NEW High Shine Gloss Mask. After one use, 95% agreed hair has a gloss-like fi nish.*

*Study of 79 women ages 18-65, on the effects

NEW High Shine Gloss Mask. After one use, 95% agreed hair has a gloss-like fi nish.*

*Study of 79 women ages 18-65, on the effects

As we gather for TFWA Asia Pacific in Singapore, the region’s travel retail landscape reveals a fascinating study in contrasts. While passenger numbers have rebounded impressively, Asia’s recovery continues to unfold in unexpected ways, with market dynamics shifting significantly.

China, once the undisputed engine of Asian travel retail, is navigating economic headwinds, with Hainan experiencing marked sales declines. Beijing has responded with a strategic pivot, implementing unprecedented visa liberalization and innovative duty free initiatives to attract international visitors. The results are encouraging, with international arrivals increasing by over 40% since implementation, and cruise tourism emerging as a notable beneficiary.

Meanwhile, India has established itself as Asia’s most dynamic market. With the economy set to exceed US$4 trillion and overtake Japan this year, India’s travel retail industry is experiencing remarkable momentum. The imminent opening of Noida International Airport highlights the country’s urgent infrastructure expansion to meet surging demand.

After weathering significant disruption following the loss of Chinese group tourists and subsequent overreliance on daigou resellers, South Korea is undergoing meaningful transformation. With bulk sales restrictions reinstated in early 2024, the industry is evolving toward a more curated, customer-centric model. Recent regulatory reforms, including reduced licensing fees and the relaxation of liquor purchase limits, are creating a more supportive environment. Major operators like Lotte and Shilla are responding by enhancing their retail environments with immersive experiences and focusing on attracting individual travelers.

The industry’s key players are positioning for this evolving landscape. Avolta continues expanding its footprint across APAC with notable contract wins at Shanghai Pudong and Shenzhen Bao’an, along with its strategic acquisition of Hong Kong-based Free Duty. Meanwhile, homegrown players like Wangfujing Group are implementing innovative “Beyond Duty Free” strategies that blend traditional retail with rapidly expanding duty free enterprises.

As our industry convenes in Singapore, the resilience and creativity on display reinforce our conviction that despite ongoing challenges, Asia Pacific remains the powerhouse of global travel retail. TFWA Asia Pacific offers an unparalleled platform to explore these transformative trends, and we at Global Travel Retail Magazine look forward to joining you for what promises to be an inspiring event.

Kindest regards,

HIBAH NOOR Editor-in-Chief hibah@gtrmag.com

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. May 2025, Vol 37. No. 3. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR Laura Shirk laura@gtrmag.com

SENIOR EDITOR Wendy Morley wendy@gtrmag.com

SENIOR CORRESPONDENT Atoosa Ryanne Arfa atoosa@gtrmag.com

SENIOR WRITER Alison Farrington alison@gtrmag.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

ADVISORY BOARD

Gary Leong Thomas Henningsen

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

16 25 years of excellence

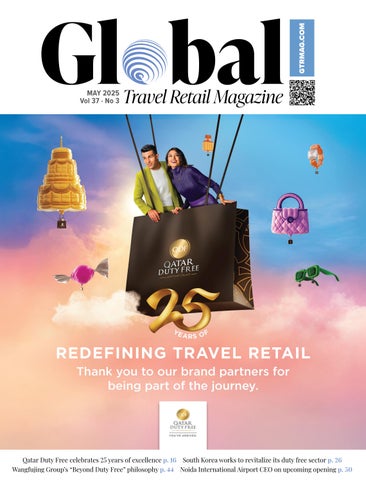

Qatar Duty Free (QDF) is preparing for an unforgettable 25th anniversary in 2025. Chief Retail and Hospitality Officer Thabet Musleh reveals how bold innovation and immersive, world-class experiences are powering QDF’s momentum, and how the very best is yet to come

26 Seoul-searching

South Korea’s duty free sector is moving beyond its reliance on bulk resellers toward a more curated, customer-centric model. As new policies take effect, operators are focusing on experiences and products that attract a wider range of travelers and drive sustainable growth

44 Redefining China’s retail frontier

Wangfujing Group is redefining China’s tourism and retail landscape with its “Beyond Duty Free” philosophy. This innovative, multi-format approach blends the company’s rich heritage in taxable retail with an expansion into the offshore duty free market

50 An urgent need to expand

With the opening of Noida International Airport scheduled for spring, Global Travel Retail Magazine speaks to CEO Christoph Schnellmann. He discusses the emergence of India as an aviation hub, as well as the prioritization of increased connectivity in the region

20 Driving global growth

Despite economic challenges and changing travel patterns, Asia Pacific remains the powerhouse of global travel retail, with emerging markets and demographic shifts creating significant long-term opportunities

30 China pivots

As economic headwinds intensify, China implements strategic visa-free policies and duty free initiatives to revitalize tourism and counter slowing luxury sales

34 Taking over APAC

Avolta’s growth in the Asia Pacific region is rooted in a “win-win-win” strategy that creates value for airports, brands, and operators alike, according to Freda Cheung, President and CEO of Asia Pacific at Avolta. With an ever-growing presence, a powerful new loyalty engine and a traveler-centric mindset, the company is laying the groundwork for long-term growth and success in the region

40 Blending exclusivity with accessibility

Delhi Duty Free’s focus on customer-centric offerings, digital innovation and sustainability is shaping the future of travel retail in India. Ashish Chopra, CEO of Delhi Duty Free, shares insights into the company's commitment to blend exclusivity with accessibility for its increasingly diverse customer clientele

46 Preparing for the world stage

Kansai International Airport (KIX) has unveiled a major Terminal 1 renovation ahead of the Osaka-Kansai 2025 Expo, enhancing capacity, efficiency and the passenger experience. As the gateway to this global event, KIX is preparing to welcome millions of visitors with upgrades that reflect a commitment to innovation, comfort and operational excellence

56 Generation disruption

As this interview with Global Travel Retail Magazine reveals, Blueprint and m1nd-set’s workshop “The Asia Pacific Revolution” in Singapore will discuss how Chinese, Indian and Korean Gen Z travelers – set to become travel retail's dominant demographic by 2028 – are fundamentally reshaping the industry

60 The go-to partner for global brands

Coty enjoyed a robust net revenue growth of roughly 20% in travel retail in FY 2024, driven by a strong geographic footprint, multicategory expansion and effective collaborations with key retailers

62 New kids on the beauty block

Gen Alpha has become a major new demographic target for beauty and skincare brands, motivating industry names to adopt tech-first, playful approaches. Read on to learn about Mavala’s new brand identity and Elizabeth Arden’s packaging revamp

68 A moment of indulgence

Moroccanoil’s next steps in global expansion and a look at the future of the beauty category in travel retail

70 Holistic taste experience

From nutrient-packed snacks and better-for-you options to purposeful eating, we dish on the latest trends in confectionery and food; plus, more on the power of social media

76 Big on baggage in travel retail

In this Baggage Report, Global Travel Retail Magazine hears from category players about the importance of circular design, the latest on b-leisure travel in Asia and product development trends

80 Premium pursuit

As travel retail rebounds across Asia Pacific, spirits brands are navigating diverse market dynamics through premium offerings, exclusives and innovative approaches to capture the attention of a new generation of consumers with evolving preferences and increasing purchasing power

82 Keeping up with the diverse returning traveler

Key consumer-driven trends across the spirits category of premiumization, exclusivity and craftsmanship show no signs of slowing down. Global Travel Retail Magazine connects with leading names in the channel to discuss emerging segments, evolving trends and new developments

86 Curious connections

Philip Morris International (PMI) has revealed a collaborative installation and interactive platform, IQOS Curious X, as part of Milan Design Week, created in partnership with Italian design firm SELETTI. Global Travel Retail Magazine was on location at Milan Design Week to take part

88 Seeking an alternative

JT International (JTI) on its innovative brand Ploom and how the company’s vision extends further with the growth of its reduced-risk product category; plus, Mevius wins big with a strong festive season

We’re pioneering the travel experience revolution. Combining the best of Autogrill, Dufry, HMSHost & Hudson.

According to a new report from China Trading Desk, Chinese travelers are on track to make 200 million international trips per year by 2028, with 155 million expected in 2025 alone. The Q1 2025 China Outbound Travel Sentiment Survey reveals evolving travel patterns, including increased spontaneity with 77% booking less than a month in advance. High-spending Chinese tourists are transforming luxury retail and duty free sectors, with 28% budgeting over US$6,800 per trip. Singapore remains the top destination (17%), followed by Japan (16%) and South Korea (13%). Digital influence is paramount, with 61% of travelers guided by social media promotions when shopping at airports.

At the APTRA Conference in Mumbai, Sunil Tuli, President of APTRA and Group CEO of King Power Group, delivered a keynote on the dynamics shaping India’s travel retail sector and opportunities to expand revenue.

He began by addressing two key forces influencing the industry today: escalating global trade tensions and India’s growing momentum. Tuli humorously remarked, “Well, we’ve picked quite a time to tell you about the exciting opportunities of doing business in India.” While acknowledging the industry's lack of control over geopolitics, he encouraged the sector to focus on what it can control: capitalizing on the economic potential that India offers.

“Even before the current tariffs battle, the world economy was already throwing a range of diverse challenges at us,” stated Tuli, pointing to mounting pressures across key duty free categories, including:

Confectionery: Cocoa prices have doubled due to climate change and supply chain disruptions in Ghana and the Ivory Coast

Beauty: Inflation, supply issues, and evolving consumer expectations in line with CSR are weighing down the category

Spirits: Tariffs on China and European cognac are hitting high-value brands

Despite the category pressures, Tuli remains optimistic about India’s long-term outlook. Inflation is down, consumer spending is up, and India’s GDP is nearing US$4 trillion.

India is expected to surpass Japan’s economy this year and Germany’s by 2027. It’s also on track to overtake China in population by 2025, with Gen Z set to drive future consumption.

