Wemaybedonewith lockdowns,reducedstore capacities,andtemporary closures-butitwillbealong timebeforemanybusinesses recoverfully.

Oneofthebesttoolstohelp getyourcompanybackonits feetistheERTC-andit'snot toolatetoclaimyourtax credits.

RetentionTaxDivisionhas partneredwithaspecialistCPAfirm tohelpbusinessesownedby womenandminoritiestoclaimtheir EmployeeRetentionTaxCredits (ERTC)beforetheprogram’s fundingrunsout.

Youcanusetheirnew15Minute Refundprogramtogethelpfrom atopCPAfirm,whichwill guaranteeyouthemaximum allowablerebate,witha minimumtimecommitment.

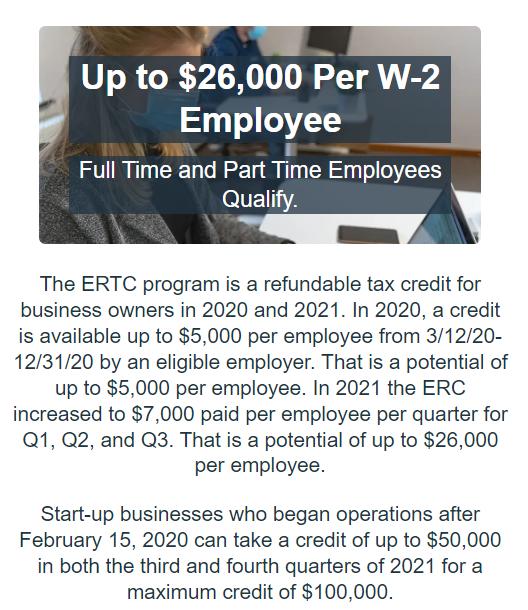

Whileindividualrebateswill vary,eligiblecompaniescan claimupto$26,000per employee.

TheERTCprogramwascreated atthesametimeasthemore popularPaycheckProtection Program,butithasbeen amendedseveraltimestothe benefitofbusinessowners.

Theeligibilitycriteriahavebeen expandedtoincludecompanies thathavealreadyreceivedaloan throughthePPP,andthetotal amountyoucanclaimhasbeen increased.

UnlikethePPP,itisstillpossibleto claimfundsthroughtheERTC program,whichprovidestaxcredits ratherthanloans.Thesetaxcredits neverneedtoberepaidandhaveno restrictionsonhowtheycanbe spent.

RetentionTaxDivisionhasa no-cost,no-obligationeligibility assessmentthatyoucanuse todetermineifyourcompanyis eligibleforrebates.

Theentireassessmentcan becompletedinoneminute, anditrequiresnoproprietary businessinformation.