1 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation Infrastructure of the Future Q1 Quarterly Update 2023 Georgia Chamber Foundation www.gachamber.com

The Georgia Chamber’s Quarterly Economic Insights provide business and community leaders with key statistics and trends to advance economic prosperity in the Peach State. This quarterly update will focus on infrastructure of the future, ensuring strategic investments are made to best position Georgia for years to come.

Georgia’s economic growth is necessitating increased investment in our infrastructure system and our growth is only expected to increase.

ECONOMIC GROWTH PROJECTIONS

Freight

By 2050, Georgia is expected to experience a 92% increase in freight flow by tons.

New long-term projections show that, between 2020 and 2050, U.S. freight activity will grow by fifty percent in tonnage to 28.7 billion tons and will double in value to $36.2 trillion (in 2017 dollars).9

Ports

By 2050, Georgia ports are projecting increases in Twenty-Foot Equivalent Units (TEUs) in yard and berth from 6 million to over 20 million for both. 10

Roads

By 2050, Vehicle Miles Traveled is projected to increase by 27%. Freight is expected to increase by 37.1% and passenger will increase by 26%. 11

By 2050, vehicle miles traveled will increase to 269,244,000

Passenger: 237,574,000

Freight: 31,671,000

Rail

By 2050, warehouse and distribution tonnage by rail will more than double. 12

Air

Based on City of Atlanta projections, total air cargo tonnage at ATL is expected to exceed 1.4 million tons by 2031. By 2040, annual air cargo tonnage is forecasted to increase to 62,170, nearly double its 2019 level. 13

Atlanta is projected to remain the country’s busiest airport, with a projected 95.3 million enplaned passengers in 2050.14

Warehouse and Distribution

By 2050, warehouse distribution tonnage will increase by 276% and value will increase by 254%. 15

Healthcare

By 2030, Georgia will need 2,850 more beds in hospitals and nursing homes to maintain current capacity levels throughout our healthcare system. 16

