HEDGE WEEK

HOW OPERATIONAL INFRASTRUCTURE IS BECOMING HEDGE FUNDS’

MAKE-OR-BREAK INVESTMENT

HOW OPERATIONAL INFRASTRUCTURE IS BECOMING HEDGE FUNDS’

MAKE-OR-BREAK INVESTMENT

The operational infrastructure landscape for hedge fund managers, especially those which are emerging, has undergone a fundamental shift, with institutional-grade service providers transitioning from aspirational to essential.

This comprehensive analysis, based on extensive surveys of allocators and fund managers across North America, Europe, and Asia-Pacific, reveals that almost three in four global allocators now consider the absence of an independent fund administrator as a critical red flag, whilst over half demand institutional-grade infrastructure as a minimum requirement for emerging managers.

In Part I of this report, we look at the allocator’s new playbook that takes you inside the decisionmaking frameworks of today’s most sophisticated investors. We examine how allocators are reshaping their operational due diligence processes, the specific infrastructure elements they now consider non-negotiable, and the regional variations that are creating both opportunities and challenges for managers seeking global capital.

Part II explores how fund managers are responding to these elevated expectations across different asset scales. We reveal the critical inflection points where operational priorities shift dramatically – including why technology integration priorities nearly double as managers cross the $1bn threshold. The analysis shows how emerging managers are navigating the tension between meeting institutional standards and managing operational costs, while established managers are grappling with legacy system modernisation.

This research provides the definitive roadmap for understanding how operational infrastructure has become the new battleground for hedge fund success, offering actionable insights for managers at every stage of their growth journey and allocators refining their due diligence frameworks.

4 THE INFRASTRUCTURE ULTIMATUM THE MANAGER PERSPECTIVE –BUILDING SCALABLE OPERATIONS

METHODOLOGY

The key source of data in this report is Hedgeweek’s Q2 Hedge Fund Manager & Allocator Survey conducted in April 2025. The 150 hedge fund firms and allocators that participated in the survey were spread across the major global domiciles, as well as AUM size category and flagship strategy type. Further insights were gathered during interviews in April and May 2025 with named and unnamed hedge fund and allocator sources as well as additional third-party research and intelligence.

