1 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation Rural Georgia Q3 Quarterly Economic Report 2023 Georgia Chamber Foundation www.gachamber.com

The Georgia Chamber’s Quarterly Economic Report provides business and community leaders with key statistics and trends to advance economic prosperity in the Peach State. This quarterly report will focus on rural prosperity because Georgia’s future depends on statewide success regardless of your zip code.

Without a doubt, rural Georgia has seen challenges in the last decade, but things are turning around. The Georgia Chamber of Commerce launched its Center for Rural Prosperity in 2017 to bolster its commitment to rural economies across the state, understanding unique solutions are needed to ensure prosperity. Thoughtful and steadfast leadership from Governor Kemp, Lieutenant Governor Jones, Speaker Burns and the Georgia General Assembly have resulted in continued growth and development in our rural communities.

This report provides relevant metrics about the current state of rural Georgia and highlights opportunities to enhance prosperity in the New Georgia Economy. Data highlighting demographic trends, infrastructure of the future, the war for talent, and economic dynamism are presented to help state and community leaders strategically discern the most effective next steps. The Georgia Chamber believes these areas will be the key to continued economic success for the state over the long-term. Thus, it is vital that these areas are well understood from a rural perspective in order to drive competitiveness and increased opportunity.

RURAL PROSPERITY HIGHLIGHTS

Demographic and Community Development Trends

Population growth in rural communities and for the state as a whole, will come from migration, as birth rates continue to decline.

The senior population growth rates in rural Georgia have historically been higher than the state average. Individuals over 65 years old are the fastest growing population in the state, but the increased growth translates to a more significant impact on rural communities 9

War for Talent

By 2032, Rural Georgia will add more than 780,000 jobs. Currently, there are 1,281, 859 individuals engaged in the workforce.10 Furthermore, 1.09 million rural Georgians are projected to retire in the next ten years. This churn represents a huge opportunity to reskill and realign for evolving workforce needs.11

Infrastructure of the Future

Roads and Bridges :

Nearly one-fourth of personal vehicle miles traveled in Georgia are on rural roadways.12

Broadband:

Every county where more than 25% of the county is unserved is rural. Every county where more than 50% of the county is unserved is rural.

Healthcare :

28% of Georgia’s rural hospitals are at risk of closure.13

Economic Dynamism

Small business transactions account for over 45% of all business sales in rural Georgia, proving small businesses play a substantial role in rural economies.14

The agriculture industry is projected to increase employment by over 8,000 jobs from 2020 to 2030, nearly a 9% increase.15

2 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

INDICATORS Labor Force Participation Rate1 61.3% (Q2 2023) 61.0% (Q1 2023) Year over Year Change in Job Postings2 -13% (Q2 2023) -19% (Q1 2023) Unemployment Rate3 3.2% (Q2 2023) 3.3% (Q1 2023) Real Georgia GDP4 $600,345.30 M (Q1 2023) $596,861.80 M (Q4 2022) Manufacturing GDP5 $76,665 million (Q1 2023) $76,157 million (Q4 2022) New Private Housing Units Authorized by Permit6 5,971 (Q2 2023 Avg) 5,409 (Q1 2023 Avg) Business Applications7 70,278 (Q2 2023 Total) 69,587 (Q1 2023 Total) TEU Throughput8 1,191,022 (Q2 2023 Total) 1,184,387 (Q1 2023 Total)

QUARTERLY ECONOMIC

DRIVING TRENDS

Driving Trends

Georgia has been the number one state in the nation in which to do business for nine consecutive years. Over the last four years, the state has continued to break economic development records with 77% of this economic activity occurring outside of Atlanta. In fiscal year 2023, 82% of new jobs and more than $20 billion in investment occurred in communities outside of Metro Atlanta.16 The innumerable assets and strengths of our rural communities leave them poised for continued growth, however there are looming risks. It is integral to understand how best to continue to capitalize on opportunities and mitigate those existing risks to continue to drive Georgia’s competitiveness for years to come.

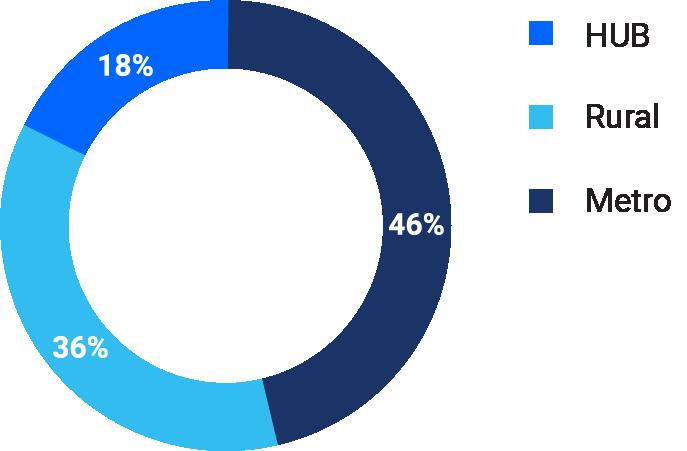

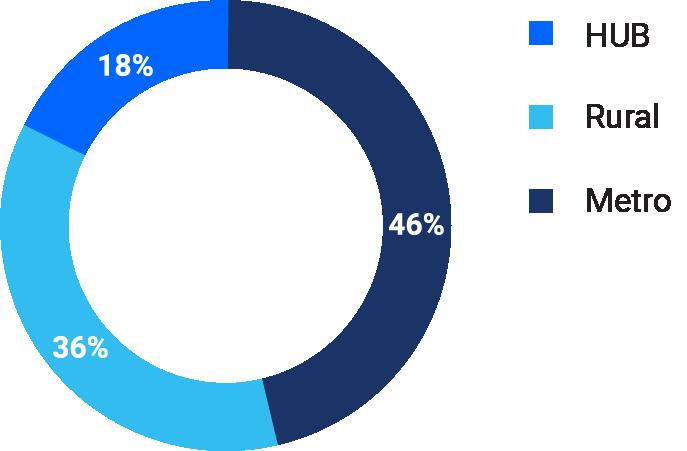

Population Growth: By 2050, Georgia’s population is projected to grow to 13,390,283, an increase of nearly 2.5 million individuals. Specifically, rural Georgia’s population will increase by 20%. Metro Atlanta is projected to increase by 31% and Hub counties’ population will grow by 18%.17 This demonstrates that growth will continue in rural Georgia over the long-term but certain counties will not experience the same rate of growth and others will experience losses. Thoughtful and strategic planning is needed to manage these population shifts, capitalizing on resources and strengths, partnering regionally, and mitigating risks.

