Since 1954, General Electric Credit Union (GECU) has been dedicated to supporting our members and our community. While things have certainly changed since we first opened our doors, our mission remains the same: Improving the Quality of Financial Lives.

We live our mission every day through the products we offer and the services we provide. Whether you’re purchasing your first car or looking for a better way to bank, we will meet you where you are and help you thrive.

Thank you for choosing GECU to serve your financial needs. As a Credit Union member, our door is your possibility.

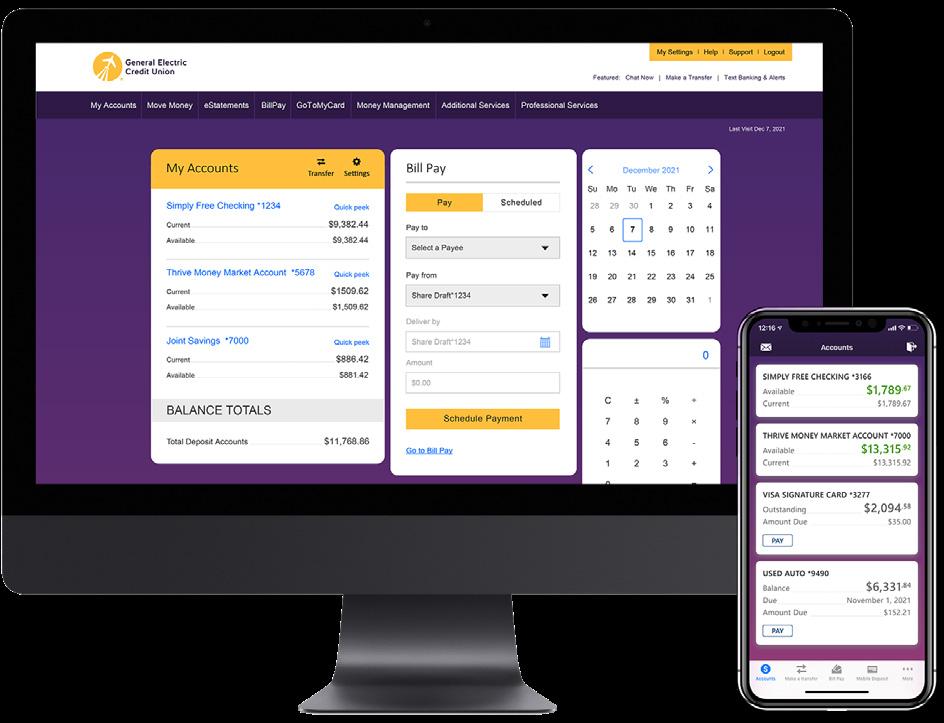

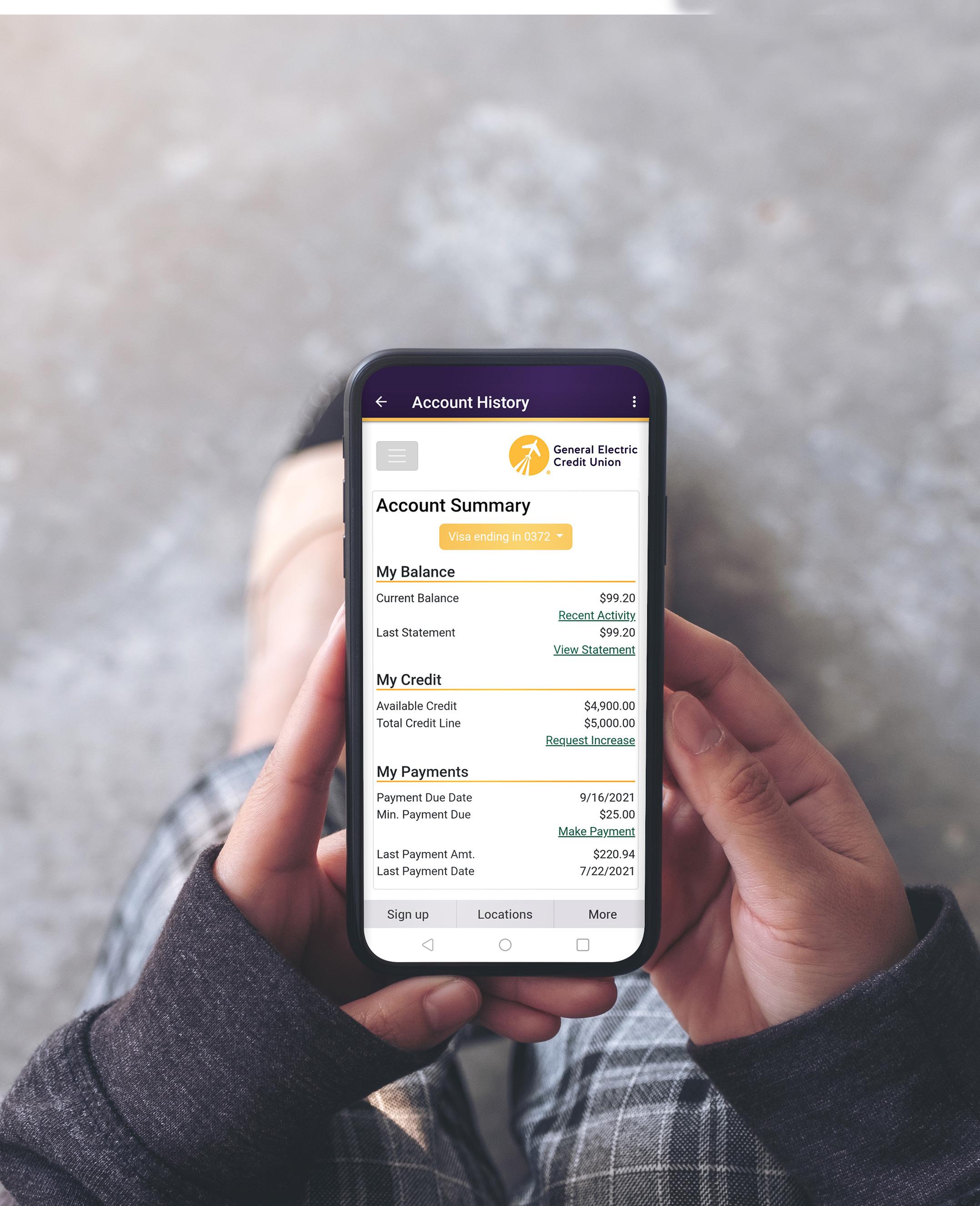

Your life is mobile, your banking should be too. Bank when it’s convenient for you with our top-rated mobile app and Online Banking services, 24 hours a day. Scan this QR code using your phone’s camera to download our mobile app, or search General Electric Credit Union in your app store!1

Whether you prefer desktop, mobile, or tablet we have you covered; enroll through Online Banking or our mobile app—enrolling in one grants access to both.

