Our team of founders, CEOs and global leaders share our founders’ burning sense of purpose.

CAMERON MCLAIN

Co-Founder, Managing Partner

“

Our founders aren’t just building companies — they’re building a better future, proving that business and technology can lead global change.

TOMMY STADLEN

Co-Founder, General Partner

“

We believe building and backing companies that matter is the most scalable way to contribute to society.

Giant backs purpose-driven founders solving the world’s biggest problems. The decade’s largest companies will be built around these challenges. Giant’s mission is to deliver exceptional returns and positive systemic change. On track to deploy $1BN into founders creating a more sustainable, healthy, and equitable planet in the 2020s.

All of Giant’s investments have core business objectives that are tightly interlocked with positive impact objectives. If our portfolio companies grow, so does their impact.

Capital is needed to fund technologies that can solve urgent climate, health, and inequality challenges in a scalable and sustainable way.

Giant invests long-term capital from mission-aligned LPs into impactful companies. We are on track to deploy $1B into purpose-driven technologies in the 2020s.

Solving impactful problems requires a multi-stakeholder approach. Giant frequently brings together leading minds to advance purpose-driven innovation. We have assembled founding teams, connected founders with corporate leaders and policymakers, all with an aim to accelerate wide-scale adoption of new technologies.

Important note: As early-stage investors we can only expect material impact from the proportion of our portfolio that scales successfully. Just as 10-year financial projections for seed stage startups are rarely - if ever - precisely accurate, we are aware that long-term impact projections, while useful, are only directional. We do, however, think it is important to attempt long-term impact forecasts, because it is only in 5-10 years that most startups will be able to deliver truly valuable impact.

In the five years since the genesis of Giant, many things have evolved. Many companies and venture firms are attempting to rebrand ’climate tech’ as ‘resilience’ or ‘national dynamism’; AI has disrupted every corner of the economy; the venture landscape is increasingly reshaped by funds shifting away from the classic VC model; the list goes on.

At Giant, we are constantly innovating how we operate as a venture firm. However, our purpose of backing and building companies that matter has not changed. Rather than chasing the next hype cycle, we have stayed laser focused on finding and earning the right to back the most ambitious founders solving impactful challenges. We believe that exceptional returns and positive system change goes hand in hand, and this core belief has not changed since day zero.

The urgency to address climate change, healthcare inaccessibility, and inequity, has accelerated. 2024 was another hottest year on recorded, health outcomes have stagnated despite rocketing costs, and economic mobility has stalled in most developed countries.

Meanwhile, it has never been a more exciting time to build. AI is accelerating innovation across all industries. It is alleviating talent bottlenecks by lowering the barrier to entry for complex tasks such as software development and robotics programming. It is also automating and speeding up processes such as material discovery, drug discovery, and manufacturing, which are critical for humanity.

We believe that breakthroughs in horizontal technology platforms such as AI, will enable more founders to solve hard but meaningful problems.

We believe that successful founders exist in many forms. Outliers can be found in all ages, backgrounds, and genders.

The common factors we look for in founders are a burning sense of purpose to deliver positive-impact at scale, and perseverance in solving hard problems. 16

Total investments made in 2024 including 13 new investments and 3 follow-on investments.

2,990

Jobs across the Giant portfolio in 2024, a 43% increase from 2023.

$500M+

Total capital raised by Giant portfolio companies in 2024.

36%

Diverse founding teams.

Giant believes the biggest companies of the decade will be built using advanced technology to tackle the world’s biggest challenges.

These themes have been selected because of their urgency for humanity, the scale of the challenge, and their potential for radical innovation through technology.

CLIMATE

$9 trillion market

Electrification

Financial markets

Corporate software

Materials

Carbon removal

Adaptation

Intelligent manufacturing

$10 trillion market

Drug discovery tools

Digital health

Personalised medicine

Health software infrastructure

Reproductive health

Alternative care models

Workflow automation

Crosses most markets

Fintech

SME software

Education software

Future of work

Job creation

Web3 incentives

Ethical AI

Our LPs share our belief that exceptional returns do not need to come at the expense of people and planet. Our commitment to our LPs is to deliver positive systemic change at scale by backing the best impact-driven companies. Our mission-aligned LPs are invested in the success of our portfolio companies and often play a key role in helping companies win customers and access strategic growth capital.

Patient risk capital is the rocket fuel required to scale technologies that can decarbonise the economy, democratise high quality healthcare, and provide fair economic opportunities for all.

OVERVIEW

$1B projected deployment in this decade.

$65M+ deployed in 2024.

# OF COMPANIES BY THEME

$ DEPLOYED BY THEME

EXAMPLE OF OUR IMPACT-ALIGNED LP BASE

We believe that a concerted effort from all stakeholders, ranging from technologists, policymakers, investors, to industry, is required to make meaningful progress on tackling climate change, health accessibility and quality, and inequality.

Giant organises events to encourage conversations and collaboration between these groups. In 2024, this included university events to inspire the next generation of founders; forums to catalyse partnerships between startups and incumbents; and our annual Giant Ideas summit that brings together 250 global leaders focused on tech as a force for good.

We also actively participate in impact-related events and conversations, to advocate for the importance of impact in investing.

Annual gathering of 100 top climate founders, CEOs, and Form Energy, and Standard Chartered Bank.

Roundtable discussions between climate tech startup founders and senior leaders in industry, including Henkel, Ocado, Coca Cola, and more.

Workshops and masterclasses for portfolio companies including on fundraising, storytelling, and sales.

investors, including from PsiQuantum, Unilever,

University events with panels of Unicorn and/or exited founders to inspire the next generation of entrepreneur.

Despite steps towards decarbonisation, 2024 was the hottest on record with global temperatures reaching 1.6°C above pre-industrial levels and emissions hitting an all time high. At the same time, the much-needed political and financing tailwinds that the climate tech sector has had over the last few years have been swiftly reversed. This ‘vibe shift’ has been intensified by the high-profile failures of climate tech companies such as Northvolt, Universal Hydrogen, and Running Tide, sowing doubt in investors’ minds as to whether climate tech is venture-backable after all.

At Giant, we remain bullish on the potential of technology to not only bend the carbon curve but also to deliver venture returns. In fact, technologies such as solar panels and electric vehicles that were developed and financed in the Cleantech 1.0 boom underpin much of the energy transition progress today. Our approach has been to invest in fundamentally sound businesses that deliver climate impact, rather than those that rely on climate philanthropy or political sentiment. Our broad scope enables us to back breakthrough innovation across sectors, from small modular reactors to material discovery engines.

1.6°C

Above pre-industrial levels of warming in 2024, surpassing the 1.5°C that scientists recommended to avoid the deadliest effects of climate change.

Copernicus, 2024

1 Climate Change Synthesis Report, 2023. IPCC, 2023.

2 Net Zero Economy Index. PwC, 2023.

A FIVEFOLD INCREASE IN CLIMATE FINANCING

BY 2030 THE EU NOW GENERATES MORE POWER FROM WIND AND SOLAR THAN FOSSIL FUELS

BUILDINGS AND ENERGY

AUTONOMOUS CONSTRUCTION

Climate change is a cross-cutting force reshaping every sector of the global economy. For entrepreneurs, it offers vast market potential and industries ripe for disruption.

Giant has backed companies developing novel solutions that are not only critical for climate mitigation but also solve a meaningful business challenge - making it a no-brainer for companies to choose the sustainable option. We have also invested in enabling technologies that support the acceleration towards a more sustainable and resilient future.

POTENTIAL IMPACT BY 2030

124Mt

of CO2e abated per year

Equal to the annual emissions of Belgium and New Zealand

7.6GW battery capacity installed

Equal to 6% of the UK’s electricity generation capacity

Important note: 2030 projects assume all relevant companies achieve scale.

