MARCH 2024 · VOL 36 · NO 1

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. Novemeber/ March 2024, Vol 36. No. 1. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE

Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER

Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF

Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR

Laura Shirk laura@gtrmag.com

SENIOR WRITER

Alison Farrington alison@gtrmag.com

SENIOR EDITOR

Wendy Morley wendy@gtrmag.com

ART DIRECTOR

Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

This Confectionery and Food Report marks our first issue of the year and we are pleased to highlight the latest category updates and consumer trends. From regional behaviors, mainly across Asia and in the Middle East, to segment insights, we speak with players from all corners of the category. Across the board, it’s agreed mindful indulgence and the demand for healthier snacking products is here to stay. Traveling consumers are increasingly seeking better-for-you options that also take into consideration the health of the planet. Additionally, companies are closely monitoring whether the shift from gifting to snacking is permanent.

In this digital issue, we sit down with Marcus Hudson, Sales Director at Mars Wrigley International Travel Retail, for a video interview. Outlining the company’s moment-led strategy and the execution of its transaction zone concept in partnership with ARI, Hudson explains the opportunity to convert at the point-of-sale and shoppers’ tendency to self-reward on impulse.

Contributing to our report on chocolate, Lindt & Sprüngli, Mondelez World Travel Retail and Ferrero Travel Market, dish on ways to enhance the consumer experience via the key pillars of partnership building, to target the new generation of travelers and to improve the omnichannel approach, respectively. Ferrero Travel Market also elaborates on its aim to increase visibility of the biscuit segment.

Under our Snacking section, we cover alternative snacking trends and the undervalued savory segment in travel retail. To note: featuring its Red Band Real Fruit, vegan products now make up 23% of Cloetta Global Travel Retail’s candy portfolio; Wonderful Pistachios’ new No Shells flavor, Jalapeño Lime, debuted in the U.S. in February; and earlier this year Kellanova released its first-ever Pringles travel retail exclusive portfolio worldwide.

We also welcome Nicola Wells, Head of Category Development at Nestlé International Travel Retail, as a guest writer in this issue. Wells discusses the company’s Food Reimagined concept, which focuses on maximizing cross-category opportunities and optimizing space in relation to passenger flow. Check out its animation video of the concept on page 46.

Plus, this report offers the latest in confectionery and food in the form of Industry Comments.

Global Travel Retail Magazine will be on location throughout the year to deliver news. The next stop: Summit of the Americas. See you soon!

Kindest regards,

Laura Shirk Deputy Editor laura@gtrmag.com

6 A taste for innovation

m1nd-set research and intelligence from brand leaders reveals shifting trends in consumer tastes and the confectionery and food category

10 Eastern indulgence

A look at the nuances of Asia’s duty free confectionery landscape with input from some of the region’s top retailers

32 Catering to the consumer

As traveling consumers seek alternative snacking options, category players are having to cater to a growing list of diets

16 Sweets in the Middle East

Gifting and sense of place continue to play key roles in the confectionery lineup in Middle East travel retail

22 A lesson in conversion and cross-category growth

Marcus Hudson, Sales Director at Mars Wrigley International Travel Retail, discusses MWITR’s moment-led strategy and the execution of its transaction zone concept in partnership with ARI

26 Sweetening the journey

Lindt & Sprüngli aims to become a staple among shoppers’ baskets by enhancing the consumer experience via the five pillars of forging strategic partnerships

28 Redefining premiumization

Mondelez World Travel Retail unveils an innovative leap towards premiumization with Toblerone Pralines and targets a new generation of travelers

30 Ferrero Travel Market

Prioritizing a sense of play and wider engagement, Ferrero Travel Market is focused on creating shareable moments for the whole family with the support of new products and digital tools

36 Savor the flavor

As savory snacks continue to grow in popularity alongside better-foryou options, the savory segment is working to close the gap in the market and adapt to changing gifting habits

40 Sweet mastery

With over 100 years of candy making, Haribo continues to navigate the post-pandemic travel retail landscape with a focus on growth and inclusion

42 Swiss charm

Recent airport activations in Zurich and Geneva have helped boost Swiss chocolatier Maestrani’s brands Avelines and Munz

44 “Antidote to Apathy” by Nestlé

Nicola Wells, Head of Category Development at Nestlé International Travel Retail, outlines its Food Reimagined concept; the theme The Emporium of Goodness is built around three key design drivers: Do Good. Be Good. Feel Good.

48 A word from the experts

Sharing insights on the category and channel, Global Travel Retail Magazine hears from leaders about what can be expected in 2024 and beyond

In an industry especially sensitive to both consumer preferences and global dynamics, the confectionery sector stands as a vivid illustration of adaptation and innovation. As the tides of consumer preferences ebb and flow, industry titans like Lindt and Mondelez navigate these waters with a keen eye on evolving tastes and market dynamics. Through the lens of exhaustive research from GTR-insight-specialist m1nd-set and brand perspective, we delve into the heart of changing consumer trends.

A recent report by travel retail research company m1nd-set shows several clear shifts in the confectionery category from pre-pandemic to current trends, arrived at from the analysis of research using a very large global sample size during the pre-pandemic years to Q3 2023.

The report analyzes trends in consumer behavior among travel retail shoppers, comparing data from preCOVID (2017-Q1 2020) to post-COVID periods (2021-2023), with a detailed focus on international airport travellers across key categories. It includes sample sizes totaling 182,453 from 2017-Q2 2023, with significant contributions from Europe (50%), the Americas (20%), Asia Pacific (17%), and Africa & the Middle East (13%), targeting adult travelers from major nationalities at key airports.

In Q3 2023, the duty free confectionery category saw significant foot traffic, with nearly 20% of passengers (PAX) visiting these areas. Out of these visitors, about half converted into buyers, highlighting a stable conversion rate despite increased footfall. This trend marks a

continuation from the patterns observed post-COVID-19, where visitor numbers saw an uptick but that did not necessarily equate to a higher buyer ratio. The pandemic’s aftermath has evidently affected the conversion dynamics within the confectionery segment, maintaining a steady share of category buyers among the total passenger count. Additionally, the average expenditure on confectionery items remained consistent across the years, with a notable peak in the first half of 2023.

The motivation to browse, the perception of a safer shopping environment and the allure of duty free shops emerged as primary factors encouraging visits to the confectionery section. These elements have gained more significance compared to the pre-pandemic era, underscoring the critical role of in-store communication and ambiance. The desire for a personal treat, attractive promotions and the visibility of certain products or brands have also become more persuasive in drawing visitors.

Convenience and the opportunity to utilize time before flights are pivotal

The share of purchases on promotion remain higher in Q3 2023 compared to pre-Covid levels, although lower compared to the total post-Covid period

PURCHASES OF CONFECTIONERY PRODUCTS ON PROMOTION –

to continue into 2024, with more consumers become increasingly interested in natural and authentic ingredients. Mindful indulgence has been on the rise and we anticipate that consumers will continue to desire food and confectionery products that do not compromise their physical/mental wellbeing, the health of others or the planet.”

Another trend that will continue:

reasons for purchasing confectionery in duty free shops rather than domestically or online. The main factors influencing product choice include convenience, value for money and indulgence. The predominant purpose for these purchases has been personal consumption, especially post-pandemic, with sharing and gifting trailing behind. Notably, the tendency to buy for sharing has risen since 2021, while gifting has slightly recovered in 2023 after an initial postpandemic decline.

Staff interaction continues to play a significant role in guiding customer purchases, despite a slight decrease in influence compared to the peak years of 2021 and 2022. The exposure to various touchpoints before shopping has realigned closer to pre-pandemic levels, with online channels being the most significant. However, the reach of information sources has generally diminished since the outbreak.

Sustainability concerns are also shaping purchasing decisions, with around 60% of shoppers expressing the importance of sustainable packaging, ingredients and production processes in confectionery. Moreover, there’s a noticeable gap between the awareness of online pre-ordering services and the interest in utilizing them, suggesting a need for improved communication in this area.

Price sensitivity and the absence of compelling promotions are the main barriers preventing potential confectionery buyers in duty free from making a purchase. The constraints of time and long queues have also become more pronounced obstacles compared to prepandemic times.

The duty free confectionery shopping scene in Q3 2023 reflects a complex interplay of factors influenced by ongoing recovery from the pandemic, evolving consumer preferences and the heightened significance of sustainability and convenience. While footfall has increased, the conversion rate remains stable, suggesting that attracting visitors does not directly translate into higher sales.

The insights from this period offer valuable lessons for retailers to adapt their strategies, focusing on enhancing the shopping experience, communicating value effectively, and addressing emerging consumer priorities to capitalize on the recovering travel retail market.

