THE PNC ECONOMIC OUTLOOK Survey of Small & Middle-Market Business Owners April 2014

U.S. Business Owners’ Outlook Finally Rises From the Doldrums; Expectations Brighten for Sales, Profits and Hiring

Our Spring 2014 survey of small and mid-sized business owners finally shows a significant improvement in business expectations and optimism compared to Autumn 2013 and the best outlook since the subpar economic recovery began in 2009. The upbeat outlook showed across all industries with manufacturing firms still relatively more positive than services companies and a major improvement among construction firms. The new findings from the biannual PNC survey, which began in 2003, show one in five small businesses plan to add new full-time employees – the most since Autumn 2012 – and one in three expect to increase salaries of workers. Private sector job growth, especially among small businesses that do the lion’s share of hiring, is essential to sustaining the expansion. Expecting much improved demand for their products and services and higher prices from their suppliers, especially for construction materials, over one-third (37%) also plan to preserve their profits by raising selling prices. Overall, these findings strongly support PNC economists’ baseline forecast that the U.S. economic and jobs expansion will proceed at a faster pace in 2014, after the harsh winter weather weighed on economic growth at the start of this year.

Key Findings PNC’s forecast for faster, above-average growth for the economy and jobs in 2014 is reflected in the much more positive outlook among business owners, according to our new findings: • Much More Optimistic about Own Company: Over one-third (37%) are optimistic about their own company’s prospects during the next six months, up significantly from 22% in Autumn and 26% in Spring 2013. Correspondingly, only 12% are pessimistic, which is down from 18% in Autumn. • Hiring Plans Grow: Hiring intentions are up significantly with 22% who plan to add full-time employees vs. 16% in the Autumn and Spring 2013 surveys – the most since 2012. Only 6% plan to reduce full-time staff. Of those businesses planning to add workers, 85% cite an improving outlook for sales, business expansion plans, or a better local economy as their top reason. • Business Investment Plans Are Stronger: 65% plan to spend on capital investments in the next six months, up from 58% in Spring 2013. Technology equipment remains the top priority, with other types of business equipment a distant second. Computer hardware and software are the top tech spending priorities and automation in manufacturing processes trails in second.

Outlook on U.S., Local and Global Economy Trending and for the next six months Optimistic (Rate 8-10) Moderately Optimistic (Rate 5-7) Pessimistic (Rate 1-4)

National Economy 6%

7%

52%

53%

Local Economy

13%

12%

16%

51%

59%

53%

21%

51%

41%

39%

35%

28%

30%

26%

4/13

10/13

4/14

4/13

10/13

4/14

• Outlook Brightens for U.S. and Local Economies: Optimism about U.S. and local economic prospects during the next six months are the best since the recovery began in 2009… • But No Better for Global Economy: Over half (56%) are optimistic and 40% are pessimistic about the global economy’s prospects, which is little changed from Autumn 2013 but somewhat better than a year ago.

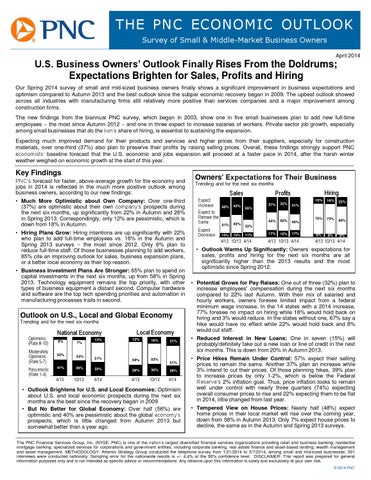

Owners’ Expectations for Their Business Trending and for the next six months

Sales Expect Increase Expect to Remain the Same Expect Decrease

48%

43%

41%

45%

10%

10%

Hiring

Profits 37%

32%

41%

44%

50%

40%

17%

15%

17%

55%

15%

16%

22%

75%

73%

69%

8%

8%

6%

32% 11%

4/13 10/13 4/14

4/13 10/13 4/14

4/13 10/13 4/14

• Outlook Warms Up Significantly: Owners’ expectations for sales, profits and hiring for the next six months are all significantly higher than the 2013 results and the most optimistic since Spring 2012. • Potential Grows for Pay Raises: One out of three (32%) plan to increase employees' compensation during the next six months compared to 22% last Autumn. With their mix of salaried and hourly workers, owners foresee limited impact from a federal minimum wage increase. In the 14 states with a 2014 increase, 77% foresee no impact on hiring while 18% would hold back on hiring and 3% would reduce. In the states without one, 67% say a hike would have no effect while 22% would hold back and 8% would cut staff. • Reduced Interest in New Loans: One in seven (15%) will probably/definitely take out a new loan or line of credit in the next six months. This is down from 20% in Autumn 2013. • Price Hikes Remain Under Control: 57% expect their selling prices to remain the same. Another 37% plan an increase while 3% intend to cut their prices. Of those planning hikes, 39% plan to increase prices by only 1-2%, which is below the Federal Reserve’s 2% inflation goal. Thus, price inflation looks to remain well under control with nearly three quarters (74%) expecting overall consumer prices to rise and 22% expecting them to be flat in 2014, little changed from last year. • Tempered View on House Prices: Nearly half (48%) expect home prices in their local market will rise over the coming year, down from 58% in Autumn 2013. Only 7% expect house prices to decline, the same as in the Autumn and Spring 2013 surveys.

The PNC Financial Services Group, Inc. (NYSE: PNC) is one of the nation’s largest diversified financial services organizations providing retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. METHODOLOGY: Artemis Strategy Group conducted the telephone survey from 1/21/2014 to 3/7/2014, among small and mid-sized businesses. 501 interviews were conducted nationally. Sampling error for the nationwide results is +/- 4.4% at the 95% confidence level. DISCLAIMER: This report was prepared for general information purposes only and is not intended as specific advice or recommendations. Any reliance upon this information is solely and exclusively at your own risk. © 2014 PNC