Plus, facial recognition (available on iPhone) and Fingerprint ID make viewing your accounts secure and convenient.

Pay your bills without the hassle of writing checks, buying stamps, or trying to remember multiple passwords. With Bill Pay you can conveniently manage and pay all your bills in one place, receive electronic versions of bills, and schedule one-time or automatic recurring payments for expenses like: rent, streaming services, and utilities.3

Learn more about paying a GECU loan on page 24.

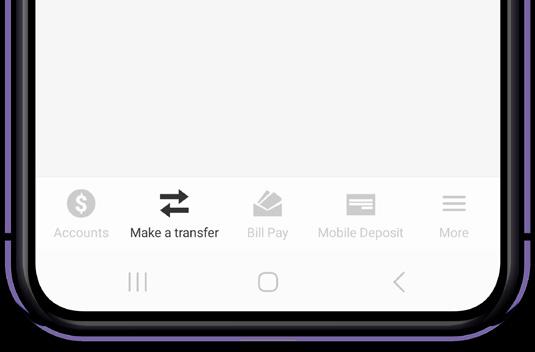

Save yourself a trip to the branch. With payments and transfers, you can securely:

• Transfer money between GECU accounts.

• Transfer funds to/from other financial institutions.

• Make a GECU loan payment.

Send money to family and friends with Zelle®.2

Don’t miss a thing with customizable account and loan alerts for: payment due dates, low or high balances, and large withdrawals or deposits. Have notifications or alerts sent via: text, email, or push notification. To get a snapshot of your accounts quickly, enable Quick Balance on iPhone® and AndroidTM devices.

Deposit a check directly into your GECU checking or savings account with just a few taps within our mobile app. Simply tap Mobile Deposit, select the account for your deposit, snap a photo of your check, and wait for the confirmation—it’s that easy! 4

Digital wallets are a quick and secure way to pay with your GECU credit and debit card(s). Use your preferred wallet app to make purchases in-store, in-app, and online. Choose the Digital Wallet that is right for you.

Connect all your bank and investment accounts, from all sources, in one place for a complete financial picture. Use free tools available through Money Management to help:

• Track spending habits with customizable categories.

• Create and follow budgets to stay on track.

• Manage savings goals.

• Set up custom text or email alerts for things like staying on budget or reaching savings goals.

Have questions about digital services? Contact us via Secure Email or Chat in Online Banking or our mobile app.

Checking accounts tailored to you. We made it easy to match with the right checking account for your lifestyle.

Earns dividends

Access to 100,000 free ATMs/ITMs6

(See page 18)

Free debit card

Free access to Online Banking and top-rated mobile app1

Free Mobile Deposit4, Bill Pay3, and eStatements

Access to Digital Wallets

Free account alerts

Early Pay Eligible

Access to Zelle®2

Overdraft solutions

(See page 7)

Free first book of checks

HSA Checks

From free ATMs to our Round-Up program, our checking accounts are packed with features to make your everyday banking better.

Save and earn cash back with a GECU

Build your savings without having to think about it! Use your GECU debit card for everyday purchases and each day we’ll automatically round-up your transactions to the nearest dollar and transfer the change into your GECU savings account.7

We’ll match 5% of your rounded up funds each month for an extra savings boost - applied directly into your account!.7 Simply enroll in Round-Up at account opening or any time.

