president’s message

The role of the Finance Officer is always changing, introducing new challenges that we address by adopting new practices, strategies and plans. As 2022 ends, I reflect on the opportunities and challenges we encountered as finance professionals in 2022 and what rests ahead for us, in 2023.

Finance Officers are preparing for implementation of the new Asset Retirement Obligation standard. To prepare our members, GFOABC held multiple interactive ARO workshops. These sessions were well attended and offered us the tools required to adopt the necessary policies, procedures and workplans for successful implementation.

The global pandemic officially ended, and we entered a new phase of managing its impacts. In 2022, we encountered challenges with retaining and recruiting staff which impacted workplans and projects across our municipalities. We continue to see economic uncertainty in the market which is impacting project budgets and timelines. As finance professionals we are being forced to find

innovative ways and strategies to lead our organizations through this economic reality.

Many municipalities are grappling with the aftermath of devasting fires and floods that have changed the landscape of communities and the lives of their residents. Finance officers continue to work with higher levels of government and locally to rebuild and address these unsurmountable events going forward. To do this effectively it takes strong collaboration within our local governments.

GFOABC’s Strategic Financial Leadership program is set to be released after significant consultation with our members. This program could not come at a better time and will provide our members with the tools required to offer strategic leadership to their organizations during a time of such uncertainty. This 10-month, cohort-based program, is a blend of in-person workshops, virtual meetings, one-on-one executive coaching, self-guided learning, and cohort collaboration. The program will help participants develop

leadership competencies, build relationships, and make a bigger impact on their organizations and their communities.

With the knowledge our members have gained through experience working in communities, GFOABC is confident that participants will leave the program with the necessary skills to meet today’s challenges. The board values the contributions from our membership and sponsors to help us ensure that the curriculum is relevant and appropriate for financial leaders. GFOABC is currently accepting expressions of interest for this program.

I wish you all the very best this holiday (and budget and audit) season and look forward to seeing you all in 2023..

Nyla Attiana, GFOABC President

Board of Directors

President, Nyla Attiana Vice President, Rianna Lachance Secretary-Treasurer, Talitha Soldera Past President, Lorraine Coughlin

Directors at Large

Julia Aspinall, City of Vancouver Shelley Hah, MFABC Kathy Humphrey, City of Kamloops Elio Iorio, District of North Vancouver Lenora Lee, KPMG

Staff

Kala Harris, Executive Director Jason Tollman, Manager, Member Services & Communications Stephanie Kast, Manager, Professional Development & Education Gerilee McBride, Graphic Design

executive director’s message

A New Year is Upon Us

Here we are again with another year in the books— time flies when you are having fun!

As we prepare to reign in the new year, it’s the perfect time to take a moment to reflect on the year that was.

Before I reflect on the year that was, I would like to begin by expressing sincere gratitude and appreciation to all our members, partners and sponsors whose participation and support makes our work possible. This association only exists because of the virtuous circle of members supporting members, partners supporting members, and sponsors supporting members directly and indirectly through GFOABC. Thank you!

This was another banner year marked by our first hybrid annual conference followed by the triumphant return of Boot Camp to the University of Victoria and finally, an overflowing Fall professional development program in Vancouver with Asset Retirement Obligations back by popular demand. We launched an Expression of Interest for the Strategic Financial Leadership Program and continue to prepare for a first cohort of the program in 2023.

Our hybrid adventure will continue this coming year with our 2023 Annual Conference, LEADING WITH PURPOSE: Creating a Culture of Collaboration. This conference will explore key topics impacting local governments, and the leadership role that finance plays in building strategic partnerships across their teams, organizations, and within their communities. We hope you will join us in person at the beautiful Fairmont

Chateau Whistler or virtually online. The conference runs from May 31 to June 2, 2023. Early bird registration opens the first week of January. If you are planning to attend in person—it’s never too early to book your accommodation .

In addition to the conference, we have a great program lineup for 2023 but if you don’t see what you are looking for let us know. No time like the present to begin preparing for 2024!

Speaking of 2024, we will begin working on our new strategic plan throughout 2023 and will be looking for member input on the online forum and program planning. Want to help? Please contact us.

Thank you to my colleagues, Jason Tollman, Manager of Member Services & Communications, and Stephanie Kast, Manager of Professional Development & Education, for their assistance and to the Board of Directors and Committee Members for their ongoing commitment, leadership, and guidance in building a strong and sustainable association.

Best wishes to everyone for a safe, happy, and healthy holiday season!

Kala Harris, Executive Director

invitation Membership

About GFOABC

GFOABC membership puts you in a league with a group of finance professionals throughout North America who are dedicated to:

• Promoting the use of efficient financial management systems in a local government setting.

• Developing individual knowledge and skills.

• Promoting the development of accounting, budgeting and financial reporting procedures in cooperation with the GFOA of the United States and Canada, CPABC, the Public-Sector Accounting Board, and similar organizations.

• Providing a forum for discussing and analyzing financial problems relevant to British Columbia and other issues of concern to public finance professionals.