AI and advanced robotics for solar panel installation and critical infrastructure for net zero.

BATTERY STORAGE & DEVELOPMENT

Energy infrastructure, such as gridscale storage at scale for net zero.

Modern data analytics platform to accelerate battery research and development.

SUSTAINABLE HOMES

End-to-end batteries installation and virtual power plants for reliable renewable energy.

Removing bottlenecks to accelerate home electrification. Sustainable home renovations that minimise waste and resource

All-in-one renewable energy subscription for sustainable and affordable residential energy in the Nordics.

SUSTAINABLE CONSUMPTION

Water measure, risk.

Biomanufacturing and financing power

Bioprocessing software speed processes.

Global platform maximise

Accelerated increase food

CONSUMPTION

Water sustainability platform to measure, respond, and report water

Biomanufacturing infrastructure financing to harness the power of biology at scale.

Financing platform to catalyse uptake of EVs and other green

Bioprocessing development software to improve yield and speed of biomanufacturing processes.

Global one-stop recyclables trading platform to avoid landfill and maximise goods’ end-of-life value.

CROPS

Accelerated crop discovery to increase crop resiliency and preserve food security.

Industrial AI to minimise material and energy wastage in factories.

Generative AI engine for novel material discovery and design for climate technologies such as DAC. AI and quantum chemistry for de novo enzyme design needed for climate solutions such as biofuels.

DATA & WEB

Decentralised and interoperable climate data infrastructure.

AI platform, tools and sensors network for hyperlocal, realtime air quality data and analysis.

Robotics for greener and cheaper ocean data and exploration.

Electric fleet management platform and multistakeholder marketplace to enable net zero last-mile delivery at scale.

Electric light aviation vehicles to reduce carbon footprint of flights.

Hydrogen electric planes to reduce carbon footprint of flights.

challenges demand breakthrough solutions that don’t exist yet. Novel materials, optimised with certain properties, could unlock advances in areas like carbon capture or semiconductors. However, despite the advancements in computational methods, materials discovery and design is still a lengthy, costly, trial-and-error driven process, which fails over 90% of the time.

is how long it can take for discovering new materials, from initial research to first use (using traditional methods) 1

CuspAI is the frontier AI company on a mission to solve the breakthrough materials needed to power human processes. Cusp is developing a novel materials design engine that leverages generative AI to explore, predict and optimize novel material structures with specific properties. Their ‘search engine’ for materials will enable faster evaluation of billions of novel structures, and in the near future, allow for ‘ondemand’ discovery of new materials. SOLUTION

In 2024, over 90% of all new US grid capacity was renewables, with solar being the largest contributor by far (81.5% of all new capacity) 2. This positive trend is projected to continue and is critically important to the energy transition as well as energy independence. While the cost of utility solar has been steadily declining, it is now the cost and availability of labour that is the bottleneck for new grid scale solar projects. This same phenomenon is impacting other critical infrastructure buildouts such as grid-scale battery storage and data centres.

61% of developers and utilities cite labour availability as the top challenge 3

faster installation time with Cosmic Cosmic is developing adaptive robots for critical infrastructure. Their robots can help eliminate uncertainty, keep projects on time, and reduce rework. Their in-house physical AI engine, Particle, powers the robots and ensures that they are adaptable across projects and varying surroundings. Additionally, they provide developers with a digital twin platform, Constellation, that enables the coordination of tools, progress tracking and project management, and insights generation, all in real time. Their overall aim is to address the urgent and growing critical infrastructure crisis.

Electricity demand in the US is growing at an unprecedented pace, marking the most significant surge in decades. This is putting significant strain on the grid infrastructure, which is ill-equipped to handle current and future demand, not least because 70% of it is more than 25 years old 1. Additionally, utilities are overwhelmed with interconnection requests leading to delays in the integration of renewable energy projects. This is a risk to the energy transition as well as economic growth.

2.6TW of generation and storage projects awaiting grid connection at the start of 2024

Distributed energy is the fastest and most resilient way to enable energy stability. It avoids costly grid upgrades and can be deployed 5x faster than centralised generation. Haven is the only fully integrated platform for deploying customer-sited storage and generation at scale. Their solution spans contractor tooling such as installation, financing, and grid services (demand response, real-time dispatch, and asset management). Haven bridges the gap between utilities and homeowners to unlock distributed storage for a more resilient and sustainable energy future.

220Kt of CO2e abated in 2024

3.5M homes covered by the end of 2024

1 Forbes, 2025

$50M

Today, aviation accounts for 2.5% of global energy-related CO2 emissions, having grown faster than rail, road or shipping. When accounting for its non-CO2 effects like nitrogen oxide emissions, its impact on global warming is estimated at around 3.5%. In 2024, record air passenger demand drove up global aviation emissions by 5.5%. Moreover, emissions from private jets - which only serve 0.003% of the global population - have surged by 46% in the last five years. Even though progress has been made to electrify and decarbonise road transportation, there is still a long way to go with aviation.

50x more polluting per passenger when comparing private jets to trains

Beyond Aero is developing the world’s first electric business aircraft using hydrogen propulsion to reach more than 800 nautical miles. They are building a clean-sheet hydrogen electric aircraft, which is significantly more sustainable and cost-effective compared to modifying an existing aircraft. Beyond Aero believes that electric aviation is not a question of if, but when. While they are starting with business aircrafts, their long term plan is to maximise climate impact by addressing commercial aircrafts as well. SOLUTION

92% potential reduction in lifetime emissions per jet compared to conventional fuel jets

23Kt avoided lifetime emissions compared to conventional fuel jets

Transitioning to renewable energy systems - such as solar panels, heat pumps, and battery storage - often involves significant upfront costs, complex installations, and ongoing maintenance. Market fragmentation, having different providers for each of these parts of the solution, further complicates the process. These barriers can deter homeowners from adoption sustainable energy solutions, especially when the longterm benefits are not immediately clear.

10% of the Sweden’s total CO2 emissions are from the residential sector

Elvy’s mission is to accelerate the transition to sustainable homes by ensuring that adopting green energy is not only good for the planet but also makes financial sense for homeowners. Elvy’s end-to-end solution for residents starts with a complete energy analysis, on which it bases recommends the best energy system. Elvy handles the installation, and once installed, it manages the facility for residents. From customers’ perspective, they enjoy sustainable, convenient energy supply for 15 years without any financial surprises.

350 customers as of 2024, 95% of which give them a 4 to 5 star rating

20% is the potential cost savings that Elvy can provide over a 15 year period

Enzymes act as catalysts to accelerate chemical reactions in living organisms. They are vital to life and play a central role in virtually all biological processes across a wide range of sectors such as biofuels, carbon capture, environmental remediation, and therapeutics. To date, we have mostly relied on naturally occurring enzymes and most recently, on enzymes developed using directed evolution and/or local optimisation. However, in order to unlock the next step change in enzymes-driven industrial and biological processes, we will require de novo enzymes.

30% of the global energy demand is from the chemical industry, only 10% of which is renewable today. Enzymes can transform this.

Xyme aims to revolutionise synthetic chemistry by providing the generative AI technology to design enzymes to make any organic molecule. This has wide-reaching applications that can meaningfully change the way we live. For example, it can be used to develop novel chemical interventions to capture carbon at scale, transform the most problematic waste products into valuable feedstock, revolutionise the energy profile of chemical manufacturing, and begin a new era for the treatment of enzyme-based diseases.