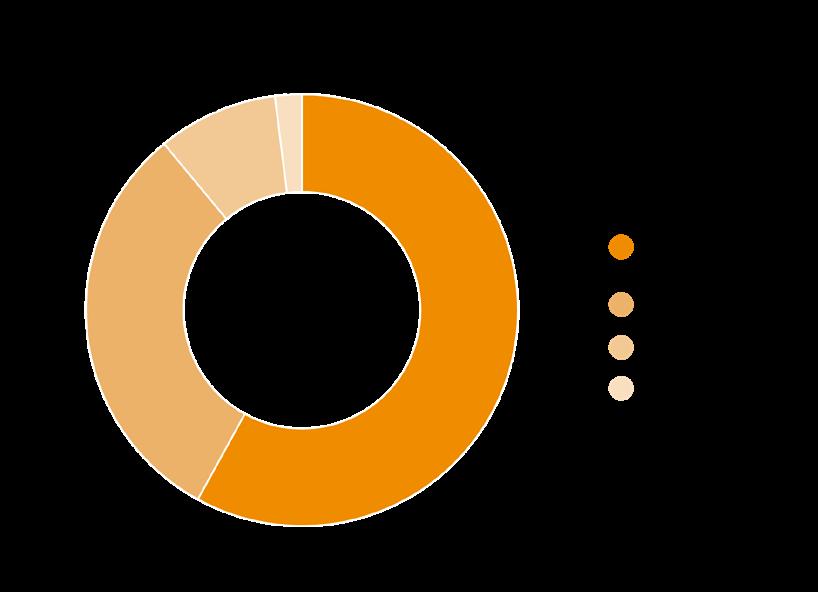

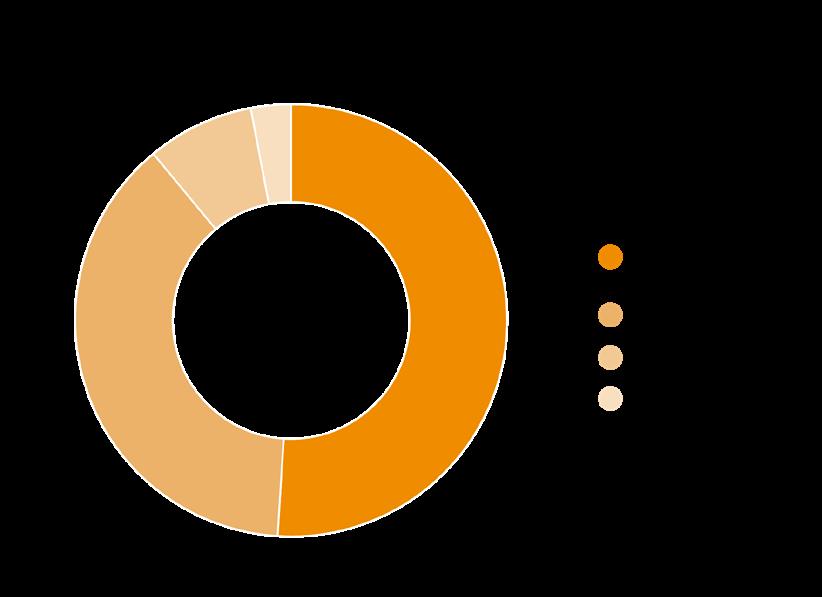

Breakdown of respondents to Hedgeweek’s Q2 Hedge Fund Manager Survey by firm location, size and approach:

Breakdown of respondents to Hedgeweek’s Q2 Allocator Survey by firm location, size and approach:

1

Institutional-grade infrastructure now non-negotiable

Over half of allocators (56%) now consider institutionalgrade service providers a minimum operational requirement for emerging managers. More critically, nearly three-quarters view absent independent fund administration as an immediate red flag – the single most important infrastructure requirement. The infrastructure bar has risen dramatically, with proper service providers and fund administration becoming immediate disqualifiers rather than mere preferences in allocation decisions.

2

Shadow books: Essential in West, optional in Asia

Operational due diligence has become dramatically more stringent, with four in five North American allocators increasing scrutiny versus just a third in Asia-Pacific. This stark regional divide mirrors shadow book expectations: nine in ten Western allocators now demand these capabilities, whilst only a third of Asia-Pacific allocators consider them important –creating a strategic investment dilemma for globally-focused managers.

3

Scaling roadmaps critical as managers struggle with growth

Clear operational scaling roadmaps rank as the top comfort factor for allocators, especially in North America where 63.6% cite this as essential. Meanwhile, managers find a host of operational challenges when thinking of scaling, with adding new funds their most challenging operational hurdle (35.2%), highlighting the gap between investor expectations and operational reality.