India is set to see a rise in passenger traffic, with yearon-year growth anticipated at 5-6%. The government’s US$11 billion plan to build 400 airports by 2047, combined with large aircraft orders from airlines including Air India, highlight the country’s growing aviation industry. Navi Mumbai International Airport, opening this year, expects an estimated capacity of 90 million by 2036.

Ospree Duty Free celebrated its first anniversary at this year’s APTRA Conference in Mumbai, marking a key milestone. The occasion followed Mumbai Travel Retail Private Limited’s rebrand as Ospree Duty Free at the APTRA India Conference in Delhi one year ago. This year, Ospree marked the anniversary as a Platinum Sponsor, hosting a vibrant dinner gala and generating social media buzz with the hashtag #OspreeTurns1. CEO Gaurav Singh reflected on a successful first year, remarking that “the journey has been fantastic” while highlighting Ospree’s strong momentum and ambitions in India’s travel retail sector.

In just one year, Ospree has rapidly expanded its presence across key Indian airports, including Mumbai, Ahmedabad, Amritsar, and Jaipur, backed by significant investments in both arrival and departure terminals.

Internationally, Ospree took its first step into overseas retail with Le Marché Duty Free at the Eurotunnel terminal in Coquelles, France. “We wanted to start small and test the waters,” Singh said, adding that the new outlet has seen double-digit growth in its first year.

Still, the company’s primary focus remains India. He emphasized India’s retail potential, citing a 21.5% CAGR over the next few years. “I see opportunity in terms of how the growth is driving the overall business,” Singh said.

Travel retail distribution specialist Blue Chip Group is celebrating new listings for two key brands.

The luxury fragrance brand Memo Paris featured with The Shilla Duty Free in Singapore Changi Airport, Terminal 1, Departure Hall East at the end of March, and Japanese skincare brand suisai will be introduced at Hong Kong International Airport’s East Hall South in May.

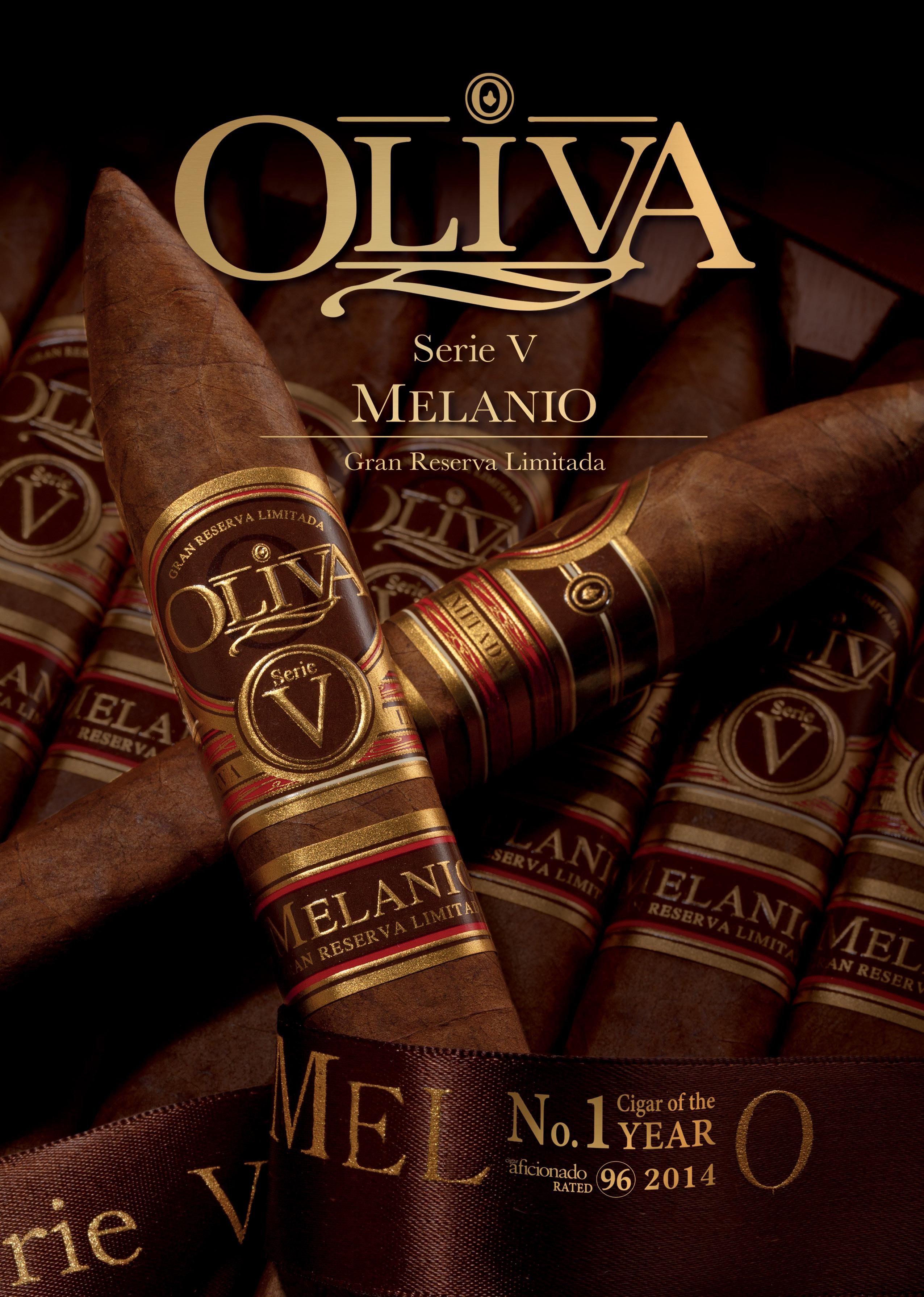

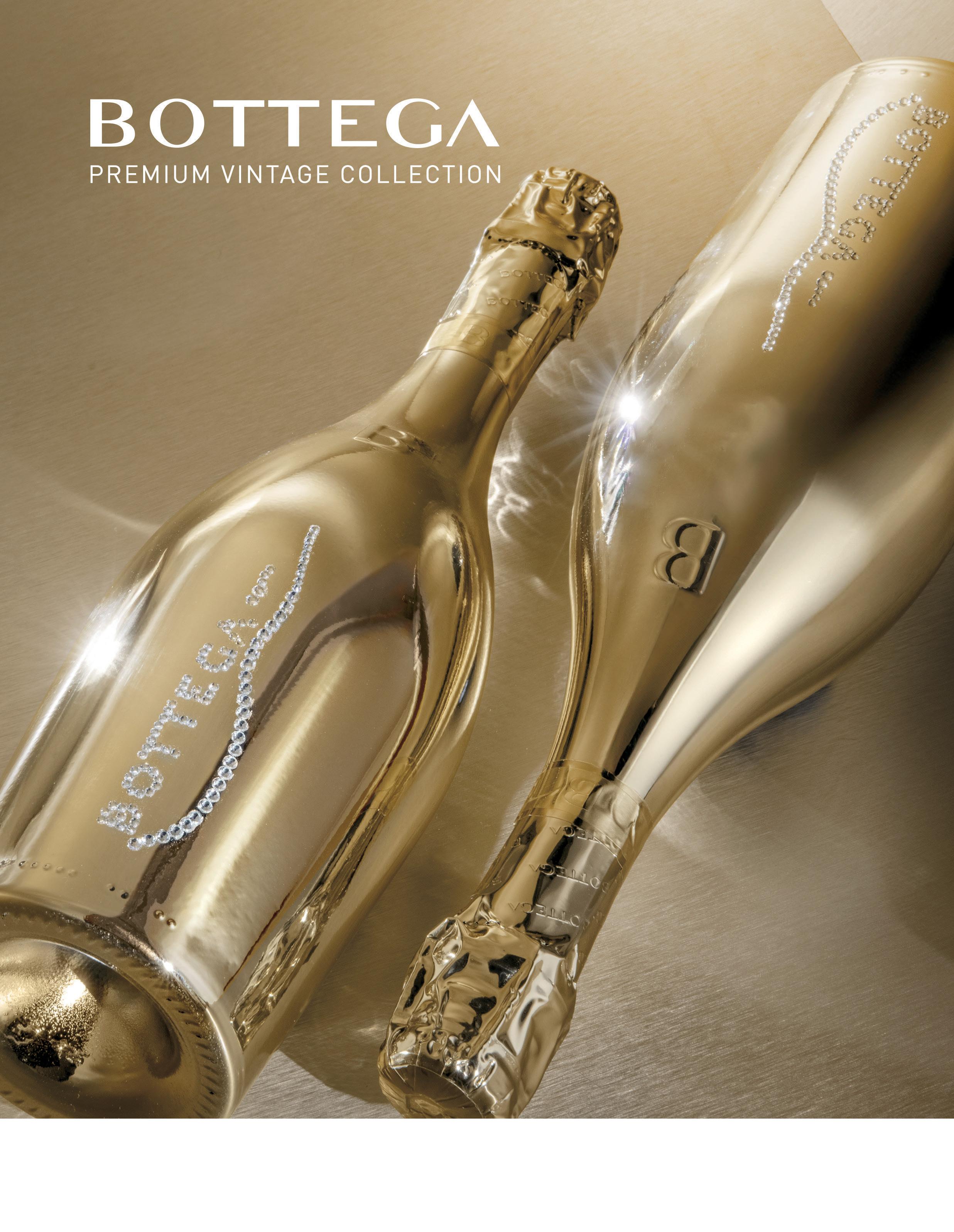

The Memo Paris launch, and its first standalone counter, at Singapore Changi signifies a strategic expansion for the brand in the APAC region.

Flora Lee, Managing Director of Blue Chip Group says, “Our ongoing partnership with Memo Paris reflects our shared vision of providing exceptional experiences in travel retail. We aim to elevate Memo Paris to a new dimension across the APAC region, connecting its craftsmanship with fragrance enthusiasts.

