Agentic AI: The Evolution of Autonomous Fraud Detection

Anurag Mohapatra, Director of Product Management and Fraud Strategy, NICE

Actimize

Anurag Mohapatra, Director of Product Management and Fraud Strategy, NICE

Actimize

A.I. Oscar, iOCBC’s virtual assistant, delivers weekly personalised stock ideas, based on your trading history and market data. Get up to S$2,000 when you transfer your shares and hold them with us.*

*T&Cs apply. Trading in capital markets products and borrowing to finance transactions can be very risky, and you may lose all or more than the amount invested or deposited. Please seek advice from an independent financial adviser before committing to a trade or purchase. Regardless, you should always carefully consider the suitability of the product and any trading decision. The information provided does not consider your investment objectives, financial situation, and particular needs. For any graph, chart, formula or device, there may be limitations and difficulties in its use. Any reference to a company, financial product, asset class or figures is for illustration purposes only. For any historical information, past performance is not necessarily indicative of future performance. OCBC Securities Private Limited (“OSPL”) makes no representations or warranties in respect of any information provided herein or in your personalised AI watchlist (generated based on demographic data and your trading history with OSPL). Any information provided should not be construed as personal trading recommendations or financial advisory from OSPL. OSPL is not responsible for any loss howsoever arising, directly or indirectly, as a result of any person acting on any information provided. The information provided may not be published or circulated in whole or in part without our prior consent. For the full disclaimers, refer to www.iocbc.com/AIOscar

Chairman and CEO

Varun SASH

Editor

Wanda Rich email: wrich@gbafmag.com

Managing Director

Martin Murphy

Project Managers

Megan Sash | Raj Gopal | Rima Attar

Executive Operations and Client Relations Specialist

Anupama KU

Head of Operations

Robert Mathew

Director of Operations

Babitha Gaikwad

Business Consultants - Digital Sales

Paul Dus Davis | Shefali Kochhar | Aakarshita Gautam

Rohit Dutta | Enosh Subba

Hajrah Amelia Hussain | Navya Rajan

Business Consultants - Nominations

Sara Mathew | Adam Luiz

Nikunj Purohit| Imlewapang | Shaheer

Research Analysts

Varshitha | Devendra Patil | Shilpa Churiwala

Video Production & Journalist

Phil Fothergill

Graphic Designer

Jesse Pitts

Advertising Phone: +44 (0) 208 144 3511 marketing@gbafmag.com

GBAF Publications, LTD

Alpha House

100 Borough High Street London, SE1 1LB United Kingdom

Global Banking & Finance Review is the trading name of GBAF Publications LTD

Company Registration Number: 7403411

VAT Number: GB 112 5966 21 ISSN 2396-717X.

The information contained in this publication has been obtained from sources the publishers believe to be correct. The publisher wishes to stress that the information contained herein may be subject to varying international, federal, state and/or local laws or regulations.

The purchaser or reader of this publication assumes all responsibility for the use of these materials and information. However, the publisher assumes no responsibility for errors, omissions, or contrary interpretations of the subject matter contained herein no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the publisher

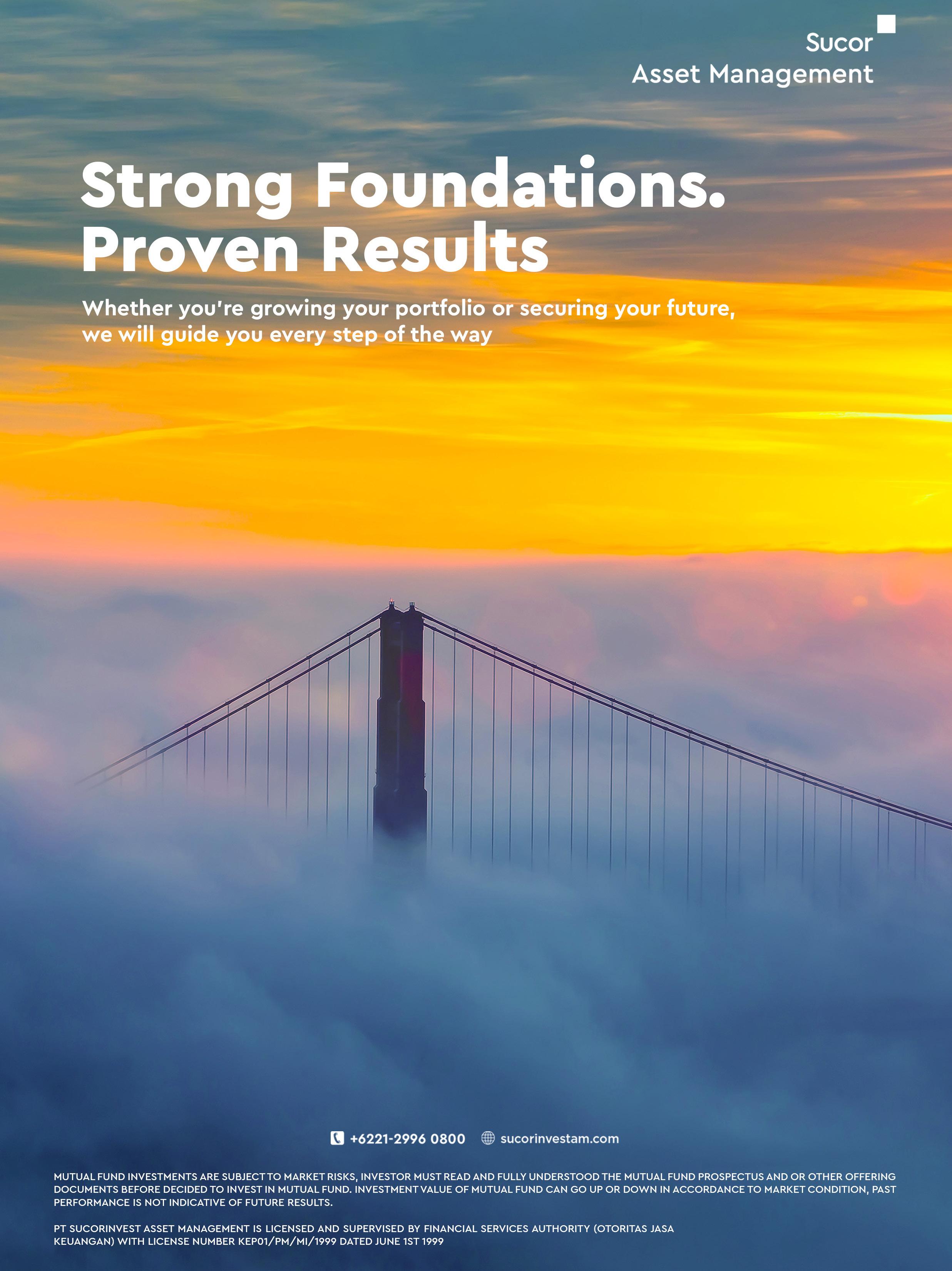

As innovation reshapes how financial institutions operate, serve customers, and ensure security, this issue explores the cutting-edge developments defining the future of banking—from fraud detection to sustainability and cloud compliance.

Featured on our front cover is Anurag Mohapatra, Director of Product Management and Fraud Strategy at NICE Actimize. In “Agentic AI: The Evolution of Autonomous Fraud Detection” (Page 24), Mohapatra outlines how fraudsters are now leveraging advanced technologies—including deepfakes, generative AI, and voice impersonation—while financial institutions are turning to Agentic AI for real-time reasoning, task automation, and fraud strategy orchestration. With regulatory demands and attack complexity on the rise, Agentic AI is fast becoming a competitive necessity in fraud prevention.

Environmental sustainability is another area where financial institutions are rethinking core operations. In “Rethinking Retail Banking Sustainability: Why the ATM is an Asset in the Sustainable Transition” (Page 08), Helena Müller, VP Banking Europe at Diebold Nixdorf, explains how modern ATMs—with their energy-efficient design, cash recycling features, and remote servicing—can play a critical role in reducing carbon emissions and enhancing service accessibility. For banks seeking measurable ESG gains, the ATM may be one of the most overlooked tools in their sustainability strategy.

