JUST LOOK FOR THE COPPER CAP AT IAADFS FOYER 1

OYER

JUST LOOK FOR THE COPPER CAP AT IAADFS FOYER 1

OYER

GLOBAL TRAVEL RETAIL MAGAZINE

Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER

Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF

Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR

Laura Shirk laura@gtrmag.com

SENIOR WRITER

Alison Farrington alison@gtrmag.com

SENIOR EDITOR

Wendy Morley wendy@gtrmag.com

ART DIRECTOR

Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

As the Summit of the Americas approaches, the air is thick with anticipation – not just for the reunion of industry stalwarts, but for the promising journey ahead in travel retail.

Travel is booming, with busy skies despite troublesome inflation. It's a testament to the indomitable spirit of wanderlust, a clear sign that the future of travel retail is not just about recovery but about growth.

In the US, as around the world, both the necessity and possibilities of airports are being recognized, with several inspired major builds and renovations that understand travelers’ experiences are just as important as getting them in the air.

The narrative of travel retail is evolving rapidly, transcending traditional boundaries to embrace a future where innovation meets convenience. Contactless shopping, digital innovation and immersive, entertaining experiences are not just buzzwords but realities shaping the new retail environment. These advancements are leapfrogging us into the future, offering travelers not just goods but memorable journeys, meaningful interactions, and a taste of what tomorrow holds, today.

We gather in West Palm Beach for more than a trade show; the Summit is a beacon for what lies ahead. The resurgence in travel has breathed new life into the industry, pushing us to rethink, reimagine and reengage with the global traveler in ways we hadn't envisioned.

The beauty of this year's event lies not just in the bustling aisles or the dazzling array of products; it's in the collective spirit, the shared optimism, and the united vision for a future where travel retail doesn't just adapt but thrives, leading the charge into a new era of consumer engagement.

So, as we prepare to meet, exchange ideas and chart the course for the coming year, let's embrace the possibilities that lie ahead. The path may be dotted with challenges, but the direction is clear — forward, toward a horizon bright with opportunity, innovation, and growth.

We wish you safe travels, great success at the show, and we are very much looking forward to seeing you in West Palm Beach — where the future of travel retail takes flight.

Kindest regards,

18 The era of expansion

Duty Free Americas navigates the market with strategic foresight and unwavering commitment, President Leon Falic shares that its journey is defined by innovation, resilience and a dedication to enriching the consumer experience

22 Expansive horizons

As Motta Internacional eyes growth through strategic brand partnerships, airport expansions and joint efforts with other retailers to common purpose, Vice President Jose Ignacio Lasa highlights the promising trajectory of Attenza Duty Free across Latin America

30 Retail reimagined Lagardère Travel Retail Head of Digital & Innovation Jimmy Motte explains how the company is leading the charge in transforming travel retail with innovative contactless solutions, prioritizing customer satisfaction and eco-friendly practices

8 A surge to the Summit

During a pre-show interview with Global Travel Retail Magazine, Michael Payne, President & CEO at IAADFS, says this year’s industry event promises great participation and diverse buyer engagement, setting the stage for a dynamic exchange of ideas and opportunities

14 Shifting trade winds

With innovative strategies and a focus on expanding market opportunities, ASUTIL President Enrique Urioste’s vision is set to redefine industry standards; registration is now open for the 2024 ASUTIL Conference in Bogotá, Columbia

16 Growth in the gateway

Continuing its strategic expansion in Brazil, Avolta inaugurates a walkthrough store at Maceió-Zumbi dos Palmares Airport, leveraging the country’s robust duty paid market

24 Retail on the go

By integrating contactless solutions and focusing on traveler convenience, Avolta addresses how the implementation of selfcheckout options and digital engagement tools is creating a shopping experience that resonates with the needs of modern travelers

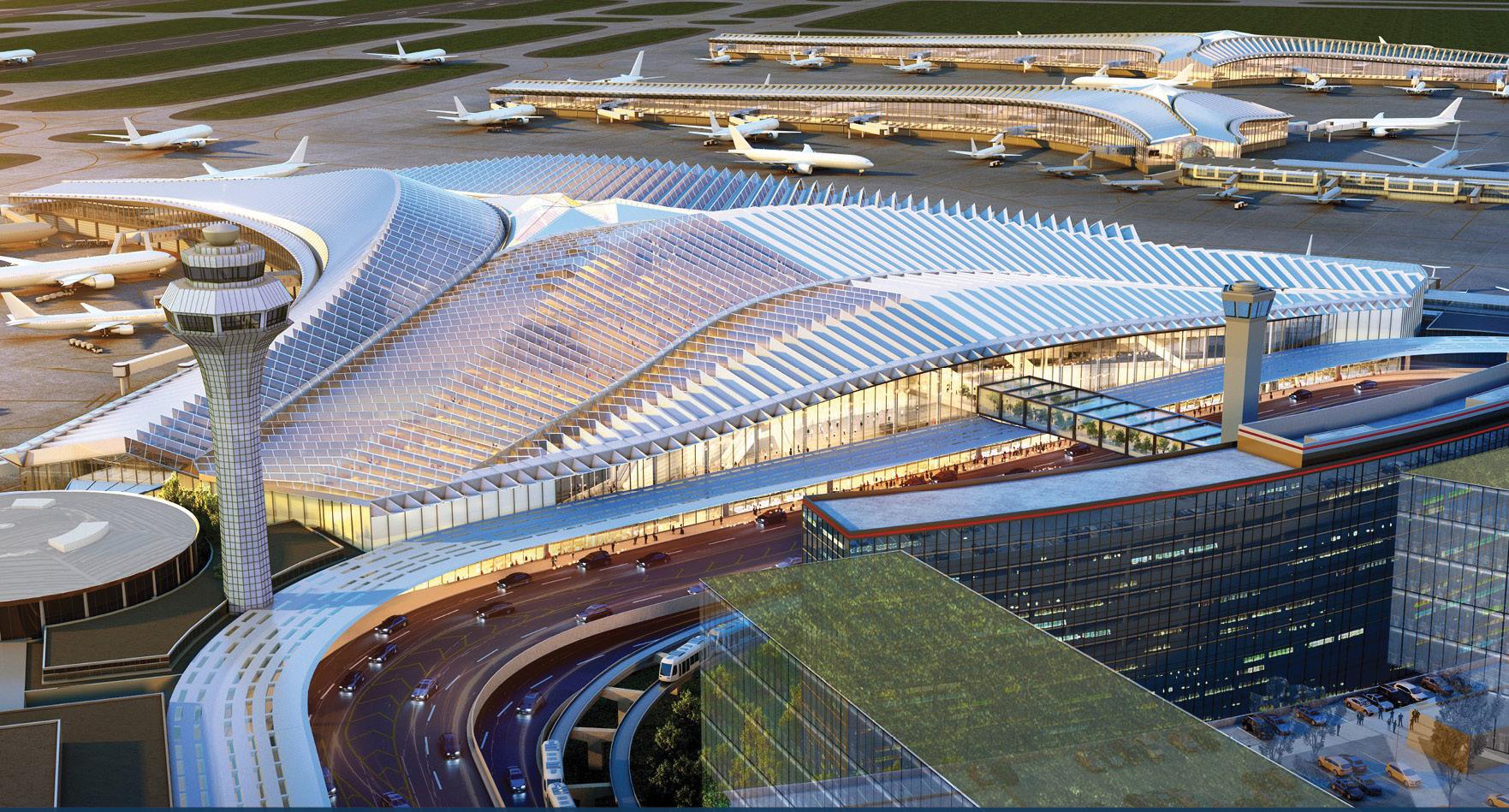

34 Breaking ground

Responding to a pressing need to modernize, several U.S. airports are embarking on major expansions and overhauls, aiming to increase innovation and improve the travel experience through enhanced facilities and improved business models

38 Securing a sustainable future

In this Q&A, Gregg Paradies, President and Chief Executive Officer at Paradies Lagardère, dishes on the company’s sustainability commitments and community initiatives; in collaboration with TerraCycle, it plans to implement a glove recycling program

42 Making waves in the Caribbean

A look at the state of travel and tourism in the Caribbean including air connectivity, multi-destination trips and the cruise sector; plus, data from m1nd-set and Tairo on consumer trends in the region

We’re making the journey as rewarding as the destination; bringing together Dufry’s retail and Autogrill’s F&B expertise to revolutionize the travel experience worldwide.