“With accessible pricing, proven effectiveness, and convenience for travelers, suisai offers an attractive proposition for those visiting Hong Kong Airport. We anticipate a strong synergy between the brand’s potential and the needs of the Hong Kong market.”

Blue Chip Group has previously launched other Kao brands in the same location.

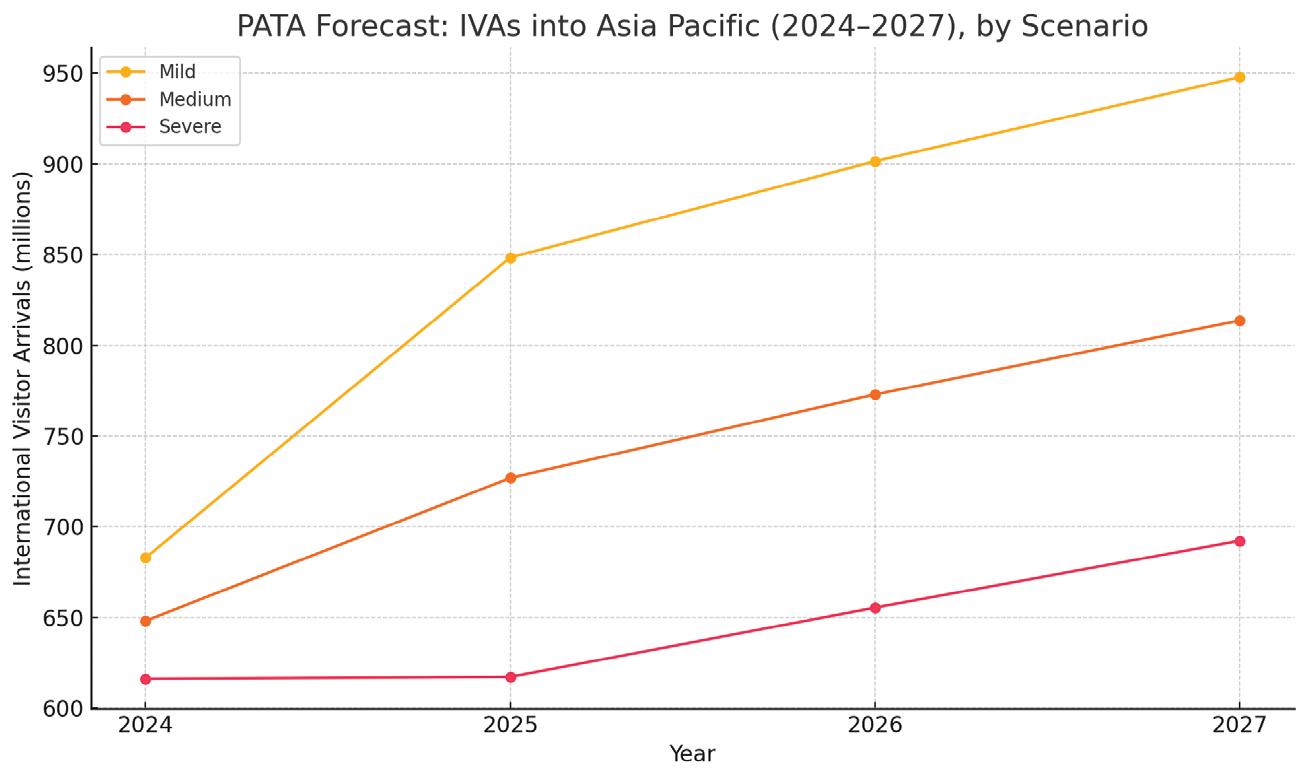

PATA’s Asia Pacific Visitor Forecasts 2025-2027 analyzes 39 destinations under three scenarios. The report identifies Mongolia, Türkiye, Sri Lanka and Japan as standout performers expected to exceed pre-pandemic visitor numbers at the fastest rates.

Under the optimistic scenario, 950 million visitors are expected to visit the region by 2027, while even the

conservative scenario shows considerable growth to 690 million. Digital transformation, sustainable tourism developments and initiatives like Thailand's “Six Countries, One Destination” are helping to support the positive growth. The USA, Hong Kong SAR and South Korea rank among the top source markets for visitors to the region, with China maintaining its position as the largest contributor.

With activations such as Live the F1 Life, QDF transformed Hamad International Airport into an immersive Formula 1 experience, featuring an F1 car on display, racing simulators, themed dining, influencer surprise and delights, exclusive brand partnerships, celebrity appearances and much more

Qatar Duty Free (QDF) is preparing for an unforgettable 25th anniversary in 2025. Chief Retail and Hospitality Officer Thabet Musleh reveals how bold innovation and immersive, world-class experiences are powering QDF’s momentum, and how the very best is yet to come

by HIBAH NOOR

In 2024, Qatar Duty Free (QDF) recorded an impressive 18% year-on-year surge in sales for the annual year, surpassing the growth in passenger traffic at the awardwinning Hamad International Airport. “Growth like this doesn’t happen by chance,” says Musleh. “It comes down to keeping things fresh, relevant and exciting.”

Through a curated mix of global powerhouse brands, customer-centric experiences and a workforce that serves as the heart of its success, QDF is transforming the airport into a destination that goes far beyond a mere transit hub.

As QDF eagerly prepares to celebrate its monumental 25th anniversary, it’s ready to raise the bar even higher.

Milestone anniversary “2025 is our 25th anniversary, and we’re taking things up a notch,” says Musleh. In celebration of this symbolic milestone, QDF will unveil more than 25 new openings. This follows a standout 2024 that introduced industry firsts such as the world’s first Dior Luxury Beauty Retreat at an airport, the first-ever “pentarchy” campaign with YSL Beauty, and the first-ever full Chanel airport takeover.

While details are still under wraps, Musleh hints at headline-making debuts that will range from never-before-seen brand concepts to world-first partnerships, stating, “One thing’s for sure: we’re making this milestone one year to remember.”

2025 is already shaping up to be a landmark year. In April, Hamad International Airport was awarded SKYTRAX’s World's Best Airport Shopping for the third consecutive year. One month earlier, the airport marked a major milestone with the grand opening of Concourses D and E. These additions are part of a long-term terminal expansion strategy launched in 2018 to enhance both capacity and experience. With this latest phase, the airport now accommodates over 65 million passengers annually and introduces 2,700 square meters of brand-new, purposebuilt retail space, paving the way for a new era of shopping, dining and discovery.

“One of the biggest advantages we

Bringing in top-tier global talent is reflected in the recent appointment of six women executives, each bringing deep expertise and a passion for bold, boundarypushing ideas. As the 25th anniversary approaches, these fresh perspectives are shaping a new era of retail and hospitality

have is how seamlessly retail, hospitality and travel work together,” says Musleh. This integrated ecosystem that unites QDF, Hamad International Airport and Qatar Airways crafts an experience that flows through every stage of a passenger’s journey. “It’s a true trinity partnership,” Musleh notes, adding that the 25th anniversary will unfold across the end-to-end travel experience. “We can do things that simply aren’t possible elsewhere.”

QDF anchors its approach in a philosophy of experiencentricity, a commitment to turning travel moments into unforgettable memories. Whether it’s racing in a Formula 1 simulator during the Live the F1 Life campaign, indulging in a wellness layover at the Dior Luxury Beauty Retreat, or stepping into a Chanel winter wonderland, QDF’s experiences are curated to be remembered long after takeoff.

Powered by people

A dynamic and global team drives

QDF’s success. “We know that building something truly exciting starts with the right people,” states Musleh. “As we celebrate our 25th anniversary, this people-first approach remains front and center.”

Part of the strategy includes deliberately bringing in top-tier talent from around the world. “These individuals not only bring deep expertise in their fields, but also share our appetite for bold thinking and boundary-pushing ideas,” according to Musleh. With fresh perspectives and the ability to challenge the status quo, these appointments have helped turn ambition into reality as the 25th anniversary approaches. “In order to build a new era of retail, hospitality and experiences, we need a leadership team that’s not afraid to ask ‘what’s next’ and then go out and make it happen.”

In the past three years alone, QDF’s workforce has tripled, growing to over 5,000 people from 78 different nationalities. That global mix has helped shape QDF into a place where ideas are

welcomed and where innovation is a shared mindset. “Our focus has always been on building a team that reflects the energy, creativity, and ambition behind everything we do,” according to Musleh.

Earlier this year, QDF expanded their leadership team with six top women executive appointments, a move that reflects its commitment to creating space for diverse talent to grow and lead. “The year is as much about our team as it is about our achievements, and we’re continuing to support and invest in the people who’ve made QDF what it is today,” says Musleh.

Sports serve as one of the most powerful ways QDF creates exclusive moments for passengers. Qatar has solidified its place on the global stage as a premier host of world-class sporting events, from the Qatar Airways Qatar Formula 1 Grand Prix to the Qatar ExxonMobil Open and the Commercial Bank Qatar Masters. QDF actively supports

This past winter, Chanel marked its firstever full airport takeover with its Chanel Winter Tale campaign, transforming the entire airport into an enchanting wonderland and showcasing QDF’s experiencentric approach to luxury retail

this momentum as an official partner and sponsor of these internationally recognized competitions. “As Qatar continues to attract more visitors, our goal is to make sure the airport experience matches the energy and ambition of the country’s tourism scene,” states Musleh.

True to that vision, QDF goes beyond traditional sponsorship. “We’re making sure that the excitement of sport doesn’t stop at the stadium. It starts the moment

travelers arrive,” Musleh says. Through activations such as Live the F1 Life, QDF transformed the airport into a Formula 1 universe, complete with a real F1 car, racing simulators, themed dining menus, and impactful duty free partnerships with brands such as Jack Daniels and Velo.

Legendary sports icons such as Lewis Hamilton and Novak Djokovic have also surprised passengers, turning

ordinary transits into once-in-a-lifetime moments. Ahead of the Qatar ExxonMobil Open, Djokovic rallied with young tennis talents on an airside court, while Hamilton previewed his new film near ORCHARD as the Formula 1 Grand Prix weekend kicked off.