4

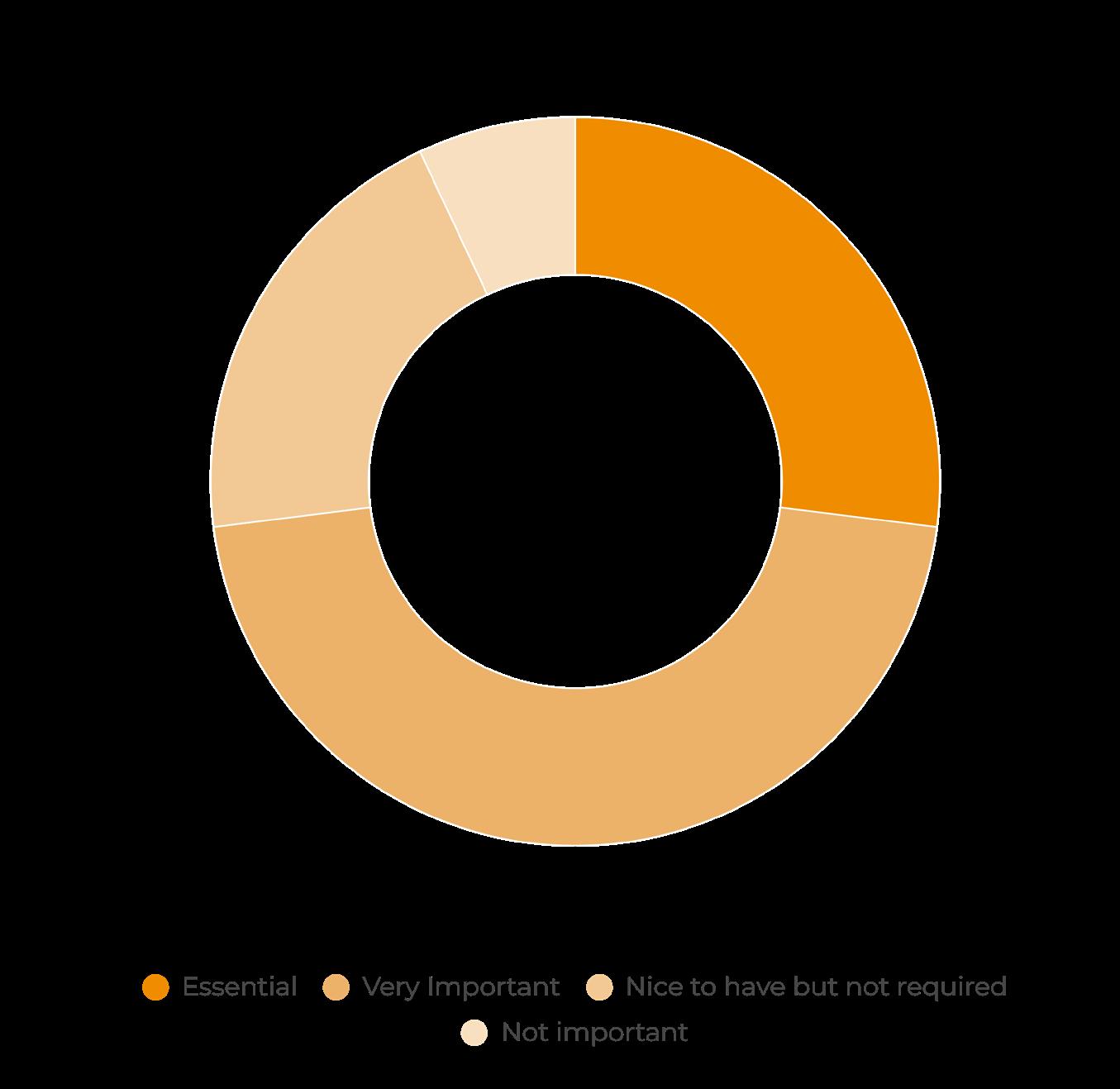

Single source of truth becomes make-orbreak at £1bn+ AUM

Front-to-back integration for a single source of truth transforms from nice-to-have to business-critical as funds scale. Nine in ten funds with £1bn+ AUM rate this as critical or very important versus less than half of sub-£1bn managers. This dramatic shift suggests that operational complexity and data integrity requirements fundamentally change at scale, creating distinct infrastructure needs across different fund sizes.

