Tra cology has partnered with data expert Casino City Press, to provide insight into website and tra c trends across a liate industries – predominantly in gaming but including others. In this edition, we review a liate programmes per vertical for January 2024. The below is a breakdown of the top 20 sites globally, including both desktop and mobile, sorted by: overall ranking, casino ranking, sports ranking, bingo ranking, lottery ranking and poker ranking

WEBSITE

www.bet365partners.com

www.entainpartners.com

affiliates.betano.com

7k.partners

TrafficOn Buffalo Partners

Rush Affiliates

WEBSITE

7k.partners

affiliate.888.com

gambling-partners.com

betssongroupaffiliates.com

superafiliados.com

trafficon.io buffalopartners.com

melbetaffiliates.com

etoropartners.com

rush-affiliates.com

kindredaffiliates.com

Betfair Partnerships

partnerships.betfair.com

draftkings.com/affiliates

exnessaffiliates.com

shin.og-affiliate.com

bet365partners.com

affiliateskto.bet

Gamesys Group Partners

gamesysgrouppartners.com

affiliates.williamhill.com

Videoslots Affiliate Program

partner.videoslots.com

rankaffiliates.com

chillipartners.com

CasinoAffiliateProgramm.de

casinoaffiliateprogramm.de

FEATURES DIGITS

RANK RANK SITES SITES 1 1 17 17 9 9 5 5 13 13 3 3 19 19 11 11 7 7 15 15 9 1 3 7 2 2 5 19 1 1 6 1 4 15 69 9 1 14 37 4 2 2 18 18 10 10 6 6 14 14 4 4 20 20 12 12 8 8 16 16 7 17 1 8 1 1 1 4 29 1 48 2 1 2 5 12 6 15 6 4 NAME NAME bet365 Partners 7K Partners DraftKings Affiliates Rank Affiliates Melbet Affiliates bet365 Partners Stoiximan.gr Affiliates Betsson Group Affiliates RevMasters BC.Game Affiliates betway Partners Africa OG Affiliate Betfred Affiliates Kindred Affiliates U-ffiliates LeoVegas Affiliate Bovada Affiliate Program Entain Partners Betsson Group Affiliates Rainmaker Affiliate Program NetHive Affiliate Program U-ffiliates Exness Affiliates Chilli Partners eToro Partners KTO Affiliates 7K Partners Super Afiliados Kindred Affiliates William Hill Affiliates Entain Partners Gambling Partners OG Affiliate

TRAFFIC REPORT

revmasters.com bc.game/affiliate www.betwaypartnersafrica.com shin.og-affiliate.com betfredaffiliates.com kindredaffiliates.com affiliate.888.com leovegasaffiliates.com bovada.lv/new-bovada-affiliate-program entainpartners.com betssongroupaffiliates.com igaming.rmkr.co www.nethive.com

2 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

RevMasters

Kindred Affiliates

WEBSITE

bet365partners.com

betwaypartnersafrica.com

nethive.com

entainpartners.com

affiliates.betano.com

bovada.lv/new-bovada-affiliate-program

partnerships.betfair.com

revmasters.com

melbetaffiliates.com

rush-affiliates.com

betfredaffiliates.com

kindredaffiliates.com

mozzartaffiliates.com

betssongroupaffiliates.com

tipsport.cz/partner

1xpartners.com

betwaypartners.com

affiliates.williamhill.com

afiliados.ecuabet.com

DraftKings Affiliates

draftkings.com/affiliates

YoGroup Affiliates

The Bingo Affiliates

1xBet Partners Prime Partners

Bingo Aliens Affiliate

WEBSITE

entainpartners.com

broadwaygaming.com

rankaffiliates.com

affiliate.888.com

revenueplanet.com

gamesysgrouppartners.com

nethive.com

yogroupaffiliates.com

partnerships.paddypower.com

bet365partners.com

betfredaffiliates.com

thebingoaffiliates.com

vistagamingaffiliates.net

kindredaffiliates.com

butlersbingo.com/affiliates

primepartners.com

www.unitedcommissions.com

maxiaffiliates.com

pdmaffiliates.com

bingoaliens.com/affiliates

DIGITS FEATURES GAMBLINGINSIDER.COM / TRAFFICOLOGY | 3 RANK RANK SITES SITES 1 1 17 17 9 9 5 5 13 13 3 3 19 19 11 11 7 7 15 15 5 4 7 20 2 1 5 3 4 1 2 3 1 6 1 1 5 2 2 1 2 2 18 18 10 10 6 6 14 14 4 4 20 20 12 12 8 8 16 16 6 5 3 9 3 1 1 3 17 2 17 39 1 1 11 3 1 1 2 1 NAME NAME bet365 Partners Entain Partners Betway Partners United Commissions Melbet Affiliates

Partners

Affiliate Program

NetHive Affiliate Program

Ecubet Affiliates

Paddy

Stoiximan.gr Affiliates Revenue Planet Mozzart

Vista Gaming Affiliates

Rank Affiliates

PDM Affiliates Betfred Affiliates Betfred Affiliates Betfair Partnerships NetHive Affiliate Program Tipsport Partners Butlers Bingo Affiliate Program betway Partners Africa Broadway Gaming Affiliates William Hill Affiliates Maxi Affiliates Rush Affiliates bet365 Partners Bovada Affiliate Program Gamesys Group Partners Betsson Group Affiliates Kindred Affiliates Entain Partners U-ffiliates

