BusinessesThatReceivedPPPMayAlsoBeEntitled toERCandClaimItRetroactively

WiththeEmployeeRetentionTaxCreditProgramthe federalgovernmentisrewardingemployersforhaving retainedtheirW-2employeesduringadifficulttimein thepandemic.

Thesespecialistsreportthatsmalland mediumsizedbusinesseswith5to500 employeesaffectedbythepandemicmaybe eligibletoreceiverefundsintheformoftax credits

ofupto$26,000perW-2employee,evenif thebusinessreceivedPPPfunding previously.HoweverERTCwillonlyapplyto wagesnotusedforthePaycheckProtection Program.

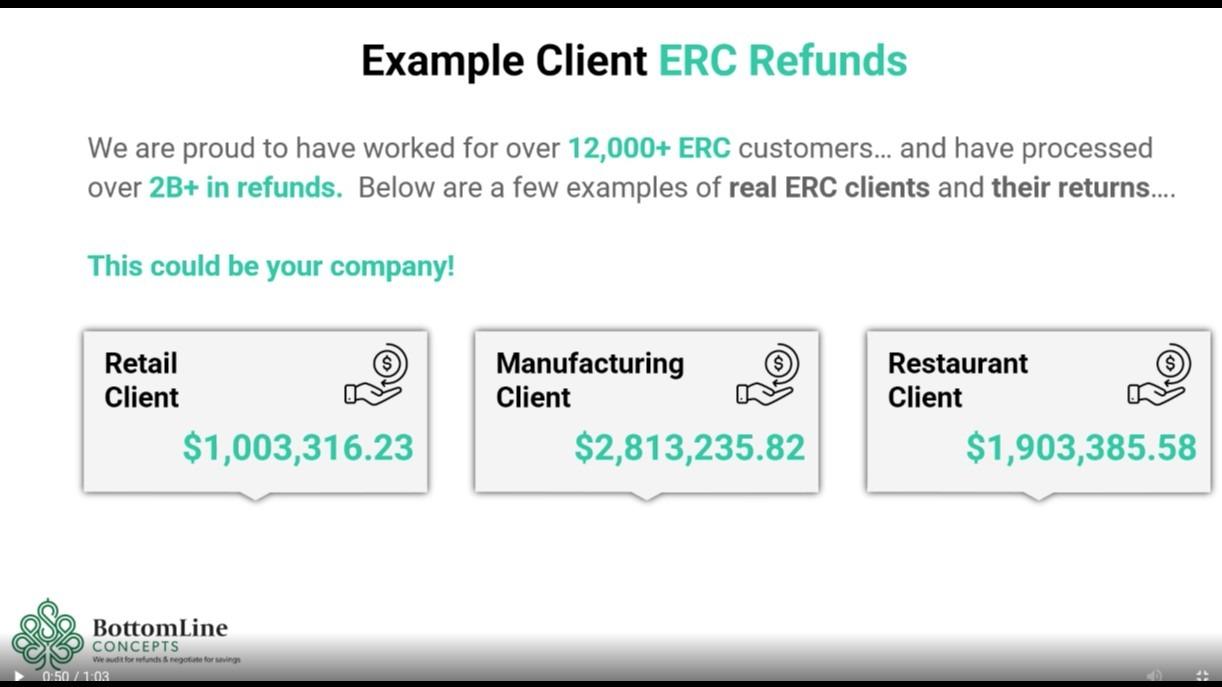

Manybusinessownersdonotrealizethatthey arenoweligiblefortheERCevenifthey receivedPPPfunds.BottomLineConcepts hassecuredrefundsforitsclientsranging from

$100Kto$40Mandassistedover20,000 businessesnavigatethecomplex EmployeeRetentionTaxCreditprocess andapplyforover$3.5Billiondollarsin refunds.

IfyouarenotreceivingERC,we wouldwelcometheopportunityto discussyoureligibility requirementsandhowtostartthe program.Wewillmanageitfrom endtoendforyou.

Wecanhelpyouthroughthemyriadofcomplexities thatmaypertaintoyourcompany'suniquesituation andgetyouupandrunningwithfundsinthebank accountfairlyquickly.