According to Lindt & Sprüngli Head of Global Travel Peter Zehnder, the trend towards healthier and more mindful eating is expected to persist: “We expect the demand for healthier food products

“Premiumization will continue to be a major dynamic in confectionery, and we’re excited to be leading this, working with retail partners to embed the actionable insights and learnings from our category vision to drive increased spend,” Zehnder states.

The launch of Toblerone Pralines is a significant step in Mondelez’s journey towards premiumization within the travel retail sector. This move is described by the company as “one piece of a much larger puzzle” that aims to leverage premiumization to fuel innovation across its product range, concepts and overarching category strategy, according to Dogus Kezer, Marketing Director, Mondelez World Travel Retail.

“Through premiumization and experiential purchase moments, we present engaging offers to consumers, enticing them to indulge for themselves or gifts for loved ones,” Kezer explains. “Toblerone Pralines are designed to provoke a feeling of elevation and exclusivity, to ensure that shoppers feel confident in gifting this high-quality product to loved ones or splurging on it for themselves.” Toblerone Pralines will serve not only as a luxurious confectionery option but also to embody the essence of shared moments and joy among friends and family, reinforcing the brand’s commitment to premium quality and memorable experiences.

Global Travel Retail Magazine explores the nuances of Asia’s duty free confectionery landscape with some of the region’s top retailers as they commandeer shifting trends, digital innovations and pet-friendly initiatives, readying delights for global travelers

by WENDY MORLEYIn travel retail, where global journeys intersect with diverse consumer appetites, the confectionery category stands out as a beacon of delight and exploration. As travelers experience the diverse landscapes of the largest continent, retailers must steer through shifting consumer trends to provide the optimal indulgent experiences for discerning global travelers.

Consumer preferences are evolving towards quality and value, as Sophie

Park, Confectionery Buyer at Lotte Duty Free attests: “Consumers are increasingly willing to pay more for good quality products, even if they are more expensive.”

She notes a noticeable inclination towards premium products, with travelers favoring superior ingredients and packaging like artisanal coffee and luxury chocolates over traditional bulk gifts. Lotte is adapting to this trend by expanding its range of high-end brands, recognizing the potential for growth in the luxury segment.

Similarly, Heinemann Asia Pacific is capitalizing on the surge in demand for local and culturally resonant products, enhancing the travel retail experience by integrating local flavors and collaborating with indigenous brands. Ranjith Menon, Purchasing Director (Beauty and Liquor, Tobacco & Confectionery) at Heinemann Asia Pacific highlights this approach: “By integrating local flavors and collaborating with local brands, we’re not just selling confectionery; we’re offering a piece of local heritage.”

Lotte consumers are willing to pay more for good quality products. This is Lotte’s Duty Free’s main store in Myeongdong on the ninth floor

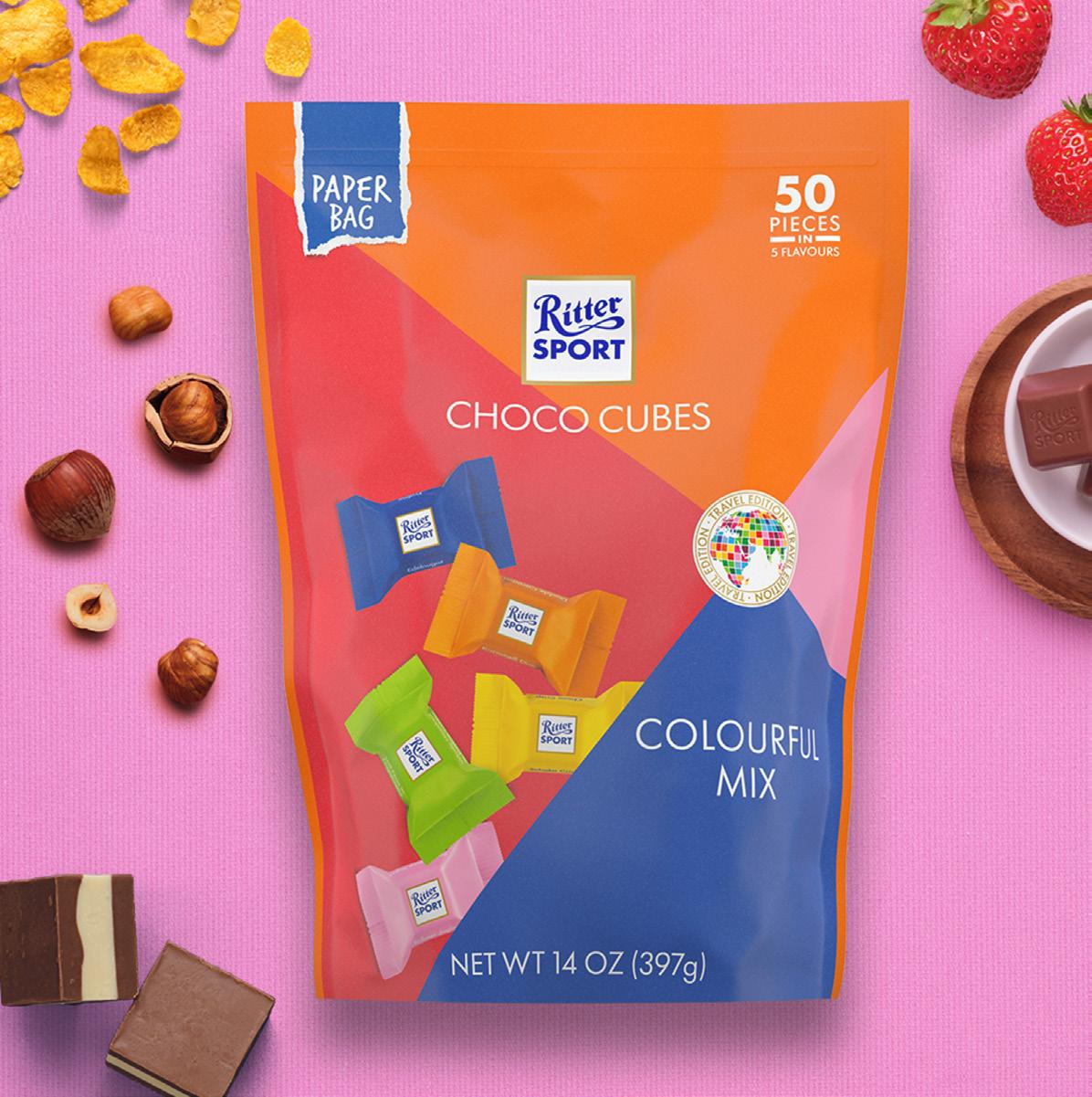

DISCOVER THE NEW RITTER SPORT FLAVOURS

With the growing interest in health and wellness, there has been an increase in demand for low-calorie foods and products with fewer additives. Park emphasizes the importance of keywords such as “zero sugar,” “natural,” “lowcalorie,” and “nuts.” Lotte Duty Free is actively working to strengthen its lineup of these options, anticipating further growth in market size and sales in the coming year. Park says, “Candies, chocolates and processed foods made with healthy ingredients such as red ginseng and ginseng are becoming increasingly popular.”

Menon also sees the impact of the health and wellness trend, stating, “The growing consumer focus on health and wellness has had a notable impact on the confectionery product range.” He notes the industry’s efforts to diversify product offerings with healthier options while still catering to indulgent tastes with initiatives such as increasing the availability of organic and natural products and prioritizing transparent and informative labeling to meet the demands of health-conscious travelers.

This trend is helpful in navigating increased regulations. Menon empha-

sizes the importance of adaptation, “It’s about seizing the opportunity to innovate and cater to the health-conscious consumer.” This includes shifts towards transparency in ingredient sourcing, reduced sugar content and the inclusion of healthier alternatives.

Lotte Duty Free is harnessing the power of social media and digital technology to revolutionize the marketing and sale of confectionery products within the travel retail sector. As the global appetite

for K-FOOD soars, propelled by the growing popularity of Korean culture, Lotte Duty Free is strategically positioning its confectionery offerings to meet this rising demand.

Lotte is offering personalized shopping suggestions based on customers’ purchase and product search histories in its online store. It utilizes data analytics to refine the shopping experience, presenting customers with customized product recommendations that align with their preferences, a technique that has proven successful. This commitment to digital innovation underscores the retailer’s efforts to stay on top of trends and cater to the evolving tastes of its global customer base.

At Changi Airport, the allure of confectionery remains strong, consistently ranking among the best-selling categories for its convenience as a last-minute gift option for those embarking on journeys, Gwyn Sin, Vice President of Airside Concessions at Changi Airport Group notes, “In the last quarter of 2023, passengers from India, China and Singapore were the top buyers in this category.”

Changi Airport Group is dedicated to enhancing the customer experience, working with retailers to introduce creative methods to draw in more patrons

The power of 13 Swiss alpine herbs

and boost retail sales through engaging, airport-wide initiatives.