Job Growth: By 2050, there is an expected 46% growth in jobs statewide. In rural Georgia, a 45% increase in jobs is projected, just slightly below the state average but over the projected 30% job growth in Hub counties. Metro Atlanta is expected to have a 53% increase in jobs.18 This proves that numerous industries that currently thrive in rural communities are projected to grow at a significant rate through 2050. Strategic investments in industries that have built the rural economy will help make sure this growth comes to fruition.

Opportunities:

War for Talent - By 2032, Rural Georgia will add more than 780,000 jobs and with 1.09 million rural Georgians projected to retire in the next ten years19 , alignment between skills and workforce needs must remain a focal point. Current challenges to attracting talent in these communities include lower labor force participation rates, fewer building permits for housing , and 25% of rural children living in poverty. 20 However, these challenges can be mitigated with greater investments in workforce development programs in K-12 education, creative solutions to local housing needs, and increased training for adults looking to upskill.

Infrastructure of the Future - Critical infrastructure is integral to Georgia’s long-term economic prosperity and a significant portion of rural Georgia’s advantage. Investments are needed to maintain roads, bridges, airports, and rail to provide much needed rural connectivity to the rest of the state. Investments in broadband and healthcare are also needed and will significantly impact the future of rural Georgia.

Economic Dynamism - Rural entrepreneurs see great opportunity, but need additional support and resources to build businesses that can successfully launch and expand over time. Innovation in mainstay industries in rural Georgiasuch as agriculture, are essential to fostering an agile, dynamic economy that can respond to the challenges of today and those yet to come.

3 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

DEVELOPMENT TRENDS

Demographic and Community Development Trends

Economic Development Highlights

Over the last 4 years, Georgia has experienced record economic growth. 77% of this economic activity has been in rural Georgia. 21

In FY 2023, Georgia once again broke previous records with new investments totaling more than $24 billion and 38,400 jobs from 426 projects. 22

82% of new jobs and more than $20 billion in investment are headed to communities outside of Metro Atlanta.23

This signals that the future of Georgia is dependent upon statewide economic growth, and it is vital to maintain strategic economic development initiatives focused on rural prosperity.

A Historical Perspective on the State of Rural Georgia

From 2010 to 2020, the highest growth rates were in the Atlanta Regional Commission, closely followed by Northeast Georgia surrounding Athens-Clarke County, and coastal Georgia from Augusta to Brunswick. 25

This demonstrates that although the fastest growth was in Metro Atlanta, significant economic activity occurred in areas outside of metro and suburban areas.

A notable trend over this period is the difference in growth rates between northern rural counties and southern rural counties, with the northern half generally experiencing higher growth rates.

Since 2010, 68 counties in Georgia have lost population and all of them are rural.26

In Georgia from 2010 to 2020, Asian and Hispanic populations have experienced the highest rates of population growth. Diverse populations have grown the most in northwest and east Georgia. 27

Historical Population Growth

To see Historical Population Growth by County, click HERE.

4 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

From 2010 to 2020, Georgia was the 13th fastest growing state by rate at 10.6%, but the 4th fastest growing state by population, behind only Texas, California and Florida.24

Region 2010 to 2015 2015 to 2020 2010 to 2020 Georgia 4.80% 5.22% 10.28% Rural 1.27% 4.84% 6.17% Hub 4.14% 2.65% 6.90% Metro Atlanta 8.01% 6.60% 15.13%

DEVELOPMENT TRENDS

by Race from 2010 to 2020 28

Current State of Rural Georgia: Demographic Trends

Working Age Adult Demographics

The largest share of rural Georgia’s adult population represents those ages 20 to 44 which bodes well when considering the need to grow the rural workforce. 29 It will be critical to retain those individuals in rural communities through good employment options, amenities, and affordable, quality housing.

Working Age

by Community Type 30

Household Median Income

Georgia’s median income in 2020 is estimated at $62,800. 31 Rural Georgia’s median income is the lowest in terms of type of community, but only slightly below the Hub average.

• Average Rural county median income: $50,200

• Average Hub county median income: $54,800

• Average Metro Atlanta county median income: $77,000

Poverty Rate

In 2021, 14.2% of all Georgians were living in poverty, and the counties experiencing the top 10 highest poverty rates are all rural. 32 On average, the highest percentage of residents living in poverty are in rural counties.

• Rural Poverty Rate: On average, 18.66% of residents in a rural county live in poverty

• Hub Poverty Rate: On average, 18.44% of residents in a Hub county live in poverty

• Metro Atlanta Poverty Rate: On average, 10.47% of residents in a Metro Atlanta county live in poverty 10.47% in Metro Atlanta counties.

Poverty represents a significant challenge for rural leaders, but an incredible opportunity to break generational cycles that limit families from prospering.

5 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

Population Growth

Georgians

Region Total Population Hispanic/ Latino White Black or African American American Indian Asian Pacific Islander Other Two or More Races Georgia 37.32% 31.60% -0.96% 12.62% -4.25% 52.61% 18.42% 191.98% 156.70% Rural 5.52% 32.79% -0.09% 2.66% -8.21% 35.63% 21.68% 234.39% 185.45% Hub 26.37% 31.03% -1.01% 7.84% -1.91% 34.34% 24.15% 199.57% 144.17% Metro Atlanta 85.99% 31.34% -2.03% 19.92% -1.36% 57.68% 9.52% 176.58% 144.38% 2023 Share of Population Ages 20-44 Share of Population Ages 45-64 Share of Population Aged 65+ Georgia 33.53% 24.96% 16.19% Rural 31.49% 25.08% 18.51% Hub 34.65% 22.75% 16.84% Metro Atlanta 34.62% 25.75% 14.19%

DEVELOPMENT TRENDS

Educational Attainment

Educational attainment rates in rural communities are lower than in urban communities.