WEBSITE

fdj.fr

lottolandaffiliates.com

westlotto.de/unternehmen/affiliate/ partnerprogramm.html

WEBSITE

wpnaffiliates.com

starsaffiliateclub.com

Michigan Lottery Affiliates U-ffiliates

michiganlottery.com/about/affiliate

thelotter-affiliates.com

affiliate.888.com

entainpartners.com

PA iLottery Affiliate Program bet365 Partners

pailottery.com/p/partners/

tipp24.com/aktionen/partnerprogramm

bet365partners.com

ggpartners.com

Affiliate Empire Natural8 Affiliates

lottogoaffiliates.com

lotteryofficeaffiliates.com

The Health Lottery Affiliate Program The Spartan Poker Affiliate Program

healthlottery.co.uk/affiliates

clobetaffiliates.com

Banana Lotto Affiliates CoinPoker Affiliates

bananalotto.fr/affiliation.php

partnerlottery.com

Lottobay Affiliate Program Betsson Group Affiliates

LottoElite

lottobay.de/partnerprogramm.html

giantaffiliates.com

lottoelite.com/login/

lottohoyaffiliates.com

Juicy Stakes Affiliates

natural8.com/affiliates

wptpartners.com

thespartanpoker.com/affiliate/overview.html

puntoscommesse.it/website/FooterMenu/ Promozioni/Affiliazioni.aspx

agents.coinpoker.com

highstakes.com/affiliates

betssongroupaffiliates.com

superafiliados.com

affiliates.juicystakes.eu

megarushaffiliates.com

MegaRush Affiliates Black Chip Poker Affiliates

winamax.fr/en/affiliates multilottoaffiliates.com

affiliate.everygame.eu

affiliates.blackchippoker.eu

rsppartners.com

eaffiliates.com

EAffiliates BetMGM Partners

betmgmpartners.com

FEATURES DIGITS 4 | GAMBLINGINSIDER.COM / TRAFFICOLOGY RANK RANK SITES SITES 1 1 17 17 9 9 5 5 13 13 3 3 19 19 11 11 7 7 15 15 1 4 1 1 1 1 3 12 1 1 1 1 3 1 1 1 1 4 1 1 2 2 18 18 10 10 6 6 14 14 4 4 20 20 12 12 8 8 16 16 8 16 1 1 1 1 1 1 1 1 1 8 1 2 1 1 1 1 2 1 NAME NAME FDJ Affiliate Program WPN Affiliates LottoHoy Affiliates Everygame Affiliate The Lottery Office Affiliates

Partners theLotter Affiliates Entain Partners Lottery Partner

Affiliates West Lotto Partners Winamax Affiliates

WPT

HighStakes

MultiLotto.com Affiliates RSP Partners Clobet Affiliates Punto Scommesse Affiliations Tipp24 Partners GGPartners Giant Affiliates Super Afiliados Lottoland Affiliates Stars Affiliate Club

The Barstool Sports timeline

Twenty years ago, Barstool Sports made its market debut as a physical gambling and sports publication on the streets of Boston. Today it is a partner with DraftKings and a social media content leader with over 16 million Instagram followers. Trafficology turns back the clock to see how we got here...

Barstool Sports is founded by David Portnoy as a free print publication, focused on gambling and sports betting.

According to reports, Barstool had roughly 80 million page views, and four million monthly readers.

Penn Entertainment purchases a 36% stake in Barstool. As a result, Penn stock rose 10.7%. With this purchase, TCG gave away control of Barstool.

Barstool Sportsbook receives approval to launch in Illinois and Virginia.

Barstool takes its publication online.

Former AOL CMO Erika Nardini is hired as Barstool Sports CEO, following a 51% stake by-out by The Chernin Group (TCG) in January.

Barstool Sportsbook enters the market via a soft launch in PA after approvals from the Pennsylvania Gaming Control Board.

2003 2007 2013 2016 2020 2020 2021 SEP DEC FEB MAR JUL SEP

FEATURES BARSTOOL 6 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

Dave Portnoy faces charges of sexual harassment. As a result, Penn’s stock fell 21%, taking $2.7bn from Penn’s market value.

Barstool Sportsbook launches in Iowa, becoming the 10th state to welcome the sportsbook.

Penn Entertainment completed its acquisition of Barstool Sports for $388m, acquiring 100% stake in the company.

Despite concerns regarding Barstool following Portnoy’s sexual misconduct charges, Penn CEO Jay Snowden said it still intended to move forward with acquiring Barstool.

ESPN partners with Penn to launch ESPN Bet. Penn then sold Barstool back to Portnoy for $1. However, the deal included a clause for Penn to receive 50% of the gross proceeds if Barstool was sold again.

Barstool Sportsbook & Casino migrates to Penn’s online gaming technology platform.

Less than one hour after Super Bowl LVIII, Barstool announced its new partnership with DraftKings.