Cloud transformation continues to accelerate across the banking sector, but so do the regulatory complexities that come with it. In “Navigating Cloud Compliance in Banking: Leveraging CSA CCM Framework” (Page 16), Samir Vinayak Bayani of VMware explores how banks can align their cloud environments with industry regulations using the Cloud Security Alliance’s Cloud Controls Matrix (CSA CCM). From risk management to control automation, this framework offers banks a structured approach to maintaining continuous compliance in a fast-changing digital landscape.

At Global Banking & Finance Review, we remain committed to covering the strategies, technologies, and regulations shaping global finance. We hope this issue provides valuable insight into the challenges—and solutions—guiding your path forward.

Enjoy the latest edition!

Wanda Rich Editor

Stay caught up on the latest news and trends taking place by signing up for our free email newsletter, reading us online at http://www.globalbankingandfinance.com/ and download our App for the latest digital magazine for free on Google Play and the Apple App Store

Rethinking Retail Banking Sustainability: Why the ATM is an Asset in the Sustainable Transition

Helena Müller, VP Banking Europe, Diebold Nixdorf

The Banking Talent Crunch: How Financial Institutions Are Competing for Digital-Native Skills

Embedding ESG in Banking: Risk, Regulation, and the Road Ahead

Beyond Interest: How Banks Are Reimagining Revenue in the Digital Age

Redefining Where, When, and How Business Gets Done

Operational Resilience: Turning Efficiency into Competitive Advantage

Digital Transformation for Small Businesses: Practical Strategies That Deliver Real Results

TECHNOLOGY

Metaverse Applications in Business: Separating Hype from Reality

Navigating Cloud Compliance in Banking: Leveraging CSA CCM Framework

Samir Vinayak Bayani, Technical Lead, VMware

Digital Identity: Transforming Modern Banking Security and Operations

The Rise of Digital Twins in Business: From Manufacturing to Financial Modeling

Anurag Mohapatra, Director of Product Management and Fraud Strategy, NICE Actimize

Banks around the world are embracing sustainability with increasing enthusiasm. From offering carbonneutral banking products to investing in green bonds, financial institutions are aligning themselves with the environmental priorities of regulators and customers alike. However, while digital transformation has been at the forefront of the innovation stage, one essential element seems to have been forgotten by financial institutions: using ATMs as a differentiating component of their sustainability strategies.

With more than 3.5 million ATMs in service globally, the ATM network represents one of the banking system’s most widespread and constantly active elements. Yet it is often overlooked when it comes to sustainability strategies. In truth, the ATM holds untapped potential to help banks reduce their environmental footprint, enhance operational efficiency, and meet their sustainability goals.

Modern ATMs are far from their energy-intensive predecessors. New generations of intelligent machines are designed with sustainability at their core. Energyefficient LED lighting, low-consumption displays, advanced sleep modes, and components engineered for longevity are now standard in the latest models. These enhancements can cut energy consumption by 30% to 60% compared to older units.

In addition, the introduction of cash recycling functionalities enables ATMs to not only dispense but also deposit and reuse banknotes within the same device. This significantly reduces the number of cashin-transit visits required to replenish cash, lowering fuel consumption and associated emissions. In some cases, cash recycling can cut transport-related visits in half.

Remote monitoring and diagnostics also play a critical role. Banks can proactively identify issues and perform software updates or troubleshooting without dispatching technicians—saving time, reducing vehicle emissions, and ensuring uptime for consumers.

In short, the modern ATM is no longer just a cashdispensing box; it is an integrated system with real potential to contribute to a bank's sustainability KPIs.

As branches become fewer, smaller and more digital, ATMs play a growing role in bridging the gap between online banking and physical access. ATMs remain a lifeline for many customers—especially those in rural or underserved areas. By deploying energy-efficient, multifunctional ATMs, banks can downsize their branches without sacrificing service. Fewer staff, smaller premises, lower energy bills, 24/7 service availability—it all adds up.

Banks that incorporate these modern ATMs into their ESG roadmaps can take credit not only for digital inclusion and customer convenience, but also for real, quantifiable reductions in emissions and waste. In this context, the ATM becomes an enabler of responsible innovation and reliable service to end users.

Sustainability isn’t just a checkbox anymore. Investors, regulators, and consumers are all paying attention—and demanding more than good intentions. ESG disclosures are becoming more detailed, and the pressure is on to demonstrate real action.

sustainability strategy, but they should be. Machine-level data—like energy consumption, lifecycle performance, or service frequency—can enrich ESG reporting and offer a more complete picture of a bank’s environmental efforts. Plus, there’s a reputational payoff. A branch that features modern, recycling-enabled ATMs sends a clear message: this is a bank that cares about innovation and sustainability.

Moreover, consumers are paying attention. A branch outfitted with low-energy equipment and recycling-enabled ATMs sends a powerful message about the bank's values and long-term vision.

As banks continue to evolve, they need to rethink what innovation really means. It’s not just about flashy apps or AI-driven customer service. Sometimes, it’s about quietly improving the basics—like the ATM.

To do so, banks should rethink the role of ATMs and start recognizing them as agile tools in the sustainability transition. Partnering with the right technology providers—those who prioritize energy efficiency, remote servicing, and sustainable design—can make a measurable difference.

In a sector striving for both trust and transformation, the ATM might just be the most unexpected ally in the race to net zero and end user satisfaction.

Helena Müller, VP Banking Europe, Diebold Nixdorf

Since Meta's high-profile pivot in 2021, the concept of the metaverse has been met with equal parts optimism and skepticism. As of 2025, the global metaverse market is valued at $316.34 billion, underscoring sustained investment and interest. Yet, the trajectory of enterprise adoption reveals a more nuanced picture—one where practical use cases are gaining traction while sweeping, transformative visions remain elusive. Assessing the current state of enterprise adoption reveals which applications are gaining momentum—and why.

Enterprise adoption of metaverse technologies presents a nuanced landscape. While certain sectors are exploring virtual environments for specific applications, widespread integration remains limited. However, it's important to note that organizations are primarily focusing on targeted use cases where virtual environments can deliver clear returns on investment rather than pursuing comprehensive metaverse strategies. This emphasis on practicality and ROI-driven strategies is shaping the current state of the metaverse in business.

Gartner forecasts that by 2026, 25% of people will spend at least one hour daily in the metaverse for activities such as work, shopping, education, social interactions, and entertainment. This projection underscores the potential for increased engagement in virtual spaces, yet it also highlights that, currently, enterprise adoption is selective and purpose-driven.

Industries such as manufacturing, healthcare, and education are experimenting with metaverse applications for training and simulation purposes. These initiatives aim to enhance learning outcomes and operational efficiency. However, challenges such as high implementation costs, technological limitations, and user adoption barriers continue to impede broader enterprise integration.

Among the various business applications of the metaverse, employee training stands out as the most mature and effective. Organizations across sectors are leveraging immersive environments to improve knowledge retention, enhance engagement, and reduce training costs.

According to case studies, industries such as manufacturing, aviation, and energy use virtual reality (VR) and augmented reality (AR) to simulate high-risk scenarios—allowing employees to train without exposure to physical danger. Airlines and heavy equipment operators have reported faster skill acquisition and higher procedural accuracy through VR-based modules. Meanwhile, sales and customer service teams benefit from practicing client interactions in simulated environments that enable repeated practice and instant feedback without real-world risk.

The industrial metaverse market is projected to exceed $150 billion by 2035, driven primarily by demand for simulation and training solutions. This surge reflects the growing recognition of virtual training as a scalable and cost-effective method, particularly in sectors where physical training can be logistically complex or prohibitively expensive.