46 Power of partnership

Seatrade Cruise Global has set out to underscore the importance of trinity partnerships, as its Miami conference dedicates an entire day to the development of cruise retail; Global Travel Retail Magazine speaks with the conference’s retail ambassador Nadine Heubel

50 Cruise control

Heinemann welcomes guests onboard Royal Caribbean’s Icon of the Seas

52 Beautiful ascendancy

Having successfully navigated recent choppy waters, Essence Corp is now stronger than ever; the company’s remarkable performance in 2023 showcased major expansions and strategic partnerships

54 Editor's picks

A collection of favorites from companies in attendance at this year’s show

56 Catering to the consumer

With traveling consumers seeking healthier snacking options and alternative ingredients, food and confectionery is having to cater to a growing list of diets; read how key category players are staying ahead of and responding to evolving trends

60 Future bound

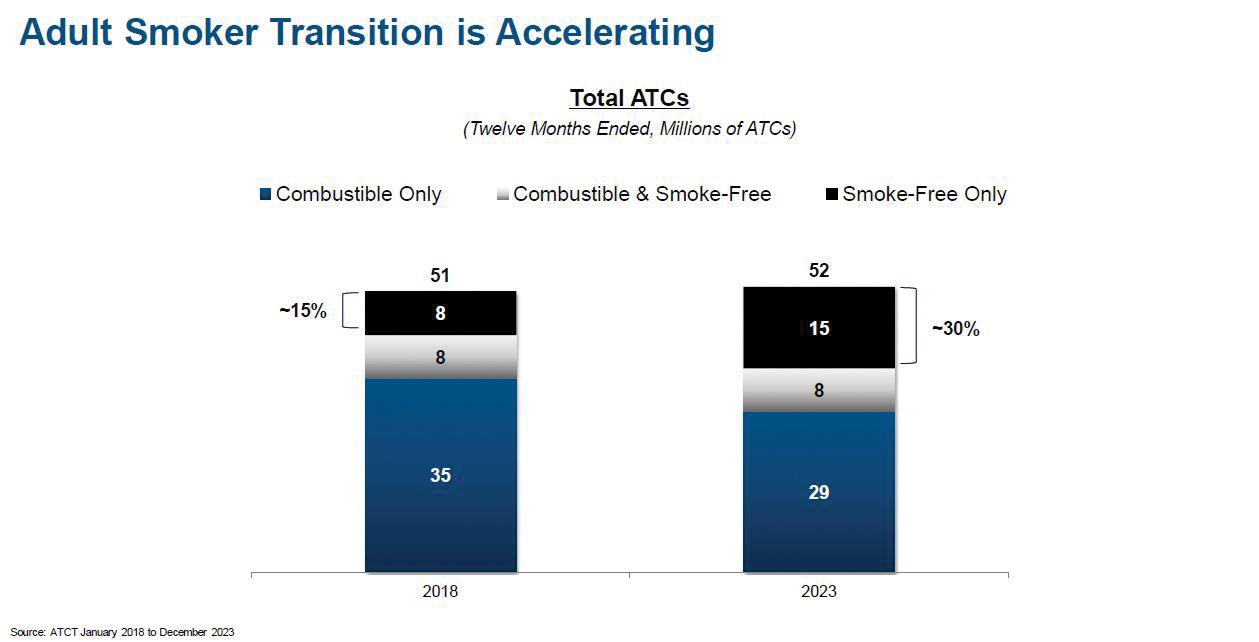

Transitioning from its historical association with traditional tobacco products to becoming a leader in alternative smoking options, Altria is innovating and redefining its goals with a focus on its smoke-free journey “Moving Beyond Smoking”

62 A thirst for cocktail culture

Driving brand discovery, the emergence on non-traditional categories and the exploration of the ready-to-pour space, Blue Caterpillar intentionally designs its portfolio according to taste profile and price point

64 The push for premiumization

Entering new markets and driving innovation across the category, Italian spirits company Illva Saronno is committed to developing a wider premium portfolio beyond its well-established icons

66 Premium spirits, soaring growth

Since its inception, MONARQ Group has been at the forefront of recognizing travel retail’s approach to premiumization; the group on how its strategic focus on premium brands positions it to capitalize on this still-growing trend

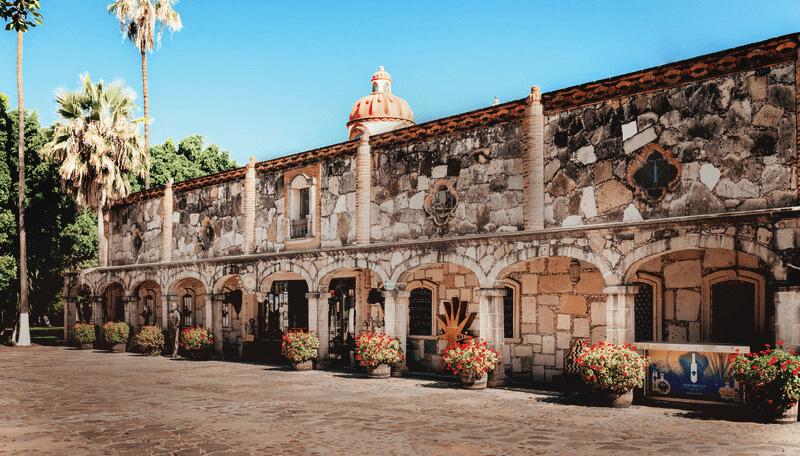

68 Spirited tradition

Fraternity Spirits offers a unique journey through Mexican heritage; anchored by Hacienda Corralejo, the company pioneers in sustainability and custom aging, reinventing the spirits landscape

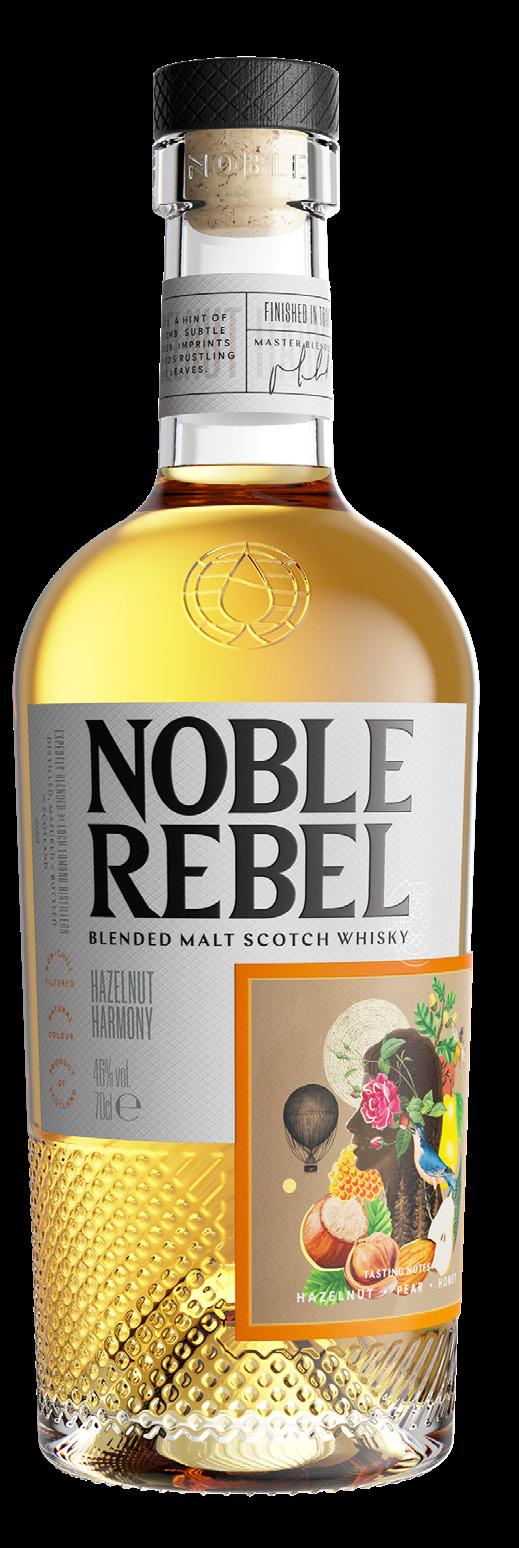

70 In good spirits

Between launching new products and exploring category growth opportunities, Duty Free Global is excited to make a splash at this year’s exhibition; the distributor will be releasing Cazcabel Tequila in the region

72 A twist on tequila

In this issue’s Tequila Report, Global Travel Retail Magazine examines the growing trend for premium tequila and contributing factors of the change in perception of the spirit among consumers such as premiumization, cocktail culture and brand proposition

As the Summit of the Americas approaches, optimism radiates from IAADFS President Michael Payne, with registration and exhibitor trends promising a vibrant gathering. With a hopeful industry backdrop, this year's event hints at stronger participation and diverse buyer engagement, setting the stage for a dynamic exchange of ideas and opportunities

by HIBAH NOOR

Michael Payne, President and CEO of IAADFS, has been optimistic about this year’s Summit of the Americas, noting, “I think we’re in a really good spot, we’re feeling very positive about it.” At date of publishing, exhibitor and registration trends were mirroring those of 2023, with a slight uptick in the supplier category and with buyers registering actively. Each year there is a surge in participation closer to the event, but hotel bookings were already indicating strong interest and attendance expectations.

While spirits, tobacco and confectionery continue to hold a large portion of spaces, Payne says accessories’ floorspace has

grown. “And we’ve had some engagement with the perfume and cosmetics people,” he says. “I think there’s going to be a way to get them back – probably not the same as before, but we hope to get them to participate in a more engaging way.”

