Giant backs purpose-driven founders solving the world’s biggest problems.

The decade’s largest companies will be built around these challenges.

We champion founders creating a more sustainable, healthy and equitable planet.

Giant’s mission is to enable category defining companies and deliver systemic change. Our team of former founders and global leaders will deploy $1 billion into purposedriven technology in the 2020s.

“ Our team of founders, CEOs and global leaders share our founders’ burning sense of purpose.

CAMERON MCLAIN

Co-Founder

10+ years experience as an early stage investor Investor in Calm, Carta, Ada

Launched Hummingbird’s London o!ce (Deliveroo, Kraken, Peak Games)

Founder & CEO, Beehive (acquired) Associate, Endeavor ($13BN)

TOMMY STADLEN

Co-Founder

Founder & CEO, Swing (acquired by Microsoft)

Founder & Chair, Tailwind ($1BN, NYSE)

Former IC member, firstminute ($400M AUM)

Best-selling climate author Ex McKinsey and Obama climate advisor

ADVISORY BOARD GLOBAL LEADERS IN OUR THEMES

LORD JOHN Former CEO, BP Founder, BeyondNetZero, General Atlantic’s Growth Fund

BOLA OLUSANYA

Chief Investment

The Nature Conservancy

TENSIE WHELAN

Former President, Alliance; Director, for Sustainable

DAVID MILIBAND

Former UK Foreign passed world’s reduction law; CEO,

LINDA AVEY Co-Founder of 23AndMe, listed on NASDAQ valuation

ALICE STEENLAND

Chief Sustainability

AXA, Dassault and

BARRY EGGERS

Founding Partner Lightspeed, the venture firm

BROWNE

BP

BeyondNetZero, Atlantic’s Climate

OLUSANYA

Investment O!cer, Conservancy

WHELAN

President, Rainforest Director, NYU Center Business

MILIBAND

Foreign Secretary, first CO2 CEO, IRC

23AndMe, NASDAQ at $3.5B

STEENLAND

Sustainability O!cer at and now Signify

EGGERS Partner of $25B AUM

HAYDEN WOOD

Founder & CEO, Beams Founder & Former CEO, Bulb

KODA WANG

Co-Founder & CEO, Block Former CCO, Rent the Runway

NIKOLAJ REFFSTRUP

Co-Founder & Former CEO, Ganni Prominent climate angel investor

GRANT ALLEN

Founding GP, Schneider Electric Ventures ($1.1BN); 4x track record, 14 unicorns (incl. Northvolt)

CORE TEAM LEADERS EXPERIENCED ENTREPRENEURS

JON DISHOTSKY

Investment Partner

Founder, Starcity: raised $50M, acquired 2021

MADELENE LARSSON

Principal

Product leader, Revolut JP Morgan tech banker

JIA LIN YONG

Investor

Chief of Sta", Babylon Health Climate & Health, PwC Strategy

ROB HICKS

Head of Finance

Experienced VC finance lead, ex PwC, Strategy&

GEORGIA RITTER

Head of Marketing & Community

Ex Pale Blue Dot, Deliveroo, AMV BBDO, former founder

LUCY BRADY

Head of Product

First Round Capital, Oscar Health & Obama White House

Important note: As early-stage investors we can only however, think it is important to attempt long-term

Solving impactful problems requires a multi-stakeholder approach. Giant convenes leaders to advocate for, discuss, and drive the adoption of purpose-driven Giant frequently brings together leading minds to advance purposedriven innovation - be it assembling founding teams or connecting corporates and founders to accelerate wide-scale adoption of new technologies.

only expect material impact from the proportion of our portfolio that scales successfully. Just as 10-year financial only directional. We do, long-term impact forecasts, because it is only in 5-10 years that most startups will be able to deliver truly valuable impact.

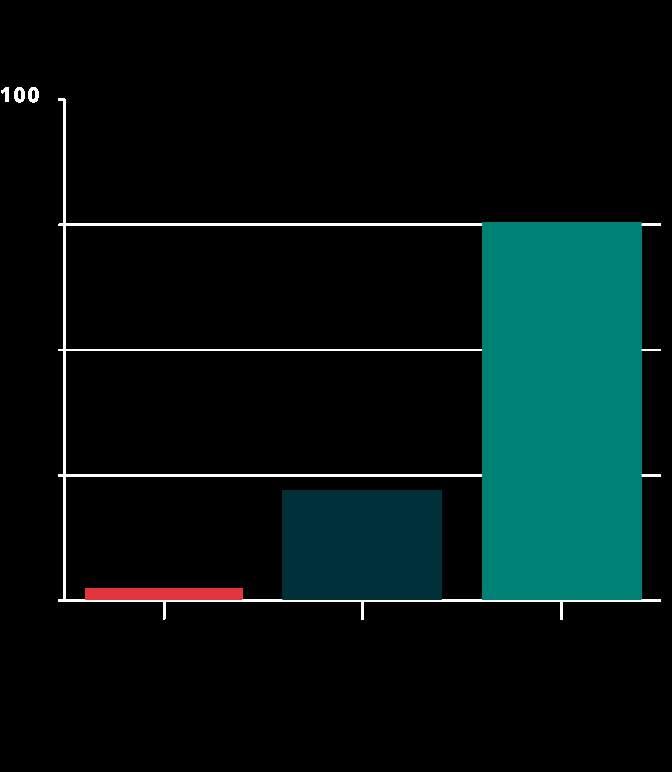

Capital available by stage based on funds raised in 2021 and 20221

US$40.0B

US$30.0B

US$29.7

US$20.0B

US$10.0B

US$0.0B

1 Building out the climate capital stack. CTVC, 2023.

Technology will play a critical role in catalysing the step changes required in manufacturing, transportation, built environment, and industry to achieve a net zero economy. However, the IEA projects that 65% of emissions reductions in 2050 will come from technologies that have already been developed2.