Looking back on 25 years of success, Musleh reflects, “One thing we’re incredibly proud of is how our openings have transformed the landscape of travel retail.” The Louis Vuitton Lounge stands out as a prime example: an industry first that fuses high fashion, gourmet dining and luxury hospitality. “It was something that no one else had done, and it proved that airport retail could offer something special,” remarks Musleh. Innovations like these actively redefine what’s possible at an airport, showcasing that transit spaces can be destinations in their own right.

As QDF approaches its milestone 25th anniversary, its mission remains more ambitious than ever: to continue reimagining travel retail through fearless innovation, experiencetricity, and visionary concepts that resonate with every traveler while setting bold new standards for the future.

Last Call is a hybrid retail and F&B concept offering travel essentials, gifts, and grab-and-go bites in a nostalgic, airportinspired setting

ADVANCED CERAMIDE CAPSULES ARE PROVEN TO TAKE UP TO 10 YEARS OFF THE LOOK OF YOUR SKIN *

SEALED FOR OPTIMAL FRESHNESS & POTENCY

test, 25 women at 12 weeks.

by WENDY MORLEY

TDespite economic challenges and changing travel patterns, Asia Pacific remains the powerhouse of global travel retail, with emerging markets and demographic shifts creating significant long-term opportunities

he Asia Pacific travel retail sector continues to prove resilient despite facing significant economic pressures and shifting travel patterns across the region. From Hainan’s sales slump to India’s explosive growth, regional markets are following divergent trajectories that reshape the industry’s distribution of power.

“The travel retail market in Asia Pacific has, for many years, been the engine room of the global industry driving significant growth, and I have every confidence that it will continue to do so for decades to come, despite the changing behavioral dynamics amongst Chinese travelers and the economic downturn in other mature markets such as South Korea, Singapore and Hong Kong,” says Sunil Tuli, APTRA

President and Group CEO King Power Group (Hong Kong).

This confidence is supported by recent forecasts from the Pacific Asia Travel Association (PATA). Under that association’s “medium” scenario, international visitor arrivals to Asia Pacific are projected to reach 813.7 million by 2027, reflecting a continued upward trend from the estimated 648.1 million in 2024.

PATA CEO Noor Ahmad Hamid notes, “As global travel continues its strong recovery, the Asia Pacific region remains a key driver of growth. This latest forecast highlights the dynamic shifts in visitor flows, policy interventions and infrastructure improvements that will shape the region’s tourism landscape over the next three years.”

Regional diversity and demographic shifts

The Asia Pacific travel retail landscape extends across 45 distinct markets, from India in the west to Fiji in the east, encompassing mature economies like Japan and emerging powerhouses like

Vietnam and Indonesia. This diversity creates a complex market where retailers must simultaneously serve aging populations in developed countries while adapting to surging numbers of young consumers elsewhere.

“The underlying long-term growth for the region as a whole is underpinned by the rising Gen Z population in many significant countries that play a major role in reshaping geopolitics,” Tuli explains.

The expanding middle class across the region – particularly in India, Indonesia, Thailand and Vietnam – represents a powerful force in travel retail. These consumers have both the financial means and desire to explore international destinations, creating a natural audience for travel retail offerings.

“It’s an exciting opportunity and one that we must continually adapt and prepare for to ensure travel retail stays relevant to these younger adults, offer-

Pacific Asia Travel Association’s forecast for Asia Pacific visitor arrivals through 2027 under three scenarios: mild (optimistic recovery with minimal disruptions), medium (moderate growth with some market challenges), and severe (conservative projection accounting for potential economic headwinds)

ing them the right brands, perhaps new categories, memorable experiences and with integrated technology along their journey to maximize engagement and conversion,” he says.

China’s recovery and transformation

Chinese outbound tourism is set to exceed 155 million travelers in 2025, surpassing pre-pandemic levels, according to China Trading Desk data. Singapore (17%), Japan (16%) and South Korea (13%) maintain dominance as the top three preferred destinations, while European destinations have climbed to fifth place in popularity.

A notable trend is the rise of spontaneous travel, with 76% of Chinese travelers now booking trips less than one month before departure, up from 73% in Q3 2024. This spontaneity extends across all demographics – even 70% of high-net-worth individuals book within a month of departure.

Luxury preferences are strengthening, with 67% of Chinese travelers now preferring four-star hotels or higher. Nearly half (49%) plan to spend at least 25,000 RMB (US$3,500) per trip, with 24% budgeting over 50,000 RMB (US$6,850).

Our Heinemann Duty Free Malaysia team was awarded the Best Overall Retailer by Malaysia Airports Holdings Berhad at its 2024 Concessionaires Conference in 2024, recognizing our strong performance in product assortment, customer service, and partnership with Kuala Lumpur International Airport. This award would not have been possible without the close collaboration of our brand partners and we look forward to continuing to turn travel time into valuable time with you in 2025 and beyond.

“While the Chinese traveler is tending to stay closer to home and with many of them prioritizing personal experiences over luxury goods, there is still a huge potential in the market,” Tuli observes. “The winners will be travel retail operators and brands who pay close attention to their needs and expectations, broadening their assortment with an integrated digital strategy throughout consumer engagement touchpoints.”

Not all markets are thriving, however. Hainan, the Chinese island province popular with domestic shoppers, experienced a 29.3% year-on-year (YOY) decline in duty free sales in 2024 as China’s sluggish economy led to a reduction in tourism.

Visitor numbers decreased by 15.9%, falling to 5.68 million in 2024 from 6.75 million the previous year. Customs data revealed that visitors to Hainan spent 30.94 billion yuan (US$4.24 billion) on duty free items in 2024, down from 43.76 billion yuan (US$5.97 billion) in 2023.

According to a reliable industry source in China, “From the beginning of this year, it seems there is no good news from China and near countries in the travel retail industry. Hainan retailers sales decrease YOY every month; some retailers close to China, and brands in Asia, have begun to lay off employees.”

China is implementing strategic policy shifts to counter these challenges and boost tourism. The State Taxation Administration announced the nationwide expansion of its instant tax refund program for overseas travelers on April 8, enabling international shoppers to receive refunds at the point of purchase rather than at departure.

This policy builds on China’s unilateral granting of visa-free access to citizens from 38 countries, accompanied by extended stay durations for foreign travelers. According to data from China’s National Immigration Administration, the number of visa-free entries by foreign nationals in 2024 reached well over 20 million, more than double the previous year.

South Korea provides a case in point. Since the visa-free policy took effect, enthusiasm for travel to China has grown sharply among Korean tourists. According to the Shanghai Municipal Government, the number of South Korean visitors to the city rose by 91.18% YOY in November and 141.46% YOY in December 2024.

“Looking beyond China, ask any brand in travel retail right now and they will tell you that India is a priority market in Asia Pacific,” Tuli states. “India’s economy – as the fastest growing on the planet – is about to pass the US$4 tril-

lion mark – making it the world’s fifthlargest economy. It is set to overtake Japan this year and – if it maintains its growth path – it will overtake thirdplaced Germany in 2027.”

This monumental shift is reshaping the travel retail ecosystem. “With its mid-Asia position bridging east and west, India is front and center to the region in many ways,” explains Tuli. “The federation is fast accelerating and is set to grow exponentially, in part due to the government’s US$11 billion investment in greater aviation infrastructure and connectivity, with over 400 new airports opening by 2047 and with Indian airlines dominating the order books for new aircraft.”

Travel retail in India shows distinct category preferences among travelers. According to Tuli’s analysis of the current market, “Alcohol – led by whisky – has been the number one category for many years. However as consumer choices evolve and the cocktail trend in India continues, tequila is growing fast. Beyond Alcohol, there is a powerful sustained increase in perfume and cosmetics sales, with the Beauty category now chasing alcohol for pole position. Confectionery and Toys are also performing well and commanding more share of space.”

India’s scale presents staggering potential. “Every day, 40,000 new Indian passports are issued,” notes Tuli. “Our target audience is literally growing by the day, and we must not take them for granted.”

South Korea’s duty free sector is moving beyond its reliance on bulk resellers toward a more curated, customercentric model. As new policies take effect, operators are focusing on experiences and products that attract a wider range of travelers and drive sustainable growth

by ATOOSA RYANNE ARFA

South Korea’s government recently announced sweeping reforms designed to reinvigorate the duty free sector. Rolling out this spring, the changes create a more supportive regulatory framework for operators, including a 50% reduction in licensing fees and the removal of a longstanding two-bottle limit on liquor purchases. These moves form part of a broader national strategy to revitalize a market still stabilizing post-pandemic, amid shifting tourist dynamics and evolving shopping behaviors. Industry insiders welcome the reforms but stress

that further action will be needed to fully improve the sector’s potential.

The latest government interventions have provided a much-needed jolt of optimism to a sector still navigating turbulence since the pandemic. Halving licensing fees and easing liquor restrictions are expected to spur investment and encourage consumer spending. Leading players such as Lotte Duty Free and The Shilla Duty Free have voiced strong support for the changes so far.

Nam-Gung Pyo, Head of Marketing

As demand shifts beyond K-Cosmetics, shoppers seek cultural and trend-driven experiences at the Shilla Duty Free

at Lotte Duty Free, believes that “the policy changes are expected to have a positive impact on both Lotte and the wider industry.” A representative at The Shilla Duty Free feels similarly, stating that “eliminating liquor bottle restrictions will significantly enhance the customer experience” and adding that the 50% reduction in licensing fees will also help address management challenges.

Yet key constraints persist. A US$400 exemption for liquor and US$800 overall duty free cap per traveler remain unchanged, an issue that continues to hamper growth. Brad Kim, Editor-inChief of South Korea-based TRNDF. com, suggests raising these limits to somewhere between US$1,200 and US$2,000 to boost spending.

In the interim, operators are recalibrating by offering smaller bottle

formats, bundling multi-bottle deals, and introducing interactive, experienceled campaigns to better engage customers under the new reforms and existing limits.