Payne admits this does affect which buyers attend, adding that some retailers have very segregated buyer responsibilities, while others have several categories. “Companies like Motta International tends to bring reps for numerous categories,” he says. “I think most of them will do that. As another example, Avolta is planning to bring over 35 buyers, which is really an important contribution.”

Payne says last year’s event saw the return of Caribbean buyers and even a few more Central American buyers. “We had a good representation from South America,” he says. “I think that’ll happen again this year. We’ve opened the Summit up to more than just airport duty free. We’ve been casting a wider net and I think that’s made a difference.”

A dynamic plenary session kicks off the event on Monday morning at 8:30am, featuring welcoming remarks and updates on the association’s developments. The session will also host an interactive panel discussion with three or four supplier brands and a concessionaire member, emphasizing an open, question-and-answer format over traditional presentations.

On Tuesday, a workshop focused on the cruise industry begins at 1:00pm. There’s also talk of adding a second work-

shop that morning, which would cover travel retail more broadly, with a special focus on food and beverage.

The event will feature social gatherings, starting with the opening reception on Sunday night, followed by receptions on Monday and Tuesday evenings, continuing the tradition of the past few years. A new addition this year is a luncheon scheduled for Tuesday, likely from 11:30am to 1:00pm. Planned to be held outdoors, the luncheon aims to provide a casual BBQ setting, allowing attendees to enjoy a meal and return to their activities refreshed and ready to engage.

Payne notes an overall positive sentiment to the state of the industry despite certain challenges. “People are pretty upbeat. It’s busy,” he remarks. The cruise segment in the Caribbean is witnessing a significant boom.

However, not all regions are experiencing the same level of recovery. Airports that traditionally relied on Chinese tourists, such as Vancouver, are only beginning to see a return of these travelers. The absence of Russian shoppers and the slower return of business travelers, who are also spending less than before the pandemic, are noticeable in certain markets.

Despite these variances, the travel industry is bustling, with flight capacities stretched thin due to high demand. Nevertheless, regional issues like the wildfires in Chile could dampen tourist travel in the short term though Payne notes that companies with a global presence can often mitigate losses in one area with gains in another.

This adaptability and global reach contribute to the industry’s optimistic outlook. Payne encapsulates this sentiment, stating, “I think they’re all optimistic; they’re getting the customers.”

Staffing continues to be a challenge within airports in particular. “It’s a real struggle to find workers still,” he says. “While not as critical as it was in latter 2022, the situation remains difficult. Airports and airlines are employing various strategies to attract employees, such as increasing wages, offering signing bonuses and providing daycare services to accommodate young mothers as examples.”

Payne mentioned that in many airport locations the commute poses an additional hurdle in hiring skilled workers. The balance between offering competitive compensation and

managing financial constraints is complex. “Everybody’s getting pushed, and finding the right combination is difficult,” he expresses, acknowledging the financial pressures airports face with obligations such as bond repayments amid inflation.

Looking ahead, Payne forecasts a bright future for the travel retail industry, driven by a burgeoning middle class. He confidently states, “There’s an explosion of middle class travel and that’s just going to keep growing.”

He anticipates changes in traveler demographics and spending habits, but remains certain about the continuous growth in travel and airport development, despite regional challenges.

A significant obstacle will be scaling airport facilities and airline capacities to match demand, including the need for more pilots. Yet, he remains undeterred, “I don’t think people’s desire to travel is going to go anywhere but up.” Payne also believes in the industry’s ability to adapt and improve the shopping experience for travelers, thereby increasing customer penetration rates.

Summing up the industry’s resilience, he concludes, “People are recognizing more the value of time and enjoyment.

The one reason they justify some of the expense of air travel is because they want to go.”

Payne says next year's Summit will be held in West Palm Beach, April 14-17, 2025, adding that he and his team are actively exploring future Florida options in response to membership requests to consider a new location.

The IAADFS recently enhanced its Board of Directors with the inclusion of three members from the supplier community, a pioneering move that allows for supplier partners to hold voting positions within the board. These appointments, heralded by IAADFS President & CEO Michael Payne and Chairman Rene Reidi, signify a milestone in acknowledging the crucial role supplier partners have played within the association.

The board welcomes Greg Ford from Pernod Ricard, Felipe Grant from Puig Travel Retail Americas, and Markus Suter from Lindt. Their varied backgrounds in travel retail management across the Americas bring a fresh perspective and depth of industry knowledge to the board's strategic discussions. This move is timely, as the industry seeks innovative responses to evolving market dynamics and aims to enhance service offerings to association members.

Set yourself up for success with Altria International Sales, featuring a premium product portfolio and unmatched service to support your business and keep traditional and contemporary adult tobacco consumers 21+ satisfied.

With innovative strategies and a focus on expanding market opportunities, ASUTIL President Enrique Urioste's vision is set to redefine industry standards

by HIBAH NOORIn January 2024, Enrique Urioste assumed his role as President of ASUTIL, concurrently holding the mantle as President and CEO of Latin America and Caribbean at Avolta. Urioste’s ASUTIL term, which spans two years, promises to usher in a transformative era for the duty free and travel retail industry across Latin America.

Urioste and his team are at the forefront of addressing the industry’s pressing challenges and exploring untapped opportunities. “We have a great team of permanent staff, and they make it all happen. We have a strategic alignment video conference every month,” he says.

ASUTIL has set ambitious objectives to enhance the duty free and travel retail landscape in Latin America, with the primary focus to advocate for increased spending allowances across all countries, a move that could significantly boost the industry’s growth and competitiveness.

One of the most contentious issues facing the channel is the potential ban on tobacco products, a situation Urioste describes with candid concern. “Every

time I use the word ‘fight’ against the banning of tobacco they criticize me; but it’s literally a fight,” he says. “My personal opinion is if we as an industry allow this to happen, it will be just the first domino to fall. Something else will come. Then we need to remove chocolate because of the sugar and then alcohol because it's dangerous, and at the end of the day we will end up selling God-knows-what.”

ASUTIL is also looking at practical measures to enhance operational efficiency and customer experience across the region. Initiatives such as automating customs permits for cashierless transactions and expanding home delivery services in countries where it’s currently not permitted are examples of the association’s efforts to adapt to global best practices and meet evolving consumer expectations.

Looking ahead, the 2024 ASUTIL Conference in Bogotá, Colombia, embodies the spirit of unity and progress that Urioste and his team advocate. The conference is poised to be a pivotal gathering for industry stakeholders.

With the Secretary General torch having passed from Jose Luis Donagaray to Carlos Loaiza-Keel, Enrique Urioste praises Loaiza-Keel’s expertise, stating, “He’s a great lawyer, lobbyist and has been directly involved in this industry for many years. It’s a great honor and pleasure to have him join us, and to work with him.”

“What happens in Latin America is very different from what happens in North America,” Urioste says, discussing the decision to revise the ASUTIL Conference. “We decided it was better to focus on the specifics of each region with the identities that each conference has.”

With a distinguished list of speakers, networking opportunities, and the support of key sponsors, the event is a testament to the industry’s resilience and potential for innovation, with Bogotá chosen not just a nexus of global connectivity but also an emblem of economic accessibility – a strategic choice that exemplifies ASUTIL’s inclusive vision. The city’s affordability and accessibility by direct flights from major cities worldwide make it an ideal meeting ground.

The event has already secured sponsorship from major operators and providers, including Avolta, Attenza, Colonia Express, Carilux Duty Free, Avianca, Mondelēz, and JTI. Limited opportunities are still available for other brands to support the conference.

The upward trajectory of travel retail in LATAM is evident. Urioste affirms the industry’s strong performance. “Yes, in general, we are seeing solid growth,” he states, mentioning significant increases in both the volume of travelers and the spend per passenger, encompassing regional and international voyagers alike.

While the resurgence is widespread, Urioste acknowledges a few outliers. “There are some exceptions that are still below, but very few,” he notes. The momentum of 2023, deemed a “great year for travel retail in general,” has continued.“The first two months of the year, started with solid growth on top of last year’s numbers. So we are really optimistic about this year,” says Urioste.

Carlos Loaiza-Keel, ASUTIL’s new Secretary General, and Erik JuulMortensen, TFWA President, echo Urioste’s optimism, highlighting the dynamic and rapidly growing nature of the South American duty free and travel retail market.

With a distinguished list of speakers, networking opportunities, and the support of key sponsors, the ASUTIL Conference is a testament to the industry’s resilience and potential for innovation

Continuing its strategic expansion in Brazil, Avolta inaugurates a walkthrough store at Maceió-Zumbi dos Palmares Airport, leveraging the country’s robust duty paid marketby HIBAH NOOR

Avolta has recently taken a significant step in Brazil with the announcement of a new sixyear agreement to manage a 170-squaremeter duty paid store at Maceió-Zumbi dos Palmares Airport. This store, which marked its operational debut at the end of January, is strategically located in the central area of the Departures zone, offering travelers a convenient walkthrough shopping experience.

Maceió-Zumbi dos Palmares Airport, serving as a crucial gateway to Brazil’s vibrant tourist destinations and historic cities, attracts over 2.5 million visitors annually, according to 2023 data. Avolta’s decision to establish a duty paid store in this location underlines its commitment to expanding its presence

in Brazil, a country with a strong market for duty paid goods.