GFOABC’s Focus Education

Provide high quality education, training and professional development programs by anticipating the needs of local government, proactively scanning the environment, responding to new legislative or other changes and continuously evaluating local government needs related to financial issues.

Communications

To inform, protect and connect our membership by using leading edge technology to support quality service delivery and effective decision making.

External Relationships

To increase the cooperation with operational and representative organizations that GFOABC works with or provides services to, to increase the effectiveness of GFOABC.

Who are GFOABC Members?

GFOABC members are employed in a financial capacity in municipal, regional district or related government organizations. From accounting clerks to Chief Financial Officers, their roles include a combination of administration and financial management.

GFOABC also has an Affiliate classification that is generally comprised from sectors closely involved with municipal finance, including municipal auditors, bankers, lawyers, consultants, software suppliers and more.

Member and Affiliate Benefits:

Member discounts on training, the annual conference, job postings and advertisements.

• Access to the secure online Forum.

• Members only website access to MemberLINK.

• Monthly updates & quarterly newsletters.

• Earn continuing professional development hours by participating in GFOABC activities, such as committees, working groups, facilitating a workshop and much more.

• Complimentary registration to all GFOABC webinar forums

• Participate in our Temporary Support Program to receive notifications from local governments requiring temporary support

Become a Member Today

Memberships can be purchased by a local government organization or an individual affiliate via the membership tab within MyAccount.

Please contact GFOABC with all your membership inquiries at office@gfoabc.ca or 250.382.6871

2023 events + Programming

2 0 2 3 E V E N T S + P R O G R A M M I N G

1 2 - m o n t h t a x a t i o n & a s s e s s m e n t w e b i n a r s e r i e s c o l l e c t o r s ' f o r u m a c c o u n t i n g & a u d i t i n g f o r u m p r o p e r t y t a x a t i o n 1 0 1 W e b i n a r S e r i e s p r o p e r t y t a x a t i o n 1 0 1 W e b i n a r S e r i e s

I n v e s t i n g & f i n a n c i n g f o r u m c o l l e c t o r s ' f o r u m

P r e - c o n f e r e n c e p d | f a i r m o n t c h a t e a u w h i s t l e r a s s e t m g m t i n t o l t f p e t h i c s & l e a d e r s h i p : p r i o r i t y s e t t i n g l a b

A n n u a l m u n i c i p a l t a x s a l e : L e g i s l a t i o n & l e g a l f i n a n c i a l i n d i c a t o r s r e g i o n a l d i s t r i c t d a y A n n u a l c o n f e r e n c e | f a i r m o n t c h a t e a u w h i s t l e r a c c o u n t i n g & a u d i t i n g f o r u m c o l l e c t o r s ' f o r u m b o o t c a m p : f i n a n c e o f f i c e r d e v e l o p m e n t p r o g r a m a n n u a l m u n i c i p a l t a x s a l e w e b i n a r s e r i e s A c c o u n t i n g & A u d i t i n g F o r u m i n v e s t i n g & f i n a n c i n g f o r u m c o l l e c t o r s ' f o r u m f a l l P D | c o a s t c o a l h a r b o u r H O T E L r e g i o n a l d i s t r i c t d a y P r o p e r t y T a x p o l i c y & r a t e s e t t i n g l o n g - t e r m f i n a n c i a l p l a n e t h i c s & l e a d e r s h i p C P A B C J o i n t L o c a l g o v ' t a c c T ' g & a u d ' g w o r k s h o p a c c o u n t i n g & a u d i t i n g f o r u m

w e b i n a r w e b i n a r

w e b i n a r

F r e e t o m e m b e r s F r e e t o m e m b e r s F r e e t o m e m b e r s

F r e e t o m e m b e r s F r e e t o m e m b e r s w e b i n a r

w e b i n a r w e b i n a r w e b i n a r

w e b i n a r F r e e t o m e m b e r s

j a n u a r y 1 8 J a n u a r y 2 5 m a r c h 8 a p r i l 4 , 1 1 , 1 8 a p r i l 6 , 1 3 , 2 0 a p r i l 1 8 a p r i l 2 6 M A Y 2 9 - 3 0 W h i s l t e r m a y 2 9 w h i s t l e r m a y 2 9 w h i s t l e r m a y 3 0 w h i s t l e r m a y 3 0 w h i s t l e r m a y 3 0 w h i s t l e r m a y 3 1 - J U N E 2 W h i s t l e r J U n e 1 4 j u l y 2 6 a u g u s t 1 3 - 1 7 U N I V E R S I T Y o f V I C T O R I A a u g u s t 2 9 , s e p t e m b e r 1 2 , 2 6 S e p t e m b e r 1 3 o c t o b e r 1 7 o c t o b e r 2 5 n o v e m b e r 2 1 - 2 2 V a n c o u v e r n o v e m b e r 2 1 V a n c o u v e r n o v e m b e r 2 1 V a n c o u v e r n o v e m b e r 2 2 V a n c o u v e r n o v e m b e r 2 2 V a n c o u v e r n O V E M B E R 2 3 - 2 4 v a n c o u v e r D E C E M B E R 1 3

w e b i n a r F r e e t o m e m b e r s w e b i n a r w e b i n a r w e b i n a r w e b i n a r w e b i n a r