The latest regulatory changes arrive at a time of continued volatility for South Korea’s duty free sector. In 2024, the country welcomed 16.37 million foreign visitors, which is an encouraging 93.5% of pre-pandemic levels. Yet duty free sales remained sluggish, reaching just 57.2% of the sector’s 2019 peak, when revenues had hit a record KRW24.85 trillion (US$16.4 billion), driven largely by Chinese tour groups and bulk-buying daigou resellers.

“The loss of Chinese group tourists during the pandemic led to reliance on

bulk buyers, or daigou,” Kim explains. “The government temporarily lifted bulk sales restrictions, but with prepandemic regulations reinstated in early 2024, the industry is now moving away from daigou dependence.”

Fast forward to February 2025, and the picture remains mixed. Duty free sales (excluding inflight) rose 4.8% month-on-month to KRW1 trillion (US$680 million), while footfall fell 8.4% to 2.1 million customers. While the sales uptick signals some recovery compared to last year, overall performance still lags significantly behind the industry’s pre-pandemic peak.

In addition to pressures stemming from the previous reliance on daigou, several other factors are at play, including the rise of free independent travel (FIT) versus group tours and China’s

“guochao” trend that favors domestic Chinese brands over foreign brands.

Amid these shifts, operators are facing challenges. Shinsegae Duty Free shuttered its Busan downtown store in January, and Hyundai Duty Free will close its Dongdaemun outlet in Seoul this July. At the same time, high-end luxury brands such as Gucci, Cartier and Louis Vuitton have begun withdrawing their presence from duty free outlets.

From volume to value Eager to change the trajectory, duty free operators are shifting their focus from volume to profitability. Lotte Duty Free, for example, made a decisive move to halt bulk sales to daigou traders in January 2025. “While we grew through daigou sales during the THAAD crisis and COVID-19, rising commission rates hurt profitability,” states Pyo. Lotte is

now directing its efforts toward targeting new customer segments, fine-tuning its pricing and enhancing its product assortment. “We aim to transform the market structure and establish a more sustainable business model,” Pyo adds.

The Shilla Duty Free is also moving away from inefficient wholesale channels to a more targeted retail strategy. “We’re prioritizing agile responses to changing conditions and focusing on building internal stability,” says a representative from The Shilla. To that end, the company is expanding its brand portfolio, developing exclusive and premium product lines, and enhancing its retail environments with immersive pop-ups and interactive event zones.

Amid ongoing reforms, operators are leaning into innovation and strategic partnerships to attract a broader

traveler base. At Lotte Duty Free, newly appointed CEO Dong-ha Kim is leading diversification efforts, supported by a newly established marketing division focused on attracting both high-spending individuals and independent travelers. One initiative includes preparing for the anticipated return of Chinese tour groups once visa-free entry resumes later this year, with targeted promotions integrated into platforms such as WeChat Pay. The company is also broadening its brand portfolio through collaborations with labels such as Polo Ralph Lauren, Maison Kitsuné, and Dassai.

In parallel, Lotte is partnering with travel agencies to develop tailored Korean travel experiences. For example, a recent agreement with the Busan Tourism Organization aims to strengthen tourism in the region. These efforts are already showing early prom-

ise, with cruise passengers flocking to Lotte Duty Free’s Busan store, attracted by exclusive perks, including Gold membership cards and QRcode-enabled discounts across the rail network.

The Shilla is also evolving, securing coveted brands and enhancing services to reflect changing customer preferences. At Incheon International

Airport, The Shilla has introduced new collaborations with Augustinus Bader, Lancome, and LOEWE, and opened a TimeVallee Swiss watch boutique at its Jeju Island store. But shoppers are seeking a truly Korean experience, as well. “Demand has extended beyond K-Cosmetics to K-Fashion and Korean lifestyle items,” says The Shilla Duty Free’s spokesperson. “Shoppers now

seek immersive experiences tied to Korean culture and trends.”

South Korea’s duty free sector remains in recovery, but signs of reinvention are taking shape. With regulatory changes unlocking new strategic opportunities and operators pivoting from high-volume models, the industry is laying the groundwork for a more profitable future.

China welcomes a surge in international visitors as visa-free policies attract 9 million travelers in early 2025, marking a 40% year-on-year increase amid national economic recalibration efforts

by WENDY MORLEY

China’s economy is showing unmistakable signs of strain, with slumping sales in Hainan’s duty free sector and weakened luxury and overall consumer demand prompting a bold pivot toward attracting international visitors. Industry experts note concerning trends across Asia’s travel retail landscape as economic pressures mount. Luxury companies including LVMH, Hermès and Burberry have reported substantial sales declines in the region during recent quarters, with fashion, leather goods and spirits categories particularly affected.

This downturn extends beyond mainland operations. The travel retail sector, particularly in Hainan – once touted as China’s domestic luxury shopping haven – has struggled throughout 2024/2025, with retailers reporting consistent monthly declines in year-on-year sales.

Industry insiders indicate that companies with significant exposure to Chinese markets have begun implementing workforce reductions as the slowdown persists.

The economic challenges appear structural rather than temporary. A reliable source in China explains that China’s economic weakness is the primary factor, with private businesses particularly vulnerable to failure and rising unemployment. The source indicates this negative trend shows no signs of abating. The deteriorating relationship between China and the United States further complicates the economic environment, with recent tariff escalations adding another layer of uncertainty.

In response to these economic challenges, Beijing has implemented an unprecedented series of visa liberalization measures. China has expanded unilateral visa-free access to citizens from

38 countries and extended its policy of visa-free entry for transit travelers from 54 countries, allowing stays of up to 10 days.

The strategy appears to be gaining traction. According to the National Immigration Administration, China welcomed more than 9 million inbound foreign travelers since the 240-hour visa-free transit policy took effect in December 2024 – a 40.2% increase year-on-year. Notably, 6.57 million entered visa-free, accounting for over 71% of the total.

This policy shift has helped drive an overall increase in cross-border movement. Chinese border officers handled 163 million entries and exits from January to March 2025, marking an increase of 15.3% year-on-year, with foreign nationals making 17.44 million border crossings – up 33.4% from the same period in 2024.

Cruise tourism surges

Maritime tourism has emerged as a major beneficiary of China’s relaxed entry policies. Shanghai’s international cruise terminal has reported a dramatic increase in both vessel arrivals and pas-

senger numbers during early 2025, with international visitors increasing nearly tenfold compared to last year.

The facility welcomed approximately 480,000 total travelers in the first quarter – more than double the previous year’s figure – and set a singleday record for international arrivals in March. These numbers represent significant progress toward pre-pandemic levels.

“Policies like the 240-hour visa-free transit have significantly boosted the appeal of cruise tourism,” says Peng Zhaoyun from Shanghai Wusongkou International Cruise Terminal Development Co., Ltd. “A spontaneous trip to China has become a real option for international travelers.”

Similar growth patterns are emerging in other coastal regions. Xiamen’s port welcomed five international cruise ships in early 2025, while Tianjin’s cruise facility is projecting substantial increases in vessel traffic during the first half of the year.

China is implementing additional policies designed to enhance the shopping experience for international visitors. The government has recently expanded its instant tax refund program nationwide, enabling overseas travelers to receive refunds at the point of purchase rather than waiting until departure. This streamlined process aims to remove friction from the shopping journey and increase spending by foreign tourists.

Simultaneously, authorities have made it easier for foreigners to navigate daily transactions within China. Foreign visitors can now conveniently link international credit cards to popular Chinese mobile payment apps like Alipay and WeChat Pay – previously a significant obstacle for tourists.

Our source also notes potential expansion beyond current duty free zones: “I also think China will convert more traditional shopping malls into tax-free retail zones in the future.”

The challenging market conditions have accelerated the adoption of new technologies across the retail sector. “Recently, more retailers and brands have started using our AI price tracking system. They’re now paying greater attention to price analysis, data collection, and leveraging AI to enhance their business operations,” the source reports.

The National Bureau of Statistics reported that foreign visitor entries to China totaled 26.94 million and revenue from international travelers reached US$94.2 billion last year, up 95.5% and 77.8% respectively from 2023. While these figures still lag pre-pandemic numbers, representing about 85% of 2019 levels for entries and 91% for revenue, they demonstrate substantial recovery potential if current policies continue to gain traction.

Avolta’s growth in the Asia Pacific region is rooted in a “win-win-win” strategy that creates value for airports, brands, and operators alike, according to Freda Cheung, President and CEO of Asia Pacific at Avolta. With an ever-growing presence, a powerful new loyalty engine and a traveler-centric mindset, the company is laying the groundwork for long-term growth and success in the region

by ATOOSA RYANNE ARFA

Avolta is accelerating its footprint across Asia Pacific, tapping into one of the most dynamic and complex travel retail markets in the world. Recent contract wins, strategic acquisitions and loyalty advancements showcase how the company is actively responding to the modern traveler’s changing expectations. Driving this momentum is a vision to build a future-ready retail and F&B ecosystem that delivers shared value for not only Avolta, but also airports, brands, and ultimately, travelers.

The appeal of Asia

“APAC accounts for more than 50% of the world’s population, more than 50% of the world’s global trade growth, and more than 50% of travel retail and travel F&B market share, so clearly this region has the highest growth potential,” says Cheung.

Given the immense scale, rich cultural diversity, and rapidly shifting consumer behaviors, the APAC region demands both agility and long-term vision. Strong economies and booming tourism hubs in the region drive high passenger volumes, but they also invite intense competition. That’s why Avolta embraces a demand-driven approach. “We believe in sustainable growth,” Cheung explains.

In addition to its presence in key markets such as India, Indonesia, Vietnam and Australia, Avolta recently expanded its already-existing footprint in China with significant contract wins at Shanghai Pudong International Airport and Shenzhen Bao’an International Airport. These wins bolster its presence in two of Asia’s most vital travel hubs.

