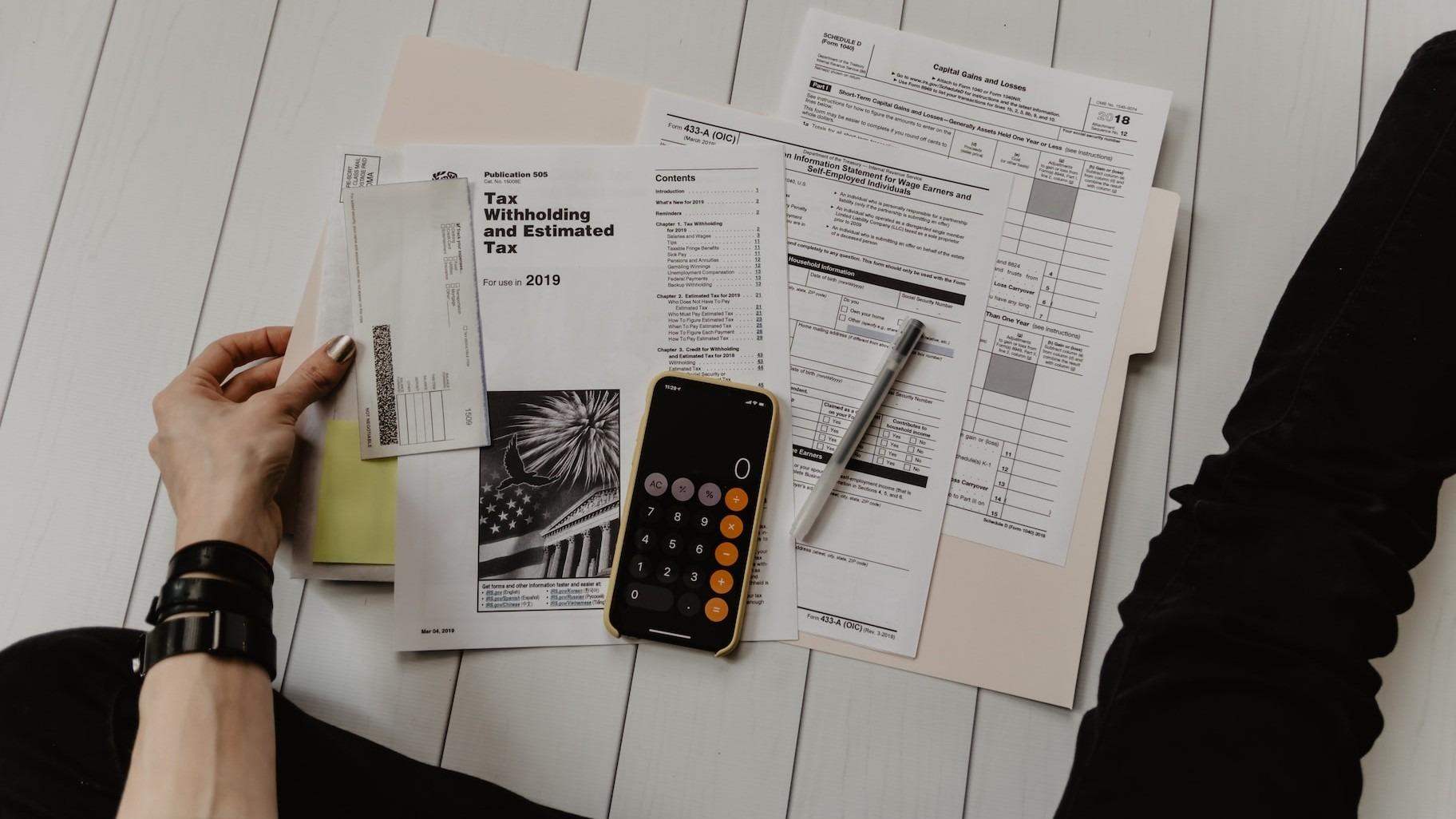

Keepingtrackofthechangesmadeto ERTCfundingisalmostascomplicated astheapplicationprocess.

That’swhyFTCOERCProshave updatedtheir‘HowDoIApplyFor ERCTaxCredit’guidewithdetailson thechangesmadein2023.

Theguidealsoadvisesthat,duetothe complicatedapplicationrequirementsand filingprocesses,youshouldseek professionalguidancepriortomakinga claim.

Astheguideoutlines,employeetax retentioncreditsweremadeavailableto helpsupportbusinessesthatretained theiremployeesduringthepandemic.

Theeligibilityforthisfundingwasforthe datesbetween13March2020to31 December2020,butrecentchangeshave expandedthisdaterangethoughto31 December2021.

Ifyouwanttolearnhowmuch yourbusinesscouldbeowed, youcanfindashorteligibility checkingserviceonthe company’ssitetogetstarted withyourapplication.