From 2017 to 2021 in urban communities, 34% of people have a bachelor’s degree or higher, and the share of people with less than a high school diploma has decreased from 13% to 11%. Conversely, of residents in rural Georgia, measured over that same time period, 17% of people have a bachelor’s degree or higher, and 16% of people have less than a high school diploma. 33

This demonstrates that increasing the skills of its citizens must be an integral part of rural Georgia’s workforce strategy. All industries will require more skills in our ever-evolving economy making it foundational to the future success of rural economies.

This means it is vital to ensure services older Georgians will need, including those related to healthcare and aging, have the capacity for growth.

Future State of Rural Georgia: Population Growth Projections

Population Projection Demographic Trends by Age and Race: 35

Rural Georgia is expected to experience decline in age groups 0 to 19 and 20 to 64 through 2030.

Rural populations aged 20-29 are projected to grow until 2035, then decline through 2045 before beginning to recover

Rural populations aged 30 to 64 are projected to continue to decline until leveling, and beginning to recover near 2035

The Northeast Georgia Mountain, Northeast Georgia, and Coastal Georgia rural regions are exceptions to this trend, which experience significant growth in this population

Across all rural Georgia, Hispanic populations are expected to grow at rates higher than any other race or ethnic group.

Rural counties in middle and South Georgia are projected to experience the most population decline in the state. Population growth in rural communities and across the state will come from migration as birth rates continue to decline The senior population growth rates in rural Georgia have historically been higher than in the state as a whole. The senior population in rural Georgia grew at nearly 20% in 2020 compared to 15% across the state, and is projected to grow 2-3 percentage points higher by 2040. Individuals over 65 years old are the fastest growing population in the state, but the increased growth translates to a more significant impact in rural communities. This means it is vital to ensure services older Georgians will need, include those related to healthcare and aging, have the capacity for growth.

Projected Population Growth by Race 36

6 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

Both urban and rural counties have approximately 22% of people with some college or technical training beyond high school.34

2023 to 2040 Total Population Growth Black or African American Hispanic Other White Georgia 17.44% 30.9% 28.83% 7.35% Rural 13.57% 34.88% 30.37% 7.35% Hub 11.05% 29.79% 17.57% 6.41% Metro 21.48% 29.52% 32.03% 7.81%

War for Talent

Fast Facts Higher Education by the numbers

10 12

9

9 Main Campuses

The breadth of universities and colleges in rural Georgia proves there are numerous higher education partners to tackle upskilling and prepare the next generation for the workforce.

State of Rural Georgia Workforce

By 2032, rural Georgia will add more than 780,000 jobs. Currently, there are 1,281, 859 individuals engaged in the workforce. Furthermore, 1.09 million rural Georgians are projected to retire in the next ten years.40

This significant churn represents an incredible opportunity, but necessitates strategic, coordinated efforts to ensure individuals have the skills to be successful in their local industries. Rural Georgia’s labor force participation rate of 57.5% falls below the state average of 61.6%. 41 Monthly mortgage payment have increased by $392.53 over the last two years for the average rural Georgia household. 42

Rural Job Growth Projections

From 2023 to 2050, rural Georgia counties are projected to experience job growth of 45%, slightly below Georgia’s growth of 46%, and Metro Atlanta’s growth of 53%, but above Hub growth of 30%. However, by 2060, rural Georgia counties, at a projected growth rate of 69%, is expected to surpass growth rates of Hub counties at 41%, approaching Metro Atlanta growth levels of 75%.43

Projected Regional Employment Growth

Many of Georgia’s largest industries thrive in rural areas and those industries are integral to the state’s long-term economic success. As these industries continue to grow, increased opportunities for employment will be generated for citizens.

7 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

WAR

FOR TALENT

42 42 Additional Campuses

Main Instructional Sites

Satellite Site s Technical College System of Georgia 39 University System of Georgia 37 Independent Colleges 38

While not every rural county will experience these projected growth rates, and some counties will have higher rates, there is much about which to be optimistic. Local leaders should engage in proactive efforts to understand how best to build and support talent pipelines in their communities.

To view county level employment projections, click HERE .

Labor Force Participation Rate (LFPR)

Over the last year, the LFPR rate has declined by a small amount. In the second quarter of 2023, Georgia’s labor force participation rate was 61.6% comparatively 45:

• Rural Georgia: 57.5%

• Hub: 57%

• Metro Atlanta: 66.4%

While rural Georgia does not have the lowest labor force participation rate by type of community, it is below the state average and only slightly above the Hub average.

The labor force participation rate is an important measure because it illustrates the amount of workforce available, capturing those that might have stopped looking for work which are not included in the unemployment rate.

This demonstrates that more than 42% of the working age individuals in rural Georgia are not engaged in the workforce although they could be. Attracting these Georgians to training programs, degree programs, and directly to employers will be invaluable to growing the rural Georgia workforce.

Labor Force Participation Rate 46

8 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

Region 2023 to 2032 Jobs Added Georgia 1,021,000 Rural 139,000 Hub 231,000 Metro Atlanta 651,000 Jobs Added per Region 2023 to 2032 44

WAR FOR TALENT

1 in 4 children in rural Georgia live in poverty.48

Children in K-12 education are our future workforce. It is vital to ensure they are exposed to growing, in-demand careers, especially those with employment options in their local communities.

Poverty exacerbates this challenge, meaning it is even more important to ensure programs and resources are available in rural communities to develop individuals prepared for longterm success in their careers.

