The EV9 is the best of two worlds. It’s a ruggedly powerful SUV with available AWD, 379 horsepower, and 5,000 lbs. of towing capacity. And, it’s a sleek and premium EV, with a three-row cabin, and Kia’s most advanced tech. It’s all the things you never knew you could have in one amazing vehicle.

This year marks the third release of the Georgia Chamber Foundation’s Economic Competitiveness Redbook, a resource that provides curated data, broken down to county-level, to showcase Georgia’s strengths and opportunities when compared to all other states.

The Economic Competitiveness Redbook ensures leaders across the state have the specialized data they need to guide strategic decision-making, regardless of zip code. As we look to the year ahead, the need for robust research and tailored insights has never been greater. We strive to enable effective resource alignment, build robust partnerships, and direct innovative policy development to sustain Georgia’s record breaking economic success. The Economic Competitiveness Redbook is another tool from the Georgia Chamber Foundation to meet those goals.

Georgia, once again, was named the number one state in the country in which to do business—for an unprecedented 11th consecutive year. To maintain this economic success, the Georgia Chamber and Georgia Chamber Foundation will focus on a long-range strategic vision: GEORGIA | 2050.

GEORGIA | 2050 will direct the efforts of both organizations, focusing on five Prosperity Pillars.

Solutions and strategies must be implemented now so that Georgia has every resource necessary to sustain our recordbreaking economic success. This includes the freight and logistics infrastructure needed to support population and job growth, a workforce that is prepared for careers of future, resources for small businesses and entrepreneurs to grow their business, a regulatory system that creates a competitive business climate, and supporting healthy communities across the state. The 2025 Economic Competitiveness Redbook provides data analysis, trends, and curated insights addressing each of these areas to equip leaders to build a prosperous Georgia in 2050.

AS LEADERS OF THE GEORGIA CHAMBER and the Georgia Chamber Foundation, through our robust surveys, listening sessions and polling, we understand the challenges and opportunities that you and your business are facing. You’ve been clear, looking to the future, the pace of change is projected to only accelerate, deepening the need for deeper insights and data to drive strategic decision making and deliver an impactful result. This serves as the impetus for the Georgia Chamber’s new strategic plan, GEORGIA | 2050, an effort to provide private and public leaders with the resources to remain prosperous in an increasingly complicated world.

The Georgia Chamber Foundation was created to engage in the development of proactive, long-term solutions to some of Georgia’s most pressing challenges. By examining current and future trends, the Foundation performs data analysis to educate, convene and drive thoughtful, powerful policymaking. Our Government Affairs Council then uses that insight to guide our advocacy and legislative priorities each year before the Georgia General Assembly and in Congress to help you and your employees thrive.

This Economic Competitiveness Redbook is an extension of our new strategic plan, helping to bolster economic growth in your community and the state as a whole. The 2025 edition delivers key takeaways as well as abundant data allowing leaders to best understand where Georgia has an economic advantage and how best to increase our competitiveness. New this year, are key trends to capitalize on to increase economic prosperity and strategies that best leverage the state’s strengths.

As we prepare for unprecedented change, we also prepare for unprecedented opportunity that will bring elected, community and business leaders together to build a brighter, more prosperous future.

ED ELKINS, CHAIR Georgia Chamber of Commerce

KIM GREENE, CHAIR Georgia Chamber Foundation

THE GEORGIA CHAMBER OF COMMERCE has helped shape Georgia’s economy for 109 years. Through meaningful partnerships with government, over 200 local chambers and business associations, economic developers, the Georgia Allies, national partners and over 50,000 Georgia businesses, we successfully advocate for free enterprise, provide valuable small business resources like our SMART health plan and our 401K plan, convene and host meaningful statewide events and programs, and offer insightful business intelligence and policy solutions. The challenges that face our state over the long-term are ever-evolving but promise to be delivered at a rapid pace. Our GEORGIA | 2050 plan promises to build upon our strengths of partnerships and steadfast leadership to convene, educate, equip and empower our members, investors, and legislative partners with a blueprint for long-term economic policy making. We stand as a united force for prosperity, committed to building successful strategies for years to come. To effectively execute this plan, a more data-driven, strategic approach, is needed. This has led to our renewed focus on providing data rich resources to drive longterm planning and thoughtful decision making. Our third edition of our annual Economic Competitiveness Redbook provides relevant data on Georgia’s current economic state as well as metrics related to the five pillars of GEORGIA | 2050. This publication is produced in concert with economic reports delivered quarterly throughout the year so that you have actionable insights in real time. We are using this data to drive everything we do and will continue to embed our insights into our policy-oriented programming. In the first quarter of 2025, we will host our Future of Talent Summit. We’ll convene for our third Future of Sustainability and Energy Summit in the spring of 2025. Our Rural Prosperity Summit will be held in Fall 2025 back in Tifton. Our Diversity, Equity and Inclusion Council will host a Women Who Lead event in March 2025, and our annual DE&I Summit will be held in November 2025. Please join us for these events and others to learn from top public and private leaders about how to develop meaningful solutions in your business and community. As our team executes our new strategic plan, you can continue to rely on our team to use data, public policy trends, and business best practices to offer proven solutions to our elected leaders in local communities, the Georgia General Assembly, and statewide elected officials to support economic growth. These goals and data will be utilized to advocate for legislation and support political candidates at the state and federal level who share our long-term vision of a thriving, strong Georgia.

CHRIS CLARK, PRESIDENT & CEO

Georgia Chamber of Commerce

DANIELA PERRY, EXECUTIVE DIRECTOR Georgia Chamber Foundation

GEORGIA | 2050 is built to help our businesses navigate the fastest economic transitions in history.

For decades, Georgia has thrived under a foundation of steady, pro-business policies and visionary political leadership. This stability has sent a clear message to companies—both global and local—that Georgia is committed to their success. We have proven ourselves as a state that listens, acts, and partners with businesses to meet their challenges and cultivate a future of shared growth. This reliable environment has drawn quality investment, creating jobs and opportunities for generations to come.

However, as we look to the future, we recognize that this stability may face challenges. Political landscapes evolve, disruptions arise, and new risks emerge. GEORGIA | 2050 is our bold initiative to anticipate risks and equip both current and future leaders with the tools they need to sustain and enhance Georgia’s business climate. This plan offers forward-thinking solutions to mitigate risk and capitalize on opportunities in an increasingly complex and interconnected global economy.

GEORGIA | 2050 is a plan with a clear purpose: to continue convening, educating, equipping, and empowering our members, investors, and legislative partners with a foundation and blueprint for long-term economic policymaking. We stand as a united force for prosperity.

Georgia’s future depends on the strength of its partnerships—from main street businesses to corporate giants, from locally-elected leaders to the Governor’s Office, from local chambers to our organization. Through GEORGIA | 2050, we will elevate these partnerships, fostering a culture of corporate citizenship, free enterprise, and collaborative servant leadership. Together, we will build a trusted community committed to ensuring that Georgia’s children and grandchildren have the resources, infrastructure, education, healthcare, skills, business climate, and career opportunities they need to thrive in an ever-evolving world.

The work we do today will define the Georgia of tomorrow—strong, vibrant, and ready to lead the way.

As the leading voice for business in Georgia, the Chamber acts as a thought leader, advocate, convener, and servant leader. Through our strategic partnerships and statewide network, the Chamber helps business and community leaders align their efforts for maximum impact.

Understanding and responding to external forces is no longer optional—it’s essential. Through the Georgia Chamber’s rigorous polling, surveys, analysis, and frontline expertise, GEORGIA | 2050 provides businesses with actionable intelligence that is not only relevant but critical to decision-making. Whether facing government regulations or unforeseen economic events, businesses can turn insights into tangible actions.

In today’s fast-paced global economy, market-moving events can disrupt entire sectors. But with the foresight offered by GEORGIA | 2050, you will be prepared. Our plan empowers executives to anticipate future events, enabling them to turn uncertainty into opportunity. Research-backed insights allow businesses to act with confidence, whether they’re navigating supply chain disruptions or regulatory shifts.

From small-town enterprises to multinational corporations, GEORGIA | 2050 provides clarity on policy, labor trends, and economic forecasts that directly impact business success. The initiative offers tailored intelligence on workforce solutions, demographic trends, and industry-specific risks and opportunities, ensuring Georgia businesses stay competitive and adaptable in an unpredictable world. We back those insights with the largest and most experienced statewide business advocacy team fighting for free enterprise.

At its core, GEORGIA | 2050 is about partnership. The Georgia Chamber is an indispensable ally to businesses, investors, and policymakers, offering insights, advocacy, and connections that keep Georgia’s economy thriving. In a chaotic world, the Georgia Chamber stands steadfast alongside our members, helping to navigate risks and seize opportunities for success.