F r e e t o m e m b e r s

E v e n t d a t e s a n d p r o g r a m m i n g a r e s u b j e c t t o c h a n g e d e p e n d i n g o n a v a i l a b i l i t y o f p r e s e n t e r s , p l e a s e c h e c k t r a i n i n g & E v e n t s f o r t h e m o s t u p t o d a t e p r o g r a m m i n g

F r e e t o m e m b e r s F r e e t o m e m b e r s v i s i t g f o a b c . c a / e v e n t s t o r e g i s t e r

gfoabc online forum

mike olson, director of finance, district of hopeAs a GFOABC member, one of the most powerful tools at your disposal is our Online Forum.

Through the Online Forum, local government finance professionals can access an archive of information going back to 2016, ask or answer questions to and from fellow finance professionals, and share pertinent documents.

We reached out to several GFOABC members who have made visiting and engaging with the forum a part of their day-to-day and will be sharing their takes over the course of the next four newsletters.

This quarter, we have Mike Olson Director of Finance for the District of Hope. Prior to his role in Hope, Mike spent his time as a Controller within the manufacturing and construction industries, and has been a long suffering San Francisco 49ers fan. Here are his answers to a few of our questions:

WHY DO YOU COME TO THE FORUM? IS LOGGING ON PART OF YOUR DAILY ROUTINE (LIKE CHECKING YOUR EMAIL)?

I come to the forum to find out about discussions that are currently happening in our industry. Being new to municipal government I use the forum as a place to see what people were saying were current issues. The theory of “you don’t know what you don’t know” applies to me. As a result, the forum is a place where I flag issues that I did not know were coming due or issues that others have been faced with that I may need to be concerned about.

My morning routine is to log on to the forum as one of the first things I do in the morning. I like to do this as it gives me a vibe for the day. Now, sometimes that vibe

is I did not even know this was an issue, but it is a vibe none the less. Overall, I find this is a great way to start the day.

HOW DO YOU THINK EXPANDED ENGAGEMENT ON THE FORUM AMONG GFOABC MEMBERS CAN HELP THEM IN THEIR DAY TO DAY?

An expanded engagement on the forum amongst GFOABC members can only help people in their day to day. Engagement can come in a variety of forums in which people use the forum. I am for most the part the classic lurker. To be clear, lurking in a forum is still a very valuable engagement for someone who is new to their role and for those that are hesitant to post.

If we as group increased our overall access to the GFOABC forum we could truly leverage all of our knowledge and experience. I see how the community interacts on the board and see how positive it is and the depth of knowledge sharing that is there. Knowing how many people were at the AGM in June this year, I can tell that we have a lot of people who are silently lurking or not using the forum. If we can get more people to contribute, we will be able to hear from more voices which will be fantastic.

WHAT FEATURES OF THE FORUM DO YOU USE THE MOST (POSTING DISCUSSIONS, COMMENTING ON EXISTING DISCUSSIONS, SEARCHING THE DATABASE FOR INFORMATION ETC.)?

The area of the forum that I use the most is reviewing of the discussions, and searching the database for information. Logging in daily, gives me that feel for the current issues. As I have gone along, I am starting to post responses to people’s discussions as I want to enhance the discussion with my posts. By being more active, my

goal is to help others, as there is no need for any of us to recreate something new when one of us has had to have seen the scenario that is being posted about.

The forum is a great resource for research. I use the search function to look for topics that I am currently dealing with. With the search function it enables searching through current and archived discussions. Although, I find the more current discussions the most relevant, there have been a couple of times where I have found information in an archived discussion to be very useful.

WHAT ARE SOME OF YOUR PERSONAL BEST PRACTICES WHEN IT COMES TO ENGAGING ON THE FORUM?

Some of the best practices I find are as follows:

• Use a detailed discussion title, for example, with Permissive Tax Exemptions, there were many topics with the label Permissive Tax Exemption, but if the headline holds a little bit more detail, such as “Permissive Tax Exemptions vs Grant?” it enables users to easily see the topic. Essentially, I treat the Discussion Title as an email subject, making it clear and distinct.

• Use Tags for the discussion. For all of us who use social media, hashtags are a way of life in communication. In this instance, we can use hashtags to find discussions and make them easier to search. A good example of a popular tag on the forum is #propertytax

• Please provide a template or answer the query in the chat. There are a few times where people have asked for templates, and the responses are that they have emailed them off. This is great for the individual who asked the question, but for the inquiring minds that did not get the response, we can only imagine what was sent

• And finally, know that this is a safe place and any question is a good question.

Thank you to Mike for his contribution for this article and his ongoing engagement on the online forum. Look out for part three in our forum series coming out in March, where we’ll hear from another highly engaged forum member.

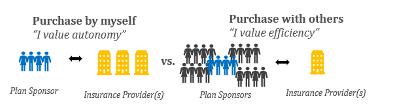

The Way You Purchase Group Benefits Influences How Much Your Plan Costs

Every group insurance program includes operating costs. Some examples of these activities are as follows:

• Claims adjudication according to the terms of the plan (typically an insurance carrier completes this function).