Pre-K

A key part of building proficient early learners that are better prepared for kindergarten is participation in Georgia’s Pre-K program. Lottery funded Pre-K slots offer free options for families to enroll in Pre-K programs statewide.

On average there are

• 2,924 Pre-K slots in a Metro Atlanta county

• 1,243 Pre-K slots in a Hub county

• 236 Pre-K slots in a rural county 49

Housing

County Level Mortgage Data 50

Average monthly mortgage payments have increased in every county, but counties in rural Georgia on average have experienced the least increase over the last two years.

However, the monthly mortgage payment has increased by $392.53 over the last two years for the average rural Georgia household. Increases of this size can be the difference in determining affordability for families, especially first-time home buyers.

9 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

More than one third of all students enrolled in public schools in Georgia are in rural. communities.47

State of Rural K-12 Education WAR FOR TALENT Public School Enrollment

FOR TALENT

A key driver of affordability has been the supply of housing. As our state has grown, the number of building permits has decreased since the Great Recession. More building permits were issued in the last five years of the 1990s than from 2010 to 2019.51 This historic trend, which was exacerbated during the pandemic, continues to impact communities across the state because sufficient housing has not been built.

Estimates of housing units demonstrate that the smallest percentage change in the number of units has occurred in rural counties compared to Hub and metro Atlanta counties. On average, rural counties have seen a 2.1% increase which translates to approximately 359.3 units. While smaller populations in rural counties would lead to a smaller raw number of units compared to Metro Atlanta and Hub counties, the percentage change indicates growth is slower in rural counties than others. 52

Ensuring housing stock is available is critical to effective retention and recruitment of talent for companies. Local communities’ workforce development strategies should consider housing as an important part of their plan.

Estimates of Housing in Counties 53

WAR FOR TALENT POLICY CONSIDERATIONS

Rural Georgia’s labor force participation rate necessitates solutions for the working aged population, but also at the K-12 level to increase the participation rate over the long-term. Early exposure to locally based industry in rural communities is a vital part of this effort.

Monthly mortgage payments have not increased as much in rural Georgia as other types of communities. Unfortunately, the smallest change in housing units has occurred in rural Georgia when compared to Hub counties and Metro Atlanta. Creative solutions to diversify housing stock will play an important role in addressing housing shortages in rural communities.

10 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

WAR

Region Change in Units 2020 to 2022 % Change 2020 to 2022 Georgia 116,056 2.6% Rural 359.3 2.1% Hub 1696 2.5% Metro Atlanta 4,136.6 2.8%