ESPN Bet launches. Barstool no longer has its own sportsbook product.

2021 2021 2022 2023 2023 2023 2023 2024 NOV NOV FEB AUG FEB MAR JUL NOV

BARSTOOL FEATURES GAMBLINGINSIDER.COM / TRAFFICOLOGY | 7

work hard, play hard

At the ExCel London in February, iGB A liate ran its final event before next year’s move to Barcelona. Tra cology looks back on the experience...

While ICE may have been the highlight of the week beginning 5 February for many in the gaming industry, for the affiliate market, iGB Affiliate was the talk of the town.

Located, much like ICE, at ExCel London, the event played host to a wide range of stalls and booths, where executives brushed shoulders with eager start-up owners and seasoned industry veterans alike. Opportunities to put a name to a face from all your emails is a welcome experience; however, this was far from all the event had to offer.

THE CONFERENCE THEATRE

Throughout the two-day event, iGB played host to a variety of talk panels at the events conference theatre. Topics ranged from ‘How to survive an ad-ban,’ ‘Scaling your affiliate business 101’ to ‘Using AI-led strategies to re-share SEO,’ with executives from companies including Betsson, Better Collective and DeepCI taking to the stage.

A total of 15 panels were scheduled across the iGB Affiliate’s two-day run.

As opportunities to learn about key topics from those in the know, these panels are invaluable, especially when combined with the opportunity to ask questions to the speakers involved. This is especially true for smaller businesses, start-ups and those looking to develop their career, as after all, knowledge is power.

Later in this issue we broke down the panel titled ‘How much AI is too much AI,’ hosted by Betsson Group Head of SEO Caroline Broman and featuring TU Internet Marketing Managing Director Claire Taylor, Kingbet Media Head of SEO Emilio Takas and Better Collective Senior Director, Group Content & Digital Performance Guillaume Mazella.

THE EVENT FLOOR

Around the event space, companies pulled out all the stops to create visually appealing, engaging stands. From dartboards to

flashing lights, to free bubble tea and spinning wheels, it was hard to decide where to focus. The event was lively, full of lights and laughs. From cat-themed costumes to Pin-Up Partners’ signature 1950’s dresses and hairdo’s, to Stake.com’s recently revealed F1 Stake Team car on full display. The visuals of the event were eyecatching, with brands vying for your attention for a chance to chat, display products and maybe get the ball rolling for future dealings.

Of course, companies in attendance were also more than generous with complementary drinks and branded merchandise. The gambling industry is one that works hard and plays hard, and few events showcase that more succinctly than ICE and iGB Affiliate. The iGB Affiliate Bar was sponsored by NetHive, while catering was sponsored by Buffalo. Of course, there was more than just alcohol on offer, with water and soft drinks also available from a variety of attending businesses.

All that, and the post-ICE parties hadn’t even started yet!

A CREATIVE SPARK

Of course, there was more to see at iGB Affiliate, if you hadn’t already had your fill of learning and networking. The event played host to a live art event where two artists spent the two days creating artworks for all to see. Utilising spray paints and other materials, the creativity involved and witnessed by attendees hopefully inspired a spark of inspiration to take back to the office on Friday.

With the level of competition in the market, creativity is key for success. If the inventive stands and curious engagement opportunities didn’t make that obvious, then maybe the art display would.

FIRA GRAN VIA, BARCELONA

From 21-22 January 2025, iGB Affiliate will make its return at Fira Gran Via, Barcelona. While a break from London’s less-than-stellar winter weather will be much appreciated, the departure from the grounds the event has called home for so many years is likely to come with some changes.

For some affiliates, the shift to mainland Europe will be a blessing – no need to haul stand supplies and displays across the English Channel, after all. However, with the UK being such a pivotal player in the affiliate market, the new venue may definitely end up missing something! While London will be missed, next year’s iGB Affiliate can at least assure a slightly lower chance of rain – and plenty to look forward to.

FEATURES IGB AFFILIATE 2024 8 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

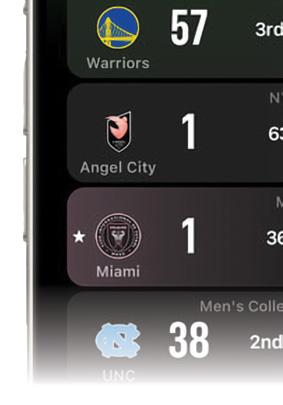

Apple Sports Review

Apple delved deeper into the sporting world with the introduction of a new sports app in February. Here, Tra cology reviews the tech giant’s latest o ering, which includes odds...

Back in February, Apple released a new free app for sports fans called Apple Sports, which focuses on providing access to real-time scores, stats and other information for several major sport teams and sport leagues. At launch, it was available for download in the US, the UK and Canada, featuring the following leagues: MLS, NBA, NCAA basketball (men’s and women’s), NHL, Bundesliga, LaLiga, Liga MX, Ligue 1, Premier League and Serie A, with more set to come over time.

Sports fans can also customise the app to feature their favourite teams, tournaments and leagues.