The strength of the duty paid market in Brazil can be attributed to several factors, including the significant number of domestic travelers who prefer shopping at airports and border stores for convenience and access to a wide range of products. Additionally, duty paid stores in Brazil offer protection against currency fluctuations, allowing customers to make purchases in local currency, which is a significant advantage in an economy prone to exchange rate volatility.

Avolta’s new store in Maceió is designed to cater to the diverse needs

of travelers, offering an assortment of products including perfumes & cosmetics, liquor, food & confectionery, jewelry & watches, fashion accessories, toys and souvenirs. This product mix not only meets the immediate needs of travelers but also capitalizes on the popularity of duty-paid shopping in Brazil, where access to such a variety of goods in a single location is highly valued.

As Avolta continues to expand its presence in Brazil, its strategic focus on enhancing the shopping experience in duty paid stores, coupled with leveraging the strong domestic travel market and favorable regulatory environment, positions the company well for continued and sustained growth in Brazil’s travel retail industry.

Enrique Urioste, Avolta’s President & CEO for LATAM comments, “We are delighted to have been awarded this new contract at Maceió-Zumbi dos Palmares Airport and we would like to take this opportunity to thank Aena and the airport team for the trust they have shown in us.”

From punchy portfolios to pioneering partnerships, DFA navigates the global market with strategic foresight and unwavering commitment, its journey defined by innovation, resilience and a dedication to enriching customer experiences

by HIBAH NOOR Leon Falic, President, Duty Free Americas

Leon Falic, President, Duty Free Americas

Duty Free Americas (DFA), a leading player in the travel retail industry, is on an ascending trajectory of global expansion and transformation under the visionary leadership of Leon Falic and the Falic brothers. While committed to strengthening its existing portfolio, DFA is also strategically pursuing new markets, innovative partnerships and engaging retail experiences.

Improving and expanding

Falic expresses a keen focus on enhancing existing store portfolios while diligently pursuing opportunities for expansion. “We are actively focused on improving and growing the stores we currently have in our portfolio,” he states, adding, “We are currently bidding for locations in New York and Chile, plus expanding in the Middle East.” He highlights the recent opening of a Falic Group office in Dubai to bolster growth ambitions, and hinted at forthcoming announcements regarding expansion – including strategic partnerships – in new markets, including India and Europe.

The expansion Falic speaks of is not just in opening new stores or moving into new countries; the company is also expanding its supply chain enterprise.

“Our distribution business is thriving,” says Falic. “In Colombia, we've become

the second-largest importer after Diageo, highlighting our strong market presence. Our operations in Honduras are performing exceptionally well. Additionally, we’ve just opened a distribution business in Israel and we have ambitious plans to become the second largest distributor in the market within the next five years.”

DFA’s Latin American operations have shown growth, especially in light of the post-pandemic era, as this region showed slower recovery than several others. Falic says the company has now established presence in almost every country across the region. “Looking ahead, we are exploring opportunities in other regions and remain optimistic about our potential for expansion and success in Latin America,” he states.

Notable is DFA’s thriving border store business in Uruguay. Falic cites significant growth, and therefore calculated attention on that country. “We are putting a strategic focus on the Uruguayan side. These have proven to be some of our best-performing businesses, with a remarkable recovery and over 50% growth in the last year,” he notes. He feels the current state of airport and border duty free allowances in LATAM are “appropriate,” hinting at a favorable operating environment for DFA’s business in the region.

While DFA is experiencing significant growth and expansion around the globe, this does not come without its challenges. One of the hurdles currently being faced by DFA is the heightened focus on discounts and promotions on the part of customers. “This is a depar-

ture from the pandemic, when customers were primarily driven by product and indulgence,” Falic says. He adds that brands that are more aggressive on pricing strategies seem to be gaining the most traction. “We are strategically aligning our offerings to cater to the evolving preferences, ensuring that our pricing models and promotions resonate with the current customer mindset in the region,” he says.

There is not a company, country or individual in the world that has not been impacted by inflation over the past couple of years, and DFA is no exception. “The challenges posed by inflation have impacted our operations,” affirms Falic. “The increased costs, particularly in payroll and overall spending, have contributed to a strain on our bottom line.”

Companies such as DFA have to walk a fine balance between price

Dior is one of many luxurious stores showcased at the The Venetian Macaoadjustments made necessary by inflation and customers looking for value purchases – to fall on one side or the other can lead to a solid red line. “Despite efforts to adjust, the ability to offset these increased costs through price adjustments has proven challenging,” says Falic. “Navigating through these inflationary pressures requires ongoing strategic adjustments and a focus on optimizing operational efficiency to mitigate the impact on our overall financial performance.”

DFA’s prioritizing emphasizes a commitment to growth and innovation, focusing on luxury brand partnerships, retail expansion, community engagement and exploring new business avenues. The company recently opened three spe-

cialty stores at Dallas Fort Worth International Airport, including the first-ever travel retail store for Toys“R”Us, a sunglasses store, SHADE, and an inaugural LEGO® store. These initiatives demonstrate a concerted effort towards diversification and enriching the customer journey, catering to contemporary trends and demands in the travel retail sector.

The retailer’s collaboration with Visa to offer exclusive benefits to travelers using Visa credit, debit or prepaid cards at select locations emphasizes its dedication to improving customer service and satisfaction. This partnership aims to facilitate a more seamless and rewarding shopping experience for travelers, aligning with DFA's focus on enhancing customer experiences across retail outlets.

Meanwhile, DFA's successful Charity Golf Tournament raised US$1 million to support the fight against cancer, underscoring the company’s support for the broader community. This reflects a model of corporate responsibility that extends beyond business operations, demonstrating DFA's commitment to making a positive impact.

DFA's commitment to innovation, sustained growth and delivering exceptional customer value remains at the core of its strategy. “In the coming year, our goals include securing more concessions to expand, streamlining business operations and investing capital expenditure in key areas,” concludes Falic. “These initiatives align with our commitment to sustained growth, innovation and delivering value to our customers.”

As Motta Internacional eyes growth through strategic brand partnerships, airport expansions and joint efforts with other retailers to common purpose, Vice President Jose Ignacio Lasa highlights the promising trajectory of Attenza Duty Free across Latin America

by LAURA SHIRK

Through Attenza Duty Free, Motta offers a comprehensive product assortment including spirits and tobacco, leather goods, luxury accessories, perfumes and cosmetics, confectionery and electronics

For last year’s Summit of the Americas issue, GTR Magazine reported on Motta Internacional’s multiplying stores at Panama’s Tocumen Airport, and that growth has not stopped. Soon after the airport’s new terminal was inaugurated, the retailer, under the commercial name Attenza Duty Free, celebrated the opening of its flagship store, which covers 1,000 square meters, offers 200+ luxury brands and focuses on sensory engagement to enhance the shopper experience.

To further strengthen its presence in Terminal 2 at the airport, Attenza Duty Free will open new luxury boutiques in Q3 and Q4. The retail spaces will range between 80 square meters and

120 square meters, with brand partners including TUMI, TAG Heuer, Longchamp, Montblanc and Tory Burch. While artistic renderings are under wraps, Jose Ignacio Lasa, Vice President Commercial at Motta Internacional, says the brands are all working together to create a visually appealing store specifically designed for the modern traveler. This will bring the total number of Attenza stores in T2 to 5.

The retailer has also been focusing on driving key expansion at main airports across the region; for example it has been taking part in the bidding process for the exclusive operation of duty free shops at Santiago Airport in Chile.

Although on hold at this time, the bid is expected to reactivate in the second half of this year.

Attenza Duty Free currently boasts more than 53 operations at airports and border points across Latin America; Panama, Colombia and Ecuador remain its strongest markets. Through Attenza Duty Free, Motta offers a comprehensive product assortment including spirits and tobacco, leather goods, perfumes and cosmetics, confectionery and electronics.

Online sales and airline partnerships

Motta’s Attenza Duty Free has long prioritized developing its online presence and pre-ordering services with the

goal to increase sales ahead of travel. With the support of direct promotions, introductory discounts and cross-promotion with partners, it is working to strengthen its site.

According to Lasa, online sales contribute to approximately 2% of overall sales. “It is growing slowly, but we hope that the ability to review promotions and products from the comfort of one’s home or office before travel is an added benefit,” he says.

Although the retailer is always evaluating partnerships with passengerrelated businesses, at the moment it is keen to continue growing the alliances in place in connection to airline mileage programs. Programs like Copa Airlines’ ConnectMiles and LifeMiles by Avianca

Airlines grant exclusive offers to Attenza Duty Free’s end consumers. “We believe there is good synergy with these programs that helps us work together to bring great experiences and benefits to our common customers,” adds Lasa.

Lasa says Motta Internacional is in talks with commercial divisions of new brands with high growth potential, looking to further build its key longterm portfolio.