INFRASTRUCTURE OF THE FUTURE

Infrastructure of the Future

Fast Facts

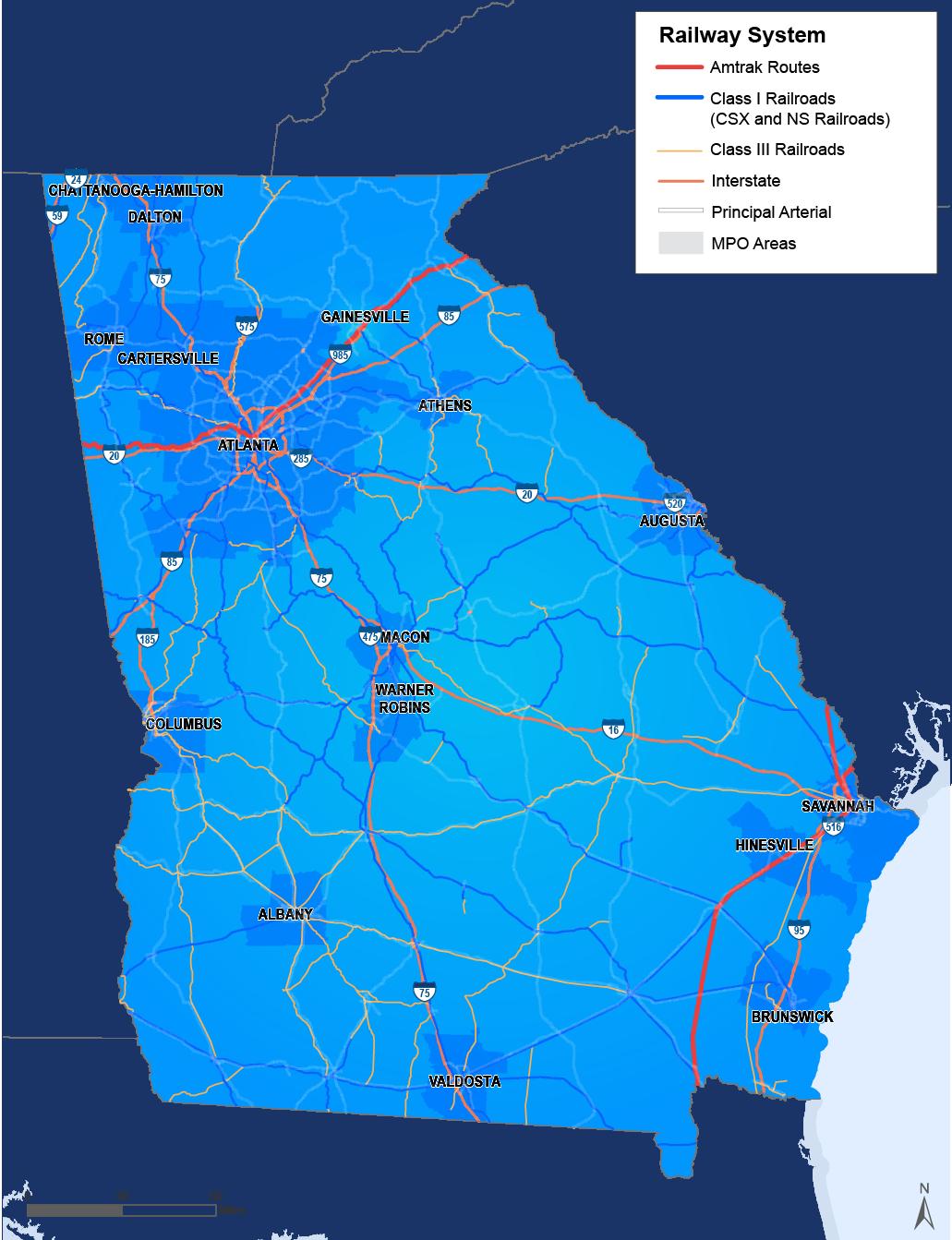

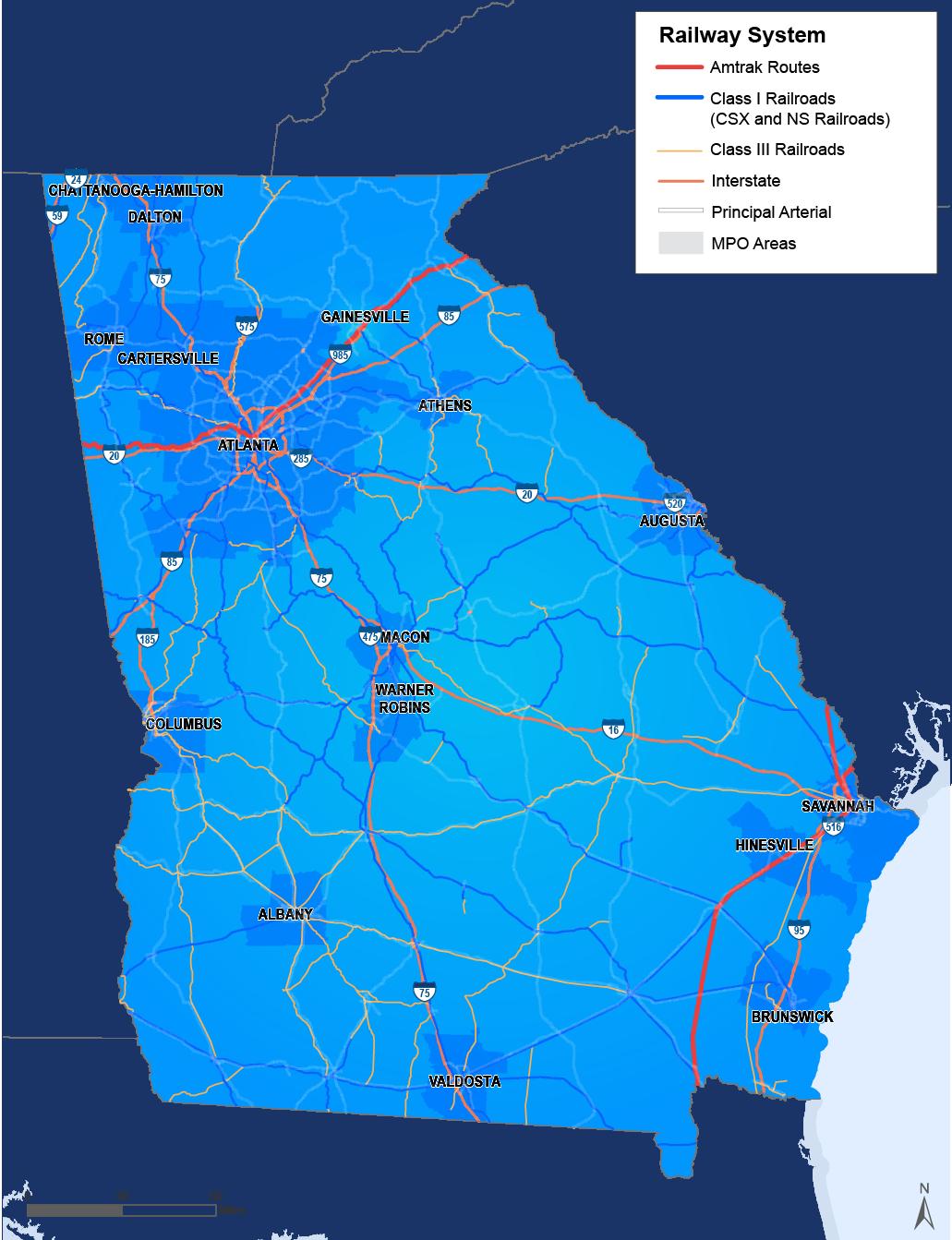

Roads, Bridges, and Freight & Logistics 54

Rural transportation networks are vital for the entire state. Rural areas account for:

• 54 percent of total lane miles on Georgia roads, meaning there are more 2,000 lane miles for every 100,000 residents.

• This is more than four times as many as the rate in metro areas.

• Nearly one-fourth of personal vehicle miles traveled in Georgia are on rural roadways

Broadband 55

• Every county where more than 25% of the county is unserved is rural.

• Every county where more than 50% of the county is unserved is rural.

Healthcare

There are 120 Georgia counties designated as rural, but only 59 total hospitals available to serve these communities leading to primary care health professional shortages in more than 200 rural designated areas. 56

28% of Georgia’s rural hospitals are at risk of closure. 57

Roads and Bridges Overview 58

Rural Georgia accounts for 54% of total lane miles on Georgia roads, more than 2,000 lane miles for every 100K residents (four times as many as in any metro).

More than half of all truck trips in Georgia pass through a rural area at some point of their journey.

There are 80 rural transit systems across the state. The highway fatality rate per 100 million vehicle-miles traveled is 56 percent higher in rural areas than in urban areas.

Weight-posted bridges require detours that are nearly 35 % longer on average in rural areas than posted bridges in Metro Atlanta. Declining bridge conditions pose a serious mobility issue for motorists and railways. 13% of bridges are posted with weight restrictions compared to 8% in Hub metros and 7% in Metro Atlanta. This is causing connectivity issues in rural Georgia.

11 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

INFRASTRUCTURE OF THE FUTURE

Air

59

Airports serve as economic drivers in rural communities. Not only do they contribute substantially to state income tax, but also employ thousands of Georgians.

