1 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation Economic Dynamism Q2 Quarterly Economic Report 2023 Georgia Chamber Foundation www.gachamber.com

QUARTERLY ECONOMIC INDICATORS

The Georgia Chamber’s Quarterly Reports provide business and community leaders with key statistics and trends to advance economic prosperity in the Peach State. This quarterly update will focus on economic dynamism, covering key areas that drive innovation and growth for our economy.

Georgia has an incredible business climate thanks to thoughtful leadership and strategic investments which have led our state to be named the number one state in the nation for business for an unprecedented 9 consecutive years. Evolutions in our economy necessitate action in specific areas to build upon Georgia’s past success. This report provides relevant metrics about our current environment and highlights where the state can engage to drive further innovation and growth to increase dynamism in our economy.

Economic dynamism refers to the frequency and pervasiveness of change across industries, geographies, and the labor market in an economy. A dynamic economy would be reflected in a state of “productive churn” where resiliency is paramount, allowing the economy and its workers to respond to disruption. Indicators 9 used to measure dynamism generally include rates of business formation and closure and the frequency at which workers change jobs. Inherent in a dynamic economy is adaptability and resiliency. These are critical elements to increasing opportunity for individuals and businesses and ensuring the state’s competitiveness in the long-term.

In addition to these, the Georgia Chamber Foundation is focusing on the areas below to better understand dynamism in the Georgia economy. Each area plays an integral role in fueling innovation, shaping new business growth from existing industries in the form of research and development and creation of new companies, as well as establishing the state’s regulatory environment determining which activities are allowable and incentivized. Finding success in these areas will determine Georgia’s competitiveness in the short and long-term.

DYNAMISM IN GEORGIA’S ECONOMY

Competitive Fiscal and Tax Structure

Georgia ranks 8th for state and local tax burden.

The tax burden provides an average of the total taxes paid per citizen. Georgia consistently ranks in the top ten meaning our tax burden is lower than most states and keeps our state competitive.

Georgia businesses pay 44% of all state and local taxes. 10

Legal Climate

Georgia is the #1 judicial hellhole in the nation.11

Georgia ranks 7th highest in tort costs per household and Georgia ranks 9th highest for tort costs as part of GDP. 12

These indicators mean our legal environment is costing Georgia taxpayers more than almost all other states and represents a larger share of GDP than almost all other states.

Entrepreneurship and Small Business Success

Georgia is ranked 3rd in the nation for the percent of adults becoming entrepreneurs each month. 13

Georgia has the 5th largest share of minority businesses in the United States. 14

Research and Development (R&D)

R&D Investments in Georgia totaled $8.45 billion in 2020.15

In FY2022 alone, scientists in the Georgia Research Alliance Academy accounted for almost $900 million in research expenditures, which is outside of state funding.16

Georgia ranks 17th for patent creation. 17

2 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

Georgia : United States Labor Force Participation Rate1 61.0% : 62.5% (Q1 2023) 61.7% : 62.2% (Q4 2022) Year over Year Change in Job Postings2 -19% : -15.7% (Q1 2023) -11% : -4.5% (Q4 2022) Unemployment Rate3 3.3% : 3.5% (Q1 2023) 3.0% : 3.6% (Q4 2022) Real Georgia GDP4 $596.8 B : $20.18 T (Q4 2022) $591.8 B : $20.05 T (Q3 2022) Manufacturing GDP5 $76.15 B : $2.9 T (Q4 2022) $74.30 B : $2.8 T (Q3 2022) New Private Housing Units Authorized by Permit6 5,409 : 1,382,000 (Q1 2023 Avg) 5,650 : 1,405,000 (Q4 2022 Avg) Business Applications7 69,587 : 1.2 M (Q1 2023 Total) 68,942 : 1.3 M (Q4 2022 Total) TEU Throughput8 1,184,387 (Q1 2023 Total) 1,458,448 (Q4 2022 Total)

DRIVING TRENDS

Driving Trends

Georgia has been the number one state in the nation in which to do business for nine consecutive years. Our strong business climate has been thoughtfully built by competitive tax policies, proactive small business growth, and long-term investments in research and development. While our state has found unparalleled economic success, there are instances where Georgia is not reaching its full potential. By strategically focusing on specific areas for growth, we can increase our competitive advantage and opportunities for citizens.

Population Growth: By 2050, Georgia’s population is projected to grow to 13,390,283, which is an increase of nearly 2.5 million individuals18 . More individuals means greater opportunity to grow a new generation of entrepreneurs and talent to create new businesses and increase our research and development efforts. Both are critical to fostering innovation and dynamism in the economy. However, as the state is growing more diverse it is essential that necessary support is available for all Georgians to ensure our potential is achieved.

Job Growth: By 2050, there is an expected 46% growth in overall state employment 19 . This job growth means that industries have also grown, much of this driven by new technologies, consumer demands, and business models. The ability of Georgia companies and the state’s workforce development entities to keep up with these shifts will greatly impact long-term success. Additionally, new jobs mean there will be new opportunities for Georgians to advance, growing their skills and ability to contribute to the state’s economy.

Opportunities

Fueling Innovation: Georgia has made great strides in increasing research and development efforts through public and private investment. However, the state still lags behind competitor states, including Texas and North Carolina, for venture capital investment. This represents an opportunity to build upon our strong innovation ecosystem to increase outside investments in the state through R&D and venture capital as well as bolstering Georgia’s start-ups, small businesses, and entrepreneurs. Securing these investments will be vital to foster a dynamic, innovative economy for years to come.

New Business Growth: Looking at entrepreneur data, Georgia ranks 3rd nationally in the percent of adults becoming entrepreneurs each month. However, Georgia ranks 19th in opportunity share of new entrepreneurs, a metric that measures the number of people that left other activities to start a business 20 . This indicates there is an opportunity to increase access to physical and social capital to continue to support small businesses. Similarly, Georgia ranks 9th in start-up early job creation, which measures the number of jobs per 1,000 created by start-ups in their first year, but 35th in start-up early survival rate 21 . This further illustrates the need for greater access to capital and support networks for entrepreneurs to aid them in beginning and growing their small businesses.