With GEORGIA | 2050, the future becomes a landscape of opportunity. By staying informed and prepared, Georgia businesses can confidently face the challenges of tomorrow, secure in the knowledge that they are supported by the state’s most influential economic institution.

The future Georgia economy will be powered by people, and a skilled workforce is essential for the Peach State to remain competitive. GEORGIA | 2050 focuses on developing talent pipelines that prepare Georgians for the jobs of tomorrow. Through educational initiatives, workforce training programs, and partnerships with educational institutions, Georgia businesses must have access to a ready and capable workforce equipped with the skills needed to thrive in a fast-paced, technology-driven world. Our new Center for Talent and Workforce Preparedness will take on the challenge of preparing the next generation for the high-demand careers that will ensure long-term economic resilience for the state.

Coordinated and consistent recruitment, retention and a world-class job creation environment are the core of Georgia’s past and future prosperity. By fostering a business-friendly environment, GEORGIA | 2050 ensures our ability to attract top investors, multinational companies, and innovative enterprises to the state. This effort also focuses on regulatory clarity, curbing lawsuit abuse, advocating for policies that protect free enterprise and minimizing red tape. By ensuring Georgia remains competitive on the global stage, businesses in our state can expand, innovate, and attract new talent and capital, driving growth across sectors. To support these efforts, look for new content, more storytelling about the good work and impact of Georgia companies.

Reliable and safe infrastructure is the foundation of any strong economy. GEORGIA | 2050 continues our state’s long prioritization of bipartisan infrastructure development—from roads and bridges to digital connectivity— ensuring Georgia’s businesses and citizens can operate efficiently and access the resources they need. In addition, we also know that the future of Georgia will be powered by a strong and reliable energy system, as consumer demand evolves. By addressing infrastructure needs today, we will lay the groundwork for the economic growth and operational efficiency of tomorrow, while also ensuring the state is prepared to meet the challenges of energy security. To facilitate this effort, we will convene Georgia leaders at an annual Sustainability and Energy Summit.

GEORGIA | 2050 emphasizes regional prosperity, ensuring that every community—urban, hub, and rural—has access to opportunities. We will continue the work of the Georgia Chamber’s Center for Rural Prosperity and Hub Chamber Council to strengthen every corner of the state. Georgians need access to quality healthcare, workforce housing, and vibrant communities that create a quality of life that keeps and attracts the next generation of talent. The Chamber’s work ensures that regions across the state can attract businesses, retain talent, and offer a high standard of living, creating a thriving and inclusive Georgia for all its citizens. GEORGIA | 2050 will also support disaster and crisis preparedness and resilience, offer low-cost health care for small businesses and build a stronger coalition of local and binational chambers across the state. We also know that strong communities need engaged citizens, and that’s why we’re introducing and hosting the National Civics Bee. This effort will further strengthen the next generation’s commitment to democracy, civility, and engagement.

The future belongs to the innovators and risk-takers and GEORGIA | 2050 cultivates a culture of entrepreneurship and innovation, encouraging start-ups and small businesses to thrive. Our affiliate, FLEX, will focus on building the next generation of entrepreneurs as we cast a wider net to support all small businesses by providing the necessary resources, networks, and support. Doing so will create jobs and introduce cutting-edge products and services. Innovation is essential to maintaining Georgia’s competitive edge, and through this pillar, the Chamber will ensure that both new and established businesses have the tools to lead in a global marketplace. In an effort to promote Georgia’s makers, doers, growers and creators, we’re launching an exciting new program: Coolest Thing Made in Georgia. This annual competition will allow Georgia companies to tell their stories, promote their products and celebrate a state of innovation!

At the heart of the GEORGIA | 2050 vision lies a steadfast commitment to four guiding principles that define the Georgia Chamber’s role as a champion for prosperity: Corporate Citizenship, Economic Stewardship, Servant Leadership, and Advocacy for Free Enterprise

The Georgia Chamber recognizes the good work that our members do every day in their communities. We know that businesses thrive when they actively contribute to the well-being of the communities they serve. Corporate Citizenship is about fostering partnerships, embracing responsibility, and ensuring that economic success goes hand in hand with strong communities.

As stewards of Georgia’s economy and business community, the Georgia Chamber is committed to promoting a thriving business ecosystem that supports quality growth, small businesses, startups, and entrepreneurs as key drivers of innovation and job creation. We also prioritize the coordination and greater chamber network through our local chamber and binational partners.

True leadership emerges when we prioritize the needs of others. At the Georgia Chamber, servant leadership is the cornerstone of our approach to building trust, empowering teams, and fostering collaboration across Georgia.

The Georgia Chamber proudly stands as the champion for free enterprise, the engine that drives opportunity, innovation, and prosperity. We firmly believe in safeguarding an environment where businesses can quickly adapt to the needs of their customers, compete fairly, and contribute to the state’s vibrant economy. Through our advocacy efforts, we promote policies that uphold the principles of a free market, encouraging competition, and letting businesses do what they do best: quickly meeting customer demand. We defend the rights of businesses to operate without undue interference while fostering conditions for economic growth and resilience, and in doing so we unite business leaders, legislators, and community stakeholders to ensure Georgia remains a beacon for investment, entrepreneurship, and innovation.

For 110 years, the Georgia Chamber has been the state’s premier convener through business summits, leadership forums, and policy roundtables. We will leverage that strong history with pillar-specific committees, events, programs, and statewide gatherings to connect your business with influencers and policymakers. Members can engage with a variety of committees, including several new groups: the Labor Relations and Employee Retention Committee, the Global Business Policy Subcommittee and the Financial Services and Insurance Policy Subcommittee

The success of GEORGIA | 2050 depends on strong partnerships across the public and private sectors. The Georgia Chamber will continue to collaborate with a diverse range of corporate partners, government agencies, educational institutions, business associations, local chambers, and nonprofit organizations. These partnerships are essential to implementing the strategies outlined in the plan, from enhancing workforce readiness to driving innovation and regional prosperity.

Critical to our success is the engagement of our Chamber Federation, a coordinated collaborative of local chambers of commerce. They serve as the grassroots advocates and conveners for regional priorities, ensuring that each community plays an active role in our statewide success. By working closely with local chambers, the Georgia Chamber ensures that the five pillars of this plan are executed at the regional level, ensuring alignment and coordination between state and local priorities.

The Georgia Chamber of Commerce’s public affairs efforts are dedicated to advocating for policies that support business growth and economic development. The Chamber engages with state and federal elected officials, regulatory agencies, and local governments to ensure that Georgia remains a competitive place to do business. Each year, through careful listening and proactive policy development, our team crafts powerful state and federal legislative priorities to bolster our already favorable business environment. Our unique and influential Government Affairs Council mobilizes business leaders to engage in the legislative process, providing a platform for members to voice their concerns and influence policy decisions. Moving forward, expect more complete and dynamic Georgia-specific policy development on key issues and model legislation that affect the business community, guiding advocacy efforts throughout the year.

Supporting, recruiting, and equipping pro-business, pro-job-creator legislators is not just a responsibility—it’s an investment in Georgia’s future. These leaders are the architects of policies that drive innovation, create jobs, and foster economic resilience. By backing the newly formed Free Enterprise Fund, we will ensure that the voices championing free markets and economic growth are not just heard but empowered to enact change. This fund is more than a resource; it’s a catalyst for advancing Georgia as a national leader in opportunity and prosperity. Every dollar invested fuels advocacy, supports candidates who prioritize business-friendly policies, and protects the foundation of free enterprise that underpins our shared success. Let’s build a legacy of growth, together, by standing firmly with those who stand for Georgia’s businesses and workers.

The Georgia Chamber Foundation is the driving force behind Georgia’s future-focused economic strategies. As a hub for research, data, and innovation, the Foundation provides critical business intelligence and insights that empower businesses to tackle their most pressing challenges. Through its work, the Foundation develops forward-thinking policies, solutions, and initiatives that shape a resilient and thriving business environment. Supporting the Foundation means investing in the thought leadership and strategic vision needed to address workforce development, infrastructure, and economic competitiveness. The Georgia Chamber Foundation isn’t just a resource for today—it’s the catalyst for securing your business’s success in the future and ensuring Georgia remains a leader in opportunity and innovation.

The Georgia Chamber of Commerce invites corporate leaders, local chambers, and community partners to join us in the implementation of GEORGIA | 2050. Together, we will build a future where Georgia leads the nation in business innovation, corporate citizenship and economic prosperity.

This is your roadmap to thriving in an era of global transformation. GEORGIA | 2050 isn’t just a strategic plan—it’s the future of business in Georgia.