The integration of metaverse technologies into product development is delivering tangible benefits, particularly through the use of digital twins and virtual prototyping. Digital twins are virtual replicas of physical objects or systems, which enable teams to visualize, test, and iterate on product designs in simulated environments before committing to physical production—reducing costs, accelerating time to market, and enhancing collaboration across geographically distributed teams.

Digital twins are especially valuable in automotive, aerospace, and advanced manufacturing industries, where physical prototyping is expensive and time-intensive. By replicating complex systems virtually, teams can simulate real-world conditions, run performance scenarios, and identify potential design flaws early in the development cycle.

Immersive tools, such as virtual reality (VR) and augmented reality (AR), are also reshaping global collaboration at the organizational level. For instance, research from German firms exploring VR for agile product development meetings reveals that while virtual collaboration offers potential efficiencies, success hinges on the quality of user experience and how well new tools are integrated into existing workflows. High initial costs, training requirements, and infrastructure limitations remain barriers to widespread implementation.

When well integrated, these environments complement traditional workflows and serve as innovation accelerators, particularly in sectors that demand precision engineering and rapid iteration.

Customer-facing applications of the metaverse have yielded uneven outcomes. While specific industries—particularly automotive, real estate, and fashion—have found value in virtual experiences, others continue to grapple with uncertain returns and limited consumer adoption.

In sectors like automotive and real estate, virtual showrooms and immersive property tours have provided consumers with interactive experiences that support decision-making without the need for physical presence. Fashion retailers have also embraced virtual try-on technologies, enabling customers to preview products through avatars or augmented reality filters. These targeted implementations often enhance convenience and engagement, especially for digital-native audiences.

However, broader social metaverse platforms have struggled to achieve meaningful scale. Meta's Horizon Worlds, for example, reportedly draws fewer than 200,000 monthly active users—far short of its original vision for mass-market engagement. This highlights the continued gap between metaverse ambition and real-world user behavior.

One of the significant barriers to broader consumer adoption remains the cost and accessibility of required equipment. According to a 2025 Statista survey, 29% of U.S. respondents cited high equipment costs as a key factor limiting their participation in the metaverse. Large-scale adoption will likely remain constrained until more affordable, user-friendly hardware becomes widely available.

The return on investment (ROI) from metaverse initiatives varies widely depending on the application. Enterprise training programs, virtual product prototyping, and industrial simulations consistently demonstrate measurable value. These implementations benefit from clear objectives, defined metrics, and alignment with operational needs—making them easier to scale and justify from a business standpoint.

In contrast, consumer-facing platforms and untargeted marketing campaigns often struggle to produce meaningful returns. The uncertainty stems from the difficulty in predicting consumer behavior in virtual environments, the lack of sustained user adoption, and the challenge of measuring the impact of virtual experiences on real-world purchasing decisions. Limited engagement and unclear KPIs have made it difficult for many organizations to validate largescale consumer initiatives—particularly when metrics are inconsistent and consumer behavior remains unpredictable.

Remote collaboration tools fall somewhere in between. Organizations that take a deliberate approach—investing in training, user experience, and integration—report higher adoption rates and productivity gains. Those who roll out platforms without a clear strategy or change management plan often encounter friction and lower impact.

The metaverse delivers the strongest business results when applied to specific challenges with defined ROI parameters. Targeted use cases outperform broad, exploratory efforts that chase scale without strategic clarity.

Despite the promise of metaverse technologies, implementation remains complex and resource-intensive. Many organizations face technical and human-centered barriers that can slow adoption and limit effectiveness if not adequately addressed.

Hardware and connectivity limitations are often the first hurdles. High hardware costs, network bandwidth requirements, and the challenge of integrating virtual environments with existing enterprise systems can deter adoption—especially for smaller or less digitally mature organizations. Ensuring data security and privacy within immersive platforms adds another layer of complexity, particularly when sensitive business processes are involved. A study analyzing barriers to metaverse adoption in manufacturing industries identified "lack of data security and privacy" as a significant challenge, underscoring the need for robust cybersecurity measures.

Equally important are the human factors. Employee resistance to change, a steep learning curve, and concerns over comfort and usability—such as motion sickness or poor ergonomics—can undermine early-stage deployments. Effective onboarding, ongoing support, and thoughtful design are essential for overcoming these obstacles. Research indicates that perceived ease of use and trust significantly influence the adoption of metaverse technologies, suggesting that usercentric design and clear communication are critical for successful implementation.

Organizations that succeed with metaverse implementation tend to take a phased approach. Pilot programs focused on a single, high-impact use case—such as training or digital prototyping—allow testing, iteration, and measurable outcomes before scaling further. Providing adequate user education and integrating virtual tools into familiar workflows also helps to build confidence and accelerate adoption.

Ultimately, successful implementation is not just about technology but alignment, usability, and strategy. Those who invest in infrastructure and change management are more likely to realize the potential of immersive platforms in a sustainable, scalable way.

The outlook for the metaverse in business is becoming more focused, especially in enterprise and industrial contexts. Rather than pursuing broad, consumer-facing platforms, organizations concentrate on high-value applications such as training, product development, and simulation.

One of the most promising developments is the integration of AI with virtual environments, which will enable more intelligent, responsive, and personalized experiences. In industrial contexts, AI-enhanced simulations and predictive analytics are driving efficiencies across design, manufacturing, and maintenance workflows. The industrial metaverse market is projected to exceed $150 billion by 2035, fueled partly by advancements in AI, immersive technologies, and digital twins.

For organizations evaluating metaverse adoption, a measured, ROI-driven approach is essential. Instead of spreading efforts thin across multiple initiatives, companies should start with targeted pilot programs—particularly where immersive environments clearly outperform traditional methods.Success in these pilots can serve as a blueprint for broader implementation.

Equally important is the focus on user experience. Providing proper onboarding, aligning virtual tools with existing workflows, and balancing virtual and real-world interaction are key to long-term engagement and impact.

Ultimately, the metaverse's business value lies not in creating entirely new virtual ecosystems but in enhancing specific business processes through immersive, data-rich, and collaborative environments. As technology matures and costs fall, these practical, focused applications will likely define the metaverse's role in the enterprise landscape.

The metaverse has moved beyond its initial hype cycle and is finding a more defined role in enterprise strategy. While it may never deliver the sweeping transformation once envisioned, it proves its value in focused applications—particularly where immersive environments address real-world business needs.

The most successful implementations prioritize outcomes over experimentation. The metaverse functions in training, simulation, digital prototyping, and intelligent virtual collaboration, enhancing performance and driving measurable returns.

Organizations that treat the metaverse as a tool rather than a destination are best positioned to unlock its potential. Rather than pursuing total immersion or broad consumer engagement, the real opportunity lies in improving specific processes, increasing efficiency, and enabling smarter, more interactive workflows.

As the technology matures and becomes more accessible, the future of the metaverse in business will be shaped not by scale but by precision—applied where it makes sense and delivers value.

The concept of the workplace is undergoing a profound transformation. It is no longer defined solely by location but by a fundamental shift in organizing and executing work. As we move through 2025, the boundaries between home and office continue to blur while artificial intelligence accelerates changes in job roles and daily operations.

Recent data illustrates the scale of this transition: 64.4% of large companies have now adopted hybrid work models as the standard approach. Yet this evolution extends beyond allowing employees to split time between home and office. It reflects a broader reimagining of workflows, collaboration, and the skills required for success in an increasingly digital and decentralized environment.

The traditional notion of "going to work"—defined by commuting and spending set hours in a central office—is rapidly becoming obsolete. Recent research from Gallup indicates that hybrid employees report higher engagement levels than their fully remote or entirely on-site counterparts. Organizations are not merely permitting flexible work; they are fundamentally reengineering operations to support it as a core strategic model.

The rise of asynchronous communication tools has been a critical enabler of this shift. In a globalized workforce spanning multiple time zones, reliance on rigid meeting schedules has given way to more dynamic collaboration methods. Tools that allow employees to contribute at different times have become essential for maintaining productivity and operational continuity.