$150B+

Funding gap for early growth stage climate tech companies 3

Significantly larger amounts of innovation capital is crucial for the next few decades.

Whilst it has been encouraging to see an increase in climate tech funding as a proportion of overall venture capital, there remains a gap for climate tech companies on the cusp of rapid growth acceleration. The lack of early growth capital means that many climate tech companies struggle to

commercialise and sufficiently scale to deliver their intended impact.

In 2023, Giant launched our latest climate growth fund to increase the pool of available Series B capital for the most ambitious climate tech companies.

2 Net Zero Roadmap: A Global Pathway to Keep the 1.5C Goal in Reach. IEA, 2023.

3 The case for a FOAK-focused fund, 2022. Note: This is referring to climate tech companies that require funding for FOAK commercial. FOAK: First of a Kind.

creating a more sustainable, healthy, and equitable planet

These themes have been selected because of their urgency for humanity, and their potential for radical innovation through technology.

Scalable carbon avoidance and removal, green finance, circular economy, electrification, biomanufacturing

HEALTH INCLUSIVE CAPITALISM

Accessible and a"ordable healthcare, drug discovery, prevention, wellness, longevity

Inclusive fintech, future of work, democratised education, a"ordable housing, SME digitisation

We believe that successful founders exist in many forms. Outliers can be found in all ages, backgrounds, and genders.

The common factors we look for in founders are a burning sense of purpose to deliver positive-impact at scale, and perseverance in solving hard problems.

Total investments made in 2023. 1

97% have maintained their environmental and/or social objective since our investment.1

2,079

Jobs across the Giant portfolio in 2023, a 48% increase from 2022.

49% Diverse founding teams.

left Airbnb Co-Founder Nathan Blecharcyzk

centre Ida Tin, Clue Co-Founder, who coined the term Femtech

right Michael Acton-Smith, Co-Founder of Calm

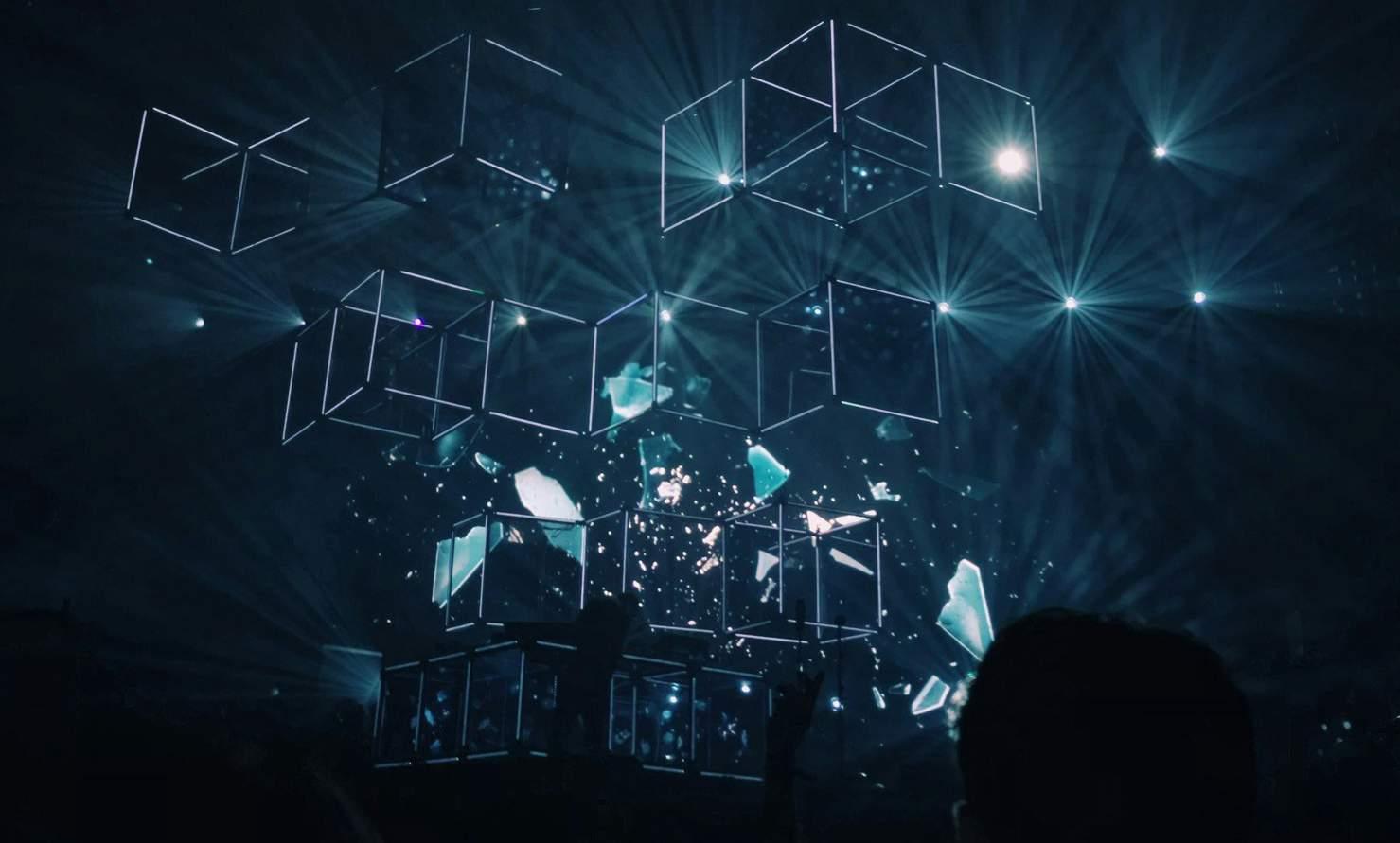

We use our convening power to assemble the top 250 global leaders focused on sustainable technology