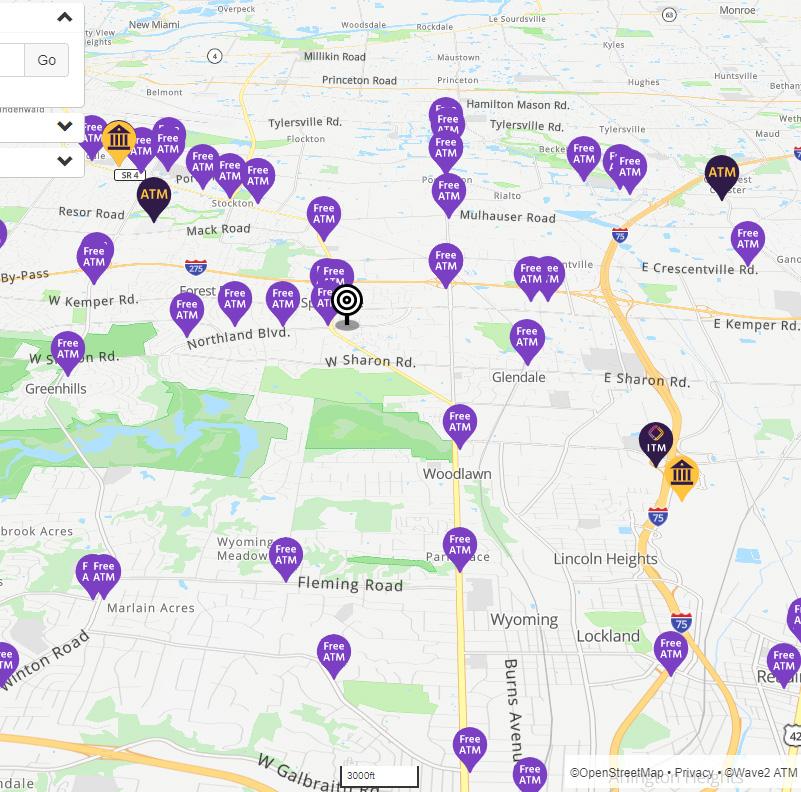

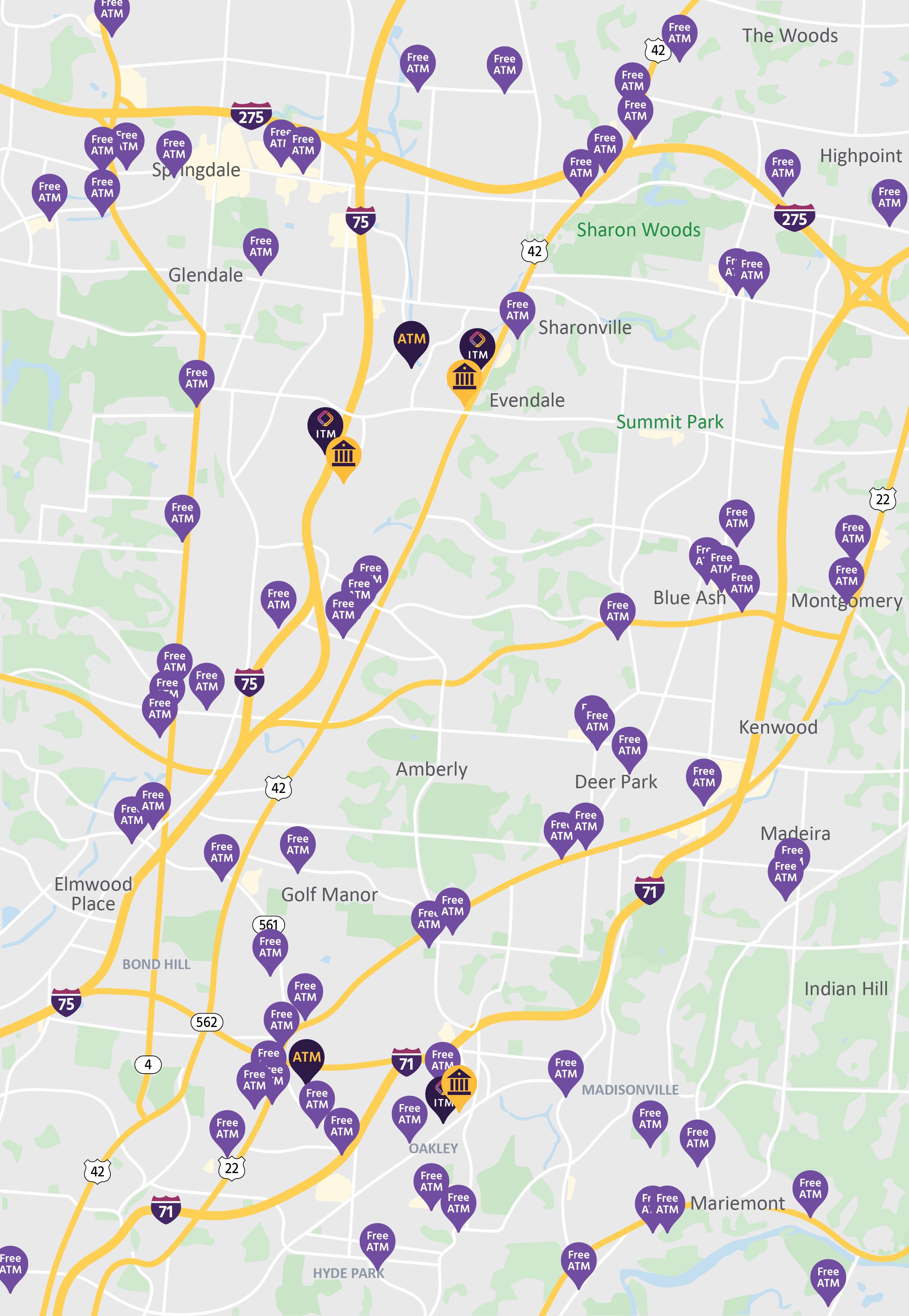

Withdraw funds from 100,000 completely free ATMs nationwide at: GECU, Allpoint, CULIANCE, MoneyPass, and Fifth Third ATMs. You can find them just about anywhere, including: Target, CVS Pharmacy, Walgreens, Kroger, Costco Wholesale, UDF, 7-Eleven, and more.

See page 18 for details or visit: gecreditunion.org/atm.

Send money to family and friends with Zelle®

Zelle® makes sending money to friends, family, and others you know fast, safe and easy—right from the GECU mobile app!2

View your FICO® Score within Online Banking and our mobile app when you have a: loan, credit card, Simply Free, Choice, or Amplified High-Yield Checking account with us. Viewing your FICO® Score doesn’t impact your credit, and it’s completely free!

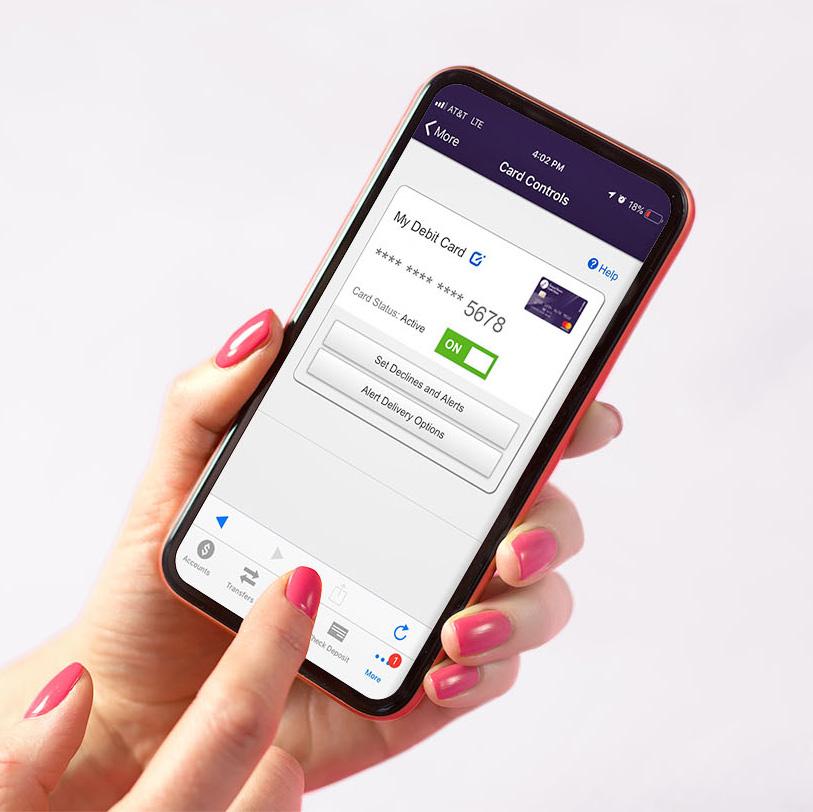

• Turn your card On/Off to temporarily deactivate your card for instant peace of mind.

• Set spend limits to prevent charges over a specified dollar amount.

• Block international purchases to limit your debit card to U.S. transactions only and instantly lift those restrictions when traveling or shopping abroad.

• Customize how you shop by enabling or disabling purchases by transaction type, such as payments made online or by phone.

• Set up alerts to get real-time notifications about your debit card activity via: text, email, and push notifications.

When it comes to getting paid, why wait? You work hard for your money, now we’re helping you get it two days faster with Early Pay! No cost. No catch. No need to sign up – we’ve already got you covered.8

Our overdraft protection options keep you moving through your day—uninterrupted.

Choose the best option for you

We’ve all forgotten about an automatic payment or miscalculated a budget—that’s life! If you accidentally overdraw your checking account or worry you don’t have enough money to cover an unexpected expense, we’ve got you covered with overdraft protection options.

Eligible accounts

Free, Choice, and Amplified High-Yield Checking

Details

Automatically transfer funds to a checking account from a GECU savings or money market account, for free.

Prevent overdrafts by automatically transferring funds to your checking account from your line of credit (upon application approval).

$0 if the transfer is initiated in Online Banking or our mobile app in advance; otherwise, $2 per transfer (plus interest).

This option covers transactions (checks, ACH, and Bill Pay) when you don’t have sufficient funds in your account. Opt-in to extended coverage and cover everyday debit card and ATM transactions.

$32 overdraft fee per item

Choose one of these options or layer them together in the order you’d like for extra protection.