The Georgia Chamber Foundation Economic Competitiveness Redbook is a collection of key data sets that showcase Georgia’s strengths and opportunities compared to all fifty states and within individual counties. This curated data enables more effective strategic decision-making for state, local, community, and business leaders to ensure Georgia remains competitive over the long-term.

Our team encourages you to review the data relevant to your community and use it to start conversations with partners and stakeholders about addressing challenges and opportunities in your organization and community.

In order to best reflect the state of Georgia, the Redbook groups counties into three distinct regions based on population and economic opportunity criteria: Rural, Hub, and Metro Atlanta. Listed below are Hub counties, which serve as regional centers of employment and growth, and the counties of Metro Atlanta. The remaining 135 counties are considered rural.

Hub Counties: Athens-Clarke, Augusta-Richmond, Chatham, Columbia, Dougherty, Floyd, Glynn, Hall, Houston, Lowndes, Macon-Bibb, Muscogee, Whitfield

Metro Atlanta Counties: Cobb, Cherokee, Clayton, DeKalb, Douglas, Fayette, Fulton, Gwinnett, Henry, Rockdale

This section focuses on providing top trends about Georgia’s economy, highlighting need-to-know facts about Georgia in 2025.

The Economic Competitiveness Redbook aims to provide the most relevant and up-to-date information available at the state and county level. The information presented in this volume is the most updated information available at the time of compilation. Due to data release schedules, there may be lags in information available and/or updated release of data post-publication.

National data may be displayed either as a national aggregate or as a state average. Regional breakdowns in the county tables are often displayed as an average of the counties in that region.

All state level tables are organized by and include a ranked comparison of all 50 states. Some tables may have multiple ranking columns. The ‘rank’ column will always refer to the measure in the column directly to its left. While national level and District of Columbia data may be included in the data set, neither will be ranked. County level tables are not ranked. In cases where multiple states are tied, it will be marked with a (T) beside the rank.

Top takeaways are provided for each table, and additional insights are located both throughout and at the beginning of each table section. Additionally, state and regional insights are provided at the beginning of the book.

Georgia’s population is growing faster than originally projected, particularly in rural regions.

• By 2050, Georgia’s population is expected to add nearly 2.5 million Georgians

• The fastest growing population group is those individuals over 65 years old

By 2050, Georgia is expected to add more than 3.1 million jobs. However, data indicates challenges ahead:

• Georgia ranks 30th nationally for change in Labor Force Participation Rate, lagging behind the national average.

• 43% of Georgians have an associate’s degree or above which is slightly below the national average. This demonstrates a need to increase the skilled talent base.

• 38.44% of Georgia third graders are reading at grade level or above.

Georgia remains a leader in logistics and infrastructure due to its robust network of sea and inland ports, airports, rail lines, highways, and roads.

• In order to maintain the state’s competitive advantage, Georgia needs $84 billion in infrastructure funding by 2050 to meet current needs so we can support the future growth of our freight and logistics network.

Georgia provides reliable energy at nationally competitive rates that fall far below the national residential price, proving the importance of our vertically integrated and regulated market structure to provide stability and aid in long-term planning.

• Georgia ranks 2nd among the top GDP producing states.

Georgia continues to foster an internationally competitive, business-friendly environment, which is essential to Georgia being the number one state to do business for an unprecedented 11 consecutive years.

• Georgia consistently has one of the lowest tax burdens in the nation and this year, Georgia ranks 8th lowest. The tax burden by state provides an average picture of total taxes paid per citizen in the state.

• Georgia has a diversified tax collection base, with personal income taxes, general sales taxes, and corporate income taxes combining for over three-fourths of the state’s total tax revenue streams.

Over the last five years, business applications in Georgia have increased significantly, indicating a growing climate of innovation and entrepreneurship. There are numerous opportunities to continue increasing investment in key industries and to expand research and development.

• Business applications in Georgia increased by 73% across the state, and skyrocketed in rural and hub communities, increasing by over 100% from 2018 to 2023

• R&D value added to the state increased by nearly 20% from 2017 to 2021

• Businesses invested over $1.5 million in venture capital in Georgia in 2023, which has increased by 40% since 2018

• To ensure Georgia remains prosperous, regions, communities, and Georgians must have access to critical resources to further upward mobility.

• The percentage of Georgia’s population living in poverty has increased over the last year to 13.6%, exceeding the national average of 12.3%

• 61% of Georgians live in a health professional shortage area, demonstrating the need for an increased emphasis on growing the healthcare workforce.

• In nine counties in Georgia there is no physician.

• In 40 counties, one quarter of all Georgia counties, there is no internal medicine physician.

• In 65 counties – more than a third – there is no pediatrician.

• In 82 counties – more than half – there is no OB-GYN.

• In 90 counties, there is no psychiatrist.

by State

Georgia Industries by GDP and Employment

2023 Exports and Imports by State

2024 Business Climate Rankings by State

2024 Average Annual Cost of Auto Insurance by State and Coverage

2023 Manufacturing Industry by State

Labor Force Participation Rate by State

Labor Force Participation Rate by County

Job Openings by State

2023 Educational Attainment by State

2022 National Association of Educational Progress: Student Reading Proficiencies by State

2022 National Association of Educational Progress: Math Proficiencies by State

End-of-Grade Educational Assessment: English Language Arts, by Georgia School System

End-of-Grade Educational Assessment: Math, by Georgia School System

2018 to 2022, Children Ages 3-4 Not Enrolled in School by State

88 INNOVATION & ENTREPRENEURSHIP

2024 High-Tech Employment by State

2023 STEM Doctorates Awarded by State

2023 Business Formation Statistics by State

Business Applications by County

2022 Technology and Science Index by State

Venture Capital Deal Activity and Fundraising by State

2021 Index of State Dynamism

2023 Business Birth and Death Rates by State

R&D Value Added by State

110 REGIONAL PROSPERITY AND HEALTHY COMMUNITIES

2023 Poverty Rate by State

2022 Poverty Rate by County

Number of Low-Income Working Families with Children by State

Housing Inventory by State

Housing Inventory by County

2023 Homeownership by State

2022 Population Living in Health Professional Shortage Area by County

Rate of Medical Professionals per 100K Residents by State

2023 Retention of Medical Residents by State

General Health of Population by County

142 INFRASTRUCTURE AND ENERGY

Hartsfield-Jackson International Airport Number of Passengers

Georgia Port Monthly TEU Throughput

2021 Rail Miles and Employment by State

2024 Warehousing Employment by State

Georgia Warehousing Rental Rates

2022 Freight Flow by State

2023 Electricity Generation by State and Source

2023 Electricity Market by State

Georgia continues to experience unprecedented economic growth, regularly hitting historic employment records despite national economic cooling. Particularly in the last year, strategic investments in infrastructure, continued population growth, and strong business climate set Georgia for success.

Excluding government, these are the largest industries in Georgia based on the number of jobs.

• Healthcare and Social Assistance: 575,895 Jobs

• Retail Trade: 535,014 Jobs

• Accommodation and Food Services: 456,261 Jobs

• Manufacturing: 442,591 Jobs

• Administrative and Support and Waste Management and Remediation Services: 381,844 Jobs

• Professional, Scientific, and Technical Services: 370,247 Jobs

For the 11th straight year, Georgia is the number one state in the nation for business.

Over the last six years, Georgia has experienced record economic growth more than

created and over $154 billion in capital investment.

Employment in the state totals 5,446,346. By 2050, job growth is projected to increase by 46%, totaling more than 3.1 million new jobs.

Georgia has and is expected to add more than 186,000 STEM jobs over the next five years which is twice the national average.

The following industries have experienced the fastest job growth over the last 5 years in the Peach State:

• Transportation and Warehousing: +70,630 Jobs

• Healthcare and Social Assistance: +65,072 Jobs

• Professional, Scientific, and Technical Services: +56,771 Jobs

• Construction: +30,735 Jobs

• Finance and Insurance: +30,635 Jobs

• Manufacturing: +26,540 Jobs

Georgia’s population has risen to over 11 million individuals. By 2050, the state’s population is expected to grow by 22.6%, equating to 2.5 million new citizens.

According to recent data from, rural Georgia can expect a in population over the next five years. This growth rate exceeds that of the state, Metro Atlanta, and Hub communities.

Georgia ranks 45th nationally when looking at the percent of business applications that actually form into a business. This indicates there is an opportunity to better prepare potential entrepreneurs and small business owners.

Small businesses in Georgia employ over

The Port of Savannah is the

Over the last ten years, there has been a in trade at the port of Savannah. Annual Georgia based freight tonnage will increase by 91% by 2050.

