The Health section of this guide provides an overview of your medical plan options. You can find detailed information about each plan, including a breakdown of costs, in each plan’s Summary of Benefits and Coverage (SBC).

The SBCs summarize important information about your health coverage options in a standard format to help you compare costs and features across plans and are available on LiveWell.HRInTouch.com. A paper copy is also available by calling 855.915.3015.

Carefully review this guide to:

• Better understand your 2023 LiveWell benefits.

• Carefully review your plan options and consider which ones best meet your needs.

• Make your choices during your enrollment period to receive coverage for the coming year.

Follow the directions below and make sure to have your enrollment completed within your allotted time frame.

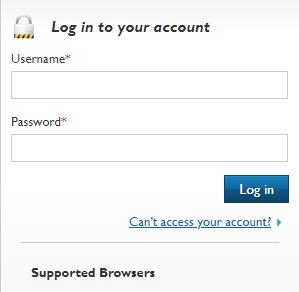

• Go to: Livewell.HRinTouch.com

• Click on ‘Can’t Access your account’ in the top right box on the screen

• Choose “forgot username” and then “employee”

• Confirm your account using the Confirmation code to your supplied email

• Login to the system. Upon logging in, complete the electronic consent on the right side of the screen before proceeding further

• Watch your Benefits video – well worth the watch!!

• Click the “Enroll in Benefits” button located at the top of your dashboard

• Continue through the task to elect benefits...

To learn more about your benefits or to get help with enrollment, contact 855.915.3015, Monday - Friday 8am - 8pm EST.

Enroll online at: LiveWell.HRInTouch.com

Log in to your Benefitplace at Livewell.HRinTouch.com to view your benefit elections, explore the 2023 Benefits Guide, Enroll, and more.

Who is eligible to enroll in LiveWell benefit offerings?

• Benefit eligibility for Anthem Medical plans (Platinum, Gold, Silver, Bronze, and Freedom) is for Full-Time Team Members. We do offer MEC Medical plan options for Part-Time Team Members that are administered by Essential Benefit Administrators (EBA).

• Benefit eligibility for Securian Supplemental medical plans includes Full-Time and Part-Time Team Members averaging 15 hours or more per week.

• Benefit eligibility for the Hartford’s Life and Disability benefits is for Full-Time Team Members only.

Premiums will be conveniently paid through payroll deduction, so you do not have to worry about writing a check or missing a payment.

What happens if my employment status changes? Can I take my coverage with me?

Yes, you can take your coverage with you when you change jobs or retire. You will need to continue to pay your premiums to keep your coverage active.

Where do I review, enroll, and update my benefits?

Go to your Benefitplace at LiveWell.HRinTouch.com and access your account by following the instructions provided on the log in page.

When you enroll, confirm dependents are eligible. You will be required to provide proof of dependent eligibility prior to your coverage effective date. If your dependent child reaches age 26, he or she will automatically be dropped from medical, dental, and vision coverage, but you must drop that dependent from your life insurance and AD&D coverage. Disabled dependent children may continue coverage after they reach 26, if requirements are met.

Before you enroll, here are some common terms you need to know and understand.

1. Premium

This is the cost you will pay to participate in the employer health plan. Your Premium is separate from your Deductible and Out-of-Pocket Max.

2. Preventive Care

Routine healthcare services like check-ups, immunizations, and screenings for adults, women, and children. For a list of Preventive Care service mandates, click here.

3. Copayment (aka, copay)

A fixed dollar amount you pay for healthcare services, such as doctor’s visits, urgent care or emergency room services. Copayments track towards your Out-of-Pocket Maximum, but do not apply towards the deductible.

4. Deductible

The amount you pay for certain covered healthcare services before your insurance plan starts to pay on your behalf. For all Anthem plans an example of deductible applies first, is lab work, hospitalization, surgery, ER visits in some cases, see your full plan summary for additional detail.

5. Coinsurance

The percentage of a covered healthcare service cost you pay after you’ve paid your deductible.

6. Out-of-Pocket Maximum

The most you will pay for healthcare services in one year. After you spend this amount on deductibles, co-payments, and coinsurance, your health plan pays 100% of the costs for covered benefits (with minimal exceptions).

Premium

You pay your portion after your employer’s contribution.