Telecom

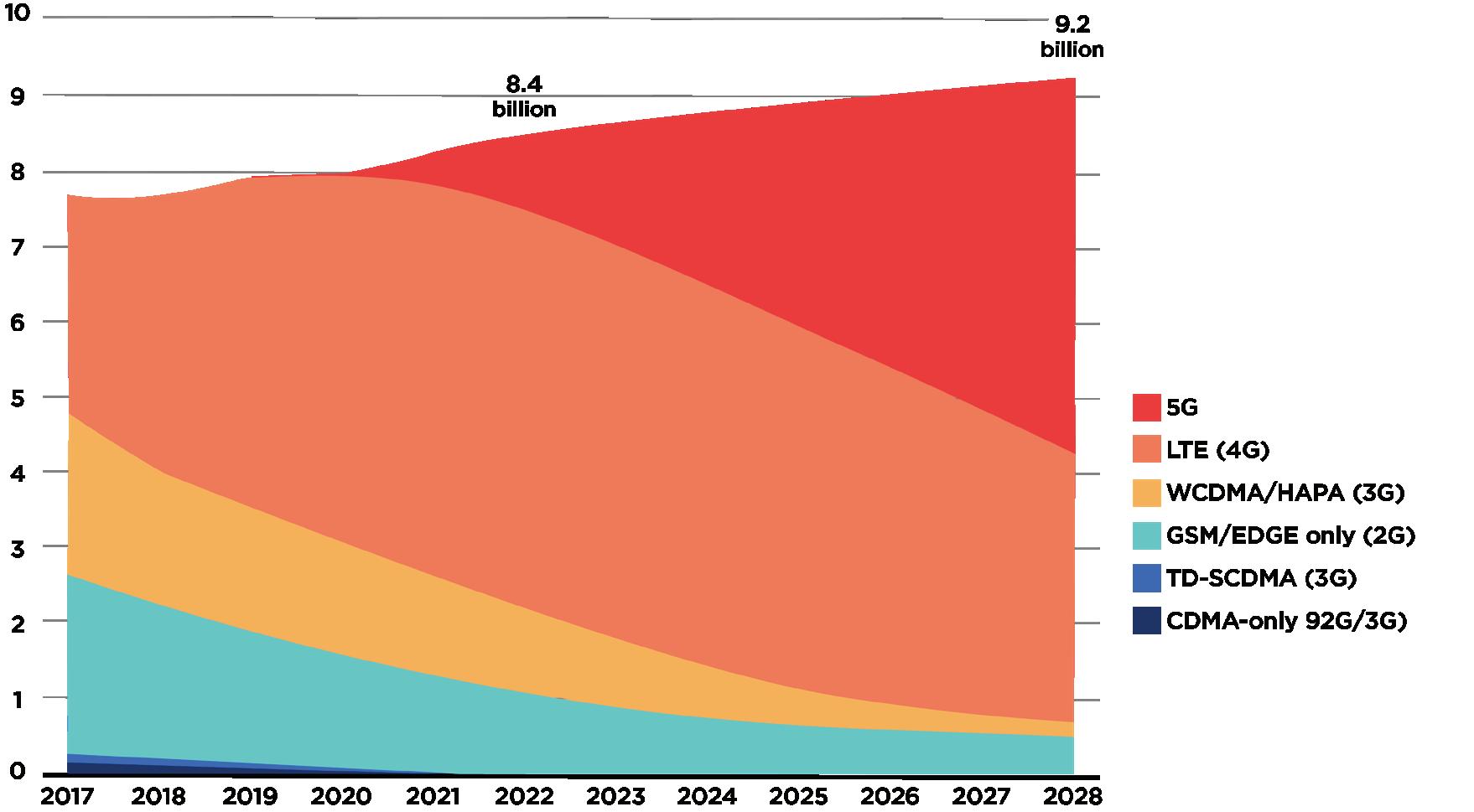

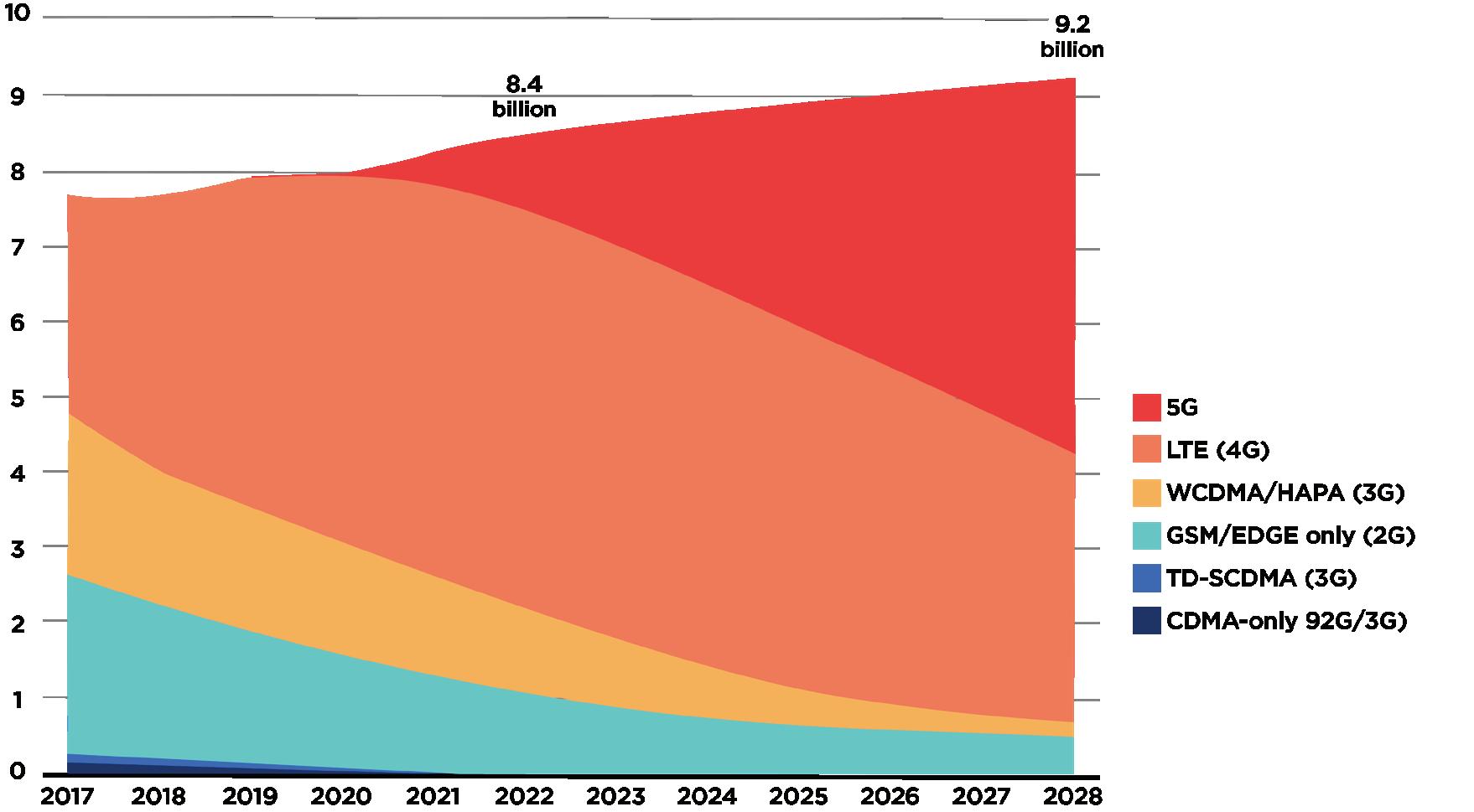

By 2028, around 420 million 5G subscriptions are expected, accounting for over 90 percent of mobile subscriptions in North America. 17