Learn More! For additional details on Overdraft solutions, scan this QR code using your phone’s camera or visit: gecreditunion.org/overdraft

Earns dividends

What are you saving for? Whether it’s your first house, a family vacation, your child’s college fund, or a new ride, GECU offers the flexibility to live in the moment while saving for your dreams.

Insured by NCUA up to at least $250,000

Free access to Online Banking and top-rated mobile app1

Free Mobile Deposit4

Access to 100,000 free ATMs/ITMs6 (see page 18)

Free eStatements

Free access to Bill Pay3

Free debit card

Free account alerts

Variety of term options

Free first book of checks

(Thrive only)

(Thrive only)

(Thrive only)

(Thrive only)

(Thrive only)

With our savings accounts, you’ll enjoy:

Comfort knowing your insured by NCUA up to at least $250,000

No monthly maintenance fees

Withdrawals at 100,000 free ATMs/ITMs6

Our savings accounts make it easy to build your savings—and easy to take a little when you need it through Online Banking and our mobile app.

Thrive Money Market, our high-yield savings account, offers competitive rates on attainable balances, so you can grow your savings faster while maintaining flexible access to your money.11 Plus, there is easy access to your funds with: Online Banking and our mobile app, a free GECU debit card, and money market checks.

Our IRA Money Market is a high-yield, tax-advantaged account designed to give your retirement savings a boost. There is no minimum to open and you get the tax advantages and guaranteed earnings of a Traditional or Roth IRA, minus the worry of market fluctuations.11

An alternative way to grow your savings is to open a certificate and earn higher dividends on your funds. With a variety of term options from three months to five years, this is a savings solution that just makes sense! We also offer HSA, IRA, Business, and Jumbo Certificates for more earning potential.12

Learn more about certificates, certificate laddering, and current rates online at: gecreditunion.org/certificates

Looking for a credit card with an unbeatable, low rate? A card that rewards you? Or both? We have the perfect option for your wallet. All our cards come with perks you’re going to love.

The no-frills, low-rate card that never goes out of style.

Our lowest rate credit card is perfect for the savvy spender who isn’t looking to earn points or cash back but wants a classic, back-to-basics credit card.

The Classic card offers many of the same perks as our other credit cards, including: access to your FICO® Score, Zero Liability13, and Cell Phone Protection, with the added benefit of having the lowest possible rate.

The unlimited cash-back rewards card that automatically applies rewards to your card account monthly.14

• Earn 2% cash back at U.S. supermarkets and wholesale clubs (including Costco and Sam’s Club).

• Earn 1.5% cash back at gas stations.

• Earn 1% cash back on all other purchases.

• Earn 10% cash back on paid finance charges.

On a monthly basis, earnings will automatically be applied to your card account balance, reducing the amount you owe.

Add your GECU credit card to your favorite digital wallet

Contactless payments are a quick and secure way to make purchases right from your device. To get started, download one of the apps, then sign up with your GECU card and simply tap or click Pay!

From The Classic to Signature, we offer the right card for you.

The flexible, unlimited point-earning card that rewards you for everyday spending.15

With the Platinum card, your points have unlimited earning potential and never expire!

• Earn 3x points at U.S. supermarkets and wholesale clubs (including Costco and Sam’s).

• Earn 2x points at gas stations.

• Earn 1x points on all other purchases.

Redeeming

Whether you want to redeem points for cash back to grow your savings or toward a vacation - the choice is yours. You can also redeem points for: merchandise, gift cards, experiences, and charitable donations.

The elite card that rewards you with unlimited 2x the points on every purchase.16

Earn 2x the points on every purchase—plus, enjoy unlimited earning potential and points that never expire!

Wherever you go, you have 24/7 assistance with a wide range of services, including: travel, entertainment, dinner reservations, and exclusive shopping offers.17

We have you covered around the world, with no foreign transaction fees to slow you down.18

With tons of flexibility and options, you can redeem points however you choose, including cash back into a savings account or your next big excursion. The choice is yours! Plus, you can also redeem points for: high-end merchandise, gift cards, exclusive experiences, and charitable donations.

Explore and compare current credit card rates and introductory offers, at: gecreditunion.org/credit-cards

Ready to apply? Scan the QR code using your phone’s camera or visit: gecreditunion.org/apply

With our Business credit card, you can easily manage business expenses and earn 2x the points with every purchase.19 Plus, with our online business credit card management, you can: view associated cards and transactions in one place, modify credit lines for existing cardholders, make payments and more. See page 20 for more information about all our business products.

With our Classic Secured card, you can easily establish or improve your credit as your credit line is secured with the amount you choose to deposit in a savings account. Pay off your card each month and the major credit bureaus will mark your progress as your credit score improves.18

With all our credit cards, you’ll get:

Digital Wallets for fast and secure checkout

Contactless payments with tap to pay chip technology

Access to FICO® Score for free

Access to online credit card and rewards management

Zero Liability 13

Earns unlimited points that don't expire

Earns unlimited automatic cash back

Visa Signature® Concierge 17

Roadside Dispatch®

Travel and Emergency Assistance

Cell Phone Protection

ID Navigator Powered by NortonLifeLock

Purchase Security

Return Protection

Travel Accident Insurance

Trip Cancellation/Interruption Insurance

Identity Theft Resolution Services

Lost Luggage Reimbursement

Within Online Banking and our mobile app, you can:

• View a snapshot of your credit card account.

• See transaction history and statement summaries.

• Schedule one-time or recurring payments.

• Customize your preferences to receive real-time texts and/or email alerts.

You have hopes, goals, and dreams. We make fulfilling them possible with a range of lending options that put funding in reach and bring adventures to life!

Funds are advanced at one time and repaid over a set period. Term loans

Perfect for you if:

You’re ready to purchase a home.

You want to refinance your home.

You want to consolidate debt.

You need to fund a home improvement project or other large purchase.

You want to purchase a vehicle.

You want to purchase a boat, RV, or motorcycle.

Other features

Access to FICO® Score

Sign up for Online Banking and our mobile app!1

Easily

Money is available up to your approved limit and can be used, repaid, and used again as needed. When using a line of credit, interest is only applied to the amount used.

Perfect for you if:

You own your home and want to leverage the equity.

You have significant equity in your home and would like an inexpensive first mortgage alternative.

You want to consolidate debt.

You need to fund a home improvement project.

You need access to cash to manage expenses.

You want to purchase a vehicle, a boat, or take a vacation.

Other features

Access to FICO® Score

No prepayment penalties

Interest Only Payments for the first 10 years

Planning a wedding or big event? Paying off high-interest debt? Buying a new home? We have financial solutions as you navigate the path of life.

Live for today. Plan for tomorrow. When you need advice for life’s major events—buying a new home, sending a child to college, planning your retirement—we’re here for you.