Preventive Care

Your plan pays

Copay and Deductible

You pay

Coinsurance

You and Your Plan each pay a % after your Deductible has been met

Out-of-Pocket Maximum

Your deductible Copays, and Coinsurance track toward your Out-of-Pocket Maximum

All Other Covered Expenses

Once you have reached your OOP Max your, your plan will pay for any charged services covered by your Plan

Once coverage is effective - download the Sydney Health App

Your one stop shop for your Anthem Healthcare needs. Find care and get personalized doctor suggestions. View your benefits, claims, or your digital ID cards.

Get answers faster with the interactive chat feature. Receive alerts, reminders, and tips directly from Sydney and it connects all of your Anthem healthcare including LiveHealth Online.

Per Pay Period costs are provided at LiveWell.HRinTouch.com

The Freedom plan is an HSA eligible benefit.

Under your LiveWell benefits, Health Savings accounts (HSA) are not offered. However, the Freedom plan is eligible if you want to open an account on your own.

Please visit irs.gov for information regarding HSA requirements.

Visit with a doctor at your convenience

Accessing the care you need, when you need it, matters. That’s why our Sydney Health mobile app connects you to a team of doctors ready to help you on your time.

• Urgent care support for health issues, such as allergies, a cold, or the flu.

• New prescriptions for concerns such as a cough or a sinus infection.

Schedule a virtual primary care appointment

• Routine care, including wellness check-ins and prescription refills.

• Personalized care plans for chronic conditions, such as asthma or diabetes.

Assess your symptoms with the Symptom Checker

When you’re sick, you can use the Symptom Checker on Sydney Health to answer a few questions about how you’re feeling. That information is run against millions of medical data points to provide care advice tailored to you.

Sydney Health brings care to you anywhere, anytime. The Symptom Checker, virtual primary care visits and on-demand urgent care are all available through the app.

Now you can connect more easily to the care you need through the Sydney Health mobile app or anthem.com. Have a live video visit with a board-certified doctor, therapist, psychiatrist, or lactation consultant on your mobile device or computer with a camera. Visit with a doctor for common health conditions

Doctors are available on demand 24/7 with no appointments or long wait times. During an online video visit, doctors can assess your condition, give medical advice, and send prescriptions to the pharmacy of your choice, if needed.1

Connect with mental health support from home

If you’re feeling anxious, depressed, or having trouble coping with problems at home or at work, you can talk with a therapist online. In most cases, you can set up a secure visit seven days a week.2 You can also schedule a visit with a psychiatrist for support on managing your medication.3

Future Moms with breastfeeding support

You can schedule live video visits with a lactation consultant, counselor, or registered dietitian experienced in providing support on lactation and nutrition. These online visits are part of the Future Moms program, so they’re available to you and your family members at no extra cost.

See a sleep specialist

Connect with board-certified sleep specialists who can diagnose and manage a wide range of sleep disorders. They can design treatment plans to help you sleep better and improve your overall health. Consult an allergy specialist

Finding relief from your allergy symptoms is now simpler and more convenient. Schedule a video visit with a board-certified doctor who specializes in allergies and knows the latest allergy treatments.

96%

Said the person they saw (provider) was professional and helpful

Download

96% Felt provider understood their concerns

or

1 Prescription availability is defined by physician judgment.

2 Appointments subject to availability of a therapist.

94%

Were able to book a virtual visit sooner than an in-person visit

3 Prescriptions determined to be a “controlled substance” (as defined by the Controlled Substances Act under federal law) cannot be prescribed using Sydney Health. Psychiatrists on Sydney Health will not offer counseling or talk therapy.

4 Based on Sydney Health utilization trends from top 10 national clients.

Life can be full of challenges. Your Anthem Employee Assistance Program (EAP) is here to help you and your household members. EAP offers a wide range of no-cost support services and resources to those enrolled in an Anthem Medical Plan, including:

Counseling

• Up to 3 visits per issue

• In-person or online visits

• Call EAP or use the online Member Center to initiate services

Legal consultation

• 30-minute phone or in-person meeting

• Discounted fees to retain a lawyer

• Free legal resources, forms, and seminars online

Financial consultation

• Phone meeting with financial pros

• Regular business hours; no appointment required

• Free financial resources and budgeting tools online

ID recovery

• Help reporting to consumer credit agencies

• Assistance with paperwork and creditor negotiations

Dependent care and daily living resources

• Online information about child care, adoption, elder care, and assisted living

• Phone consultation with a work-life specialist

• Help with pet sitting, moving, and other common needs

Other AnthemEAP.com resources

• Well-being articles, podcasts, and monthly webinars

• Self-assessment tools for emotional health issues

Crisis consultation

• Toll-free emergency number; 24/7 support

• Online critical event support during crises

We are ready to support you. You can call us at 800.865.1044, or go to anthemEAP.com and enter your company code: GIOA

Available 24/7, 365 days a year. Everything you share is confidential*

When something unexpected happens, EAP can help you figure out your next steps.