2 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation QUARTERLY ECONOMIC INDICATORS Labor Force Participation Rate1 61.7% (Q4 2022) 62.1% (Q3 2022) Year over Year Change in Job Postings2 -11% (Q4 2022) 10.7% (Q3 2022) Unemployment Rate3 3% (Q4 2022) 2.8% (Q3 2022) Real Georgia GDP4 $591,868.70 (Q3 2022) $587.662.50 (Q2 2022) Manufacturing GDP5 $74,306.00(Q3 2022) $73,410.00 (Q2 2022) New Private Housing Units Authorized by Permit6 5,406.33 (Q4 2022 Average) 6,610.33 (Q3 Average) Business Applications7 68,942 (Q4 2022 total) 69,239 (Q3 2022 total) TEU Throughput8 1,458,448 (Q4 2022 total) 1,542,592 (Q3 2022 total)

DRIVING TRENDS

Driving Trends

true as it relates to our freight and logistics infrastructure.

Population Growth: By 2050, Georgia’s population is projected to grow to 13,390,283 which is an increase of nearly 2.5 million individuals. This growth is increasing the demands on every part of our infrastructure system from roads, bridges, to supply chain networks and broadband.18

Georgia has the nation’s fastest growing proportion of residents aged 65 and older which will impact demands on our healthcare infrastructure as well as traditional infrastructure in communities as individuals transition to different phases of life.

Job Growth : By 2050, there is expected 46% growth in overall state employment. This increase in jobs will create new strains on our infrastructure network from an individual and business need perspective.19

Economic Growth : 358 companies announced expansion or new locations in Georgia, with more than $21 billion in private investment. $17.8 billion (84%) will be logistics-enabled businesses. 20

Manufacturing and Automotive

215 companies investing $15.4 billion and creating more than 28,000 jobs

By 2050, Manufacturing is expected to grow by 77%

Logistics / Distribution

34 companies investing $966 million and creating more than 6,200 jobs

Agribusiness and Food Processing

48 companies investing $1.4 billion and creating more than 2,600 jobs

By 2050, Agriculture is expected to growth by 43%

E-Commerce : In 2021, retail e-commerce sales amounted to approximately 4.9 trillion U.S. dollars worldwide. This figure is forecast to grow by 50 percent over the next four years, reaching about 7.4 trillion dollars by 2025. This represents a huge opportunity for Georgia to strengthen its position as a logistics and distribution hub with the increased demand for last-mile delivery. 21

Federal Investment: Georgia will benefit from the passage of the $1 trillion Infrastructure Investment and Jobs Act in November 2021. Nearly half of this, $450 billion, is simply reauthorization of spending under current policy and there will be about $550 billion in “new” spending above current policy. Rising costs of materials and labor will also impact how far these dollars will go as recent reports from Georgia Department of Transportation have projects costing 122% more this year than last year. 22

3 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

There are a few major trends driving Georgia’s economic growth, and thus impacting the demand on our state’s infrastructure. This is especially

KEY TAKEAWAY

Georgia has benefitted from thoughtful, long-term investments in our infrastructure system by state leaders. It is now time for additional investments to maintain current operations and strategically support key projects to drive Georgia’s economy forward.

FREIGHT

Freight

Georgia’s multimodal transportation system includes an extensive network of facilities important for moving freight. 23

128,300 miles of highways

3,288 miles of Class 1 rail

1,012 miles of Class 3 rail

2 deepwater ports

2 inland ports affiliated with the Georgia Ports Authority (GPA) (third in early planning)

9 commercial service airports

Georgia has a robust freight network. However increased demands from our growing economy necessitate increased investments to alleviate existing bottlenecks and ensure efficient movement through the state.

4 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

Direction of Flow Tons 2050 Tons Growth 2019-2050 Tons Growth CAGR 2019-2050 Inbound to GA 319 M 76% 1.9% Outbound from GA 271 M 86% 2.1% Within GA 310 M 117% 2.6% Through 222 M 93% 2.2% Grand Total 1,122 M 92% 2.2%

Georgia Freight Flow Summary by Tonnage, 2050

Source: Analysis of Transearch and STB Waybill Data

Freight Roads

125,705 centerline miles

14,895 bridges

Cargo is within two or fewer days by truck from 80% of U.S. consumers 25

Top 5 Commodities by Value Inbound ($)

Freight Rail 24

4,600 miles

Top 5 Commodities by Value Outbound ($)

Georgia receives more freight by rail than it ships.