Regulatory: Both Georgia’s corporate and personal income tax rates are significantly below the national average 22 . Furthermore, Georgia ranks in the top ten states nationally for corporate tax climate and state and local tax burden. This proves Georgians and Georgia businesses are benefitting from predictable, fiscally responsible tax policy. There are opportunities within the tax code to improve our state’s competitiveness, especially as other states are making changes to also remain competitive. Georgia’s legal climate poses challenges for the state. Georgia ranks in the top ten for highest tort costs per household, well above the national average, and for tort cost as a share of GDP. These costs impact Georgia families directly, especially as the effects of national inflation are top of mind. Common sense reforms to the civil justice system are needed to level the playing field and restore stability.

3 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

DYNAMISM

Dynamism in Georgia’s Economy: An Overview

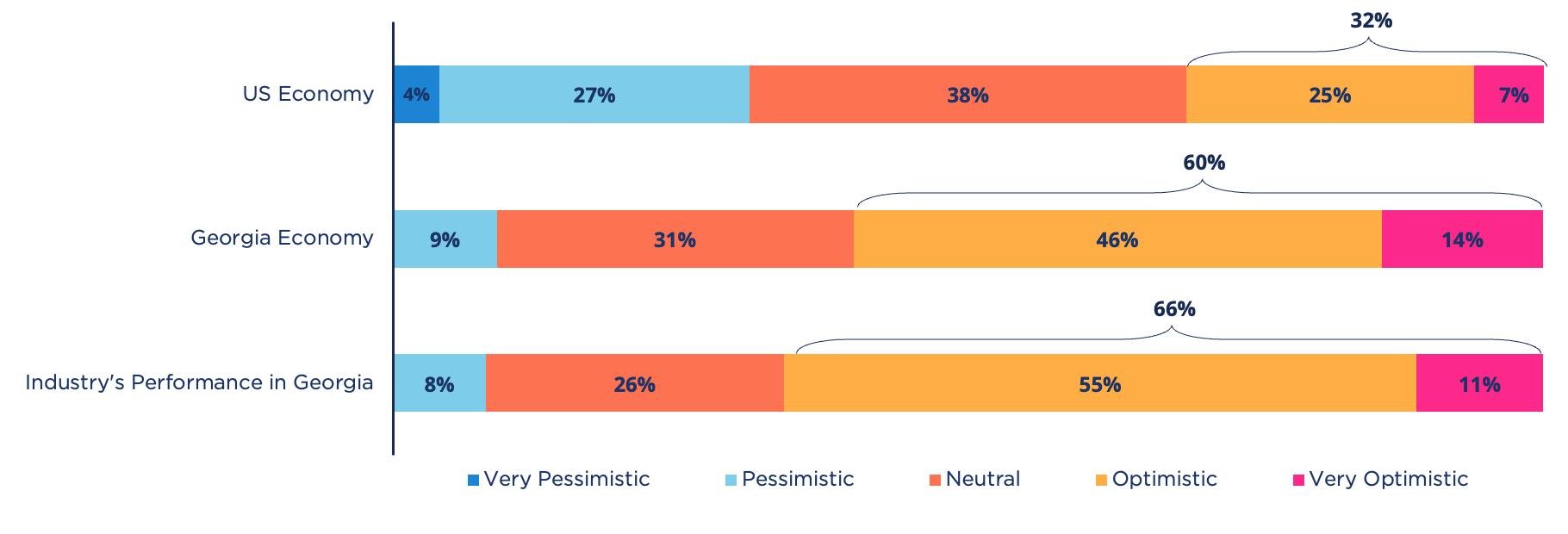

Earlier this year, the Georgia Chamber of Commerce in partnership with Deloitte Consulting LLP, completed its first annual CEO and Executive Insights Survey.

Results indicated that Georgia business leaders overwhelmingly agree that the state is a great place to operate their business in the current climate and grow their business in the long-term.

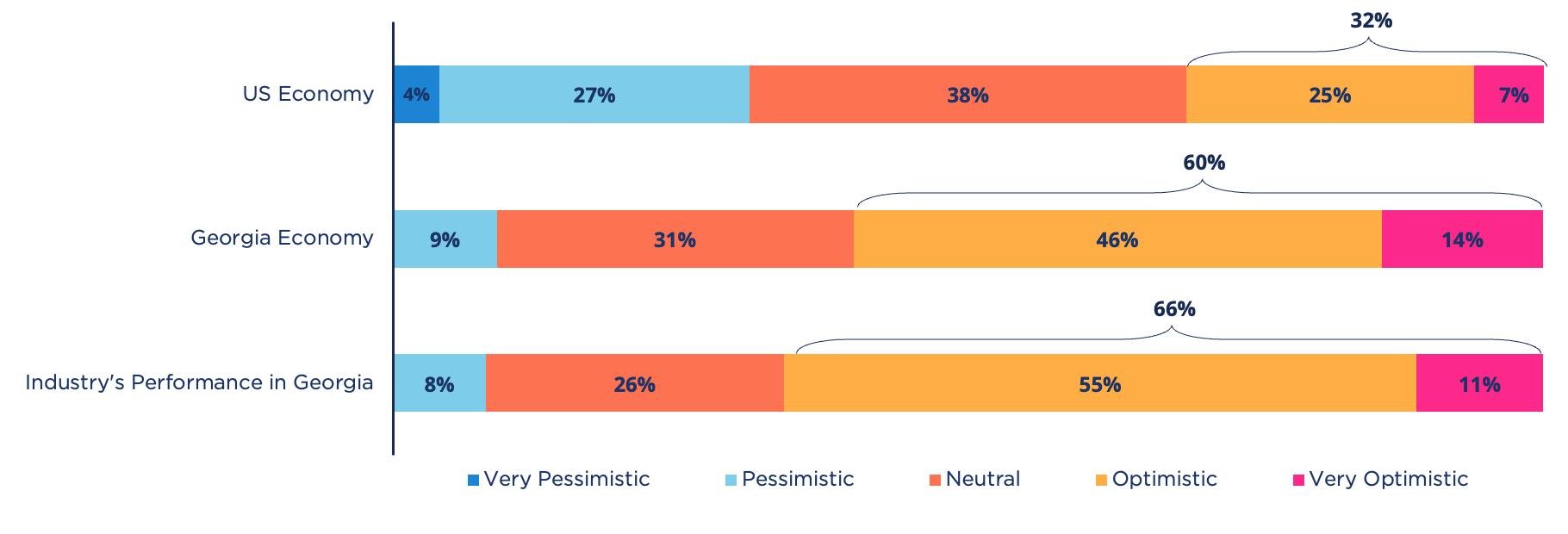

When asked about their overall sentiment towards the economy, 60% of CEOs were “Optimistic” or “Very Optimistic” about the Georgia economy, compared to 32% about the U.S. economy.