How operational standards became make-or-break for hedge fund capital raising

Source: Hedgeweek 2025 Investor Survey

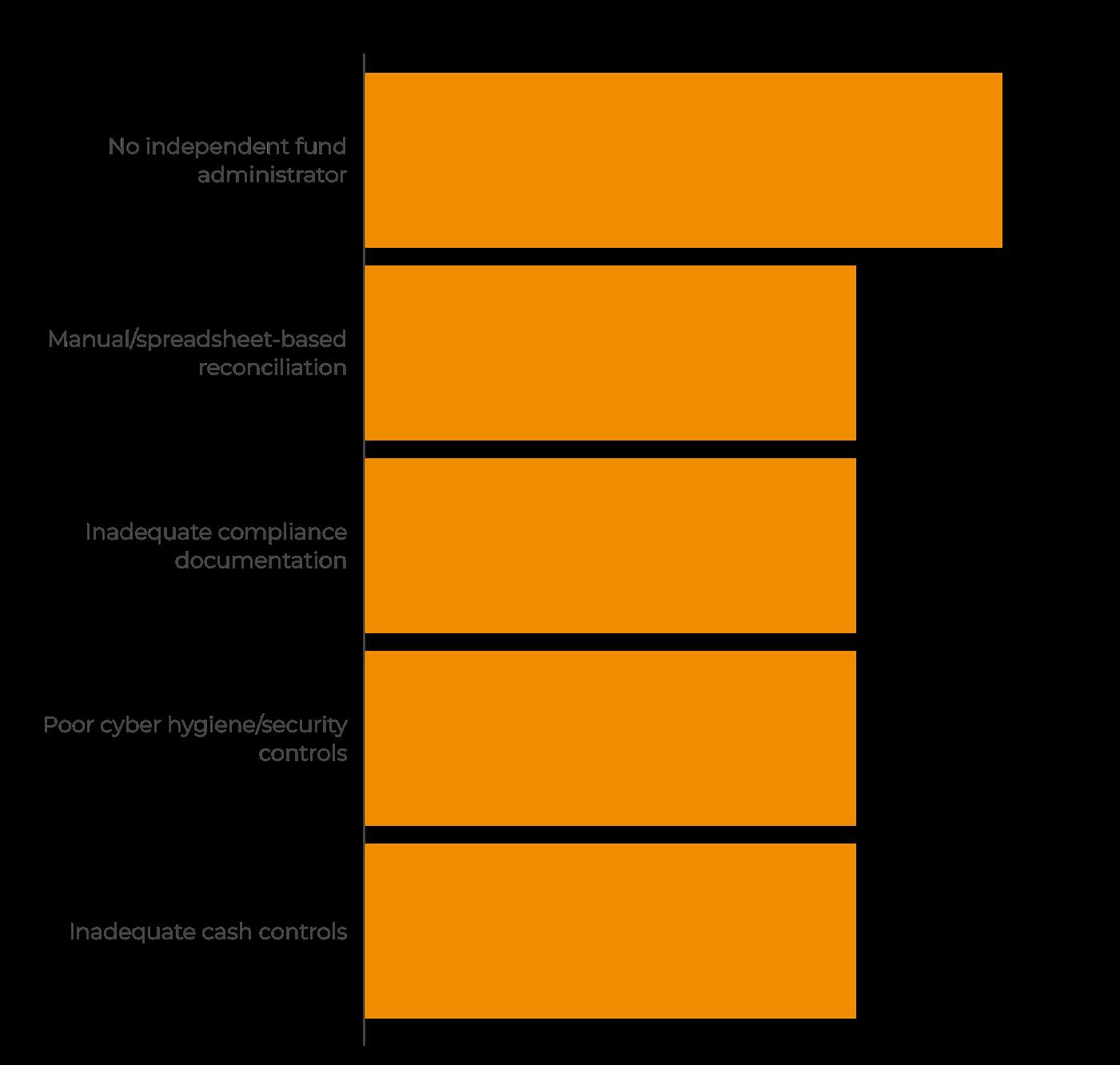

The operational infrastructure requirements for hedge fund managers have become increasingly stringent, with allocators demonstrating clear preferences that extend beyond mere operational competence to fundamental business viability. The absence of institutional-grade infrastructure has evolved from a concern to a disqualifier in many allocation decisions.

“We never just looked at track records, but our operational due diligence processes have become much more stringent today,” said a senior allocator at a European fund of hedge fund with over $5bn in alternative investments. “A manager can have the most compelling strategy in the world, but if they don’t have proper operational infrastructure, we simply can’t take the reputational risk.

Michael Weinberg, Adjunct Professor of Finance and Economics at Columbia Business School, provides an allocator’s perspective on this evolution: “The regulatory burden, including legal and compliance, has risen dramatically. Both in the US and particularly for those managers with a research or marketing presence in Europe.”

However, Weinberg clarifies that for established allocators, the standards have remained consistent rather than escalated: “We have always required our emerging managers to have institutional-grade service providers.

In our view this has not changed. That said, they may be smaller or less well-known service providers that charge lower fees. They don’t have to be the largest, name brand providers. A high-quality, well-respected boutique accounting firm is just as acceptable as a big three.”

This perspective reveals an important nuance in the 56% figure for institutional-grade infrastructure requirements. The definition of “institutional-grade” seems to have broadened to encompass rather nimble, specialised providers that maintain rigorous standards whilst offering competitive pricing for emerging managers.

A US-based family office allocator, who oversees hedge fund investments across multiple strategies, echoed this sentiment: “We’ve become more pragmatic about service providers. It’s not about the brand name on the door—it’s about whether they can deliver institutional-quality processes and controls at a scale that makes sense for an emerging manager.”

The survey data shows that independent fund administration has become non-negotiable, with 73.9% of allocators considering its absence a red flag. This represents the single most important infrastructure requirement, surpassing all other operational considerations in terms of universal acceptance across allocator communities.

Source: Hedgeweek 2025 Investor Survey

Analysis of Hedgeweek’s Q2 survey of allocators reveals pronounced regional differences in how they approach operational due diligence, creating distinct challenges for managers seeking to raise capital across different geographies.

North American allocators are implementing some of the most rigorous operational due diligence standards, with 82% reporting increased scrutiny over the past two to three years. The breakdown shows 36% have become “more rigorous” and 46% “somewhat more rigorous” in their operational assessments, with only 18% maintaining unchanged standards.

This heightened scrutiny extends to specific capabilities. Nearly 90% of North American allocators consider shadow books of records either essential (35%) or very important (54.1%), with only 9.1% viewing them as merely “nice to have”. This near-universal expectation reflects both regulatory pressures and prevalence of much more complex strategies which need more stringent monitoring.

The focus on comprehensive infrastructure is matched by emphasis on scaling capabilities. North American allocators demonstrate the

strongest preference for clear operational scaling roadmaps, with 63.6% citing this as a key comfort factor when evaluating emerging managers.

European allocators demonstrate a more moderate approach to operational due diligence evolution. Whilst 40% report increased rigour, a significant 60% maintain unchanged standards, suggesting a more stable operational due diligence environment compared to North America.

“We’ve always been process-oriented in Europe,” noted a European fund of hedge funds. “The difference now is that we’re much more focused on understanding the daily operational rhythms of our managers. We want to see inside the engine, not just test the output.”