33 percent of the state’s total rail tonnage is shipped from other states to Georgia, while 14 percent of the total rail tonnage is transported from Georgia to other states.

A smaller share of the state’s rail tonnage (6 percent) is shipped within Georgia. The Atlanta metropolitan area is Georgia’s largest intermodal freight market, accounting for over three quarters of the state’s terminating intermodal traffic and over two thirds of the state’s originating intermodal traffic

Georgia is home to 28 freight railroads (2 class-1s and 26 short-line railroads)

Rail transport directly employs over 6,500 Georgians

Georgia railroads move 190 million tons of freight in Georgia annually.

It would have taken approximately 2.1 million additional trucks to handle the 38.4 million tons of freight that originated by rail in Georgia in 2021.

5 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

Commodity 2019 Commodity 2050 Motor Vehicles $15,354,704,246 Motor Vehicles $35,060,310,978 Petroleum Refining Products $11,330,201,712 Live Poultry $25,644,461,387 Motor Vehicle Parts or Accessories $9,125,061,550 Motor Vehicle Parts or Accessories $14,570,963,736 Live Poultry $8,299,638,159 Drugs $13,203,956,316 Dressed Poultry, Frozen $4,728,818,902 Plastic Mater or Synth Fibers $12,817,417,152 Commodity 2019 Commodity 2050 Motor Vehicles $23,212,403,339 Motor Vehicles $43,426,518,466 Petroleum Refining Products $12,176,771,611 Live Poultry $31,638,314,905 Motor Vehicle Parts or Accessories $9,470,676,019 Motor Vehicle Parts or Accessories $21,702,893,085 Live Poultry $9,414,337,931 Drugs $18,014,811,294 Dressed Poultry, Frozen $6,275,906,579 Plastic Mater or Synth Fibers $17,615,319,369

FREIGHT

PORTS

Ports

4 ports 26

The Port of Savannah’s Garden City Terminal the largest single container terminal in North America.

The Port of Savannah is the nation’s fastest growing container port

The Port of Brunswick is 2nd busiest port in the U.S. for total ro/ro volume, ro/ro imports, and ro/ro exports.

The Port handles nearly 35% of the nation’s containerized poultry exports and is #1 for refrigerated exports on the East & Gulf Coasts

TEU capacity at the Port of Savannah increased 20% between 2020 and 2021 and is expected to experience another 60% increase in capacity by 2025.28

Activity at Georgia ports is expected to continue to rise over the long-term projections for TEUs handled to rise to over 20 million in yard and berth by 2050.29

Twenty Foot Equivalent Units (TEUs) Projections in Yard and Berth

6 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

Inbound TEUs Outbound TEUs Furniture Nesoi 33,474 Kaolin 61,290 Parts and Access for Motor Vehicles 24,196 Wood 33,032 New Pneumatic Tires (Rubber) 11,306 Motor Cars/Vehicles 25,623 Lamps and Lighting 10,018 Paper and Paperboard 23,452 Floor Cover and Wall Cover (Plastics) 9,468 Meat 23,075 Top 5 Commodities (TEU-Container Volume) 27

Year Yard Birth 2022 6M 6M 2023 7M 7.5M 2025 9.5M 9M 2030 10M 10M 2050 20M+ 20M+

Air

105 airports in Georgia

Six airports in Georgia currently support regularly scheduled air cargo service.

58 airports with air cargo activity and whether the air cargo activity is scheduled, ad hoc, or both.

Over 80% of U.S. consumers are within a 2-hour flight time.30

Hartsfield Jackson International Airport Facts

World’s busiest passenger airport, with 2,500 arrivals and departures and 250,000 passengers per day 31

ATL handles 95% of the state’s annual air freight volume

In 2021, 13th largest airport in the U.S. for cargo, and 43rd in the world

It is the only air cargo perishable complex in the Southeast approved by the USDA to offer on-site cold treatment and fumigation treatment of fruit fly host plants

Based on City of Atlanta projections, total air cargo tonnage at ATL is expected to exceed 1.4 million tons by 2031. An estimated 60 percent of all air cargo tonnage moved through ATL will be transported by all cargo carriers, and the remaining 40 percent will be carried in the belly-hold of domestic and international commercial passenger flights

Overall Georgia Airport Facts

Domestically, goods with a total annual value of almost $3 billion are transported by air to and from Georgia. Internationally, the value of goods transported to and from Georgia by air is almost $27 billion. Top commodities transported to Georgia by air include electronics, motor vehicle parts, pharmaceuticals, machinery, and transport equipment. 32

7 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

AIR TEUs Outbound TEUs 2011 2031 AAGR Total Annual Cargo Tonnage 663,100 1,414,000 3.9% Dedicated Air Cargo Tonnage Only (Estimated) 397.900 848,400 3.9% Air Cargo Operations 11,900 19,200 2.4%

ATL Air Cargo Forecasts

Looking to the future of aviation in Georgia

The civil Unmanned Aerial System (UAS), also referred to as Unmanned Aerial Vehicles (UAV) or “drones”, market had a global market value of $5.5 billion in 2019, and the market for production and service applications, primarily driven by the infrastructure sector, is forecasted to grow around 11 percent a year over the next six-year period.