Life can be full of ups and downs. Our alliance with Cincinnati-based law firm, Wood + Lamping LLP, offers guidance when navigating challenges. With more than 90 years of experience in 18 distinct practice areas, they are committed to serving your best interests.23 Areas of specialty include, but are not limited to:

• Wills and estate planning

• Divorce/dissolution

• Elder law

• Real estate law

Learn more at: gecreditunion.org/legal

Knowledge is power. Your relationship with us goes beyond valuable accounts. Our team members, many of whom are certified financial coaches, are here to support you. Tap into information and expert advice that can help your careers, your personal finances, and so much more.

Money Minutes Blog: Discover new content weekly on our Money Minutes blog. We cover subjects important to your financial journey so you can learn best practices, navigate current economic trends, and make decisions with confidence.

Free webinars and seminars: We regularly present free webinars and seminars addressing popular topics you truly care about, including:

• Social Security

• Retirement income planning*

• Long-term care and Medicaid

• Estate planning

• Rebuilding your credit

• Elder law

• Budgeting

• Paying for college

• Home Buying

• Small Business Insights

Can’t attend live? Visit our Events page to watch recorded webinars on past topics at your convenience. We’re excited to be your one-stop-shop, and provide you with professional advice right from the comfort of your home! To learn more, scan the QR code using your phone’s camera or visit: gecreditunion.org/cu-events

Preserve your wealth

Grow investments

Plan for your family

Investment Services

provided by CUSO Financial Services, L.P. (CFS)* Investing is all about financial goals; we have resources and strategies to help you achieve them, including access to view accounts and a discount brokerage all within Online Banking and our mobile app. Our licensed CFS advisors* take the time to understand your goals and identify custom solutions for you.

• Financial partners who understand your big picture.

• Judgment-free, no pressure environment.

• Industry-leading software to determine financial strategies and solutions.

• Answers to all your questions.

Learn more at: gecreditunion.org/investment-services

CFS* Financial Advisors:

Erik Waldron

CFS* Financial Advisor OH Ins. License #1005593

erik.waldron@cusonet.com o: 513.204.7710

Areas of specialty include:

• Financial planning

• Wealth management

• Retirement income planning

• Long-term care planning

• Social Security Planning

• Asset Allocation and Diversification of Investments

• College Fund Planning

• Medicare Planning

• Discount Brokerage

Todd Blessing

CFS* Financial Advisor OH Ins. License #592161

todd.blessing@cusonet.com o: 513.577.8901

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a Registered Broker-dealer (Member FINRA/ SIPC) and SEC-registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

Learn more at: gecreditunion.org

Get cash from 100,000 completely free ATMs/ITMs nationwide at all: GECU, Allpoint, CULIANCE, MoneyPass, and Fifth Third ATMs.6

Convenient locations

You may not see our name on the ATM, but we’re still there. Just look for Allpoint ATMs in places you already know and love, including:

Use our mobile app to conveniently find an ATM or ITM near you. Or visit our website at: gecreditunion.org/atm

Experience our Interactive Teller Machines (ITMs)! This first, true evolution of the ATM offers both self-service and personal, assisted service. With our ITMs you get the convenience of an ATM, plus all the capabilities of an in-person teller. You decide!

(Available an hour before branch opening via drive-thru or lobby vestibule)

When you tap the ITM screen to talk with a Personal Teller, you’ll be connected with a local GECU team member via two-way video. Our Personal Tellers will help you with the same transactions you do at the teller line.

• Deposit and withdraw cash down to $1 increments.

• Deposit checks and cash without envelopes.

• Cash a check down to the penny.

• Transfer money between GECU accounts.

• Make a loan payment.

• Access money from a GECU line of credit.

• Check account balances.

Hours:

Unrivaled convenience far beyond an ATM! (Available 24/7/365)

Your debit card unlocks more account access, more functionality, and more ways to bank 24/7/365. Our ITMs combine the convenience of an ATM with expanded functionality across all of your accounts, so you can skip the teller line and bank on your time.

• View your full relationship and accounts.

• Make a payment to your loan or credit card.

• Withdraw cash in $1 increments.

• Deposit cash/checks into GECU accounts without envelopes.

• Interact and transfer funds between GECU accounts.

• View images of deposited checks on receipts.

• ITM lobby vestibules and drive-thrus are accessible to members 24/7/365. Swipe your debit card for secure access to enter the ITM lobby after-hours.

• ITMs located inside branches are available during regular business hours.

To learn more and view ITM locations, scan the QR code or visit: gecreditunion.org/itm.

Your business banking, simplified. Choosing GECU for your business banking needs means you have a local partner who understands the community you serve. We partner with businesses and non-profit organizations of all various sizes, and we can create a custom tailored solution that precisely aligns with your unique needs.

Full-service banking solutions to meet a range of business needs.

Relationship pricing on the suite of services tailored to your needs.

Leading rates to help your business save more.

A local relationship partner to offer expertise, guidance, and quick turnaround on decisions.

As a business owner, you probably work beyond the hours of 8 to 5 and need to bank when it’s convenient for you. Our digital services put you in control with the features you need to manage and grow your business. Our business accountholders have access to both a simplified and more robust Business Online Banking option.24

Our standard Online Banking is perfect for small businesses looking for basic online banking features. With Online Banking you can securely:

• View and access your accounts in real time.

• Deposit checks through the mobile app using Mobile Deposit.

• Transfer funds between GECU accounts and from accounts at other banks or credit unions.

Use Money Management to analyze finances and spending

Apply for a personal loan

Review account details and transactions

Customize alerts and reminders

Transfer funds from internal and external accounts

Make a GECU loan or credit card payment

Enroll in eStatements

Speak with GECU team members via Secure Chat

Connect to Quicken/QuickBooks

Access credit card statements, activity, and rewards

Access multiple accounts under a single login

Manage users and customize user access

Mitigate the risk of fraud with Positive Pay

Access to Autobooks

Perfect for mid-sized businesses or business owners managing multiple entities, Business Online Banking provides a more robust experience so you can access and manage accounts. You can also:

• Add and manage multiple user access.

• Link business accounts with different Tax Identification Numbers (TINs).

• Initiate template-based ACH and wire transfers.25

• Mitigate the risk of fraud with Positive Pay.

Checking accounts are the engine of your business finance machine. It’s what you use to manage the day-to-day operations of your company. We offer two business checking solutions to perfectly fit your business needs.

Free Business Checking26 Premier Business Checking26

Speak with one of our treasury management officers to learn about additional services we can offer your business including:

Remote Deposit Capture (RDC)

Services

For specialized business account options, including: Zero Balance Account Sweeps, Investment Sweeps, Interest on Lawyer’s Trust Accounts (IOLTAs), and Interest on Trust Accounts (IOTAs), contact Business Services at: 513.588.1699/800.542.7093 x1669 or businessservices@gecreditunion.org

Save paper and time by viewing up to two years of statement history whenever you want within Online Banking or our mobile app.1 Easily save or print your eStatement for your records. A simple, secure, and convenient way to stay on top of your money.