• An insurance carrier providing some element of insurance (varies depending on underwriting arrangement).

• Creating and maintaining plan documents (Booklets and Contracts).

• Service representatives to assist members and administrators with their inquiries (either through a broker or directly with the insurance carrier).

• Financial analysis of your plan for renewal rating purposes.

If you purchase coverage through a broker or directly with an insurance carrier, the total operating costs are funded by your plan on its own. These costs are sometimes added explicitly (for self-insured arrangements) or implicitly through the financial terms under your policy (for insured arrangements).

You can reduce the operating costs of your group benefit plan by working alongside other organizations and purchasing coverage through a pooled arrangement.

By purchasing alongside other groups, you share operating costs amongst a greater member base, and ultimately reduce your plan’s portion through economies of scale. This strategy enables small and mid-sized organizations the ability to purchase coverage according to similar terms that are enjoyed by larger groups.

In addition to reducing the operating costs under your plan, a pooled arrangement can also have the following advantages:

• Providers are more receptive to offering customized services due to the size of the existing contract. For example, the UBCM Benefit Plan has a Performance Standards Agreement with their insurance carrier (Pacific Blue Cross) which outlines the

service timelines that their participating groups will receive under the Plan. Participating members therefore receive superior service that is measured and managed over time. These groups would not be able to obtain these terms on their own outside of the pool.

• A pooled arrangement can also provide access to subject matter experts such as pharmacists, actuaries, lawyers, and disability management experts. A Plan Sponsor could engage these individuals under broker or direct models, however, doing so under a pooled arrangement as part of a broader initiative helps to reduce costs given the fees can be spread out over multiple Plan Sponsors who have similar needs.

Pooled arrangements reduce costs over the long term. That being said, they are not a “one size fits all” type of arrangement and the following considerations should be noted before joining a pool:

• Under most pooled arrangements, the choice of benefits provider (i.e., insurance carrier) is determined by the sponsor of the pool and is not chosen by the individual groups.

• Transparency is a common concern in the group benefits industry, but this can be exaggerated in some private sector pooled arrangements. If you participate in a pooled arrangement and are not aware of the financial terms, you should ask to ensure you are aware of the general process as to how your premium rates are established.

Read more about the UBCM Group Benefits plan.

This article has been drafted on behalf of the UBCM Benefits Plan, a collective of approximately 130 municipal and affiliated groups across British Columbia. If you have any questions about the Plan, please contact Elvira Khismatullina (GroupBenefitsPlan@ubcm.ca) and we would be pleased to assist you.

MFA’s Corner

taking action to reduce your cyber “in”-security

HERE ARE SOME WAYS YOU CAN IMMEDIATELY ELEVATE YOUR CYBER RESILIENCE:

• Increase minimum required password length to 15 characters

• Use a password manager to prevent password re-use and encourage good password behaviour

• Require multifactor authentication everywhere possible

• Deploy end-user security awareness training and start a phishing campaign to turn your staff into a ‘human firewall’

• Enable an “external email” identifier on all incoming emails from outside your organization

Everywhere you turn, we are bombarded with news about cybersecurity incidents, and the broad-based ramifications for the local governments involved. I think most of us can’t help but focus on our cyber IN-security! Finance teams at local governments where these events have occurred understand that technology problems rapidly become finance problems! It is hard to know where to start, what to do, and where to turn for clear information and assistance. The Municipal Finance Authority of BC has been on its own digital transformation and cybersecurity journey over the last three years, and I have some suggestions and resources to share. Cyber hygiene, like the personal hygiene we are more familiar with, is about doing the baseline, regular maintenance needed to ensure good working order. In other words, our cybersecurity posture doesn’t have to be “world class” to make a difference. I encourage you to review “Defensible Security Framework” , developed by the Province of BC. This is an actionable roadmap help you achieve cyber hygiene.

• Patch all software and firmware as soon as possible to keep your entire environment safe

• Complete a cybersecurity assessment at least annually to determine what needs work

• Incorporate the principle of “least access” by limiting administrator rights and file access to those who truly need it

• Develop strong policies and controls that balance convenience with security

• Know your vendors, confirm what they have access to, and ensure their systems are also secure

• Remove access from departed staff members and vendors who no longer work with you

• Have an Incident Response plan that may include purchasing cyber insurance and hiring an incident response service provider

• Complete regular back ups of your important data and store them away from your production environment

• Consider working with other local governments to support each other, share information, and even purchase similar tools to make collaboration easier

I recommend your IT teams join the Municipal Information Systems Association of BC (MISABC) , a group of local government technology team members who provide conferences, training, and networking with peers. Consider attending or sending your technology team members to the upcoming Vancouver International Privacy & Security Summit February 22-24, 2023. This outstanding event attracts attendees, presenters, and vendors from across North America. There will also be a Local Government Sector Day session in early February 2023 with details to be announced shortly.