When both the military and civilian markets are considered, by 2026, the value of the Unmanned Aerial Systems market is expected to be $58.6 billion.35

8 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

AIR Preferred Forecast of Annual Air Cargo Tonnage 33 City Airport Name FAA ID AAGR 2019 2025 2030 2040 Albany Southwest Georgia Regional Airport ABY 2.8% 24,950 24,950 33,810 44,560 Columbus Columbus AIrport CSG 2.8% 430 510 580 770 Savannah Savannah/Hilton Head International Airport SAV 2.8% 8,390 9,900 11,370 14,980 Statesboro Statesboro-Bulloch County Airport TBR 2.8% 350 410 470 630 Swainsboro East Georgia Regional Airport SBO 2.8% 690 810 930 1,230 All Airports 34,810 41,080 47,170 62,170 Source: FAA Aerospace Forecast, Aviation Analysis, October 2021

Over the next 20 years, airports in Georgia, currently served by an integrated express air cargo carrier, are expected to see air cargo tonnage double.34

4 of the top 5 global public refrigerated warehousing companies have locations in Georgia

90 percent of the world’s top third-party logistics providers (3PLs) operate in Georgia

100+ cold chain facilities in Georgia

14+ million square feet of cold store space

Home to nearly 900 million square feet of warehouse distribution space36

Between 2015 and 2020, employment in warehousing services nearly doubled, at 93 percent, compared to the nationwide employment growth rate of 80 percent. This proves our growth is outpacing the nation and Georgia is truly becoming a warehouse and distribution hub.

Over the past six years, the state’s share of employment as a portion of the transportation and warehousing sector has grown from 20 percent to just under 30 percent, although efficiency advancements such as automation have the propensity to slow future growth.37

Click here to learn more about Warehouse Employment in all 50 States.

9 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

WAREHOUSE & DISTRIBUTION Warehouse and Distribution

Reducing disease burdens in the state could lead to an additional $79 billion in GDP from 2022 to 2030.38

Furthermore, if health outcomes were improved by this margin, there could be up to $82 billion of economy wide impact from increased healthcare expenditures and up to $52 billion from healthcare and social assistance industries.39

Health improvements could lead to a 7 percent increase in the overall state labor supply by 2030 due to a healthier workforce.40

Chronic conditions and diseases, some which accompany aging, could inhibit this economic growth. The state is expected to see increased incidences of chronic conditions. Averages for some chronic conditions and non-communicable diseases are included below: 41

To learn more about the impact to your individual county click here

As illustrated above, many of these conditions impact urban, rural, and hub communities similarly with the largest differences for beneficiaries with heart disease.

To improve healthy outcomes at this scale, it is vital to increase our healthcare workforce, increase capacity within our healthcare system, and ensure access to quality, affordable healthcare for Georgians.

10 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

HEALTHCARE

Access to Mental Health - Providers per 100k (average) Healthcare Professional Shortage Area Population (By %, average) Beneficiaries with Heart Disease (By %, average) Approximate Share of Poor Mental Health Days per Month (average) Diabetes (By percent of those diagnosed age 20+, average) Beneficiaries with Kidney Disease (By %, average) Beneficiaries with COPD (By %, average) Metro Atlanta 47.34 55.85% 56.29% 18.28% 9.33% 27.59% 13.30% Rural 44.45 57.13% 44.48% 18.50% 9.26% 27.78% 13.71% Hub 45.87 57.27% 45.04% 18.47% 9.27% 27.75% 13.67% State Average 44.45 57.13% 44.48% 18.50% 9.26% 27.78% 13.71% Non-Communicable Disease Analysis 42 Healthcare