We know life happens. That’s why we give you options when it comes to overdraft protection. You can decide how you want items to be paid or declined in the event of an overdraft situation with: Business Overdraft Protection Transfers9, Business Line of Credit, and Courtesy Overdraft.10

Withdraw funds from 100,000 completely free ATMs/ITMs nationwide. You can find them just about anywhere, even at many popular retailers, including: Target, CVS Pharmacy, Walgreens, Kroger, Costco Wholesale, UDF, 7-Eleven, and more. See page 18 for details.

What are you saving for? Whether it’s a future project,an expansion, or earning more on the funds you have saved, we have options to help make your strategic plans a reality.

dividends Free access to Online Banking and top-rated mobile app1

Variety of term options

Our Business savings accounts have no monthly fee and offer dividends to grow your savings. Plus, use your savings account as free overdraft protection when you link it to your GECU business checking account.

With BAMMA, you’ll experience the power of competitive returns, accessibility, and easy account management. Multiple tiers allow you to earn more as your balance increases.28 Plus, your funds are always within reach, so you can access cash whenever you need it. Higher interest and flexibility? It’s a win-win.

Turn your savings into earnings. We offer a variety of term options from three months to five years, with no minimum amount to open. Want to save more on a high balance? Open a Jumbo Business Certificate with $100,000, and watch your savings grow.12

Bring your business’s next big idea to life. From business lines of credit that increase cash flow, to financing equipment for maximized productivity, we have the right lending solution for you.

Simplify purchasing with a GECU Business Credit Card. Competitive rates, 2x the points on every purchase, and unlimited points that never expire.19 Redeem points for: cash back into a GECU checking or high-yield savings account, travel, merchandise, experiences, gift cards, or charitable donations.

Additional Business Credit Card perks:

• Choice of individual or consolidated pay

• Multiple card management through Online Banking

• Ability to add authorized users

• ID Navigator Powered by NortonLifeLock

Fixed or variable interest rates are available, with flexible payment terms that can be tailored to match your cash flow or marketing cycles.

Take your commercial real estate projects from start to finish. Whether purchasing or constructing your next location, we have the right lending solutions for your business.

• Zero Liability 13

• Cell Phone Protection

• Purchase Security

• Travel Accident Insurance

Whether you want to upgrade, refinance, or purchase new equipment, we offer a variety of monthly payment options and competitive interest rates.

Backed by government-sponsored loan guarantees, SBA loans can be used to purchase assets (e.g., land, buildings, and equipment) or short-term working capital needs.

Whether it’s your auto loan payment, credit card, or Home Equity Line of Credit, we have free payment methods to help you pay bills on time, every time!

Tip: If you’d like to manage all of your bills in one convenient place, use our free Bill Pay service in Online Banking or our mobile app. Learn more at: gecreditunion.org/billpay

The guide below shows completely free ways to make your monthly payment from a GECU account or an external account (any non-GECU account) using Online Banking or our mobile app.

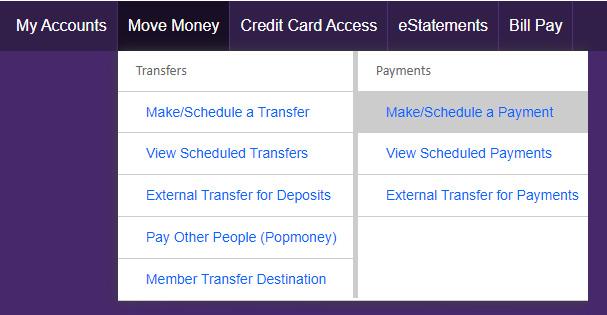

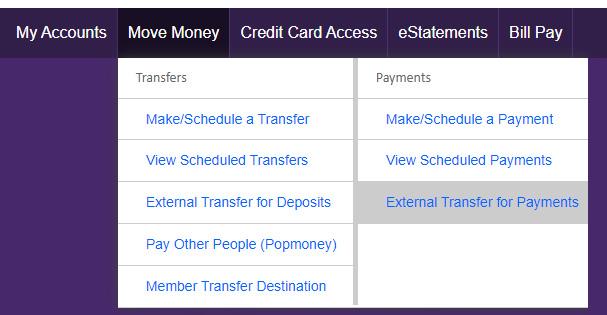

1. Hover over Move Money and select Make/Schedule a Payment.

Hover over Move Money and select

2. Enter the amount you wish to pay, the payment date, and submit your payment.

(For your first payment, you will need to select Add an External Account and enter the routing and account number for the account.)

Tip: You can set up automatic recurring payments by selecting the box next to Repeat.

1. Tap Make a transfer at the bottom.

2. Enter the account you wish to pay from, the payment date and amount, and submit your payment.

2. Enter the account you wish to pay from, the payment date and amount, and submit your payment. 2. Enter the amount you wish to pay, the payment date, and submit your payment. (For your first payment, you will need to select Add an External Account and enter the routing and account number for the account.)

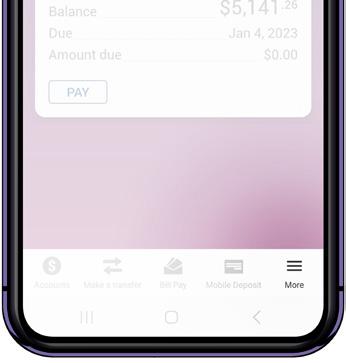

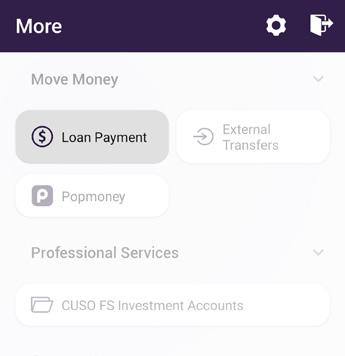

Tap More, select Loan Payment, then tap Pay from bank account.

When you have a question or you need to talk to us about your next financial move, we make it easy to get in touch with our friendly experts.

24-hour self-service telephone banking: 513.243.3333 / 800.589.2875

Learn more at: gecreditunion.org/callconnect

For questions about your accounts, contact us at: 513.243.4328 / 800.542.7093

Email: memberservices@gecreditunion.org

Fax: 513.398.0076

Hours:

Monday - Thursday: 8 am – 5 pm Friday: 8 am – 6 pm Saturday: 9 am – 2 pm

Click here to open a new account via Virtual appointment.

Phone: 513.577.8976

To learn more, visit us at: gecreditunion.org /appointments

Hours:

Monday - Thursday: 9 am – 5 pm Friday: 9am - 6pm Saturday: 9 am – 2 pm

Phone: 513.588.1699 / 800.542.7093 x1699

Hours: Monday - Friday: 8 am – 5 pm

Email: businessservices@gecreditunion.org

Visit our Title Services page for more information and online resources, including Duplicate Lien Release or State-to-State Change request forms.

Email: title@gecreditunion.org

Fax: 513.554.1203

Learn more at: gecreditunion.org/title

Debit Cards:

• To activate your debit card or for debit card PIN change requests, call: 877.205.1659.