On top of real-time scores, match stats, lineups and match schedules, the app gives users information on match betting odds. Supplied by DraftKings, the data is presented in American odds. The app doesn’t allow you to place bets, but offers sports fans an overview of odds, total and spread for a particular match. This feature can be disabled in the iPhone’s settings, hiding betting odds.

The app could be viewed as quite a simple application. It does what it says on the tin, namely, to be a scores app. For example, if an Arsenal fan only cares about keeping up with Arsenal and Arsenal alone, then it is easy for that person to customise the app to indicate Arsenal as their favourite team.

After this, the user will be welcomed by a screen with ‘Yesterday,’ ‘Today’ and ‘Upcoming.’ This allows fans to stay informed on recent results/fixtures for the Gunners, providing simple information such as form and the Premier League table ahead of a game or the key match stats from a game the day before.

If this is all that is required by a particular fan, then this app is probably the perfect addition to their iPhone’s home screen.

However, we at Trafficology feel a lot more could have been done, though of course the app is still in its early stages.

Firstly, something simple which is missing from a scores app, is the ability to receive notifications on a particular game. It is inconvenient to constantly be on your phone trying to keep up with a game and a simple notification indicating a goal, full-time, etc, would help to make the app more appealing. This would be especially beneficial to Apple Watch users.

Nearly every app offers this functionality and we found it strange that an option didn’t seem to be present here. Even the fact that within the app there doesn’t seem to be a way to view fixtures beyond ‘Yesterday, ‘Today’ and ‘Upcoming’ shows its limitations.

While it helps to keep things simple, which is okay for some, one thing that has become evident over the last few years is that sports fans have an appetite for more than just surface level stats.

As an example, in football we are seeing more and more new stats, whether that is expected goals (xG) or progressive passes. Fans want to know and sports apps deliver.

There are now also more ways that sports are being covered in the media, and those working within it want easy access to those stats to add value to their content.

Apps such as FotMob and Sofascore offer a wide variety of stats both during the match and overall, for both players and teams.While not every fan cares about seeing them, a growing number are taking an interest.

Now not every fan wants to be bombarded with news articles, which some apps most certainly do, but a company the size of Apple, we feel, is missing out by not including some articles on its app.

Given the size of the company, it would surely be easy to attract the best writing talent, like The Athletic have been doing. The traffic to the site will be, without question, sizeable.

Our analysis may come across as harsh and in all honesty as an app offering sports scores, it does its job well. Plus, as something fresh on the market, it is likely to be developed further.

Nevertheless, with Apple looking to make a real scene in the sports industry, currently holding deals to show games from Major League Baseball and Major League Soccer, an app called ‘Apple Sports’ should be seeking to be a real game changer, which at the moment it doesn’t seem to be.

FEATURES REVIEW 10 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

The DraftKings and Barstool Sports story

After having its stocks sold back to Founder Dave Portnoy for $1 as part of the launch of ESPN Bet, Barstool and Penn Entertainment went their separate ways. Now a new player, DraftKings has swept up the platform. Trafficology dives deeper...

Following Penn’s offloadings of Barstool upon the launch of ESPN Bet in August, Barstool could not partner with another sportsbook until the NFL Season ended. With Taylor Swift-fever gripping the US, Super Bowl LVIII had one more surprise up its sleeve.

Not even an hour after the Kansas City Chiefs took the win over the San Francisco 49ers, Barstool Founder Dave Portnoy took to Twitter to announce the company’s next move – a multiyear partnership with DraftKings. “We’re back in the gambling business,” Portnoy said in one of his videos following the announcement, dressed in a DraftKings vest. “We just formed a partnership with DraftKings. We’re back where we started. Big, huge deal, I don’t know the numbers, a lot of zeros, maybe the biggest deal in the history of the gambling space.”

Before diving into the deal, some context. Barstool Sports was founded by Portnoy in the early 2000’s as a gambling and fantasy sports magazine, later going online. The platform grew exponentially, with an ‘everyday man’ attitude that frequently saw the platform and Portnoy called out for misogyny and other offensive comments. Today, Barstool Sports has 16 million followers on Instagram alone.

In early 2020, Penn Entertainment purchased a 36% stake in Barstool for $163m, with the intention to purchase the

remaining stake of the company at a later date. Indeed, this purchase would be completed in February 2023 with the remaining 64% of Barstool stake acquired for $388m, though it was far from smooth sailing. During this time, Portnoy faced charges of sexual harassment, with several US gaming boards warning Penn against completing the acquisition. This was despite Barstool Sportsbook already being live in several states.

When the chance to launch a sportsbook with ESPN arose, Penn leapt at it. Following an $850m write-off on the acquisition and the return of Barstool to Portnoy for $1, ESPN Bet entered the scene.

Since then, Penn’s Barstool Sportsbook has been replaced with ESPN Bet, while Barstool has been unable to re-enter the sports betting market. However, all of that has now changed.

PARTNERING WITH DRAFTKINGS

In the sports betting market, DraftKings is the secondbiggest by market share in the US, falling only behind FanDuel. It has a deep-set understanding of popular culture, with Michael Jordan positioned as Special Advisor to the Board of Directors and much like Barstool Sports, came from humble beginnings, starting operations over a decade ago from one of the Founders’ homes.