359,000 Jobs 2.1M STEM Professionals 1.7M people 6% Growth 90% increase 61% 66,000 healthcare jobs

and these employees make up 42% of all Georgia employees.

In 40 counties, one quarter of all Georgia counties, there is no internal medicine physician. All of those counties are rural.

of Georgians live in a health professional shortage area meaning there is a significant need to grow the state’s healthcare workforce shortage.

Projections indicate the state will need to add by 2032 in addition to accounting for 173,000 healthcare workforce exit replacements.

Hub communities are Georgia’s 11 midsize Metropolitan Statistical Areas (MSAs) located outside of Metro Atlanta, which act as regional economic drivers and hubs of employment and educational opportunities. Many Hub communities also support at least one military installation. Challenges in small business growth and labor participation must be addressed to ensure these communities continue to thrive and support regional economic opportunity.

• Healthcare and Social Assistance: 144,674

• Manufacturing: 118,079

• Retail Trade: 113,190

• Accommodation and Food Services: 109,315

• Administrative Support and Waste Remediation: 69,791

• Transportation and Warehousing: +10,505

• Healthcare and Social Assistance: +9,794

• Manufacturing: +8,192

• Construction: +4771

• Administrative Support and Waste Remediation: +4,671

Hub communities have particularly struggled with labor force participation over the past five years, decreasing from

and have fallen behind Metro Atlanta and rural regions in the past year in job growth.

Hub communities

support the largest healthcare systems outside of Atlanta, which are critical for building and maintaining much needed healthcare workforce across the state.

Major infrastructure and logistics centers such as the regional airports, the coastal Ports of Savannah and Brunswick, inland ports in Georgia’s north and southwest, as well as extensive road networks are critical in supporting regional development and opportunity.

60.3% to 57.6%, manufacturing, logistics, and financial industries

Growth in the number of occupations related to

will continue to provide promising opportunities for those people living in hub communities.

The Fiserv Small Business index, which measures multiple indicators of small business health, fell in mid-metropolitan areas at the beginning of 2024.

Directing resources to these regions which may lack Atlantasized entrepreneur networks but fall short of rural resources could further boost economic opportunity in these regions.

THE FISERV SMALL BUSINESS INDEX DECLINED BY 12.5% in midsized

from Q1 of 2023 to Q1 of 2024

The Metro Atlanta region continues to have new, diversified economic opportunities, leaning into science and technology development as well as financial services. While many workplaces/employers have resumed their in-office models, hybrid and remote options continue to impact business trends including workers moving to outlying metro communities, increasing commuter flows into the heart of the city.

• Healthcare and Social Assistance: 303,573

• Retail Trade: 258,504

• Professional, Scientific and Technical Services: 252, 760

• Accommodation and Food Services: 231,331

• Transportation and Warehousing: +42,590

• Healthcare and Social Assistance: +39,753

• Professional, Scientific and Technical Services: +28,645

• Finance and Insurance: +18,980

• Construction: +16,046

• Administrative Support and Waste Management: 204,393 Historic trends indicate greater population growth in the outlying counties of the Metro Atlanta region, which may drive further infrastructure development and spin-off business growth.

Metro Atlanta population is expected to grow by about but will surpass 20% growth in population by 2050, outpacing other regions in Georgia. 5% by 2028 Solutions need to be implemented to mitigate bottlenecks, such as interchange improvements, utilization of commercial vehicle lanes, and improvements to the truck network.

As Atlanta expands as a tech hub, software development occupations are expected to grow significantly, with managerial and strategy occupations to follow. Although many of these jobs require a bachelor’s degree, this industry is particularly receptive to career switching and more skills-based hiring models.

The top 20 bottleneck locations in the Metro Atlanta region generate in user costs to trucks and shippers each day.

All top 20 bottleneck locations are projected to experience at least in truck traffic from 2019-2050. $3.5 Million

Chamber Foundation

Rural communities continue to thrive on local collaboration and developing regionally focused solutions to further opportunity and prosperity. The growth of economic development projects in and near rural communities continued over the last year, particularly with new announcements in the advanced manufacturing sector.

• Manufacturing: 184,704

• Retail Trade: 156,587

• Healthcare & Social Assistance: 118,800

• Accommodation & Food Services: 117,708

• Construction: 85,580

• Transportation & Warehousing: +17,463

• Retail Trade: +17,274

• Accommodation & Food Services: +12,108

• Manufacturing: +10,398

• Construction: +10,036

Employment in rural Georgia has grown steadily and sits at around

1,339,000 older individuals 20%

of rural Georgia’s population is projected to be above the age of 65 by 2028, compared to only 15% in Metro Atlanta.

However, only 56.7% of working-aged individuals are engaged in the workforce compared to 61.4% at the state level. will grow by 6%

Despite benefitting from population growth, rural Georgia has a larger share of than in other regions, underscoring the need for talent pipeline development to sustain businesses and communities over the long-term.

Rural Georgia’s population is increasing faster than earlier projections anticipated. The population in rural areas over the next five years, which is greater than the projected growth in metropolitan communities.

Georgia’s population is growing faster than originally projected, particularly in rural regions, which has critical implications for directing investments and plays directly into economic growth and development needs. In the next five years, the rural Georgia population growth rate is projected to surpass Hub communities and Metro Atlanta, although Metro Atlanta will support the highest growth rate, at 17% by 2040. However, the fastest growing population group in the state is those over 65 years old. Businesses should invest in succession planning and workforce strategies that engage older Georgians and retirees.

• TABLE 01

2023 State Population by Age

• TABLE 02

2023 State Population by Race

• TABLE 03

2024 County Population by Age

• TABLE 04

2024 County Population by Race

• TABLE 05

County Population Projections

FROM 2022 TO 2023 ALONE, Georgia’s population grew by 100,000, with notable growth in American Indian, Asian and ‘Other’ groups indicating the state is becoming more diverse. The fastest growing population group in the state is those over 65 years old.