What is your personal outlook towards the following over the next 12 months?

Looking ahead, the majority of CEOs are expecting to increase both revenue, full-time employment, and capital investment in the next 12 months – 83%, 78%, and 64%, respectively.

Over the next year, by what percentage do you expect your company’s revenue to grow?

Over the next year, by what percentage do you expect full-time employment in your company to grow?

Over the next year, by what percentage do you expect your company’s capital investments to grow?

To learn more about the top takeaways from the 2023 CEO and Executive Insights Survey, click here.

4 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

DYNAMISM

Employment and Establishment Trend Highlights

Since 2020...

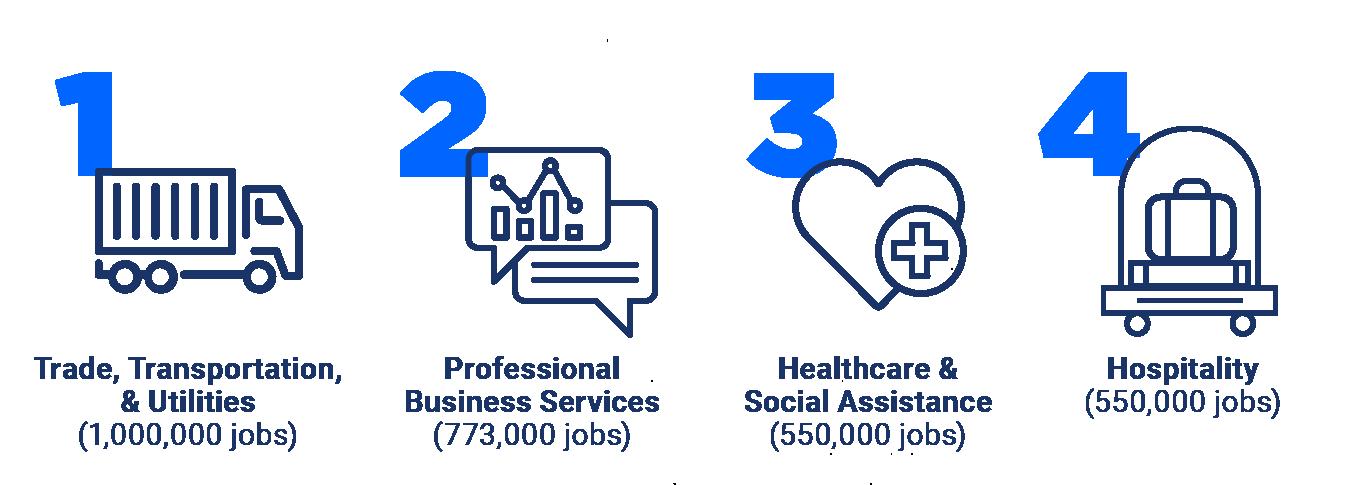

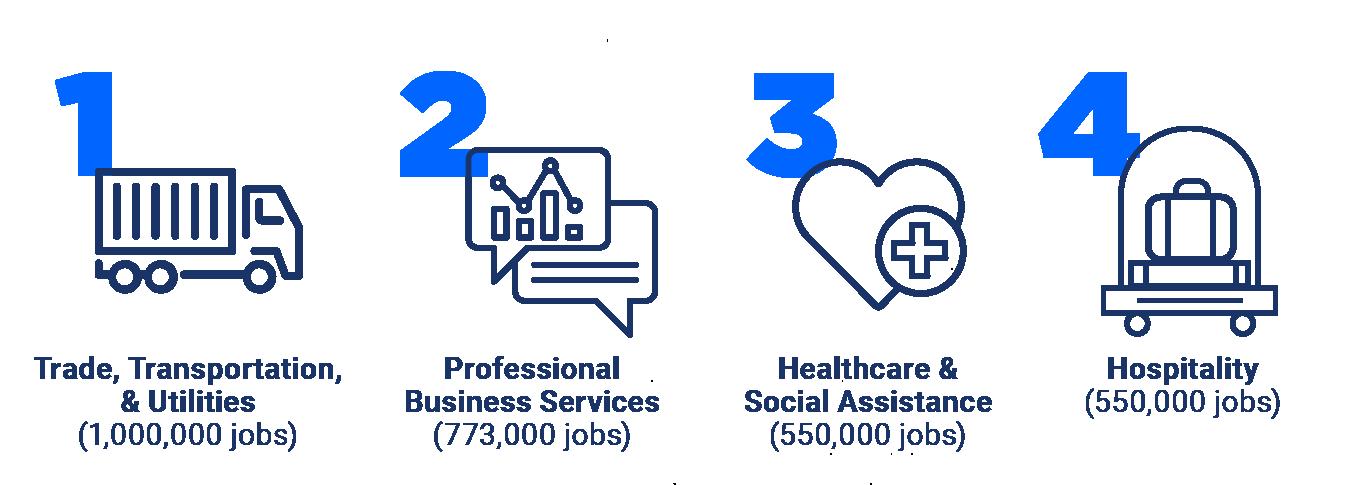

Transportation and warehousing has moved from the 5th largest industry by employment to the 1st largest, while healthcare and social assistance has moved from 1st to 5th. Professional scientific services has moved from 6th to 2nd largest by employment and maintained the most physical business operating locations with fewer than 20 employees. The largest employing industry with firms of less than 20 employees was healthcare, followed by retail and hospitality23

Employment Overview: March 2023

In Q1, there were 357,386 job postings with more than 32,000 employers competing for talent. This shows there is a substantial need for employees at every skill level.24

Trends to Note 27

Industries related to hospitality and leisure, such as entertainment and food services have seen the highest year over year growth- averaging nearly 10% - as of March 2023. These sectors have experienced significant growth as the pandemic has subsided and individuals are eager to travel and have experiences that were limited previously.

The healthcare and social assistance industry continues to see one of the highest levels of employment growth outside of the industries mentioned above, at about 5.4% in the last year. This industry currently employs approximately 550,000 workers. Professional and scientific industries face a slightly lower, but healthy employment growth level at just over 2%.