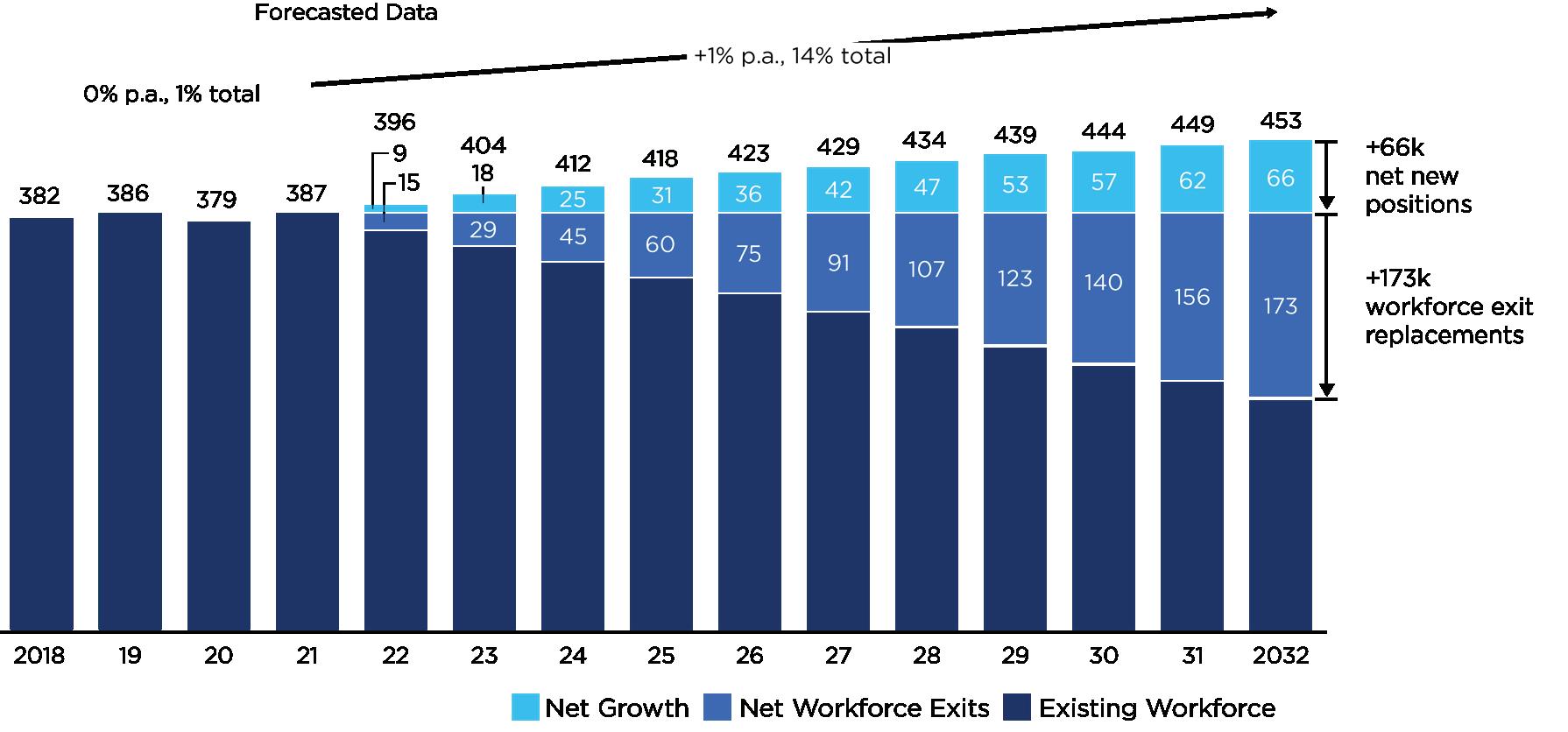

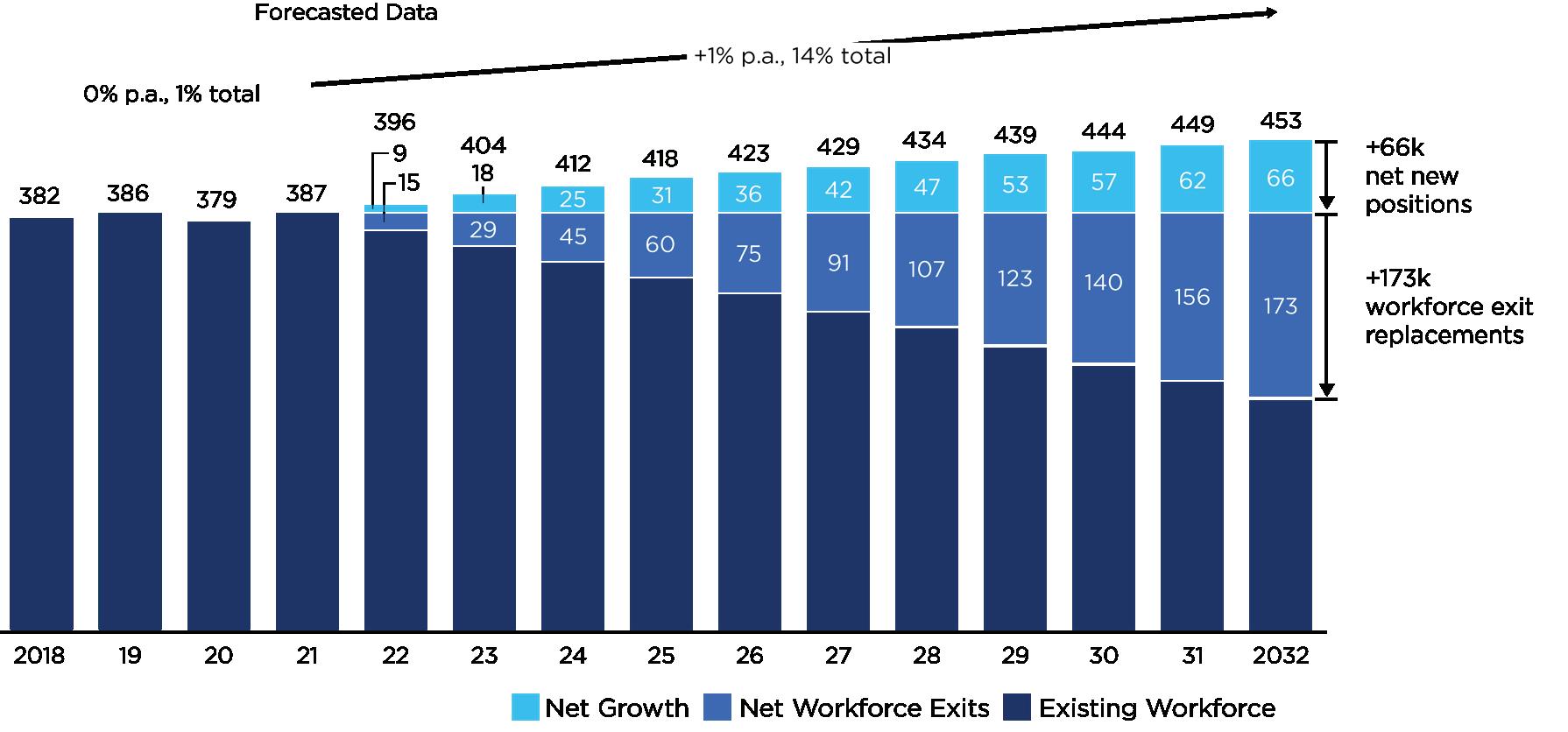

Projections show that Georgia needs to add 66,000 new positions through 2032 in addition to accounting for 173,000 workforce exit replacements.

20% of nurses, behavioral health, and specialty care workers are over 55 years old and likely to retire over the next ten years.

Georgia is consistently losing 3.7% of its workforce every year which is not being replaced by new graduates.

Georgia performs better than many of its regional peers in retaining 58% of its healthcare graduates, however there is a significant need to retain existing talent and increase the number of healthcare graduates to meet our workforce needs driven by the state’s population growth and growth of residents over 65 years old.

The total retained capacity of the healthcare education system falls short of the forecasted demand, which includes new positions and retirement replacements, by 8,100 positions per year over the next five years.

To learn more about the number of physicians, physicians assistants, and nurses in your county click here.

11 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

43

HEALTHCARE Key Figures: Healthcare Workforce

Georgia Healthcare Employment Forecast

Governor Kemp has invested nearly $1 billion in expanding broadband access which does not include hundreds of millions in private commitments resulting from public-private partnerships.44

TRENDS TO NOTE46

Every county where more than 25% of county is unserved is rural.

Every county where more than 50% of county is unserved is rural.

To learn more about the percent of unserved individual in your county click here.

Significant progress has been made in broadband investment across the state. However, there is a clear disparity in access to broadband for rural residents. Further investments in broadband infrastructure are required to continue to support economic growth statewide.

12 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

TELECOMMUNICATIONS

Average Percent Population Unserved by County Type 45 Urban Hub Rural 1.1% 4.4% 32.3% Telecom

5G subscription uptake is faster than that of 4G following its launch in 2009, with 5G expected to reach 1 billion subscriptions 2 years sooner than 4G.

By 2028, around 420 million 5G subscriptions are expected, accounting for over 90 percent of mobile subscriptions in North America.

As our state prepares for rapid growth of 5G, it is vital that technologies can be deployed efficiently to ensure the state is able to harness their full potential to advance economic growth and prosperity.

To learn more about much needed investments in our freight and logistics network please click here.

To dive deeper into data regarding Georgia’s economic competitiveness please click here.

Read more at www.gachamber.com.

13 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

TELECOMMUNICATIONS

Looking to the Future 47

5G subscriptions are forecast to reach 5 billion in 2028.