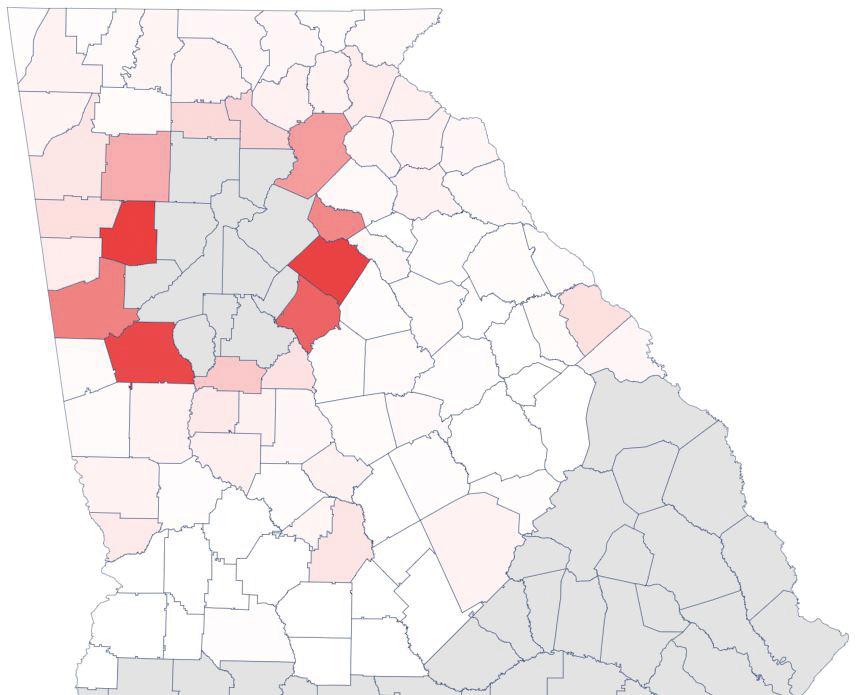

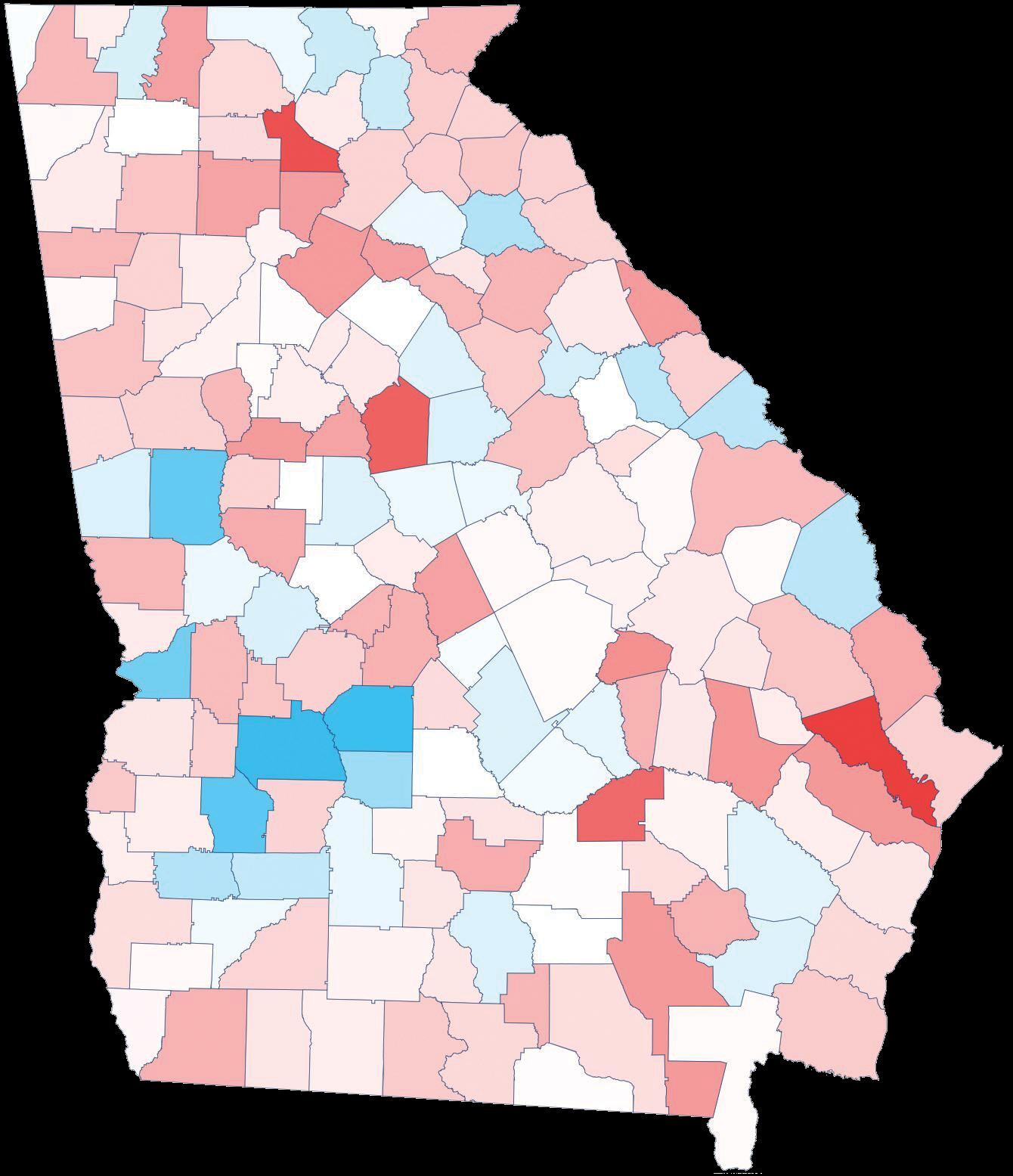

2023 to 2028

Projected Population Change %

Georgia’s population is slightly younger than the national average, with a median age of just under 38 compared to the United States at just above 39 years old. Georgia supports a significant number of experienced workforce and potential retirees, but the number of children 14 and younger is greater than number of Georgians ages 15 to 24 years old. This indicates that Georgia is well positioned to support the growing number of retirees as they transition out of the workforce.

Sourced from the US Census Bureau, 2023 1 year American Community Survey Population Estimates

While Georgia’s population is predominantly comprised of White or African American individuals, the state continues to diversify, especially as economic opportunity continues to expand.

Sourced from the US Census Bureau 2023 1 Year American Community Survey

Georgia supports a slightly younger population than the national average, with 16% of Georgia's population over 65 years of age, compared to the national average of 17.7%. Rural Georgia has the largest share of its population over 65 years of age and Metro Atlanta has the lowest percentage. Metro Atlanta has the largest share of its population being working-age adults at 54% of the population.

Sourced from the Governor’s Office of Planning and Budget, 2024 Population Projections Data

Individuals over 65 years old are the fastest growing population group in the state.

Sourced from McKinsey and Company, Investing in Georgia for the economy of tomorrow report.

White individuals continue to make up the largest share of the state's population, as well as the largest share regionnally. Metro Atlanta has the largest share of African American individuals and the largest share of Hispanic individuals as part of its population of any community type.

Sourced from the Governor’s Office of Planning and Budget, 2024 Population Projections Data Discrepencies in totals between county and state-level data may exist due to ‘Hispanic’ as an ethnicity overlayed with other race categories.

The rate of population growth in rural Georgia is expected to surpass growth rates in Hub and Metro regions over the next five years, but will slow in the long run through 2040. Metro Atlanta has the highest projected population growth rate between 2030 and 2040.

Sourced from the Governor's Office of Planning and Budget, 2024 Population Projections Data

Georgia continues to foster an internationally competitive, business-friendly environment, exhibiting robust workforce training programs and the 11th most manufacturing jobs nationwide. Georgia has consistently had one of the lowest tax burdens in the nation and this year ranks 8th. Maintaining a competitive regulatory environment is key to the state’s success.

• TABLE 06

2022 Businesses’ Share of Total State and Local Taxes

• TABLE 07

Per Capita Personal Income by State

• TABLE 08

2022 State and Local Tax Burden by State

• TABLE 09

2023 Sources of State and Local Tax Collections by State

• TABLE 10 Real GDP by State

• TABLE 11 Non-Agricultural Employment by State

• TABLE 12

Georgia Industries by GDP and Employment

• TABLE 13 Exports and Imports by State

• TABLE 14

2024 Business Climate Rankings by State

• TABLE 15

2024 Average Annual Cost of Auto Insurance by State and Coverage

• TABLE 16

2023 Manufacturing Industry by State

Georgia remains the 7th largest state in the U.S. for total trade. In 2023, Georgia’s air and sea ports facilitated more than $186.3 billion in total trade across the globe.

Top trading partners include:

Georgia businesses pay 41.4% of state and local taxes, which is below the national average and ranks 17th lowest in the country. This is important in maintaining a competitive business climate while businesses explore locations for new projects and expansions.

Per capita income is a measure of the amount of income earned per person in a specific geographic region. Georgia ranks 45th nationally for its growth of per capita income from 2022 to 2023, indicating per capita income remained consistent while most states experienced more growth comparatively.

Sourced from the Bureau of Economic Analysis, Personal Income by State Report

The tax burden by state provides an average picture of total taxes paid per citizen in the state. Georgia has consistently had one of the lowest tax burdens in the nation and this year ranks 8th.

Sourced from the Tax Foundation, State-Local Tax Burden Rankings FY 2022

For Georgia to remain competitive, the overall state and local tax burden must remain low. The state continues to succeed in this area and outpaces most Southern state competitors.

Georgia has a diversified tax collection base, with personal income taxes, sales taxes, and corporate income taxes combining for over three-fourths of the state's total tax revenue streams.

Sourced from The Pew Charitable Trusts, How States Raise Their Tax Dollars

Georgia ranks 46th in GDP growth from 2022 to 2023, a notable decline from our 11th place ranking the previous year. Texas and Florida were the top Southern states within the top ten national ranking.

Sourced from Bureau of Economic Analysis, Gross Domestic Product by State and Region Report

Georgia ranks 19th in the nation for the percent change in non-agriculture employment from 2023 to 2024. Georgia is on par with the U.S. growth, but falls behind Southern competitors including Alabama, Florida, South Carolina, and Texas.

Sourced from the Bureau of Labor Statistics, Change in Total Nonfarm Employment by State

Manufacturing, healthcare, as well as professional, scientific, and technical services continue to drive the economy in all parts of the state, supporting over 1.4 million jobs in Georgia. These industries often offer higher-than-average wages and support high-quality career opportunities. Additionally, industries such as transportation and warehousing, construction, and retail trade also offer a high number of quality opportunities, and are crucial in supporting Georgia's rapidly growing population and number of businesses.

Sourced from Lightcast, Industry Table Does not include

Georgia ranks 7th in net exports among all states, showcasing a dynamic trade environment with substantial import and export activity.

Sourced from Lightcast, Regional Comparison Report

Calendar year 2023 marked the third record-breaking year in a row for Georgia exports, with companies exporting $49.7 billion in goods to 215 unique countries and territories. Georgia remains the 7th largest state in the U.S. for total trade.

Georgia is the number one state in the country to do business for an unprecedented 11 consecutive years. Georgia's impressive workforce training programs and well rounded economic development profile have cemented its top state status.