However, European allocators display unique preferences that distinguish them from other regions. Most notably, 60% cite “transparency into daily processes” as a key comfort factor, the highest percentage across all regions for this criterion. This emphasis on operational visibility and process clarity reflects European institutional culture and regulatory frameworks.

Regarding shadow books, 90% of European allocators rate them as essential or very important, though fewer rate them

Chart 1.5 What would make you more comfortable with an emerging manager’s operational setup?

Source: Hedgeweek 2025 Investor Survey

as “essential” compared to their North American counterparts. This suggests similar expectations but potentially a bit more flexibility in implementation approaches.

“Shadow books are important, but it really depends on the strategy,” said a European allocator who spoke on condition of anonymity. “For a long-only equity manager, monthly reconciliation might be sufficient. But if you’re running complex derivatives, you need daily or even intraday shadow books. We’re much more flexible with vanilla long-short managers than we are with multi-strategy funds that have operational complexity.”

Asia-Pacific allocators exhibit the most stable operational expectations, with two-thirds reporting unchanged due diligence standards over the past two to three years. Only one in three report increased rigour, representing the smallest shift among the three regions.

This stability reflects different priorities rather than lower standards. Asia-Pacific allocators demonstrate the strongest preference for “prior operational experience at established firms”, with 67% citing this as a comfort factor – significantly higher than North America (46%) or Europe (40%).

The regional difference is most pronounced in shadow book expectations. Two-thirds of AsiaPacific allocators view shadow books as either “not important” or just “nice to have”, creating a

stark contrast with Western markets where they are considered essential infrastructure.

The importance of shadow book of records capabilities represents one of the most significant operational developments revealed in the research. Overall, 73% of allocators consider shadow books either “essential” (27.3%) or “very important” (45.5%).

Weinberg explains the regulatory drivers behind this trend: “The increased regulatory burden that we alluded to earlier, including both legal and compliance, has driven the greater prevalence of shadow books. Greater SEC enforcement with severe monetary and other penalties has also been a driver.”

The regional divide stems from a fundamental mismatch between evolving strategies and outdated infrastructure, according to Aani Nerlekar, Managing Director, SS&C Advent. “Strategies are no longer simple in North America and Europe, but some administrators are stuck with legacy platforms serving thousands of clients,” he explains. “As managers deploy more complex asset classes and face intricate investor fee demands, shadow books become the only way to ensure administrators can actually deliver what’s required.”

The regional variation in shadow book expectations creates operational challenges for managers seeking global capital. North

American and European markets demonstrate near-universal expectations, whilst Asia-Pacific markets show significantly lower requirements. This divergence forces managers to make strategic decisions about infrastructure investment based on their target investor geography.

For managers targeting North American capital, shadow book capabilities have effectively become mandatory, with 89% of allocators rating them as essential or very important. European expectations are similarly high at 90%, though with more flexibility in the “essential” categorisation.

Our survey also reveals that clear operational scaling roadmaps have emerged as the most significant comfort factor for allocators evaluating emerging managers. This finding reflects allocators’ focus on long-term operational sustainability rather than just current capabilities.

“We’re not just investing in a strategy – we’re investing in a business,” explained a senior allocator at a US family office. “If a manager can’t articulate how they’ll scale operationally from $100m to $1bn, that tells us they haven’t thought through the business model. That’s a red flag regardless of how attractive the returns look.”

Weinberg confirms this perspective: “The same way we assess the managers ability

to implement the initial fund or strategy. The hurdle for incremental ones is no different.” This suggests that operational scalability is viewed as an extension of fundamental management competence.

The data shows that 64% of North American allocators cite clear scaling roadmaps as increasing their comfort with managers. Other important factors include outsourced operations support, prior operational experience, and process transparency, though these vary significantly by region.

Independent Fund Administrator

Allocator Consensus (%)

74

Criticality Level Regional Variation

Critical Universal

Institutional-Grade Infrastructure

Allocator Consensus (%) Criticality Level Regional Variation

56

Allocator Consensus (%)

73 Shadow Book of Records

Clear Operational Scaling Plan

Allocator Consensus (%) Criticality Level Regional Variation

64

Consistent globally

Outsourced Operations Support

Allocator Consensus (%)

Prior Operational Experience

Allocator Consensus (%)

Managing Director, Solutions Management and Consulting at SS&C Advent

Allocators increasingly consider institutional-grade service providers a minimum requirement for emerging managers. How has this changed operational approaches compared to five years ago?

There’s significantly more pressure now from allocators for what we call institutional-grade infrastructure,” explains Nerlekar. “Nobody wants to invest in a manager still doing things in Excel. Whether you’re a £10 million shop or a £1 billion fund, the level of security, technology, and data quality that allocators expect has dramatically increased.