Cyber security and resilience are multi-layered, ongoing activities that will continue to challenge BC local governments with constrained budgets and capacity, and ever-growing community services and expectations. The MFA acknowledges the significant financial and systemic risk this issue has for our clients and strongly encourages our members to take steps to mitigate this serious threat. Contact me directly if I can be of assistance!

SOME ADDITIONAL

RENATA HALE , Director of Technology & Strategy, is a CPA, CGA and has been with the MFA since 2002. She manages the MFA’s technology operations and has been working to enhance functionality and security while modernizing this key function since 2015. Renata also takes a lead role in stakeholder engagement, including the organization’s sponsorship & education activities, communications, creating the Annual Report, and setting annual business plans. Renata believes in staying curious and continuing to learn and grow. A self-proclaimed ‘book nerd’, she reads over 100 books every year and is always looking for recommendations.

Budget 2023 provided a number of significant financial challenges for the Capital Regional District (CRD). Yet, despite soaring inflation and various measures of cost escalation in everything from goods & services to utilities & fuel, staff were able to bring a budget forward with a tax impact of 2.3% for the CRD and 0% for the Capital Regional Hospital District (CRHD). For rate payers in Southern Vancouver Island, that’s a net impact of 1.8% while still delivering on strategic Board priorities to support community needs.

Staff believed a budget increase in line with inflation during a local government election would be untenable. As such, our dedicated staff accepted the challenge to prepare and present as modest a budget increase as possible to our Board in September 2022.

This required leading the organization through a multicriteria decision making process to fully review service plans, initiatives, and core operating functions. Through systematic prioritization of work utilizing newly developed frameworks including capital reserve & debt term guidelines, financing & investment strategies, as well as corporate planning constructs designed to measure organizational progress towards shared outcomes, the CRD Board approved the budget.

Despite focus on restraint, Budget 2023 will enable delivery of important priorities and set the organization up for continued success while protecting taxpayers in this uncertain climate. Highlights of key capital projects and investments include:

• The Hartland Renewable Natural Gas Initiative will upgrade the biogas generated at Hartland Landfill to renewable natural gas for sale to Fortis BC. This project is expected to reduce the capital region’s greenhouse gas (GHG) emissions by approximately 450,000 tonnes of carbon dioxide over the next 25 years.

• As a result of a detailed condition assessment undertaken in 2021, CRD Regional Parks has initiated critical repairs to the Selkirk Trestle beginning with

CRD Budget

preliminary repairs to pillars and support structures in 2022. Below deck repairs will continue in 2023, focusing on the remaining structural components of the trestle. The final phase of the project will include above deck surfacing and widening work, providing a 6.5m wide separated use pathway for visitors as well as lighting for visitor safety.

• Replacement of the regional water supply UV system continues in 2023. The existing UV disinfection infrastructure is reaching end-of–life status and requires replacement with modern, integrated and efficient equipment that meets Island Health and CRD requirements.

• The CRD continues to invest in affordable housing with the Regional Housing First Program and through the Capital Regional Housing Corporation (CRHC). This past year the process to replace 12 townhouses, at the CRHC’s Campus View property in Saanich, with 119 units of affordable housing began. The project is funded through the RHFP.

When presenting our budget to the Board, I open with sincere gratitude and appreciation to the talented and committed staff of the CRD, CRHD and CRHC. For the past four years we have been recognized nationally as one of Canada’s Greenest Employers and provincially in BC’s Top 100 Employers. This is a result of the incredible efforts of individual staff that I am proud to work alongside. Collectively, this dedicated team of professional is making a difference … together.

As Chief Financial Officer for the CRD, CRHD and CRHC, NELSON CHAN , MBA FCPA FCMA, brings 25 years of experience in executive leadership, strategy and business transformation. He also serves as Board Chair and Chancellor of Royal Roads University and is a Board Director for Community Living BC, the provincial crown corporation providing support services to adults with developmental disabilities.

The Long-Term Economic Sustainability of Your Municipality Will Benefit from a Climate-Risk Strategy

To maintain a high standard of living and to the support prosperity across communities, the need for planning and action on sustainability and climate change risk is now critical. Well-governed municipalities recognize that a forward-looking Sustainability Strategy and Climate Change Risk Mitigation Plan can help maintain the prosperity and standard of living that communities have become accustomed to.

The impact of Hurricane Fiona last month in Nova Scotia, Prince Edward Island and Newfoundland, with winds and storm surges measured at record levels, is among many recent reminders of the impact of climate change. Similarly, residents (and governments) in the Fraser Valley are still recovering from record rainfalls that disrupted roads, bridges and water treatment facilities, causing billions of dollars of damage in personal property and infrastructure.

As municipalities grapple with preparatory measures, several key questions are being asked. Are we aware of our most vulnerable areas and greatest risks; what is our municipality’s historical record of climate-related events; how do we protect our critical infrastructure; how are we prepared to evolve emergency management in response to climate-related event projections? Assessing the level of present risk for your municipality is a necessary first step.