Giant Ideas is designed to spark conversations and new collaborations amongst global leaders to shape a more sustainable, healthy, and equitable world. Through our annual event, we have connected founders to investors and legislators to corporate leaders. The aim is to enable dialogue and accelerate technology adoption as a force for good, from climate to healthcare. The event is supplemented by the Giant Ideas podcast featuring in-depth thought leadership.

Speakers include: Deepmind founder Mustafa Suleyman, Airbnb founder

Nathan Blecharcyzk, Sir Richard

Branson, ex UK Foreign Secretary David

Miliband, 23andme founder Linda Avey, ex BP CEO Lord Browne, Oscar winner

Oliver Stone, Calm founder Michael

Acton Smith, NBA All-Star Russell

Westbrook, a16z GP Sriram Krishnan,

Octopus Energy founder Greg Jackson, SunEdison founder & US DoE leader Jigar Shah and FT columnist Gillian Tett.

Sourcing & screening

Source companies in line with Giant’s Impact Framework and exclusions policy.

Evaluate founders’ intentionality, impact vision, and scalability of technology and impact.

Ensure core alignment between the company objective and at least one of Giant’s themes.

Ensure contribution to at least one UN SDG target.

Founder mission alignment

Scalable through technology

Has the potential to drive systemic change in one of Giant’s thematic areas ! ! !

Entry criteria of Giant’s Impact Framework

Develop an impact thesis and identify risks and dependencies to the thesis.

Score potential investments using the Giant Impact Scorecard and only progress companies with suitably high scores.

Include impact assessment in investment memos for investment committee consideration.

What

What outcome is occurring?

How important is it to the people (or planet) experiencing it?

Who

Who experiences the outcome?

How underserved are the affected stakeholders in relation to the outcome?

How much of the outcome is occurring? In mind of Scale, Depth, and Duration.

How likely would this change have happened anyway?

Post-investment support

Collaborate with portfolio companies to select impact-related KPIs.