100x faster than conventional methods in generating energy landscapes, is what Xyme’s finetuned AI models can achieve

>2x

improvement in quality of their fine-tuned AI models compared with off-the-shelf models

The Problem

In 2024, health systems continued to grapple with significant challenges. In the US, increased healthcare spending has not improved outcomes. Despite spending reached $4.9T, which on a per capita basis is the highest globally, the average American lives with disease for 12.4 years, surpassing the global average of 9.6 years 1 . In the EU and UK, health systems are faced with an ageing population, workforce shortages, and budget constraints. 2 in 3 clinical staff in the UK feel unable to carry out their jobs fully due to work shortages, while 1 in 3 of doctors in EU are over the age of 55 2 . Meanwhile, emerging challenges such as worsening mental health, the rise of cancer in youth, and infertility, are increasing the burden on health systems.

Giant’s Thesis

Technology can help overcome system constraints and improve health outcomes. For example, US adult obesity rates decreased for the first time in over 10 years with the adoption of GLP-1s 3. Moreover, use of tools such as AI scribes are enabling clinicians to refocus on patient care, rather than administrative tasks. Physicians’ use of AI scribes in Permanente North Carolina found that it saved nearly five years of work hours and improved physician-patient communication 4. We believe that startups play a key role in unlocking productivity across healthcare, not only in hospitals but in drug discovery, diagnostics, and consumer health.

1 American Medical Association, 2024.

2 National State of Patient Safety, 2024.

3 JAMA Health Forum, 2024.

4 Permanente Medicine, 2025.

91M or 35% of Americans report being unable to afford quality healthcare, four points higher than in 2023.

5 BMJ Oncology, 2023.

6 The Health Foundation, 2025.

West Health-Gallup Healthcare Indices

The number of cancer cases among the under-50s around the world has risen sharply 5 .

There is a 19 years difference in healthy life expectancy between the most and least

being healthcare, 2023.

Study, 2024

Giant backs companies developing transformative technologies in health and life sciences. This includes deep tech companies that are leveraging multimodel AI and vast amounts of untapped data for precision cancer treatment and drug discovery; as well as consumer companies helping people live healthier lives. Giant has also invested in companies that work with incumbent payors and providers to ensure the efficacy of day-to-day operations, in order to maximise patient outcomes.

BY 2030

WELLNESS CARE DELIVERY

REMOTE PATIENT MONITORING

Virtual wards and proactive monitoring to unlock clinical capacity and improve health, delivering scalable cost savings to the health system.

DIRECT-TO-PATIENT CARE

Direct-to-patient care to increase quality, affordability, and access to care.

Mental to help sleep healthier AI-native to-end starting 22M total number of lives touched Equal to the population of Portugal and Sweden

£840M savings for the NHS

Equal to 0.5% of NHS England’s budget today.

Mental health and meditation app help people manage stress, sleep better, and live a happier, healthier life.

Medically tailored groceries to prevent and reverse chronic conditions and make healthy food affordable and accessible.

AUTOMATION

OPERATING SYSTEMS

AI-native operating system for endto-end workflows in hospitals, starting with pathology.

LONGEVITY

Health and wellness focused community and habit formations to increase healthy behaviours.

ONCOLOGY

AI to elevate the standard of oncology care through the prediction of recurrence and treatment response, starting with breast cancer.

THERAPEUTICS

DRUG DISCOVERY

AI platform to reprogram protein networks, enabling the rational design of small molecules that can drug the undruggable.

In 2024, inability to pay for care and medicine in the US hit a new high. Over 1 in 3 Americans report that they are unable to access quality, affordable healthcare and 12% of US adults report borrowing money to pay for healthcare last year, amounting to an estimated $74 billion borrowed. Nearly 60% of US adults report feeling “somewhat” or “very” concerned about going into debt due to a major medical event. The need for affordable and accessible care is more urgent than ever. 1

This was the best experience I've had in my 61 years of life. This service is life changing in the most positive way for me. “

Sesame patient

Sesame’s two-sided marketplace connects patients to physicians directly for high quality care. By cutting out the middlemen, bureaucracy and rules associated with health insurance, Sesame can meaningfully lower the cost of care — often delivering appointments to patients at less than half the cost of the average cost in the US. Sesame has built America’s only superstore for great doctors and specialists, covering both virtual and in-person visits.

350K appointments in 2024

1M+ appointments conducted since launch

$65M

The NHS has a shortage of hospital beds, with occupancy rates consistently exceeding safe levels. Since 2010, average bed occupancy has consistently surpassed 85% with some trusts regularly exceeding 95% capacity in the winter months. This challenge will only continue to grow given the ageing population and rise in long term conditions70% of inpatient bed days are due to long term conditions. 2

SOLUTION

We are excited to be working with Doccla to implement best in class technology that means we can keep patients with long term conditions safe at home. “

Dr. Fiona McCann, Northampton General Hospital NHS Trust

Doccla, Europe’s leading virtual care provider helps unblock beds, unlock clinical capacity and support long-term condition management. Their vertically-integrated proactive monitoring platform not only enables safe and earlier discharge of inpatients but also enables patients with long-term conditions to manage them at home. Its connected care experience enables faster decisions from data-driven insights, less admin, and a better experience for both patients and clinicians.