Emotional Well-being Resources offer help when you need it most.

Your emotional health is an important part of your overall health. With Emotional Well-being Resources, administered by Learn to Live, you can receive support to help you and your household live your happiest, healthiest lives.

Built on the proven principles of Cognitive Behavioral Therapy (CBT), our digital tools are available anywhere, anytime. They can help you identify thoughts and behavior patterns that affect your emotional well-being – and work through them. You’ll learn effective ways to manage stress, depression, anxiety, substance use, and sleep issues.

Team up with an experienced coach who can provide support and encouragement by email, text, or phone.

Add friends or family members as “Teammates.”

They can help you stay motivated and accountable while you work through programs.

Receive weekly text messages filled with positivity, quick tips, and exercises to improve your mood.

Learn how to improve mental well-being with useful tips and advice from experts.

Take a quick assessment to find the program that’s right for you.

To access our Emotional Well-being Resources:

1. Use the Sydney Health app

2. Go to My Health Dashboard

3. Choose Programs

4. Select Emotional Well-being Resources

PerkSpot is a one-stop-shop for exclusive discounts at many of your favorite national and local merchants. It is completely free and optimized for use on any device: desktops, tablets and phones. Enjoy access to thousands of discounts in dozens of categories, updated daily. Take advantage of online offers from popular national retailers, and discover discounts in your neighborhood with PerkSpot’s streamlined Local Map. Filter your map results by categories like restaurants, health and fitness, retail and more. Opt in to PerkSpot’s weekly email to receive a curated selection of discounts. Each week’s email features both new and popular deals, as well as seasonal and thematic groupings of offers. The PerkSpot weekly email is a particularly great resource for your holiday shopping. Start saving today by signing up or logging in at: LiveWell.PerkSpot.com

Located in the Quick Links section, Local Offers allow you to use your location to see all of the discounts near you, wherever you are! Discounts can be filtered by category and distance.

Interests

Let us know what you’re interested in so we can ensure you are seeing the perks you’ll most enjoy, front and center on your Discount Program Home Page.

Brands

Looking for something specific? The Brands tab, found in the Quick Links section, is an easy and quick way to search for all the discounts available to you.

Do not see what you are looking for? Head to the Suggest a Business page, found in the upper right-hand corner of your Home Page, to suggest your favorite brands and local spots be added to your Discount Program.

PerkSpot’s customer service team works tirelessly to help you access your Discount Program and redeem deals easily. Below are some important details regarding customer service availability.

Head to LiveWell.PerkSpot.com to get started! Employer Pass Phrase: livewellwithperkspot

As an Anthem member, in addition to your PerkSpot benefit, you qualify for discounts on products and services that help promote better health and well-being.* These discounts are available through Special Offers to help you save money while taking care of your health.

Vision, Hearing, and Dental Glasses.comtm and 1-800-CONTACTStm — Shop for the latest brand-name frames at a fraction of the cost for similar frames at other retailers. You are also entitled to an additional $20 off orders of $100 or more, free shipping and free returns.

EyeMed — Take 30% off a new pair of glasses, 20% off non-prescription sunglasses and 20% off all eyewear accessories.

Premier LASIK — Save $800 on LASIK when you choose any “featured” Premier LASIK Network provider. Save 15% with all other in-network providers.

TruVision — Save up to 40% on LASIK eye surgery at more than 1,000 locations.

Amplifon — Take 25% off, plus an extra $50 off one hearing aid; $125 off two.

23andMe — Take $40 off each Health + Ancestry kit. Save 20% on a 23andMe kit and learn about your wellness, ancestry and more.

LifeMart® — Take advantage of great deals on beauty and skin care, diet plans, fitness club memberships and plans, personal care, spa services and yoga classes, sports gear and vision care.

Active&Fit Directtm — Active&Fit Direct allows you to choose from more than 11,000 participating fitness centers nationwide for $25 a month (plus a $25 enrollment fee and applicable taxes). Offered through American Specialty Health Fitness, Inc.