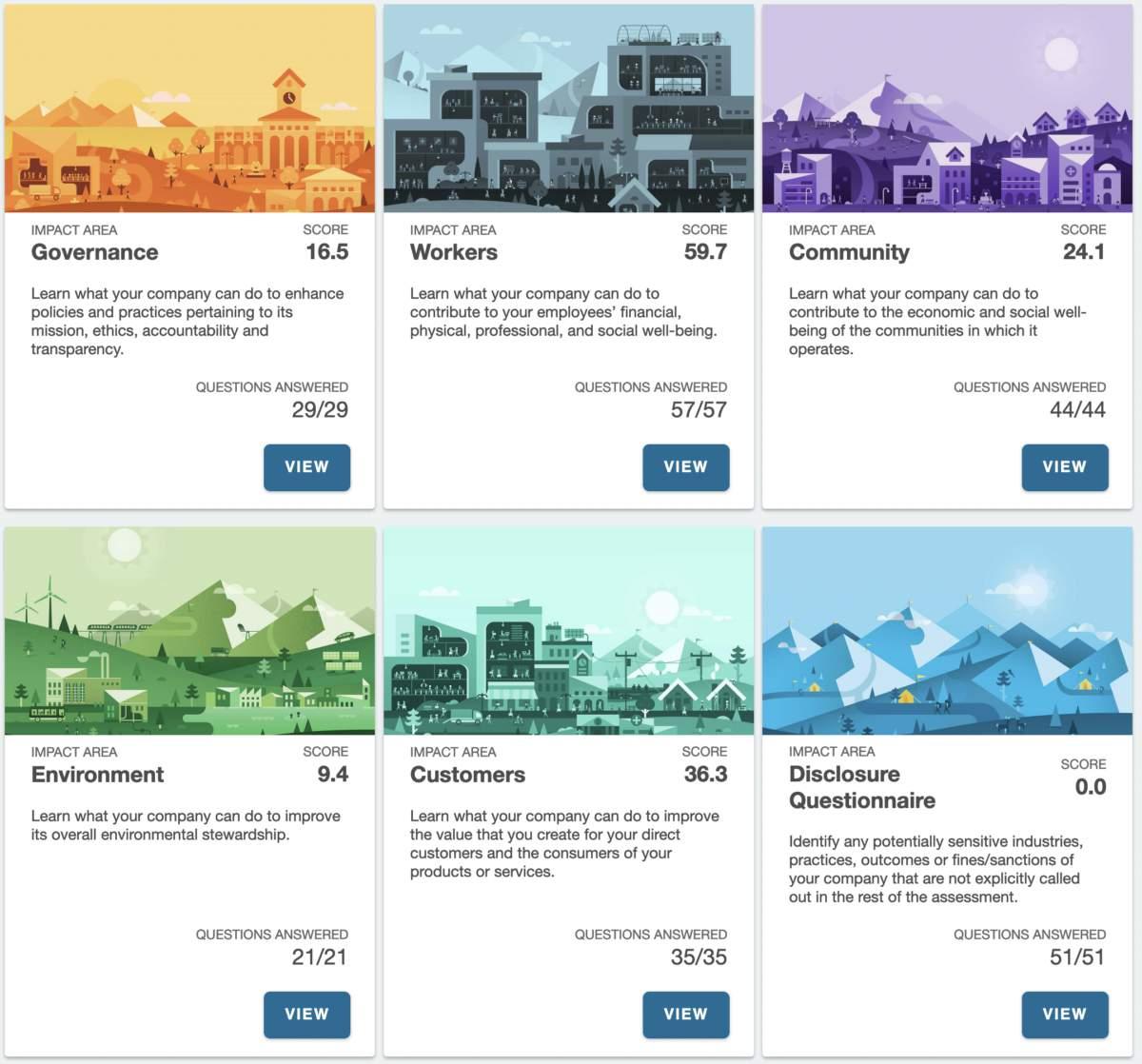

Conduct annual B-Impact assessment to evaluate companies’ progress on impact and highlight ESG risks and opportunities.

Use our Board position to highlight and address any impact and/or ESG-related concerns.

Impact Pathway (as defined by the Impact Management Project) used to inform impact KPIs

Note: For early-stage companies, the impact-related KPIs are typically impact drivers but as they scale, they will shift to outcomes and impact. We review the impact KPIs with portfolio companies annually.

Portfolio companies report on their impact-related KPIs to Giant quarterly.

Publish annual Giant Impact Report, including results from B-Impact Assessments, annual impact KPIs review, and qualitative reviews.

Giant uses the B-Impact Assessment to review companies’ impact contribution and identify impact and ESG risks.

Giant is not based in the EU. However, we are aligning our impact methodology as closely as possible to the EU SFDR requirements for Article 9 funds. Our aim is to remain pragmatic whilst rigorously seeking and reporting on impact.

ARTICLE 9 INVESTMENT CHARACTERISTICS

CONTRIBUTES TO A SOCIAL AND/OR ENVIRONMENTAL OBJECTIVE

DOES NO SIGNIFICANT HARM

PROMOTES GOOD GOVERNANCE

Sourcing & screening 1

Screen companies against Giant themes and UN SDGs.

Screen for negative impacts and ESG

Screen out companies with clear governance issues.

Note: Giant’s funds are not Article 9 Funds today. The framework be fully implemented over the next two years.

screening companies themes negative ESG risks. companies governance

2

Due diligence

3

Investment documents

4

Post-investment

Assess companies’ impact using Giant Impact Scorecard.

Document company’s objective in investment memo. Identify and assess impact and ESG risks. Consider the mandatory Principle Adverse Impact (PAI) indicators. Review of companies’ governance practices.

framework described above is expected to

Include a clause on companies’ commitment to contribute to an environmental and/or social objective and to notify Giant if the objective changes.

Include a clause on companies’ commitment to integrate ESG best practices across management and operations.

Include a clause on companies’ commitment to uphold good governance practices.

Measure and report impact on a quarterly basis. Review companies’ impact and ESG performance annually to identify and mitigate any potential risks. Review companies’ governance annually.

The latest IPCC report paints a bleak future where our time to avoid breaching the carbon budget for a 1.5°C warming world is rapidly depleting. Over three billion people today live in climate vulnerable regions, extreme weather events continue to intensify, and both the natural and built environment have experienced devastating destruction1. To avoid irreversible catastrophe, the world needs to decarbonise seven times as fast as the current rate to limit warming to 1.5°C2. This requires a concerted effort across sectors, countries, and private and public stakeholders to ensure a climate-resilient future.

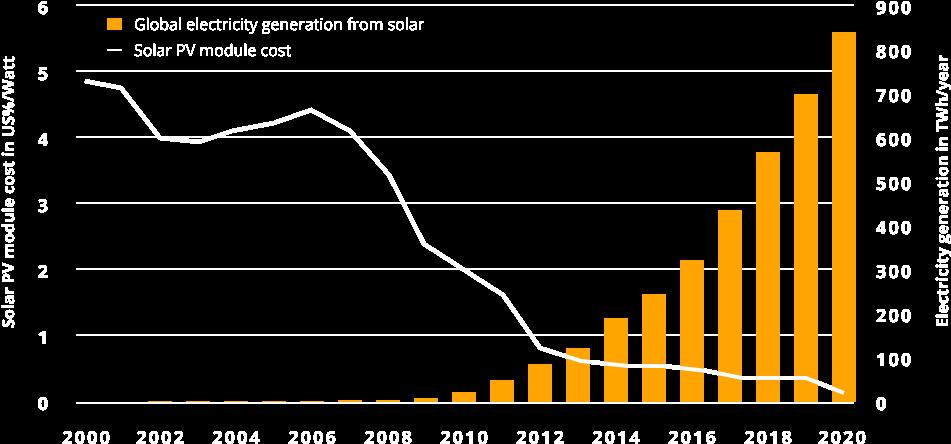

At Giant, we are optimistic that technology and entrepreneurship have the potential to unlock the emission reduction, fuel substitution, resource efficiency, and carbon removal needed at scale for a net zero future. Just as step changes in solar photovoltaics technology and disruptive startups like Tesla contributed to the widespread adoption of solar and electric vehicles, emerging technologies and startups will play a critical role in addressing climate challenges, and will lead to enduring, valuable companies.

1 Climate Change Synthesis Report, 2023. IPCC, 2023.

2 Net Zero Economy Index. PwC, 2023.

$4.5T

Annual clean energy investment needed to reach net zero emissions by 2030

IEA Net Zero Analysis, 2023

WE ARE ON THE PATH TO BREACHING 1.5°C WARMING

climate.nasa.gov, 2023

TECHNOLOGY ADVANCEMENTS CAN BRING DOWN COSTS AND DRIVE ADOPTION OF CLIMATE-POSITIVE TECHNOLOGIES

Climate change does not discriminate. It affects all corners of the economy and therefore, the solution also lies in multiple sectors.