In the face of global inflation, Lotte Duty Free’s approach to mitigate consumer impact is to minimize price increases through consultation with brands, aiming to reduce the burden on consumers.

Heinemann Asia Pacific adopts various strategies, including pricing adjustments and cost optimization, to meet consumer expectations. Both retailers emphasize strategic pricing and cost management to balance operational sustainability and consumer affordability amidst inflation in the duty free confectionery market.

Lotte Duty Free is noting a remarkable upswing in a niche market often overlooked in duty free retail: pet-related products, specifically within the confectionery and food category. This trend correlates with the increasing number of single-person households and the concurrent rise in pet ownership. Pet

food is expected to occupy a growing share of the food category’s sales at Lotte Duty Free, indicating that high-quality pet nutrition is not just a passing trend but a significant and growing sector in travel retail. “There is distinct growth in the market for pet-related products in the duty-free shop’s confectionery/food category,” Park says.

The statistics are telling; sales of pet food and treats at Lotte Duty Free surged nearly fivefold in 2023 compared to the previous year. This spike reflects a broader market evolution, with global pet care expanding and the industry responding with specialized offerings such as organic and special diet pet foods.

FNA Group International is actively collaborating with suppliers to broaden its product offerings, focusing on the introduction of limited-edition gift packs and locally designed packaging tailored to seasonal occasions such as Lunar New Year, Valentine’s Day, Hari Raya, Easter, Diwali and Christmas.

Pamela Loo, Director of Retail and

Local Sales at FNA Group International, emphasizes the company’s commitment to enhancing the shopping experience through exclusive offerings. “We developed ‘The Cocoa Trees’ gift boxes and bags, providing customers with the opportunity to curate their own selection of products,” states Loo. “These unique offerings are available exclusively at the Terminal 2 [Changi] main store, which opened in October last year.”

Heinemann Asia Pacific is employing innovative strategies to optimize its confectionery spaces, focusing on creating an engaging shopping environment that resonates with the desires of modern travelers.

“Optimizing our confectionery space is about more than just efficient product placement; it’s about creating experiences that captivate our customers,” Menon says. “Through strategic zoning, engaging digital interfaces, and personalized cross-promotions, we’re elevating the shopping experience to meet the expectations of today’s discerning travelers.”

With the category offering alternatives to mainstream chocolate products, Lagardère’s Chatterjee says the impact of the growing health and wellness trend on category demand is limited

In Middle Eastern travel retail, the confectionery landscape is evolving, blending deep-rooted gifting traditions with a keen awareness of health, offering travelers indulgent yet mindful choicesby HIBAH NOOR

ifting and sense of place –along with an increasing awareness of health and wellness issues – continue to play key roles in the confectionery category in travel retail in the Middle East, according to two leading retailers in the region.

Sharon Beecham, Senior Vice President – Purchasing at Dubai Duty Free and Tirthaa Chatterjee, Lagardère Travel Retail Middle East’s Category Manager, Food, share their thoughts on key trends.

According to Beecham, Dubai Duty Free’s confectionery category “is predominantly driven by gifting, which makes up 72% of total confectionery sales.” She says most gifting choices revolve around family get-togethers and celebrations, and notes that a “universal consensus among shoppers that buying brands and products that are perceived as valuable gifts on the receiving side is a priority for shoppers.”

Self-indulgence represents just under 5% of sales. “Today’s consumers are well-informed about health and wellness and their shopping is driven by those choices,” Beecham says. “However, when traveling, shoppers usually have different priorities when it comes to consumption or self-indulgence. It is like they have an on/off switch button and use travel as an opportunity to make it a cheat day for self-treating and put aside usual healthy routines.”

She cites research suggesting that confectionery is directly linked to sensory feelings, a good mood that is hard to resist, and notes that health and wellness in confectionery “have not made similar progress in travel retail as they have in the domestic market”.

According to Chatterjee, the impact on confectionery category demand resulting from the growing health and wellness subcategory in food is limited, with the category offering alternatives to mainstream chocolate products. “This

Sharon Beecham, Senior Vice President – Purchasing at Dubai Duty Free

Sharon Beecham, Senior Vice President – Purchasing at Dubai Duty Free

could be one of the reasons behind why these two categories can sustain value without impacting each other,” she says. “A customer looking to buy differential/ healthy products opts for chocolatecoated dates and nuts. This is growing the category instead of cannibalizing the sales of confectionery.”

Considering the role of social media and digital technology in the marketing and sale of confectionery products, Beecham describes social media as an “important tool to connect retailers with travelers on an emotional level, while at the same time building awareness and trust before passengers are exposed to travel and shopping experiences.”

Dubai Duty Free uses social media to showcase exclusive product launches, high-profile and seasonal activations, adding links to the retailer’s website so shoppers can make online purchases.

“We have witnessed customers who are more inclined to shop for Beauty, Electronics, and Liquor products online, while they prefer a personal shopping experience when it comes to confectionery and food purchases,” Becham adds. “Social media then serves as a powerful tool to showcase the offers and raise awareness about the product range we are offering.”

Chatterjee highlights how brands are engaging on social media platforms

to drive sales by focusing on travel retail exclusives, differential products and packaging. “The most highlighted category is gifting,” she says.

“Brands are still learning about conversion rates from social media imprint. The use of digital marketing is an emerging trend and brands are opting it to have more interactions and creating value for the category with higher customer engagement, especially with millennials.”

“We have already seen traffic light control systems implemented for food labeling guidelines paving the path in the UK and other countries,” Beecham says. “Europe also has stringent measures for food ingredients, and it is

Dubai Duty Free’s strong and steady sales of dates, chocolate-covered dates, Arabic and regional sweets, as well as regional chocolate brands

expected that the UAE may implement similar requirements in the near future. Confectionery brands need to stay alert and agile, expecting those changes, and be ready for any such changes.”

She notes that some brands are keen to highlight health and wellness on their packaging, with statements including “Free from Palm Oil,” “Plant Based,” “Lactose Free” and others such as those. “It’s useful to target that limited consumer base that specifically looks for this information on packaging,” Beecham adds.

Chatterjee says Lagardère Travel Retail has established categories to target business in the emerging health and wellness categories and notes a shift in consumer preferences towards healthier choices such as protein bars, nut bars and food products made with dates.

Considering the developing interest in fine foods in travel retail, Beecham says the increasing number of F&B outlets in Dubai International Airport is testament to the growing demand, and Chatterjee underlines the role of sense of place.

“The Fine Foods category is growing significantly due to its sense of place equation in the Middle East, especially in the category of dates and nuts,” she says. “We have seen over 11% growth in Saudi Arabia during 2023 over 2022 in the Fine Foods category. The overall growth trend is very impressive in this category since it plays heavily into gifting and souvenirs.”

Beecham emphasizes Dubai Duty Free’s strong and steady sales of dates, chocolate covered dates, Arabic and regional sweets, as well as regional chocolate brands. Patchi, Bateel, Al Nassma are just three of the established regional brands that perform well in the travel retailer’s stores. She also underlines the key role of bespoke destination packaging.

Lagardère Travel Retail has made sense of place an integral part of most of its outlets and the company’s global CSR commitments include sourcing more local products. In the Middle East the growing trend in local products is focused on various snacking options made with dates, nuts and dried fruits. “This category is usually price positioned around 20-30% higher than confection-

ery,” Chatterjee adds. “In travel retail, sense of place products are supporting the growth in the gifting category.”

Beecham believes merging food with souvenirs and the rest of the fast-moving consumer goods (FMCG) categories could be a strong option in optimizing confectionery space. She also suggests that food service counters offer loose dates, nuts and honey to increase the average transaction value (ATV) of shoppers.

Chatterjee notes a confectionery category shift in consumer behaviour post-COVID. “Customers are trying to shrink their budget while staying healthy and the impulse category in confectionery is gaining attention and market share, with small sized gifts

introduced at cash tills to capture turnover and convert sales.”

Inflation and its effect on the confectionery category

Beecham says an increasing number of confectionery suppliers are introducing bite-size snacking options to lessen the effects of inflation and higher prices.

“High-ticket items and passpacks have already been affected by crossing the acceptable price threshold. We need to reevaluate the composition of these promotional bags to make them more affordable and regain their appeal.”

“Over 2022 and 2023, one of the significant strategies from brands to control price increase has been in the form of decreasing the pack size,” Chatterjee adds. “This is where local confectionery is gaining sales.”