Meanwhile, artificial intelligence is redefining the very nature of work. Routine administrative tasks are increasingly automated, shifting the human role toward more strategic, creative, and decision-making activities. The knowledge worker of 2025 is emerging as an AI-augmented professional—leveraging intelligent tools to analyze data, optimize processes, and drive business innovation at a scale previously unattainable through manual efforts alone.

Traditional productivity measures—such as hours worked— are being reevaluated in light of new workforce expectations. The United Kingdom’s groundbreaking four-day workweek pilot produced compelling results: participating companies reported a 35% increase in revenue and a 57% reduction in staff turnover. Notably, 92% of businesses continued with the shortened workweek after the trial concluded, highlighting the strong business case for flexible work arrangements.

Employee well-being has emerged as an equally important outcome. A report by The Guardian found that 82% of companies participating in the trial observed improved staff well-being. These findings underscore that flexibility enhances business performance and fosters a more satisfied and resilient workforce.

However, challenges remain. The “quiet quitting” phenomenon—employees disengaging from discretionary effort without formally resigning—has evolved rather than disappeared. Workers today are placing a higher premium on purpose, fulfillment, and values alignment with their employers. As a result, organizations must look beyond productivity metrics and build workplace cultures that address deeper human needs to attract and retain top talent.

The most forward-thinking companies are moving away from time-based work to outcome-based models. When your team is distributed across the globe, counting hours becomes meaningless. What matters is results.

This shift is reshaping how companies build their teams. Geographic borders mean less than ever—28% of employees worldwide now work remotely, creating a truly global talent pool. But this borderless workforce requires a new kind of leadership.

Today's effective leaders need a unique blend of skills, and the importance of these skills is only growing in the new era: digital fluency, emotional intelligence, and the ability to build culture across screens. They're learning to measure success not by time spent in meetings but by the concrete outcomes their teams deliver, empowering their teams to thrive in the evolving workplace.

Moreover, companies are experimenting with decentralized decision-making, trusting teams to self-organize and innovate without rigid oversight. Agile management methodologies, once confined to tech startups, are now being widely adopted across industries to foster greater flexibility, faster adaptation, and stronger ownership among employees.

As we navigate through 2025, the workplace continues to evolve, shaped by technological advancements, shifting employee expectations, and the lessons learned over recent years. Traditional metrics of success—such as hours logged in the office—are giving way to more nuanced evaluations that prioritize outcomes, employee well-being, and adaptability.

Companies are increasingly recognizing that flexibility is not merely a perk but a strategic imperative. Organizations that foster environments where employees feel valued and empowered are better positioned to attract and retain top talent. This involves embracing diverse work arrangements, investing in digital collaboration tools, and cultivating a culture prioritizing trust and accountability.

Leadership in this new era demands digital proficiency, emotional intelligence, and a commitment to continuous learning. Leaders must navigate the complexities of remote and hybrid teams, ensuring that all employees remain engaged, connected, and aligned with the organization's goals.

Integrating artificial intelligence and automation into daily workflows also redefines roles and responsibilities. Rather than replacing human workers, these technologies are augmenting capabilities, allowing employees to focus on strategic, creative, and interpersonal aspects of their roles.

Ultimately, the future of work is not a fixed destination but an ongoing journey. Organizations that remain agile, empathetic, and forward-thinking will not only navigate the uncertainties ahead but also thrive in an everchanging landscape.

The modern banking industry, often considered the custodian of the world’s wealth, operates in an environment that demands the utmost diligence in risk management and regulatory compliance. Banking institutions are entrusted with managing financial resources on a global scale, and as a result, they are held to stringent regulatory standards to ensure the accurate assessment and management of risks. In an era where information technology (IT) underpins nearly every aspect of banking operations, these regulations extend their reach to encompass the use of IT infrastructure and services within banking institutions.

As the banking industry undergoes a digital transformation, regulatory bodies recognize that cloud technology offers the agility and scalability needed to remain competitive. However, this transformation brings forth the challenge of adapting traditional compliance models to cloud environments. In the words of Bill Walker, Head of Operational Readiness at Deutsche Bank, “The changes in the operating model from adopting cloud platforms made it evident that we’d need to revisit each and every control within our current control set.”

This is where the Cloud Security Alliance’s Cloud Controls Matrix (CSA CCM) framework comes into play. CSA CCM provides a structured and comprehensive approach to cloud compliance, enabling organizations, including banks, to align their cloud operations with industry regulations and best practices. By leveraging the CSA CCM framework, banks can ensure the effectiveness of their cloud compliance efforts and navigate the intricate landscape of cloud technology while staying fully compliant with regulatory mandates.

The banking industry operates within a highly regulated environment, characterized by a complex web of industry-specific laws, regulations, and standards. These regulations exist to ensure the stability of financial institutions, protect customer interests, and maintain the integrity of the global financial system. Historically, regulatory compliance has been a cornerstone of banking operations, enforced through meticulous on-premises control frameworks.

However, the role of information technology (IT) in banking has evolved dramatically. IT systems underpin everything from customer transactions to risk assessment and fraud prevention. Consequently, regulatory bodies have expanded their focus to encompass IT operations within banking institutions. This shift in perspective acknowledges that the use of cloud infrastructure and services, offered by providers like AWS, Google Cloud Platform (GCP), and Microsoft Azure, is increasingly prevalent in the sector.

For instance, Google Cloud offers banking institutions a robust set of compliance resources and solutions. With GCP, banks can leverage services like Cloud Asset Inventory and Security Command Center to maintain continuous visibility and control over their cloud resources. Google Cloud’s commitment to transparency and compliance is exemplified through its extensive documentation and certifications, such as SOC 2, ISO 27001, and more.

As the banking industry undergoes a significant transformation by embracing cloud computing, it’s crucial to recognize the need for adjusting control definitions and attestation processes to suit the unique challenges of cloud operations. In this section, we’ll delve into the imperative task of aligning control frameworks with the dynamic nature of cloud environments, with a focus on security controls, compliance controls, and the guidance provided by the Cloud Security Alliance’s Cloud Controls Matrix (CSA CCM).

Security and compliance controls have long been the bedrock of risk management and regulatory compliance within the banking sector. These controls are designed to ensure the confidentiality, integrity, and availability of critical data and operations. However, the shift from on-premises to cloud introduces a new level of complexity and agility.

For example, consider a scenario in which a large banking institution migrates its customer data and transaction processing systems to Microsoft Azure’s cloud infrastructure. In the traditional onpremises environment, controls were designed around a relatively stable technology stack, and changes were infrequent. In the cloud, Azure’s rapid scalability and continuous deployment capabilities allow the institution to roll out hundreds of changes daily. This dynamic environment necessitates the adaptation of controls to keep pace with the speed of change while maintaining compliance.

The Cloud Security Alliance’s Cloud Controls Matrix (CSA CCM) is a robust and widely recognized framework designed to facilitate compliance efforts in cloud computing environments, and its relevance to the banking sector cannot be overstated. This framework provides a structured approach to categorizing and organizing cloud controls, enabling organizations, including banks, to navigate the complexities of cloud compliance with precision.

CSA CCM consists of a comprehensive set of control objectives that cover various domains, including governance and risk management, audit and assurance, and information security. It serves as a roadmap for aligning controls with cloud-specific requirements, offering a standardized approach to cloud compliance that banks can readily adopt.

Structuring and Organizing Cloud Controls: One of the primary strengths of CSA CCM is its systematic organization of controls. For instance, within the framework, enterprise-wide controls address overarching aspects that apply uniformly across the cloud environment. These controls, such as access management, data encryption, and identity and access management (IAM), are integral to cloud compliance.

Benefits of CSA CCM in Banking: Banks operating in the cloud can reap numerous benefits from leveraging CSA CCM. Firstly, it offers a structured and well-defined set of controls that simplify the process of adapting control frameworks for cloud environments. Banks can use CSA CCM to precisely identify the controls that apply to their cloud infrastructure, which is invaluable in maintaining compliance.