At Shanghai Pudong, Avolta now operates over 2,000 square meters of

retail and F&B space, featuring notable names such as Wolfgang Puck Kitchen Counter + Bar, HEYTEA, T9 Premium TEA, and Kumo Kumo. Last November, the company secured a long-term partnership with Shenzhen Bao’an, China’s fourth-busiest airport, to add over 1,000 square meters of space, debuting China’s

first Hudson Café hybrid concept alongside La Mian Xiao Long Bao from Michelin-starred Crystal Jade.

Further solidifying its presence in the region, Avolta recently acquired Hong Kong-based Free Duty, a leader in border retail, from NWS Holdings. This acquisition connects Avolta to over 150 million travelers across the Greater Bay Area and opens new multi-channel opportunities across air, land, and sea.

Still, the company remains focused and selective when it comes to acquisitions. “We make an acquisition only when we believe that there’s value creation,” says Cheung, emphasizing that Avolta’s growth strategy in APAC is a careful balance of natural expansion and selective partnerships that bring long-term value.

The Asia Pacific region offers some of the most dynamic and diverse travel retail opportunities in the world, and Avolta is keen to design its offerings

around these fast-evolving expectations. “APAC is a market that treasures convenience, speed, options, and control, mainly due to the fast-paced and sometimes hectic lifestyle,” says Cheung. “That’s why we prioritize technology that enables a traveler-centric journey and delivers all of the above.”

Operating across more than 70 countries, with a growing presence in key APAC markets, Avolta consistently builds around the traveler, not the transaction. “It’s at the heart of everything we do in each of our retail stores and F&B outlets,” says Cheung.

Leveraging its global scale, Avolta ensures brand consistency while still delivering hyper-local relevance. “We are committed to offering travelers whatever it is they want to buy, not what we want to sell,” she adds. This traveler-first philosophy shapes Avolta’s diverse and memorable product assortments. From duck neck in China and bear cookies in Hong Kong to artisan wellness goods in Indonesia, locally

produced whisky in India and manuka honey in Australia, Avolta delivers offerings that reflect the culture and desires of travelers in each part of the region.

Store design plays a role in enhancing the overall experience, featuring curated brand selections, immersive entertainment, competitive pricing and localized storytelling. Different markets require different strategies, according to Cheung. Mature markets demand breakthrough innovation, growth markets call for elevating offerings and standards, while infant markets present limitless opportunities to build from the ground up. “As we are the leading global travel retail and F&B player, we offer not only duty free and duty paid but also travel essentials and F&B,” states Cheung. “Therefore, we are flexible in how we match our offers to the needs of each market.”

In APAC, where travel retail often takes the spotlight over travel F&B, Avolta champions hybrid formats that merge the two together. A standout

example is the debut of the first Hudson Café at Shenzhen Bao’an, combining the familiar worldwide airport convenience store concept with an innovative café bar twist. Meanwhile, the company is integrating digital touchpoints that put choice and control directly into travelers’ hands, from Reserve & Collect services to QR code menus and selforder kiosks.

Avolta’s latest technology-driven innovation, the Club Avolta loyalty program, made its debut last September at the TFWA World Exhibition and Conference in Cannes. This announcement was particularly significant for the APAC region, where the impact and importance of loyalty programs are especially pronounced.

In APAC, loyalty programs are omnipresent, spanning from luxury boutiques, convenience stores and fine dining to high-speed rail and ferries. “Loyalty programs are definitely an integral part of everyday life here,” shares Cheung. “This isn’t just because consumers want rewards, but also because they want a sense of belonging and to be part of a community with shared values

and common interests.”

At the global level, Club Avolta rewards its members wherever they shop within the company’s expansive network, which spans an impressive 5,000 points of sale across more than 70 countries. The program provides continuity, connecting travelers to a unified ecosystem no matter where their journeys lead. The company views Club Avolta as a “tool that turns a single purchase from a transaction into a habit, and from a habit into a lifestyle,” Cheung notes.

“Club Avolta has been very wellreceived in APAC,” shares Cheung with enthusiasm. “We’re excited to see how this community of like-minded travelers continues to grow.”

Overall, Avolta’s strategic expansion across APAC, from China and India to Vietnam, Indonesia and Australia, highlights its focus on cultural adaptability and operational excellence, with no signs of slowing down.

“APAC is truly an exciting region,” concludes Cheung. “The sky is the limit.”

Delhi Duty Free’s focus on customer-centric offerings, digital innovation and sustainability is shaping the future of travel retail in India. Ashish Chopra, CEO of Delhi Duty Free, shares insights into the company's commitment to blend exclusivity with accessibility for its increasingly diverse customer clientele

by ATOOSA RYANNE ARFA

Aremarkable transformation is unfolding in India. The nation is rapidly emerging as a global powerhouse of innovation and luxury, propelled by an expanding middle class, an influx of international travelers and a new generation of tech-savvy consumers.

At the heart of this evolution, Delhi Duty Free is evolving to meet the changing preferences of today's travelers. Its record-breaking annual sales of ₹2,177 crores (US$261 million) for the financial year ending March 31, 2025, attest to this impact. And now the future looks even brighter, with the GMR Group poised to fully acquire Delhi Duty Free in August 2025, a move that promises to pave the way for even more opportunities for growth and innovation.

As India cements its reputation on the global stage, Delhi Duty Free is committed to advancing its offerings at Indira Gandhi International Airport.

“We’re proud to reflect India’s rise as a global leader in innovation and luxury,” says Chopra.

Delhi Duty Free strengthens its premium positioning through renowned global partnerships. In Terminal 3, it recently collaborated with Suntory Global Spirits to create a shop-in-shop concept that blends Japanese craftsmanship with modern design. Further enhancing its luxury appeal, the company launched Dior’s La Collection Privée pop-up, showcasing ultrapremium fragrances, and expanded its

portfolio with English perfume house Penhaligon’s. It also unveiled the first Les Exclusifs de Chanel shop-in-shop located in the Indian subcontinent.

Alongside these international offerings, Delhi Duty Free highlights India’s heritage through locally sourced products. A curated selection of premium Indian whiskies, including Indri, Paul John, Rampur and Longitude 77, offers travelers a taste of the country’s artisanal excellence. “This balance ensures that international travelers have access to both the best global brands and India’s finest homegrown products, making their shopping experience more authentic and enriching,” Chopra explains.

With factors including increased discretionary spending by Indian residents and a renewed influx of international tourists, Delhi Duty Free recognizes varying tastes and needs by curating

an assortment that appeals to both value-conscious consumers and those with a taste for high-end exclusivity.

“The key is understanding our customer base and strategically segmenting our offerings,” explains Chopra. “Altogether, we focus on premiumization, exclusive collaborations, collectible items and sustainable products.”

By leveraging market intelligence, the company offers exclusive, high-value items such as the Royal Salute 25-YearOld Delhi Edition for its premium clientele, while also ensuring a varied range of more accessible options for a broader audience. This balance ensures a shopping experience that is both inclusive and aspirational.

Understanding that today’s travelers are highly connected through the power of technology, Delhi Duty Free has embraced digital innovation. “Today’s

younger travelers are digitally savvy, seeking both convenience and exclusivity,” notes Chopra.

With this in mind, the company has introduced an advanced CMS platform that allows customers to effortlessly browse and reserve products even before they set foot in the airport. Once inside the store, travelers are greeted by interactive displays and dynamic video walls that create an immersive and captivating shopping environment. To keep things fresh and exciting, Delhi Duty Free frequently introduces exclusive digital product promotions and limited edition collaborations, catering to the demand for unique, standout offerings that create lasting memories.

Chopra proudly highlights the company’s early adoption of paper bags and its ongoing pilot of biodegradable, nonplastic alternatives. Additionally, Indira

Gandhi International Airport, home to Delhi Duty Free, continues to lead by example in environmental stewardship as a single-use plastic-free airport.

Expanding its sustainability efforts, Delhi Duty Free has transitioned to 100% LED lighting across its retail locations and offices to further reduce its carbon footprint. It also champions green commuting by encouraging metro rail travel and offering shuttle services to connect employees to the workplace. “These efforts ensure that sustainability remains at the forefront of our operations, while offering eco-conscious shopping options for travelers,” notes Chopra.

Looking ahead, Chopra exudes confidence in Delhi Duty Free’s leadership in India’s travel retail sector. The essence of the strategy remains to create an experience that is as aspirational as it is accessible, ensuring that Delhi Duty Free continues to captivate a diverse global audience.

art of serıes “kı” the crafted by japan’s nature

Wangfujing International Duty Free Port in Wanning saw a 63% sales increase and a 77% rise in foot traffic, establishing itself as a premier duty free and premium outlet destination

Wangfujing Group is redefining China’s tourism and retail landscape with its “Beyond Duty Free” philosophy. This innovative, multi-format approach blends the company’s rich heritage in taxable retail with an expansion into the offshore duty free market

by ATOOSA RYANNE ARFA

In June 2020, Wangfujing Group made history by becoming the first Chinese department store chain to secure a duty free goods operation license. This achievement set the stage for a core business model that leverages the company’s established success in taxable retail with a rapidly expanding duty free enterprise.

A dual-engine strategy

At the heart of this evolution is Wangfujing’s dual-engine strategy, which integrates both tax-paid and tax-free operations with the explicit goal of transforming China’s retail and tourism sectors. The company blends two

distinct but complementary business models into one cohesive vision, driving both innovation and growth.

“We adhere to the philosophy of ‘Beyond Duty Free,’” shares the public relations spokesperson for Wangfujing Duty Free. “By aligning strategies and clarifying priorities, we aim to establish a multi-format, multi-polar duty free ecosystem, driving rapid expansion and implementation of duty free projects.” Through this approach, Wangfujing not only strengthens its traditional retail roots but also positions itself to respond swiftly to shifting market conditions and evolving consumer preferences.