Speaking about the opportunity to convert at the point-of-sale and the range of its moment-led strategy, Marcus Hudson, Sales Director at Mars Wrigley International Travel Retail, discusses the execution of MWITR’s transaction zone in partnership with ARI

by LAURA SHIRK

Leading up to the release of this issue, Global Travel Retail Magazine sat down with Marcus Hudson, Sales Director at Mars Wrigley International Travel Retail (MWITR), to learn about its agenda for this year and the launching of its transaction zone concept in partnership with Aer Rianta International (ARI). At Dublin Airport Terminal 1 and 2, passengers can find a new queue system and manned transaction zone including an optimized crosscategory portfolio.

During the interview, Hudson referred to the “persevilliance” that MWITR exhibited in 2023 – a more challenging year than expected for both the company and the category. He said the team kicked off 2024 with the same acceleration as last year, but with a heavy mindset on execution. Experiencing growing support for what it wants to deliver in the channel, MWITR is ready to perform at the highest level. According to Hudson, it’s nice to have a game plan and now it’s time to win the match.

Wanting to refresh its strategy in November 2022 and find ways to increase conversion, MWITR took note of the domestic market and started to examine the moment of purchase and the act of checking out. Hudson explained the stress level of a con-

sumer is known to rise considerably at this time – especially in the case of self-checkout – which often causes the person to look for a way to self-reward on impulse. The same type of consumption such as a well-deserved treat could serve a different purpose including to recharge or to remind. He pointed out that “to remind” is particularly relevant in an airport setting where travelers are inclined to purchase gifts or essentials like a portable charger or bottle of water.

“We knew that these impulse moments existed and we knew that the recharge, reward, remind strategy really plays out, so it was about bringing these two together with a strategic intent and a vison on what we could execute to enable this conversion moment crosscategory, not only within confectionery.

One thing that we sometimes forget because we’re working with such wellknown brands is that every time we convert one extra consumer that wasn’t thinking about purchasing our product it’s a victory,” said Hudson.

A relatively untested concept in travel retail, MWITR recognized that the implementation of its transaction zone relied on full collaboration, since retailers have a greater understanding of the traveling consumer. The company teamed up with ARI to help build its story and benefitted from the retailer’s open-mindedness. The two aligned on the “power categories” of the zone and then modeled its execution around those and the needs of the consumer.

Commenting on the process and partnership, Hudson shared that based on feedback from ARI, MWITR returned to the drawing board to figure out how to integrate the need for shopping bags into the space.

“What we didn’t want to do is force fit a domestic transaction zone into an airport environment; but in order to not do that, we needed to work with a retailer to find out what categories need to be reflected and how. Then, we worked together on what it might look like and what flow we believe is best,” he said.

When asked how the design of the transaction zone varied between T1 and T2 at the airport, Hudson said each one required a different approach in order to remain contextually relevant per store. Compared to the zone at the store in T1, which combines confectionery and spirits – and is experiencing a

significant uptick in gifting as expected – passengers will see a more traditional confectionery portfolio on display in T2.

In the first four weeks of opening the zone at the store in T2, the growth of the items offered increased 50 percentage points faster than the category. The company has already started discussing how the concept could be incorporated into the perfumes and cosmetics space where the opportunity to convert also exists.

Although Hudson admitted that the team entered the market prematurely, without the clarity of what the concept could deliver overall, he said MWITR will keep this in mind for the future. Alongside MWITR’s responsibility to grow the “total category pie,” a crosscategory solution is key to the longevity of its transaction zone strategy. The

company needs to be thinking globally in order for the strategy to be a success and reach its potential.

“We need to adapt the concept to the channel, but at the same time what we do in the channel needs to be integrated into what we do globally and adapted to local consumer requirements,” explained Hudson. “It’s a lot of work, but we have a strict process that we go through to build the transaction zone concept per location.”

The launch at Dublin Airport, which coincided with the upgrading of transaction zones at stores in Larnaca, Cyprus, is the first of many that will take place this year worldwide. Working with its partners across the globe, Hudson said MWITR seeks to turn the traditional point-of-sale into a revenue generator for travel retailers, supporting a category conversion growth of over 20% in the coming years.

Lindt & Sprüngli’s innovative strategies to transform travel retail confectionery, from enhancing customer experiences via the five pillars to forging strategic partnerships, aim to make Lindt a staple in every traveler’s basket

by WENDY MORLEY

Leveraging consumer insights and strategic partnerships, Lindt & Sprüngli is redefining the confectionery landscape in GTR. With a commitment to premium quality and an innovative approach to product and retail concepts, Lindt is poised to captivate the discerning traveler. Company strategy encompasses indulgent experiences and the essence of gifting, aiming to make Lindt chocolates a quintessential component of every travel retail experience.

Lindt intends to fulfill its ambitious target of incorporating confectionery into every travel retail basket by collaborating closely with retail partners as part of its category vision.

“The ‘Recharge’ – or snacking – pillar in our category vision is the largest consumption moment, accounting for more than 30% of purchases in travel retail.” This highlights Lindt’s focus on ensuring their offerings are well-suited to meet

immediate consumer needs for snacks that are convenient and satisfying.

“On ‘Indulge,’ we remain committed to driving category growth through premium indulgence with the quality credentials that shine across our entire range.” This underscores the company’s dedication to enhancing the appeal of their confectionery products through superior quality.

Zehnder remarks on the perennial nature of the ‘Delight’ aspect, which focuses on gifting, “While gifting does have a few peak seasons annually, it is in fact a year-round opportunity: the majority of gifts are not purchased to celebrate a particular holiday but simply to show someone that you care.” Lindt is working with retailers to ensure a robust year-round gifting offer, while also catering to demand during key festive periods.

The “Treat” pillar, according to Zehnder, offers a simple, quick guiltfree and comforting indulgence that provides an emotional uplift for travel-

ers. This is exemplified by the LINDOR Mini Bag 100g.

Lastly, the “Connect” pillar is all about sharing the experience, with Zehnder explaining that it “is focused on products that help consumers share the adventure and indulge together along their journey.” He suggests products like NAPOLITAINS and LINDOR as ideal for these shared moments.

According to Zehnder, the trend towards healthier eating is here to stay. “We expect the demand for healthier food products to continue into 2024, with more consumers trying to limit their sugar intake,” he states. “Additionally, consumers will become increasingly interested in natural and authentic ingredients that are free from artificial additives.”

He adds that “mindful indulgence” is on the rise. “We anticipate that consumers will continue to desire food and confectionery products that do not

compromise their physical/mental wellbeing, the health of others or the planet.”

Lindt's expansion of its consumer study to include insights from various countries including Germany, Spain, Saudi Arabia and China underscores the unique shopping behaviors in travel retail versus local markets and the regional variations in consumer preferences.

Zehnder highlights the importance of adapting to cultural celebrations and consumer tastes for growth, stating, "By tailoring our approach, we believe we can deliver double-digit growth in targeted regions." The company capitalizes on festive periods like Diwali, leveraging them as significant opportunities for gift-giving and tailoring marketing strategies to fit shopper profiles and locations. Lindt's successfully expanded Diwali campaigns in airports across the Middle East and India exemplify this approach.

Challenges persist post-pandemic, Zehnder notes. “As with 2023, we antici-

pate there will be challenges with supply chain and increased costs.” To address these, Lindt has adopted a forward looking purchasing strategy to ensure the availability of raw materials and support growth, highlighted by their move to a new logistic hub in Belgium. Despite market fluctuations and increased operational costs, particularly for cocoa, Zehnder assures that Lindt's product manufacturing remains stable, underscoring their commitment to mitigating impact through internal efficiencies and strategic planning.

Lindt continues as a leader in the travel retail confectionery sector, focusing on premium products. Zehnder highlights the ongoing significance of premiumization in the market, stating, “Premiumization will continue to be a major dynamic, and we're excited to be leading this.” He stresses the critical role of product accessibility and quality, especially for gifting, to draw in customers for retailers. Zehnder reaffirms Lindt's esteemed position and its crucial role in driving growth within the category, concluding with the brand's mission, “Lindt GTR continues to enchant the world with chocolate.”

Mondelez WTR unveils an innovative leap towards premiumization with Toblerone Pralines, targeting a new generation of travelers with premiumization, experiential purchase moments, originality and authenticity

by WENDY MORLEYMondelez World Travel Retail is stirring up the confectionery category with the launch of Toblerone Pralines, a strategic move that epitomizes the company's commitment to premiumization. With a focus on catering to the evolving tastes of travelers, particularly the younger demographic, Mondelez is not just introducing a new product but is also redefining the experience of indulgence in travel retail. This initiative aligns seamlessly with the company’s broader strategy to elevate category awareness and enhance consumer engagement through innovative offerings and experiential purchase moments.