FEATURES BARSTOOL 12 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

From Barstool’s perspective, the benefits of the partnership are clear. DraftKings is a significant industry player with a fun brand image. It is also a multi-year deal, giving the two plenty of time to make a dent in the market. Plus, DraftKings has the funds back it.

In its Q4 2023 report, revenue was up 44% year-onyear for a total of $1.23bn. The company still reported an operating loss, sure, but this loss was cut significantly from last year, going from a net loss of $232.2m to $43.8m – a trajectory that may see DraftKings operating at a net profit very soon.

If 2023 was a year for revenue growth, 2024 will be a year of differentiation, according to DraftKings CEO Jason Robins. “Looking ahead to 2024 and beyond, our focus remains on disciplined execution against our core value drivers... and fulfilling our product roadmap to consistently differentiate ourselves competitively,” he said.

Though, is working so closely with Portnoy the best call when it comes to differentiations your offering? DraftKings will have to wait and see, though as has been shown with Penn, Portnoy has the uncanny ability to shift a business’s stock prices through words alone.

ACQUIRING JACKPOCKET

Speaking of DraftKings’ Q4 results, alongside its reported earnings, DraftKings also revealed that it had acquired Jackpocket for $750m. The acquisition is expected to boost DraftKings' adjusted EBITDA by $60m – $100m in 2026, with Robins stating he is “excited to enter the rapidly growing US digital lottery vertical.”

Less than two weeks after the acquisition was announced, Jackpocket earned a certification from the Internet Compliance Assessment Program (iCAP) for “best practices in player protection,” making Jackpocket one of the first iGaming operators in the US to receive such a certification.

While not completed, the transaction is expected to close by the second half of 2024.

THE DRAFTKINGS ARSENAL

Consider, then, the number of businesses now within DraftKings’ armory. It is affiliated with Barstool Sports, a previously successful sportsbook and major social media figure; meanwhile, Jackpocket provides a new avenue into the digital lottery market, plus in-house products including the peer-to-peer fantasy sports site Pick6. The company has its thumb in a lot of metaphorical pies, and with the number one sportsbook spot so close, it is no shock to see DraftKings trying out some unique strategies in its attempt to climb to the top.

We should use this time to mention a new contender in the sports app market. Apple Sports is Apple’s offering to the sports betting market, launching in February and currently offering leagues including the NBA, Premier League and NHL. Customisable to user’s tastes, the app displays betting odds as well as real-time scores, and match stats and several other features. The catch? The app does not take bets.

Having only launched recently, it is likely we will see further developments to the app in the future. Furthermore, the app's odds, lineups and other statistics are currently being supplied by DraftKings, adding another notch to DraftKings' belt in its attempts to take gold in the sports betting market. While it is uncertain whether betting will become a feature on the app (and whether this, too, will be supplied by DraftKings), with Apple’s immense wealth and hold over the smartphone market (which has been key to the success of online sportsbooks like DraftKings), it is unlikely Apple Sports will be going anywhere anytime soon.

THE CATCH

All of this sounds well and good, but there is one crucial factor to consider. Following his reacquisition of Barstool, Portnoy has stated he will hold the company “’til I die.” This, in part, can be explained due to a clause in the reacquisition deal stating that, if Barstool were to be re-sold, Penn Entertainment would receive 50% of the gross proceeds. A grudge against Penn, or a Founder protective of his brand? It is hard to tell. Maybe both. But the fact is with Portnoy set to maintain control of Barstool, as a partner of the affiliate, DraftKings may always be looking over its shoulder with an added element of regulatory risk.

Still, a multiyear contract is a long time. Enough time for these brands to do some serious work together and for Barstool to get its needed leg-up in re-entering the sports betting market. So far, it is impossible to say exactly what that will look like, but what we do know is that it will certainly make a splash in the US sports betting market.

Let’s just hope Portnoy keeps himself out of trouble long enough to not knock over the ladder they are climbing together. FanDuel's no #1 spot remains well within DraftKings' sights.

BARSTOOL FEATURES GAMBLINGINSIDER.COM / TRAFFICOLOGY | 13

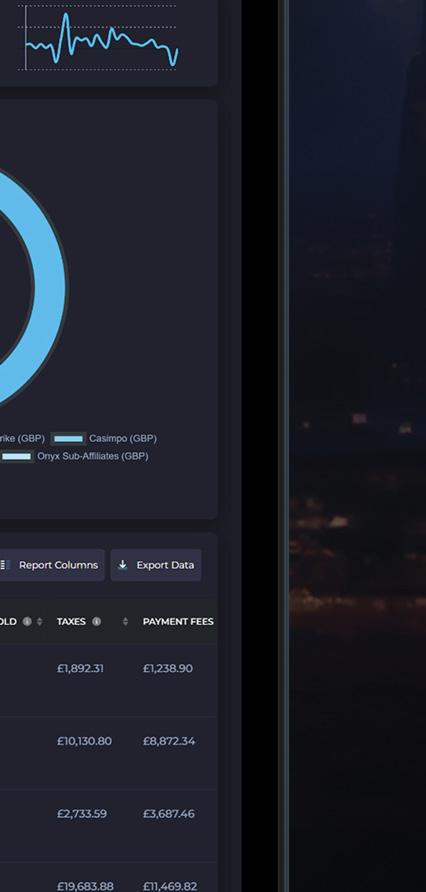

The GiG economy

With its Q4 results in, GiG Media CEO Jonas Warrer , Chairman of the Board Petter Nylander and CEO of Platform & Sportsbook Richard Carter discussed...