In essence, the CSA Cloud Controls Matrix empowers banks to efficiently structure their cloud control framework, providing a solid foundation for continuous compliance efforts. As banking institutions navigate the intricacies of cloud technology, CSA CCM serves as a trusted companion in their quest for compliance excellence.

Optimizing Cloud Compliance with CSA CCM

In cloud compliance, the Cloud Security Alliance’s Cloud Controls Matrix (CSA CCM) framework is instrumental. It enhances compliance by organizing controls effectively. CSA CCM helps categorize controls into enterprise-wide, platform-wide, and workload-specific ones. For example, AWS aligns with CSA CCM for streamlined assessments. Assessing cloud adequacy is crucial, and CSA CCM aids in evaluating controls for cloud suitability, as seen in Google Cloud’s alignment. Empowering cloud compliance involves fostering a culture of excellence through CSA CCM, while clear traceability enhances control automation and monitoring, boosting compliance efforts across cloud providers.

The future of cloud compliance in banking holds the promise of greater efficiency and innovation, but it also brings new challenges. The Cloud Security Alliance’s Cloud Controls Matrix (CSA CCM) framework has emerged as a vital tool to navigate this transformation. As technology advances, the integration of Artificial Intelligence (AI) and Machine Learning (ML) will revolutionize compliance monitoring and risk assessment, providing real-time insights.

Banks must commit to continuous evolution, adapting their controls and compliance frameworks to the ever-changing landscape. By leveraging CSA CCM, embracing AI/ML, and staying proactive, banks can thrive in the cloud-powered future, ensuring regulatory adherence and safeguarding their operations.

Operational resilience, a key component of corporate strategy, is gaining prominence as businesses strive to uphold performance in challenging circumstances. Whether coping with supply chain disruptions, cyber incidents, or geopolitical instability, organizations are reimagining their operational structures to remain agile and effective. Research from McKinsey & Company underscores the significant benefits of mature resilience capabilities, with companies reporting productivity enhancements of up to 90% and lead time reductions of as much as 80%. This underscores the tangible benefits of resilience when integrated effectively, turning it from a mere strategy into a competitive advantage.

The link between resilience and efficiency lies in preparedness. Rather than reacting to disruption, resilient organizations operate with built-in continuity—minimizing downtime and avoiding the costly need to rebuild processes under pressure. As outlined by Riskonnect, effective resilience strategies streamline workflows by embedding flexible response frameworks into day-to-day operations. This allows companies to maintain productivity, even amid disruption, while allocating fewer resources to crisis response.

Operational resilience delivers measurable outcomes that extend well beyond risk mitigation. According to McKinsey & Company, organizations that embed resilience into their digital and operational processes report lead time reductions of up to 80%, enabling faster response in highstakes environments.

Research from The Conference Board supports this performance-driven view. In a recent study, business leaders cited resilience as a mechanism for managing disruption and a means of sustaining business continuity and customer trust. By reducing recovery times and limiting losses, resilient operations help maintain output under pressure—delivering value that extends to the bottom line.

Digital transformation bolsters operational resilience by facilitating faster decision-making, seamless process execution, and greater adaptability across systems. According to CL Digital, technologies such as automation, real-time analytics, and cloud-based platforms are instrumental in supporting efficiency and continuity, ensuring that businesses can respond swiftly to change while maintaining performance.

This relationship between digitalization and resilience is cyclical: as organizations digitize core processes, they improve operational speed and flexibility. These improvements, in turn, enhance their ability to absorb disruptions, creating a feedback loop that drives further gains in efficiency and responsiveness.

Organizations that lead in resilience are capable of navigating disruptions and use those moments as inflection points for improvement. The Business Continuity Institute emphasizes that the ability to collect, analyze, and act on data during crises is fundamental to achieving and sustaining operational resilience. Real-time insights help businesses respond with agility, allocate resources effectively, and uncover process inefficiencies that may have remained hidden during routine operations. This approach turns disruptions into opportunities for improvement, fostering a culture of continuous growth and innovation.

This data-backed approach allows disruptions to serve as diagnostic events—accelerating innovation, reinforcing business continuity, and driving competitive differentiation over the long term.

To translate operational resilience into lasting efficiency gains, companies must apply structured metrics that track how well systems recover, adapt, and maintain continuity under stress.

According to PwC’s Global Crisis and Resilience Survey 2023, 89% of global business leaders now see resilience as a key strategic priority. However, it's crucial to note that only a fraction consistently measure its impact through operational performance indicators, highlighting the need for a more data-driven approach in assessing resilience.

Common metrics include:

• Recovery Time Objectives (RTOs): Maximum allowable downtime for essential systems.

• Mean Time to Recovery (MTTR): Average time required to resume normal operations.

• Service Availability Rates: Uptime percentages for businesscritical processes.

• Cost Avoidance: Estimates of financial losses prevented through resilience planning.

• Customer Satisfaction Metrics: Measures of service experience during disruptions.

By embedding these indicators into their resilience frameworks, organizations can benchmark effectiveness, identify gaps, and align investments with long-term performance goals.

Transforming operational resilience into a source of efficiency requires more than reactive planning—it demands integration across systems, processes, and decisionmaking. According to Vital Records Control, organizations that digitize workflows, adopt cloud-based systems, and automate records management are better equipped to respond quickly to disruptions while maintaining productivity. These technologies reduce manual inefficiencies and enable faster recovery when operations are interrupted.

Research from Deloitte emphasizes that building a resilient supply chain requires investment in four key pillars: visibility, flexibility, collaboration, and control. Organizations that enhance these areas are better equipped to navigate uncertainty and respond in real time to unexpected events.

Beyond technology, resilience must be embedded into operational design. This includes scenario planning, workforce readiness, and diversified sourcing strategies—elements that help organizations withstand disruption and maintain performance. When built into the fabric of operations, resilience becomes more than a defensive measure; it functions as a driver of sustained efficiency and strategic advantage.

The connection between operational resilience and competitive advantage is increasingly supported by empirical research. A study published in Operations Research Perspectives found that resilience— particularly the ability to absorb and recover from disruptions— has a direct, positive effect on operational efficiency. According to ScienceDirect, organizations that develop strong resilience capabilities see improvements in performance outcomes, making resilience a mediating factor between knowledge acquisition and sustained operational success.

This research reinforces what many business leaders are now recognizing: resilience is not just about continuity but about positioning the organization to outperform peers when facing similar challenges. As disruptions become more frequent and complex, the ability to recover quickly, adapt intelligently, and maintain efficiency is becoming a defining feature of market leaders.

As volatility becomes the norm rather than the exception, resilience is no longer a defensive tactic but a foundation for long-term performance. Organizations that embed resilience into their operational strategies are better positioned to sustain efficiency, respond to uncertainty, and protect customer trust. More importantly, resilience empowers businesses to strengthen their operational model over time by learning from disruption and investing in adaptive capabilities. In doing so, they don’t just weather challenges— they build a durable competitive edge in an unpredictable world.

The banking industry is advancing deeper into the digital era, but the pace of transformation is exposing a critical vulnerability: a growing shortage of skilled talent. As banks expand their digital capabilities, the gap between technology ambitions and workforce readiness is widening. In the United States alone, the shortfall is projected to reach 350,000 workers with digital and technology skills by 2025, according to Financier Worldwide. Addressing this gap is no longer optional — it is central to how banks will compete and grow in a digitalfirst economy.

Traditional banks are finding that their long-established talent pipelines are no longer sufficient for the digital age. Post-pandemic surveys show that banks consistently cite a lack of digital skills among candidates as one of their most pressing challenges, according to BAI.

The gap is not limited to highly technical roles. Institutions are struggling to find professionals who can bridge legacy banking operations with emerging digital strategies. Today’s banking workforce needs to navigate a far more complex environment that demands expertise in advanced data analytics, artificial intelligence, digital payments, blockchain, and cybersecurity.