The launch of Toblerone Pralines marks a pivotal step in Mondelez's pre-

miumization strategy in the GTR channel, which is part of a broader initiative to drive innovation and enhance its category strategy. Dogus Kezer, Marketing Director, Mondelez World Travel Retail states, “Through premiumization and experiential purchase moments, we present engaging offers to consumers, enticing them to indulge for themselves or gift for loved ones.” This approach aims to enrich the shopping experience with immersive, curated activations that go beyond mere transactions, thus adding value and confidence in the purchase.

Mondelez WTR is revitalizing Toblerone Pralines to focus on younger travelers poised to become a significant

portion of the travel market by 2030. In tune with this demographic shift, Mondelez is tailoring its products to appeal to the tastes and values of younger generations with thoughtful design that highlights premium quality through distinctive shapes, engaging messages and complex flavors. Central to this strategy, Kezer states, “We are leveraging popular themes amongst young consumers; the tag line, ‘Diamond Shaped, Never Square,’ taps into originality and authenticity, sentiments that resonate with the new generation who seek to stand out in a standardized world.”

With digital-centric marketing, the company has focused on enhancing online visibility and engagement, recognizing the importance of the digital landscape where “young shoppers spend most of their time.” High-impact digital advertisements in key international airports such as Zurich, Heathrow and Barcelona, and partnerships with Avolta and Zurich Airport allow for an immersive digital experience. “By employing a digitization strategy with effective touchpoints and channel-exclusive activations, our goal is to drive greater digital engagement, awareness, and sales,” says Kezer.

Gifting occupies a central position in the strategic marketing of Toblerone Pralines, with the product crafted to evoke a sense of sophistication and uniqueness. This approach is aimed at providing consumers with the assurance that Toblerone Pralines are an ideal choice for a premium gift or a personal treat. “Toblerone Pralines are designed to provoke a feeling of elevation and exclusivity, to ensure that shoppers feel confident in gifting this high-quality product to loved ones or splurging on it for themselves,” says Kezer. Toblerone Pralines will not only serve as a luxurious confectionery option but also to embody the essence of shared moments and joy among friends and family, reinforcing the brand's commitment to premium quality and memorable experiences.

Mondelez WTR emphasizes sustainability across its operations, particularly in the travel retail confectionery sector, aiming for a more eco-conscious business model. Toblerone Pralines are produced in line with Mondelez's Cocoa Life program, reflecting the company's commitment to ethical and sustainable

chocolate production. Kezer articulates this commitment, stating, “Sustainability is at the forefront of every mind – from consumers to retailers, brands and operators, we are all striving to be kinder to people and the planet. As the confectionery category leader in travel retail, Mondelez WTR is dedicated to leading the charge in progressing sustainable practices and products.” This initiative addresses critical issues like climate change and social inequality, ensuring the chocolate is “made right” from the start, thus underscoring Mondelez WTR's dedication to advancing sustainable practices within the industry.

by LAURA SHIRK

by LAURA SHIRK

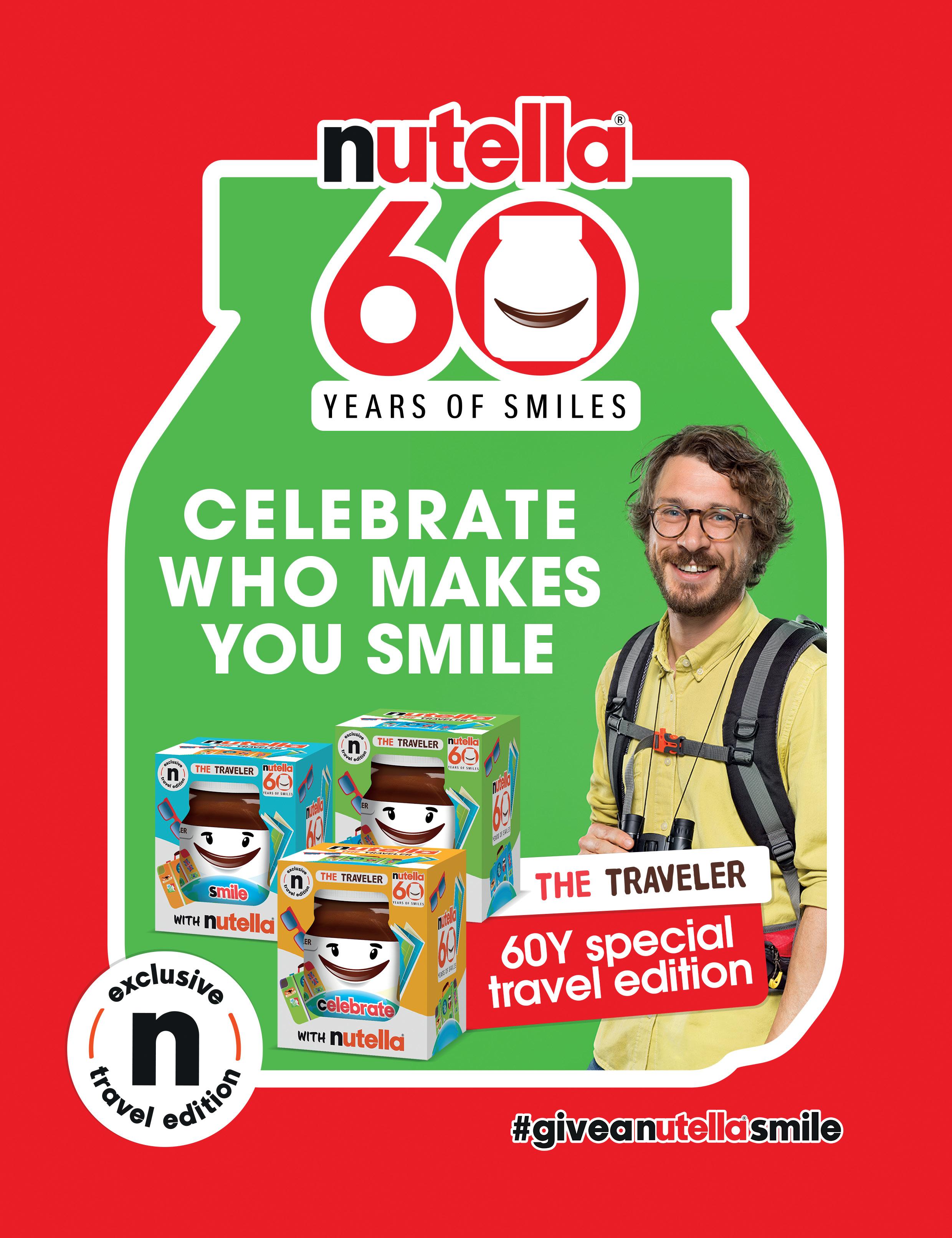

To mark 60 years of Nutella, Ferrero Travel Market released a travel retail exclusive jar design: The Traveler

Described as an underserved seg ment, the company says it offers a great opportunity to drive increased spend, build cross-category engagement with the wider food market and generate consumer engagement.

“Biscuits offer something different for traveling consumers; they are a product that taps into the desire for sharing and snacking, as well as creating an opportunity to craft memorable moments with fun products,” says Sergio Salvagno, General Manager, Ferrero Travel Market.

Launched in 2022, Ferrero Travel Market’s La Biscotteria concept is about leveraging the power of internationally

recognized brands such as Kinder and Nutella to create new products, which enhance gifting and sharing opportunities among shoppers. Since its launch, the concept has continued to grow; most recently, FTM’s new sharing product Kinderini debuted last year in Cannes. According to Salvagno, the ongoing global travel retail rollout of Kinderini will be a focus in the coming months.

With play a central part of its offer, Ferrero Travel Market creates memorable and shareable moments for consumers of all ages. “Our brands are recognized and loved around the world and we want to bring the unique brand experiences to life for shoppers in a new and engaging way,” explains Salvagno. “Often in the modern market, that means making the most of digital touchpoints and omnichannel opportunities. Last year’s ‘Next Destination’ campaign is a great example of this: by scanning a

QR code consumers were invited to take pictures and post them online to get exclusive prizes.”

When it comes to new releases, FTM aims to introduce more than a fresh product to the market; it designs a complete offer based on a sense of play and wider engagement. As an example, supporting playful gifting and the desire for personalization, the Kinder Chocolate PENCIL CASE takes the Kinder brand beyond the category to provide a popular lifestyle offer. The pencil case can be personalized per user, with children able to add their photo or favorite stickers.

“To create a truly personal and playful offer, we have to think beyond the normal constraints of the travel retail and confectionery or biscuits sector. A great example is the Kinder Surprise Paw Patrol, which debuted at the TFWA World Exhibition. Created in partnership with the children’s TV phenomenon, each pack contains 100% Paw Patrol toys, so younger shoppers can collect the whole set and carry them around in the specially-created suitcaseshaped pack,” says Salvagno.