Municipalities across Canada continue to recognize that infrastructure planning and construction must evolve to accommodate real climactic changes. Existing infrastructure was not built to manage today’s climactic realities, inferring new capital costs will be required to support and build new resilience. In addition to managing new infrastructure cost, attention must also be paid to supporting policies and long-term operational planning.

More and more, municipalities recognize that not acting on climate change is coming at a significant cost, both financially and to the wellbeing of the community. Investors are less likely to fund municipalities that are perceived to be vulnerable to climactic risks. The impacts include increased insurance and municipality borrowing rates as residents become more sensitive to climate risks. Municipalities now need evolved planning and new infrastructure funding that takes stock of real climactic changes that are forecast to increase in intensity and in frequency.

A well-crafted Sustainability Strategy and Climate Change Risk Mitigation Plan can support your municipality on a better path to manage risks and realize opportunities in the future. Be it accessing lower cost capital, attracting new business, or welcoming population growth to your municipality, thoughtful planning can position your municipality as one where both businesses and residents want to be.

PIERRE TAILLEFER is the partner leading the BDO Canada LLP Environment, Social and Governance (ESG) practice. He has more than thirty years of in-depth experience including seven years as an external auditor and over twenty- three years performing both sustainability, assurance and risk-related advisory engagements.

SIMON HUTTON is a Director in BDO’s Vancouver office with over 15 years of global experience providing strategic, investment, and ESG advisory services to senior executives across a variety of sectors. Simon specializes in growth strategy analysis, business planning, modelling competitive differentiators, corporate communications, sustainability, and ESG strategy.

How a Court Extended the Right of an Owner to Challenge a Tax Sale

• The owner can sue to set aside the sale

• Council can cancel a sale based on a manifest error in the sale process.

After the redemption period ends:

• The owner can sue for compensation for the loss of their property. However, this relief is not available if the owner had actual knowledge of the sale prior to the expiry of the redemption period.

The LGA provides that after the redemption period ends, no action may be brought to set aside the sale. This gives certainty for the purchaser, who can be assured that the property is theirs once the redemption period ends.

Every year local governments are required to offer for sale at public auction properties on which delinquent taxes are owed. For properties sold at tax sales the Local Government Act (“LGA”) requires local governments to provide written notice to owners and charge holders that a property was sold. The notice must be given within three months of the sale, by personal service or registered mail. The notice must set out the deadline for redemption, being one year from the day the tax sale began. These provisions are designed to provide plenty of opportunity for owners to redeem their property.

The LGA provides for relief to owners and charge holders who were not notified in accordance with the LGA. The relief available depends on whether the redemption period has lapsed. Before the redemption period ends:

In 521006 BC Ltd. v Pemberton (Village), the Village of Pemberton sold two parcels at a tax sale and notified the owner. However, through inadvertence, the redemption deadline in the notice was incorrect by a day. When the owner attempted to redeem the properties on the deadline contained in the notice, he was in fact a day past the actual deadline. The owner sued for a declaration that the sale was invalid.

The court declared the sale to be invalid because the Village’s notice was deficient. The court found that the prohibition in the LGA against bringing an action to set aside the sale after the redemption period was not a bar to declaring that the sale was invalid. The court’s reasoning is that without effective notice, no sale in fact occurred.

This decision reinforces that local governments are required to strictly adhere to the LGA when conducting tax sales. In this case, getting the redemption deadline wrong by one day invalidated the sale. To avoid a similar situation, local governments should:

• Strongly consider cancelling the sale immediately to avoid potential liability to the owner if failure to provide notice is identified during the redemption period.

• Ensure that cancellation is affected by council during the redemption period.

The court’s decision is currently under appeal. We recommend that local governments speak with their municipal solicitor if they have questions about tax sales. Members of the MIABC can utilize Casual Legal Advice program to receive up to 30 minutes of free legal advice on this, or any other legal issue.

MARINA SEN-PARTRIDGE , CIP, CAIB, CRM is the Manager of Member Engagement and a licensed insurance broker at the MIABC. She believes her work goes far beyond the placement of an insurance policy. She’s passionate about connecting local governments with the tools they need to meet their ever-changing needs and focus on what’s most important to them – serving their communities.

DEVIN BUCHANAN is a Senior Associate at Fulton & Company. Devin’s local government practice includes strategic advice and litigation, construction disputes and builders liens, property and contract disputes and insurance claims. He enjoys deconstructing complex legal problems to offer meaningful resolutions.

Inflation and Interest Rate Outlook

The post-pandemic economy has left all economic actors grappling with high levels of uncertainty. Workers, investors, businesses, financial institution, and policymakers, all face elevated levels of uncertainty about the future state of the economy in the near and medium term. The major concerns have been revolving around three terms: inflation, interest rate, and recession. “When will the inflation rate return to normal levels?”, “how far will the central banks go in hiking interest rates?”, “will the rising interest rates cause a recession?”

WHEN WILL THE INFLATION RATE RETURN TO NORMAL LEVELS?