When asked about non-traditional duty free product lines in the mix, Lasa refers to the sports-team inspired apparel brand New Era. Designed for customizable sizing, the brand provides adjustable sports caps that guarantee

comfort without compromising on style. He says the brand is steadily growing in Latin America.

Beyond conversation around its portfolio and online presence, Motta Internacional is in close communication with airports and competing duty free retailers in a joint effort to reach potential duty free shoppers. Since market research can help to better understand consumer behavior and attract a new pool of customers, the company is uniting with other stakeholders in the channel such as airports, even competitors in the same airport to increase the overall effectiveness of duty free shopping as a marketing strategy.

“We believe the most important work still to be done effectively is communicating the benefits of duty free shopping. Although the next step is to create a market study, in the past the perception among potential clients is that duty free focuses on high-end products, hence high-ticket prices,” he explains. “This might be a deterrent for some clients. Our idea is to get to know the customer and then work together, as an industry, to invite them to visit our stores.”

Contactless shopping creates convenience for customers, bringing predictability and speed to their shopping experience on their day of travel. This positive experience helps to build customer loyalty by meeting their needs, according to Quinn. Avolta’s statement is: “We put the traveler at the center of everything we do”

By integrating cutting-edge contactless shopping solutions and focusing on traveler convenience, Avolta is setting new standards in travel retail. The implementation of selfcheckout options and digital engagement tools is creating a more efficient, enjoyable shopping experience that resonates with the dynamic needs of today’s travelers

by WENDY MORLEYMajor global travel retailers such as Avolta are revolutionizing the way travelers shop with cutting-edge contactless shopping solutions. By prioritizing the traveler's convenience and integrating personal devices into the retail experience, these retailers ensure a seamless, efficient and personalized shopping journey. This innovative approach, characterized by self-checkout options and digital engagement, is transforming travel retail, making shopping faster, more

convenient, and tailored to the needs of the modern traveler.

Through Hudson, self-checkout is available at many of Avolta’s North America travel convenience stores, as well as proprietary retail stores like Evolve by Hudson. “We operate contactless, 24/7 automated retail concepts featuring leading brands and exclusive products, and our Hudson Nonstop stores offer a frictionless shopping experience

powered by Amazon’s Just Walk Out technology,” says Brian Quinn, Chief Operating Officer – Retail, North America, Avolta.

Avolta is conscious of the fact that travelers want a seamless, personalized experience that allows them to set the pace for their journey, especially when they are pressed for time. “The contact-

less technology we offer in our stores provides travelers with the flexibility they desire, and this is evident in the significant uplift in customer conversion we have seen since we introduced this kind of shopping experience,” says Quinn. “Based on the significant uplift in customer conversion we have seen since implementing contactless shopping, we know that travelers want to go at their own pace throughout their travel journey — especially in an airport environment where there so many things out of their control.”

These contactless options have produced a significant increase in customer conversion, according to Quinn, who says the increased number of total checkout points allows more customers the ability to be in and out as fast as they need to with their purchased items in hand.

Nearly every part of the airport experience can be contactless. “Many passen-

gers already use their mobile phones to book flights, choose seats, check in with their airline, request a rideshare to the airport, pass through security, and even pre-order food or get on a restaurant’s waiting list,” says Quinn. “Contactless shopping is another way we can remove friction in their experience traveling through an airport — and ultimately make travelers happier.”

Avolta’s Reserve & Collect pre-ordering shopping service offers convenience, predictability, and speed to customers, according to Quinn. “With Reserve & Collect, travelers can browse and reserve over 40,000 duty free products online including beauty, accessories, food, liquor and more. They can reserve items online up to 29 days in advance, and collect and pay for them in-store when they arrive at the terminal.”

The Reserve & Collect program has

been particularly successful among Red By Dufry loyalty program members. “In 2023, nearly 70% of purchases from the program were from loyalty members. Reserve & Collect shoppers also average 80% higher transaction value than purchases made in-store,” says Quinn.

As is often the case in business, the biggest challenge Avolta faces is the flipside of a substantial opportunity, as contactless technology allows store associates to focus on customer service. “Our biggest challenge has been training thousands of employees to think of themselves as hospitality ambassadors instead of cashiers,” says Quinn. “For those who have spent their career in retail, working in an environment with contactless technology requires a shift in mindset. We do everything we can to provide training, guidance, and continued support to help employees feel comfortable

advertisement removed for legal reasons

Personal service results in more satisfied customers and higher sales, and contactless shopping allows this. “When they are not tied to a point-ofsale system where they spend their day completing transactions, our employees can serve as hospitality ambassadors, helping passengers find the item they need or the perfect souvenir, answering questions about products, and ensuring shelves are fully stocked,” says Quinn.

become advocates for the technology," he adds.

As part of Avolta’s Destination 2027 strategy, the company is committed to innovating the traveler-centered experience with enhanced digital engagement. Quinn says travelers should expect to see exciting things in the coming months and years.

expanded our original scope and development plans. Travelers should expect to see more self-checkout, more Hudson Nonstop, and more automated retail in the coming months and years to help create a frictionless travel experience wherever they go.”

As part of Avolta, Hudson has a unique position in the travel retail market, as the subsidiary can tap into its global partners to see the very best of what’s happening in the sector.

These employees become hospitality ambassadors instead of cashiers. Quinn says once they become comfortable with the updated role and responsibilities, employees adapt very well. “We see a gradual increase in contactless transactions by travelers as our employees

“We recently opened our largest Evolve by Hudson store at Chicago Midway International Airport and plan to continue to develop this concept, along with Hudson Nonstop powered by Amazon’s Just Walk Out technology,” he shares. “Our contactless shopping has been so successful that we have in this role.”

“We put the traveler at the center of everything we do, so as their priorities change, so do ours,” says Quinn.

“But what remains constant is that we will continue to deliver the travel experience revolution through enhanced digital engagement.”

advertisement removed for legal reasons

Lagardère Travel Retail Head of Digital & Innovation

Jimmy Motte explains how the company is leading the charge in transforming travel retail with innovative contactless solutions, prioritizing customer satisfaction and eco-friendly practices

by WENDY MORLEYLagardère Travel Retail is at the forefront of cutting-edge contactless shopping experiences. Embracing self- and mobile-checkout options along with eco-friendly digital receipts, Lagardère Travel Retail is redefining convenience and sustainability in travel retail. Self-checkout kiosks, instrumental in enhancing customer satisfaction, significantly contribute to operational efficiency, particularly during peak hours, accounting for a substantial portion of transactions in duty free stores.

For Lagardère Travel Retail, contactless shopping is about enhancing customer satisfaction, service and convenience. “Mobile checkout, specifically the Pay

& Go mobile self-checkout, stands as an innovative alternative solution for customers. The emphasis on speed and minimized contact aligns with safety and health protocols, contributing to a safer and more efficient shopping experience,” says Jimmy Motte – Head of Digital & Innovation at Lagardère Travel Retail. “Self-checkout boosts the Stop ratio by generating additional transactions, capturing new customers, especially during peak hours.”

As sustainability has become more important both ecologically and in customers’ minds, Lagardère Travel Retail introduced eco-friendly digital receipts in collaboration with ReceiptHero, to reduce its carbon footprint by

eliminating paper receipts. “Not only does it offer retailers an environmentally friendly alternative, but digital receipts also serve as an effective marketing channel and a tool for fostering customer loyalty,” says Motte.

In other developments, Lagardère Travel Retail continues to prioritize and develop close relationships with airlines, collaborating to develop optimal solutions. “We have successfully established partnerships with airlines; for example

Goods Express at Charlotte Douglas International Airport is Paradies Lagardère’s first retail location to offer Amazon’s Just Walk Out technology. Decision-makers at Lagardère Travel Retail believe cashier-less shopping is poised to become the next major trend in the retail industry

Goods Express at Charlotte Douglas International Airport is Paradies Lagardère’s first retail location to offer Amazon’s Just Walk Out technology. Decision-makers at Lagardère Travel Retail believe cashier-less shopping is poised to become the next major trend in the retail industry

our collaboration with Airpoints™, Air New Zealand's loyalty program,” says Motte. “Customers can easily utilize their points for payments, elevating the shopping experience to a new level.”

The company’s strategic approach involves rapid innovation testing and continuous evaluation, ensuring it leads in offering seamless, technology-driven travel experiences. A notable example is the collaboration with Amazon's Just Walk Out technology at Charlotte Douglas International Airport, setting new standards in retail efficiency and convenience.

“Goods Express at Charlotte Douglas International Airport is Paradies Lagardère’s first retail location to offer Amazon’s Just Walk Out technology,” says Motte. “This innovative retail space meets the needs of on-the-go travelers, setting a new standard for speed, convenience and quality. Customers enter the shop using their app or credit card. The system detects items taken from or returned to the shelves, eliminating the need to wait in line for payment before exiting the store, offering a high level of efficiency for travelers.”

With an ambitious strategy and an agile organization, Lagardère Travel Retail is focusing on quick innovation testing and continuous value monitoring for landlords and travelers. “Our broad network of innovators draws from global experiences to offer support and guidance to landlords for the implementation of improvements stemming from new initiatives,” says Motte. “We are continuously redefining and enhancing travel experiences through the seamless integration of autonomous technology into our network.”