Customer experience design has also emerged as a core competency, requiring a blend of technical knowledge and human-centered thinking. Meanwhile, new fields like regulatory technology (RegTech) and compliance automation are creating skill demands that did not exist a decade ago. The evolving skill set for banking professionals is no longer optional—it is foundational to future growth.

As banks work to close the digital skills gap, a generational shift is reshaping the workforce. According to EY, Generation Z now accounts for more than a quarter of the global workforce, bringing with them not only digital fluency but a fundamentally different set of expectations around work, purpose, and career development.

Research from ASG shows that 72% of Gen Z professionals prioritize career growth over salary, prompting banks to rethink how they structure roles, learning pathways, and advancement strategies. Meeting these expectations requires more than competitive pay — it demands a meaningful employee value proposition built around flexibility, purpose, and continuous skills development.

Forward-looking banks are reengineering their recruitment strategies to compete for digital-native talent. Many are adopting video interviews and digital assessment platforms to streamline hiring and meet younger candidates' expectations for technology-driven interactions. According to Anderson Search, these tools enhance efficiency and signal a bank’s commitment to innovation — an increasingly important factor for Generation Z candidates.

In addition to modernizing the hiring process, financial institutions are broadening their talent search, recruiting professionals from technology firms, startups, and even the gaming industry to access a wider pool of transferable digital skills. Some banks are pushing boundaries even further. Deka Bank, for example, launched the first-ever Metaverse Career Day, demonstrating how immersive digital environments can be leveraged to attract tech-savvy candidates and position the bank as an employer of choice for the next generation.

With the demand for digital expertise outpacing supply, banks are turning inward—prioritizing the development of their existing workforce. According to PwC, closing the digital skills gap through targeted upskilling could unlock a US$263 million boost to global GDP for the financial services industry, underscoring the economic case for investing in workforce development.

In response, leading banks are rolling out structured learning strategies that span technical and leadership competencies. On the technical side, employees are trained in data analytics, artificial intelligence, digital payments, and blockchain applications. At the same time, institutions are emphasizing change management, digital leadership, and innovation-focused thinking—capabilities essential for navigating ongoing transformation.

Many institutions are adopting AI-powered learning platforms that deliver personalized development plans to scale these efforts effectively. As Docebo highlights, these systems adapt to employees' learning styles and progress, helping banks deliver consistent, selfpaced upskilling experiences across global teams.

Attracting and retaining digital-native talent is not just recruitment or upskilling—it requires a fundamental cultural reset. According to Arabian Business, banks aiming to engage Gen Z must fully embrace technology at every level of the organization and foster a workplace culture deeply rooted in innovation and flexibility.

This transformation often begins with rethinking the work environment. Hybrid models, flexible hours, and project-based work structures—long associated with the tech sector—are now becoming standard across leading financial institutions. These changes reflect a growing recognition that top digital talent expects autonomy, purpose-driven work, and the ability to experiment.

Many banks also invest in dedicated innovation labs designed to test and deploy new technologies in real-world settings. These labs create a startuplike environment within traditional institutions, empowering employees to ideate, collaborate, and build solutions in agile cycles.

Equally important is reimagining mentorship. By pairing experienced bankers with digital-first employees, banks enable two-way knowledge transfer: blending institutional wisdom with digital fluency. This approach accelerates learning and helps bridge generational divides within the workforce.

As banks invest more heavily in digital talent strategies, the focus has shifted toward measuring outcomes beyond traditional HR metrics. Institutions are now tracking indicators such as digital skill acquisition rates, innovation pipeline

activity, and the successful delivery of technology-driven projects. This shift underscores the need for greater accountability and clearer demonstration of the business value generated by workforce transformation.

Equally important is the impact on customer experience. Improvements in digital service delivery, personalization, and client satisfaction are emerging as key measures of whether workforce transformation efforts translate into business value. Rather than viewing recruitment and upskilling as standalone functions, leading banks evaluate their ROI through a broader lens—linking talent initiatives directly to operational agility, innovation capacity, and long-term growth.

The financial services industry is placing greater strategic emphasis on talent than ever before. According to WTW, firms prioritize their employee value propositions and digital skills development as core components of longterm growth.

The most successful institutions are taking a dual-track approach—recruiting specialized digital talent while simultaneously building internal capabilities through upskilling and re-skilling programs. Many are forming partnerships with tech education providers and launching in-house digital academies to create sustainable pipelines of future-ready talent.

Retention strategies are also evolving. Rather than relying solely on compensation, banks are designing clearer career pathways, flexible work environments, and innovation-focused cultures that align with the expectations of digital-native professionals. Continuous learning and cross-functional mobility are becoming key differentiators, helping banks retain top performers and prepare them to lead future transformation.

The banking talent crunch is not simply a temporary challenge but a defining test of strategic resilience. Institutions that respond with vision and investment will emerge stronger, equipped with a workforce capable of driving innovation, delivering superior customer experiences, and sustaining competitive advantage in an increasingly digital economy.

The future belongs to banks that view talent development as a catalyst for broader transformation. Building the workforce of tomorrow requires more than recruiting technical skills; it demands creating an environment where innovation thrives, learning is continuous, and career growth is deeply embedded in the organizational culture.

In the race for digital leadership, success will not be determined by technology alone. It will be shaped by how effectively banks attract, develop, and empower the next generation of talent.

Fraudsters have consistently positioned themselves at the cutting edge of technological innovation. With the recent explosion in AI capabilities—spanning large language models (LLMs), Generative AI, and now Agentic AI—criminal actors are leveraging advanced techniques to create deepfake images, video clones, and voice impersonations that deceive victims into transferring funds. Meanwhile, financial institutions face mounting pressure to evolve their fraud prevention systems beyond traditional rule-based or purely predictive models.

Over the past 12 months, the rapid evolution of AI has shifted from theoretical research to operational reality. As fraud attacks increase in scale and complexity, integrating autonomous and reasoning-driven AI into fraud prevention isn't a luxury; it's a competitive necessity. Before diving into Agentic AI, review the three main AI paradigms currently used in fraud prevention: Predictive, Symbolic, and Generative AI.

Predictive AI: Pattern Recognition and Probability

Predictive AI employs supervised learning models that analyze labelled fraud data. These models may include past fraudulent transactions, authentication results, and behavioral anomalies that differentiate between legitimate and suspicious activities.

Providing interpretable risk factors that meet stringent Model Risk Governance requirements, these models may offer instantaneous risk assessments. Often achieving response times as low as 20 milliseconds which is critical for fast payment systems, they can process millions of

transactions simultaneously and Data from Tier-1 financial institutions indicate that these systems can detect up to 80% of fraud in real-time, with detection rates further increasing with rule-based (Symbolic AI) enhancements.

Unsupervised learning algorithms also detect anomalies in scenarios where labelled data is scarce which can identify unusual payment flows or unexpected relationships between entities, helping to uncover emerging fraud patterns before they become widespread.

Symbolic AI, or rule-based AI, relies on explicitly encoded knowledge through if-then rules, logic frameworks, and ontologies. While highly explainable and transparent, these systems struggle with adaptability, requiring manual updates as fraud patterns evolve. Many financial institutions continue to use Symbolic AI due to its high explainability—decisions are traceable to specific rules, making it easier to satisfy governance teams—and its alignment with regulatory requirements, as it facilitates the maintenance of essential audit trails.

Most fraud prevention teams today implement hybrid models, integrating Predictive AI scores into rule-based engines to enhance decision-making while maintaining regulatory explainability. For example, a rule might decline a suspect transaction if the predictive risk exceeds 70 and the transaction amount exceeds $5,000.

Generative AI is designed to produce new content—including text, images, and synthetic data—by learning from vast datasets. In fraud prevention, primary applications include text summarization where large language models can consolidate detailed case investigations and confirmed fraud data into comprehensive Suspicious Activity Report (SAR) narratives, potentially reducing filing times by up to 70%. Additionally, research co-pilots can summarize trends and benchmark metrics and recommend rule modifications, supporting fraud strategy teams in decision-making. While these systems excel at processing and summarizing data, they remain primarily reactive, providing insights but not autonomously executing corrective workflows.