The CPI inflation in Canada rose to the peak of 8.1% in June, and while declining for three consecutive months, stood at 6.8% in September, much higher than the Bank of Canada 2% target. As the major shocks contributing to the rising prices (government deficit spending, commodity prices, and supply chain disruptions) dissipate, it is unlikely to see a rise in the inflation rate absent an unexpected shock to the economy. However, there are still inflationary elements currently active in the economy. Amid a very tight labour market, wage growth remains higher than historical averages and the household disposable income continues to be elevated. Both channels could exacerbate demand-supply imbalances, keeping inflation from returning to the target rate. All factors considered; it is expected that the CPI inflation rate returns to the 2% target by early 2024.

HOW FAR WILL THE CENTRAL BANKS GO IN HIKING INTEREST RATES?

The overnight rate rose from its effective lower bound of 0.25% to 3.75% during 2022, the fastest increase in decades. With the inflation falling for three consecutive months, and potential for the non-policy elements

pushing it even closer to the target rate, it is expected that the bank of Canada moderates its rate hikes into next year, keeping the rate in the in the 4.25 to 4.5% level while they await further data on inflation.

A major concern in conducting monetary policy in the current environment is the possibility of an economic downturn following rising interest rates. The interest rate decisions in 2023 will depend on the new data on inflation and economic activity. The central bank will likely keep the interest rate at its peak if the deflationary forces fail to bring inflation closer to the 2% by the end of 2023.

WILL THE RISING INTEREST RATES CAUSE A RECESSION?

When prices rise rapidly and interest rates are low, businesses expand, invest more, and hire more workers, causing a boom. With the interest rates remaining below the rate of inflation since 2020, the post-pandemic recovery saw such a boom. The recent interest rate hikes and rising uncertainties in the economy have led the Canadian businesses to lower their investment for the first time since the start of the pandemic. 2023 will either see a decline in the inflation rate or a continued rise in interest rates, either of which will act as a drag on business expansion and GDP growth. Continued contraction in investment by firms can lead to a looser labor market, lowered economic activity, and maybe a recession in 2023.

SOHEIL MAHMOODZADEH obtained his PhD in Economics from Simon Fraser University in 2015. After spending two years as a member of the research team at the Economics Department of the University of Cambridge in the UK, Soheil joined Canadian Western Bank (CWB) risk group and currently works as the Chief Economist.

Perspectives on PS 3280 Asset Retirement Obligations

The latest session of the GFOABC Asset Retirement Obligations (“ARO”) workshop highlighted the fact that most organizations are well into scoping activities and moving into the measurement phase of their implementation projects. What was also evident is the increasing number of questions and challenges about the complex and nuanced guidance in PS 3280 Asset Retirement Obligations (“PS 3280”), particularly in areas where the guidance is purposely open-ended or not prescriptive.

Public sector entities are being challenged to apply PS 3280, leverage data that is often imperfect, make assumptions and judgments, and use internal team members’ insights to derive a reasonable (and auditable) estimate for the ARO liability. In some cases, technical guidance provided in PS 3280 can be interpreted in multiple ways, with different interpretations each being reasonable and supportable. The good news is that many of the challenges and questions arising are common across the public sector.

To help address common challenges and questions, KPMG Canada has authored the Perspectives on PS 3280 Asset Retirement Obligations guide, which provides KPMG’s perspective on key implementation issues and technical interpretations of the PS 3280 guidance. It provides insights into challenges that public sector entities are likely to face as they implement the standard for the first time and establish a process for the review of the obligation at each financial reporting date. This guide aims to help management and other stakeholders

by discussing key matters arising from implementation of the standard. Some of the questions answered by the guide include:

• Should an ARO be recorded when the tangible capital asset is acquired or when the legal act, regulation or bylaw creating the obligation came into effect?

• Should an ARO liability be recorded if a lease agreement includes a legal obligation to perform retirement activities but the lease term continues to be renewed indefinitely?

• Should tangible capital asset useful lives be revised as part of the ARO implementation project?

• Should the estimated ARO costs be discounted, and if so, what is the appropriate discount rate?

• What is the impact of PS 3280 on solid waste landfill closure and post-closure costs?

• What are the financial statement impacts of the different transition method options?

KPMG’s guide strives to enhance consistency in the application of the PS 3280 technical guidance and provide insights into how key implementation decisions will impact the financial statements. A copy of the guide can be accessed on KPMG’s ARO portal

ASIFA HIRJI is a Partner with KPMG providing public sector audit and accounting advisory services. Asifa is the BC Local Government Sector Audit Leader and BC ARO Leader for KPMG. Asifa co-facilitated GFOABC’s ARO workshops, which provided insights into the ARO implementation process. She has co-authored KPMG’s ARO Interpretative Guide.

Member Spotlight

Genelle Davidson

For this quarters’ member spotlight, GFOABC would like to celebrate Genelle Davidson from the City of Kelowna.

Genelle was recently featured in Municipal World’s 2022 Women of Influence article. The article discusses her achievements as the first woman to hold the role of Divisional Director of Financial Services for the City of Kelowna, and her implementation of financial management programs that have helped Kelowna grow from a mid-size city to a large.

During her tenure, Genelle has also implemented several strategic plans & principles that helped set up the City of Kelowna for financial success for years to come.