Mobile Subscriptions by technology (billion)

5bn

Quarterly Update 1 Citations

14 Infrastructure of the Future: Q1 Quarterly Update 2023 | Georgia Chamber Foundation

United States Bureau of Labor Statistics, 2022: Labor Force Participation Rate, retrieved from FRED, Federal Reserve Bank of St. Louis 2 Lightcast Data Aggregation Software, 2023; Sources: Multiple 3 Georgia Department of Labor, 2022: Monthly Labor Force Estimates 4 United States Bureau of Economic Analysis, 2022: Real GDP: All Industry, Seasonally Adjusted, retrieved from FRED, Federal Reserve Bank of St. Louis 5 United States Bureau of Economic Analysis, 2022: GDP Manufacturing, Seasonally Adjusted, retrieved from FRED, Federal Reserve Bank of St. Louis 6 United States Census Bureau, 2022: New Private Housing Unites Authorized by Building Permits, retrieved from FRED, Federal Reserve Bank of St. Louis 7 United States Census Bureau, 2023: Business Formation Statistics by State 8 Georgia Ports, 2023: Monthly TEU Throughput ‘By the Numbers’: January Report 9 United States Bureau of Transportation, 2021: Freight Activity Release 10 Georgia Ports Authority, 2023: Growing Big Report 11 Georgia Department of Transportation, 2021: Georgia State Rail Plan Final Report 12 Commissioner of Georgia Department of Transportation, Russell McMurray; February 6, 2023. Senate Transportation Committee 13 Georgia Department of Transportation, 2022: Statewide Air Cargo Study Technical Report 14 Federal Aviation Administration, 2022: 2022 TAF Executive Summary 15 Commissioner of Georgia Department of Transportation, Russell McMurray; February 6, 2023. Senate Transportation Committee

McKinsey & Company, 2022: Burns, T et al. ‘Investing in Georgia today for the economy of tomorrow’ 17 Ericsson Group, 2022: November 30, 2022 Press Release 18 Georgia Office of Budget and Planning, 2023: Population Projections, State Residential Population 19 Woods and Poole Economics, 2022: Employment Projections, Georgia 20 Commissioner of Georgia Department of Transportation, Russell McMurray; February 6, 2023. Senate Transportation Committee 21 Asendia Insights, 2022: ‘E- Commerce sales worldwide set to increase by 50% by 2025, reaching 7.5 trillion dollars’ 22 Georgia Center for Innovation and Selig Center for Economic Growth, 2021: InMotion 2021 Report 23 Georgia Department of Transportation, 2021: Statewide Strategic Transportation Plan: 2050 24 Association of American Railroads, 2021: Georgia Freight Rail 2021 Data Publication 25 Georgia Department of Economic Development, 2019: Logistics Fact Sheet of Georgia 26 Georgia Department of Economic Development, 2019: Logistics Fact Sheet of Georgia 27 Georgia Department of Economic Development, 2019: Logistics Fact Sheet of Georgia 28 Georgia Department of Economic Development, 2019: Logistics Fact Sheet of Georgia 29 Georgia Department of Economic Development, 2019: Logistics Fact Sheet of Georgia 30 Georgia Department of Transportation, 2022: Statewide Air Cargo Study Technical Report 31 Georgia Department of Transportation, 2021: Statewide Air Cargo Study Executive Summary 32 Georgia Department of Transportation, 2021: Statewide Air Cargo Study Executive Summary 33 Georgia Department of Transportation, 2021: Statewide Air Cargo Study Executive Summary 34 Georgia Department of Transportation, 2022: Statewide Air Cargo Study Technical Report 35 Georgia Department of Transportation, 2021: Statewide Air Cargo Study Executive Summary 36 Georgia Department of Economic Development, 2019: Logistics Fact Sheet of Georgia 37 Georgia Center for Innovation and Selig Center for Economic Growth, 2021: InMotion 2021 Report 38 McKinsey & Company, 2022: Burns, T et al. ‘Investing in Georgia today for the economy of tomorrow’ 39 McKinsey & Company, 2022: Burns, T et al. ‘Investing in Georgia today for the economy of tomorrow’ 40 McKinsey & Company, 2022: Burns, T et al. ‘Investing in Georgia today for the economy of tomorrow’ 41 Georgia Department of Community Health, 2022: Healthcare Workforce Commission Final Report 42 Georgia Rural Health Innovation Center, 2022: Indicator Report Data Hub; Non Communicable Disease 43 Georgia Department of Community Affairs, 2022: Georgia Broadband Program 44 Georgia Office of the Governor, 2022: August 12, 2022 Press Release 45 Georgia Department of Community Affairs, 2022: Georgia Broadband Availability Map 46 Georgia Department of Community Affairs, 2022: Georgia Broadband Program 47 Ericsson Group, 2022: November 30, 2022 Press Release

1

16