The company’s vision for the future includes expanding automated store technologies across continents, emphasizing the ongoing demand for contactless retail solutions. “As consumer demands for enhanced convenience and speed continue to rise, we eagerly anticipate leading the way in introducing innovative solutions and retail concepts,” says Motte. “Our goal is to not only meet but exceed the expectations of both travelers and partners. The significance of contactless passenger experiences has evolved from a nice-tohave feature to an essential aspect for

maintaining competitiveness.”

Recognizing the shifting landscape, decision-makers at Lagardère Travel Retail believe cashier-less shopping is poised to become the next major trend in the retail industry. “The digital shift accelerated during the pandemic, with widespread adoption of contactless payments, increased reliance on e-commerce, and the surge in online learning,” says Motte.

There is clear demand for autonomous shopping, providing passengers with a swift, contactless, and seamless shopping experience. Travelers also now anticipate more from brick-and-mortar stores, seeking a novel and enhanced shopping experience, Motte suggests.

“Our extensive network of innovators leverages our global experience to support and advise landlords on improvements generated by new initiatives,” says Motte. “We operate automated stores across three continents, utilizing five separate technologies and a wide array of applications. As the demand for contactless shopping continues to rise, we will make sure to continue to always stay one step ahead of the curve.”

Amid a pressing need to modernize, several US airports are embarking on ambitious expansions and overhauls, aiming to increase innovation and improve the travel experience through enhanced facilities, sustainability and efficiencyby WENDY MORLEY

Anoticeable gap between the rapid growth of air travel, the diverging needs of travelers and the outdated condition of many airports has been apparent throughout the US. Despite the increase in passengers and flights, numerous airports still operate with facilities and designs that have barely changed since the 1970s. This situation has only become more critical as air traffic has grown, highlighting the inability of these older airports to handle the current volume of passengers and flights efficiently.

Contrast this with stunning airports pushing the boundaries of what an airport could be – Changi or Doha as prime examples – and the US seems very far behind indeed. This mismatch affects passenger experience and puts the airports themselves in a state where they are not receiving all possible revenue, underscoring a pressing need for

comprehensive renovations and updates to meet modern demands.

Then-Vice President Joe Biden’s famous comment in 2014 likening LaGuardia to an airport in a thirdworld country may not have been the catalyst for all the phenomenal rebuilds taking place right now, but its timing was providential. Since then several substantial builds and renovations have been planned or executed, not the least of which has been LaGuardia itself.

Preparing for 100 million

Dallas Fort Worth International Airport (DFW) is set to embark on a significant expansion with the new Terminal F and the reconstruction of Terminal C. With a projected cost of US$1.6 billion for Terminal F, construction is expected to commence this year and conclude by 2026. This new terminal will be situated south of Terminal D and will include a 15-gate concourse.

Dallas Fort Worth International Airport is set to embark on a significant expansion with the new Terminal F and the reconstruction of Terminal C; with a projected cost of US$1.6 billion for the new terminal, construction is expected to commence this year

With an estimated budget of US$2.72 billion, Terminal C will undergo a major overhaul aimed at updating the facility to better accommodate the needs of Fort Worth-based American Airlines. Scheduled for completion by 2028, this project involves the removal of over 400 columns to enhance walkability, and the installation of tall glass windows. This ambitious endeavor is part of a broader plan to cater to growing passenger traffic, which is expected to reach 100 million people annually by 2030.

Charm and convenience

Dubbed “Elevate BUR,” construction of a new replacement passenger terminal has officially begun at Hollywood Burbank Airport. The ground breaking

A major component

International Airport’s 20-year plan is the development of a new terminal that encompasses a broad scope of improvements

took place on January 25, 2024, marking a significant milestone for the BurbankGlendale-Pasadena Airport Authority (BGPAA). This project aims to create a safer, modern and more convenient facility. The new 33,000-square-meter terminal will enhance the overall passenger experience, promising a variety of shopping and dining options, upgraded restrooms, and more spacious areas for passengers.

The team is aiming for a minimum of LEED Silver certification to ensure sustainability. Construction is expected to be completed by October 2026 with a budget of approximately US$1.25 billion. It will be funded without state, county, or local taxes, reflecting the community's dedication to maintaining the charm and convenience the airport is known for.

San Antonio International Airport is embarking on an ambitious expansion with the development of a new terminal. This major component of a comprehensive 20-year, US$2.5 billion strategic development plan aims to elevate the airport to meet and surpass the city's stature and aspirations. Slated to begin in 2024 and be completed by 2028, this

project encompasses a broad scope of improvements. The new terminal will exceed the combined size of the current terminals, featuring up to 17 gates, expansive passenger departure and arrival lanes and enhanced club lounges within a sprawling 74,300-squaremeter space.

The upcoming interior remodel of O'Hare International Airport's Terminal 3 is set to be a significant overhaul with a budget of US$200 million. This project will focus on enhancing passenger space, streamlining security checkpoints, upgrading baggage

areas and adding new concessions. The remodel aims to reconfigure the TSA checkpoint for new screening technologies, expand the passenger corridor between concourses K and L, renovate restrooms, and add 930 square meters of new concessions space.

Additionally, Terminal 3 will see an expansion project adding three new gates, providing more space for concessions and gate hold rooms. This remodel is part of broader efforts to modernize the airport and improve the overall passenger experience, complementing other ongoing projects like the Terminal 2 expansion and the Terminal 5 extension.

In this Q&A, Gregg Paradies, President and Chief Executive Officer at Paradies Lagardère, dishes on the company’s CSR roadmap, key sustainability commitments and latest community initiatives; in collaboration with TerraCycle, it plans to implement a glove recycling program in the coming months

by LAURA SHIRK

As the North American division of Lagardère Travel Retail, Paradies Lagardère has a long history of pioneering trends, delivering engaging experiences and developing innovative shopping and dining options. The airport concessionaire is present at over 100 locations and teams up with partners to enhance offerings across retail categories.

Global Travel Retail Magazine (GTR Magazine) connected with Gregg Paradies, President and Chief Executive Officer at Paradies Lagardère, to learn more about how the division is working to contribute to a more sustainable industry.

GTR Magazine: What are the key pillars of Paradies Lagardère’s CSR roadmap to create a more sustainable future?

Gregg Paradies (Paradies): Paradies Lagardère fully supports and participates in the program and direction of

its parent company, Lagardère Travel Retail. Globally, our long-term, sciencebased, cooperative and transparent CSR (corporate social responsibility) strategy is articulated around four pillars, covering specific targets where we can make an impact. These pillars are known as PEPS: Planet. Ethics. People. Social.

Under Planet, our focus is on reducing the environmental impact of our operations in cooperation with our airports, brand partners and suppliers. Our key commitments are threefold: to reduce our carbon emissions, to reduce waste and to promote responsible packaging and disposables.

To drive these key initiatives forward, we introduced a new Corporate Social Responsibility Manager role in early 2023. Company veteran Valerie Davis assumed this role and has guided our strategy around each PEPS initiative, interpreting themes for implementation and success in our specific North American businesses.

GTR Magazine: How is Paradies Lagardère working to reduce its environmental footprint?

Paradies: Through our three key commitments, we are keeping a tight focus on our greenhouse gas emissions and working to reduce our operational impact. To further reduce food waste, we are expanding our food donation programs to support our local communities. This incidentally helps drive our Social pillar work as well, ensuring children and their families get the support that they need.

Additionally, we are promoting responsible packaging by replacing our plastic shopping bags with a 100% recyclable paper option, which is made from

Gregg Paradies, President and Chief Executive Officer at Paradies Lagardère

Gregg Paradies, President and Chief Executive Officer at Paradies Lagardère

BLEND Palm Beach County opens connections between minority-owned businesses in the food space and the local community through mentoring vendors on culinary expertise, as well as business practices

95% post-consumer recycled content. Complementing this effort, we are also offering virgin plastic bottle alternatives for water in our travel essentials and market concepts.

GTR Magazine: What is Paradies Lagardère’s latest success story in association with its CSR strategy and/or sustainability efforts?

Paradies: We are excited about our new partnership with Nimble, a sustainable consumer technology brand committed to creating high-quality, eco-friendly tech products made from postconsumer recycled content for their electronics and packaging.

Certified company has diverted 481,766 pounds of waste from landfills at the time of this interview. This relationship ties directly to all three targets under our Planet pillar. Nimble products hit the shelves of Paradies Lagardère’s travel essentials stores across the United States in March.

GTR Magazine: The company underlined its commitment to sustainability earlier this year, with a $25K donation to BLEND Palm Beach County. Tell me about its relationship with the program and any other upcoming community initiatives.

Paradies: BLEND Palm Beach County (BLEND PBC) opens connections between minority-owned business enterprises in the food space and the local community through mentoring vendors on culinary expertise, as well as business practices.