Along with her outstanding leadership at the City of Kelowna, Genelle has been a long-time supporter of GFOABC, serving as President through the COVID-19 Pandemic. The article also talks about her strong belief in diversity, equity, and inclusion and how Genelle has ensured City staff are treated fairly.

Congratulations to Genelle for this well-deserved recognition. Our entire GFOABC community thanks you for your service and for being a prime example of how to build a career through passion, fairness, and hard work.

collectors’ corner

the permissive tax exemption dilemma

Are

Permissive Tax Exemptions

(PTE) the best way to achieve the Council objective of decreasing or eliminating municipal property taxes for eligible non-profit organizations? Consider the unintended consequences and drawbacks to this approach.

The property taxes charged by the other authorities (e.g., School, BCA, MFA, RD) are also shifted to the remaining taxpayers; whereas Council is attempting to shift just the municipal portion that they control. The PTE bylaws must be adopted and submitted to BC Assessment by October 31st of the preceding year. At that stage in the financial planning process, Council can only estimate the taxes that would be exempt. This early deadline takes PTE off the table in the financial planning process because the bylaws are already adopted by the time the hard decisions are on the table. Though PTEs are transparent, being presented and adopted at open Council meetings and advertised for two subsequent weeks, do taxpayers understand the dollar impact to them? PTEs require a surprising amount of staff time collecting and organizing the applications, summarizing the portion of assessed values that would qualify for an exemption, estimating the financial

impact, assessing the applications against Council criteria, and preparing the recommendation, bylaws, and advertising. If assessing the non-profits’ “financial need” is a PTE policy criteria, this can be difficult. What “financial need” metrics are most fair? What about non-profits that are mainly provincially funded?

This brings us back to the question - what is the purpose of PTE? Is it to decrease or exempt municipal taxes for non-profits so that they can continue contributing to the community in a way that aligns with Council’s strategic priorities? Could a grant-in-aid in the amount of the current year municipal property taxes be given in May after the non-profit’s property tax bill is known but before it is due? Or should the grants-in-aid not be tied to the municipal property tax amount but to the actual need of the non-profit? This, in turn, could be handled through the usual approach for grants-in-aid.

Grants-in-aid require less staff time and are a more agile tool for matching financial assistance with financial need. They solve the unintended consequence of shifting tax burdens levied by other authorities. A budget for grants-in-aid can be easily established without needing to know the estimated future

assessed values of the applicants’ property and the estimated property tax rate. Grants-in-aid are part of the financial planning process so if the property tax rate is inching too high, the grants-in-aid limit can be assessed. The public is also able to easily understand how grants-in-aid assist non-profits compared to the PTE approach. Over time, grants-inaid will likely result in shifting the financial assistance amongst the non-profits that receive PTE since financial need will be the driving factor for financial assistance and not the size of their property tax bill.

There are more questions than answers at this point but perhaps this topic deserves some collaborative consideration from all parties involved to ensure financial need and financial assistance are matched as accurately and efficiently as possible.

MALLORY DENNISTON is the Chief Financial Officer for the City of Powell River. She has been with the City for 6 years. Prior to joining the City, Mallory worked as a Business Analyst for Catalyst Paper in Powell River. She is a CA, CPA with a Masters in Professional Accounting.

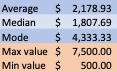

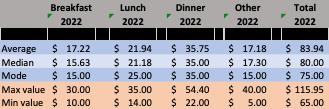

quarterly question results

Travel and Training

What does travel and training look like in BC local government? You responded and the results present a varied approach.

We asked you about per diems, travel, tipping and training budgets.

PER DIEM RATES REPORTED:

TRAINING BUDGETS FOR FINANCE DEPARTMENT STAFF PER EMPLOYEE REPORTED:

Tipping?

• 82% of local governments report that their policy does not include a tipping restriction

• 11% reported that tipping is restricted at 15%

• One local government reports that tipping is prohibited

• Two outliers reported tipping restrictions of 18% and 20%

Accomodations:

• Only 5% of local governments reported having a maximum dollar cap on hotel charges

For detailed results for this question or any past question, please contact surveys@civicinfo.bc.ca.

A PLEASE USE THIS LINK TO BE A PART OF THE RESULTS OF THE NEXT QUARTERLY QUESTION. YOUR PEERS WILL THANK YOU!

The survey should only take about 3–5 minutes to complete. The responses to this question will be profiled in the next GFOABC Newsletter.

If you have a topic for a future quarterly question, please contact the office at office@gfoabc.ca or (250) 382-6871

If you would like to learn more about this free service, contact CivicInfoBC at info@civicinfo.bc.ca

NEXT NEWSLETTER PUBLICATION IS MARCH

Please contact us if you would like to submit an article or suggest a newsletter topic: office@gfoabc.ca • (250) 382-6871

Thank You Exhibitors

Thank You Sponsors

PLATINUM GOLD SILVER BRONZE

Would you like to see your logo here? Become a GFOABC sponsor today. office@gfoabc.ca • (250) 382-6871