In rural Georgia, direct spending and economic activity total more than $413 million and $603 million respectively.

While this is below Hub and Metro Atlanta totals, there is less airport activity in rural communities. Increased investments in rural airports will increase activity and provide greater economic opportunity for communities.

Increased economic growth can certainly be derived from growing cargo activity at rural airports. Many rural airports currently only experience occasional ad hoc operations. Gaps do exist based on demand generators, often around major interstate corridors.

12 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

Income Tax Generated by Georgia’s Airport by Community Type Economic Impact of Georgia’s Airports by Community Type State Income Tax- On-Airport Employees State Income Tax - Visitor Supported Employees Total State Income Tax Airport Management Business Tenants Capital Investment Commercial Service General Aviation Hub $1,925,130.00 $ 135,265,540.00 $1,480,240.00 $7,367,500.00 $973,400.00 $147,011,810.00 Rural $260,680.00 $4,519,780.00 $440,350.00 $ - $417,060.00 $5,637,870.00 Metro Atlanta $115,570.00 $5,686,090.00 $ 179,240.00 $ - $691,270.00 $6,672,170.00 Total Direct Employment Total Direct Total Direct Spending Total Direct Annual Economic Activity Rural 4,084 $190,382,200 $413,201,600 $603,583,800 Hub 25,323 $1,637,715,200 $1,220,383,600 $2,858,098,800 Metro Atlanta 29,407 $1,828,097,400 $1,633,585,200 $3,461,682,600 Georgia’s Current and Ad Hoc Air Activity

INFRASTRUCTURE OF THE FUTURE

Broadband

The future of rural Georgia depends on the state’s ability to ensure access to critical 21st century infrastructure, which includes broadband.

In June 2023, Governor Kemp announced $15 million in state funds for the Capital Projects Fund Grant Program. Coupled with local and private investments, there will be $30 million invested in more than 3,500 locations. Recipients of these awards are all in rural Georgia. 60

This builds upon the $234 million that was invested by the Kemp Administration in grant funds for 28 counties in the state. All 28 counties were rural.61

Governor Kemp has invested nearly $1 billion in expanding broadband access which does not include hundreds of millions in private commitments resulting from public-private partnerships.62

While significant progress has been made, due to strong partnerships among private industry, state officials and community stakeholders, additional funding is needed to address the digital divide.

Healthcare

Healthcare is critical infrastructure in a community, and this is especially true in rural cities and counties where entities often serve multiple purposes and take on more than one role. Access to affordable, high-quality care ensures citizens can remain healthy, productive, and able to contribute to their communities and families.

As mentioned earlier in this report, rural Georgia has more older individuals than other types of communities in the state, necessitating even greater access to healthcare. This trend is forecasted to remain calling for more solutions.

Preventative care is vital to manage non-communicable diseases including diabetes, heart disease, and chronic respiratory diseases. Consequentially, lack of access to preventative care and information may lead rural residents to suffer from notably higher rates of these diseases.

Data shows that almost all counties in which 30% or more of the population suffer from obesity or heart disease are rural.64

In the average rural Georgia county, about 27% of the population suffers from heart disease, which is just above the state average of 26%.65

• Of all the counties in which a third or more of the population suffers from heart disease, all but two are rural.

• Rural communities suffer from higher average poor mental health days per month, nearly 6 days per month, compared to the state average of under 5. 66

• According to data from the CDC, in 2018, the average rural county had a population with an obesity rate of 23%, compared to 29% in Metro Atlanta and 24% statewide. 67

• In the counties in which a third or more of the population is obese, all but two are rural.68

Click HERE, to see how chronic, non-communicable diseases are impacting your community.

13 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

Average Percent Population Unserved by Community Type 63 Urban HUB Rural 1.1% 4.4% 32.3%

OF THE FUTURE

Healthcare Professional Shortages

There are 120 Georgia counties designated as rural, but only 59 total hospitals available to serve these communities leading to primary care health professional shortages in more than 200 rural designated areas. 69

In the Metro Atlanta area, counties have an average of over 217 physicians per 100 thousand residents, while in rural counties, the average is only 77 per 100 thousand residents3. Advanced practice registered nurses (APRN) are also lower in non-metropolitan counties by about 2.5 APRNs per 10,000 residents. 70

Physician’s Assistant count

• The average rural county has 15 PAs per 100k residents, compared to 35 per 100k in metro Atlanta and 19 per 100k statewide. 71

Nurse count

• The average rural county has 1,417 nurses per 100k residents, compared to 1,255 in the average Metro Atlanta county and 1,414 in the average county statewide.72

Physician count

• The average Rural county has 77 physicians per 100k residents, compared to 217 per 100k in Metro Atlanta and 108 per 100k statewide.73

Rural Hospital Closure Insights 74

Research demonstrates that in rural communities that experience a hospital closure also have decreases in workforce, population, and annual county income.

Between 2005 and 2019, more than 150 rural hospitals closed in the U.S. In 2020, 18 hospitals closed.

But only six more closed in 2021 and 2022, because of the financial assistance hospitals received over the course of the pandemic.

Since 2005, 9 rural hospitals have closed in Georgia.75

When compared to other southern states, Georgia is currently outperforming as it pertains to hospitals at risk of closing and hospitals at immediate risk of closing.

14 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

State Percent Rural Hospitals at Risk of Closing Percent Rural Hospitals at Immediate Risk of Closing Georgia 28% 18% Alabama 56% 37% Mississippi 45% 32% North Carolina 19% 11% South Carolina 39% 26% Tennessee 40% 29%

INFRASTRUCTURE

Click HERE, to learn more about rural hospital closures in other states. Rural Hospital Closure Risk: Southeastern States 76

INFRASTRUCTURE OF THE FUTURE

INFRASTRUCTURE OF THE FUTURE POLICY CONSIDERATIONS

Infrastructure is a significant part of rural Georgia’s connectivity to other parts of the state. Georgians in every county benefit from the transportation activity that occurs in rural counties to bring goods and services to their homes and local businesses.