In a webinar hosted on Valentine’s Day (14 February), Gaming Innovation Group (GiG) reported an all-time high in Q4 revenue and EBITDA. The webinar, which followed the publication of the results, included GiG Media and Group CEO Jonas Warrer, Chairman of the Board Petter Nylander and CEO of Platform & Sportsbook Richard Carter, who discussed these results in-depth and how they reflect the company’s goals going forward into 2024 (including the affiliate side). They also discussed the impact of two of their most notable acquisitions in the past year, AskGamblers and KaFe Rocks.

In Q4 2023, revenue was reported at €35.6m ($38.1m), while for the year, the total came to €126.9m. From last year, this reflects growth of 41%, while from 2019, this saw growth of 195.1%. Alongside these all-time high revenue reports, both AskGambers and publishing excluding AskGamblers reached all-time high revenues, up 32% and 3% quarter-on-quarter respectively. Warrer described the results as a “hat-trick,”

“We had a management meeting in Copenhagen with KaFe Rocks and I think I saw a hunger in a few people’s eyes” - Jonas Warrer

though noted that the quarter had been unusual in its number of unexpected one-off costs. Warrer said: “Any company has unexpected costs, one-off costs and whatnot, but I think Q4 has been very unusual with several one-off and split related costs. For instance we have legal auditing fees and so on. It’s quite a transformative quarter for us.”

Accounting for this, the report stated: ‘Adjusting for oneoffs and split related costs, underlying EBITDA margin was 47% in the quarter.’

"IT GETS A BIT NERDY AND A BIT DETAILED, SO FORGIVE ME"

Beyond these figures, Warrer broke down the company’s First Time Depositors (FTDs) numbers. FTDs ended at 138,000, up 19% year-on-year and 21% quarter-on-quarter for another alltime high. Furthermore, of these FTDs, 95% took full revenue share or hybrid deals, compared to other deal types like flat fees. When excluding AskGamblers, publishing player intake grew 100% year-on-year. Meanwhile, AskGamblers alone grew its player intake 12% quarter-on-quarter, with a 62% increase in run rate since it was acquired by GiG.

THE KAFE ROCKS ACQUISITION

Warrer made note that, in Q4 2023, GiG was able to finalise its acquisition of affiliate KaFe Rocks. The €35m acquisition was completed in November 2023 and included the company’s 15+ market portfolio, with KaFe Rocks having previously been part of a called-off acquisition by Glitnor Group.

In our December issue of Trafficology, we spoke to Warrer about the acquisition. He said: "The US market is a very interesting market. One where if we look back at our history,

FEATURES GIG RESULTS 14 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

Jonas Warrer

maybe GiG Media has yet to realise the potential of what we could do there. So, with this acquisition we hope to fast-track things beyond getting a very strong publishing website. KaFe Rocks is already established in the US and you can say the acquisition satisfied both those goals."

This sentiment was one echoed in the Valentine’s Day webinar, when Warrer spoke of goals of enhancing GiG’s lead in the casino affiliate sector, with KaFe Rocks able to provide particular support to North American and LatAm ventures.

Post-merger integration began in early January, which Warrer described as “[enabling] KaFe Rocks to begin optimising.” He said he was “very positive about KaFe Rocks and what we can do with the team,” citing the talent and assets of the team as driving forces behind his belief.

“We had a management meeting in Copenhagen with KaFe Rocks and I think I saw a hunger in a few people’s eyes... because they know they can improve the businesses,” Warrer added later in the webinar Q&A.

ASKGAMBLERS TAKES OFF

After acquiring the company in December 2022, AskGamblers.com has become a key part of GiG’s network. As mentioned, AskGamblers revenue was at an all-time high this quarter, with statistics compared to the run rate at take-over stating that revenue was up 93%, with (FTDs) up 62%.

“The team has done a fantastic job there and it’s been really pleasant to see,” said Warrer. “Without sounding too positive, AskGambers has performed fantastically over the past 12 months... I’m quite surprised”.

The performance of the AskGamblers website even caused GiG to intentionally delay the integration of the site into GiG

Media’s platform. “We have delayed our migration... Simply because the site is doing so well right now, we are afraid to touch it,” Warrer explained.

Still, the integration is expected to take place at the quarter’s end, with sports set to be added to the site ‘to double the size of the addressable market,’ as the presentation stated. It is likely we will see sports launched on the AskGamblers site around the time of Euro 2024, due to the sporting opportunity it provides.

HOW IS THE MARKET CHANGING FOR AFFILIATES?

Asked by host Hjalmar Ahlberg, Warrer gave his thoughts on the current market and how to navigate it. “I think the market is changing in the sense that you see consolidation, the big players are becoming bigger and bigger.” Warrer said. “I think in that sense, also, competition is becoming tougher. You need to know your details, you need to know your game and we believe very much that you need to have technology... to win on the battlefield.”