Agentic AI represents a breakthrough that is set to revolutionize fraud prevention. Unlike traditional approaches focused solely on probability or static rule execution, Agentic AI systems autonomously plan, learn, and execute tasks using a suite of integrated tools within end-to-end workflow automation. Recent advancements drive this breakthrough, including chain-ofthought reasoning, retrieval-augmented generation (RAG), and API integrations. With the release of more sophisticated models like GPT-4, systems have demonstrated enhanced capabilities for maintaining context over extended interactions and managing complex, multi-step analytical processes. Importantly, they can now integrate with external tools and databases via APIs, leading to the definitive shape of Agentic AI.

A key characteristic of Agentic systems is an ability to reason and plan. An Agentic system must demonstrate autonomous reasoning to decide and plan the tasks it is expected to execute. A system with a chained set of steps and sequential or parallel calls to tools does not qualify as Agentic. For example, an Agentic AI can analyze multidimensional data—such as transaction history, device fingerprints, and recent security events—and generate detailed chain-ofthought reasoning that mirrors an expert fraud strategist's process.

Consider a scenario where the system executes the following reasoning sequence:

1. Observe a 32% increase in declined transactions from a specific region over 72 hours.

2. Identify that 87% of these transactions have previously unseen device fingerprints.

3. Note that many affected accounts had recent password resets.

4. Correlate this with external threat intelligence on regional data breaches.

5. Conclude a coordinated account takeover is likely underway.

6. Recommend heightened authentication measures for targeted accounts.

Agentic AI also excels in workflow integration. It can retrieve and analyze relevant data via APIs, generate and simulate candidate rules, submit those rules for human review through a "four-eye" process, and deploy and continuously monitor rule performance. This level of orchestration significantly reduces the manual effort and time required to adapt fraud strategies.

Another defining capability of agentic AI is continuous learning. Making them uniquely positioned to keep pace with the ever-evolving threat landscape, Agentic AI systems refine their techniques through feedback loops that adapt to new fraud tactics without human intervention.

Agents can and will impact several aspects of fraud prevention. One of the most promising and early use cases could be fraud strategy and decision-making. This area is particularly suitable because mature testing, simulation, and four-eye review processes already exist within fraud workflows. Rather than requiring an overhaul, Agentic AI can leverage existing interfaces and tools to deliver results.

Fraud strategy involves deciding whether to allow, block, challenge, or deny transactions based on complex data analysis. Traditionally, this process involves six steps: discovery of new fraud patterns, development of rules based on predictive risk scores and other data, simulation of those rules against historical data, deployment through a controlled four-eye review process, measurement of rule performance, and tuning based on feedback.

Agentic AI transforms this process by integrating automated reasoning, contextual data retrieval, and end-toend orchestration. For instance, when a new fraud pattern emerges, the Agentic AI system can analyze the anomaly using chain-of-thought reasoning, retrieve relevant historical data and institutional policies via RAG, generate a calibrated rule that balances fraud prevention with customer experience, and orchestrate rule testing and deployment through API integrations. It can then monitor performance and trigger continuous improvements within minutes rather than days.

Anurag

Director of Product Management and Fraud Strategy, NICE

Agentic AI marks more than an incremental improvement, it signifies a paradigm shift in fraud prevention. By integrating sophisticated reasoning, real-time data analysis, and end-to-end workflow automation, these systems can anticipate fraud before it materializes and continuously adapt to emerging threats. As financial institutions face increasingly sophisticated attacks, deploying Agentic AI solutions will soon become a competitive necessity.

Digital identity has become a foundational element of the modern banking ecosystem, redefining how institutions secure customer information, streamline operations, and meet evolving regulatory demands. In an era shaped by rapid digitalization, financial institutions are moving beyond legacy systems to deploy advanced identity verification frameworks that combine security, compliance, and user experience. As fraud risks increase and customer expectations shift, the adoption of digital identity solutions has become essential to resilience, trust, and longterm viability in modern banking.

The financial sector is experiencing a sharp increase in sophisticated identity-related threats, making digital identity systems essential infrastructure for modern banking. Digital document forgeries surged by 244% year-over-year, now accounting for over 57% of all document fraud cases. This marks the first time digital forgeries have overtaken physical ones—a trend driven by the growing availability of generative AI tools and fraud-as-a-service platforms.

Entrust's 2025 Identity Fraud Report also highlights the rise of f deepfake attacks, which now represent 40% of video biometric fraud attempts and occur roughly every five minutes. While concerning, these developments also underscore the potential of advanced technologies to counter such threats, revealing the limitations of legacy verification systems in combating dynamic, AI-enhanced fraud tactics.

In response, financial institutions are implementing multi-layered digital identity frameworks that incorporate biometric verification, behavioral analytics, and AI-powered anomaly detection. These systems strengthen security and enhance operational efficiency by streamlining onboarding and authentication processes.

Digital identity systems have become foundational to how banks secure customer data, reduce fraud, and meet compliance expectations. As threats evolve and expectations rise, banks are shifting from fragmented solutions to longterm identity strategies.

As cyber threats grow in scale and sophistication, financial institutions are advancing beyond traditional passwordbased systems to adopt layered, biometric-driven authentication models. Modern biometric technologies now form the backbone of identity verification in digital banking, combining physiological and behavioral data to ensure secure and user-friendly access.

Multimodal biometric systems are gaining traction. They integrate multiple identifiers—such as fingerprints, facial recognition, and voice patterns—with behavioral biometrics that assess how users interact with devices. This layered approach significantly reduces false positives and strengthens fraud prevention, as it is far more difficult to spoof multiple biometric and behavioral traits simultaneously.

In addition to biometric inputs, financial institutions are also leveraging contextual authentication—a method that considers real-time data such as device fingerprinting, geolocation, and transaction history. These systems continuously evaluate risk in the background, granting or restricting access based on deviations from established behavior.

By combining physical, behavioral, and contextual signals, banks can implement dynamic security frameworks that adapt to evolving user patterns while minimizing friction. This strategy allows institutions to uphold rigorous security standards without sacrificing user experience.

Identity fraud is escalating in frequency and complexity, with reported incidents increasing by 12% annually since 2020. This rise is fueled by widespread digital adoption and gaps in legacy verification systems, which are creating persistent vulnerabilities across financial institutions.

To counter these threats, financial institutions are deploying AI-driven identity verification tools that operate in real-time. These systems analyze high volumes of transactional data, identifying subtle behavioral anomalies and patterns that may indicate fraud. Advanced models can flag synthetic identities, account takeovers, and document tampering with increasing precision, mitigating risk before losses occur.

Research from BAI highlights the growing use of omnichannel identity intelligence platforms that unify data across mobile, online, and in-branch channels. Approximately 70% of financial institutions now leverage cross-industry fraud intelligence networks, enabling stronger, more predictive fraud prevention capabilities.

This shift toward collaborative, AI-enhanced fraud detection marks a strategic departure from isolated security systems. By sharing anonymized threat intelligence and integrating verification across the customer journey, institutions gain broader visibility and improve their ability to respond to increasingly complex fraud scenarios.

The compliance landscape in banking is becoming increasingly dynamic. Global regulatory expectations are evolving in response to heightened concerns over data privacy, financial crime, and cross-border transactions. In this context, digital identity systems are emerging as critical tools for navigating regulatory complexity, particularly in meeting Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Automated identity verification solutions reduce manual compliance workloads while increasing accuracy and auditability. By embedding digital ID checks into onboarding and transaction monitoring processes, financial institutions can maintain real-time oversight of client activity, flag inconsistencies, and ensure proper recordkeeping—capabilities increasingly expected by regulators.