FitBit — Work toward your fitness goals with Fitbit trackers and smartwatches that go with your lifestyle and budget. Save up to 22% on select Fitbit devices.

Garmin — Take 20% off select Garmin wellness devices. GlobalFit — Discounts apply on gym memberships, fitness equipment, coaching and other services.

Puritan’s Pride® — Choose from a large selection of discounted vitamins, minerals and supplements from Puritan’s Pride.

Allergy Control Products and National Allergy Supply — Save up to 25% on select doctor-recommended products such as allergy-friendly bedding, air purifiers and filters, asthma products and more. Orders over $59 ship for free by ground within the contiguous U.S.

Nations Hearing — Receive hearing screenings and in-home service at no additional cost. All hearing aids start at $599 each.

Hearing Care Solutions — Digital instruments start at $500, and a hearing exam is free. Hearing Care Solutions has 3,100 locations and eight manufacturers, and offers a three-year warranty, batteries for two years and unlimited visits for one year.

ProCleartm Aligners — Take $1,200 off a set of custom aligners. You can improve your smile without metal braces and time-consuming dental visits. Your order is 50% off and comes with a free whitening kit.

Safe Beginnings® — Babyproof your home while saving 15% on everything from safety gates to outlet covers.

WINFertility® — Save up to 40% on infertility treatment. WINFertility helps make quality treatment affordable.

Jenny Craig® — Join this weight loss program for free. Jenny Craig provides you with everything you need, making it easier to reach your goals. You can save $200 in food, in addition to free coaching, with minimum purchase. Save an extra 5% off your full menu purchase. Details apply.

ChooseHealthy® — Discounts are available on acupuncture, chiropractic, massage, podiatry, physical therapy and nutritional services. You also have discounts on fitness equipment, wearable trackers and health products, such as vitamins and nutrition bars.

SelfHelpWorks — Choose one of the online Living programs and save 15% on coaching to help you lose weight, stop smoking, manage stress or diabetes, restore sound sleep or face an alcohol problem.

Brevena — Enjoy a 41% discount on Brevena skin care creams and balms for smooth, rejuvenated skin from face to foot.

We will continue to offer medical plan coverage options to our part-time team members. MEC plans provide an affordable coverage option to take care of your basic medical needs

For Part-time team members, your LiveWell benefits offers Minimum Essential Coverage (MEC) plans which provide minimal levels of coverage as defined by ACA requirements for wellness and preventive care; however, coverage is not comprehensive. This allows the plans to be more affordable. You will have the choice of three MEC plan offerings. A comparison of the plans is shown below.

Your LiveWell MEC plans are administered by Essential Benefit Administrators (EBA) utilizing the First Health network of providers. These plans do not offer out-of-network benefits, so make sure your provider is in-network before visiting MyFirstHealth.com.

Under your LiveWell benefits, Minimum Essential Care (MEC) plans meet the Affordable Care Act requirement for having health coverage by covering the wellness and preventive services the ACA deems essential. These plans do not offer comprehensive healthcare.

As part of your LiveWell benefits package, Team Members averaging 15 hours or more have access to a variety of supplemental medical programs offered by Securian that can help protect you from significant expenses not covered by your medical plan.

Supplemental medical plans help you bridge the gap between what your medical plan covers and the everyday expenses and costs for care that your plan may not cover. Benefits are paid in addition to your medical plan and are payable regardless of any other insurance plans you may have. Be sure to consider your anticipated medical needs for the year along with the cost of the medical plans available to you.

Accident insurance supplements your primary medical plan and disability programs by providing cash benefits in cases of accidental injuries like a fracture or dislocation.

High and low plan options are available. You’ll receive cash benefits for services resulting from an accident such as emergency transportation, emergency room or urgent care facility visits, x-rays and labs, rehabilitation, chiropractic services and alternative therapy, durable medical equipment, and surgery.

You can use this money to help pay for uncovered medical expenses, such as your deductible or coinsurance, or for ongoing living expenses, such as your mortgage or rent.

The plan pays a $50 cash benefit if you complete a covered health screening such as a wellness exam or cancer screening. Benefits are paid directly to you and are paid in addition to other coverages you may have, such as medical insurance.

Supplemental medical plans are intended to enhance your medical plan and do not provide comprehensive medical coverage nor are they a Medicare supplement plan.