Fastest Annual Predicted Growth through 2030:

• Nurse Practitioners 6%

• Flight Attendants 5.6%

• Occupational Therapist Assistants 5%

You can click here to access GDOL’s full list of Hot Careers.

5 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

occupations by

post ings

non-governmental industries by

Top

job

25 Largest

employment 26

Index of State Dynamism

It is evident that Georgia’s overall economy is strong and business leaders are confident making short and long-term investment in the state. Dynamism is important to cultivate because a less dynamic economy tends to be less resilient to shocks, less innovative, less productive, and lacking in opportunity over the long-term.

“The Great Recession” shows a marked shift in dynamism at the state and national level, but Southern and Western states have had the advantage over other parts of the country.29 Recent research by EIG has taken a historical review of dynamism and found that nationally, dynamism has been declining for decades. Since 1990, the average state has experienced a 30 percent decline in economic dynamism. This is measured by their Index of State Dynamism which uses 8 metrics to compare all 50 states. 30 Georgia ranks 14th nationally, which is an increase from 15th a year ago.

Strengths

31

6th in Reallocation rate measuring the churn of workers among firms. This process spreads skills and ideas throughout the economy

7th in Core Start-up Rate measuring a state’s production of new businesses across key industries.

Opportunities

32

29th in Patents per 1,000 measuring a state’s propensity for producing new products, ideas, inventions, and innovation overall.

33rd in Labor Force Participation which measures the share of residents active in the labor force.

Competitor States: State Dynamism Ranking 33

Georgia 14th

Alabama 46th

North Carolina 25th

Tennessee 23rd

South Carolina 18th

Florida 12th

Texas 7th

While Georgia outpaces many southern states, Florida and Texas serve as strong competitors. Both of those states experienced declines in their rank over the last five years creating opportunity for Georgia which increased its rank over the same period.

6 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation National Business Rankings for Georgia28 DYNAMISM Area Development Overall 1 Cost of Business 1 Labor Market / Labor Supply 1 Regulatory Environment 2 Access to Capital / Growth Prospects 7

FISCAL & TAX STRUCTURE

Fiscal and Tax Structure

Georgia’s Competitive Advantage

Georgia ranks

8th nationally for corporate tax climate 34

8th lowest state and local tax burden 35

Businesses pay about 43% of state and local level taxes. Businesses pay about 44% of all sales tax in the state.

Fast Facts

Georgia’s corporate and personal income tax rates are significantly below that of the national average. The corporate income tax rate (5.75%) is higher than the highest rate in Georgia’s individual income graduated tax rate level (5.7%). 39

In FY 2021, about 50% of Georgia tax revenue sources are from personal income, and 36% are from sales taxes. 40

State rankings for all 50 states

To view estimated tax burden by state, click here.

To view business’ share of state and local taxes, click here.

7 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

Graded at an A for taxation on software and digital products 36

Graded at a C for business input exemptions 37

Business Share of Taxes 38

Georgia’s Legal Climate

This year, the American Tort Reform Association (ATRA) ranked Georgia as the #1 judicial hellhole, topping California who was previously ranked #1.41

Others in the top 5 worst judicial hellholes include 42

• Pennsylvania Supreme Court and the Philadelphia Court of Common Pleas

• California

• New York

• Cook County, Illinois

Tort Costs by State, click here .

Tort Fast Facts 43

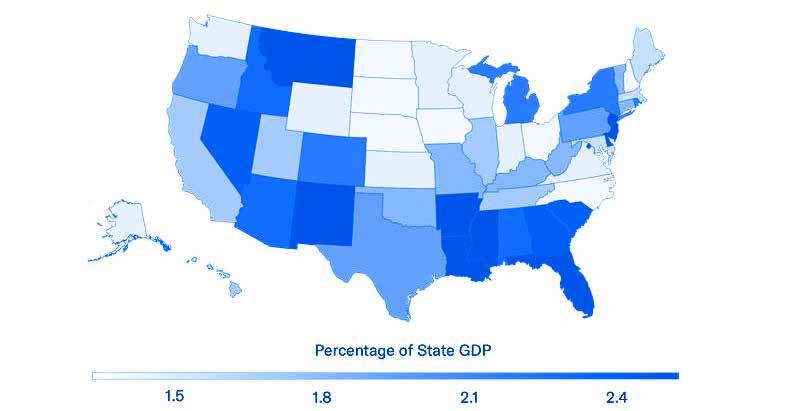

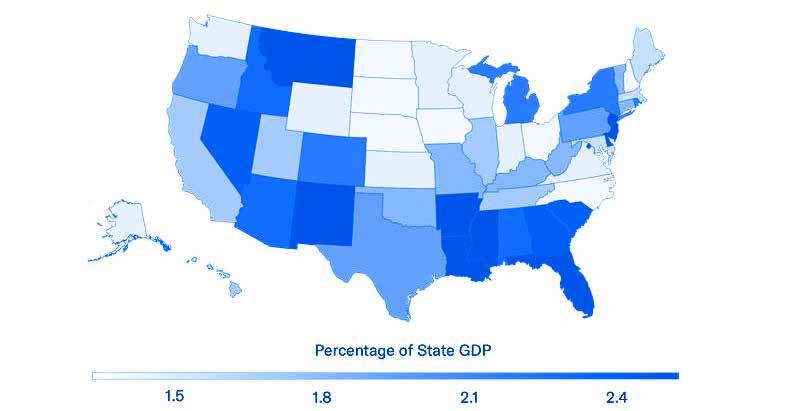

Georgia ranked 7th nationally in Tort Costs per household at $4,157, with a national average of $4,724. Tort Costs make up a 2.56% share of GDP, ranking Georgia 9th nationally.

TORT COSTS AS A PERCENTAGE OF GDP BY STATE (2020)

Georgia households pay almost $600 per year than more than the average U.S. household.

This indicates Georgia has a competitive disadvantage to many of our peer states due to the costs of our tort system on citizens and businesses. Only Florida has overall higher costs per household than Georgia. In response to these tremendous costs, Florida signed into law sweeping reforms to civil procedure in early 2023.