Additionally, the ability to maintain detailed digital audit trails and instantly verify customer data across platforms enhances responsiveness during regulatory inquiries. This is especially important in jurisdictions where supervisory bodies accelerate digital reporting standards and tighten enforcement protocols.

Digital identity tools support compliance with data protection frameworks such as GDPR and PSD2 and enable institutions to adapt quickly to shifting legal environments with minimal disruption to operations. As regulatory scrutiny intensifies globally, institutions that leverage digital identity infrastructure will be better positioned to manage risk and avoid costly penalties.

Synthetic identity fraud, a form of financial crime now recognized as the fastest-growing form of financial crime in 2025. Unlike traditional fraud tactics that exploit stolen data, synthetic identities are constructed from a blend of real and fabricated information, making detection significantly more difficult using conventional verification tools. This type of fraud often involves the creation of a new identity that is not associated with any real person, making it particularly challenging to detect.

The rise of synthetic identity fraud has prompted institutions to adopt proactive countermeasures that combine artificial intelligence, machine learning, and advanced data analysis. AI models can track behavioral anomalies, flag irregular digital footprints, and assess the legitimacy of identities over time. These capabilities are especially critical when fraudsters bypass traditional red flags by establishing synthetic identities through legitimate-seeming activity.

RCB Bank’s research emphasizes that combating synthetic fraud requires crossinstitutional intelligence sharing. This allows financial institutions to identify patterns that may not be visible in isolated systems. By collaborating on anonymized identity data, institutions can more effectively prevent fraud attempts before accounts are created or transactions are initiated.

Emerging technologies such as blockchain are also being explored as part of decentralized identity frameworks. These systems create immutable records of identity validation while giving users control over their data. Immutability and decentralization offer an added layer of trust and traceability. When integrated responsibly, they can reinforce fraud defenses while respecting evolving data privacy expectations, thereby enhancing customer trust in the security of their digital identities.

While security is often the driving force behind digital identity adoption, its impact on operational efficiency and customer experience is equally transformative. Recent analysis highlights that biometricdriven authentication and real-time identity verification can reduce onboarding time by as much as 80%—without compromising regulatory or security standards.

The benefits extend well beyond account opening. McKinsey research shows that nearly 25% of financial applications in the UK are abandoned due to complex onboarding processes, highlighting the urgency for streamlined digital identity frameworks. Automated systems eliminate repetitive document reviews, reduce operational overhead, and enable customers to engage with banking services more fluidly.

Digital identity also enables more personalized banking journeys. Identity data—used responsibly— can help institutions tailor product recommendations, anticipate customer needs, and provide contextual support through secure channels. This results in greater engagement, improved loyalty, and a measurable competitive edge in an increasingly digital-first environment.

Digital identity infrastructure offers a scalable, secure solution for institutions seeking to modernize customer service without introducing unnecessary complexity. When implemented strategically, it not only reduces operational friction but also reinforces brand trust—an essential asset in today’s competitive, experience-led marketplace.

Digital identity is poised for continued transformation, supported by broader economic and technological momentum. Morgan Stanley's 2025 Capital Markets Outlook projects improved macroeconomic conditions—including lower inflation and more favorable interest rates—that are expected to encourage renewed capital investment across industries, including banking. These conditions create an opportunity for institutions to expand their digital infrastructure, including identity verification systems that underpin secure and efficient customer engagement.

At the same time, financial institutions are rethinking the future architecture of digital identity itself. According to the World Economic Forum, the next generation of digital identity systems will likely shift toward decentralized, user-controlled models prioritizing privacy and data portability. These emerging frameworks rely on technologies such as blockchain and zero-knowledge proofs to create verifiable, tamper-resistant records that can be used across institutions and platforms—without exposing sensitive customer data.

Artificial intelligence and biometric advancements will also be central in shaping future solutions. AI-powered risk scoring, behavioral pattern recognition, and adaptive authentication mechanisms are expected to become core elements of digital onboarding and fraud prevention strategies.

As digital identity strategies mature, institutions that prioritize flexible, secure, and interoperable systems will be best positioned to deliver efficient customer experiences, meet compliance obligations, and remain competitive in a rapidly evolving financial ecosystem.

Digital identity has moved from a back-end security feature to a core function reshaping how banks operate, serve customers, and meet regulatory demands. As fraud threats evolve and customer expectations grow, institutions that treat identity as an integrated, adaptive system will be better equipped to compete and innovate. The path forward lies in leveraging intelligent, secure, and user-centric identity frameworks that deliver trust, efficiency, and longterm value across every channel.

Banks are under increasing pressure in 2025 to embed environmental, social, and governance (ESG) principles into their core operations. With over 2,400 ESG-related regulations in place globally, the compliance landscape has become increasingly complex. But this isn’t only about meeting regulatory expectations—it reflects a broader shift in how banks are expected to contribute to sustainable development.

A major change this year is the introduction of the European Union’s Corporate Sustainability Reporting Directive (CSRD), which expands ESG disclosure requirements to large companies and listed SMEs. Unlike earlier voluntary frameworks, the CSRD introduces mandatory, detailed reporting on sustainability-related risks, impacts, and targets. For financial institutions, it raises the standard for transparency and makes ESG a formal part of business reporting.

Banks are now required to report in greater detail on how they identify and manage sustainability risks. These mandatory disclosures go beyond general sustainability narratives, calling for specific information on how environmental and social factors are integrated into risk frameworks. In response, the European Banking Authority (EBA) has issued detailed guidelines to strengthen ESG risk management practices across the sector. These include expectations for governance structures, internal controls, and scenario analysis—raising the bar for how banks evaluate and disclose ESG-related risks.

Climate-related risk has become a central focus of banking regulation and internal risk modeling. Institutions are now expected to evaluate both physical risks—such as the impact of extreme weather events on asset quality—and transition risks tied to the global shift toward a lower-carbon economy. This dual perspective requires banks to build risk models that capture not only current environmental vulnerabilities, but also the long-term financial implications of decarbonization policies and changing market dynamics.

Banks are expanding their risk management frameworks to address ESG-related exposures with the same rigor applied to credit, market, and operational risks. When ESG risks materialize, they can lead to direct financial losses, balance sheet deterioration, and reputational damage. According to KPMG, ESG factors— particularly those linked to environmental regulation, climate events, or social controversies—can impair asset values and weaken a bank’s long-term resilience. As a result, institutions are incorporating environmental and social dimensions more explicitly into their enterprise risk management strategies.

Environmental risk assessments in banking now extend well beyond direct emissions or operational footprints. A growing focus is being placed on financed emissions—classified as Scope 3—which often account for the largest share of a bank’s overall environmental impact. These emissions arise from lending and investment activities and are more difficult to quantify. In response, banks are adopting new tools to improve emissions tracking, scenario analysis, and portfolio alignment with net-zero targets, as highlighted in London Stock Exchange Group’s analysis of Scope 3 for financials.

Social risk has become an increasingly important component of ESG frameworks in banking. Institutions are now expected to assess factors such as labor practices, human rights issues, and community impacts within their lending and investment portfolios. This heightened focus is driven by growing stakeholder scrutiny over the broader social consequences of financial activities. As a result, many banks are incorporating social risk indicators into their due diligence, lending criteria, and broader ESG reporting processes.

A 2024 study by Oliver Wyman highlights that banks with well-integrated ESG risk management frameworks are better positioned to navigate regulatory complexities and mitigate greenwashing risks. The study emphasizes the need for compliance departments to take a proactive role in sustainability initiatives, ensuring that environmental commitments are substantiated and aligned with evolving regulations. This approach not only enhances resilience during market volatility but also strengthens stakeholder trust.

Banks are increasingly expected to demonstrate measurable outcomes from their ESG initiatives, not just meet regulatory thresholds. To this end, many have introduced tools and metrics to quantify their environmental impact— such as reductions in financed emissions, growth in green lending portfolios, and support for renewable energy projects. These metrics are also being used to track progress toward long-term climate goals, including portfolio alignment with net-zero pathways.