Offshore innovations

The 2023 debut of the Wangfujing International Duty Free Port, which is positioned as both a duty free and premium outlet destination, signaled the early success of this strategy, which has already delivered outstanding results. The location reported a 63% year-on-year increase in total sales as of January 2025, along with a 77% surge in customer footfall. These impressive figures showcase the power of the dualengine strategy and demonstrate how effectively it drives substantial growth.

Located in Wanning City near popular surfing resorts such as Riyue Bay and Shimei Bay, the 170,000-square-meter Wangfujing International Duty Free Port offers nearly 800 international and domestic brands across nine product categories, including luxury goods, sports gear and fragrances.

But this Hainan destination goes beyond traditional retail. It is also designed to provide experiential attractions that cater to travelers seeking

active lifestyle experiences. Notable highlights include a competition-grade skatepark and Hainan’s first dedicated duty free sports section for surf and skate enthusiasts, making it the island’s largest sports hub.

In addition, Wangfujing has partnered with prestigious brands such as MAX MARA and Penfolds to offer customers an elevated shopping experience, while a drive-in cinema adds an element of entertainment that further enhances the destination’s appeal.

Wangfujing Group has also expanded its retail footprint at major Chinese travel hubs in Heilongjiang Province’s key cities. In August 2024, the company secured agreements to operate departure duty free stores at Harbin Taiping International Airport and Mudanjiang Hailang International Airport. These stores represent the company’s ability to create retail environments that enhance the transit experience of departing passengers, offering a wide range of products from fragrances and cosmetics to wines and luggage.

These airport duty free spaces also ensure that travelers not only shop, but also engage with the region’s cultural identity, creating a unique sense of place. In Harbin, for example, where operations began in January 2025, Wangfujing has developed a space that reflects the city’s iconic cold-climate

heritage, highlighted by its renowned Harbin Ice Festival. “The designs blend Harbin’s urban identity and ice-snow culture with airport layouts, creating functional, locally themed shopping spaces,” states Wangfujing Duty Free’s spokesperson.

Urban retail

In addition to its successes in offshore and airport locations, Wangfujing Group is redefining urban retail by introducing easily accessible duty free spaces in major cities, blending modern shopping with local cultural heritage.

One standout project is located in the bustling Wushang Mall in Wuhan, where Wangfujing Duty Free obtained operational rights in December 2024. Developed in collaboration with Wushang Group, this urban duty free space integrates iconic architectural elements such as the Yellow Crane Tower and the Yangtze River Bridge, merging traditional Chinese symbolism with ontrend retail offerings.

Similarly, another innovative Wangfujing Duty Free project that began operations in January 2025 is located within the flagship Wangfujing Department Store in Changsha. This space combines cultural emblems such as Yuelu Academy, a historic learning center dating back to the Song Dynasty, with Xiang embroidery, a traditional craft known for its intricate and colorful designs.

Kansai International Airport (KIX) has unveiled a major Terminal 1 renovation ahead of the Osaka-Kansai 2025 Expo, enhancing capacity, efficiency and the passenger experience. As the gateway to this global event, KIX is preparing to welcome millions of visitors with upgrades that reflect a commitment to innovation, comfort and operational excellence

by ATOOSA RYANNE ARFA

Kansai International Airport (KIX), the gateway to western Japan, marks a major milestone with the unveiling of its most significant renovation since 1994, in time for the Osaka-Kansai 2025 Expo. This upgrade enhances passenger flow, modernizes retail offerings and delivers an elevated travel experience that combines advanced technology with refined Japanese aesthetics.

Landmark renovation

On March 27, 2025, KIX reached a historic juncture in its multi-phase renovation that began in 2022. Terminal 1 reimagines the space to support a growing international traveler base,

featuring innovations such as a consolidated international security checkpoint, eGate immigration control, expanded duty free zones and a spacious airline common lounge.

The reception on March 15, 2025, celebrated both the revamped Terminal 1 and the airport’s 30th anniversary. Attended by 450 guests, including government dignitaries, airline executives and industry stakeholders, the event highlighted the support from Kansai Airports’ shareholders, VINCI Airports and ORIX, which together are driving initiatives that enhance connectivity, promote sustainable growth and boost the Kansai region’s appeal.

KIX serves a diverse mix of passengers, with major nationalities including Japanese (21%), Chinese (20%), Korean (19%) and Taiwanese (11%) in 2024. Since 2015, the airport has seen a significant shift in passenger demographics. Originally designed for a 50/50 split between domestic and international travelers, the terminal saw international traffic share surge to 78% by 2018.

Fumio Owada, Chief Commercial Officer of Non-Aero at Kansai Airports, explains the need for Terminal 1’s reno-

vation, “In 2018, international passengers reached 21 million, far exceeding the 12 million originally planned and leading to severe congestion.”

The new terminal incorporates technological upgrades to streamline passenger flow. Features like smart security lanes, self-check-in kiosks and automated bag drop stations make travelers’ journeys smoother. Expanded security checkpoints ensure 90% of travelers pass through security in under ten minutes. Additionally, Japan’s largest walkthrough duty free store and expanded dining

options offer a shopping and culinary experience that blends local and global influences.

In 2024, KIX served over 30.6 million passengers. With expanded capacity to handle 40 million international passengers annually, the airport is poised to welcome more visitors during the Osaka-Kansai 2025 Expo.

The renovation of Terminal 1 has been carried out in four stages. The first, completed in 2022, expanded and updated

The newly expanded airline common lounge accommodates over 1,000 passengers, offering a more comfortable and spacious experience

the domestic terminal. In 2023, the second stage moved the international area and redesigned shopping and dining on the second floor. The third stage, recently completed, created a larger security area, improved lounges and refreshed shopping on the fourth floor. The final phase, due by summer 2026, will add 20 new stores, including luxury boutiques and a larger food offering.

for every mood

KIX has transformed transit time into a memorable journey with its innovative “Mood Areas.” Reflecting on the transformation so far, Owada’s greatest pride revolves around this innovative space as he explains that “passengers are invited to spend time in the new area

according to their mood.” These themed zones offer personalized experiences for travelers seeking vibrant energy, cultural discovery, functional ease or tranquil relaxation.

The retail redesign blends commerce with culture and leisure, integrating traditional Japanese aesthetics through natural wood finishes and signature colors. Recent retail additions include Gacha Matsuri, a capsule toy shop featuring Japan’s beloved gachapon collectibles. New duty free arrival shops offer a wide variety of tobacco, liquor and confectionery, attracting mainly Chinese and Japanese travelers.

Innovation and sustainability Sustainability drives KIX’s transfor-

mation. The renovation incorporates numerous green initiatives designed to drive the airport toward net-zero emissions by 2050. By optimizing energy efficiency, deploying electric and fuel-cell vehicles and utilizing seaweed beds as CO₂ absorbers, KIX has attained Level 4 Airport Carbon Accreditation. It also boasts the largest solar power generation capacity among Japanese airports. The transformation at KIX remains far from over. While the Terminal 1 renovation marks the airport’s most significant upgrade to date, discussions are currently underway regarding the reorganization of Terminal 2, the airport’s low-cost carrier (LCC) terminal.

With the opening of Noida International Airport scheduled for spring, Global Travel Retail Magazine speaks to CEO Christoph Schnellmann. He discusses the emergence of India as an aviation hub, as well as the prioritization of increased connectivity in the region

Hby LAURA SHIRK

aving started construction in June 2022, Noida International Airport (NIA) is making steady progress toward operational readiness. Located in the Indian town of Jewar, Greater Noida, Uttar Pradesh, NIA is on track to become a major center of aviation in the National Capital Region (NCR).

According to Christoph Schnellmann, Chief Executive Officer at Noida International Airport, the next major milestone is the granting of its aerodrome license, which is expected to take place in May.

“The Airports Authority of India is advancing its work in the air traffic control tower, while construction of the passenger terminal and associated infrastructure is progressing well. The airport will begin operations with domestic flights, with international routes to follow in the subsequent months,” says Schnellmann. “Discussions are ongoing with the state and central government regarding the start of commercial operations.”

Noida International Airport is being built by Yamuna International Airport Private Limited – a fully-owned subsid-

iary of Zurich International Airport AG. At the time of opening, it will have one runway and a terminal building.

Expected to ease congestion at Delhi’s Indira Gandhi International Airport, NIA is set to handle up to 12 million passengers annually. Speaking about India’s emergence as an aviation hub and how increased connectivity (both air and road) serves as a priority, Schnellmann explains, “The aviation sector in India is witnessing remarkable growth, highlighted by the substantial aircraft orders placed by major carriers like IndiGo and Air India. This surge in demand underscores the urgent need to expand airport infrastructure to accommodate increasing air traffic.

“In particular, the Delhi-NCR region requires additional capacity to handle the rising demand for air travel. Noida

International Airport is poised to play a vital role in addressing these concerns. By developing world-class commercial real estate, NIA will not only support the expansion of the aviation sector but also contribute to the economic growth of the region.”

According to Schnellmann, by prioritizing enhanced activity, NIA will serve as a catalyst for economic growth, a driver of tourism and a gateway to opportunity for the people of Uttar Pradesh and beyond. He adds, “We are committed to working with all stakeholders to realize this vision and make NIA a world-class airport that meets global standards in safety, efficiency and passenger service.”

In March, the Yamuna Authority passed a proposal related to the connectivity of NIA. It was determined that 250 buses will run from the airport to 26 districts and several other states. Plus,

a high-speed metro corridor between Jewar and the city of Ghaziabad is in the works.

Drawn from Indian architecture, Noida International Airport’s design and development has been future-focused from the start. “The passenger terminal will feature intricate ornamental lattice screens,” remarks Schnellmann. “Design elements will also include flights of steps at the terminal forecourt, like the famous ghats of Varanasi and Haridwar. Emulating the look and feel of a haveli, a courtyard will allow fresh air and sunlight into the terminal building. Inspired by important rivers of the region, a white, translucent, wavy roof will give the effect of a flowing water body.”

Smooth transit throughout the airport will be supported by a state-ofthe-art digital platform that ensures an elevated end-to-end digital experience. This platform will reach travelers via

all available digital touchpoints and provide flight information, wayfinding, F&B opening times and more.