£40M+ savings for the NHS in 2024

98.9% of patients rated the service as good or very good

PROBLEM

RAISED $24M

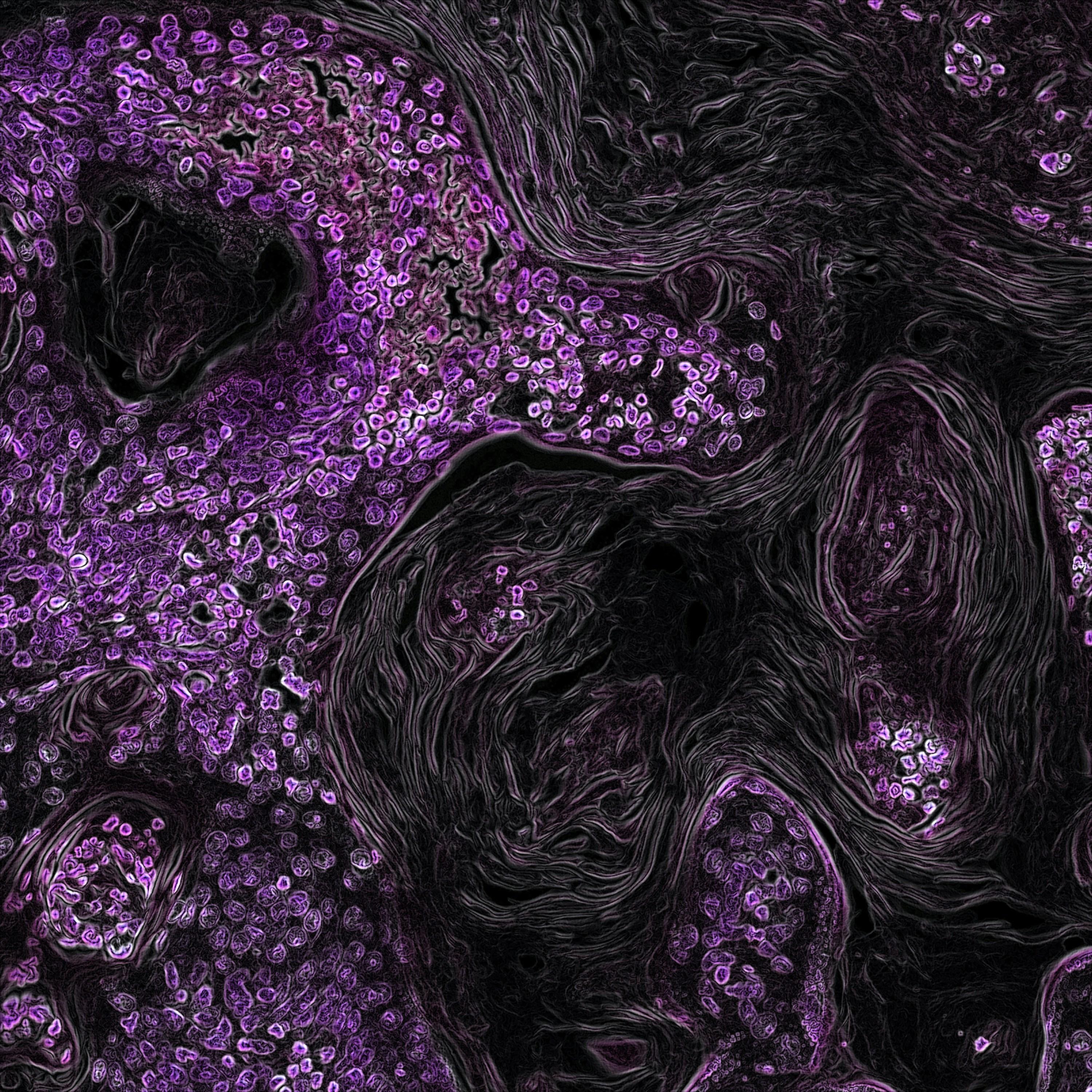

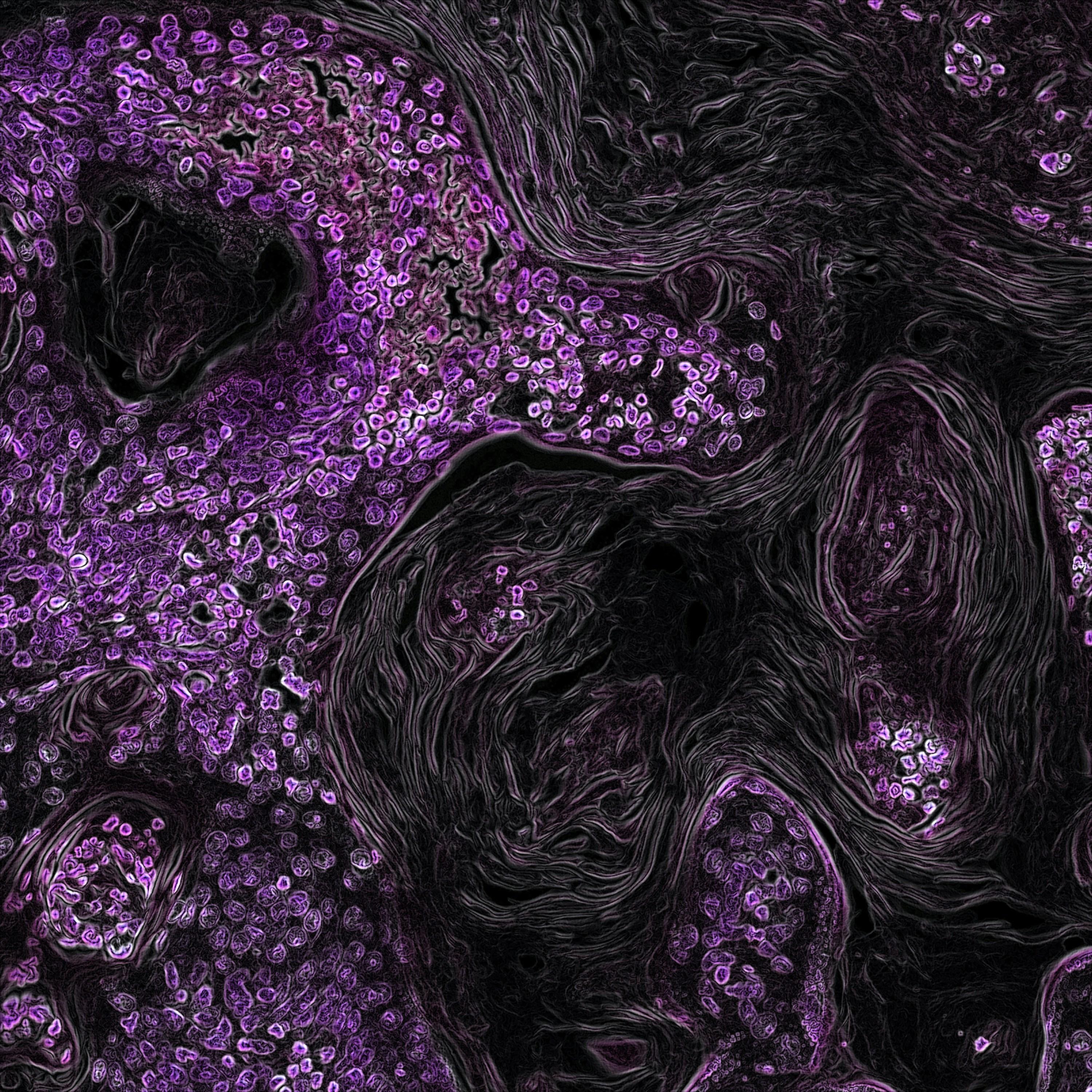

Globally, cancer is the second leading cause of death behind cardiovascular diseases, the equivalent to one in six deaths. About 1 in 5 people develop cancer in their lifetime, approximately 1 in 9 men and 1 in 12 women die from the disease, and this is expected to grow rapidly in the next few decades. Whilst there is improved precision in early detection, there is a still a lack of precision in the treatment administered to cancer patients. 1

79% increase in incidence of cancers in people aged 14 - 49 years 2

2.4M new cancer cases projected in the US in 2025 3

Ataraxis is using AI that is trained on hundreds of millions of real images to predict whether cancer is aggressive and likely to come back in the future, and whether it is responsive to different types of therapies. This will enable personalised treatment plans for each patient, for example, if there is only a small chance of the cancer coming back, chemotherapy can be avoided for the patient. This not only results in cost savings but also improved quality of life for the patient.

30% is how much more accurate Ataraxis Breast is at predicting the risk of cancer recurrence than standard genomic assays

50% of all new cancer cases positively impacted by Ataraxis by 2030

PROBLEM

$218M

Approximately 970 million people worldwide are living with a mental health condition. Depression and anxiety contribute to the loss of about 12 billion working days annually, costing the global economy over $1 trillion each year thirds of people with mental health conditions don’t receive the care they need. Mental illness is still a relatively taboo topic, where more than 1 in 4 Americans feel discouraged from seeking mental health treatment due to shame

SOLUTION

Calm has changed my life in immeasurable ways. I am more resilient and feel so much more connected to myself. “

Allison, San Jose

Calm, the world’s first mental health unicorn, has revolutionised mental health care by making tools and resources for stress reduction, anxiety management, improved sleep, and mindfulness practices accessible and affordable. Its widespread adoption has played a key role in removing the social stigma in mental health and mindfulness practices.

180M+

3M+

PROBLEM

Poor diet in America creates a significant health and economic burden. More than one million Americans die from diet-related diseases every year and poor diet leads an estimated $1.1 trillion in healthcare expenditures and lost productivity. More than a third of Americans have poor dietary quality, as defined by the American Heart Association, and only 1.58% of Americans have an ideal diet 1. Although the rise of GLP-1s has the potential to address diet-related diseases, the most sustainable and cost effective approach is by making healthy diets accessible and convenient.

This program is so beneficial to me in so many ways. I have lost 20 pounds since I was enrolled, my blood pressure is more stable than ever. “

RxDiet’s AI platform generates meal plans personalised to each individual’s medical needs, dietary requirements, as well as personal and cultural preferences. They partner with the US’s largest payors to provide medically tailored groceries and coaching that guides users through the cooking steps, whilst educating them on nutrition. RxDiet is scalable, cost-effective, and has a 95% adherence rate.