When a serious illness strikes, critical illness insurance protects against the financial impact of these illnesses. Benefits are payable in a lump sum directly to you to cover out-of-pocket expenses for your treatments that are not covered by your medical plan as well as everyday living expenses, such as housekeeping services, special transportation services, and day care.

Plans are available in options of $10,000 and $20,000 benefit amounts. Your spouse and children are eligible to receive 50% of the employee face amount if diagnosed with a covered illness and you elect dependent coverage.

Covered illnesses include, but are not limited to, heart attacks, stroke, organ failure, ESRD, loss of hearing, sight, or speech and cancer.

A trip to the hospital can be stressful, and so can the bills. The average hospital stay in America costs nearly $11,000. Even with a major medical plan, you may still be responsible for copays, deductibles, and the out-of-pocket costs. A hospital indemnity plan provides supplemental payments directly to you to cover expenses that your medical plan doesn’t cover for hospital stays.

Benefits are available in high and low options and include cash payments for hospital stays per admission, daily benefits, as well as ICU admission, and rehab stay.

If I am enrolled in a medical plan, why would I need accident insurance?

Your health insurance will cover some of the medical expenses that you’ll incur from getting treatment for an injury, such as a broken bone or stitches, but you might still have copays, coinsurance, or a high deductible to meet before your coverage kicks in — not to mention the other bills like rent, childcare, and other personal expenses that add up fast during recovery.

What are some examples of “covered injuries” and the payment associated with them?

You have the option of a Low Plan or High Plan with Securian’s Accident coverage and here are some examples of injuries and their lump sum payments:

• A fractured ankle - You receive $500 on Low Plan and $1,250 on High Plan.

• A 3rd degree burn - You receive $1,000 on Low Plan and $2,000 on High Plan.

• A dislocated shoulder - You receive $400 on Low Plan and $1,000 on High Plan.

• Click Here for the full listing of covered injuries and payments.

How much does accident coverage cost?

It may be less expensive than you think! Both of the High and Low plans offers coverage for you, your spouse and/or children. LiveWell’s Accident insurance rates below:

What are some examples of “covered specified diseases”?

Heart attack, stroke, Alzheimer’s disease, Multiple sclerosis, and loss of hearing or speech. Click HERE for a full listing of covered specified diseases.

How much does critical illness/specified disease coverage cost?

It may be less expensive than you think! There are two different plan options – a $10,000 or $20,000 coverage option - and you can include your family members in the coverage. Your rate is based on your age at the time you enroll and tobacco status. Exact rates can be found in the Benefitplace platform during enrollment and in Securian’s Specified Disease insurance flyer

Is the lump sum payment paid directly to me or to my health care provider?

The critical illness plan options provide a lump-sum benefit of your choice in the amounts of $10,000 or $20,000. The lump sum payments will be paid directly to you, not to the doctors, hospitals, or other health care providers. You will receive a check, payable to you, for maximum convenience. That way you could be less likely to dip into your savings or use a credit card, adding to the peace of mind in an uncertain time. You can use these funds to cover medical costs, groceries, housing expenses, car payments and more.

Is the claims process simple?

Yes – Securian has made their online process for filing a claim as simple as possible.

• Visit Securian.com/benefits and select “Employer” under report a new claim.

• Select “Start a new claim” and answer all questions to the best of your ability. Hospital Indemnity Insurance FAQs

What are examples of hospital stays and the lump sum amount you can receive?

How much does hospital indemnity coverage cost?

It may be less expensive than you think! There are two different plan options and you can include your family members in the coverage.

Do I have to get a health exam to get the coverage? Are there any pre-existing health condition limits?

No – you do not have to complete any health questions, exams, or blood tests to be able to enroll in this coverage. And there are no pre-existing condition limits on this plan. All coverage is guaranteed when initially eligible, during annual enrollments periods, and after a family status change.

Are benefits paid directly to me or to my health care provider?

The lump sum payments will be paid directly to you, not to the doctors, hospitals, or other health care providers. You will receive a check, payable to you, for maximum convenience. Benefits are paid no matter what your other health insurance may cover.

Is the claims process simple?

Yes – Securian has made their online process for filing a claim for all of the plans above is as simple as possible. You will visit Securian.com/benefits to file a new claim or view an existing claim.

Your benefits include programs to help ensure financial security for you and your family. LiveWell life and disability benefits provide meaningful financial resources in the event of a loss or disability that prevents you from working.