Warrer suggested a humble approach, combined with technology and attention to detail as the “secret” to maintaining and growing business in the current affiliate market.

IN SHORT

2023 was a notable year for GiG, with the company pulling in some of its biggest annual figures yet. In part, these numbers can be put down to the consolidation of AskGamblers and KaFe Rocks, which aided not only in growing GiG’s FTD numbers but the company’s product and territory diversification as well. More sites, more markets and more customers are the biggest generators of growth, and it seems these two acquisitions have delivered. “We have transitioned from a domestic champion, being very focused on the Nordics, to global leaders. GiG Media is increasingly well positioned for long-term growth,” said Warrer.

GIG RESULTS FEATURES GAMBLINGINSIDER.COM / TRAFFICOLOGY | 15

Richard Carter

Petter Nylander

What’s in a brand?

In the era of social media, it’s easier than ever for companies to adjust the public perception of brands, from ambassadors, marketing and potentially even partnerships

You don’t have to be a businessman to understand how important a brand is. A brand is the face of a business that can take on a life of its own through marketing campaigns and public perception. For example, Paddy Power is a fun and casual bookie, while William Hill can be seen as a slightly more mature sports betting platform.

Of course, we could sit here all day and evaluate each piece of marketing from different operators and discuss what image it builds for a brand as if we were back in English lessons in school – but it would exclude one important factor. These would just be our opinions and thus would not reflect the wider public perception of these businesses.

For example, where did the more ‘mature sports betting platform’ line come from regarding William Hill? Well, a YouGov poll on The Most Popular Gambling & Betting Brands (Q4 2023) ranked William Hill as the 7th most popular brand for Baby Boomers (1946 – 1964), behind the likes of the People’s Postcode Lottery and Mecca Bingo, while Paddy Power was all the way down at 14th.

If we change the filter to only include results from Millennials (1981 – 1996), Paddy Power is now the fourthmost popular brand while Mecca Bingo has fallen down to 15th place. Not only that, but 46% of Millennials had a positive opinion of Paddy Power, while only 11% of Baby Boomers shared the same sentiment.

HOW CAN A BRAND BUILD MORE TRUST WITH ITS AUDIENCE?

One method is for a company to align itself with another respected entity and build respect through association. This is one of the reasons many brands use ambassadors for their products. Do you like Luís Figo? Then you’ll probably pay more attention to Digitain’s sportsbook, seeing as the football legend is plastered all over its marketing.

But not every company can hold a great reputation at every point in its lifetime. A prime example is Barstool Sports, a digital media company that has its own ‘Controversies’ section on its Wikipedia page. These range from copyright issues, off-colour remarks from its owner Dave Portnoy regarding women and, quite frankly, things we can’t talk about here.

So how did Barstool Sports land a multi-year exclusive sports betting partnership with DraftKings?

IT’S IN THE NUMBERS

Controversies aside, Barstool Sports has 5.6 million followers on X (Twitter) and 16 million on Instagram – no small follower count, considering the official DraftKings Instagram page has only accumulated 215,000 followers. If DraftKings wanted a company to promote its odds to a large audience, then Barstool Sports, regardless of how some may perceive it, is a great contender.

Although, it’s also worth mentioning that Barstool Sports has been under new management over the past few years. In 2020, Penn Entertainment bought a 36% stake in the company for $163m and bought the remaining portion of the company in February 2023 for $388m.

Under Penn Entertainment and The Chernin Group, Barstool launched its mobile sportsbook, which handled $11m in wagers during its launch week. Not only that, but Penn Entertainment also announced that it would match all first-time deposits by donating to the Barstool Fund, which raised $4.6m for small businesses in Michigan. Barstool Sports also went on to become the title sponsor of the Arizona Bowl and partnered with several local and international companies.

Perhaps it was this distance from the original owner (Portnoy) that allowed Barstool to rebrand. After all, many of the controversies that had arisen from the company have come from comments he’s made. Despite this, Penn Entertainment sold the company back to Portnoy for $1 last year after it rebranded the Barstool Sportsbook to ESPN Bet. A bold move and one Penn will have to work hard to recover from, considering Q4 revenue from its Interactive segment was down over 80% from Q4 2022.

WHERE DOES THIS LEAVE BARSTOOL?

The affiliate is now in a relatively unique position. It has the chance to start again. The brand has gone through its ‘bad boy’ era under Portnoy in the past, then was catapulted into the world of sports betting beyond journalism through Penn Entertainment. Therefore, it makes perfect sense for Barstool Sports to maintain that momentum by announcing its partnership with DraftKings a mere 30 minutes after its non-competition clause ended with Penn Entertainment.

FEATURES BRANDING 16 | GAMBLINGINSIDER.COM / TRAFFICOLOGY

Walking the AI wire

A talk at iGB A liate in February raised the question of AI – how can a liates avoid overusing this technology and how can it be navigated for e cient, rather than excessive, use? Tra cology investigates...

How much AI is too much? This was the topic of conversation on Thursday 8 February at iGB Affiliate, as industry members weighed in on finding the balance of leveraging AI without biting off more than you can chew.