Georgia ranks 40th in the nation for the cost of minimum auto insurance coverage, a significant outlier from several neighboring states in the southeast. Georgia's litigious environment drives higher auto insurance costs for all Georgians.

Manufacturing is one of the largest and fastest growing industries in the state. Georgia currently ranks 11th nationally for number of jobs in the manufacturing sector. Adjusted earnings exceed $88,000 for manufacturing jobs, far ahead of the median income.

Sourced from Lightcast Regional Report

Manufacturing

• TABLE 17 Labor Force Participation Rate by State

• TABLE 18 Labor Force Participation Rate by County

• TABLE 19 Job Openings by State

• TABLE 20

2023 Educational Attainment by State

• TABLE 21

2022 National Association of Educational Progress: Student Reading Proficiencies by State

• TABLE 22

2022 National Association of Educational Progress: Math Proficiencies by State

• TABLE 23

End-of-Grade Educational Assessment: English Language Arts, by Georgia School System

• TABLE 24

End-of-Grade Educational Assessment: Math, by Georgia School System

• TABLE 25 2018 to 2022, Children Ages 3-4 Not Enrolled in School by State

OVER THE LAST YEAR, the influx of economic development projects and expansions has contributed to healthy employment turnover which bodes well for sustainable growth and long-term resiliency. However, this underscores the need for continued development of, and investment in, our talent pipelines to maintain Georgia’s record-breaking economic success.

Educational attainment remains a challenge across the state. Georgia lags national attainment levels in both associate’s and bachelor’s degrees. This poses challenges as the state aims to build a skilled workforce that aligns with industry needs.

Prioritizing investments in K-12 education remains important to increase proficiency in Math and English Language Arts. Below 50% of Georgia’s students reaching grade-level proficiency in each subject. While Georgia has engaged slightly more children in early education programs from 2021 to 2022, the state still ranks 27th nationally for the change in number of children enrolled in these programs. Cost and access are the leading barriers to increasing enrollment. This poses a major barrier for companies seeking to attract and retain talent and negatively impacts Georgia children’s learning and life trajectories.

Nationally, labor force participation has increased slightly over the last five years, although this is still well below historic highs. Georgia experienced a 1.2 percentage point decline in labor force participation during this time period, tied with Kentucky for 30th place. Only 12 states experienced an increase in their labor force participation rates. Research suggests that factors including a lack of access to childcare and transportation, and a growing retirement age population could be contributing to this shift.

Sourced from the Federal Reserve of St. Louis FRED Data Tool, September Labor Force Participation Rate by State Release Data

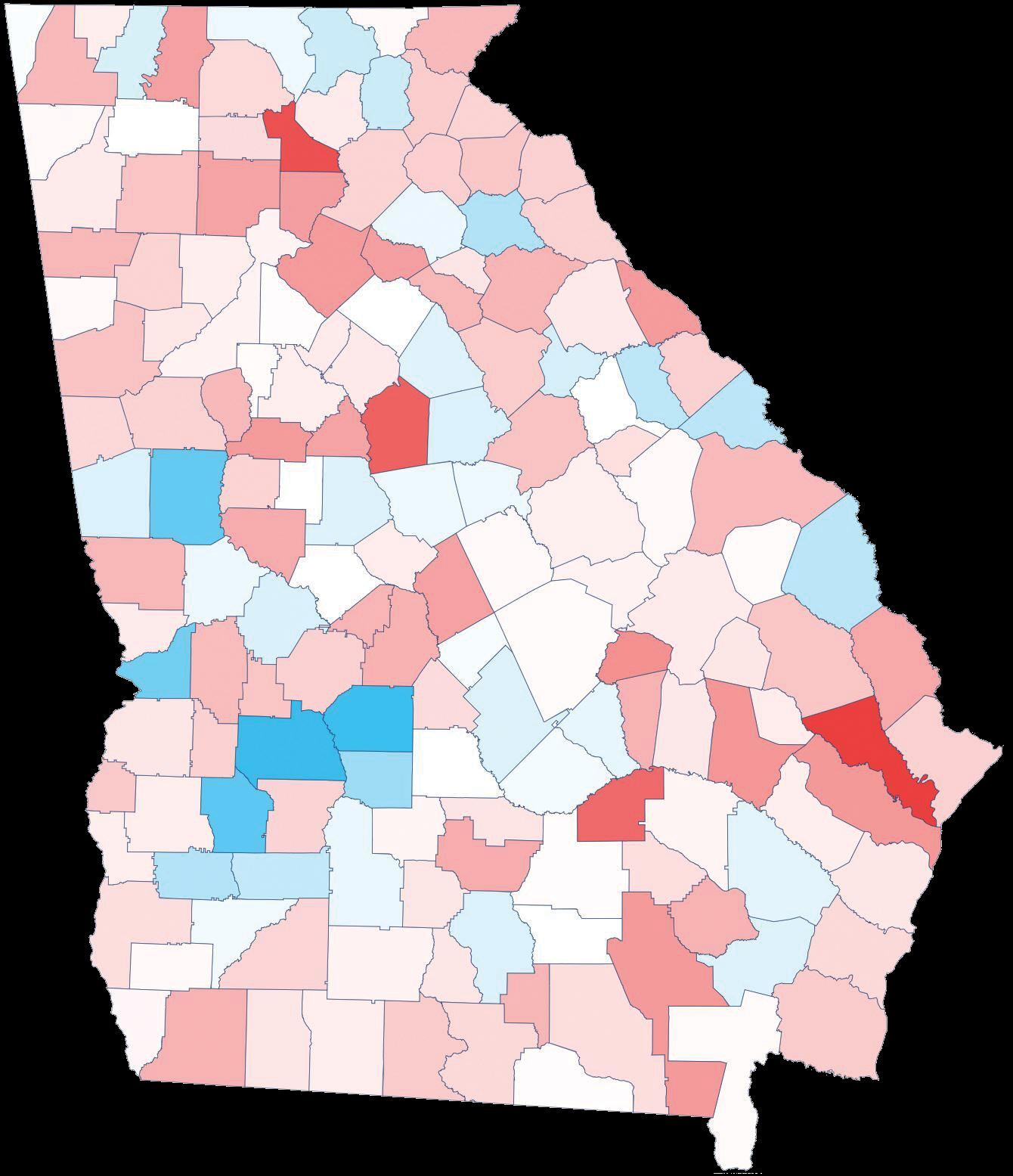

Georgia has struggled with declining labor force participation rates over the last five years in every region of the state. Hub communities, Georgia's midsize metropolitan areas, experienced the greatest decline with nearly a three-point drop from 2018 to 2023. However, some counties such as Appling, Calhoun, and White Counties have notably increased labor force participation rates, indicating that avenues to engage disengaged workers exist.

2018 Data Sourced from the US Census Bureau 2018 5 Year American Community Survey, Employment Status 16 and Over

2023 Data and Regional Summary Rates Sourced from Lightcast Data Software

Rural, Hub and Metro Atlanta Regional Estimates show the average of counties in those communities.

Significant economic development and job growth over the last five years has pushed Georgia employment levels to record highs, even in the face of slowing job openings in 2024. Through August 2024, Georgia maintains an average annual job openings rate higher than 2018 levels, although this may not reach levels seen in 2023.

Souced from the US Bureau of Labor Statistics, Job Openings and Labor Turnover Survey

43% of Georgians have an associate's degree or above, which is slightly below the national average. The percentage of the population with an associate's degree and above is often used to assess the skilled talent pool in a state. A skilled workforce is vital for Georgia's long-term prosperity, especially as technology evolves workers' roles and responsibilities.

Sourced from the US Census Bureau, 2023 1 Year American Community Survey, Educational Attainment

Georgia’s educational attainment rate for both groups has increased slightly since the previous year. While many factors play a role, this bodes well for investment in postsecondary education and training.

Georgia ranks in the middle of the pack, 27th, for 4th grade reading proficiency. Florida outpaces Georgia substantially, while South Carolina and North Carolina fall just above. Georgia’s proficiency rate has declined since 2017, and remains unchanged from the 2019 exam results. However, Georgia fell below national proficiency rates for both 2017 and 2019.

Georgia ranks 31st nationally for 8th grade math proficiency. NAEP results show a significant decline from 31% proficiency to 24% between the 2019 and 2022 exam results. It is likely that learning interruptions between these years may have impacted students' progress, and continued efforts to support student recovery are crucial to preparing them for continued education and career opportunities.

Proficiency in reading and language arts continues to be a challenge in most communities across the state. Investments in early learning are vital to ensure students are prepared when they enter 3rd grade, as this is a pivotal transition when students are reading to learn new concepts instead of learning to read.