Full-time team members are eligible to elect life and disability benefits. You have the option of electing coverage for yourself and your family. You must elect coverage for yourself if you also wish to elect coverage for your dependents.

If you want added protection, you can purchase supplemental life and/or AD&D insurance for yourself. You may elect coverage in increments of $25,000 up to $100,000.

You may also purchase life and/or AD&D insurance for your spouse in increments of $10,000 up to $50,000 or 50% of the team member election.

Optional child life insurance provides $10,000 of life insurance for all eligible dependent children if you choose to elect child voluntary life coverage.

The loss of income due to illness or disability can cause serious financial hardship for your family. Our disability insurance programs work together to replace a portion of your income when you’re unable to work. The disability benefits you receive allow you to continue paying your bills and meeting your financial obligations during this difficult time. Full-time team members are eligible to elect short-term disability coverage.

Benefit Provided: Up to 60% of your weekly salary

Maximum Benefit Payable: $200 to $1,500 per week

Maximum Benefit Duration: 26 weeks

Waiting Period: 7 days injury or sickness

Federal tax law requires employers to report the cost of company-paid life insurance in excess of $50,000 as imputed income. AD&D benefits are paid in addition to any life insurance if you die in an accident or become seriously injured or physically disabled. You may have to complete an evidence of insurability (EOI) medical questionnaire to determine whether you or your spouse is insurable for supplemental life insurance amounts. If required, one will be provided to you.

Should you lose your life, sight, hearing, speech, or use of your limb(s) in an accident, AD&D provides additional benefits to help keep your family financially secure. AD&D benefits are paid as a percentage of your coverage amount — from 50% to 100% — depending on the type of loss.

Be sure you’ve selected a beneficiary for all your life and accident insurance policies. The beneficiary will receive the benefit paid by a policy in the event of the policyholder’s death. It’s important to designate a beneficiary and keep that information up-to-date. Visit LiveWell.HRInTouch.com to add or change a beneficiary.

What is voluntary/supplemental life insurance?

A voluntary life insurance policy provides financial protection for your family beyond other basic life insurance benefits. These benefits can assist with your final expenses and your dependents’ care, living expenses, or college tuition. Policy premiums do not increase because of age. The policy stays with you even if you change jobs or retire.

Do I have to get a health exam to get the life insurance policy?

Depending on the amount of coverage you elect, you may be required to complete an “evidence of insurability” (EOI) which is a medical questionnaire to determine whether you or your spouse is insurable at the amount you elected.

What are the amounts of the voluntary/supplemental life insurance policies?

• Team members are able to elect coverage in increments of $25,000 up to $100,000.

• To elect spouse and/or child voluntary life insurance, the Team Member must first enroll themselves in the benefit.

• For spouse voluntary life the increments are in $10,000 and go up to $50,000 – and the spouse can only be enrolled in up to 50% of the Team Member coverage. (Example: If a Team Member enrolls themselves in a $50,000 policy, then the most they can enroll their spouse in is a $25,000 policy.)

• For child voluntary life there is only one option that provides a $10,000 policy for all eligible dependent children and an EOI medical questionnaire is never required for child life policies.

What is AD&D insurance?

AD&D stands for Accidental Death & Dismemberment and offers additional benefits should you lose your life, sight, hearing, speech, or use of your limb(s) in an accident. AD&D benefits are paid as a percentage of your coverage amount – from 50% to 100% - depending on the type of loss. AD&D coverage is part of Team Member and their Spouse voluntary life insurance benefits.

Why is it so important for a Team Member to designate a beneficiary for their life insurance policy?

• A beneficiary is the person or entity you name in a Life and AD&D insurance policy to receive the benefits paid out in the event of the policyholder’s death. You can name a spouse, children, family members, the trustee of a trust you’ve set up, a charity or your estate.

• It is important for Team Members to designate beneficiaries in the system to help family members avoid financial complications when they die and makes the process of handling assets much smoother later on. By designating beneficiaries, you ensure that your money will go where you wanted it to and speed up the legal probate process for your loved ones.

• It is also very important for Team Members to review and update their beneficiaries on a regular basis – and OE is a perfect time to remind your team to go in and ensure everything is still correct. Life changes and things like marriage, divorce, a new child or the death of a loved one can affect your financial plans and your beneficiary information.

Watch these short videos to learn more!

• Life Insurance Decisions

• Life Insurance Overview

Disability Insurance FAQs

What is disability insurance and why should I enroll in this benefit?