Increased funding is needed to support our freight and logistics network that utilize rural infrastructure.

Substantial resources have been devoted to rural counties for broadband advancements by Governor Kemp and numerous Georgia businesses. Gaps still exist more pervasively in rural counties than other types of communities.

Healthcare is critical infrastructure, especially in a rural economy. Innovative solutions are required to train more healthcare professionals at all skill levels, increasing access for rural Georgians.

To learn more about infrastructure of the future, please click here.

15 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

ECONOMIC DYNAMISM

Economic Dynamism

Economic dynamism refers to the frequency and pervasiveness of change across industries, geographies, and the labor market in an economy. A dynamic economy would be reflected in a state of “productive churn” where resiliency is paramount, allowing the economy and its workers to respond to disruption.77

Various indicators are utilized to measure how dynamic an economy is. The data that follows in this section illustrates key facets of Georgia’s rural economy that fuel innovation and shaping new business growth from existing industries in the form of research and development and creation of new companies. Finding success in these areas will determine Georgia’s competitiveness in the short and long-term.78

Fast Facts

Small business transactions account for over 45% of all business sales in rural Georgia.79

In the past 5 years, growth in the number of business applications in rural counties outpaced the state and metropolitan growth rates. 80

The agriculture industry is projected to increase employment by over 8,000 jobs from 2020 to 2030, nearly a 9% increase. 81

Small Business Insights 82

Rural Georgia generates 25% of total business sales in the state, and just over 30% of all small business sales in the state

Small business transactions account for over 45% of all business sales in rural Georgia. This means small businesses play a substantial role in the rural economy and are important to preserve over the long-term.

Sales growth in rural Georgia has been higher than in any other part of the state in both small business and total business sales. This growth indicates the rural economy is ripe for increased opportunity for business owners and entrepreneurs.

*Based on data available. Some discrepancies may exist due to lack of existing data from small sample sizes by county.

County Level Business Applications83

Georgia 126%, Rural 139%, Hub 154%,

Metro Atlanta 125%

Number of firms by county

In the past 5 years, growth in the number of business applications in rural counties outpaced the state and metropolitan growth rates indicating rural Georgians see substantial opportunities to turn their ideas into a successful business.

In the past 5 years, the number of firms in rural counties grew 3.2%, slightly less than the state rate of 3.7%. Metro Atlanta outpaced all regions at 6.3% and Hub metropolitans just behind rural Georgia at 2.5%. 84

These statistics show that while many individuals might have a concept for a business, there are challenges translating that into a productive business in rural Georgia. More support may be needed for entrepreneurs as they develop business models, acquire funding, and look to grow their business.

16 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

In 2020, Georgia’s Farm Gate Value was $12.2 billion and Georgia had approximately 42,400 farms encompassing nearly 10 million acres of land. 86

The agriculture industry is projected to increase employment by over 8,000 jobs from 2020 to 2030, nearly a 9% increase. 87

The majority of this employment is expected in crop production (7,860 jobs), but animal production will experience the largest growth rate (16%). 88 The Georgia economy for generations; however, this industry has innovated substantially and is poised to evolve further.

As technology in the agricultural space continues to play a more pivotal role, growers will have an opportunity to focus on improving efficiency and developing more sustainable supply chains to tackle some of our most pressing national issues. Research and development by the public and private sectors will assist in fueling this innovation, ensuring Georgia’s number one industry prospers long into the future.

ECONOMIC DYNAMISM POLICY CONSIDERATIONS

The disproportionate number of business applications as compared to steady business growth may suggest that entrepreneurs and business owners need greater resources to scale their companies.

This will come in the form of human, social, and financial capital to make sure the mentorship, partnerships, and financial support are available.

Research and development play an important part in driving innovation in the rural economy, and there is no clearer example than the agriculture industry. Additional support for research and development will bolster key rural industries to preserve and increase projected job growth.

To learn more about the case for economic dynamism please click here.

Read more at www.gachamber.com.

17 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation ECONOMIC DYNAMISM Agriculture

Agribusiness contributes an estimated $70 billion annually to Georgia’s economy, and is considered a cornerstone of Georgia’s rural economy and communities.85

Endnotes

1 United States Bureau of Labor Statistics, 2023: Labor Force Participation Rate, retrieved from FRED, Federal Reserve Bank of St. Louis

2 Lightcast Data Aggregation Software, 2023: Sources, Multiple

3 Georgia Department of Labor, 2023: Monthly Labor Force Estimates

4 United States Bureau of Economic Analysis, 2023: Real GDP: All Industry, Seasonally Adjusted, retrieved from FRED, Federal Reserve Bank of St. Louis

5 United States Bureau of Economic Analysis, 2023: GDP Manufacturing, Seasonally Adjusted, retrieved from FRED, Federal Reserve Bank of St. Louis

6 United States Census Bureau, 2023: New Private Housing Unites Authorized by Building Permits, retrieved from FRED, Federal Reserve Bank of St. Louis