8 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

LEGAL CLIMATE

State General / Commercial Medical Liability Automobile Total Costs Tort Costs as % of State GDP Tort Costs per Household ($) Georgia $6,867 $607 $8,447 $15,922 2.56% $4,157 North Carolina $4,152 $284 $4,541 $8,978 1.52% $2,227 Florida $19,931 $1,146 $19,096 $40,173 3.63% $5,065 Alabama $2,682 $196 $2,744 $5,622 2.48% $2,977 South Carolina $ 2,529 $172 $3,539 $6,239 2.55% $3,183 Tennessee $3,956 $448 $3,214 $7,258 1.96% $2,750 Texas $19,959 $858 $17,858 $38,676 2.18% $3,904

Small Business Impact

The tort tax in our state due to the high costs of the civil justice system places financial burdens on Georgia’s families and businesses. Because runaway jury verdicts have become so rampant, operating costs for businesses have increased, thus forcing small businesses to increase prices for consumers or close their doors altogether.

Legal Advertising Cost and Impact

Georgia residents heard the 4th most local legal services radio ads and legal services television ads between 2017 and 2021. Over this period Plaintiffs’ lawyers spent $391 million on 4,449,755 advertisements across television, radio, and outdoor mediums.45

Other top states include: Florida, Texas, California, and Nevada

This advertising is meant to increase litigation in the state against businesses which directly results in increased operating costs. The costs associated with lawsuits are unpredictable and are becoming even more expensive. This can often lead to small businesses shuttering, increased operating costs, and closures of locations for larger businesses.

In 2021 alone, more than 15 million ads for legal services aired on local television broadcast networks in the 210 media markets across the U.S., totaling approximately $971.6 million. By comparison, pizza restaurants spent $67.4 million on a mere 845,000 ads while furniture retailers spent $589 million on 4.8 million ads aired on local television broadcast networks.

This type of advertising indirectly decreases economic activity, often in underserved communities, that benefit most from critical services and a strong local economy.

9 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation LEGAL CLIMATE

Nationally, while small businesses accounted for 19 percent of the business revenues earned in 2018, they bore 53 percent of the costs of the commercial tort system or roughly $182 billion.44

Year $ Spent # of Ads 2017 $63,215,447 720,724 2018 $75,576,577 812,727 2019 $82,946,377 1,008,059 2020 $80,451,374 910,970 2021 $89,120,526 997,275 TOTAL $391,310,301 4,449,755

Total - Georgia Local Legal Services Advertising 46

SMALL BUSINESS

Entrepreneurship and Small Business Success

Entrepreneurial Indicators

Since 2020, there has been a spike in the rate of new entrepreneurs, but a decrease in the share of people creating them because of opportunity. 47

To view Business Birth Rates in Georgia, click here .

The first year business survival rate has increased in the past two years, and now sits slightly above the national average at 80%. However, this position still leaves Georgia ranked 35th. Georgia’s rate of new employer businesses has increased over the past 5 years and the rate is above regional and national averages.48

Georgia is ranked 3rd in the nation for the percent of adults becoming entrepreneurs each month.49

Georgia ranks 19th in opportunity share of new entrepreneurs which measures the number of people that left their jobs to start a business. This indicates there is an opportunity to increase access to capital, mentorship, and social capital to continue to support small businesses. Georgia’s startups are creating more jobs in their first year, leading to the state being ranked 9th nationally.50

Minority Business Indicators

Minority Business Enterprises generate an estimated $400 billion in economic output, resulting in an additional 2.2 million jobs nationwide51. In Georgia, an estimated 40% of small businesses are minority-owned and operated. 52

Georgia has the 5th largest share of minority businesses in the United States.53

Minority-owned businesses are integral to Georgia’s economy and this will remain true in future years. By 2050, it is projected that minority individuals will make up 28% of Georgia’s population from 15% in 2020. To ensure long-term dynamism in our economy, minority-owned businesses must have the support to be successful in terms of human, social, and financial capital. 54

10 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

SMALL BUSINESS

Fiserv is a global technology leader with a flagship presence in Georgia, enabling payments, financial services and commerce for thousands of financial institutions and millions of people and businesses worldwide. The company analyzed transaction data to provide insights into small business sales in the state.

Metro Atlanta small business sales make up the largest portion of total small business state sales. However, small business sales represent over a third of all regional sales in Hub communities, and nearly half of all regional sales in rural communities, illustrating their importance to these regions’ local economies.

There are 39 counties (nearly a quarter of all Georgia counties) in which small business sales represent 50% or more of total consumer spending in the county. Of these counties, all are rural. Small business is the backbone of Georgia’s economy, and critical to the wellbeing of our rural communities.

Metro Atlanta small business sales make up 47% of total state small business sales. While the region accounts for 56% of all business sales in the state, small businesses sales represent only 36% of total sales in Metro Atlanta.

While Hub communities contribute only about 15% of small business and total business sales to the state, small business generates nearly 38% of sales in their local regions. Rural communities represent 36% of small business sales and 30% of total business sales to the state. Additionally, small business sales represent over 45% of total sales in their local economies.

11 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

Fiserv Spotlight 55

In Georgia, 31.33% (nearly a third) of business sales are produced by small businesses.

Location Small Business Sales Growth Regional % Contribution of total Small Business Sales in GA Regional % Contribution of all Business Sales in GA Small Business' % Share of Regional Sales Georgia 3.79% - - 31.33% Metro 3.22% 47.50% 56.36% 36.64% Hub 3.90% 15.74% 14.22% 37.83% Rural 5.58% 36.76% 29.42% 45.47%

Georgia Regional Sales Snapshot

RESEARCH AND DEVELOPMENT

Research and Development

Georgia’s colleges and universities posted $2.95 billion in research expenditures in FY21, a 6% increase over the previous year. Georgia now ranks 8th nationwide. Just five years ago, the state ranked 12th. 56