At the end of last year, m1nd-set reported the influence of kids on their

parents’ shopping behavior should not be underestimated. When asked how FTM delivers inclusive messaging and age-appropriate content that targets kids and traveling families, Salvagno referred to two digital experiences: Applaydu app and Kinder Memory Maker. The first is an “edutainment” platform for children between 4-9 years, which aims to help users develop skills through family games and activities; the second is initiated in travel retail at points-of-sale. Thanks to Memory Maker, passengers can scan a QR code and play the game to unlock and share the first memory of their trip via social media.

“Digital is a key tool for engaging the modern travel retail shopper. We can no longer rely simply on in-store activations, they must be paired with digital and online outreach, which creates more touchpoints and more opportunities for memorable moments for customers.

“For this reason, we are now adding a QR code on many new products that allows consumers to access specific exclusive contents. In many cases, this information taps into key purchase drivers such as sustainability or digital engagement. For example, our QR codes give shoppers access to platforms with information on how to upcycle

and decorate your home with the new Rocher golden gift tin or log in to an augmented reality experience powered by Kinder brand,” adds Salvagno.

An interactive game dedicated to Kinder Kinderini is also available. The new app invites players to participate in an online game, which involves recreating the fun faces found on the biscuits.

Nutella turns 60

To celebrate Nutella’s 60th anniversary this year, the company launched #GiveANutellaSmile. The omnichannel campaign features the release of a series of limited-edition Nutella jars supported by a digital activation and physical retail events.

To mark the occasion, Ferrero Travel Market released a travel retail exclusive jar design: The Traveler. Each product displays special messages including “Celebrate with Nutella” and “I Love You.” It is also hosting high-profile installations at key airports around the world. The dedicated Nutella pop-up spaces offer the new jars, alongside access to the digital campaign.

With traveling consumers seeking healthier snacking options and alternative ingredients, food and confectionery is having to cater to a growing list of diets; read how category players are staying ahead of and responding to evolving trendsby LAURA SHIRK

With evolving dietary restrictions and preferences among traveling consumers impacting the market on a greater scale, confectionery and food brands have had to monitor developments closely in order to respond proactively. Beyond travelers seeking to remain health-conscious in-transit and expecting alternative ingredients on the shop floor, those in the category are having to cater to a steadily growing list of diets.

From nutritional snacking to the world of indulgence; plus, current pressures on food systems, this article will look at different corners of the category. We’ll hear from representatives of the following segments: sugar confectionery, nuts and dried fruits and chocolate, who work to help satisfy the traveler’s sweet tooth and love of all things savory.

Across the board, confectionery and food players are conducting regular market research and examining consumer preferences based on key performance indicators to stay at the forefront of evolving dietary trends. At the top of the list, consumers are voicing the need for more raw materials with their health in mind and continuing the push toward sustainable solutions. The health of people and the planet has become a shared priority.

According to Jana Stroop, Global Travel Retail Manager at Cloetta Global Travel Retail (GTR), the company is working toward targets in order to make the move to healthier alternatives for life’s sweetest moments. Over the last year, Cloetta GTR has introduced more

vegan options, which now represent 23% of its candy portfolio; 90% of this portfolio consists of non-artificial colors and flavors. “We want to accelerate these developments over the coming years and increase our plant-based confectionery portfolio to 100% by 2025 vs. 2019. Our strategy is to provide more options to our classic brands so that consumers can make a health-conscious choice if they want to,” says Stroop.

Cloetta GTR’s Red Band Real Fruit exemplifies this strategy; as it sees basket spend decreasing and self-consumption on the rise, Stroop says this candy’s 200-gram standing pouches are well positioned to adhere to changing consumer demands, specifically those of the new generation of travelers. The concept of 50% real fruit is unique to the sugar confectionery segment and Cloetta GTR is the first company to make this claim on pack. Red Band Real Fruit is quickly picking up traction worldwide, especially since the product is vegan.

“Cloetta’s discovery platforms and innovation teams work to find ways to provide options that meet these changing tastes while still staying true to our product offering. Innovating for the future is a key success factor in order for Cloetta to stay in tune with consumers’ changing demands,” she adds.

On the same note, Seeberger understands the diverse dietary needs of customers, offering vegan-friendly, gluten-free and sugar-free options without compromising on taste. The family-owned company says its range of natural snacks based on nuts and dried fruits are better-for-you products of the highest quality that are innovative and indulgent. This year, the company wants to focus on communicating to consumers how it conducts business, as well as its plans for the future. An addition to its CVS-focused assortment, Seeberger will launch its first travel edition mid-2024.

“Seeberger has experienced positive outcomes from the increased consumer focus on ingredient listings. By providing transparent and clean ingredient information, as well as information about our sustainability work on our products across the supply chain, we have built trust with consumers who are more attentive to what goes into their snacks. This practice resonates well with traveling consumers, contributing to our brand's success in the global market,” explains the brand.

The release of Ritter Sport’s new vegan range at the start of 2023 cemented its response to changing consumer behavior and the increase in “flexitarians” (a person who has a primarily vegetarian diet, but occasionally eats meat or fish). This range also looks to please those who simply want to try something new. Jan Pasold, Managing Director Global Travel Retail at Ritter Sport, says as the company’s main focus

Ritter Sport Assorted Vegan Bars 100 grams; the range is available in five flavors

Ritter Sport Assorted Vegan Bars 100 grams; the range is available in five flavors

last year, promotional activities to support the release took place worldwide. “The response among the trade has been positive. There currently aren’t a lot of vegan products in the travel retail market in confectionery and retailers have a need to provide such an offer. We can’t compare to the regular TREX article in our portfolio in terms of sales, but the range is here to stay. Our highest sales are in Europe among vegan travelers and younger generations,” he shares.

As shoppers seek healthier snacking options, there is opportunity for growth within the savory segment, which is said to be undervalued across the channel. New ways of thinking can also be implemented as more global consumers are making an effort to track their food intake, physical activity and overall lifestyle. Trends in global consumerism can reflect trends in travel retail. “We believe that consumers should be able

to choose how they indulge, hence why in each of our products we try to offer a clean recipe, which is reflected on pack as well, meaning traveling consumers can make the same quick and informed decisions as they might do in their home market,” says Stroop. When asked how the category will meet the next wave of innovation in personalization, Seeberger comments it is likely that such tracking will involve advancements in technology, data analytics and artificial intelligence.

Back on the shop floor, the pressures on food systems in connection to dietary preferences and restrictions – and beyond – are visible. As shared by Pasold, the increased price of raw materials continues to heavily impact the cost of manufacturing and the final price point. “In the last two years, we have not increased the [product] price on the same level as the increase in our costs. Hence, we absorb a part of it and give RSP recommendations to the trade that

we believe are fair to the trade and the consumer. Every stakeholder in the business has to give something, especially if we want to offer the traveler price points that are acceptable,” he says.

As savory snacks continue to grow in popularity alongside better-for-you options, the savory segment is working to close the gap in the market and adapt to changing gifting habits

by LAURA SHIRK

Considered an underserved segment within confectionery and food in global travel retail, savory snacks are growing in popularity alongside betterfor-you options. Whether finding space on the shelf as a hero brand of the segment or blending together sweet and savory flavors in one bite, names like Pringles, Wonderful Pistachios and Hershey serve as easy reaches for those browsing the aisles of duty free. This is the case whether browsing with the purpose to snack, share or gift.

Formerly Kellogg, Kellanova owns the stackable potato crisp brand Pringles, which is working with its retail partners to close the considerable gap in the market. According to Jacco Douma, Benelux Business Manager Emerging Channels BNLX & Global Travel Retail/Duty Free at the company, while the savory segment represents 11% share in the domestic market within confectionery, in global travel retail it has been estimated at 2%.

At the end of January, Kellanova released its first-ever Pringles travel retail exclusive portfolio worldwide to fulfill consumers’ need for gifting. The company is in discussion with its partners and marketing and category management teams to “execute activation support in excellence.” This is on the mark, as reported by m1nd-set in Q3 of last year, the share of confectionery duty free shoppers who purchase travel retail exclusives remains well above pre-COVID levels at 57%. Available now is a 1x165-gram tin can format in four flavors and

two different-sized multi-packs.

Although gifting has lost weight post-pandemic, the research agency observed a small recovery in 2023. Building on this finding, Douma says the most important touchpoint of this new offer will be the “gifting consumption moment,” which he adds is new to the savory category in the channel.

“We are now popping up throughout the world and the pick-up and rotation of Pringles in all zones across the globe is very promising. Together, with our partners we are implementing the right consumer touchpoints and by offering our portfolio we see the savory category is already growing and we have just started by distributing our Pringles portfolio range,” says Douma.