7 United States Census Bureau, 2023: Business Formation Statistics by State

8 Georgia Ports, 2023: Monthly TEU Throughput ‘By the Numbers’

9 Carl Vinson Institute, 2021: Rural Georgia in Focus

10

11

Lightcast Data Aggregation Software, 2023: Source, Bureau of Labor Statistics

Lightcast Data Aggregation Software, 2023: Source, Census Bureau

12 Georgia Department of Transportation, 2023: 2021 Statewide Strategic Transportation Plan

13 Georgia Department of Community Affairs, 2023: Georgia Broadband Availability

14 Center for Healthcare Quality & Payment Reform, Accessed 2023: “Rural Hospitals at Risk of Closing”

15 Fiserv, 2023: Data provided in partnership with the Georgia Chamber of Commerce

16 Georgia department

18 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation

of Labor, 2023: Industry Outlook Data Explorer 17 Georgia Office of the Governor, 2023: “…Georgia Breaks Economic Development Records…” 18 Governor’s Office of Budget and Planning, 2023: Population Projections 19 Woods and Poole Consulting, 2022: Data provided in partnership with the Georgia Chamber of Commerce 20 Lightcast Data Aggregation Software, 2023: Source, Bureau of Labor Statistics 21 United States Census Bureau, American Community Survey 5-year estimates 22 Georgia Office of the Governor, 2023: “…Georgia Breaks Economic Development Records…” 23 Georgia Office of the Governor, 2023: “…Georgia Breaks Economic Development Records…” 24 Carl Vinson Institute, 2021: Rural Georgia in Focus 25 Carl Vinson Institute, 2021: Rural Georgia in Focus 26 Carl Vinson Institute, 2021: Rural Georgia in Focus 27 Carl Vinson Institute, 2021: Rural Georgia in Focus 28 United States Census Bureau, 2021: Historical Population Change Data 29 Lightcast Data Aggregation Software, 2023: Source, Census Bureau 30 Governor’s Office of Budget and Planning, 2023: Population Projections 31 Carl Vinson Institute, 2023: Economic Data File 32 Carl Vinson Institute, 2023: Economic Data File 33 Carl Vinson Institute, 2023: Education Attainment Dashboard 34 Carl Vinson Institute, 2023: Education Attainment Dashboard 35 Carl Vinson Institute, 2023: Population Analysis 36 Governor’s Office of Budget and Planning, 2023: Population Projections 37 University System of Georgia, 2023: USG Colleges and Universities 38 Georgia Independent College Association, 2023: Member Institutions 39 Technical College System of Georgia, 2022: Service Delivery Areas 40 Lightcast Data Aggregation Software, 2023: Source, Bureau of Labor Statistics 41 Lightcast Data Aggregation Software, 2023: Sources, Multiple 42 National Association of Realtors, 2023: County Median Home Prices... Map 43 Woods and Poole Consulting, 2022: Data provided in partnership with the Georgia Chamber of Commerce 44 Woods and Poole Consulting, 2022: Data provided in partnership with the Georgia Chamber of Commerce 45 Lightcast Data Aggregation Software, 2023: Sources, Bureau of Labor Statistics 46 Lightcast Data Aggregation Software, 2023: Sources, Bureau of Labor Statistics 47 Georgia Department of Education, 2023: Enrollment Data 48 Georgia Department of Education, 2023: Office of Deputy Superintendent Ragan-Martin 49 Geargia Early Education Alliance for Ready Students, 2023: Readiness Radar 50 National Association of Realtors, 2023: County Median Home Prices... Map 51 Georgia Public Policy Foundation, 2022: Government Regulation in the Price of a New Home: Georgia 52 National Association of Realtors, 2023: County Median Home Prices... Map 53 United States Census Bureau, 2023: National, State and County Housing Unit Totals: 2020-2022 54 Georgia Department of Transportation, 2023: 2021 Statewide Strategic Transportation Plan 55 Georgia Department of Community Affairs, 2023: Georgia Broadband Availability 56 Georgia Department of Community Health, 2023: SORH Fact Sheet 57 Center for Healthcare Quality & Payment Reform, Accessed 2023: “Rural Hospitals at Risk of Closing” 58 Georgia Department of Transportation, 2023: 2021 Statewide Strategic Transportation Plan 59 Georgia Department of Transportation, 2023: 2022 Statewide Air Cargo Study Executive Summary 60 Georgia Office of the Governor, 2023: Governor Kemp Announces Grant Funds… 61 Georgia Office of the Governor, 2023: Governor Kemp Announces Grant Funds… 62 Georgia Office of the Governor, 2023: Governor Kemp Announces Grant Funds… 63 Georgia Department of Community Affairs, 2023: Georgia Broadband Availability 64 Rural Health Information Hub, 2023: Rural Data Explorer, Obesity Prevalence

19 Rural Georgia : Q3 Quarterly Update 2023 | Georgia Chamber Foundation 65 Georgia Rural Health Innovation Center, 2023: Georgia Health Data Hub 66 Rural Health Information Hub, 2023: Rural Data Explorer, Obesity Prevalence 67 Georgia Rural Health Innovation Center, 2023: Georgia Health Data Hub 68 Centers for Disease Control, 2023: United States Diabetes Surveillance System 69 Rural Health Information Hub, 2023: Rural Data Explorer, Obesity Prevalence 70 Georgia Department of Community Health, 2023: SORH Fact Sheet 71 Insights Georgia, 2023: State of Georgia Physician Workforce 72 Insights Georgia, 2023: State of Georgia Physician Workforce 73 Insights Georgia, 2023: State of Georgia Physician Workforce 74 Insights Georgia, 2023: State of Georgia Physician Workforce 75 Center for Healthcare Quality & Payment Reform, Accessed 2023: “Rural Hospitals at Risk of Closing” 76 Center for Healthcare Quality & Payment Reform, Accessed 2023: “Rural Hospitals at Risk of Closing” 77 Center for Healthcare Quality & Payment Reform, Accessed 2023: “Rural Hospitals at Risk of Closing” 78 Economic Innovation Group, 2022: The Cast for Economic Dynamism 79 Fiserv, 2023: Data provided in partnership with the Georgia Chamber of Commerce 80 United States Census Bureau, 2023: Business Formation Statistics by State 81 Georgia department of Labor, 2023: Industry Outlook Data Explorer 82 Fiserv, 2023: Data provided in partnership with the Georgia Chamber of Commerce 83 United States Census Bureau, 2023: Business Formation Statistics by State 84 United States Census Bureau, 2020: Annual Business Survey 85 Georgia Department of Agriculture, 2023: Agribusiness 86 Georgia Farm Bureau, 2023: About Georgia Agriculture 87 Georgia department of Labor, 2023: Industry Outlook Data Explorer 88 Georgia department of Labor, 2023: Industry Outlook Data Explorer