190k+ healthy meals provided in 2024 30x ROI potential for payors for type 2 diabetes patients

1 National Health and Nutrition Examination Survey, 2024

PROBLEM

$4.5M

Pathology labs across the world are struggling to deliver high-quality, timely pathology services, a large part due to the workforce shortage crisis. In Germany, the situation is particularly serious where it has one of the lowest ratios of pathologists per capita in Europe, with a significant portion of their medical professionals approaching retirement age, all whilst demand for pathology services is increasing 2. Similarly in the US, even though the number of pathologists has increased, it has been outpaced by increased demand for services.

1/3 of clinicians’ time is spent on clinical documentation and administrative tasks

SOLUTION

elea is building a vertically integrated AI-native operating system for pathology labs. Rather than building another point solution, elea’s operating system facilitates administrative staff and clinicians across the end-to-end pathology workflow. elea’s context-aware AI enables clinicians to focus on highest value tasks by automating manual tasks and orchestrating workflows in the background.

70k+ annual cases to be processed by elea from its first customer in 2024

58% burnout rate amongst pathologists 1 National Health and Nutrition Examination Survey, 2024

70%+ decrease in average processing time per case

Wealth inequality is high and rising in the US. The collective net worth of America’s top 12 billionaires now surpass $2 trillion, and while the most affluent families have added to their net worth, the bottom 40% have dipped into ‘negative wealth’, owning more debt than assets 1 . This has become more of a problem as economic mobility has stalled, not just in the US but also in Europe, a global leader in social mobility. Jobs losses due to AI and automation also largely affect lower income households, putting further strain on their livelihoods. Although large enterprises have continued to increase in value, small businesses have suffered a different fate in the last few years. Small businesses have been hampered by inflation, rising costs, supply chain disruptions, and labour shortages. In short, the inequalities within populations and amongst the business community is growing.

1 National Bureau of Economic Research, 2025.

Giant believes that technology, when applied correctly, has the potential to level the playing field between the haves and have-nots. We take a techno-optimistic view to how technology can benefit society: it lowers the barrier for entrepreneurship; it automates administrative tasks to enable small businesses and critical institutions like colleges to focus on their core operations; it democratises upskilling to increase earnings potential; it enables efficient marketplaces for improved value capture, and similarly protects individuals and small businesses against the misuse of technologies. employment, jobs, and progress. McKinsey &

employment, less-productive slower career

Cumulative wage growth by wage bracket (1980-2023)

EDUCATION SMALL BUSINESSES

Giant’s portfolio companies are leveraging technology to redistribute wealth to disadvantaged communities, reignite upward social mobility, and improve the odds of success for small businesses.

Additionally, they are developing scalable solutions to ensuring that the negative impacts of technologies such as AI are mitigated. These include protecting individual creators’ work from being unfairly used by large enterprise, and mitigating the ethical and financial risks of AI hallucinations.

MARKETPLACES

Online shopping community that reduces the cost of living for its customers in Africa.

Transparent and data-driven marketplace to enable small business succession.

PAYMENTS

PAYMENTS

Modern students increase completion

A career support the income

Equal to the population of Mexico BY 2030

130M lives positively impacted

Collection and automation of funds distribution for SMBs to increase cost competitiveness.

PAYMENTS & FINANCING

Modern financial services for students and universities to increase tertiary educational completion and attainment.

Platform to reduce bureaucracy in accessing financial, social, and tax benefits, which have a meaningful impact on social mobility.

HOUSING

career mobility platform to support upskilling and increase income potential of people.

Contractor-first renovation technology to spread tech-enabled wealth to construction workers.

RIGHTS PROTECTION

Platform to enable authors and creators to take control of their work’s AI rights and get compensated for its use by AI companies.

EXPLAINABLE AI

Accelerating safe AI adoption in critical industries such as finance and healthcare with explainable AI.

PROBLEM

AMOUNT RAISED $10M

AI and the value it creates has been disproportionately accrued by generative (gen) AI companies, especially companies building foundation models. Data - generated by humans - is critical for the training and fine-tuning of these AI models. Not only are the creators not financially compensated for the use of their work as training data, gen AI models are now cheaply making copies (or lookalikes) of their work and craft, making it financially unviable to continue their craft. There are now well over 30 copyright infringement lawsuits by copyright owners (creators) against gen AI developers 1 .

SOLUTION

Created by Humans is solving authors’ key challenges with AI: control over how our work is used by AI companies, the accuracy of outputs referencing our work, and getting compensation for our work’s use.

Walter Isaacson

Created by Humans is enabling authors and creators to take control of their work’s AI rights and get compensated for its use by AI companies. Its platform will facilitate the licensing of AI rights, including creator enrolment, and support flexible terms that work for creators and AI companies of all sizes. As such, it will be simple for rights holders to enrol and receive fair compensation for the use of their work. This makes it financially sustainable for authors, artists, and all forms of creators to continue creating.

Copyright Alliance, 2025

PROBLEM

$8.6M

Tertiary education plays a key role in economic mobility, where college degree holders experience a 75% average wage premium compared to diploma (high school) holders 2 . However, students face multiple challenges in earning a degree, the top one being financial barriers that go beyond cost alone. A lack of transparency in fees and the complexity in navigating various financial aids and tools add to the financial stress, and as a result, 59% of students consider dropping out due to financial stress 3 .

SOLUTION

“

Meadow helps us improve the student experience and maintain institutional financial health. We view them not just as a technology provider, but as a strategic partner.

Ryan Thoroman Bursar, Salt Lake Community College

Meadow clarifies and simplifies the financial experience for students, improving enrolment, retention, and payment outcomes for institutions. Meadow aims to improve economic mobility through higher education by removing payments-related barriers for students. It has also helped strengthen the financial resilience of the all important colleges by increasing student retention and on-time payments.

730k students on Meadow’s platform in 2024 25% increase in on-time payments

CO-INVESTORS

PROBLEM

$15.5M

Small businesses are the backbone of the US economy. Small businesses employ 45.9% of Americans, account for 99.9% of all businesses, and account for 43.5% of America’s GDP. However, 51% of small business owners are over 55 years old and preparing to retire within the next 5 -10 years. At the same time, interest in entrepreneurship is booming. While the supply and demand for small businesses is clear, the process with which small businesses are bought and sold is manual, costly, and lengthy process.

SOLUTION

The whole process was painless and actually not stressful. They brought us through the process, giving us facts, and limited advice where it was our decision, and not a pressure sale. He always had our best interest in mind. “

Hans Kuhn Former Owner, ASAP Pharmacy

Baton is committed to being the best place for a small business to change hands. Its leading marketplace revolutionises the buying and selling process by combining cutting-edge technology with human expertise ensuring sellers can realise the full value of their work while connecting buyers with high-quality opportunities.

15.4k customers on Baton’s platform in 2024 10x higher success rate for business sales compared to traditional methods

While AI adoption brings transformative potential to businesses, it also presents a unique set of challenges, particularly for companies operating in high stakes industries such as financial services and pharmaceuticals. The inability for businesses to leverage their internal, fragmented data means that businesses are often slow to adopt or use generic models that are not fit-for-purpose. Moreover, black box AI that cannot be audited poses significant regulatory, ethical, and business risks.

SOLUTION

We used Prometheux as our reasoning layer… letting us iterate quickly on a virtual knowledge graph of our data and business rules, instead of writing complex database queries or migrating data. “

Head of Advanced Risk Analytics Revolut

Prometheux’s platform lets enterprise build virtual knowledge graphs of their fragmented data and power faster, fully explainable AI applications. Their platform can connect to any source and create a concept layer that focuses on what matters to the business. Instead of copying data, Prometheux virtualises it across distributed sources, expose meaningful concepts accessible to both humans and agents, and allow enterprises to define constraints and ask questions. Prometheux enables businesses to maximise the potential of AI deployment.

$67.4B in global losses were linked to AI hallucinations across industries 2 2 McKinsey AI Impact Report, 2025

25% of global CO2 agriculture industry

In 2023, Giant launched our latest climate growth fund to increase the pool of available early growth capital for the most ambitious climate tech companies.