Responding to the fact that duty free stores have a limited snacking portfolio compared to domestic retailers, Wonderful Pistachios is trying to increase the size of this section because it knows

the demand exists for impulse salty snack purchases. As shared by James Kfouri, Director of Sales Global Travel Retail at Wonderful Pistachios, the brand is available in duty free markets where it is not offered domestically such as Australia, New Zealand, Argentina and Paraguay.

“Wonderful Pistachios is in a unique position to turn heads while consumers browse duty free aisles because we’re not a globally distributed brand. Duty free consumers are naturally curious and enjoy being exposed to products they might not have available at their local retailers, so when some shoppers see Wonderful Pistachios, they often stop to take a look.

“Also, our Wonderful Pistachios flavors and pack-sizes vary from marketto-market and this is a huge contributor to the disruption of habitual browsing. For instance, in the U.S. we offer the widest array of our No Shells varieties including Sea Salt & Vinegar and Chili Roasted, which have bold and brightly

colored packaging that can be seen from a distance,” says Kfouri.

Supporting this business model, m1nd-set also reported that confectionery buyers in travel retail are open to discovery; almost seven out of 10 purchase products for the first time. The agency found that the willingness to seek uniqueness and find novelties in Q3 2023 remained higher vs. preCOVID levels. Kfouri adds, “Wonderful Pistachios No Shells flavors are proven to drive incremental sales and bring new buys into the nut category. In fact, Wonderful Pistachios No Shells have outpaced category growth by three times since first launching in 2019.” A new No Shells flavor, Jalapeño Lime, debuted in the U.S. in February and will launch in Canada and Mexico later this year.

Reflecting on the noticeable behavioral shift from gifting to snacking within the category, the brand reasons this is mainly because the time spent at the airport has increased compared

to pre-pandemic. Travelers often arrive earlier to the airport expecting longer lines, tighter security and/or potential delays that they are now more likely to purchase food and snacks to serve as a meal replacement or help pass the time. The leading purpose of confectionery purchases in Q3 at 41% was self-consumption. As this way of thinking and these times eventually reduce, Kfouri expects that self-purchasing among traveling consumers will normalize.

All in one

Featuring REESE’S Peanut Butter Cups, barkTHINS Snacking Chocolate, HERSHEY’S Dipped Pretzels and more, the extensive portfolio of The Hershey Company can be characterized as category-bending. With its growth projected to significantly exceed 2019 sales in the coming year, Hershey plans to disrupt the category – and travel retail channel – through a consumer-first innovation plan and is focused on driving footfall and conversion in-store. The company is successfully meeting the growing need of consumers looking for healthier snacking options, while also keeping up with the demand for more indulgent snacks. The global confectionery leader is also partnering with customers to ensure it drives impulse purchasing on the shop floor, rather than relying on the shopper to walk down the confectionery aisle.

“We believe that consumer, customer, category and competitive insights are absolutely critical in facilitating our ability to make data-driven decisions, across all facets of the business. In 2024, our approach is to have a true partnership with our customers, by sharing our insights to enable us to work together to grow the category and leverage the strength of our power brands,” says Andie Doan, Marketing Manager World Travel Retail, The Hershey Company.

When asked about Hershey’s interest in further exploring the savory segment, Doan points out that the launch of its Dipped Pretzels range last year resulted

Wonderful Pistachios’ new No Shells flavor, Jalapeño Lime, debuted in the U.S. in February; it will launch in Canada and Mexico later this year

in initial sales figures approaching performance of the core portfolio items. According to Doan, Hershey expects listings to increase in 2024 to enable expansion of the offering beyond Asia and the range to continue satisfying the demand for self-snacking products.

Speaking about the desire for alternative snacking options globally among duty free shoppers, Doan shares 34% of consumers worldwide have increased their consumption of healthy snacks (Source: Innova Market Insights). To tap into this market, Hershey is launching REESE’s Thins this year. Described as individually wrapped thin portion cups, REESE’s Thins will appeal to shoppers who want a better-for-you option, as well as a sweet treat in one.

“Looking beyond 2024, as a marketing and insights team we are considering this shift as part of our portfolio strategy composition and how we think about our long-term innovation pipeline. We must meet our consumers’ snacking needs by ensuring we have the right mix on-shelf with strong availability. Hershey is focused on being agile and will stay up to date on shopper trends should this snacking trend pivot, particularly with the more substantive return of the Asia PAX,” explains Doan.

Weighing in on the gifting landscape in the category, the company believes it has been driven by two key factors: the slower market recovery in Asia Pacific and a fundamental shift in consumer behavior around the willingness to self-

treat, particularly among the younger demographic. The company will continue to monitor whether recovery across the region – specifically China –results in a return to the “status quo” or if the shift from gifting to snacking is permanent.

“For Hershey, it is about getting the right balance in-store and making sure all consumer needs are properly met. We believe that due to its suitability for immediate consumption and high levels of impulsivity, confectionery is a perfect category to capitalize on the shift

Wonderful Pistachios’ flavors and pack-sizes vary from marketto-market which contributes to the brand’s disruption of habitual browsing

in behavior from shopping for others to shopping for oneself. To capitalize on the impulsive nature of purchasing for oneself, our focus will be on secondary positions near the queue and till,” concludes Doan.

Innovation is a key element in Haribo's operational ethos, as highlighted by Elisa Fontana, Director of Marketing for Travel Retail. She emphasizes its critical role in shaping the company's product development and marketing strategies, ensuring Haribo remains abreast of market trends and consistently addresses the changing demands of its customers.

“In the post-pandemic travel retail environment several segments are showing strong growth, led by self-consumption, sharing and the continued importance of gifting,” says Fontana. “We have a good pipeline of innovation for each of these opportunities, with trusted traditional Haribo favourites and exciting

launches with new flavours, textures and formats.”

For the self-consumption purchase occasion, Haribo is prioritising the availability of its hero products in tall, colourful pouches to maximise the on-shelf vertical merchandising opportunity.

Recognizing the growing influence of Generation Z, Haribo is proactively evolving its product range to cater to this demographic's preferences, notably a shift towards sharing-sized bags, mirroring Gen Z's social habits and their penchant for travel. The HariboMaoam Duo Pack Sour 653g is a perfect

With over 100 years of candy making and almost as long creating its infamous bears, Haribo has navigated the postpandemic GTR landscape with remarkable agility, focusing on areas of strong growth and inclusion

example. A GTR-exclusive and firstof-its-kind for the company, this pack uniquely combines the most popular sour candies – Haribo Roulette Fizz, Haribo Goldbears Sour, Maoam Bloxx Sour, and Maoam Stripes Sour.

Haribo is also tapping into the burgeoning global demand for plantbased and vegan snacks. Gen Z's strong inclination in this direction, fueled by their pursuit of responsible consumption, has led Haribo to introduce a new vegetarian line including products like the Smurfs 425g, Lakritz Schnecken 450g and Pico Balla 425g. The market size for vegan snacks is expected to reach approximately US$80.53 billion by 2030.

Consumers are increasingly demanding sustainable sourcing. “At Haribo we believe that happiness comes with responsibility. That’s why we continually work to improve our environmental and social footprint across all operations,” says Fontana. “For instance, our decentralized approach enables us to spread production across key regions. This enables us to source many key ingredients regionally and avoid long transportation distances.”

Haribo's strategy in managing labor and human rights aligns with both local

legal standards and the International Labor Organization (ILO) guidelines. The company collaborates exclusively with certified suppliers who comply with Haribo's stringent global Supplier Code of Conduct.

Haribo's introduction of the Halal range is a strategic endeavor to embrace market diversity. Fontana elaborates, “Our HALAL range in GTR, with beef gelatine, is developed for the key growth demographic requiring Halal-certified confectionery, especially across IMEA.

tendencies are particularly prevalent during travel and also in the context of purchasing confections to share or gift upon returning home.

We continue to monitor consumer trends and to develop exciting, satisfying alternatives to engage this important and growing consumer profile.”

Haribo's strategy is centered on addressing the requirements of various customer segments, with families traveling with children being the most significant demographic. This group not only enjoys confectionery but also exhibits the tendencies of sharing and gifting, which are common across numerous occasions of consumption. These

In October Haribo and B&S celebrated the first year of their partnership, mainly in Central and South Americas, expanding travel retail locations in new countries. Haribo's partnership with B&S underscores the company's commitment to widening its international presence. Gilles Hennericy, Director of Sales at Travel Retail Haribo, expressed his satisfaction with the collaboration, stating, “We have been delighted by the service quality and reliability of the distribution service provided by B&S throughout the past year, and this has been a powerful support in our business growth over this period.”

Recent airport activations in Zurich and Geneva have helped boost Swiss chocolatier Maestrani’s brands Avelines and Munz in travel retail, GTR Magazine reports

by ALISON FARRINGTON

Maestrani, the Swiss familyowned independent chocolate company with a history of 170 years, is going on a charm-offensive to deliver its 100% fair trade Swiss-made organic chocolate products to more travelers around the world.

