; Thailand ranked second at 6.9 million seats and accounted for 18% of the region’s capacity. The leading data platform for the global travel industry reported the top domestic route in Southeast Asia remained Hanoi (HAN) to Ho Chi Minh City (SGN); Singapore continues to be a key international hub in the region, home to six of the top 10 international routes in the region starting or ending there. Plus, Lion Air remained Southeast Asia’s largest carrier by seat volume, with 3.4 million seats (based on departing seats). The airline’s capacity last month was 14% higher than in April 2019.

“The expansion of low-cost carriers [in APAC] has a significant impact on stimulating travel and tourism within the region. This, in turn, contributes to the growth of the tourism sector by increasing visitor arrivals, supporting local businesses, and generating economic activity in destination cities.

“Successful low-cost carriers continually expand their route networks to tap into new markets, increase market share, and capture passenger demand. This involves identifying underserved routes, launching new routes with high demand potential, and strategically positioning hubs to facilitate seamless connections,” concludes Lu.

VISIT US AT THE TFWA ASIA PACIFIC EXHIBITION & CONFERENCE

SINGAPORE

STAND BASEMENT 2-G18 MINI TREATS IN A RE-USABLE

In this exclusive interview with Global Travel Retail Magazine (GTR Magazine), Charlotte Birley, Managing Director at experiential marketing agency ALIVE, sheds light on the innovative strategies and groundbreaking initiatives of the Singaporebased company. ALIVE, renowned for its unique blend of experiential and personalized marketing solutions, is setting new standards in the travel retail sector. With a focus on bridging the gap between physical and digital realms, Birley discusses the company's latest venture, Aviator, and its transformative impact on navigating the complexities of airport marketing.

GTR Magazine: On the company’s website, the team at ALIVE is described as not human beings, but “humans doing.” How does this thinking help the company to set itself apart from its competitors?

Charlotte Birley (Birley): ALIVE has established a culture of serving and acting with intention and accountability. That means training and empowering everyone in the business to be better lis-

teners, critical thinkers, problem solvers and decision makers. This type of culture drives performance and ultimately client outcomes for everything we do.