Georgia ranks 17th in patents.57

Venture Capital (VC) Overview

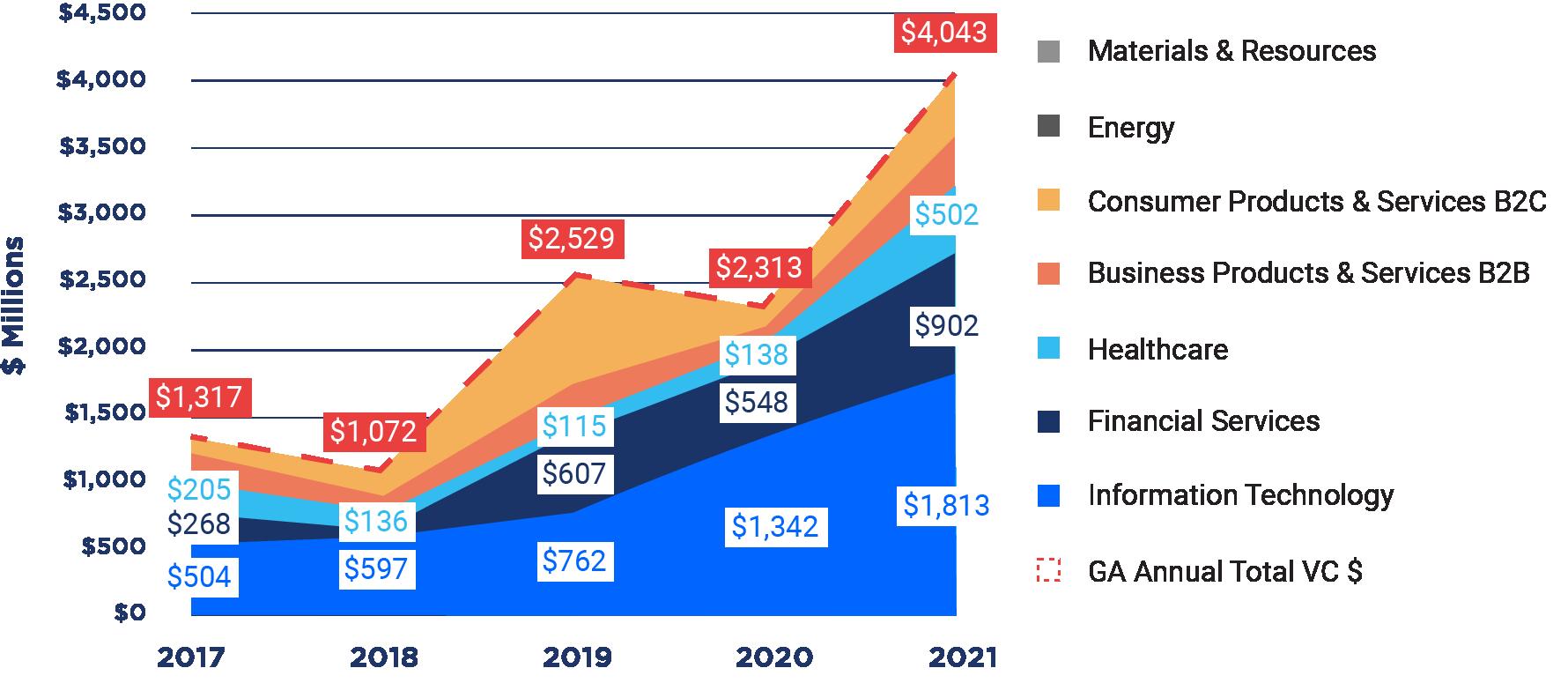

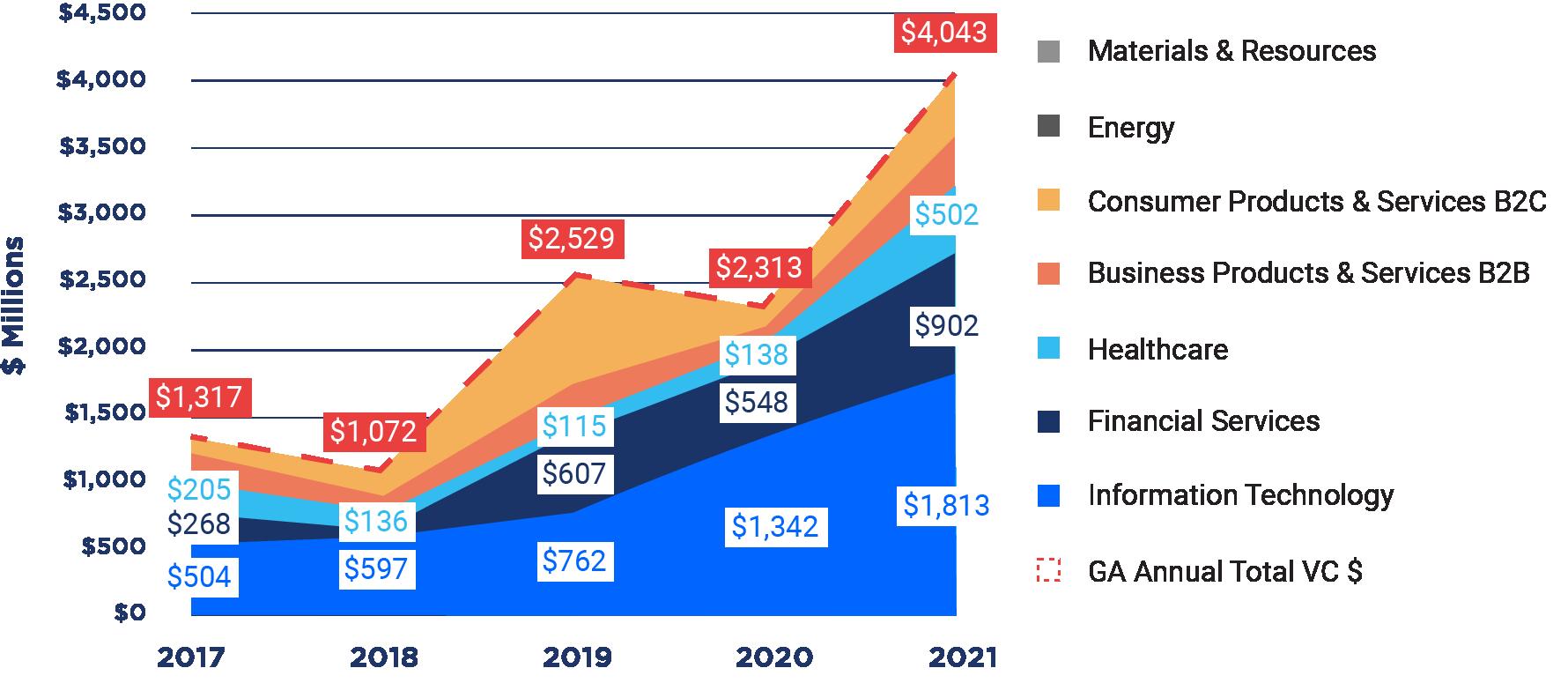

In 2021, Georgia had the 15th most companies receiving venture capital funds and the 13th most venture capital raised in the US. From 2020 to 2021, Georgia startups increased venture investment amount by nearly $2 billion, about a 75% increase in investment. Compared to Georgia’s 75% increase in investment in 2021, the US increased investment only by 45%. 58