“It’s time to focus on global travel retail this year,” says Maestrani Senior Key Account Manager Business Development & Travel Retail Faozia MathLy-Roun. “With the raw materials and transport cost increases, we are seeking consolidation of our development plans to expand into global markets. We are giving priority to investments for activations in selective [airport] points of sale, which allows us to grow despite the business challenges.

“Our iconic brands Munz and Avelines have conquered the hearts and palates of our Swiss customers for a long time. Now, we are ready to allow more people to discover why so many Swiss people love our chocolate that is 100% produced in Switzerland.”

2023 was a very good year for Maestrani in travel retail; sales exceeded prepandemic levels at key airports Dubai, Istanbul, Bangkok, Taipei, Zurich, Geneva and new listing in Abu Dhabi, Bahrain. “We believe we still have great sales potential to grow further in the major air hubs for discerning travelers looking for premium quality chocolate gifts and treats,” she adds.

Organic chocolate pioneer Maestrani considers itself a worldwide pioneer in organic chocolate production, using fair trade chocolate since 1987. And innovation is still very much on the agenda; the company kicked off 2023 with the launch of its Swiss organic Choco Balls and Bio chocolate bar products and educational promotion at

the first-ever new wing built sustainably at Geneva Airport.

“We have tried our best to give key informative assets about the Munz Swiss organic range with directional signage highlighting the organic and all-natural ingredients with no palm oil, FSC packaging and 100% Swiss-made production. We were proud to launch Munz Choco Balls as a travel retail exclusive at Zürich, Geneva, Istanbul, Ankara, Izmir, Bodrum, Larcana, Abu Dhabi Manilla and Jeju airports,” says Math-Ly-Roun.

Pretty in pink

2022 saw Maestrani integrate the premium Swiss chocolate praline brand Avelines into its portfolio, which was acquired from Swiss chocolatier Favarger. This marked Maestrani’s

entry into the praline category, boosting its luxury appeal, especially for a global travel retail audience.

At the end of 2023, Maestrani launched Avelines Gold as a travel retail exclusive and a new product offer: Avelines Princesses. Inspired by a traditional chocolate specialty recipe Amandes Princesses from Geneva, Avelines Princesses launched under the campaign ‘Life is better in pink and with Swiss chocolate!’

To celebrate the new Avelines Princesses release, travelers at Geneva Airport were invited to spin the Avelines Princesses wheel with the possibility to win pink-themed travel gifts from partner brands such as Mavala Switzerland, Kusmi Tea Paris, Caran d’Ache Geneve or ON Shoes Switzerland. After Geneva, the Avelines Princesses promotion landed at Zurich Airport until the end of February.

“For this winter season, we implemented a Swiss chocolate fondue activation with a chocolate fountain spreading a delicate chocolate smell in the duty free shops at Geneva and Zurich airports. We wanted to invite all travelers to a gourmet chocolate tasting with fresh fruit and a unique local experience before boarding the plane,” explains Math-Ly-Roun.

The travel exclusive Munz Kids is already famous with unicorn, ladybird and butterfly-themed products and the line has been extended for 2024 with three new products: a plane, rocket and pirate boat under the campaign, ‘Let’s travel and have fun with Munz!’

For the newly expanded Munz Kids travel line, Math-Ly-Roun says the company is proposing a fun, compact retail display unit to feature the full travel exclusive kids collection.

“With the addition of Avelines into Maestrani’s brands portfolio alongside the latest organic developments for Munz Bio and the new Munz Kids additions, we have been able to broaden our potential for international duty free markets,” she adds.

In this guest column, Nicola Wells, Head of Category Development at Nestlé International Travel Retail, outlines its Food Reimagined concept; the theme The Emporium of Goodness is built around three key design drivers: Do Good. Be Good. Feel Good.

by NICOLA WELLS,Head of Category Development, Nestlé International Travel Retail

Leveraging the downtime enforced by the pandemic in 2020-2021, Nestlé International Travel Retail began exploring how it could grow the confectionery and food category and accelerate industry recovery overall.

Whilst one would expect a difference between domestic and travel retail markets, when we looked at category performance we saw that food and confectionery was at best flat in global travel retail, but experiencing double-digit growth in domestic. Breaking the category down,

we discovered that confectionery was 77% of sales in travel retail vs. 7% in domestic. Subsequent bespoke research among travelers of key nationalities on the appeal to explore different food segments confirmed a clear opportunity for category growth.

As an industry, travel retail had been experiencing spend and conversion decline before the pandemic and one of the drivers of this was the increasing apathy of travelers towards the travel retail offer, particularly the younger generations.

As the world’s largest food company, it felt natural that we should lead the development of this growth opportunity – not only for the category, but also the industry – and thus our strategy to make food the number one most purchased category in travel retail launched at TFWA Cannes in 2021.

This strategy is underpinned by our VERSE model, which is designed to unleash the growth potential of food. VERSE is based on five key category growth drivers: value, engagement, regeneration, sense of place and execution.

Driving strategy execution is the core objective of our Food Reimagined project, as well as inspiring the channel to think about food differently and prioritize the category.

In late 2022, we engaged industry experts Portland Design, who we had previously worked with on other projects and who were aligned with our strategy about delivering thought leadership and inspiring change by pushing boundaries.

At the heart of the brief was delivering an “Antidote to Apathy” to address the spend and conversion decline and create a space where travelers would want to linger. Other main components of the brief included:

• Harness the strength of food as the most appealing category across all age demographics (with a focus on Gen Z as the future largest shopper segment)

• Leverage the unique ability of food to appeal to all of the senses

• Incorporate all elements of the VERSE model

We launched Food Reimagined in October of last year and have engaged separately with key customers and the feedback has been hugely positive. The theme of Food Reimagined is about creating The Emporium of Goodness, which is built around three design drivers: Let’s Do Good. Let’s Be Good. Let’s Feel Good. The first driver has to do with being environmentally conscious, and supporting local; the second with making healthy choices and treating yourself, as well as others well; and the third is based on building shareable experiences and making memories.

Retailers are the experts at designing and delivering shops and we would never claim to know better. Rather than a blueprint design, Food Reimagined is a set of principles to follow in order to create inspiration.

Key recommendations:

• Lead with local as a sense of place purchase and engagement driver; followed by confectionery, and then global and local combinations and snacking (space per subcategory based on local needs)

• Group food in one location vs. confectionery in a different location; group local food together and set apart from other subcategories

• Merchandise according to meeting an occasion vs. offering brand personalization

• Promote cross-category concepts that create bridges between subcategories

• Position sustainability at the core of design and implementation

• Embed digitalization and personalization throughout the experience

• Bring to life the space through multi-sensory touchpoints

Food trends change frequently and to embrace these and refresh the store we recommend creating a space last in flow that can be re-merchandised and updated easily.

The response to date from our retail partners has been overwhelmingly positive and we are delighted to be engaging with several to translate certain concepts and trial in-store. These include wellbeing concepts, hot drinks and biscuits, gifting, and sustainability.

We are excited about this next phase as we continue on our journey to make food the number one most purchased category in global travel retail.

Sharing insights on the channel, Global Travel Retail Magazine hears from leaders across the food and confectionery category about what can be expected in 2024 and beyond

QUESTION: WHAT SPECIFIC CONFECTIONERY AND FOOD TRENDS WILL TRAVEL RETAIL SEE IN 2024?

Peter Zehnder, Head ofDivision –Global Travel Retail, Lindt & Sprüngli (Schweiz) AG

As with recent years, we expect the demand for healthier food products to continue into 2024, with more consumers trying to limit their sugar intake. Additionally, consumers will become increasingly interested in natural and authentic ingredients that are free from artificial additives.

Mindful indulgence has been on the rise and we anticipate that consumers will continue to desire food and confectionery products that do not compromise their physical and mental wellbeing, the health of others or the planet.

James Kfouri, Director of Sales Oceania, SE Asia, GTR, CaSA, Wonderful Pistachios

A continual trend that we are seeing is that consumers are eating healthier and we anticipate that to continue in 2024. As consumers seek healthier snacking options, pistachios are a smart choice, known for plant protein power, fiber, and better-for-you unsaturated fats. With 47% of consumers snacking three or more times per day, consumers can choose which Wonderful Pistachios products work best for their snacking occasion.

Another trend we anticipate in 2024 is flavor innovation. In the United States, Wonderful Pistachios introduced new flavors in 2023 including In-Shell Seasoned Salt and No Shells Sea Salt & Pepper. We are seeing incremental sales growth as a result of introducing new flavors to the market which reinforces the notion that new flavors create new consumer interest.