The talk was moderated by Betsson Group Head of SEO Caroline Broman. The participants of the talk were Emilio Takas (Kingbet Media Head of SEO), Claire Taylor (TU Internet Marketing Managing Director) and Guillaume Mazella (Better Collective Senior Director, Group Content & Digital Performance).

HOW HAS WORKFLOW WITH AI EVOLVED FROM LAST YEAR TO THIS YEAR?

Firstly, attention was brought to the growth of AI technology. For affiliates and businesses in general, 2023 seemed like the year that AI came into the mainstream conversation. Chatbot

platform ChatGPT launched in late 2022 and grew to one million active users in less than a week, with 100 million users by January 2023. This level of accessibility has made AI a viable tool for just about any business, from major conglomerates to small-team startups.

As Mazella said: “We need to jump onto this trend, but how do we do it?”

Across the panel, the consensus seemed to be that while last year was a time for initial implementation, this year will be one for refinement. “This year is the year we have training... it gives us the opportunity to make what we wanted from the beginning,” Mazella continued.

Notes were also made regarding inefficient early use of AI among affiliates. New and accessible technology often comes with a rush of users engaging with it without knowing how to use it maturely. It was seen with the early internet and the

18 | GAMBLINGINSIDER.COM / TRAFFICOLOGY FEATURES ARTIFICIAL INTELLIGENCE

rise of the dot.com bubble, and as history so often repeats, it seems some affiliates have fallen into a similar AI trap. Artificial intelligence allows for quick scalability due to the amount of content the technology can generate; however, while growth may be quick, it may collapse just as quickly. “If it doesn’t help the end user, it may be more harmful to you,” Taylor warned.

IDEATION > CREATION

While AI is a useful tool for creating content en masse, the lack of a ‘human touch’ can make content feel hollow and disconnected. Mazella commented on how work made with AI “from A-Z” can feel “off,” with Taylor adding that if everything is made with AI, companies run the risk of all their content coming out the same.

This is where the idea of using AI for ideation over creation comes in. AI tools, as they currently exist, lack the sophistication to create works with a wholly 'human touch.' However, for generating ideas and being used as a buffering tool to develop and grow existing ideas, AI has potential as a creative aid. Mazella suggested affiliates should take a “hybrid” approach to their use of AI in content creation, allowing human beings to remain at the centre of the creative process while leveraging AI in ways to help speed up and streamline the creative process.

Furthermore, when creating SEO for ranking content, affiliates work with a wide and experienced team. SEO specialists and managers, along with teams of writers and analysts, work tirelessly to find ways to get content to the top of Google’s listings. “It’s not just one person making 50 prompts and ranking number one on Google,” one of the panelists commented.

GOOGLE DOESN’T CARE

Despite all the points made throughout the panel, on the importance of adding human agency to content and the potential for disaster if AI is used for inefficient scaling rates, at the end of it all, if the content is ranking well, Google and other search engines do not care if the work is human or AI generated. Google’s focus is on bringing the content users want to them, with the source only being a secondary concern. As Broman noted, Google’s focus is on “content for people, rather than by people.”

Furthermore, when creating content, the focus should always be on the wants of users. If the focus turns too much to appealing to search engines rather than the end user, it may come back to bite you. “If you don’t have a site for a user experience, if you create for Google, you’re doomed,” Takas said.

Currently, search engines do not distinguish between content made by people or AI. This has begun to be implemented in the AI-generated image field, with the panel seemingly in agreement that such a system may become more widespread in future, with guidance and legislation potentially

being implemented to curb the use of videos and imagery without permission. Without such a distinction in place, the affiliate content with the best ranking will therefore be the work most favourable with end users, regardless of origins.

Unique content with rich potential for engagement is not something easily made – it is the struggle of any SEO team and affiliate company. But without human hands to help shape this content, AI will likely struggle to do all the lifting on its own. “It can work for a while, then it stops working entirely,” said Taylor.

DOES IT PROVIDE VALUE TO YOU?

Overall, it seems the answer to the question of ‘how much AI is too much AI’ is... it depends. AI allows for quick content creation without the manpower, able to take one piece of content or one idea and expand upon it. However, like a pyramid of cards, using AI as the entire structure of a business makes it bound to collapse.

Finding the right balance between man and machine will be unique to each business in the affiliate sector, based on each business workforce, business model and objectives. As AI becomes more refined this year and in years to follow, this balance may shift. But even with the most advanced AI, without a human touch, the house of cards can only stand for so long.

Trafficology is brought to you every month by the Gambling Insider team at Players Publishing. For all editorial enquiries please contact us at trafficology@gamblinginsider.com, and for advertising enquiries please contact commercial director Deepak Malkani at sales@gamblinginsider.com. We would like to thank the following contributors to this issue: Casino City Press, Jonas Warrer, Caroline Broman, Emilio Takas, Claire Taylor and Guillaume Mazella. "I don't want to be a pie! I don't like gravy" - Chicken Run, 2000 Players Publishing Limited, all rights reserved.

ARTIFICIAL INTELLIGENCE FEATURES GAMBLINGINSIDER.COM / TRAFFICOLOGY | 19