System Name

System Name

Sourced from the Georgia Department of Education, Georgia Milestones End of Grade Spring Reports Rural, Hub and Metro Regional estimates the average of all counties in each respective region.

Since 2023, many communities across the state have seen substantial gains in 8th grade math proficiency and the state as a whole has seen a 7.5 percentage point increase. This indicates students are making gains from learning loss caused by the pandemic.

Sourced from the Georgia Department of Education, Georgia Milestones End of Grade Spring Reports Rural, Hub and Metro Regional estimates the average of all counties in each respective region.

Georgia experienced a decline in the number of 3 to 4 year-old children not enrolled in school, but many other states experienced greater declines. Cost and physical access to early learning and childcare facilities continue to be a challenge in Georgia.

Sourced from the Annie E Casey Foundation Kids Count Database, ‘Young Children not in School’

• TABLE 26

2024 High-Tech Employment by State

• TABLE 27

2023 STEM Doctorates Awarded by State

• TABLE 28 2023 Business Formation Statistics by State

• TABLE 29 Business Applications by County

• TABLE 30 2022 Technology and Science Index by State

• TABLE 31

Venture Capital Deal Activity and Fundraising by State

• TABLE 32 2021 Index of State Dynamism

• TABLE 33

2023 Business Birth and Death Rates by State

• TABLE 34

R&D Value Added by State

The state garnered a healthy influx of startup activity, graduated the 14th most STEM doctorates, and grew business applications by 73%.

Georgia has opportunities to continue to grow investment in key sectors and to develop the talent needed to support these businesses and entrepreneurs, but must improve on capital investment.

14th most STEM doctorates

73% increase in business applications

5th

GEORGIA RANKS NATIONALLY

in total number of business applications but 44th in percent of businesses expected to form within 4 quarters.

A robust high-tech workforce is needed to drive innovation in the state. Georgia experienced large growth in the number of high-tech jobs over the last year. This puts Georgia at 9th nationally by number of high-tech jobs, not far behind states like Virginia and Massachusetts. Though Georgia ranks 20th in growth of high-tech jobs, Georgia is still performing well above national levels, and maintains a median salary close to the top 10 states.

Sourced from CompTIA 2024 State of

Georgia ranks 9th nationally for number of high-tech jobs.

Georgia has increased the number of doctorate degrees awarded in 2023 from 2022, but has declined from 11th to 13th compared to other states. North Carolina, Indiana and Virginia all improved from 2022, now in front of Georgia.

Sourced from the National Center for Science and Engineering Statistics, Survey of Earned Doctorates

Georgia ranks 5th in the number of total business applications, showcasing the state's highly entrepreneurial business climate. However, Georgia ranks substantially lower nationally when looking at the percentage of business applications expected to form a business.

Reported by the US Chamber of Commerce and Sourced from the US Census Bureau Business Formation Statistics Survey

Georgia ranks 44th for its percent of business applications projected to actually form into a business. Last year, Georgia ranked 45th. This proves there is a continued need to invest in small business and entrepreneurship programs across the state.

The total number of business applications in Georgia grew substantially in the past five years, especially in Rural and Hub communities. This boom is a strong indicator that entrepreneurs in every corner of the state recognize economic opportunity, and that local economies continues to diversify.

Sourced from the US Census Bureau Business Formation Statistics Report

Slight descrpencies may exist between this table and ‘Georgia’ in Table 51 due to reporting estimates

While the greatest growth in number of applications is being experienced in Rural and Hub communities, the majority of applications continue to come from Metro Atlanta. Resources are needed statewide to support entrepreneur and small business growth.

Georgia ranks 22nd in the nation on the Technology and Science Index, and performs best in 'Technology Concentration' and 'Dynamism', which measure the intensity and expansion of high-tech businesses. This is a critical indicator of if businesses in the state are able to transform themselves from a small entrepreneurial operation into a larger, growing company.

Sourced from the Milken Institute, Science and Technology Index by State

ABOUT THE INDEX: The State Technology and Science Index provides a benchmark for evaluating the knowledge economies of all 50 US states. The index compares each state's capacity for achieving prosperity through scientific discovery and technological innovation. It is a composite of five sub-indexes, which rank states on a set of indicators. These sub-indexes cover a diverse range of topics: research and development (R&D) inputs, risk capital and entrepreneurial infrastructure, human capital investment, technology and science workforce, and technology concentration and dynamism.

Georgia increased venture capital investment by nearly 40% from 2018 to 2023, but falls behind the top quarter of states, which in many cases, increased investment by well over 100%. Georgia did surpass the national average.

Sourced from the National Venture Capital Association, 2023 and 2019 Yearbooks

Georgia ranks 10th nationally for the dynamism of its economy, and 7th for the state’s improvement in dynamism. Georgia ranks 10th nationally for the dynamism of its economy, and 7th for the state’s improvement in dynamism.

Sourced from the Economic Innovation Group, State Economic Dynamism Indices

Top states like Delaware and Utah have improved greatly due to increased workers at young firms, worker churn, and total firm growth.

Net business births in the United States have decreased notably since 2021, with 9 states experiencing net decline. Georgia experienced net births greater than national growth, but sits at a lower rank and growth rate than in 2021. While net births are still positive, this does mark a leveling off of the entrepreneurship boom that began in 2020.

Sourced from the US Bureau of Labor Statistics, Busines Employment Dynamics Database

Georgia falls behind southern competitors including North Carolina, Alabama, South Carolina and Texas for net growth. Looking to solutions those states implemented could yield opportunities for Georgia.

Georgia experienced nearly 20% growth in research and development value added from 2017 to 2021, but still falls in the bottom 15 states for value-added growth.

Sourced from the US Bureau of Economic Analysis, Research and Development Satellite Account Report

R&D value added calculates the contribution of R&D to GDP, indicating how much economic activity is generated by R&D. R&D activity is highly concentrated in the United States. The top ten R&D-producing states account for 70 percent of U.S. R&D value added.

• TABLE 35

2023 Poverty Rate by State

• TABLE 36

2022 Poverty Rate by County

• TABLE 37

Number of Low-Income, Working Households with Children by State

• TABLE 38

Housing Inventory by State

• TABLE 39

Housing Inventory by County

• TABLE 40

2023 Homeownership by State

• TABLE 41

2022 Population Living in Health Professional Shortage Area by County

• TABLE 42

Rate of Medical Professionals per 100K Residents by State

• TABLE 43

2023 Retention of Medical Residents by State

• TABLE 44

General Health of Population by County

Prosperous communities are the core of a strong Georgia economy, but this prosperity hinges on the successful interaction of a variety of socioeconomic factors.

Quality, affordable healthcare ensures that Georgians can lead productive lives, boosting workforce participation and community engagement. Lower poverty rates contribute to increased stability for families, better educational outcomes, and increased opportunities for upward mobility. Together, these factors create a positive cycle of wellness and economic vitality, attracting businesses, fostering innovation, and strengthening Georgia’s overall quality of life.

Georgia retains the 11th most medical residents as a share of total residents in comparison to other states.

While the percentage of Georgians living in poverty decreased slightly, the population living in poverty in rural Georgia increased by over two percent.

Georgia outpaced national growth in housing inventory by over 10%, showing positive trends in growth across Rural, Hub, and Metro counties.

After a sharp decline in 2022, where the poverty rate fell by more than 8.5% from the prior year, Georgia experienced a slight increase in the poverty rate from 2022 to 2023. This increase was one of the highest in the nation, with only Delaware having a higher increase.

Sourced from US Census Bureau, American Community Survey “Poverty Status in the Past 12 Months”

Georgia ranks 38th nationally for its percentage of the population below the poverty level.

The number of Georgians living in poverty decreased by nearly half a percentage point from 2021 to 2022, but the number of rural Georgians living in poverty increased by more than two percent during that time period.

Sourced from the US Census Bureau, American Community Survey “Poverty Status in the Last 12 Months”

United for ALICE reports that 13% of Georgia households live below the Federal Poverty Level, but another 35% were ALICE households, meaning they earned above the Federal Poverty Level, but not enough to afford the basics in the communities wehre they live.

ALICE is an acronym referring to individuals that are Asset Limited, Income Constrained, Employed.

Sourced from United for ALICE Georgia Overview

The percentage of low-income working families with children increased significantly from 2021 to 2022. Only four states saw a decline in the number of low-income working families since 2021. Georgia's increase is roughly in line with the national average.

Sourced from Kids Count Database, Low-Income Working Families with Children

Georgia ranks 5th in the country for annual percentage growth of housing inventory, showcasing a nearly 43% increase in active listings compared to Q3 2023.