Competitor States

North Carolina: 140%

South Carolina: -42%

Tennessee: 86%

Texas: 123%

Texas and North Carolina saw larger increases than Georgia and continue to be our largest competitors, especially due to the historical strength of these states in the R&D arena. 59

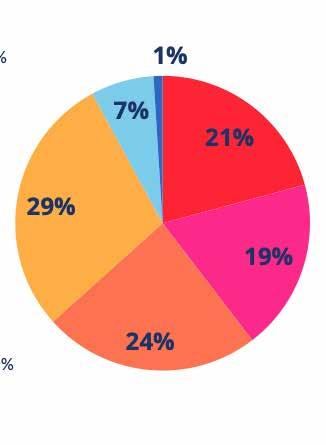

VENTURE INVESTMENT ($M) BY SECTOR 60

Pandemic Impact on Venture Capital (VC) Funding

Georgia has seen a 90% increase in VC deal value in the 2 years since the pandemic versus in the two years prior. There has also bee an 18% increase in the number of deals for the same period. 61

12 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

RESEARCH AND DEVELOPMENT

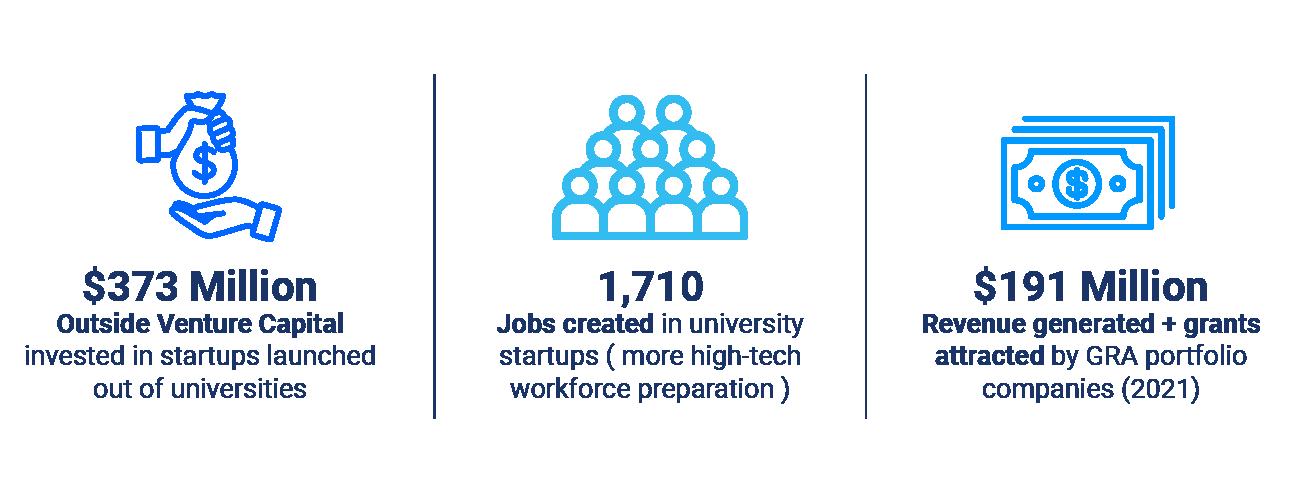

Georgia Research Alliance Spotlight 62

The Georgia Research Alliance (GRA) helps our state’s universities conduct more research and create more companies — all to grow Georgia’s economy.

GRA works to:

• Recruit star research talent to Georgia’s universities

• Invest in state-of-the-art lab technology (which scientists share)

• Seed and shape companies around scientists’ inventions

GRA’s 2022 Impact

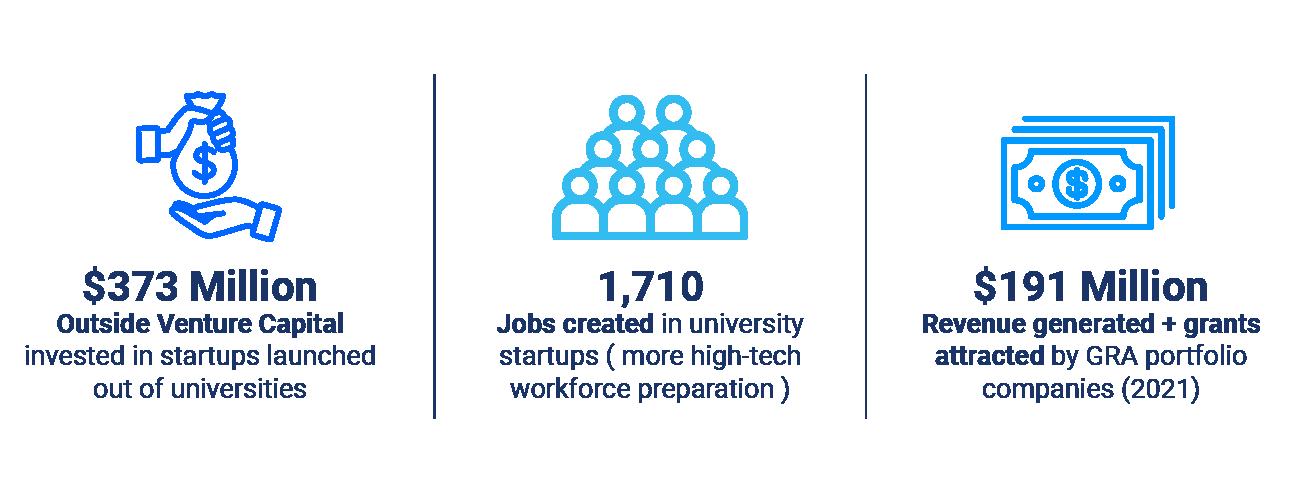

In FY2022 alone, the scientists in the GRA Academy accounted for almost $900 million in research expenditures. This is not state funding – these are competitive public and private research dollars that come from outside Georgia.

Specifically, the $899 million in research expenditures support

• Hiring people

• Renovating spaces

• Purchasing equipment and supplies

All of these stimulate the state and local economies

These dollars are invested in the state tax base through

• Payroll taxes

• Sales tax

• Income tax

13 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

RESEARCH AND DEVELOPMENT

GRA’s investment has led to the creation of nearly 2,000 jobs in university lab, including 525 Ph.D.s and M.D.s, all of which contributes significantly to the high-tech workforce.