This transformation stems from heightened cybersecurity concerns, demand for sophisticated analytics and the evolution toward more complex strategies. As managers venture into more and more complex strategies seeking alpha, they require robust systems capable of handling these instruments – creating a virtuous cycle where superior infrastructure enables strategy diversification and attracts additional capital.

With two-thirds of managers acknowledging limitations in their multiasset infrastructure, what should emerging managers prioritise when building technology stacks that accommodate future growth?

Cloud-native solutions offering strategic flexibility should top the priority list for emerging managers. The ideal technology partner provides infrastructure supporting current investment approaches while enabling rapid pivots to different asset classes as opportunities emerge.

This adaptability proves crucial as managers navigate market dislocations and pursue shifting alpha sources. A truly effective infrastructure seamlessly handles the entire investment lifecycle—from front-office trading through middle-office compliance to backoffice accounting—across all potential asset classes.

The ability to transition smoothly between strategies without overhauling technology infrastructure has become essential in today’s dynamic market environment.

Why are so many allocators considering shadow book capabilities essential, and what innovations help emerging managers meet this requirement affordably?

The increasing complexity of both investment strategies and fee structures has driven the shadow book requirement. As administrators struggle to rapidly modernise legacy platforms, managers need independent verification capabilities, particularly for complex fee calculations and the growing demands for sophisticated investor reporting.

Allocators now expect unprecedented transparency – including detailed look-through reporting for compliance and granular portfolio exposure – requiring managers to maintain accurate, real-time internal books of record.

Co-sourcing represents the most significant innovation in this space. Rather than building in-house teams with attendant salary costs and key-person risks, managers can maintain control of their data while outsourcing reconciliations and system management, freeing internal resources for higher-value activities.

With larger managers rating front-to-back integration as a critical factor, what trends are you seeing in integration approaches?

Seamless integration across investment technology stacks has become universally expected. Managers demand consistent user experiences without concerning themselves with whether trades booked in the front office properly flow through to accounting systems.

This expectation has fundamentally transformed product development approaches. Emerging managers increasingly adopt unified cloud platforms offering singleinterface experiences from trading through accounting. Larger institutions pursuing “best of breed” approaches still expect vendors to handle integration complexity.

Leading technology providers have restructured development teams to ensure consistent design philosophy across products, with unified leadership spanning front and back office solutions, allowing product managers to conceptualise problems holistically from trading compliance through final accounting.

Strategic infrastructure planning from inception

From the manager’s perspective, the elevated infrastructure requirements create both challenges and opportunities. The key lies in strategic planning that balances immediate operational needs with long-term scalability requirements.

“Due diligence trends are driven by previous issues, so we have seen multiple changes in focus over the years,” observes Phillip Chapple, Chief Operating Officer of Monterone Partners. The main concern for institutional allocators, he notes, is avoiding infrastructure risk. “Each strategy has its own risks, so it’s important for a manager to demonstrate that their infrastructure is appropriate for those risks.”

This highlights a crucial insight: infrastructure requirements are not uniform but must be tailored to specific strategies and risk profiles. Different types of investors will have varying levels of comfort around infrastructure, meaning there is no one-size-fits-all solution.

Neil Hamilton, Chief Operating Officer at PVTL Point, describes the practical approach as a newly launched manager: “When we set up, we knew investors would expect institutional-grade service providers. To scale for growth, we tried to be deliberate in our efforts to establish a solid foundation.”

Shantanu Shete, founder and CEO of Singapore-based SuPra Fund Management, observes that the service provider landscape has evolved to support emerging managers. “The segment of service provider partners

Source: Hedgeweek 2025 Manager Survey

Source: Hedgeweek 2025 Manager Survey

continues to grow, driving fees toward the lower bound,” he notes. Service providers are increasingly willing to invest in emerging managers “with expectations that future AUM growth will compensate for present lower fees.”

The survey data reveals the primary operational challenges managers face as they scale. Adding new funds ranks as the top challenge for 35% of managers, followed closely by expanding into new asset classes or strategies at 30%. These findings underscore the importance of building flexible infrastructure from inception.

Chapple emphasises the strategic importance of preparation: “A scaling roadmap is critical for newly established managers.” Starting with full institutional infrastructure may limit the time horizon to build track record and raise assets under management due to cost constraints. “Therefore, having a clear plan as to appropriate upgrades to infrastructure is important.”

This highlights a fundamental tension in manager operations: the trade-off between comprehensive infrastructure investment at launch versus phased implementation. The survey suggests successful managers resolve this through careful planning and strategic phasing.