Giant is focused on backing companies that have the potential to drive systemic change whilst delivering venture scale returns. This often means reimagining how things are made, the materials that we use, and the environment that we live in.

POTENTIAL IMPACT BY 2030

263Mt

of CO2e abated per year

Equal to the annual emissions of the Netherlands, Portugal, and Belgium

1.6 GW of battery capacity installed

Equal to 2% of the UK’s electricity generation capacity

1.5B m3 of water conserved

Equal to more than Jamaica’s annual water consumption

BUILDINGS AND ENERGY

NET-ZERO CONSTRUCTION

Advanced robotics and materials for sustainable homes. 99% less waste generated per home.

BATTERY STORAGE & DEVELOPMENT

Building energy infrastructure at scale required for net zero.

Accelerating battery research and development through modern data analytics platform.

SUSTAINABLE HOMES

End-to-end batteries installation and virtual power plants for reliable renewable energy.

Removing bottlenecks to accelerate home electrification. Sustainable home renovations that minimise waste and resource consumption.

SUSTAINABLE CONSUMPTION

Water measure, risk.

Biomanufacturing and financing power

Bioprocessing software speed processes.

Heat pump marketplace to drive widescale adoption of sustainable heating solutions in the Nordics.

Accelerated increase food

Global platform maximise An

CONSUMPTION

Water sustainability platform to measure, respond, and report water

Biomanufacturing infrastructure financing to harness the power of biology at scale.

Bioprocessing development software to improve yield and speed of biomanufacturing processes.

Global one-stop recyclables trading platform to avoid landfill and maximise goods’ end-of-life value.

Accelerated crop discovery to increase crop resiliency and preserve food security.

CARBON MARKETS

Regenerative agriculture to improve soil health and sequester carbon.

DATA & WEB

Decentralised and interoperable climate data infrastructure.

AI platform, tools and sensors network for hyperlocal, realtime air quality data and analysis.

Platform and robotics for greener, and cheaper ocean data.

ELECTRIC VEHICLES

Financing platform to catalyse uptake of EVs and other green solutions.

Optimised electric fleet management platform and multistakeholder marketplace to enable net zero last-mile delivery at scale.

AVIATION

Electric light aviation vehicles to reduce carbon footprint of flights.

Agreena is accelerating soil restoration and carbon removal at scale

Carbon farmers 1k+ 10k+ 2023 IMPACT 2030 PROJECTED IMPACT

Land converted to regenerative agriculture (Ha) 2M Equal to the size of Slovenia 150M Equal to the size of the UK, France, Germany and Spain combined Annual carbon removed (Mt CO2e) 1 2.8 Equal to Geneva’s annual emissions2

“

Just

walking across fields, I can feel in feet how much the has changed. Driving I notice all the flocks birds and other wildlife in my fields that neighbours’ fields.

Jonathan Humphrey, AgreenaCarbon

3 MRV: Monitoring, reporting, and verification

across my in my the soil Driving by, flocks of wildlife aren’t in fields.

Although soil carbon permanence is lower than some other carbon removal methods, it plays a key role in tackling climate change as it is implementable at scale today. Furthermore, the added benefits of restoring biodiversity play a critical role in both climate mitigation and adaptation.

Waterplan’s mission is to accelerate the transition to a water-secure world.

Water may be abundant but usable and available freshwater makes up only 0.5% of all water on earth. For every 1°C increase in the global average temperature, there is a projected 20% reduction in renewable water sources, such as lakes and rivers. By the end of the decade, there is an expected 40% gap between water supply and demand, which is not only a huge threat to the environment and health but also to businesses and the economy.

Corporations not only need to be prepared to respond to water risks in their supply chains to avoid business disruption but also increasingly minimise their impact on water resources to comply with emerging water protection regulations.

Waterplan helps large corporations measure, report, and respond to water risk. Waterplan automates, standardises, and consolidates corporate water data and reporting using AI, providing high-quality local water data for making informed decisions and taking action, such as reducing water usage and avoiding water-stressed sources.

We are experiencing the largest energy transition in history, where 69% of global power generation is expected to come from renewables by 2050. Increased electrification combined with ageing grid infrastructure has led to an increase in power outages. Therefore, mass deployment of energy storage is needed to achieve this transition without compromising energy reliability.

64% increase in outages in the US over the last 10 years1

Haven is accelerating the adoption of home battery systems. Its platform simplifies the end-to-end process of purchasing and installing residential batteries. Every battery installed is then added to its virtual power plant. Residents not only protect their home from power disruptions but also make money by participating in the demand response program.

100MW battery capacity installed by 2030

The effects of climate change events, increased pathogens reduced soil fertility - are threatening systems. Climate-resilient crops feed the expected global population billion people by 2050. However, strains is not only costly but

8y+ and $100M is cost to develop

Avalo’s AI platform accelerates to create climate-resilient crops. discovery engine is adept at basis of complex traits with insights translate into industry-leading predictions for creating the multi-trait, in silico breeding understudied crops, Avalo can time by years and cut costs

75% faster crop with Avalo

change - extreme weather pathogens from warmer climates, threatening our food crops are critical if we are to population of over nine However, discovering new crop but also extremely slow.

PROBLEM

You can’t solve a problem you can’t measure. This is particularly true with climate, where decisions ranging across academia, policy, and risk management are complex and have long-term implications. Therefore, it is important that they are grounded in sound data and evidence. The challenge is that most available data is inaccessible, hard to understand, and lacks quality.