• For general debit card questions, to file a dispute, or to report a debit card lost or stolen, call: 513.243.4328 / 800.542.7093 and select option 6.

Credit Cards:

• To activate a GECU credit card, call: 833.541.0770.

• For credit card PIN change requests, call: 866.297.3413.

• For general credit card questions, to report a credit card lost or stolen, report fraud, or to file a credit card dispute, call: 877.205.3175 (follow the prompts).

• For business credit card after-hours support, call: 877.205.3177.

Open an account or apply for a loan today!

You can open an account in person or online at your convenience. Simply scan this QR code directly from your phone’s camera, or visit: gecreditunion.org/apply. If you already have Online Banking or our mobile app, you can easily apply from within and your application will be started for you!

Don’t miss a thing! Follow us on social media for:

• Recorded webinars

• Community events and activities

• The latest posts from our blog—Money Minutes

• Credit union announcements

To learn more about GECU and our products and services, visit: gecreditunion.org. Follow us on Facebook, Instagram, Linkedin and YouTube

Membership eligibility available throughout the Tri-State. For questions or concerns, please contact us at 513.243.4328/800.542.7093 or visit: gecreditunion.org/membership for details.

1Online Banking/mobile app: We provide Online Banking and our mobile app to you for free; however, mobile/Internet data charges may apply. Please contact your service provider for details. 2 Zelle: U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes. 3Bill Pay: Our unlimited Bill Pay service must be used in conjunction with a GECU checking account.

4Mobile Deposit: Funds are generally made available two days after deposit, but are subject to GECU discretion. 5Checking: You must deposit $25 to open a GECU consumer checking account. The account must be funded within 30 calendar days. For dividend-earning accounts, rates are based on the account balance and account tier. We use the average daily balance method to calculate the dividends on your account. Fees may reduce earnings. Simply Free Checking: is a non-dividend bearing account. There is no minimum balance required to maintain this account.

Choice Checking: If your average daily balance is below $500, you will incur a $10 monthly maintenance fee. The tiers are as follows: Tier 1 daily balance of $0.01 to $4,999.99; Tier 2: $5,000 or more. Amplified High-Yield Checking: If your average daily balance is below $1,500, you will incur a $15 monthly maintenance fee. GECU will rebate Amplified accountholders up to 10 out-of-network (foreign) ATM fees per month per membership when you use your GECU debit card to make: a deposit, withdrawal, transfer, or balance inquiry. Fees are rebated at the end of the month. For complete details, visit: gecreditunion.org/checking 6ATM network: is fee free for withdrawals for GECU debit cardholders. In-network ATMs include: GECU, Allpoint, MoneyPass, CULIANCE, and Fifth Third ATM networks. For more details visit: gecreditunion.org/debitatm-access. Foreign transaction fees apply to out-of-network ATMs, please review our Fee Schedule for those details.7Round Up: Only available for Simply Free, Choice, and Amplified High-Yield Checking accounts. Funds will be added to member’s chosen GECU savings or money market account; excluding Certificates, IRAs, or IRA Money Market accounts. Match will be paid on eligible funds at the end of the month with an annual match limit up to $350; reportable on IRS Form 1099. 8Early Pay: For GECU consumer checking accounts only; not available on GECU: money market, business checking, or Health Savings Accounts. Early Pay is a service in which we credit eligible ACH deposits up to two business days early. The timing of when these transactions will be credited is based on when the payer submits the information to us. This means the timing of when transactions are credited could vary and funds may not be received early. We cannot guarantee that you will receive Early Pay due to unanticipated circumstances. Eligible ACH deposits include, but are not limited to: payroll, pensions, and government deposits. Other deposits, such as: check or mobile deposits and card transactions are not eligible for Early Pay. Early Pay is automatic and there is no fee, you can opt out at any time. for details, visit: gecreditunion.org/earlypay. 9Overdraft Protection Transfers: Only available to: Simply Free, Choice, and Amplified High-Yield Checking accountholders. Should there not be enough funds in your primary overdraft savings account, the switch to your secondary overdraft account will occur next business day. 10Courtesy Overdraft: Whether or not overdrafts will be paid is discretionary and GECU reserves the right not to pay. We typically do not pay overdrafts if an account is not in good standing, regular deposits are not made, or there are too many overdrafts. GECU reserves the right to require you to pay an overdraft immediately or on demand. Overdraft/return check fees may apply. If the account balance above reflects a negative balance, please deposit funds to bring your account back to a positive balance. Generally, your account must be brought to a positive balance within 32 days from the first overdraft to avoid suspension of overdraft privileges or the account being closed. Any item (check, ACH, or other electronic transaction) that is initially returned to the payee because the available balance in your account was not sufficient to cover the item can be represented by the payee for payment multiple times, which is beyond our control. We will charge an overdraft or return item fee of $32 regardless of the number of times an item is presented to us for payment against insufficient funds, and regardless of whether we pay or return the item. 11Money Market Accounts: There is no minimum balance requirement to open these accounts. The tiers are as follows: Tier 1 daily balance up to $99.99, Tier 2: $100.00 - $4,999.99; Tier 3: $5,000 - $24,999.99; Tier 4: $25,000 - $249,999.99; Tier 5: $250,000 or more. You must maintain the corresponding daily balance to obtain the disclosed APY. We use the daily balance method to calculate the dividend on your account. Accounts will be opened, and interest will accrue as of the date funding is received; funding must be received within 30 calendar days of account opening. Fees may reduce earnings. Thrive Money Market: Rates earned are based on balances, calculated daily, and credited to the account monthly. Separate checks and debit cards are issued to access this account. IRA Money Market Account: Rates earned are based on balances, calculated daily, and credited to the account quarterly. 12Certificates: Your Certificate will automatically renew at the end of the term. GECU will send you a maturity notice prior to renewal. Upon maturity, if the same term is no longer offered, the certificate will automatically renew into the closest term and best rate available for that term. Fees may reduce earnings. Subject to early withdrawal penalties. Please refer to the Account Disclosures at gecreditunion.org for all account information. 13Zero Liability: You agree to promptly notify the Cardholder Services, telephone number: 513.243.4328 or 800.542.7093 in the event you suspect any unauthorized use of the card. You will not be liable for unauthorized use that occurs after you notify GECU orally or in writing, of the loss, theft, or possible unauthorized use. 14Gold Reward Points: This card is subject to credit approval. New Gold cardholders have the opportunity to earn a $100 cash-back bonus upon making $1,000 in purchases within the first 90 days after account opening. When meeting the requirement, a $100 rebate will be applied as a statement credit the cycle after meeting the requirement. For each dollar charged on a qualifying purchase, and incurred finance charges in each billing period, on your GECU Visa Gold card, you’ll earn cash back. Cash back is based on a businesses’ MCC (Merchant Category Code) and are determined by the individual business and the category in which they reside. Qualifying purchases are purchases for goods and services minus returns and other credits. Qualifying purchases do NOT include: fees, balance transfers, cash advances, or purchases of other cash equivalents. Additional terms and restrictions apply. This rewards program is offered at the discretion of GECU and may be changed from time to time with or without notification. Full terms and details of the rewards program will be included with your card and can also be found at: gecreditunion.org/gold 15Platinum Reward Points: This card is subject to credit approval. New Platinum cardholders have the opportunity to earn 10,000 bonus points upon making $1,000 in purchases within the first 90 days of account opening. The bonus points will be added to your reward point balance and will be identified as such on your statement, eStatement, or within Online Banking. For each dollar charged on a qualifying purchase in each billing period on your GECU Platinum card, you’ll earn reward points.