We are seeking companies that have the potential to solve critical climate challenges at scale. These companies are building in categories where venture outcomes can be realised, and a critical decoupling of growth from emissions can be achieved.

As of 2024, we have invested in five companies addressing some of the largest and fastestgrowing climate challenges, from data centres to grid-scale renewables.

1 Including land use, land use change, and forestry

2 UNESCO, World Atlas of Desertification, 2024.

3 Frontiers, An overview of the contribution of the textiles sector to climate change, 2022.

4 UN Office for Disaster Risk Reduction, 2022.

5 Morgan Stanley Research, 2024.

6 European Environment Agency, 2025

In addition to being a top contributor greenhouse gas emissions, agriculture cause of deforestation and soil of the world’s land surface could

$400B+ of annual disasters

The UN projects that the world disasters every year by 2030 4. set up to protect against this new significant global protection gap.

By 2030, the EU is aiming for renewable to reduce the greenhouse However, the existing grid and unable to support this transition energy reliability. of EU energy converted to 2030 to meet

CO2 emissions from the industry by 2030 1

contributor to global agriculture is the primary soil degradation, where 90% could be degraded by 2050 2 .

10% of global CO2 emissions from the textile industry by 2030

The textile industry is responsible for up to 10% of global emissions today and expected to remain a significant contributor without intervention 3. Additionally, 92 million tonnes of textile waste is generated globally each year, accounting for 7% of total waste in global landfill space. Less than 1% of used textiles is being reprocessed and reused today.

MANAGEMENT

annual losses from natural disasters in 2030

world will face around 560 Traditional insurance is not new type of risk leading to a gap.

4% of global CO2 emissions from the data centre industry by 2030

RENEWABLES

42.% of energy source to be greenhouse gas emissions 6 . and energy infrastructure is transition without compromising source that needs to be renewable sources by targets

By 2030, the emissions from data centres globally are expected to triple. The projected 2.5 billion metric tons of CO2-equivalent emissions from the global data centre industry is equivalent to 73% of the European Union’s current annual emissions 5 .

Registered under Verra's Verified Carbon Standard (VCS). The first large-scale agricultural cropland project registered under Verra’s VCS VM0042 methodology.

5.9Mt

CO2e carbon emissions removed annually

Regenerative farming gives you better soils crops… It makes your farm more resilient. drought or heavy rains, you’ll always survive.

Teo Dascalu,

4.5M

soils and resilient. Even with survive.

Agriculture is the primary cause of >50% of global deforestation and contributes to over a quarter of global greenhouse gas emissions. Unsustainable farming practices is a key driver for the over 100 million hectares of healthy land lost annually.

Regenerative agriculture is a well-proven solution for avoiding or reversing some of these damages: it could sequester up to 2.2 gigatonnes of carbon emissions annually, boost soil organic carbon by 20% within five years, all whilst increasing yield by 30% 1. However, the transition to regenerative agriculture can be overly complex, but Agreena makes it possible.

Agreena enables farmers to adopt and implement sustainable farming strategies. Using their leading digital measurement, reporting and verification (dMRV) technology, powered by AI and satellite imagery, Agreena verifies farmers’ climate impact with field-level accuracy. This enables companies to make credible sustainability claims and support farmer-led climate action by purchasing high-integrity carbon credits, accredited by highest global standards.

Agreena’s overall ambition is to create a positive impact that can be seen from the moon.

Today, the textile industry faces the dual challenge of producing significant emissions and waste, accounting for 10% of global emissions (more than international flights and maritime combined) and 92 million tonnes of waste per year. In the apparel industry, less than half of used clothes are collected for reuse or recycling, and only 1% of used clothes are recycled into new clothes.

Polyester, the fastest-growing textile globally, is one of the top emitters. Virgin polyester is derived from petroleum and has two to three times higher embedded carbon than cotton. While recycled polyester (rPET) exists today, over 99% is made from recycled PET bottles, which does not address the circularity challenge and is often scrutinised for diverting away PET bottles that can be recycled continuously or many times into rPET bottles. There have also been claims that bottle-to-fibre rPET has driven up the demand for plastic bottles.

Syre aims to contribute to the decarbonisation and dewasting of the textile industry through textile-totextile recycling, starting with polyester, which will enable a true circular economy.

2024 IMPACT MILESTONES

120 Employees

1 Swiss Re Institute, 2025.

15+ countries utilising Arbol products

Arbol’s parametric solution peace of mind that we could our operations and support community without interruption the face of severe droughts climate events “

In 2024, there was a total of 336 natural disasters, incurring a total of $328 billion of economic losses which is the equivalent to 0.3% of global GDP.

Outdated and legacy climate risk products is leading to a significant protection gap, which was 57% in 2024 1 . For example, traditional insurance models that are reliant on after-the-fact claims adjustments and subjective damage assessments, are increasingly inadequate in the face of such rapid and severe climatic events.

Arbol aims to bridge the climate risk gap for all. Their platform uses a data-driven, technology-centric approach that harnesses AI and blockchain for precise risk assessment and transparent transactions. For example, they provide customers with parametric insurance products that offers swift, objective, and scalable coverage, addressing specific climate risks without disputes or delays. Arbol’s full suite of climate risk management products include property insurance, reinsurance, and agriculture and energy derivatives.

solution gave us the could maintain support our local interruption even in droughts or other

Choosing data centre locations where they can take advantage of opportunities for natural cooling to reduce

Unencumbered server equipment, the world’s cloud architecture

Using AI and dynamic provisioning to constantly optimise their cloud for efficiency.Balance workloads across data centres based on the spot price of electricity.

Rely exclusively sources

Data centres account for 3% of power demand and 2% of global greenhouse gas emissions globally, on par with the aviation industry.

The surge in AI activity is projected to significantly increase the demand for data centres and its corresponding energy demand. The International Energy Agency projects that electricity demand from AI-optimised data centres are projected to more than quadruple by 2030 1 .

In advanced economies, data centres are projected to drive more than 20% of the growth in electric demand between now and 2030. For example, after 15 years of decline, Europe’s power consumption appears to be picking up again due to the growth in data centres.

evroc is building the world’s cleanest hyperscale data centre and cloud services to ensure that we do not need to compromise on environmental impact to win the AI race. They are building with sustainability in mind from day one, by using 100% renewable energy, energy efficient hardware, and selecting sites with least environmental damage. In addition, to their potential climate impact, evroc is ensuring that Europe has local, resilient and secure AI and data centre infrastructure.

2024 IMPACT MILESTONES

280MW

utility battery energy storage system portfolio

127 Employees

2GWh+

utility battery energy storage system in pipeline

17k+ EV chargers

15M

tonnes of CO2e abated by 2030

We identified in terms of the battery “

Development,

A rapid transition to renewable energy is critical if we are to mitigate the worst of climate change. However, it is equally important to ensure that the transition does not put energy reliability and security at risk.

While Europe has made strides towards renewable energy adoption, further adoption could be limited by Europe’s ageing power grid infrastructure that is not designed for variable and unpredictable energy supply such as wind and solar. For example, in 2024, nearly 10% of Britain’s wind energy was curtailed due to inadequate infrastructure to store or transport excess electricity produced.

Flower is addressing this by combining advanced software with battery energy storage to optimise renewable energy systems. The company’s platform allows grid operators to stabilise energy flows, manage solar and wind production, and maintain price consistency. Its AI-powered forecasting supports efficient, clean energy distribution, reducing the need for costly grid expansion. Additionally, Flower’s solution is designed to be scalable across regions and energy infrastructure.

Flower’s vertically integrated solution aims to enable Europe to transition to a renewable energy future without the risks of outages and grid instability.

identified Flower as experts of how to maximise

system’s potential.