GRA’s overall economic ROI in 2022 totals nearly $1.5 billion. Those dollars are tied directly to GRA’s action and expertise – they don’t represent by any type of multiplier.

This funding supports nearly 2,000 jobs in university labs and the supervision of 525 PhDs and MDs, which significantly contributes to the high-tech workforce. Overall, GRA’s total economic ROI for FY 2022, is nearly 1.5 billion which are all dollars directly tied to GRA expertise and actions and was not generated by any type of multiplier.

GRA currently has 226 startups in its portfolio. In 2022, these companies raised over $373 million in outside venture capital and created over 1700 jobs.

Every $1 Georgia invests in university start-ups, through GRA’s venture program, brings $37 in outside venture investment to our state.

To learn more about the case for economic dynamism please click here.

To dive deeper into data regarding Georgia’s economic competitiveness please click here.

Read more at www.gachamber.com.

14 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

Q2 Quarterly Economic Report Citations

1 United States Bureau of Labor Statistics, 2023: Labor Force Participation Rate, retrieved from FRED, Federal Reserve Bank of St. Louis

2 Lightcast Data Aggregation Software, 2023; Sources: Multiple

3 Georgia Department of Labor, 2023: Monthly Labor Force Estimates

4 United States Bureau of Economic Analysis, 2023: Real GDP: All Industry, Seasonally Adjusted, retrieved from FRED, Federal Reserve Bank of St. Louis

5 United States Bureau of Economic Analysis, 2023: GDP Manufacturing, Seasonally Adjusted, retrieved from FRED, Federal Reserve Bank of St. Louis

2023:

15 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation

9 Economic

Taxation,

11 ATR

12 Institute

Reform,

Costs

Report 13 Kauffman Indicators of Entrepreneurship

National

Data provided in partnership

17 Data provided in partnership with the Georgia Research Alliance 18 Governor’s Office of Budget and Planning 2023: Population Projections 19 Woods and Poole Economics, 2022: Employment Projections, Georgia 20 Ewing Marion Kauffman Institute: Kauffman Indicators of Entrepreneurship 21 Ewing Marion Kauffman Institute: Kauffman Indicators of Entrepreneurship 22 The Tax Foundation, 2021: State Taxes per Capita 23 United States Census Bureau, 2023: Statistics of US Businesses Survey 24 Georgia Department of Labor, 2023: Non Agriculture Employment Report 25 Georgia Department of Labor, 2023: Non Agriculture Employment Report 26 Georgia Department of Labor,

Non Agriculture Employment Report 27 Georgia Department of Labor, 2023: Non Agriculture Employment Report 28 Area Development, 2022: Top States for Doing Business 29 Economic Innovation Group, 2022: The Case for Economic Dynamism 30 Economic Innovation Group, 2022: The Index of State Dynamism 31 Economic Innovation Group, 2022: The Index of State Dynamism 32 Economic Innovation Group, 2022: The Index of State Dynamism 33 Economic Innovation Group, 2022: The Index of State Dynamism 34 Tax Foundation, 2023: 2023 State Business Tax Climate Report 35 Tax Foundation, 2023: 2023 State Business Tax Climate Report 36 Council on States Taxation, 2022: ‘The Best and Worst of States Sales Tax Systems’ Report 37 Council on States Taxation, 2022: ‘The Best and Worst of States Sales Tax Systems’ Report 38 Council on States Taxation, 2022: ‘Total State and Local Business Taxes’ Report 39 Tax Foundation, 2023: State Individual Income Taxes and Brackets for 2023 40 PEW Foundation, 2023: How States Raise their Tax Dollars in FY 2021 41 American Tort Reform Foundation, 2023: Judicial Hellholes, 2022-2023 Executive Report 42 American Tort Reform Foundation, 2023: Judicial Hellholes, 2022-2023 Executive Report 43 Institute for Legal Reform, 2023: The Eight States with the Highest Tort Costs per Household

6 United States Census Bureau,

New Private Housing Unites Authorized by Building Permits, retrieved from FRED, Federal Reserve Bank of St. Louis 7 United States Census Bureau, 2023: Business Formation Statistics by State 8 Georgia Ports, 2023: Monthly TEU Throughput ‘By the Numbers’

Innovation Group, 2022: The Case for Economic Dynamism 10 Council on State

2022: ‘Total state and local business taxes’ Report

Foundation, 2023: National Judicial Hellhole Rankings

for Legal

2022: ‘Tort

in America’

14 MAXFilings 2023: The Best & Worst States for Minority-Owned Small Businesses 15

Science Foundation, 2023: National Patterns of R&D Table 10 16

with the Georgia Research Alliance

2023:

44 Leader’s Choice Insurance, 2021: Small Firms Saddled with the Majority of Tort Liability

45 American Tort Reform Association, 2022: Legal Services Advertising in the United States

46 American Tort Reform Association, 2022: Legal Services Advertising in the United States

47 Ewing Marion Kauffman Institute: Kauffman Indicators of Entrepreneurship

48 Ewing Marion Kauffman Institute: Kauffman Indicators of Entrepreneurship

49 Ewing Marion Kauffman Institute: Kauffman Indicators of Entrepreneurship

50 Ewing Marion Kauffman Institute: Kauffman Indicators of Entrepreneurship

51 National Minority Supplier Development Council, 2023: NMSDC Facts and Figures

52 US Small Business Administration, 2022: SBA 2022 Georgia Small Business Profile

53 MAXFilings 2023: The Best & Worst States for Minority-Owned Small Businesses

54 Georgia Budget and Policy Institute, 2018: ‘Growing Diverse, Thriving Together’

55

Data provided in partnership with FISERV

56 Georgia Research Alliance, 2023: Jan. 11th, 2023 Blog Report

57 US Patents and Trademarks Office, 2023 via Statista: Fy 2021 Patents Grants by State

58 The National Venture Capital Association, 2023: The NVCA Yearbook

59 The National Venture Capital Association, 2023: The NVCA Yearbook

60 The National Venture Capital Association, 2021: Georgia Entrepreneurial Ecosystem

61 The National Venture Capital Association, 2023: The NVCA Yearbook

62

Data provided in partnership with the Georgia Research Alliance

16 Economic Dynamism: Q2 Quarterly Update 2023 | Georgia Chamber Foundation