As part of its initiative, BLEND PBC has an agricultural elementary school program that brings microgreen harvesting to local schools as a way to educate students on economic sustainability. The program debuted in 2022 at a pair of schools in West Palm Beach,

Florida, and expanded to four additional schools and community centers last year. When we learned about the program, we were excited to support the cause with a donation, as it aligns with both our philanthropic and sustainbilty initiatives on a local, as well as company-wide level.

Our CSR Manager is connecting with our airport partners across North America to learn about their sustainability initiatives and how we can work together to maximize our collective efforts.

GTR Magazine: What sustainable practices do you expect to see in travel retail in 2024?

Paradies: A key to reducing waste is finding new and innovative ways to recycle the products we use, particularly items that are not part of the standard waste stream. I am very proud of our new initiative to recycle food service gloves in partnership with TerraCycle, an international leader in innovative sustainability solutions. After a successful pilot program, we plan to implement this glove recycling initiative in high priority operations in the coming months.

michelgermain.com

A look at the state of travel and tourism in the Caribbean including air connectivity, multi-destination trips and the cruise sector; plus, data from m1ndset and Tairo on consumer trends in the region

by LAURA SHIRK

Based on preliminary data, Caribbean Tourism Organization says the region set a new record for tourist arrivals in 2023 at approximately 32 million tourists

In 2023, regional tourism continued to grow, by an estimated increase of 14% in international tourists visiting the Caribbean.

According to Caribbean Tourism Organization (CTO), this growth aligned with the year’s projected expansion of 10-15%. For an update on the Caribbean, Global Travel Retail Magazine connected with CTO, m1nd-set and Tairo International (Tairo). Based on preliminary data provided by Caribbean destinations, the number of tourist visits to the region last year (approximately 32 million) is around four million more compared to 2022. As shared by CTO, these results indicate that the region has surpassed its pre-pandemic level

Across the Caribbean, the key drivers of performance are consistent among the destinations. These include a continuous demand for outbound travel from the United States, which remains the region’s primary source market

of tourist visits by 0.8%, setting a new record for tourist arrivals.

Dated the first week of March 2024, the organization’s latest 2023 statistics (categorized by tourist arrivals per month) show Dominican Republic as the most popular Caribbean destination to visit. Based on non-resident air arrivals, the region welcomed 867,570 tourists in December; this is up 13% versus 2022. Cuba, Puerto Rico and Aruba followed, respectively. In addition, the figures for December show Belize experienced the greatest yearover-year percentage increase (47%), followed closely by Curacao (41%); the remaining destinations trailing behind considerably.

Caribbean Tourism Organization says pent-up demand and the resumption of operations continued to drive strong bookings for Caribbean cruises last year, in addition to improved infrastructure including larger ships, as well as enhanced facilities, itineraries and excursions

“Across the Caribbean, the key drivers of performance are consistent among the destinations. These include a continuous demand for outbound travel from the United States, which remains the region’s primary source market. Additionally, significant improvements in tourism-related infrastructure within these destinations, the fulfillment of strategic marketing initiatives and augmented airlift capacity between the region and its primary source markets,” reveals the organization.

On the cruise side, 2023 data shows Caribbean destinations received an estimated 31 million cruise visits, reflecting an increase of 57% versus 2019. This achievement sets a new benchmark for the regional cruise sector, outperforming the previous record set in 2019 by 2.4%. According to CTO, pent-up demand and the resumption of operations continued to drive strong bookings for Caribbean cruises, in addition to improved infrastructure including larger ships, as well as enhanced facilities, itineraries and excursions.

Although the travel and tourism industry saw a surge in outbound travel from primary source markets last year, the sector’s growth experienced uneven patterns due to difficulties such as economic volatility, labor shortages, measured reopening strategies in specific markets and the challenging recovery of air capacity.

Discussing how airlines and destinations can continue to tap into the demand for multi-destination trips among travelers in the Caribbean, CTO says this demand is particularly pronounced among European travelers who are increasingly seeking unique and diverse experiences. “With its rich tapestry of cultures, landscapes and histories, the Caribbean offers unparalleled opportunities for exploration across multiple destinations. However, in order to fully capitalize on this opportunity, it’s crucial that the issue of intra-regional airlift connectivity is addressed,” explains CTO. “Airlines and destinations must forge stronger collaborations to enhance intra-regional connectivity and harness the growing demand for multi-destination travel.”

Looking ahead, the organization shares that encouraging developments are on the horizon, notably with the expansion efforts of Caribbean Airlines and interCaribbean Airways, as well as the transformation of LIAT into a new company. “These include streamlining flight routes, improving scheduling and frequency, and offering attractive travel packages that encourage travelers to explore multiple destinations in one trip.

“By working together to improve airlift and promote multi-destination trips, the industry can unlock unprecedented opportunities for the Caribbean region

and provide unforgettable experiences for travelers from around the world,” says CTO.

When it comes to travel retail in the region, we spoke with research agency m1nd-set for the latest. Despite increasing on a more stable rate compared to the global average, international pax in Central America and the Caribbean reached pre-pandemic levels in 2023 (+3% vs. 2019). Global pax is still down 7% compared to 2019. m1nd-set consultant Anna Degli Esposti, shares that this growing trend will continue in the coming years and regional air pax is forecasted to reach 137 million passengers in 2025. This will exceed the 2019 air pax of +16%.

Featuring consumer behavior, top categories and key purchase drivers, see below for a 2023 snapshot of the duty free channel in the region:

• The gender of duty free shoppers in Central America and the Caribbean exhibited an almost equal split (44% males and 55% females); however, the share of female duty free shoppers has increased over the past two years after a significant drop post-pandemic

• Duty free shoppers who travel for leisure purposes represented 8 in 10 shoppers; this share has remained constant over the past six years and is higher versus the global average (73%)

• At 8% Gen Z duty free shoppers in Central America and the Caribbean have doubled since 2021; this is in line with the global trend

• The most purchased duty free categories in 2023 at Central American and Caribbean airports were confectionery (31%), alcohol (29%), perfumes (22%), tobacco (20%) and souvenirs (15%); confectionery and tobacco both increased by 13% compared to pre-pandemic levels and remain slightly above the global average

• The significant decrease in value for money as a key purchase driver (70% pre-pandemic and 44% in 2023) indicates that decision-making among duty free shoppers in the region has become more influenced by multiple factors including experiential retail, rather than a single driver

According to m1nd-set, pre-pandemic Central America and the Caribbean registered the largest gap between the share of duty free shoppers who pre-planned their purchase(s) and those who noticed touchpoint(s) on their consumer journey. Degli Esposti points out that this represents a missed opportunity to communicate with travelers

before their trip about what the channel has to offer. It also highlights the importance of delivering consistent messaging when executing an omnichannel marketing strategy.

Speaking about evolving consumer preferences and trends in the Caribbean, Tairo International President Bryan Hollander refers to the push for sustainable goods, as well as natural, organic and vegan products that cater to the health-conscious consumer. The leading distributor of perfumes and cosmetics is also seeing a rise in premiumization and increased pricing among niche brands. He names Coty as making great strides in the region, with a number of its premium brands like Gucci, Burberry, Hugo Boss and Marc Jacobs.

“The Caribbean is a great market with great clients and partners. Further supported by a stable currency mostly tied to the U.S. dollar. But clearly, understanding the uniqueness of each of the islands and the clients in each market is very important,” says Hollander. “We continue to look for new ways to improve upon this through communication and technology in order to ensure we are engaging with and understanding the ever-changing needs of our clients.”

Hollander points out that logistics can be a challenge in the region, especially in terms of avoiding ruptures at the point-of-sale. The company is implementing a new enterprise ERP (Enterprise, Resource, Planning) system that will allow Tairo to create further efficiency via a more dynamic, transparent and timely flow of information.

On how booming business in the Caribbean is linked to the cruise sector, Hollander notes that this means of travel is convenient and cost-effective for families to visit multiple locations in a designated period of time. With this demand, cruise lines continue to build and bring to market more advanced ships that appeal to high-end consumers, as well as those who are price-sensitive.

“To accommodate large cruise ships and enhance the passenger experience, some Caribbean countries have invested in upgrading and expanding their port facilities. This includes building new cruise terminals, docking infrastructure and amenities such as shops, restaurants and entertainment venues. These investments not only support the cruise industry, but also improve overall tourism infrastructure and competitiveness,” he says.

Seatrade Cruise Global has set out to underscore the importance of trinity partnerships, as its Miami conference dedicates an entire day to the development of cruise retail. Global Travel Retail Magazine talks to the conference’s retail ambassador Nadine Heubel

by ALISON FARRINGTONThis year, Seatrade Cruise Global recognized that retail is a growing vertical in the cruise industry and that it has been missing in the conference’s programming previously.

The Retail Day, which takes place on April 10 and is organized in partnership with The Moodie Davitt Report, kicks off with a cruise line CEO Q&A session, which will focus on how cruise retail plays an increasingly critical role in shaping the guest experience. The discussion will cover challenges and opportunities for retailing, space and profitability, key consumer groups, product and store development, plus how partnerships in the industry are evolving.