Fröjd, SVP Strategy and Business Development, Ellevio Energy Solutions

CO-INVESTORS

CURRENT

Our impact approach is guided by our Impact Principles below.

• Founder-first and pragmatic: Giant delivers impact by backing the best companies and helping them succeed. The impact process should never be reason we lose a deal nor should it hinder portfolio companies’ focus on scaling.

• Transparent: We have honest conversations about whether companies pass the impact bar, and transparently flag when there are impact or ESG-related risks.

• Collaborative: We work closely with founders, peers, our LPs, and industry stakeholders about impact best practices. We are openminded, welcome feedback, and constantly evolve our impact approach to stay in line with industry best practices.

FUND

SOURCING & SCREENING

DEEP DIVE

DECISION-MAKING

DUE DILIGENCE

POST-INVESTMENT

Use Giant’s Impact

• Assess founders’

• Assess the scalability

• Ensure alignment and economic

Develop Impact risks)

Score using the SEED

Company completes Statement INVESTMENT DOCS

Term Sheet includes delivering positive

Impact side letter reporting requirements

Quarterly Impact

Annual B-Impact

Impact Framework to: founders’ commitment to purpose scalability of technology and impact alignment to one of our climate, health, economic mobility themes

Impact Thesis (including identifying impact

Use Giant’s Impact Framework to:

• Assess founders’ commitment to purpose

• Assess the scalability of technology and impact

• Ensure the company addresses a meaningful climate challenge

Develop Impact Thesis (including identifying impact risks)

Develop Theory of Change

Quantify Impact Materiality (potential, planned, and unit impact)

the Giant Impact Assessment Scorecard

Assess whether Impact Materiality and Theory of Change is satisfactory

completes the Giant ESG Disclosure Company completes the Giant ESG Disclosure Statement (minimum safeguards) includes company’s commitment to positive impact and avoiding harm

letter with impact commitments and requirements

Impact KPIs reporting B-Impact Assessment

Term Sheet includes company’s commitment to delivering positive impact and avoiding harm

Impact side letter with impact commitments and reporting requirements

Quarterly Impact KPIs reporting

Annual B-Impact Assessment

Annual PAI indicators reporting

Sourcing & screening

Source companies in line with Giant’s Impact Framework and exclusions policy.

Evaluate founders’ intentionality, impact vision, and scalability of technology and impact.

Ensure core alignment between the company objective and at least one of Giant’s themes.

Ensure contribution to at least one UN SDG target.

Develop an impact thesis and identify risks and dependencies to the thesis.

Score potential investments using the Giant Impact Scorecard and only progress companies with suitably high scores.

Include impact assessment in investment memos for investment committee consideration.

What outcome is occurring?

How important is it to the people (or planet) experiencing it?

Who experiences the outcome?

How underserved are the affected stakeholders in relation to the outcome?

How much of the outcome is occurring? In mind of Scale, Depth, and Duration.

How likely would this change have happened anyway?

Post-investment support

Collaborate with portfolio companies to select impact-related KPIs.

Conduct annual B-Impact assessment to evaluate companies’ progress on impact and highlight ESG risks and opportunities.

Use our Board position to highlight and address any impact and/or ESG-related concerns.

Impact Pathway (as defined by the Impact Management Project) used to inform impact KPIs

Note: For early-stage companies, the impact-related KPIs are typically impact drivers but as they scale, they will shift to outcomes and impact. We review the impact KPIs with portfolio companies annually.

Portfolio companies report on their impact-related KPIs to Giant quarterly.

Publish annual Giant Impact Report, including results from B-Impact Assessments, annual impact KPIs review, and qualitative reviews.

Giant uses the B-Impact Assessment to review companies’ impact contribution and identify impact and ESG risks.

Giant is not based in the EU. However, we are aligning our impact methodology as closely as possible to the EU SFDR requirements for Article 9 funds. Our aim is to remain pragmatic while rigorously seeking and reporting on impact.

ARTICLE 9 INVESTMENT CHARACTERISTICS

CONTRIBUTES TO A SOCIAL AND/OR ENVIRONMENTAL OBJECTIVE

DOES NO SIGNIFICANT HARM PROMOTES GOOD GOVERNANCE

& screening 1

Identify the core objective of companies and ensure it is addressing a meaningful social and/or environmental challenge. Screen for negative impacts and ESG

Screen out companies with clear governance issues.

Note: Giant’s funds are not Article 9 Funds today.

screening core companies is meaningful negative ESG risks. companies governance

2

Due diligence

3

Investment documents

4

Post-investment

Quantify the potential and planned impact of the company. Develop a Theory of Change and document it in the investment memo.

Identify and assess impact and ESG risks.

Consider the mandatory Principle Adverse Impact (PAI) indicators. Review of companies’ governance practices.

Include a clause on companies’ commitment to contribute to an environmental and/or social objective and to notify Giant if the objective changes.

Include a clause on companies’ commitment to integrate ESG best practices across management and operations.

Include a clause on companies’ commitment to uphold good governance practices.

Measure and report impact on a quarterly basis. Review companies’ impact and ESG performance annually to identify and mitigate any potential risks. Review companies’ governance annually.

Prior to every investment from the Growth fund, we estimate the unit impact, potential impact, and planned impact of the company, which we collectively consider the Impact Materiality of a company at scale.

This methodology is based on the Project Frame approach.

The difference between greenhouse gas emissions and/or impact released by a single unit of the company’s innovation and a single unit of the status quo/incumbent technology.

There may be multiple impacts of a company, which will need to be estimated separately.

The change in greenhouse gases and/ or impact that the company may cause, compared to an incumbent and based on a standardised growth trajectory that assumes that the company’s innovation takes over the Serviceable Obtainable Market.

We recognise that there are many factors, such as adoption curve, regulatory changes, economic conditions, that need to be modelled to more accurately estimate the potential impact. However, this helps us assess the total potential impact in the most optimistic scenario.

The change in greenhouse gas emissions and/or impact that the company both intends and expects to cause based on a realistic analysis of its business model.

The planned impact is calculated using a bottom-up approach that takes into account the company’s customer pipeline, expected sales, and growth plan. It also helps us understand the required market penetration to achieve the planned impact.

SOM Units/Year (Based on market analysis)

Unit Impact (CO2e/Year) X X Units/Year (Based on business plan)

Potential Impact (CO2e/Year)

Planned Impact (CO2e/Year) = =

Lead Investors need to develop a Theory of Change for every potential investment presented at the Investment Decision-making meeting. The Theory of Change should clearly map the company’s activities to its long-term intended positive impacts.

THEORY OF CHANGE

PARAMETER:

DESCRIPTION

AGREENA EXAMPLE (SIMPLIFIED)

What does the do to drive impact?

Provides a platform supports farmers transitioning to regenerative practices.

Investors are also required to qualitatively counterfactual. For example, in saturated markets high attribution. ATTRIBUTION

company impact?

The tangible products that result from the activities. The short-term results that are immediately achieved after an activity has taken place.

The mid-term results of the activities that take time to emerge. These are the changes that the organisation wants/ expects to see in the medium term.

The resulting long-term impact, typically measured in emissions savings and/or financial savings.

platform that farmers in to practices.

Farmers sign up to Agreena and adopt regenerative practices. [#]

Soil on farms managed by those farmers (Agreena’s customers) converted to carbon sinks. [Hectares]

Carbon removal from soil carbon sinks (as a result from adopting regenerative agriculture practices). [CO2e/year)

assess attribution and consider how likely this change would have happened anyways i.e. the markets of commoditised solutions, it is unlikely that a single company would have exceedingly

In recent times, ESG initiatives have encountered backlash and become a focal point of political contention. At Giant, we believe robust ESG performance is not about ticking boxes, but about creating the conditions for business performance.