60% of countries lack basic water information, and even more lack reliable climate data2

SOLUTION

accelerates natural crop evolution crops. Avalo's patented gene at identifying the genetic minimal data. These industry-leading genomic first biologically realistic, breeding platform. Even for can reduce developmental by an order of magnitude.

is the average time and develop a new crop variety crop development

dClimate is a decentralised climate information network revolutionising the way we measure climate change. Through indexed data stored on an immutable ledger, dClimate enables hyperlocal analysis of global climatic systems. Its interoperable platform aims to unlock interconnected climate solutions needed for net zero.

1 petabyte of climate data on dClimate platform by 2030

In 2023, US healthcare spending totalled a record $4.7T. This is expected to continue outpacing GDP growth until the end of the decade1. Meanwhile, health outcomes and life expectancy are deteriorating. In the UK, the NHS is on the brink of crisis: 7.7M people are on a waitlist for routine care; 277,000 vacancies for health and social care workers are unfilled; and cumulative underspend totals over £300B2. More broadly, an ageing population and its associated diseases, growing health inequities, rising chronic diseases and misaligned incentives threaten the resilience of health systems as we know it.

Giant is optimistic that these healthcare challenges are surmountable. Recent AI advancements have the potential to plug gaps in staff shortages by multiplying clinicians’ productivity, be it through automating administrative tasks or assisting with clinical decisionmaking. As technology costs continue to decrease, solutions that were once only available to the 1% –personalised nutrition, concierge medicine, coachingcan now be accessible to all. The consumerisation of health can shift care from hospitals to homes, nurses to family members, and clinicians to consumers, making everyone active participants in their health and alleviating the burden on health systems.

18% of GDP spent on healthcare in in 2023

1 Peter G. Peterson Foundation, 2023.

2 Waitlist number source: The Health Foundation, 2024; unfilled vacancies source: Skills for Care annual report, 2022 and BMA, 2023; cumulative underspend source: BMA, 2023.

Health System Tracker, 2024

The shortage of health and social care workers is further straining the NHS which is facing growing demand for services.

Actual growth over past decade

Projected growth needed to meet demand over next decade

Source: The Health Foundation, 2021. REAL Centre calculations based on data from NHS Digital and Skills for Care.

Note: For the NHS, previous decade is June 2011-June2021 and next decade is 2018/19 to 2030/31. For social care, previous decade is 2012/13 - 2020/21 and next decade is 2018/19 to 2030/31. Growth rates for the NHS and social care are calculated on a full-time equivalent basis.

Startups have and continue to play a transformative role in reimagining how healthcare is delivered and experienced.

The previous over-concentration of telemedicine solutions has left investors disillusioned. However, if we look beyond that, there are opportunities aplenty.

Our portfolio spans the full health spectrum, from diagnostics to treatment, from wellness to secondary care, and from acute to chronic care.

BY 2030

19M+ total number of lives touched

Equal to more than the population of Sweden and Denmark.

£840M savings for the NHS

Equal to 0.5% of NHS England’s budget today.

20k+ cancer cases meaningfully impacted

With the potential to deliver $1B in health system savings.

WELLNESS CARE DELIVERY

REMOTE PATIENT MONITORING

Remote patient monitoring to unlock clinical capacity and improve health, delivering scalable cost savings to the health system.

DIRECT-TO-PATIENT CARE

Direct-to-patient care to increase quality, affordability, and access to care.

Mental manage live a

Accessible and

maximise

ONCOLOGY

Mental health app to help people manage stress, sleep better, and a happier, healthier life.

Accessible and affordable prepostpartum support to maximise maternal health.

Medically tailored groceries to prevent and reverse chronic conditions and make healthy food affordable and accessible.

Super-app to democratise health and longevity interventions to drive healthy habits and increase health span.

AI to elevate the standard of care through the prediction of recurrence and treatment response, starting with breast cancer.

Doccla’s mission is to provide patients and clinicians with the transformative power of remote patient monitoring.

The UK NHS is increasingly strained from both sides: demand for beds has been steadily increasing, whilst ward capacity is decreasing. The UK has 50% fewer hospital beds than the EU average. During winter, bed occupancy is significantly above safe thresholds of 85%, often exceeding 95%.

Doccla provides virtual wards to help free up hospitals and clinicians' capacity. Using Doccla’s platform, clinicians seamlessly discharge patients and enable them to recover in the comfort of their own homes.

Through effective monitoring, Doccla increases patient compliance, leading to improved health outcomes and reduced readmissions, which are costly for the NHS.

Doccla’s platform is fully integrated into existing clinical workflows and systems, minimising disruption to clinicians. By providing a fully managed service, Doccla ensures that clinicians and nurses are always operating at the top of their licenses.

Sesame is delivering affordable, high quality care for all 2030 PROJECTED IMPACT

Number of patients

I don’t have insurance and couldn’t risk hundreds for a bill. Knowing how much pay upfroint meant could actually afford doctor on Sesame. “

Sesame’s mission is to eliminate the pain of high health insurance deductibles or the lack of insurance by building a first-of-its-kind, super simple healthcare system. Its platform connects patients directly to clinicians who offer high-quality, convenient medical care at half the typical price. By introducing marketplace dynamics in consumer healthcare, Sesame has created an environment where providers compete to serve patients. The resulting competition halves the typical price of care, with no sacrifice to quality or convenience.

Sesame’s Marketplace offers primary care, speciality care, lab tests, and imaging within 1-2 hours, virtually and in-person.