Importantly, Chapple notes that “scaling can go both ways,” so having a clear plan provides

“comfort of resilience to a reduction of AUM.” This recognises that operational infrastructure must withstand both growth and contraction scenarios.

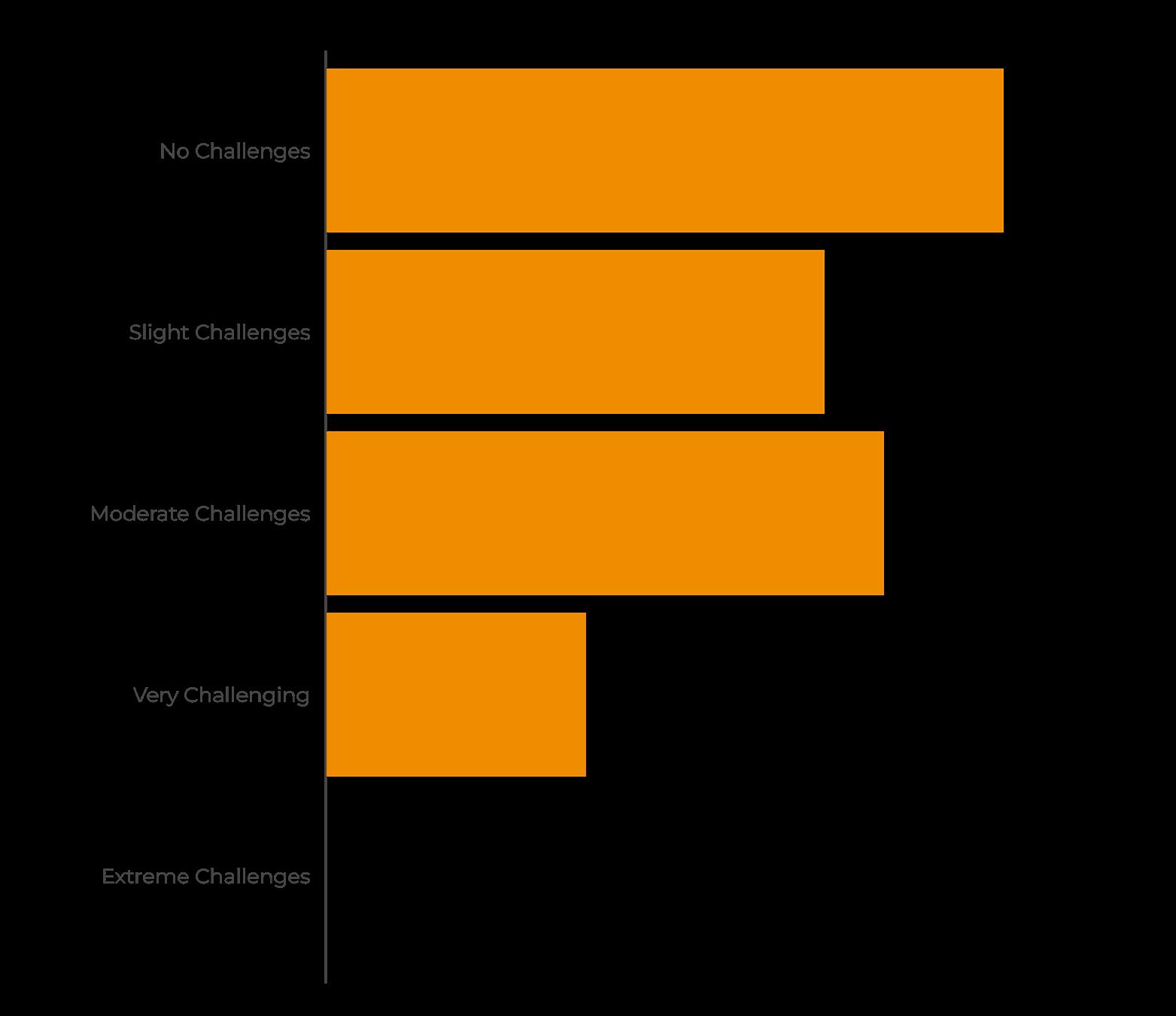

Hedgeweek’s Q2 manager survey reveals that whilst no managers report “extreme challenges” with technology integration, 28% face “moderate challenges”, indicating that technology implementation remains a major operational consideration. The distribution shows 34% report no challenges, 25% slight challenges, and 12.7% very challenging experiences.

Proper implementation is crucial, according to Chapple: “Integrating technology can be challenging. It is essential to build enough time in any integration to ensure full testing.” Even sophisticated systems become risky “if not implemented correctly with a full understanding of all moving parts.”