Considering the airport’s ambitious net-zero emission philosophy, sustainability also played a significant role in the design of NIA. Sustainability and environmental impact were some of the criteria based on which planning and design teams, construction partners and concessionaires have been selected.

“The airport planning, construction, operation and development has been undertaken while minimizing impact on the environment. We are implementing technologies and processes like zero-emission fuels and green (renewable) electricity, waste-water management and environmental management systems to realize this goal,” he says.

On the dynamic mix of retail, dining and lounge options that will be available at NIA, the airport has partnered with

Travel Food Services to offer diverse multi-cuisine dining options and a firstrate lounge including both premium and luxury zones. Specifically created for NIA, Schnellmann believes “Braj Ki Galiyan” will be a hit among visitors. “Featuring dishes inspired by Indian cities like Vrindavan and Mathura, [“Braj Ki Galiyan”] is aimed at providing a delightful and diverse culinary experience to vegetarians and those seeking plant-based options. These outlets will provide an aspirational yet affordable dining experience, offering a sense of novelty and freshness,” he comments.

Additionally, HMSHost India will operate a variety of restaurants and cafés within the terminal, ensuring a strong sense of place and blend of local and global flavors. Promising a memorable shopping experience, the airport previously awarded the duty free concession to a consortium of Heinemann Asia Pacific and BWC Forwarders.

As this interview with Global Travel Retail Magazine reveals, Blueprint and m1nd-set’s upcoming workshop will discuss how Chinese, Indian and Korean Gen Z travelers – set to become travel retail's dominant demographic by 2028 – are fundamentally reshaping the industry with behavior driven by social media, experiential demands and evolving market dynamics, and how the industry should respond

Global Travel Retail Magazine (GTR Magazine): “The Asia Pacific Revolution” is the third installment of insights workshops that Blueprint has co-organized with m1nd-set. Can you tell us about the reasons and motivations behind these seminars?

Blueprint: The idea for these seminars arose during industry events where Blueprint and m1nd-set teams would exchange perspectives on how the Gen Z lifestyle is shaping travel retail. Their unique shopping behavior shaped by experiential retail, social media algorithms, technology and sustainability, particularly in travel retail, stood out. Our client discussions, echoed these findings. m1nd-set also noted growing interest from clients seeking deeper insights into this demographic.

We recognized the need for dedicated seminars to offer case-based, practi-

cal and data-driven insights. m1nd-set would share bespoke consumer data from global shopper interviews, while Blueprint would present real-world case studies from travel retail, high street retail and e-commerce on how to engage Gen Z.

After positive feedback from our clients, we launched the first “GenZ RedY” insights workshop in Cannes in 2023, followed by an Asia Pacific edition in Singapore in 2024. As experiential retail emerged as a major trend, we introduced the “EX.CEL Experiential Retail Workshop” in Cannes last year. Parallel to these workshops, we have held tailored seminars for leading companies.

Our goal is to explore evolving consumer behavior, identify key drivers of change, and offer actionable recommendations to help industry stakeholders adapt.

m1nd-set brings a wealth of experi-

ence and bespoke research to the table. The past 18 years m1nd-set has conducted more than three million interviews and sits on the most sophisticated consumer research database in the industry.

GTR Magazine: So the next collaborative workshop will highlight evolutions among this shopper segment too?

Blueprint: Absolutely. The Asia Pacific region is undergoing significant changes, particularly with the dominance of three key nationalities: Chinese, Indians and South Koreans. International departures among these groups rose by 30% last year, expected to grow by another 19% this year. Together, they account for 37% of all international departures in the region with over 455 million flights, a staggering number of travelers.

As younger generations from these nationalities travel more, their shopping

behavior – distinct from older generations – is reshaping attitudes toward travel and travel retail. It is crucial for industry stakeholders to understand the market size and evolving attitudes, as well as the needs and expectations of these travelers to remain relevant.

GTR Magazine: Can you expand on some of the changes you're seeing among these travelers?

Blueprint: The speed and intensity of change have now accelerated to a level where industry stakeholders must revisit their travel retail playbook. At Blueprint, we help these companies adapt to a constantly changing marketplace, as it is essential to focus on market opportunities.

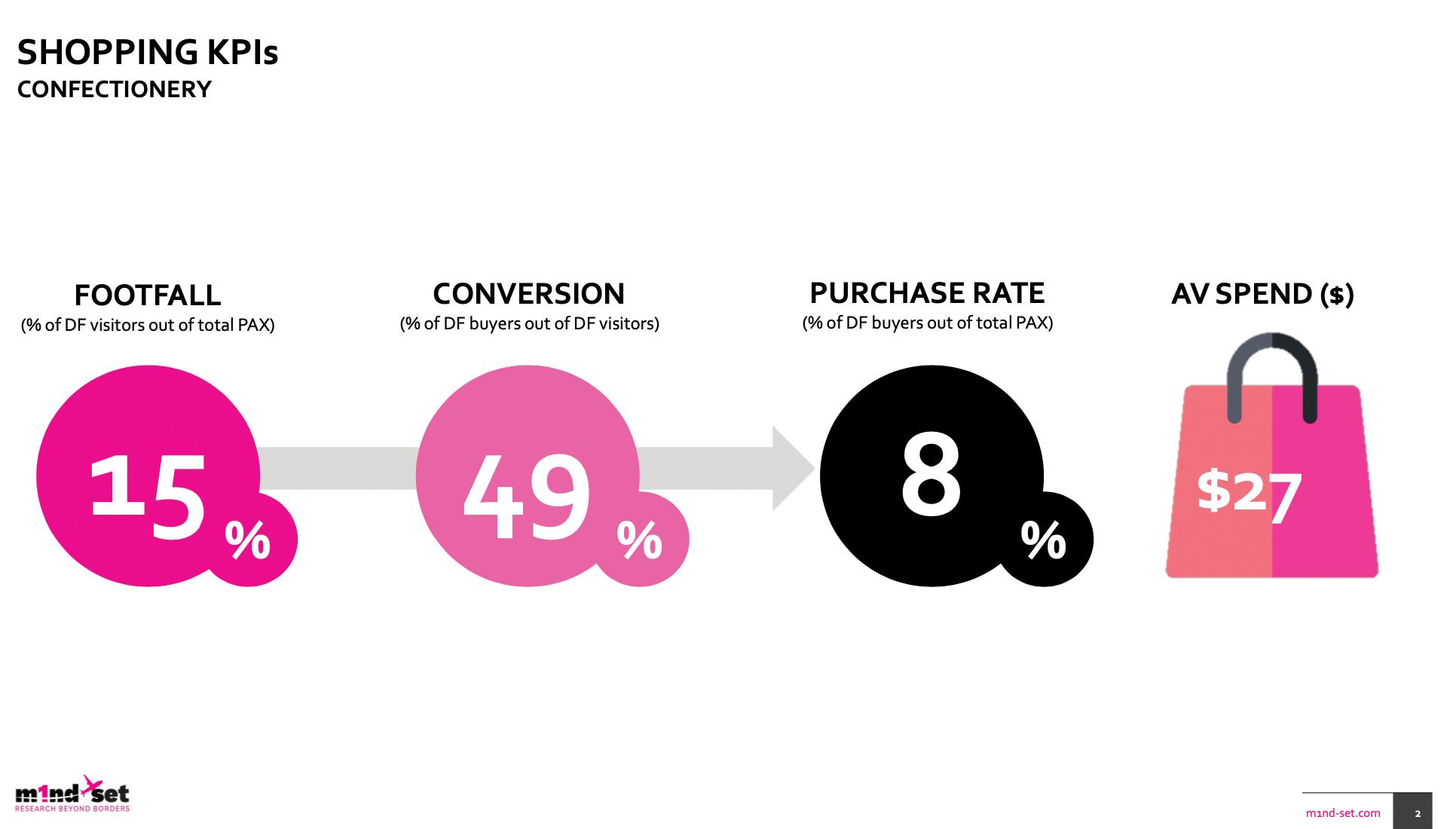

For instance, m1nd-set data shows that footfall among Chinese travelers is below average; fewer than four in ten enter stores. This figure drops even further among older travelers, with less than a third of seniors visiting retail spaces.

Indian Gen Z travelers are on the rise. Last year, nearly one in five (19%) Indian passengers belonged to Gen Z – 5% above the global average. This marks a significant increase from previous years, where they represented 8% and 12% of passengers in 2022 and 2023, respectively.

During the workshop, we’ll explore these evolving trends and discuss practical strategies to attract key traveler segments and convert browsers into shoppers.

GTR Magazine: Can you give us a sneak preview of some of the recommendations you will be sharing at the workshop?

Blueprint: Without revealing too much, we’ll be discussing extraordinary cases influenced by social media, social commerce, experiential retail, artificial intelligence, geopolitics and much more. Most of these megatrends are powered by the influx of Gen Z lifestyle shoppers who are changing the travel retail landscape as we speak. As we approach 2028, these

younger travelers will represent 1.2 billion shoppers and become travel retail’s biggest customer profile.

The recommendations will be relevant to industry stakeholders including airports, operators, retailers, brands and industry associations on how to drive

footfall, dwell time, conversion, satisfaction and spend.

“The Asia Pacific Revolution” will take place at the MBS Expo Centre, Level 4, on the afternoon of Sunday, May 11, between 15.00 and 17.30 before the official TFWA Asia Pacific opening cocktail commences. Seats can be reserved at the following link: https://asia-pacificrevolution.eventbrite.ch

Coty enjoyed a robust net revenue growth of roughly 20% in travel retail in FY 2024, driven by a strong geographic footprint, multi-category expansion and effective collaborations with key retailers by HIBAH

Exclusive activations, immersive concepts and increased customer engagement: three key aspects of a travel retail strategy keeping Coty a major player at the top of the sector’s Beauty category, according to the company’s Chief Commercial Officer, Caroline Andreotti.