In 2023, Sesame launched Sesame @ Work to provide employees with access to America’s lowest prices for health care at zero cost to employers, further increasing their reach.

insurance risk paying bill. much to meant I afford my Sesame.

PROBLEM

Unhealthy lifestyles are responsible for ~60% of premature deaths worldwide. In the US, 70% of the disease burden is lifestyle-driven and costs $1.65T per year. At the same time, health systems’ capacity to treat and manage chronic diseases is dwindling due to the shortage of doctors. Cost-effective and scalable non-clinical interventions are needed to curb this growing disease burden.

#1 contributor to chronic diseases is poor diet

SOLUTION

RxDiet provides medically tailored groceries and meal plans to meet members’ medical requirements and personal preferences. Its AI engine takes into account the real-time supply and price of groceries to increase cost efficiency and minimise waste. Its automated supply chain makes food-as-medicine intervention accessible to members in urban New York and rural Georgia alike. Paired with coaching, RxDiet members not only improve their health but also build lasting healthy food habits.

3.36 HbA1c reduction for members using RxDiet1

RxDiet is aiming to achieve the following by 2030: 290M+ healthy meals delivered 593k+ Quality-adjusted Life Years (QALY) saved $700M food waste saved due to AI meal planning

1 HbA1c refers to average blood glucose (sugar) level

PROBLEM

Cancer is a leading cause of death, accounting for nearly one in six deaths globally. In the US alone, costs associated with cancer total over $200B per year. Whilst we know that early and optimised intervention can improve survival rates, current methods of optimising treatment and predicting recurrence are manual, subjective, and often costly as doctors rely on trial and error and generalised treatments.

1 in 6 deaths can be attributed to cancer

SOLUTION

Ataraxis has developed a platform that combines complex digital patient data with images and clinical information for a multimodal approach to predictive diagnosis. The system elevates the standard of care by aiding doctors in making more personalised treatment decisions while saving time and cost for the healthcare system.

75% cost saving using an Ataraxis test compared to traditional testing methods

Ataraxis is aiming to achieve the following by 2030: 100k+ cancer patients served 20k+ cancer cases meaningfully impacted $1B+ savings to the health system

The Problem

Rising interest rates and soaring prices, exacerbated by wars and geopolitical tensions, have hampered efforts for economic growth following years of COVID-19. This has disproportionately affected lower-income households and SMEs.

Whilst wealth inequality between countries has decreased, it has continued to grow within countries. Unemployment rates are at an all-time low, yet wealth continues to accumulate among the richest 10% of the population.

SMEs are the backbone of economies globally, contributing to job creation and economic development. In the UK and US, they make up over 90% of businesses and 50% of employment. However, in 2023, we saw more SMEs closing down than starting up for the first time in over a decade.

Giant’s Thesis

Our inclusive capitalism thesis continues to be centred on products rebalancing the relationship between labour and capital. Technologies that are open source and affordable enable small businesses to “do more with less”, thereby reducing their exposure to the challenges of access to capital and talent. Furthermore, novel financial products, globalisation of workforce, and open infrastructure have the potential to drive social mobility and economic empowerment whilst creating business opportunities for startups.

of total wealth by the top

Giant takes a diversified approach to inclusive capitalism, given the breadth of potential impact in this theme.

Underserved segments, such as small analogue businesses and traditional sectors, such as education, are ripe for innovation. We believe that these are opportunities for venture returns alongside positive benefits of social mobility, increased educational attainment, and financial inclusion.

Equal to the population of Indonesia BY 2030

lives positively impacted

EDUCATION SMALL BUSINESSES

MARKETPLACES

Online shopping community that reduces the cost of living for its customers in Africa.

Transparent and data-driven marketplace to enable small business succession.

PAYMENTS

Collection and automation of funds distribution for SMBs to increase cost competitiveness.

PAYMENTS

Simplified for students to increase educational attainment.

A career support increase of people.

PAYMENTS & FINANCING

Simplified financial services students and universities increase tertiary educational completion and attainment.

Platform to reduce administrative burden to accessing financial, social, and tax benefits, which have a meaningful impact on social mobility.

HOUSING

career mobility platform to support upskilling and increase the income potential people.

Contractor-first renovation technology to spread tech-enabled wealth to construction workers

IS

Kapu delivers savings to consumers and increased earnings to Kapu agents

Kapu has created employment opportunities for women

“ Leonida Wamalwa, Kapu Agent

The money I make Kapu helps me my son’s fees

Kapu’s mission is to reduce the cost of living and save $1B for consumers in Africa over the next ten years.

Consumers in sub-Saharan Africa spend 40% of their daily income on groceries and household essentials. With over 80% of the population living on <$5.50 per day, they must spend little and frequently. Low purchase volumes and inefficient grocery supply chains make grocery prices 30-40% more expensive than in countries with comparable GDP per capita.

Kapu addresses this challenge by digitising group buying. Group buying lowers prices through economies of scale and reduced marketing costs. Additionally, Kapu drives cost efficiency by digitising the end-to-end buying experience and consolidating logistics movements.

Kapu not only makes day-to-day needs more affordable but also frees up income for health and education spending, which has the potential to drive intergenerational social mobility.

PROBLEM

Trillions of dollars of benefits are granted every year by governments. They have significant potential in the economic empowerment of disadvantaged and marginalised communities. However, the process of discovering and accessing these benefits is still largely analogue and complex. This means that 1 in 2 people eligible for benefits do not access them today.