Startups thrive on meritocracy so ensuring top talent is not missed due to biases, is strategically important. Additionally, good governance practices, such as having board oversight and the necessary financial controls can avoid some of the startup blowups that have happened in the last few years.

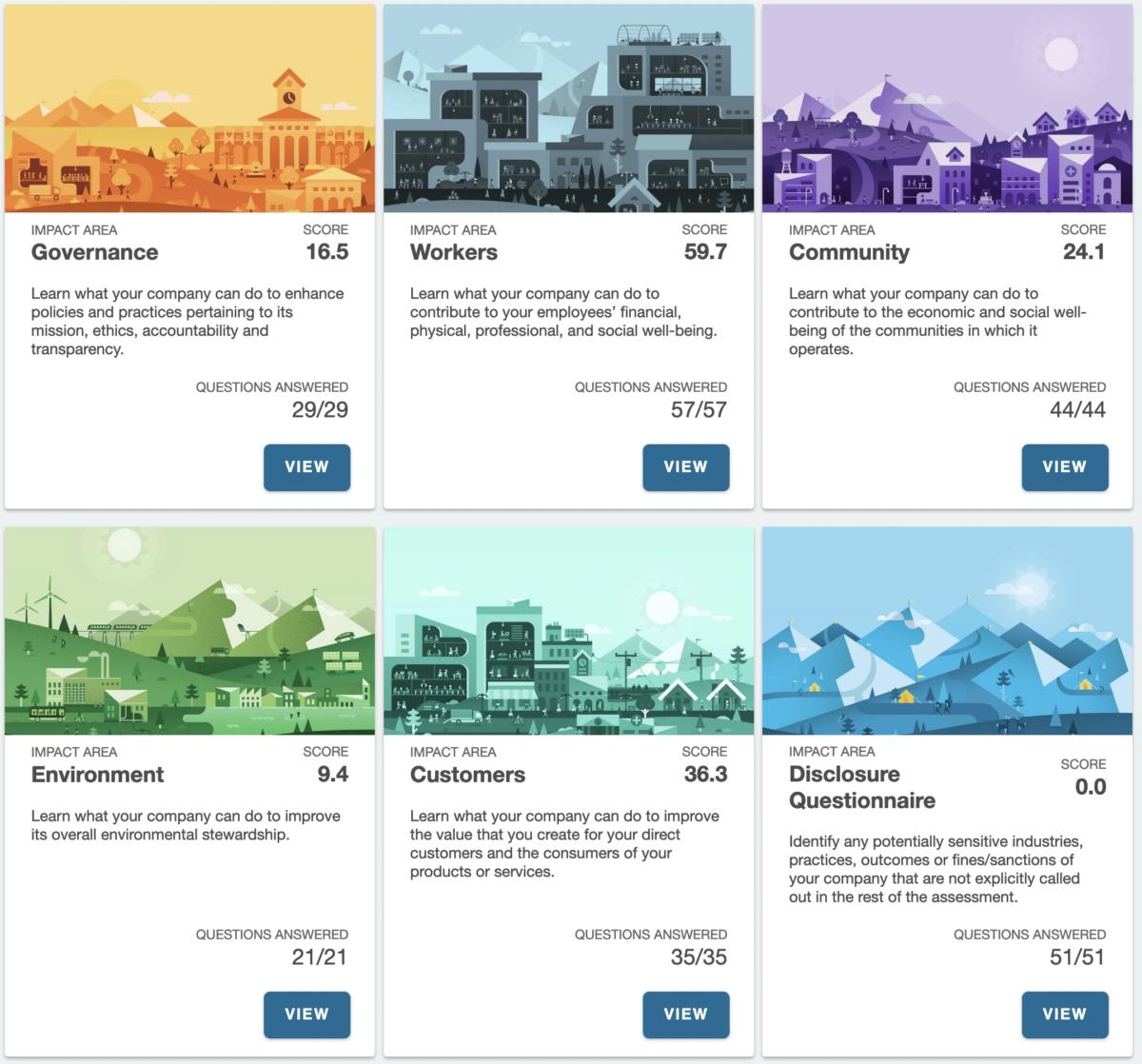

Every year, Giant’s portfolio companies complete the online B-Impact Assessment to better understand their impact across the ESG dimensions of governance, workers, customers, community, and environment. The disclosure statement enables us to monitor companies’ adherence to our minimum safeguarding requirements.

OVERVIEW

2,990

Total jobs created across our portfolio in 2024 B-IMPACT PERFORMANCE

77%

Completion rate of the annual B-Impact assessment

ANTI-HARASSMENT & NONDISCRIMINATION POLICIES

Note on B-Impact Assessment: Giant encourages the whole investor and have information rights. The eligible sample size

25,000+ Potential jobs created across our portfolio in 2030 36%

Diverse founders

95% either prioritise or incorporate social and environmental impact in decision-making

63% improved their B-impact score since last year

DIVERSITY & INCLUSION

We believe that Giant can best deliver positive ESG impact by supporting our portfolio companies, as many of them will (hopefully) scale quickly and expand their footprint exponentially.

As such, our priority is to work with our portfolio companies to lay strong ESG foundations. We actively support them in implementing best practice governance to minimise risks and maximise their potential positive impact.

Giant recognises that we must lead by example and that our footprint will scale as our AUM grows. As such, we have a formal ESG policy that guides our actions.

Giant’s ESG policy sets out how we systematically operations.

Investments: ESG is considered at every due diligence to decision-making and portfolio

Operations: We strive to adhere to good work environment, and improve our environmental

The General Partners have oversight of every Giant employee is personally responsible incorporating ESG into investment decision-making

Highlights include:

EMost of our footprint today is made up of our office and travel.

Our office is fitted with energyefficient and smart devices to minimise waste and emissions.

We have policies and incentives to encourage sustainable travel.

In the next 5 years, we aim to improve the footprint, and build a path towards achieving

systematically integrate ESG into our investments and

every step of the investment cycle, from sourcing and portfolio support.

good governance practices, build a fair and inclusive environmental footprint.

the ESG policy and performance at Giant. However, responsible for upholding Giant’s ESG policy and decision-making and portfolio support.

S46% of our team are women, and 33% of our investment team are women.

We offer comprehensive health and wellbeing benefits for all employees.

We have a flexible hybrid work setup.

GFor good corporate governance, we hold regular Advisory Board and LP Advisory Committee meetings and compliance training.

We have an employee handbook that includes a whistleblowing, non-discrimination, and antiharassment policies.

the diversity of our partnership, measure and reduce our environmental achieving net zero.

We recognise that impact measurement, as it relates to our portfolio companies, is a work in progress. Early-stage businesses are on a continuum of impact reporting quality. From due diligence to onboarding, we analyse and validate the impact methodology just as we scrutinise the company's economic aspects.

Post-investment, we seek continuous improvement of every company’s impact calculations. We hold quarterly reviews to challenge internal assumptions and develop more granular conversion and emission factors to more accurately reflect their footprints. We also develop new metrics as they roll out additional product offerings.

Many of Giant’s portfolio companies are still in the development phase –removing no, or only a small amount of CO2e, for example – but our investment helps them accelerate their development and achieve their impact potential.

Each company has a unique set of impact KPIs. Forward-looking KPIs are self-reported by companies unless explicitly mentioned otherwise. Because there are a limited number of companies in the Giant portfolio, and impact KPIs are specific to each company, the aggregated KPIs come from one or just a few companies where relevant.

Diversity and inclusion data is selfreported from portfolio companies.

This is a contribution-based report; therefore, we are looking at overall potential outcomes delivered by our and our portfolio companies’ activities. At this stage, we have not conducted an attribution and counterfactual analysis.

Historical data is reported for the 1 Jan 2024 to 31 Dec 2024 period.