Sourced from Realtor.com Monthly Inventory Report Inventory is defined by number of active listing on the market

Georgia outpaced national growth in housing inventory by over 10% and showed positive trends of growth in all of our Rural, Hub, and Metro regions. Housing inventory growth was particularly strong in Metro Atlanta, where available inventory increased by over 50%.

Georgia's homeownership has increased to 65.5% from 64.7% from 2022 to 2023 but ranks 40th nationally and sits just below the national homeownership rate. Homeownership is considered an important wealth-building tool and is important in supporting personal and state-level economic growth.

Sourced from U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey

Despite a slow increase in homeownership since 2018, Georgia’s rate still sits far below the pre-2008 peak of over 70%

More than 64% of rural Georgians live in an area with a health professional shortage, which is slightly higher than the previous year’s mark of 61%. Both Hub communities and Metro Atlanta had increased populations living in health professional shortage areas. This demonstrates the need to continue growing our healthcare workforce.

Sourced from the Georgia Rural Health Innovation Center, Health Indicators Report

Projections indicate that Georgia needs to add 66,000 new healthcare positions through 2032 in addition to accounting for 173,000 healthcare workforce exit replacements.

Georgia ranks 40th in the rate of physicians, illustrating the need for increased educational opportunities and residency placements in the state to encourage improved healthcare opportunities.

Georgia completes just over the national average of medical residencies and retains the 11th most medical residents compared to other states. Medical residents come from both in-state and out-of-state schools, and retaining them is important to bolstering our healthcare workforce.

Sourced from the Association of American Medical Colleges, Physician Retention in State of Residency Training

States like California and Texas, which retain the most residents, fund state programs to sponsor medical residency slots. These programs often require a commitment to practice in-state following residency completion.

The percentage of adults in Georgia reporting poor or fair health is above the national rate, and an indication of the prevalence of chronic and non-communicable conditions such as heart disease and diabetes. This is much higher in Rural and Hub communities than in Metro Atlanta.

Cobb 13.00%

Coffee 24.00%

Colquitt 25.00%

Columbia 13.00%

Cook 23.00%

Coweta 14.00%

Crawford 19.00%

Crisp 24.00%

Dade 17.00%

Dawson 14.00%

Decatur 23.00%

Dekalb 16.00%

Dodge 22.00%

Dooly 24.00%

Dougherty 24.00%

Douglas 18.00%

Early 24.00%

Echols 23.00%

Effingham 15.00%

Elbert 23.00%

Emanuel 24.00%

Evans 24.00%

Fannin 17.00%

Fayette 12.00%

Floyd 20.00%

Forsyth 11.00%

County Percentage of Adults with Poor or Fair Health

County Percentage of Adults with Poor or Fair Health

Monroe 16.00%

Montgomery 22.00%

Morgan 15.00%

Murray 20.00%

Muscogee 20.00%

Newton 19.00%

Oconee 11.00%

Oglethorpe 18.00%

Paulding 15.00%

Peach 20.00%

Pickens 16.00%

Pierce 20.00%

Pike 15.00%

Polk 21.00%

Pulaski 21.00%

Putnam 19.00%

Quitman 24.00%

Rabun 18.00%

Randolph 31.00%

Richmond 22.00%

Rockdale 20.00%

Schley 19.00%

Screven 20.00%

Seminole 21.00%

Spalding 20.00%

Stephens 18.00%

Stewart 28.00%

Lanier

Laurens

Sumter 23.00%

Talbot 24.00%

Taliaferro 24.00%

Tattnall 23.00%

Taylor 26.00%

Telfair 29.00%

Terrell 27.00%

Thomas 19.00%

Tift 21.00%

Toombs 22.00%

Towns 15.00%

Treutlen 27.00%

Troup 20.00%

Turner 26.00%

Twiggs 20.00%

Union 17.00%

County

Reported by the Rural Health Innovation Center

Reducing disease burdens in the state could lead to an additional $79 billion in GDP by 2030.

Sourced from McKinsey and Company report, ‘Investing in Georgia today for the economy of tomorrow’

• TABLE 45

Hartsfield-Jackson International Airport Number of Passengers

• TABLE 46

Georgia Port Monthly TEU Throughput

• TABLE 47

2021 Rail Miles and Employment by State

• TABLE 48

2024 Warehousing Employment by State

• TABLE 49

Georgia Warehousing Rental Rates

• TABLE 50

2022 Freight Flow by State

• TABLE 51

2023 Electricity Generation by State and Source

• TABLE 52

2023 Electricity Market by State

Tremendous economic activity growth in the state necessitates significant investment to repair, improve, and expand Georgia’s infrastructure and energy systems.

Georgia maintains the world’s busiest airport, regularly moving over 100 million passengers a year. Georgia’s sea and inland ports are critical in providing national and international trade access and connecting our rail network which originates and terminates over 100 million tons of freight through the state a year. Additionally, Georgia’s energy grid provides stable and reliable service as our businesses and population grow.

Georgia’s rail networks employ the 6th most workers in the nation, operating the 7th most rail miles.

Residential energy rates are the 2nd lowest of the highestproducing GDP states in the nation.

The Port of Savannah is the fastest growing port in the nation, and the Port of Brunswick is the busiest port for Ro/Ro containers.

The world’s busiest airport continues to serve more than 100 million passengers annually. Following a COVID-19 pandemic-era decline in air travel, the airport is on track to surpass the number of passengers served in 2023, reaching near-record breaking levels in 2024. Hartsfield-Jackson Atlanta International Airport is critical to Georgia, moving both people and cargo, serving as an integral piece in our infrastructure and logistics system.

Sourced from Hartsfield-Jackson International Airport,

The Georgia Ports Authority continues to administer strong growth at Georgia’s largest port over the last year. September 2024 was the second busiest September on record, demonstrating how integral the Port of Savannah is to Georgia’s freight and logistics network.

2023 to 2024 YOY Growth

Sourced from the Georgia Ports Athority, By the Numbers Reports

The Port of Savannah’s Garden City Terminal is the largest single terminal in North America and fourth busiest container port in the U.S.

Georgia ranks 7th nationally for number of rail miles in the state, and 6th for the number of people employed by the rail industry. These top rankings illustrate the significance of Georgia’s rail network to the state economy, and our position as a logistics hub.

Sourced from the Association of American Railroads, State Rankings 2021

Rail transportation is one of the most efficient and sustainable ways to move goods in the state. It would take 2.1 million additional trucks on the road to move the 38.4 million tons of freight that originated by rail in Georgia in 2021.

Georgia has increased the number of jobs in the warehousing industry by 76% since 2019, exemplifying the intense growth in this industry in the wake of corporate expansions and relocations in the state. This signals that continuing to provide career opportunities in this industry is needed to keep Georgia’s infrastructure and logistics system competitive.

Sourced from Lightcast, Regional Comparison Report

Transportation and Warehousing is Georgia’s fastest growing industry over the last five years, adding more than 70,630 jobs

Atlanta and Savannah warehouse rental rates continue to remain below the national average, keeping our state economically competitive. Savannah’s warehouse rental rates do exceed Atlanta. Over the last three years, warehouse rental rates have increased nationally and within Georgia due to rising demand and growing e-commerce industries.

Sourced from the Georgia Department of Economic Development, Market Logistics Snapshots

Georgia ranks 10th nationally in terms of value of freight flow and 16th nationally for tons of freight flow.

Sourced from the US Bureau of Transportation Statistics, Freight Flows by State: Total State by Origin

A mix of generative technologies is necessary to provide the most reliable and affordable energy services possible.

Sourced from the Energy Information Administration, Power Plant Operations Report

Georgia provides reliable energy at nationally competitive rates that fall far below the national average residential price. Georgia has the second most affordable among top GDP producing states. Georgia’s vertically integrated and regulated market structure provides stability to allow for long-term planning, prioritizing coordination and reliability.

Sourced from the Energy Information Administration, Annual Electric Power Industry Report and US Electricity Profile, and from the Bureau of Economic Analysis, Gross Domestic Product by State and Region Report

Acworth

More businesses are celebrating grand openings in MEAG Power communities because MEAG Power provides some of the most reliable, cost-effective and cleanest wholesale energy in the South – 66% emissions-free on average!

Moreover, these 49 Georgia public power communities are ideal hometowns for your company’s present facility or future site. And because these communities own and manage their local electric utilities, they have the flexiliby to adjust rates to attract your business. Moreover, all the electric utility revenue is retained and reinvested in the community so these great places to live just keep getting better.

For companies looking for a place that offers ultra-clean, highly reliable, low-cost power, locate your enterprise in one of these MEAG Power communities. They mean business.