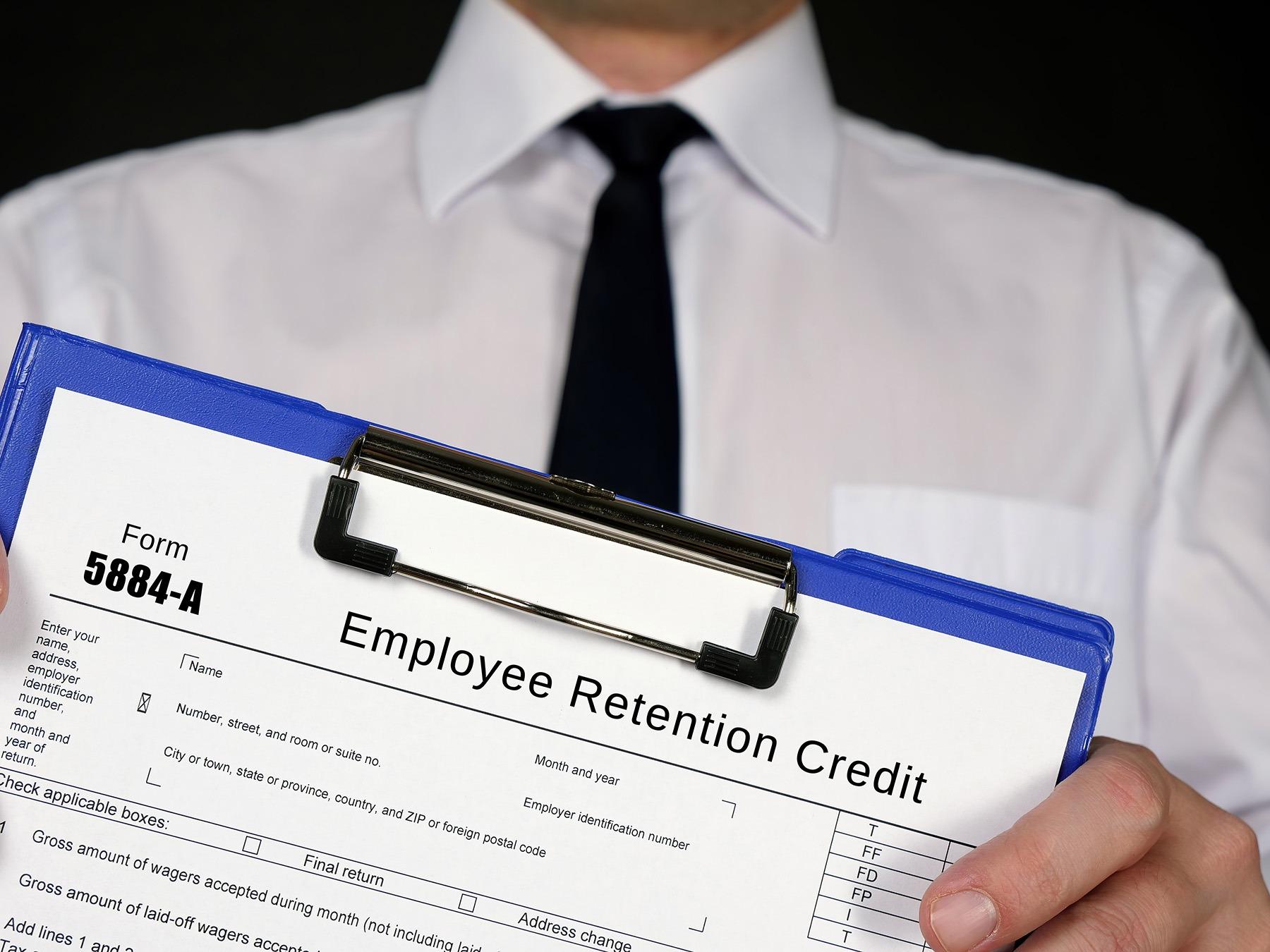

BusinessesAffectedByCOVID-19MayBe EligibleForAnotherRoundofTaxRefunds

EmployeeRetentionTaxCredit submissionfirm,isexcitedtoshare somegreatnewsforsmalland medium-sizedbusinesseswho wereimpactedbytheCOVID-19 pandemic.

Thesebusinessesmaynow beeligibletocollect thousandsofdollarsin governmenttaxcreditswith nostringsattached.

ERTCissimilartothe PaycheckProtectionProgram, butthebigdifferenceisthat ERTChasnorestrictionsand neverhastobepaidback.

Itpaysupto$26,000perW-2 employee,whichcanaddup tosignificantamountsof moneyforbusinesseswitha largenumberofemployees.

Previously,youhadto choose:PPPorERTC? Youcouldn'tdoboth.

ThenonMarch11,2021, CongresspassedTheAmerican RescuePlanAct,which expandedERTC'seligibilityrules toincludebusinessesthathad alreadyreceivedPPPfunds.

Nowyoucandoboth,and thesetaxcreditscanbe claimedretroactively.

Mostbookkeepers,CPA's,and payrollserviceprovidersdon't havethetimetolearnthe complexitiesoftheERTC programanditsassociatedIRS taxcodes.

TheCPA'satERTCExpressare ERTCspecialists.Theyonlydo ERTC.Withtheironlineform, you'llknowthesizeofyour refundwithin90seconds!They makeERTCasEasyasABC.

Moreandmorepeopleare startingtohearaboutERTC, sorightnowisthebesttime tosubmitanapplication.