A disability can happen to anyone – a back injury, a high-risk pregnancy, or a serious illness can lead to months without a regular paycheck. Short-Term Disability (STD) insurance offers some financial protection by continuing to pay you a portion of your earnings when you are not able to work and earn a paycheck.

What amounts does this benefit pay out to a Team Member if they are deemed “disabled” and unable to work for a period of time?

• A Team Member may choose their weekly benefit amount in increments of $25 beginning at $200 and may not exceed 60% of their total weekly earnings.

• The STD benefits start on Day 8 of disability and can be paid out for a maximum of 26 weeks.

What does it mean to be “disabled” for Short-Term Disability benefits?

Before benefits start, disabled means, due to accidental bodily injury, sickness, mental illness, substance abuse or pregnancy you are unable to perform the essential duties of your job, and as a result, you are earning 20% or less of your pre-disability weekly earnings. After the STD benefits start and you are disabled but still working, you must earn more than 20% but less than 80% of your pre-disability earnings to receive the STD paid benefits. The full definition of “Disability” is in The Hartford’s certificate with GIOA.

Watch these short videos to learn more!

• Disability Insurance Decisions

• Disability Insurance Overview

Offered to those enrolled in a medical plan

LiveWell benefits are designed to help you feel your best and live well. Your benefits include concierge services to help you and your family find the care you need when you need it.

Navigating the health care system is complicated and sometimes we all need some assistance to manage issues. Health Advocate can help you understand your benefits, find providers, manage complex conditions, interpret test results and resolve billing errors, and locate eldercare and caregiver services. Health Advocate can also consult with you on medical treatments and claims issues.

Health Advocate’s services are built into your LiveWell Benefits at no cost to you.

Health Advocate’s Personal Health Advocates are healthcare experts with extensive experience supporting people with important medical issues and decisions, no matter how common or complex. Typically, registered nurses supported by medical directors and benefits experts, Health Advocate will work on your behalf to get you and your family the answers and peace of mind you need.

Health Advocate can:

• Use their Perfect Match provider locator to match you with the right quality providers for your condition.

• Make an appointment at a time that works for your schedule.

Have you recently been diagnosed with a medical issue?

You can count on Health Advocate to:

• Answer questions about your condition, diagnosis and treatments, no matter how complex.

• Research and explore the latest treatment options.

• Coordinate services relating to all aspects of your care.

Baffled by medical bills, claims denials, or benefit questions?

Health Advocate’s experts can:

• Explain how your benefits work.

• Review medical bills to uncover possible duplicate charges or other errors.

• Do the research and make the calls to resolve claims and billing issues.

Health Advocate can assist you with obtaining a second opinion by helping you to research and identify top experts and Centers of Excellence nationwide. Additionally, they can arrange for the transfer of medical records, tests, lab results, and X-rays as well as set up face-to-face appointments.

After you’ve carefully considered your benefit options and anticipated needs, it’s time to make your benefit selections. Follow the instructions to enroll yourself and any eligible dependents in health and insurance benefits for 2023.

Follow the directions below and make sure to have your enrollment completed within your allotted time frame.

• Go to: https://livewell.hrintouch.com/

• Click on ‘Can’t Access your account’ in the top right box on the screen

• Choose “forgot username” and then “employee”

• Confirm your account using the Confirmation code to your supplied email

• Login to the system. Upon logging in, complete the electronic consent on the right side of the screen before proceeding further

• Watch your Benefits video – well worth the watch!!

• Click the “Enroll in Benefits” button located at the top of your dashboard

• Continue through the task to elect benefits...

By Phone

To learn more about your benefits or to get help with enrollment, contact 855.915.3015, Monday - Friday 8am - 8pm EST.

Effective Date of Coverage

Elections made during enrollment will be effective as of the first of the month following your operator’s selected waiting period (0, 30, or 60 days).

Insurance Cards

You will receive new insurance cards 14-21 days from election.

After your enrollment opportunity ends, you won’t be able to change your benefits coverage during the year unless you experience a qualifying life event, such as marriage, divorce, birth, adoption, or a change in your or your spouse’s employment status that affects your benefits eligibility.

You will be required to provide proof of dependent eligibility 30 days from the effective date of your coverage.

Please contact the appropriate provider listed below to learn more about a specific benefit plan.

Chart below shows benefits eligibility for Full-time and Part-time team members.