Points are based on a businesses’ MCC (Merchant Category Code) and are determined by the individual business and the category in which they reside. Qualifying purchases are purchases for goods and services minus returns and other credits. Qualifying purchases do NOT include fees or interest charges, balance transfers, cash advances, or purchases of other cash equivalents. Additional terms and restrictions apply. This rewards program is offered at the discretion of GECU and may be changed from time to time with or without notification. Full terms and details of the rewards program will be included with your card and can also be found at: gecreditunion.org/platinum. 16Visa Signature® Reward Points: This card is subject to credit approval. New Signature® cardholders have the opportunity to earn 20,000 bonus points upon making $2,500 in purchases within the first 90 days of account opening. The bonus points will be added to your point balance and will be identified as such on your statement, eStatement, quarterly rewards statement, or within Online Banking/mobile app. For each dollar charged on a qualifying purchase in each billing period on your GECU Visa Signature card, you’ll earn reward points. Points are based on a businesses’ MCC (Merchant Category Code) and are determined by the individual business and the category in which they reside. Qualifying purchases are purchases for goods and services minus returns and other credits. Qualifying purchases do NOT include fees or interest charges, balance transfers, cash advances, or purchases of other cash equivalents. Additional terms and restrictions apply. This rewards program is offered at the discretion of GECU and may be changed from time to time with or without notification. Full terms and details of the rewards program will be included with your card and can also be found at: gecreditunion.org/signature. 17Exclusive Perks: Certain limitations, exclusions, and restrictions apply. In order for coverage to apply you must use your covered Visa Signature® Card to secure transactions. Benefits are subject to change at any time without notice. For more information on these benefits, please see Visa Signature® Guide to Benefits. 18Credit Card Fees: Regular APR applies; foreign transaction fee (for The Classic, Gold, and Platinum cards) is 1.5% of each transaction in U.S. dollars, foreign transaction fee for Visa Signature® is 0% of each transaction in U.S. dollars. There is a $10 or 3% of the amount (whichever is greater) fee to transfer balances from other credit cards to a GECU credit card; the current APR will be applied to the transferred balance. 19Business Reward Points: New Business cardholders have the opportunity to earn 20,000 bonus points upon making $5,000 in purchases within the first 90 days of account opening. The bonus points will be added to your reward point balance and will be identified as such on your statement, eStatement, or within Online Banking/mobile app. For each dollar charged on a qualifying purchase in each billing period on your GECU Business card, you’ll earn reward points. Qualifying purchases are purchases for goods and services minus returns and other credits. Qualifying purchases do NOT include fees or interest charges, balance transfers, cash advances, or purchases of other cash equivalents. Additional terms and restrictions apply. This rewards program is offered at the discretion of GECU and may be changed from time to time with or without notification. Full terms and details of the rewards program will be included with your card and can also be found at: gecreditunion.org/business. 20Home Loans: For qualified borrowers only. Limited to owner occupied, single family property in OH, KY, and IN. 21Home Equity: Limited to owner occupied, single family property in OH, KY, and IN. For qualified borrowers only. The minimum finance amount is $10,000. The loan must be for a primary residence only. Contact a tax advisor to determine their deductibility of interest. Property insurance is required to open plan. 22Home Equity Line of Credit and Equity Rich Line of Credit: The term is 20 years; a 10-year draw period with interest only payments followed by a 10-year repayment period with principal plus interest, which may increase monthly payments. Consult a tax advisor for deductibility of interest. No application fee, closing costs, or pre-payment penalty. Property insurance required. 23Legal Services: Provided through CUSO Corp., a credit union service organization wholly owned by GECU and located in GECU’s Reading Road office. Legal Services is staffed by attorneys from the Cincinnati law firm Wood + Lamping LLP. 24Business Online Banking: We provide Online Banking and our mobile app for free; however, our enhanced Business Online Banking is available for a fee. 25ACH Origination and Remote Deposit Capture (RDC): Subject to approval; see account agreements for further information. A monthly service fee will be assessed for RDC. You must have an open GECU Business checking account to be enrolled in Business RDC and fees will be billed to that account. Fees may apply for additional services. Transaction and other types of fees associated with your checking account still apply. Business RDC requires a contractual agreement. Requires internet access, and internet service fees may apply. 26Business Checking: You must deposit $25 to open a GECU business checking account. The account must be funded within 30 calendar days. Fees may reduce earnings. Simply Free Business Checking: is a non-dividend-bearing account. There is no minimum balance required to maintain this account. Premier Business Checking: If your average daily balance is below $10,000, you will incur a $15 monthly maintenance fee. To earn dividends, you must have a balance greater than $10,000. The tiers are as follows: Tier 1 daily balance of $10,000 to $24,999.99; Tier 2 $25,000 or more. We use the daily balance method to calculate dividends on dividend-bearing accounts. Dividends begin to accrue no later than the business day we receive the deposit to your account. You will receive the accrued dividends if you close your account before dividends are posted. APY will vary due to the account activity and balance. 27Business Transactions: A transaction is a check paid, deposit processed, deposited item, debit card withdrawal, or ACH credits/debits. There is a $0.25 additional fee for transactions over the monthly allowance. 28Business Advantage Money market (BAMMA): There is no minimum balance requirement to open this account. Funding must be received within 30 calendar days of account opening. Dividends begin to accrue no later than the business day we receive the deposit to your account. To earn dividends, you must have a balance greater than $0. Rates earned are based on balances, calculated daily, and compounded to the account monthly. Dividend rates are based on the account balance and account tier. The tiers are as follows: Tier 1 daily balance of: $0.01 to $24,999.99; Tier 2: $25,000 to $99,999.99; Tier 3: $100,000 to $499,999.99; Tier 4: $500,000 or more. All tiers are subject to variable rate pricing. Under no circumstance will the rate for any tier be less than 0.10%. Fees may reduce earnings.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Terms and conditions may apply.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Apple Pay® is a trademark of Apple, Inc., registered in the U.S. and other countries. Google PayTM is a trademark of Google, Inc.

Samsung PayTM is a registered trademark of Samsung Electronics Co., Ltd. Fitbit is a registered trademark and service mark of Fitbit, Inc.

Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.