Meanwhile the multi-asset class capability data reveals significant gaps in current infrastructure. Only 33% of managers rate their systems as “excellent” or “very good” for handling multiple asset classes, whilst 67% acknowledge limitations. This becomes problematic as roughly a third of the surveyed managers identify expanding into new asset classes as a primary scaling challenge.

Source: Hedgeweek 2025 Manager Survey

Perhaps the most striking finding seems to be the dramatic shift in front-to-back office integration importance as firms scale. The survey reveals a clear bifurcation between smaller and larger managers:

Sub-$1bn managers: 45% rate integration as “very important” or “critical”

$1bn+ managers: 88% rate integration as “very important” or “critical”

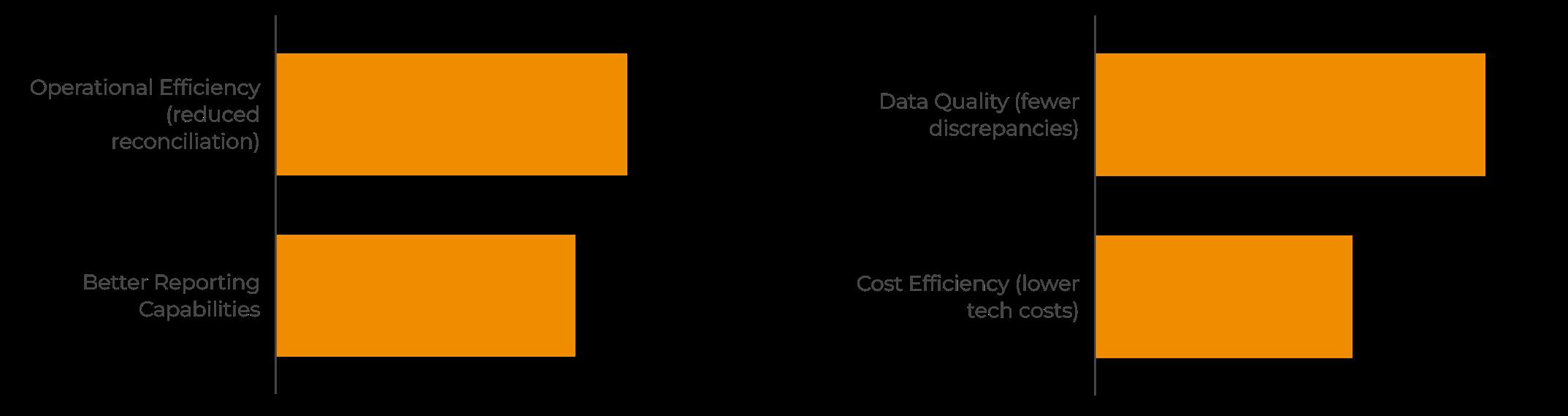

This evolution reflects changing operational complexities and priorities. Sub-$1bn managers focus primarily on operational efficiency benefits from unified systems, with 27% citing reduced reconciliation time as the top priority and 23% emphasising better reporting capabilities.

Larger managers demonstrate different priorities, with 38% focusing on data quality improvements and 25% emphasising cost efficiency. This shift suggests that as firms grow, the focus moves from processing efficiency to data integrity and comprehensive system integration.

The interviews reveal that successful managers view operational infrastructure as a foundation for long-term business sustainability rather than mere compliance. Hamilton advocates extreme discipline “about the deals you strike at the outset, both with service providers and investors.” Managers must be “very aware of the potential fragility that comes with a concentrated investor base” and should only enter agreements that “genuinely support the long-term success of the firm.”

Operational resilience, he contends, extends beyond systems and processes to building “a business that will endure through market cycles and unexpected challenges.” The focus should be on protecting the product and partnering only with those offering terms that support long-term sustainability.

The operational infrastructure landscape continues to evolve, driven by regulatory requirements, technological advancement, and changing allocator expectations. The research reveals several key trends that will shape the industry going forward.

For allocators, the focus on institutional-grade infrastructure reflects lessons learned from operational failures whilst creating regional variations that require sophisticated navigation by managers seeking global capital. For managers, success requires viewing operational infrastructure not as compliance burden but as strategic capability. The integration of robust systems, careful service provider selection, and strategic scaling planning creates competitive advantages in an increasingly demanding environment.

The evolution from operational efficiency focus to data quality priorities as firms scale suggests that infrastructure decisions must anticipate

changing needs rather than merely addressing current requirements. Those managers who master this balance will be best positioned for sustainable growth in the evolving hedge fund landscape.

CONTRIBUTORS:

Manas Pratap Singh Head of Hedge Fund Research manas.singh@globalfundmedia.com

Johnathan Glenn Head of Design FOR SPONSORSHIP & COMMERCIAL ENQUIRIES: Please contact sales@globalfundmedia.com