Cruise industry consultant, Nadine Heubel, is Seatrade’s retail ambassador

Cruise industry consultant, Nadine Heubel, is Seatrade’s retail ambassador

The Retail Day’s central theme is the cruise trinity. So, it’s no surprise there will be a trio of cruise retail heavyweights –brand owner (LVMH), cruise line (Carnival) and concessionaire (Starboard) – on hand to cover how each partner views the cruise industry trinity, how they see the relationships today and tomorrow, and crucially how they can collaborate more deeply for the benefit of the guest via retail stores on board, promotional offers and partnerships.

Currently Seatrade’s retail ambassador Nadine Heubel’s involvement with the cruise line began with a podcast about the event, to generate awareness about cruise retail in general, followed by an hour-long session on retail, last year. Heubel says it was then that the Seatrade team realized it wasn’t giving retail enough airtime. She says she knew having a whole day dedicated to retail would enrich the Seatrade conference, which is recognized as the biggest cruise conference in the world.

The content program is focused on exploring new trinity relationships within cruise. While many in travel retail consider the trinity relationship as one between airport, travel retailer and brand, Heubel thinks it’s just as important for cruise operators to consider a similar dynamic as they dedicate significantly larger spaces to retail on board their ships. “While there are existing trinity relationships within cruise retail, with players such as Gebr. Heinemann, Starboard, Harding+, MSC and others, it’s growing bigger. There is plenty more that can happen in the marketplace and Seatrade wants to be where learnings take place and partnerships are forged,” she says.

The duty free cruise retail market is poised to soar to an impressive US$2.9 billion by 2028 (Source: Allied Market Research).

Highlighting the fast-growing importance of retail within the cruise channel and its pivotal role in enhancing the guest experience, Seatrade Cruise Global is hosting its first-ever The Retail Day, during its April 8-11 conference in Miami.

Leading this initiative is industry consultant Nadine Heubel Seatrade’s retail ambassador. Programming will cover topics such as luxury retail, sustainable practices, staff training and the power of trinity partnerships in cruise retail.

One discussion feels long overdue for Heubel, and that’s looking into how cruise ports can be brought into the retail equation to work more closely with operators. She says, “We want to leverage the participation of the ports which are already present at Seatrade, many of them are even exhibiting. Traditionally they have never been part of the retail conversation but they absolutely should be.”

She adds that the overarching goal is that Seatrade hopes to spark conversations and really support elevating cruise retail to the next level.

An impressive number of new ships have launched into the market recently, and Heubel shares the common theme is that

they all celebrate a custom approach to creativity in retail. “One of these new ships is close to my heart from previously working on the retail concept when I was with Heinemann. Royal Caribbean’s Icon of the Seas has an amazing luxury offer on board, including pre-owned luxury accessories,” says Heubel. This aligns with her role as Global SVP Revenue at the start-up Reklaim, which she believes is redefining the luxury category in travel retail.

Alongside Icon of the Seas, Heubel considers Sun Princess with Harding+ and Carnival Jubilee with Starboard as stand out retail offers. “These are all very different and it comes from a tailor-made offering focused on the cruise brands themselves – each cruise operator pitches each ship differently and the retail reflects that dynamic,” she says.

More and more space is being allocated to cruise retail. Now it's about curating an attractive assortment, according to Heubel. She says it not just one size fits all; it's much more about discovery. Retail has become a complete integration into the whole experience of a cruise ship; it’s being designed around the sports activities on deck, as well as entertainment.

“From ice rinks and 3D cinemas to innovative spa treatments, if brands want to keep up with these developments and be noticed, they have to be different in their offer. It’s all about discovery, which is why we are seeing a lot of innovation and more ‘first at sea’ concepts in cruise retail. It’s an exciting time to be having these conversations,” she concludes.

Heinemann Americas has started to operate 14 retail venues onboard the Icon of the Seas.

The stores offer an exclusive selection of Royal Caribbean branded logo merchandise, in addition to fine watches, fine & fashion jewelry, spirits, perfumes & cosmetics, and vintage luxury leather goods and watches.

Several prestigious brands, including Chanel in the beauty category and Cartier and Hublot watches, are being offered in a multibrand store. Certified pre-owned Rolex are also featured, along with the first-at-sea Omega boutique and new brands to the cruise channel, such as Sunday Riley, Bond No.9, Parfums de Marly, Kylie Cosmetics, Supergoop, Sol de Janeiro and Casamigos. There is also a store offering certified pre-owned luxury handbags with exclusive models from Hermès, Louis Vuitton and others. The curated selection features a co-branded collec-

tion with Vineyard Vines and an Icon exclusive Woodford Reserve.

Strategically positioned throughout the ship, the stores are found in key areas like the Royal Promenade, picturesque Central Park, and the familyfriendly Surfside. These retail spaces offer more than just shopping; they provide guests with immersive retailtainment experiences, supported by a team of 35 dedicated professionals.

Nicolas Hoeborn, Managing Director of Heinemann Americas, said, “We are thrilled to be able to equip this stunning ship with such a diverse and exceptional retail offering. Guests can expect a spectacular assortment and unforgettable shopping experience aboard Icon of the Seas.”

On the subject of pre-owned luxury products, Hoeborn added, “Our certified pre-owned products offer luxury brands at affordable prices, great quality, variety and availability. Pre-owned luxury also makes a lot of sense from a

sustainability perspective, as these products contribute to the careful use of resources".

Icon of the Seas set sail on its maiden voyage from Miami to the Caribbean in January. The ship is 365 meters long and can accommodate 5,610 guests and 2,850 crew members. As a result of a 2019 tender, this will be the fourth Royal Caribbean ship awarded to the travel retailer, currently operating aboard Wonder of the Seas, Odyssey of the Seas and Independence of the Seas.

As a result of the successful partnership that commenced in 2019, Icon of the Seas will mark the third new build launched by Heinemann Americas since the onset of the pandemic. This achievement is said to “firmly cement the travel retailer’s standing as the leading expert for new builds within the industry.”

As sales grow, Essence Corp is also growing within. The company added 21 new employees last year

Navigating through recent choppy waters, Essence Corp has emerged stronger than ever, punctuating a remarkable performance in 2023 with significant expansions and strategic partnerships that highlight the company’s adaptability and foresight, setting a new standard in the travel retail industry

by HIBAH NOORAmid a dynamic period of expansion and strategic partnership, Essence Corp has not only weathered the challenges posed by the recent global climate but has emerged stronger, as shown by its impressive performance in 2023.

The pandemic is long forgotten as Essence Corp sales breezed by those of pre-COVID. “Essence had a fantastic 2023. We had a substantial double-digit growth over 2019,” says Antoine Bona, VP of Sales. “Two of our biggest brand partners for the entire travel retail region are Interparfums and EuroItalia. Interparfums acquired Ferragamo at the end of 2021 and DKNY last year. EuroItalia recently added Atkinsons and they have Michael Kors starting this year. So all of this is definitely helping growth. Additionally, Rituals, Victoria’s Secret and Bath & Body Works maintained steady growth as it has over the years.”

As its sales grow, Essence Corp is also growing within. The company added 21 new employees last year, also streamlining financial administration processes. With a workforce now 90 employees strong, Essence is poised to take on its strategic tasks with agility and foresight.

Distribution arm

Puig granted Essence the distribution for Uruguay’s borders with Argentina and Brazil, offering an opportunity the company couldn’t resist. “So we set up a distribution company called Essence International at the end of 2022, operational as of January 2023,” says Bona.

This venture, located in the free zone of Montevideo and leveraging thirdparty logistics from Costa Oriental, signifies a tailored approach to meeting the nuanced demands of the local market. With a lean local team made up of a General Manager, an Account Supervisor and a Market Coordinator, fully supported by the Miami office Essence fulfills the strategy of combining local expertise with its global vision.

The acquisition of the Shiseido Group under distribution, starting with Issey Miyake in June of 2023 and expanding into skincare starting January

2024, marks a significant enhancement of Essence's portfolio. “Our intention is definitely to grow with other brands if there are opportunities. Anything travel retail is part of our expertise and scope, and we would like to grow,” says Bona. This vision for growth is not just about adding more brands but about enriching the travel retail experience with exceptional service and innovative offerings.

In an industry where adaptation and agility are key to capturing market trends Essence Corp must navigate the complexities of the travel retail channel. Guillame Bona, VP of Sales, says, “The size of stores in travel retail are always a challenge if you compare them with department stores in the US. Travel retail stores don't really have the space to react fast and welcome all these new trendy brands.”

Bona emphasizes the necessity of timing and adaptability in the face of these challenges, suggesting that these constraints are not merely obstacles but avenues for innovation and growth. “We need to make sure that we launch them when they reach their peak, at the right moment. So it's a challenge but it's also

an opportunity for us to transform the business to adapt.”

Bona sees the evolving consumer preferences as a strategic focal point. “The niche market is getting close to 12% of total business in the US. So here again, it's an opportunity for operators and for distributors such as us.”

Despite facing unprecedented challenges in recent years, the Caribbean's appeal as a prime tourist destination is only growing, as shown by impressive tourism figures and strategic investments in infrastructure.