! 4T+ spent on benefits per year in the EU

BonusX is a platform designed to enable easy discovery, access, and claims to social, tax, and financial benefits. Rather than having to navigate multiple organisations, fill in many forms, and wait in the dark as their application is processed, BonusX is a fully digital one-stop platform for all benefits that users are eligible for.

! 38M benefits accessed on platform in 2023, and they aim to process…

PROBLEM

The current college payment expensive, and opaque. Financial worrying about paying on time processes are often cited as students to drop out of college. the system, incurring over $100B $15B in unpaid student balances

#1 reason students didn’t was financial barriers. goes beyond cost

Meadow aims to simplify the experience from application suite of modern student billing engagement tools. It provides personalised and predictable colleges with streamlined student billing processes to reduce administrative

300k students and they

! 27B benefits by 2030 4M students by 2030

payment process is complicated, Financial reasons such as time and complicated as leading reasons for college. This is also taxing on $100B in late payments and balances annually.

didn’t earn a degree barriers. The challenge alone.

students served in 2023, they aim to serve… the student financial application to graduation with its billing and financial provides students with predictable cost of attendance and student communication and administrative friction.

There is a small business succession crisis: about 90% of US businesses are family-owned, and among those, 30% make it to a second generation, while just 12% make it to a third. At the same time, the market for buying small businesses is legacy, expensive, and typically low-trust.

6%

success rate through traditional brokerage models for small business sellers 7x

Baton’s digital marketplace connects small business sellers directly with buyers. For buyers, Baton provides vetted, high-quality listings and support throughout the buying journey. For sellers, Baton helps them strengthen their valuation and position their business for the best sale. Although a digital marketplace, a human is in the loop. This combination has increased the speed, fairness and success rate of transactions.

Increased likelihood of sale with Baton

Small businesses supported by 2030

It is now widely known that strong ESG performance is linked to improved financial performance and downside risk protection. As such, we regularly engage with our portfolio companies on ESG issues as well as impact.

Every year, Giant’s portfolio companies complete the online BImpact Assessment to better understand their impact across the ESG dimensions of governance, workers, customers, community, and environment. The assessment also includes a disclosure statement that enables us to monitor companies’ adherence to our minimum safeguarding requirements. These insights enable Giant to engage portfolio companies meaningfully on their ESG performance.

We recognise that there is still a long way to go in measuring and improving diversity and environmental footprint across the portfolio.

OVERVIEW

2,079

Total jobs created across our portfolio in 2023

B-IMPACT PERFORMANCE

89%

Completion rate of the annual B-Impact assessment

ANTI-HARASSMENT & NONDISCRIMINATION POLICIES

69%

Note on B-Impact Assessment: Giant encourages the whole investor and have information rights. The eligible sample size

14,600+ Potential jobs created across our portfolio in 2030 49%

Diverse founders

87% either prioritise or incorporate social and environmental impact in decision-making

95% improved their B-impact score since last year

We believe that Giant can best deliver positive ESG impact by supporting our portfolio companies, as many of them will (hopefully) scale quickly and expand their footprint exponentially.

As such, our priority is to work with our portfolio companies to lay strong ESG foundations. We actively support them in implementing best practice governance to minimise risks and maximise their potential positive impact.

Giant recognises that we must lead by example and that our footprint will scale as our AUM grows; therefore, we have introduced a formal ESG policy to guide our actions.

Giant’s ESG policy sets out how we systematically investments and operations.

Investments: ESG is considered at every sourcing and due diligence to decision-making

Operations: We strive to adhere to good inclusive work environment, and improve

Every Giant employee is personally responsible and incorporating ESG into investment

Highlights include:

EMost of our footprint today is made up of our office and travel.

Our office is fitted with energyefficient and smart devices to minimise waste and emissions.

We have policies and incentives to encourage sustainable travel.

In the next 5 years, we aim to improve the footprint, and build a path towards achieving

systematically integrate ESG into our

every step of the investment cycle, from decision-making and portfolio support.

good governance practices, build a fair and improve our environmental footprint.

responsible for upholding Giant’s ESG policy decision-making and portfolio support.

S50% of our team are women, and 40% of our investment team are women.

We introduced comprehensive health and wellbeing benefits for all employees.

GFor good corporate governance, we hold regular Advisory Board and LP Advisory Committee meetings and compliance training.

the diversity of our partnership, measure and reduce our environmental achieving net zero.

We recognise that impact measurement, as it relates to our portfolio companies, is a work in progress. Early-stage businesses are on a continuum of impact reporting quality. From due diligence to onboarding, we analyse and validate the impact methodology just as we scrutinise the company's economic aspects.

Post-investment, we seek continuous improvement of every company’s impact calculations. We hold quarterly reviews to challenge internal assumptions and develop more granular conversion and emission factors to more accurately reflect their footprints. We also develop new metrics as they roll out additional product offerings.

Many of Giant’s portfolio companies are still in the development phase –removing no, or only a small amount of CO2e, for example – but our investment helps them accelerate their development and achieve their impact potential.

Each company has a unique set of impact KPIs. Forward-looking KPIs are self-reported by companies unless explicitly mentioned otherwise. Because there are a limited number of companies in the Giant portfolio, and impact KPIs are specific to each company, the aggregated KPIs come from one or just a few companies where relevant.

Diversity and inclusion data is selfreported from portfolio companies.

This is a contribution-based report; therefore, we are looking at overall potential outcomes delivered by our and our portfolio companies’ activities. At this stage, we have not conducted an attribution and counterfactual analysis.

Historical data is reported for the 1 Jan 2023 to 31 Dec 2023 period.

This report has been subject to an independent review by Sustainability Analytics.

www.sustainabilityanalytics.co.uk